Sustainable Development of Entrepreneurship through Operational Risk Management: The Role of Corporate Social Responsibility

Abstract

1. Introduction

2. Literature Review

2.1. The System of Operational Risks to Companies and the Contribution of Operational Risk Management to the Sustainable Development of Entrepreneurship

- Risk of reduction of income (Gara et al. 2024), the sign of which is the reduction of companies’ revenues in value terms ($ millions) in the considered period compared to the preceding period, i.e., negative yearly revenue change in per cent;

- Risk of reduction of profit (Lai and Hu 2024), the sign of which is the reduction of profits in value terms ($ millions) in the considered period compared to the preceding period, i.e., negative yearly profit change in per cent;

- Risk of reduction of asset value (Ouyang et al. 2024), including reduction of market capitalization (Baruník and Ellington 2024) and loss of intangible assets (Khasanov et al. 2019), the signs of which are reduction of assets in value terms ($ millions), reduction of market capitalization in % of GDP, reduction of unicorn valuation in % of GDP, and intangible asset intensity, top 15 in %, in the considered period compared to the preceding period;

- Risk of depreciation of global business reputation (Al-Ghazali et al. 2024), the sign of which is the reduction of global brand value, top 5000 in % of GDP, in the considered period compared to the preceding period;

- Risk of outflow of venture investments (Ben Lahouel et al. 2024; Zhu and Chen 2024), the signs of which are reduction of venture capital (VC) investors, deals/bn PPP$ GDP, VC recipients, deals/bn PPP$ GDP and VC received, value, % of GDP, in the considered period compared to the preceding period.

2.2. Corporate Social Responsibility as a Tool of Operational Risk Management of Companies in Support of Their Sustainable Development

- Creation of knowledge-intensive jobs in support of SDG 8 (Sozinova et al. 2023);

- Stimulation of the growth of labor efficiency in support of SDG 8 (Bashir et al. 2024);

- Development of human capital through corporate training in support of SDG 4 (Mamaeva et al. 2020);

- Attraction of female researchers to the staff in support of SDG 5 (Shevyakova et al. 2019);

- Stimulation of the innovative activity of employees through support for research talents in support of SDG 9 (Bogoviz et al. 2020).

3. Materials and Methods

- “Knowledge-intensive employment, %” (RHRM1): the creation of knowledge-intensive jobs in support of SDG 8 contributes to the creation of intangible assets and the inflow of venture investments, potentially reducing the corresponding operational risks to companies. This variable is used to test the sub-hypothesis H1.

- “Labor productivity growth, %” (RHRM2): stimulation of the growth of labor productivity in support of SDG 8 ensures fuller development of the human potential of the employees, potentially raising market capitalization and reducing the corresponding operational risk to companies. This variable is used to test the sub-hypothesis H2.

- “Firms offering formal training, %” (RHRM3): development of human capital through corporate training in support of SDG 4 potentially raises the investment attractiveness and market capitalization of companies, contributing to the reduction of their corresponding operational risks. This variable is used to test the sub-hypothesis H3.

- “Females employed w/advanced degrees, %” (RHRM4): attraction of female researchers to the staff in support of SDG 5 strengthens companies’ global business reputations, thus potentially reducing the corresponding operational risk to companies. This variable is used to test the sub-hypothesis H4.

- “Research talent, % in businesses” (RHRM5): stimulation of the innovative activity of employees through support for research talents in support of SDG 9 facilitates the creation of intangible assets and an inflow of venture investments, which reduces the corresponding operational risks to companies. This variable is used to test the sub-hypothesis H5.

- “Intangible asset intensity, top 15, %” (FR1) as the indicator of the risk of loss of intangible assets (measured in per cent);

- “Global brand value, top 5000, % GDP” (FR2) as the indicator of risk of depreciation of global business reputation (measured in % of GDP);

- “Market capitalization, % GDP” (FR3) as the indicator of risk of reduction of market capitalization (measured in % of GDP);

- “Venture capital (VC) investors, deals/bn PPP$ GDP” (FR4) as the indicator of risk of outflows of venture investments (measured in; deals/bn PPP$ GDP);

- “VC recipients, deals/bn PPP$ GDP” (FR5) as the indicator of risk of outflows of venture investments (measured in deals/bn PPP$ GDP);

- “VC received, value, % GDP” (FR6) as the indicator of risk of outflows of venture investments (measured in % of GDP);

- “Unicorn valuation, % GDP” (FR7) as the indicator of risk of the reduction of market capitalization (measured in % of GDP).

4. Results

4.1. The Role of Responsible HRM in the Reduction of Operational Risks to International Companies

- Medium correlation with the financial measuring of profitability of international companies: 0.2031; the share of positive values of correlation coefficients among 25 countries equals 68%;

- Medium correlation with the growth rate of profitability of international companies: −0.2006; the share of positive values of correlation coefficients among 25 countries equals 24%;

- Medium correlation with the financial measuring of profit of international companies: 0.0922; the share of positive values of correlation coefficients among 25 countries equals 64%;

- Medium correlation with the growth rate of profit of international companies: −0.0369; the share of positive values of correlation coefficients among 25 countries equals 40%;

- Medium correlation with the asset value of international companies: −0.0427; the share of positive values of correlation coefficients among 25 countries equals 52%.

4.2. Financial Risk Management through Responsible HRM in the Model of the Sustainable Development of International Entrepreneurship

4.3. Scenarios of the Sustainable Development of International Entrepreneurship through Operational Risk Management with the Help of Responsible HRM

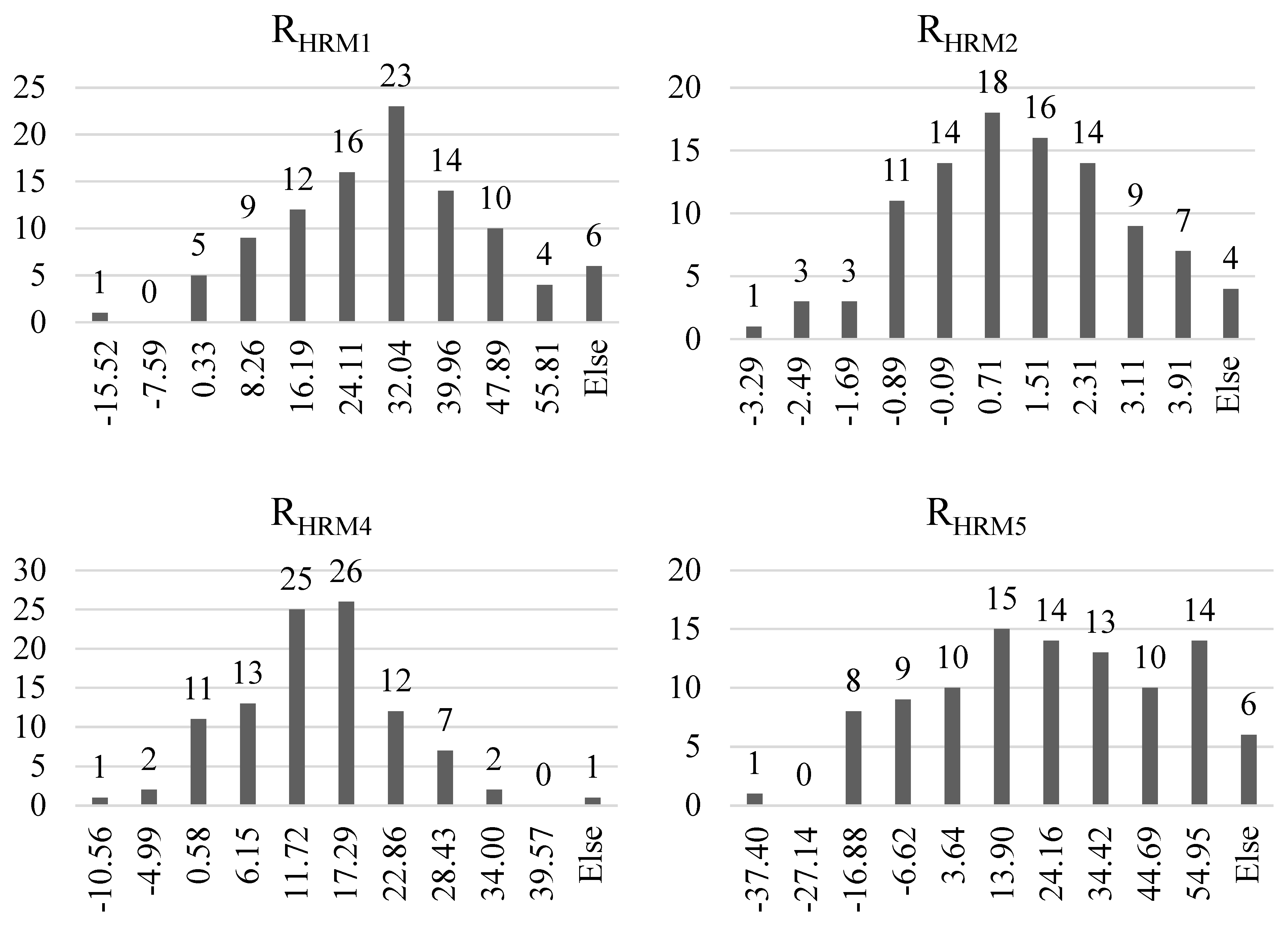

- Growth of the share of knowledge-intensive jobs by 28.68% (from 24.90% in 2023 to 32.04% by 2030);

- An increase in the growth rate of labor efficiency of 47.49% (from 1.02% in 2023 to 1.51% by 2030);

- Growth of the share of female researchers in corporate staff by 40.38% (from 12.32% in 2023 to 17.29% by 2030);

- Growth of the share of companies that support research talents by 17.48% (from 20.57% in 2023 to 24.16% by 2030).

