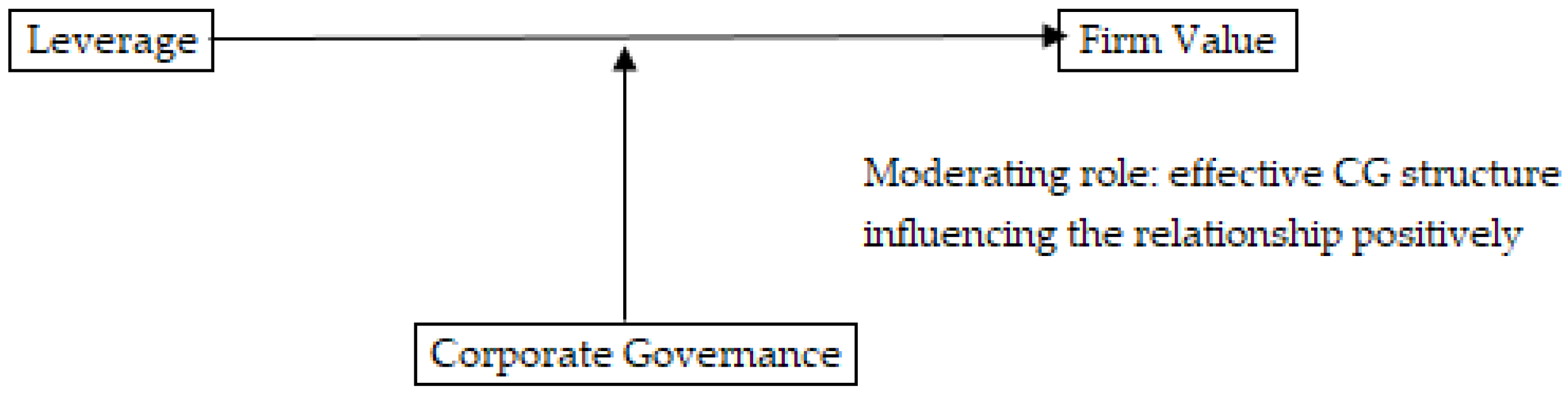

The Moderating Role of Corporate Governance in the Relationship between Leverage and Firm Value: Evidence from the Korean Market

Abstract

1. Introduction

2. Literature Review

2.1. Leverage and FV

2.2. CG and FV

2.3. Leverage, CG, and FV

3. Empirical Design

3.1. CG Metrics

3.2. Research Model

3.2.1. Leverage and FV

3.2.2. CG and FV

3.2.3. Leverage, CG, and FV

4. Sample Statistics

5. Regression Analysis

5.1. Relationship between Leverage and FV

5.2. Relationship between CG and FV

5.3. Relationship between Leverage, CG (with Interaction Effect), and FV

5.4. Robustness Tests

5.4.1. Analysis of the Leverage Difference between Firms with High and Low Levels of CG

5.4.2. Analysis 2SLS Regression

5.4.3. Analysis of GMM Regression

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Hariem, and Turgut Tursoy. 2021. Capital Structure and Firm Performance: Evidence of Germany under IFRS Adoption. Review of Managerial Science 15: 379–98. [Google Scholar] [CrossRef]

- Abor, Joshua. 2005. The Effect of Capital Structure on Profitability: An Empirical Analysis of Listed Firms in Ghana. Journal of Risk Finance 6: 16–30. [Google Scholar] [CrossRef]

- Aggarwal, Reena, Isil Erel, René Stulz, and Rohan Williamson. 2007. Governance Practices between U.S. and Foreign Firms: Measurement, Causes and Consequences. Oxford: Oxford University Press. NBER Working Paper Series 13288. [Google Scholar]

- Aldamen, Husam, Keith Duncan, Simone Kelly, and Ray McNamara. 2012. Audit Committee Characteristics and Firm Performance during the Global Financial Crisis. Accounting & Finance 52: 971–1000. [Google Scholar]

- Altieri, Michela. 2022. Agency Costs of Debt in Conglomerate Firms. Journal of Financial and Quantitative Analysis 57: 3048–80. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another Look at the Instrumental Variable Estimation of Error-Components Models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Test of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Baihaqqi, Muhamad, Muhammad Widyanto, and Sri Kurniawati. 2023. How Financial Ratio, Good Corporate Governance, and Firm Size Affect Firm Value in Infraestructure Companies. East African Scholars Journal of Economic, Business and Management 6: 145–54. [Google Scholar]

