Abstract

The activities of economic entities of the public sector in the conditions of uncertainty are associated with many risks, which manifest themselves in negative consequences, i.e., the lower effectiveness of executing assigned powers. Many subjective and objective factors influencing managerial decisions require the knowledge of methods for assessing and managing risks in order to reduce their consequences and achieve the strategic goals of economic entities. There is a promising theory of risk management that does not have the proper theoretical and methodological support, which limits its application. Currently, most studies are concerned with the feasibility of applying and adapting control mechanisms in the public sector. However, the theory of risk control, or risk management, is not considered by modern economists. The objective is to form a budget management mechanism in the Federal Treasury (regulatory body) as an element of risk control. The study considers the optimality and efficiency of the distribution of budgetary funds in the process of exercising the assigned budgetary powers by regulatory authorities and conducting a comprehensive analysis of causes and conditions that affect negative deviations from the standard values. The results of this study contribute to the body of knowledge about risk management, and the proposed approach can be used in similar studies in the public sector.

1. Introduction

Control is recognized as the most effective management tool, including in the public sector. The scientific concept of control is based on the continental (German) and Anglo-American economic schools. The German school considers control as a sub-function of the corporate management system and as a form of management process in the public sector. The Anglo-American school analyzes control in relation to the public sector within the scientific concept of the management control system. For the purposes of this study, the Anglo-American model of control was used, in which a major role is given to such control directions as budgeting and management accounting.

Approaches to the definition of control in the economic literature are associated with the identification and assessment of risks, which are an integral element of all managerial decisions. The global experience demonstrates that ignoring risks can hinder the development of an economic entity and economy as a whole. At the same time, there is no sufficient experience in risk management in the public sector—i.e., risk controlling.

The public sector requires risk controlling since the state manages taxpayers’ money, which is connected with enormous risks. The most dangerous consequences are social unrest. In the public sector, the following types of risks are most often distinguished: political, economic, social, technological, legislative, and environmental. Scientific papers provide examples when non-compliance with risk controlling requirements became the reason for the political failure of public authorities and social actions (Cooper 2010) and excessive internal budgetary pressure led to the inability to provide adequate insurance in the event of a deterioration in the macroeconomic situation (Williams 2009). Among the reasons why risk management in the public sector should be carried out, Tworek (2015) cited the threat of terrorism, violations associated with the introduction of new IT systems (e-risk), corruption and fraud, poor quality of public services, medical threats in society (epidemics of HIV/AIDS, coronavirus), dangers and disruptions associated with and resulting from the implementation of public investment projects, etc.

One of the important aspects of government bodies’ activities is their compliance with established standards, regulations, etc. Failure to comply with these requirements entails catastrophic risks that can cause state damage. In the public sector, risk management is essentially concentrated in the hands of financial authorities, which should become the driver for creating a full-fledged system forecasting and managing risks in the public sector and, as a result, risk controlling.

The main object of this study is the internal and external risks of failure to achieve performance indicators by the structural divisions of the Federal Treasury, which may signal an insufficiently optimal distribution of budgetary funds in the process of exercising budgetary powers.

The main areas of risk controlling are the systems of internal financial control and internal financial audit. We believe that in the conditions of development uncertainty of the internal and external environment in the modern economy, a risk-controlling system is needed to optimize the goals of organization based on risk identification. Risk control is a developing direction in management science, focused on achieving strategic and operational goals through the early diagnosis of risks and developing a response system based on feedback in ambiguous internal and external environments. At the same time, insufficient attention is paid to methodological aspects of the introduction of risk control tools in the public sector. There are practically no studies in the field of risk management of financial responsibility centers, methods of managing costs (expenses), and assessing the effectiveness and efficiency of such expenditures in the public sector.

There are scientific works on the influence and pressure of top management on the implementation of risk management in public administration (Schäfer et al. 2022); the distribution of risks in public–private partnerships (Hwang and Kim 2022; Wardhana et al. 2022); the calculation of the costs of services provided by public sector organizations and institutions in accordance with the risk-based approach (Ostadi and Zare 2022); the assessment of the intermediary effect of corporate risk management on the performance of public institutions (De Oliveira et al. 2021). The publications we reviewed do not study the use of risk control tools in assessing the optimal distribution of budgetary funds in the public sector.

The study aims at determining methodological foundations, rules, and procedures for a risk-based approach to budgeting activities of the Federal Treasury as a regulatory body. Increasing the efficiency of the Federal Treasury in the execution of budgetary powers is a condition for achieving its strategic goals, national goals, and sustainable development goals.

