Direct Effect of TC on the LME Copper Prices

Abstract

1. Introduction

2. Literature Review

3. Research Model and Data

3.1. Regression Model

3.2. Data

3.3. Stationarity Check: Unit Root Tests

4. Results

4.1. Empirical Regression Results

4.2. VAR Model Specification and Impulse Response Results

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Canarella, Giorgio, and Stephen K. Pollard. 1986. The ‘Efficiency’ of the London Metal Exchange: A Test with Overlapping and Non-Overlapping Data. Journal of Banking and Finance 10: 575–93. [Google Scholar] [CrossRef]

- Cheng, Ing-Haw, and Wei Xiong. 2014. Financialization of Commodity Markets. Annual Review of Financial Economics 6: 419–41. [Google Scholar] [CrossRef]

- Diaz-Borrego, Francisco J., María del Mar Miras-Rodríguez, and Bernabé Escobar-Pérez. 2019. Looking for Accurate Forecasting of Copper TC/RC Benchmark Levels. Complexity 2019: 8523748. [Google Scholar] [CrossRef]

- Figuerrola-Ferretti, Isabel, and Christopher L. Gilbert. 2008. Commonality in the LME Aluminum and Copper Volatility Processes through a FIGARCH Lens. The Journal of Futures Markets 28: 935–62. [Google Scholar] [CrossRef]

- Guzman, Juan Ignacio, and Enrique Silva. 2018. Copper Price Determination: Fundamentals versus Non-fundamentals. Mineral Economics 31: 283–300. [Google Scholar] [CrossRef]

- Irwin, Scott H., and Dwight R. Sanders. 2012. Testing the Masters Hypothesis in Commodity Futures Markets. Energy Economics 34: 256–69. [Google Scholar] [CrossRef]

- Koitsiwe, Kegomoditswe, and Tsuyoshi Adachi. 2018. The Role of Financial Speculation in Copper Prices. Applied Economics and Finance 5: 87–94. [Google Scholar] [CrossRef]

- MacDonald, Ronald, and Mark Taylor. 1988. Metal Prices, Efficiency and Cointegration: Some Evidence from the LME. Bulletin of Economic Research 40: 235–39. [Google Scholar] [CrossRef]

- Otto, Sascha. 2011. A Speculative Efficiency Analysis of the London Metal Exchange in a Multi-Contract Framework. International Journal of Economics and Finance 3: 3–16. [Google Scholar] [CrossRef]

- Park, Jaehwan. 2018. Volatility Transmission between Oil and LME Futures. Applied Economics and Finance 5: 65–72. [Google Scholar] [CrossRef]

- Park, Jaehwan. 2019a. The Role of Canceled Warrants in the LME Market. International Journal of Financial Studies 7: 10. [Google Scholar] [CrossRef]

- Park, Jaehwan. 2019b. Effect of Speculators’ Position Changes on the LME Futures Market. International Journal of Financial Studies 7: 32. [Google Scholar] [CrossRef]

- Park, Jaehwan, and Byungkwon Lim. 2018. Testing Efficiency of the London Metal Exchange: New Evidence. International Journal of Financial Studies 6: 32. [Google Scholar] [CrossRef]

- Tang, Ke, and Wei Xiong. 2012. Index Investment and the Financialization of Commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

| 1 | The origins of the LME can be traced back as far as the opening of the Royal Exchange in London in 1571, during the reign of Queen Elizabeth I. The LME officially opened in 1877; it has been recognized as the global benchmark for the metal market since then. Major producers and consumers use LME contracts for hedging price risks and the reference price for spot and futures price. The LME is now the world’s largest future exchange in the metal industry, including copper, which is known to correlate quite a bit with business cycle (Park 2018; Tang and Xiong 2012; and Cheng and Xiong 2014). Even though copper is traded at both CME (Chicago Mercantile Exchange) and SHFE (Shanghai Futures Exchange), LME remains a global benchmark. Previous studies in the LME-related area had three categories. First, Canarella and Pollard (1986) and MacDonald and Taylor (1988) found that the LME was efficient, while Otto (2011) and Park and Lim (2018) found opposing results. Second, Park (2019b) presented statistically significant evidence that the speculators Granger-caused the prices of base metals. Third, Figuerrola-Ferretti and Gilbert (2008) examined copper volatilities, while Park (2018) provided the evidence of volatility transmission between oil and LME. |

| 2 | This information is a valuable investment factor of market supply trends, which can provide a meaningful implication of possible price direction. |

