1. Introduction

Trade-off theory suggests that convergence toward target capital structures represents the optimal capital structure decision for effectively balancing the costs and benefits of debt (

Fischer et al. 1989). The capital structure adjustment process, which exploits the tax benefits of debt and does not lead to financial distress, is a type of risk exposure adjustment. Thus, risk management is related to capital structure adjustments.

Previous studies have investigated capital structure adjustment, focusing only on the difference between actual and target leverage to measure the outcome of such adjustments (e.g.,

Uysal 2011;

Oztekin and Flannery 2012;

Hovakimian and Hovakimian 2019;

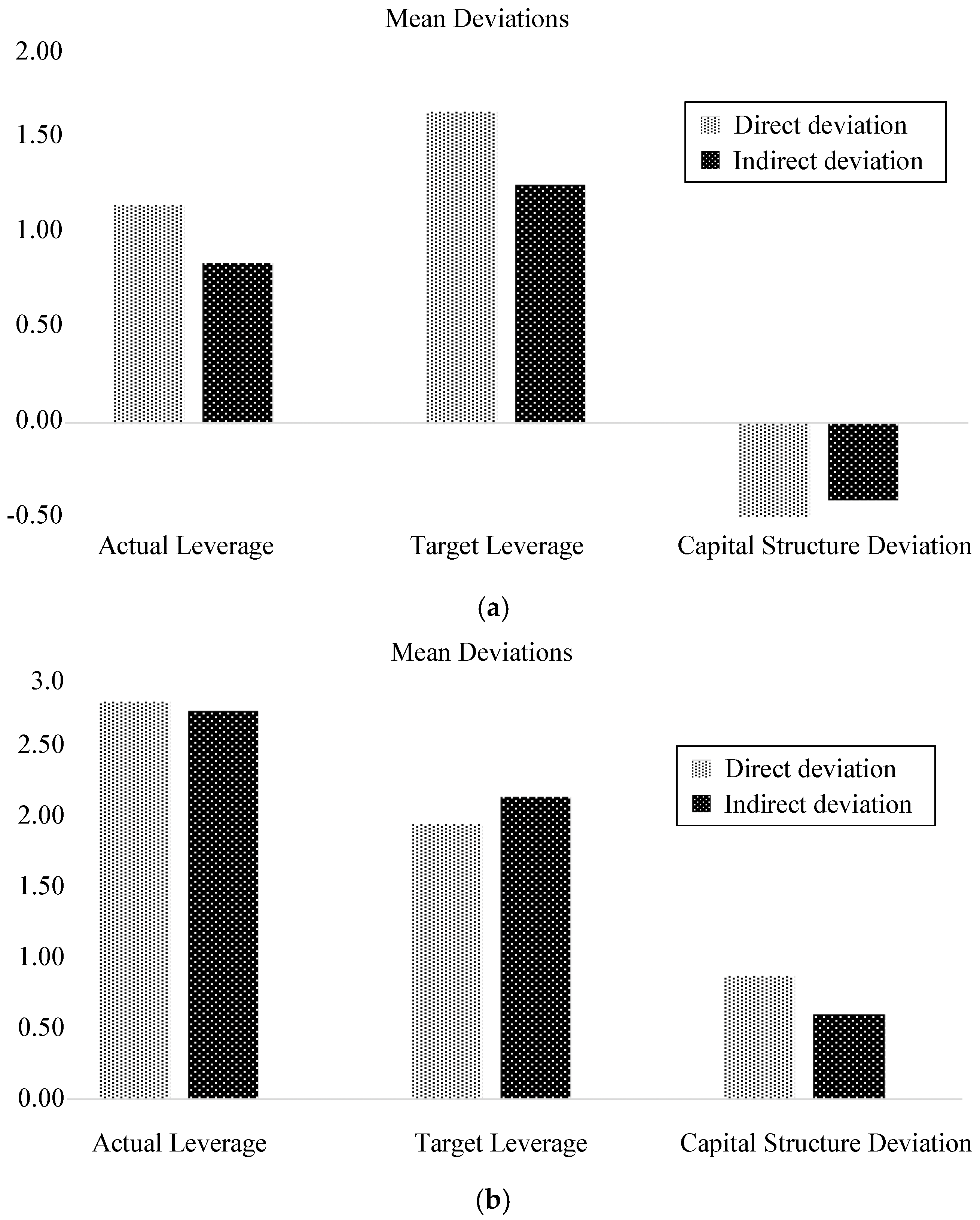

Wang et al. 2024). However, variations in both actual and target leverage can lead to variations in deviations from the target leverage. For example, an increase in capital structure deviations (actual leverage minus target leverage) can reflect either an increase in actual leverage or a reduction in target leverage, each of which involves different mechanisms. We argue that capital structure deviations can be categorized as direct or indirect.

