Comparative Analysis of Long-Term Care in OECD Countries: Focusing on Long-Term Care Financing Type

Abstract

1. Introduction

2. Theoretical Background: Long-Term Care System and Financing System

3. Research Method

4. Research Results

4.1. Allocation: Selection Criteria (Selectivity and Universality), Level of Coverage

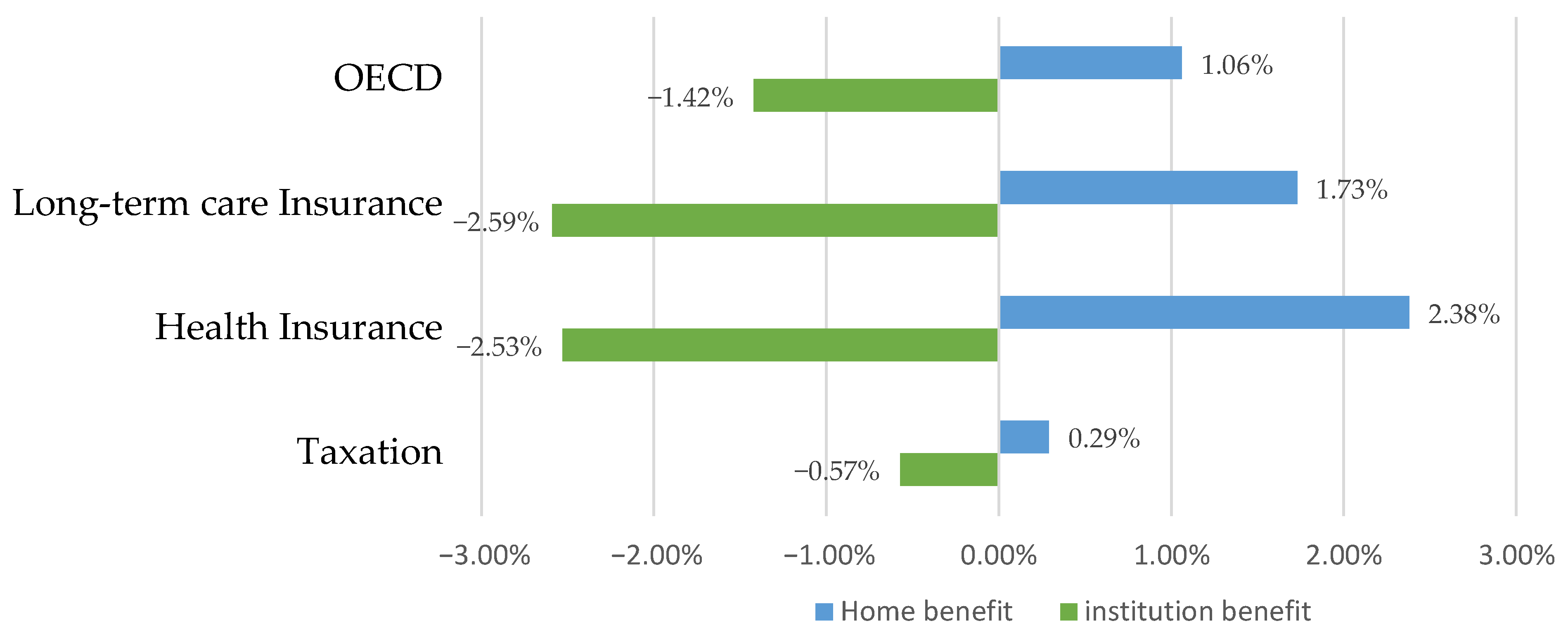

4.2. Benefits: Benefit Type and Amount of Benefits per Capita

4.3. Service Delivery: Central and Local Governments

4.4. Finance

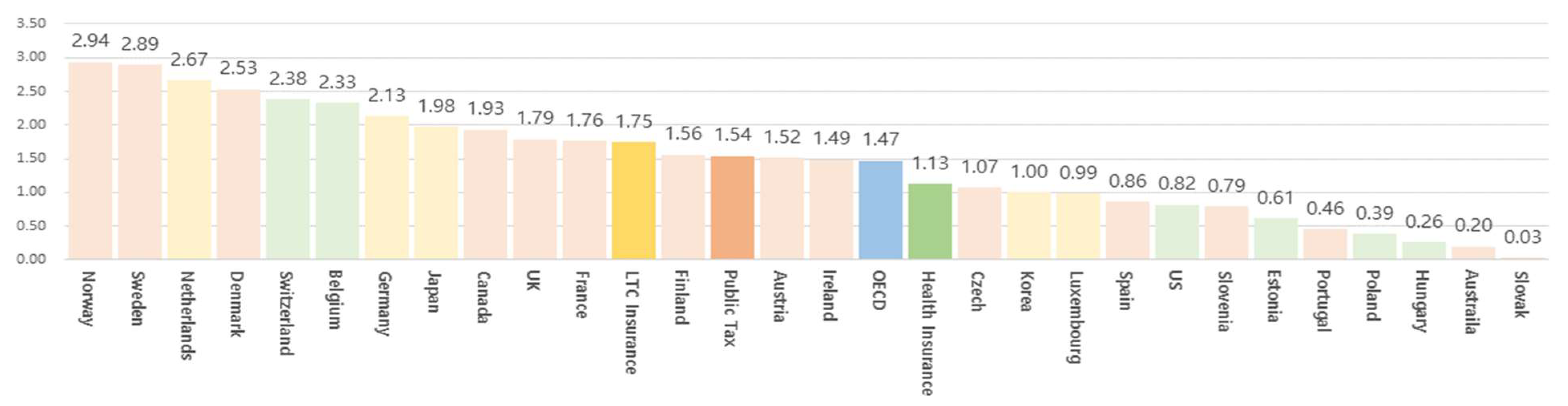

4.4.1. Budget Size

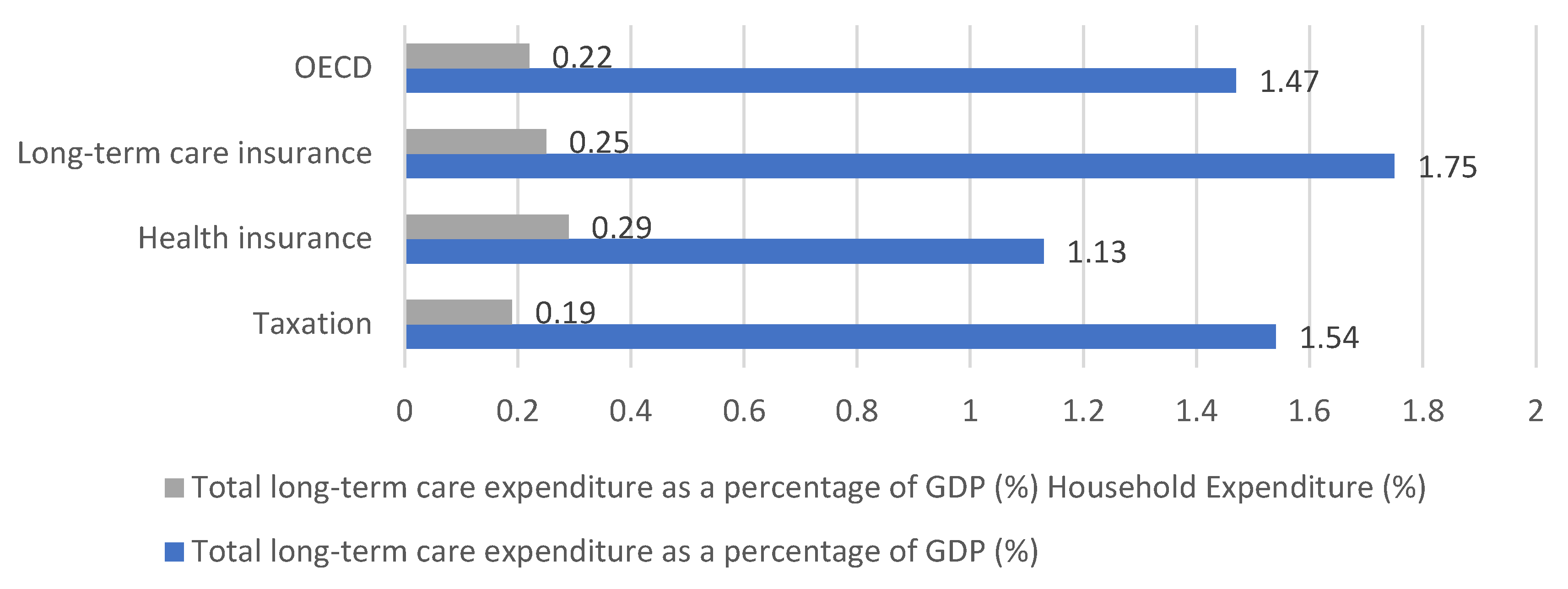

4.4.2. Percentage of Public and Private Expenditure

5. Conclusions

6. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Esping-Andersen, G. Social Foundation of Postindustrial Economies; Oxford University Press: New York, NY, USA, 1999. [Google Scholar]

- OECD. Assessing the Comparability of Long-Term Care Spending Estimates under the Joint Health Accounts Questionnaire; OECD: Paris, France, 2020. [Google Scholar]

