1. Introduction

The launch of the Aid for Trade (AfT) Initiative by the Members of the World Trade Organization (WTO) in 2005 at the WTO’s Hong Kong Ministerial Conference has triggered a growing interest of the international trade and development communities in the effectiveness of this initiative. It is worth recalling that, according to Paragraph 57 of the WTO’s Hong Kong Ministerial Declaration (see WTO document WT/MIN(05)/DEC—(

WTO 2005)), the objective of the AfT Initiative is to “help developing countries, particularly Least developed countries (LDCs), to build the supply-side capacity and trade-related infrastructure that they need to assist them to implement and benefit from WTO Agreements and more broadly to expand their trade.” The Organization of Economic Cooperation and Development (OECD) has classified AfT into three categories. These include AfT related to economic infrastructure, which encompasses transport and storage, communications, and energy generation and supply. AfT dedicated to building productive capacity, which includes banking and financial services, business and other services, agriculture, forestry, fishing, industry, mineral resources, mining, and tourism. AfT is related to trade policy and regulations, which is comprised of trade policy, regulations, and trade-related adjustment interventions.

Many studies by scholars and researchers have investigated empirically the effectiveness of the AfT, including with respect to recipient countries’ export volumes, export upgrading, and export revenue volatility (see for example OECD/WTO, 2017 for a literature review on the impact of AfT on export performance, (

Gnangnon 2018a;

Gnangnon and Roberts 2017;

Wang and Xu 2018). In a recent study,

Gnangnon (

2018b) has investigated the impact of AfT flows on domestic trade policies of recipient countries and reported evidence that AfT interventions are conducive to trade policy liberalization. However, so far, little attention has been paid to the effect of AfT on trade policy volatility. The importance of this issue rests on the fact that trade policy volatility, and, particularly, tariff policy volatility makes the business environment less transparent and unpredictable. It increases uncertainty surrounding the trade policy stance and induces higher business and investment costs for businesses and investors. Consumers and producers also suffer from trade policy volatility such as tariff policy volatility, due

inter alia, to its eventual effect on domestic prices.

The current article aims to contribute to the literature on the AfT effectiveness by exploring the impact of AfT related to trade policies and regulations on tariff policy volatility in AfT-recipient countries. It further investigates whether this effect (if any at all) depends on the AfT recipient countries’ quality of institutions and governance. Assessing the impact of AfT related to trade policies and regulations on tariff policy volatility is all the more relevant that tariff policy uncertainty could have large effects on trade flows and other outcomes (

Ashraf et al. 2009;

Handley 2014;

Handley and Limão 2015;

Pierce and Schott 2015).

The literature on the macroeconomic determinants of trade policy volatility is very scant

1. One of the rare studies on this issue is

Cadot et al. (

2008), who have examined the extent to which regional trade agreements (RTAs) influence agricultural trade policy volatility. Their findings suggest that RTAs have exerted a reducing effect on agricultural trade policy volatility. Furthermore, these authors have reported evidence that the WTO’s agricultural agreement has also contributed to lowering agricultural trade policy volatility. In the current study, we postulate that aid for trade policies and regulations would help improve policymakers’ understandings of WTO Agreements and Decisions, and allow them to devise appropriate national trade strategies that would help both promote their trade, and, in particular, exports of goods and services, but also comply with their international obligations vis-à-vis the WTO. In this context, higher aid for trade policies and regulations would lead policymakers in recipient countries to devise trade policies that would result in lower tariffs volatility with a view to ensure a predictable and transparent business environment for businesses involved in international trade activities. Incidentally, since good institutional and governance quality would contribute toward improving the business environment and promoting trade (

Ades and Di Tella 1999;

Treisman 2000;

Faruq 2011;

Iqbal and Daly 2014), we expect this reducing effect of aid for trade policies and regulations on tariff policy volatility to be further enhanced in the context of good quality of domestic institutional and governance.

The empirical analysis has been performed on a sample of 107 AfT recipient countries, over the period from 2002 to 2015. Results, based on the two-step system Generalized Methods of Moments (GMM) approach, show that aid for trade policies and regulations are associated with lower tariff policy volatility. Additionally, when this reducing effect is higher, the recipient countries’ institutional and governance quality is better.

The rest of the paper is organized as follows.