- “Intangible asset intensity, top 15” will reduce by 0.39% (from 24.81% in 2023 to 24.71% by 2030);

- “Global brand value, top 5000” grows by 14.27% (from 3.28% of GDP in 2023 to 3.75% of GDP by 2030);

- “Market capitalization” grows by 7.47% (from 35.43% of GDP in 2023 to 38.08% of GDP by 2030);

- “Venture capital (VC) investors” grow by 49.53% (from 0.17 deals/bn PPP$ GDP in 2023 to 0.25 deals/bn PPP$ GDP by 2030);

- “VC recipients” grow by 57.93% (from 0,07 deals/bn PPP$ GDP in 2023 to 0.11 deals/bn PPP$ GDP by 2030);

- “VC received, value” grows by 22.46% (from 0.0016% of GDP in 2023 to 0.0020% of GDP by 2030);

- “Unicorn valuation” grows by 30.38% (from 1.00% of GDP in 2023 to 1.60% of GDP by 2030).

- A decrease in the share of knowledge-intensive jobs by 66.83% (down to 8.26% by 2030);

- A decrease in the growth rate of labor efficiency of 30.65% (down to 0.71% by 2030);

- A reduction of the share of female researchers in corporate staff by 50.07% (down to 6.15% by 2030);

- A reduction of the share of companies that support research talents by 82.30% (down to 3.64% by 2030).

- “Intangible asset intensity, top 15” is reduced by 51.58% (down to 12.01% by 2030);

- “Global brand value, top 5000” is reduced by 89.64% (down to 0.34% of GDP by 2030);

- “Market capitalization” is reduced by 46.80% (down to 18.85% of GDP by 2030);

- “Venture capital (VC) investors” is reduced by 100.00% (down to 0 deals/bn PPP$ GDP by 2030);

- “VC recipients” is reduced by 100.00% (down to 0 deals/bn PPP$ GDP by 2030);

- “VC received, value” is reduced by 100.00% (down to 0% of GDP by 2030);

- “Unicorn valuation, % GDP” is reduced by 100.00% (down to 0% of GDP by 2030).

- “Intangible asset intensity, top 15” grows by 76.57% (up to 43.80% by 2030);

- “Global brand value, top 5000” grows by 131.59% (up to 7.60% of GDP by 2030);

- “Market capitalization” grows by 63.01% (up to 57.76% of GDP by 2030);

- “Venture capital (VC) investors” grow by 163.18% (up to 0,44 deals/bn PPP$ GDP by 2030);

- “VC recipients” grow by 187.14% (up to 0.20 deals/bn PPP$ GDP by 2030);

- “VC received, value” grows by 144.91% (up to 0.004% of GDP by 2030);

- “Unicorn valuation, % GDP” grows by 218.76% (up to 3.18% of GDP by 2030).

- Growth of the share of knowledge-intensive jobs by 92.34% (up to 47.89% by 2030);

- An increase in the growth rate of labor efficiency by 203.77% (up to 3.11% by 2030);

- Growth of the share of female researchers in corporate staff by 130.83% (up to 58.43% by 2030);

- Growth of the share of companies that support research talents by 167.19% (up to 54.95% by 2030).

5. Discussion

- Unlike Khasanov et al. (2019), the connection with the risk of loss of intangible assets is weak: it is assessed at 12.49% and is positive only with RHRM1 and RHRM5;

- Unlike Al-Ghazali et al. (2024), the connection with the risk of depreciation of global business reputation is weak: it is assessed at 27.33% and is positive only with RHRM1 and RHRM5;

- Unlike Baruník and Ellington (2024), the connection with the risk of reduction of market capitalization is weak: it is assessed at 7.64% for “market capitalization” (it is positive only with RHRM1 and RHRM5) and at 22.52% for “unicorn valuation”;

- In support of Ben Lahouel et al. (2024) and Zhu and Chen (2024), the connection with the risk of venture investments outflows is strong: it is assessed at 23.23% with “venture capital (VC) investors, deals/bn PPP$ GDP” (it is positive with RHRM1, RHRM2, RHRM4), at 25.72% with “VC recipients, deals/bn PPP$ GDP” (it is positive with RHRM1, RHRM2, RHRM4, and RHRM5), and at 24.00% with “VC received, value, % GDP” (it is positive with RHRM1, RHRM2, RHRM4, and RHRM5).

- To confirm Sozinova et al. (2023), the influence of knowledge-intensive jobs is strong and positive: it is assessed at 40.38% and is positive with all resulting variables. This confirmed sub-hypothesis H1 and proved that the operational risks of companies are reduced due to the creation of knowledge-intensive jobs.

- Unlike Bashir et al. (2024), the influence of labor efficiency is contradictory: it is assessed at −3.40% and is positive only with FR4-FR7. This partially proved the sub-hypothesis H2, which needs further in-depth cross-checking. Therefore, future research should specify how exactly stimulation of the growth of labor efficiency influences operational risks of companies—perhaps, with the help of quantitative–qualitative studies by the example of concrete companies.

- Unlike Mamaeva et al. (2020), the influence of corporate training is negative: it is assessed at −11.15% and is negative with all resulting variables. This disproved the sub-hypothesis H3; this shows that the operational risks of companies do not reduce, but grow due to corporate training.

- Unlike Shevyakova et al. (2019), the influence of female researchers on the staff is contradictory: it is assessed at 35.90% and is positive only with FR4-FR7. This partially proved the sub-hypothesis H4, which needs further in-depth cross-checking. Therefore, future research should specify how the attraction of female researchers to the staff influences the operational risks of companies—perhaps, with the help of quantitative–qualitative studies by the example of concrete companies.

- To confirm Bogoviz et al. (2020), the influence of support for research talents is strong and positive: it is assessed at 40.37% and positive with all resulting variables (except for FR4). This proved the sub-hypothesis H5: operational risks of companies are reduced due to the growth of support for research talents.

6. Conclusions

- (1)

- We established a close connection between the number of employees and operational risks to international companies from “Global 500” in 2021–2023. Based on this connection, we proved the contradictory influence of responsible HRM on the operational risks of international companies.

- (2)

- We compiled the economic and mathematical model of the sustainable development of international entrepreneurship, which demonstrated wide opportunities for operational risk management through responsible HRM.

- (3)

- We determined scenarios of the sustainable development of international entrepreneurship, which showed that in the Decade of Action, the successfulness of operational risk management is largely determined by the activity of the use of responsible HRM practices.

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Country | Intangible Asset Intensity, Top 15, % | Global Brand Value, Top 5000, % GDP | Market Capitalization, % GDP | Venture Capital (VC) Investors, Deals/bn PPP$ GDP | VC Recipients, Deals/bn PPP$ GDP | VC Received, Value, % GDP | Unicorn Valuation, % GDP | Knowledge-Intensive Employment, % | Labor Productivity Growth, % | Firms Offering Formal Training, % | Females Employed w/Advanced Degrees, % | Research Talent, % in Businesses |

| Albania | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 18.36 | 2.22 | 46.20 | 12.90 | 0.00 |

| Algeria | 0.00 | 0.00 | 0.23 | 0.00 | 0.00 | 0.00 | 0.00 | 17.86 | −0.04 | 0.00 | 8.10 | 0.46 |

| Angola | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.50 | −3.94 | 0.00 | 1.29 | 0.00 |

| Argentina | 69.00 | 1.09 | 11.49 | 0.02 | 0.02 | 0.00 | 0.38 | 25.30 | −1.81 | 40.20 | 16.34 | 10.59 |

| Armenia | 0.00 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 0.00 | 18.68 | 3.20 | 27.50 | 16.36 | 0.00 |

| Australia | 66.87 | 7.55 | 108.31 | 0.27 | 0.13 | 0.00 | 3.10 | 51.48 | 0.46 | 0.00 | 28.70 | 0.00 |

| Austria | 53.00 | 7.51 | 28.65 | 0.27 | 0.09 | 0.00 | 1.61 | 44.26 | 0.22 | 42.60 | 13.38 | 63.30 |

| Azerbaijan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 23.23 | 1.03 | 33.90 | 13.52 | 0.00 |

| Bahrain | −7.06 | 1.22 | 66.08 | 0.13 | 0.04 | 0.00 | 0.00 | 21.90 | 2.35 | 0.00 | 0.00 | 0.41 |