- Black, Bernard, Hasung Jang, and Woochan Kim. 2006. Does Corporate Governance Predict Firm’s Market Values? Evidence from Korea. The Journal of Law, Economics, & Organization 22: 366–413. [Google Scholar]

- Brown, Lawrence, and Marcus Caylor. 2006. Corporate Governance and Firm Valuation. Journal of Accounting and Public Policy 25: 409–34. [Google Scholar] [CrossRef]

- Budiharjo, Roy. 2021. The Effect of Good Corporate Governance and Leverage toward Company Value with Profitability as a Moderating Variable. International Journal of Management Studies and Social Science Research 3: 220–34. [Google Scholar]

- Chan-Lau, Jorge. 2001. The Impact of Corporate Governance Structures on the Agency Cost of Debt. International Monetary Fund 1: 1–14. [Google Scholar]

- Chen, Jean. 2004. Determinants of Capital Structure of Chinese Listed Companies. Journal of Business Research 57: 1341–51. [Google Scholar] [CrossRef]

- Cheng, Yu-Shu, Yi-Pei Liu, and Chu-Yang Chien. 2010. Capital Structure and Firm Value in China Panel Threshold Regression Analysis. African Journal of Business Management 4: 2500–7. [Google Scholar]

- Detthamrong, Umawadee, Nongnit Chancharat, and Chaiporn Vithessonthi. 2017. Corporate Governance, Capital Structure and Firm Performance: Evidence from Thailand. Research in International Business and Finance 42: 689–709. [Google Scholar] [CrossRef]

- Durnev, Art, and Han Kim. 2005. To Steal or Not to Steal: Firm Attributes, Legal Environment, and Valuation. Journal of Finance 60: 1461–93. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1992. The Cross-Section of Expected Stock Returns. The Journal of Finance 47: 427. [Google Scholar]

- Fama, Eugene, and Kenneth French. 1998. Taxes, Financing Decision and Firm Value. The Journal of Finance 53: 819–43. Available online: https://www.jstor.org/stable/117379 (accessed on 10 August 2023). [CrossRef]

- Ferentinou, Aikaterini, and Searina Anagnostopoulou. 2016. Accrual-Based and Real Earnings Management before and after IFRS Adoption: The Case of Greece. Journal of Applied Accounting Research 17: 2–23. [Google Scholar] [CrossRef]

- Foerster, Stephen, Stephen Sapp, and Yaqui Shi. 2013. The Effect of Voluntary Disclosure on Firm Risk and Firm Value: Evidence from Management Earnings Forecasts. SSRN Electronic Journal, 1–41. [Google Scholar] [CrossRef]

- Geiger, Marshall, and David North. 2013. Do Strong Shareholder Rights Mitigate Earnings Management? Journal of Accounting, Ethics and Public Policy 14: 289–322. [Google Scholar]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics 118: 107–55. [Google Scholar] [CrossRef]

- González, Víctor. 2013. Leverage and Corporate Performance: International Evidence. International Review of Economics and Finance 25: 169–84. [Google Scholar] [CrossRef]

- Gujarati, Damodar. 1988. Basic Econometrics, 2nd ed. New York: McGraw Hill. [Google Scholar]

- Harris, Milton, and Artur Raviv. 1991. The Theory of Capital Structure. The Journal of Finance 46: 296–355. [Google Scholar] [CrossRef]

- Ibhagui, Oyakhilome, and Felicia Olokoyo. 2018. Leverage and Firm Performance: New Evidence on the Role of Firm Size. The North American Journal of Economics and Finance 45: 57–82. Available online: https://www.sciencedirect.com/science/article/pii/S1062940817302620 (accessed on 1 November 2023). [CrossRef]

- Jensen, Michael. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76: 323–39. [Google Scholar]

- Jiraporn, Pornsit, Gary Miller, Soon Suk Yoon, and Young Kim. 2008. Is Earnings Management Opportunistic or Beneficial? An Agency Theory Perspective. International Review of Financial Analysis 17: 622–34. [Google Scholar] [CrossRef]

- Jiraporn, Pornsit, Jang-Chul Kim, Young Sang Kim, and Pattanaporn Kitsabunnarat. 2012. Capital Structure and Corporate Governance Quality: Evidence from the Institutional Shareholder Services (ISS). International Review of Economics and Finance 22: 208–21. [Google Scholar] [CrossRef]

- Kijkasiwat, Ploypailin, Anwar Hussain, and Amna Muntaz. 2022. Corporate Governance, Firm Performance and Financial Leverage across Developed and Emerging Economies. Risks 10: 185. [Google Scholar] [CrossRef]

- Kim, Yangseon, Caixing Liu, and Stephen Rhee. 2003. The Relation of Earnings Management to Firm Size. Social Science Research Network 4: 81–88. [Google Scholar]

- Kis-Value Version 3.2. 2018.

