An Empirical Investigation of Foreign Financial Assistance Inflows and Its Fungibility Analyses: Evidence from Bangladesh

Abstract

1. Introduction

- (1)

- Does external financing attribute to the crowding out of public expenditure in Bangladesh?

- (2)

- Does the composition of FFA affect the government expenditure movements in Bangladesh?

- (3)

- Is there any sectoral variation in public expenditure responses to incoming FFA? Are the FFA inflows fungible?

- (4)

- Do the FFA inflows affect the government’s tax efforts, revenue generation policies, and domestic public borrowing?

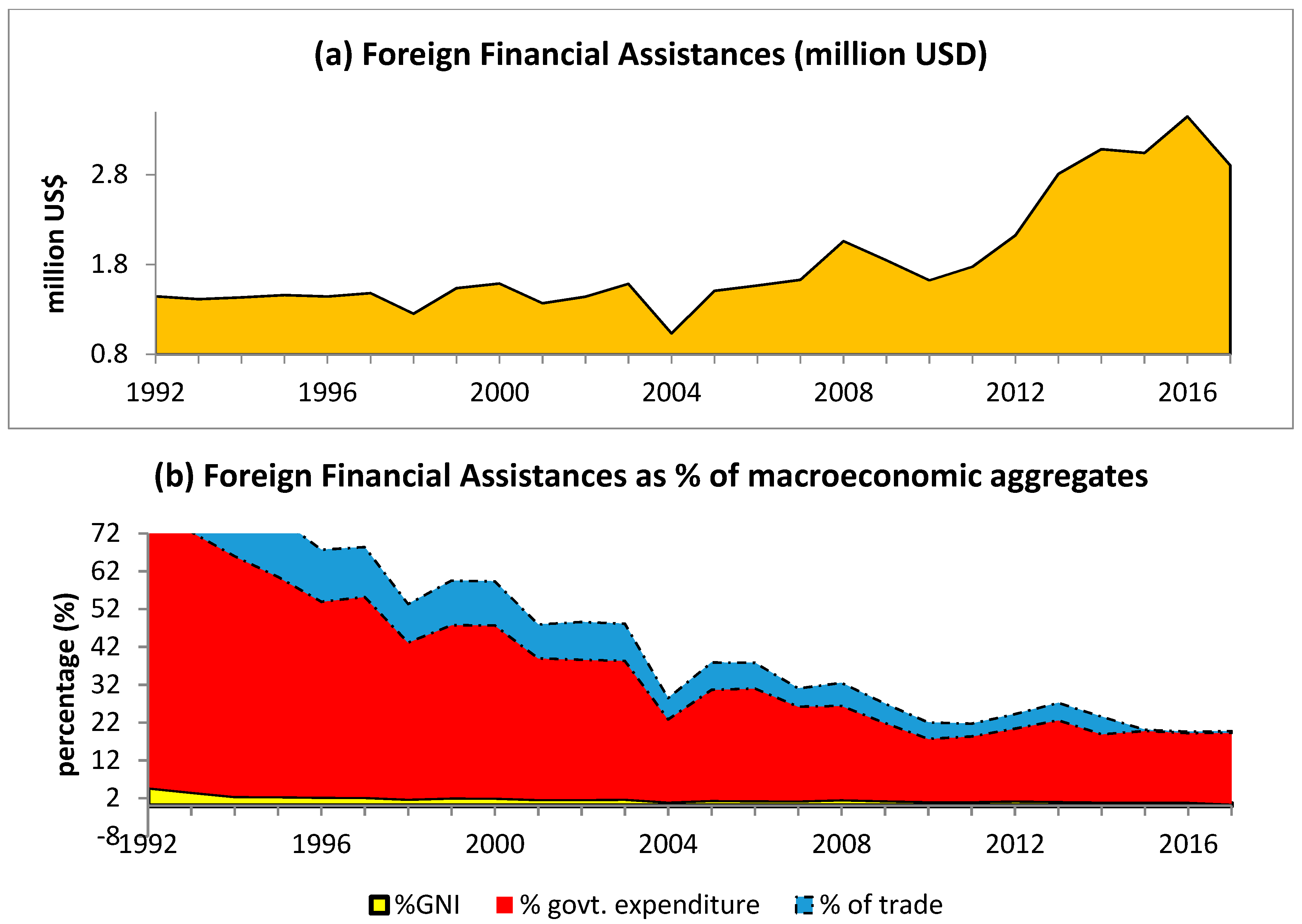

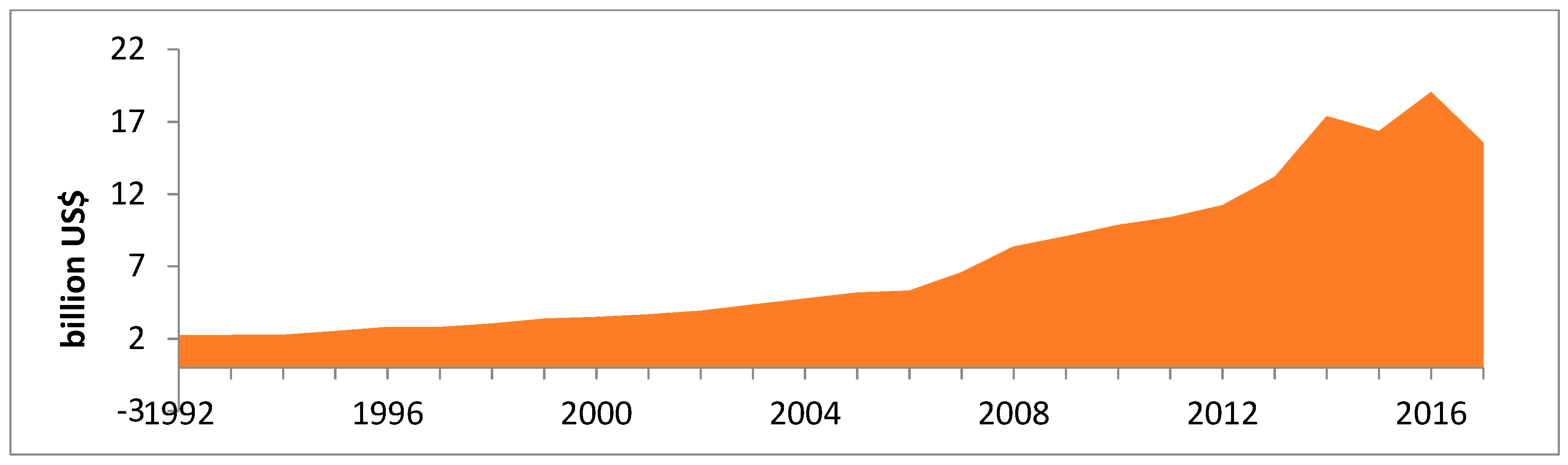

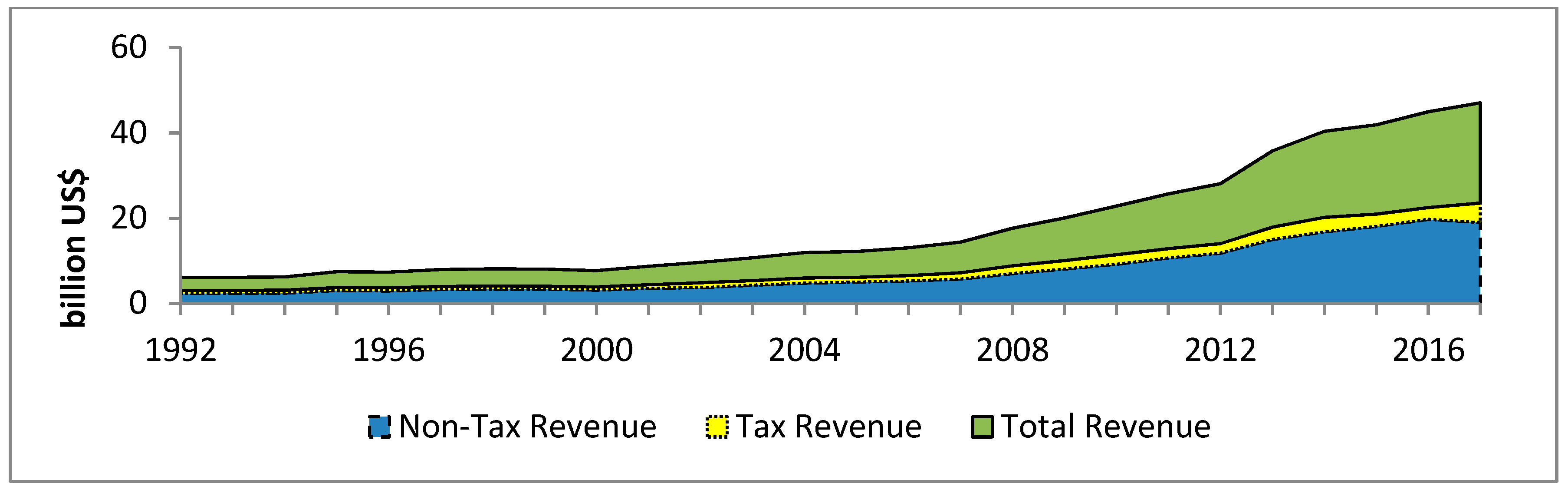

2. An Overview of the FFA and Fiscal Trends in Bangladesh

3. Review of Literature

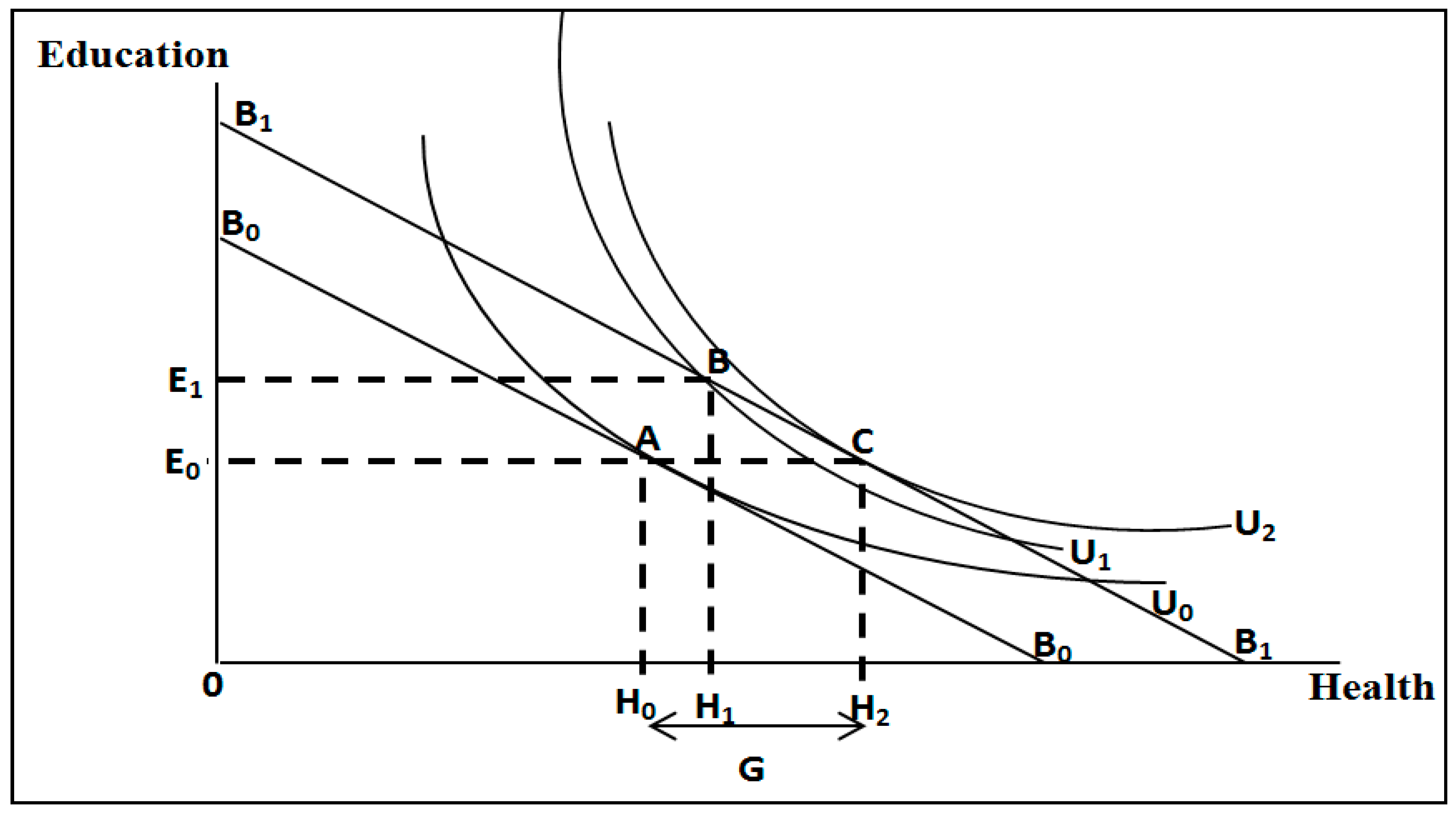

3.1. Theoretical Framework

3.2. Empirical Findings

4. Empirical Models and Data Specification

5. Methodology

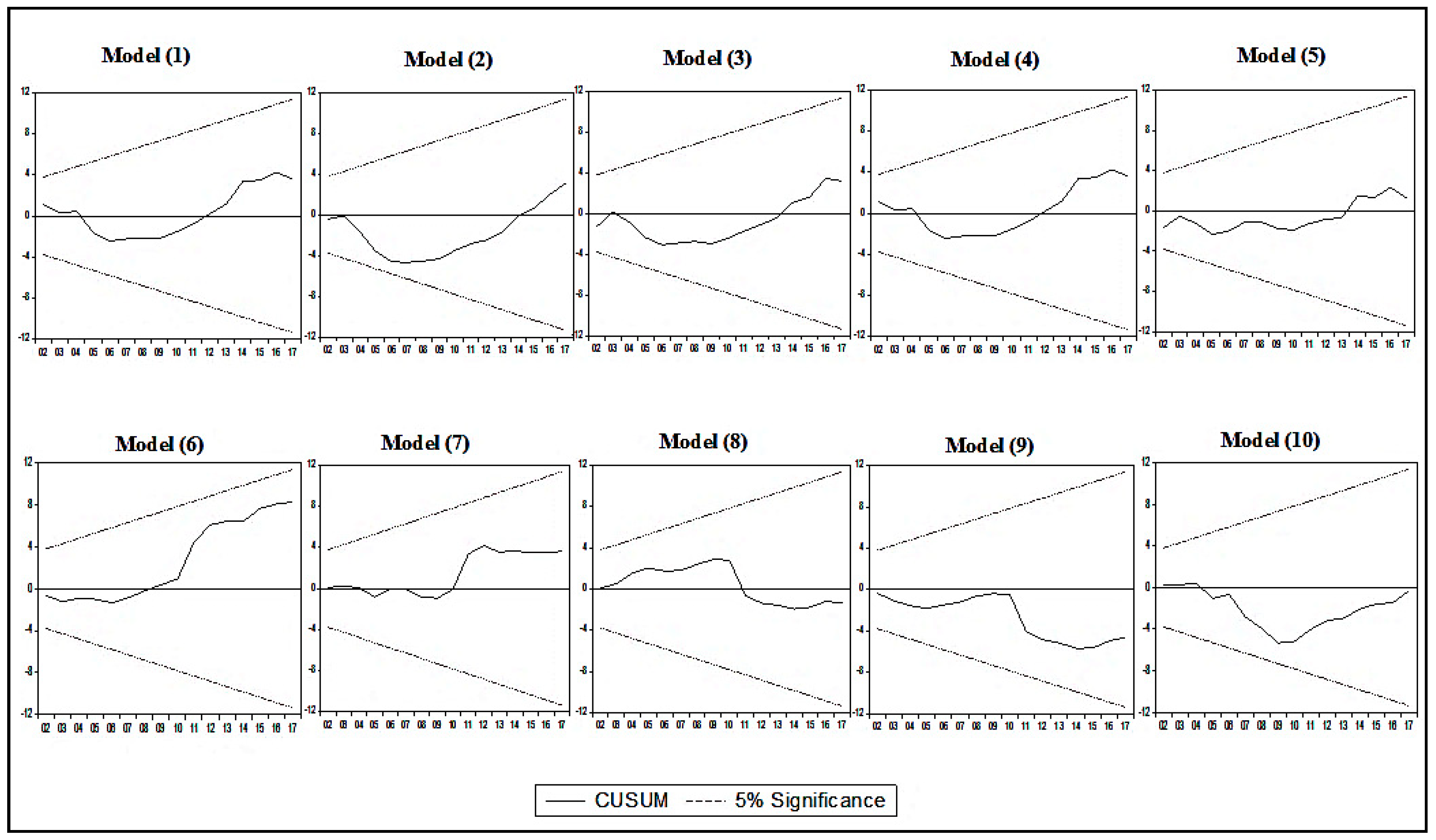