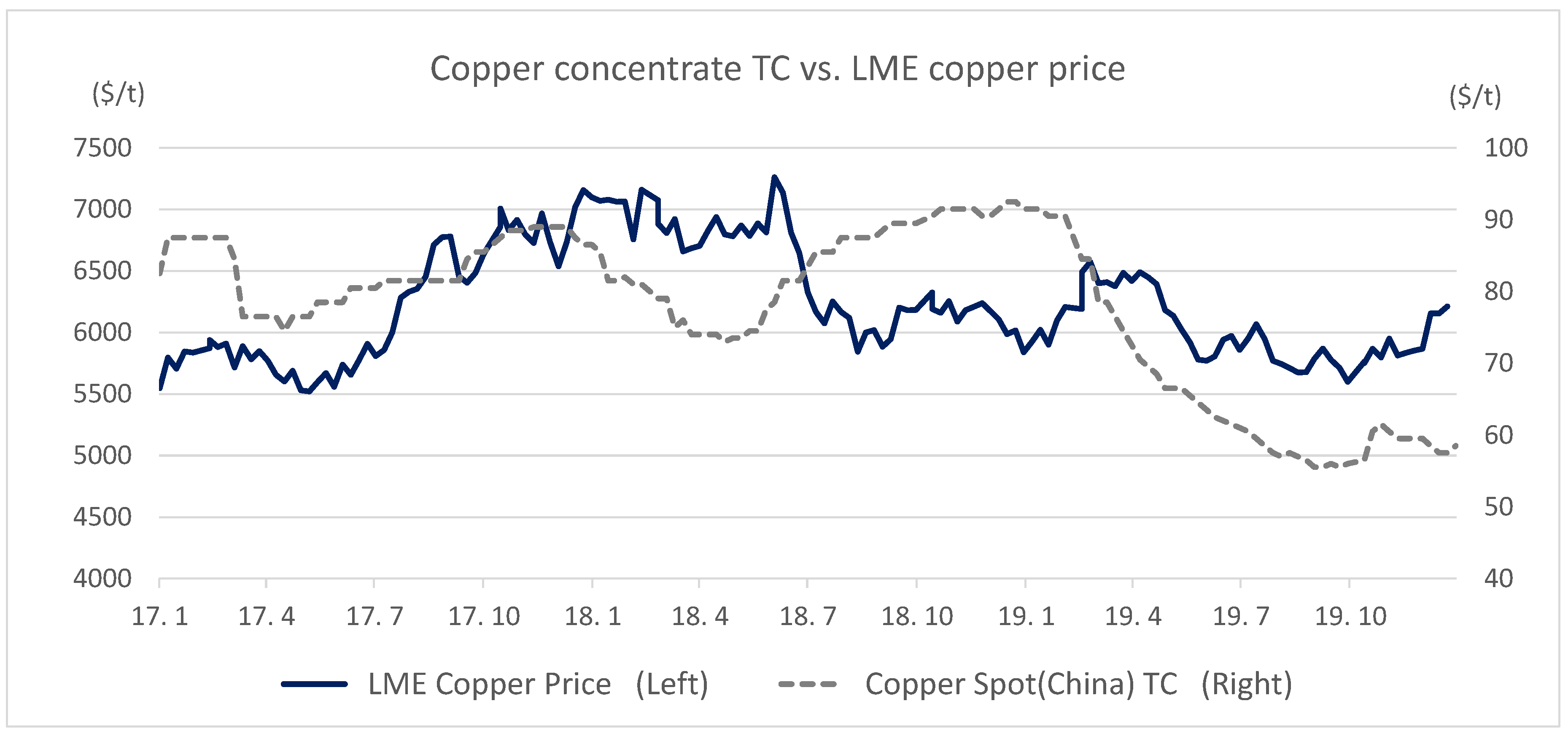

| 3 | The TC is different from region-wide, such as Europe, Asia and US. This paper examines the China copper concentrate TC as a benchmark copper TC through Bloomberg. |

| 4 | The Fastmarket data are also compared and partly reflect the data point. |

| 5 | Irwin and Sanders (2012) reported that a total of $161.2 billion was invested in commodity index investments as of March 31, 2010. Moreover, 78% of index investments were in the U.S. futures market, which invited major index funds with rising trading volumes. These are very meaningful market trends. |

