1. Introduction

A multi-asset price model with systemic risk was recently proposed by

Chen and Makarov (

2017);

Xu and Makarov (

2021). We combined a common “systemic-risk” asset with several conditionally independent “ordinary” assets. This approach allows for analyzing and modeling a portfolio that integrates high-activity security, such as an Exchange Trading Fund (ETF) tracking a major market index (e.g., S&P500), and several low-activity securities. The latter may have missing or asynchronous pricing data due to infrequent trading on financial markets. Thus, one of the significant features of the proposed model is the possibility of estimating parameters for each asset price process individually, even if historical pricing data are incomplete. It can be achieved by employing the conditional maximum likelihood estimation (MLE) method. First, we estimate real-world parameters of the systemic-risk (high-activity) asset and then estimate parameters for each ordinary (low-activity) asset by conditioning on the parameters of the systemic risk asset. The joint likelihood function (LF) is a product of the marginal LF of the systemic risk asset and conditional likelihood functions. That is, the solution to the joint MLE problem is found by solving

MLE problems for individual assets, where

n is the number of ordinary assets. This method admits a closed-form solution when the conditional dynamics of each ordinary asset follow a geometric Brownian motion (GBM).

We can also use option data for individual assets to calibrate the model under the risk-neutral probability measure. Firstly, we calibrate the systemic risk asset. Secondly, we calibrate ordinary assets using the least-squares method with a corresponding marginal probability distribution where the systemic risk asset parameters are fixed. All we need are market values of single-asset derivatives. Note that the number of parameters grows linearly in the number of ordinary assets in contrast with the quadratic growth through the correlation matrix, which is typical for a multivariate asset price model.

An essential property of the proposed model is that the asset price processes are conditionally independent given the value of the systemic risk asset value. By conditioning on the systemic risk asset, we can easily price European-style basket options and compute risk measures such as the Value at Risk (VaR) and conditional Value at Risk (CVaR). The latter can be achieved by using the result of

Rockafellar and Uryasev (

2000). The CVaR of loss

L at level

is computed as follows:

The proposed framework allows for constructing several multivariate jump-diffusion asset price models, including the following: (i) the model without jumps where all asset price processes are GBMs, (ii) the model with only common jumps, (iii) the model with both common and asset-specific (idiosyncratic) jumps, and (iv) the model with only asset-specific jumps. Although we can employ the double exponential (as in the Kou model

Kou (

2002)) probability distribution for jump sizes, this paper focuses on the case with normally distributed jump amplitudes. So, the model considered here is a particular case of the multivariate Merton jump-diffusion model

Merton (

1976).

The main distinction of our model is that the common factor represents a systemic risk asset traded on the market. Thus, we can use historical data to estimate its parameters. If the transition probability density is available in closed form, the Maximum likelihood estimation (MLE) method can be employed to fit the model to the data. All model components can be calibrated individually using conditional MLE and least-squares methods. Secondly, the proposed framework allows for tuning the model complexity to meet the restrictions of numerical algorithms and market requirements. The model with jumps performs better under extreme market conditions. Also, pricing basket options on the geometric average and the minimum/maximum value can be efficiently done for the most general model with systemic (common) and idiosyncratic (ordinary-asset-specific) jumps. On the other hand, our method of computing VaR and CVaR assumes that, by conditioning on the common factor, we can represent the portfolio return as a sum of independent lognormal random variables. Therefore, to solve the portfolio optimization problem in closed form, we employ the model with common jumps only. However, as discussed in

Section 5, it is also possible to apply our approach to the case of normally distributed asset-specific jumps.

Most papers on multivariate models of asset prices are primarily theoretical, with practical implementation relying on simulation techniques when the number of underlying assets is large. Non-simulation approaches are typically efficient when the number of assets does not exceed 2 or 3 (e.g., see

Dimitroff et al. 2011;

Shirzadi et al. 2020). The proposed model allows for pricing European-style basket options and computing VaR and CVaR of static portfolios without using Monte Carlo methods, regardless of the number of underlying assets. As demonstrated in

Section 7, the computational methods are efficient and robust.

We tested variants of the proposed model using several datasets, including asynchronous and incomplete asset returns

Chen and Makarov (

2017) and high-frequency trading data

Xu and Makarov (

2021). In

Chen and Makarov (

2017), two models without jumps and with common jumps, respectively, were applied to a portfolio with ten low-frequently trading Canadian ETFs. The S&P/TSX60 Composite Index was used as the high-activity asset

. The two jump-diffusion processes, namely, the Merton and Kou models, were compared with the Gaussian case without jumps. The trading frequency for low-activity assets varies from once a week to once a month. Our method was robust for assets with various trading activities, and the results were consistent for all three models.

