1. Introduction

One of our highlighted topics in recent years has been one that is becoming increasingly important with each passing day, with it gaining significance, i.e., corporate financial literacy and its relevance with regard to the business sector of a given country and the performance and results of its domestic economy. So far, we have been implementing in-depth processing of the relevant literature in both domestic and international contexts, and we gave special attention to the issue of corporate risk management. The current article is the latest stage of our corporate financial literacy research and is an organic continuation of an earlier study (

Toth et al. 2022) in which we indicated the need to extend the variables in the model in the future. In this paper, we present this extension and the refinement and fitting of this extended model, complemented by a third data sample. Therefore, this article mainly presents a methodological development: we carry out the fit test of the resulting framework. The starting point is the problem posed by the research that is typical for numerous authors and studies; i.e., they are inclined to take the model presented as a given without carrying out more serious statistical and fit tests. Therefore, our article has two different aims. Firstly, we intend to present a group of methodological fit tests that are practical in their application in such modeling (including parsimonious and incremental fits, beyond the absolute fit). Secondly, the resulting verified model makes it possible for us through three samplings to make deductions in terms of the financial literacy of the businesses.

The literature dealing with the financial literacy of corporations can be broken down into two basic parts: the majority of the studies analyze the topic during times of economic boom (

Rakow 2019;

Anderson et al. 2017;

Gyori and Czako 2018;

Lee 2017), while in recent times, there have been a number of studies published that focus on periods of crisis where the dominant effects have been the external negative ones (

Stella et al. 2022;

Tian et al. 2020,

2023).

Kuruczleki (

2020), however, warns of the need for further research in order to understand the differences in the research of corporate financial literacy during times of economic boom and downturn; i.e., there arises the need for research that is capable of grasping these completely different cycles as for their nature. This article undertakes that very task. We have supplied our model with respective data for three periods ((1) in 2021, we repeated a sampling for a period prior to COVID-19; (2) when the pandemic was decimating the SMEs; (3) in 2022, when a new type of crisis was gaining ground thanks to the Russian–Ukrainian conflict), and we are in search of the answer to whether the model is operable in all three periods, i.e., whether it meets the criteria set by the statistical model diagnostics (fit, validity).

Research related to the analysis of financial literacy has really spread in the last five years, with its roots primarily connected to the 2008/2009 crisis. Today, from more and more countries around the world, we can read scientifically sophisticated analyses, which regularly draw attention to the decisive role that financial awareness and financial literacy related to businesses play in business life. Despite this, it can be seen that even today there is no uniform definition of corporate financial literacy. In their study, Ansary and co-authors (

Ansari et al. 2022) strove to explore the conceptual elements related to financial awareness with scientific rigor, examining all this over a 20-year time horizon, through the analysis of scientific writings published between 2002 and 2022. According to the findings of the research, the indicators dealing with financial literacy include loans and related consultancy, knowledge of investment returns and risks, the importance of confidence levels and their impact on business decisions, the importance of financial trainings, financial planning, and conscious debt management. Our research has concluded that the testing and analysis of financial literacy involve two main directions: performance testing and correlations with education. We seem to identify very close research correlations with our own research direction and findings so far, as we have previously also been dealing with the inescapable role of financial trainings and the impact of the level of financial literacy on corporate performance (

Toth et al. 2022;

Tóth et al. 2022). Earlier, we attempted to give a conceptual definition as follows: corporate financial literacy is, thus, a conscious and company-specific application of knowledge and tools from the financial management tools within the company and macroenvironmental financial variables outside the company that improves the company’s efficiency, effectiveness, and competitiveness (own definition). In light of our definition and previous findings, the stipulation (in close correlation with the opinions of Ansary and co-authors) can also be made that there lies a significant correlation between the creation of corporate human capital and the financial literacy of the business. It can be concluded that the more developed the financial literacy of a business is, the more typical it is for a business to invest in realizing various internal and external trainings (

Tóth 2020).

Given the above, it can be ascertained that we have managed to tap into a rather complex area that is even currently being analyzed from various aspects by many actors in the field. If we want to shed light on why more and more people are dealing with the importance of social and corporate financial literacy, we could say that the most important reasons include the cyclical movement of the economy, the globalization of financial processes, the increasingly complex nature of financial risks, and a more accurate understanding of crises experienced in the last 100 years (

Klapper et al. 2012;

Babajide et al. 2021). At the same time, the fact that financial literacy plays a crucial role in the understanding of the overall performance of small- and medium-sized enterprises is of particular importance (

Graña-Alvarez et al. 2022). However, it can be seen from all the analyses dealing with the topic that the improvement of corporate financial literacy not only is in the interest of businesses, but also benefits the banking system, the state, and society. Commercial banks are considered to be the traditional channel of including companies in the formal financial system in most developing countries. Several authors found that commercial banks enhanced financial literacy through a number of financial consulting activities (

Paramasivan and Kamaraj 2015;

Raihanath and Pavithran 2014). Several confirm that the financial performance indicators such as bank return on assets, bank return on equity, and bank net interest margin clearly improve in the event that financially conscious enterprises represent a larger proportion in the portfolio of the given financial institution (

Kaya 2022;

Hermansson and Jonsson 2021;

Csiszárik-Kocsir 2021). The development of financial literacy is an important interest of the state as well as financial market players. At the macro level, the more developed the financial literacy of a national economy, the greater the available savings and the more stable the financial system (

