Did Decentralisation Affect Citizens’ Perception of the European Union? The Impact during the Height of Decentralisation in Europe

Abstract

1. Introduction

2. Decentralisation and the European Project

2.1. The Benefits and Costs of Decentralisation under the Umbrella of the European Integration

2.2. Perceptions and Public Attitudes toward European Integration

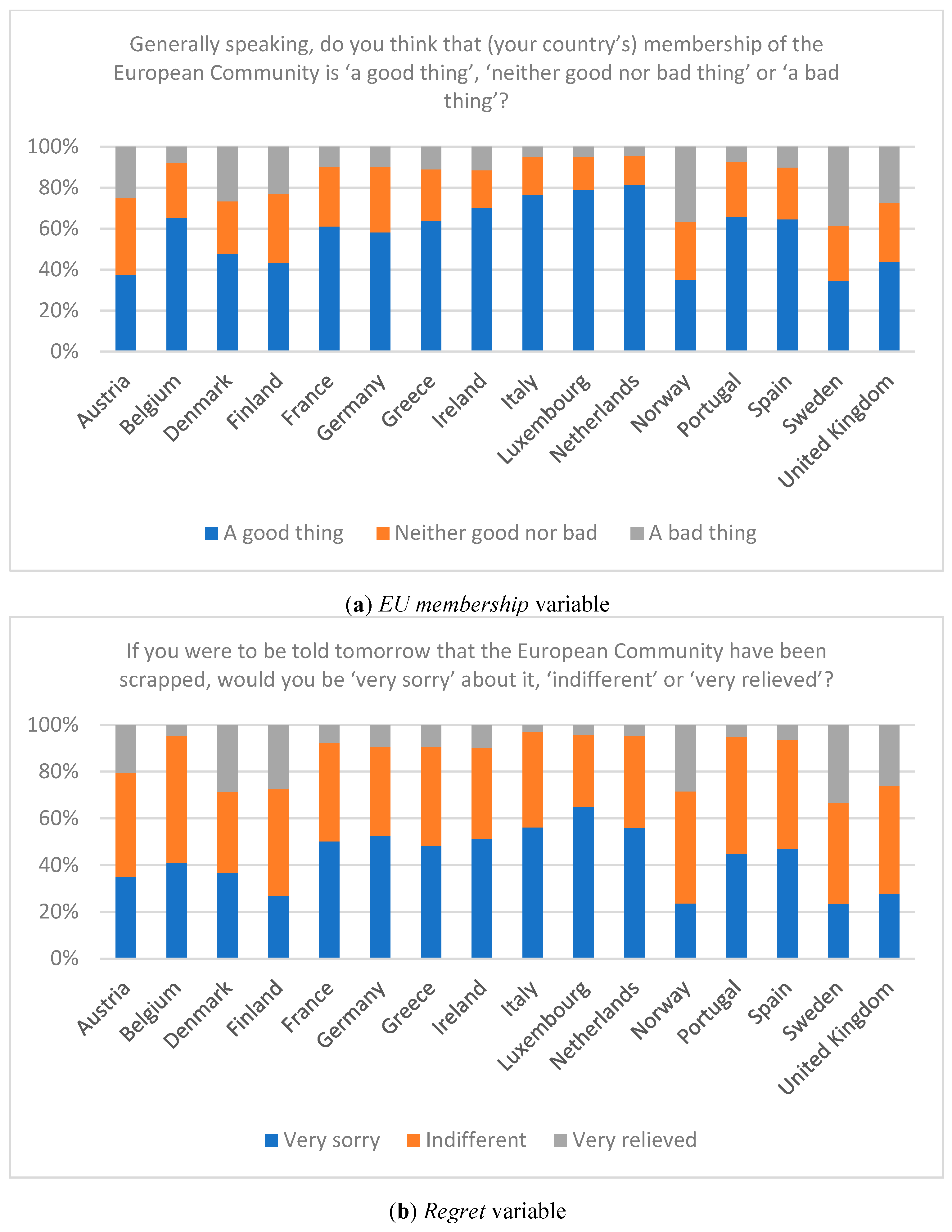

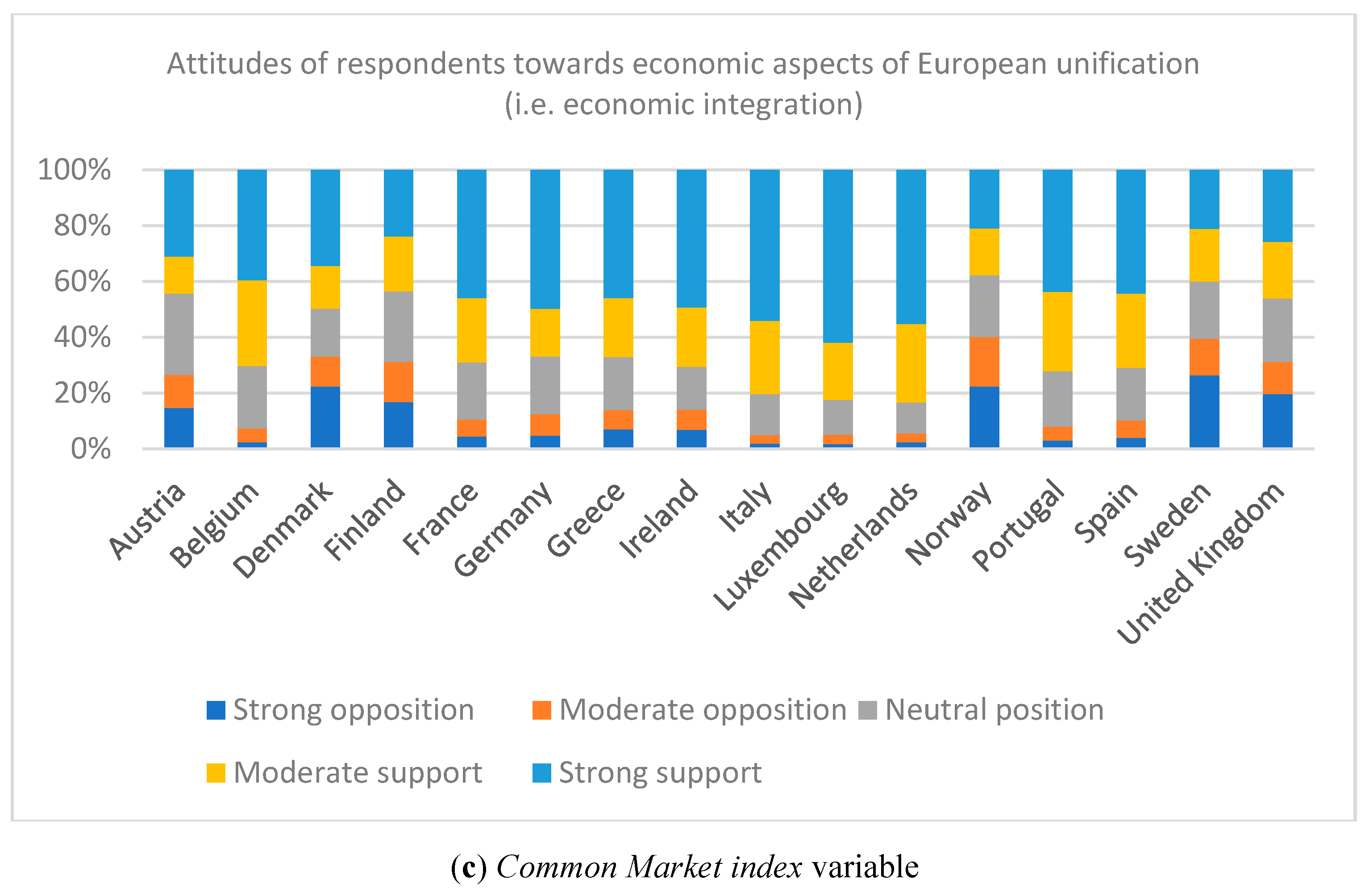

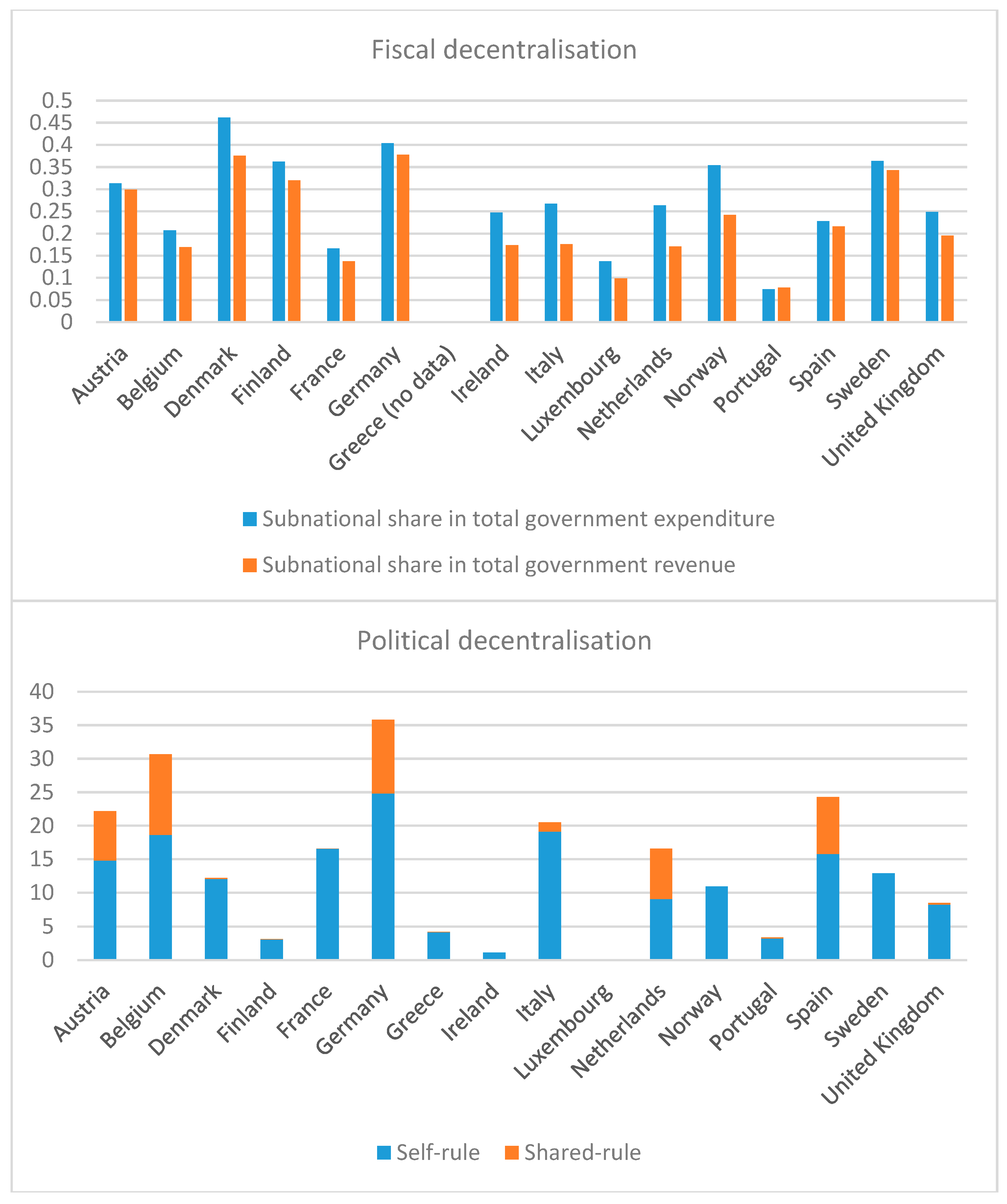

3. Data and Variables

4. Multinomial Logistic Regressions

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Unweighted Regressions

| Variables | A Good Thing | Neither Good nor Bad | A Bad Thing | A Good Thing | Neither Good nor Bad | A Bad Thing |