In

Xu and Makarov (

2021), we studied whether a systemic risk component in a multi-asset price model could explain all jumps in the market dynamics. The S&P500 stock index is commonly considered to be an indicator of the U.S. economy as a whole. Two representative high-frequently trading assets with tickets AAPL (Apple, Inc., Cupertino, CA, USA) and WMT (Walmart, Inc., Bentonville, AR, USA) were selected for our analysis. The high-frequency intraday price data (at the millisecond level) were obtained from Wharton Research Data Services (WRDS). All transactions for each trading day from 9:30 a.m. to 4:00 p.m. in 2018 were collected. Statistical tests

Aït-Sahalia and Jacod (

2009);

Jacod and Todorov (

2009) were used to detect disjoint and common jumps in intraday time series of asset prices.

The main contribution of this paper is two-fold. Firstly, we provide an overview of the general model and its properties. We develop and present two techniques for estimating the model parameters: the MLE method for real-world parameters using historical asset returns and the least-squares method for risk-neutral parameters using market option values. The numerical tests conducted for this study confirm the robustness of both techniques. Secondly, we apply the model to two practical problems: portfolio optimization and no-arbitrage pricing of basket options. We develop a new approach for computing VaR and CVaR using the inverse Laplace transform. We then apply it to find minimum-Var and minimum-CVaR portfolios for cases with many assets. The same technique can also be applied to pricing basket options on a weighted average of stock prices.

The rest of the paper is organized as follows.

Section 2 presents the general model with common and asset-specific jumps. We compute correlations between log values and discuss the structure of the correlation matrix of log returns. Furthermore, we find the marginal and conditional distributions of asset values.

Section 3 and

Section 4 discuss the estimation of asset parameters using the conditional MLE method (under the real-world probability measure) and the least-squares method (under the equivalent martingale measure). In

Section 5, we discuss the portfolio optimization problem and the computation of the expected exponential utility, VaR, and CVaR using the inverse Laplace transform method. In

Section 6, we derive pricing formulae for European-style basket options with the geometric average, the arithmetic average, and the minimum/maximum value. The no-arbitrage value of a basket option with ordinary assets is computed by conditioning on the systemic-asset value. The resulting semi-analytic formulae are written as a single or double integral. In

Section 7, we present numerical results. We found portfolios with minimum VaR and CVaR on the efficient frontier, compared the actual cumulative distribution function (CDF) with its empirical counterpart for the geometric and arithmetic averages and the maximum value of eight stock returns, calculated no-arbitrage values of three basket call options for a portfolio with eight stocks, and compared them with Monte Carlo estimates.

Section 8 concludes and discusses possible future developments.

2. Multi-Asset Model

Let all stochastic processes be defined on a filtered probability space

with a real-world probability measure

. Let

denote a systemic risk asset such as a market index or an ETF tracking the index. This asset affects the dynamics of all other underlying risky securities. Assume the value of

follows a jump-diffusion process. Under the real-world probability measure, the stochastic differential equation (SDE) for

is as follows:

Here, the constants

and

represent the drift rate and volatility of return of the systemic risk asset, respectively;

denotes the continuously compounded dividend yield;

is a standard Brownian Motion,

is a Poisson process with intensity

, and

is a sequence of iid random jump sizes with mean

and variance

. Assume that these processes and random variables are jointly independent. In this paper, we consider normally distributed jump sizes. However, the case with jump amplitude having a double-exponential distribution can also be considered (see

Chen and Makarov 2017;

Kou (

2002)).

In addition to the systemic risk asset

, consider a portfolio of

n ordinary assets denoted

, whose prices are governed by the SDEs

Here,

and

are, respectively, the drift rate and volatility of asset

;

denotes the continuously compounded dividend yield of

; the coefficient

defines the correlation between

and

(see Lemma 2). The process

is a standard Brownian Motion,

is a Poisson process with intensity

, and

is a sequence of iid random jump sizes with mean

and variance

. Again, all processes and random variables are jointly independent.

The system of SDEs (

1)–(

2) admits the following strong solutions:

where

for

Due to the presence of the common component

in the solution, the asset-price processes

are dependent. However, conditional on

or

, the processes

are independent.

The general model (

1)–(

4) includes several special cases:

- (1)

The case without jumps when

for all

. In this case, the processes in (

3)–(4) are geometric Brownian motions (GBMs). It is a special case of a general multi-asset model based on a multivariate Brownian motion.

- (2)

The case with only common jumps when

and

for all

. This model was introduced in

Chen and Makarov (

2017).

- (3)

The case with both common and asset-specific (idiosyncratic) jumps when

and

for some

. This model was discussed by

Xu and Makarov (

2021).

- (4)

The case with only asset-specific jumps when and for some .

