Generalized Trust and Economic Growth: The Nexus in MENA Countries

Abstract

1. Introduction

2. Literature Review

2.1. Trust and ITS Measurement

2.2. Trust and Economic Growth—Theoretical Underpinnings

2.3. Trust and Economic Growth—Empirical Findings

3. Methodology

4. Results and Discussion

4.1. The General Model

4.2. The Economic Development Country Classifications’ Model

4.3. The MENA-Wave-Specific Model

4.4. The Democracy–Trust Model

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

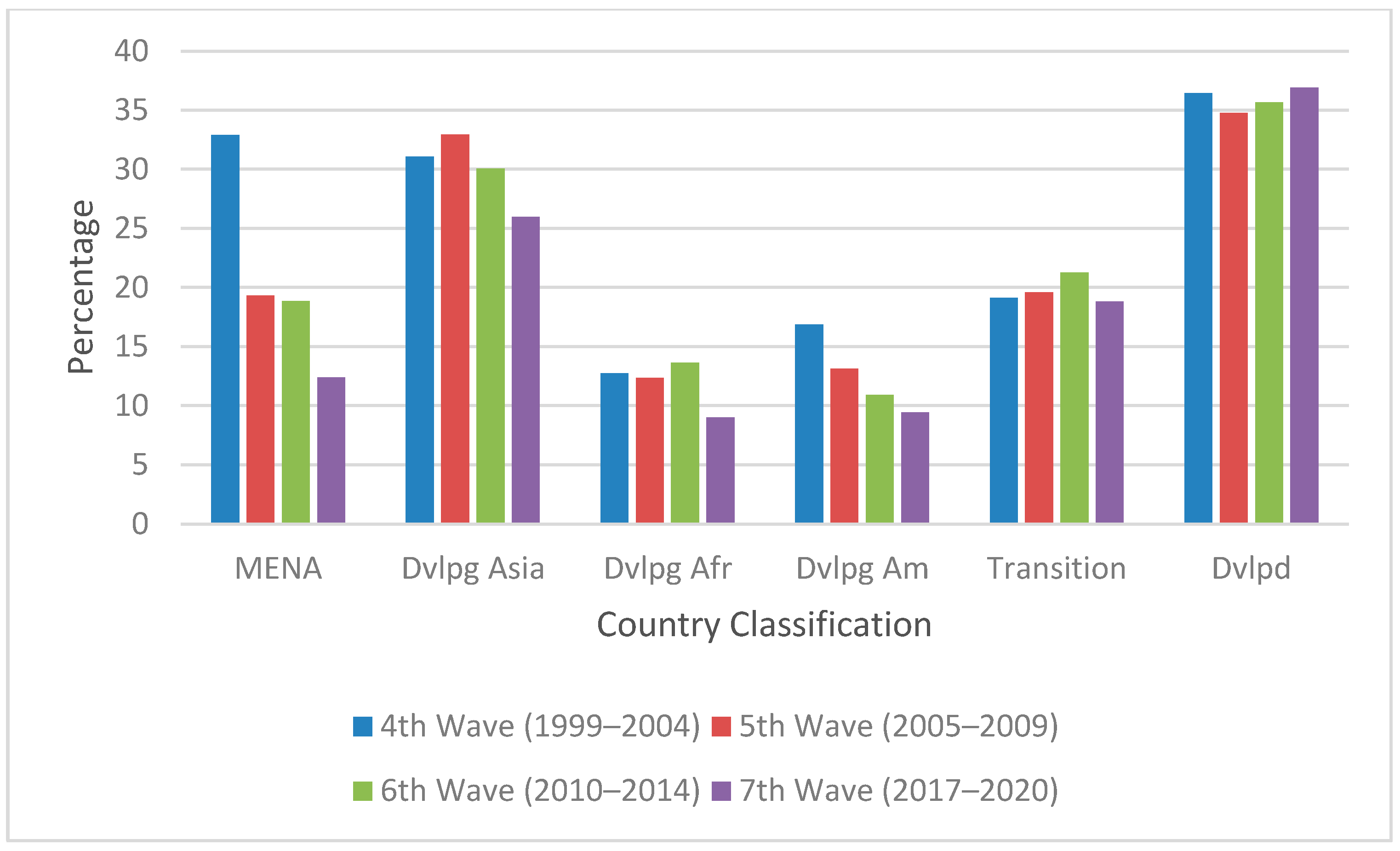

| Classification of Countries | 4th Wave | 5th Wave | 6th Wave | 7th Wave | ||||

|---|---|---|---|---|---|---|---|---|

| (1999–2004) | (2005–2009) | (2010–2014) | (2017–2020) | |||||

| Mean | # of Surveyed People | Mean | # of Surveyed People | Mean | # of Surveyed People | Mean | # of Surveyed People | |

| MENA | 32.9 | 16,516 | 19.32 | 11,819 | 18.86 | 16,827 | 12.39 | 9925 |

| Dvlg Asia | 31.07 | 12,414 | 32.94 | 11,901 | 30.05 | 15,688 | 25.97 | 20,187 |

| Dvlg Afr | 12.76 | 8198 | 12.37 | 9109 | 13.64 | 9868 | 9 | 3682 |

| Dvlg Am | 16.88 | 10,306 | 13.13 | 10,505 | 10.91 | 12,778 | 9.43 | 14,094 |

| Transition | 19.11 | 7562 | 19.58 | 6799 | 21.28 | 11,839 | 18.83 | 22,279 |

| Dvlpd | 36.45 | 9416 | 34.77 | 26,409 | 35.65 | 19,408 | 36.9 | 53,709 |

| MENA (Dem) | DvgAsia(Dem) | DvgAfr (Dem) | DvgAm (Dem) | Transition (Dem) | Dvlpd (Dem) |

|---|---|---|---|---|---|

| Algeria (0) | Bangladesh (*) | BurkinFaso (0) | Argentina (1) | Albania (0) | Andorra (.) |