- Pavolini, E.; Ranci, C. Restructuring the welfare state: Reforms in long-term care in Western European countries. J. Eur. Soc. Policy 2008, 18, 246–259. [Google Scholar] [CrossRef]

- Xia, L.; Chai, L.; Zhang, H.; Sun, Z. Mapping the global landscape of long-term care insurance research: A scientometric analysis. Int. J. Environ. Res. Public Health 2022, 19, 7425. [Google Scholar] [CrossRef]

- Esping-Andersen, G. Welfare State in Transition; Thousand Oaks, Sage: London, UK, 1996. [Google Scholar]

- Neil, G.; Paul, T. Dimensions of Social Welfare Policy, 8th ed.; University of California: Berkeley, CA, USA, 2013. [Google Scholar]

- Neubert, A.; Baji, P.; Tambor, M.; Groot, W.; Gulacsi, L.; Pavlova, M. Long-term care financing in Europe: An overview. Public Health Manag./Zdr. Publiczne Zarz. 2019, 17, 131–145. [Google Scholar] [CrossRef]

- Cristiano, G.; Jose-Luis, F.; Raphael, W. Long-Term Care Reforms in OECD Countries: Successes and Failures; Policy Press: Bristol, UK, 2016. [Google Scholar]

- McLaughlin, E.; Glendinning, C. Paying for care in Europe: Is there a feminist approach? In Family Policy and the Welfare of Women; Hantrais, L., Mangen, S., Eds.; Cross-National Research Papers Series 3, No 3; University of Loughborough: Loughborough, UK, 1994. [Google Scholar]

- Richards, E.; Coote, A. Paying for Long Term Care; Institute for Public Policy Research: London, UK, 1996. [Google Scholar]

- Glendinning, C.; Schunk, M.; McLaughlin, E. Paying for long-term domiciliary care: A comparative perspective. Ageing Soc. 1997, 17, 123–140. [Google Scholar] [CrossRef]

- Costa-Font, J.; Courbage, C. Financing Long-Term Care in Europe: Institutions, Markets and Models; Palgrave Macmillan: Basingstoke, UK, 2011. [Google Scholar]

- Schneider, U. Germany’s social long-term care insurance: Design, implementation and evaluation. Int. Soc. Secur. Rev. 1999, 52, 31–74. [Google Scholar] [CrossRef]

- Robinson, R. The Finance and Provision of Long-Term Care for Elderly People in the UK: Recent Trends, Current Policy and Future Prospects; Mimeo, London School of Economics: London, UK, 2001. [Google Scholar]

