Spatial Patterns in Fiscal Impacts of Environmental Taxation in the EU

Abstract

1. Introduction

2. Methodology

2.1. Data

2.2. Methodology—Cluster/Grouping Analysis

3. Results

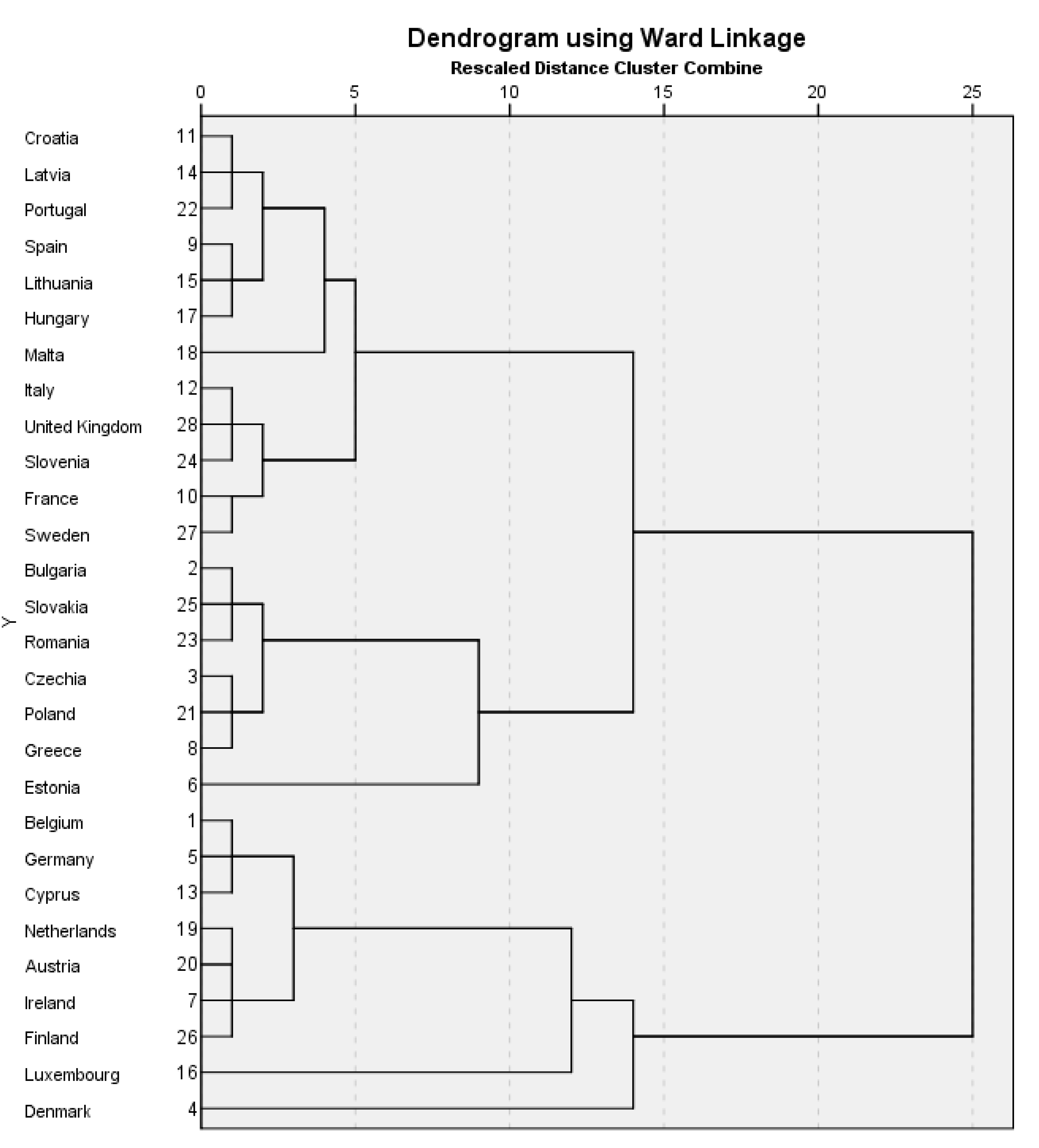

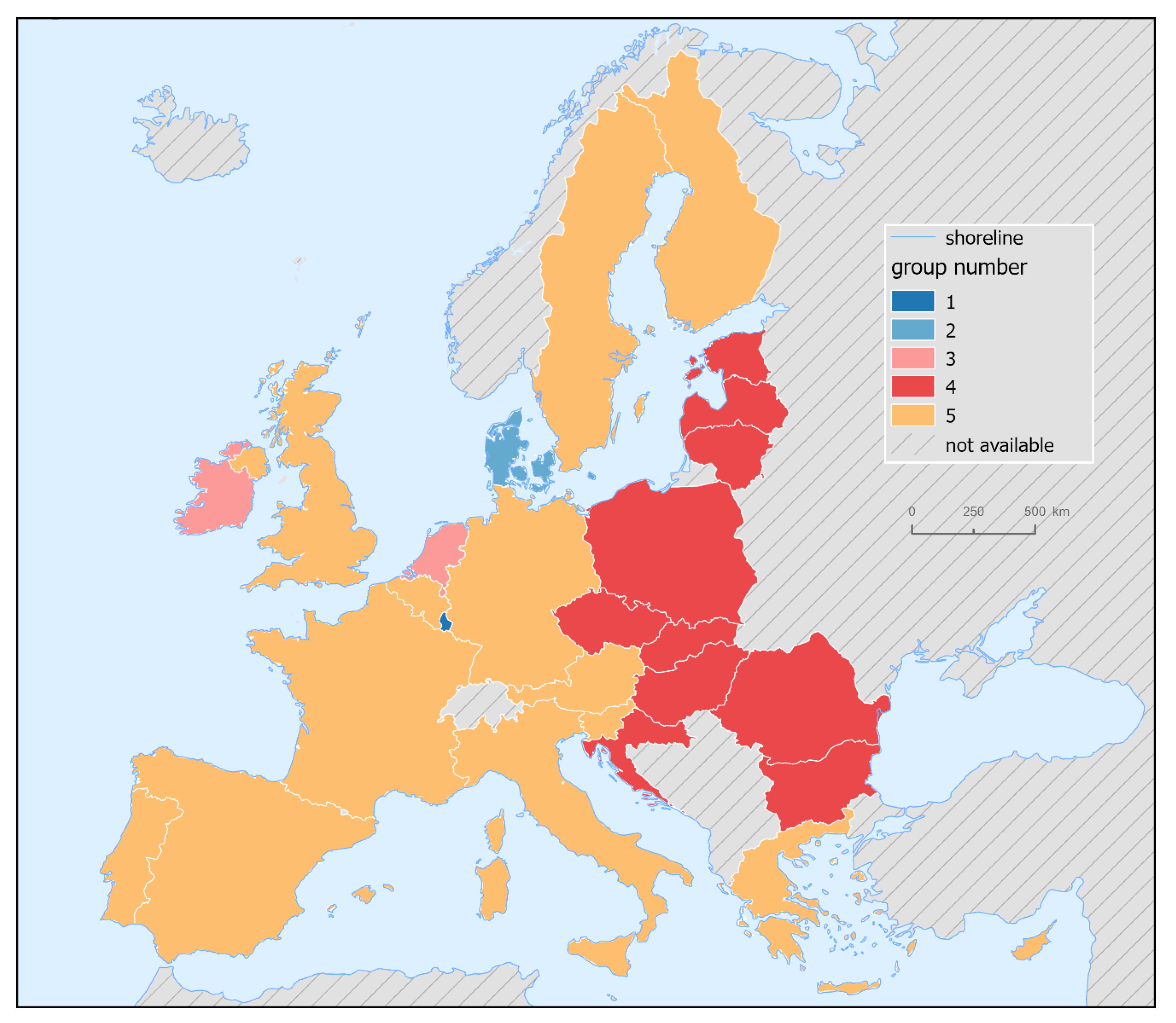

3.1. Non-Spatial Clustering

- cluster 1, represented by low GDP and low environmental taxes revenues—mostly new EU member states (Czechia, Malta, Portugal, Slovenia, Bulgaria, Romania, Lithuania, Poland, Estonia, Slovakia, Croatia, Latvia, Hungary);

- cluster 2, represented by high GDP and high environmental taxes revenues (Denmark, Ireland, Netherlands, Sweden, Austria, Finland, Germany, UK, France, Belgium, Spain, Cyprus, Greece, Italy);

- cluster 3, represented by one country with the highest GDP and energy taxes revenues (Luxembourg).

