Earnings Management in Frontier Market: Do Institutional Settings Matter?

Abstract

1. Introduction

2. Related Literature and Hypothesis Development

2.1. Accruals Earnings Management

2.2. Characteristics of Frontier Markets

2.3. Institutional Setting Variables

2.3.1. Minority Investor Rights

2.3.2. Legal Enforcement

2.3.3. Disclosure Requirements

2.3.4. Analysts Following

2.4. Culture Effect

2.4.1. Societal Trust

3. Research Design and Hypothesis Development

3.1. Sample and Data Selection

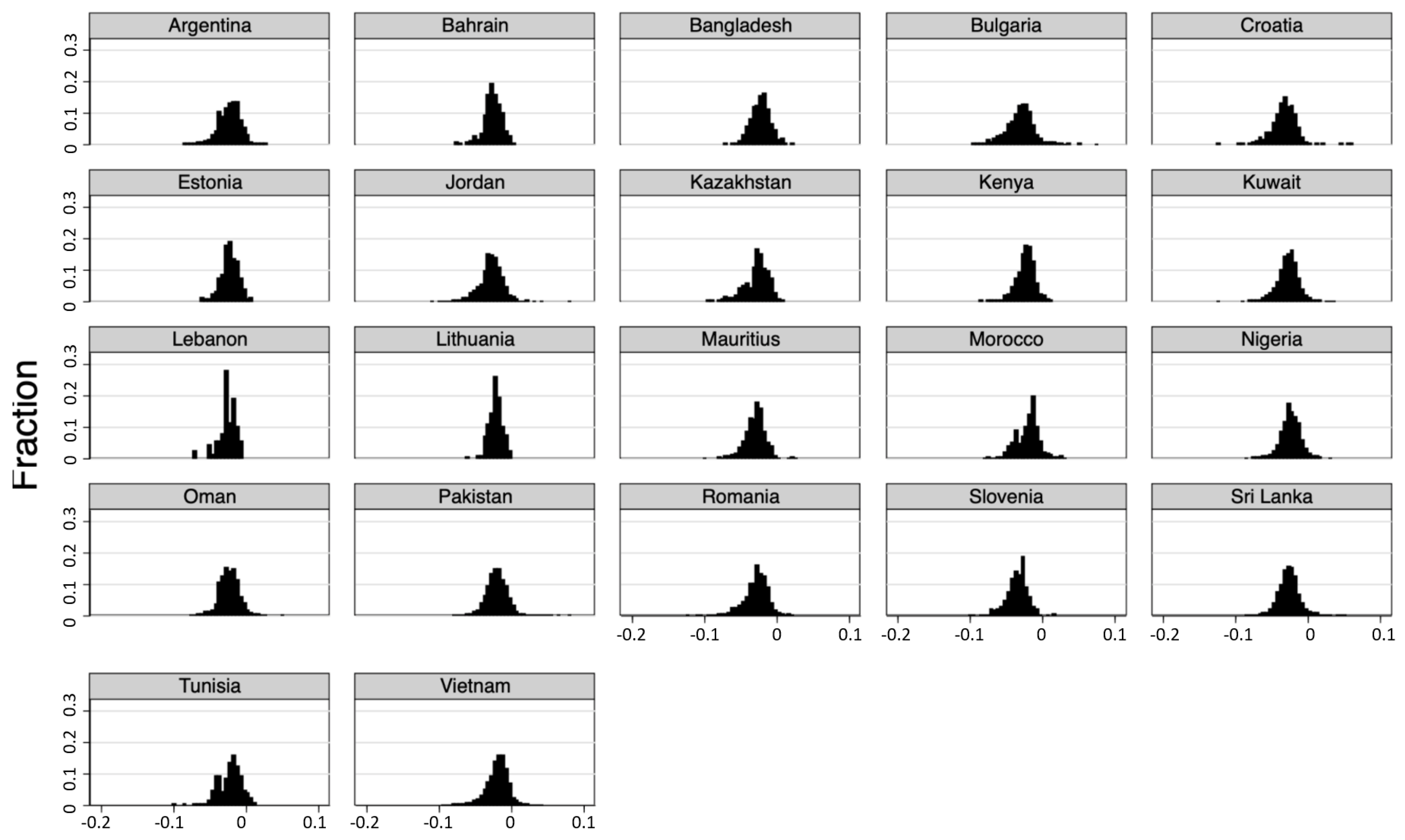

3.2. Accrual Earnings Management Detection Methods

3.2.1. The Leuz Model Described

3.2.2. The Yoon Model Described

3.2.3. The Kothari Model Described

3.3. Regression Models

4. Empirical Results

4.1. Descriptive Statistics

4.2. Regression Results

5. Robustness Checks

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Description |

|---|---|

| Firm-level | |

| Assets | Long-term assets and items of both current and non-current assets) |

| Accounts Receivables | Gross receivables less allowance for doubtful accounts |

| Revenue | Revenues from the sale of merchandise goods, manufactured products and services, |

| Property Plant & Equipment | Property/Plant/Equipment, Total items assumed to be used for operations |

| Return on Assets | Measure of management’s effectiveness in using assets to generate earnings. Generally obtained using Ordinary Profit , divided by Total Assets |

| Trade Receivables | Trade Receivables, receivables from the sale of merchandise or services provided to affiliates or other related companies |

| Expense | Selling/General/Administrative Expense, the operating costs of running a business other than the costs of readying products or services for sale |

| Trade payables | Trade Payable, payables for the receipt of merchandise or services provided to affiliates or other related companies |

| Pension | Pension, all incomes and expenses associated with the company’s pension plan. |

| Current assets | Total Current Assets, the sum of Cash and Short Term Investment, Total Receivables, Net Total Inventory, Prepaid Expenses, and Other Current Assets, |

| Cash | Cash and cash equivalent |

| Current Liabilities | Total Current Liabilities, liabilities incurred from operating activities and expected to be due within one year. |

| Short term debt | Short-Term Debt, short-term bank borrowings. It also represents notes payable that are issued to suppliers and other short-term interest-bearing liabilities |

| Taxes payable | Taxes Payable, represents changes in taxes payable during the period. |

| Deprecation | Depreciation and amortisation |

| Accruals | Accruals, measured as the change in current assets minus the change in current liabilities minus depreciation expense as per Dechow et al. (1995) |

| Cash flow from operations | Cash From Operating Activities |

| Firm Control Variable | |

| Analyst Following | Calculated as the natural log plus one of the number of analysts following a stock. Source: Thomson Reuters Datastream |

| Book to market ratio | Calculated as the quotient of the book value of equity by the market value of equity |

| Leverage | Calculated as the quotient of total assets by total liabilities |

| Size | Calculated as the natural logarithm of the market value of equity |

| Year Dummies | Year Dummy variables for each year in the study |

| Industry Dummies | Industry dummy variables for each industry in the study |

| Country-Level | |

| Legal Enforcement | Source: WDI’s Governance Indicators and Transparency International |

| Disclosure Requirements | Source: WDI’s Worldwide Extent of Business Disclosure Index. |

| Minority Investors Rights | Source: World Economic Forum Global Corruption Index on the Strength of Investor Protection |

| Societal Trust | Source: World Values Survey |

| Country Control Variables | |

| Big-4 | The percentage of firms that employ a Big4 auditing firm |

| IFRS adoption | A dichotomous variable of 1 if the country has adopted IFRS, 0 otherwise. Source: IFRS.org |

| GDP per Capita | Log of GDP per capita (constant 2005 US$). Source: WDI. |

| GDP growth rate | Rate of change in real GDP: Source |

| Trade openness | Trade openness 100 (Exports + imports/GDP. Source: WDI |

References

- Ahmed, Farhan, Afzal Ahmed, and Sahabia Kanwal. 2018. Mergers and acquisitions in selected frontier markets of Asia. Signifikan: Jurnal Ilmu Ekonomi 7: 123–36. [Google Scholar] [CrossRef]