5.1. Unit Root and Cointegration Analyses

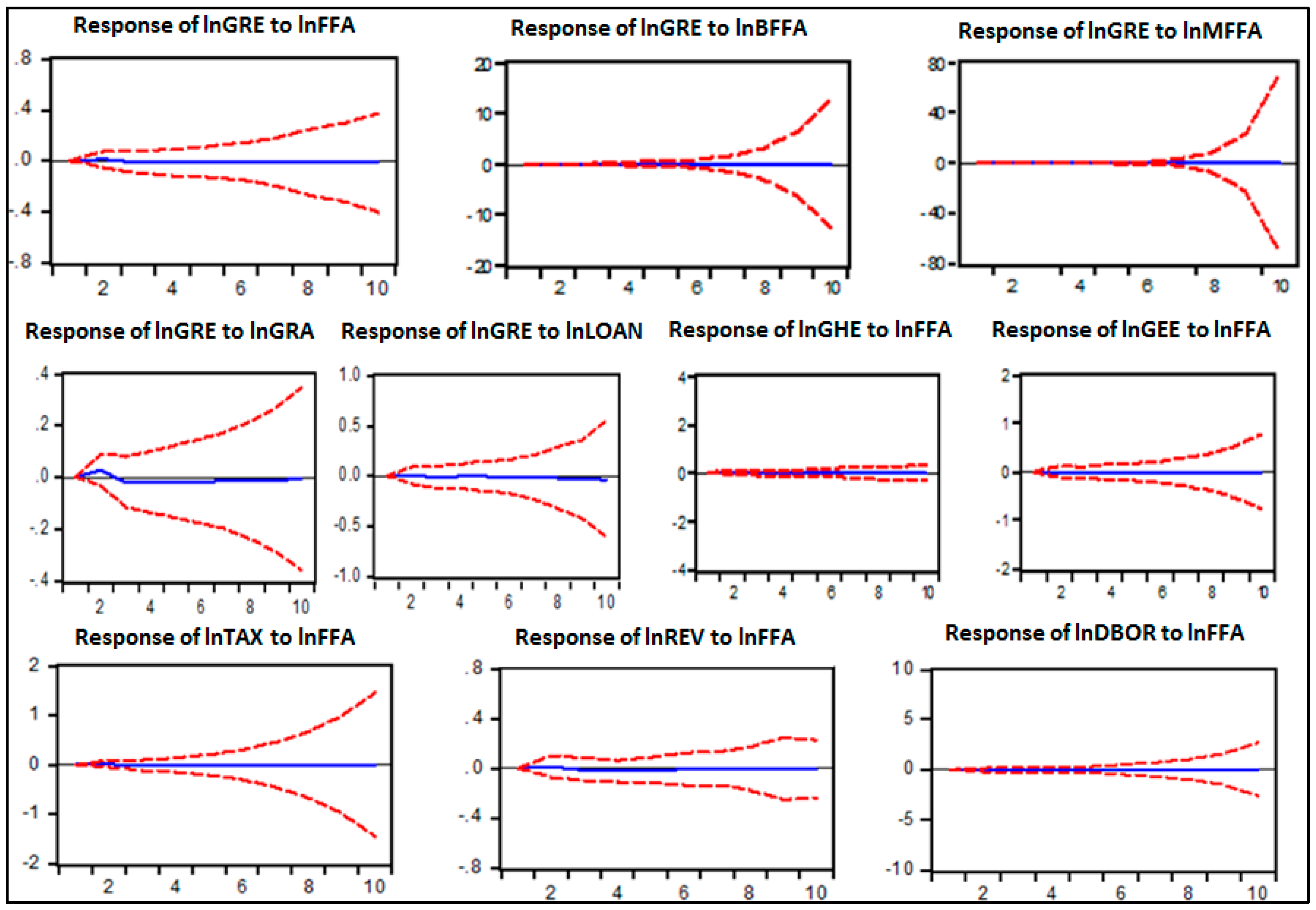

5.2. Vector Error-Correction Model Approach

6. Results

7. Conclusions

Funding

Conflicts of Interest

Appendix A

Appendix B

| Study | Estimation Method | Period | Countries | Results |

|---|---|---|---|---|

| Pack and Pack (1993) | Seemingly unrelated regression estimator | 1968–1986 | Dominican Republic | Foreign assistances intended for development expenditure are displaced to fiscal-deficit reduction and debt servicing. |