| Bangladesh | 61.17 | 0.36 | 22.14 | 0.00 | 0.01 | 0.00 | 0.00 | 8.32 | 4.49 | 21.90 | 1.26 | 0.00 |

| Belarus | 0.00 | 0.00 | 1.42 | 0.01 | 0.01 | 0.00 | 0.00 | 41.65 | 0.94 | 31.50 | 20.86 | 0.00 |

| Belgium | 62.06 | 4.81 | 75.20 | 0.29 | 0.09 | 0.00 | 1.69 | 49.17 | 0.16 | 57.80 | 28.34 | 64.27 |

| Benin | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.06 | 3.45 | 20.00 | 1.24 | 0.00 |

| Bolivia (Plurinational State of) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.93 | 0.30 | 49.90 | 11.93 | 0.00 |

| Bosnia and Herzegovina | −27.86 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.23 | 1.53 | 37.90 | 10.65 | 9.71 |

| Botswana | 1.84 | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 23.34 | −0.63 | 0.00 | 17.88 | 1.05 |

| Brazil | 64.11 | 3.61 | 59.81 | 0.05 | 0.04 | 0.00 | 1.90 | 23.87 | −0.05 | 0.00 | 14.52 | 26.05 |

| Brunei Darussalam | 0.00 | 0.00 | 0.00 | 0.07 | 0.00 | 0.00 | 0.00 | 33.50 | −1.72 | 0.00 | 12.98 | 0.00 |

| Bulgaria | 71.64 | 0.00 | 24.22 | 0.09 | 0.03 | 0.00 | 0.00 | 32.63 | 2.86 | 20.00 | 20.12 | 49.77 |

| Burkina Faso | 0.00 | 0.00 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 13.27 | 1.39 | 0.00 | 0.82 | 0.00 |

| Burundi | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.75 | −2.19 | 32.00 | 0.72 | 1.53 |

| Cabo Verde | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 17.12 | 2.17 | 0.00 | 7.56 | 0.00 |

| Cambodia | 0.00 | 0.00 | 0.00 | 0.03 | 0.02 | 0.00 | 0.00 | 5.94 | 2.60 | 22.20 | 2.13 | 4.33 |

| Cameroon | 0.00 | 0.00 | 0.00 | 0.03 | 0.01 | 0.00 | 0.00 | 10.87 | 0.79 | 37.60 | 1.99 | 0.00 |

| Canada | 67.61 | 11.44 | 137.05 | 0.49 | 0.36 | 0.01 | 2.16 | 43.72 | 0.17 | 0.00 | 19.96 | 60.46 |

| Chile | 42.22 | 3.38 | 77.02 | 0.06 | 0.03 | 0.00 | 0.72 | 31.88 | 1.87 | 0.00 | 12.42 | 26.57 |

| China | 75.67 | 9.36 | 62.77 | 0.11 | 0.10 | 0.00 | 3.82 | 0.00 | 6.02 | 0.00 | 0.00 | 58.49 |

| Colombia | −19.03 | 2.28 | 37.09 | 0.02 | 0.03 | 0.00 | 2.04 | 24.18 | 3.07 | 63.00 | 16.25 | 2.54 |

| Costa Rica | 0.00 | 0.00 | 3.45 | 0.04 | 0.02 | 0.00 | 0.00 | 21.38 | 1.44 | 0.00 | 11.80 | 0.00 |

| Côte d’Ivoire | 35.86 | 0.52 | 13.45 | 0.04 | 0.03 | 0.00 | 0.00 | 7.10 | 1.95 | 35.50 | 1.16 | 0.00 |

| Croatia | 37.26 | 0.21 | 35.87 | 0.02 | 0.04 | 0.00 | 4.08 | 35.24 | 1.75 | 26.20 | 17.85 | 26.39 |

| Cyprus | 40.50 | 0.00 | 16.08 | 1.55 | 0.19 | 0.00 | 0.00 | 38.40 | 1.35 | 39.70 | 26.71 | 35.38 |

| Czech Republic | 0.00 | 1.61 | 10.62 | 0.09 | 0.03 | 0.00 | 0.38 | 40.05 | 0.93 | 43.60 | 13.87 | 53.27 |

| Denmark | 85.73 | 14.24 | 0.00 | 0.39 | 0.16 | 0.00 | 1.70 | 48.89 | 0.39 | 40.60 | 25.30 | 56.17 |

| Dominican Republic | 0.00 | 0.22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 15.19 | 2.97 | 23.40 | 9.65 | 0.00 |

| Ecuador | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.25 | 12.48 | −0.83 | 73.70 | 8.58 | 0.00 |

| Egypt | 47.84 | 0.57 | 14.24 | 0.04 | 0.05 | 0.00 | 0.21 | 22.76 | 3.28 | 7.90 | 5.72 | 6.32 |

| El Salvador | 0.00 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 | 14.79 | 0.98 | 53.80 | 4.91 | 0.00 |

| Estonia | 46.91 | 0.00 | 0.00 | 1.29 | 0.71 | 0.02 | 23.84 | 46.83 | 1.95 | 40.70 | 28.05 | 43.19 |

| Ethiopia | 0.00 | 0.39 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 4.39 | 3.98 | 20.80 | 0.31 | 2.18 |

| Finland | 73.01 | 11.76 | 0.00 | 0.31 | 0.20 | 0.00 | 4.39 | 47.42 | −0.49 | 50.20 | 26.42 | 62.03 |

| France | 87.99 | 18.38 | 92.67 | 0.25 | 0.16 | 0.00 | 2.12 | 47.74 | −0.25 | 67.90 | 25.29 | 61.76 |

| Georgia | 0.00 | 1.27 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 24.71 | 5.77 | 32.00 | 18.08 | 0.00 |

| Germany | 73.61 | 15.63 | 52.28 | 0.23 | 0.12 | 0.00 | 1.96 | 46.13 | −0.05 | 44.10 | 15.62 | 60.13 |

| Ghana | −52.75 | 0.00 | 13.20 | 0.05 | 0.05 | 0.00 | 0.00 | 9.58 | 2.00 | 40.10 | 2.93 | 0.00 |

| Greece | 55.95 | 0.72 | 23.74 | 0.06 | 0.01 | 0.00 | 1.47 | 31.96 | −0.56 | 21.60 | 20.10 | 29.76 |

| Guatemala | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 9.32 | 1.52 | 55.70 | 2.72 | 3.54 |

| Guinea | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.40 | 2.90 | 16.00 | 2.24 | 0.00 |

| Honduras | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 12.26 | 0.86 | 47.70 | 4.83 | 3.35 |

| Hungary | 45.32 | 0.85 | 18.62 | 0.05 | 0.02 | 0.00 | 0.00 | 38.73 | 2.41 | 29.30 | 18.32 | 60.62 |

| Iceland | 54.98 | 0.71 | 0.00 | 0.64 | 0.43 | 0.01 | 0.00 | 52.19 | 0.61 | 0.00 | 26.46 | 53.07 |

| India | 78.63 | 5.52 | 87.50 | 0.11 | 0.11 | 0.01 | 5.04 | 12.96 | 1.59 | 35.90 | 2.60 | 30.67 |

| Indonesia | 69.72 | 3.16 | 46.77 | 0.03 | 0.03 | 0.00 | 2.10 | 10.87 | 1.29 | 7.70 | 6.33 | 7.51 |

| Iran (Islamic Republic of) | 0.00 | 0.04 | 221.51 | 0.00 | 0.00 | 0.00 | 0.00 | 19.93 | 0.39 | 0.00 | 7.57 | 19.25 |

| Ireland | 81.76 | 4.34 | 37.40 | 0.27 | 0.10 | 0.00 | 1.83 | 47.20 | −0.07 | 59.80 | 29.49 | 45.55 |

| Israel | 66.81 | 2.40 | 57.39 | 0.92 | 0.69 | 0.02 | 9.65 | 51.89 | 2.37 | 18.60 | 24.24 | 0.00 |

| Italy | 77.57 | 9.97 | 26.33 | 0.04 | 0.03 | 0.00 | 0.10 | 35.68 | 0.25 | 12.60 | 13.91 | 48.79 |

| Jamaica | 53.37 | 8.08 | 86.99 | 0.03 | 0.00 | 0.00 | 0.00 | 21.64 | −1.91 | 0.00 | 4.14 | 0.00 |

| Japan | 69.03 | 15.96 | 119.76 | 0.20 | 0.14 | 0.00 | 0.20 | 20.84 | −0.61 | 0.00 | 22.94 | 75.10 |

| Jordan | 39.73 | 0.86 | 46.80 | 0.11 | 0.08 | 0.00 | 0.00 | 22.96 | −1.01 | 16.90 | 8.40 | 0.00 |

| Kazakhstan | 13.21 | 0.31 | 23.94 | 0.00 | 0.00 | 0.00 | 0.00 | 36.92 | 1.62 | 21.80 | 20.72 | 0.00 |

| Kenya | −18.34 | 1.76 | 23.11 | 0.10 | 0.16 | 0.00 | 0.00 | 13.80 | 2.47 | 37.40 | 1.68 | 0.00 |