- Klapper, Leora, and Inessa Love. 2004. Corporate Governance, Investor Protection and Performance in Emerging Markets. Journal of Corporate Finance 10: 703–28. [Google Scholar] [CrossRef]

- Klein, April. 2002. Audit Committee, Board of Director Characteristics and Earnings Management. Journal of Accounting and Economics 33: 375–400. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio López-de-Silanes, Andrei Shleifer, and Robert Vishny. 2002. Investor Protection and Corporate Valuation. Journal of Finance 57: 1147–70. [Google Scholar] [CrossRef]

- Lee, Younghwan, Sun Kang, and Sang Min Cho. 2015. The Effect of Voluntary IFRS Adoption by Unlisted Firms on Earnings Quality and the Cost of Debt: Empirical Evidence from Korea. Journal of Business Economics and Management 16: 931–48. [Google Scholar] [CrossRef][Green Version]

- Lin, Feng-Li, and Tsangyao Chang. 2011. Does Debt Affect Firm Value in Taiwan? A Panel Threshold Regression Analysis. Applied Economics 43: 117–28. [Google Scholar] [CrossRef]

- Liu, Chunyan, Konari Uchida, and Yufeng Yang. 2012. Corporate Governance and Firm Value during the Global Financial Crisis: Evidence from China. International Review of Financial Analysis 21: 70–80. [Google Scholar] [CrossRef]

- Lopes, Ana Paula. 2018. Audit Quality and Earnings Management: Evidence from Portugal. Athens Journal of Business and Economics 4: 179–92. [Google Scholar] [CrossRef]

- Marcoulides, Katerina, and Tenko Raykov. 2018. Evaluation of Variance Inflation Factors in Regression Models Using Latent Variable Modeling Methods. Educational and Psychological Measurement 79: 874–82. [Google Scholar] [CrossRef]

- Memon, Zulfiqar, Yan Chen, and Ayaz Samo. 2019. Corporate Governance, Firm Age, and Leverage: Empirical Evidence from China. Research Journal of Finance and Accounting 10: 19–31. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1958. The Cost of Capital, Corporation Finance and the Theory of Investment. American Economic Review 48: 261–97. [Google Scholar]

- Ngatno, Ngatno, Endang P. Apriatni, and Arief Youlianto. 2021. Moderating Effects of Corporate Governance Mechanism on the Relation between Capital Structure and Firm Performance. Cogent Business & Management 8: 1866822. [Google Scholar]

- Nwakuya, Moussa, and Marcus Ijomah. 2017. Fixed Effect versus Random Effects Modeling in a Panel Data Analysis: A Consideration of Economic and Political Indicators in Six African Countries. International Journal of Statistics and Applications 7: 275–79. [Google Scholar]

- Oke, Simon, and Brus Afolabi. 2011. Capital Structure and Industrial Performance in Nigeria. International Business and Management 2: 100–6. [Google Scholar]

- Onaolapo, Abdrahman, and Sunday Kajola. 2010. Capital Structure and Firm Performance: Evidence from Nigeria. European Journal of Economics, Finance, and Administrative Sciences 25: 70–82. [Google Scholar]

- Opler, Tim, and Sheridan Titman. 1994. Financial Distress and Corporate Performance. Journal of Finance 49: 1015–40. [Google Scholar] [CrossRef]

- Ozkan, Aydin. 2001. Determinants of Capital Structure and Adjustment to Long Run Target: Evidence from UK Company Panel Data. Journal of Business Finance and Accounting 28: 175–98. [Google Scholar] [CrossRef]

- Persons, Obeua. 1995. Using Financial Statement Data to Identify Factors Associated with Fraudulent Financial Reporting. Journal of Applied Business Research 11: 38–47. [Google Scholar] [CrossRef]

- Pratomo, Wahyu, and Abdul Ismail. 2006. Islamic Bank Performance and Capital Structure. MPRA 6012. Available online: https://mpra.ub.uni-muenchen.de/6012/ (accessed on 10 August 2023).