| Franco-Rodriguez et al. (1998) | Non-linear three-stage least squares estimator | 1956–1995 | Pakistan | Only about 50% of total aid inflows have augmented total government consumption in Pakistan. An increase in foreign aid inflow is associated with a positive impact on government expenditure and a negative impact on the tax revenues. |

| Mavrotas (2002) | Non-linear three-stage least squares estimator | 1973–1992 | India (1973–1990) Kenya (1973–1992) | Project aids flowing into India are found to be less fungible compared to program aids. Similarly, the fungibility of aid inflows to Kenya depends on the type of the aid. |

| Osei et al. (2005) | VAR, VECM, and impulse response functions | 1966–1988 | Ghana | No direct impact of foreign aid inflows on public expenditure in the short run. The inflows are found to affect domestic public borrowing and tax revenues negatively and positively, respectively. |

| McGillivray and Ouattara (2005) | ARDL cointegration approach, non-linear three-stage least squares estimator | 1975–1999 | Cote d’Ivoire | Government expenditure does not increase following inward flows of foreign aids. Most of the aid is utilized for debt servicing, and foreign aid inflows attribute to rising public debts. |

| Bhattarai (2007) | Johansen cointegration and generalized impulse response analyses | 1975–2002 | Nepal | Foreign aid positively affects both development and non-development expenditure. Development aid is found to be fungible due to it being displaced to the non-development expenditure of the government. |

| Martins (2007) | Non-linear three-stage leastsquares estimator | 1964–2005 | Ethiopia | Foreign aid positively affects government investment. Foreign loans have a stronger impact on public expenditure than grants. Foreign aid reduces domestic public borrowing and displaces public revenues. |

| Bwire et al. (2013) | Cointegrated VAR analysis | 1972–2008 | Uganda | Foreign aids increase government expenditure and raise the tax efforts as well. |

| Thamae and Kolobe (2016) | Johansen cointegration analysis and Granger causality tests | 1982–2010 | Lesotho | A rise in the inflow of foreign aids results in adverse impacts on recurrent expenditure while increasing the capital expenditure of the government. Thus, foreign aid inflows are referred to be non-fungible in nature. A unidirectional long-run causal association stemming from foreign aid to recurrent public expenditure is found. |

| Bwire et al. (2017) | Cointegrated VAR analysis | 1990Q1–2015Q4 | Rwanda | Foreign aid inflows increase public expenditure and tax revenues while reducing public borrowings from domestic sources |

References

- Amin, Sakib Bin, and Muntasir Murshed. 2018a. An Empirical Investigation of Foreign Aid and Dutch Disease in Bangladesh. The Journal of Developing Areas 52: 169–82. [Google Scholar] [CrossRef]

- Amin, Sakib Bin, and Muntasir Murshed. 2018b. A Cross-Country Investigation of Foreign Aid and Dutch Disease: Evidence from selected SAARC Countries. Journal of Accounting, Finance and Economics 8: 40–58. [Google Scholar]

- BER. 2005. Bangladesh Economic Review. Dhaka: Ministry of Foreign Affairs, People’s Republic of Bangladesh. [Google Scholar]

- BER. 2010. Bangladesh Economic Review. Dhaka: Ministry of Foreign Affairs, People’s Republic of Bangladesh. [Google Scholar]

- BER. 2017. Bangladesh Economic Review. Dhaka: Ministry of Foreign Affairs, People’s Republic of Bangladesh. [Google Scholar]

- Bhattacharya, Debapriya, M. Syeed Ahamed, Wasel Bin Shadat, and Md. Masum Billah. 2005. State of the Bangladesh Economy in FY2003−04. Independent Review of Bangladesh’s Development. Centre for Policy Dialogue, Bangladesh. Available online: https://www.cpd.org.bd/downloads/IRBD/SecInt_IRBD2005.pdf (accessed on 29 June 2018).

- Bhattarai, Badri Prasad. 2007. Foreign aid and government’s fiscal behaviour in Nepal: An empirical analysis. Economic Analysis and Policy 37: 41–60. [Google Scholar] [CrossRef]

- Bräutigam, Deborah. 2011. Aid ‘with Chinese characteristics’: Chinese foreign aid and development finance meet the OECD-DAC aid regime. Journal of International Development 23: 752–64. [Google Scholar] [CrossRef]

- Bräutigam, Deborah A., and Stephen Knack. 2004. Foreign aid, institutions, and governance in sub-Saharan Africa. Economic Development and Cultural Change 52: 255–85. [Google Scholar] [CrossRef]

- Breusch, Trevor S., and Lesley G. Godfrey. 1980. A Review of Recent Work on Testing for Autocorrelation in Dynamic Economic Models. Southampton: University of Southampton. [Google Scholar]

- Bwire, Thomas, Oliver Morrissey, and Tim Lloyd. 2013. A Timeseries Analysis of the Impact of Foreign Aid on Central Government’s Fiscal Budget in Uganda. WIDER Working Paper No. 2013/101. Helsinki: World Institute for Development Economics Research (UNU-WIDER), United Nations University. [Google Scholar]

- Bwire, Thomas, Caleb Tamwesigire, and Pascal Munyankindi. 2017. Fiscal Effects of Aid in Rwanda. In Studies on Economic Development and Growth in Selected African Countries. Singapore: Springer, pp. 79–101. [Google Scholar]

- Chaity, Afroz Jahan. 2018. Budget Allocations for Health, Education Continue to Shrink. Dhaka Tribune. Available online: https://www.dhakatribune.com/bangladesh/2018/06/29/budget-allocations-for-health-education-continue-to-shrink (accessed on 29 June 2018).

- Chenery, Hollis B., and Alan M. Strout. 1966. Foreign assistance and economic development. The American Economic Review 56: 679–733. [Google Scholar]

- Devarajan, Shantayanan, and Vinaya Swaroop. 2000. The implications of foreign aid fungibility for development assistance. In The World Bank: Structure and Policies. Cambridge: Cambridge University Press, pp. 196–209. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society 49: 1057–72. [Google Scholar] [CrossRef]

- Dinku, Yonatan Minuye. 2009. The Impact of Foreign Aid on Government Fiscal Behaviour: Evidence from Ethiopia. Ph.D. thesis, University of the Western Cape, Cape Town, South Africa. Available online: http://etd.uwc.ac.za/handle/11394/2701 (accessed on 29 June 2018).