The study contributes to the approbation of risk control tools in budgeting activities of the Federal Treasury as a regulatory body. The optimal expenditures (costs) of the Federal Treasury as an economic entity are determined as the key object of risk management. They allow assessing the targeted use of budgetary funds and the effective execution of budgetary powers. The effectiveness of the Federal Treasury is determined using proposed methods for assessing the indicators for the execution of the budgetary powers in functional areas.

2. Literature Review

The feasibility and necessity of risk management in the public sector have become the subject of discussion recently. This scientific analysis suggests that most of them study the possibility of adapting risk management mechanisms used in the commercial sector to the public sector. This statement is confirmed by Bracci et al. (2021), who reviewed 63 articles from the Scopus database between 1990 and 2018, and concluded that there was a lack of theoretical research on risk management in the public sector. At the same time, risk management is understood as the process of predicting possible losses and their timely elimination.

While considering certain issues of risk management in the public sector, Rana et al. (2019) emphasized the need to integrate risk management with strategy and performance assessment systems, which will improve the quality of management decisions and the efficiency of public organizations.

The analysis of publications shows that most of them associate risk control with risk management. Bracci et al. (2021) claimed that the use of risk management methods in the controlling mechanism improves management efficiency and the achievement of targets in the implementation of management decisions. Felício et al. (2021) associated the development of risk control with the prediction of losses and the development of measures to eliminate them.

Ostadi and Zare (2022) considered the costing of public sector services using the costing method by activity centers in accordance with a risk-based approach. At the same time, the identified costs were distributed by activity centers, and the authors concluded that there were critical risks that could affect costs.

De Oliveira et al. (2021) evaluated the impact of corporate risk management practices in the public sector. Based on a survey of 139 civil servants from 15 different public organizations, the authors concluded that corporate risk management had a rather indirect effect on the relationship between business strategies and the performance of Brazilian public institutions (13.3%).

A review of the Russian scientific literature has revealed several concepts of risk control. S.V. Slabinskij (2011), V.B. Ivashkevich (2012), and Abilova and Ryzhkova (2017) introduced the financial and accounting concept of risk control and regarded it as an improved system of internal control. Matushevskaja and Alekseeva (2017) and A.I. Orlov (2014) support the concept of “service function” in risk management. The latter consists of supplying managers with analytical information for making management decisions (monitoring the achievement of targets and standards, diagnosing deviations and complications in achieving planned results, identifying and testing significant changes, and developing management decisions, including those for adjusting goals). V.V. Gordina (2012) and N.S. Necheuhina (2015) supported the concept of the “meta-function” of risk control, which is the coordination and integration of risk management with management functions and finding a balance between income and risks.

Certain structures dealing with risk management stipulate the need to determine the role of risk control in the organization’s management system. Similar studies were carried out by Grishunin et al. (2018) and Filko and Filko (2016). The authors claimed that the risk-controlling system should not duplicate the risk management system. Risk control cannot perform the service function of the risk management system because risk control becomes a function and is not integrated into the overall management process of an organization. The integration concept of risk control, i.e., the meta-function of the risk management system, has its drawbacks. These are difficulties in establishing boundaries between risk control and management in general. Keeping this in mind, Grishunin et al. (2018) defined the risk controlling system as “a goal-oriented set of methods and tools for organizing risk management in all areas and management processes”. The goal-setting of the risk control system is viewed as the creation and maintenance of the ideology, principles, organization, tools, and processes of risk management, which are used by the organization’s specialists in risk management and managerial decision making.

The object of risk control is the optimal distribution of the following: standard costs (Federal Treasury 2016) (Ctotal) across financial responsibility centers, which is a total expression of the remuneration of employees involved in the implementation of budgetary powers; the cost of remuneration of employees who are not involved in the implementation of budgetary powers; costs for information and communication technologies; the capital repairs of property; costs for the financial support of reconstruction, technical re-equipment of capital construction objects or acquisition of real estate objects; costs for the additional professional education of employees; costs for providing residential premises included in the specialized housing facilities; other costs.

3. Methods

To achieve the study objective, we should undergo several stages, including the use of quantitative and qualitative indicators (Table 1).

Table 1.

Stages and methods of this research.

The purpose of the first stage was to determine financial responsibility centers—structural units (groups of structural units) for the functioning of which financial resources are allocated. At the second stage, to ensure the efficiency of distribution of budgetary funds among financial responsibility centers, a mechanism for managing costs was formed. At the third stage, a system of indicators was developed to assess the efficiency and effectiveness of expenditures (expenses) of the Central Federal District. Thus, quantitative indicators are understood as cost and natural indicators that allow quantitative measurement and assess the implementation of cost estimates. Qualitative indicators for evaluating non-quantified characteristics allow determining the efficiency and effectiveness of expenses (costs) of financial responsibility centers. The center of financial responsibility is a structural subdivision (a group of structural subdivisions), in relation to which financial resources are distributed and/or used and information is systematized and accumulated.