To some extent, this situation is similar to the direct and indirect interventions employed by a country’s central bank in the foreign exchange market. A country’s central bank can directly intervene by influencing the demand or supply of its currency; however, this can also affect other factors, such as interest rates and government controls, which will affect the value of the currency; this is an example of indirect intervention. Although direct and indirect interventions can have the same effect on currency value, their mechanisms are different. Inspired by the direct and indirect interventions noted above, we argue that a firm can deliberately cause capital structure deviations by directly changing actual leverage or indirectly changing factors that can subsequently affect target leverage. Therefore, in this study, we identify different types of capital structure deviations based on changes in actual or target leverage. If | ΔLevact | > | ΔLevtgt |, the deviation is regarded as a direct deviation, while the reverse is regarded as an indirect deviation. | ΔLevact | represents the absolute value of the difference between time t and time t − 1 for actual leverage, and | ΔLevtgt | represents that for target leverage.

The categorization of capital structure deviations into direct and indirect forms builds on the theoretical understanding that deviations can stem from different adjustment mechanisms—either through active changes in actual leverage or passive fluctuations in target leverage due to external factors. Direct deviations occur when actual leverage diverges more significantly than target leverage, reflecting an active management response where firms can promptly adjust leverage levels. Conversely, indirect deviations result from greater variation in target leverage due to external factors like market conditions or asset price fluctuations, which are harder to manage directly.

Reinsurance impacts these deviation types through distinct mechanisms. For direct deviations, reinsurance allows insurers to offload risk and free up capital, which can be used to actively recalibrate their leverage ratios. However, for indirect deviations, reinsurance is less effective in influencing target leverage, as it does not directly address the factors (e.g., profitability and stock prices) that affect target levels. This theoretical distinction highlights how reinsurance aligns more with active adjustments, making it more relevant for managing direct deviations.

Variations that are generally discernible in firm characteristics are not normally regarded as a means of adjusting target leverage; therefore, any changes in target leverage are likely to be passively influenced by firm characteristics. We define capital structure deviations as indirect deviations when they are primarily the result of variations in target leverage, indicating a situation in which capital structure deviations are primarily the result of other factors affecting target leverage. Conversely, because actual leverage is observable, direct adjustment is possible. As such, an insurer can actively and directly manage its actual leverage toward its target leverage by changing the amount of debt or assets that it holds. When capital structure deviation is primarily the result of a change in actual leverage, such capital structure movements are regarded as direct deviations.

Risk management, and particularly reinsurance, is a critical consideration for insurance companies. Reinsurance allows insurers to mitigate risk by transferring a portion of their liabilities to other parties (

Mayers and Smith 1990). This practice provides financial stability and enables insurers to underwrite more policies, increasing their capacity to generate revenue. Effective risk-management strategies are essential for maintaining solvency, especially in the face of catastrophic events that can lead to considerable financial losses. Therefore, reinsurance has a dramatic effect on capital structure deviations (

Li and Shiu 2023).

Understanding how property casualty insurers adjust their capital structures in response to deviations from target levels is critical. It sheds light on the strategic financial decisions made by insurers and their approaches to risk management through reinsurance. The regulatory environment in the US further underscores the importance of studying this sector. Insurers are subject to stringent capital requirements and oversight by regulatory bodies, such as the National Association of Insurance Commissioners (NAIC). These regulations aim to ensure that insurers maintain adequate capital reserves to meet policyholders’ obligations, thereby protecting consumers and maintaining market stability.

We aim to fill a gap in the literature by providing empirical evidence on the dynamic relationship between capital structure deviations and risk-management practices in the US property casualty insurance industry. We also innovatively identify different types of capital structure deviations based on those resulting mainly from changes in either actual or target leverage, thereby providing deeper insights into the different types of capital structure deviations.