Widdowson and Kim 2007). A higher level of financial literacy greatly helps businesses manage unexpected macroeconomic and income shocks. It directly follows from this that the state is able to intervene in a much more concentrated manner in order to mitigate economic fluctuations; thus, it can use public financial instruments and resources more efficiently and effectively, and from a budgetary point of view, more sparingly. Our basic argument is that a developed financial literacy can significantly contribute to the resilience of the national economy as a whole and the central budget. If we accept all of this, it is clear why it is necessary to focus on the topic. We have a double goal with this study. First, we attempt to validate the indicators of the financial literacy index (externally and internally oriented latent variables) previously created by exploratory methods on each of three independent samples, to improve their fit, to determine the relative importance of each sub-index in the aggregate indicators, thus exploiting the specificities of the three reach sampling dates (2019: “year of peace”; 2021: pandemic recession; 2022: energy and raw materials crisis caused by the Russian–Ukrainian war) to give a sense of dynamism to the static indicators. On the other hand, we would like to provide a small methodological contribution to a small slice of empirical modeling by systematically collecting from the divergent literature the ways and methods of testing the fit of such a confirmatory model (confirmative factor analysis (CFA)) and the accepted thresholds in the literature. While the method is popular (see, for example, (

del Río-Rama et al. 2020;

Elshaer 2022;

Shah et al. 2020)), the tests and the fit and reliability calculations, not to mention the acceptable or accepted levels of thresholds for each goodness-of-fit indicator, vary widely.

The main objective of our paper is to highlight the factors of uncertainty in corporate governance that will fundamentally determine their operations from 2020 onwards. A huge energy crisis has unfolded, which in many cases is placing unmanageable burdens on businesses. With Brent oil at USD 61 in January 2019 and USD 122 in May 2022, we can see that global oil prices have risen sharply since the outbreak of the Russia-Ukraine war—but have fallen back to around USD 80 by the end of 2022. European natural gas prices continued to fall in the first trading days of 2023, dipping below EUR 70 nowadays, a new low since February 2022, before the outbreak of the war in Ukraine. Gas prices on the stock exchange have also come and gone: the benchmark TTF-type gas was quoted at EUR 20 (megawatt-hour) on the Rotterdam exchange in January 2021, reaching EUR 300 a year later, in early 2022, and is currently trading below EUR 120. The price hikes have all fuelled inflation, which was already 4.7% in Hungary in January 2020 and over 22% in November 2022. Cost management for companies has become a sensitive issue. Deteriorating global market conditions have forced monetary policymakers, central banks, to abandon their supportive monetary policies and move towards tightening, in line with their primary anchor of price stability. Of course, this has created another risk, which now directly affects the area of corporate finance: the low interest rate period has ended, which has reduced the conditions for access to credit. This is not unique to Hungary, as both the ECB and the FED have expressed their commitment to bringing down inflation, which clearly means making expensive corporate loans more durable. At its last policy meeting in 2022, the FED raised the benchmark dollar rate from 4.00% to 4.50%, while the ECB raised the policy rate by 50 basis points and announced the start of quantitative tightening. It is noted that in order to restore economic stability as soon as possible, there is a strong need for central banks to suck liquidity out of the economy, even if this means creating difficulties for the corporate segment. At the same time, financial benchmarks (such as the one in our study) can make corporate risks more identifiable and manageable.

Since 2020, we have come to find ourselves in a brave new world, that of crisis upon crisis. We are convinced that appropriate crisis management requires working along the lines of solidarity. We reckon that the government, the public, and the business sector need to come together for the sake of proper crisis management. All this also requires the policies to give direction and make use of subsidizing instruments to incentivize businesses. We see corporate financial literacy and awareness as some of the instruments of this incentive scheme as businesses with a higher level of financial literacy (1) are more effective and balanced in their business endeavors from a financial point of view, (2) have a more conscious risk management policy, (3) have an adequate growth strategy, and (4) exhibit more targeted and effective financial and investment decisions (

Toth et al. 2022;

Tóth 2020;

Tóth et al. 2022). To summarize all of the above, we find it evident that economic policies need to prioritize the development of financial awareness as, in line with the majority of the experts involved with the subject matter, it has high returns. They do so because businesses that do so are financially less vulnerable and prone to adversity; with regard to tax paying and levels of employment, they are more stable and easier to calculate with; their creditability is stronger, and they have a higher capacity in terms of loan repayment.

The article consists of five sections after the introduction. The first and second sections include a literature review on the benefits and barriers of financial literacy. To analyze the practical and methodology-related parts of the research, it is important to examine the theory behind the research. Therefore, in these two sections, we endeavor to highlight the necessity and interpretation of corporate financial awareness. The next section presents the sources and characteristics of the data and methods used. This is a greater part as we would like for our paper to contribute to methodological issues as well. On the one hand, we find that it is important that an article include the tests, indicators, and benchmarks required for the general fit tests of the models as well as the indisputability of the fit and validity of the corporate financial literacy model created by us. The next section provides the results and a discussion of the research, and the last section presents our final conclusions.

2. Literature Review: The Background of Financial Literacy

The current market economy is characterized by turbulent and rapid development and uncertainty, and the number of changes is growing: COVID-19 and its effects on the global economy, reduction of energy consumption, climate change and its effects, the intensive development of technology, and the change in the economic life cycle (

Litvaj et al. 2022;

Perišić et al. 2022;

Urbaniec et al. 2022). According to researchers and global economic forecasts, nations, companies, entrepreneurs, and households may face many obstacles, such as a lack of financial assistance, a lack of information on business matters, higher and higher taxes, and soaring inflation (

Srimulyani and Hermanto 2021;

Rodousakis and Soklis 2021). In addition to all this, we cannot ignore the Russian–Ukrainian war and its almost unfathomable negative business effects. This conflict has been causing knock-on effects worldwide. During and after the COVID-19 pandemic and now, during the Russian–Ukrainian war, small- and medium-sized companies have been severely affected. It, however, is important to add that the two major crises lasting since 2020 are very different in nature. Their occurrence can be related to different reasons, had different courses, had different effects and consequences, and shed light on different economic and social weaknesses. While the crisis created by COVID-19 pointed out the weaknesses in the healthcare system, health sector, and supply chains, the Russian–Ukrainian conflict cleared the air around energy dependence and economic dependence. At the same time, both crises highlighted the fact that there is a need to reimagine the whole of the economic system and competitiveness models, where businesses are of paramount importance. A new situation has emerged to which companies and nations have to adapt their activities (

Prohorovs 2022). The companies have been forced to adapt quickly to this new reality. In business, there is a renewed appreciation for good management knowledge and skills. At the same time, the need to make informed decisions based on theoretical knowledge and intuition and the ability to react quickly, make quick decisions, and improvise are becoming increasingly important in a context of limited access to different funds, reduced purchasing power, a threat to sustainable growth, and restrictions on trade as a result of sanctions (

Lim et al. 2022;

Foris et al. 2022;

Beraich et al. 2022). Agility and creativity play pivotal roles in identifying opportunities which can help companies overcome difficulties.

