Asymmetric Effects of Tax Competition on FDI vs. Budget Balance in European OECD Economies: Heterogeneous Panel Approach †

Abstract

:1. Introduction

2. Literature Review

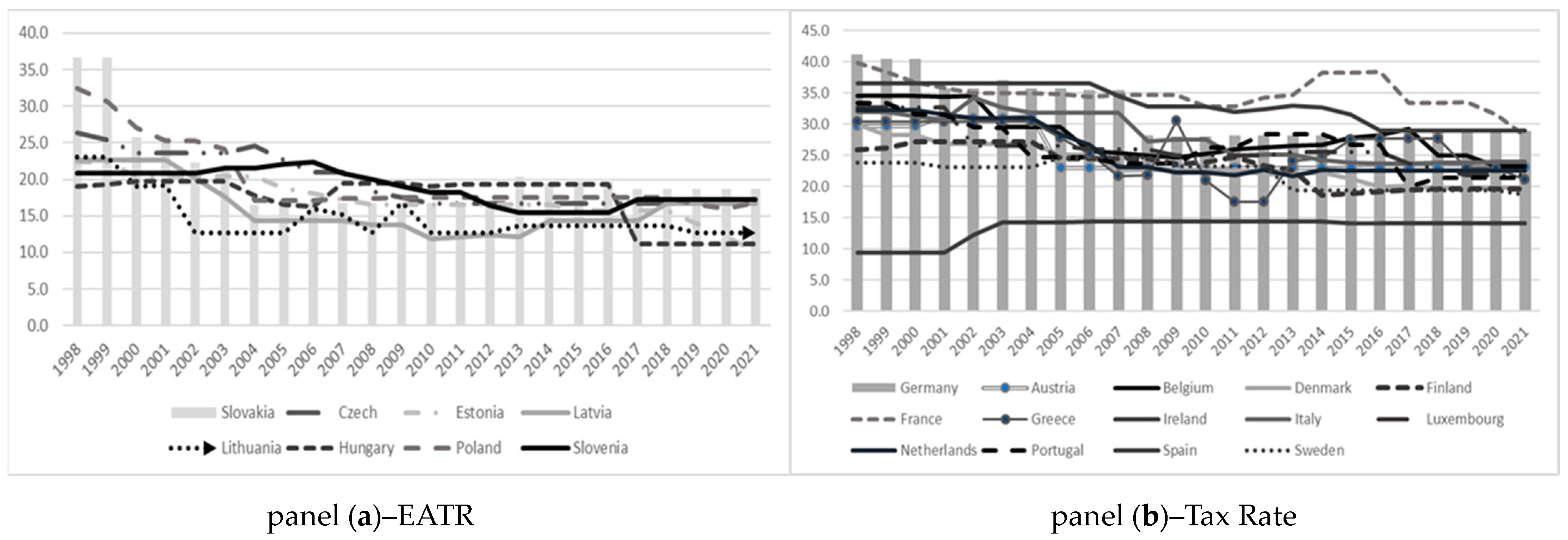

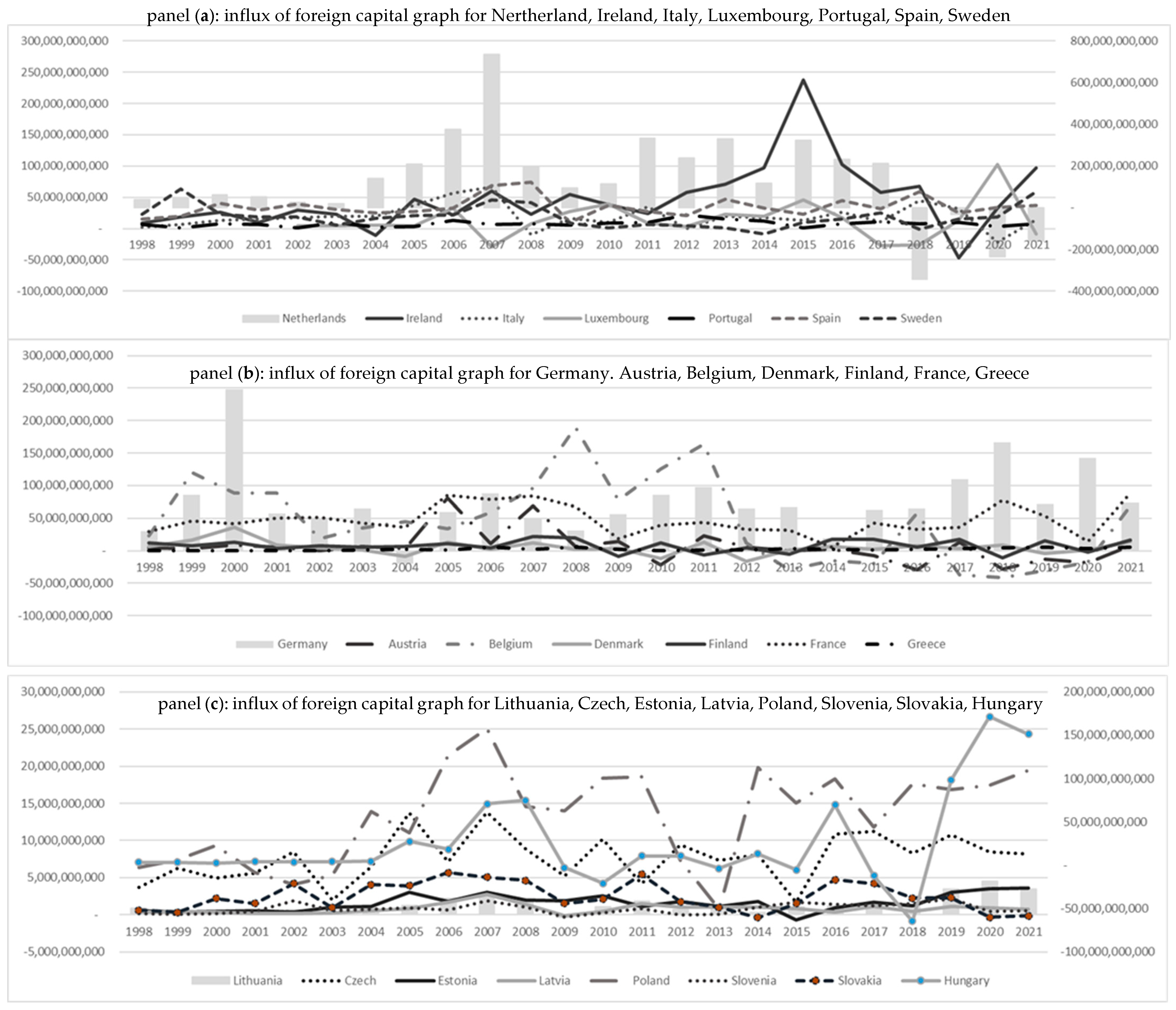

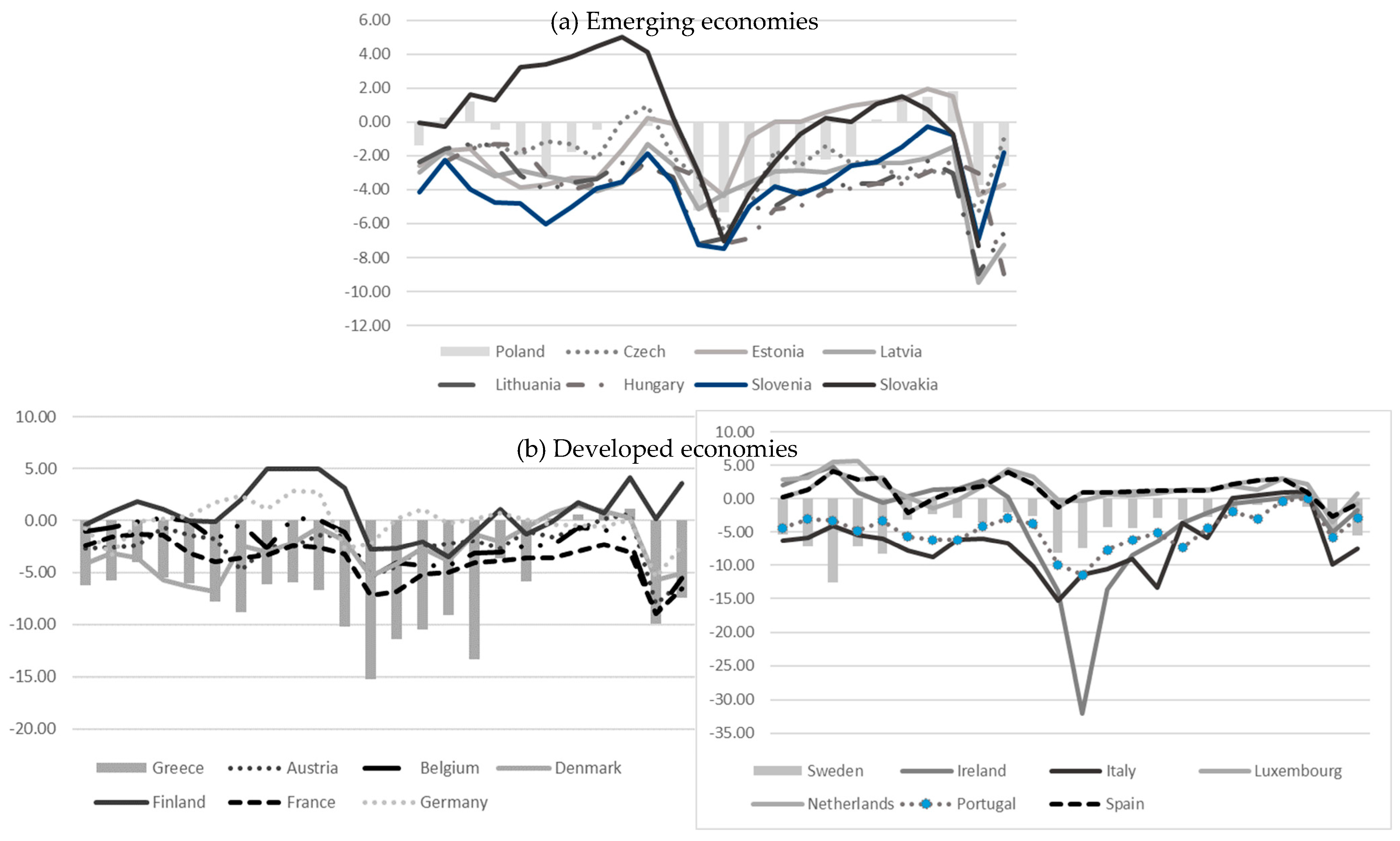

3. Descriptive Analysis: EATR, FDI, and BB

4. Methodology and Data

4.1. Pooled Mean Group vs. Mean Group Estimator

Non-Linear Pooled Mean Group Estimator

4.2. Robust Check—Common Correlated Effects (CCE)

5. Empirical Results and Discussion

5.1. Heterogeneous Effects of EATR on FDI and BB: Pooled Mean Group vs. Mean Group Estimator Results

5.2. Asymmetric Effects of EATR on FDI and BB: Before and after Crisis (Pooled) Mean Group Estimator Results

5.3. Asymmetric Effects of EATR on FDI and BB: Nonlinear Pooled Mean Group vs. Nonlinear Mean Group Estimator Results

5.4. Robustness Check

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Andresen, Maria R., Benjamin R. Kett, and Erik von Uexkull. 2018. Corporate Tax Incentives and FDI in Developing Countries. In Global Investment Competitiveness Report 2017/2018 Foreign Investor Perspectives and Policy Implications. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Anguelov, Nikolay. 2017. Lowering the Marginal Corporate Tax Rate: Why the Debate? Economic Affairs 37: 2. [Google Scholar] [CrossRef]

- Arnold, Jens Matthias, Bert Brys, Christopher Heady, Asa Johansson, Cyrille Schwellnus, and Laura Vartia. 2011. Tax Policy for Economic Recovery and Growth. The Economic Journal 12: 59–80. [Google Scholar] [CrossRef]