|---|---|---|---|---|---|---|

| (1) | (2) | |||||

| FiscDec (expenditures) | −0.6604 *** | −0.1772 | ||||

| FiscDec (revenues) | 1.2896 *** | −1.0376 *** | ||||

| PolDec (RAI index) | 0.0037 ** | 0.0545 *** | −0.0086 *** | 0.0538 *** | ||

| Male | base | base | base | base | ||

| Female | −0.2974 *** | −0.1967 *** | −0.2963 *** | −0.1966 *** | ||

| Age | 0.0132 *** | 0.0293 *** | 0.0131 *** | 0.0293 *** | ||

| Age × Age | −0.0001 *** | −0.0002 *** | −0.0001 *** | −0.0002 *** | ||

| Education | ||||||

| Up to 14 | base | base | base | base | ||

| Up to 15 | 0.0483 *** | −0.0120 | 0.0550 *** | −0.0113 | ||

| Up to 16 | 0.1479 *** | −0.1390 *** | 0.1476 *** | −0.1380 *** | ||

| Up to 17 | 0.3051 *** | −0.1149 *** | 0.3075 *** | −0.1145 *** | ||

| Up to 18 | 0.4232 *** | −0.1433 *** | 0.4230 *** | −0.1427 *** | ||

| Up to 19 | 0.5374 *** | −0.0403* | 0.5409 *** | −0.0394 * | ||

| Up to 20 | 0.6299 *** | −0.1068 *** | 0.6270 *** | −0.1061 *** | ||

| Up to 21 | 0.7839 *** | −0.1181 *** | 0.7758 *** | −0.1181 *** | ||

| 22 or older | 0.9447 *** | −0.0248 | 0.9402 *** | −0.0241 | ||

| Still studying | 0.8148 *** | −0.0612 *** | 0.8161 *** | −0.0610 *** | ||

| GDP per capita | 0.0001 *** | −0.0000 *** | ||||

| tfp | −1.0844 *** | 0.1305 | 1.7627 *** | −1.0792 *** | ||

| Year-dummies | YES | YES | YES | YES | ||

| Country-dummies | YES | YES | YES | YES | ||

| Constant | −0.8128 *** | −1.5909 *** | −1.6020 *** | −1.0026 *** | ||

| Observations | 669,740 | 669,740 | ||||

| LR chi2 | 102,862.84 | 101,662.69 | ||||

| Prob > chi2 | 0.0000 | 0.0000 | ||||

| Pseudo R2 | 0.0834 | 0.0824 | ||||

| Log likelihood | −565,389.72 | −565,989.79 |

| Variables | Very Sorry | Indifferent | Very Relieved | Very Sorry | Indifferent | Very Relieved |

|---|---|---|---|---|---|---|

| (1) | (2) | |||||

| FiscDec (expenditures) | −1.2494 *** | −0.6395 *** | ||||

| FiscDec (revenues) | −0.5262 *** | −2.5251 *** | ||||

| PolDec (RAI index) | 0.0336 *** | 0.0769 *** | 0.0269 *** | 0.0829 *** | ||

| Male | base | base | base | base | ||

| Female | −0.3788 *** | −0.1528 *** | −0.3780 *** | −0.1527 *** | ||

| Age | 0.0525 *** | 0.0593 *** | 0.0522 *** | 0.0593 *** | ||

| Age × Age | −0.0004 *** | −0.0005 *** | −0.0004 *** | −0.0005 *** | ||

| Education | ||||||

| Up to 14 | base | base | base | base | ||

| Up to 15 | 0.0992 *** | 0.0481 ** | 0.1024 *** | 0.0483 ** | ||

| Up to 16 | 0.2013 *** | −0.1122 *** | 0.1986 *** | −0.1124 *** | ||

| Up to 17 | 0.4094 *** | −0.0704 *** | 0.4101 *** | −0.0693 *** | ||

| Up to 18 | 0.5551 *** | −0.1296 *** | 0.5554 *** | −0.1277 *** | ||

| Up to 19 | 0.6864 *** | −0.0221 | 0.6873 *** | −0.0192 | ||

| Up to 20 | 0.8160 *** | −0.0616 * | 0.8109 *** | −0.0598 * | ||

| Up to 21 | 0.9159 *** | −0.1753 *** | 0.9084 *** | −0.1711 *** | ||

| 22 or older | 1.1244 *** | 0.0318 | 1.1191 *** | 0.0332 | ||

| Still studying | 0.9378 *** | −0.0030 | 0.9354 *** | −0.0024 | ||

| GDP per capita | 0.0001 *** | −0.0000 *** | ||||

| tfp | −2.6815 *** | 1.3428 *** | −0.8407 *** | −0.9043 *** | ||

| Year-dummies | YES | YES | YES | YES | ||

| Country-dummies | YES | YES | YES | YES | ||

| Constant | −0.8885 *** | −3.8285 *** | −1.3022 *** | −2.8548 *** | ||

| Observations | 363,990 | 363,990 | ||||

| LR chi2 | 58,510.29 | 57,992.43 | ||||

| Prob > chi2 | 0.0000 | 0.0000 | ||||

| Pseudo R2 | 0.0827 | 0.0820 | ||||

| Log likelihood | −324,389.85 | −324,648.77 |

| Variables | Strong Opposition | Moderate Opposition | Neutral Position | Moderate Support | Strong Support | Strong Opposition | Moderate Opposition | Neutral Position | Moderate Support | Strong Support |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | |||||||||

| FiscDec (expenditures) | −1.1167 *** | −0.3622 | −0.0477 | −1.3709 *** | ||||||

| FiscDec (revenues) | −2.7411 *** | −1.6282 *** | 1.2650 *** | 0.2932 ** | ||||||

| PolDec (RAI index) | 0.0824 *** | 0.0279 *** | −0.0147 *** | 0.0251 *** | 0.0864 *** | 0.0337 *** | −0.0234 *** | 0.0114 *** | ||

| Male | base | base | base | base | base | base | base | base | ||

| Female | −0.2014 *** | −0.1339 *** | −0.0884 *** | −0.4101 *** | −0.2008 *** | −0.1339 *** | −0.0879 *** | −0.4090 *** | ||

| Age | 0.0530 *** | 0.0245 *** | −0.0125 *** | 0.0410 *** | 0.0530 *** | 0.0245 *** | −0.0125 *** | 0.0408 *** | ||

| Age × Age | −0.0005 *** | −0.0002 *** | 0.0001 *** | −0.0003 *** | −0.0005 *** | −0.0002 *** | 0.0001 *** | −0.0003 *** | ||

| Education | ||||||||||

| Up to 14 | base | base | base | base | base | base | base | base | ||

| Up to 15 | 0.0207 | −0.0189 | −0.0654 *** | 0.0681 *** | 0.0215 | −0.0188 | −0.0642 *** | 0.0714 *** | ||

| Up to 16 | −0.1839 *** | −0.0635 ** | 0.0354 * | 0.1896 *** | −0.1839 *** | −0.0636 ** | 0.0369* | 0.1893 *** | ||

| Up to 17 | −0.1460 *** | −0.0351 | 0.1426 *** | 0.4329 *** | −0.1451 *** | −0.0342 | 0.1430 *** | 0.4343 *** | ||

| Up to 18 | −0.1695 *** | −0.0674 ** | 0.1921 *** | 0.6177 *** | −0.1683 *** | −0.0657 ** | 0.1910 *** | 0.6176 *** | ||

| Up to 19 | 0.0194 | −0.0573 | 0.2620 *** | 0.7738 *** | 0.0231 | −0.0549 | 0.2626 *** | 0.7755 *** | ||

| Up to 20 | −0.0508 | −0.0151 | 0.2543 *** | 0.9165 *** | −0.0495 | −0.0131 | 0.2525 *** | 0.9111 *** | ||