To make sense of all this, we also need to consider the business environment in which businesses operate. It can be stated that an increasingly uncertain macroenvironment has been present since 2020, affected by the pandemic and a new political and economic crisis caused by the escalation of the Russian–Ukrainian conflict (

Krugman 2022).

Our argument according to the above supports that, in particular, the increasing quality of entrepreneurship education plays an important role in the growth of entrepreneurs and economies. Corporate financial literacy actually means knowing the elements of a financial management toolbox and their conscious application. According to

Kefela (

2011), financial literacy, thus, includes the following areas: budgeting, savings, debt management, financial negotiations, risk management, taxation, and banking services. Without knowledge of financial, economic, taxation, business, and management principles, it is extremely difficult to make well-informed and financially sufficiently grounded decisions that are most likely to reflect how each decision will affect a company’s results, not only in the short term but medium to long term as well (

Dalton 2021;

Agyei 2018). However, in today’s unprecedented crisis situations, it is clearly visible that companies and entrepreneurs are facing complex financial decisions in the midst of unexpected and various economic crises to turn their businesses around (

Makdissi et al. 2020;

Morillas-Jurado et al. 2021;

Zaitul and Ilona 2022). They make financial decisions in the form of savings, investment, green and energy-efficiency investments, and decisions for overcoming and managing inflation, which makes financial literacy crucial in business financing decisions and subsequent performance. Several authors link financial literacy to corporate failures and bankruptcies, and this approach is especially important in today’s crisis period.

Kotzé and Smit (

2008),

Freiling and Laudien (

2013), and

Jackson (

2021) found that lack of corporate financial literacy and skills in business are the main reasons for the failure of SMEs. At the same time, the high failure rate of SMEs has a negative impact on crisis management and sustainable development. That is why all governments are trying to prevent the wave of corporate bankruptcies (e.g., massive company closures) during the coronavirus crisis and the current energy crisis, especially in the European economies. The policymakers are also aware of the basic economic connection of firms and entrepreneurship being able to boost economic growth through many direct and indirect positive effects: they deliver new jobs, contribute to social development, encourage an increase in awareness of local products and services, reduce inequality, have positive effects on innovation, introduce new technologies, and encourage the creation of new business opportunities (

Schlaegel and Koenig 2014;

Castaño et al. 2015;

Galindo and Méndez 2014;

Nurunnabi 2020;

Seraj et al. 2022).

3. Materials and Methods

In compliance with the EU SME proposal 2003/361, our study population comprises Hungarian enterprises with between 25 and 250 employees and an annual revenue of less than EUR 50 million or an annual balance sheet total of less than EUR 43 million. To establish the ideal sample size, we employed a confidence level of 95% and aimed for a standard error of less than 5%.

In our survey, a systematic random sampling method was used: companies were contacted during national roadshows between February and May 2019 (so the sample includes companies with financial data from the 2018 fiscal year), and a second sampling was conducted among the same respondents between May and August of 2021 and May and August of 2022. Ultimately, we built our models from these three independent samples. At the same time, these samples had to be truncated due to the rigorous application of the method, so we removed all the elements from the samples where the response was incomplete or the respondents could be considered outliers based on their answers (primarily, the specimens with outstanding turnovers that were removed from the sample). Based on these, the number of elements of the test samples is lower than the actual sampling: n1 = 1365 enterprises from survey of 2019, n2 = 1496 enterprises of 2021, and n3 = 992. All three samples have a standard error below 3% and a confidence interval of 95%. The samples thus taken are considered to be representative of the consolidated sectoral breakdown of the Hungarian economy (Mann–Whitney U-test: p1 = 0.172; p2 = 0.167; p3 = 0.089) and provide a uniform distribution for size categories based on the number of employees (Kolmogorov–Smirnov test: p1 = 0.091; p2 = 0.056; p3 = 0.051).

In this article, we present the test results of the confirmatory factor model for all three samples. To prepare the analyses, we used the IBM SPSS AMOS program package and the SmartPLS 4 program. The estimated method used was the maximum-likelihood method, following the recommendation of

Thompson (

2004). There is consensus in the relevant literature regarding the possibility of verifying the models based on factor analysis performed with explorative methods with the use of the technique appropriating the procedure of the confirmative factoring model (

In’nami and Koizumi 2013;

Shah et al. 2020;

Ullman 2001;

Kendall and Stuart 1977;

Wong et al. 2014;

Hayduk et al. 2007). Thus, we have decided to settle on it in the present article. There is, however, a lack of consensus in the relevant literature (

Baird and Borich 1989;

Levine et al. 2006;

Husain et al. 2021), which can even be quite permissive as to what tests, indices, and pertaining accepted benchmarks may serve to conduct this verification and its relating fit tests. In our article, we also perform a classification for these.

In view of the aim of the research, we have set the following hypotheses:

H1. The fit of our financial literacy model is appropriate, underpinned by all of the fit tests performed on the three independent samples.

H2. Financial literacy cannot be measured by a single index, as the internal and external factors that are occasionally independent of one another have a very clearly identifiable role in it.

H3. The external elements of the financial literacy index (risk taking and insurance, taxing external financial management elements) had gained increased significance by 2020.