| Egypt (0) | China (0) | Ethiopia a (0) | Bolivia (0) | Armenia (0) | Australia (1) |

| Iran (0) | HongKonga (*) | Ghana (*) | Brazil (1) | Azerbaijan (0) | Austria (1) |

| Iraq (0) | India (1) | Mali (0) | Chile (1) | Belarus (0) | Bulgaria (1) |

| Jordan (0) | Indonesia (1) | Nigeria (0) | Colombia (1) | Bos.& Herzeg.(0) | Canada (1) |

| Kuwait (0) | Macaoa (.) | Rwanda (0) | Ecuador (*) | Georgia (0) | Croatia (1) |

| Lebanon (0) | Malaysia (1) | S. Africa (1) | Guatemala (*) | Kazakhstan (0) | Cyprus (1) |

| Libya a (0) | Myanmar (0) | Tanzania (0) | Haitia (0) | Kyrgyzstan (0) | Czech Rep. (1) |

| Morocco (0) | Pakistan (0) | Uganda (0) | Mexico (1) | Macedonia (*) | Denmark (1) |

| Palestine a (0) | Philippines (1) | Zambia (0) | Nicaragua (0) | Moldova (1) | Estonia (1) |

| Qatar (0) | Singapore (0) | Zimbabwe (0) | Peru (1) | Montenegro a (*) | Finland (1) |

| S. Arabia (0) | S. Korea (1) | Trin.&Tob. (1) | Russia (0) | France (1) | |

| Tunisia (*) | Taiwana (1) | Uruguay (1) | Serbia (1) | Germany (1) | |

| Turkey (0) | Thailand (1) | Venezuela (0) | Tajikistan a (0) | Greece (1) | |

| Yemen (0) | Vietnam (0) | Ukraine (*) | Hungary (1) | ||

| Uzbekistan a (0) | Iceland a (1) | ||||

| Israel (1) | |||||

| Italy (1) | |||||

| Japan (1) | |||||

| Lithuania (1) | |||||

| Netherlands (1) | |||||

| N. Zealand (1) | |||||

| Norway (1) | |||||

| Poland (1) | |||||

| Puerto Rico a (1) | |||||

| Romania (1) | |||||

| Slovakia (1) | |||||

| Slovenia (1) | |||||

| Spain (1) | |||||

| Sweden (1) | |||||

| Switzerland (1) | |||||

| UK (1) | |||||

| USA (1) |

| Determinates of Growth | Variable | Variable Definition | Expected Sign | Data Sources |

|---|---|---|---|---|

| Dependent Variable | Growth | The growth rate of real GDPPC (measured in constant (2010) US dollars) during each observation window | NA | World Development Indicators (WDI) |

| Trust (Indep. Variable) | Trust | % of respondents who answered that most people can be trusted | +ve | WVS (Inglehart et al. 2014–2020) |

| Initial Level of GDPPC (Control Variable) | GDPPCt−5 | The first value of real GDPPC (measured in constant (2010) US dollars) in the observation window of each country | −ve | WDI |

| Inflation (Control Variable) | Infl | The annual percentage change in the price of the average consumer’s goods basket | −ve | WDI |

| Life Expectancy (Control Variable) | Lexpec | Life expectancy of individuals in years | Ambiguous | WDI |

| Schooling Attain. (Control Variable) | Schooling | Average years of schooling for those above 25 years old | +ve | Barro and Lee (2010) & Human Development Report |

| Investment (Control Variable) | Inv | Share of investment in GDP | +ve | WDI |

| Military Expend. (Control Variable) | Military | Share of military expenditure as a percentage of GDP | Ambiguous | WDI |

| Price of Invest. Goods (Control Variable) | POI | Price level of investment goods relative to the US prices | −ve | Penn World Table (PWT) 9 (Feenstra et al. 2015) |

| Trade Openness (Control Variable) | Openness | The share of trade in GDP | +ve | WDI |

| Rule of Law (Control Variable) | RLW | The perception of individuals to the extent of confidence in rules, enforcement of contracts, courts and police. It takes the value between −2.5 and +2.5 | +ve | Worldwide Governance Indicators |

| Democracy (Control Variable) | Democ | Democracy index expresses the quality of democracies as a number between 0 and 100 | Ambiguous | EIU |

| Variable | Obs. | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| Growth | 229 | 2.53 | 2.37 | −6.81 | 10.88 |

| GDPPCt−5 | 229 | 17,040.42 | 19,269.65 | 232.78 | 91,549.04 |

| Infl | 223 | 6.12 | 13.00 | −0.49 | 174.21 |

| Lexpec | 228 | 73.84 | 7.35 | 44.57 | 84.81 |

| Schooling | 229 | 9.27 | 2.88 | 1.25 | 14.10 |

| Inv | 228 | 0.23 | 0.06 | 0.06 | 0.43 |

| Military | 215 | 2.06 | 1.35 | 0.36 | 9.97 |

| POI | 227 | 0.63 | 0.25 | 0.11 | 1.54 |

| Openness | 226 | 83.63 | 56.96 | 13.75 | 396.04 |

| RWL | 229 | 0.18 | 1.00 | −1.75 | 2.04 |

| Democ | 227 | 61.42 | 20.21 | 18.74 | 98.80 |

| Trust | 232 | 24.91 | 16.36 | 2.10 | 73.90 |

| MENA_Trust | 232 | 3.07 | 8.79 | 0 | 50.50 |

| DvlgAfr_Trust | 232 | 1.01 | 3.79 | 0 | 25.30 |

| DvlgAm_Trust | 232 | 1.75 | 4.82 | 0 | 24.60 |

| Transition_Trust | 232 | 2.79 | 7.56 | 0 | 40.00 |

| Dvlpd_Trust | 232 | 11.33 | 19.54 | 0 | 73.90 |

| MENAW4_Trust | 232 | 1.13 | 6.57 | 0 | 50.50 |

| MENAW5_Trust | 232 | 0.50 | 3.61 | 0 | 38.60 |

| MENAW6_Trust | 232 | 1.06 | 4.79 | 0 | 38.50 |

| MENAW7_Trust | 232 | 0.37 | 2.18 | 0 | 15.90 |

| Democ2 | 227 | 0.58 | 0.50 | 0 | 1.00 |

| Democ2_Trust | 227 | 15.96 | 19.36 | 0 | 73.90 |

| GDPPCt−5 | Infl | Lexpec | Schooling | Inv | Military | POI | Openness | RWL | Democ | Trust | e1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDPPCt−5 | 1.00 | |||||||||||