- Arsić, Milojko, and Saša Ranđelović. 2017. Ekonomija Oporezovanja: Teorija i Politika. Beogradu: Centar za izdavačku delatnost Ekonomskog fakulteta u Beogradu. ISBN 978-86-403-1529-6. [Google Scholar]

- Auerbach, Alan. 2013. Capital Income Taxation, Corporate Taxation, Wealth Transfer Taxes and Consumption Tax Reforms. Chicago: The Empirical Foundations of SupplySide Economics, The Becker Friedman Institute, University of Chicago. [Google Scholar]

- Barrios, Salvador, Gaëtan Nicodème, and Antonio Jesus Sanchez Fuentes. 2014. Effective Corporate Taxation, Tax Incidence and Tax Reforms: Evidence from OECD Countries. Working Paper Series 5017. CESifo. Brussels: European Commission. [Google Scholar]

- Beljić, Marina, Olgica Glavaški, and Jovica Pejčić. 2023. Tax Strategies and FDI Sensitivity in Crisis Conditions: The Case of EU. Paper presented at 28th International Scientific Conference Strategic Management and Decision Support Systems in Strategic Management-SM 2023, Subotica, Serbia, May 18–19; pp. 166–74. [Google Scholar]

- Bellak, Christian, and Markus Leibrecht. 2005. Do Low Corporate Income Tax Rates Attract FDI? Evidence from Eight Central and East European Countries. Research paper series Globalisation, Productivity and Technology. Nottingham: University of Nothingham. [Google Scholar] [CrossRef]

- Bénassy-Quéré, Agnès, Lionel Fontagné, and Amina Lahrèche-Révil. 2005. How Does FDI React to Corporate Taxation? International Tax and Public Finance 12: 583–603. [Google Scholar] [CrossRef]

- Blackburne, Edward, and Mark Frank. 2007. Estimation of Nonstationary Heterogeneous Panels. Stata Journal 7: 197–208. [Google Scholar] [CrossRef]

- Blanchard, Olivier, Alvaro Leandro, and Zettelmeyer Jeromin. 2021. Redesigning EU Fiscal Rules: From Rules to Standards. Economic Policy 36: 195–236. Available online: https://academic.oup.com/economicpolicy/article/36/106/195/6122701 (accessed on 17 September 2023). [CrossRef]

- Dabla-Norris, Era, and Federico Lima. 2023. Macroeconomic Effects of Tax Rate and Base Changes: Evidence from Fiscal Consolidations. European Economic Review 153: 104399. [Google Scholar] [CrossRef]

- Devereux, Michael, Rachel Griffith, and Alexander Klemm. 2002. Corporate income tax reforms and international tax competition. Economic Policy 17: 449–95. [Google Scholar] [CrossRef]

- Eberhardt, Markus, and Francis Teal. 2009. A common factor approach to spatial heterogeneity in agricultural productivity analysis. MPRA Paper, 15810. [Google Scholar]

- Egger, Peter, Simon Loretz, Michael Pfaffermayr, and Hannes Winner. 2009. Bilateral Effective Tax Rates and Foreign Direct, Investment. International Tax Public Finance 16: 822–49. [Google Scholar] [CrossRef]

- Elschner, Christina, and Werner Vanborren. 2009. Corporate Effective Tax Rates in an Enlarged European Union. Directorate General Taxation and Customs Union, European Commission, Taxation Papers 14. Brussels: European Commission. [Google Scholar]

- Ercegovac, Dajana, and Emilija Beker Pucar. 2022. The Nexus Between FDI and External Balance in Selected Emerging European Economies—A panel data approach. The Annals of the Faculty of Economics in Subotica 58: 147–64. [Google Scholar] [CrossRef]

- Fernández-Rodríguez, Elena, Roberto García-Fernández, and Antonio Martínez-Arias. 2023. Institutional Determinants of the Effective Tax Rate in G7 and BRIC countries. Economic Systems 47: 101079. [Google Scholar] [CrossRef]

- Gale, G. William, and Andrew A. Samwick. 2014. Effects of Income Tax Changes on Economic Growth. The Brookings Institution. [Google Scholar] [CrossRef]