3.1. Validity Tests

We use a confirmatory factor model to verify our financial literacy model. In the case of confirmatory factor analysis, it is extremely important to establish validity, especially convergent and discriminant validity (

Carmines and Zeller 1979). If the factors do not show a sufficient degree of validity and reliability, then our efforts to analyze the causal models built for them will be in vain because they cannot be interpreted correctly. Only a few indicators are available in the statistics toolbox to test validity; examples include CR (composite reliability) and AVE (average variance expressed). The threshold values of these two indicators should be as follows: CR > 0.7; CR > AVE; AVE > 0.5 (

Hair et al. 2010). The classification of measures of convergent validity is described by

Fornell and Larcker (

1981), according to which convergent validity is achieved when the following three conditions are met:

Fornell and Larcker (

1981) also laid down the requirements for discriminant validity. This type of validity is achieved when the following conditions are met:

The root of the average variance expressed by the given factor exceeds the correlation coefficient between the factor and all the others;

MSV < AVE (MSV: maximum shared variance);

ASV < AVE for each factor (ASV: average shared variance)

In addition to all of this, we also have to make sure that the model we have created provides the best possible construction that can no longer be improved. For this, all three types of fit tests (absolute, incremental, and parsimonious fit) of the constructs must be performed until the test values improve. If the improvement is no longer significant, then we have reached the best construction. To determine the threshold values of the indicators, it is advisable to use the stricter values accepted in the literature as a basis (

Wheaton et al. 1977;

Mulaik et al. 1989;

Schreiber et al. 2006).

3.2. Fit Tests

Various goodness-of-fit indices exist to examine the fit of statistical models. Based on published research, four to six fit indices are usually used and recommended to assess how well the models fit the data structure (

Medsker et al. 1994). However, in order to filter the robustness of individual indicators, it is advisable to define several fit indicators (

Wheaton 1987). Accordingly,

Hair et al. (

1998) recommend using at least three groups of fit indicators:

Absolute fit indices: measure how well the model takes into account the observed covariance of the data (

Hu and Bentler 1995).

Incremental fit indices: compare how well the proposed model fits the data compared to a basic model that assumes independence between all variables (

Bentler 1990).

Parsimonious fit indices: enable the examination of the fit of competing models on a common basis (

Wong et al. 2014).

3.2.1. Absolute Fit

During the examination of the absolute fit, the indicators are derived from the implied covariance matrices and the maximum-likelihood (ML) minimization function. The determination of the following absolute fit measures is justified to verify the structure of a confirmatory model.

χ

2 (or normed chi-square): The χ

2 value is derived directly from the fit function; it examines the exact fit of the model and forms the basis of many further fit tests (

Newsom 2020). However, it must be handled with due caution, as it is extremely sensitive to the number of sample elements: larger samples result in larger χ

2 values, which are significant even in the case of very small differences between the assumed and obtained covariance matrices, and small samples may make it too likely to accept a bad model (probability of type-2 error) (

Hayduk et al. 2007). The pointer indicates the fit of the model. If χ

2 is not significant (

p > 0.05), it indicates a proper presentation of the data (

Byrne 2010;

Kline 2005).

GFI (goodness-of-fit index) (or

as referred to by

Steiger (

1989)): A value close to 0 indicates a poor fit, while a value close to 1 indicates a perfect fit. In statistical practice, the GFI > 0.9 value is the most accepted (

Hair et al. 2010;

Kline 2005). The index was developed by

Jöreskog and Sörbom (

1984), and it was generalized by

Tanaka and Huba (

1985) as the ratio of the minimum value of the discrepancy function

and its maximum-likelihood estimate

:

AGFI (adjusted goodness-of-fit index): AGFI takes into account the degrees of freedom

and the number of free parameters (

p) available for testing the model. Thus, the proportion of the total covariance matrix that is accounted for by the model in each of the

G groups of variables is

, where

g is an index that ranges from 1 to

G (the number of groups of variables in the model). The indicator is limited from above, and its maximum value is 1, but it is not limited from below, like the GFI indicator:

RMR (root mean square residual) (or in some cases its standardized value (SRMR)): RMR is the square root of the mean square sum by which the variances and covariance of the sample

differ from their estimates (model-implied covariance

) of groups

g obtained assuming the correctness of the model. It also considers the

total number of unique covariances among the observed variables in the data and the proportion of the

total covariance matrix that is accounted for by the model in each of the

G groups of variables, as estimated from the structural equation model:

RMSEA (root mean square error of approximation): Values below 0.05 are generally considered a good fit, but even values below 0.08 are acceptable in terms of model fit. However, values close to 0.1 mark the lower limit of fit (

Browne and Cudeck 1993;

Kline 2005). RMSEA is also considered a noncentrality-based index (

Newsom 2020). It considers the

discrepancy between the observed covariance matrix and the model-implied covariance matrix. This is often referred to as the “badness of fit” index:

3.2.2. Incremental Fit

These indices compare the χ

2 of the tested model (substantive model) to that of a null model (or baseline model or independence model). The null model is a model in which there is no correlation between any of the measured variables (there are no latent variables). The null model should always have an extremely large χ

2 value (poor fit) (

Newsom 2020). The typical null model is the independence model in which all observed variables are assumed to be uncorrelated (

Widaman and Thompson 2003). For maximum-likelihood estimation, these indices are usually computed by using the χ

2 statistics of the maximum-likelihood fitting function (ML-χ

2).

The majority of these fit indices are calculated using ratios of the model chi-square and the null model chi-square, taking their degrees of freedom into consideration. The values of these indices vary between roughly 0 and 1. Certain indices are “normed” such that their values cannot be less than 0 or more than 1 (e.g., NFI, CFI). Others are called “non-normalized” because they may sometimes be more than 1 or slightly below 0 (e.g., TLI, IFI). A previous standard utilized a value greater than 0.90 as a cut-off for well-fitting models (

Newsom 2020), but there is currently an agreement that this value should be raised to about 0.95 (

Hu and Bentler 1995).