- Roo, A.; Chambaud, L.; Guntert, B. Social health insurance systems in western Europe. In European Observatory on Health Care Systems; Saltman, R., Busse, R., Figueras, J., Eds.; Open University Press: London, UK, 2004; pp. 281–298. [Google Scholar]

- Karlsson, M.; Mayhew, L.; Plumb, R.; Rickayzen, B. An International Comparison of Long-Term Care Arrangements: An Investigation into the Equity, Efficiency and Sustainability of the Long-Term Care Systems in Germany, Japan, Sweden, the United Kingdom and the United States; Mimeo: London, UK, 2004. [Google Scholar]

- Costa-Font, J.; Courbage, C.; Zweifel, P. Policy dilemmas in financing long-term care in Europe. Glob. Policy 2017, 8, 38–45. [Google Scholar] [CrossRef]

- OECD Health Statistic. 2021. Available online: https://stats.oecd.org/ (accessed on 1 June 2022).

- Sabrina, L. Long-term care reform in Germany—At long last. Br. Actuar. J. 2019, 24, e17. [Google Scholar]

- European Commission. Identifying Fiscal Sustainability Challenges in the Areas of Pension, Health Care, and Long-Term Care Policies; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- Reidel, M.; Kraus, M. Differences and similarities in monetary benefits for informal care in old and new EU member states. Int. J. Soc. Welf. 2016, 25, 7–17. [Google Scholar] [CrossRef]

- Anna, A.; Jacob, L.; Anu, S.; Stine, V. Willingness to pay for long-term home care services: Evidence from a stated preferences analysis. J. Econ. Ageing 2020, 17, 100238. [Google Scholar]

- OECD. Who Cares Attracting and Retaining Care Workers for the Elderly; OECD: Paris, France, 2020. [Google Scholar]

- Waitzberg, R.; Andrea, E.; Schmidt, M.; Anne, P.; Antonis, F.; Åsa, L.; Francesco, B.; Gonçalo, F.A.; Gregory, P.M.; Ingrid, S.; et al. Mapping variability in allocation of Long-Term Care funds across payer agencies in OECD countries. Health Policy 2020, 124, 491–500. [Google Scholar] [CrossRef] [PubMed]

- OECD. Help Wanted? Providing and Paying for Long-Term Care; OECD: Paris, France, 2011. [Google Scholar]

- Zhou, Y.-R.; Zhang, X. The Experience and Enlightenment of the Community-Based Long-Term Care in Japan. Healthcare 2022, 10, 1599. [Google Scholar] [CrossRef]

| Dimension | Scope | Analysis Content |

|---|---|---|

| Allocation (Allocation) | Target system (Eligibility criteria) |

|

| Benefit (Provision) | Benefit system (Type of benefit) |

|

| Delivery (Delivery) | Delivery system (Delivery method) |

|

| Finance (Finance) | Financial system (Financial system) |

|

| No. | Country | Type of Financing (Main Resource) | Total Population (Million People) | Elderly Population Ratio (%) | Elderly Dependency Ratio | GDP (per Capita, USD PPPs) | Health Expenditure (%, Share of GDP) | Health Status (Good/Very Good, 65+) | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | Variation (1) | 2020 | Variation | 2020 | Variation | 2020 | 2020 | 2020 | |||

| 1 | Sweden | Taxation | 10.4 | 10.4% | 20.1 | 9.7% | 0.32 | 14.9% | 49,491 | 11.5 | 59.4 |

| 2 | Norway | 5.4 | 10.0% | 17.7 | 18.4% | 0.27 | 20.4% | 60,911 | 9.7 | 60.6 | |

| 3 | Finland | 5.5 | 3.1% | 22.5 | 30.3% | 0.36 | 39.4% | 44,724 | 9.6 | 51.4 | |

