Predicting the Economic Impact of the COVID-19 Pandemic in the United Kingdom Using Time-Series Mining

Abstract

:1. Introduction

2. Literature Review

- -

- The impact of COVID-19, associated behaviours and policies on the UK economy has been studied by a computable general equilibrium model (Keogh-Brown et al. 2020). The authors of the study used a computable general equilibrium (CGE) model linked to a population-wide epidemiological demographic model to analyse the potential macroeconomic impact of the COVID-19 on the UK economy. The study found out that the mitigation strategies that the government imposes for 12 weeks would reduce case fatalities by 29% but impose a total cost to the economy of 13.5% of GDP, due to business closure and labour loss from working parents during school closures. The mitigation strategies to face the pandemic that lasts for a longer period would reduce deaths by 95% but would increase the total cost to the UK economy to 29.2% of GDP, where 7.3% of GDP is due to school closures and 21.9% of GDP to business closures. The authors concluded that COVID-19 has the potential to impose unprecedented economic impact on the UK economy and those impacts are likely to be dominated by the indirect costs of mitigation of the pandemic. The duration of the policies of mitigating the spread of the disease is a key to determining the economic impact.

- -

- The impacts of COVID-19 and Brexit on the UK economy were investigated (De Lyon and Dhingra 2021) using real-time data provided by the Confederation of British Industry (CBI) to assess the impact of COVID-19 on firms’ activities and predicted the economic consequences of the preventive measures that the government imposed. The authors have demonstrated that the pandemic has caused a sharp reduction in the growth rate of nominal wages. Before the pandemic, in January 2020 nominal wages had grown by 3.1% over the previous 12-month period compared with 0.9% a year later. However, average prices have continued to increase 0.5% throughout the pandemic, with a producer price inflation of 0.6% reported by the ONS for all manufactured products. Lower wages often reduce demand for goods and services and put downward pressure on prices. Yet despite lower earnings growth since the pandemic, prices have increased. This is partially explained by rising average costs, at least in the manufacturing sector. The increase in costs was mainly due to the increased input costs by increasing barriers to trade between the UK and the EU imposed by Brexit in addition to delays at the border, burdensome administrative costs, the adopted new technologies and management practices due to the pandemic. These costs contributed to the sharp fall in UK trade in 2021, leading to rising costs, higher prices, and reduced competitiveness.