NFI (normed fit index): NFI is the simplest incremental fit index (

Bentler and Bonett 1980); however, it does not consider model complexity. This can be considered as the normalization of the chi-square statistic

associated with the null model (a model with no constraints on the parameters) and the chi-square statistic

associated with the model being tested (model with constraints on the parameters). That is, a more complex model always yields higher NFI values compared to a more parsimonious nested model (

Schmukle and Hardt 2005):

TLI (Tucker–Lewis index): It was developed by

Tucker and Lewis (

1973) and later adjusted by

Bentler and Bonett (

1980) in the context of analysis of moment structures, and it is also known as the Bentler–Bonett non-normed fit index (NNFI). The advantage of the TLI is that it is not biased by sample size (

Marsh et al. 1988). The typical range for TLI lies between 0 and 1, but it is not limited to that range. TLI values close to 1 indicate a very good fit (

Hu and Bentler 1995):

IFI (incremental fit index): IFI, also known as Bollen’s IFI, is also relatively insensitive to sample size. Values greater than 0.90 are considered acceptable, although this index may exceed 1. To calculate the IFI, we first calculate the difference between the chi-square of the independence model

—in which the variables are uncorrelated—and the chi-square of the target model

. Then we calculate the difference between the chi-square of the target model and the

df of the target model. The ratio of these values represents the IFI (

Bollen 1989):

CFI (comparative fit index): CFI compares our model to other models, such as the null or independence model. Bentler’s comparative fit index is also known as the CFI. It reflects the ratio of the discrepancy of our target model to the discrepancy of the independence model, indicating the degree to which our model is superior to the independence model. Values close to 1 suggest an appropriate match. CFI is not very concerned with sample size (

Fan et al. 1999). It may be computed by dividing the NCP (discrepancy, degrees of freedom, and estimate of the noncentrality parameter for the model being assessed) by the NCP

b (discrepancy, degrees of freedom, and estimate of the noncentrality parameter for the baseline model). The numerator of the CFI formula represents the improvement in the fit of the model being tested over the baseline model, adjusted for the degrees of freedom. The denominator represents the maximum possible improvement in fit over the baseline model, adjusted for the degrees of freedom and sample size:

3.2.3. Parsimonious Fit

High parsimony or simplicity is attributed to models with a small number of parameters and a big number of degrees of freedom. On the other hand, we are aware that models with a large number of parameters (and few degrees of freedom) are complex or lack parsimony. Simultaneously, it is important to recognize that the application of the words “simplicity” and “complexity” in mathematical statistics does not necessarily match their common meanings. “Complex” would be used to describe a saturated model, while a model with an intricate structure of linear relationships but strictly limited parameter values would be considered simple. Parsimony-corrected fit indices are relative fit indices that are modifications to the majority of the fit indices listed before. The changes are intended to punish less parsimonious models, thus favoring simpler theoretical processes over more complicated ones (

Newsom 2020). Researchers often choose parsimonious models (

Mulaik et al. 1989); there is a consensus that parsimonious models are better than those that are more complicated. Likewise, models that fit well are preferred to those that do not. Numerous fit measures aim to strike a compromise between these two competing objectives: simplicity and fit quality. There is considerable controversy as to whether or not parsimony adjustments are acceptable, despite the fact that many studies feel they are essential. Nonetheless, parsimony-adjusted relative fit indices are seldom utilized in the literature (

Newsom 2020).

χ2/df: an index calculated from the χ

2 index of absolute fit; the acceptance criterion varies by researcher, ranging from less than 2 (

Ullman 2001) to less than 5 (

Schumacker and Lomax 2004).

The following parsimonious fit indicators are given as the JMB (

James et al. 1982) transformation of the absolute and incremental indicators (

James et al. 1982): the original indicator is multiplied by the quotient of the degrees of freedom of our model (

df) and the degrees of freedom of the baseline model (

dfb), where

PGFI (parsimony goodness-of-fit index): The PGFI is a modification of the GFI that takes into account the degrees of freedom available for model testing (

Mulaik et al. 1989):

PCFI (parsimony comparative fit index): The PCFI is the result of applying the James, Mulaik, and Brett (

James et al. 1982) parsimony adjustment to the CFI:

PNFI (parsimony normed fit index):