In quantitative terms, the coefficient of budget execution of functional and professional financial responsibility centers is the ratio between the actual budget execution and the planned expenses.

The performance index in functional and professional areas for the relevant period is an average assessment of the i-th functional or professional performance for the relevant period in conjunction with the cost–performance ratio.

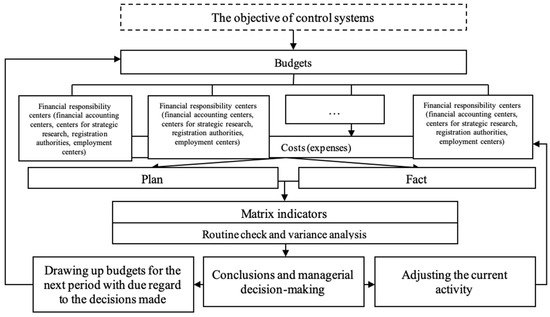

The mechanism for the execution of budgets for the expenses (costs) of financial responsibility centers should ensure the effectiveness of the costs (expenses) incurred, which are distributed among the budgets and represent a set of general business, direct and overhead costs. The mechanism of budget management (Figure 1) involves the formation of budgets for financial responsibility centers. Since financial responsibility centers are structural components of a particular participant in the budget process, the budget is a personalized part of budget estimates. At the same time, the budget estimate provides exclusively for expenditures as it sets limits on the budgetary obligations of a participant in the budget process. Incomes are provided by the law (decision) on the budget or other legal basis for their receipt. While assessing the effectiveness of budget execution in terms of expenditures, it is inappropriate to consider the revenue. The budget management mechanism provides for the current control and analysis of deviations of planned and actual indicators using a matrix of indicators. Based on the results, we drew conclusions and made managerial decisions to form a budget for the next financial year or to adjust the current activities.

Figure 1.

The mechanism of budget management in the controlling system.

Direct expenses include expenses that aim at endowing the Federal Treasury with budgetary powers.

Overhead costs are expenses that cannot be attributed to the organization and execution of a specific budgetary power but are associated with the simultaneous execution of several budgetary authorities. Budgetary powers are understood as the rights and obligations of participants in the budget process established and accepted in accordance with budgetary legislation.

General business expenses are expenses necessary to ensure the activities of an economic entity as a whole.

Expenses not related to the organization and execution of budgetary powers are as follows: the costs of paying taxes; the expenses for the maintenance of property not used for the execution of budgetary powers and for general business needs. In addition, this group might include expenses according to the Classification of operations in the general government sector 262 (“Benefits for social assistance to the population”), 263 (“Pensions and benefits paid by organizations in the general government sector”), 273 (“Extraordinary expenses for operations with assets”), 291 (“Taxes, duties, fees”), and 296 (“Other expenses”).

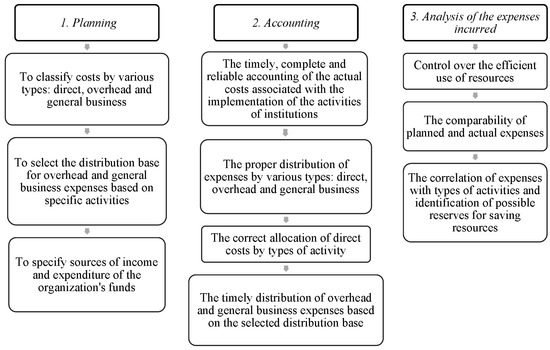

The mechanism for managing costs (expenses) includes the following steps (Figure 2).

Figure 2.

The mechanism for managing costs (expenses).

The information accumulated within the framework of the proposed mechanism (Figure 2) is used to calculate the performance ratio for further measurement of the cost (expense) efficiency index of both functional and professional areas.

The performance ratio is the ratio between actual expenses (costs) for ensuring activities of the i-th functional or professional area of the Federal Treasury for the corresponding period (Cfi) and the planned expenses (costs) for ensuring activities of the i-th functional or professional area of the Federal Treasury for the corresponding period (Cpi). Together with the performance ratio, the efficiency index is measured with due regard to the effectiveness of each functional and professional sphere (cost center).

Performance is presented as an indicator summarizing the performance of each functional and professional area (cost center) through the ranking system, i.e., the matrix of indicators, including target, general, accounting, and control indicators.