- -

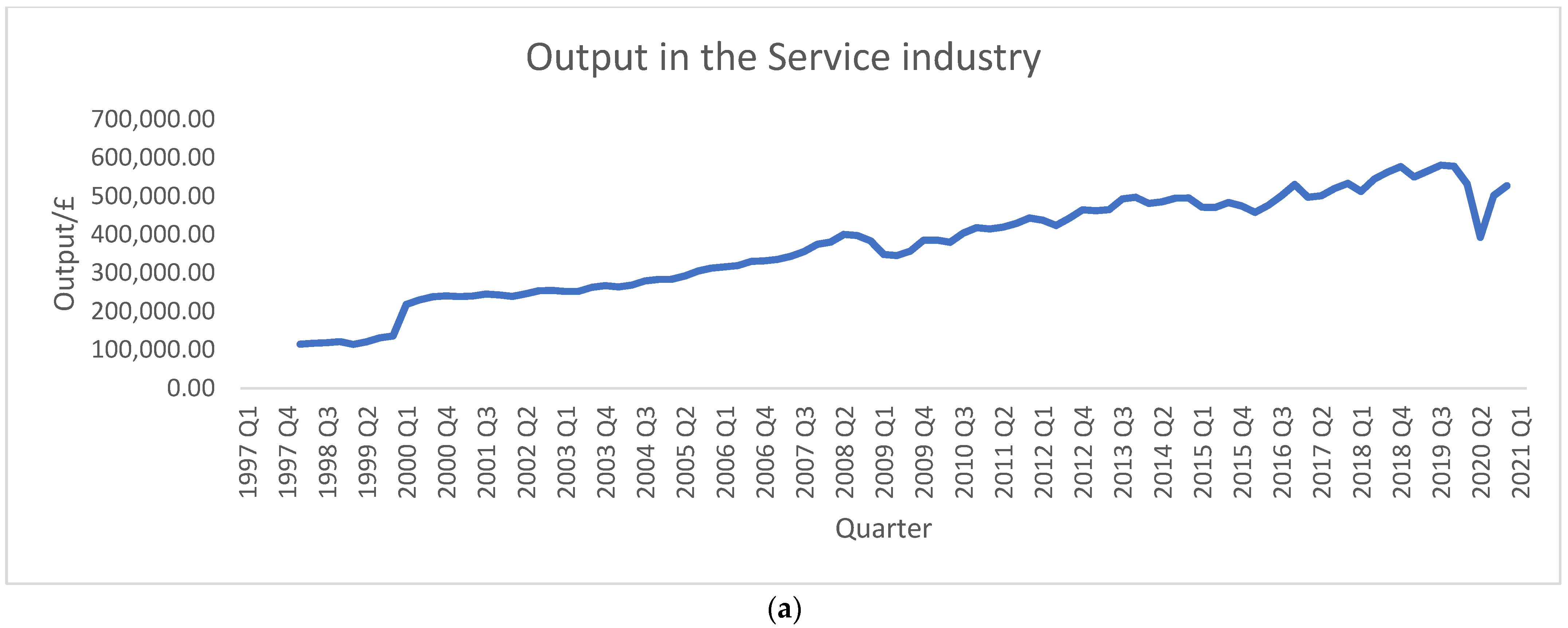

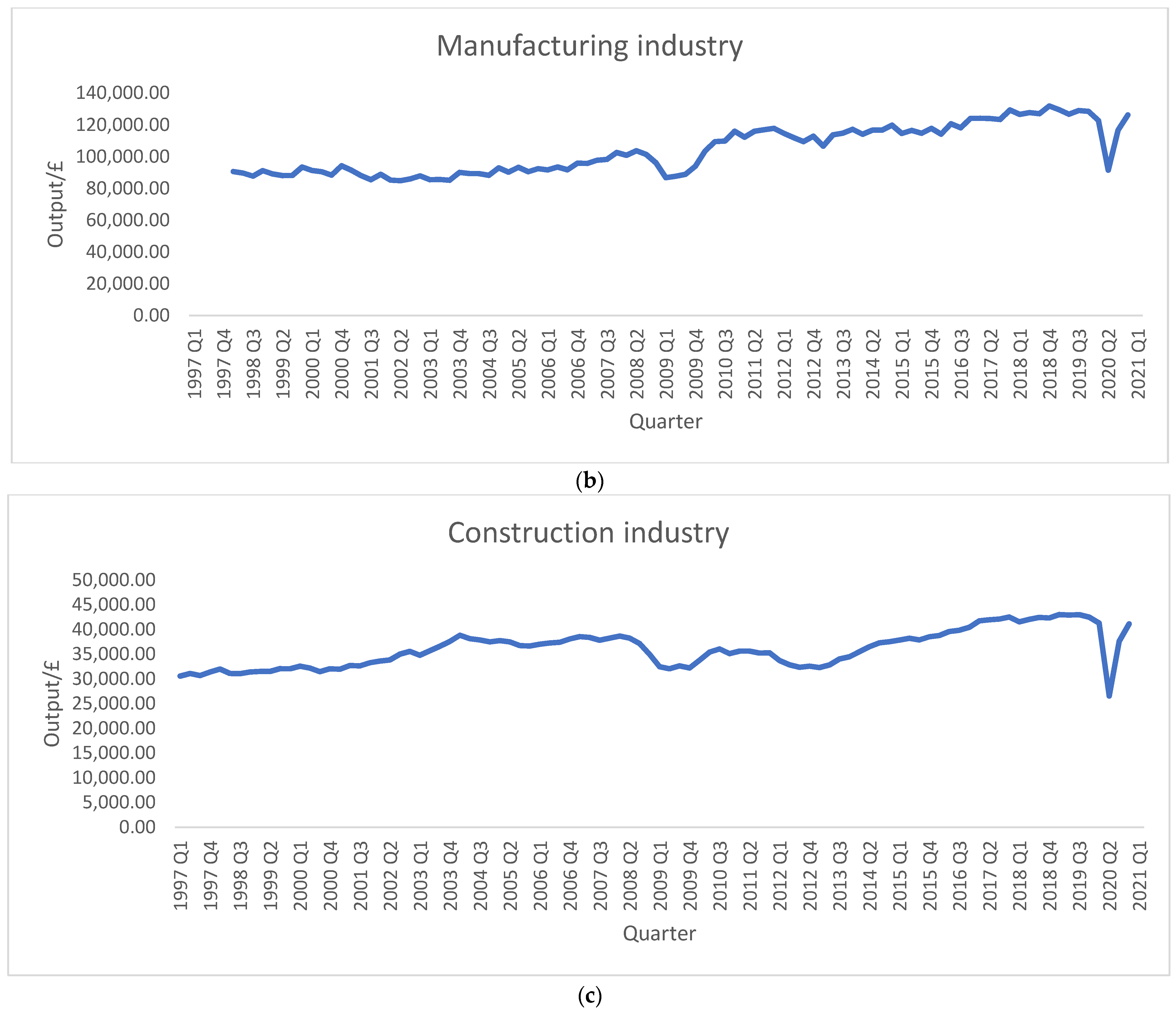

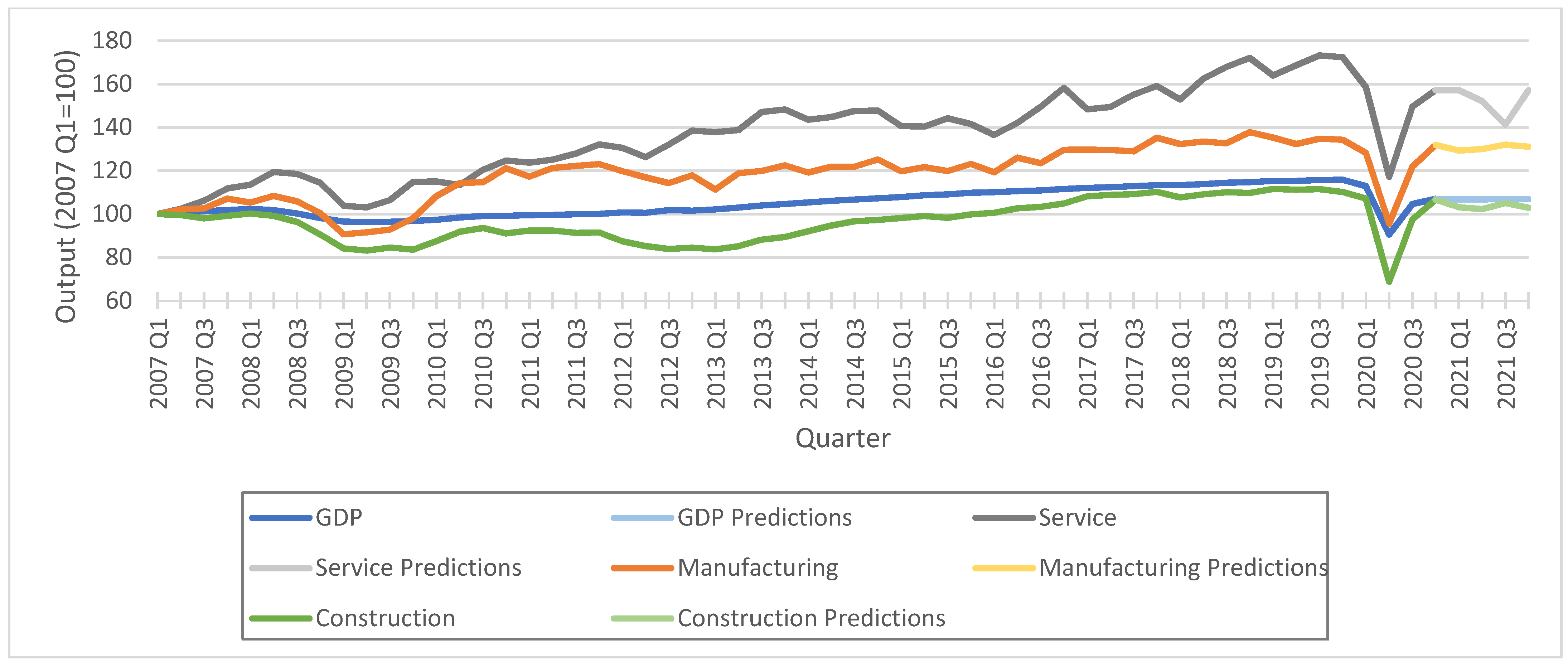

- Another study (Stephens et al. 2020) has been conducted on the UK economy by analysing the overall impacts of the (COVID-19) pandemic on GDP during July 2020 using an online questionnaire, and the Monthly Business Survey (MBS) as the primary data source for 75% of production industries and 50% of services industries. The authors concluded that total services output during July 2020 were significantly affected by the COVID-19 pandemic and fell at 12.6% below the February 2020 level, the last full month of “normal” operating conditions. The transport sector remained one of the biggest areas of services affected by the coronavirus as people have been homeworking, land transport has been affected by a reduction in commuters, especially the London Underground, which in July 2020 was at 23% of its usage in July 2019. Production output during July 2020 was at 7.0% below the level of February 2020, the last full month of “normal” operating conditions. In July 2020, wearing apparel was 32.9% below the February 2020 level. Construction output was 11.6% below its February 2020 level.A five-part framework (O’Donnell and Begg 2020) has been proposed for assessing why the UK performed poorly compared with other countries regarding the medical, social and economic challenges brought about by the COVID-19. They suggested that there have been problems as to how evidence about the pandemic and its anticipated effects has been collected, processed and circulated. Subsequently, this affected policy maker’s ability to evaluate the risk and providing them with inadequate information to face the multidimensional challenges brought about by the pandemic with the proper policy response. The study also revealed that the UK’s institutional setting may have been a driver of this poor performance towards the pandemic. The authors argued that UK policymakers may have over-relied on the medical sciences at the expense of other (social) scientific evidence. Another study emphasised the importance of widening organisational decision making as an approach (Child 2021) to address the problems that were brought about by the pandemic. The author defined ‘organisational participation’ and provided a framework for the different forms of participation, concluding that a combination of co-determination and workplace self-management is likely to have the most consequential effects. The author argued that the public response to the crisis might lead to a constructive way forward to deal with the pandemic and emphasised the need to develop effective systems of participation at all levels of human organization.