4. Results

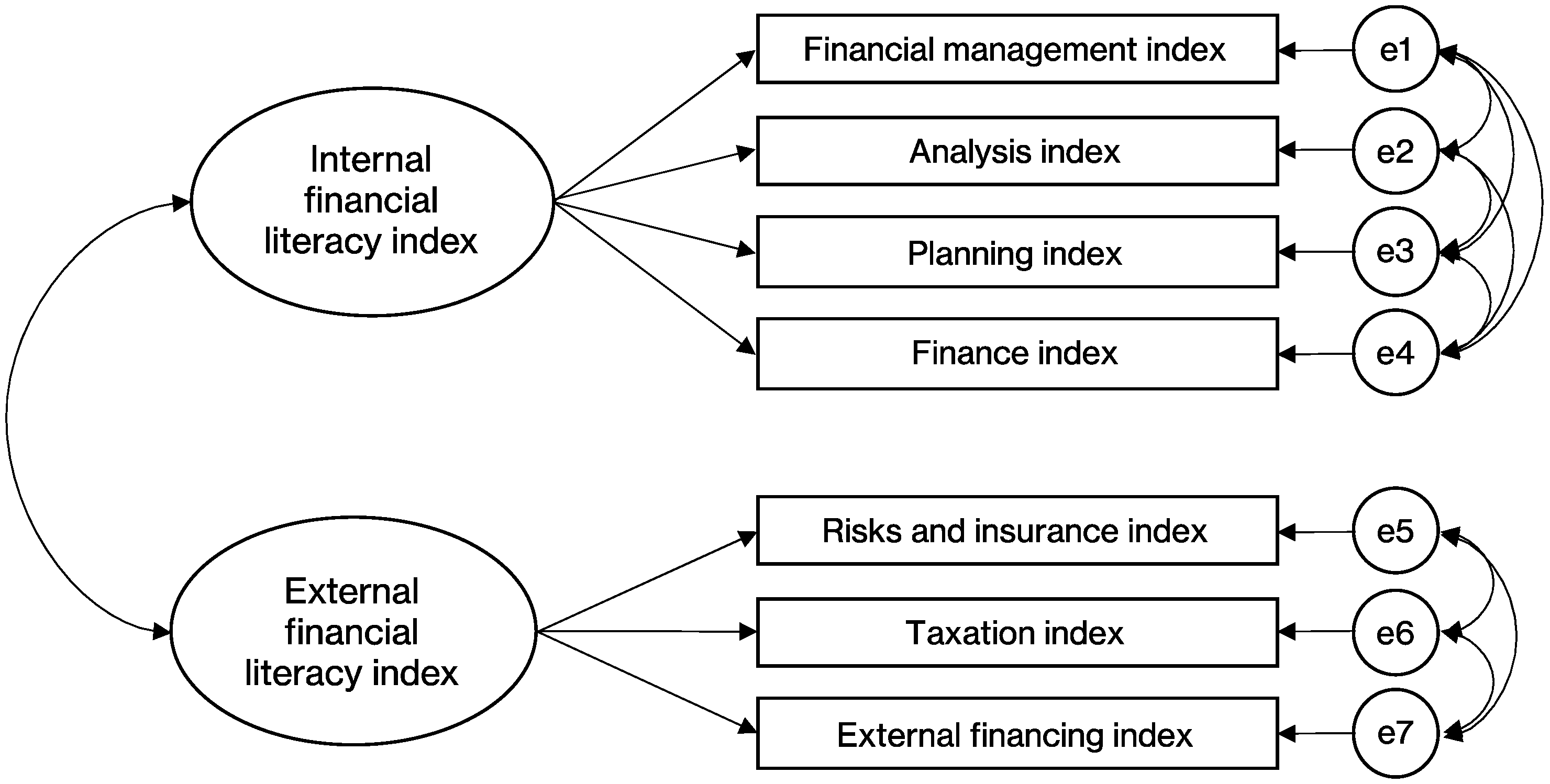

In the following, we present the factor model built from the elements of the financial literacy index, the sub-models from the samples taken at different times, and their fit analysis. During our previous research, we created the model structure according to

Figure 1 with the help of exploratory factor analysis. It can be seen from this that the elements of the internal financial literacy include the financial management index (

finmng:

profitability; efficiancy; cashflow management; regular controlling reports; financial reserve; investment; cost management; growth; conscious financial, strategic management; use of modern banking and financial services), analysis index (

analysis: review of the financial situation; revenue structure analysis; liquidity analysis; analysis of the possibilities of obtaining application funds; cost structure analysis; profitability analysis; plan-fact analysis; asset analysis), planning index (

planning: revenue and expenditure plan; design premises and conditions; written strategy; short-term operational plan; financial strategy; financing strategy), and finance index (

finance: borrowing; liquidity management; financial and capital structure; use of internal financing instruments; conscious design of capital structure); the external index contains the risk and insurance index (

risk: risk management; acquisition and analysis of financial information; credit insurance), taxation index (

taxation: search for tax optimization; applying tax optimization; considering the tax implications of financial decisions) and external financing index (

external: following the communication of the Hungarian National Bank; monitoring macroeconomic processes; monitoring the operation of the state and changes in economic policy; use of counseling; monitoring inflation and the central bank base rate).

When creating the corporate finance index (hereinafter referred to as CFI), the main goal is for the index to record the financial awareness of the businesses, as well as referring to the practice of planning, analytical and control functions, the conscious management of liquidity, the awareness of short and long term strategic planning, widespread access to information, the use of state-of-the-art banking services, capital intensity, and indebtedness and management of financial risks.

The model below, which can be used for confirmation, contains the error terms (e1, …, e7) associated with the measured and exploratory factor analysis (varimax rotation and Kaiser normalization) indices, the covariance between them, and the covariance creating the relationship between the two latent variables. You may find the process, technique, and related unique measured variables of the creation of the seven indices within the model in a previous article of ours (

Tóth 2020;

Tóth et al. 2022).

The results are favorable both for the entire model and for the three sub-models as it can be seen in

Table 1. This means that for all models, the indicators of absolute fit, incremental fit, and parsimonious fit are within the threshold values. On the one hand, this indicates the goodness of the model, and on the other hand, it enables the analysis of the model’s standardized coefficients, as well as further work with the model, analyses, and conclusions.