| Infl | −0.21 | 1.00 | ||||||||||

| Lexpec | 0.59 | −0.40 | 1.00 | |||||||||

| Schooling | 0.56 | −0.19 | 0.65 | 1.00 | ||||||||

| Inv | 0.22 | −0.11 | 0.36 | 0.11 | 1.00 | |||||||

| Military | −0.16 | 0.14 | −0.06 | −0.09 | −0.02 | 1.00 | ||||||

| POI | 0.72 | −0.23 | 0.50 | 0.64 | −0.01 | −0.21 | 1.00 | |||||

| Openness | 0.10 | −0.09 | 0.24 | 0.29 | 0.22 | −0.03 | −0.03 | 1.00 | ||||

| RWL | 0.81 | −0.30 | 0.65 | 0.60 | 0.32 | −0.12 | 0.63 | 0.22 | 1.00 | |||

| Democ | 0.66 | −0.24 | 0.55 | 0.57 | 0.13 | −0.35 | 0.59 | 0.06 | 0.77 | 1.00 | ||

| Trust | 0.63 | −0.13 | 0.39 | 0.32 | 0.19 | −0.05 | 0.47 | 0.06 | 0.55 | 0.34 | 1.00 | |

| e1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 |

| GDPPCt−5 | Infl | Lexp | Scho | Inv | Milit | POI | Open | RWL | Dem | Trust | MENA Trust | DvgAfr Trust | DvgAm Trust | Tran Trust | Dvlpd Trust | e2 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDPPCt−5 | 1.00 | ||||||||||||||||

| Infl | −0.21 | 1.00 | |||||||||||||||

| Lexpec | 0.59 | −0.40 | 1.00 | ||||||||||||||

| Schooling | 0.56 | −0.19 | 0.65 | 1.00 | |||||||||||||

| Inv | 0.22 | −0.11 | 0.36 | 0.11 | 1.00 | ||||||||||||

| Military | −0.16 | 0.14 | −0.06 | −0.09 | −0.02 | 1.00 | |||||||||||

| POI | 0.72 | −0.23 | 0.50 | 0.64 | −0.01 | −0.21 | 1.00 | ||||||||||

| Openness | 0.10 | −0.09 | 0.24 | 0.29 | 0.22 | −0.03 | −0.03 | 1.00 | |||||||||

| RWL | 0.81 | −0.30 | 0.65 | 0.60 | 0.32 | −0.12 | 0.63 | 0.22 | 1.00 | ||||||||

| Democ | 0.66 | −0.24 | 0.55 | 0.57 | 0.13 | −0.35 | 0.59 | 0.06 | 0.77 | 1.00 | |||||||

| Trust | 0.63 | −0.13 | 0.39 | 0.32 | 0.19 | −0.05 | 0.47 | 0.06 | 0.55 | 0.34 | 1.00 | ||||||

| MENA_Trust | −0.15 | 0.08 | −0.10 | −0.34 | 0.03 | 0.39 | −0.31 | −0.08 | −0.22 | −0.43 | 0.09 | 1.00 | |||||

| DvgAfr_Trust | −0.16 | 0.23 | −0.70 | −0.37 | −0.19 | −0.14 | −0.08 | −0.19 | −0.21 | −0.20 | −0.16 | −0.10 | 1.00 | ||||

| DvgAm_Trust | −0.16 | 0.05 | 0.06 | −0.14 | −0.13 | −0.18 | 0.00 | −0.21 | −0.14 | 0.12 | −0.23 | −0.13 | −0.10 | 1.00 | |||

| Transition_Trust | −0.21 | 0.07 | −0.08 | 0.24 | −0.19 | 0.10 | −0.01 | 0.13 | −0.28 | −0.28 | −0.04 | −0.13 | −0.10 | −0.14 | 1.00 | ||

| Dvlpd_Trust | 0.85 | −0.19 | 0.53 | 0.58 | 0.12 | −0.21 | 0.73 | 0.06 | 0.79 | 0.71 | 0.73 | −0.21 | −0.16 | −0.22 | −0.21 | 1.00 | |

| e2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | GDPPCt−5 | 1.00 | |||||||||||||||||||

| 2 | Infl | −0.21 | 1.00 | ||||||||||||||||||

| 3 | Lexpec | 0.59 | −0.40 | 1.00 | |||||||||||||||||

| 4 | Schooling | 0.56 | −0.19 | 0.65 | 1.00 | ||||||||||||||||

| 5 | Inv | 0.22 | −0.11 | 0.36 | 0.11 | 1.00 | |||||||||||||||

| 6 | Military | −0.16 | 0.14 | −0.06 | −0.09 | −0.02 | 1.00 | ||||||||||||||

| 7 | POI | 0.72 | −0.23 | 0.50 | 0.64 | −0.01 | −0.21 | 1.00 | |||||||||||||

| 8 | Openness | 0.10 | −0.09 | 0.24 | 0.29 | 0.22 | −0.03 | −0.03 | 1.00 | ||||||||||||

| 9 | RWL | 0.81 | −0.30 | 0.65 | 0.60 | 0.32 | −0.12 | 0.63 | 0.22 | 1.00 | |||||||||||

| 10 | Democ | 0.66 | −0.24 | 0.55 | 0.57 | 0.13 | −0.35 | 0.59 | 0.06 | 0.77 | 1.00 | ||||||||||

