Exploring the Interaction Effects of Board Meetings on Information Disclosure and Financial Performance in Public Listed Companies

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Background

2.2. Environmental and Social Disclosure

2.3. Board Meeting

2.4. Firm Performance

3. Measurement of Variables

4. Data and Methodology

- = natural logarithm of firm financial performance measured by Tobin’s Q and Return on Equity (ROE), ES is the natural logarithm of the environmental and social disclosure score.

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Al Farooque, Omar, Wonlop Buachoom, and Lan Sun. 2020. Board, audit committee, ownership and financial performance—Emerging trends from Thailand. Pacific Accounting Review 32: 54–81. [Google Scholar] [CrossRef]

- Allegrini, Marco, and Giulio Greco. 2013. Corporate boards, audit committees and voluntary disclosure: Evidence from Italian listed companies. Journal of Management and Governance 17: 187–216. [Google Scholar] [CrossRef]

- Amin, Aminul, Niki Lukviarman, Djoko Suhardjanto, and Erna Setiany. 2018. Audit committee characteristics and audit-earnings quality: Empirical evidence of the company with concentrated ownership. Review of Integrative Business and Economics Research 7: 18–33. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277. [Google Scholar] [CrossRef]

- Atan, Ruhaya, Fatin Adilah Razali, Jamaliah Said, and Saunah Zainun. 2016. Environmental, Social and Governance (ESG) disclosure and its effect on firm’s performance: A comparative study. International Journal of Economics and Management 10: 355–75. [Google Scholar]

- Azar, Adel, FaribaHabibi Rad, and Botyari Ehsan. 2014. Board characteristics and firm performance in Malaysia. Journal of Research in Business and Management 2: 28–34. [Google Scholar]

- Botosan, Christine A. 1997. Disclosure of level and the cost equity capital. The Accounting Review 72: 323–49. [Google Scholar]

- Buachoom, Wonlop. 2018. How do board structures of Thai firms influence different quantile levels of firm performance? Advances in Pacific Basin Business, Economics and Finance, 157–89. [Google Scholar] [CrossRef]

- Bursa Malaysia Berhad. 2017. Corporate Governance Guide Executive Summary, 3rd ed. Kuala Lumpur: Bursa Malaysia Berhad. [Google Scholar]

- Che Hat, Mohd Hassan, Rashidah Abdul Rahman, and Sakthi Mahenthiran. 2008. Corporate governance, transparency and performance of Malaysian companies. Managerial Auditing Journal 23: 744–78. [Google Scholar] [CrossRef]

- Chen, L., A. Feldmann, and O. Tang. 2015. The relationship between disclosures of corporate social performance and financial performance: Evidences from GRI reports in manufacturing industry. International Journal of Production Economics 170: 445–456. [Google Scholar] [CrossRef]

- Chou, Hsin-I., Huimin Chung, and Xiangkang Yin. 2013. Attendance of board meetings and company performance: Evidence from Taiwan. Journal of Banking and Finance 37: 4157–71. [Google Scholar] [CrossRef]

- Chung, Huimin, William Q. Judge, and Yi-Hua Li. 2015. Voluntary disclosure, excess executive compensation, and firm value. Journal of Corporate Finance 32: 64–90. [Google Scholar] [CrossRef]

- Cooke, Terry E. 1989. Voluntary corporate disclosure by Swedish companies. Journal of International Financial Management & Accounting 1: 171–95. [Google Scholar]

- Correia, Thamirys de Sousa, and Wenner Glaucio Lopes Lucena. 2020. Board of directors and code of business ethics of Brazilian companies. RAUSP Management Journal 55: 263–79. [Google Scholar]

- Donnelly, Ray, and Mark Mulcahy. 2008. Board structure, ownership, and voluntary disclosure in Ireland. Corporate Governance: The International Journal of Business in Society 16: 416–29. [Google Scholar] [CrossRef]

- Elamer, Ahmed A., Aws AlHares, Collins G. Ntim, and Ismail Benyazid. 2018. The corporate governance–risk-taking nexus: Evidence from insurance companies. International Journal of Ethics and Systems 34: 493–509. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical Work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Gackowski, Tomasz. 2017. The idea of investor relations in the modern economy: A communication approach. Economic Research-Ekonomska Istrazivanja 30: 1–13. [Google Scholar] [CrossRef][Green Version]