| Kuwait | 51.19 | 7.85 | 93.38 | 0.05 | 0.01 | 0.00 | 0.00 | 22.65 | 1.12 | 0.00 | 0.00 | 0.00 |

| Kyrgyzstan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 18.06 | −0.01 | 41.40 | 11.73 | 0.00 |

| Lao People’s Democratic Republic | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.59 | 1.57 | 24.40 | 3.81 | 0.00 |

| Latvia | −18.72 | 0.00 | 0.00 | 0.12 | 0.08 | 0.00 | 0.00 | 44.74 | 2.27 | 52.90 | 27.07 | 25.52 |

| Lebanon | 0.00 | 0.00 | 17.88 | 0.15 | 0.04 | 0.00 | 0.00 | 27.50 | −4.86 | 20.80 | 14.60 | 0.00 |

| Lithuania | 17.54 | 0.00 | 0.00 | 0.16 | 0.14 | 0.00 | 8.44 | 46.59 | 1.98 | 27.50 | 30.79 | 30.85 |

| Luxembourg | 71.58 | 11.55 | 67.58 | 1.93 | 0.10 | 0.00 | 2.38 | 64.13 | −1.15 | 66.10 | 27.61 | 31.57 |

| Madagascar | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.66 | −0.92 | 12.70 | 1.94 | 0.00 |

| Malaysia | 62.68 | 10.15 | 116.99 | 0.11 | 0.09 | 0.00 | 0.36 | 28.24 | 1.29 | 24.00 | 14.69 | 15.83 |

| Mali | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 | 3.56 | 0.24 | 17.70 | 0.48 | 31.43 |

| Malta | 64.65 | 5.25 | 33.62 | 1.14 | 0.09 | 0.01 | 0.00 | 45.53 | −0.07 | 49.90 | 17.17 | 47.70 |

| Mauritania | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.35 | 52.70 | 0.65 | 0.00 |

| Mauritius | 46.10 | 0.00 | 60.18 | 2.20 | 0.12 | 0.01 | 0.00 | 23.20 | 0.73 | 0.00 | 9.23 | 4.40 |

| Mexico | 72.42 | 4.86 | 33.58 | 0.02 | 0.02 | 0.00 | 1.27 | 20.02 | −1.79 | 0.00 | 10.42 | 47.23 |

| Mongolia | −42.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 26.77 | 0.00 | 66.20 | 23.93 | 0.00 |

| Montenegro | −181.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 36.72 | 1.40 | 15.80 | 18.19 | 12.58 |

| Morocco | 61.59 | 1.33 | 50.92 | 0.04 | 0.03 | 0.00 | 0.00 | 8.15 | 1.29 | 35.70 | 3.01 | 6.98 |

| Mozambique | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 3.85 | −0.77 | 20.70 | 0.75 | 0.30 |

| Namibia | 0.00 | 0.00 | 18.81 | 0.00 | 0.00 | 0.00 | 0.00 | 18.08 | −2.07 | 25.40 | 7.40 | 6.95 |

| Nepal | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 13.23 | 1.80 | 31.90 | 2.93 | 0.00 |

| Netherlands | 80.48 | 9.14 | 109.95 | 0.37 | 0.12 | 0.00 | 2.20 | 53.65 | −0.14 | 54.10 | 23.25 | 70.15 |

| New Zealand | 58.40 | 3.51 | 51.21 | 0.23 | 0.14 | 0.00 | 0.00 | 0.00 | 1.07 | 0.00 | 21.54 | 35.71 |

| Nicaragua | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.80 | −0.58 | 57.30 | 6.09 | 0.00 |

| Niger | 0.00 | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 | 0.00 | 15.27 | 1.88 | 27.50 | 0.66 | 0.00 |

| Nigeria | 47.52 | 0.45 | 10.12 | 0.05 | 0.06 | 0.00 | 0.35 | 38.14 | −1.07 | 30.70 | 5.83 | 0.00 |

| North Macedonia | −26.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 33.16 | 1.26 | 39.00 | 16.99 | 27.88 |

| Norway | 64.09 | 7.54 | 68.75 | 0.19 | 0.08 | 0.00 | 0.93 | 52.27 | 0.22 | 0.00 | 27.64 | 51.04 |

| Oman | 33.97 | 0.68 | 20.56 | 0.07 | 0.01 | 0.00 | 0.00 | 15.90 | 2.90 | 0.00 | 0.90 | 0.32 |

| Pakistan | 53.76 | 0.00 | 0.00 | 0.02 | 0.02 | 0.00 | 0.00 | 11.44 | 0.88 | 32.00 | 2.00 | 0.00 |

| Panama | 2.49 | 0.39 | 25.24 | 0.02 | 0.01 | 0.00 | 0.00 | 10.90 | 0.36 | 0.00 | 11.34 | 0.00 |

| Paraguay | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 20.59 | −0.13 | 46.40 | 9.55 | 0.00 |

| Peru | 44.92 | 0.71 | 42.82 | 0.01 | 0.01 | 0.00 | 0.00 | 14.93 | 0.63 | 65.90 | 11.52 | 0.00 |

| Philippines | 56.97 | 3.89 | 74.30 | 0.04 | 0.02 | 0.00 | 0.23 | 17.51 | 0.48 | 59.80 | 12.25 | 51.82 |

| Poland | 72.12 | 4.39 | 27.44 | 0.03 | 0.02 | 0.00 | 0.00 | 41.52 | 3.30 | 21.70 | 22.62 | 53.15 |

| Portugal | 67.90 | 4.92 | 29.15 | 0.13 | 0.06 | 0.00 | 0.00 | 41.92 | 0.76 | 29.00 | 21.20 | 43.98 |

| Qatar | 48.04 | 9.42 | 98.16 | 0.06 | 0.00 | 0.00 | 0.00 | 21.88 | 0.32 | 0.00 | 5.30 | 16.08 |

| Republic of Korea | 63.36 | 16.81 | 101.41 | 0.12 | 0.03 | 0.00 | 1.82 | 39.59 | 1.21 | 0.00 | 21.37 | 82.94 |

| Republic of Moldova | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 | 17.71 | 2.22 | 38.10 | 10.90 | 6.20 |

| Romania | 49.68 | 1.45 | 9.71 | 0.03 | 0.02 | 0.00 | 0.00 | 28.24 | 3.32 | 20.50 | 13.25 | 33.14 |

| Russian Federation | 51.53 | 3.30 | 42.72 | 0.02 | 0.00 | 0.00 | 0.00 | 45.48 | 1.26 | 11.80 | 26.14 | 46.54 |

| Rwanda | 0.00 | 0.00 | 31.04 | 0.00 | 0.13 | 0.00 | 0.00 | 6.53 | 5.95 | 35.90 | 3.28 | 5.57 |

| Saudi Arabia | 65.06 | 9.94 | 235.21 | 0.06 | 0.02 | 0.00 | 0.00 | 0.00 | −1.92 | 0.00 | 0.00 | 0.00 |

| Senegal | 0.00 | 1.50 | 0.00 | 0.08 | 0.07 | 0.00 | 5.71 | 4.63 | 0.90 | 17.40 | 0.96 | 0.00 |

| Serbia | −110.41 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.27 | 3.12 | 38.30 | 15.16 | 10.49 |

| Singapore | 42.44 | 13.55 | 185.67 | 1.87 | 0.90 | 0.01 | 5.12 | 59.87 | 2.10 | 0.00 | 29.61 | 54.15 |

| Slovakia | −175.02 | 0.20 | 5.56 | 0.05 | 0.02 | 0.00 | 0.00 | 38.31 | 1.09 | 43.30 | 18.85 | 27.16 |

| Slovenia | −164.65 | 0.45 | 14.58 | 0.03 | 0.04 | 0.00 | 0.00 | 46.66 | 1.63 | 44.00 | 25.68 | 59.87 |

| South Africa | 58.40 | 8.43 | 265.81 | 0.11 | 0.06 | 0.00 | 0.61 | 22.30 | 1.27 | 7.90 | 10.04 | 11.38 |

| Spain | 64.46 | 8.24 | 55.85 | 0.10 | 0.06 | 0.00 | 0.50 | 35.71 | −0.49 | 55.20 | 24.88 | 39.17 |

| Sri Lanka | 46.56 | 0.00 | 17.62 | 0.01 | 0.01 | 0.00 | 0.00 | 21.73 | −0.61 | 0.00 | 3.74 | 20.02 |

| Sweden | 79.41 | 17.76 | 0.00 | 0.39 | 0.17 | 0.01 | 3.46 | 57.14 | 0.99 | 61.90 | 28.70 | 77.55 |

| Switzerland | 76.18 | 22.59 | 241.15 | 0.72 | 0.26 | 0.00 | 1.47 | 50.93 | 0.91 | 0.00 | 20.74 | 48.28 |

| Tajikistan | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 | 5.31 | 24.30 | 0.00 | 0.00 |

| Thailand | 66.48 | 7.39 | 104.05 | 0.14 | 0.13 | 0.00 | 0.60 | 13.66 | −0.05 | 18.00 | 10.59 | 60.76 |