Following

Cheang and Chiarella (

2011);

Cont and Tankov (

2003);

Runggaldier (

2003), we can find the Radon–Nikodym derivative for transforming from one probability measure

(e.g., the real-world measure) to some equivalent measure

(e.g., an equivalent martingale measure). As is well known, the multi-asset jump-diffusion model (

1)–(4) is incomplete in the presence of jumps. It is complete only if all jump intensity rates

are zero.

Lemma 1. Fix and consider the filtered probability space so that Brownian motions and compound Poisson processes for are adapted to the filtration . Definewhere with denoting the moment-generating function (MGF) of the jump size , and being the mathematical expectation under . Then, is a Radon–Nikodym derivative process parametrized by . It defines a probability measure equivalent to , i.e., . Furthermore, under the new probability measure , the process is a standard Brownian motion, the Poisson process has the intensity rate , and the distribution of the jump sizes has the MGF , for all . Let us find the risk-neutral dynamics of the multi-asset model (

1)–(4) under the equivalent martingale measure (EMM)

with the risk-free bank account

used as a numeraire asset. Assume that the risk-free interest rate

is constant. The EMM

is defined so that the discounted processes

are

-martingales for all

. Computing the expectation of

,

and equating it to

gives us the following values of

under

:

Assuming that jump amplitudes are normal random variables (with

), we obtain the following formulae for drift rates:

2.1. Correlations between Log Prices

We introduce log values

for

. From the solutions (

3)–(4), we have

The processes

,

are independent jump-diffusion processes; each is a sum of Brownian motion and a compound Poisson process. Thus,

Using these properties, we find correlations between log values

.

Lemma 2. The correlation coefficients between are:where and . According to Lemma 2, the

n-by-

n correlation matrix

for

(i.e., log values of all assets except for the systemic risk asset) and the

-by-

correlation matrix

for the log values

are as follows:

Clearly, both

and

are symmetric matrices, and, as follows from Lemma 3, they are positive-definite (see also

Baba and Shibata 2006).

Lemma 3 (

Makarov 2022).

Let for all . Then, and are positive-definite matrices. The fact that the correlation matrix

is positive definite for any choice of

,

opens up the possibility to develop a new continuous-time stochastic model for a correlation matrix of an arbitrary dimension by modeling

,

using, for example, a Jacobi diffusion process (see

Karlin and Taylor 1981). As a result, we can develop a scalable multi-asset jump-diffusion asset price model with stochastic correlations.

For structured correlation matrices like the matrix

, we can also solve the problem stated in the Perron–Frobenius theorem (see

MacCluer 2000 and references cited therein). The theorem asserts that a real square matrix with positive entries has a unique largest real eigenvalue and that the corresponding eigenvector can be chosen to have strictly positive components. If the coefficients

are all positive or all negative, then

satisfies the conditions of the Perron–Frobenius theorem. Otherwise, we can show that finding a dominant eigenvector with positive components is impossible.

2.2. Distribution of Log Returns

As follows from (

10)–(11), the log returns

, with

and

, are dependent via the common, systemic risk component

. Let us find the conditional distribution of

given the log return on the systemic asset,

. We can solve (

10) for

to remove it from the equation for

:

We assume normally distributed jump sizes for all assets. That is,

,

are iid

for

. Given that

(i.e., asset

has

k jumps over

), the conditional distribution of

is

. Thus, the PDF of

is

where

denotes the standard normal PDF. The conditional density of

given

is then

Similarly, the unconditional PDF of

is given by

To obtain the densities for the case without jumps, we only need to consider the first terms (with

or

) in (

16) and (

17).

Equation (11) also allows us to find the marginal distribution of the log return

. Given that

and

have

ℓ and

k jumps over

, respectively (i.e.,

and

), the distribution of

is normal with the following mean and variance:

The marginal PDF of

can be written as a double summation (w.r.t.

ℓ and

k) of normal densities with Poisson weights:

3. Estimation of Real-World Model Parameters

We consider two approaches: (1) the estimation of real-world parameters (under the physical probability measure

) from historical asset prices; (2) the estimation of risk-neutral parameters (under the equivalent martingale measure

) from historical option prices. The latter is discussed in

Section 4.

Maximum likelihood estimation (MLE) is a commonly used method to estimate the parameters of asset price models. We maximize the likelihood function, defined as a joint probability density function of asset values or their returns. Since the assets are conditionally independent given the values of the index , we first estimate the parameters of and then calibrate the other processes one by one using the conditional MLE method.

For simplicity of the presentation, we assume that all dividend yields are zero, and we work with dividend-adjusted asset prices. Suppose that the systemic risk asset is an high-activity security for which we have trading information for all time points where with , , and . On the other hand, the trading data about ordinary assets , may be incomplete. Using the historical prices , , , we compute the log returns and over .