- Ghani, Erlane K., Nurazrin Tarmezi, Jamaliah Said, and Yuliansyah Yuliansyah. 2016. The effect of risk management and operational information disclosure practices on public listed firms’ financial performance. International Journal of Economics and Management 10: 235–52. [Google Scholar]

- Han, Seung Hun, Minhee Kim, Duk Hee Lee, and Sangwon Lee. 2014. Information asymmetry, corporate governance, and shareholder wealth: Evidence from unfaithful disclosures of Korean listed firms. Asia-Pacific Journal of Financial Studies 43: 690–720. [Google Scholar] [CrossRef]

- Hanh, Le Thi My, Irene Wei Kiong Ting, Qian Long Kweh, and Lam Thi Hoang Hoanh. 2018. Board meeting frequency and financial performance: A case of listed firms in Vietnam. International Journal of Business and Society 19: 464–72. [Google Scholar]

- Hansen, Lars Peter, and Kenneth J. Singleton. 1982. Generalized instrumental variables estimation of nonlinear rational expectations models. Econometrica 50: 1269–86. [Google Scholar] [CrossRef]

- Hashim, Mohd Hafiz, Anuar Nawawi, and Ahmad Saiful Azlin Puteh Salin. 2014. Determinants of strategic information disclosure-Malaysian evidence. International Journal of Business and Society 15: 547–72. [Google Scholar]

- Hussain, Nazim, Ugo Rigoni, and René P. Orij. 2018. Corporate governance and sustainability performance: Analysis of triple bottom line performance. Journal of Business Ethics 149: 411–32. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1993. The modern industrial revolution, exit and the failure of internal control systems. The Journal of Finance 48: 831–80. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kasbun, Nur Fatin, Boon Heng Teh, and Tze San Ong. 2016. Sustainability Reporting and Financial Performance of Malaysian Public Listed Companies. Institutions and Economics 8: 78–93. [Google Scholar]

- Kowalewski, Oskar. 2016. Corporate governance and corporate performance: Financial crisis (2008). Management Research Review 39: 1494–515. [Google Scholar] [CrossRef]

- Loh, Lawrence, Nguyen Thi Phuong Thao, Isabel Sim, Thomas Thomas, and Wang Yu. 2016. Sustainability reporting in Asean: No. October. Singapore: Asean CSR Network and Centre for Governance, Institutions Organisations, NUS Business School. [Google Scholar]

- Maina, Edward Kandiru, Hazel Gachunga, Willy Muturi, and Martin Ogutu. 2017. Influence of firm characteristics on the impact of disclosure and transparency in the performance of companies listed in Nairobi Securities Exchange. International Journal of Scientific Research and Management 5: 6994–7007. [Google Scholar] [CrossRef]

- Merton, Robert C. 1986. A simple model of capital market equilibrium with incomplete information. Journal of Finance 42: 483–510. [Google Scholar] [CrossRef]

- Mishra, Rakesh Kumar, and Sheeba Kapil. 2018. Effect of board characteristics on firm value: Evidence from India. South Asian Journal of Business Studies 7: 41–72. [Google Scholar] [CrossRef]

- Nguyen, Thi H. H., Mohamed H. Elmagrhi, Collins G. Ntim, and Yue Wu. 2021. Environmental performance, sustainability, governance and financial performance: Evidence from heavily polluting industries in China. Business Strategy and the Environment, 1–19. [Google Scholar] [CrossRef]

- Norraidah, Abu Hasan, and Yakob Noor Azuddin. 2018. Symmetrical Information Disclosure for Investors’ Investment Decisions. International Journal of Engineering & Technology 7: 397–99. [Google Scholar]

- Nurulyasmin, Ju Ahmad, Afzalur Rashid, and Jeff Gow. 2017. Board meeting frequency and corporate social responsibility (CSR) reporting: Evidence from Malaysia. Corporate Board: Role, Duties and Composition 13: 87–99. [Google Scholar]

- Paul, Jyoti. 2017. Board activity and firm performance. Indian Journal of Corporate Governance 10: 44–57. [Google Scholar] [CrossRef]

- Preston, Lee E., and Douglas P. O’bannon. 1997. The corporate social-financial performance relationship Reproduced with permission of the copyright owner: Further reproduction prohibited without permission. Business & Society 36: 419–29. [Google Scholar]