Section 2 discusses how aid for trade policies and regulations could influence tariff policy volatility.

Section 3 presents the model specification that helps address the issue at hand.

Section 4 provides some preliminary data analysis.

Section 5 presents the econometric methodology to estimate the model, while

Section 6 discusses the empirical results.

Section 7 deepens the analysis by investigating whether the effect of aid for trade policies and regulations on tariff policy volatility depends on recipient countries’ level of institutional and governance quality.

Section 8 concludes the paper.

3. Model Specification

As noted above, to the best of our knowledge, apart from

Cadot et al. (

2008) who have focused on the effect of RTAs on agricultural trade policy volatility (and not on the overall tariff policy volatility), no other study has examined the macroeconomic determinants of tariff policy volatility. To explore empirically the effect of aid for trade policies and regulation on tariff policy volatility, we draw on some insights from

Cadot et al. (

2008) and postulate the following Model (1).

where

i represents the index of a recipient country of aid for trade policies and regulations and t denotes the time period. Model (1) is estimated using an unbalanced panel dataset comprising 107 recipient countries over the period from 2002 to 2015.

to

are parameters to be estimated.

are countries’ fixed effects.

is a well-behaving error term.

The variable “VOLTARIFF” is the measure of tariffs volatility. It has been calculated over the period from 2002 to 2015 using the method discussed in

Chowdhury (

1993), and recently employed,

inter alia, in

Chowdhury (

2015). According to this method, the volatility of the tariff is calculated as the moving sample standard deviation of the growth rate of tariffs. The formula used (see

Chowdhury 1993,

2015) is shown below.

where

k is the order of the moving average. This generates a time varying measure of the tariffs volatility. In light of the short-term nature of the time series of our panel dataset (2002–2015), we use

k = 2 to compute the tariff volatility variable. The tariff data used, in this case, is for each country and for every year including the weighted mean of the applied tariff rate to all products (in percentage). Data on tariffs is extracted from the World Development Indicators (WDI) of the World Bank. The one-year lag of the variable “VOLTARIFF” has been introduced in Model (1) to capture the eventual persistence over time of tariffs’ volatility.

The variable “AfTPOL” is the key variable of interest, and represents the gross disbursements of aid for trade policies and regulations. It has been primarily measured by the real values of the gross disbursements of aid for trade policies and regulations, i.e., the gross disbursements of aid for trade policies and regulations, in constant 2014 US Dollars. This variable is denoted “AfTPOLCST”. For a robustness check, we have also used the ratio of the gross disbursements of aid for trade policies and regulations (in current US Dollar) to recipient country’s GDP (in current US Dollar). This variable is denoted “AfTPOLGDP”. Data on the gross disbursements of aid for trade policies and regulations, in both 2014 constant US Dollars, and current US Dollars is collected from the OECD/DAC-CRS (Organization for Economic Cooperation and Development/Donor Assistance Committee)-Credit Reporting System (CRS). Data on GDP (current US Dollar) is extracted from the WDI.

The variables “GROWTHVOL” and “REERVOL” represent, respectively, the volatility of the economic growth rate, and the volatility of the real effective exchange rate. They have been computed using Formula (2): the volatility of the economic growth rate has been calculated as the moving sample standard deviation of the economic growth rate. The volatility of the real effective exchange rate has been calculated as the moving sample standard deviation of the growth rate of the real effective exchange rate. Data on economic growth rates (constant 2010 US$) comes from the WDI, while data on the real effective exchange rate (index base 2005) comes from the database of the United Nations Conference on Trade and Development (UNCTAD). The inclusion of the variable capturing the economic growth volatility aims to account for the effect of macroeconomic shocks on tariffs policy volatility. Higher economic growth volatility and higher volatility of the real effective exchange could reflect shocks that are affecting the economy and, consequently, incentivize governments to use trade policies, including tariffs to address the adverse economic consequences of these shocks. In this regard, significant changes in tariffs in order to promote and stabilize the economic growth rate would lead to higher tariffs’ volatility. In these circumstances, higher volatility in economic growth, and higher real effective exchange rate volatility would result in higher tariff policy volatility.