The joint likelihood function,

, for historical log returns

and

,

can be represented as a product of the marginal likelihood function

for

and conditional likelihood functions

for

with

. Indeed, the joint PDF of one-period log returns

and

is

So, we have the following MLE problem:

That is, a sub-optimal solution to the joint MLE problem with the likelihood function

can be found by solving

MLE problems for individual assets.

3.1. Estimation of Parameters of the Systemic Risk Asset

If the process

has no jumps, its drift and diffusion parameters can be estimated using well-known formulae (see, e.g.,

Remillard 2016):

where

and

.

For the model with jumps, we apply the MLE method to estimate

,

,

, as well as the mean

and the variance

of the jump-amplitude distribution. Using (

17), we obtain the PDF of the one-period log return

Z as follows:

The parameters of the systemic risk asset

are found by maximizing the log likelihood function:

3.2. Estimation of Parameters of an Ordinary Asset

Select one ordinary asset with index . Due to the low-frequency trading, prices of may only be available for selected times when assets had been traded. Hence, we only have partial trading information for particular dates for each low-activity asset, whereas data for the other time points are missing.

3.2.1. The Case with Common Jumps Only

Assume that for the low-activity asset

we know

historical values at times

. For simplicity, we omit the hat accent above

t’s and

m in what follows. Denote

for

Using the strong solutions in (

10) and (11), we obtain

where

. After solving (

21) for

and plugging the results in (22), we have

As we can see,

conditional on

follows a normal distribution, and there is no jump part in the equation for

. The conditional PDF of

given

is

Thus, the conditional likelihood function for low-activity asset

takes the following form:

where

and

for

.

To maximize the log likelihood function

, we find zeros of its partial derivatives w.r.t. the parameters

,

, and

. From

Chen and Makarov (

2017), we have the following solution.

Lemma 4. The conditional likelihood function attains its maximum value for the following parameters:whereand each summation is for . Note that Equations (

25)–(27) can be simplified using the facts that

If

for all

, the Formulas (26) and (27) can be written in terms of statistics

and

as follows:

and

3.2.2. The Case with Asset-Specific Jumps

Now, we consider the case with asset-specific jumps. Reorganize and combine the solutions in (

10) and (11) to obtain:

The equation has an additional jump part, and the jump sizes for assets are normally distributed. Assume at most one jump in each time interval

. In this case, the conditional distribution of

given

is a mixture of two normal distributions:

We use a numerical optimization method such as the Nelder–Mead simplex method to maximize

w.r.t. model parameters

,

,

,

,

, and

. As with the systemic risk asset

, we can also employ the multinomial MLE method.

4. Estimation of Risk-Neutral Model Parameters

We can find the risk-neutral values of parameters by calibrating the model to no-arbitrage market prices of some financial instruments. A usual approach is to minimize the difference between the market and model prices using the least-squares method. A typical application of the calibrated model is the risk-neutral pricing of derivatives such as options, swaps, etc.

Let

and

denote the set of model parameters and the space of all admissible sets, respectively. Additionally,

denotes the model price of some instrument for the parameter set

. For example, it can be the no-arbitrage price of a European option with strike

K and maturity

T. Furthermore, let

C be the market price of the same instrument, and

be some function applied to the discrepancy between the market and model prices. For example,

H can be the absolute value function or a power function:

where

is an exponent (typically,

p equals 1 or 2), and

is a weight. For example,

w can be inversely proportional to the square of the bid-ask spread

, or all weights can be the same.

Enumerate all instruments with available market prices and formulate the optimization problem as follows:

For the least-squares formulate (

), (

29) takes the form

It is often an ill-posed problem that can be improved by adding a penalty function (see, e.g.,

Cont and Tankov 2004;

Hirsa 2013). This system of nonlinear equations can be solved using an iterative method. Since multiple solutions may exist corresponding to different local minima of the objective function, we may run the method several times with different starting values of

. Such seeds can be selected at random in

.

The structure of the proposed model allows for implementing a two-stage calibration procedure. Firstly, we calibrate the systemic risk asset model using prices of derivatives written on . Let denote the set of parameters for . For example, assuming the Merton model for the jump-diffusion dynamic, we have that . Consider a collection of derivative instruments written on the systemic risk asset with available market prices, , along with their respective model prices, . Solve the optimization problem to find the optimal set of parameters, . Secondly, we calibrate each asset with one by one using the set for . Let denote the set of parameters for . Consider a collection of derivative instruments written on the asset with available market prices, , along with their respective model prices, , conditional on . Solve the optimization problem to find the optimal set of parameters, . After repeating the second step for each asset , we obtain a fully calibrated model. The advantage of this approach is that we only use single-asset derivatives such as regular European call and put options.

5. Portfolio Optimization

Consider a self-financing portfolio strategy comprising n assets . Let denote the number of shares of at time . The wealth of the strategy is . The return is then , where is the return on over , and , are allocation weights so that .