| Up to 21 | −0.1309 *** | −0.1072 ** | 0.3698 *** | 1.0676 *** | −0.1288 ** | −0.1039 ** | 0.3652 *** | 1.0581 *** | ||

| 22 or older | 0.1098 *** | −0.0097 | 0.3964 *** | 1.2798 *** | 0.1112 *** | −0.0080 | 0.3952 *** | 1.2745 *** | ||

| Still studying | 0.0433 | −0.0976 ** | 0.3435 *** | 1.0829 *** | 0.0439 | −0.0962 ** | 0.3443 *** | 1.0810 *** | ||

| GDP per capita | −0.0000 *** | −0.0000 *** | 0.0000 *** | 0.0001 *** | ||||||

| tfp | 1.1779 *** | 0.5194 | 0.5605 ** | −1.5982 *** | −0.6136 ** | −0.9033 *** | 1.6966 *** | 0.5167 *** | ||

| Year−dummies | YES | YES | YES | YES | YES | YES | YES | YES | ||

| Country−dummies | YES | YES | YES | YES | YES | YES | YES | YES | ||

| Constant | −3.2346 *** | −1.9042 *** | −1.0104 *** | −0.8491 *** | −2.4907 *** | −1.2981 *** | −1.4813 *** | −1.5306 *** | ||

| Observations | 348,259 | 348,259 | ||||||||

| LR chi2 | 67,149.52 | 66,916.85 | ||||||||

| Prob > chi2 | 0.0000 | 0.0000 | ||||||||

| Pseudo R2 | 0.0690 | 0.0688 | ||||||||

| Log likelihood | −452,921.06 | −453,037.39 |

References

- Aiello, Valentina, Pierre Maurice Reverberi, and Cristina Brasili. 2019. European identity and citizens’ support for the EU: Testing the utilitarian approach. Regional Science Policy and Practice 11: 673–94. [Google Scholar] [CrossRef]

- Bardhan, Pranab, and Dilip Mookherjee. 2006. Decentralisation and accountability in infrastructure delivery in developing countries. Economic Journal 116: 101–27. [Google Scholar] [CrossRef]

- Bjørnskov, Christian, Alex Drehe, and Justina A.V. Fischer. 2008. On decentralization and life satisfaction. Economics Letters 99: 147–51. [Google Scholar] [CrossRef]

- Brown, J. Christopher, and Mark Purcell. 2005. There’s nothing inherent about scale: Political ecology, the local trap, and the politics of development in the Brazilian Amazon. Geoforum 36: 607–24. [Google Scholar] [CrossRef]

- Brusis, Martin. 2002. Between EU requirements, competitive politics, and national traditions: Re-creating regions in the accession countries of Central and Eastern Europe. Governance—An International Journal of Policy and Administration 15: 531–59. [Google Scholar] [CrossRef]

- Bruszt, László. 2008. Multi-level governance—The Eastern versions: Emerging patterns of regional developmental governance in the new member states. Regional and Federal Studies 18: 607–27. [Google Scholar] [CrossRef]

- Canaleta, Carlos Gil, Pedro Pascual Arzoz, and Manuel Rapun Garate. 2004. Regional economic disparities and decentralisation. Urban Studies 41: 71–94. [Google Scholar] [CrossRef]

- Chalmers, Adam William, and Lisa Maria Dellmuth. 2015. Fiscal redistribution and public support for European integration. European Union Politics 16: 386–407. [Google Scholar] [CrossRef]

- Dąbrowski, Marcin, Dominic Stead, and Bardia Mashhoodi. 2017. Towards a Regional Typology of EU Identification: Cohesify Research Paper 6. Delft: Delft University of Technology. [Google Scholar]

- Daniele, Gianmarco, and Benny Geys. 2015. Public support for European fiscal integration in times of crisis. Journal of European Public Policy 22: 650–70. [Google Scholar] [CrossRef]

- Davoodi, Hamid, and Heng-fu Zou. 1998. Fiscal decentralization and economic growth: A cross-country study. Journal of Urban Economics 43: 244–57. [Google Scholar] [CrossRef]

- de Mello, Luiz. 2011. Does fiscal decentralisation strengthen social capital? Cross-country evidence and the experiences of Brazil and Indonesia. Environment and Planning C: Government and Policy 29: 281–96. [Google Scholar] [CrossRef]

- de Vries, Catherine E. 2013. Ambivalent Europeans? Public Support for European Integration in East and West. Government and Opposition 48: 434–61. [Google Scholar] [CrossRef]

- Díaz-Serrano, Luis, and Andrés Rodríguez-Pose. 2012. Decentralization, subjective well-being, and the perception of institutions. Kyklos 65: 179–93. [Google Scholar] [CrossRef]

- Díaz-Serrano, Luis, and Andrés Rodríguez-Pose. 2015. Decentralization and the Welfare State: What Do Citizens Perceive? Social Indicators Research 120: 411–35. [Google Scholar] [CrossRef]

- Escaleras, Monica, and Charles A. Register. 2012. Fiscal decentralization and natural hazard risks. Public Choice 151: 165–83. [Google Scholar] [CrossRef]

- Eurobarometer. 2017. Standard Eurobarometer 87. Public Opinion in the European Union. Key Trends. Brussels and Luxembourg: Publication Office of the European Union. [Google Scholar]

- European Commission. 2013. Empowering Local Authorities in Partner Countries for Enhanced Governance and More Effective Development Outcomes. Brussels, 15.5.2013, COM(2013) 280 Final, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Brussels: European Commission. [Google Scholar]

- Ezcurra, Roberto, and Pedro Pascual. 2008. Fiscal decentralization and regional disparities: Evidence from several European Union countries. Environment and Planning A: Economy and Space 40: 1185–201. [Google Scholar] [CrossRef]

- Feenstra, Robert C., Robert Inklaar, and Marcel P. Timmer. 2015. The Next Generation of the Penn World Table. American Economic Review 105: 3150–82. Available online: www.ggdc.net/pwt (accessed on 17 February 2018). [CrossRef]

- Fisman, Raymond, and Roberta Gatti. 2002. Decentralization and corruption: Evidence across countries. Journal of Public Economics 83: 325–45. [Google Scholar] [CrossRef]

- Franklin, Mark, Michael Marsh, and Lauren McLaren. 1994. Uncorking the bottle–Popular opposition to European Unification in the wake of Maastricht. Journal of Common Market Studies 32: 455–72. [Google Scholar] [CrossRef]

- Gabel, Matthew. 1998. Public support for European integration: An empirical test of five theories. Journal of Politics 60: 333–54. [Google Scholar] [CrossRef]