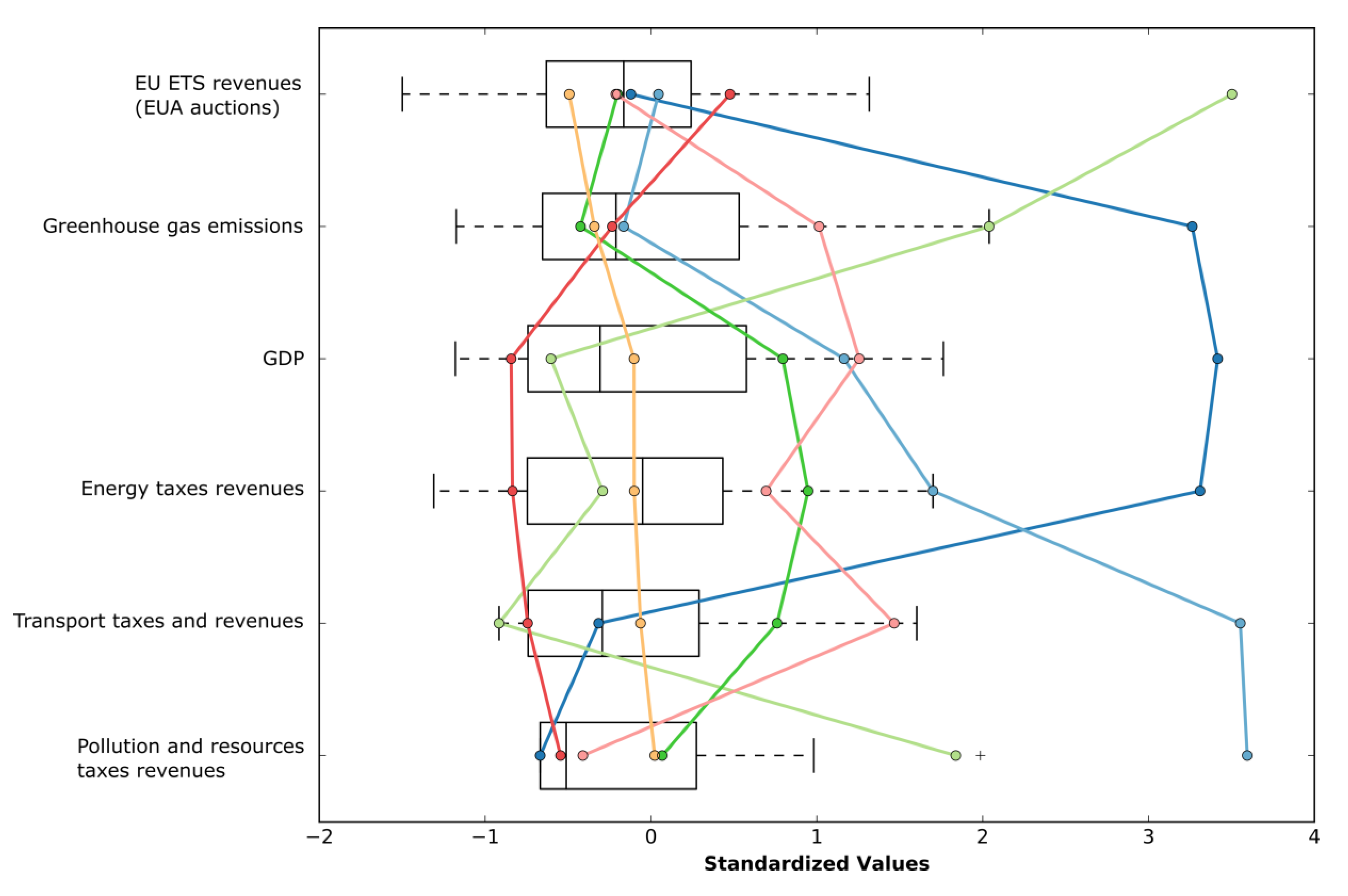

- cluster 1, represented by low CO2 emissions, middle tax revenues and low EU ETS revenues (Croatia, Latvia, Portugal, Spain, Lithuania, Hungary, Malta);

- cluster 2, represented by low CO2 emissions, high tax revenues and low EU ETS revenues (Italy, UK, Slovenia, France, Sweden);

- cluster 3, characterized by increased CO2 emissions, low tax revenues, high EU ETS revenues and low GDP (Bulgaria, Slovakia, Romania, Czechia, Poland, Greece);

- cluster 4, represented by one country with the lowest transport tax revenues, high CO2 emissions and the highest EU ETS revenues (Estonia);

- cluster 5, characterized by increased CO2 emissions, high transport tax revenues and high energy tax revenues (Belgium, Germany, Cyprus, Netherlands, Austria, Ireland, Finland);

- cluster 6, represented by one country with the highest CO2 emissions and too high tax revenues (Luxembourg);

- cluster 7, represented by one country with low CO2 emissions and too high tax revenues (Denmark).

