Abstract

The rapid growth over recent decades of the impact of natural disasters on economies, especially in vulnerable areas, urges stakeholders to promote innovative solutions involving risk transfers that account for the new risk exposures. These proposed solutions are designed to optimize and expedite the indemnification process, which can ultimately be beneficial for both policyholders and insurers alike. This article explores the possibility of supplementing the current Romanian dwelling insurance protection scheme with a parametric mechanism. To determine the triggering parameter of the insurance pay-out, the authors consider various hazard scenarios developed based on historical events. This paper focuses on Probable Maximum Loss (PML) determination computed for events with epicenters in the Vrancea (a region and a mountain in the Carpathians) seismic area. This area is the most exposed in Romania to earthquakes, and it includes the capital, Bucharest, which is the urban area with the highest population concentration and, consequently, the highest exposure to the discussed risks.

1. Introduction

Parametric insurance has the potential to act as a tool for innovation in the insurance industry as a response to the growing challenges related to the vulnerability of the human communities and their assets to natural disasters. A current response to the need for increasing vulnerable communities’ resilience to natural disasters is represented by parametric insurance (or index-based insurance, as it may also be called). Parametric insurance is used for events related to natural disasters, adverse weather conditions, pandemics (i.e., business interruption) and cyberattacks, which may impact various economic sectors, such as agriculture, renewable energy (wind, solar) and building and construction.

This modern concept is designed for covering catastrophic risks and has a few particularities compared with traditional insurance. In this case, the indemnification process is based on a triggering parameter which has to be aligned with the exposure to the event.

The main characteristics of this insurance include:

- -

- The indemnification is quick and cash is immediately paid out;

- -

- If the event occurs, the payment is guaranteed;

- -

- The products could be tailor-made, according to the specificity of the risk.

This study examines the opportunity to use a complementary risk transfer solution in the existing mandatory Romanian dwellings insurance system. This initiative is encouraged by the worldwide experience on this matter. The pool established in 2007 by 16 Caribbean states with the support of The World Bank (1978) introduced the first multi-risk parametric insurance product, covering three risks: hurricane, earthquake and heavy rain. At the same time, earthquake risk is also covered by this type of insurance in countries such as Turkey, Mexico and Chile, which have a significant loss history marked by the impact of this risk and the efforts to decrease community vulnerability. In 2011, the World Bank introduced a program entitled the “Global Index Insurance Facility” aimed at supporting parametric insurance and established a financial instrument to promote it, namely, the International Finance Corporation (IFC). Recently, a parametric insurance scheme proposal has been used in Greece, covering earthquake risk (Franco et al. 2019). These programs, which are internationally promoted, are primarily focused on parametric insurance products covering the farming sector, and they are implemented mainly in lesser-developed regions. The interest in earthquake risk cover has pierced through the theoretical framework approaches and has passed into the area of designing risk models for specific real situations and areas. A relevant example is the product designed for protecting homes and small businesses in California (Lin and Kwon 2020). The same parametric approach is further considered for future cover against earthquakes, volcanic eruptions and tsunamis (Hattori 2018).

Additionally, an insurance mechanism based on parametric insurance is the recommended solution in a report published under the aegis of the OECD for the state of Chile following the earthquake of February 2011 (Robert Muir-Wood 2011, p. 20).

A deficiency of this insurance product is the way in which the loss of the buyer is treated. Depending on the ratio between the level of the index, which functions as a trigger of the insurer’s obligation to pay, and the actual level recorded by it, buyers of the insurance policy may find themselves in one of the following situations: they have recorded a loss, but have not been compensated, or they have not recorded the loss, but will receive compensation.

For developing countries with a shortage of resources that generates difficulties in the process of financing a response to a natural disaster, the involvement of the private sector is a solution that is part of the World Bank’s strategy (Freeman 2003).

Despite the advantages of this product, the demand for parametric insurance products is lower than expected. Explaining this situation is an important topic in recent literature (Clarke 2016; Peter and Ying 2020; Jaspersen et al. 2022).

The model built by Clarke is based on the idea that risk adversity seems to be the important factor that shapes the demand for the parametric insurance product. The estimation of the level and form of the demand for the parametric meteorological type of insurance highlights important changes in the case of traditional insurance based on compensation. The construction and conclusions of the model are validated based on data on parametric insurances provided to poor farmers in developing countries.

Peter and Ying (2020) focus on how the optimal insurance demand evolves if the buyers face the risk of the nonperformance of the contract (nonperformance risk). Low confidence in the insurance mechanism correlates with the low level of information. The solution is represented by requesting information that reduces the ambiguity regarding the non-execution of the contract by the insurer.

The literature devoted to the relationship between probability weighting and insurance demand is expanded and supplemented by Jaspersen et al.’s (2022) study that focuses on the comparative study of demand for low-probability, high-impact (LPHI) risks, versus high-probability, low-impact (HPLI) risks. For the LPHI risks, in the case of natural disasters, the causes of under-insurance are analyzed.

There is a clear trend in disaster risk management, which involves focusing on multi-jurisdictional coordination by pooling together regional and national risks and creating innovative insurance products covering a larger area of interest. This may be achieved by introducing parametric insurance, which in turn may support the enhancement of regional resilience and strengthen the Sustainable Development Goals (Amarnath et al. 2021).

Parametric insurance is increasingly required as a tool to cover damages associated with the occurrence of various natural disasters. However, the models built for these products have to be agreed upon by policyholders, insurers and risk managers (Figueiredo et al. 2018).

This paper starts by looking at the elements of the compulsory Romanian dwellings’ mechanism, together with showcasing the seismic activity-prone areas in Romania. This article discusses several issues which may lay the ground for setting up a complementary insurance product based on parametric triggers. The purpose of said instrument is to decrease the impact on vulnerable communities, particularly those exposed to earthquake risk.

2. The Specific Nature of the Home Insurance System in Romania

In Romania, there is a dual insurance scheme for residential buildings, which is made up of two complementary categories of products, namely, a compulsory component and a facultative component. Taking out facultative insurance is conditional on the existence of compulsory insurance.

