Regime Type, Issue Type and Economic Sanctions: The Role of Domestic Players

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. Success of Economic Sanctions

2.2. Domestic Actors’ Response to Economic Sanctions

2.3. Regime Type and Sanction Success

2.4. Issue Salience Association with Sanctions’ Success

3. Methodology

3.1. Description of a Basic Economic Sanctions Game

3.2. The Games in General and Sequence of the Moves

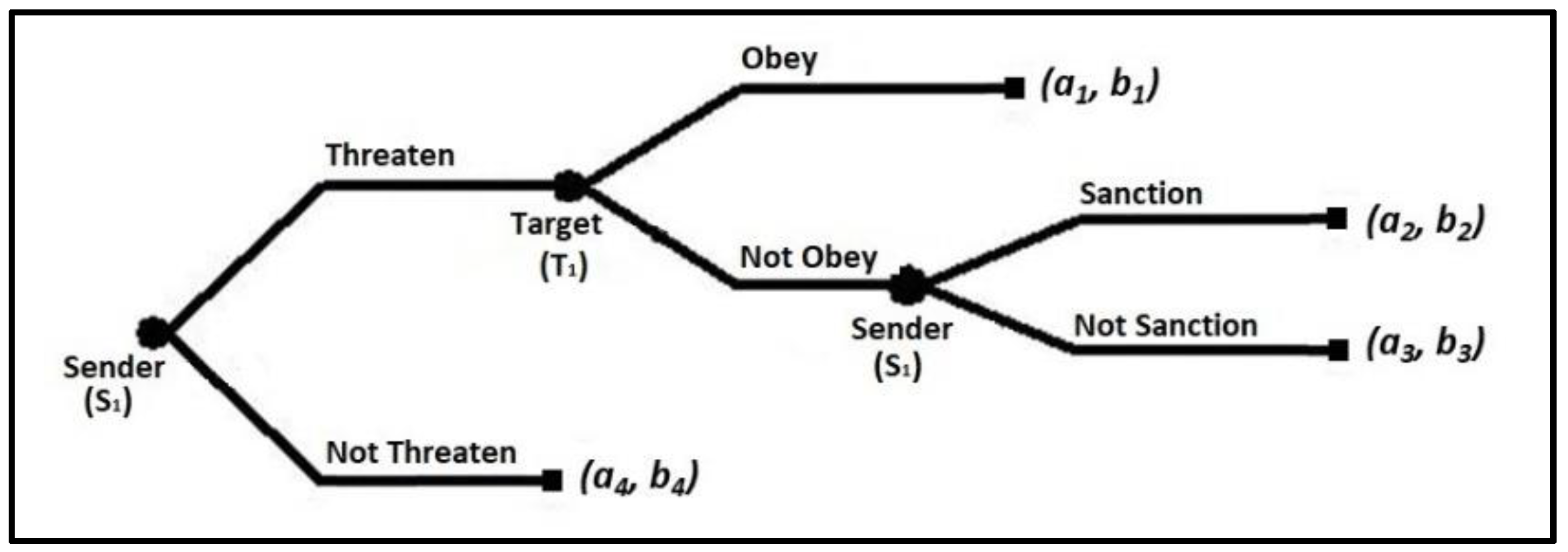

3.2.1. The Game with no Opposition Party (Non-Democracy v. Non-Democracy)

- The sender S1 moves first by choosing either to threaten or not to threaten economic sanctions on a target state, T1.

- After observing the sender’s S1 behavior, the target state T1 either obeys S1’s terms or does not obey its demands. If T1 obeys, then the game ends peacefully.

- If T1 chooses not to obey, then S1 chooses either to sanction (SA) or not to sanction (SN).