Let us fix the maturity and assume that the trading strategy admits no short selling and has constant allocation weights: for all . The portfolio return at maturity is with . Additionally, we assume that the model has only common jumps (i.e., for all ).

The distribution of

can be found by conditioning on the common factor

. We have that

and, as follows from (11),

and

. Thus, conditional on

, the return

is a sum of independent log normal random variables. For simplicity of presentation, we assume that all dividend yields

are zero.

In

Furman et al. (

2020), an efficient algorithm for approximating sums of independent log normally distributed random variables has been proposed. The main idea of

Furman et al. (

2020) is that

can be approximated by a sum of

m independent gamma-distributed random variables:

where the gamma random variable

,

has rate

and shape

. For each

, it is possible to choose the parameters

and

such that the Laplace transforms of

converges exponentially fast to the Laplace transforms of

L, as

. Let

,

denote the Laplace transform of a random variable

X. The approximation in (

30) implies that

Clearly, if

is the Laplace transform of

, then

is the Laplace transform of

. Thus, a sum of

n independent log normal random variables,

, with

can be approximated by the sum

, where each

is an approximation to the corresponding random variate

. Therefore, the Laplace transform of

A is approximated as follows:

where

and

are parameters of the gamma random variables used to construct the approximation

. Any quantity of interest can be found by inverting the corresponding Laplace transform. For example, the CDF of

is computed by means of the Bromwich integral:

where we use the fact that

and apply the change of variable

as proposed by

Furman et al. (

2020). Here,

denotes the inverse Laplace transform,

is the imaginary part of

,

c is a positive number, and

a is a complex number with

. Following

Furman et al. (

2020), we choose

a and

c so that

,

, and

.

Equations (

32) and (

33) allow us to find the conditional Laplace transform and CDF of the portfolio return

given the common factor

:

for

, where

and

are parameters of the gamma random variables used to construct the approximation for the distribution

with

,

.

To compute the parameters for the approximation

to

, we use the algorithm outlined in

Furman et al. (

2020). As mentioned in the paper, the numerical procedure requires high-precision arithmetic. For example, we can use Maple for calculating the

and

parameters (Maple is a trademark of Waterloo Maple Inc.).

The unconditional Laplace transform and CDF of the portfolio return are recovered by the integration of the conditional counterparts w.r.t. the distribution of the common factor:

These results allow us to find optimal efficient portfolios without short selling (and, hence, the allocation weights are nonnegative) with the maximum utility or the minimum risk metric. Consider the exponential utility function of the portfolio return

given by

with

. Clearly, the expected utility can be computed using the Laplace transform:

Thus, we can find an optimal portfolio with weights

that maximizes the expected utility:

Define the loss of a portfolio as the negative return:

. The Value at Risk (VaR) of the loss at confidence level

is given by

. The VaR values can be computed by inverting the CDF

; hence, we can find the minimum VaR portfolio:

Similarly, we can find an optimal portfolio that minimizes the conditional Value at Risk (CVaR), also known as the expected shortfall (ES). This can be achieved by using the result of

Rockafellar and Uryasev (

2000). The CVaR of the loss at the confidence level

is computed as follows:

As usual,

denotes the positive part of

x. The evaluation of

is similar to pricing a put option on the return

with strike

and maturity

T. For each

, introduce the probability measure

equivalent to

and defined by the Radon–Nikodym derivative

where

. It is a special case of the general Radon–Nikodym derivative in (

5). After comparing (

39) and (4), we obtain that

We can now use the change of numeraire approach combined with conditioning on

as follows:

As follows from Lemma 1,

,

, and

for

and

are

-BM. Thus, under

, the asset return process

,

, has the following strong solution:

Moreover, under the probability measure

, the intensity rate of

equals

, and the MGF of jump sizes

is

. If the jump sizes have a normal distribution, then

. That is, under

, we have

for all

. The PDF of

takes the form

where

and

.

To compute

and

under the equivalent probability measures

and

, we employ the inverse Laplace transform. The probability distribution of

conditional on

is equivalent to a sum of independent log normal random variables. Although we deal with

different probability measures; the variance parameter of

conditional on

remains the same for each

. So, we need to find the

and

parameters used to construct the approximation for

only once. The final valuation formula takes the following form:

Here,

with

denotes the conditional

-CDF of the portfolio return

given that

. It is calculated using (

33). The PDF

is also computed under

. So, we need to evaluate

double integrals to compute the expectation.