Since Romania is a country that is significantly exposed to natural disasters, especially earthquakes and floods, in the framework of the project implemented with World Bank support, entitled “Natural Hazard Risk Mitigation and Emergency Preparedness”, the ground was laid for the setting up of a mandatory home insurance scheme against natural disasters. This scheme was regulated in a special law, Law No. 260/2008, which established compulsory home insurance against earthquakes, landslides and floods. The institutional solution implemented meant that a corporation was set up whose main business consists of the management of the compulsory home insurance scheme, entitled the Pool for Insurance against Natural Disasters (or PAID, as the Romanian acronym).

PAID is an insurance pool, established through the association based on the consent expressed by twelve insurance companies of Romania that are licensed to underwrite natural disaster risks. The distributors of the compulsory home insurance are all the insurance companies that underwrite natural disaster risks. The company which manages the compulsory insurance scheme of Romania has in its portfolio only one insurance product, namely, the compulsory home insurance policy, called PAD. It was designed to provide simple and affordable coverage for all residential properties.

Compulsory home insurance, or PAD, is a first risk insurance, according to which compensation is paid to the value of the damage caused to the housing unit in any circumstance as a consequence of the three insured risks, regardless of the severity of the event. The system has two sub-limits of EUR 10,000 and EUR 20,000, depending on the building material.

Exploring the use of another risk transfer method for this type of insurance is, therefore, a challenge and, at the same time, a necessity, considering the interest the insured parties attach to diminishing the post-disaster response time.

PAD insurance is a unique product, with a mandatory nature, and should it not be issued, the other facultative home insurance policies of Romania cannot be taken out. Facultative home insurance policies are sold with a deductible excess equal to the PAD limits for earthquake, flood and landslide risks.

The law provides the sum insured at two different levels (EUR 20,000 and EUR 10,000) depending on the building materials used. Accordingly, the insurance premium stands at EUR 20 and EUR 10, respectively. Buildings technically assessed and classified in seismic risk class 1 are excluded. According to the Romanian Normative P100-92, there are four classes of buildings vulnerability for seismic risk:

- Class 1—constructions with very high risk of collapse;

- Class 2—constructions with low risk of collapse, but for which a major structural degradation is expected;

- Class 3—constructions for which structural degradation is expected, with no impact on structural safety, but with important degradation of non-structural elements;

- Class 4—constructions for which the expected seismic response is similar to the one corresponding to the new buildings, designed based on the current legislation.

Table 1 shows the relationship between the two categories of insurance in terms of the gross written premiums and the gross claims paid, respectively. This relationship reflects the specific nature of the two types of insurance in terms of determining the insurance premiums and how damaging the insured risks may be. The information presented in the yearly reports submitted by the Financial Supervisory Authority of Romania was processed to develop this table.

Table 1.

The mandatory insurance scheme vs. the facultative insurance scheme for the home insurance market of Romania.

In Table 1, it is noteworthy the volume of facultative gross written premiums is at least double compared to the mandatory one for a relatively equal number of policies. However, the volume of indemnities paid through the mandatory system represents between 4% and 6% of the indemnities paid in the facultative system. This is explained by the attributes of the risks included in the mandatory policies, with a relatively low occurrence frequency at a low penetration rate.

Figure 1 shows the evolution of the number of mandatory policies, correlated with the penetration rate for the residential buildings. The information presented in the Natural Disaster Insurance Pool (PAID) reports of 2020 and that submitted by the National Institute of Statistics of Romania also in 2020 was processed to develop the following graph.

Figure 1.

Mandatory (PAD) portfolio evolution for 2013–2020. Source: data obtained according to the calculations of the author based on data from PAID and the National Institute of Statistics of Romania.

3. The Specific Nature of the Seismic Activity for Romania

Overall, Romania is a country characterized by a moderate type of seismic activity, and as a territory of Europe, it is perceived as a country with some of the most active seismic sources. Jointly with Greece, Turkey and Italy, Romania has experienced high-intensity earthquakes with catastrophic consequences, including the loss of human lives and significant material damages. In the territory of Romania, the seismic area with the highest catastrophic potential is located at the curb of the Eastern Carpathians in the Vrancea region. This area largely affects the extra-Carpathian territories in south-eastern Romania, which account for a third of the area of the country. As a general rule, the severest consequences are identified not in the area in the close vicinity of the epicenter, but on one side of it and the other, towards the north-east, on the Focsani–Iasi–Chisinau axis, or to the south-west, on the Bucharest–Zimnicea–Sofia axis. A feature of the earthquakes occurring in Vrancea is that they are less dramatically experienced in the interior of the Carpathian arch (Balan et al. 1982).

In Romania, the area most at risk to earthquakes with the highest catastrophic potential is located in the Vrancea region, a complex seismic area, which lies on the curb of the Eastern Carpathians where three tectonic plates meet: The East European, the Intra-Alpine and the Moesica plates. The main feature of the earthquakes located in Vrancea is that medium- to intermediate-depth earthquakes occur quite frequently (at depths of 60–200 Km).

Besides the Vrancea area, there are a few areas of shallow seismic sources of local importance for earthquake hazards: east Vrancea, Fagaras-Campulung, Danube area, Banat, Crisana-Maramures, the Barlad Depression, the Predobrogean Depression, the Intramoesica fault and the Transylvanian Depression (Radulian et al. 2000).

Bucharest is a city where, frequently, the high level of social vulnerability overlaps with the increased vulnerability of the buildings (Armaş et al. 2017).

The specialized literature uses a series of criteria to determine the profile of each earthquake as a natural event. For our research topic, we are interested in the earthquakes that have a moment magnitude (Mw) higher than 6.

The magnitude scale of the seismic moment (Mw) is used to measure the magnitude of earthquakes, depending on the energy released. It was developed in the 1970s to replace the Richter scale of magnitude, in which magnitude is defined by the logarithm of the amplitude of seismic waves recorded by a seismograph of a certain type, measured at a certain distance from the epicenter. Both scales are continuous, logarithmic and practically coincide in the field of medium magnitude earthquakes.