- -

- Moreover, the main challenges facing policymakers, when trying to balance between finding jobs for the layout workers and getting them back to the right jobs, were highlighted in the study by (Costa et al. 2020). These authors concluded that the nature of the economic shock associated with the COVID-19 pandemic is highly unusual; it has led to not only a sharp fall in labour demand in many sectors of the economy, much more than in a typical downturn or slowdown in economic activity, but also a radical change in the types of economic activity in the UK which will cause employers to expect large changes to their workforce over the next year. This would lead the government to take a forward-looking approach and equip people with the skills that are likely to be in demand in the future, provided a potential shift towards e-commerce, and the need to move to a net-zero, which is the target for the UK to reach by 2050.

- -

- The Impact of COVID-19 on share prices in the UK (Griffith et al. 2020) was investigated by Rachel Griffith and colleagues. These authors described how the impacts of the COVID-19 pandemic have varied across industries, using data on the share prices of the firms listed on the London Stock Exchange. The value of traded shares in the stock market reflects not only how well a company is doing today, but also how well it is expected to do in the future. In addition, share prices reflect market expectations about changes in final demand, intermediate demand, and restrictions in supply. The authors concluded that the industries that have been hit the hardest include tourism and leisure, fossil fuels production and distribution, banking, insurance, and retailers. On the other hand, other industries have outperformed the market, including food and drug manufacturers and retailers, utilities, high-tech manufacturing, tobacco, and firms in medical and biotech research. As social distancing measures continue, capital-intensive firms might lose the skills and experience of their workers. If those firms are not able to reduce their costs, they are more likely to suffer in the future if not backed by government support.