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society 55: 251–76. [Google Scholar] [CrossRef]

- Feeny, Simon. 2003. The impact of foreign aid on poverty and human well-being in Papua New Guinea. Asia Pacific Development Journal 10: 73–93. [Google Scholar] [CrossRef]

- Feyzioglu, Tarhan, Vinaya Swaroop, and Min Zhu. 1996. Foreign Aid’s Impact on Public Spending. No. 1610. Washington, DC: The World Bank. [Google Scholar]

- Fosu, Augustin Kwasi. 2008. Implications of the external debt-servicing constraint for public health expenditure in sub-Saharan Africa. Oxford Development Studies 36: 363–77. [Google Scholar] [CrossRef]

- Franco-Rodriguez, Susana, Oliver Morrissey, and Mark McGillivray. 1998. Aid and the public sector in Pakistan: Evidence with endogenous aid. World Development 26: 1241–50. [Google Scholar] [CrossRef]

- Gbesemete, Kwame P., and Ulf-G. Gerdtham. 1992. Determinants of health care expenditure in Africa: A cross-sectional study. World Development 20: 303–8. [Google Scholar] [CrossRef]

- Griffin, Keith. 1970. Foreign capital, domestic savings and economic development. Bulletin of the Oxford University Institute of Economics & Statistics 32: 99–112. [Google Scholar]

- Habib, Wasim Bin. 2018. Education lacks due attention. The Daily Star. June 8. Available online: https://www.thedailystar.net/frontpage/bangladesh-national-budget-2018-19-education-outlay-not-enough-1588219 (accessed on 28 May 2019).

- Hasan, Md Didarul. 2011. Foreign Aid Dependency of Bangladesh: An Evaluation. The Chittagong University Journal of Business Administration 26: 281–94. [Google Scholar]

- Jarque, Carlos M., and Anil K. Bera. 1980. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6: 255–59. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Khan, Haider Ali, and Eiichi Hoshino. 1992. Impact of foreign aid on the fiscal behavior of LDC governments. World Development 10: 1481–88. [Google Scholar] [CrossRef]

- Lancaster, Carol. 1999. Aid effectiveness in Africa: The unfinished agenda. Journal of African Economies 8: 487–503. [Google Scholar] [CrossRef]

- Lancaster, Carol. 2008. Foreign Aid: Diplomacy, Development, Domestic Politics. Chicago: University of Chicago Press. [Google Scholar]

- Marc, Lukasz. 2012. New Evidence on Fungibility at the Aggregate Level. No. 12−083/2. Amsterdam: Tinbergen Institute. [Google Scholar]

- Martins, Pedro. 2007. The Fiscal Impact of Aid Flows: Evidence from Ethiopia. No. 43. Brasilia: International Policy Centre for Inclusive Growth. [Google Scholar]

- Martins, Pedro M. G. 2009. The impact of foreign aid on government spending, revenue and domestic borrowing in Ethiopia. In Economic Alternatives for Growth, Employment and Poverty Reduction. London: Palgrave Macmillan, pp. 100–36. [Google Scholar]

- Masud, Nadia, and Boriana Yontcheva. 2005. Does Foreign aid Reduce Poverty? Empirical Evidence from Nongovernmental and Bilateral Aid. Washington, DC: International Monetary Fund. [Google Scholar]

- Mavrotas, George. 2002. Foreign aid and fiscal response: Does aid disaggregation matter? Weltwirtschaftliches Archiv 138: 534–59. [Google Scholar] [CrossRef]

- McGillivray, Mark. 1989. The allocation of aid among developing countries: A multi-donor analysis using a per capita aid index. World Development 17: 561–68. [Google Scholar] [CrossRef]

- McGillivray, Mark, and Oliver Morrissey. 2001. A Review of Evidence on the Fiscal Effects of Aid. CREDIT Working Paper No. 01/13. Nottingham: Centre for Research in Economic Development and International Trade. [Google Scholar]

- McGillivray, Mark, and Bazoumana Ouattara. 2005. Aid, debt burden and government fiscal behaviour in Cote d’Ivoire. Journal of African Economies 14: 247–69. [Google Scholar] [CrossRef][Green Version]

- Murshed, Muntasir. 2018. The Harberger-Laursen-Metzler Effect and Dutch Disease Problem: Evidence from South and Southeast Asia. Journal of Accounting, Finance and Economics 8: 134–66. [Google Scholar]

- Murshed, Murshed, and Syed Y. Saadat. 2018. Modeling Tax Evasion across South Asia: Evidence from Bangladesh, India, Pakistan, Sri Lanka and Nepal. Journal of Accounting, Finance and Economics 8: 15–32. [Google Scholar]

- O’Connell, Stephen A., Christopher Adam, and Edward F. Buffie. 2008. Aid and Fiscal Instability. Oxford: University of Oxford, Centre for the Study of African Economies. [Google Scholar]

- Osei, Robert, Oliver Morrissey, and Tim Lloyd. 2005. The fiscal effects of aid in Ghana. Journal of International Development 17: 1037–53. [Google Scholar] [CrossRef]

- Pack, Howard, and Janet Rothenberg Pack. 1990. Is foreign aid fungible? The case of Indonesia. The Economic Journal 100: 188–94. [Google Scholar] [CrossRef]

- Pack, Howard, and Janet Rothenberg Pack. 1993. Foreign aid and the question of fungibility. The Review of Economics and Statistics 75: 258–65. [Google Scholar] [CrossRef]

- Page, Ewan S. 1954. Continuous inspection schemes. Biometrika 41: 100–15. [Google Scholar] [CrossRef]

- Pivovarsky, Alexander, Benedict J. Clements, Sanjeev Gupta, and Erwin Tiongson. 2003. Foreign Aid and Revenue Response: Does the Composition of Aid Matter? No. 3-176. Washington, DC: International Monetary Fund. [Google Scholar]

- Remmer, Karen L. 2004. Does foreign aid promote the expansion of government? American Journal of Political Science 48: 77–92. [Google Scholar] [CrossRef]

- Thamae, Retselisitsoe Isaiah, and Lineo Gloria Kolobe. 2016. The Fiscal Effects of Foreign Aid in Lesotho. Mediterranean Journal of Social Sciences 7: 116. [Google Scholar] [CrossRef][Green Version]

- Thornton, John. 2014. Does foreign aid reduce tax revenue? Further evidence. Applied Economics 46: 359–73. [Google Scholar] [CrossRef]

- WGI. 2017. Worldwide Governance Indicators Database. Washington, DC: The World Bank Group. [Google Scholar]

- White, Halbert. 1980. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica: Journal of the Econometric Society 48: 817–38. [Google Scholar] [CrossRef]

- Williamson, Claudia R. 2008. Foreign aid and human development: The impact of foreign aid to the health sector. Southern Economic Journal 75: 188–207. [Google Scholar]