The literature uses a number of criteria to establish the profile of the earthquake as a natural event. For our research, only the earthquakes that have a magnitude (Mw) greater than 6 on the Richter scale are considered to be relevant. The earthquakes are analyzed in terms of:

- (a)

- The period in which they occurred;

- (b)

- The location of the epicenter in the CRESTA zones;

- (c)

- The number of earthquakes based on the magnitude ranges in the Vrancea CRESTA zones.

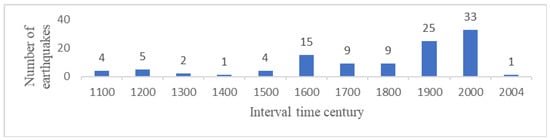

From the historical catalogues of the earthquakes presented, one can see that every century, Vrancea experiences many earthquakes of medium magnitude, but there are also some stronger earthquakes, which are sometimes catastrophic.

- (a)

- Depending on the period in which they occurred, earthquakes are analyzed based on the data from the ROMPLUS INFP catalogue related to the earthquakes of Romania, which shows that 74 earthquakes with Mw ≥ 6 occurred in the period 984–1900. Nine earthquakes of these were viewed as catastrophic and were recorded in the following years: 1196, 1446, 1471, 1516, 1620, 1679, 1738, 1802 and 1838. The period with the most intense seismic activity is the 20th century, when a total of 33 earthquakes exceeding the magnitude of 6 were recorded. Two earthquakes of these were viewed as disastrous and were recorded in 1940 and 1977, respectively. The 21st century opened with an earthquake that occurred in the year 2004 with a magnitude of 6.

The Figure 2 shows earthquakes that were recorded in this area, per century.

Figure 2.

Breakdown of the earthquakes, beginning with 984, Mw ≥ 6. Source: ROMPLUS Catalogue (2021).

The highest magnitude earthquake ever recorded in the territory of Romania occurred on 26th of October 1802 with an estimated Mw = 7.9. However, the most devastating earthquake ever recorded was that of 4 March 1977, with a Mw = 7.4. Following this earthquake, two-thirds of the Romanian territory was affected by significant seismic movements, with significant human and material losses. Many buildings were recorded as damaged or collapsed, including 32,900 residential buildings, 763 commercial/industrial buildings, 47 hospitals, 257 educational buildings and 181 cultural buildings. The business losses sustained were around USD 2 billion. In Bucharest, 1424 people died and 7600 were injured. At the same time, 25 real estate properties built in the interwar period collapsed. Of the real estate properties built after the year 1960, two blocks of flats partially collapsed, whereas an office building completely collapsed. Bucharest sustained 70% of the total economic loss recorded for the whole country. Another 23 counties were severely affected by the consequences of the earthquake. The propagation of the seismic waves on the NE-SW axis led to significant losses in the Iasi and Bacau counties, as well as in the Teleorman, Dolj and Prahova counties.

- (b)

- The earthquakes are analyzed depending on the location of the epicenter in the CRESTA zones.

CRESTA (Catastrophe Risk Evaluation and Standardizing Target Accumulations) is a worldwide standardized system to control the risks caused by natural hazards, especially earthquakes, storms and floods. This system applies throughout the whole international insurance industry. In Romania, the CRESTA zones overlap the counties of the country.

The map below (Figure 3) shows the distribution by CRESTA zones of all 108 earthquake events that occurred between January 984 and September 2021, with a magnitude ≥ 6 on the Richter scale. The epicenters of the earthquakes are concentrated in eight CRESTA zones, most of them being located in the Vrancea area (84.26%).

Figure 3.

Earthquakes in Romania depending on the location of the epicenter in the CRESTA zones. Source: developed by the author based on the ROMPLUS catalogue data of 30th of September 2021, www.infp.ro/index.php?i=romplus (accessed on 17 November 2021).

- (c)

- The distribution of the events for the Vrancea zone with a magnitude ≥ 6 is shown in Table 2 (a total number of 91 earthquakes). The distribution of the events for Romania with a magnitude ≥6 is shown in Table 3 (a total number of 108 earthquakes).

Table 2. The distribution of the events with a magnitude moment ≥6 that occurred in Vrancea zones (a total number of 91 earthquakes).

Table 2. The distribution of the events with a magnitude moment ≥6 that occurred in Vrancea zones (a total number of 91 earthquakes). Table 3. The distribution of the events with a magnitude moment ≥6 that occurred in Romania in CRESTA zones (a total number of 108 earthquakes).

Table 3. The distribution of the events with a magnitude moment ≥6 that occurred in Romania in CRESTA zones (a total number of 108 earthquakes).

4. The Opportunity to Introduce Parametric Insurance in Romania

According to a World Bank report of 1978 after the 1977 earthquake, the cost of damages and production losses was USD 2.05 billion (the equivalent of around USD 8 billion today or even more than 6% of the official GDP of the currency exchange rate of Romania at that time (Simpson et al. 2020)). In the case of a similar event occurring these days, the estimated loss for the residential stock would stand at over USD 5 billion.

In Romania, at the moment, the home insurance penetration against natural disasters, which includes the risk of earthquake, is 20%, which means that four out of five homes are not insured, according to the data in Figure 1.

Additionally, the claim-handling capability in the case of a major disaster is quite slow. However, the low penetration also characterizes other geographical areas. In these circumstances, looking for other effective solutions is mandatory. For example, the parametric solution is considered in California for increasing the penetration for dwellings against earthquake risk (Pothon et al. 2019). Taking all these into account, efforts are being made to find solutions to implement a plan to handle claims in the event of a major disaster, aimed at taking uniform action and streamlining the resources pooled by all insurance companies in Romania, but this plan is far from being realized. Even in this case, as it was actually proven to be the case in most states which experienced such an event, there will be issues in effectively managing the claim-handling process.

Usually, reasons have to do with the insufficient resources in such cases, both for the identification and the settlement of claims. When it comes to the settlement of claims, the extremely long time it could take to survey the structurally damaged buildings must also be factored in. There could also be delays in the actual payment stage as a result of the significant transfers of reinsurance monies and of the currency exchange in national currency operations and, therefore, a delay the compensation transfers to beneficiaries.