The variable “TBGDP” represents a country’s level of trade balance (% GDP), measured as the difference between exports of goods and services and imports of goods and services, as a share of GDP. Data on this variable has been collected from the WDI. Countries with higher trade deficits would be inclined to frequently use tariffs to address these deficits vis-à-vis their trading partners. This could result in higher tariffs volatility. As a result, higher trade deficits might be associated with higher tariff policy volatility (that is, higher trade surpluses would be associated with lower tariffs volatility). Note that we have not applied the natural logarithm to the variable “TBGDP” because it contains negative values.

The variable “GDPC” stands for the real per capita income (constant 2010 US$) of an AfT-recipient country. Extracted from the WDI, it has been included in Model (1) to control for countries’ development levels.

Lastly, the variable “INST” represents the institutional and governance quality. It has been calculated by relying on the factor analysis (notably the Principal Component Analysis, PCA) and, hence, using the first principal components of six indicators of governance (e.g.,

Globerman and Shapiro 2002;

Buchanan et al. 2012;

Gnangnon 2018b). These indicators include the voice and accountability, the political stability and absence of violence/terrorism, the regulatory quality, the rule of law, the government effectiveness, and corruption. The first principal component accounts for as much of the variability in the data as possible, and each succeeding component accounts for as much of the remaining variability as possible. Thus, the PCA technique generates linear combinations of object measures (called eigenvectors), which show the greatest statistical variance over all of the objects under consideration. The values of the “INST” indicator ranged between −4.267 and 3.080, with higher values reflecting better institutional and governance quality. For instance, for the variable “TBGDP”, we have not applied the natural logarithm to the variable “INST” because it contains negative values. Data on the six indicators used to compute the index “INST” comes from the Worldwide Governance Indicators

2 (see

Kaufmann et al. 2010).

Let us now discuss the effect of institutional and governance quality on tariff policy volatility. Institutions are the humanly devised constraints that structure political, economic, and social interactions (

North 1990). Thus, they can contribute to shaping the incentive structure in the society that may increase or hamper economic activities. Additionally, they could help reduce uncertainties that arise from incomplete information concerning the behavior of other individuals in the process of interaction, and, therefore, lower transaction costs and improve the business environment.

Faruq (

2011) has argued that widespread corruption, inefficient bureaucracy, and a high risk of expropriation of private property by the government can create uncertainty among producers and discourage them from investing and innovating over the long term.

Iqbal and Daly (

2014) have indicated that weak institutions divert resources from a productive sector to an unproductive sector and, hence, promote rent-seeking activities. In the same vein,

Beck and Levine (

2004) have argued that bad institutions increase the general costs of doing business and enhance the efficiency of resource allocation.

Bernard and Jones (

1996) have emphasized that good quality institutions enhance the ability of a country to adopt new technologies invented elsewhere, which may play an important role in upgrading the development process of a country. Better institutional and governance quality could also help promote trade flows (e.g.,

Jansen and Nordås 2004;

Li and Samsell 2009;

Wu et al. 2012), while trade could, in turn, increase the costs of excessive regulation and induce domestic and foreign investors to sustain pressure on governments to undertake institutional reforms (e.g.,

Ades and Di Tella 1999;

Treisman 2000). In this context, governments would be more willing to reduce the volatility of their trade policies, including their tariffs policy in order to further enhance the predictability of the business environment generated by better institutional and governance quality. We postulate that good institutional and governance quality would help improve the business environment, promote innovation, and enhance trade flows and, consequently, lead recipient countries’ governments to devise tariff policies so as to ensure a predictable and transparent environment for businesses. In doing so, improvement in the quality of institutions and governance would contribute for reducing the uncertainty surrounding tariff policy, and, ultimately, lead to lower tariffs’ volatility. One could also argue that, even in the context of improved governance and institutional quality, countries could experience higher fluctuations of tariffs. This is because governments may be willing to address some short-term macroeconomic imbalances such as trade deficits with its trading partners. In this scenario, good institutional and governance quality would result in higher tariffs’ volatility. Overall, we expect the quality of institutions and governance to be negatively associated with tariffs’ volatility. However, we do not rule out the possibility that a better institutional and governance quality could exert a positive effect on tariffs’ volatility. Additionally, an average positive effect might hide differentiated effects (in terms of sign, statistical significant, and magnitude) across countries in the full sample.