The performance of the i-th functional or professional area of the Federal Treasury for the corresponding period is determined using formula (1):

where Nt is the number of target indicators of the k-th responsibility center;

- E(Pti)

- is the assessment of the i-th target indicator of the k-th responsibility center for the corresponding period. The calculation of the assessment of each i-th target indicator is different; the formula for each indicator is established by the Federal Treasury individually for each functional and professional area (structural divisions with the execution of budgetary powers). For example, 24 indicators (17 target and 7 general) were set for the functional area “Information support”; for the functional area “Staffing”, the total number of target indicators is 21, of which 7 are general and 17 are for accounting;

- summarizes scores of all target indicators of the k-th responsibility center for the corresponding period;

- Ng

- is the number of general indicators of the k-th responsibility center;

- E(Pgi)

- is the assessment of the i-th general indicator of the k-th responsibility center for the corresponding period; it is calculated according to the evaluation criteria established by the Matrix of indicators of the Federal Treasury by functional areas or the Matrix of indicators of the Federal Treasury by professional areas;

- summarizes scores of all general indicators of the k-th responsibility center for the corresponding period;

- Na

- is the number of accounting indicators of the k-th responsibility center;

- E(Pai)

- is the assessment of the i-th accounting indicator of the k-th responsibility center for the corresponding period; it is calculated according to the evaluation criteria established by the Matrix of indicators of the Federal Treasury by functional areas or the Matrix of indicators of the Federal Treasury by professional areas;

- summarizes scores of all accounting indicators of the k-th responsibility center for the corresponding period;

- Nc

- is the number of control indicators of the k-th responsibility center;

- E(Pci)

- is the assessment of the i-th control indicator of the k-th responsibility center for the corresponding period; it is calculated according to the evaluation criteria established by the Matrix of indicators of the Federal Treasury by functional areas or the Matrix of indicators of the Federal Treasury by professional areas;

- summarizes scores of all control indicators of the k-th responsibility center for the corresponding period.

As a result of applying Formula (1), the maximum score that can be obtained for each functional or professional area calculated. The calculation of indicators should be carried out automatically in the departmental information system “SMART control (controlling)”.

Based on the above-mentioned indicators, it is worth mentioning that accounting for the costs (expenses) for maintenance and functioning and accounting for the results of functional and professional areas become an information basis for providing an effective employee motivation mechanism (KPI).

The effectiveness of both functional and professional spheres of the Federal Treasury can be calculated through the efficiency index for a certain period (a month, quarter, year, or three years). At the same time, efficiency is understood as the arithmetic mean of the efficiency values of each functional and professional area of the Federal Treasury:

where E is the efficiency index of both functional and professional spheres of the Federal Treasury for the corresponding period;

- Pi

- is the performance of the i-th functional or professional area of the Federal Treasury for the corresponding period;

- N

- is the number of functional or professional spheres of the Federal Treasury analyzed for the corresponding period.

- is a performance ratio, which is the ratio of actual and planned expenses (costs) ensuring the activity of the i-th functional or professional area of the Federal Treasury for the corresponding period;

- is the actual value of expenses (costs) ensuring the activity of the i-th functional or professional area of the Federal Treasury for the corresponding period according to the register “Execution of the cost estimates (costs) by financial responsibility centers (cost centers)”;

- is the planned value of expenses (costs) ensuring activities of the i-th functional or professional area of the Federal Treasury for the corresponding period according to the register “Estimated expenses (costs) by financial responsibility centers (cost centers)”.

Thus, based on the performance indicators of each functional or professional area, it is possible to calculate the effectiveness of the Federal Treasury for the corresponding period. The calculation of the indicator should be carried out automatically in the departmental information system “SMART control (controlling)”.

In turn, the value of the efficiency index shows the ratio of the execution of budgetary powers by the Federal Treasury in functional and professional areas and the quality of expenditure execution. Changes in the efficiency index can be the basis for analyzing the balance between costs (expenses) and results, which is a criterion for assessing the accuracy of managerial decisions.

4. Results

The concept of risk-based management of expenditures of the Federal Treasury within the execution of its budgetary powers provides for the formation of “responsibility centers” as organizational units for systematizing information on the implementation of budgetary procedures. Each responsibility center should achieve the established criteria for assessing the effective execution of budgetary powers and contribute to the overall financial result in the form of expenses (costs)1 systematized by types of financial responsibility centers.

Centers for financial responsibility are structural subdivisions (groups of structural subdivisions), in relation to which financial resources are distributed and/or used, and an information resource is systematized and accumulated.

Centers for financial responsibility can be divided into:

- −

- The Strategic Results Center is an organizational unit for collecting information resources on the execution of budgetary procedures of the Federal Treasury.