- Gabel, Matthew, and Harvey D. Palmer. 1995. Understanding variations in public support for European Integration. European Journal of Political Research 27: 3–19. [Google Scholar] [CrossRef]

- Gabel, Matthew, and Guy D. Whitten. 1997. Economic conditions, economic perceptions, and public support for European integration. Political Behavior 19: 81–96. [Google Scholar] [CrossRef]

- Hobolt, Sara B., and Catherine E. de Vries. 2016. Public Support for European Integration. Annual Review of Political Science 19: 413–32. [Google Scholar] [CrossRef]

- Hooghe, Liesbet, Gary Marks, Arjan H. Schakel, Sandra Chapman Osterkatz, Sara Niedzwiecki, and Sarah Shair-Rosenfield. 2016. Measuring Regional Authority: A Postfunctionalist Theory of Governance. Oxford: Oxford University Press, vol. I. [Google Scholar]

- Iimi, Atsushi. 2005. Decentralization and economic growth revisited: An empirical note. Journal of Urban Economics 57: 449–61. [Google Scholar] [CrossRef]

- Inglehart, Ronald. 1970a. Cognitive mobilization and European identity. Comparative Politics 3: 45–70. [Google Scholar] [CrossRef]

- Inglehart, Ronald. 1970b. Public opinion and regional integration. International Organization 24: 764–95. [Google Scholar] [CrossRef]

- Inglehart, Ronald, Jacques-René Rabier, and Karlheinz Reif. 1987. The Evolution of Public Attitudes toward European Integration: 1970–1986. Journal of European Integration 10: 135–55. [Google Scholar] [CrossRef]

- Jones, Erik, R. Daniel Kelemen, and Sophie Meunier. 2016. Failing Forward? The Euro Crisis and the Incomplete Nature of European Integration. Comparative Political Studies 49: 1010–34. [Google Scholar] [CrossRef]

- Kuhn, Theresa, and Florian Stoeckel. 2014. When European integration becomes costly: The euro crisis and public support for European economic governance. Journal of European Public Policy 21: 624–41. [Google Scholar] [CrossRef]

- Kyriacou, Andreas P., and Oriol Roca-Sagalés. 2011. Fiscal and political decentralization and government quality. Environment and Planning C: Government and Policy 29: 204–23. [Google Scholar] [CrossRef]

- Lakey, Brian, Kristen M. McCabe, Sebastiano A. Fisicaro, and Jana Brittain Drew. 1996. Environmental and personal determinants of support perceptions: Three generalizability studies. Journal of Personality and Social Psychology 70: 1270–80. [Google Scholar] [CrossRef] [PubMed]

- Lessmann, Christian. 2009. Fiscal decentralization and regional disparity: Evidence from cross-section and panel data. Environment and Planning A: Economy and Space 41: 2455–73. [Google Scholar] [CrossRef]

- López-Bazo, Enrique, and Vicente Royuela. 2019. Citizens’ perception of the Cohesion Policy and support for the European Union. Regional Science Policy and Practice 11: 733–50. [Google Scholar] [CrossRef]

- Musgrave, Richard Abel. 1959. The Theory of Public Finance. New York: McGraw Hill. [Google Scholar]

- Neyapti, Bilin. 2006. Revenue decentralization and income distribution. Economics Letters 92: 409–16. [Google Scholar] [CrossRef]

- O’Dwyer, Conor. 2006. Reforming regional governance in East Central Europe: Europeanization or domestic politics as usual? East European Politics and Societies 20: 219–53. [Google Scholar] [CrossRef]

- Oates, Wallace E. 1972. Fiscal Federalism. New York: Harcourt Brace Jovanovich. [Google Scholar]

- Olson, Mancur. 1971. The Logic of Collective Action: Public Goods and the Theory of Groups. Harvard: Harvard University Press. [Google Scholar]

- Pike, Andy, Andrés Rodríguez-Pose, John Tomaney, Gianpiero Torrisi, and Vassilis Tselios. 2012. In search of the ‘economic dividend’ of devolution: Spatial disparities, spatial economic policy, and decentralisation in the UK. Environment and Planning C: Government and Policy 30: 10–28. [Google Scholar] [CrossRef]

- Prud’homme, Remy. 1995. The dangers of decentralization. World Bank Research Observer 10: 201–20. [Google Scholar] [CrossRef]

- Robinson, Marguerite S. 1988. Local Politics: The Law of the Fishes. Development through Political Change in Medak District, Andhra Pradesh (South India). Delhi: Oxford University Press. [Google Scholar]

- Rodríguez-Pose, Andrés, and Adala Bwire. 2004. The economic (in)efficiency of devolution. Environment and Planning A: Economy and Space 36: 1907–28. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Roberto Ezcurra. 2010. Does decentralization matter for regional disparities? A cross-country analysis. Journal of Economic Geography 10: 619–44. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Roberto Ezcurra. 2011. Is fiscal decentralisation harmful for regional growth? Evidence from the OECD countries. Journal of Economic Geography 11: 619–43. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Nicholas Gill. 2003. The global trend towards devolution and its implications. Environment and Planning C: Government and Policy 21: 333–51. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Nicholas Gill. 2004. Is there a global link between regional disparities and devolution? Environment and Planning A: Economy and Space 36: 2097–117. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Kristina Maslauskaite. 2012. Can policy make us happier? Individual characteristics, socio-economic factors and life satisfaction in Central and Eastern Europe. Cambridge Journal of Regions Economy and Society 5: 77–96. [Google Scholar] [CrossRef]

- Schmitt, Hermann, and Evi Scholz. 2005. The Mannheim Eurobarometer Trend File, 1970–2002: Prepared by Zentralarchiv fur Empirische Sozialforschung. ICPSR04357-v1. Mannheim, Germany: Mannheimer Zentrum fur Europaische Sozialforschung and Zentrum fur Umfragen, Methoden und Analysen [producers], 2005. Cologne: Zentralarchiv fur Empirische Sozialforschung. Ann Arbor: Inter-university Consortium for Political and Social Research [Distributors]. [Google Scholar] [CrossRef]

- Schout, J. Adriaan, and Andrew J. Jordan. 2007. From cohesion to territorial policy integration (TPI): Exploring the governance challenges in the European Union. European Planning Studies 15: 835–51. [Google Scholar] [CrossRef]

- Singer, Jerome L. 1952. Personal and environmental determinants of perception in a size constancy experiment. Journal of Experimental Psychology 43: 420–27. [Google Scholar] [CrossRef] [PubMed]