3. Methodology

3.1. Sample Section

3.2. Prediction Using AI

3.2.1. Continuous Time-Series Forecasting

3.2.2. Categorical Time-Series Forecasting

- value at value at Growth

- value at value at Constant

- value at value at Fall

- Growth

- Constant

- Fall

4. Results

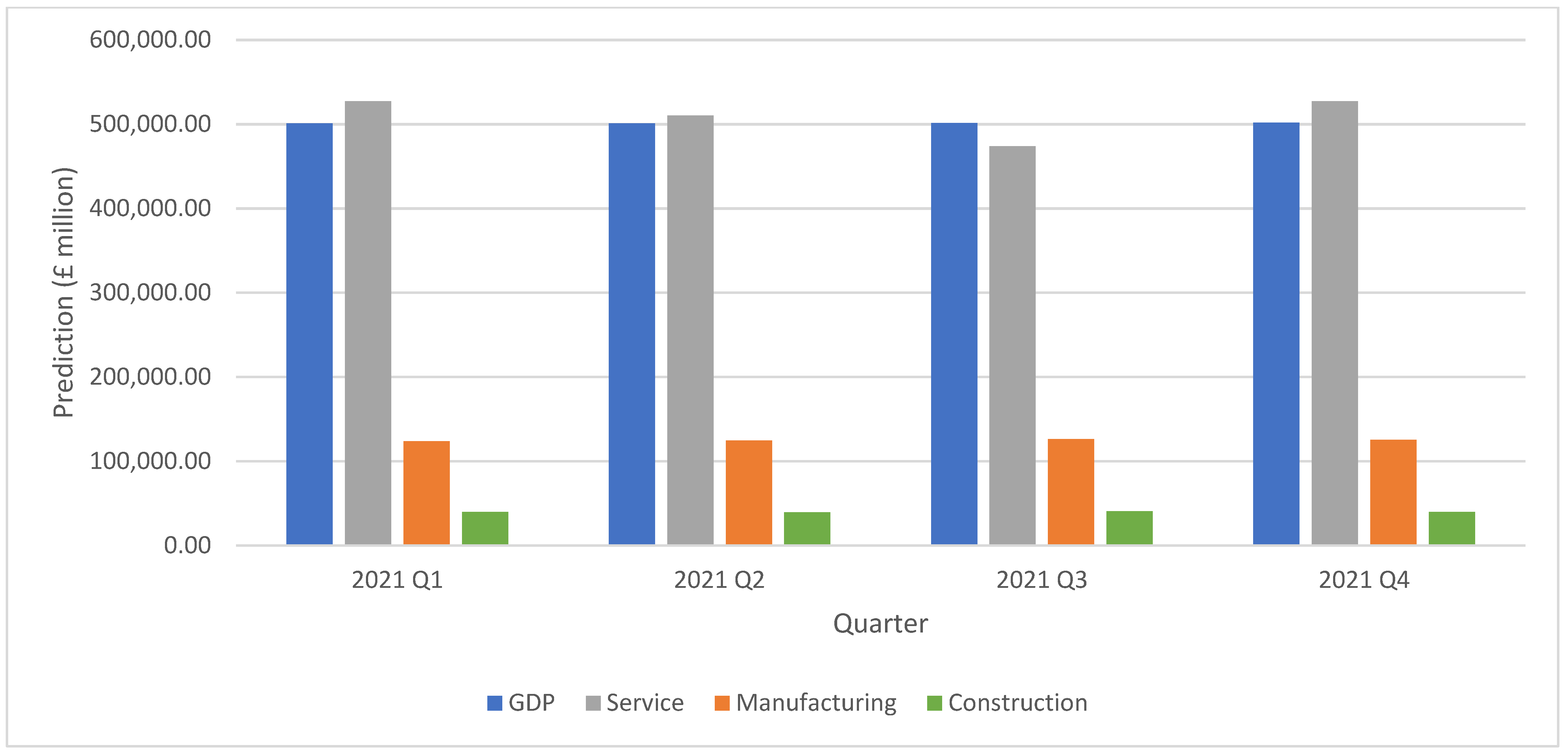

4.1. AI-Based Model Predictions

4.1.1. Continuous Time-Series Forecasting

- Root Mean Squared Error (RMSE): Square root of the average of squared differences between actual and predicted values. This measure was widely used and preferred by this research considering its sensitivity to large errors.

- Mean Absolute Percentage Error (MAPE): Average of absolute percent error. Unlike the RMSE, MAPE is a unit-free measure, which can use to compare performance between models.

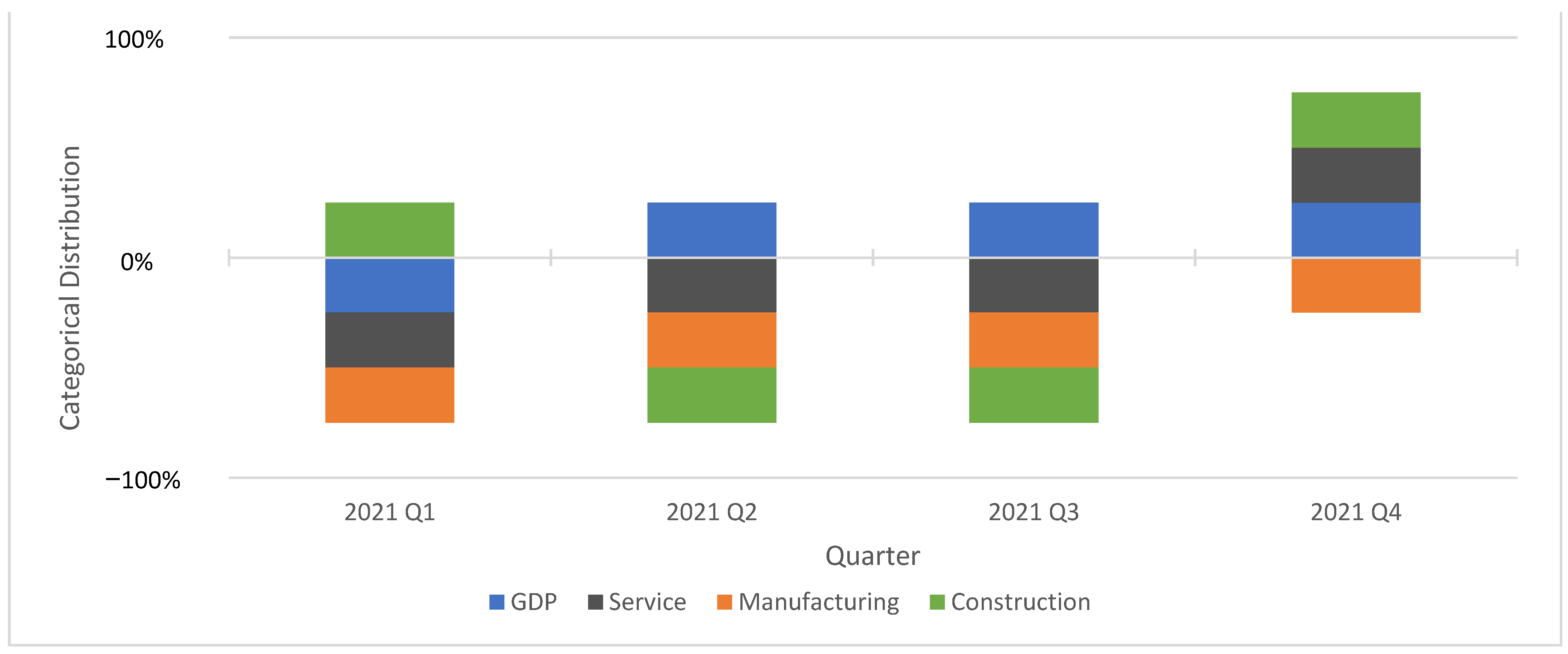

4.1.2. Categorical Time-Series Forecasting

- Recall: Fraction of the correctly identified categories among the total observations.

- Precision: Fraction of correctly identified categories among the predicted categories.

- F1: Weighted harmonic mean of precision and recall.