- Alareeni, Bahaaeddin, and Omar Aljuaidi. 2014. The modified jones and yoon models in detecting earnings management in palestine exchange (pex). International Journal of Innovation and Applied Studies 9: 1472. [Google Scholar]

- Alfraih, Mishari M. 2016. Have financial statements lost their relevance? Empirical evidence from the frontier market of Kuwait. Journal of Advances in Management Research 13: 225–39. [Google Scholar] [CrossRef]

- Ali, Usman, Muhammad Noor, Muhammad Kashif Khurshid, and Akhtar Mahmood. 2015. Impact of firm size on earnings management: A study of textile sector of Pakistan. European Journal of Business and Management 7: 28. [Google Scholar] [CrossRef]

- Alzoubi, Ebraheem Saleem Salem. 2016a. Audit quality and earnings management: Evidence from jordan. Journal of Applied Accounting Research 17: 170–89. [Google Scholar] [CrossRef]

- Alzoubi, Ebraheem Saleem Salem. 2016b. Disclosure quality and earnings management: Evidence from jordan. Accounting Research Journal 29: 429–56. [Google Scholar] [CrossRef]

- Anagnostopoulou, Seraina C., and Andrianos E Tsekrekos. 2017. The effect of financial leverage on real and accrual-based earnings management. Accounting and Business Research 47L: 191–236. [Google Scholar]

- Arnold, David J., and John A. Quelch. 1998. New strategies in emerging markets. MIT Sloan Management Review 40: 7. [Google Scholar]

- Atwi, Leila, Assem Safieddine, and Sheridan Titman. 2017. Investor protection and governance in the valuation of emerging markets investments. Journal of Applied Corporate Finance 29: 89–100. [Google Scholar] [CrossRef]

- Bao, Ben-Hsien, and Da-Hsien Bao. 2004. Income smoothing, earnings quality and firm valuation. Journal of Business Finance & Accounting 31: 1525–57. [Google Scholar]

- Barton, Jan, and Paul J Simko. 2002. The balance sheet as an earnings management constraint. The Accounting Review 77: 1–27. [Google Scholar] [CrossRef]

- Baumöhl, Eduard, and Štefan Lyócsa. 2014. Volatility and dynamic conditional correlations of worldwide emerging and frontier markets. Economic Modelling 38: 175–83. [Google Scholar] [CrossRef]

- Bekiris, Fivos V., and Leonidas C. Doukakis. 2011. Corporate governance and accruals earnings management. Managerial and Decision Economics 32: 439–56. [Google Scholar] [CrossRef]

- Berger, Dave, Kuntara Pukthuanthong, and J. Jimmy Yang. 2011. International diversification with frontier markets. Journal of Financial Economics 101: 227–42. [Google Scholar] [CrossRef]

- Bhattacharyya, Sambit. 2012. Trade liberalization and institutional development. Journal of Policy Modeling 34: 253–69. [Google Scholar] [CrossRef]

- Bley, Jorg, and Mohsen Saad. 2012. Idiosyncratic risk and expected returns in frontier markets: Evidence from gcc. Journal of International Financial Markets, Institutions and Money 22: 538–54. [Google Scholar] [CrossRef]

- Boonlert-U-Thai, Kriengkrai, Gary K. Meek, and Sandeep Nabar. 2006. Earnings attributes and investor-protection: International evidence. The International Journal of Accounting 41: 327–57. [Google Scholar] [CrossRef]

- Bozanic, Zahn, Jing Chen, and Michael J. Jung. 2019. Analyst contrarianism. Journal of Financial Reporting 4: 61–88. [Google Scholar] [CrossRef]

- Burgstahler, David, and Ilia Dichev. 1997. Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics 24: 99–126. [Google Scholar] [CrossRef]

- Cai, Guilong, Wenfei Li, and Zhenyang Tang. 2020. Religion and the method of earnings management: Evidence from China. Journal of Business Ethics 161: 71–90. [Google Scholar] [CrossRef]

- Callen, Jeffrey L., Mindy Morel, and Grant Richardson. 2011. Do culture and religion mitigate earnings management? Evidence from a cross-country analysis. International Journal of Disclosure and Governance 8: 103–21. [Google Scholar] [CrossRef]

- Capkun, Vedran, Dan Collins, and Thomas Jeanjean. 2016. The effect of ias/ifrs adoption on earnings management (smoothing): A closer look at competing explanations. Journal of Accounting and Public Policy 35: 352–94. [Google Scholar] [CrossRef]

- Chan, Lilian H., Kevin C. W. Chen, Tai Yuan Chen, and Yangxin Yu. 2014. Substitution between real and accruals-based earnings management after voluntary adoption of compensation clawback provisions. The Accounting Review 90: 147–74. [Google Scholar] [CrossRef]

- Chapple, Larelle, Keitha Dunstan, and Thu Phuong Truong. 2018. Corporate governance and management earnings forecast behaviour. Pacific Accounting Review 30: 222–42. [Google Scholar] [CrossRef]

- Chen, Clara Chia Sheng, Yan-Yu Chou, and Peihwang Wei. 2020. Country factors in earnings management of adr firms. Finance Research Letters 32: 101146. [Google Scholar] [CrossRef]

- Chen, Mei-Ping, Pei-Fen Chen, and Chien-Chiang Lee. 2014. Frontier stock market integration and the global financial crisis. The North American Journal of Economics and Finance 29: 84–103. [Google Scholar] [CrossRef]

- Chen, Shihua, Wanying Cai, and Khalil Jebran. 2019. Does social trust mitigate earnings management? Evidence from china. Emerging Markets Finance and Trade 55: 1–22. [Google Scholar] [CrossRef]

- Chen, Wei, Paul Hribar, and Samuel Melessa. 2018. Incorrect inferences when using residuals as dependent variables. Journal of Accounting Research 56: 751–96. [Google Scholar] [CrossRef]

- Chen, Xia, Qiang Cheng, Ying Hao, and Qiang Liu. 2020. Gdp growth incentives and earnings management: Evidence from china. Review of Accounting Studies 25: 1–38. [Google Scholar] [CrossRef]

- Chui, Andy C. W., Alison E. Lloyd, and Chuck C. Y. Kwok. 2002. The determination of capital structure: Is national culture a missing piece to the puzzle? Journal of International Business Studies 33: 99–127. [Google Scholar] [CrossRef]

- Chung, Kee H., and Hao Zhang. 2011. Corporate governance and institutional ownership. Journal of Financial and Quantitative Analysis 46: 247–73. [Google Scholar] [CrossRef]

- Coën, A., and A. Desfleurs. 2016. Another look at financial analysts’ forecasts accuracy: Recent evidence from eastern european frontier markets. In Handbook of Frontier Markets. Amsterdam: Elsevier, pp. 171–89. [Google Scholar]