- Rahman, Rashidah Abdul, and Roszaini Mohd Haniffa. 2005. The effect of role duality on corporate performance. Corporate Ownership & Control 2: 40–47. [Google Scholar]

- Vafeas, Nikos, and Elena Theodorou. 1998. The relationship between board structure and firm performance in the UK. British Accounting Review 30: 383–407. [Google Scholar] [CrossRef]

- Wang, Yan, Kaleemullah Abbasi, Bola Babajide, and Kemi C. Yekini. 2020. Corporate governance mechanisms and firm performance: Evidence from the emerging market following the revised CG code. Corporate Governance (Bingley) 20: 158–74. [Google Scholar] [CrossRef]

| Variables | Measurement | Data Source |

|---|---|---|

| Dependent Variable | ||

| Firm Performance | Tobin’s Q (market value of equities plus book value of liabilities divided by book value of total assets) and Return on equity | Bloomberg |

| Independent Variable | ||

| Environmental and Social Disclosure | Environmental and Social Score | Bloomberg |

| Moderating Variable Board Meeting | Number of board meetings held for the financial year | Annual Report |

| Variables | Mean | Median | Std. Dev. | Min | Max | Obs |

|---|---|---|---|---|---|---|

| Dependent variable | ||||||

| Tobin Q | 1.60 | 1.05 | 5.740 | 0.30 | 207.02 | 1366 |

| ROE | 8.83 | 7.37 | 30.323 | 105.74 | 369.91 | 1373 |

| Independent variable ES Moderating variable | 80.35 | 83.33 | 10.481 | 16.67 | 100.00 | 1290 |