- −

- The Development Center is an authorized body responsible for the effective and targeted use of budgetary funds in the process of exercising its budgetary powers in order to achieve the strategic goals and objectives of the Federal Treasury in the functional spheres assigned to them. The Development Center has the right to exert a controlling impact on constituent elements of the activities of the Federal Treasury that fall within its sphere of responsibility.

- −

- The Cost Center is a structural unit of the Federal Treasury that uses resources to fulfill its functional purpose and is responsible for costs (expenses) and has the ability to influence their level.

- −

- The Financial Accounting Center is a structural unit of the Federal Treasury that keeps records of the established indicators of costs (expenses) but is not responsible for their amount.

The above-mentioned financial responsibility centers form the financial structure of an economic entity and determine the following tasks: to distribute spheres of responsibility and authority among the heads of financial responsibility centers to manage costs (expenses) and achieve the established indicators; to create an effective system of personnel motivation (KPI) with the effective execution of budgetary powers. At the same time, each financial responsibility center has a developed budget in physical and/or in monetary terms, which determines the need for the effective execution of budgetary powers. The budget of financial responsibility centers is based on standard costs for ensuring the functions of the Federal Treasury for each functional and professional sphere.

According to the mechanism shown in Figure 2, cost (expense) management at the first stage involves the classification of costs by their types: direct, overhead, or general business. At the second stage, it is necessary to distribute expenses by these types. At the third stage, the planned and actual expenses are compared. The proposed algorithm determines the accounting, analysis, and control of distribution and classification of expenses (costs) by financial responsibility centers (functional and professional areas of the Federal Treasury in the course of exercising budgetary powers) and by types of expenses (Table 2).

Table 2.

The proposed distribution of costs (expenses) of functional and professional areas of the Federal Treasury.

With the help of the recommended distribution of costs (expenses), information on the actual costs (expenses) of each financial responsibility center (cost center) using the chart of accounts of management accounting of the Federal Treasury2 should be integrated into the developed register “The structure of expenses (costs) by financial responsibility centers (cost centers)” (Table 3).

Table 3.

The proposed form of the register “Structure of expenses (costs) by financial responsibility centers (cost centers)”.

The specification of the planned expenses (costs) by financial responsibility centers (cost centers) in the context of budget classification should be reflected in the register “Estimated costs (expenses) by financial responsibility centers (cost centers)” (Table 4).

Table 4.

The proposed form of the register “Estimated costs (expenses) by financial responsibility centers (cost centers)” (with due regard to conditional information).

The specification of actual costs (expenses) by financial responsibility centers (cost centers) in the context of budget classification should be reflected in the register “Estimated expenses (costs) by financial responsibility centers (cost centers)” (Table 5).

Table 5.

The proposed form of the register “Budget expenditure reports of financial responsibility centers (cost centers)” (with due regard to conditional information).

This information on budget expenditure reports of financial responsibility centers (Table 3, Table 4 and Table 5) allows us to calculate the performance ratio, the efficiency index of expenses (costs) of functional and professional spheres and the key performance indicator of each functional and professional area (center costs), whose calculation method is presented above.

Methods for assessing the efficiency index of the Federal Treasury in both functional and professional areas include the following steps:

- The indicator is calculated automatically in the departmental information system “SMART control (controlling)”.

- The procedure for assessing the index is established by an internal local act of the Federal Treasury.

- The index is estimated in points (from 0 to 1) according to formula (2) and shows the results of the execution of budgetary powers by the Federal Treasury in functional and professional areas and the quality of expenditure execution.

- If the calculated score differs from the maximum score (1 point) by more than −25%, it is necessary to conduct a comprehensive analysis of the causes and conditions that influenced the current negative trend, as well as to develop an action plan to bring it into line with the established requirements of the organization process and implementation of activities.

The performance of the Federal Treasury is determined using the indicator matrix for the execution of budgetary powers within functional areas through a ranking system. The indicator matrix is grouped by areas and types of indicators (target, general, accounting, control) with calculated values.

Here are some methods for assessing indicators for the execution of budgetary powers within functional spheres:

- Indicators are calculated automatically in the departmental information system “SMART control (controlling)”.

- The procedure for assessing indicators is established by an internal document of the Federal Treasury.

- Indicators are assessed in points (there are two values (0 or 1) depending on compliance or non-compliance with the assessed requirement).

- In the absence of initial data for calculating the indicator or the failure to implement the process assessed by the indicator in the reporting period, the indicator is not calculated (the maximum score for a group of indicators/professional or functional area is reduced by the maximum score for the indicator) (Table 6).

Table 6. The maximum score for functional spheres.

Table 6. The maximum score for functional spheres.