- Cornett, Marcia Millon, Alan J. Marcus, and Hassan Tehranian. 2008. Corporate governance and pay-for-performance: The impact of earnings management. Journal of Financial Economics 87: 357–73. [Google Scholar] [CrossRef]

- Crittenden, Carl A., and William F. Crittenden. 2014. The accounting profession’s role in corporate governance in frontier markets: A research agenda. Organizations and Markets in Emerging Economies 5: 7–22. [Google Scholar] [CrossRef]

- Cui, Wei. 2017. Social trust, institution, and economic growth: Evidence from China. Emerging Markets Finance and Trade 53: 1243–61. [Google Scholar] [CrossRef]

- De Jong, Abe, Gerard Mertens, Marieke van der Poel, and Ronald van Dijk. 2014. How does earnings management influence investor’s perceptions of firm value? Survey evidence from financial analysts. Review of Accounting Studies 19: 606–27. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Richard G. Sloan, and Amy P. Sweeney. 1995. Detecting earnings management. Accounting Review 70: 193–225. [Google Scholar]

- Deltuvaitė, Vilma, and Lina Sinevičienė. 2014. Research on the relationship between the structure of financial system and economic development. Procedia-Social and Behavioral Sciences 156: 533–37. [Google Scholar]

- Dimitras, Augustinos I., Maria I. Kyriakou, and George Iatridis. 2015. Financial crisis, gdp variation and earnings management in Europe. Research in International Business and Finance 34: 338–54. [Google Scholar] [CrossRef]

- Dong, Wang, Hongling Han, Yun Ke, and Kam C. Chan. 2018. Social trust and corporate misconduct: Evidence from China. Journal of Business Ethics 151: 539–62. [Google Scholar] [CrossRef]

- Doupnik, Timothy S., and George T. Tsakumis. 2004. A critical review of tests of gray’s theory of cultural relevance and suggestions for future research. Journal of Accounting Literature 23: 1. [Google Scholar]

- El-Helaly, Moataz, Nermeen F Shehata, and Reem El-Sherif. 2018. National corporate governance, gmi ratings and earnings management. Asian Review of Accounting 26: 373–90. [Google Scholar] [CrossRef]

- Enomoto, Masahiro, Fumihiko Kimura, and Tomoyasu Yamaguchi. 2015. Accrual-based and real earnings management: An international comparison for investor protection. Journal of Contemporary Accounting & Economics 11: 183–98. [Google Scholar]

- Enomoto, Masahiro, Fumihiko Kimura, and Tomoyasu Yamaguchi. 2018. A cross-country study on the relationship between financial development and earnings management. Journal of International Financial Management & Accounting 29: 166–94. [Google Scholar]

- Esty, Benjamin C., and William L Megginson. 2003. Creditor rights, enforcement, and debt ownership structure: Evidence from the global syndicated loan market. Journal of Financial and Quantitative Analysis 38: 37–59. [Google Scholar] [CrossRef]

- Fan, Joseph P. H., K. C. John Wei, and Xinzhong Xu. 2011. Corporate finance and governance in emerging markets: A selective review and an agenda for future research. Journal of Corporate Finance 17: 207–214. [Google Scholar] [CrossRef]

- Festinger, Leon. 1954. A theory of social comparison processes. Human Relations 7: 117–40. [Google Scholar] [CrossRef]

- Gilliam, Thomas A., Frank Heflin, and Jeffrey S. Paterson. 2015. Evidence that the zero-earnings discontinuity has disappeared. Journal of Accounting and Economics 60: 117–32. [Google Scholar] [CrossRef]

- Girard, Eric, and Amit Sinha. 2008. Risk and return in the next frontier. Journal of Emerging Market Finance 7: 43–80. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. [Google Scholar] [CrossRef]

- Guan, Yuyan, Gerald J. Lobo, Albert Tsang, and Xiangang Xin. 2020. Societal trust and management earnings forecasts. The Accounting Review 95: 149–84. [Google Scholar] [CrossRef]

- Guesmi, Khaled, and Duc Khuong Nguyen. 2011. How strong is the global integration of emerging market regions? An empirical assessment. Economic Modelling 28: 2517–27. [Google Scholar] [CrossRef]

- Haidar, Jamal Ibrahim. 2009. Investor protections and economic growth. Economics Letters 103: 1–4. [Google Scholar] [CrossRef]

- Hayn, Carla. 1995. The information content of losses. Journal of Accounting and Economics 20: 125–53. [Google Scholar] [CrossRef]

- Ho, Kung-Cheng, Huang-Ping Yen, Yan Gu, and Lisi Shi. 2020. Does societal trust make firms more trustworthy? Emerging Markets Review 42: 100674. [Google Scholar] [CrossRef]

- Hoang, Khanh Mai Thi, and Thu Anh Phung. 2019. The effect of financial leverage on real and accrual-based earnings management in vietnamese firms. Economics & Sociology 12: 299–333. [Google Scholar]

- Hofstede, Geert. 1980. Motivation, leadership, and organization: Do american theories apply abroad? Organizational Dynamics 9: 42–63. [Google Scholar] [CrossRef]

- Hong, Yongtao, Fariz Huseynov, and Wei Zhang. 2014. Earnings management and analyst following: A simultaneous equations analysis. Financial Management 43: 355–90. [Google Scholar] [CrossRef]

- Hoskisson, Robert E, Mike Wright, Igor Filatotchev, and Mike W Peng. 2013. Emerging multinationals from mid-range economies: The influence of institutions and factor markets. Journal of Management Studies 50: 1295–321. [Google Scholar] [CrossRef]

- Hsiao, Daniel F., Yan Hu, and Jerry W. Lin. 2016. The earnings management opportunity for us oil and gas firms during the 2011 arab spring event. Pacific Accounting Review 28: 71–91. [Google Scholar] [CrossRef]

- Hutchison, Michael M. 2002. European banking distress and emu: Institutional and macroeconomic risks. Scandinavian Journal of Economics 104: 365–89. [Google Scholar] [CrossRef]

- Hye, Qazi Muhammad Adnan, Shahida Wizarat, and Wee-Yeap Lau. 2016. The impact of trade openness on economic growth in China: An empirical analysis. The Journal of Asian Finance, Economics, and Business 3: 27–37. [Google Scholar] [CrossRef]

- InvestmentFrontier. 2017. Frontier Stock Market Correlations for 2017—Investment Frontier. Available online: https://www.investmentfrontier.com/2017/06/05/frontier-stock-market-correlations-2017/ (accessed on 26 July 2020).

- Ippoliti, Roberto, Alessandro Melcarne, and Giovanni B Ramello. 2015. The impact of judicial efficiency on entrepreneurial action: A European perspective. Economic Notes: Review of Banking, Finance and Monetary Economics 44: 57–74. [Google Scholar] [CrossRef]

- Islam, Md Aminul, Ruhani Ali, and Zamri Ahmad. 2011. Is modified jones model effective in detecting earnings management? Evidence from a developing economy. International Journal of Economics and Finance 3: 116. [Google Scholar] [CrossRef]

- Jones, Jennifer J. 1991. Earnings management during import relief investigations. Journal of Accounting Review 29: 193–228. [Google Scholar] [CrossRef]

- Kanagaretnam, Kiridaran, Gerald J. Lobo, Chen Ma, and Jian Zhou. 2016. National culture and internal control material weaknesses around the world. Journal of Accounting, Auditing & Finance 31: 28–50. [Google Scholar]

- Khanna, Tarun. 2014. Contextual intelligence. Harvard Business Review 32: 58–68. [Google Scholar]

- Kim, Jeong-Bon, and Byungcherl Charlie Sohn. 2011. Real versus Accrual-Based Earnings Management and Implied Cost of Equity Capital. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1297938 (accessed on 26 July 2020).