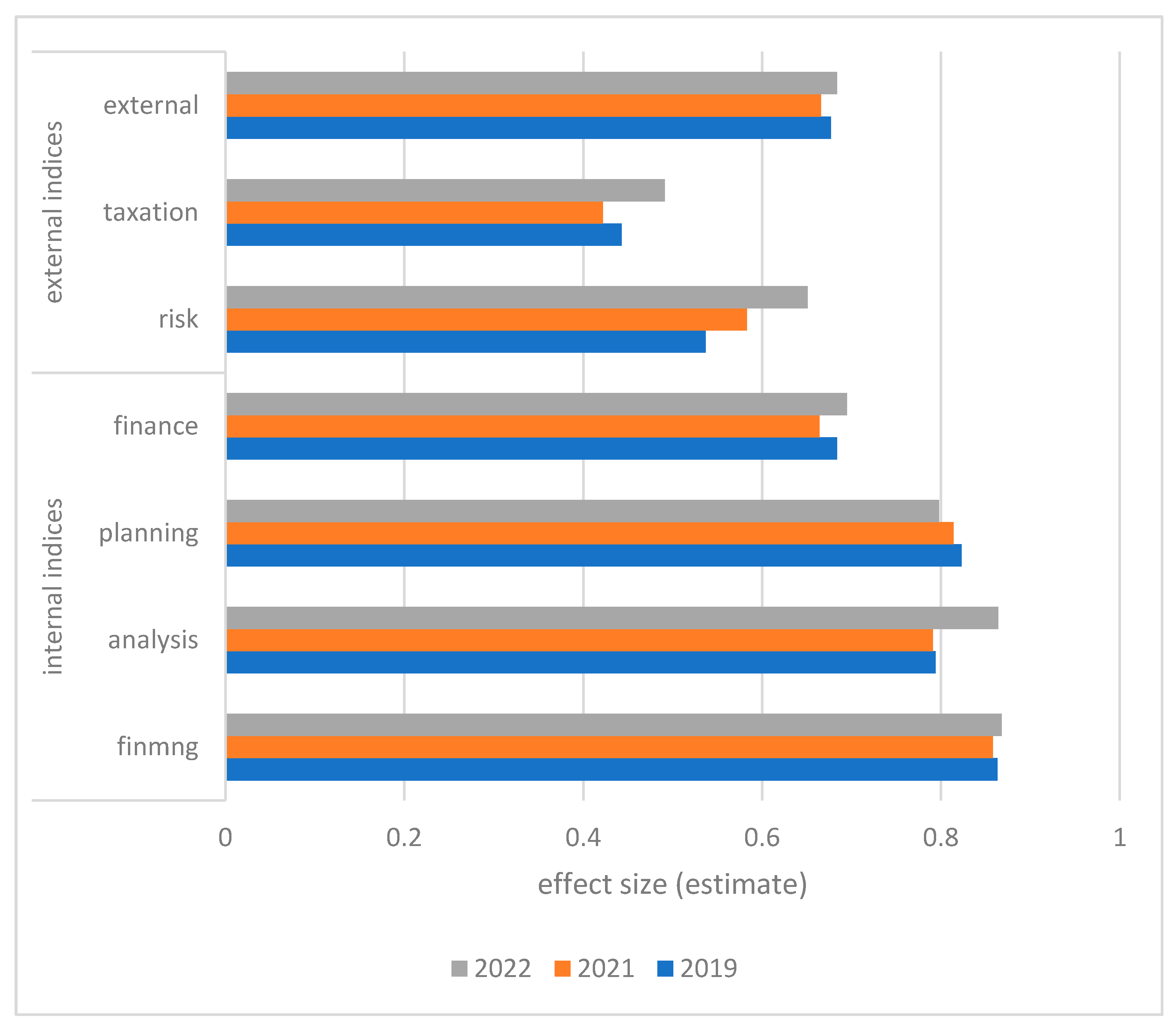

All of the standardized coefficients (as shown in

Table 2) of the entire model are significant (

p < 0.001), the standard error is sufficiently low everywhere, and the composite reliability is sufficiently high for all parameters. In the tables below, we provide these indicators for the constructions: the internal financial literacy index (INT_F) and the external financial literacy (EXT_F) factors. The estimated standard coefficients can also be compared with each other, so we can see which indicator has the greatest weight in which construction. In the internal financial literacy index, the financial management index stands out, while in the external financial literacy, the external financing index stands out. In the latter construction, the weights are slightly lower compared to the components of the internal financial literacy, but they are still above the 0.5 threshold and are significant.

Like the full model, the model fitted to the 2019 data series is also very similar as shown in

Table 3. One of the reasons for this can be traced back to the methodology, considering that the exploratory factor model was built on the entire database in order to ensure a linear relationship (this is also because we can test the entire model at the same time in the confirmatory phase, which is the subject of the current article), but another reason is that, that due to the relatively high number of sample elements, we can work with a low standard error and thus create a more homogeneous, static model that is better suited to reality, where the constellation and structure can be considered relatively constant (this is also true for the saturated and independence models, which were used in the fit test).

5. Discussion

Since the fit of both the full model and the sub-models is adequate and the estimated parameters are standardized, we have the opportunity to directly compare the estimated parameters of each index in the three years examined. This refers to the change in the relative importance of the financial literacy index component in the three periods: the last “year of peace” before the COVID-19 pandemic in 2019, the period of initial reorganization after the COVID-19 pandemic, and the crisis situation due to the Russian–Ukrainian war. The weight of the index of financial management elements is the highest among all indices, and it remained so for all three years, and by 2022 its role had even increased slightly. At the same time, the role of the analysis index, which is also significant and ranks third in the index importance ranking, did not change between 2019 and 2021; however, it significantly increased in value by 2022, which indicates that the role of analyses (business, environmental) has been important until now, but with the increase in uncertainty experienced in the economic and market environment, its role became even more important by 2022, and together with the financial management index, it was placed on the top step of the podium. However, we see something different in relation to the evolution of the planning index: its relative importance, which it maintained for 2022, is also very significant, but the value of the standardized coefficient decreased slightly. The role of the financing index in internal financial literacy also increased by 2022.

Overall, we see that there was some reorganization in the structure of the internal financial literacy index as a result of the war: the role of the analysis index and the financing index were mostly appreciated, while planning (plannability) decreased somewhat, but financial management and analysis has gained the most important role. This is also supported by other sources in the literature (

Diéguez-Soto et al. 2021;

Hendrawaty et al. 2020); however, there are quite a few sources for benchmarking in a recession period.