- Zampelli, Ernest M. 1986. Resource fungibility, the flypaper effect, and the expenditure impact of grants-in-aid. The Review of Economics and Statistics 68: 33–40. [Google Scholar] [CrossRef]

| Null Hypothesis: Variable Has a Unit Root | |||||||

|---|---|---|---|---|---|---|---|

| Variable | t-Statistic | Variable | t-Statistic | Variable | t-Statistic | Variable | t-Statistic |

| Δ ln GRE | 1.067 *** | Δ ln CC | −4.304 * | Δ ln INF | −5.986 * | Δ ln DEBT | −4.079 * |

| Δ ln FFA | −5.978 * | Δ ln PRI | −2.103 ** | Δ ln GHE | −5.007 * | ||

| Δ ln BFFA | −3.157 * | Δ ln UP | −2.231 ** | Δ ln GEE | −4.065 | Δ ln GDPG | −5.147 * |

| Δ ln MFFA | −7.389 * | Δ ln PGR | −2.135 ** | Δ ln TAX | −5.882 * | Δ ln TAD | −5.118 * |

| Δ ln GRN | −6.044 * | Δ ln HAD | −4.701 * | Δ ln M2 | −3.028 * | Δ ln DBOR | −6.559 * |

| Δ ln LOAN | −4.703 * | Δ ln EAD | −4.089 * | Δ ln GNI | −2.001 ** | Δ ln REV | −2.054 ** |

| Eqn. | Null Hypo. | Alt. Hypo. | Max. Eigen Stat. | 95% Crit. Val. | Decision |

|---|---|---|---|---|---|

| (1) | r ≤ 1 | r = 2 | 46.905 | 33.46 | 2 cointegrating equations |

| (2) | r ≤ 3 | r = 4 | 94.985 | 94.150 | 4 cointegrating equations |

| (3) | r ≤ 4 | r = 5 | 69.582 | 68.52 | 5 cointegrating equations |

| (4) | r = 0 | r = 1 | 72.087 | 68.520 | 1 cointegrating equation |

| (5) | r ≤ 1 | r = 2 | 15.987 | 15.667 | 2 cointegrating equations |

| (6) | r = 0 | r = 1 | 19.998 | 18.296 | 1 cointegrating equation |

| (7) | r ≤ 2 | r = 3 | 96.505 | 94.15 | 3 cointegrating equations |

| (8) | r ≤ 6 | r = 7 | 15.345 | 14.070 | 7 cointegrating equations |

| (9) | r ≤ 4 | r = 5 | 67.867 | 66.360 | 5 cointegrating equations |

| (10) | r = 0 | r = 1 | 80.189 | 68.52 | 1 cointegrating equation |

| Dependent Variable | ln GREt | ln GREt | ln GREt | ln GREt | ln GREt |

|---|---|---|---|---|---|

| Equation | (1) | (2) | (3) | (4) | (5) |

| Long-Run Analysis | |||||

| Regressors | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient |

| ln FFAt | −5.507 (2.010) * | --- | --- | --- | --- |

| ln BFFAt | --- | −0.268 (0.063) * | --- | --- | --- |

| ln MFFAt | --- | --- | 0.048 (0.024) ** | --- | --- |

| ln GRAt | --- | --- | --- | −0.003 (0.090) | --- |

| ln LOANt | --- | --- | --- | --- | 0.646 (0.081) * |

| ln TADt | 7.321 (2.624) * | 0.739 (0.096) * | −0.222 (0.019) * | 0.175 (0.075) ** | --- |

| ln DEBTt | −3.804 (1.844) ** | −0.090 (0.079) | 0.096 (0.012) * | −0.210 (0.085) * | −3.829 (0.863) * |

| ln GDPGt | −15.128 (4.960) * | 2.400 (0.251) * | 1.411 (0.028) * | 1.296 (0.192) * | −7.373 (1.838) * |

| ln INFt | 2.504 (0.512) * | −0.271 (0.039) * | −0.254 (0.002) * | 0.000 (0.020) | 0.050 (0.196) |

| ln UPt | 72.452 (10.441) * | −8.771 (0.835) * | −3.083 (0.061) * | −2.420 (0.587) * | 6.514 (5.120) |

| ln PGRt | 8.822 (2.389) * | −0.859 (0.181) * | 0.053 (0.027) ** | −0.501 (0.093) * | 0.585 (1.082) |

| ln CCt | 6.187 (1.720) * | 1.162 (0.104) * | 0.537 (0.010) * | −0.447 (0.062) * | 1.677 (0.641) * |

| ln PRIt | −25.197 (2.745) * | 1.680 (0.266) * | 0.064 (0.018) * | −0.447 (0.186) ** | −4.741 (0.846) * |

| Constant | 984.264 (25.887) * | 120.101 (28.92) * | 39.736 (19.112) * | 34.379 (12.222) * | −48.187 (18.110) * |

| R2 | 0.985 | 0.968 | 0.971 | 0.897 | 0.841 |

| Short-Run Analysis | |||||

| Δ ln GRE | −0.318 (0.205) | 0.779 (0.647) | 4.159 (2.148) *** | 0.045 (0.641) | −0.149 (0.275) |

| Δ ln FFAt | −0.457 (0.271) ** | --- | --- | --- | --- |

| Δ ln BFASt | --- | −0.594 (0.35) *** | --- | --- | --- |

| Δ ln MFASt | --- | --- | 2.767 (1.370) ** | --- | --- |

| Δ ln GRAt | --- | --- | --- | −0.152 (0.131) | --- |

| Δ ln LOANt | --- | --- | --- | --- | 0.494 (0.145) * |

| Δ ln TADt | 0.509 (0.230) ** | 0.304 (0.138) *** | −3.426 (1.81) *** | 0.184 (0.160) | 0.207 (0.091) *** |

| Δ ln DEBTt | −0.398 (0.259) | −0.072 (0.316) | 1.494 (0.962) | −0.623 (0.555) | −0.458 (2.887) |

| Δ ln GDPGt | 0.409 (0.360) | 1.915 (0.891) *** | 7.961 (3.912) ** | 0.234 (0.873) | 0.183 (0.612) |

| Δ ln INFt | −0.183 (0.093) ** | −0.314 (0.170) ** | 0.003 (0.056) | −0.039 (0.073) | −0.075 (0.086) |

| Δ ln UPt | −5.405 (3.924) | −14.626 (9.459) | −46.51 (22.92) ** | −1.038 (5.801) | −0.157 (3.416) |

| Δ ln PGRt | 1.261 (0.572) ** | −0.933 (0.703) | −16.190 (7.57) ** | −2.541 (0.89) *** | −0.556 (0.689) |

| Δ ln CCt | −0.232 (0.218) | −1.020 (0.658) | 2.935 (1.458) ** | −0.116 (0.350) | 0.084 (0.001) * |

| Δ lnPRIt | 1.105 (0.556) ** | 1.519 (0.854) *** | 0.458 (0.343) | −0.147 (0.356) | 0.169 (0.021) * |