| Togo | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 14.10 | 1.79 | 33.70 | 0.91 | 0.00 |

| Trinidad and Tobago | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 | 31.89 | −0.41 | 0.00 | 12.83 | 1.40 |

| Tunisia | 37.42 | 0.00 | 19.98 | 0.05 | 0.04 | 0.00 | 0.00 | 15.85 | 0.23 | 19.10 | 8.81 | 5.24 |

| T¼rkiye | 75.04 | 1.30 | 25.49 | 0.03 | 0.02 | 0.00 | 1.36 | 23.95 | 2.63 | 30.70 | 11.33 | 66.89 |

| Uganda | 0.00 | 0.00 | 0.00 | 0.01 | 0.06 | 0.00 | 0.00 | 4.51 | 0.61 | 34.70 | 3.28 | 3.96 |

| United Arab Emirates | 60.34 | 12.13 | 65.86 | 0.34 | 0.09 | 0.01 | 0.97 | 35.12 | 0.99 | 0.00 | 12.18 | 77.86 |

| United Kingdom | 85.16 | 14.05 | 126.59 | 0.61 | 0.28 | 0.01 | 5.21 | 50.56 | 0.35 | 0.00 | 24.15 | 41.78 |

| United Republic of Tanzania | 0.00 | 0.00 | 10.39 | 0.01 | 0.03 | 0.00 | 0.00 | 3.23 | 2.94 | 30.70 | 0.15 | 0.00 |

| United States of America | 93.40 | 20.56 | 166.70 | 0.41 | 0.32 | 0.01 | 7.83 | 51.46 | 1.38 | 0.00 | 27.92 | 80.44 |

| Uruguay | 0.00 | 0.00 | 0.00 | 0.34 | 0.03 | 0.00 | 0.00 | 24.74 | 0.50 | 53.30 | 10.42 | 0.79 |

| Uzbekistan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.00 | 16.90 | 8.05 | 12.90 |

| Viet Nam | 59.31 | 8.37 | 47.08 | 0.04 | 0.04 | 0.00 | 1.12 | 7.80 | 5.34 | 22.20 | 7.45 | 24.06 |

| Zambia | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 | 10.62 | −1.30 | 36.60 | 3.77 | 0.00 |

| Zimbabwe | 46.54 | 0.46 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 9.42 | −1.79 | 26.40 | 9.77 | 0.00 |

Appendix B

| № | Knowledge-Intensive Employment, % | Labor Productivity Growth, % | Females Employed w/Advanced Degrees, % | Research Talent, % in Businesses | № | Knowledge-Intensive Employment, % | Labor Productivity Growth, % | Females Employed w/Advanced Degrees, % | Research Talent, % in Businesses |

| 1 | 19.8415 | 2.64886 | 5.04395 | 2.14793 | 51 | 24.6127 | 4.17243 | 24.6064 | 6.82573 |

| 2 | 17.4396 | 2.80581 | 5.87802 | 4.81803 | 52 | 16.9063 | −0.1816 | 8.92065 | 16.6468 |

| 3 | 5.90166 | 2.36295 | 1.13146 | 56.1988 | 53 | 25.3801 | 0.97133 | 1.51095 | −17.298 |

| 4 | 41.3536 | −0.0055 | 27.7812 | −14.721 | 54 | 25.1465 | 1.70548 | −1.6379 | 20.0519 |

| 5 | 36.2483 | 0.30288 | 15.9056 | 22.0001 | 55 | 26.8002 | 0.52825 | 8.93347 | 5.0839 |

| 6 | 45.5569 | −0.7942 | 16.2571 | −22.838 | 56 | 20.5914 | 1.40411 | 0.14253 | 8.96998 |

| 7 | 43.6174 | 2.33261 | 11.8516 | 29.9359 | 57 | 17.2771 | 4.21122 | 14.3034 | 48.0879 |

| 8 | 6.83933 | −0.2021 | 10.5689 | 37.0207 | 58 | 25.2799 | 2.40387 | 23.7908 | −16.12 |

| 9 | 8.45883 | −1.3894 | −2.1889 | −21.213 | 59 | 23.154 | 1.62115 | 11.0211 | 29.8494 |

| 10 | 10.2552 | 1.22545 | 9.1317 | 48.2637 | 60 | 18.0556 | −0.2353 | 9.46851 | 37.3748 |

| 11 | 49.4302 | −1.169 | 12.2922 | −6.8187 | 61 | 10.4885 | −0.9857 | 7.05626 | 2.00177 |

| 12 | 15.9996 | 1.25322 | 10.2399 | 54.1409 | 62 | 34.2584 | 4.42205 | 13.2895 | −6.3978 |

| 13 | 24.9179 | 1.1836 | 19.8098 | −21.951 | 63 | 35.1362 | 0.09722 | −3.6359 | 27.9782 |

| 14 | 10.3704 | −3.2898 | 15.0689 | −8.9231 | 64 | 34.9826 | −0.3492 | 15.3822 | 1.4286 |

| 15 | 15.505 | 3.12606 | 19.2479 | 17.0841 | 65 | 20.4068 | 2.78988 | 9.32104 | 45.362 |

| 16 | 38.099 | −0.4856 | 7.05542 | 9.1344 | 66 | 28.065 | 3.64094 | 20.3741 | 27.1329 |

| 17 | 29.8173 | 1.29272 | 16.6192 | −8.82 | 67 | 35.6457 | 0.27602 | 11.1313 | 1.22496 |

| 18 | 13.4344 | 1.44507 | 15.187 | 59.1159 | 68 | 49.6758 | −0.3968 | 9.11449 | 53.4725 |

| 19 | −15.516 | 0.32854 | 4.11925 | 44.607 | 69 | 3.65846 | −0.9156 | 13.8656 | 55.2677 |

| 20 | 27.5414 | 1.16446 | 11.6073 | 37.0135 | 70 | 23.6441 | 0.55707 | 6.42041 | −3.939 |

| 21 | 28.9543 | −2.7726 | 18.2101 | 49.0718 | 71 | 12.6036 | 3.73215 | 8.18588 | 30.1237 |

| 22 | 61.293 | 2.39274 | 27.0525 | 17.6829 | 72 | 28.3286 | 2.20057 | −7.7377 | 39.915 |

| 23 | 58.1741 | 0.89327 | 16.6341 | 27.0832 | 73 | 18.8266 | 1.83895 | 20.0617 | 10.2429 |

| 24 | 6.68848 | −1.0104 | 17.4862 | 25.7322 | 74 | 39.8778 | 1.24522 | 23.2449 | −0.9504 |

| 25 | 63.7401 | 0.76248 | 12.3598 | 23.2385 | 75 | 28.1658 | −0.9282 | 22.7336 | 7.45331 |

| 26 | 45.7176 | 0.94556 | 3.83464 | 65.208 | 76 | 39.2179 | 1.02954 | −2.7301 | 27.4198 |

| 27 | 45.9725 | 0.52897 | 10.1755 | 7.54134 | 77 | 4.35729 | −1.2018 | −10.555 | 15.5491 |

| 28 | 26.8636 | −0.4066 | 6.5161 | 18.1527 | 78 | 15.906 | 0.57545 | 8.69181 | 19.925 |

| 29 | 29.9118 | 1.78584 | 14.4045 | −37.404 | 79 | −7.5609 | −1.1855 | 1.60022 | −7.7279 |

| 30 | 61.7451 | 0.35197 | 21.65 | −14.198 | 80 | −0.7099 | 3.26039 | 16.1294 | −22.243 |

| 31 | 38.825 | 0.26692 | 2.65299 | 41.7594 | 81 | 20.5812 | 0.28131 | 4.30814 | −3.7112 |

| 32 | 0.34624 | −0.4548 | 6.38922 | −17.852 | 82 | 6.37474 | 1.57823 | 10.9036 | 26.3641 |

| 33 | 15.1486 | 1.57794 | 16.9825 | 49.0937 | 83 | 63.7401 | 0.64585 | 21.1216 | 5.68386 |

| 34 | 42.0151 | 0.60766 | −0.983 | 29.4043 | 84 | 40.0342 | −2.2747 | 19.6791 | 45.4498 |

| 35 | 24.7857 | −0.4097 | 9.67991 | 8.82651 | 85 | 33.1306 | 3.70375 | 10.91 | 8.42402 |

| 36 | 42.3148 | −2.5901 | −0.6479 | −3.3367 | 86 | 23.82 | −0.6331 | 16.0092 | 46.1176 |

| 37 | −2.416 | −0.6983 | 15.1966 | 54.3059 | 87 | 60.8236 | 1.52404 | 19.1261 | 23.8386 |

| 38 | 36.3259 | 2.38904 | 0.16446 | 11.1814 | 88 | 19.8402 | 0.07786 | 20.4321 | 21.8903 |

| 39 | −7.073 | −2.2633 | 45.1396 | 56.5864 | 89 | 24.0898 | −0.3665 | −8.9069 | 51.4596 |

| 40 | 40.293 | 3.59581 | 29.3925 | 10.0984 | 90 | 31.2808 | −0.6216 | 12.8406 | 43.8701 |