Carrying out the same examination of the elements of the external financial literacy index, we can see that the role of the risk and insurance index has increased significantly by 2022: of all the indicators, the role of this index has been appreciated the most, first due to the COVID-19 pandemic, and later in connection with the outbreak of war. It is interesting that the role of the taxation index has not yet changed significantly by 2021, and even decreased somewhat, but by 2022 its importance has increased among the elements of external financial literacy, but it still has the lowest weight in the created latent variable weighting system. In this constellation, external financing, namely the external financial index, has the greatest weight, the role of which also increased in value as a result of the war. The reason for this is the fact that most central banks have introduced sturdy monetary restrictions, the result of which has started to show in the financing budgets. In Hungary, for instance, the base rate has increased to 13%, and the overnight funding rate has gone up to 18%. This means that the investment loans with a longer run have reached 20%. This is a rate that cannot by any means be ignored by the CEOs of businesses, as to find the instruments for this in their budgets may be infeasible. There is no place for poorly thought-out decisions with such extensive financing costs. These changes can be clearly observed in

Figure 2.

Overall, it can be seen that by 2022 the importance of the elements of the external financial literacy index increased to a much greater extent (by 9% on average) than that of the internal elements (by 3% on average). A more significant decrease in the taxation index can be seen in 2021, which can be explained by the fact that in order to alleviate the economic difficulties caused by the COVID-19 pandemic, the government eased taxation in Hungary and other OECD countries as well (

Lentner et al. 2022). Businesses have started considering risks at a much more serious rate (that is part of the external financial index) as well as their respective management, which there is a clear need for, given that businesses have been faced with various risks: inflation, increasing financing costs, labor shortage, demand for pay-rise, source-material and goods shortages, lagging procedures, etc. The conscious management and planning of these factors are key.

The present study suffers from some limitations. The authors intend to extend the study in the future by addressing mixed qualitative and quantitative research methods to examine more deeply the role of corporate financial literacy after the crises and its further comparison before the 2020 period. Future lines of the research should be focused on motivating more participants willing to fill in the questionnaire, as well as a deeper analysis of the questionnaire, such as building a structural equation model on the data to find out which elements of the internal and external financial literacy indices are interrelated. Authors could also extend the analysis to key entrepreneurial soft skills in crisis management. We see the analysis of the correlation system of the green economy, green funding, and corporate financial awareness as a further direction for research. Our scope of research for the future involves the backtesting of the results of public schemes focused on corporate financial awareness and the impact of such schemes on economic growth and stability. From a methodological point of view, we would like to develop our research with a Monte Carlo simulation to identify the interdependencies of elements of the internal and external financial literacy indices.

The above results evidence our hypotheses, considering the following:

With respect to H1, the fit of the models founded on the database deriving from all three independent samplings is good, including the total of 13 indices of absolute fit, parsimonious fit, and incremental fit, and thus we can stipulate that the model in accordance with

Figure 1 is valid and suitable in any sample for carrying out measurements related to the financial awareness of businesses (mainly SMEs) and making deductions from the models created in such fashion.

In terms of H2, we may also stipulate that, given the first hypothesis, financial awareness is measured by two dimensions orthogonally irrespective of one another: external and internal financial awareness.

In terms of H3, the evolution of the estimated effect size values are clear indicators that the external elements of the financial literacy index (risk taking and insurance, taxing, external financial management elements) had gained extensive significance by 2022, and the difference is significant (p < 0.001).

6. Conclusions and Policy Implications

In this study, a novel method was developed to investigate the concept of corporate financial literacy. The combination of the academic and practical, business-oriented approaches allowed us to continue our previous research and find new results. According to the above, our conclusion is that within the internal financial literacy index, the role of analysis and financing role have grown most, and within the framework of the external financial literacy index, the sub-index related to risk management was evaluated the most, which follows directly from the epidemic and war processes that occurred in the recent period. If we analyze the external environment outside the companies, it is clear that uncertainty has increased significantly in the past year, but more broadly in the past 3 years. In 2020, the coronavirus crisis and the health and economic risks associated with it brought enormous unpredictability to business life, both on a national and global level. This was exacerbated by the Russian–Ukrainian war that would break out in 2022. Behind the uncertainty is now a complex system, the most important elements of which are the rearrangement of economic and geopolitical power relations, the disruption of global supply chains, and the resurfacing of the related contradiction between globalization and localization. The processes that have been taking place in the world economy since 2020 have a negative effect on corporate management, so the application of our financial literacy index can be of good service to financial decision-makers.

Our results highlight that the external financial literacy index elements have a significant impact in a period when risks increase. When it comes to maintaining the operations of companies (ongoing concern), decisive importance is given to not only internal management aspects (marketing tools, management culture, etc.) but also the ability to comply with the external environment and the quality of external transfers. We experienced that the companies that were in crisis in 2007–2008 did not significantly change their business processes and did not put more emphasis on improving their financial skills. It can also be seen that they were not able to save themselves in the difficult situation at that time; they needed a strong external institutionalized support system (e.g., the Growth Loan Program of the Hungarian National Bank and government subsidies, as in other countries). However, the government’s monetary and fiscal reserves were significantly reduced by the end of the previous decade, so corporate financial awareness has a greater role to play, and it is even necessary to place a greater focus on the state level because previous experience proves that the fate of companies (especially the smallest ones) also depends on how economic policy helps them. Here, we would like to refer back to what was stated in the theoretical part, according to which the development of corporate financial literacy cannot be the responsibility of the state alone. It is necessary for the state to participate, but at the same time, the companies themselves must also initiate the continuous elimination of their backwardness in this area. Perhaps their own commitment is more important than any state stimulus package.

The development of corporate financial literacy is clearly in the best interest of the government, most of all during times of increasing competition around the world aimed at reshuffling the existing power structure. The states that integrate awareness in this process may gain a serious advantage over the others. Our conviction is that the more financially aware businesses are not only making more conscious and effective economic decisions, giving a boost to the whole economy, but also strengthening the competitiveness of the labor market (creating higher added-value positions), optimizing tax returns deriving from the business sector, and stabilizing GDP growth. It is also important to remark that the development of financial awareness bears positive results for bank loan monitoring and debt claims as well as tax authority audits and all other risk audits. The continued measurement and backtesting as well as a more overall verification of these factors are among the aims of our future research.