| 11 | Trust | 0.63 | −0.13 | 0.39 | 0.32 | 0.19 | −0.05 | 0.47 | 0.06 | 0.55 | 0.34 | 1.00 | |||||||||

| 12 | DvgAfr_Trust | −0.16 | 0.23 | −0.70 | −0.37 | −0.19 | −0.14 | −0.08 | −0.19 | −0.21 | −0.20 | −0.16 | 1.00 | ||||||||

| 13 | DvgAm_Trust | −0.16 | 0.05 | 0.06 | −0.14 | −0.13 | −0.18 | 0.00 | −0.21 | −0.14 | 0.12 | −0.23 | −0.10 | 1.00 | |||||||

| 14 | Transition_Trust | −0.21 | 0.07 | −0.08 | 0.24 | −0.19 | 0.10 | −0.01 | 0.13 | −0.28 | −0.28 | −0.04 | −0.10 | −0.14 | 1.00 | ||||||

| 15 | Dvlpd_Trust | 0.85 | −0.19 | 0.53 | 0.58 | 0.12 | −0.21 | 0.73 | 0.06 | 0.79 | 0.71 | 0.73 | −0.16 | −0.22 | −0.21 | 1.00 | |||||

| 16 | MENAW4_Trust | −0.10 | 0.05 | −0.08 | −0.20 | 0.07 | 0.28 | −0.22 | −0.09 | −0.10 | −0.25 | 0.16 | −0.05 | −0.07 | −0.07 | −0.11 | 1.00 | ||||

| 17 | MENAW5_Trust | −0.10 | 0.06 | −0.06 | −0.12 | 0.00 | 0.14 | −0.11 | 0.00 | −0.12 | −0.17 | 0.02 | −0.04 | −0.05 | −0.05 | −0.08 | −0.03 | 1.00 | |||

| 18 | MENAW6_Trust | −0.02 | −0.01 | −0.05 | −0.23 | −0.05 | 0.16 | −0.12 | −0.01 | −0.12 | −0.25 | −0.01 | −0.06 | −0.08 | −0.08 | −0.12 | −0.04 | −0.03 | 1.00 | ||

| 19 | MENAW7_Trust | −0.09 | 0.05 | 0.04 | −0.05 | −0.01 | 0.14 | −0.13 | −0.02 | −0.11 | −0.18 | −0.13 | −0.05 | −0.07 | −0.07 | −0.11 | −0.03 | −0.03 | −0.04 | 1.00 | |

| 20 | e3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 |

| GDPPCt−5 | Infl | Lexpec | Schooling | Inv | Military | POI | Openness | RWL | Trust | Democ2 Trust | e4 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDPPCt−5 | 1.00 | |||||||||||

| Infl | −0.21 | 1.00 | ||||||||||

| Lexpec | 0.59 | −0.40 | 1.00 | |||||||||

| Schooling | 0.56 | −0.19 | 0.65 | 1.00 | ||||||||

| Inv | 0.22 | −0.11 | 0.36 | 0.11 | 1.00 | |||||||

| Military | −0.16 | 0.14 | −0.06 | −0.09 | −0.02 | 1.00 | ||||||

| POI | 0.72 | −0.23 | 0.50 | 0.64 | −0.01 | −0.21 | 1.00 | |||||

| Openness | 0.10 | −0.09 | 0.24 | 0.29 | 0.22 | −0.03 | −0.03 | 1.00 | ||||

| RWL | 0.81 | −0.30 | 0.65 | 0.60 | 0.32 | −0.12 | 0.63 | 0.22 | 1.00 | |||

| Trust | 0.63 | −0.13 | 0.39 | 0.32 | 0.19 | −0.05 | 0.47 | 0.06 | 0.55 | 1.00 | ||

| Democ2_Trust | 0.77 | −0.18 | 0.51 | 0.54 | 0.13 | −0.27 | 0.65 | 0.04 | 0.78 | 0.72 | 1.00 | |

| e4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 |

References

- Acheboune, Amale, and Ahmed Driouchi. 2014. Unemployment Persistence, Risks of Skill Obsolescence, and Impacts on the Knowledge Economy in Arab Countries. In Knowledge-Based Economic Policy Development in the Arab World. Hershey: IGI Global, pp. 273–91. [Google Scholar]

- Aghion, Philippe, Yann Algan, and Pierre Cahuc. 2011. Can policy affect culture? Minimum wage and the quality of labor relations. The Journal of the European Economic Association 9: 3–42. [Google Scholar] [CrossRef]

- Alesina, Alberto, Sule Özler, Nouriel Roubini, and Phillip Swagel. 1996. Political stability and economic growth. Journal of Economic Growth 1: 189–211. [Google Scholar] [CrossRef]

- Algan, Yann. 2018. Trust and Social Capital. In For Good Measure: Advancing Research on Well-being Metrics Beyond GDP. Edited by Joseph Stiglitz, Jean-Paul Fitoussi and Martine Durand. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Algan, Yann, and Pierre Cahuc. 2010. Inherited trust and growth. The American Economic Review 100: 2060–92. [Google Scholar] [CrossRef]

- Algan, Yann, and Pierre Cahuc. 2014. Trust, growth and well-being: New evidence and policy implications. In Handbook of Economic Growth. Edited by Philippe Aghion and Steven Durlauf. Amsterdam: Elsevier, vol. 2, pp. 49–120. [Google Scholar]

- Arrow, Kenneth. 1972. Gifts and exchanges. Philosophy and Public Affairs 1: 343–62. [Google Scholar]

- Arab Barometer. 2020. Survey Data on Egypt from AB Wave II (2010–2011) and AB Wave V (2018–2019). Available online: www.arabbarometer.org/survey-data/ (accessed on 17 February 2021).