Consequently, using the traditional claim-settling methods in cases of natural catastrophes will take an extremely long time to compensate the policy holders. Therefore, the payment of damages following the activation of the triggering parameters may be a solution to speed up payments and to facilitate the claim-handling process.

Using this type of insurance, upon the occurrence of an unforeseeable triggering event, the client is entitled to receive compensation if the predetermined parametric conditions are met. The triggering parameter associated with the insurance means that the compensation is exclusively based on the values of the triggering parameter, as there is a predefined scheme which is mutually agreed upon by the parties. In addition to traditional insurance, this type of insurance has the major advantage of mitigating information asymmetry to the exclusion.

This survey does not ignore the main drawbacks of parametric insurance, chiefly the fact that the loss incurred cannot be fully covered. This drawback may be coped with by taking out a facultative insurance policy customized based on the needs of each client. At the same time, the possibility that parametric insurance might be a more expensive product than traditional insurance is not ignored. The intervention of the public authority by setting up a type of subsidy scheme or a tax deductibility procedure could mitigate this drawback (Tiwari and Patro 2018).

The implementation of this type of insurance in Romania would take place if there were constraints whose mitigation does not exclusively depend on the PAID response. The legislative constraint which may be overcome by amending the current legislative framework involves the action of institutions entrusted with public power and, consequently, the political will. Raising their awareness should be performed through the broad involvement of citizens’ associations and academic circles with expertise in the field, which would also lead to increasing the number of building owners who would purchase this type of product. The long term and difficulty of the regulatory process of earthquake risk management can be an additional source of delay in the implementation of an adequate protection system (Gizzi et al. 2021).

On the other hand, the insurance professionals, including the market supervisory authority, would have made available an instrument that ensures the development of the insurance market in Romania. A major technical hurdle is the design of appropriate risk models for Romania that are compatible with the regime set through Solvency II and implemented at a European level through EIOPA. The time and cost required to implement this new method of risk transfer from the perspective of research, know-how purchase and the implementation of business operational procedures is an element which should not be ignored.

The main benefits of parametric insurance for Romania would be:

- Facilitating claim-handling processes: the quick settlement of claims is preferred to the detriment of accuracy in claim-handling processes, as both the identification of losses and the received compensation spending arguments are not required because payments are not connected to real damage or losses.

- Offsetting speed/quick payout: parametric insurance is the easiest way to streamline the cash flow in the aftermath of a natural disaster, providing quick liquidity, as the offsetting of claims is agreed upon in advance and supplies immediate funding in a few days, not after months, as is the case with traditional insurance, and without a cumbersome claim-handling process.

- Ensuring cost efficiency: parametric insurance is based on a simplified and transparent writing process following the setting up of the triggering parameter, as it has a significant impact on establishing the cost of insurance in a competitive market. The premium is based on the probability of the occurrence of the “triggering event” and may vary according to the intensity of the event.

Basic risk: in parametric insurance, the main element is the “triggering event”. Access to compensation can result in uncompensated losses, but also in significant gains.

The main drawbacks of parametric insurance:

- It does not wholly cover the loss sustained;

- Parametric insurance may be a more expensive product than traditional insurance.

It is very important that the beneficiary of this category of insurance should understand the typology of the trigger, as it determines the pay-out conditions. Insurance solutions and tools have to be associated with incentives to improve the earthquake resistance of buildings (De Masi and Porrini 2018).

5. Determination of the Triggering Parameters for the Earthquake Risk

For the earthquake risk, the triggers may be set based on intensity and location, with factors such as magnitude, latitude, longitude, depth, etc., whereas in the case of hurricanes and floods, the triggers may be the wind speed and rainfalls. Power cuts, crop yields, etc., may also be considered to cover an event.

If the triggering parameter scheme is not aligned well with the exposure, the policy holder will sustain a net loss in premium pay-outs. Therefore, when designing a parametric insurance system, one needs to develop a mechanism of reducing the impact of an erroneous trigger (Goda 2015).

In order to establish the trigger, the magnitude and the intensity have been analyzed using the National Institute of Statistics (INS) database with regard to the earthquakes occurred between January 984 and September 2021.

The PML mentioned in the article has been calculated for the entire housing stock in Romania, according to the 2019 study of the National Institute of Statistics. For this calculation, we have used the average sums insured per CRESTA zone, which were determined based on the actual portfolio of mandatory policies in force, as of September 2021 (Table 4).

5.1. Identification of Triggering Parameters

Many triggers for parametric insurance schemes are tied onto the event intensity range. For instance, in the case of an earthquake insurance policy, a certain amount of money could be paid if a certain magnitude, acceleration, depth, etc., are reached. In Istanbul, the development of a model for CAT bond parametric insurance for housing stock highlights the possibility that an intensity-based triggering mechanism will gain more and more popularity as the difference between estimated and final loss is not significant (Mousavi et al. 2019).

5.1.1. Definition of the Seismic Area and Selecting the Maximum and the Minimum Earthquake for the Vrancea Seismic Area

The study of earthquake hazards is an important field of seismological research and acts as an interface between seismological research and the continuous development of various fields of business (building and construction, financial, insurance, etc.). For the current study, such research helped to determine the triggering parameters for the earthquake risk used in parametric insurance.

The most important seismic area on the territory of Romania, described in the previous chapter, is the Vrancea area. A detailed survey of the geo-dynamics of this unique area in Europe was conducted by Ismail-Zadeh (2003).

The first complete catalogues of the earthquakes that occurred in the territory of Romania were developed by Cornelius Radu and Constantinescu and Marza. In 1997, Romplus launched a version based on the Constantinescu–Marza catalogue, which is constantly updated on the website of the National Institute for Earth Physics, this is the version being used in this survey.

The main features of an earthquake are:

- Time of origin: the moment of occurrence is indicated based on Greenwich mean time;

- Duration: this represents the time for the propagation of the elastic waves;

- Total energy released, expressed in ergs (ERG− is the unit of energy and mechanical work in the centimeter–gram–second system of physical units) (fr.erg, gr.ergon ) (Dex text: unitate de masura pentru energie, dex.ro).