Table 6 shows that the total number of target indicators for the functional area “Information support” is 24 points. We should note that the maximum score for each indicator 1 point. Thus, in case of achievement of all targets, the maximum score for the group of indicators “Information support” is 24 points, for the functional area “Organizational support” it is 17 points, etc. For the period considered in Table 6, the target indicators in the functional areas “Information support”, “Organizational support”, “Planning and financial support”, and “Legal support” were not achieved.

If there is a deviation of the calculated estimates from the maximum score for financial responsibility centers by more than 25% in the negative direction, it is necessary to conduct a comprehensive analysis of the causes and conditions that influenced the current negative trend, as well as to develop an action plan to comply it with the established requirements of the organization process and implementation of activities.

5. Discussion

The results obtained contribute to the research of some scientists who addressed the implementation and development of risk management in the public sector. Bracci et al. (2021) considered risk management in the public sector as a “black box” and insisted on the lack of theoretical research in this field of knowledge. At the same time, the authors highlighted performance management as the key area of risk management in the public sector. Rana et al. (2019) also called for further research on risk management in the public sector and focused on the need to implement the best practices and promote appropriate changes.

According to Mišún and Hudáková (2020), Garcia-Sanchez and Cuadrado-Ballesteros (2016), and Revkuts et al. (2019), risk control is considered a component of risk management focused on achieving risk management goals and, above all, financial risks, which is consistent with the results of this study. In particular, this research assesses the risks of compliance with regulatory costs incurred by financial responsibility centers of the Federal Treasury.

Thus, Zyryanov and Kalmykova (2019) highlighted the need to assess the efficiency of spending budgetary funds in the exercise of the assigned powers by control and supervisory bodies. The threshold value of calculated deviations from the maximum score for the corresponding financial responsibility center (25%) proposed by the authors emphasizes the inadmissibility of the outstripping growth of budget expenditures over the growth in the performance of regulatory authorities, which V.V. Klimanov (2018) mentioned in his studies.

While considering the pricing mechanism in the public sector as exemplified by a non-profit training center, Ostadi and Zare (2022) used the activity-based costing method (ABC) in accordance with the cost of risk factors associated with the process. The above-mentioned approach to optimizing the costs (expenses) of responsibility centers correlates with the results of B. Ostadi and R. Zare. They distributed the identified costs by activity centers and indicated the existence of critical risks that affect such costs.

Assessing the mediating effect of corporate risk management on the performance of public institutions, De Oliveira et al. (2021) conducted a preliminary study using a quantitative approach and structural equations. Thus, the authors concluded that public institutions should use the experience of corporate risk management. Based on the use of such control tools as budgeting and management accounting, the study results further develop the conclusions of De Oliveira et al., who singled out costs as the main variable in the equation for the impact of risks on the performance of public institutions.

The recommended methods provide for budgeting and management accounting as the main tool for risk control, which is consistent with the opinion of most authors who consider the effectiveness of the public sector through building an effective management control system (Oates 2015; Van der Kolk 2019; Verbeeten and Speklé 2015).

Nuhu et al. (2019) addressed changes in public sector organizations to improve their performance. The study aims at introducing and developing risk control, including the early diagnosis of the risks of inefficient spending of budget funds allocated for the implementation of the assigned powers by the Federal Treasury.

The proposed methods solve the issue of methodological support for mechanisms managing the costs (expenses) of regulatory authorities based on a risk-based approach.

6. Conclusions

Within the framework of this study, the financial and accounting concept plays the main role, according to which the key element of risk control in the public sector was considered a financial risk. This reflects the likelihood of negative consequences allowed by an economic entity of the public sector or its structural subdivision in the performance of assigned functions and related to the formation, distribution, and use of financial resources.

The study results consist of methods for a risk-based approach to budgeting activities of the Federal Treasury that ensures: (1) transparency in spending funds at the disposal of the Federal Treasury; (2) assistance in creating the necessary information base for making managerial decisions; (3) and the optimization of expenses (costs) of the Federal Treasury as an economic entity.

The above-mentioned methods provide for the final assessment of the effectiveness of each responsibility center of the Federal Treasury and its comparison with the maximum score. A limit reference point (25%) has been established, whose excess is the basis for a comprehensive analysis of the causes and conditions that influenced the negative trend. Based on the analysis conducted, it is recommended to develop an action plan to comply with the organization and implementation of internal financial control with the established requirements.

To manage financial risks, the Federal Treasury should exercise constant control in order to prevent a critical (more than 25%) deviation of the final performance indicator of each financial responsibility center from the maximum possible value. The application of such methods allows controlling the risks of reducing the effective management of expenditures (costs) of the Federal Treasury due to uncertainty and limited budgetary funds, which will increase the effectiveness of regulatory authorities in exercising the assigned powers and achieving the strategic goals of their activity.