- Tiebout, Charles M. 1956. A pure theory of local expenditures. Journal of Political Economy 64: 416–24. [Google Scholar] [CrossRef]

- Toshkov, Dimiter, and Elitsa Kortenska. 2015. Does Immigration Undermine Public Support for Integration in the European Union? JCMS-Journal of Common Market Studies 53: 910–25. [Google Scholar] [CrossRef]

- Tsaliki, Liza. 2007. The construction of European identity and citizenship through cultural policy. European Studies 24: 157–182. [Google Scholar]

- Tselios, Vassilis, and John Tomaney. 2018. Decentralisation and European identity. Environment and Planning A: Economy and Space. [Google Scholar] [CrossRef]

- Tselios, Vassilis, and Emma L. Tompkins. 2017. Local government, political decentralisation and resilience to natural hazard-associated disasters. Environmental Hazards 16: 228–52. [Google Scholar] [CrossRef]

- Tselios, Vassilis, and Emma L. Tompkins. 2019. What causes nations to recover from disasters? An inquiry into the role of wealth, income inequality, and social welfare provisioning. International Journal of Disaster Risk Reduction 33: 162–80. [Google Scholar] [CrossRef]

- Tselios, Vassilis, Andrés Rodríguez-Pose, Andy Pike, John Tomaney, and Gianpiero Torrisi. 2012. Income inequality, decentralisation, and regional development in Western Europe. Environment and Planning A: Economy and Space 44: 1278–301. [Google Scholar] [CrossRef]

- Weingast, Barry R. 2009. Second generation fiscal federalism: The implications of fiscal incentives. Journal of Urban Economics 65: 279–93. [Google Scholar] [CrossRef]

- Wyplosz, Charles. 2015. The Centralization-Decentralization Issue: European Economy Discussion Papers. Discussion Paper 014, September 2015, Fellowship Initiative 2014–2015 ‘Growth, Integration and Structural Convergence Revisited’. Luxembourg: Publications Office of the European Union. [Google Scholar]

| 1 | Fiscal decentralisation refers to the degree to which central governments transfer fiscal autonomy to subnational government entities, while political decentralisation refers to the power of subnational governments to undertake the political functions of governance (Pike et al. 2012). |

| 2 | |

| 3 | The same country/years as for the Regret variable. |

| 4 | Reflecting (i) the degree of the autonomous power rather than deconcentrated power of regional governments (score: 0–3); (ii) the competence areas that are the responsibility of regional governments (score: 0–4); (iii) the independent capacity to tax of regional governments (score: 0–4); and (iv) the borrowing capacity of regional governments (score: 0–3); and (v) the presence of independent legislature and executive at regional levels (score: 0–4). |

| 5 | Calculated as the sum of the extent to which (i) regions influence the national legislative process (score: 0–2); (ii) regions influence national policy in intergovernmental meetings (score: 0–2); (iii) regions influence the geographical allocation of national tax revenues (score: 0–2); (iv) regions are capable of influencing subnational and national borrowing constraints (score: 0–2); and (v) regions affect constitutional change (score: 0–4). |

| 6 | We do not control for other key individual control variables such as occupation, family composition and happiness due to the low number of observations. |

| 7 | We have also calculated the relative risk ratio (rrr). This is the the ratio of the probability of selecting one potential outcome category over the odds of choosing the baseline category. The rrr can be provided upon authors’ request. |

| 8 | For the unweighted regressions, the correlation coefficient between fiscal decentralisation and political decentralisation is not high (i.e., below 0.5). |

| Variables | Responses | Fiscal Decentralisation (Expenditures) | Fiscal Decentralisation (Revenues) | Political Decentralisation (RAI Total) |

|---|---|---|---|---|

| EU membership | A good thing | 0.2633 | 0.2272 | 16.4809 |

| Neither good nor bad | 0.2809 | 0.2493 | 17.3602 | |

| A bad thing | 0.3060 | 0.2663 | 14.4851 | |

| Regret | Very sorry | 0.2583 | 0.2119 | 16.6071 |

| Indifferent | 0.2588 | 0.2110 | 16.3808 | |

| Very relieved | 0.3083 | 0.2533 | 13.5791 | |

| Common Market index | Strong opposition | 0.3146 | 0.2529 | 12.6517 |

| Moderate opposition | 0.2898 | 0.2412 | 15.1993 | |

| Neutral position | 0.2668 | 0.2208 | 16.7211 | |

| Moderate support | 0.2500 | 0.2035 | 16.4917 | |

| Strong support | 0.2578 | 0.2114 | 16.5753 |

| Variables | Obs | Mean or Percent | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Sex | 1,116,301 | ||||

| Male | 538,732 | 48.26 | |||

| Female | 577,569 | 51.74 | |||

| Age | 1,073,412 | 43.37 | 17.92 | 15 | 99 |

| Education | 1,008,131 | ||||

| Up to 14 | 260,226 | 25.81 | |||

| Up to 15 | 92,467 | 9.17 | |||

| Up to 16 | 119,656 | 11.87 | |||

| Up to 17 | 77,546 | 7.69 | |||

| Up to 18 | 111,130 | 11.02 | |||

| Up to 19 | 52,216 | 5.18 | |||

| Up to 20 | 41,515 | 4.12 | |||

| Up to 21 | 32,230 | 3.20 | |||

| 22 or older | 125,347 | 12.43 | |||

| Still studying | 95,798 | 9.50 | |||

| GDP per capita | 1,116,576 | 29,285.69 | 7581.23 | 14,444.50 | 67,912.03 |

| tfp | 1,116,576 | 0.94 | 0.12 | 0.62 | 1.24 |

| Variables | A Good Thing | Neither Good nor Bad | A Bad Thing | A Good Thing | Neither Good nor Bad | A Bad Thing | A Good Thing | Neither Good nor Bad | A Bad Thing |

