A Basic Asymptotic Test for Value-at-Risk Subadditivity

Abstract

1. Introduction

- are independent, light-tailed and is small.

- are independent and heavy tailed (see Embrechts et al. (2002)).

- have special dependence (see Embrechts et al. (2005)).

2. Asymptotic Hypothesis Test

3. Simulation Studies

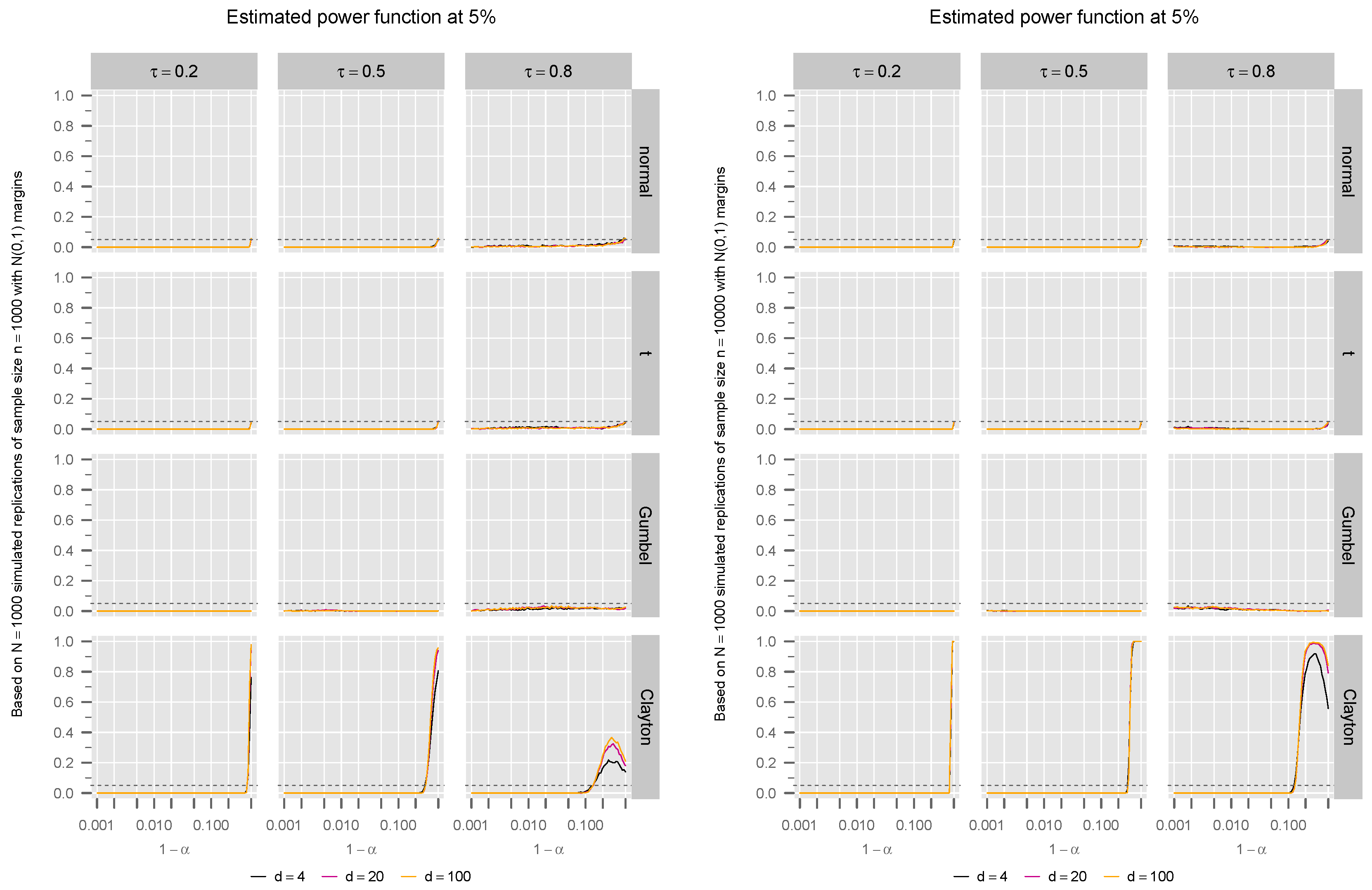