| 4 | Denmark | 5.8 | 5.1% | 20 | 20.9% | 0.31 | 24.2% | 51,493 | 10.5 | 57.1 | |

| 5 | Austria | 8.9 | 6.6% | 19.2 | 8.4% | 0.29 | 10.1% | 49,031 | 11.5 | 47 | |

| 6 | Czech Republic | 10.7 | 1.7% | 20 | 30.4% | 0.31 | 43.4% | 36,208 | 9.2 | 27.5 | |

| 7 | Slovakia | 5.5 | 0.5% | 16.8 | 36.2% | 0.25 | 46.4% | 32,283 | 9.2 | 23.6 | |

| 8 | Slovenia | 2.1 | 2.5% | 20.5 | 23.7% | 0.32 | 33.0% | 34,708 | 9.5 | 34.1 | |

| 9 | Portugal | 10.3 | −2.6% | 22.3 | 20.6% | 0.35 | 24.6% | 30,512 | 10.5 | 13 | |

| 10 | Spain | 47.4 | 1.7% | 19.6 | 15.9% | 0.3 | 19.7% | 33,613 | 10.7 | 42.9 | |

| 11 | The UK | 67.1 | 6.9% | 18.6 | 14.0% | 0.29 | 18.6% | 39,788 | 12 | 57.1 | |

| 12 | France | 67.3 | 4.0% | 20.6 | 23.3% | 0.33 | 29.6% | 39,548 | 12.2 | 44.5 | |

| 13 | Ireland | 5 | 9.3% | 14.5 | 27.9% | 0.22 | 32.4% | 88,111 | 7.1 | 69 | |

| 14 | Australia | 25.7 | 16.6% | 16.3 | 20.4% | 0.25 | 24.7% | 48,094 | 10.6 | 73.8 | |

| 15 | Canada | 38 | 11.8% | 18 | 27.3% | 0.27 | 33.5% | 43,376 | 12.9 | 82.2 | |

| Tax-based country | 315 | 5.8% | 19.1 | 21.2% | 0.3 | 26.8% | 45,459 | 10.5 | 49.5 | ||

| 16 | Estonia | Health Insurance | 1.3 | −0.1% | 20.2 | 15.8% | 0.32 | 23.0% | 33,746 | 7.8 | 20.6 |

| 17 | USA | 329.5 | 6.5% | 16.9 | 29.1% | 0.26 | 33.7% | 58,408 | 18.8 | 77.4 | |

| 18 | Belgium | 11.5 | 5.6% | 19.3 | 12.2% | 0.3 | 15.6% | 45,733 | 11.1 | 53.8 | |

| 19 | Hungary | 9.8 | −2.5% | 20.1 | 20.5% | 0.31 | 26.6% | 30,404 | 7.3 | 21 | |

| 20 | Poland | 38.4 | −0.4% | 18.4 | 36.9% | 0.28 | 47.3% | 31,179 | 6.5 | 22.4 | |

| 21 | Switzerland | 8.6 | 10.4% | 18.7 | 10.7% | 0.28 | 13.6% | 65,754 | 11.8 | 69.7 | |

| Health Insurance-based countries | 399.1 | 5.6% | 18.9 | 20.9% | 0.29 | 25.4% | 44,204 | 10.5 | 44.2 | ||

| 22 | Germany | Long-term Care Insurance | 83.2 | 1.7% | 21.9 | 6.0% | 0.34 | 8.5% | 48,243 | 12.8 | 39.1 |

| 23 | Netherlands | 17.4 | 5.0% | 19.6 | 27.1% | 0.3 | 31.6% | 51,522 | 11.1 | 62.2 | |

| 24 | Luxembourg | 0.6 | 24.4% | 14.6 | 4.6% | 0.21 | 3.0% | 106,383 | 5.8 | 55.5 | |

| 25 | Japan | 125.7 | −1.8% | 28.8 | 25.0% | 0.49 | 34.7% | 40,604 | 11.1 | 25.1 | |