- Glavaški, Olgica, Emilija Beker Pucar, and Stefan Stojkov. 2022a. Public Revenues and Public Expenditure Nexus: Evidence of Eurozone Heterogeneity. The Annals of the Faculty of Economics in Subotica 58: 083–099. [Google Scholar] [CrossRef]

- Glavaški, Olgica, Emilija Beker Pucar, Marina Beljić, and Stefan Stojkov. 2022b. Coordination vs. Competitiveness of Effective Average Tax Rates in Relation to FDI: The Case of Emerging EU Economies. Sustainability 15: 227. [Google Scholar] [CrossRef]

- Gropp, Reint, and Kristina Kostial. 2000. The Disappearing Tax Base: Is Foreign Direct Investment Eroding Corporate Income Taxes? Working Paper 31. Frankfurt am Main: European Central Bank. [Google Scholar]

- Gunter, Samara, Riera-Crichton Daniel, Carlos A. Vegh, and Guillermo Vuletin. 2021. Non-linear Effects of Tax Changes on Output: The Role of the Initial Level of Taxation. Journal of International Economics 131: 103450. [Google Scholar] [CrossRef]

- Hausman, Jerry A. 1978. Specification Tests in Econometrics. Econometrica 46: 1251–71. [Google Scholar] [CrossRef]

- Im, Kyung So, Hashem M. Pesaran, and Yongcheol Shin. 2003. Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Kostin, Konstantin B., Philippe Runge, and Ronald Adams. 2021. Investment Strategies in Pandemic Situations: An analysis and Comparison of Prospective Returns between Developed and Emerging Markets. Strategic Management 26: 034–052. [Google Scholar] [CrossRef]

- Marques, Mario, Carlos Pinho, and Tania Menezes Montenegro. 2019. The Effect of International Income Shifting on the Link Between Real Investment and Corporate Taxation. Journal of International Accounting, Auditing and Taxation 36: 100268. [Google Scholar] [CrossRef]

- Matthews, Stephen. 2011. Trends in Top Incomes and their Tax Policy Implications. OECD Taxation Working Papers, No. 4. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Milton, Ayoki. 2017. Estimating the Revenue Impacts of Tax Harmonization. Institute of Policy Research and Analysis, MPRA Paper No. 83548. Available online: https://mpra.ub.uni-muenchen.de/83548/ (accessed on 11 November 2023).

- Mohammadzadeh, Ardashir, Chunwei Zhang, Khalid A. Alattas, Fayez F. M. El-Sousy, and Mai The Vu. 2023. Fourier-Based Type-2 Fuzzy Neural Network: Simple and Effective for High Dimensional Problems. Neurocomputing 547: 126316. [Google Scholar] [CrossRef]

- Moosa, A. Imad, and Ebrahim Merza. 2022. The effect of COVID-19 on Foreign Direct Investment Inflows: Stylized Facts and Some Explanations. Future Business Journal 8: 20. [Google Scholar] [CrossRef]

- OECD. 2008. Tax Effects on Foreign Direct Investment. Paris: Organization for Economic Co-Operation and Development, Policy Brief. Available online: https://www.oecd.org/investment/investment-policy/40152903.pdf (accessed on 11 November 2023).

- Pesaran, Hashem. M. 2006. Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74: 967–1012. [Google Scholar] [CrossRef]

- Podviezko, Askoldas, Lyudmila Parfenova, and Andrey Pugachev. 2019. Tax Competitiveness of the New EU Member States. Risk Financial Management 12: 34. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. Festschrift in Honor of Peter Schmidt, 281–314. [Google Scholar]

- Spengel, Christopher, Frank Schmidt, Jost H. Heckemeyer, Katharina Nicolay, Alexandra Bartholmeß, Christopher Ludwig, Daniela Steinbrenner, Peter Buchmann, Anna Theresa Bührle, Verena Fischer Dutt, and et al. 2019. Effective Tax Levels Using the Devereux/Griffith Methodology, Project for the EU Commission TAXUD/2019/DE/312: Final Report 2019. ZEW-Gutachten und Forschungsberichte. Mannheim: ZEW-Leibniz-Zentrum für Europäische Wirtschaftsforschung. [Google Scholar]

- Stanišić, Nenad. 2008. Do Foreign Direct Investments Increase the Economic Growth of Southeastern European Transition Economies? South-Eastern Europe Journal of Economics 6: 29–38. Available online: http://www.asecu.gr/Seeje/issue10/stanisic.pdf (accessed on 11 November 2023).