Author Contributions

All authors contributed equally. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The article is based on the results and research conducted at the expense of budgetary funds under the state order of the Financial University on the topic “The development of regulatory mechanisms in the system of state financial control”.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | According to Classification of operations in the general government sector 1—“Budget activity”—such concepts as “costs” and “expenses” are identical from an economic viewpoint, due to the fact that budget funds are used in strict conformity with the estimated budget, and the financial and economic activities of a public institution are connected with the implementation of state’s functions in the process of providing public services. After this public institution executes the estimated budget, an analysis of the final balance sheet shows that account 140130000, “Financial performance of the previous reporting period”, has a credit balance in the balance sheet, i.e., income or acquisition by the institution in the form of balance sheets for non-financial and financial assets by the end of the financial year. |

| 2 | It became null and void. Federal Treasury (2012). |

References

- Abilova, Makhabat Gumarovna, and Olga Andreevna Ryzhkova. 2017. Risk controlling in the system of management of financial risks of industrial enterprise. Upravlenie Jekonomicheskimi Sistemami 5: 35–39. [Google Scholar]

- Bracci, Enrico, Tallaki Mouhcine, Tarek Rana, and Danture Wickramasinghe. 2021. Risk management and management accounting control systems in public sector organizations: A systematic literature review. Public Money and Management 42: 361–364. [Google Scholar] [CrossRef]

- Cooper, Thomas. 2010. Strategic Risk Management in the Municipal and Public Sector. An Exploration of Critical Success Factors and Barriers to Strategic Risk Management within the Province of Newfoundland and Labrador. Project Report. The Harris Centre: Available online: http://research.library.mun.ca/id/eprint/209 (accessed on 18 April 2022).

- De Oliveira, José Fábio, Cleber Mitchell De Lima, Newton Franklin Almeida, Ari Melo Mariano, Ana Carla Bittencourt Reis, and João Mello Da Silva. 2021. Costs influence and mediating effect of corporate risk management on organizational performance: A study applied to the Brazilian public service. Paper presented at the 16th Iberian Conference on Information Systems and Technologies (CISTI), Chaves, Portugal, June 23–26. [Google Scholar]

- Federal Treasury. 2012. Order of the Federal Treasury of December 11, 2012. No. 473 On Organizing Management Accounting in the Federal Treasury. Available online: https://roskazna.gov.ru/upload/iblock/535/prikaz_473.pdf (accessed on 18 April 2022).

- Federal Treasury. 2016. Order of the Federal Treasury of July 29, 2016 No. 300 On Establishing Standard Costs for Ensuring the Functions of Territorial Bodies of the Federal Treasury and the Federal Government Institution “Center ensuring the Activity of the Federal Treasury of the Russian Federation”. Available online: https://roskazna.gov.ru/upload/iblock/048/doc01277320160805132702_300.pdf (accessed on 18 April 2022).

- Felício, Teresa, António Samagaio, and Ricardo Rodrigues. 2021. Adoption of management control systems and performance in public sector organizations. Journal of Business Research 124: 593–602. [Google Scholar] [CrossRef]

- Filko, S. V., and I. V. Filko. 2016. Risk-kontrolling informatsionnoi bezopasnosti [The risk management of information security]. Uchet, analiz i audit: Problemy teorii i praktiki 16: 123–27. [Google Scholar]

- Garcia-Sanchez, Isabel-Maria, and Beatriz Cuadrado-Ballesteros. 2016. New public financial management. In Global Encyclopedia of Public Administration, Public Policy, and Governance. Edited by A. Farazmand. Cham: Springer. [Google Scholar] [CrossRef]

- Gordina, V. V. 2012. Several aspects of forming of risk-controlling system at the enterprise. Finansy i kredit 28: 30–36. [Google Scholar]

- Grishunin, Sergei V., Natalya V. Mukhanova, and Svetlana B. Suloeva. 2018. Razrabotka kontseptsii risk-kontrollinga dlya promyshlennogo predpriyatiya [Developing the concept of risk controlling for industrial facilities]. Organizator Proizvodstva 26: 47–52. [Google Scholar] [CrossRef]

- Hwang, Heeju, and Hyungtai Kim. 2022. Demand risk transfer and government’s cost efficiency: Focusing on Korean waste treatment PPP cases. Waste Management 137: 31–38. [Google Scholar] [CrossRef]

- Ivashkevich, V. B. 2012. Strategic decision in controlling. Controlling 4: 8–11. [Google Scholar]