- Kim, Jeong-Bon, and Cheong H. Yi. 2006. Ownership structure, business group affiliation, listing status, and earnings management: Evidence from Korea. Contemporary Accounting Research 23: 427–64. [Google Scholar] [CrossRef]

- Kothari, S. P., Natalie Mizik, and Sugata Roychowdhury. 2012. Managing for the Moment: The Role of Real Activity versus Accruals Earnings Management in Seo Valuation. Technical Report, Working Paper. Available online: https://olin.wustl.edu/docs/Faculty/ROYCHOWDHURY.pdf (accessed on 2 October 2020).

- Kothari, Sagar P., Andrew J. Leone, and Charles E. Wasley. 2005. Performance matched discretionary accrual measures. Journal of Accounting and Economics 39: 163–97. [Google Scholar] [CrossRef]

- Krishnan, Gopal V. 2003. Audit quality and the pricing of discretionary accruals. Auditing: A Journal of Practice & Theory 22: 109–26. [Google Scholar]

- Kutz, Matthew R., and Anita Bamford-Wade. 2014. Approaches to Managing Organizational Diversity and Innovation. Hershey: IGI Global, pp. 579–98. [Google Scholar]

- Kwok, Chuck C. Y., and Solomon Tadesse. 2006. National culture and financial systems. Journal of International Business Studies 37: 227–47. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de Silanes, Andrei Shleifer, and Robert Vishny. 2002. Investor protection and corporate valuation. The Journal of Finance 57: 1147–70. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de Silanes, Andrei Shleifer, and Robert W Vishny. 1997. Legal determinants of external finance. The Journal of Finance 52: 1131–50. [Google Scholar] [CrossRef]

- Lang, Mark, and Mark Maffett. 2011. Transparency and liquidity uncertainty in crisis periods. Journal of Accounting and Economics 52: 101–25. [Google Scholar] [CrossRef]

- Lee, Hsien-Li, and Hua Lee. 2015. Effect of information disclosure and transparency ranking system on mispricing of accruals of Taiwanese firms. Review of Quantitative Finance and Accounting 44: 445–71. [Google Scholar] [CrossRef]

- Lemma, Tesfaye Taddese, Ayalew Lulseged, Mthokozisi Mlilo, and Minga Negash. 2019. Political stability, political rights and earnings management: Some international evidence. Accounting Research Journal 33: 57–74. [Google Scholar] [CrossRef]

- Leuz, Christian, Dhananjay Nanda, and Peter D. Wysocki. 2003. Earnings management and investor protection: An international comparison. Journal of Financial Economics 69: 505–27. [Google Scholar] [CrossRef]

- Levine, Ross, Norman Loayza, and Thorsten Beck. 2000. Financial intermediation and growth: Causality and causes. Journal of Monetary Economics 46: 31–77. [Google Scholar] [CrossRef]

- Lin, Fengyi, and Sheng-Fu Wu. 2014. Comparison of cosmetic earnings management for the developed markets and emerging markets: Some empirical evidence from the united states and Taiwan. Economic Modelling 36: 466–73. [Google Scholar] [CrossRef]

- Lobo, Gerald J., and Jian Zhou. 2001. Disclosure quality and earnings management. Asia-Pacific Journal of Accounting & Economics 8: 1–20. [Google Scholar]

- Ma, Jianyu, Jose A. Pagan, and Yun Chu. 2009. Abnormal returns to mergers and acquisitions in ten Asian stock markets. International Journal of Business 14: 235–50. [Google Scholar]

- Ma, Lingjie, and Larry Pohlman. 2008. Return forecasts and optimal portfolio construction: A quantile regression approach. The European Journal of Finance 14: 409–25. [Google Scholar] [CrossRef]

- Ma, Shiguang, and Liangbo Ma. 2017. The association of earnings quality with corporate performance. Pacific Accounting Review 29: 397–422. [Google Scholar] [CrossRef]

- Man, Chi Keung, and Brossa Wong. 2013. Corporate governance and earnings management: A survey of literature. Journal of Applied Business Research. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3003835 (accessed on 2 October 2020).

- Martens, Wil, Prem W. S. Yapa, and Maryam Safari. 2020. The impact of financial statement comparability on earnings management: Evidence from frontier markets. International Journal of Financial Studies 8: 73. [Google Scholar] [CrossRef]

- Miranda, Kleber F., Marcio A. V. Machado, and Luciana A. F. Macedo. 2018. Investor sentiment and earnings management: Does analysts’ monitoring matter? RAM. Revista de Administração Mackenzie 19: 2–29. [Google Scholar] [CrossRef]

- Mohti, Wahbeeah, Andreia Dionísio, Isabel Vieira, and Paulo Ferreira. 2019. Financial contagion analysis in frontier markets: Evidence from the us subprime and the eurozone debt crises. Physica A: Statistical Mechanics and Its Applications 525: 1388–98. [Google Scholar] [CrossRef]

- Mostafa, Wael. 2017. The impact of earnings management on the value relevance of earnings: Empirical evidence from egypt. Managerial Auditing Journal 32: 50–74. [Google Scholar] [CrossRef]

- MSCI. 2020. Msci Frontier Markets Index. Available online: https://www.msci.com/documents/10199/f9354b32-04ac-4c7e-b76e-460848afe026 (accessed on 20 January 2021).

- Odell, Jamieson, and Usman Ali. 2016. Esg investing in emerging and frontier markets. Journal of Applied Corporate Finance 28: 96–101. [Google Scholar]

- Pae, Jinhan. 2005. Expected accrual models: The impact of operating cash flows and reversals of accruals. Review of Quantitative Finance and Accounting 24: 5–22. [Google Scholar] [CrossRef]

- Papanastasopoulos, Georgios, and Emmanuel Tsiritakis. 2015. The accrual anomaly in Europe: The role of accounting distortions. International Review of Financial Analysis 41: 176. [Google Scholar] [CrossRef]

- Patel, Sandeep A, Amra Balic, and Liliane Bwakira. 2002. Measuring transparency and disclosure at firm-level in emerging markets. Emerging Markets Review 3: 325–37. [Google Scholar] [CrossRef]

- Persakis, Anthony, and George Emmanuel Iatridis. 2016. Audit quality, investor protection and earnings management during the financial crisis of 2008: An international perspective. Journal of International Financial Markets, Institutions and Money 41: 73–101. [Google Scholar] [CrossRef]

- Pincus, Morton, Shivaram Rajgopal, and Mohan Venkatachalam. 2007. The accrual anomaly: International evidence. The Accounting Review 82: 169–203. [Google Scholar] [CrossRef]

- Pucheta-Martínez, María Consuelo, and Emma García-Meca. 2014. Institutional investors on boards and audit committees and their effects on financial reporting quality. Corporate Governance: An International Review 22: 347–63. [Google Scholar] [CrossRef]