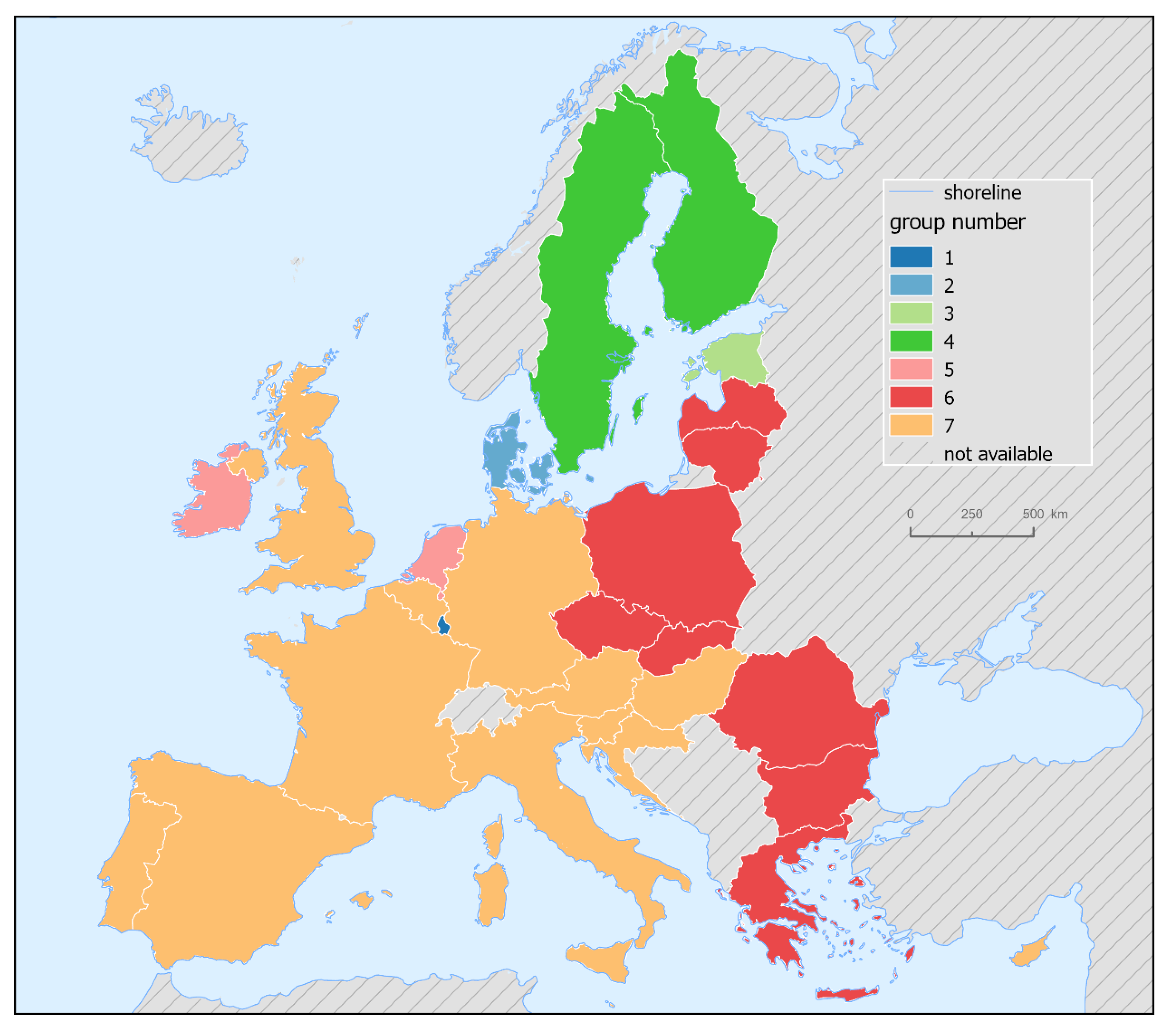

3.2. Spatial Clustering

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Barrage, Lint. 2020. Optimal Dynamic Carbon Taxes in a Climate–Economy Model with Distortionary Fiscal Policy. The Review of Economic Studies 87: 1–39. [Google Scholar] [CrossRef]

- Bumpus, Adam. G. 2015. Firm responses to a carbon price: corporate decision making under British Columbia’s carbon tax. Climate Policy 15: 475–93. [Google Scholar] [CrossRef]

- EEX. 2020. Emission Spot Primary Market Auction Report 2017. Available online: https://www.eex.com/en/market-data/environmental-markets/eua-primary-auction-spot-download (accessed on 20 April 2020).

- Esri. 2016. How Grouping Analysis Works. Available online: https://desktop.arcgis.com/en/arcmap/10.3/tools/spatial-statistics-toolbox/how-grouping-analysis-works.htm (accessed on 10 September 2020).

- European Commission. 2016. The EU Emissions Trading System (EU ETS). European Union. Available online: https://ec.europa.eu/clima/sites/clima/files/factsheet_ets_en.pdf (accessed on 10 January 2020).

- European Commission. 2019. Evaluation of the Council Directive 2003/96/EC of 27 October 2003 Restructuring the Community Framework for the Taxation of Energy Products and Electricity SWD (2019) 332 Final. Available online: https://ec.europa.eu/transparency/regdoc/rep/10102/2019/EN/SWD-2019-332-F1-EN-MAIN-PART-1.PDF (accessed on 10 January 2020).

- Eurostat. 2013. Environmental Taxes: A Statistical Guide. Available online: https://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/KS-GQ-13-005 (accessed on 10 January 2020).

- Eurostat. 2020. Environmental Tax Revenues. Available online: https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=env_ac_tax&lang=en (accessed on 20 April 2020).

- Everitt, Brian S., Sabine Landau, Morven Leese, and Daniel Stahl. 2011. Cluster Analysis, 5th ed. Hoboken: Wiley. [Google Scholar]

- Frey, Miriam. 2017. Assessing the impact of a carbon tax in Ukraine. Climate Policy 17: 378–96. [Google Scholar] [CrossRef]

- Gemechu, Eskinder Demisse, Isabela Butnar, Maria Llop, and Francesc Castells. 2014. Economic and environmental effects of CO2 taxation: an input-output analysis for Spain. Journal of Environmental Planning and Management 57: 751–68. [Google Scholar] [CrossRef]

- Hair, Joseph, William C. Black, Barry J. Babin, and Rolph E. Anderson. 2010. Multivariate Data Analysis. Upper Saddle River: Prentice Hall. [Google Scholar]

- Hájek, Miroslav, Jarmila Zimmermannová, Karel Helman, and Ladislav Rozenský. 2019. Analysis of carbon tax efficiency in energy industries of selected EU countries. Energy Policy 134: 110955. [Google Scholar] [CrossRef]

- ICE. 2019. EUA UK Auction. Available online: https://www.theice.com/products/18997864/EUA-UK-Auction-Daily-Futures (accessed on 20 April 2020).