The magnitude scale of the seismic time Mw introduced by Hans and Kaamori in 1979 serves to measure the magnitude of earthquakes based on the energy released.

Regression analyses of the magnitudes of earthquakes in the Vrancea region determined the empirical relationships for the average number of earthquakes, annually, n, with magnitudes greater than Mw. For earthquakes in the Vrancea area, a correspondence between regression periods and magnitude has been shown. The seismic potential of the Vrancea area is defined through the maximum magnitude earthquake. Thus, the Vrancea seismic zone is analyzed and the maximum magnitudes that can be generated by it are evaluated.

5.1.2. The Estimation of Maximum Magnitude for Vrancea Seismic Area

The method of estimating the credible maximum magnitude Mw max for the Vrancea seismic sources used by Coppersmith K. J. is an empirical method that establishes relationships on the basis of the rupture surface parameters associated with the magnitude. In the case of this type of rupture and crust earthquakes, the Wells and Coppersmith regression equations (Wells and Coppersmith 1994), indicate the correlation of the moment magnitude, Mw, with the SRL (Surface Rupture Length (km)) and the SRA (Surface Rupture Area (km2)).

Thus, the maximum reliable moment magnitude from the Vrancea source was estimated at a value of Mw, max = 8.1 in compliance with the Wells and Coppersmith regression equations.

To determine the completeness magnitude or the minimum magnitude Mw 0 of the Vrancea source, the regression analyses used the moment magnitude (Mw), which is currently accepted worldwide as a more appropriate indicator of the magnitude of earthquakes occurring under the crust. In this respect, an exponential distribution of the earthquake magnitude was used (the ratio between the number of small events as compared to the number of big events), expressed as a relationship between the frequency and the magnitude of the earthquakes. This regression equation, described as the Gutenberg–Richter equation for earthquakes occurring under the crust (depth of the outbreak, 60–170 km) in the Vrancea region with the magnitude Mw ≥ 6.3, is determined based on the catalogue developed by seismologist Cornelius Radu for the 20th century (Radu compiled a historical catalogue of the earthquakes in the Vrancea area, ca. 984–1900; Radu’s manuscripts, from 1994, were selected and adapted by Dan Lungu in Lungu et al. 1996). Using Equation (1), the yearly average number of seismologic events in the Vrancea area with a magnitude Mw that equals or is higher than 6.3 was estimated.

where n(≥Mw) is the yearly average number of events with the magnitude (≥Mw) (Lungu et al. 1998).

logn(≥Mw) = a − b*Mw

logn(≥Mw) = 3.76 − 0.73*Mw

M = Mw − 0.3

The seismicity parameters in the above recurrence equation are obtained from the ROMPLUS catalogue for the Vrancea region. The minimum magnitude considered in this case study calibrates the numerical coefficients in Equation (1). Earthquakes of this magnitude characterize the range of maximum extreme events produced in the Vrancea area under the crust quite well. Earthquakes of magnitude Mw0 < 6.3 have not been considered, as they cannot cause significant material damage.

To satisfy the properties of a probability allocation, Elnashai and Lungu (1995) apply the equation proposed by Hwang and Huo (1994), with the regression equation for events located within the magnitude range (Mw0, Mwmax).

According to studies by seismology and building and construction experts, there is a link between magnitude and seismic intensity, with seismic intensity (I0) being a qualitative parameter that considers the complexity of the seismic phenomenon, both in terms of ground motion and of the effect on humans, animals and buildings.

Even though more equations to convert epicenter intensity into Gutenberg–Richter magnitudes (M) are known, this survey used the conversion of magnitude to intensity developed by the seismologist Vasile Marza (Sandi et al. 1997), as follows:

M = 9.02lgI0 − 1.05

Customizing this for the intensity ranges used in this study, we obtain information in Table 4:

Table 4.

Conversion of the magnitude into intensity I0.

Table 4.

Conversion of the magnitude into intensity I0.

| Magnitude (Mw) | 6.3 | 6.4 | 6.5 | 6.6 | 6.7 | 6.8 | 6.9 | 7.1 | 7.3 | 7.4 | 7.5 | 7.7 | 7.9 | 8.1 |

| I0 Ranges | VII–VIII | VIII–IX | IX–X | ≥X | ||||||||||

Source: data obtained according to the calculations of the author, using Equation (2) and based on the ROMPLUS catalogue data of September 2021, www.infp.ro/index.php?i=romplus 14 November 2021.

5.2. Determination of the Sum Insured and of the Probable Maximum Loss

Considering the model imposed by the Delegated Regulation No. 35/2015, using the standard formula and the data supplied by the Institute of Statistics referring to the total number of households—the residential stock of Romania—the results related to PML earthquake were noted, as can be seen in the table mentioned below. To estimate the Probable Maximum Loss, the main source in the earthquake risk modelling process was the residential sector portfolio of the most important vulnerable cities/counties, considering an average sum insured determined by the sums insured through the PAD policies.

The Probable Maximum Loss (PML) is the maximum loss forecast by an insurer on the insured policy portfolio, and this helps the latter establish both the claims it will have to pay out and the insurance and reinsurance premiums. One of the most important risk factors for catastrophic risks is the classification of the insured property in CRESTA zones (for Romania, the mapping of risk areas is based on its administrative units, i.e., the counties of the country). The Probable Maximum Loss for the earthquake risk is calculated in compliance with the Commission Delegated Regulation (EU) 2015/35 of 10 October 2014, supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II), page 100 (EU 2015), as follows:

where:

- Learthquake, is the Probable Maximum Loss—PML.

- QearthquakeR = 1.7 is the country factor, the earthquake risk factor estimated in the scenario for Romania, in the Delegated Regulation (EU) 2015/35 of the Commission of 10 October 2014.

- WSI (earthquake, i) and WSI (earthquake, j) are the weighted sums insured for the earthquake risk in the earthquake areas i and j located in the CRESTA zones.