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| First Quarter | Last Quarter | Number of Quarters of Negative Growth | Total Decline/% |

|---|---|---|---|

| 1956 Q2 | 1956 Q3 | Two quarters | −0.3 |

| 1961 Q3 | 1961 Q4 | Two quarters | −0.7 |

| 1973 Q3 | 1974 Q1 | Three quarters | −4.1 |

| 1975 Q2 | 1975 Q3 | Two quarters | −2.0 |

| 1980 Q1 | 1981 Q1 | Five quarters | −4.2 |

| 1990 Q3 | 1991 Q3 | Five quarters | −2.0 |

| 2008 Q2 | 2009 Q2 | Five quarters | −6.0 |

| 2020 Q1 | 2020 Q2 (Keogh-Brown et al. 2020) | Two quarters | −22.1 |

Appendix B

References

- Ahuja, Abhimanyu S. 2019. The impact of artificial intelligence in medicine on the future role of the physician. PeerJ 7: e7702. [Google Scholar] [CrossRef] [PubMed]

- Arslan, Janan, and Kurt K. Benke. 2021. Artificial Intelligence and Telehealth may provide early warning of epidemics. Frontiers in Artificial Intelligence 4: 556848. [Google Scholar] [CrossRef]

- Balmford, Ben, James D. Annan, Julia C. Hargreaves, Marina Altoè, and Ian J. Bateman. 2020. Cross-country comparisons of COVID-19: Policy, politics and the price of life. Environmental and Resource Economics 76: 525–51. [Google Scholar] [CrossRef] [PubMed]

- Barro, Robert J., José F. Ursúa, and Joanna Weng. 2020. The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity (No. w26866). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Beckett, Andy. 2020. Nobody Denies Johnson’s Government is Incompetent. But Do Enough Voters Care? The Guardian. August 22. Available online: https://www.theguardian.com/commentisfree/2020/aug/22/boris-johnson-government-incompetent-prime-minister-competent (accessed on 28 September 2020).

- Benvenuto, Domenico, Marta Giovanetti, Lazzaro Vassallo, Silvia Angeletti, and Massimo Ciccozzi. 2020. Application of the ARIMA model on the COVID-2019 epidemic dataset. Data in Brief 29: 105340. [Google Scholar] [CrossRef] [PubMed]

- BFPG. 2020. The British Foreign Policy Group. Available online: https://bfpg.co.uk/2020/04/covid-19-timeline/ (accessed on 1 October 2020).

- BoE (Bank of England). 2021. Monetary Policy Report. London: Bank of England, p. 2. [Google Scholar]

- Boissay, Frederic, and Phurichai Rungcharoenkitkul. 2020. Macroeconomic Effects of COVID-19: An Early Review (No. 7). Basel: Bank for International Settlements. [Google Scholar]

- Chatfield, Chris. 2000. Time-Series Forecasting. Boca Raton: CRC Press. [Google Scholar]

- Child, John. 2021. Organizational participation in post-covid society—Its contributions and enabling conditions. International Review of Applied Economics 35: 117–46. [Google Scholar] [CrossRef]

- Coakley, Jerry, Periklis Kougoulis, and John C. Nankervis. 2014. Comovement and FTSE 100 index changes. International Journal of Behavioural Accounting and Finance 4: 93–112. [Google Scholar] [CrossRef]

- Costa Dias, Monica, Robert Joyce, Fabien Postel-Vinay, and Xiaowei Xu. 2020. The challenges for labour market policy during the COVID-19 pandemic. Fiscal Studies 41: 371–82. [Google Scholar] [CrossRef]

- De Lyon, Josh, and Swati Dhingra. 2021. The Impacts of COVID-19 and Brexit on the UK Economy: Early Evidence in 2021. London: Centre for Economic Performance, London School of Economics and Political Science. [Google Scholar]

- Fattah, Jamal, Latifa Ezzine, Zanab Aman, Haj El Moussami, and Abdeslam Lachhab. 2018. Forecasting of demand using ARIMA model. International Journal of Engineering Business Management 10: 1847979018808673. [Google Scholar] [CrossRef] [Green Version]

- Forrest, Nick, Hannah Audino, Jonathan Gillham, and Barret Kupelian. 2021. UK Economic Update. ©PriceWaterhouse Coopers LLP (PwC Network). Available online: https://www.pwc.co.uk/ (accessed on 1 March 2021).