- Rajan, Raghuram G., and Luigi Zingales. 1995. What Do We Know about Capital Structure? Some Evidence from International Data. The Journal of Finance 50: 1421–60. [Google Scholar] [CrossRef]

- Ruland, William, and Ping Zhou. 2005. Debt Diversification and Valuation. Review of Quantitative Financial Accounting 25: 277–91. [Google Scholar] [CrossRef]

- Standard & Poor’s Governance Services. 2004. Criteria, Methodology and Definitions. In Standard & Poor’s Corporate Governance Scores and Evaluations. New York: McGraw-Hill Companies Inc., pp. 1–23. [Google Scholar]

- Titman, Sheridan, and Roberto Wessels. 1988. The Determinants of Capital Structure Choice. The Journal of Finance 43: 1–19. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, Ana Belén, and Younghwan Lee. 2022a. Real Earnings Management and Firm Value Using Quarterly Financial Data: Evidence from Korea. Global Business & Finance Review 27: 50–64. [Google Scholar]

- Tulcanaza-Prieto, Ana Belén, and Younghwan Lee. 2022b. Real Earnings Management, Firm Value, and Corporate Governance: Evidence from the Korean Market. International Journal of Financial Studies 10: 19. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, Ana Belén, HoKyun Shin, Younghwan Lee, and Chang Won Lee. 2020a. Relationship among CSR Initiatives and Financial and Non-Financial Corporate Performance in the Ecuadorian Banking Environment. Sustainability 12: 1621. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, Ana Belén, Younghwan Lee, and Jeong-Ho Koo. 2020b. Leverage, Corporate Governance and Real Earnings Management: Evidence from Korean Market. Global Business & Finance Review 4: 51–72. [Google Scholar]

- Uchida, Konari. 2011. Does Corporate Board Downsize Increase Shareholder Value? Evidence from Japan. International Review of Economics and Finance 20: 562–73. [Google Scholar] [CrossRef]

- Wen, Yu, Kami Rwegasira, and Jan Bilderbeek. 2002. Corporate Governance and Capital Structure Decisions of the Chinese Listed Firms. International Review of Corporate Governance 10: 75–83. [Google Scholar] [CrossRef]

- Wruck, Karen. 1990. Financial Distress, Reorganization and Organizational Efficiency. Journal of Financial Economics 27: 419–44. [Google Scholar] [CrossRef]

- Yoon, Soon Suk, Gary Miller, and Pornsit Jiraporn. 2006. Earnings Management Vehicles for Korean Firms. Journal of International Financial Management & Accounting 17: 85–109. [Google Scholar]

| Detail | No. |

|---|---|

| Initial number of firms | 265 |

| (−) Firms with incomplete information for four years | 42 |

| (−) Firms with extreme values and outliers | 8 |

| =Final number of firms | 215 |

| Number of firms per industry | No. |

| Communications | 26 |

| Construction | 27 |

| Electrical and electronic equipment | 27 |

| Electricity and gas | 26 |

| Food and beverages | 26 |

| Non-metallic-mineral production | 29 |

| Paper and wood | 28 |

| Transport and storage | 26 |

| Final number of firms per industry | 215 |

| Variables | Mean | Std. Dev. | Min | Lower Quartile (Q1) | Median | Upper Quartile (Q3) | Max |

|---|---|---|---|---|---|---|---|

| Dependent variables | |||||||

| Tobin’s Q | 0.030 | 0.054 | −0.202 | 0.005 | 0.030 | 0.057 | 0.287 |

| Price-to-book ratio | 0.563 | 0.181 | 0.006 | 0.425 | 0.573 | 0.711 | 0.900 |

| Independent variables | |||||||

| Lev | 0.437 | 0.181 | 0.096 | 0.289 | 0.427 | 0.576 | 0.935 |

| CGS | 2.211 | 0.101 | 1.902 | 2.142 | 2.210 | 2.266 | 2.599 |

| CG1 | 1.726 | 0.079 | 1.347 | 1.679 | 1.736 | 1.786 | 1.897 |

| CG2 | 1.200 | 0.173 | 0.574 | 1.097 | 1.211 | 1.273 | 1.923 |

| CG3 | 1.332 | 0.199 | 0.854 | 1.196 | 1.301 | 1.456 | 1.887 |

| CG4 | 1.633 | 0.146 | 0.903 | 1.556 | 1.623 | 1.732 | 1.982 |

| CG5 | 1.137 | 0.655 | 0.000 | 1.000 | 1.477 | 1.602 | 1.954 |

| Control variables | |||||||

| Tang | 0.323 | 0.174 | 0.005 | 0.186 | 0.302 | 0.445 | 0.922 |

| Size | 19.877 | 1.487 | 16.185 | 18.848 | 19.507 | 20.481 | 25.824 |

| Liq | 1.739 | 1.141 | 0.213 | 0.974 | 1.422 | 2.137 | 7.782 |

| NetIntPay | −0.007 | 0.012 | −0.097 | −0.013 | −0.005 | 0.001 | 0.023 |

| Tobin’s Q | Price-to-Book Ratio | Lev | CGS | CG1 | CG2 | CG3 | CG4 | CG5 | Tang | Size | Liq | NetIntPay | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tobin’s Q | 1 | ||||||||||||