| 26 | Republic of Korea | 51.8 | 4.5% | 15.7 | 44.9% | 0.22 | 46.8% | 41,385 | 8.4 | 20 | |

| Long-term Care Insurance-based Countries | 278.7 | 0.8% | 20.1 | 21.5% | 0.31 | 24.9% | 57,627 | 9.8 | 40.4 | ||

| OECD | 1369 | 5.8% | 17.5 | 21.1% | 0.27 | 24.5% | 47,510 | 10.4 | 46.5 | ||

| No. | Classification | Country | Age Criteria | Dependency Criteria | Means Test Criteria |

|---|---|---|---|---|---|

| 1 | Taxation | Sweden | no | yes | no |

| 2 | Norway | no | - | no | |

| 3 | Finland | no | yes | no | |

| 4 | Denmark | no | no | no | |

| 5 | Austria | no | yes | yes | |

| 6 | Czech Republic | no | yes | no | |

| 7 | Slovakia | no | yes | yes | |

| 8 | Slovenia | no | yes | yes | |

| 9 | Portugal | no | no | yes | |

| 10 | Spain | no | yes | yes | |

| 11 | The UK | no | yes | yes | |

| 12 | France | no | yes | yes | |

| 13 | Ireland | no | yes | yes | |

| 14 | Australia | - | - | - | |

| 15 | Canada | no | - | - | |

| Ratio | 0.0% | 81.8% | 66.7% | ||

| 16 | Health Insurance (+Taxation) | Estonia | no | no | no |

| 17 | USA | no | - | yes | |

| 18 | Belgium | no | yes | yes | |

| 19 | Hungary | no | yes | yes | |

| 20 | Poland | no | yes | yes | |

| 21 | Switzerland | no | - | - | |

| Ratio | 0.0% | 75.0% | 80.0% | ||

| 22 | Long-term Care Insurance (+Taxation) | Germany | no | yes | no |

| 23 | Netherlands | no | no | no | |

| 24 | Luxembourg | no | yes | no | |

| 25 | Japan | yes | yes | no | |

| 26 | Republic of Korea | yes | yes | no | |

| Ratio | 40.0% | 80.0% | 0.0% |

| Classification | Coverage Rate (65 Years Old and Above, %) | |||||

|---|---|---|---|---|---|---|

| Institution | Home | Total | ||||

| 2019 | 2010 | 2019 | 2010 | 2019 | 2010 | |

| Taxation | 3.6 | 4.2 | 8.4 | 8.6 | 12.1 | 12.7 |

| Health Insurance | 4.3 | 3.7 | 10.0 | 7.8 | 14.0 | 11.5 |

| Long-term Care Insurance | 3.8 | 4.1 | 9.0 | 8.5 | 13.2 | 12.6 |

| OECD | 3.8 | 4.1 | 8.9 | 8.4 | 12.7 | 12.4 |

| Classification | Health Service | Social Service | ||||

|---|---|---|---|---|---|---|

| Institution | Weekly | Outpatient | Home | |||

| Taxation | 82.1% | 61.5% | 3.5% | 11.5% | 40.7% | 17.9% |

| Health Insurance | 90.3% | 74.6% | 1.0% | 1.2% | 29.0% | 11.7% |

| Long-term Care Insurance | 87.9% | 67.5% | 7.2% | 1.5% | 24.7% | 12.1% |

| OECD | 85.1% | 65.7% | 4.0% | 6.4% | 34.4% | 15.5% |

| Classification | A. LTC Expenditure per Capita (USD) | B. GDP per Capita (USD PPP) | A/B × 100 (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2010 | Difference | 2019 | 2010 | Difference | 2019 | 2010 | Difference | |

| Taxation | 741.3 | 501 | 271 | 51,214 | 36,441 | 14,773 | 1.45% | 1.37% | 0.08% |

| Health Insurance | 614.3 | 419 | 195 | 49,734 | 34,421 | 15,313 | 1.24% | 1.22% | 0.02% |