- Klimanov, Vladimir. 2018. K voprosu ob otsenke rezultativnosti i effektivnosti kontrolno-nadzornoi deyatelnosti [Assessing the effectiveness and performance of regulatory authorities]. Voprosy Gosudarstvennogo i Munitsipalnogo Upravleniya 1: 206–13. [Google Scholar]

- Matushevskaja, E. A., and L. A. Alekseeva. 2017. Risk controlling and its role in management of the enterprise. Tavricheskij Nauchnyj Obozrevatel 5: 21–25. [Google Scholar]

- Mišún, Juraj, and Ivana Mišúnová Hudáková. 2020. Convergence of two controlling terms. Do we face a common future between controlling and management accounting? SHS Web of Conferences 83: 01048. [Google Scholar] [CrossRef]

- Necheuhina, N. S. 2015. Organizational and management accounting tools in system of controlling. Mezhdunarodnyj zhurnal Prikladnyh i Fundamentalnyh Issledovanij 10: 550–54. [Google Scholar]

- Nuhu, Nuraddeen Abubakar, Kevin Baird, and Ranjith Appuhami. 2019. The impact of management control systems on organisational change and performance in the public sector: The role of organisational dynamic capabilities. Journal of Accounting & Organizational Change 15: 473–95. [Google Scholar] [CrossRef]

- Oates, Grainne. 2015. Literature review and synthesis of management control systems: In the context of the public sector. International Journal of Business and Management 10: 52–57. [Google Scholar] [CrossRef]

- Orlov, Alexander Ivanovich. 2014. The current state of risk controlling. Nauchnyj zhurnal KubGAU 98: 32–64. [Google Scholar]

- Ostadi, Bakhtiar, and Reza Zare. 2022. Activity-based costing in the public sector and non-profit organisations: Towards risk-based approach. International Journal of Productivity and Quality Management 35: 1–16. [Google Scholar] [CrossRef]

- Rana, Tarek, Danture Wickramasinghe, and Enrico Bracci. 2019. New development: Integrating risk management in management control systems-lessons for public sector managers. Public Money and Management 39: 148–51. [Google Scholar] [CrossRef]

- Revkuts, Alexandra V., Svetlana K. Demchenko, Natalia N. Tereshchenko, Yuri L. Aleksandrov, and Olga S. Demchenko. 2019. Public sector transformation and its effectiveness in the national economy. Espacios 40: 4. [Google Scholar]

- Schäfer, Fabienne-Sophie, Bernhard Hirsch, and Christian Nitzl. 2022. Stakeholder pressure as a driver of risk management practices in public administrations. Journal of Accounting & Organizational Change 18: 33–56. [Google Scholar] [CrossRef]

- Slabinskij, S. V. 2011. Forming of risk-controlling mechanism at industrial enterprise. European Social Science Journal 6: 395–402. [Google Scholar]

- Tworek, Piotr. 2015. Public Risk Management (PRM). Paper presented at the 10th International Scientific Conference Financial Management of Firms and Financial Institutions Ostrava VŠB-TU of Ostrava, Ostrava, Czech Republic, September 7–8; Ostrava: VŠB-Technická Univerzita Ostrava, pp. 1340–47. [Google Scholar]

- Van der Kolk, Berend. 2019. Management control packages: A literature review and guidelines for public sector research. Public Money & Management 39: 512–20. [Google Scholar]

- Verbeeten, Frank H. M., and Roland F. Speklé. 2015. Management control, results-oriented culture and public sector performance: Empirical evidence on new public management. Organization Studies 36: 953–78. [Google Scholar] [CrossRef]

- Wardhana, Adhika Nandi, Farida Rachmawati, and Erwin Widodo. 2022. Game theory approach for risk allocation in public private partnership. In Proceedings of the Second International Conference of Construction, Infrastructure, and Materials. Edited by Han Ay Lie, Monty Sutrisna, Joewono Prasetijo, Bonaventura H.W. Hadikusumo and Leksmono Suryo Putranto. Singapore: Springer, vol. 216, pp. 471–78. [Google Scholar] [CrossRef]

- Williams, Graham. 2009. Applying Management of Risk for Public Services. Alexandria: The Public Risk Management Association. [Google Scholar]

- Zyryanov, Sergey, and Anastasia Kalmykova. 2019. Podkhody k otsenke effektivnosti deyatelnosti kontrolno-nadzornykh organov po preduprezhdeniyu narushenii obyazatelnykh trebovanii [Approaches to assessing the efficiency of regulatory authorities preventing the violation of mandatory requirements]. Voprosy Gosudarstvennogo i Munitsipalnogo Upravleniya 3: 31–66. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).