| Price-to-book ratio | 0.538 *** | 1 | |||||||||||

| Lev | −0.442 *** | −0.311 *** | 1 | ||||||||||

| CGS | 0.193 *** | 0.196 *** | −0.097 *** | 1 | |||||||||

| CG1 | 0.069 ** | 0.049 ** | −0.127 *** | 0.439 *** | 1 | ||||||||

| CG2 | 0.125 *** | 0.110 *** | 0.096 *** | 0.571 *** | 0.028 | 1 | |||||||

| CG3 | 0.137 *** | 0.137 *** | 0.030 *** | 0.641 *** | 0.144 *** | 0.514 *** | 1 | ||||||

| CG4 | 0.034 *** | 0.052 ** | 0.094 *** | 0.598 *** | 0.086 ** | 0.447 *** | 0.454 *** | 1 | |||||

| CG5 | 0.181 *** | 0.208 *** | −0.220 *** | 0.586 *** | 0.161 *** | 0.071 ** | 0.119 *** | −0.010 *** | 1 | ||||

| Tang | −0.172 *** | −0.154 *** | 0.197 *** | 0.006 | −0.001 | 0.030 | −0.046 | 0.059 | −0.065 | 1 | |||

| Size | 0.097 *** | 0.086 ** | 0.097 *** | 0.542 *** | 0.038 | 0.614 *** | 0.616 *** | 0.572 *** | 0.068 ** | 0.081 ** | 1 | ||

| Liq | 0.308 *** | 0.235 *** | −0.715 *** | 0.084 ** | 0.193 *** | −0.118 *** | −0.026 | −0.060 | 0.178 *** | −0.268 *** | −0.091 *** | 1 | |

| NetIntPay | 0.456 *** | 0.390 *** | −0.635 *** | 0.217 *** | 0.122 *** | 0.036 | 0.173 *** | −0.002 | 0.253 *** | −0.234 *** | 0.094 *** | 0.514 *** | 1 |

| Variables | Tobin’s Q | Price-to-Book Ratio | ||

|---|---|---|---|---|

| Lev | −0.080 *** | −0.021 *** | ||

| (−5.428) [3.075] | (−3.161) [3.259] | |||

| StLev | −0.037 *** | |||

| (−3.287) | ||||

| [2.261] | ||||

| −0.083 *** | ||||

| LtLev | (−4.248) | |||

| [1.760] | ||||

| Tang | −0.025 *** | −0.029 *** | −0.012 ** | −0.029 ** |

| (−2.669) [1.194] | (−2.940) [1.281] | (−2.195) [1.287] | (−2.492) [1.203] | |

| Size | 0.004 *** | 0.003 *** | 0.006 *** | 0.004 *** |

| (4.004) [1.154] | (2.777) [1.195] | (4.770) [1.344] | (3.022) [1.154] | |

| Liq | −0.002 * | 0.002 * | 0.004 ** | −0.001 ** |

| (−1.900) [2.192] | (1.852) [2.202] | (2.425) [1.482] | (−2.096) [2.219] | |

| NetIntPay | 0.206 *** | 0.604 *** | 1.431 *** | 0.437 *** |

| (6.517) [1.973] | (9.502) [1.597] | (8.229) [1.721] | (5.903) [2.111] | |

| Intercept | 0.006 | 0.005 | −0.056 | −0.009 |

| (0.261) | (0.186) | (−1.332) | (−0.310) | |

| Year—fixed effects | Yes | Yes | Yes | Yes |

| Industry—fixed effects | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.309 | 0.289 | 0.299 | 0.212 |

| F-Stat. | 26.549 *** | 24.251 *** | 25.466 *** | 12.535 *** |

| DW | 1.963 | 1.893 | 1.909 | 1.949 |

| Variables | Tobin’s Q | Price-to-Book Ratio | |||||

|---|---|---|---|---|---|---|---|

| CGS | 0.045 ** | 0.053 ** | |||||

| (2.378) | (2.200) | ||||||

| [1.555] | [1.568] | ||||||

| CG1 | 0.011 ** | ||||||

| (2.538) | |||||||

| [1.102] | |||||||

| CG2 | 0.034 *** | ||||||

| (2.759) | |||||||

| [1.934] | |||||||

| CG3 | 0.019 * | ||||||

| (1.859) | |||||||

| [1.740] | |||||||

| CG4 | 0.006 ** | ||||||

| (2.450) | |||||||

| [1.582] | |||||||

| CG5 | 0.006 *** | ||||||

| (2.621) | |||||||

| [1.111] | |||||||

| Tang | −0.023 ** | −0.023 ** | −0.022 ** | −0.022 ** | −0.023 ** | −0.022 ** | −0.028 ** |