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | |||||||

| FiscDec (expenditures) | −0.2641 *** | −0.3619 ** | |||||||

| FiscDec (revenues) | 0.4022 *** | −0.2975 * | |||||||

| PolDec (RAI index) | 0.0025 * | 0.0571 *** | |||||||

| Male | base | base | base | base | base | base | |||

| Female | −0.2719 *** | −0.2841 *** | −0.2717 *** | −0.2843 *** | −0.2723 *** | −0.2893 *** | |||

| Age | 0.0138 *** | 0.0297 *** | 0.0137 *** | 0.0297 *** | 0.0136 *** | 0.0292 *** | |||

| Age × Age | −0.0001 *** | −0.0002 *** | −0.0001 *** | −0.0002 *** | −0.0001 *** | −0.0002 *** | |||

| Education | |||||||||

| Up to 14 | base | base | base | base | base | base | |||

| Up to 15 | 0.0423 *** | 0.0043 | 0.0426 *** | 0.0042 | 0.0359 *** | 0.0054 | |||

| Up to 16 | 0.1490 *** | −0.1473 *** | 0.1491 *** | −0.1463 *** | 0.1390 *** | −0.1375 *** | |||

| Up to 17 | 0.3093 *** | −0.0871 *** | 0.3093 *** | −0.0866 *** | 0.2989 *** | −0.0820 *** | |||

| Up to 18 | 0.4447 *** | −0.1384 *** | 0.4443 *** | −0.1383 *** | 0.4333 *** | −0.1339 *** | |||

| Up to 19 | 0.5557 *** | −0.0153 | 0.5580 *** | −0.0157 | 0.5394 *** | −0.0162 | |||

| Up to 20 | 0.6343 *** | −0.0944 *** | 0.6322 *** | −0.0950 *** | 0.6120 *** | −0.1013 *** | |||

| Up to 21 | 0.8460 *** | −0.1160 *** | 0.8425 *** | −0.1167 *** | 0.8234 *** | −0.1090 *** | |||

| 22 or older | 1.0073 *** | −0.0833 *** | 1.0061 *** | −0.0844 *** | 0.9804 *** | −0.0760 *** | |||

| Still studying | 0.8131 *** | −0.1161 *** | 0.8114 *** | −0.1162 *** | 0.7902 *** | −0.1113 *** | |||

| GDP per capita | 0.0001 *** | −0.0000 *** | 0.0000 *** | 0.0000 *** | |||||

| tfp | −0.2477 ** | 0.5155 *** | 0.4209 *** | 0.0748 | −0.5735 *** | 1.9888 *** | |||

| Year-dummies | YES | YES | YES | YES | YES | YES | |||

| Country-dummies | YES | YES | YES | YES | YES | YES | |||

| Constant | −0.9053 *** | −0.7463 *** | −0.4383 *** | −0.9787 *** | −0.3768 *** | −4.1326 *** | |||

| Observations | 659,509 | 659,509 | 704,835 | ||||||

| LR chi2 | 92,920.63 | 92,596.33 | 97,746.12 | ||||||

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | ||||||

| Pseudo R2 | 0.0764 | 0.0761 | 0.0753 | ||||||

| Log likelihood | −561,753.01 | −561,915.16 | −600,219.99 |

| Variables | Very Sorry | Indifferent | Very Relieved | Very Sorry | Indifferent | Very Relieved | Very Sorry | Indifferent | Very Relieved |

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | |||||||

| FiscDec (expenditures) | −1.1637 *** | −0.5030 ** | |||||||

| FiscDec (revenues) | 0.0019 | −0.5642 ** | |||||||

| PolDec (RAI index) | 0.0305 *** | 0.0900 *** | |||||||

| Male | base | base | base | base | base | base | |||

| Female | −0.3525 *** | −0.2200 *** | −0.3522 *** | −0.2199 *** | −0.3519 *** | −0.2254 *** | |||

| Age | 0.0571 *** | 0.0595 *** | 0.0570 *** | 0.0594 *** | 0.0569 *** | 0.0589 *** | |||

| Age × Age | −0.0005 *** | −0.0005 *** | −0.0005 *** | −0.0005 *** | −0.0005 *** | −0.0005 *** | |||

| Education | |||||||||

| Up to 14 | base | base | base | base | base | base | |||

| Up to 15 | 0.0925 *** | 0.0266 | 0.0917 *** | 0.0267 | 0.0797 *** | 0.0249 | |||

| Up to 16 | 0.1991 *** | −0.1266 *** | 0.1991 *** | −0.1259 *** | 0.1891 *** | −0.1187 *** | |||

| Up to 17 | 0.4086 *** | −0.0283 | 0.4082 *** | −0.0277 | 0.3979 *** | −0.0227 | |||

| Up to 18 | 0.5699 *** | −0.1446 *** | 0.5691 *** | −0.1441 *** | 0.5537 *** | −0.1411 *** | |||

| Up to 19 | 0.7157 *** | −0.0377 | 0.7170 *** | −0.0370 | 0.6940 *** | −0.0423 | |||

| Up to 20 | 0.8343 *** | −0.0854 ** | 0.8318 *** | −0.0850 ** | 0.8082 *** | −0.0870 ** | |||

| Up to 21 | 0.9482 *** | −0.2969 *** | 0.9421 *** | −0.2972 *** | 0.9223 *** | −0.2881 *** | |||

| 22 or older | 1.1767 *** | −0.1832 *** | 1.1746 *** | −0.1836 *** | 1.1439 *** | −0.1736 *** | |||

| Still studying | 0.9432 *** | −0.1730 *** | 0.9412 *** | −0.1728 *** | 0.9174 *** | −0.1538 *** | |||

| GDP per capita | 0.0000 *** | −0.0000 *** | 0.0000 *** | 0.0000 | |||||

| tfp | −2.5139 *** | 0.7434 *** | −2.0891 *** | 0.0671 | −2.1849 *** | 3.0973 *** | |||

| Year-dummies | YES | YES | YES | YES | YES | YES | |||

| Country-dummies | YES | YES | YES | YES | YES | YES | |||

| Constant | 0.5075 *** | −2.2406 *** | 0.1055 | −2.3584 *** | −0.9186 *** | −6.7580 *** | |||

| Observations | 356,565 | 356,565 | 385,958 | ||||||

| LR chi2 | 57,832.20 | 57,655.70 | 62,106.83 | ||||||

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | ||||||

| Pseudo R2 | 0.0839 | 0.0836 | 0.0833 | ||||||

| Log likelihood | −315,827.05 | −315,915.3 | −341,788.49 |

| Variables | Strong Opposition | Moderate Opposition | Neutral Position | Moderate Support | Strong Support | Strong Opposition | Moderate Opposition | Neutral Position | Moderate Support | Strong Support |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | |||||||||

| FiscDec (expenditures) | −1.6284 *** | −0.1277 | 0.2381 | −1.1733 *** | ||||||

| FiscDec (revenues) | −1.6626 *** | −0.3044 | 0.2530 | 0.0807 | ||||||

| Male | base | base | base | base | base | base | base | base | ||

| Female | −0.3255 *** | −0.1656 *** | −0.0859 *** | −0.3805 *** | −0.3251 *** | −0.1657 *** | −0.0859 *** | −0.3801 *** | ||

| Age | 0.0531 *** | 0.0277 *** | −0.0132 *** | 0.0449 *** | 0.0530 *** | 0.0276 *** | −0.0132 *** | 0.0448 *** | ||