- Reddy, Kotapati Srinivasa, Vinay Kumar Nangia, and Rajat Agrawal. 2013. Indian economic-policy reforms, bank mergers, and lawful proposals: The ex-ante and ex-post ‘lookup’. Journal of Policy Modeling 35: 601–22. [Google Scholar] [CrossRef]

- Reimann, Mathias. 2000. Beyond national systems: A comparative law for the international age. Tulane Law Review 75: 1103. [Google Scholar]

- Saona, Paolo, and Laura Muro. 2018. Firm-and country-level attributes as determinants of earnings management: An analysis for Latin American firms. Emerging Markets Finance and Trade 54: 2736–64. [Google Scholar] [CrossRef]

- Scholtens, Bert, and Feng-Ching Kang. 2013. Corporate social responsibility and earnings management: Evidence from Asian economies. Corporate Social Responsibility and Environmental Management 20: 95–112. [Google Scholar] [CrossRef]

- Shawtari, Fekri Ali, Milad Abdelnabi Salem, Hafezali Iqbal Hussain, Omar Alaeddin, and Omer Bin Thabit. 2016. Corporate governance characteristics and valuation: Inferences from quantile regression. Journal of Economics, Finance and Administrative Science 21: 81–88. [Google Scholar] [CrossRef]

- Shen, Chung-Hua, and Hsiang-Lin Chih. 2005. Investor protection, prospect theory, and earnings management: An international comparison of the banking industry. Journal of Banking & Finance 29: 2675–97. [Google Scholar]

- Siregar, Sylvia Veronica, and Sidharta Utama. 2008. Type of earnings management and the effect of ownership structure, firm size, and corporate-governance practices: Evidence from Indonesia. The International Journal of Accounting 43: 1–27. [Google Scholar] [CrossRef]

- Sloan, Richard G. 1996. Do stock prices fully reflect information in accruals and cash flows about future earnings? Accounting Review 71: 289–315. [Google Scholar]

- Sohn, Byungcherl Charlie. 2016. The effect of accounting comparability on the accrual-based and real earnings management. Journal of Accounting and Public Policy 35: 513–39. [Google Scholar] [CrossRef]

- Stulz, Rene M., and Rohan Williamson. 2003. Culture, openness, and finance. Journal of Financial Economics 70: 313–49. [Google Scholar] [CrossRef]

- Subramanyam, K. R. 1996. The pricing of discretionary accruals. Journal of Accounting and Economics 22: 249–81. [Google Scholar] [CrossRef]

- Tang, HuiWen, Anlin Chang, and Chong-Chuo Chen. 2013. Insider trading, accrual abuse, and corporate governance in emerging markets—Evidence from Taiwan. Pacific-Basin Finance Journal 24: 132–55. [Google Scholar] [CrossRef]

- Wang, Yacan, Yu Wang, Luyao Xie, and Huiyu Zhou. 2018. Impact of perceived uncertainty on public acceptability of congestion charging: An empirical study in China. Sustainability 11: 129. [Google Scholar] [CrossRef]

- Watts, Ross L., and Jerold L. Zimmerman. 1986. Impact of perceived uncertainty on public acceptability of congestion charging: An empirical study in China. In Positive Accounting Theory. Upper Saddle River: Prentice-Hill. Available online: https://ssrn.com/abstract=928677 (accessed on 2 October 2020).

- Wijayana, Singgih, and Sidney J Gray. 2019. Institutional factors and earnings management in the Asia-Pacific: Is ifrs adoption making a difference? Management International Review 59: 307–34. [Google Scholar] [CrossRef]

- Williams, C., A. Colovic, and J. Zhu. 2017. Earnings management involves using managerial discretion to distort firm financial performance. Journal of World Business 52: 798–808. [Google Scholar]

- Wiprächtiger, David, Gopalakrishnan Narayanamurthy, Roger Moser, and Tuhin Sengupta. 2019. Access-based business model innovation in frontier markets: Case study of shared mobility in timor-leste. Technological Forecasting and Social Change 143: 224–38. [Google Scholar] [CrossRef]

- Wu, Shih-Wei, Fengyi Lin, and Wenchang Fang. 2012. Earnings management and investor’s stock return. Emerging Markets Finance and Trade 48: 129–40. [Google Scholar] [CrossRef]

- Xie, Biao, Wallace N. Davidson, III, and Peter J. DaDalt. 2003. Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance 9: 295–316. [Google Scholar] [CrossRef]

- Yoon, Soon Suk, Gary Miller, and Pornsit Jiraporn. 2006. Earnings management vehicles for korean firms. Journal of International Financial Management & Accounting 17: 85–109. [Google Scholar]

- Yu, Fang Frank. 2008. Analyst coverage and earnings management. Journal of Financial Economics 88: 245–71. [Google Scholar] [CrossRef]

- Zhang, Joseph H. 2018. Accounting comparability, audit effort, and audit outcomes. Contemporary Accounting Research 35: 245–76. [Google Scholar] [CrossRef]

- Zhu, Tingting, Meiting Lu, Yaowen Shan, and Yuanlong Zhang. 2015. Accrual-based and real activity earnings management at the back door: Evidence from Chinese reverse mergers. Pacific-Basin Finance Journal 35: 317–39. [Google Scholar] [CrossRef]

| 1 | Frontier market median correlation with US and EU markets are 0.54 and 0.39, respectively (InvestmentFrontier 2017). |

| 2 | Table 1 provides a breakdown of this study’s respective countries’ correlation figures with US and European (EU) markets. |

| 3 | As opposed to the cash component of income. |

| 4 | examples include: investor protection, political risks, firm and, management factors, laws, market mechanisms, and regulations. |

| 5 | relative to those governed by common law. |

| 6 | institutional character, physical geography, market dynamics, infrastructure, and educational norms. |

| 7 | Data was taken in USD for all years and countries. |

| 8 | Serbia, a frontier market country, was excluded due to periods of hyperinflation. |

| 9 | scaling the score neutralises the effect of country size on the aggregate measure of AEM. |

| 10 | The sum of cost of goods sold and selling and general administrative expenses, excluding non-cash expenses. |

| 11 | Dubin-Wu-Hausman endogeneity test rejects that null of the instrument variables beings exogenous at an alpha of 0.10. |

| 12 | Multicollinearity was ruled out via a variance inflation factor (VIF) test showing factors less than 2.2 for all AEM proxies. |

| Country | Minority Investor Rights | Legal Enforcement | Disclosure Index | Analyst Following | Societal Trust | GDP Change (%) | GPD per Capita | Inflation Change (%) | Trade Openness | Big-4 Ratio (%) | Correlation to US Markets | Correlation to EU Markets |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Argentina | 6.0 | 3.3 | 7 | 2.0 | 4.1 | 2.5 | 9455 | 14.4 | 33.1 | 40.1 | 0.30 | 0.40 |

| Bahrain | 4.8 | 6.0 | 8 | 5.5 | 6.9 | 4.6 | 22,649 | 2.0 | 149.4 | 0.5 | 0.15 | 0.16 |

| Bangladesh | 5.3 | 4.1 | 6 | 0.0 | 4.8 | 3.6 | 734 | 7.2 | 37.8 | 13.7 | −0.05 | −0.19 |

| Bulgaria | 7.2 | 5.1 | 10 | 13.3 | 5.1 | 3.3 | 6306 | 3.5 | 115.9 | 63.2 | 0.15 | 0.15 |