- Talpoş, Ioan, and Ionel Vancu. 2009. Corporate Income Taxation Effects on Investment Decisions in the European Union. Annales Universitatis Apulensis Series Oeconomica 1: 513–18. Available online: https://EconPapers.repec.org/RePEc:alu:journl:v:1:y:2009:i:11:p:51 (accessed on 11 November 2023).

- Thanh, Su Dihn, and Nguyen Phuc Canh. 2020. Taxation and Capital Formation: Non-linear Effects and Asymmetry between Developing and Developed countries. The Journal of Economic Asymmetries 22: e00174. [Google Scholar] [CrossRef]

- Todorova, P. Tanya. 2019. Government Budget Balance and Economic Growth. Journal of International Scientific Publications 13: 1689–99. [Google Scholar]

- Van Ganzen, Bastiaan. 2023. Determinants of Top Personal Income Tax Rates in 19 OECD Countries, 1981–2018. Journal of Public Policy 43: 401–26. [Google Scholar] [CrossRef]

| Variables | Pesaran CD Test | p-Values | Lags | Pesaran (CIPS) Test in the Level | p-Values | Pesaran (CIPS) Test at the First Differences | p-Values | Westerlund Cointegration Test | p-Values | |

|---|---|---|---|---|---|---|---|---|---|---|

| Sample: 22 European OECD economies; period 1998–2021 | ||||||||||

| EATR | 37.97 | 0.000 | 0 | −1.190 | 0.117 | −13.937 | 0.000 | Pt | −9.552 | 0.000 |

| 1 | −1.566 | 0.059 | −5.892 | 0.000 | ||||||

| 2 | −1.003 | 0.158 | −3.881 | 0.000 | ||||||

| FDI | 10.36 | 0.000 | 0 | −7.694 | 0.000 | −19.935 | 0.000 | Pa | −6.782 | 0.000 |

| 1 | −2.479 | 0.007 | −14.416 | 0.000 | ||||||

| 2 | 0.396 | 0.654 | −5.586 | 0.000 | ||||||

| Sample: 22 European OECD economies; period 1998–2021 | ||||||||||

| EATR | 36.35 | 0.000 | 0 | −1.190 | 0.117 | −13.937 | 0.000 | Pt | −9.640 | 0.000 |

| 1 | −1.566 | 0.059 | −5.892 | 0.000 | ||||||

| 2 | −1.003 | 0.158 | −3.881 | 0.000 | ||||||

| BB | 33.93 | 0.000 | 0 | −0.758 | 0.224 | −17.016 | 0.000 | Pa | −6.887 | 0.000 |

| 1 | 1.450 | 0.926 | −5.186 | 0.000 | ||||||

| 2 | 2.163 | 0.985 | −2.929 | 0.002 | ||||||

| Sample: | 22 European OECD Economies; Period 1998–2021 | ||||||||

| Dependent Variable: FDI Panel (a) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent Variable: BB Panel (b) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||

| MG | −0.0519 | 0.523 | −0.724 | 0.000 | MG | 0.144 | 0.118 | −0.486 | 0.000 |

| PMG | −0.098 | 0.006 | −0.703 | 0.000 | PMG | 0.182 | 0.001 | −0.446 | 0.000 |

| Hausman test statistic | 0.5537 | Hausman test statistic | 0.6258 | ||||||

| Sample: | 14 Developed European OECD economies; period 1998–2021 | ||||||||

| Dependent variable: FDI Panel (c) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent variable: BB Panel (d) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||