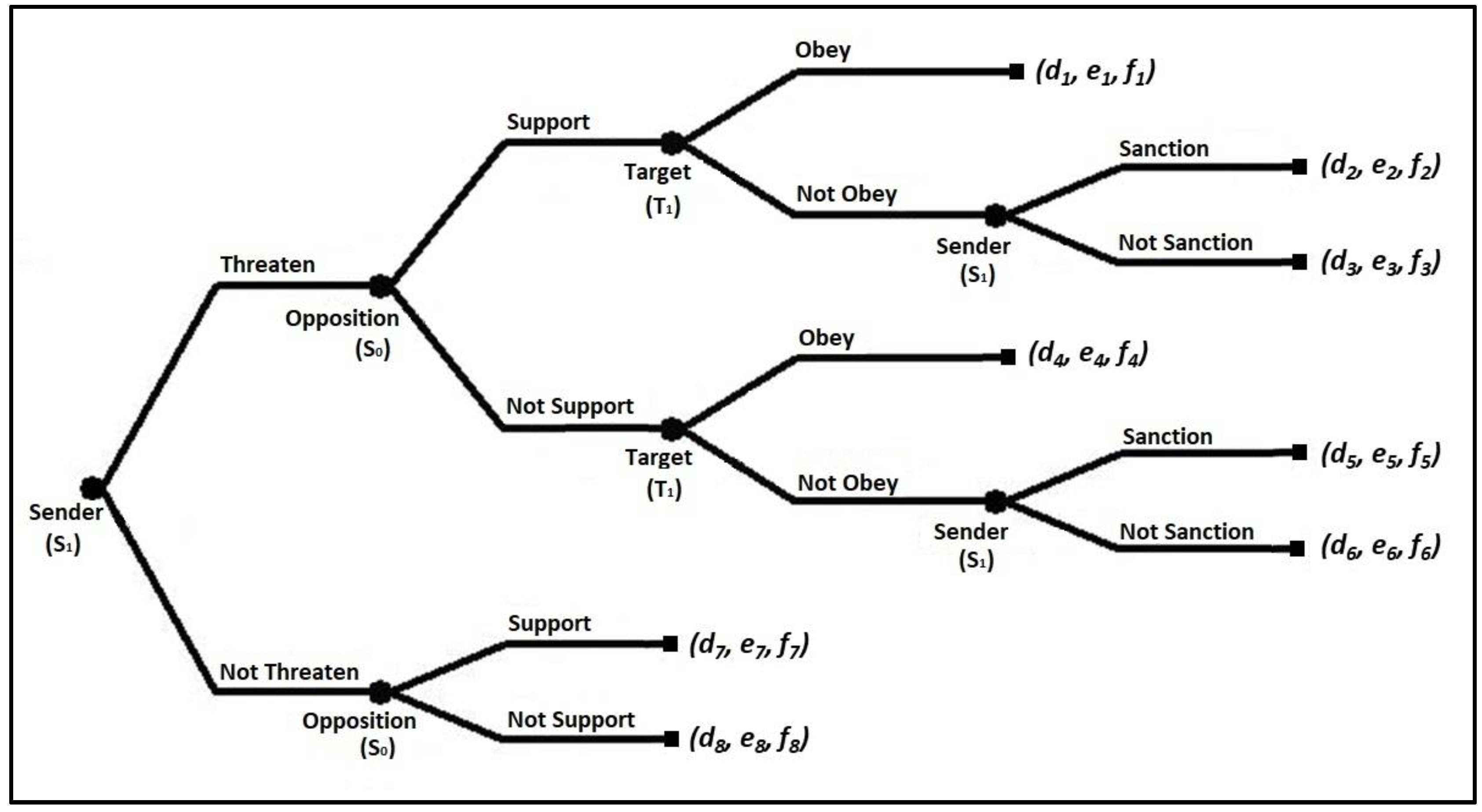

3.2.2. The Game with an Opposition Party in Sender State (Democracy v. Non-Democracy)

- The sender state S1 moves first by choosing either to threaten economic sanctions on a target state T1 or chooses not to threaten economic sanctions.

- The opposition party S0 in the sender state moves next by selecting options either to support or not to support the government’s policy.

- After observing the sender’s (S1) and the opposition’s (S0) strategies, the target state T1 either obeys or does not obey the sender state. If T1 obeys, then the game ends peacefully.

- If T1 chooses not to obey, then S1 chooses either to impose sanctions or not to impose sanctions.

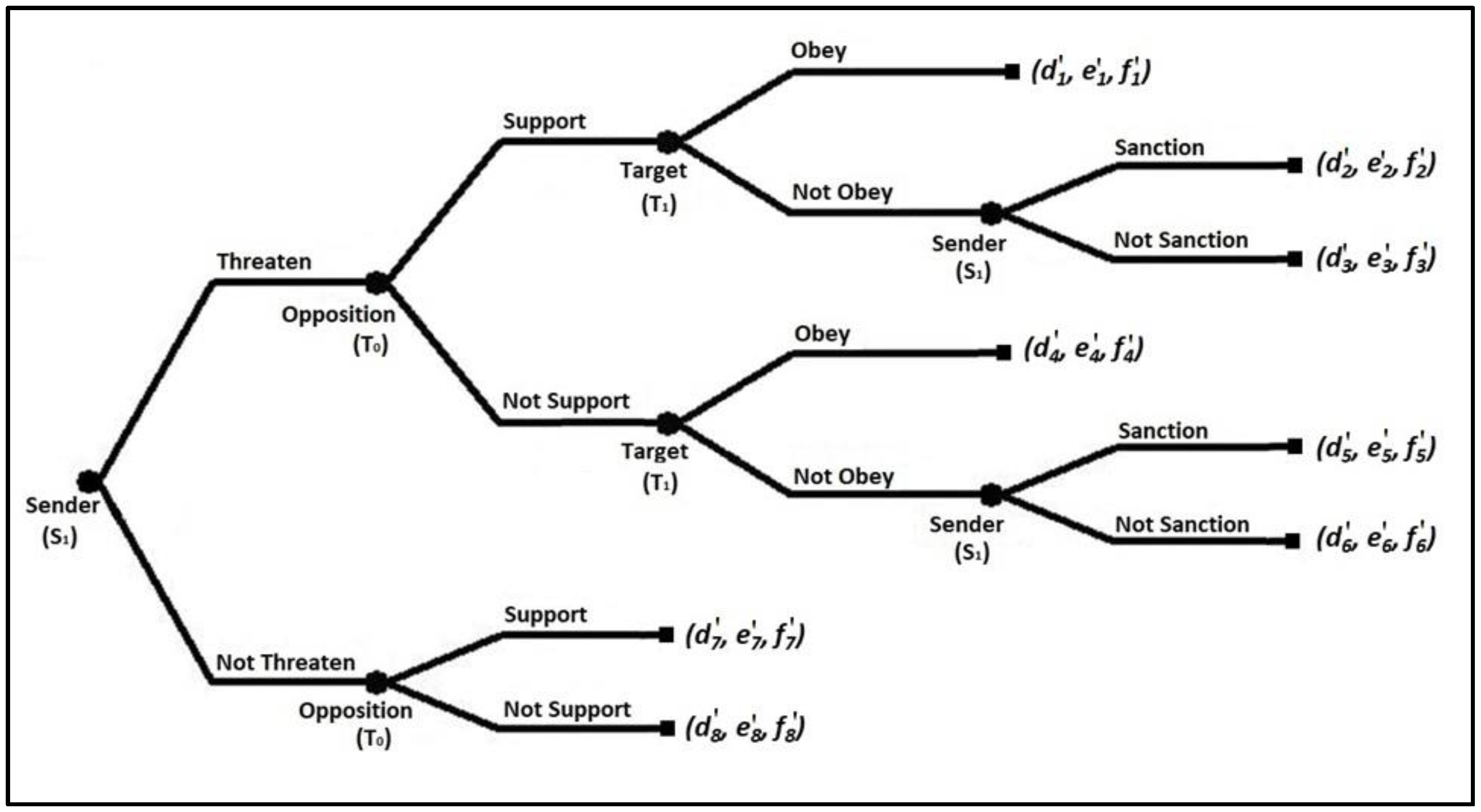

3.2.3. The Game with an Opposition Party in Target State (Non-Democracy v. Democracy)

- The sender state S1 moves first by choosing either to threaten or not to threaten economic sanctions.

- The target state T1 moves next by selecting options either to obey or not to obey.

- After observing S1’s and T1’s strategies, the opposition in target T0 either supports or does not support the target state.

- If T1 chooses not to obey, S1 chooses either to sanction the sanctions, or not to sanction after T0′s strategies.