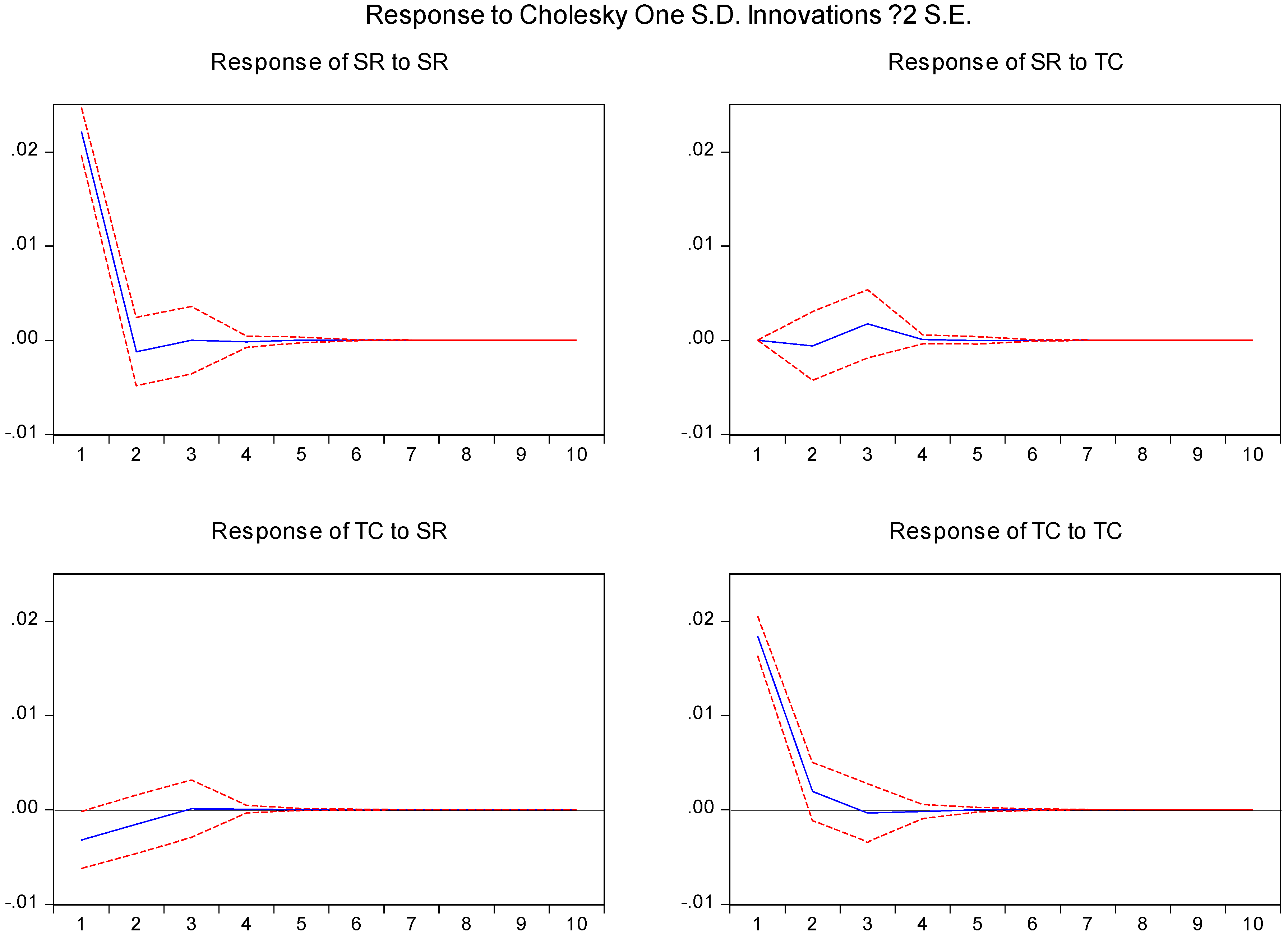

| 6 | Two lags are appropriate, based on the test (likelihood-ratio test). |

| Metal Concentrates | TC | Effect on Metal Price |

|---|---|---|

| Up | Up | Negative |

| Down | Down | Positive |

| Variables | Mean | Standard Deviation | Skewness | Maximum | Minimum | Kurtosis | Jarque–Bera |

|---|---|---|---|---|---|---|---|

| SR | 0.0007 | 0.022 | 0.1461 | 0.0637 | −0.0493 | 6.8328 | 307.1 (0.00) |

| TC | −0.0019 | 0.018 | −1.3038 | 0.0684 | −0.0994 | 10.4485 | 402.2 (0.00) |

| Variables | Augmented Dickey–Fuller (ADF) | Phillip–Perron (PP) | Order of Integration |

|---|---|---|---|

| SR | −13.30 *** | −13.50 *** | I(0) |

| TC | −10.89 *** | −11.02 *** | I(0) |

| Metal | F-Statistics | MSE (Mean Squared Error) | |||

|---|---|---|---|---|---|

| copper | 0.0003 | −0.18 | 0.03 | 4.31 ** | 0.01 |

| (0.19) | (−2.07) ** |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lim, B.; Kim, H.S.; Park, J. Direct Effect of TC on the LME Copper Prices. Economies 2020, 8, 36. https://doi.org/10.3390/economies8020036

Lim B, Kim HS, Park J. Direct Effect of TC on the LME Copper Prices. Economies. 2020; 8(2):36. https://doi.org/10.3390/economies8020036

Chicago/Turabian StyleLim, Byungkwon, Hyeon Sook Kim, and Jaehwan Park. 2020. "Direct Effect of TC on the LME Copper Prices" Economies 8, no. 2: 36. https://doi.org/10.3390/economies8020036

APA StyleLim, B., Kim, H. S., & Park, J. (2020). Direct Effect of TC on the LME Copper Prices. Economies, 8(2), 36. https://doi.org/10.3390/economies8020036