- Corr (earthquake, i, j) is the correlation coefficient for the earthquake risk in the earthquake areas i and j in the CRESTA zones. The headings of the rows and columns denote the region-specific risk zones according to the numbers of the segments set out in defining the risk zones for regions where the zonation is based on administrative units, Annex IX, pg L12/245 and the correlation coefficients for earthquake risk in the Republic of Romania, pg L12/541. The sum is calculated for all the possible combinations of the earthquake areas (i, j) in compliance with the CRESTA zones.

In addition,

WSIearthquake, i = Wearthquake, i * SIearthquake, i

- SIearthquake, i is the sum insured for the earthquake risk related to households located in the CRESTA i zones.

- Wearthquake, i is the weighted factor for the earthquake risk related to the i area, estimated in this scenario.

For this research, the authors considered the residential stock for four CRESTA zones, which have been modeled for the purpose of computing the PML distinctively for each zone, but also as an aggregate for all four zones.

Table 5 lists the results of the calculations for the PAD sum insured and the probable maximum loss for the earthquake risk, applied to the whole residential stock of the CRESTA zones, taking into consideration an earthquake with a return period of 1:200 years. For this calculation, we have used the average sums insured per CRESTA zones, which were determined based on the actual portfolio of mandatory policies in force, as of September 2021.

Table 5.

Estimating the Probable Maximum Loss (PML), (Thousand EUR).

The 200-year return period loss represents the long-term mean loss value due to direct damage caused by earthquake ground shaking in the residential, commercial and industrial building stock, considering structural and non-structural components and building contents, which is expected to be equaled or exceeded at least once every 200 years.

In this case study, the capital of Romania, Bucharest, was also included, as it is located in a maximum risk area and is the city with the highest seismic risk in Europe because of its soil characteristics, the population concentration, the distance of only 170 km from the Vrancea seismic source and, last but not least, because of the vulnerability of its buildings to earthquakes. The most vulnerable residential buildings in Bucharest are located in the inner-city neighborhoods, which were mostly built before 1963 when the seismic design was not mandatory. According to the latest report of the Bucharest City Hall (of 9 March 2021), 363 residential buildings fall under the seismic risk class I (the most vulnerable), whereas 373 falls in the seismic risk class II.

Estimating the seismic ground motion in a given urban area prior to a devastating earthquake requires detailed knowledge of both the underground structure within the city and the probable location and the characteristics of the seismic sources around it (Panza et al. 2001).

5.3. Case Study: Earthquake Parametric Insurance Product

Parametric insurance is described mostly by three essential elements: parametric triggers, independent data supplier and payment scheme.

In this case study, to create a parametric insurance system, the starting point was to identify the triggering parameters using the available data/methods mentioned in Section 5.1: this involved, on the one hand, the earthquake magnitude, intensity and source, and on the other hand, in Section 5.2, the calculation of the sum insured and the probable maximum loss.

5.3.1. Parametric Trigger

- Intensity of the EQ at the location of the policy holder;

- Different possible measures (e.g., Mercalli intensity scale).

The I0 intensity ranges presented in the table above may be recalibrated using other seismic surveys as well, and may provide information beyond the mathematic calculations used in this survey, as shown in Table 6.

Table 6.

Potential ranges for parametric triggers.

5.3.2. Reporting Agent

An essential element in parametric insurance is the data supply from independent sources, as the compensation is calculated based on such data. Data suppliers may be: institutes for earth physics, institutes of statistics, weather institutions, etc. Thus, in the case of Romania, should the National Institute for Earth Physics not confirm the minimum of the triggering parameter Mw ≥ 6.3, the insurer will not pay out up to the sum insured.

5.3.3. Payment Scheme

If the parameter is reached or exceeded, irrespective of the real physical loss incurred, the insurer pays out up to the sum insured, which is predetermined based upon the conclusion of the insurance contract. It can be defined as a stepped % function of the nominal value (PML EUR 1.46 billion), with limits paid according to the intensity of the event.

Based on the hypothesis noted in Table 7 set in this research, the authors demonstrated that in the Vrancea area, there could be a probable maximum loss of EUR 366 million for an event of [6.3, 7.0] magnitude Mw, EUR 733 million for [7.1, 7.5] magnitude Mw, EUR 1.1 billion for [7.6, 8.0] magnitude Mw and EUR 1.46 billion for a magnitude Mw ≥ 8.1.

Table 7.

Compensation % based on the magnitude trigger ranges.

Under these scenarios, the Mw levels would be measured and reported by a third-party government agency (in this case the National Institute for Earth Physics), and the policy holder would receive the payout immediately upon the decision.

6. Conclusions

The parametric risk transfer mechanism is no doubt a potential solution which may complement the traditional insurance products currently available. It primarily addresses the overall needs of governments and/or companies that manage major catastrophic risks.

For a successful implementation, this scheme must be developed in a transparent manner, have clearly defined rules and be known by all involved parties. In this respect, the international insurance/reinsurance market, who are interested in this topic, can allocate significant resources for research and consultancy.

However, in order to prove the practicality of the system, it is imperative to demonstrate the relationship that exists between the triggering parameter and the financial impact that the event could cause. Consequently, any parameter which is used to trigger the facility must be demonstrated through a complex model that is appropriate to the risk tolerance of the insured and clearly communicated to all stakeholders.

Given the primary benefit, i.e., quick pay-outs, this new insurance concept becomes of interest for the insureds/reinsurers, but may also act as a government buffer by acting as a secure post-disaster fund. Large corporations and governments may be more complex clients of parametric products, as these instruments may support them in obtaining the necessary funding for catastrophic risk coverage.

To make use of this proposed instrument, insurers need specific tools to continuously analyze and model catastrophic risks to determine the preset parameters, the sum insured and the insurance premium, depending on the insured risk, vulnerability, occurrence probabilities, insured areas, activity, etc.

Through this study, which is based on a concrete situation in a given seismic zone, we can contribute to an expansion of the specialized literature and to a boost of research on earthquake risk insurance. For this type of product, in which the insured risk has a low frequency of manifestation and a high force of destruction, the buyer’s confidence may have a more important role than the adversity to the risk.