- Jurušs, Māris, and Janis Brizga. 2017. Assessment of the environmental tax system in Latvia. NISPAcee Journal of Public Administration and Policy 10: 135–54. [Google Scholar] [CrossRef][Green Version]

- Labandeira, Xavier, José M. Labeaga, and Xiral López-Otero. 2019. New Green Tax Reforms: Ex-Ante Assessments for Spain. Sustainability 11: 5640. [Google Scholar] [CrossRef]

- Liapis, Konstantinos, Antonis Rovolis, Christos Galanos, and Eleftherio Thalassinos. 2013. The Clusters of Economic Similarities between EU Countries: A View Under Recent Financial and Debt Crisis. European Research Studies 16: 41. [Google Scholar] [CrossRef]

- Lin, Chih-Ming, and Tzai-Hung Wen. 2012. Temporal changes in geographical disparities in alcohol-attributed disease mortality before and after implementation of the alcohol tax policy in Taiwan. BMC Public Health 12: 889. [Google Scholar] [CrossRef] [PubMed]

- Marek, Lukáš, Vít Pászto, and Pavel Tuček. 2015. Using clustering in geosciences: examples and case studies. Paper presented at 15th International Multidisciplinary Scientific Geoconference, Informatics, Geoinformatics and Remote Sensing, Albena, Bulgaria, 18–24 June, vol. 2, pp. 1207–14. [Google Scholar]

- Maršík, Martin, and Daniel Kopta. 2013. Use of the cluster analysis for assessment of economic situation of an enterprise. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 46: 405–10. [Google Scholar] [CrossRef]

- Magyar Nemzeti Bank (MNB). 2019. Long-Term Sustainable Econo-mix. Budapest: Magyar Nemzeti Bank. [Google Scholar]

- OECD. 2016. Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems. Paris: OECD Publishing. [Google Scholar]

- OECD. 2019. Central and Eastern European Countries (CEECs). Available online: https://stats.oecd.org/glossary/detail.asp?ID=303 (accessed on 10 December 2019).

- Pászto, Vít, and Jarmila Zimmermannová. 2019. Relation of economic and environmental indicators to the European Union Emission Trading System: a spatial analysis. GeoScape 13: 1–15. [Google Scholar] [CrossRef]

- Pereira, Alfredo M., and Rui M. Pereira. 2014. Environmental fiscal reform and fiscal consolidation: the quest for the third dividend in Portugal. Public Finance Review 42: 222–53. [Google Scholar] [CrossRef]

- Rozmahel, Petr, Luděk Kouba, Ladislava Grochová, and Nikola Najman. 2013. Integration of Central and Eastern European countries: Increasing EU heterogeneity. WWWforEurope Working Paper, No. 9, WWWforEurope—WelfareWealthWork, Wien. Available online: https://www.econstor.eu/bitstream/10419/125664/1/WWWforEurope_WPS_no009_MS77.pdf (accessed on 10 June 2020).

- Skaličková, Jolana. 2018. Shluková analýza regionů z pohledu lokalizace velkých podniků. Logos Polytechnikos 9: 124–38. [Google Scholar]

- Skovgaard, Jakob, Sofia Sacks Ferrari, and Åsa Knaggård. 2019. Mapping and clustering the adoption of carbon pricing policies: what polities price carbon and why? Climate Policy 19: 1173–85. [Google Scholar] [CrossRef]

- Soetewey, Antoine. 2020. The Complete Guide to Clustering Analysis: k-means and Hierarchical Clustering by Hand and in R. Available online: https://www.statsandr.com/blog/clustering-analysis-k-means-and-hierarchical-clustering-by-hand-and-in-r/ (accessed on 13 November 2020).

- Solaymani, Saeed. 2017. Carbon and energy taxes in a small and open country. Global Journal of Environmental Science and Management 3: 51–62. [Google Scholar]

- Stuhlmacher, Michelle, Sanjay Patnaik, Dmitry Streletskiy, and Kelsey Taylor. 2019. Cap-and-trade and emissions clustering: A spatial-temporal analysis of the European Union Emissions Trading Scheme. Journal of Environmental Management 249: 109352. [Google Scholar] [CrossRef] [PubMed]

- Theodoridis, Sergios, and Konstantinos Koutroumbas. 2006. Pattern Recognition, 3rd ed. Cambridge: Academic Press. 856p. [Google Scholar]

- Van Heerden, Jan, James Blignaut, Heinrich Bohlmann, Anton Cartwright, Nicci Diederichs, and Myles Mander. 2016. The economic and environmental effects of a carbon tax in South Africa: A dynamic CGE modelling approach. South African Journal of Economic and Management Sciences 19: 714–32. [Google Scholar] [CrossRef]