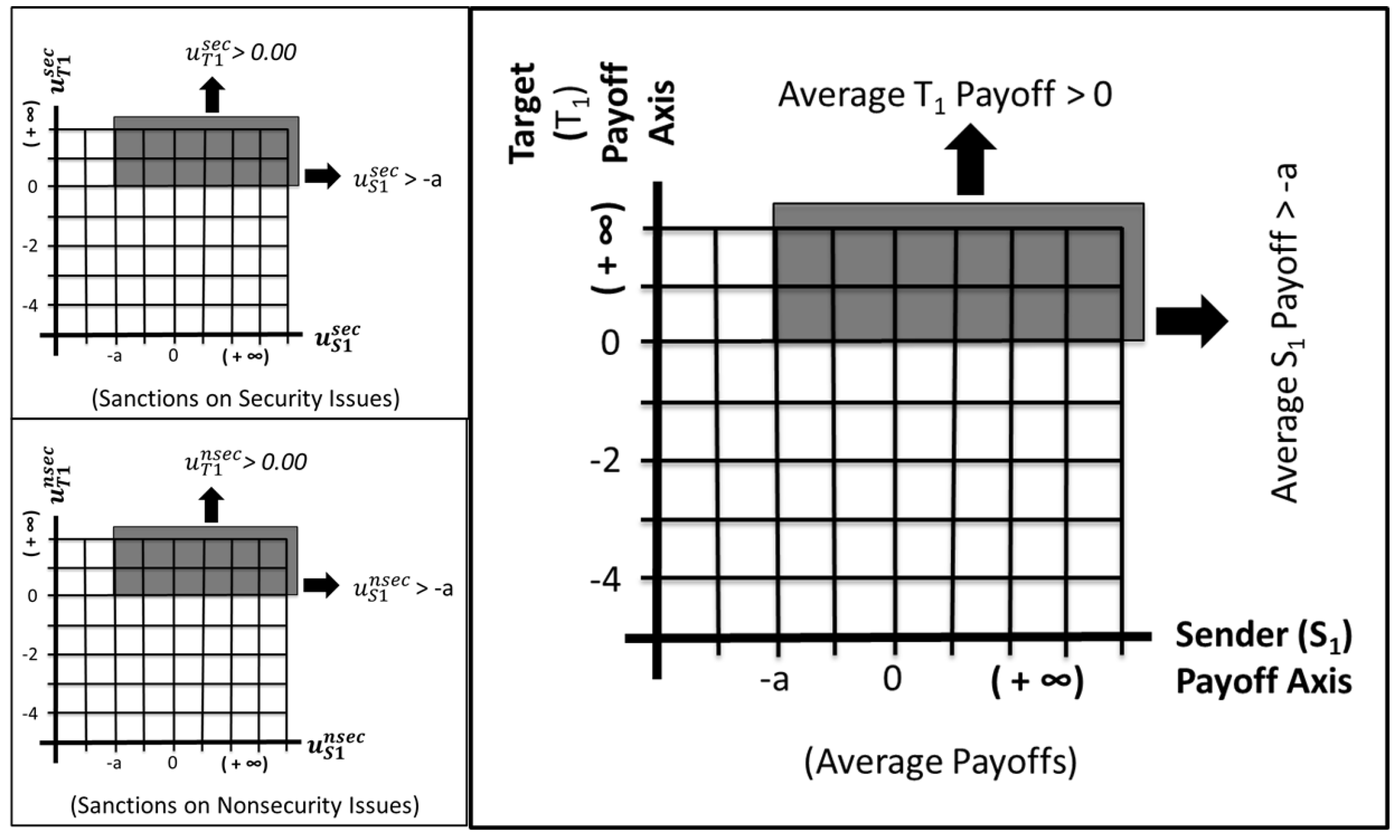

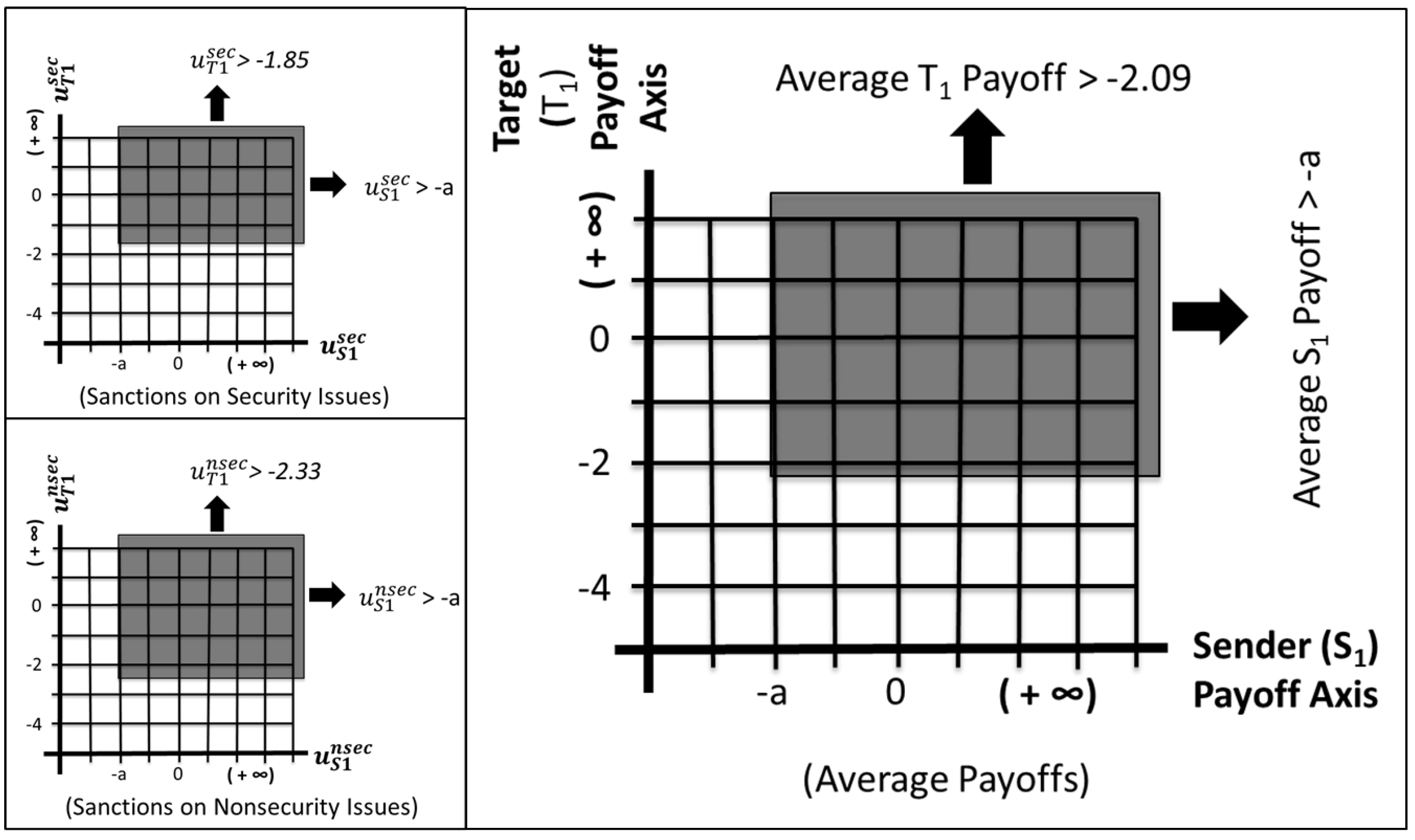

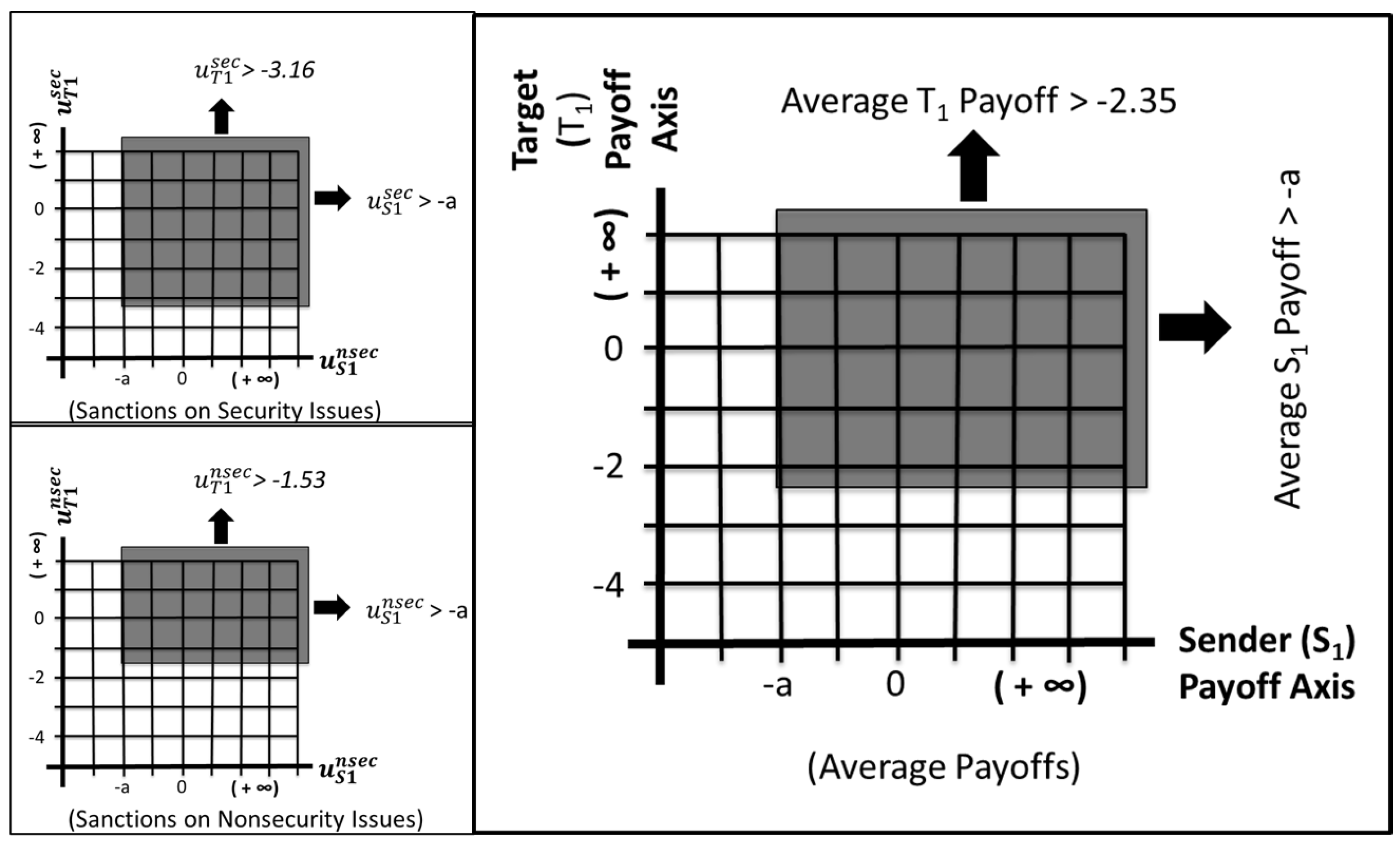

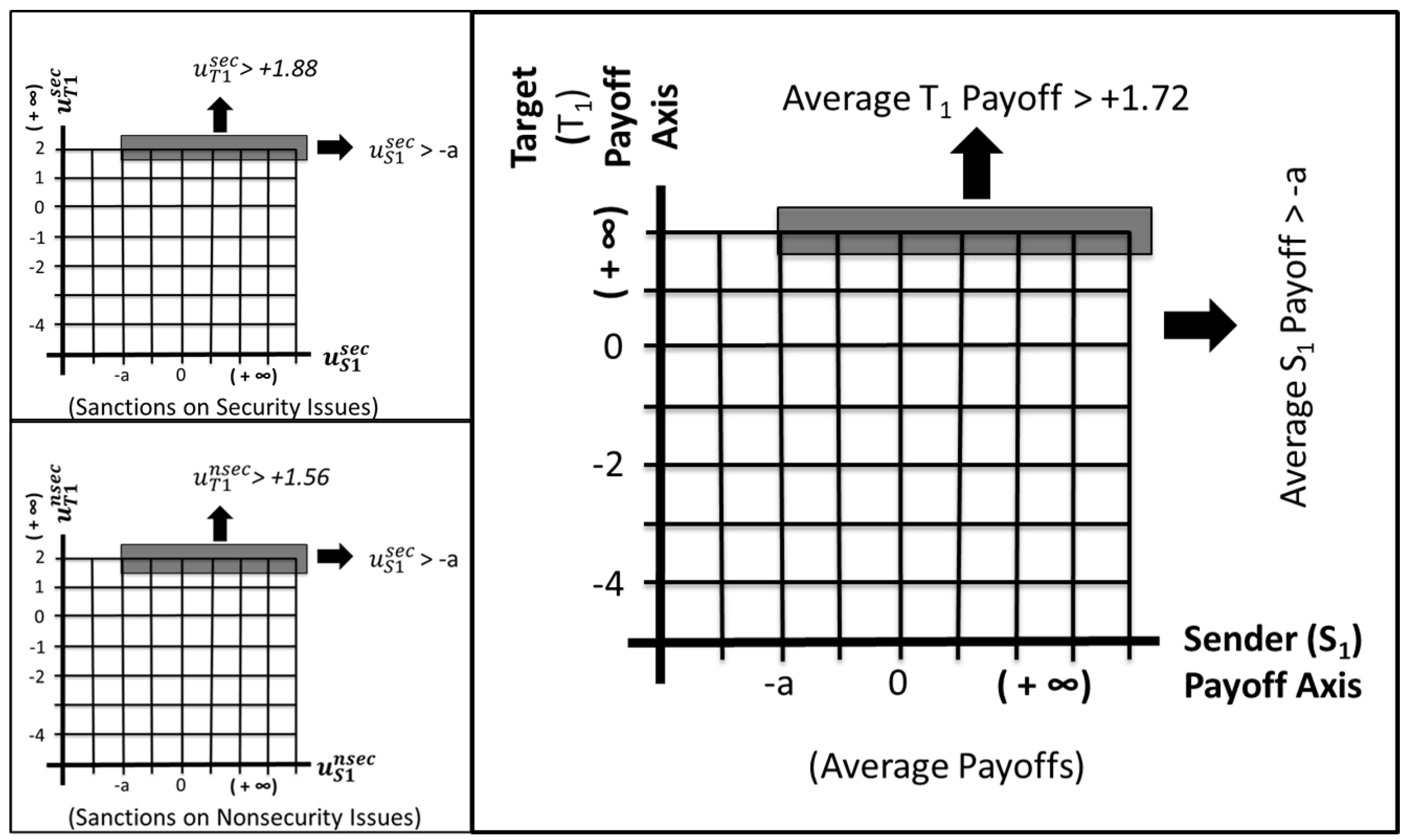