This study contributes to the literature in two ways. First, our findings contribute to the growing literature on capital structure deviations in financial decisions (e.g.,

Harford et al. 2009;

Cook and Tang 2010;

Uysal 2011;

Faulkender et al. 2012;

Zhou et al. 2016). Previous studies on capital structure deviation usually focused on the relative position between actual and target leverage (over-leveraged or under-leveraged status). A firm with higher actual leverage than the target leverage is regarded as over-leveraged. Conversely, a firm with actual leverage lower than the target leverage is under-leveraged. However, none of these studies identified the types of capital structure deviation based on channels, resulting in variations. Variations in both the actual and target leverage can lead to variations in deviations toward the target leverage. Therefore, our study innovatively identifies direct and indirect capital structure deviations, rather than positive and negative deviations.

Second, this study contributes to the literature on risk management and capital structure. Most studies investigated the effects of risk management and capital structure (e.g.,

Zou and Adams 2008;

Pérez-González and Yun 2013;

Shiu 2016;

Li and Shiu 2021). We focus on the effect of risk management on capital structure deviations rather than capital structure. Insurers are subject to stringent regulatory requirements to ensure that they have sufficient capital to cover policyholder liabilities. Deviations from a target capital structure can lead to regulatory noncompliance, risking fines or sanctions. Leverage increases the risk of financial distress, potentially leading to bankruptcy or restructuring. Therefore, insurers’ capital structures are a critical aspect of their financial management and have key implications for regulatory compliance, risk management, financial stability, and market competitiveness. Capital structure deviations can have severe consequences, making it crucial for insurers to carefully manage their mix of debt and equity.

As risk management is related to capital structure adjustment, this study investigates whether risk management plays different roles across direct and indirect deviations. The main results are summarized as follows: First, our empirical analyses reveal that both under-leveraged and over-leveraged insurers with direct deviations tend to actively adjust their leverage levels to converge with their target leverage by adopting risk-management methods, whereas this is not indicated for insurers with indirect deviations. We also find that risk management both helps reduce deviations toward the target leverage and makes these adjustments more efficient. Insurers with direct deviations adjust their capital structure approximately 29.2% faster than insurers with indirect deviations.

The remainder of this paper is organized as follows:

Section 2 describes the data and methodology, including the research design, data sources, and sample selection used in the analysis.

Section 3 presents the findings. Finally,

Section 4 presents the conclusions of this study.

2. Data and Methodology

We use annual statement data obtained from the NAIC from 2001 to 2016. We exclude insurers with negative assets and those with missing reinsurance data from the sample. Our final sample contained 2829 insurers, providing an unbalanced panel of 29,549 firm-year observations. To eliminate outliers, all variables are winsorized at the top and bottom 1% levels (

Che and Liebenberg 2017).

We first follow these studies to estimate the target capital structures of our sample of insurers using the two-way fixed effects method (e.g.,

Flannery and Rangan 2006;

Zhou et al. 2016). Target leverage is defined as follows:

where

refers to the target leverage of firm

i at time

t;

β is a vector of coefficients; and

is a vector of target leverage determinants.

1 Second, we measure capital structure deviations based on the target capital structure. Capital structure deviation is defined as actual leverage minus target leverage. Notably, both actual and target leverage can lead to variations in capital structure deviations from targets; for example, an increase in capital structure deviations can be the result of either an increase in actual leverage, a reduction in target leverage, or both. Moreover, actual leverage can be directly observed and adjusted, whereas target leverage is unobservable and, therefore, only estimated. Inspired by the idea of central banks’ direct and indirect interventions, we classify capital structure deviations into direct and indirect. We identify different deviations based upon deviations primarily resulting from actual or target leverage, such that | Δ

Levact | > | Δ

Levtgt | is regarded as a direct deviation, while | Δ

Levact | < | Δ

Levtgt | is regarded as an indirect deviation. For convenience, the definitions of | Δ

Levact | and | Δ

Levtgt | are restated here. | Δ

Levact | represents the absolute value of the difference between time

t and time

t − 1 for actual leverage, and | Δ

Levtgt | represents that for target leverage. To test the effect of reinsurance on capital structure deviation, we include several control variables: Size, defined as the natural logarithm of total assets (

Powell and Sommer 2007); Prof, profitability, the ratio of net income to assets (

De Haan and Kakes 2010);

GrOpp, growth opportunities, defined as changes in net premiums written (

Myers 1984); and HHIBus (HHIGeo), the Herfindahl–Hirschman Index based upon lines of business concentration (geographical concentration) (

Berry-Stölzle et al. 2012;

Che and Liebenberg 2017). Derivatives are calculated as the fair value of derivative transactions divided by total assets (

Leland 1998;

Guay 1999;

Cummins et al. 2001).