| Constant | 0.137 (0.081) * | 0.065 (0.065) | −0.092 (0.078) | 0.060 (0.107) | −0.054 (0.079) |

| ECTt−1 | −0.070 (0.031) * | −1.341 (0.723) ** | −1.173 (0.324) * | −0.895 (0.31) | 0.107 (0.128) |

| R2 | 0.830 | 0.812 | 0.728 | 0.597 | 0.592 |

| Dependent Variable: | ln GHEt | ln GEEt |

|---|---|---|

| Column | (6) | (7) |

| Long-Run Analysis | ||

| Regressors | Coefficient | Coefficient |

| ln FFAt | −0.896 (0.134) * | 1.253 (0.037) * |

| ln HADt | −0.381 (0.071) * | --- |

| ln EADt | --- | 1.960 (0.041) * |

| ln DEBTt | −1.092 (0.238) * | −5.304 (0.108) * |

| ln GDPGt | 0.054 (0.256) | 7.983 (0.178) * |

| ln INFt | 0.004 (0.048) | −0.028 (0.601) |

| ln UPt | −0.417 (0.863) | −21.163 (0.460) * |

| ln PGRt | −0.557 (0.162) * | 1.602 (0.041) * |

| ln CCt | 0.236 (0.083) ** | 1.981 (0.044) * |

| lnPRIt | 1.650 (0.416) * | 8.850 (0.197) * |

| Constant | 14.471 (6.810) * | 254.803 (67.998) * |

| R2 | 0.785 | 0.981 |

| Short-Run Analysis | ||

| Δ ln GHEt | −1.188 * (0.067) | --- |

| Δ ln GEEt | --- | 0.502 (0.157) * |

| Δ ln FFAt | −0.318 (0.831) | 5.329 (0.000) * |

| Δ ln HADt | 0.339 (0.161) *** | --- |

| Δ ln EADt | --- | 5.538 (1.356) * |

| Δ ln DEBTt | −0.328 (0.837) | −2.770 (0.877) ** |

| Δ ln GDPGt | −0.264 (0.291) | 15.901 (3.679) * |

| Δ ln INFt | 0.102 (0.078) | −1.322 (0.298) * |

| Δ ln UPt | 3.441 (0.156) * | 13.621 (3.881) * |

| Δ ln PGRt | −0.065 (4.048) | 9.762 (3.991) * |

| Δ ln CCt | 0.201 (0.220) | 0.045 (1.311) |

| Δ lnPRIt | 0.196 (0.651) | 24.100 (5.786) * |

| Constant | 0.029 (0.008) *** | −0.031 (0.109) |

| ECTt−1 | 0.279 (1.137) | −3.597 (0.814) * |

| R2 | 0.640 | 0.906 |

| Dependent Variable: | ln TAXt | Ln REVt | ln DBORt |

|---|---|---|---|

| Column | (8) | (9) | (10) |

| Long-Run Analysis | |||

| Regressors | Coefficient | Coefficient | Coefficient |

| ln FFAt | −1.831 (0.434) * | −7.059 (2.230) * | −0.183 (0.309) |

| ln GNIt | 12.646 (5.778) ** | −108.795 (29.768) * | --- |

| ln M2t | 2.872 (1.249) ** | 40.291 (6.507) * | --- |

| ln INFt | −0.075 (0.001) ** | −2.011 (0.908) ** | 3.960 (0.198) * |

| ln DEBTt | −1.937 (0.734) * | −15.240* (34.764) * | 2.696 (0.681) * |

| ln UPt | 27.755 (6.789) * | −5.240 (2.475) ** | --- |

| ln CCt | 1.688 (0.661) ** | −6.080 (4.843) ** | −4.024 (0.226) * |

| ln GDPGt | --- | --- | −3.874 (0.757) * |

| lnPRIt | 0.581 (0.881) | 6.327 (4.843) | 1.372 (0.989) |

| Constant | 153.603 (56.990) * | 234.093 (34.881) * | −32.019 (11.560) * |

| R2 | 0.981 | 0.982 | 0.912 |

| Short-Run Analysis | |||

| Δ ln TAXt | −0.234 (0.227) | --- | --- |

| Δ ln REVt | --- | −0.002 (0.218) | |

| Δ ln DBORt | --- | --- | −0.520 (0.258) ** |

| Δ ln FFAt | −0.207 (0.901) *** | 0.234 (0.002) * | 0.338 (0.503) |

| Δ ln GNIt | −1.960 (3.247) | −15.331 (6.216) ** | --- |

| Δ ln M2t | 1.936 (0.801) ** | 1.830 (0.647) * | --- |

| Δ ln INFt | −0.551 (0.990) * | −0.011 (0.074) | 0.009 (0.350) |

| Δ ln DEBTt | −0.210 (0.371) | −1.077 (0.447) ** | 0.894 (0.401) *** |

| Δ ln UPt | 2.239 (0.891) ** | 7.762 (3.611) ** | --- |

| Δ ln CCt | 1.711 (0.027) * | 0.201 (0.001) * | 0.462 (0.409) |

| Δ ln GDPGt | --- | --- | −0.561 (0.250) *** |

| Δ ln PRIt | 0.302 (0.4423) | −0.307 (0.427) | 0.248 (1.067) |

| Constant | 0.082 (0.496) | 0.096 (0.095) | 0.028 (0.207) |

| ECTt−1 | −0.056 (0.776) | −0.055 (0.022) ** | −0.489 (0.978) |

| R2 | 0.776 | 0.596 | 0.613 |

| Model (1): Variance Decomposition of ln GRE | ||||||||||

| Pd. * | ln GRE | ln FFA | ln TAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.00 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 24.048 | 3.136 | 11.158 | 20.430 | 18.736 | 3.726 | 12.00 | 0.807 | 4.594 | 1.369 |

| 10 | 17.222 | 4.215 | 13.564 | 15.493 | 13.540 | 2.006 | 20.90 | 4.235 | 3.864 | 1.170 |

| Model (2): Variance Decomposition of ln GRE | ||||||||||

| Pd. * | ln GRE | ln BFFA | ln TAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.00 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 15.153 | 3.834 | 7.000 | 28.841 | 14.757 | 3.616 | 15.06 | 0.165 | 10.68 | 0.879 |

| 10 | 15.494 | 2.096 | 5.806 | 30.954 | 10.582 | 2.815 | 14.87 | 5.059 | 11.16 | 1.154 |

| Model (3): Variance Decomposition of ln GRE | ||||||||||

| Pd. * | ln GRE | ln MFFA | ln TAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 22.405 | 12.518 | 22.571 | 22.129 | 8.653 | 1.656 | 3.530 | 0.766 | 0.283 | 0.006 |

| 10 | 15.393 | 8.913 | 11.860 | 19.903 | 10.000 | 0.069 | 14.960 | 3.670 | 0.356 | 0.061 |

| Model (4): Variance Decomposition of ln GRE | ||||||||||

| Pd. * | ln GRE | ln GRN | ln TAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 26.987 | 9.455 | 0.257 | 18.117 | 21.475 | 3.338 | 12.972 | 0.636 | 6.319 | 0.384 |