- Arora, Suchit. 2001. Health, human productivity, and long-term economic growth. The Journal of Economic History 61: 699–749. [Google Scholar]

- Barro, Robert. 1991. Economic growth in a cross section of countries. The Quarterly Journal of Economics 106: 407–43. [Google Scholar] [CrossRef]

- Barro, Robert. 1995. Inflation and Economic Growth. Working Paper No. w5326. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Barro, Robert. 2003. Determinants of economic growth in a panel of countries. Annals of Economics and Finance 4: 231–74. [Google Scholar]

- Barro, Robert, and Jong Lee. 1993. International comparisons of educational attainment. Journal of Monetary Economics 32: 363–94. [Google Scholar] [CrossRef]

- Barro, Robert, and Jong Lee. 1994. Sources of economic growth. Carnegie-Rochester Conference Series on Public Policy 40: 1–46. [Google Scholar] [CrossRef]

- Barro, Robert, and Jong Lee. 2010. A New Data Set of Educational Attainment in the World, 1950–2010. Journal of Development Economics 104: 184–98. [Google Scholar] [CrossRef]

- Bellet, Clement, Jan-Emmanuel De Neve, and George Ward. 2020. Does Employee Happiness Have an Impact on Productivity? London: Centre for Economic Performance, LSE. [Google Scholar]

- Bertrand, Marianne, and Antoinette Schoar. 2006. The role of family in family firms. The Journal of Economic Perspectives 20: 73–96. [Google Scholar] [CrossRef]

- Beugelsdijk, Sjoerd, and Ton Van Schaik. 2005. Social capital and growth in European regions: An empirical test. European Journal of Political Economy 21: 301–24. [Google Scholar] [CrossRef]

- Bhargava, Alok, Dean Jamison, Lawernce Lau, and Christopher Murray. 2001. Modeling the effects of health on economic growth. Journal of Health Economics 20: 423–40. [Google Scholar] [CrossRef]

- Bjørnskov, Christian. 2006. The multiple facets of social capital. European Journal of Political Economy 22: 22–40. [Google Scholar] [CrossRef]

- Bjørnskov, Christian. 2012. How does social trust affect economic growth? Southern Economic Journal 78: 1346–68. [Google Scholar]

- Bjørnskov, Christian, and Pierre Méon. 2013. Is trust the missing root of institutions, education, and development? Public Choice 157: 641–69. [Google Scholar] [CrossRef]

- Blanchard, Olivier, and Andrei Shleifer. 2001. Federalism with and without Political Centralization, China Versus Russia. IMF Papers 48: 171–79. [Google Scholar]

- Blomstrom, Mangus, Robert Lipsey, and Mario Zejan. 1996. What explains the growth of developing countries? In Convergence of Productivity: Cross-National Studies and Historical Evidence. New York: Oxford University Press, pp. 243–59. [Google Scholar]

- Bloom, David, David Canning, and Pia Malaney. 2000. Population dynamics and economic growth in Asia. Population and Development Review 26: 257–90. [Google Scholar]

- Bloom, Nicholas, Raffaela Sadun, and John Van Reenen. 2012. The organization of firms across countries. The Quarterly Journal of Economics 127: 1663–1705. [Google Scholar] [CrossRef]

- Bruno, Michael, and William Easterly. 1995. Inflation crises and long-run growth. Journal of Monetary Economics 41: 3–26. [Google Scholar] [CrossRef]

- Chletsos, Michael, and Christos Kollias. 1995. The demand for Turkish military expenditure 1960–1992. Cyprus Journal of Economics 8: 64–74. [Google Scholar]

- CIA (Central Intelligence Agency). 2021. The World Factbook, Countries, Iraq. Available online: https://www.cia.gov/the-world-factbook/countries/iraq/#economy (accessed on 18 February 2021).

- Clague, Christopher, Philip Keefer, Stephen Knack, and Mancur Olson. 1996. Property and contract rights in autocracies and democracies. Journal of Economic Growth 1: 243–76. [Google Scholar] [CrossRef]

- Clague, Christopher, Philip Keefer, Stephen Knack, and Mancur Olson. 1999. Contract-intensive money: Contract enforcement, property rights, and economic performance. Journal of economic growth 4: 185–211. [Google Scholar] [CrossRef]

- Coase, Ronald. 1990. The Firm, the Market and the Law. Chicago: University of Chicago Press. [Google Scholar]

- Coleman, James. 1988. Social capital in the creation of human capital. American Journal of Sociology 94: S95–S120. [Google Scholar] [CrossRef]

- Cui, Wei. 2017. Social trust, institution, and economic growth: Evidence from China. Emerging Markets Finance and Trade 53: 1243–1261. [Google Scholar] [CrossRef]

- De Groot, Henri, Gert-Jan Linders, Piet Rietveld, and Uma Subramanian. 2004. The institutional determinants of bilateral trade patterns. Kyklos 57: 103–23. [Google Scholar] [CrossRef]

- De Long, Baradford, and Lawerence Summers. 1991. Equipment investment and economic growth. The Quarterly Journal of Economics 106: 445–502. [Google Scholar] [CrossRef]

- De Long, Bradford, and Lawerence Summers. 1993. How strongly do developing economies benefit from equipment investment? Journal of Monetary Economics 32: 395–415. [Google Scholar] [CrossRef]

- Dearmon, Jacob, and Kevin Grier. 2009. Trust and development. Journal of Economic Behavior and Organization 71: 210–20. [Google Scholar] [CrossRef]

- Dearmon, Jacob, and Kevin Grier. 2011. Trust and the accumulation of physical and human capital. European Journal of Political Economy 27: 507–19. [Google Scholar] [CrossRef]

- Dincer, Oguzhan, and Eric Uslaner. 2010. Trust and Growth. Public Choice 142: 59–67. [Google Scholar] [CrossRef]

- Diwan, Ishac. 2016. Economic Growth after the Arab Spring. Analysis and Opinions—Project Syndicate. Belfer Center. Harvard Kennedy School. Available online: https://www.belfercenter.org/publication/economic-growth-after-arab-spring (accessed on 17 February 2021).