3.3. Payoffs

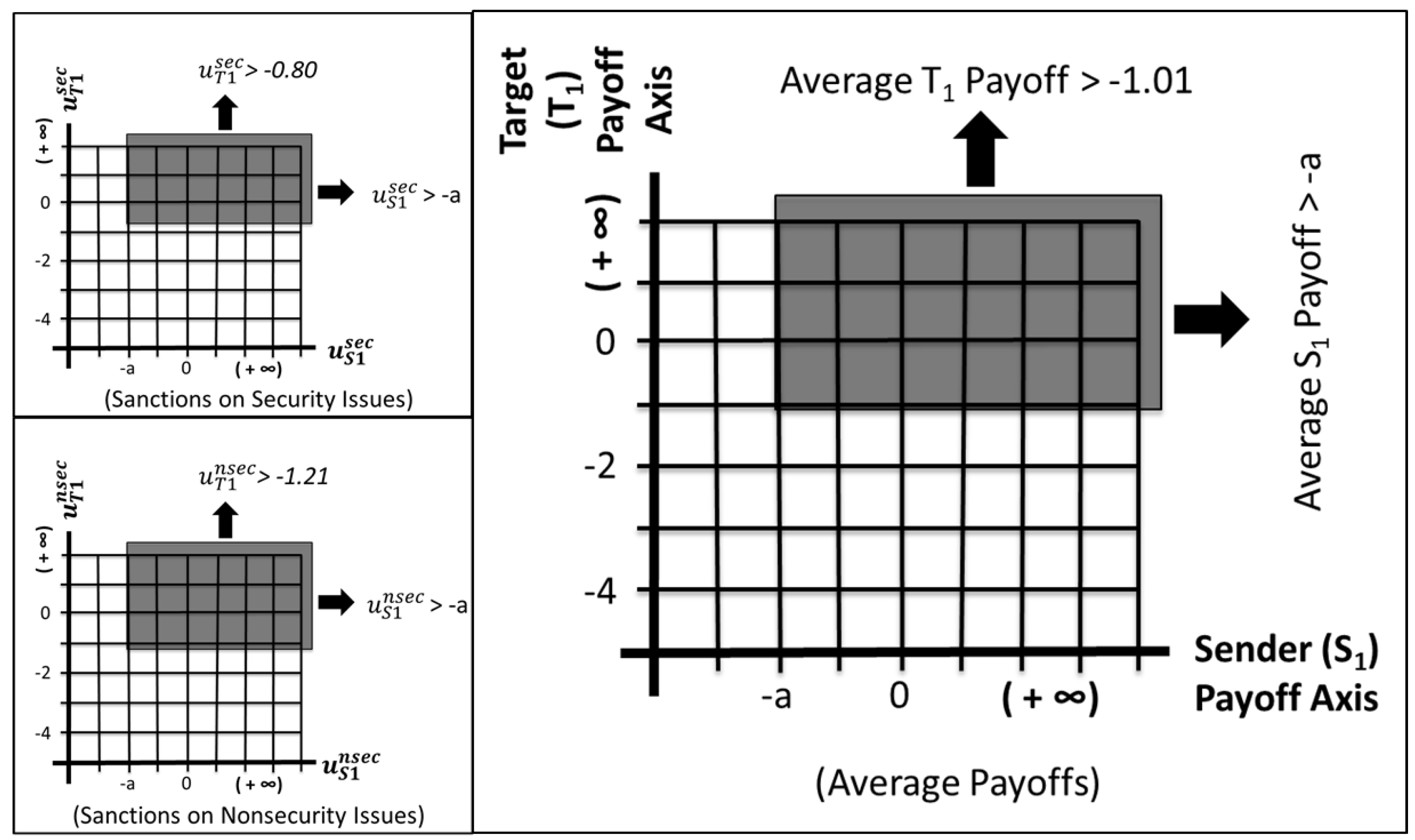

- Assume that the cost of economic sanctions, both for security and nonsecurity-related issues, is ci. Here, cs1 is a value from [0, Cs1] for the sender state S1 and cT1 is the cost of sanctions, which is a value from [0, CT1], for the target state T1.