In this context, we assume the absence of asset-specific jumps to ensure the portfolio return is expressed as a sum of independent log normal random variables conditioned on the common factor. Consequently, the Laplace transform of the portfolio return is a product of Laplace transforms of individual asset returns. Introducing asset-specific jumps with normally distributed sizes results in the probability distribution of an ordinary asset return, conditioned on the common factor, forming a mixture of log normal distributions with Poisson weights. Thus, the Laplace transform of the asset return also constitutes a mixture of Laplace transforms of log normal random variables. Therefore, we can continue to apply the above approach by conditioning on the common factor and restricting the number of jumps over the specified period.

Let us consider the

ith asset return

. If the intensity rate

is small, we can truncate the series representation of the mixture so that there are at most

jumps to obtain the following approximation:

where the log normal random variable

has the same conditional distribution as

given that

has

ℓ jumps over

and

. To implement the method, we need to compute the coefficients

for each

.

6. Pricing Basket Options

Consider a portfolio of

n ordinary assets

. The no-arbitrage initial price

of a European-style option with payoff

can be calculated using the general no-arbitrage pricing formula

where

denotes the expectation under the risk-neutral probability measure

.

In this section, we consider three examples where the option payoff is a function of the geometric average, the arithmetic average, or the maximum/minimum value of the prices . Let be the value of some nonnegative function g of asset prices at time T. Consider a European-style basket option with payoff for a call or for a put.

Since the log price

is a linear function of the random factor

, we perform calculations by conditioning on

. The initial no-arbitrage price of a European-style basket option is given by

with conditional PDF

of

given

and marginal PDF

of

under

. Note that we may only know the characteristic function of

conditional on

(or the Laplace transform) and, hence, the internal integral is calculated using the inverse Fourier (Laplace) transform. If all jump amplitudes

have a normal distribution, the PDF

is a mixture of normal densities, as given in (

15).

6.1. Options on a Geometric Average

Consider the geometric average

where

are positive weights. For example, we can assume equal weights:

for all

. Using the strong solutions for the asset price processes in (4), we obtain the following formula for the average

:

where the drift rate

is given in (9).

Using the fact that a linear combination of independent Brownian motions is a scaled Brownian motion and that a sum of independent compound Poisson processes is another compound Poisson process, we obtain the following representation:

where

is a standard Brownian motion,

is a Poisson process with the rate

. Here,

are i.i.d. random variables having a mixture distribution with the CDF

where

is the CDF of

for

and

,

with

. If there are only common jumps (i.e.,

for all

), we have that

and

. As we see, the factor

is already embedded in the formula for

; hence, we can find the probability distribution of the average

without conditioning on

.

To calculate the expectation of the payoff

, we can use the method of characteristic functions. It is easy to find the characteristic function

of log value of the geometric average

, thanks to the mutual conditional independence of all random factors. The expectation is then computed using the inverse Fourier transform (e.g., see

Carr and Madan 1999). For example, the price of a call option on the geometric average can be calculated using the Carr–Madan method

Hirsa (

2013):

where

is the log strike,

is the Fourier transform of the option price considered as a function of

,

denotes the real part of a complex-valued

z, and

is a dumping factor.

6.2. Options on a Maximum/Minimum Price

This section considers the case with a payoff that depends on the maximum price at maturity, . The case with the minimum price is very similar, hence omitted here.

Assume that there are no jumps specific for ordinary assets (i.e.,

for all

). That is,

for

. In this case, the conditional distribution of

given

is normal, and we have

where

, assuming that all jump sizes are normally distributed. Since the log prices

are conditionally independent, the risk-neutral conditional CDF of the max log price

given the value of

is

Here,

denotes the standard normal CDF. The conditional PDF

is readily available by differentiation of the CDF

F w.r.t.

x:

The risk-neutral pricing formula for the call basket option is written as a double integral:

Note that in the presence of asset-specific jumps, the normal CDF in (

43) is replaced by a mixture of normal CDFs for every index

i so that

.

6.3. Options on an Arithmetic Average

Consider the arithmetic average

, where

are positive weights. For example, as in

Section 6.1, we can assume equal weights:

for all

. We use the Laplace transform method to price a European-style option on the average

.

Assume that there are no ordinary asset-specific jumps. As follows from (

41) and (42), the risk-neutral probability distribution of

,

conditional on

is log normal:

Since the random variables

,

are conditionally independent, the Laplace transform of the arithmetic average

is approximated as given in (

32).

To calculate the initial no-arbitrage price of a call option on the arithmetic average, we use the change of numeraire approach combined with conditioning on

as follows:

The probability measure

is an EMM relative to numeraire

for

. It is defined by the Radon–Nikodym derivative

. Using the strong solution, we can show that it is given by (

39).

The final no-arbitrage pricing formula for the call option on

with maturity

and strike

takes the form:

Here,

with

denotes the conditional

-CDF of the sum

approximating

given that

. It is calculated using (

33). The PDF

is also computed under

.