For the introduction of a parametric insurance product in the case of earthquake risk, there is a fact that can make the difference: potential buyers of a parametric product for the agricultural field can analyze, over relatively short periods, the effects of the decision to buy or not to buy the product. In contrast, for the risk of an earthquake, the length of the period for which the policy is purchased has a significant importance for the buyer, but also for the product bidder. Both are interested in setting up reserves whose level allows the coverage of significant losses.

Imposing a parametric insurance product for a natural disaster generated by the occurrence of an earthquake involves correlations with adjacent tools that influence whether homeowners purchase this product. The obligation established by law proved, at least in the example of Romania, to be insufficient. We believe that a mechanism based on tax incentives can prove appropriate. Combining a parametric insurance with a credit product is another way to achieve increased favorable effects (Mahul and Stutley 2010; Lin and Kwon 2020).

Through this study, we appreciate that we managed to outline a methodological framework with which to approach and propose a solution for some important aspects related to the architecture of a parametric insurance product for the earthquake risk in the Vrancea area.

The indicator used in our study is PML, a tool widely used in the field of financial risk management. It was calculated for the total housing stock in Romania and for four distinct CRESTA areas. The comeback period considered was 1:200 years. The PML was estimated on the basis of three magnitude ranges of the earthquake.

For urban areas, numerous studies analyze the complexity and difficulty of the process of returning to a normal post-disaster life. Resilience is considered to be the most important principle that should govern the reconstruction of areas affected by an earthquake (Contreras et al. 2017). In this process of collaboration, we believe that the parametric insurance can play the role of bringing a first flow of capital necessary to solve the housing problem, relieving, to a certain extent, the public authority.

We appreciate that the peculiarities of the mechanism of functioning of the parametric insurance system can reduce the perception of the corruption of the central and local public power factors in the allocation and management of financial resources to reduce the effects of a natural disaster. This has an important role because it provides the framework for a collaboration based on trust between the authority structures that intervene and the affected population. The modeling of how the population’s perception can evolve in the event of a natural disaster in relation to corruption in the public sector has demonstrated that a collective memory operates over a period of five to twenty-five years that acts as a determining factor in estimating future corruption (Escaleras and Register 2015).

Ultimately, the goal of any insurance solutions is customer satisfaction in conditions of market simplicity, transparency, predictability, swiftness and flexibility. This is the reason why such innovative insurance products will evolve and, thus, hybrid insurance solutions will be provided to cover complete and complex (re)insurance services that will be of interest for increasingly diverse business lines.

Author Contributions

All authors have contributed significantly to this research in all phases and sections. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the first author.

Conflicts of Interest

The authors declare no conflict of interest. The research performed by Nicoleta Radu was carried out within the doctoral training plan as part of a doctoral thesis.

References

- Amarnath, Giriraj, Upali A. Amarasinghe, and Niranga Alahacoon. 2021. Disaster Risk Mapping: A Desk Review of Global Best Practices and Evidence for South Asia. Sustainability 13: 12779. [Google Scholar] [CrossRef]

- Armaş, Iuliana, Dragos Toma-Danila, Radu Ionescu, and Alexandru Gavriş. 2017. Vulnerability to Earthquake Hazard: Bucharest Case Study, Romania. International Journal of Disaster Risk Science 8: 182–95. [Google Scholar] [CrossRef]

- Balan, Stefan, Valeriu Cristescu, and Ion Cornea. 1982. Earthquake in Romania from March 4, 1977. Bucuresti: Editura Academiei Romane. [Google Scholar]

- Clarke, Daniel J. 2016. A Theory of Rational Demand for Index Insurance. American Economic Journal: Microeconomics 8: 283–306. [Google Scholar] [CrossRef] [Green Version]

- Contreras, Diana, Thomas Blaschke, and Michael E. Hodgson. 2017. Lack of spatial resilience in a recovery process: Case L’Aquila, Italy. Technological Forecasting and Social Change 121: 76–88. [Google Scholar] [CrossRef]

- De Masi, Francesco, and Donatella Porrini. 2018. Vulnerability to Natural Disasters and Insurance: Insights from the Italian Case. International Journal of Financial Studies 6: 56. [Google Scholar] [CrossRef] [Green Version]

- Elnashai, A., and D. Lungu. 1995. Zonation as a tool for retrofit and design of new facilities. Paper prezented at the 5th International Conference on Seismic Zonation, Nice, France, October 16–19; pp. 2057–82. [Google Scholar]

- Escaleras, Monica, and Charles Register. 2015. Public Sector Corruption and Natural Hazards. Public Finance Review 44: 746–68. [Google Scholar] [CrossRef]

- EU. 2015. Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 Supplementing Directive 2009/138/EC of the European Parliament and of the Council on the Taking-Up and Pursuit of the Business of Insurance and Reinsurance (Solvency II). Official Journal of the European Union L12: 1. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32015R0035&from=EN (accessed on 9 December 2021).

- Figueiredo, Rui, Mario L.V. Martina, David B. Stephenson, and Benjamin D. Youngman. 2018. A Probabilistic Paradigm for the Parametric Insurance of Natural Hazards. Risk Analysis 38: 2400–14. [Google Scholar] [CrossRef] [PubMed]

- Franco, Guillermo, Roberto Guidotti, Christopher Bayliss, Alejandro Estrada-Moreno, Angel A. Juan, and A. Pomonis. 2019. Earthquake Financial Protection for Greece: A Parametric Insurance Cover Prototype. Paper prezented at the 2nd International Conference on Natural Hazards & Infrastructure, Chania, Greece, June 23–26; Available online: https://iconhic.com/2019/wp/wp-content/uploads/2019/10/ID_32.pdf (accessed on 26 December 2021).

- Freeman. 2003. Natural Hazard Risk and Privatization, Building Safer Cities: The Future of Disaster Risk. Edited by Alcira Kreimer, Margaret Arnold and Anne Carlin. Washington, DC: The World Bank Disaster Management Facility, pp. 45–47. Available online: https://documents1.worldbank.org/curated/en/584631468779951316/pdf/272110PAPER0Building0safer0cities.pdf (accessed on 18 December 2021).