| (−2.361) | (−2.398) | (−2.295) | (−2.244) | (−2.421) | (−2.321) | (−2.368) | |

| [1.193] | [1.193] | [1.195] | [1.202] | [1.192] | [1.194] | [1.202] | |

| Size | 0.002 | 0.004 *** | 0.001 | 0.002 | 0.004 *** | 0.004 *** | 0.002 |

| (1.602) | (3.368) | (1.001) | (1.628) | (2.986) | (3.213) | (1.320) | |

| [1.575] | [1.142] | [1.799] | [1.732] | [1.714] | [1.142] | [1.572] | |

| Liq | 0.004 ** | 0.004 *** | 0.005 *** | 0.005 *** | 0.004 *** | 0.004 ** | 0.001 *** |

| (2.501) | (2.686) | (2.815) | (2.741) | (2.640) | (2.481) | (2.618) | |

| [1.482] | [1.514] | [1.483] | [1.482] | [1.478] | [1.483] | [1.509] | |

| NetIntPay | 0.671 *** | 0.712 *** | 0.710 *** | 0.673 *** | 0.705 *** | 0.636 *** | 0.512 *** |

| (10.185) | (10.523) | (10.561) | (10.223) | (10.451) | (9.943) | (7.231) | |

| [1.496] | [1.474] | [1.474] | [1.498] | [1.483] | [1.520] | [1.568] | |

| Intercept | −0.091 ** | −0.005 | −0.019 | −0.019 | −0.020 | −0.027 | −0.098 ** |

| (−2.487) | (−0.120) | (−0.849) | (−0.841) | (−0.856) | (−1.183) | (−2.111) | |

| Year—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.289 | 0.285 | 0.291 | 0.287 | 0.285 | 0.290 | 0.216 |

| F-Stat. | 24.291 *** | 23.782 *** | 24.476 *** | 24.083 *** | 23.774 *** | 24.406 *** | 12.836 *** |

| DW | 1.991 | 2.082 | 2.086 | 1.988 | 2.183 | 2.095 | 2.063 |

| Variables | Tobin’s Q | Price-to-Book Ratio | |||||

|---|---|---|---|---|---|---|---|

| Lev | 1.379 | 2.563 | 0.388 | 0.675 | 0.015 | 0.652 | 0.219 |

| (0.827) | (1.479) | (0.707) | (1.298) | (0.016) | (0.791) | (0.901) | |

| [3.227] | [3.086] | [3.589] | [3.610] | [3.886] | [5.691] | [3.851] | |

| CGS | 0.771 *** | 0.100 *** | |||||

| (3.124) | (2.866) | ||||||

| [7.895] | [7.734] | ||||||

| CG1 | 0.546 *** | ||||||

| (3.147) | |||||||

| [8.395] | |||||||

| CG2 | 0.669 *** | ||||||

| (3.078) | |||||||

| [8.420] | |||||||

| CG3 | 0.620 *** | ||||||

| (3.410) | |||||||

| [7.762] | |||||||

| CG4 | 0.143 *** | ||||||

| (2.598) | |||||||

| [7.068] | |||||||

| CG5 | 0.053 *** | ||||||

| (2.943) | |||||||

| [8.093] | |||||||

| Lev × CGS | 0.927 ** | 0.108 *** | |||||

| (2.238) | (1.966) | ||||||

| [3.454] | [2.209] | ||||||

| Lev × CG1 | 1.091 ** | ||||||

| (2.086) | |||||||

| [2.584] | |||||||

| Lev× CG2 | 0.868 ** | ||||||

| (2.004) | |||||||

| [5.209] | |||||||

| Lev× CG3 | 1.002 ** | ||||||

| (2.121) | |||||||

| [6.520] | |||||||

| Lev× CG4 | 0.418 ** | ||||||

| (2.090) | |||||||

| [1.667] | |||||||

| Lev × CG5 | 0.013 ** | ||||||

| (2.116) | |||||||

| [3.085] | |||||||

| Tang | −0.216 *** | −0.217 *** | −0.205 ** | −0.213 *** | −0.215 *** | −0.211 ** | −0.029 ** |