| LTC Insurance | 1034.2 | 677 | 357 | 64,149 | 47,309 | 16,840 | 1.61% | 1.43% | 0.18% |

| OECD | 768.3 | 516 | 270 | 53,360 | 38,065 | 15,295 | 1.44% | 1.35% | 0.09% |

| No. | Financing | Country | Responsibility for Recipient Selection | Financial Responsibility | Responsibility for Service Provision |

|---|---|---|---|---|---|

| 1 | Taxation | Sweden | Local | Central and local | Local |

| 2 | Norway | Local | Central and local | Local | |

| 3 | Finland | - | - | - | |

| 4 | Denmark | Local | Local | Local | |

| 5 | Austria | Central | Central | Central | |

| 6 | Czech Republic | Central | Central and local | Central | |

| 7 | Slovakia | - | - | - | |

| 8 | Slovenia | - | - | - | |

| 9 | Portugal | - | - | - | |

| 10 | Spain | Local | Central and local | Local | |

| 11 | The UK | Local | Central and local | Local | |

| 12 | France | Central | Central and local | Local | |

| 13 | Ireland | - | Central | - | |

| 14 | Australia | Central | Central | Central | |

| 15 | Canada | Local | Central and local | - | |

| 16 | Health Insurance | Estonia | - | - | - |

| 17 | USA | Local | Central and local | Central and local | |

| 18 | Belgium | - | - | - | |

| 19 | Hungary | Local | Local | Local | |

| 20 | Poland | Central and local | Central and local | Local | |

| 21 | Switzerland | Local | Local | Local | |

| 22 | Long-term Care Insurance | Germany | Central | Central and local | Central |

| 23 | Netherlands | Local | Local | Local | |

| 24 | Luxembourg | Central | Central (sickness fund) | Central (sickness fund) | |

| 25 | Japan | Local | Central and local | Local | |

| 26 | Republic of Korea | Central | Central and local | Local |

| Dimension | Scope | Analysis Content | Analysis Results |

|---|---|---|---|

| Allocation | Target system (qualifications) | Recipient selection criteria | Dependency criteria: common (except for some Nordic countries) Age criteria: Republic of Korea and Japan |

| Selectivity/universality classification (the presence of a means test) | Universality: LTCI; selectivity: taxation and health insurance | ||

| Level of coverage (65 years old and above) | Coverage rate: health insurance > LTCI > taxation Home and institution classification coverage rate

| ||

| Benefit (Provision) | Benefit system (type of benefit) | Benefit type | Home and institution benefits (proportion of expenditure)

|

| Benefit amount (per capita) |

| ||

| Delivery | Delivery system (delivery method) | Central/local | No difference by type

|

| Finance | Financial system | Budget size | LTCI > taxation > health insurance |

| Public/private pay ratio | Public: taxation > LTCI > health insurance Individual: health insurance > LTCI > taxation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.-H.; Chon, Y.; Kim, Y.-Y. Comparative Analysis of Long-Term Care in OECD Countries: Focusing on Long-Term Care Financing Type. Healthcare 2023, 11, 206. https://doi.org/10.3390/healthcare11020206

Lee S-H, Chon Y, Kim Y-Y. Comparative Analysis of Long-Term Care in OECD Countries: Focusing on Long-Term Care Financing Type. Healthcare. 2023; 11(2):206. https://doi.org/10.3390/healthcare11020206

Chicago/Turabian StyleLee, Seok-Hwan, Yongho Chon, and Yun-Young Kim. 2023. "Comparative Analysis of Long-Term Care in OECD Countries: Focusing on Long-Term Care Financing Type" Healthcare 11, no. 2: 206. https://doi.org/10.3390/healthcare11020206

APA StyleLee, S.-H., Chon, Y., & Kim, Y.-Y. (2023). Comparative Analysis of Long-Term Care in OECD Countries: Focusing on Long-Term Care Financing Type. Healthcare, 11(2), 206. https://doi.org/10.3390/healthcare11020206