- Dunne, Paul, and Dimitrios Vougas. 1999. Military spending and economic growth in South Africa: A causal analysis. Journal of Conflict Resolution 43: 521–37. [Google Scholar] [CrossRef]

- Dunne, Paul, Eftychia Nikolaidou, and Ron Smith. 2002. Military spending, investment and economic growth in small industrialising economies. South African Journal of Economics 70: 789–808. [Google Scholar] [CrossRef]

- Economic Intelligence Unit. 2020. Democracy Indices Dataset—v3. London: Economic Intelligence Unit. [Google Scholar]

- El-Katiri, Laura, Bassam Fattouh, and Richard Mallinson. 2014. The Arab Uprisings and MENA Political Instability–Implications for Oil & Gas Markets. MEP8. Oxford: Oxford Institute for Energy Studies. [Google Scholar]

- Feenstra, Robert, Robert Inklaar, and Marcel P. Timmer. 2015. The Next Generation of the Penn World Table. American Economic Review 105: 3150–82. [Google Scholar] [CrossRef]

- Frankel, Jeffrey, and David Romer. 1999. Does trade cause growth? American Economic Review 893: 379–99. [Google Scholar] [CrossRef]

- Fukuyama, F. 1995. Trust: The Social Virtues and the Creation of Prosperity. New York: Free Press. [Google Scholar]

- Gokal, Vikesh, and Subrina Hanif. 2004. Relationship between Inflation and Economic Growth. Working Paper. Suva: Economics Department, Reserve Bank of Fiji. [Google Scholar]

- Grossman, Gene, and Elhanan Helpman. 1991. Innovation and Growth in the World Economy. Cambridge: Harvard University Press. [Google Scholar]

- Haggard, Stephan. 1997. Democratic institutions and economic policy. In Institutions and Economic Development. Edited by Christopher Clague. Baltimore: Johns Hopkins University Press. [Google Scholar]

- Hardin, Russell. 2002. Trust and Trustworthiness. New York: Russell Sage Foundation. [Google Scholar]

- Horváth, Roman. 2013. Does Trust Promote Growth? Journal of Comparative Economics 41: 777–88. [Google Scholar] [CrossRef]

- Inglehart, R., C. Haerpfer, A. Moreno, C. Welzel, K. Kizilova, J. Diez-Medrano, M. Lagos, P. Norris, E. Ponarin, and B. Puranen, eds. 2014–2020. World Values Survey: Round Four, Five, Six and Seven—Country-Pooled Datafile. Madrid: JD Systems Institute, Available online: http://www.worldvaluessurvey.org/WVSDocumentationWV7.jsp and www.worldvaluessurvey.org/WVSDocumentationWV4/5/6/7.jsp. (accessed on 8 September 2020). [Google Scholar]

- Kasmaoui, Kamal, Mazhar Mughal, and Jamal Bouoiyour. 2018. Does Trust Influence Economic Growth? Evidence from the Arab World. Economics Bulletin 38: 880–91. [Google Scholar]

- Katz, Harvey, and Julian Rotter. 1969. Interpersonal trust scores of college students and their parents. Child Development 40: 657–61. [Google Scholar] [CrossRef]

- Knack, Stephen. 2001. Trust, Associational Life, and Economic Performance. Working Paper. Munich: University Library of Munich. [Google Scholar]

- Knack, Stephen. 2002. Social Capital and the Quality of Government: Evidence from the US States. American Journal of Political Science 46: 772–85. [Google Scholar] [CrossRef]

- Knack, Stephen, and Philip Keefer. 1995. Institutions and economic performance: Cross-country tests using alternative institutional measures. Economics and Politics 7: 207–27. [Google Scholar] [CrossRef]

- Knack, Stephen, and Philip Keefer. 1997. Does social capital have an economic payoff? A cross-country investigation. The Quarterly Journal of Economics 112: 1251–88. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert Vishny. 1997. Trust in Large Organizations. The American Economic Review, 333–38. [Google Scholar]

- Lopes, Thiago, and Miguel Rivera-Castro. 2018. Democracy, Trust and Economic Growth. The Empirical Economics Letters 16: 1277–86. [Google Scholar]

- Lundmark, Sebastian, Mikael Gilljam, and Stefan Dahlberg. 2016. Measuring generalized trust: An examination of question wording and the number of scale points. Public Opinion Quarterly 80: 26–43. [Google Scholar] [CrossRef]

- Mankiw, Gregory, David Romer, and David Weil. 1992. A contribution to the empirics of economic growth. The Quarterly Journal of Economics 107: 407–37. [Google Scholar] [CrossRef]

- Naufal, George, and Carlos Vargas-Silva. 2010. Migrant transfers in the MENA region: A two way street in which traffic is changing. Migration Letters 7: 168–78. [Google Scholar] [CrossRef]

- Nelson, Richard, and Edmund Phelps. 1966. Investment in humans, technological diffusion, and economic growth. The American Economic Review 56: 69–75. [Google Scholar]

- OECD. 2017. OECD Guidelines on Measuring Trust. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Olson, Mancur. 1982. The Rise and Decline of Nations. New Haven: Yale University Press. [Google Scholar]

- Ostrom, Elinor. 1990. Governing the Commons. Cambridge: Cambridge University Press. [Google Scholar]

- Peiró-Palomino, Jesus, and Emili Tortosa-Ausina. 2013. Can trust effects on development be generalized? A response by quantile. European Journal of Political Economy 32: 377–90. [Google Scholar] [CrossRef]

- Persson, Perotti, and Guido Tabellini. 1992. Growth, distribution and politics. European Economic Review 36: 593–602. [Google Scholar] [CrossRef]

- Putnam, Robert. 2000. Bowling Alone: The Collapse and Revival of American Community. New York: Simon and Schuster. [Google Scholar]

- Ram, Rati. 1989. Government size and economic growth: A new framework and some evidence from cross-section and time-series data: Reply. The American Economic Review 79: 281–84. [Google Scholar]