| Croatia | 6.5 | 5.6 | 3 | 4.5 | 3.9 | 1.4 | 13,535 | 1.9 | 85.9 | 95.8 | 0.36 | 0.25 |

| Estonia | 5.5 | 7.9 | 8 | 0.6 | 8.1 | 3.2 | 15,267 | 3.2 | 145.4 | 36.9 | 0.18 | 0.33 |

| Jordan | 3.7 | 5.5 | 4 | 4.9 | 2.6 | 4.5 | 3353 | 3.7 | 120.6 | 38.2 | 0.18 | 0.09 |

| Kazakhstan | 6.7 | 4.0 | 9 | 11.8 | 7.7 | 5.6 | 7907 | 8.5 | 75.9 | 78.1 | 0.40 | 0.30 |

| Kenya | 4.7 | 3.9 | 3 | 0.6 | 2.0 | 4.8 | 956 | 9.7 | 53.4 | 59.3 | 0.33 | 0.30 |

| Kuwait | 5.7 | 4.8 | 4 | 1.6 | 6.2 | 3.7 | 40,167 | 3.8 | 94.0 | 98.9 | 0.31 | 0.30 |

| Lebanon | 4.3 | 3.6 | 9 | 0.3 | 3.0 | 4.2 | 7339 | 2.4 | 85.1 | 100 | - | - |

| Lithuania | 6.2 | 6.7 | 7 | 0.5 | 5.3 | 3.7 | 12,156 | 2.6 | 133.8 | 87.0 | 0.20 | 0.28 |

| Mauritius | 6.5 | 6.6 | 6 | 11.7 | 0.0 | 4.0 | 7610 | 4.2 | 112.6 | 68.8 | 0.20 | 0.09 |

| Morocco | 5.0 | 4.8 | 6 | 0.6 | 4.8 | 4.3 | 2720 | 1.6 | 74.4 | 37.1 | - | - |

| Nigeria | 6.8 | 2.9 | 7 | 1.0 | 1.6 | 5.8 | 2043 | 11.7 | 47.0 | 26.5 | 0.22 | 0.15 |

| Oman | 4.3 | 6.0 | 8 | 1.4 | 3.8 | 3.6 | 17,946 | 2.6 | 94.5 | 47.2 | 0.30 | 0.07 |

| Pakistan | 6.7 | 3.5 | 6 | 1.2 | 3.9 | 4.3 | 990 | 8.3 | 31.4 | 93.3 | 0.23 | 0.26 |

| Romania | 5.8 | 5.4 | 9 | 4.2 | 0.0 | 3.8 | 7858 | 7.3 | 76.3 | 30.6 | 0.53 | 0.28 |

| Serbia | 5.5 | 4.9 | 4 | 1.2 | 3.4 | 2.5 | 5002 | 8.1 | 85.7 | 27.9 | 0.18 | 0.43 |

| Slovenia | 7.5 | 6.6 | 5 | 4.7 | 3.9 | 1.9 | 22,574 | 2.4 | 131.4 | 28.0 | 0.33 | 0.35 |

| Sri Lanka | 6.0 | 4.6 | 6 | 2.4 | 0.0 | 5.8 | 2719 | 8.2 | 57.7 | 57.6 | 0.20 | 0.15 |

| Tunisia | 5.0 | 4.6 | 4 | 1.0 | 3.4 | 3.1 | 3799 | 3.9 | 98.1 | 17.0 | 0.01 | −0.11 |

| Vietnam | 4.5 | 4.1 | 7 | 1.7 | 3.9 | 6.2 | 1204 | 7.8 | 161.9 | 18.9 | 0.36 | 0.24 |

| Average | 5.7 | 5 | 6.3 | 3.3 | 3.8 | 3.9 | 9317 | 5.6 | 91.4 | 50.6 | 0.24 | 0.20 |

| Median | 5.7 | 4.8 | 6.0 | 1.6 | 3.9 | 3.8 | 7339 | 3.9 | 85.9 | 40.1 | 0.22 | 0.25 |

| Std. Dev | 1.0 | 1.3 | 2.0 | 3.9 | 2.2 | 1.2 | 9449 | 3.5 | 38.1 | 30.1 | 0.13 | 0.16 |

| Sample by Calendar Year | Sample by Country of Listing | Sample by Industry | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | n | % | Country | n | Observations | % | Industry | Observations | % | ||

| 2000 | 332 | 1.07 | Argentina | 85 | 1348 | 4.35 | Chemical Products | 3176 | 10.26 | ||

| 2001 | 570 | 1.84 | Bahrain | 30 | 459 | 1.48 | Communications | 1773 | 5.73 | ||

| 2002 | 759 | 2.45 | Bangladesh | 96 | 704 | 2.27 | Durable goods | 1237 | 3.99 | ||

| 2003 | 1116 | 3.60 | Bulgaria | 255 | 3116 | 10.06 | Electric, gas and sanitary services | 385 | 1.25 | ||

| 2004 | 1421 | 4.59 | Croatia | 90 | 1185 | 3.83 | Electronic Equipment | 468 | 1.51 | ||

| 2005 | 1605 | 5.18 | Estonia | 15 | 214 | 0.69 | Entertainment Services | 605 | 1.95 | ||

| 2006 | 1739 | 5.62 | Jordan | 177 | 2305 | 7.44 | Food Products | 6236 | 20.00 | ||

| 2007 | 1847 | 5.96 | Kazakhstan | 57 | 566 | 1.83 | Health | 942 | 3.04 | ||

| 2008 | 1941 | 6.27 | Kenya | 41 | 630 | 2.03 | Manufacturing | 8551 | 27.61 | ||

| 2009 | 2017 | 6.51 | Kuwait | 165 | 2299 | 7.42 | Oil & Gas | 2237 | 7.22 | ||

| 2010 | 2084 | 6.73 | Lebanon | 6 | 94 | 0.30 | Paper and paper products | 3359 | 10.85 | ||

| 2011 | 2166 | 6.99 | Lithuania | 19 | 247 | 0.80 | Retail | 302 | 0.98 | ||

| 2012 | 2274 | 7.34 | Mauritius | 73 | 728 | 2.35 | Scientific instruments | 739 | 2.39 | ||

| 2013 | 2339 | 7.55 | Morocco | 67 | 961 | 3.10 | Transportation | 959 | 3.10 | ||

| 2014 | 2367 | 7.64 | Nigeria | 147 | 1481 | 4.78 | |||||

| 2015 | 2362 | 7.63 | Oman | 108 | 1634 | 5.28 | |||||

| 2016 | 2377 | 7.68 | Pakistan | 221 | 2910 | 9.40 | |||||

| 2017 | 1653 | 5.34 | Romania | 148 | 1803 | 5.82 | |||||

| Slovenia | 38 | 501 | 1.62 | ||||||||

| Sri Lanka | 258 | 3462 | 11.18 | ||||||||

| Tunisia | 68 | 792 | 2.56 | ||||||||

| Vietnam | 345 | 3530 | 11.40 | ||||||||

| Total | 30,969 | 100 | Total | 2509 | 30,969 | 100 | 30,969 | 100 | |||

| Variable | Mean | Std. Dev | Q1 | Median | Q3 | Min | Max |

|---|---|---|---|---|---|---|---|

| AEM_L | 0.5101 | 0.1671 | 0.3948 | 0.5086 | 0.6250 | 0.0230 | 1.0000 |

| AEM_Y | 0.5100 | 0.2890 | 0.2600 | 0.5088 | 0.7600 | 0.0030 | 1.0000 |

| AEM_K | 0.5101 | 0.2891 | 0.2602 | 0.5091 | 0.7610 | 0.0030 | 1.0000 |

| Analyst Following | 5.1785 | 8.4176 | 1.3665 | 1.9720 | 4.9270 | 0.2930 | 47.7660 |