- Fu, Xin, Hao Yang, Chenxi Liu, Jianwei Wang, and Yinhai Wang. 2019. A hybrid neural network for large-scale expressway network OD prediction based on toll data. PLoS ONE 14: e0217241. [Google Scholar] [CrossRef] [Green Version]

- Grantz, Kyra H., Madhura S Rane, Henrik Salje, Gregory E. Glass, Stephen E. Schachterle, and Derek A.T. Cummings. 2016. Disparities in influenza mortality and transmission related to sociodemographic factors within Chicago in the pandemic of 1918. Proceedings of the National Academy of Sciences of the United States of America 113: 13839–44. [Google Scholar] [CrossRef] [Green Version]

- Griffith, Rachel, Peter Levell, and Rebekah Stroud. 2020. The Impact of COVID-19 on Share Prices in the UK. Fiscal Studies 41: 363–69. [Google Scholar] [CrossRef] [PubMed]

- Harari, Daniel, Matthew Keep, and Philip Brien. 2021. Coronavirus: Economic Impact. Briefing Paper. Number 8866, 26 February 2021. London: The House of Commons Library. Available online: https://commonslibrary.parliament.uk/research-briefings/cbp-8866/ (accessed on 24 September 2021).

- Herrera, Manuel, Aida A Ferreira, David Coley, and Ronaldo R.B. de Aquino. 2016. SAX-quantile based multiresolution approach for finding heatwave events in summer temperature time series. AI Communications 29: 725–32. [Google Scholar] [CrossRef] [Green Version]

- Hewamalage, Hansika, Christoph Bergmeir, and Kasun Bandara. 2021. Recurrent neural networks for time series forecasting: Current status and future directions. International Journal of Forecasting 37: 388–427. [Google Scholar] [CrossRef]

- HM Treasury. 2021. Survey of Independent Forecasts for the UK Economy: February 2021. London: HM Treasury. [Google Scholar]

- Huang, Chaolin, Yeming Wang, Xingwang Li, Lili Ren, Jianping Zhao, Zhang Hu, Fan Li, Guohui Yi, Jiuyang Xu, and Xiaoying Gu. 2020. Clinical features of patients infected with 2019 novel coronavirus in Wuhan, China. Lancet 395: 497–506. [Google Scholar] [CrossRef] [Green Version]

- Ibrahim, Asmaa, Paul Gamble, Ronnachai Jaroensri, Mohammed M Abdelsamea, Craig H. Mermel, Po-Hsuan Cameron Chen, and Emad A. Rakha. 2020. Artificial intelligence in digital breast pathology: Techniques and applications. Breast 49: 267–73. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kelso, Paul. 2020. Coronavirus: Economic Impact Bigger than First Feared, Warns IMF. Sky News. Available online: https://news.sky.com/ (accessed on 10 October 2020).

- Keogh, Eamonn, Jessica Lin, and Ada Fu. 2005. Hot sax: Efficiently finding the most unusual time series subsequence. In Proceedings of the Fifth IEEE International Conference on Data Mining (ICDM’05), Houston, TX, USA, November 27–30; p. 8. [Google Scholar]

- Keogh-Brown, Marcus R., Herning Tarp Jensen, John W. Edmunds, and Richard D. Smith. 2020. The impact of COVID-19, associated behaviours and policies on the UK economy: A computable general equilibrium model. SSM-Population Health 12: 100651. [Google Scholar] [CrossRef]

- Kim, Myung Hwa, Ju Hyung Kim, Kyoungjin Lee, and Gwang-Yong Gim. 2021. The Prediction of COVID-19 Using LSTM Algorithms. International Journal of Networked and Distributed Computing 9: 19–24. [Google Scholar] [CrossRef]

- McKibbin, Warwick, and Roshen Fernando. 2020. The Global Macroeconomic Impacts of COVID-19: Seven Scenarios. Centre for Applied Macroeconomic Analysis (CAMA) Working Paper 19: 1–43. [Google Scholar] [CrossRef] [Green Version]

- O’Donnell, Gus, and Harry Begg. 2020. Far from Well: The UK since COVID-19, and Learning to Follow the Science (s). Fiscal Studies 41: 761–804. [Google Scholar] [CrossRef]

- ONS. 2021. Office for National Statistics: Coronavirus and the Impact on Output in the UK Economy. Available online: https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/coronavirusandtheimpactonoutputintheukeconomy/december2020 (accessed on 20 March 2021).

- Paisley, Anne. 2020. COVID-19: The State of Global Pandemic Preparedness. Available online: https://www.one.org/international/blog/state-of-global-pandemic-preparedness/ (accessed on 1 October 2020).

- Partington, Richard. 2020. How Does UK’s COVID Recession Compare with Previous Ones? The Guardian. August 12. Available online: https://www.theguardian.com/business/2020/aug/12/how-does-uks-covid-recession-compare-with-previous-ones (accessed on 1 October 2020).