- Ramsey, Frank. 1928. A mathematical theory of saving. The Economic Journal 38: 543–59. [Google Scholar] [CrossRef]

- Rao, Vaman. 1984. Democracy and economic development. Studies on Competitive International Development 19: 67–81. [Google Scholar] [CrossRef]

- Rice, Tom, and Jan Feldman. 1997. Civic culture and democracy from Europe to America. The Journal of Politics 59: 1143–72. [Google Scholar] [CrossRef]

- Roth, Felix. 2009. Does too much trust hamper economic growth? Kyklos 62: 103–28. [Google Scholar] [CrossRef]

- Rothstein, Bo, and Dietlind Stolle. 2008. The state and social capital: An institutional theory of generalized trust. Comparative Politics 40: 441–67. [Google Scholar] [CrossRef]

- Sachs, Jeffrey, and Andrew Warner. 1995. Natural Resource Abundance and Economic Growth. Working Paper No. w5398. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Sachs, Jeffrey, and Andrew Warner. 1997. Fundamental sources of long-run growth. The American Economic Review 87: 184–88. [Google Scholar]

- Schmidt, Katja. 2003. Is Trust Important for Economic Development and Growth? Berlin Disponível Science and Politics 28: 664–83. [Google Scholar]

- Solow, Robert. 1956. A contribution to the theory of economic growth. The Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Spierings, Niels. 2019. Social Trust in the Middle East and North Africa: The Context-Dependent Impact of Citizens’ Socio-Economic and Religious Characteristics. European Sociological Review 35: 894–911. [Google Scholar] [CrossRef]

- Tavares, Jose, and Romain Wacziarg. 2001. How democracy affects growth. European Economic Review 45: 1341–78. [Google Scholar] [CrossRef]

- Taylor, Alan. 1994. Domestic Saving and International Capital Flows Reconsidered. Working Paper No. 4892. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Temple, Jonathan. 2001. Generalizations that aren’t? Evidence on education and growth. European Economic Review 45: 905–18. [Google Scholar] [CrossRef]

- Uslaner, Eric. 2008. The foundations of trust: Macro and micro. Cambridge Journal of Economics 32: 289–94. [Google Scholar] [CrossRef]

- Uslaner, Eric. 2012. Generalized Trust Questions. In Improving Public Opinion Surveys: Interdisciplinary Innovation and the American National Election Studies. Edited by John H. Aldrich and Kathleen M. McGraw. Princeton: Princeton University Press, pp. 101–14. [Google Scholar]

- Uslaner, Eric. 2015. Measuring generalized trust: In defense of the ‘standard’ question. In Handbook of Research Methods on Trust. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Volland, Benjamin. 2010. Trust, Confidence and Economic Growth: An Evaluation of the Beugelsdijk Hypothesis. Jena Economic Research Papers 2010,080. Jena: Friedrich Schiller University Jena and Max Planck Institute of Economics. [Google Scholar]

- Whitely, Paul. 2000. Economic growth and social capital. Political Studies 48: 443–66. [Google Scholar] [CrossRef]

- World Bank. 2018. World Development Indicators. Washington: World Bank. [Google Scholar]

- Zak, Paul, and Stephen Knack. 2001. Trust and growth. The Economic Journal 111: 295–321. [Google Scholar] [CrossRef]

| Dependent Var. | Coef. | Coef. | Coef. | Coef. | ||||

|---|---|---|---|---|---|---|---|---|

| Growth | (1) | (2) | (3) | (4) | ||||

| GDPPCt−5 | −0.0001 | *** | −0.0001 | *** | −0.0001 | *** | −0.0001 | *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| Infl | −0.0580 | *** | −0.0535 | *** | −0.0528 | *** | −0.0556 | *** |