Appendix A displays the list of countries used in the full sample, and

Appendix B reports descriptive statistics on the variables used in Model (1).

4. Preliminary Data Analysis

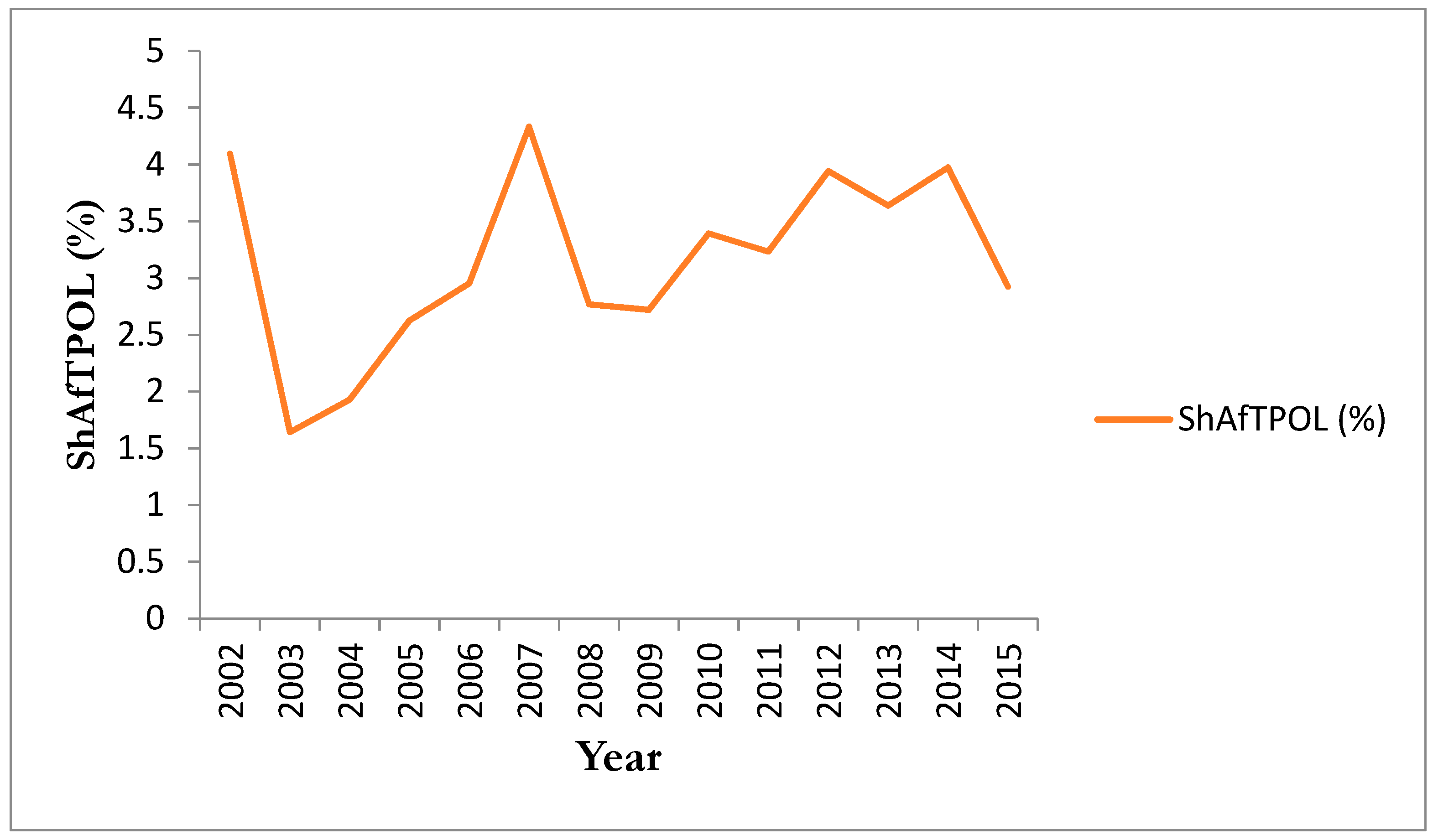

We present in

Figure 1 the average share (%) of aid for trade policies and regulations in total AfT. We observe from this figure that this share has severely fluctuated over the considered period. This average has been calculated over the 107 recipient countries of Aid for trade policies and regulations of the panel dataset from 2002 to 2015. In particular, it has significantly dropped from 4.1% in 2002 to 1.64% in 2003, and then rebounded to reach its maximum level (over the full period), i.e., 4.33% in 2007. It has then declined to 2.77% in 2008 (due possibly to the 2008 global financial crisis). Since then, it has experienced ups and downs to reach 3.97% in 2014, and 2.93% in 2015.