| 41 | 31.4629 | −0.8995 | 13.9228 | 36.4157 | 91 | 15.4171 | 0.84507 | 25.2406 | 40.3078 |

| 42 | 40.5084 | 1.69697 | −3.305 | −13.342 | 92 | 32.7516 | 1.79909 | 15.3383 | 19.2323 |

| 43 | 30.7196 | 1.85764 | 23.7177 | 20.3653 | 93 | 51.9965 | 3.22198 | 4.74357 | 27.1489 |

| 44 | 37.4255 | 0.32554 | 16.9993 | −16.566 | 94 | 9.00534 | 0.4552 | 15.9535 | 5.88956 |

| 45 | 24.0478 | 0.71669 | 6.22794 | 48.6587 | 95 | 27.37 | 4.708 | 10.1574 | 24.9824 |

| 46 | 4.57732 | −1.1163 | 3.95455 | 33.1608 | 96 | 30.0754 | 2.81439 | 11.1455 | 45.3027 |

| 47 | 18.4229 | −2.832 | 13.589 | 37.6063 | 97 | 7.43428 | −1.0714 | 1.55432 | 44.9402 |

| 48 | 52.8901 | 1.90106 | 13.1055 | 56.1202 | 98 | 25.2157 | 1.60515 | −0.3039 | 7.54574 |

| 49 | 27.7131 | 0.64159 | 0.76147 | −20.955 | 99 | 0.19208 | 1.76807 | 15.3732 | 17.6617 |

| 50 | 25.1798 | −1.7963 | 28.5084 | −0.5728 | 100 | 35.7368 | 1.37937 | −2.2699 | −23.053 |

References

- Al-Ghazali, Hussam Ali Abdel-Sada, Hawraa Falyyih Hasan, and Ammar Saleem Mohammed Al-Ameri. 2024. Analysis of the Company’s Financial Performance under the Risks of (COVID-19) a Case Study in Industrial Companies. AIP Conference Proceedings 3092: 080027. [Google Scholar] [CrossRef]

- Aust, Ina, Fang Lee Cooke, Michael Muller-Camen, and Geoffrey Wood. 2024. Achieving sustainable development goals through common-good HRM: Context, approach and practice. German Journal of Human Resource Management 38: 93–110. [Google Scholar] [CrossRef]

- Azzam, Mohammad, and Eman Abu-Shamleh. 2024. Does the COVID-19 pandemic create an incentive for firms to manage earnings? The role of board independence and corporate social responsibility. Decision Science Letters 13: 99–110. [Google Scholar] [CrossRef]

- Baruník, Jozef, and Michael Ellington. 2024. Persistence in financial connectedness and systemic risk. European Journal of Operational Research 314: 393–407. [Google Scholar] [CrossRef]

- Bashir, Huma, Muntaz Ali Memon, and Nuttawuth Muenjohn. 2024. Fostering a safe workplace: The transformative impact of responsible leadership and employee-oriented HRM. International Journal of Manpower. [Google Scholar] [CrossRef]

- Ben Lahouel, Bechir, Taleb Lotfi, Younes Ben Zaied, and Shunsuke Managi. 2024. Financial stability, liquidity risk and income diversification: Evidence from European banks using the CAMELS–DEA approach. Annals of Operations Research 334: 391–422. [Google Scholar] [CrossRef]

- Bogoviz, Aleksei, Evgeny Shvakov, Olga Tretyakova, Mikhail Zakharov, and Aleksandr Abramov. 2020. Globalization of Education in the Conditions of Formation of the Global Knowledge Economy: Regularities and Tendencies. Lecture Notes in Networks and Systems 73: 993–1000. [Google Scholar] [CrossRef]

- Brewster, Chris, and Michael Brookes. 2024. Sustainable development goals and new approaches to HRM: Why HRM specialists will not reach the sustainable development goals and why it matters. German Journal of Human Resource Management 38: 183–201. [Google Scholar] [CrossRef]

- D’Amico, Guglielmo, Bice Di Basilio, and Filippo Petroni. 2024. Drawdown-based risk indicators for high-frequency financial volumes. Financial Innovation 10: 83. [Google Scholar] [CrossRef]

- Deng, Shangkun, Qunfang Luo, Yingke Zhu, Hong Ning, and Tatsuro Shimada. 2024. Financial risk forewarning with an interpretable ensemble learning approach: An empirical analysis based on Chinese listed companies. Pacific Basin Finance Journal 85: 102393. [Google Scholar] [CrossRef]

- Duan, Wei, Nan Hu, and Fujing Xue. 2024. The information content of financial statement fraud risk: An ensemble learning approach. Decision Support Systems 182: 114231. [Google Scholar] [CrossRef]

- Fortune. 2024. Global 500 Excel List. Available online: https://fortune.com/ranking/global500/ (accessed on 29 March 2024).

- Frintrup, Markus, and Dennis Hilgers. 2024. Drivers and risk factors of German local financial sustainability focusing on adjusted income. International Review of Administrative Sciences 90: 29–47. [Google Scholar] [CrossRef]

- Galoyan, Diana R., Firuza N. Mayilyan, Yevgenya A. Bazinyan, Manuk E. Movsisyan, and Alik A. Torosyan. 2023a. Triple Exploitation of Human Capital in Developing Countries. Environmental Footprints and Eco-Design of Products and Processes 2023: 375–83. [Google Scholar]

- Galoyan, Diana, Tatul Mkrtchyan Viktoriia Hrosul, Roman Buhrimenko Polina Smirnova, and Hanna Balamut. 2023b. Formation of Adaptation Strategy for Business Entities in the Context of Digital Transformation of the Economy. Review of Economics and Finance 21: 616–21. [Google Scholar]

- Gara, Atdhatar, Vesa Qehaja-Keka, Arber Hoti, and Driton Qehaja. 2024. The evolving financial landscape: Analyzing uncertainty, risks, and growth in G7 economies of the 21st century. Multidisciplinary Science Journal 6: e2024077. [Google Scholar] [CrossRef]

- Guo, Yixuan, Hongyan Ge, Zhicheng Liao, Yaoyu Hu, and Bihui Huang. 2024. The influence of financial innovation on enterprise risk management. Finance Research Letters 62: 105098. [Google Scholar] [CrossRef]

- Hojer, A., and Virginie Mataigne. 2024. CSR in the banking industry: A longitudinal analysis of the impact on financial performance and risk-taking. Finance Research Letters 64: 105497. [Google Scholar] [CrossRef]

- Horvath, Jaroslav, and Guanyi Yang. 2024. Global Financial Risk, Equity Returns and Economic Activity in Emerging Countries. Oxford Bulletin of Economics and Statistics 86: 672–89. [Google Scholar] [CrossRef]

- Hsiao, Hsiao-Fen, Tingtong Zhong, and Jun Wang. 2024. Does national culture influence corporate social responsibility on firm performance? Humanities and Social Sciences Communications 11: 5. [Google Scholar] [CrossRef]

- Hu, Yan, and Jian Ni. 2024. A deep learning-based financial hedging approach for the effective management of commodity risks. Journal of Futures Markets 44: 879–900. [Google Scholar] [CrossRef]

- Huang, Yu-Fan, Wenting Liao, Sui Luo, and Jun Ma. 2024. Financial conditions, macroeconomic uncertainty, and macroeconomic tail risks. Journal of Economic Dynamics and Control 163: 104871. [Google Scholar] [CrossRef]

- Jin, Hebo, Xuexiao Li, and Guangsen Li. 2024. Impact of corporate social responsibility on employee loyalty: Mediating role of person-organization fit and employee trust. PLoS ONE 19: e0300933. [Google Scholar] [CrossRef]

- Khasanov, Bakhodir Akramovich, U. T. Eshboev, R. B. Hasanova, Z. A. Mukumov, A. I. Alikulov, and A. B. Djumanova. 2019. Calculation of the invested capital profitability in the financial condition analysis process. International Journal of Advanced Science and Technology 28: 42–48. [Google Scholar]

- Labelle, Francois, Annick Parent-Lamarche, Siba Theodore Koropogui, and Rahma Chouchane. 2024. The relationship between sustainable HRM practices and employees’ attraction: The influence of SME managers’ values and intentions. Journal of Organizational Effectiveness. [Google Scholar] [CrossRef]

- Lai, Jieji, and Shiyang Hu. 2024. Bankruptcy judicial system reform and corporate financial litigation risk: A quasi-natural experiment in China. Finance Research Letters 62: 105182. [Google Scholar] [CrossRef]

- Lang, Chunlim, Danyang Xu, Shaen Corbet, Yang Hu, and John Goodell. 2024. Global operational risk and market connectedness: An empirical analysis of COVOL and major financial markets. International Review of Financial Analysis 93: 103152. [Google Scholar] [CrossRef]

- Liang, Yuan, Tung-Ju Wu, and Yushu Wang. 2024. Forced shift to teleworking: How abusive supervision promotes counterproductive work behavior when employees experience COVID-19 corporate social responsibility. Journal of Organizational Change Management 37: 192–213. [Google Scholar] [CrossRef]