| (−2.649) | (−2.654) | (−2.515) | (−2.610) | (−2.630) | (−2.577) | (−2.434) | |

| [1.196] | [1.195] | [1.197] | [1.206] | [1.196] | [1.205] | [1.205] | |

| Size | 0.025 ** | 0.037 *** | 0.020 *** | 0.026 ** | 0.040 *** | 0.036 *** | 0.002 ** |

| (2.300) | (3.943) | (2.662) | (2.262) | (3.464) | (3.866) | (2.491) | |

| [1.603] | [1.161] | [1.823] | [1.753] | [1.748] | [1.159] | [1.596] | |

| Liq | −0.016 | −0.011 | −0.007 | −0.008 | −0.013 | −0.016 | −0.003 |

| (−0.954) | (−0.638) | (−0.398) | (−0.452) | (−0.774) | (−0.922) | (−0.105) | |

| [2.196] | [2.308] | [2.263] | [2.241] | [2.238] | [2.235] | [2.221] | |

| NetIntPay | 0.033 *** | 0.325 *** | 0.243 *** | 0.842 *** | 0.303 *** | 0.950 *** | 0.371 *** |

| (6.308) | (6.496) | (6.482) | (6.180) | (6.474) | (6.230) | (5.605) | |

| [1.991] | [1.975] | [1.976] | [2.008] | [1.979] | [2.003] | [2.146] | |

| Intercept | 0.536 *** | 2.955 *** | 1.528 *** | 1.387 *** | 1.714 *** | 1.965 *** | −0.197 * |

| (2.666) | (3.484) | (4.730) | (4.408) | (3.914) | (9.474) | (−1.668) | |

| Year—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.312 | 0.308 | 0.316 | 0.317 | 0.307 | 0.311 | 0.216 |

| F-Stat. | 23.955 *** | 23.484 *** | 24.374 *** | 24.407 *** | 23.427 *** | 23.809 *** | 21.464 *** |

| DW | 1.919 | 1.918 | 1.929 | 1.933 | 1.921 | 1.912 | 2.063 |

| Variable | Firms with High Level of CG | Firms with Low Level of CG | Difference | t-Value |

|---|---|---|---|---|

| Tobin’s Q | 0.042 | 0.018 | 0.024 | 4.291 *** |

| Lev | 0.429 | 0.476 | −0.047 | −2.780 *** |

| CGS | 2.341 | 2.087 | 0.254 | 48.729 *** |

| CG1 | 1.757 | 1.672 | 0.085 | 11.194 *** |

| CG2 | 1.350 | 1.136 | 0.214 | 13.122 *** |

| CG3 | 1.522 | 1.215 | 0.307 | 17.396 *** |

| CG4 | 1.763 | 1.537 | 0.225 | 19.102 *** |

| CG5 | 1.510 | 0.456 | 1.055 | 20.654 *** |

| Variables | Tobin’s Q | |||||

|---|---|---|---|---|---|---|

| Firms with High Level of CG | Firms with Low Level of CG | |||||

| Lev | −0.019 | −0.109 *** | ||||

| (−0.581) | (−3.226) | |||||

| [1.866] | [3.804] | |||||

| StLev | −0.033 | −0.102 *** | ||||

| (−0.978) | (−2.649) | |||||

| [2.763] | [2.572] | |||||

| LtLev | −0.126 | −0.078 *** | ||||

| (−1.468) | (−2.620) | |||||

| [1.478] | [3.403] | |||||

| Tang | −0.053 ** | −0.045 ** | −0.031 | −0.044 * | −0.054 ** | −0.031 |

| (−2.523) | (−2.041) | (−1.407) | (−1.828) | (−2.145) | (−1.223) | |

| [1.255] | [1.392] | [1.453] | [1.482] | [1.574] | [1.530] | |

| Size | 0.004 | 0.005 | 0.007 * | 0.004 | 0.002 | 0.005 ** |

| (1.149) | (1.316) | (1.903) | (1.687) | (0.680) | (2.044) | |

| [1.124] | [1.172] | [1.260] | [1.444] | [1.601] | [1.722] | |

| Liq | 0.008 | 0.013 ** | 0.010 ** | −0.005 | −0.006 | 0.003 |

| (1.361) | (2.294) | (2.260) | (−1.147) | (−1.117) | (0.792) | |

| [2.280] | [2.366] | [1.446] | [2.141] | [2.681] | [1.593] | |

| NetIntPay | 1.827 *** | 2.060 *** | 1.797 *** | 1.278 ** | 2.317 *** | 1.501 ** |