| 10 | 16.706 | 8.488 | 2.977 | 15.675 | 12.859 | 2.429 | 22.834 | 3.273 | 5.459 | 0.307 |

| Model (5): Variance Decomposition of ln GRE | ||||||||||

| Pd. * | ln GRE | ln LOAN | ln TAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 25.816 | 1.107 | 4.540 | 26.574 | 16.083 | 3.554 | 16.067 | 1.160 | 4.722 | 0.432 |

| 10 | 17.727 | 7.801 | 2.807 | 21.574 | 12.595 | 1.939 | 25.858 | 4.425 | 4.803 | 0.470 |

| Model (6): Variance Decomposition of ln GHE | ||||||||||

| Pd. * | ln GHE | ln FFA | ln HAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 61.820 | 2.174 | 15.764 | 7.019 | 1.855 | 0.225 | 15.010 | 0.757 | 0.520 | 0.361 |

| 10 | 20.561 | 3.333 | 18.710 | 6.134 | 2.287 | 7.159 | 22.027 | 0.703 | 2.245 | 0.270 |

| Model (7): Variance Decomposition of ln GEE | ||||||||||

| Pd. * | ln GEE | ln FFA | ln EAD | ln DEBT | ln GDPG | ln INF | ln UP | ln PGR | ln CC | ln PRI |

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 55.761 | 3.152 | 2.056 | 3.632 | 5.464 | 1.659 | 20.079 | 1.161 | 0.919 | 0.057 |

| 10 | 36.635 | 3.301 | 9.457 | 9.409 | 1.972 | 33.32 | 18.811 | 0.557 | 1.696 | 0.409 |

| Model (8): Variance Decomposition of ln TAX | |||||||||||||||

| Pd * | ln TAX | ln FFA | ln GNI | ln M2 | ln INF | ln DEBT | ln UP | ln CC | ln PRI | ||||||

| 1 | 100.00 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||

| 4 | 64.745 | 7.610 | 22.470 | 0.786 | 22.647 | 0.357 | 2.017 | 17.368 | 0.854 | ||||||

| 10 | 45.096 | 7.314 | 22.744 | 5.301 | 31.600 | 0.929 | 14.225 | 22.379 | 3.413 | ||||||

| Model (9): Variance Decomposition of ln REV | |||||||||||||||

| Pd * | ln REV | ln FFA | ln GNI | ln M2 | ln INF | ln DEBT | ln UP | ln CC | ln PRI | ||||||

| 1 | 100.00 | 0.000 | 0.000 | 0.000 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||

| 4 | 68.029 | 4.953 | 22.105 | 1.746 | 31.092 | 0.553 | 0.765 | 11.139 | 1.617 | ||||||

| 10 | 50.653 | 5.089 | 21.985 | 6.018 | 35.510 | 1.135 | 10.731 | 14.289 | 3.560 | ||||||

| Model (10): Variance Decomposition of ln DBOR | |||||||||||||||

| Pd * | ln DBOR | ln FFA | ln INF | ln DEBT | ln CC | ln GDPG | ln PRI | ||||||||

| 1 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||||

| 4 | 57.880 | 4.887 | 0.278 | 28.205 | 0.772 | 4.204 | 3.778 | ||||||||

| 10 | 45.304 | 2.989 | 0.946 | 32.153 | 1.424 | 2.657 | 15.528 | ||||||||

| Model | Short-Run Causality | Short-Run Causality | Long-Run Causality |

|---|---|---|---|

| Null Hypothesis | Wald Statistic | ECTt−1 | |

| (1) | ln FFAt does not Granger cause ln GREt | −0.457 *** | −0.070 * |

| ln GREt does not Granger cause ln FFAt | −0.289 | 0.958 | |

| (2) | ln BFFAt does not Granger cause ln GREt | −0.059 *** | −1.341 ** |

| ln GREt does not Granger cause ln BFFAt | 2.002 | −3.273 *** | |

| (3) | ln MFFAt does not Granger cause ln GREt | 2.767 ** | −1.173 * |

| ln GREt does not Granger cause ln MFFAt | −3.423 | 5.012 | |

| (4) | ln GRNt does not Granger cause ln GREt | 0.152 | −0.895 |

| ln GREt does not Granger cause ln GRNt | −1.822 | 4.021 | |

| (5) | ln LOAN does not Granger cause ln GRE | 0.194 | 0.107 |

| ln GRE does not Granger cause ln LOAN | 0.145 | −0.145 | |

| (6) | ln FFAt does not Granger cause ln GHEt | −0.317 | 0.279 |

| ln GHEt does not Granger cause ln FFAt | 1.447 | −1.634 | |

| (7) | ln FFAt does not Granger cause ln GEEt | −5.329 * | −3.597 * |

| ln GEEt does not Granger cause ln FFAt | 0.19 | −0.708 |

| Equations | Tests | ||

|---|---|---|---|

| Autocorrelation a Lagrange Multiplier Statistic | Normality b Jarque–Bera Statistic | Homoscedasticity c F-Statistic | |

| (1) | 0.274 (0.764) | 17.532 (0.618) | 0.793 (0.628) |

| (2) | 0.023 (0.877) | 13.662 (0.847) | 0.713 (0.690) |

| (3) | 0.032 (0.869) | 10.053 (0.967) | 0.969 (0.501) |

| (4) | 0.142 (0.768) | 24.667 (0.215) | 0.656 (0.735) |

| (5) | 1.428 (0.275) | 23.600 (0.260) | 1.164 (0.382) |

| (6) | 1.032 (0.384) | 21.910 (0.159) | 0.954 (0.511) |

| (7) | 1.688 (0.223) | 22.551 (0.311) | 0.910 (0.541) |

| (8) | 0.304 (0.742) | 17.883 (0.601) | 1.478 (0.241) |

| (9) | 1.714 (0.217) | 16.556 (0.516) | 1.761 (0.164) |

| (10) | 0.319 (0.852) | 24.109 (0.198) | 1.569 (0.213) |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murshed, M. An Empirical Investigation of Foreign Financial Assistance Inflows and Its Fungibility Analyses: Evidence from Bangladesh. Economies 2019, 7, 95. https://doi.org/10.3390/economies7030095

Murshed M. An Empirical Investigation of Foreign Financial Assistance Inflows and Its Fungibility Analyses: Evidence from Bangladesh. Economies. 2019; 7(3):95. https://doi.org/10.3390/economies7030095

Chicago/Turabian StyleMurshed, Muntasir. 2019. "An Empirical Investigation of Foreign Financial Assistance Inflows and Its Fungibility Analyses: Evidence from Bangladesh" Economies 7, no. 3: 95. https://doi.org/10.3390/economies7030095

APA StyleMurshed, M. (2019). An Empirical Investigation of Foreign Financial Assistance Inflows and Its Fungibility Analyses: Evidence from Bangladesh. Economies, 7(3), 95. https://doi.org/10.3390/economies7030095