- Ward, Joe. H. 1963. Hierarchical Grouping to Optimize an Objective Function. Journal of the American Statistical Association 58: 236–44. [Google Scholar] [CrossRef]

- Xiangmei, Xue, and Xu Yang. 2018. Temporal and Spatial Distribution Characteristics of Air Pollution Index (API) and its Correlation with the Improvement of Environmental Tax Law. Journal of Environmental Protection and Ecology 19: 471–76. [Google Scholar]

- Zaharia, Marian, Aurelia Pătrașcu, Manuela Rodica Gogonea, Ana Tănăsescu, and Constanta Popescu. 2017. A Cluster Design on the Influence of Energy Taxation in Shaping the New EU-28. Economic Paradigm. Energies 10: 257. [Google Scholar] [CrossRef]

| Variable | Unit | Year | N | Min | Max | Mean | Average |

|---|---|---|---|---|---|---|---|

| Greenhouse gas emissions | tons/capita | 2008 | 28 | 5.6 | 27.5 | 10.7 | 11.1 |

| 2017 | 28 | 5.5 | 20.0 | 8.6 | 9.3 | ||

| GDP | EUR/capita | 2008 | 28 | 4900.0 | 77,900.0 | 23,000.0 | 24,810.7 |

| 2017 | 28 | 7300.0 | 92,600.0 | 23,500.0 | 29,200.0 | ||

| Energy taxes revenues without EU ETS | EUR/capita | 2008 | 28 | 95.43 | 1899.28 | 358.90 | 444.08 |

| 2017 | 28 | 168.4 | 1471.3 | 523.4 | 537.7 | ||

| EU ETS revenues (EUA auctions) | EUR/capita | 2008 | 28 | 0.0 | 0.00 | 0.00 | 0.00 |

| 2017 | 28 | 4.7 | 29.91 | 11.42 | 12.25 | ||

| Transport taxes revenues | EUR/capita | 2008 | 28 | 4.5 | 774.9 | 114.9 | 168.6 |

| 2017 | 28 | 9.9 | 786.6 | 118.1 | 169.1 | ||

| Pollution and resource taxes revenues | EUR/capita | 2008 | 28 | 0.0 | 121.8 | 4.1 | 13.3 |

| 2017 | 28 | 0.0 | 88.5 | 3.3 | 13.9 |

| Country | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| EU 28 | 10.6 | 9.6 | 9.8 | 9.5 | 9.3 | 9.1 | 8.7 | 8.8 | 8.7 | 8.8 |

| Belgium | 13.5 | 12.1 | 12.7 | 11.6 | 11.3 | 11.2 | 10.6 | 11 | 10.8 | 10.8 |

| Bulgaria | 9 | 7.9 | 8.3 | 9.1 | 8.4 | 7.7 | 8.2 | 8.7 | 8.4 | 8.8 |

| Czechia | 14.3 | 13.3 | 13.5 | 13.4 | 12.9 | 12.4 | 12.2 | 12.3 | 12.5 | 12.4 |

| Denmark | 12.5 | 11.9 | 11.9 | 10.9 | 10.1 | 10.3 | 9.6 | 9 | 9.3 | 8.9 |

| Germany | 12.2 | 11.4 | 11.8 | 11.7 | 11.8 | 12 | 11.4 | 11.4 | 11.4 | 11.2 |

| Estonia | 15 | 12.5 | 15.9 | 16 | 15.2 | 16.7 | 16.1 | 13.9 | 15 | 16 |

| Ireland | 15.7 | 14.1 | 13.9 | 12.9 | 12.9 | 12.9 | 12.8 | 13.2 | 13.5 | 13.3 |

| Greece | 12.2 | 11.5 | 10.9 | 10.7 | 10.4 | 9.6 | 9.4 | 9.1 | 8.8 | 9.2 |

| Spain | 9.3 | 8.3 | 8 | 8 | 7.8 | 7.2 | 7.3 | 7.6 | 7.4 | 7.7 |

| France | 8.4 | 8.1 | 8.1 | 7.7 | 7.6 | 7.6 | 7.1 | 7.1 | 7.1 | 7.2 |

| Croatia | 7.2 | 6.7 | 6.6 | 6.5 | 6.1 | 5.8 | 5.7 | 5.8 | 5.9 | 6.2 |

| Italy | 9.6 | 8.6 | 8.8 | 8.6 | 8.3 | 7.6 | 7.2 | 7.4 | 7.4 | 7.3 |

| Cyprus | 13.9 | 13.2 | 12.5 | 11.8 | 11 | 10.1 | 10.6 | 10.7 | 11.4 | 11.6 |

| Latvia | 5.6 | 5.4 | 6 | 5.8 | 5.7 | 5.8 | 5.8 | 5.8 | 5.9 | 6 |

| Lithuania | 7.7 | 6.4 | 6.8 | 7.1 | 7.2 | 6.9 | 6.9 | 7.1 | 7.2 | 7.4 |

| Luxembourg | 27.5 | 25.8 | 26.5 | 25.6 | 24.3 | 22.7 | 21.5 | 20.4 | 19.8 | 20 |