- Assume that the utility obtained from sanctions, related to security issues, is uisec, while uinsec is for the utility obtained from sanctions related to nonsecurity issues.

- The probability of economic sanctions imposition is p.

- The ultimate payoffs for players are the difference between the utility obtained from economic sanctions minus the cost of the sanctions: uisec*p-ci (for sanctions related to security issues) or uinsec*p-ci (for sanctions related with nonsecurity issues).

- For simplicity, the cost is assumed to be a constant value, and the utility of sanctions is a function F(x). For sanctions related to security issues, uS1sec ~ F(uS1sec) on [p-Cs1, p] for S1; uT1sec ~ G(uT1sec) on [p-CT1, p] for T1. For sanctions related to nonsecurity issues, uS1sec ~ F(uS1nsec) on [p-Cs1, p] for S1, and uT1nsec ~ G(uT1nsec) on [1-p-CT1, 1-p] for T1.

- The expected utility of players for games on security-related sanctions is a function of uisec where f(uisec) = (uisec*p-ci). Similarly, the expected utility of players for games on nonsecurity-related sanctions is a function of uinsec, where f(uinsec) = (uinsec*p-ci). For simplicity, uisec and uinsec are normalized to 1.

- The sender and its opposition know their cost (ci), and the target and their opposition know their cost (ci). Therefore, it is assumed that players know their costs, but not that of their opponent(s).

- Credit that the opposition gets for supporting the current sanction policy is denoted as q, and reduces the sender state’s (S1) payoff by a factor of (1-q).

- Reputation loss by the sender state for backing down and/or the target state for obeying is known as audience cost, and is coded as −a for actors. Conversely, opposition in sender state and target state, which gains utility from their governments’ reputation loss, is coded as a.

4. Results

5. Discussion

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Adam, Antonis, and Sofia Tsarsitalidou. 2019. Do sanctions lead to a decline in civil liberties? Public Choice 180: 191–215. [Google Scholar] [CrossRef]

- Allen, Susan Hannah. 2005. The determinants of economic sanctions success and failure. International Interactions 31: 117–38. [Google Scholar] [CrossRef]

- Allen, Susan Hannah. 2008. The domestic political costs of economic sanctions. Journal of Conflict Resolution 52: 916–44. [Google Scholar] [CrossRef]

- Ang, Adrian U-Jin, and Dursun Peksen. 2007. When do economic sanctions work? Asymmetric perceptions, issue salience, and outcomes. Political Research Quarterly 60: 135–45. [Google Scholar] [CrossRef]

- Bienen, Henry, and Robert Gilpin. 1980. Economic Sanctions as a Response to Terrorism. Journal of Strategic Studies 3: 89–98. [Google Scholar] [CrossRef]

- Biersteker, Thomas J., Sue E. Eckert, and Marcos Tourinho, eds. 2016. Targeted Sanctions. Cambridge: Cambridge University Press. [Google Scholar]

- Brooks, Risa A. 2002. Sanctions and regime type: What works, and when? Security Studies 11: 1–50. [Google Scholar] [CrossRef]

- Cortright, David, and George Lopez. 2000. The Sanctions Decade: Assessing UN Strategies in the 1990s. Boulder: Lynne Reinner. [Google Scholar]

- de Mesquita, Bruce Bueno, Alastair Smith, James D. Morrow, and Randolh M. Siverson. 2005. The Logic of Political Survival. Cambridge: MIT Press. [Google Scholar]

- Doxey, Margaret P. 1971. Economic Sanctions and International Enforcement. Oxford: Oxford University Press. [Google Scholar]

- Eckert, Sue E. 2008. The Use of Financial Measures to Promote Security. Journal of International Affairs 62: 103–11. [Google Scholar]

- Escribà-Folch, Abel. 2012. Authoritarian responses to foreign pressure: Spending, repression, and sanctions. Comparative Political Studies 45: 683–713. [Google Scholar] [CrossRef]

- Escribà-Folch, Abel, and Joseph Wright. 2010. Dealing with tyranny: International sanctions and the survival of authoritarian rulers. International Studies Quarterly 54: 335–59. [Google Scholar] [CrossRef]

- Galtung, Johan. 1967. On the Effects of International Economic Sanctions: With Examples from the Case of Rhodesia. World Politics 19: 378–416. [Google Scholar] [CrossRef]

- Giumelli, Francesco. 2011. Coercing, Constraining and Signalling: Explaining UN and EU Sanctions after the Cold War. London: ECPR Press. [Google Scholar]

- Grauvogel, Julia, Amanda A. Licht, and Christian von Soest. 2017. Sanctions and signals: How international sanction threats trigger domestic protest in targeted regimes. International Studies Quarterly 61: 86–97. [Google Scholar] [CrossRef]

- Hufbauer, Gary Clyde, Jeffrey J. Schott, and Kimberly Ann Elliott. 1990. Economic Sanctions Reconsidered. Washington, DC: Peterson Institute for International Economics. [Google Scholar]

- Jones, Lee. 2015. Societies Under Siege: Exploring How International Economic Sanctions (Do Not) Work. Oxford: Oxford University Press. [Google Scholar]

- Kaempfer, William H., Anton D. Lowenberg, and William Mertens. 2004. International economic sanctions against a dictator. Economics & Politics 16: 29–51. [Google Scholar]

- Kaplowitz, Donna Rich. 1998. Anatomy of a Failed Embargo: U.S. Sanctions against Cuba. Boulder: Lynne Rienner Publishers. [Google Scholar]