| (0.0113) | (0.0113) | (0.0112) | (0.0113) | |||||

| Lexpec | −0.0949 | *** | −0.0802 | * | −0.0625 | −0.0969 | *** | |

| (0.0298) | (0.0442) | (0.0443) | (0.0293) | |||||

| Schooling | 0.1784 | ** | 0.0925 | 0.0737 | 0.1971 | *** | ||

| (0.0771) | (0.0905) | (0.0900) | (0.0762) | |||||

| Inv | 5.9858 | ** | 4.5016 | * | 3.5803 | 5.2405 | ** | |

| (2.4689) | (2.5154) | (2.4999) | (2.4505) | |||||

| Military | −0.2577 | ** | −0.2070 | * | −0.2131 | * | −0.3131 | *** |

| (0.1123) | (0.1162) | (0.1146) | (0.1082) | |||||

| POI | −0.8394 | −0.7602 | −0.8042 | −0.8440 | ||||

| (0.9451) | (1.0087) | (1.0018) | (0.9341) | |||||

| Openness | 0.0037 | 0.0017 | 0.0017 | 0.0026 | ||||

| (0.0033) | (0.0033) | (0.0033) | (0.0033) | |||||

| RWL | 0.5417 | * | 0.6808 | ** | 0.6656 | ** | 0.7282 | ** |

| (0.3178) | (0.3296) | (0.3254) | (0.2951) | |||||

| Democ | −0.0090 | −0.0105 | −0.0162 | |||||

| (0.0124) | (0.0138) | (0.0138) | ||||||

| Trust | 0.0429 | *** | 0.0607 | *** | 0.0547 | *** | 0.0602 | *** |

| (0.0107) | (0.0139) | (0.0139) | (0.0124) | |||||

| MENA_Trust | −0.0667 | *** | ||||||

| (0.0191) | ||||||||

| DvlgAfr_Trust | −0.0389 | −0.0367 | ||||||

| (0.0615) | (0.0610) | |||||||

| DvlgAm_Trust | −0.0489 | −0.0581 | ||||||

| (0.0355) | (0.0352) | |||||||

| Transition_Trust | 0.0056 | 0.0017 | ||||||

| (0.0250) | (0.0248) | |||||||

| Dvlpd_Trust | −0.0335 | * | −0.0336 | * | ||||

| (0.0196) | (0.0193) | |||||||

| MENAW4_Trust | −0.0528 | ** | ||||||

| (0.0222) | ||||||||

| MENAW5_Trust | −0.0213 | |||||||

| (0.0361) | ||||||||

| MENAW6_Trust | −0.1206 | *** | ||||||

| (0.0307) | ||||||||

| MENAW7_Trust | −0.1721 | *** | ||||||

| (0.0616) | ||||||||

| Democ2_Trust | −0.0350 | ** | ||||||

| (0.0152) | ||||||||

| _cons | 8.4658 | *** | 8.6085 | *** | 8.2073 | *** | 8.2871 | *** |

| (2.0514) | (3.1239) | (3.1027) | (1.9170) | |||||

| Number of obs. | 214 | 214 | 214 | 214 | ||||

| F (11, 202) = | 10.38 | F (16, 197) = 8.62 | F (19, 194) = 7.96 | F (11, 202) = 11.06 | ||||

| Prob > F | 0 | 0 | 0 | 0 | ||||

| R-squared | 0.36 | 0.41 | 0.44 | 0.38 | ||||

| Adj R-squared | 0.33 | 0.36 | 0.38 | 0.34 | ||||

| Root MSE | 1.94 | 1.88 | 1.85 | 1.92 | ||||

| a | c | d | ||||||

| Variable | VIF | 1/VIF | Variable | VIF | 1/VIF | Variable | VIF | 1/VIF |

| RWL | 5.52 | 0.18 | Dvlpd_Trust | 9.09 | 0.11 | Democ2_Trust | 10.11 | 0.10 |

| GDPPCt−5 | 4.39 | 0.23 | Lexpec | 6.48 | 0.15 | RWL | 4.90 | 0.20 |

| Democ | 3.48 | 0.29 | RWL | 6.32 | 0.16 | GDPPCt−5 | 4.54 | 0.22 |

| POI | 3.08 | 0.32 | GDPPCt−5 | 5.33 | 0.19 | Democ2 | 4.11 | 0.24 |

| Schooling | 2.77 | 0.36 | Democ | 4.71 | 0.21 | Trust | 3.89 | 0.26 |

| Lexpec | 2.68 | 0.37 | Schooling | 4.13 | 0.24 | POI | 3.24 | 0.31 |

| Trust | 1.78 | 0.56 | POI | 3.78 | 0.26 | Schooling | 2.86 | 0.35 |

| Inv | 1.40 | 0.72 | Trust | 3.27 | 0.31 | Lexpec | 2.75 | 0.36 |

| Openness | 1.33 | 0.75 | DvlgAfr_Trust | 3.13 | 0.32 | Inv | 1.41 | 0.71 |

| Military | 1.31 | 0.77 | Transition_Trust | 2.09 | 0.48 | Openness | 1.34 | 0.75 |

| Infl | 1.28 | 0.78 | DvlgAm_Trust | 1.78 | 0.56 | Infl | 1.29 | 0.78 |

| Mean VIF | 2.64 | Inv | 1.57 | 0.64 | Military | 1.29 | 0.78 | |

| Military | 1.49 | 0.67 | Mean VIF | 3.48 | ||||

| MENAW4_Trust | 1.43 | 0.70 | ||||||

| b | Openness | 1.39 | 0.72 | e | ||||

| Variable | VIF | 1/VIF | MENAW6_Trust | 1.36 | 0.73 | Variable | VIF | 1/VIF |

| Dvlpd_Trust | 9.02 | 0.11 | Infl | 1.35 | 0.74 | Democ2_Trust | 4.95 | 0.20 |

| RWL | 6.28 | 0.16 | MENAW7_Trust | 1.21 | 0.83 | RWL | 4.87 | 0.21 |

| Lexpec | 6.25 | 0.16 | MENAW5_Trust | 1.14 | 0.88 | GDPPCt−5 | 4.43 | 0.23 |

| GDPPCt−5 | 5.18 | 0.19 | Mean VIF | 3.21 | POI | 3.08 | 0.32 | |

| Democ | 4.60 | 0.22 | Schooling | 2.77 | 0.36 | |||

| Schooling | 4.05 | 0.25 | Lexpec | 2.65 | 0.38 | |||

| POI | 3.71 | 0.27 | Trust | 2.45 | 0.41 | |||

| Trust | 3.17 | 0.32 | Inv | 1.41 | 0.71 | |||

| DvlgAfr_Trust | 3.09 | 0.32 | Openness | 1.32 | 0.75 | |||

| Transition_Trust | 2.07 | 0.48 | Infl | 1.29 | 0.78 | |||

| MENA_Trust | 1.80 | 0.56 | Military | 1.24 | 0.81 | |||

| DvlgAm_Trust | 1.75 | 0.57 | Mean VIF | 2.77 | ||||

| Inv | 1.54 | 0.65 | ||||||

| Military | 1.48 | 0.68 | ||||||

| Openness | 1.38 | 0.73 | ||||||

| Infl | 1.34 | 0.74 | ||||||

| Mean VIF | 3.54 | |||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miniesy, R.S.; AbdelKarim, M. Generalized Trust and Economic Growth: The Nexus in MENA Countries. Economies 2021, 9, 39. https://doi.org/10.3390/economies9010039

Miniesy RS, AbdelKarim M. Generalized Trust and Economic Growth: The Nexus in MENA Countries. Economies. 2021; 9(1):39. https://doi.org/10.3390/economies9010039

Chicago/Turabian StyleMiniesy, Rania S., and Mariam AbdelKarim. 2021. "Generalized Trust and Economic Growth: The Nexus in MENA Countries" Economies 9, no. 1: 39. https://doi.org/10.3390/economies9010039

APA StyleMiniesy, R. S., & AbdelKarim, M. (2021). Generalized Trust and Economic Growth: The Nexus in MENA Countries. Economies, 9(1), 39. https://doi.org/10.3390/economies9010039