Table 1 provides the definitions of the variables.

To mitigate the potential endogeneity between reinsurance and deviations from target capital structures, we use a simultaneous equation model with the three-stage least squares (3SLS) method. We use a simultaneous equation model to test the effect of reinsurance on capital structure deviations. This is a type of statistical model used in econometrics and other fields to describe multiple interdependent relationships between variables. Unlike single-equation models, in which each equation stands alone, simultaneous equation models comprise multiple equations that are estimated together because the dependent variables in these equations are determined jointly. The dependent variables are the capital structure deviation and reinsurance. Regarding the estimation method, following

Shim (

2010) and

Mankai and Belgacem (

2016), we employ 3SLS. 3SLS is an advanced estimation technique that improves upon the two-stage least squares method by accounting for the correlations between error terms across equations in a simultaneous system. This leads to more efficient and robust estimates, making the 3SLS particularly valuable for complex economic models and other applications involving interdependent relationships among variables.

4. Conclusions

Previous studies usually investigate capital structure adjustments based on the difference between actual and target leverage. However, both actual and target leverage can lead to variations in capital structure deviations from targets; for example, an increase in capital structure deviations can be the result of either an increase in actual leverage, a reduction in target leverage, or both. The variation in capital structure deviation, stemming from different components, indicates distinct types of deviations.

We identify an important connection between risk management and capital structure deviations. In particular, we innovatively classify capital structure deviations into direct deviations and indirect deviations, resulting primarily from changes in actual leverage (direct capital structure deviations). That is, reinsurance plays a key role in mitigating capital structure deviations, particularly for direct deviations. Insurers that adopt reinsurance can align their actual leverage with target levels, thereby enhancing financial stability and regulatory compliance. Further, our empirical analysis reveals that insurers experiencing direct deviations adjust their leverage levels more rapidly and converge toward their target leverage. By contrast, insurers with indirect deviations exhibit slower adjustment speeds, indicating that these deviations are more passive and influenced by external factors. Specifically, insurers with direct deviations adjust their capital structure approximately 29.2% faster than insurers with indirect deviations. This insight challenges and refines the existing financial theories, offering a new lens through which to view the strategic role of reinsurance in managing financial risk and stability.

These findings have two key implications. First, for insurance practitioners, this study underscores the strategic importance of reinsurance in managing capital structure. Insurers with significant direct deviations can leverage reinsurance to more effectively reduce deviations, enhancing their ability to meet regulatory requirements and improving financial resilience. By aligning actual leverage with target levels, insurers reduce the risk of over- or under-leverage, thus fostering a more stable and competitive market position. This strategic use of reinsurance both helps manage day-to-day operational risks and strengthens the insurer’s overall financial health and competitive positioning within the industry.

Second, for regulatory bodies, our findings provide insights into how insurers use reinsurance as a tool for capital structure optimization. Recognizing the differing impacts of reinsurance on direct and indirect deviations, regulators might consider tailored guidelines that encourage effective reinsurance practices, particularly for insurers managing high direct deviations, which are more responsive to reinsurance adjustments.

Our study focuses exclusively on the insurance sector, which operates under specific regulatory and financial conditions, such as risk-based capital requirements and stringent solvency standards. This unique regulatory environment may limit the generalizability of our findings to other industries in which capital structure management and reinsurance function differently or are less regulated. Additionally, while reinsurance is a primary risk management tool in insurance, other sectors rely on a broader range of risk mitigation strategies, such as derivatives, hedging, and diversification. Future studies could explore how these tools impact capital structure deviations across different sectors.

To expand these insights, future research could explore cross-industry comparisons to determine if direct and indirect deviation classifications hold in sectors beyond insurance, where risk management tools and leverage adjustments differ. Additionally, examining how economic cycles or regulatory changes impact insurers’ responses to capital structure deviations could deepen the theoretical framework, especially regarding adaptation under financial stress or regulatory shifts.