7. Numerical Results

This section provides numerical examples of portfolio optimization and pricing European-style basket options. The Merton model for the systemic risk asset (with normally distributed jump sizes) is used here. Additionally, we assume that there are no ordinary-asset-specific jumps. That is, the conditional distribution of assets’ prices, , is log normal.

The SPDR S&P 500 ETF Trust (SPY) was used as the systemic risk asset . We used historical close prices for the two years from 26 April 2021 to 26 April 2023 to estimate its real-world parameters. Additionally, we collected prices for eight stocks/ETFs (the ordinary assets in our model) with the following tickers: AAPL (Apple, Inc.), AMZN (Amazon.com, Inc., Seattle, WA, USA) BEKE (KE Holdings, Inc., Beijing, China), BRK.B (Berkshire Hathaway, Inc., Omaha, NE, USA), MDGL (Madrigal Pharmaceuticals, Inc., Conshohocken, PA, USA), SQQQ (ProShares UltraPro Short QQQ), TQQQ (ProShares UltraPro QQQ), and TSLA (Tesla, Inc., Austin, TX, USA). We selected companies representing different industries among the top 10 S&P 500 Stocks by the index weight (AAPL, AMZN, BRK.B, TSLA), as well as assets with a negative beta value (SQQQ, BEKE, MDGL). The one-year interval from 26 April 2022 to 26 April 2023 was used to estimate the real-world parameters.

To analyze if the model with estimated real-world parameters captures the correlations

between the log returns

and

with

, we computed the correlations using (

12) and compared them with estimated values for the interval from 26 April 2022 to 26 April 2023. As we can see from

Table 1, the computed correlations are close to the estimated values.

Additionally, to estimate risk-neutral parameters, we calibrated the asset price model to historical European call option prices collected on 26 April 2023. All options expired on 19 May 2023, so they had 17 days to maturity. We used the risk-free rate,

. It was the overnight federal funds rate as of 26 April 2023. The parameters of the systemic risk asset model are reported in

Table 2. The parameters of the eight ordinary assets are given in

Table 3.

To find optimal portfolios with the eight ordinary assets, we first compute the expected returns and covariance between returns for the fixed maturity

. The column vector

and square matrix

with

are given in (

44):

Secondly, we find the efficient frontier for the case without short-selling by solving the following quadratic optimization problem (see

Best 2010):

The no-short-selling efficient frontier is a piecewise-defined continuous function of

, so that

and

respectively correspond to the minimum variance portfolio and an asset with the largest expected return, which is MDGL with

. The risk–reward plot of the efficient frontier is given in

Figure 1. The search for optimal portfolios is performed on the efficient frontier for simplicity. This approach allows for reducing a multivariate optimization problem to a single-variable one. In particular, we have found the minimum