- Kirshner, Jonathan. 1997. The microfoundations of economic sanctions. Security Studies 6: 32–64. [Google Scholar] [CrossRef]

- Leoffler, Rachel L. 2009. Bank Shots: How the Financial System Can Isolate Regimes. Foreign Affairs 88: 101–10. [Google Scholar]

- Lindsay, James M. 1986. Trade Sanctions as Policy Instruments. International Studies Quarterly 30: 153–73. [Google Scholar] [CrossRef]

- Major, Solomon. 2012. Timing Is Everything: Economic Sanctions, Regime Type, and Domestic Instability. International Interactions 38: 79–110. [Google Scholar] [CrossRef]

- McCormack, Daniel, and Henry Pascoe. 2017. Sanctions and preventive war. Journal of Conflict Resolution 61: 1711–739. [Google Scholar] [CrossRef]

- Mclean, Elena V., and Dwight A. Roblyer. 2016. Public support for economic sanctions: An experimental analysis. Foreign Policy Analysis 13: 233–54. [Google Scholar] [CrossRef]

- McLean, Elena V., and Taehee Whang. 2014. Designing foreign policy: Voters, special interest groups, and economic sanctions. Journal of Peace Research 51: 589–602. [Google Scholar] [CrossRef]

- Morgan, T. Clifton, Navin Bapat, and Yoshiharu Kobayashi. 2014. Threat and imposition of economic sanctions 1945–2005: Updating the TIES dataset. Conflict Management and Peace Science 31: 541–58. [Google Scholar] [CrossRef]

- Nossal, Richard Kim. 1999. Liberal Democratic Regimes, International Sanctions, and Global Governance. In Globalization and Global Governance. Edited by Vayrynen Raimo. Baltimore: Rowman & Littlefield. [Google Scholar]

- Onder, M. 2019. International Economic Sanctions Outcome: The Influence of Political Agreement. Ph.D. dissertation, Wayne State University, Detroit, MI, USA. [Google Scholar]

- Pape, Robert A. 1997. Why economic sanctions do not work. International Security 22: 90–136. [Google Scholar] [CrossRef]

- Peksen, Dursun. 2009. Better or worse? The effect of economic sanctions on human rights. Journal of Peace Research 46: 59–77. [Google Scholar] [CrossRef]

- Peksen, Dursun. 2019. Autocracies and Economic Sanctions: The Divergent Impact of Authoritarian Regime Type on Sanctions Success. Defence and Peace Economics 30: 253–68. [Google Scholar] [CrossRef]

- Peksen, Dursun, and A. Cooper Drury. 2010. Coercive or corrosive: The negative impact of economic sanctions on democracy. International Interactions 36: 240–64. [Google Scholar] [CrossRef]

- Tsebelis, George. 1990. Are sanctions effective? A game-theoretic analysis. Journal of Conflict Resolution 34: 3–28. [Google Scholar] [CrossRef]

- Wallace, Geoffrey. 2013. Regime type, issues of contention, and economic sanctions: Re-evaluating the economic peace between democracies. Journal of Peace Research 50: 479–93. [Google Scholar] [CrossRef]

- Whang, Taehee. 2011. Playing to the home crowd? Symbolic use of economic sanctions in the United States. International Studies Quarterly 55: 787–801. [Google Scholar] [CrossRef]

- William, H. Kaempfer, and Anton David Lowenberg. 1988. The theory of international economic sanctions: A public choice approach. The American Economic Review 78: 786–93. [Google Scholar]

- Wood, Reed M. 2008. “A hand upon the throat of the nation”: Economic sanctions and state repression, 1976–2001. International Studies Quarterly 52: 489–513. [Google Scholar] [CrossRef]

- Wright, Joseph, and Abel Escribà-Folch. 2012. Authoritarian institutions and regime survival: Transitions to democracy and subsequent autocracy. British Journal of Political Science 42: 283–309. [Google Scholar] [CrossRef]

- Zarate, Juan. 2013. Treasury’s War: The Unleashing of a New Era of Financial Warfare. New York: Public Affairs. [Google Scholar]

| Success Definition | Successes | Missing Final Outcome Considered Failure (N = 1412) | Missing Final Outcome Removed (N = 1024) |

|---|---|---|---|

| Restrictive | 384 | 27.2% | 37.5% |

| Negotiated Settlements | 576 | 40.8% | 56.3% |

| Settlement Nature | 454 | 32.2% | 44% |

| Security Category | Nonsecurity Category |

|---|---|

| 1. Contain political influence (1) | 1. Release citizens, property, or material (4) |