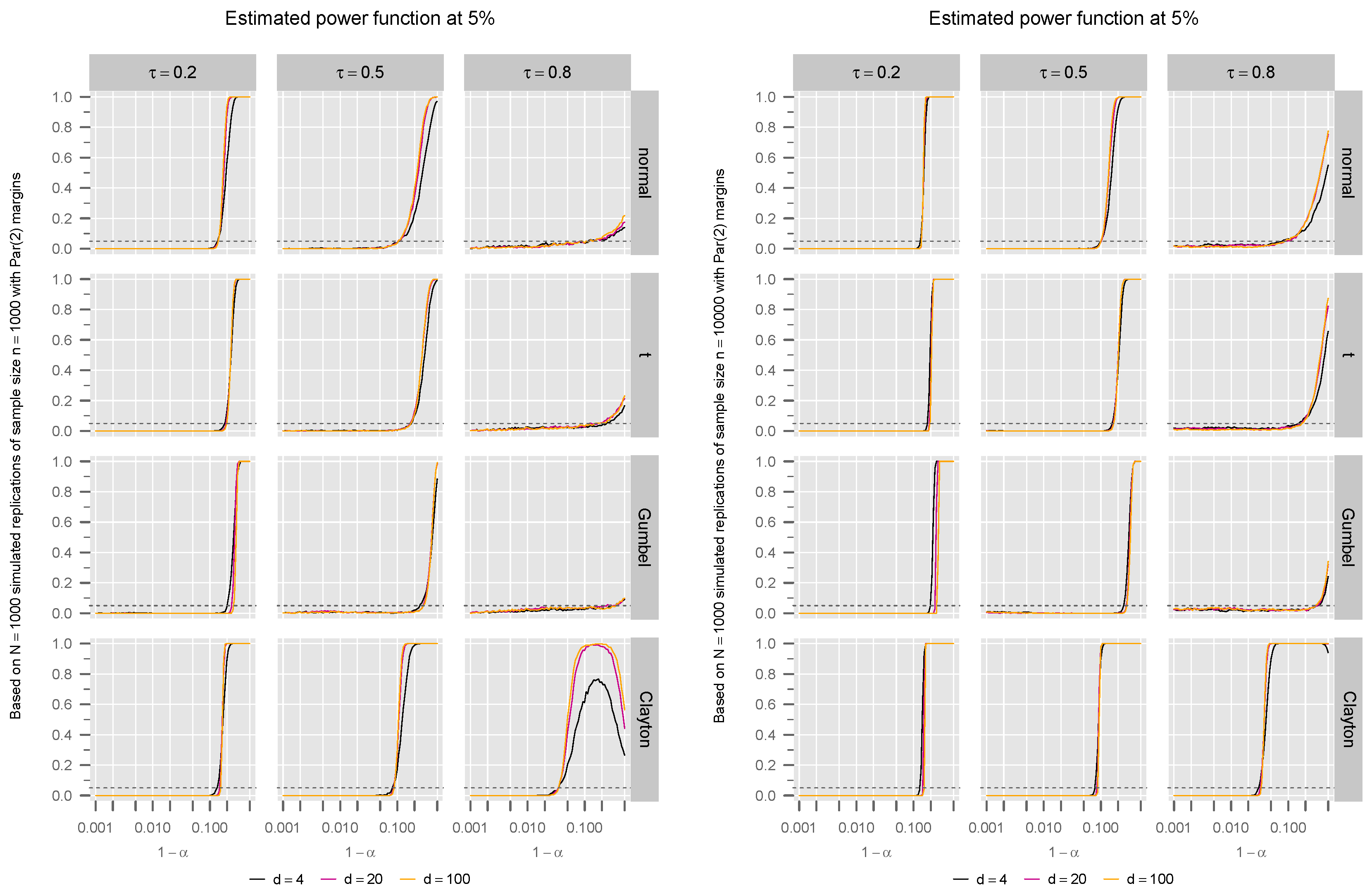

3.1. Estimated Power Function

3.2. Estimated p-Values by Simulation

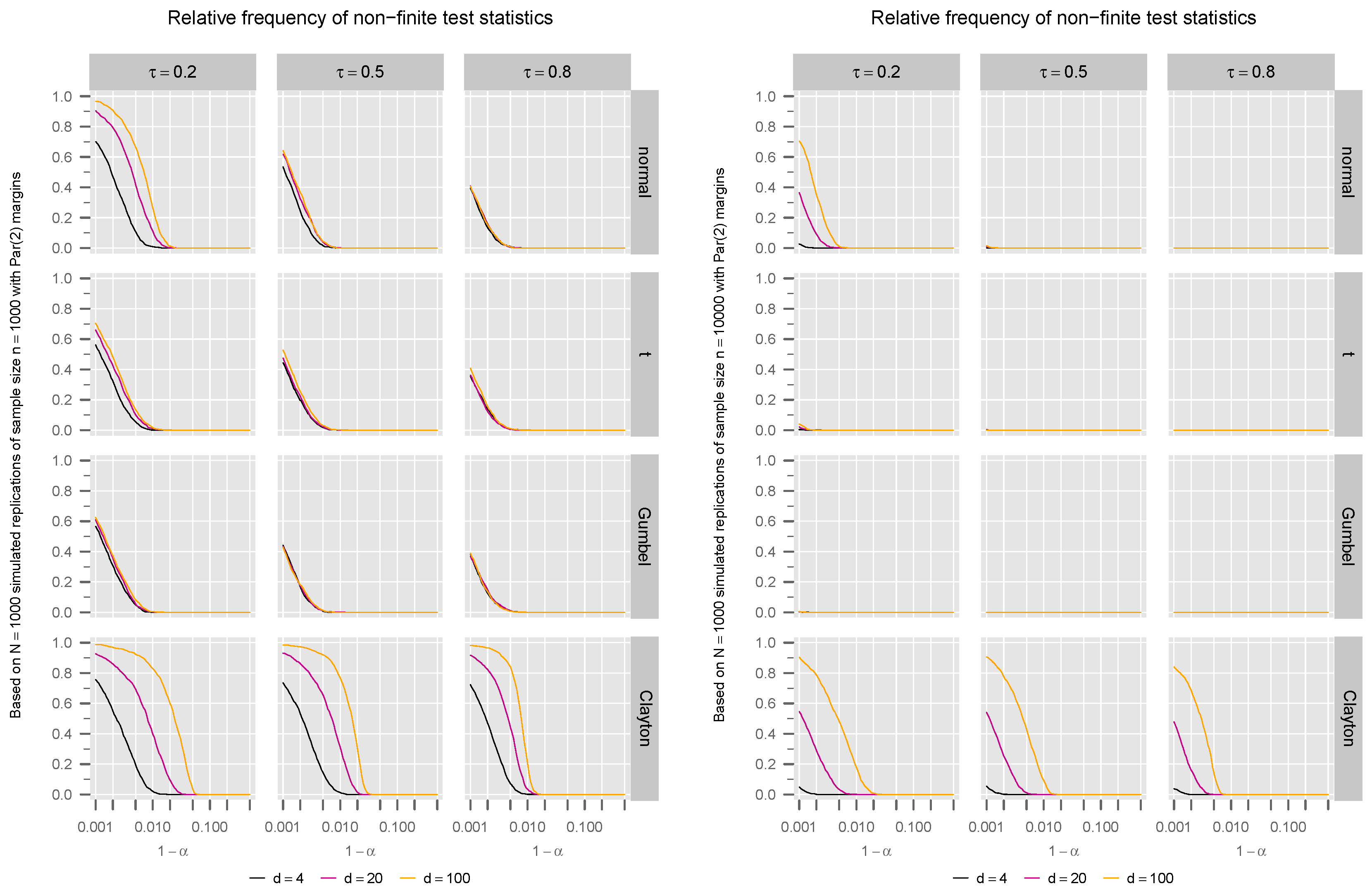

3.3. A Numerical Issue

4. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Asymptotic Confidence Interval for FS(s)

References

- Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent measures of risk. Mathematical Finance 9: 203–28. [Google Scholar] [CrossRef]

- Boudt, Kris, Edgars Jakobsons, and Steven Vanduffel. 2015. Block rearranging elements within matrix columns to minimize the variability of the row sums. 4OR-A Quarterly Journal of Operations Research 16: 31–50. [Google Scholar] [CrossRef]