- Saker, Lance, Kelley Lee, Barbara Cannito, Anna Gilmore, and Diarmid Campbell-Lendrum. 2004. Globalization and Infectious Diseases: A Review of the Linkages. Geneva: UNDP/World Bank/WHO Special Programme on Tropical Diseases Research. [Google Scholar]

- Senin, Pavel, and Sergey Malinchik. 2013. Sax-vsm: Interpretable time series classification using sax and vector space model. In Proceedings of the 2013 IEEE 13th International Conference on Data Mining, Dallas, TX, USA, December 7–10; pp. 1175–1180. [Google Scholar]

- Singh, S. N., and Abheejeet Mohapatra. 2019. Repeated wavelet transform based ARIMA model for very short-term wind speed forecasting. Renewable Energy 136: 758–68. [Google Scholar]

- Song, Ligang, and Yixiao Zhou. 2020. The COVID-19 pandemic and its impact on the global economy: What does it take to turn crisis into opportunity? China and World Economy 28: 1–25. [Google Scholar] [CrossRef]

- Stephens, Mark, Sian Cross, and Gareth Luckwell. 2020. Coronavirus and the Impact on Output in the UK Economy: June 2020; London: Office for National Statistics, p. 12.

- Stilo, Giovanni, and Paola Velardi. 2016. Efficient temporal mining of micro-blog texts and its application to event discovery. Data Mining and Knowledge Discovery 30: 372–402. [Google Scholar] [CrossRef]

- TWB (The World Bank). 2021. Global Economic Prospects 2021. Available online: https://www.worldbank.org/en/publication/global-economic-prospects (accessed on 24 September 2021).

- Wahl, Brian, Aline Cossy-Gantner, Stefan Germann, and Nina R. Schwalbe. 2018. Artificial intelligence (AI) and global health: How can AI contribute to health in resource-poor settings? BMJ Global Health 3: e000798. [Google Scholar] [CrossRef] [PubMed] [Green Version]

| Period | Reason for the Downturn | Total Drop in GDP over the Period/% | Lowest Figure Quarter Following the Start of the Crisis | How Many Quarters Did It Take to Return to Baseline |

|---|---|---|---|---|

| 2019 Q4 to 2020 Q2 | COVID-19 | −21.2 | Second quarter of 2020 | Ongoing |

| 2008 Q1 to 2009 Q2 | The 2008 global financial crisis | −5.9 | Fourth quarter of 2008 | Six quarters |

| 1974 Q2 to 1975 Q3 | 1974 Miners’ strikes | −5.4 | Second quarter of 1975 | Five quarters |

| 1979 Q2 to 1981 Q1 | During the 1980′s economic downturn | −5.3 | Second quarter of 1980 | Seven quarters |

| 1990 Q2 to 1991 Q3 | The early 1990 recession | −2.0 | Third quarter of 1990 | Five quarters |

| Time-Series | RMSE | MAPE |

|---|---|---|

| GDP (CVM) | 27,202.4208 | 0.0227 |

| Service | 42,746.6305 | 0.0559 |

| Manufacturing | 7898.8470 | 0.0370 |

| Construction (CVM) | 3344.7944 | 0.0489 |

| Time-Series | Recall | Precision | F1 |

|---|---|---|---|

| GDP (CVM) | 0.8889 | 0.7901 | 0.8366 |

| Service | 0.5185 | 0.5472 | 0.5266 |

| Manufacturing | 0.5185 | 0.5153 | 0.5104 |

| Construction (CVM) | 0.5926 | 0.6442 | 0.6120 |

| Time-Series | F1 (p = 1) | F1 (p = 2) | F1 (p = 3) | F1 (p = 4) | Average F1 |

|---|---|---|---|---|---|

| GDP (CVM) | 0.8693 | 0.8872 | 0.9559 | 0.9007 | 0.9033 |

| Service | 0.8739 | 0.9167 | 0.6901 | 0.8482 | 0.8322 |

| Manufacturing | 0.7713 | 0.7500 | 0.7273 | 0.7967 | 0.7613 |

| Construction (CVM) | 0.7320 | 0.7366 | 0.7641 | 0.7330 | 0.7414 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rakha, A.; Hettiarachchi, H.; Rady, D.; Gaber, M.M.; Rakha, E.; Abdelsamea, M.M. Predicting the Economic Impact of the COVID-19 Pandemic in the United Kingdom Using Time-Series Mining. Economies 2021, 9, 137. https://doi.org/10.3390/economies9040137

Rakha A, Hettiarachchi H, Rady D, Gaber MM, Rakha E, Abdelsamea MM. Predicting the Economic Impact of the COVID-19 Pandemic in the United Kingdom Using Time-Series Mining. Economies. 2021; 9(4):137. https://doi.org/10.3390/economies9040137

Chicago/Turabian StyleRakha, Ahmed, Hansi Hettiarachchi, Dina Rady, Mohamed Medhat Gaber, Emad Rakha, and Mohammed M. Abdelsamea. 2021. "Predicting the Economic Impact of the COVID-19 Pandemic in the United Kingdom Using Time-Series Mining" Economies 9, no. 4: 137. https://doi.org/10.3390/economies9040137

APA StyleRakha, A., Hettiarachchi, H., Rady, D., Gaber, M. M., Rakha, E., & Abdelsamea, M. M. (2021). Predicting the Economic Impact of the COVID-19 Pandemic in the United Kingdom Using Time-Series Mining. Economies, 9(4), 137. https://doi.org/10.3390/economies9040137