| MG | −2.745 | 0.785 | −0.852 | 0.000 | MG | 0.116 | 0.383 | −0.500 | 0.000 |

| PMG | −1.678 | 0.002 | −0.826 | 0.000 | PM | 0.210 | 0.001 | −0.453 | 0.000 |

| Hausman test statistic | 0.9053 | Hausman test statistic | 0.4312 | ||||||

| Sample: | 8 Emerging European OECD economies; period 1998–2021 | ||||||||

| Dependent variable: FDI Panel (e) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent variable: BB Panel (f) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||

| MG | −2.051 | 0.245 | −0.726 | 0.000 | MG | 0.193 | 0.078 | −0.463 | 0.000 |

| PMG | −1.271 | 0.000 | −0.660 | 0.000 | PMG | 0.126 | 0.006 | −0.435 | 0.000 |

| Hausman test statistic | 0.3980 | Hausman test statistic | 0.3152 | ||||||

| Sample: 22 European OECD Economies; Period 1998–2021 | ||||||||

|---|---|---|---|---|---|---|---|---|

| (a) Dependent Variable: FDI | (b) Dependent Variable: BB | |||||||

| PMG Estimator | Error-Correction (Φi) | ∆EATR | Error-Correction (Φi) | ∆EATR | ||||

| Emerging European OECD Economies | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value |

| Czech | −1.215 | 0.000 | −0.0508 | 0.614 | −0.7058 | 0.002 | 0.245553 | 0.559 |

| Estonia | −0.364 | 0.026 | 0.066 | 0.418 | −0.2912 | 0.043 | 0.39071 | 0.381 |

| Latvia | −0.357 | 0.022 | 0.0321 | 0.431 | −0.5860 | 0.009 | 0.0605 | 0.829 |

| Lithuania | −0.245 | 0.141 | 0.0075 | −0.075 | −0.3207 | 0.135 | −0.2693 | 0.344 |

| Hungary | −0.056 | 0.603 | 0.115 | 0.108 | −0.4261 | 0.012 | −0.1321 | 0.435 |

| Poland | −0.692 | 0.000 | 0.0109 | −0.0486 | −0.4004 | 0.016 | −0.114 | 0.593 |

| Slovenia | −0.531 | 0.002 | 0.3158 | 0.048 | −0.552 | 0.004 | 0.3822 | 0.474 |

| Slovakia | −0.7789 | 0.000 | 0.037 | 0.220 | −0.1721 | 0.251 | −0.2038 | 0.227 |

| Developed European OECD economies | ||||||||

| Austria | −0.897 | 0.001 | −0.0098 | 0.924 | −0.6625 | 0.003 | −0.0941 | 0.695 |

| Belgium | −0.7156 | 0.020 | −0.032 | 0.621 | −0.6331 | 0.002 | −0.0505 | 0.840 |

| Denmark | −1.01 | 0.000 | −0.104 | 0.225 | −0.306 | 0.036 | −0.3181 | 0.539 |

| Finland | −1.133 | 0.000 | 0.061 | 0.383 | −0.389 | 0.025 | −0.2825 | 0.473 |

| France | −0.9503 | 0.000 | 0.0047 | 0.018 | −0.233 | 0.078 | −0.170 | 0.615 |

| Germany | −0.733 | 0.001 | 0.023 | 0.487 | −0.5338 | 0.003 | 0.3909 | 0.045 |

| Greece | −0.476 | 0.000 | 0.073 | 0.025 | −0.2321 | 0.090 | −0.272 | 0.018 |

| Ireland | −0.5023 | 0.023 | −0.005 | 0.927 | −0.399 | 0.017 | −0.251 | 0.808 |

| Italy | −1.037 | 0.000 | −0.0028 | 0.973 | −0.324 | 0.043 | −0.221 | 0.804 |

| Luxembourg | −0.727 | 0.019 | −0.122 | 0.457 | −0.829 | 0.000 | −0.298 | 0.236 |

| Netherlands | −0.346 | 0.044 | −0.026 | 0.43 | −0.579 | 0.002 | −0.396 | 0.283 |

| Portugal | −0.925 | 0.000 | 0.1283 | 0.009 | −0.481 | 0.005 | 0.0485 | 0.914 |

| Spain | −1.313 | 0.000 | 0.0341 | 0.201 | −0.394 | 0.016 | −0.887 | 0.138 |

| Sweden | −0.450 | 0.050 | 0.204 | 0.148 | −0.3793 | 0.021 | −0.0364 | 0.947 |

| Sample: | 22 European OECD Economies; Period before Global Crisis 1998–2007 | ||||||||