- Embrechts, Paul, Alexander J. McNeil, and Daniel Straumann. 2002. Correlation and dependency in risk management: Properties and pitfalls. In Risk Management: Value at Risk and Beyond. Edited by Michael Dempster. Cambridge, MA: Cambridge University Press, pp. 176–223. [Google Scholar]

- Embrechts, Paul, and Marius Hofert. 2013. A note on generalized inverses. Mathematical Methods of Operations Research 77: 423–32. [Google Scholar] [CrossRef]

- Embrechts, Paul, Andrea Höing, and Giovanni Puccetti. 2005. Worst var scenarios. Insurance: Mathematics and Economics 37: 115–34. [Google Scholar] [CrossRef]

- Embrechts, Paul, Giovanni Puccetti, and Ludger Rüschendorf. 2013. Model uncertainty and var aggregation. Journal of Banking & Finance 37: 2750–64. [Google Scholar]

- Hofert, Marius. 2016. Crop: Graphics Cropping Tool. R Package Version 0.0-3. Madison: R Package Vignette. [Google Scholar] [CrossRef]

- Hofert, Marius. 2020. Implementing the Rearrangement Algorithm: An Example from Computational Risk Management. Risks 8: 47. [Google Scholar] [CrossRef]

- Hofert, Marius, Amir Memartoluie, David Saunders, and Tony Wirjanto. 2017. Improved algorithms for computing worst Value-at-Risk. Statistics & Risk Modeling 34: 13–31. [Google Scholar] [CrossRef]

- Hofert, Marius, and Alexander J. McNeil. 2015. Subadditivity of value-at-risk for bernoulli random variables. Statistics & Probability Letters 98: 79–88. [Google Scholar] [CrossRef]

- Hofert, Marius, and Martin Maechler. 2018. simsalapar: Tools for Simulation Studies in Parallel with R. R Package Version 1.0-10. Madison: R Package Vignette. [Google Scholar] [CrossRef]

- Hofert, Marius, Ivan Kojadinovic, Martin Maechler, Jun Yan, Johanna G. Nešlehová, and Rebecca Morger. 2020. copula: Multivariate Dependence with Copulas. R Package Version 1.0.0. Madison: R Package Vignette. [Google Scholar] [CrossRef]

- Hofert, Marius, Ivan Kojadinovic, Martin Mächler, and Jun Yan. 2018. Elements of Copula Modeling with R. Springer Use R! Series; Cham: Springer. [Google Scholar] [CrossRef]

- Massart, Pascal. 1990. The tight constant in the Dvoretzky–Kiefer–Wolfowitz inequality. The Annals of Probability 18: 1269–83. [Google Scholar] [CrossRef]

- McNeil, Alexander J., Rüdiger Frey, and Paul Embrechts. 2015. Quantitative Risk Management: Concepts, Techniques and Tools, 2nd ed. Princeton: Princeton University Press. [Google Scholar]

- Nelsen, Roger B. 2006. An Introduction to Copulas. New York: Springer. [Google Scholar]

- Newcombe, Robert G. 1998. Two-sided confidence intervals for the single proportion: Comparison of seven methods. Statistics in Medicine 17: 857–72. [Google Scholar] [CrossRef]

- Resnick, Sidney I. 2014. A Probability Path. Basel: Birkhäuser. [Google Scholar]

- Sklar, Abe. 1959. Fonctions de répartition à n dimensions et leurs marges. Publications de L’Institut de Statistique de L’Université de Paris 8: 229–31. [Google Scholar]

- Wilson, Edwin B. 1927. Probable inference, the law of succession, and statistical inference. Journal of the American Statistical Association 22: 209–12. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hofert, M. A Basic Asymptotic Test for Value-at-Risk Subadditivity. Risks 2024, 12, 199. https://doi.org/10.3390/risks12120199

Hofert M. A Basic Asymptotic Test for Value-at-Risk Subadditivity. Risks. 2024; 12(12):199. https://doi.org/10.3390/risks12120199

Chicago/Turabian StyleHofert, Marius. 2024. "A Basic Asymptotic Test for Value-at-Risk Subadditivity" Risks 12, no. 12: 199. https://doi.org/10.3390/risks12120199

APA StyleHofert, M. (2024). A Basic Asymptotic Test for Value-at-Risk Subadditivity. Risks, 12(12), 199. https://doi.org/10.3390/risks12120199