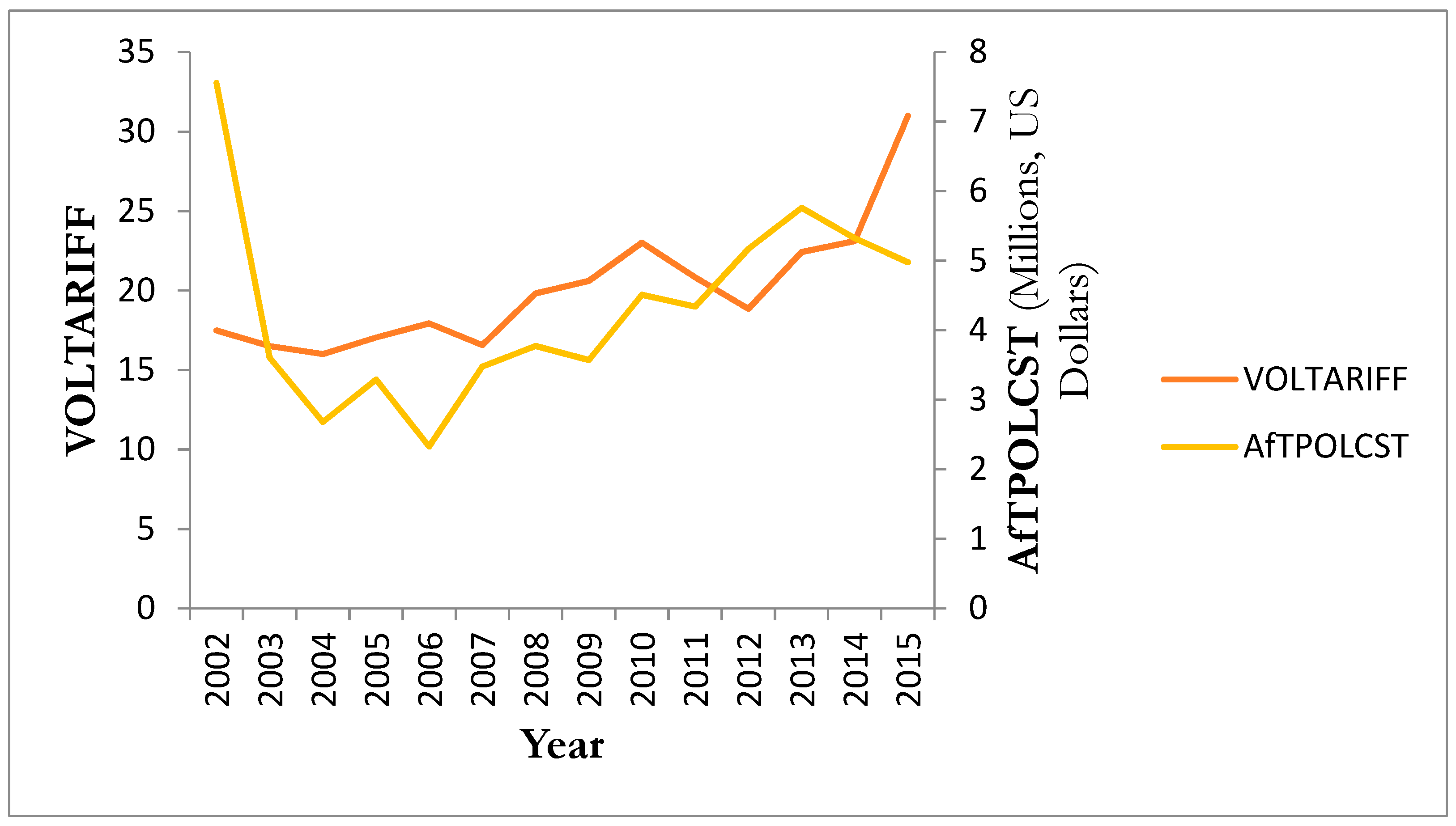

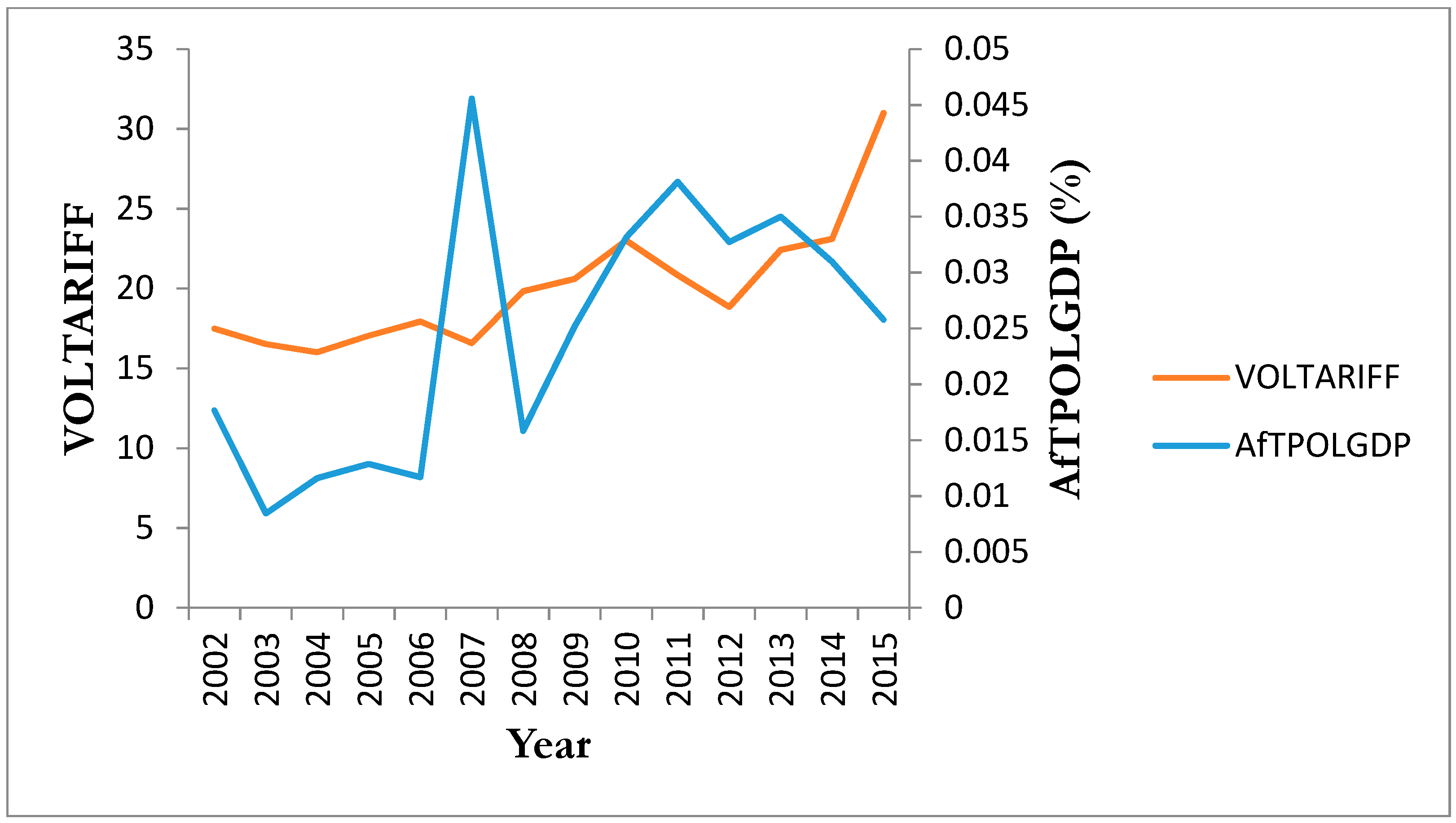

To have an idea on the relationship between aid for trade policies and regulations and tariffs’ volatility variables, we present, in

Figure 2, the evolution of both the average of AfTPOLCST and the average of VOLTARIFF. Similarly, we display, in

Figure 3, the evolution of the average of AfTPOLGDP and the average of VOLTARIFF. The averages of these variables have been calculated over the 107 recipient countries of the panel dataset.