| (4.872) | (5.692) | (5.378) | (2.507) | (5.536) | (2.412) | |

| [1.782] | [1.666] | [1.456] | [2.415] | [1.593] | [3.463] | |

| Intercept | −0.001 | −0.044 | −0.066 | 0.048 | 0.078 | −0.028 |

| (−0.010) | (−0.556) | (−0.881) | (1.000) | (1.391) | (−0.578) | |

| Year—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry—fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.370 | 0.372 | 0.387 | 0.335 | 0.320 | 0.309 |

| F-Stat. | 9.962 *** | 10.037 *** | 10.658 *** | 8.177 *** | 7.725 *** | 7.380 *** |

| DW | 1.723 | 1.768 | 1.745 | 2.058 | 2.086 | 2.025 |

| First-Stage Regression Results | ||

|---|---|---|

| Variable | CGS | |

| Tobin’s Q | 0.583 *** | |

| (3.017) | ||

| Intercept | 1.957 *** | |

| (22.87) | ||

| Adj. R2 | 0.009 | |

| F-Stat. | 9.101 *** | |

| Covariance Tobin’s Q | 0.094 | |

| Second-Stage Regression Results | ||

| Variable | Tobin’s Q | |

| Lev | 0.680 | 1.379 |

| (1.384) | (0.827) | |

| [3.077] | [3.227] | |

| CGS | 0.368 ** | 0.771 ** |

| (2.285) | (2.124) | |

| [1.556] | [7.895] | |

| Lev*CGS | 0.927 ** | |

| (2.238) | ||

| [3.454] | ||

| Tang | −0.213 *** | −0.216 *** |

| (−2.612) | (−2.649) | |

| [1.195] | [1.196] | |

| Size | 0.024 ** | 0.025 ** |

| (2.214) | (2.300) | |

| [1.594] | [1.603] | |

| Liq | −0.017 | −0.016 |

| (−0.978) | (−0.954) | |

| [2.195] | [2.196] | |

| NetIntPay | 0.610 *** | 0.533 *** |

| (6.291) | (6.308) | |

| [1.991] | [1.991] | |

| Intercept | 1.454 *** | 0.536 |

| (4.632) | (0.666) | |

| Quarter—fixed effects | Yes | Yes |

| Industry—fixed effects | Yes | Yes |

| Adj. R2 | 0.312 | 0.312 |

| F-Stat. | 25.340 *** | 23.955 *** |

| DW | 1.913 | 1.919 |

| Variables | Tobin’s Q | ||

|---|---|---|---|

| Levt−1 | −0.005 ** | 0.038 | |

| (−2.385) | (1.557) | ||

| CGSt−1 | 0.051 ** | 0.062 *** | |

| (2.473) | (3.072) | ||

| Lev × CGS | 0.048 *** | ||

| (5.553) | |||

| Tang | −0.014 ** | −0.016 ** | −0.019 * |

| (−2.247) | (−2.220) | (−1.763) | |

| Size | 0.003 ** | 0.001 *** | 0.002 *** |

| (2.355) | (2.897) | (2.653) | |

| Liq | 0.003 | 0.004 | −0.003 |

| (1.562) | (1.632) | (−1.368) | |

| NetIntPay | 1.782 *** | 1.768 *** | 1.248 *** |

| (8.534) | (9.015) | (5.596) | |

| Sargan test (p-value) | 0.908 | 0.898 | 0.874 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tulcanaza-Prieto, A.B.; Lee, Y.; Anzules-Falcones, W. The Moderating Role of Corporate Governance in the Relationship between Leverage and Firm Value: Evidence from the Korean Market. Risks 2024, 12, 11. https://doi.org/10.3390/risks12010011

Tulcanaza-Prieto AB, Lee Y, Anzules-Falcones W. The Moderating Role of Corporate Governance in the Relationship between Leverage and Firm Value: Evidence from the Korean Market. Risks. 2024; 12(1):11. https://doi.org/10.3390/risks12010011

Chicago/Turabian StyleTulcanaza-Prieto, Ana Belén, Younghwan Lee, and Wendy Anzules-Falcones. 2024. "The Moderating Role of Corporate Governance in the Relationship between Leverage and Firm Value: Evidence from the Korean Market" Risks 12, no. 1: 11. https://doi.org/10.3390/risks12010011

APA StyleTulcanaza-Prieto, A. B., Lee, Y., & Anzules-Falcones, W. (2024). The Moderating Role of Corporate Governance in the Relationship between Leverage and Firm Value: Evidence from the Korean Market. Risks, 12(1), 11. https://doi.org/10.3390/risks12010011