| Dependent Variable: FDI Panel (a) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent Variable: BB Panel (b) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||

| MG | −0.202 | 0.309 | −0.161 | 0.034 | MG | 0.667 | 0.017 | −0.735 | 0.000 |

| PMG | −1.957 | 0.000 | −0.691 | 0.000 | PMG | 0.764 | 0.000 | −0.453 | 0.000 |

| Hausman test statistic | 0.2687 | Hausman test statistic | 0.7554 | ||||||

| Sample: | 22 European OECD Economies; Period after Global Crisis 2008–2021 | ||||||||

| Dependent Variable: FDI Panel (c) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent Variable: BB Panel (d) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||

| MG | −2.97 | 0.334 | −1.013 | 0.000 | MG | 1.017 | 0.448 | −0.762 | 0.000 |

| PMG | −1.290 | 0.028 | −0.938 | 0.000 | PMG | 0.078 | 0.035 | −0.573 | 0.000 |

| Hausman test statistic | 0.4273 | Hausman test statistic | 0.5560 | ||||||

| Sample | 22 European OECD Economies; Period 1998–2021 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: FDI Panel (a) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | Dependent Variable: BB Panel (b) | Long-Run Equilibrium (θ) | Error-Correction (Φi) | ||||||

| Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value | ||||

| MG | EATRdecre | −0.594 | 0.318 | −0.765 | 0.000 | MG | EATRdecre | 0.147 | 0.644 | −0.504 | 0.000 |

| EATRincre | −0.560 | 0.335 | EATRincre | 0.311 | 0.228 | ||||||

| PMG | EATRdecre | −0.2664 | 0.008 | −0.705 | 0.000 | PMG | EATRdecre | 0.338 | 0.001 | −0.454 | 0.000 |

| EATRincre | −0.125 | 0.000 | EATRincre | 0.214 | 0.000 | ||||||

| Hausman test statistic | 0.3915 | Hausman test statistic | 0.486 | ||||||||

| 22 European OECD Economies; Period 1998–2021 | |||||

|---|---|---|---|---|---|

| Dependent Variable: FDI | Homogenous Coefficient | Dependent Variable: BB * | Homogenous Coefficient | ||

| Coef. | p-Value | Coef. | p-Value | ||

| EATR | −0.919 | 0.047 | EATR | 0.150 | 0.044 |

| Long_IR | −0.477 | 0.087 | gdppc_growth | 0.099 | 0.000 |

| Dummy_crisis | −0.318 | 0.000 | Labor | 4.156 | 0.083 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Beljić, M.; Glavaški, O.; Beker Pucar, E.; Stojkov, S.; Pejčić, J. Asymmetric Effects of Tax Competition on FDI vs. Budget Balance in European OECD Economies: Heterogeneous Panel Approach. Risks 2023, 11, 219. https://doi.org/10.3390/risks11120219

Beljić M, Glavaški O, Beker Pucar E, Stojkov S, Pejčić J. Asymmetric Effects of Tax Competition on FDI vs. Budget Balance in European OECD Economies: Heterogeneous Panel Approach. Risks. 2023; 11(12):219. https://doi.org/10.3390/risks11120219

Chicago/Turabian StyleBeljić, Marina, Olgica Glavaški, Emilija Beker Pucar, Stefan Stojkov, and Jovica Pejčić. 2023. "Asymmetric Effects of Tax Competition on FDI vs. Budget Balance in European OECD Economies: Heterogeneous Panel Approach" Risks 11, no. 12: 219. https://doi.org/10.3390/risks11120219

APA StyleBeljić, M., Glavaški, O., Beker Pucar, E., Stojkov, S., & Pejčić, J. (2023). Asymmetric Effects of Tax Competition on FDI vs. Budget Balance in European OECD Economies: Heterogeneous Panel Approach. Risks, 11(12), 219. https://doi.org/10.3390/risks11120219