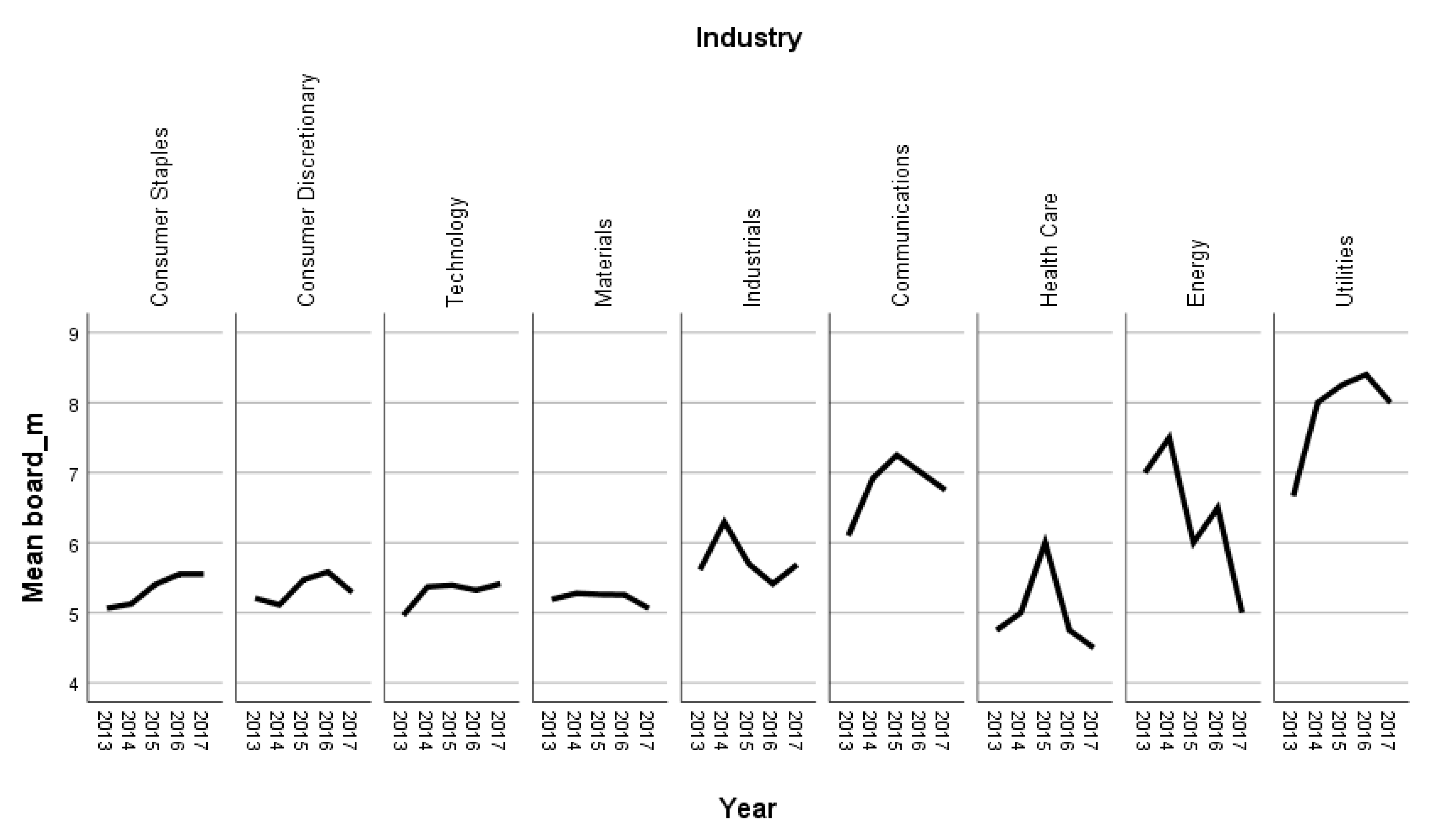

| Board meeting | 5.53 | 5.00 | 1.910 | 1.00 | 27.00 | 1334 |

| Tobin Q | ROA | ROE | ES | Board Meeting | |

|---|---|---|---|---|---|

| tobin | 1.00 | ||||

| roa | 0.3277 * | 1.00 | |||

| roe | 0.3087 * | 0.9195 * | 1.00 | ||

| es | 0.1061 * | 0.1035 * | 0.1181 * | 1.00 | |

| board_m | −0.0506 * | −0.1122 * | −0.0608 * | 0.0613 * | 1.00 |

| Variables | Model 1a | Model 2a | Model 1b | Model 2b |

|---|---|---|---|---|

| System GMM Two-Step | System GMM Two-Step | |||

| Tobin Q | ROE | |||

| Firm Performance (−1) | 0.399 *** | 0.572 *** | 0.207 | 0.282 *** |

| (0.0992) | (0.0584) | (0.141) | (0.0802) | |

| es | −0.410 * | −1.098 * | −4.748 ** | −7.236 ** |

| (0.246) | (0.562) | (1.885) | (3.457) | |

| bm | −0.666 * | −3.980 | ||

| (0.400) | (2.488) | |||

| es*bm | 0.156 * | 0.950 * | ||

| (0.0922) | (0.574) | |||

| Constant | 1.24 | 4.460 * | 21.43 *** | 29.78 ** |

| (0.984) | (2.426) | (7.872) | (15.01) | |

| Observations | 941 | 941 | 946 | 946 |

| Number of groups | 258 | 258 | 258 | 258 |

| Number of instruments | 46 | 74 | 31 | 60 |

| AR1 | 0.000 | 0.000 | 0.006 | 0.000 |

| AR2 | 0.110 | 0.338 | 0.585 | 0.368 |

| Hansen | 0.599 | 0.231 | 0.560 | 0.223 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yakob, N.A.; Abu Hasan, N. Exploring the Interaction Effects of Board Meetings on Information Disclosure and Financial Performance in Public Listed Companies. Economies 2021, 9, 139. https://doi.org/10.3390/economies9040139

Yakob NA, Abu Hasan N. Exploring the Interaction Effects of Board Meetings on Information Disclosure and Financial Performance in Public Listed Companies. Economies. 2021; 9(4):139. https://doi.org/10.3390/economies9040139

Chicago/Turabian StyleYakob, Noor Azuddin, and Norraidah Abu Hasan. 2021. "Exploring the Interaction Effects of Board Meetings on Information Disclosure and Financial Performance in Public Listed Companies" Economies 9, no. 4: 139. https://doi.org/10.3390/economies9040139

APA StyleYakob, N. A., & Abu Hasan, N. (2021). Exploring the Interaction Effects of Board Meetings on Information Disclosure and Financial Performance in Public Listed Companies. Economies, 9(4), 139. https://doi.org/10.3390/economies9040139