and minimum

portfolios for

. To compute the risk metrics as discussed in

Section 5, we found

and

,

for each ordinary asset using their real-world values

,

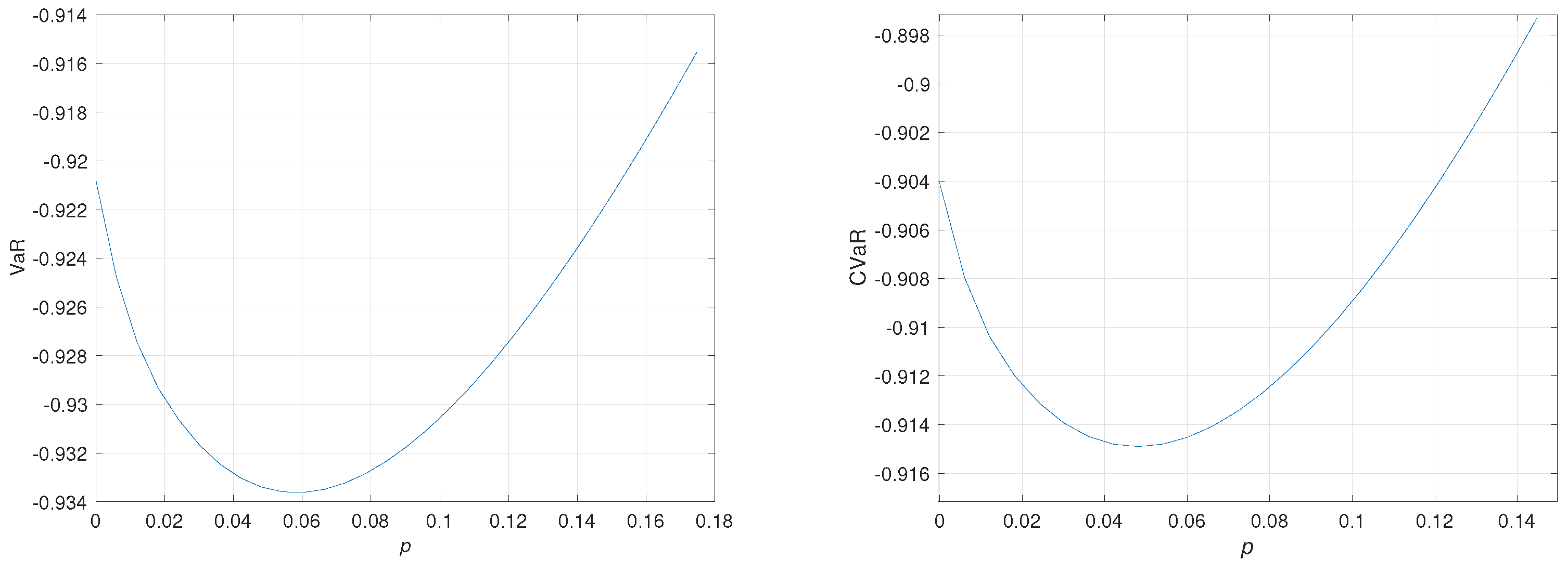

. We used Maple, ver. 2021.2, with a working precision of 500 digits. The plots of

and

computed on the efficient portfolio are given in

Figure 2. The optimal portfolios are presented in

Table 4.

Additionally, we calculated no-arbitrage prices of three call options on the geometric average

, the maximum price

, and the arithmetic average

written on the ordinary assets. Since the initial values vary greatly from asset to asset, we used the returns

,

to compute payoffs of these basket options:

The following parameters were used:

,

, and

for all

. The initial no-arbitrage prices

were approximated using Monte Carlo simulations with

samples and semi-analytic formulae from

Section 6. All calculations were done using MATLAB, ver. 9.14.0 (R2023a) (MATLAB is a trademark of MathWorks Inc.). The

and

parameters (with approximation order

) used for pricing basket options on an arithmetic average were calculated using Maple. The results of our calculations are provided in

Table 5. Here,

denotes the sample mean estimate,

is the standard statistical error given by a ratio of the sample standard deviation

S and the square root of

N.

Additionally, we calculated values of the CDF using semi-analytical formulae and the Monte Carlo method (with

realizations) for the arithmetic and geometric averages, as well as for the maximum value. The plots are compared in

Figure 3. We can see that the true CDF, obtained using semi-analytical methods, coincides with the corresponding empirical CDF obtained using simulations across the range for all three examples.

8. Discussion and Conclusions

In this paper, we presented a multi-asset jump-diffusion pricing model that combines a systemic risk asset with several ordinary assets. The proposed model has several advantages in comparison with a model with fully correlated assets. Firstly, it remains tractable for any number of ordinary assets. As demonstrated, the number of model parameters grows linearly with the number of assets. Practitioners can adjust the model complexity before applying it. The simplest scenario is a particular case of the multivariate GBM model, whereas the unabridged model includes common and asset-specific jumps with possibly different distributions of jump sizes.

Secondly, the model parameters can be estimated under real-world (physical) and martingale (risk-neutral) probability measures. We only need historical asset prices or market values of single-asset derivatives such as standard European options. We proposed two-stage MLE and least-squares methods, where we first estimate systemic risk asset parameters and then find parameters of each ordinary asset price process. As confirmed by numerical tests, the two-stage approach is robust and can accommodate many assets.

Thirdly, the model’s real-world parameters can be estimated even when the asset prices are incomplete and asynchronous due to infrequent trading. We found an analytical solution to the MLE problem with incomplete return values for the case with common jumps only.

Fourthly, we derived closed-form formulas for pricing European-style basket options. Three examples with the geometric average, maximum price, and arithmetic average were considered. Additionally, we demonstrated how optimal portfolios with minimum VaR or CVaR can be found without using simulations. We constructed an algorithm combining a change of probability measure and Laplace transform inversion.

Although we focused here on the scenario with only common jumps having normally distributed sizes, all presented methods work well for other distributions of jump amplitudes and the case with asset-specific jumps.

The clear disadvantage of the proposed model is that all pairwise correlations between log returns have the multiplicative structure . Although both positive and negative correlations can be accommodated, this restriction limits the model’s applicability to asset portfolios with a diverse correlation structure. A possible remedy is the inclusion of another common factor (which can be observable or not) so that the correlations can be written in the form .

The proposed model allows for employing the double calibration framework in which we jointly (1) estimate the model parameters on the multivariate time series of log returns and (2) calibrate the implied volatility surface (see

Tassinari and Bianchi (

2014) for a detailed description of the calibration approach). This approach can be amended by finding the model parameters that also best fit the empirical correlation matrix.

Our future research will pursue two directions. First, we will enhance the model by introducing stochastic volatility, a stochastic interest rate, and another common factor while preserving the model’s tractability. Second, we will conduct a comprehensive empirical study of the model and apply it to assets from different industries under diverse market conditions.