| Age × Age | −0.0004 *** | −0.0002 *** | 0.0001 *** | −0.0004 *** | −0.0004 *** | −0.0002 *** | 0.0001 *** | −0.0004 *** | ||

| Education | ||||||||||

| Up to 14 | base | base | base | base | base | base | base | base | ||

| Up to 15 | −0.0043 | −0.0359 | −0.0657 *** | 0.0682 *** | −0.0044 | −0.0359 | −0.0659 *** | 0.0674 *** | ||

| Up to 16 | −0.2104 *** | −0.0869 *** | 0.0159 | 0.1812 *** | −0.2102 *** | −0.0865 *** | 0.0154 | 0.1817 *** | ||

| Up to 17 | −0.1062 *** | 0.0193 | 0.1486 *** | 0.4269 *** | −0.1060 *** | 0.0199 | 0.1479 *** | 0.4267 *** | ||

| Up to 18 | −0.1740 *** | −0.0423 | 0.1881 *** | 0.6458 *** | −0.1740 *** | −0.0418 | 0.1872 *** | 0.6453 *** | ||

| Up to 19 | 0.0160 | −0.0109 | 0.2604 *** | 0.8085 *** | 0.0175 | −0.0105 | 0.2598 *** | 0.8100 *** | ||

| Up to 20 | −0.1012 * | −0.0313 | 0.2229 *** | 0.9204 *** | −0.1020 * | −0.0306 | 0.2220 *** | 0.9181 *** | ||

| Up to 21 | −0.2793 *** | 0.0219 | 0.4202 *** | 1.1255 *** | −0.2810 *** | 0.0226 | 0.4193 *** | 1.1197 *** | ||

| 22 or older | −0.1116 *** | −0.0355 | 0.4227 *** | 1.3570 *** | −0.1122 *** | −0.0354 | 0.4222 *** | 1.3552 *** | ||

| Still studying | −0.1890 *** | −0.1495 *** | 0.3039 *** | 1.0620 *** | −0.1897 *** | −0.1489 *** | 0.3032 *** | 1.0601 *** | ||

| GDP per capita | −0.0000 | −0.0000 | 0.0000 ** | 0.0000 *** | ||||||

| tfp | 1.4245 *** | 0.4865 | 1.3868 *** | −0.9523 *** | 0.7254 * | 0.0172 | 1.7541 *** | −0.4125 ** | ||

| Year-dummies | YES | YES | YES | YES | YES | YES | YES | YES | ||

| Country-dummies | YES | YES | YES | YES | YES | YES | YES | YES | ||

| Constant | −1.9913 *** | −1.6492 *** | −1.8198 *** | 0.0020 | −1.9410 *** | −1.6684 *** | −1.6611 *** | −0.4665 ** | ||

| Observations | 341,692 | 341,692 | ||||||||

| LR chi2 | 64,400.38 | 64,230.83 | ||||||||

| Prob > chi2 | 0.0000 | 0.0000 | ||||||||

| Pseudo R2 | 0.0677 | 0.0675 | ||||||||

| Log likelihood | −443,362.33 | −443,447.11 | ||||||||

| Variables | Strong Opposition | Moderate Opposition | Neutral Position | Moderate Support | Strong Support | |||||

| (3) | ||||||||||

| PolDec (RAI index) | 0.0920 *** | 0.0338 *** | −0.0155 *** | 0.0193 *** | ||||||

| Male | base | base | base | base | ||||||

| Female | −0.3313 *** | −0.1697 *** | −0.0858 *** | −0.3801 *** | ||||||

| Age | 0.0524 *** | 0.0273 *** | −0.0129 *** | 0.0448 *** | ||||||

| Age × Age | −0.0004 *** | −0.0002 *** | 0.0001 *** | −0.0004 *** | ||||||

| Education | ||||||||||

| Up to 14 | base | base | base | base | ||||||

| Up to 15 | −0.0034 | −0.0386 | −0.0658 *** | 0.0541 *** | ||||||

| Up to 16 | −0.1997 *** | −0.0856 *** | 0.0089 | 0.1682 *** | ||||||

| Up to 17 | −0.1004 *** | 0.0192 | 0.1403 *** | 0.4121 *** | ||||||

| Up to 18 | −0.1657 *** | −0.0485 | 0.1780 *** | 0.6249 *** | ||||||

| Up to 19 | 0.0104 | −0.0125 | 0.2497 *** | 0.7833 *** | ||||||

| Up to 20 | −0.1133** | −0.0359 | 0.2062 *** | 0.8864 *** | ||||||

| Up to 21 | −0.2778 *** | 0.0209 | 0.4033 *** | 1.0903 *** | ||||||

| 22 or older | −0.0989 *** | −0.0355 | 0.4031 *** | 1.3146 *** | ||||||

| Still studying | −0.1625 *** | −0.1411 *** | 0.2897 *** | 1.0287 *** | ||||||

| GDP per capita | 0.0000 | −0.0000 | −0.0000 *** | 0.0000 | ||||||

| tfp | 4.0612 *** | 1.2415 *** | 0.8225 *** | −1.0184 *** | ||||||

| Year-dummies | YES | YES | YES | YES | ||||||

| Country-dummies | YES | YES | YES | YES | ||||||

| Constant | −6.9517 *** | −3.2203 *** | −0.1119 | −0.5316 *** | ||||||

| Observations | 369,609 | |||||||||

| LR chi2 | 68,663.55 | |||||||||

| Prob > chi2 | 0.0000 | |||||||||

| Pseudo R2 | 0.0668 | |||||||||

| Log likelihood | −479,840.84 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tselios, V.; Rodríguez-Pose, A. Did Decentralisation Affect Citizens’ Perception of the European Union? The Impact during the Height of Decentralisation in Europe. Economies 2020, 8, 38. https://doi.org/10.3390/economies8020038

Tselios V, Rodríguez-Pose A. Did Decentralisation Affect Citizens’ Perception of the European Union? The Impact during the Height of Decentralisation in Europe. Economies. 2020; 8(2):38. https://doi.org/10.3390/economies8020038

Chicago/Turabian StyleTselios, Vassilis, and Andrés Rodríguez-Pose. 2020. "Did Decentralisation Affect Citizens’ Perception of the European Union? The Impact during the Height of Decentralisation in Europe" Economies 8, no. 2: 38. https://doi.org/10.3390/economies8020038

APA StyleTselios, V., & Rodríguez-Pose, A. (2020). Did Decentralisation Affect Citizens’ Perception of the European Union? The Impact during the Height of Decentralisation in Europe. Economies, 8(2), 38. https://doi.org/10.3390/economies8020038