- Liu, Haiming, and Yao-Min Chiang. 2024. Employment protection and environmental corporate social responsibility: Evidence from China. International Review of Financial Analysis 92: 103078. [Google Scholar] [CrossRef]

- Liu, Yu. 2024. Discussion on the Enterprise Financial Risk Management Framework Based on AI Fintech. Decision Making: Applications in Management and Engineering 7: 254–69. [Google Scholar] [CrossRef]

- Lobova, Svetlana, Alexander Alekseev, Tatiana Litvinova, and Natalia Sadovnikova. 2020. Labor division and advantages and limits of participation in creation of intangible assets in industry 4.0: Humans versus machines. Journal of Intellectual Capital 21: 623–38. [Google Scholar] [CrossRef]

- Mamaeva, Diana, Lyudmila Shabaltina, Vera Garnova, Elena Petrenko, and Stanislav Borovsky. 2020. Digital transformation of higher educational system. Journal of Physics Conference Series 1691: 012081. [Google Scholar] [CrossRef]

- Martini, Mattia, Egidio Riva, and Elisabetta Marafioti. 2023. Sustainable HRM, training for employability and organizational outcomes: The moderating role of competitive intensity. Employee Relations 45: 79–102. [Google Scholar] [CrossRef]

- Musallam, Sami. 2024. The effect of the board of directors on financial performance and the existence of risk management as an intervening variable. Journal of Islamic Marketing 15: 1097–114. [Google Scholar] [CrossRef]

- Nakra, Neelam, and Vaneet Kashyap. 2023. Investigating the link between socially-responsible HRM and organizational sustainability performance—An HRD perspective. European Journal of Training and Development. [Google Scholar] [CrossRef]

- Ouyang, Zisheng, Xuewei Zhou, Min Lu, and Ke Liu. 2024. Imported operational risk in global stock markets: Evidence from the interconnected network. Research in International Business and Finance 69: 102300. [Google Scholar] [CrossRef]

- Qamar, Faisal, Gul Afshan, and Salman Anwar Rana. 2023. Sustainable HRM and well-being: Systematic review and future research agenda. Management Review Quarterly. [Google Scholar] [CrossRef]

- Shevyakova, Anasatasi, Elena Petrenko, Yulia Vechkinzova, and Anna Koroleva. 2019. Features of the development of female entrepreneurship in Kazakhstan. Paper presented at the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management through Vision, Granada, Spain, April 10–11; pp. 6587–95. [Google Scholar]

- Sozinova, Anastasia, Igor Denisov, Stanislav Benčič, and Nikita Stolyarov. 2023. Intellectual economic growth in the ‘knowledge economy’ as the basis for the development of international trade in modern global markets. International Journal of Trade and Global Markets 18: 230–41. [Google Scholar] [CrossRef]

- Tee, Kienpin, Xihui Haviour Chen, and Chee-Wool Hool. 2024. The evolution of corporate social responsibility in China: Do political connection and ownership matter? Global Finance Journal 60: 100941. [Google Scholar] [CrossRef]

- Tursunov, Bobir. 2022. Financial security in small business in period of digital economy: In case of Uzbekistan. ACM International Conference Proceeding Series 2022: 491–98. [Google Scholar]

- Vaughan, Yue, Yinyoung Rhou, Yoom Koh, and Manisha Singal. 2024. Slack resources and employee-centered corporate social responsibility in restaurant companies. Tourism Economics 30: 592–614. [Google Scholar] [CrossRef]

- WIPO. 2024. Global Innovation Index 2023: Innovation in the Face of Uncertainty. Available online: https://www.wipo.int/global_innovation_index/en/2023/ (accessed on 29 March 2024).

- Xing, Frank. 2024. Financial risk tolerance profiling from text. Information Processing and Management 61: 103704. [Google Scholar] [CrossRef]

- Yang, Jianlei. 2024. Financial stability policy and downside risk in stock returns. North American Journal of Economics and Finance 73: 102196. [Google Scholar] [CrossRef]

- Yang, Ming-Yang, Zhen-Guo Wu, Xin Wu, and Sai-Ping Li. 2024. Influential risk spreaders and systemic risk in Chinese financial networks. Emerging Markets Review 60: 101138. [Google Scholar] [CrossRef]

- Zhu, H., and E. Wagner. 2024. Is corporate social responsibility a matter of trust? A cross-country investigation. International Review of Financial Analysis 93: 103127. [Google Scholar] [CrossRef]

- Zhu, R., and F. Chen. 2024. Tax and financial credit risks—Empirical evidence from Chinese investment enterprises. Finance Research Letters 61: 104917. [Google Scholar] [CrossRef]

| Country | Revenues ($millions) | Revenue Change | Profits ($millions) | Profit Change | Assets ($millions) |

|---|---|---|---|---|---|

| Australia | −0.1607 | −0.2158 | −0.5723 | 0.1576 | −0.4610 |

| Belgium | 0.9489 | −0.6037 | 0.6655 | −0.7674 | 0.9971 |

| Brazil | 0.3761 | −0.2081 | −0.1656 | −0.1189 | −0.1737 |

| Britain | 0.2538 | −0.1630 | 0.1252 | −0.0966 | 0.2081 |

| Canada | 0.3868 | −0.2768 | −0.2687 | −0.1110 | −0.0827 |

| China | 0.7526 | −0.0450 | 0.3401 | −0.0819 | 0.3207 |

| Denmark | −0.1791 | −0.8972 | 0.3847 | 0.9954 | 0.7137 |

| Finland | −0.7278 | −0.6267 | −0.9702 | −0.9999 | −0.6697 |

| France | −0.1235 | −0.0531 | −0.3302 | −0.0534 | −0.1784 |

| Germany | 0.5239 | −0.2053 | 0.2809 | −0.1415 | 0.0176 |

| India | 0.4279 | −0.0200 | 0.6272 | −0.0995 | 0.7142 |

| Ireland | 0.9707 | 0.6066 | 0.7587 | −0.1150 | −0.4758 |

| Italy | −0.5749 | −0.2667 | 0.2466 | 0.6464 | 0.3373 |

| Japan | 0.5728 | −0.0452 | 0.2850 | 0.0266 | 0.0821 |

| Mexico | −0.6601 | 0.1283 | 0.4829 | −0.2504 | −0.9974 |

| Netherlands | 0.2668 | 0.1000 | 0.0651 | 0.0878 | −0.2453 |

| Russia | 0.0702 | 0.0061 | 0.2942 | −0.3779 | 0.1777 |

| Saudi Arabia | −0.7380 | −0.9988 | −0.7789 | −0.9715 | −0.7170 |

| Singapore | −0.7102 | −0.3293 | −0.4765 | 0.5108 | −0.5807 |

| South Korea | 0.9240 | −0.2100 | 0.6708 | 0.0708 | 0.2229 |

| Spain | 0.2650 | −0.2948 | −0.0318 | −0.0193 | 0.6173 |

| Sweden | 0.2731 | −0.9830 | −0.9956 | −0.1538 | −0.8538 |

| Switzerland | 0.2350 | 0.0016 | 0.5529 | 0.1649 | −0.1798 |

| Turkey | 0.9960 | 0.6701 | 0.9673 | 0.7416 | 0.1148 |

| U.S. | 0.7089 | −0.0862 | 0.1482 | 0.0340 | 0.0235 |

| Arithmetic mean | 0.2031 | −0.2006 | 0.0922 | −0.0369 | −0.0427 |

| Number of positive values | 17 | 6 | 16 | 10 | 13 |

| Share of positive values, % | 68 | 24 | 64 | 40 | 52 |

| FR1 | FR2 | FR3 | FR4 | FR5 | FR6 | FR7 | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FR1 | 1.00 | - | - | - | - | - | - | - | - | - | - | - |

| FR2 | 0.57 | 1.00 | - | - | - | - | - | - | - | - | - | - |

| FR3 | 0.44 | 0.67 | 1.00 | - | - | - | - | - | - | - | - | - |

| FR4 | 0.29 | 0.32 | 0.28 | 1.00 | - | - | - | - | - | - | - | - |

| FR5 | 0.31 | 0.40 | 0.35 | 0.67 | 1.00 | - | - | - | - | - | - | - |

| FR6 | 0.34 | 0.36 | 0.29 | 0.68 | 0.88 | 1.00 | - | - | - | - | - | - |

| FR7 | 0.26 | 0.25 | 0.15 | 0.41 | 0.70 | 0.85 | 1.00 | - | - | - | - | - |

| RHRM1 | 0.25 | 0.50 | 0.27 | 0.50 | 0.49 | 0.45 | 0.37 | 1.00 | - | - | - | - |

| RHRM2 | −0.12 | −0.11 | −0.10 | −0.06 | 0.05 | 0.04 | 0.07 | −0.15 | 1.00 | - | - | - |

| RHRM3 | −0.17 | −0.13 | −0.35 | 0.00 | −0.11 | −0.05 | 0.02 | 0.09 | −0.01 | 1.00 | - | - |

| RHRM4 | 0.22 | 0.43 | 0.20 | 0.43 | 0.47 | 0.40 | 0.38 | 0.86 | −0.10 | 0.15 | 1.00 | - |

| RHRM5 | 0.45 | 0.68 | 0.36 | 0.30 | 0.38 | 0.36 | 0.30 | 0.62 | −0.02 | 0.01 | 0.62 | 1.00 |

| FR1 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.4934 | 0.2434 | 0.2129 | 42.0774 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 70,626.6975 | 14,125.3395 | 7.9781 (Obs.) | 1.5098 × 10−6 | |