| Disclosure Requirements | 6.4587 | 2.0042 | 5.0000 | 6.0000 | 8.0000 | 3.0000 | 10.0000 |

| Legal Enforcement | 4.6966 | 0.9561 | 4.0660 | 4.7710 | 5.4060 | 2.8830 | 7.8720 |

| Minority Investors Rights | 5.7057 | 1.0496 | 4.7000 | 5.8000 | 6.7000 | 3.7000 | 7.5000 |

| Societal Trust | 3.4013 | 2.0364 | 2.0000 | 3.9000 | 4.8000 | 0.0000 | 8.1000 |

| Big-4 Auditor Following | 0.5166 | 0.2769 | 0.2800 | 0.4718 | 0.6320 | 0.0050 | 1.0000 |

| GDP Per Captia (log) | 113.9067 | 100.2616 | 46.7000 | 74.8000 | 154.5000 | 6.6000 | 464.3000 |

| GDP Growth (%) | 4.2564 | 3.4025 | 2.5900 | 4.7400 | 6.4200 | −14.8100 | 17.3200 |

| Trade Openness | 91.2884 | 42.1611 | 55.9500 | 88.8600 | 120.5100 | 20.7200 | 200.3100 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| (1) AEM_L | 1 | |||||||

| (2) AEM_Y | 0.485 *** | 1 | ||||||

| (3) AEM_K | 0.476 *** | 0.758 *** | 1 | |||||

| (4) Analysts Following | −0.0198 * | −0.0339 *** | −0.0359 *** | 1 | ||||

| (5) Disclosure Index | −0.268 *** | −0.251 *** | −0.249 *** | 0.0920 *** | 1 | |||

| (6) Legal Enforcement | −0.160 *** | −0.166 *** | −0.168 *** | 0.203 *** | 0.0843 *** | 1 | ||

| (7) Minority Investor Rights | −0.0483 *** | −0.0832 *** | −0.0863 *** | 0.245 *** | 0.310 *** | −0.0907 *** | 1 | |

| (8) Societal Trust | 0.160 *** | 0.138 *** | 0.137 *** | 0.209 *** | 0.137 *** | −0.308 *** | 0.390 *** | 1 |

| Panel A-AEM_L | ||||||

| Constant | 57.4878 *** | 3.6038 | 98.1515 *** | 79.3471 *** | 44.3968 *** | 108.4712 *** |

| (38.4411) | (0.8789) | (16.0532) | (12.0074) | (17.4969) | (11.7814) | |

| Analyst Following | −0.308 ** | −0.0753 | ||||

| (−2.152) | (−0.5474) | |||||

| Disclosure Index | −7.7137 *** | 9.7555 ** | ||||

| (−12.978) | (−16.0529) | |||||

| Legal Enforcement | −9.3783 ** | −11.1189 *** | ||||

| (−7.2708) | (−8.6184) | |||||

| Minority Investor Rights | −4.3545 *** | −13.4551 *** | ||||

| (−3.8141) | (−11.364) | |||||

| Societal Trust | 0.2945 *** | 0.3196 *** | ||||

| (4.5797) | (4.8845) | |||||

| Number of observations | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 |

| R2 (or adjusted R2) | 0.0026 | 0.084 | 0.028 | 0.0079 | 0.0113 | 0.1825 |

| Panel B-AEM_Y | ||||||

| Constant | 57.2011 *** | 5.8752 | 96.3802 *** | 89.1008 *** | 47.198 *** | 118.3319 *** |

| (46.8657) | (1.7765) | (19.3719) | (16.5167) | (22.7636) | (16.3301) | |

| Analyst Following | −0.3786 *** | −0.0617 | ||||

| (−3.1976) | (−0.5676) | |||||

| Disclosure Index | −7.3599 *** | −9.7382 *** | ||||

| (−15.2126) | (−20.416) | |||||

| Legal Enforcement | −9.1133 *** | −11.0163 *** | ||||

| (−8.6823) | (−10.9826) | |||||

| Minority Investor Rights | −6.1755 *** | −14.8405 *** | ||||

| (−6.612) | (−15.9982) | |||||

| Societal Trust | 0.198 *** | 0.248 *** | ||||

| (3.7763) | (4.9479) | |||||

| Number of observations | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 |

| R2 (or adjusted R2) | 0.0053 | 0.1046 | 0.0367 | 0.0216 | 0.0071 | 0.2526 |

| Panel C-AEM_K | ||||||

| Constant | 57.3058 *** | 4.3185 | 96.1639 *** | 89.6948 *** | 47.0118 *** | 118.2039 *** |

| (44.64) | (1.2397) | (18.3453) | (15.8017) | (21.5649) | (15.3851) | |

| Analyst Following | −0.3605 *** | −0.0825 | ||||

| (−2.8946) | (−0.7157) | |||||

| Disclosure Index | −7.6184 *** | −10.0412 *** | ||||

| (−14.9504) | (−19.8546) | |||||

| Legal Enforcement | −9.0377 *** | −11.0182 *** | ||||

| (−8.1723) | (−10.3601) | |||||

| Minority Investor Rights | −6.2564 *** | −15.2311 *** | ||||

| (−6.3662) | (−15.4859) | |||||

| Societal Trust | 0.2072 *** | 0.2615 *** | ||||

| (3.76) | (4.9212) | |||||

| Number of observations | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 | 17,136 |

| R2 (or adjusted R2) | 0.0044 | 0.1014 | 0.0326 | 0.02 | 0.0071 | 0.2398 |

| Pooled OLS Model | Quantile Regression Model | 2SLS Regression Model | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | AEM_L | AEM_Y | AEM_K | AEM_L | AEM_Y | AEM_K | AEM_L | AEM_Y | AEM_K | ||

| Constant | 108.4712 *** | 118.3319 *** | 118.2039 *** | 31.945 *** | 34.383 *** | 34.671 *** | 89.296 *** | 100.592 *** | 101.043 *** | ||

| (11.781) | (16.3301) | (15.3851) | (8.32) | (9.92) | (10.00) | (27.37) | (32.67) | (32.79) | |||

| Analyst Following | −0.0753 | −0.0617 | −0.0825 | −0.071 | −0.124 * | −0.123 * | −0.035 | −0.007 | −0.006 | ||

| (−0.5474) | (−.5676) | (−0.7157) | (−1.11) | (−2.47) | (−2.46) | (−0.64) | (−0.17) | (−0.14) | |||

| Disclosure Index | −9.7555 *** | −9.7382*** | −10.0412 *** | −7.252 *** | −6.935 *** | −6.934 *** | −8.804 *** | −8.830 *** | −8.834 *** | ||

| (−16.0529) | (−20.416) | (−19.8546) | (−29.23) | (−30.80) | (−30.78) | (−41.76) | (−44.15) | (−44.13) | |||