- Gizzi, Fabrizio Terenzio, Donatella Porrini, and Francesco De Masi. 2021. Building a Natural Hazard Insurance System (NHIS): The Long-Lasting Italian Case. Sustainability 13: 12269. [Google Scholar] [CrossRef]

- Goda, Katsu. 2015. Seismic Risk Management of Insurance Portfolio Using Catastrophe Bonds. Computer-Aided Civil and Infrastructure Engineering 30: 570–82. [Google Scholar] [CrossRef]

- Hattori, Kazuya. 2018. Society 5.0 and Parametric Insurance Clearing a Path to “Risk Transfer” for Catastrophic Disasters. New York: AIG. [Google Scholar]

- Hwang, Howard H. M., and J. R. Huo. 1994. Generation of Hazard-Consistent Fragility Curves for Seismic Lossestimation Studies. Tehnical Report NCEER-94–0015. Buffalo: National Center for Earthquake Engineering Research, State Universityof New York. [Google Scholar]

- Ismail-Zadeh, Alik. 2003. Modelling Of Stress And Seismicity In The South-Eastern Carpathians A Basis for Seismic Risk Estimation. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.585.4643&rep=rep1&type=pdf (accessed on 26 December 2021).

- Jaspersen, Johannes G., Richard Peter, and Marc A. Ragin. 2022. Probability weighting and insurance demand in a unifed framework. The Geneva Risk and Insurance Review. [Google Scholar] [CrossRef]

- Lin, Xiao, and Jean Kwon. 2020. Application of parametric insurance in principle-compliant and innovative ways. Risk Management and Insurance Review 23: 121–50. [Google Scholar] [CrossRef]

- Lungu, Dan, Pieter Van Gelder, and Romeo Trandafir. 1996. Comparative study of Eurocode 1, ISO and ASCE Procedures for Calculating wind Loads. IABSE Reports. Available online: https://www.e-periodica.ch/digbib/view?pid=bse-re-003:1996:74::50#434 (accessed on 26 December 2021).

- Lungu, Dan, Alexandru Aldea, A. Zaicenco, and T. Cornea. 1998. PSHA and GIS technology—Tools for seismic hazard in Eastern Europe. Paper prezented at XIth European Conference on Earthquake Engineering, Paris, France, September 6–11. Abstract Volume & CD-ROM, Balkema. [Google Scholar]

- Mahul, Olivier, and Charles J. Stutley. 2010. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries. Washington, DC: The World Bank. [Google Scholar]

- Mousavi, Mehdi, Sinan Akkar, and Mustafa Erdik. 2019. A Candidate Proxy to be Used in Intensity-Based Triggering Mechanism for Parametric CAT-Bond Insurance: Istanbul Case Study. Earthquake Spectra 35: 565–88. [Google Scholar] [CrossRef]

- Muir-Wood, Robert. 2011. Designing Optimal Risk Mitigation and Risk Transfer Mechanisms to Improve the Management of Earthquake Risk in Chile, OECD Working Papers on Finance, Insurance and Private Pensions, No. 12. Paris: OECD Publishing. [Google Scholar]

- Panza, Giuliano F., Leonardo Alvarez, Abdelkrim Aoudia, Abdelhakim Ayadi, Hadj Benhallou, Djillali Benouar, Zoltan Bus, Yun-Tai Chen, Carmen Cioflan, Zhifeng Ding, and et al. 2001. Realistic Modeling of Seismic Input for Megacities and Large Urban Areas (the UNESCO/IUGS/IGCP Project 414). Available online: https://hero.epa.gov/hero/index.cfm/reference/details/reference_id/7548533 (accessed on 8 December 2021).

- Peter, Richard, and Jie Ying. 2020. Do you trust your insurer? Ambiguity about contract nonperformance and optimal insurance demand. Journal of Economic Behavior & Organization 180: 938–54. [Google Scholar] [CrossRef]

- Pothon, Adrien, Philippe Gueguen, Sylvain Buisine, and Pierre Yves Bard. 2019. California earthquake insurance unpopularity: The issue is the price, not the risk perception. Natural Hazards and Earth System Sciences 19: 1909–24. [Google Scholar] [CrossRef] [Green Version]

- Radulian, Mircea, Nicolae Mandrescu, Giuliano Panza, Emilia Popescu, and A. Utale. 2000. Chapter Characterization of Seismogenic Zones of Romania. In Seismic Hazard of the Circum-Pannonian Region. Basel: Birkhäuser, pp. 57–77. [Google Scholar]

- ROMPLUS Catalogue. 2021. September. Available online: http://www.infp.ro/catalog-seismic (accessed on 17 December 2021).

- Sandi, Horea, Panait Mazilu, Dan Lungu, Vasile Marza, Mihaela Bontea, and Ion Floricel. 1997. Ghid Pentru Specificarea Conditiilor Seismice din Romania, Proiect. Bucharest: INCERC. [Google Scholar]

- Simpson, Alanna, Antonios Pomonis, and Emil Sever Georgescu. 2020. Cum transforma romanii mostenirea ascunsa a riscului seismic intr-o oportunitate de rezilienta in caz de catastrofe. Available online: https://blogs.worldbank.org/ro/europeandcentralasia/cum-transforma-romanii-mostenirea-ascunsa-riscului-seismic-intr-o-oportunitate (accessed on 11 December 2021).

- The World Bank. 1978. Report and Recommendation of the President of the International Bank for Reconstruction and Development to the Executive Directors on a Proposed Loan to the Investment Bank with the Guarantee of the Socialist Republic of Romania for a Post Earthquake Construction Assistance Project. Report No. P-2240-RO. May 17. Available online: https://documents1.worldbank.org/curated/en/648451468092386192/pdf/multi0page.pdf (accessed on 8 December 2021).

- Tiwari, Ashu, and Archana Patro. 2018. Memory, Risk Aversion, and Nonlife Insurance Consumption: Evidence from Emerging and Developing Markets. Risks 6: 145. [Google Scholar] [CrossRef] [Green Version]

- Wells, Donald L., and Kevi J. Coppersmith. 1994. New empirical relations among magnitude, rupturelength, rupture width, rupture area and surface displacement. Bulletin of the Seismological Society of America 84: 974–1002. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).