| Hungary | 7.1 | 6.5 | 6.6 | 6.4 | 6.1 | 5.8 | 5.9 | 6.2 | 6.3 | 6.6 |

| Malta | 8.2 | 7.7 | 7.9 | 7.9 | 8.3 | 7.5 | 7.5 | 5.9 | 5.1 | 5.5 |

| Netherlands | 13.3 | 12.8 | 13.5 | 12.6 | 12.3 | 12.2 | 11.8 | 12.2 | 12.2 | 12 |

| Austria | 10.7 | 9.8 | 10.4 | 10.1 | 9.7 | 9.7 | 9.2 | 9.3 | 9.4 | 9.6 |

| Poland | 10.9 | 10.4 | 10.9 | 10.9 | 10.7 | 10.6 | 10.3 | 10.4 | 10.6 | 11 |

| Portugal | 7.5 | 7.2 | 6.8 | 6.7 | 6.5 | 6.4 | 6.4 | 6.9 | 6.7 | 7.2 |

| Romania | 7.3 | 6.3 | 6.2 | 6.4 | 6.3 | 5.8 | 5.9 | 5.9 | 5.8 | 6 |

| Slovenia | 10.7 | 9.6 | 9.6 | 9.6 | 9.3 | 8.9 | 8.1 | 8.2 | 8.6 | 8.4 |

| Slovakia | 9.3 | 8.5 | 8.6 | 8.5 | 8 | 7.9 | 7.6 | 7.7 | 7.8 | 8 |

| Finland | 13.8 | 13 | 14.4 | 13 | 11.9 | 11.9 | 11.1 | 10.4 | 10.9 | 10.4 |

| Sweden | 7.1 | 6.5 | 7.1 | 6.6 | 6.2 | 6 | 5.8 | 5.7 | 5.6 | 5.5 |

| United Kingdom | 11.1 | 10.1 | 10.2 | 9.4 | 9.6 | 9.3 | 8.7 | 8.3 | 7.9 | 7.7 |

| Stage | Cluster Combined | Coefficients | Stage Cluster First Appears | Next Stage | ||

|---|---|---|---|---|---|---|

| Cluster 1 | Cluster 2 | Cluster 1 | Cluster 2 | |||

| 1 | 15 | 21 | 0.015 | 0 | 0 | 12 |

| 2 | 2 | 25 | 0.051 | 0 | 0 | 9 |

| 3 | 3 | 14 | 0.112 | 0 | 0 | 13 |

| 4 | 5 | 24 | 0.203 | 0 | 0 | 18 |

| 5 | 9 | 22 | 0.297 | 0 | 0 | 17 |

| 6 | 7 | 19 | 0.401 | 0 | 0 | 11 |

| 7 | 12 | 28 | 0.515 | 0 | 0 | 14 |

| 8 | 11 | 17 | 0.681 | 0 | 0 | 12 |

| 9 | 2 | 23 | 0.907 | 2 | 0 | 13 |

| 10 | 1 | 18 | 1.159 | 0 | 0 | 18 |

| 11 | 7 | 20 | 1.474 | 6 | 0 | 19 |

| 12 | 11 | 15 | 1.818 | 8 | 1 | 17 |

| 13 | 2 | 3 | 2.225 | 9 | 3 | 21 |

| 14 | 12 | 27 | 2.668 | 7 | 0 | 20 |

| 15 | 10 | 13 | 3.194 | 0 | 0 | 20 |

| 16 | 6 | 8 | 4.105 | 0 | 0 | 21 |

| 17 | 9 | 11 | 5.155 | 5 | 12 | 23 |

| 18 | 1 | 5 | 6.294 | 10 | 4 | 22 |

| 19 | 7 | 26 | 7.885 | 11 | 0 | 22 |

| 20 | 10 | 12 | 9.955 | 15 | 14 | 23 |

| 21 | 2 | 6 | 12.992 | 13 | 16 | 26 |

| 22 | 1 | 7 | 16.950 | 18 | 19 | 25 |

| 23 | 9 | 10 | 23.089 | 17 | 20 | 26 |

| 24 | 4 | 16 | 31.157 | 0 | 0 | 25 |

| 25 | 1 | 4 | 40.301 | 22 | 24 | 27 |

| 26 | 2 | 9 | 59.518 | 21 | 23 | 27 |

| 27 | 1 | 2 | 81.000 | 25 | 26 | 0 |

| Stage | Cluster Combined | Coefficients | Stage Cluster First Appears | Next Stage | ||