| Residual | 124 | 219,542.9376 | 1770.5076 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 290,169.6351 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 22.8101 | 0.0709 | −3.1110 | −0.3681 | −0.4821 | 0.9196 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 8.5639 | 0.4744 | 2.0717 | 0.1838 | 0.8282 | 0.1936 | |

| FR2 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.7139 | 0.5097 | 0.4899 | 3.7187 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 1782.61 | 356.5220 | 25.7814 (Obs.) | 9.1 × 10−18 | |

| Residual | 124 | 1714.75 | 13.8286 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 3497.36 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 0.8223 | 0.0881 | −0.2337 | −0.0340 | −0.1023 | 0.1288 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 0.7567 | 0.0419 | 0.1831 | 0.0162 | 0.0732 | 0.0171 | |

| FR3 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.5184 | 0.2687 | 0.2392 | 46.7913 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 99,755.4 | 19,951.1 | 9.1125 (Obs.) | 2.1 × 10−7 | |

| Residual | 124 | 271,489 | 2189.43 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 371,244 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 40.6084 | 0.5547 | −2.4479 | −0.9207 | −0.5053 | 0.6637 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 9.5233 | 0.5275 | 2.3038 | 0.2044 | 0.9210 | 0.2153 | |

| FR7 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.4075 | 0.1661 | 0.1324 | 2.4781 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 151.646 | 30.3292 | 4.9388 | 0.0004 | |

| Residual | 124 | 761.481 | 6.1410 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 913.127 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| −0.6503 | 0.0279 | 0.1670 | −0.0034 | 0.0588 | 0.0072 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 0.5044 | 0.0279 | 0.1220 | 0.0108 | 0.0488 | 0.0114 | |

| FR4 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.4987 | 0.2487 | 0.2184 | 0.3305 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 4.4843 | 0.8969 | 8.2110 (Obs.) | 1 × 10−6 | |

| Residual | 124 | 13.5442 | 0.1092 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 18.0284 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | Y-intercept | Y-intercept | Y-intercept | Y-intercept | Y-intercept | |

| −0.1019 | −0.1019 | −0.1019 | −0.1019 | −0.1019 | −0.1019 | |

| Standard error | ||||||

| Y-intercept | Y-intercept | Y-intercept | Y-intercept | Y-intercept | Y-intercept | |

| 0.0673 | 0.0673 | 0.0673 | 0.0673 | 0.0673 | 0.0673 | |

| FR5 | Regression statistics | |||||

| Multiple R | Multiple R | Multiple R | Multiple R | Multiple R | Multiple R | |

| 0.5437 | 0.5437 | 0.5437 | 0.5437 | 0.5437 | 0.5437 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 0.6607 | 0.1321 | 10.4060 (Obs.) | 2.4 × 10−8 | |

| Residual | 124 | 1.5746 | 0.0127 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 2.2353 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| −0.0181 | 0.0028 | 0.0088 | −0.0010 | 0.0024 | 0.0003 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 0.0229 | 0.0013 | 0.0055 | 0.0005 | 0.0022 | 0.0005 | |

| FR6 | Regression statistics | |||||

| Multiple R | R-square | Adjusted R-square | Standard error | Observations | Level of significance | |

| 0.4808 | 0.2311 | 0.2001 | 0.0028 | 130 | 0.01 | |

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 5 | 0.0003 | 5.9 × 10−5 | 7.4551 (Obs.) | 3.8 × 10−6 | |

| Residual | 124 | 0.0010 | 8 × 10−6 | 1.5162 (Table) | F-test is passed | |

| Total | 129 | 0.0013 | k1 = 5, k2 = 130 − 5 − 1 = 124 | |||

| Coefficients | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| −0.0005 | 0.00008 | 0.0002 | −0.00001 | 0.000001 | 0.00001 | |

| Standard error | ||||||

| Y-intercept | RHRM1 | RHRM2 | RHRM3 | RHRM4 | RHRM5 | |

| 0.00057 | 0.00003 | 0.00013 | 0.00001 | 0.00005 | 0.00001 | |

| Variable | Basic Values, 2023 | Realistic Scenario | Optimistic Scenario | Pessimistic Scenario | |||

|---|---|---|---|---|---|---|---|

| Value | Change Compared to 2023, % | Value | Change Compared to 2023, % | Value | Change Compared to 2023, % | ||

| RHRM1 | 24.90 | 32.04 | 28.68 | 47.89 | 92.34 | 8.26 | −66.83 |

| RHRM2 | 1.02 | 1.51 | 47.49 | 3.11 | 203.77 | 0.71 | −30.65 |

| RHRM3 | 25.97 | 25.97 | 0.00 | 25.97 | 0.00 | 25.97 | 0.00 |

| RHRM4 | 12.32 | 17.29 | 40.38 | 28.43 | 130.83 | 6.15 | −50.07 |

| RHRM5 | 20.57 | 24.16 | 17.48 | 54.95 | 167.19 | 3.64 | −82.30 |

| FR1 | 24.81 | 24.71 | −0.39 | 43.80 | 76.57 | 12.01 | −51.58 |

| FR2 | 3.28 | 3.75 | 14.27 | 7.60 | 131.59 | 0.34 | −89.64 |

| FR3 | 35.43 | 38.08 | 7.47 | 57.76 | 63.01 | 18.85 | −46.80 |

| FR4 | 0.17 | 0.25 | 49.53 | 0.44 | 163.18 | 0.00 | −100.00 |

| FR5 | 0.07 | 0.11 | 57.93 | 0.20 | 187.14 | 0.00 | −100.00 |

| FR6 | 0.0016 | 0.0020 | 22.46 | 0.0040 | 144.91 | 0.00 | −100.00 |

| FR7 | 1.00 | 1.60 | 60.38 | 3.18 | 218.76 | 0.00 | −100.00 |

| Sphere of Comparison | Existing Literature | This Paper | |||

|---|---|---|---|---|---|

| Character of Connection | Quantitative Assessment of the Connection | ||||

| Connection between selected operational risks to companies and their responsible HRM | Risk of loss of intangible assets | (Khasanov et al. 2019) | weak | 12.49% | |

| Risk of depreciation of global business reputation | (Al-Ghazali et al. 2024) | weak | 27.33% | ||

| Risk of decrease in market capitalization | Market capitalization, % GDP | weak | 7.64% | 7.64% | |

| Unicorn valuation, % GDP | weak | 22.52% | 22.52% | ||

| Risk of venture investment outflows | Venture capital (VC) investors, deals/bn PPP$ GDP | strong | 23.23% | 23.23% | |

| VC recipients, deals/bn PPP$ GDP | strong | 25.72% | 25.72% | ||

| VC received, value, % GDP | strong | 24.00% | 24.00% | ||

| Influence of the practices of responsible HRM of the reduction of operational risks of companies | Creation of knowledge-intensive jobs | (Sozinova et al. 2023) | strong positive | 40.38% | |

| Stimulation of the growth of labor efficiency | (Bashir et al. 2024) | contradictory | −3.40% | ||

| Development of human capital through corporate training | (Mamaeva et al. 2020) | negative | −11.15% | ||

| Attraction of female researchers to the staff | (Shevyakova et al. 2019) | contradictory | 35.90% | ||

| Stimulation of the innovative activity of employees through support for research talents | (Bogoviz et al. 2020) | strong positive | 40.37% | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karlibaeva, R.H.; Lipinsky, D.A.; Volokhina, V.A.; Gureeva, E.A.; Makarov, I.N. Sustainable Development of Entrepreneurship through Operational Risk Management: The Role of Corporate Social Responsibility. Risks 2024, 12, 118. https://doi.org/10.3390/risks12080118

Karlibaeva RH, Lipinsky DA, Volokhina VA, Gureeva EA, Makarov IN. Sustainable Development of Entrepreneurship through Operational Risk Management: The Role of Corporate Social Responsibility. Risks. 2024; 12(8):118. https://doi.org/10.3390/risks12080118

Chicago/Turabian StyleKarlibaeva, Raya H., Dmitry A. Lipinsky, Vera A. Volokhina, Elena A. Gureeva, and Ivan N. Makarov. 2024. "Sustainable Development of Entrepreneurship through Operational Risk Management: The Role of Corporate Social Responsibility" Risks 12, no. 8: 118. https://doi.org/10.3390/risks12080118

APA StyleKarlibaeva, R. H., Lipinsky, D. A., Volokhina, V. A., Gureeva, E. A., & Makarov, I. N. (2024). Sustainable Development of Entrepreneurship through Operational Risk Management: The Role of Corporate Social Responsibility. Risks, 12(8), 118. https://doi.org/10.3390/risks12080118