| Legal Enforcement | −11.1189 *** | −11.0163 *** | −11.0182 *** | −4.191 *** | −4.189 *** | −4.239 *** | −8.999 *** | −9.920 *** | −9.953 *** | ||

| ( −8.6184) | (−10.9826) | (−10.3601) | (−7.65) | (−8.43) | (−8.53) | (−19.32) | (−22.49) | (−22.54) | |||

| Minority Rights | −13.4551 *** | −14.8405 *** | −15.2311 *** | −4.880 *** | −4.848 *** | −4.842 *** | −11.339 *** | −12.254 *** | −12.310 *** | ||

| (−11.364) | (−15.9982) | (−15.4859) | (−9.87) | (−10.76) | (−10.74) | (−26.99) | (−30.62) | (−30.73) | |||

| Societal Trust | 0.3196 *** | 0.248 *** | 0.2615 *** | 0.286 *** | 0.237 *** | 0.236 *** | 0.425 *** | 0.369 *** | 0.370 *** | ||

| (4.8845) | (4.9479) | (4.9212) | (9.93) | (9.20) | (9.15) | (17.37) | (16.15) | (16.17) | |||

| N | 17,136 | 17,136 | 17,136 | 15,674 | 17,336 | 17,336 | 15,674 | 17,336 | 17,336 | ||

| adj R2/PseudoR2 | 0.1825 | 0.2526 | 0.2398 | 0.055 | 0.052 | 0.052 | 0.145 | 0.147 | 0.148 | ||

| Pooled OLS Model | Quantile Regression Model | 2SLS Regression Model | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | AEM_L | AEM_Y | AEM_K | AEM_L | AEM_Y | AEM_K | AEM_L | AEM_Y | AEM_K |

| Constant | 47.700 * | 72.748 *** | 75.733 *** | 113.379 *** | 93.995 *** | 87.331 *** | 92.724 *** | 65.091 *** | 60.618 *** |

| (2.49) | (9.79) | (10.23) | (10.91) | (9.10) | (8.88) | (11.63) | (8.04) | (7.43) | |

| Analyst Following | −0.106 | −0.227 *** | −0.254 *** | 0.008 | −0.291 *** | −0.313 *** | − 0.633 *** | −0.475 *** | −0.473 *** |

| (−1.80) | (−4.35) | (−4.88) | (0.09) | (−3.49) | (−3.95) | (−7.91) | (−6.65) | (−6.56) | |

| Disclosure Index | −6.767 *** | −6.925 *** | −7.273 *** | −6.109 *** | −6.855 *** | −7.109 *** | −2.284 *** | −2.466 *** | −2.664 *** |

| (−32.58) | (−34.81) | (−36.68) | (−18.70) | (−21.61) | (−23.53) | (−6.64) | (−7.54) | (−8.08) | |

| Legal Enforcement | −4.827 *** | −5.649 *** | −5.544 *** | −4.354** | −6.292 *** | −6.205 *** | −49.509 *** | −53.212 *** | −54.743 *** |

| (−4.70) | (−5.94) | (−5.85) | (−2.69) | (−4.15) | (−4.30) | (−15.56) | (−17.64) | (−18.01) | |

| Minority Rights | −1.052 * | −1.787 *** | −1.518 ** | −0.795 | −0.178 | −0.108 | −16.110 *** | −18.108 *** | −18.387 *** |

| (−2.09) | (−3.64) | (−3.10) | (−1.00) | (−0.23) | (−0.15) | (−16.00) | (−17.68) | (−17.82) | |

| Societal Trust | 0.179 *** | 0.145 *** | 0.131 *** | 0.182 *** | 0.161 *** | 0.182 *** | 0.973 *** | 0.999 *** | 1.014 *** |

| (5.92) | (5.06) | (4.60) | (3.83) | (3.53) | (4.19) | (16.45) | (17.37) | (17.51) | |

| Big-4 | −38.503 *** | −28.546 *** | −25.823 *** | −36.558 *** | −31.194 *** | −30.668 *** | 14.187 *** | 27.387 *** | 32.004 *** |

| (−15.39) | (−12.15) | (−11.03) | (−9.29) | (−8.33) | (−8.59) | (3.45) | (6.86) | (7.95) | |

| GDP per capita (ln) | −9.409 *** | −8.794 *** | −8.986 *** | 6.085 *** | 5.384 *** | 6.048 *** | −10.664 *** | −12.535 *** | −13.077 *** |

| (−12.42) | (−12.49) | (−12.81) | (5.11) | (4.80) | (5.66) | (−6.72) | (−8.38) | (−8.67) | |

| Trade openness | 0.155 *** | 0.088 *** | 0.060* | 0.091* | 0.046 | 0.025 | 1.001 *** | 0.990 *** | 0.994 *** |

| (6.05) | (3.62) | (2.48) | (2.27) | (1.20) | (0.67) | (16.56) | (17.06) | (16.99) | |

| GDP Growth (%) | −0.797 *** | −0.718 *** | −0.771 *** | −0.634** | −0.752 *** | −0.703 ** | −1.497 *** | −1.693 *** | −1.780 *** |

| (−5.22) | (−5.02) | (−5.41) | (−2.64) | (−3.30) | (−3.24) | (−8.11) | (−9.40) | (−9.80) | |

| Book to Market | −0.006 | −0.011 | −0.013 | 0.005 | −0.002 | −0.039 ** | −0.012 | −0.019 | −0.021 |

| (−0.58) | (−1.15) | (−1.34) | (0.32) | (−0.11) | (−2.60) | (−1.09) | (−1.62) | (−1.78) | |

| IFRS | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Leverage | 0.008 | 0.012 * | 0.016 ** | 0.005 | 0.013 | 0.014 | 0.001 | 0.020 *** | 0.025 *** |

| (1.72) | (2.38) | (3.24) | (0.72) | (1.67) | (1.89) | (0.24) | (3.45) | (4.19) | |

| Size | −2.781 *** | −1.444 *** | − 0.699** | −3.521 *** | − 1.902 *** | −0.780 * | −2.273 *** | − 0.763 ** | −0.005 |

| (−12.52) | (−6.59) | (−3.20) | (−10.08) | (−5.44) | (−2.34) | (−8.79) | (−2.92) | (−0.02) | |

| Industry Dummy | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| Year Dummy | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| Observations | 7193 | 7944 | 7944 | 7193 | 7944 | 7944 | 7193 | 7944 | 7944 |

| Adjusted R-squared | 0.338 | 0.306 | 0.300 | 0.174 | 0.155 | 0.158 | 0.110 | 0.030 | 0.001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martens, W.; Yapa, P.; Safari, M. Earnings Management in Frontier Market: Do Institutional Settings Matter? Economies 2021, 9, 17. https://doi.org/10.3390/economies9010017

Martens W, Yapa P, Safari M. Earnings Management in Frontier Market: Do Institutional Settings Matter? Economies. 2021; 9(1):17. https://doi.org/10.3390/economies9010017

Chicago/Turabian StyleMartens, Wil, Prem Yapa, and Maryam Safari. 2021. "Earnings Management in Frontier Market: Do Institutional Settings Matter?" Economies 9, no. 1: 17. https://doi.org/10.3390/economies9010017

APA StyleMartens, W., Yapa, P., & Safari, M. (2021). Earnings Management in Frontier Market: Do Institutional Settings Matter? Economies, 9(1), 17. https://doi.org/10.3390/economies9010017