| 2. Contain military influence (2) | 2. Improve human rights (8) |

| 3. Destabilize regime (3) | 3. Deter or punish drug trafficking (11) |

| 4. Solve territorial disputes (5) | 4. Improve environmental policies (12) |

| 5. Deny strategic materials (6) | 5. Trader practices (13) |

| 6. Retaliate for alliance choices (7) | 6. Implement economic reform (14) |

| 7. End weapons/materials proliferation (9) | |

| 8. Terminate support of non-state actors (10) |

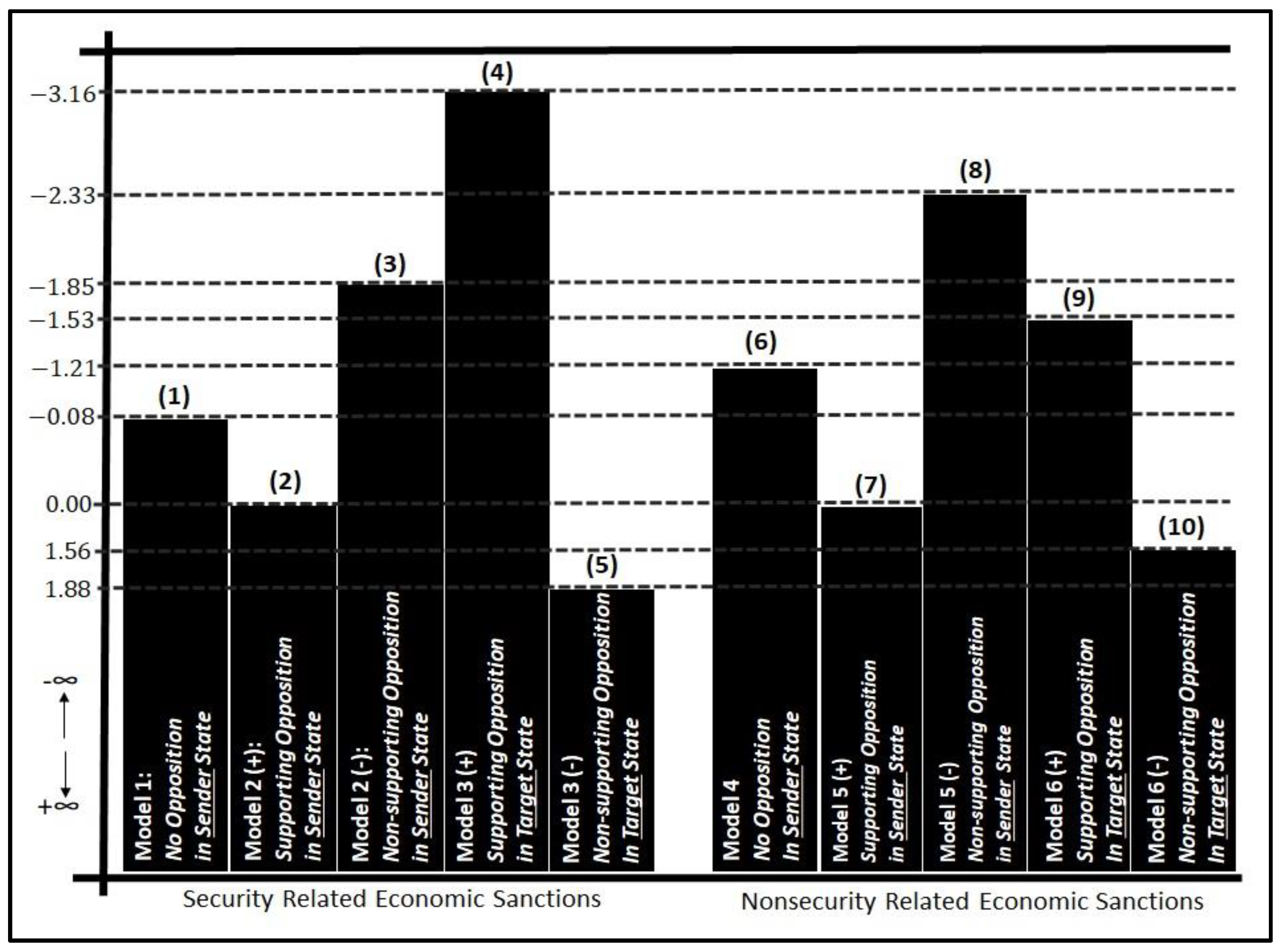

| Models | Sanctions on Security Issues | Models | Sanctions on Nonsecurity Issues |

|---|---|---|---|

| Model 1: | Sender with no opposition | Model 4: | Sender with no opposition |

| Model 2 (+): | Sender with supporting opposition | Model 5 (+): | Sender with supporting opposition |

| Model 2 (−): | Sender with non-supporting opposition | Model 5 (−): | Sender with non-supporting opposition |

| Model 3 (+): | Target with supporting opposition | Model 6 (+): | Target with supporting opposition |

| Model 3 (−): | Target with non-supporting opposition | Model 6 (−): | Target with non-supporting opposition |

| Issue Types | Economic Sanctions Threatened | Economic Sanctions Imposed |

|---|---|---|

| Security-related Disputes | 348 | 185 |

| Nonsecurity-related Disputed | 722 | 333 |

| Comparison of Models | Conditional Probability | Security Issues | Nonsecurity Issues | Probability Difference * |

|---|---|---|---|---|

| Row 1: Model 1 vs. Model 4 (Probability of a sender to sanction) | 0.53 | 0.45 | 18% (decrease) | |

| Row 2: Model 1 vs. Model 4 (Probability of a sender not sanctioning) | 0.46 | 0.55 | 20% (increase) | |

| Row 3: Model 2 (+) vs. Model 5 (+) (Probability of a sender to sanction with a supporting opposition in sender) | 1 | 1 | No Change | |

| Row 4: Model 2 (+) vs. Model 5 (+) (Probability of a sender not sanctioning with a supporting opposition in sender) | 0 | 0 | No Change | |

| Row 5: Model 2 (−) vs. Model 5 (−) (Probability of a sender to sanction with a non-supporting opposition in sender) | 0.34 | 0.30 | 13% (decrease) | |

| Row 6: Model 2 (−) vs. Model 5 (−) (Probability of a sender not sanctioning with a non-supporting opposition in sender) | 0.63 | 0.70 | 11% (increase) | |

| Row 7: Model 3 (+) vs. Model 6 (+) (Probability of a sender to sanction given a supporting opposition in target) | 0.24 | 0.51 | 125% (increase) | |

| Row 8: Model 3 (+) vs. Model 6 (+) (Probability of a sender not sanctioning given a supporting opposition in target) | 0.76 | 0.78 | 3% (increase) | |

| Row 9: Model 3 (−) vs. Model 6 (−) (Probability of a sender to sanction given a non-supporting opposition in target) | 0.35 | 0.38 | 8% (increase) | |

| Row 10: Model 3 (−) vs. Model 6 (−) (Probability of a sender not sanctioning given a non-supporting opposition in target) | 0.66 | 0.59 | 10% (decrease) |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Onder, M. Regime Type, Issue Type and Economic Sanctions: The Role of Domestic Players. Economies 2020, 8, 2. https://doi.org/10.3390/economies8010002

Onder M. Regime Type, Issue Type and Economic Sanctions: The Role of Domestic Players. Economies. 2020; 8(1):2. https://doi.org/10.3390/economies8010002

Chicago/Turabian StyleOnder, Mehmet. 2020. "Regime Type, Issue Type and Economic Sanctions: The Role of Domestic Players" Economies 8, no. 1: 2. https://doi.org/10.3390/economies8010002

APA StyleOnder, M. (2020). Regime Type, Issue Type and Economic Sanctions: The Role of Domestic Players. Economies, 8(1), 2. https://doi.org/10.3390/economies8010002