|---|---|---|---|---|---|---|

| Cluster 1 | Cluster 2 | Cluster 1 | Cluster 2 | |||

| 1 | 11 | 14 | 0.136 | 0 | 0 | 6 |

| 2 | 2 | 25 | 0.414 | 0 | 0 | 10 |

| 3 | 12 | 28 | 0.724 | 0 | 0 | 11 |

| 4 | 9 | 15 | 1.048 | 0 | 0 | 8 |

| 5 | 1 | 5 | 1.404 | 0 | 0 | 15 |

| 6 | 11 | 22 | 1.772 | 1 | 0 | 17 |

| 7 | 19 | 20 | 2.498 | 0 | 0 | 14 |

| 8 | 9 | 17 | 3.236 | 4 | 0 | 17 |

| 9 | 3 | 21 | 3.976 | 0 | 0 | 12 |

| 10 | 2 | 23 | 4.764 | 2 | 0 | 19 |

| 11 | 12 | 24 | 5.643 | 3 | 0 | 18 |

| 12 | 3 | 8 | 6.758 | 9 | 0 | 19 |

| 13 | 10 | 27 | 7.894 | 0 | 0 | 18 |

| 14 | 7 | 19 | 9.070 | 0 | 7 | 16 |

| 15 | 1 | 13 | 10.455 | 5 | 0 | 20 |

| 16 | 7 | 26 | 12.181 | 14 | 0 | 20 |

| 17 | 9 | 11 | 14.284 | 8 | 6 | 21 |

| 18 | 10 | 12 | 16.616 | 13 | 11 | 22 |

| 19 | 2 | 3 | 18.992 | 10 | 12 | 23 |

| 20 | 1 | 7 | 23.451 | 15 | 16 | 24 |

| 21 | 9 | 18 | 28.843 | 17 | 0 | 22 |

| 22 | 9 | 10 | 36.540 | 21 | 18 | 26 |

| 23 | 2 | 6 | 51.428 | 19 | 0 | 26 |

| 24 | 1 | 16 | 72.095 | 20 | 0 | 25 |

| 25 | 1 | 4 | 95.251 | 24 | 0 | 27 |

| 26 | 2 | 9 | 118.657 | 23 | 22 | 27 |

| 27 | 1 | 2 | 162.000 | 25 | 26 | 0 |

| Non—Spatial Clusters | Spatial Clusters | Common Features |

|---|---|---|

| Czechia, Malta, Portugal, Slovenia, Bulgaria, Romania, Lithuania, Poland, Estonia, Slovakia, Croatia, Latvia, Hungary | Czechia, Malta, Portugal, Slovenia, Bulgaria, Romania, Lithuania, Poland, Estonia, Slovakia, Croatia, Latvia, Hungary | low emissions & low tax revenues |

| Denmark, Ireland, Netherlands, Sweden, Austria, Finland, Germany, UK, France, Belgium, Spain, Cyprus, Greece, Italy | Sweden, Austria, Finland, Germany, UK, France, Belgium, Spain, Cyprus, Greece, Italy | high emissions & high tax revenues |

| Luxembourg | Luxembourg | extra high emissions & extra high energy tax revenues & low other revenues |

| Denmark | middle emissions & high tax revenues | |

| Ireland, Netherlands | high emissions & middle tax revenues |

| Non—Spatial Clusters | Spatial Clusters | Common Features |

|---|---|---|

| Croatia, Hungary, Latvia, Lithuania, Malta, Portugal, Spain | Croatia, Hungary, Malta, Portugal, Spain, Belgium, Germany, Cyprus, Austria, Ireland, Italy, the UK, Slovenia, France | middle emissions & middle revenues |

| Italy, the UK, Slovenia, France, Sweden | Sweden, Finland | low emissions & high tax revenues |

| Bulgaria, Slovakia, Romania, Czechia, Poland, Greece | Bulgaria, Slovakia, Romania, Czechia, Poland, Latvia, Lithuania, Greece | middle emissions & extremely low GDP & low tax revenues & high EU ETS revenues |

| Estonia | Estonia | high emissions & low tax revenues & the highest EU ETS revenues |

| Belgium, Germany, Cyprus, Netherlands, Austria, Ireland, Finland | Ireland, Netherlands | middle emissions & high tax revenues |

| Luxembourg | Luxembourg | highest emissions & highest GDP & highest energy tax & low other revenues |

| Denmark | Denmark | middle emissions & high tax revenues & highest transport and pollution taxes revenues |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pászto, V.; Zimmermannová, J.; Skaličková, J.; Sági, J. Spatial Patterns in Fiscal Impacts of Environmental Taxation in the EU. Economies 2020, 8, 104. https://doi.org/10.3390/economies8040104

Pászto V, Zimmermannová J, Skaličková J, Sági J. Spatial Patterns in Fiscal Impacts of Environmental Taxation in the EU. Economies. 2020; 8(4):104. https://doi.org/10.3390/economies8040104

Chicago/Turabian StylePászto, Vít, Jarmila Zimmermannová, Jolana Skaličková, and Judit Sági. 2020. "Spatial Patterns in Fiscal Impacts of Environmental Taxation in the EU" Economies 8, no. 4: 104. https://doi.org/10.3390/economies8040104

APA StylePászto, V., Zimmermannová, J., Skaličková, J., & Sági, J. (2020). Spatial Patterns in Fiscal Impacts of Environmental Taxation in the EU. Economies, 8(4), 104. https://doi.org/10.3390/economies8040104