Figure 2 and

Figure 3 show that the variables AfTPOLCST and AfTPOLGDP (which have more or less displayed patterns that are to some extent similar to that of

Figure 1) have evolved in opposite directions vis-à-vis tariffs volatility. Specifically, in these two figures, tariffs volatility has slightly fluctuated, but it has been on a rising trend. In

Figure 2, after a sudden drop from

$7.56 million USD in 2002 to

$3.61 million USD in 2003, AfTPOLCST has also experienced ups and downs, but it has been on average on a rising trend. However, it has declined from

$5.33 million USD in 2014 to

$4.98 million USD in 2015. AfTPOLGDP has exhibited a similar pattern to the one in

Figure 1. In particular, it represented 0.01767% in 2002, 0.0084% in 2003, and 0.0455% in 2007, which is its highest level over the entire period. It has then suddenly declined to 0.016% in 2008, and then moved up to reach 0.038% in 2011. Since then, it has been on a declining trend to reach 0.0257% in 2015.

5. Econometric Strategy

We first estimate a static version of model (1) (i.e., Model (1) without the one-year lag of the dependent variable as a right-hand side variable) where the variables “AfTPOL” and “TBGDP” have been considered with a one-year lag to mitigate the endogeneity concerns related to the reverse causality issue. While aid for trade policies and regulations could influence tariff policy volatility, it is also possible that the degree of tariff policy volatility in a given recipient country influences the amounts of the aid for trade policies and regulations that the country would obtain from donors. Likewise, while the level of trade balance (trade deficit versus trade surplus levels) would influence tariff policy volatility, we could also expect higher tariff policy volatility to affect trade flows, and, hence, the levels of trade balance. Incidentally, the use of the factor analysis helps severely mitigate the endogeneity concern associated with the eventual reverse causality from the dependent variable to the variable capturing the institutional and governance quality (e.g.,

Portugal-Perez and Wilson 2012). This endogeneity concern is further mitigated by the fact that the variable INST changes little over time. Against this background, we first estimate the static version of model (1) described above by using the within fixed effect estimator (denoted “FE-DK”) where standard errors have been corrected by means of the

Driscoll and Kraay (

1998) technique. This technique allows us to take into account the presence of cross-sectional dependence, autocorrelation, and heteroscedasticity in the dataset. Second, we employ the random effects estimator (henceforth denoted “RE”) where standard errors are clustered at the country level. While the fixed effects estimations rely on within-country differences (eventually at the cost of reducing efficiency due to the removal of all between-group variation in the dataset), the random effects estimations capture cross-country and within country differences. The results of the estimations of the different variants of the static specification of Model (1)—using each of the two AfTPOL variables—by means of “FE-DK” and “RE” estimators are reported in

Table 1.

However, these estimators could generate biased estimates because using the one-year lag of the variables “AfTPOL” and “TBGDP” might not fully address the endogeneity problem related to the reverse causality concerning these two variables. Additionally, the model may suffer from the omission of the one-year lag of the dependent variable as a right-hand side variable. In the meantime, the estimation of the dynamic specification of Model (1)—with the one-year lag of the dependent variable as a regressor—could lead to biased estimates, which could be severe in a panel dataset with a limited time-period and a large cross-section (the so-called Nickell bias, see

Nickell 1981). To address these endogeneity concerns, we employ the popular two-step system Generalized Methods of Moments (GMM) estimator to estimate Model (1) proposed by

Blundell and Bond (

1998). This estimator is appropriate for dynamic models in the context of panel dataset with a large cross-section (N) and limited time-period (T) like ours (T = 14, and N = 107 in the current analysis), and helps deal with the endogeneity problems induced by the bi-directional causality between regressors and the dependent variable. It entails the combination of the estimation of an equation in differences with an equation in levels where lagged first differences are used as instruments for the levels equation and lagged levels are used as instruments for the first-difference equation. The two-step system GMM estimator has also many advantages over the difference-GMM estimator developed by

Arellano and Bond (

1991). For example, the two-step system GMM estimator allows using additional moment conditions, which helps reduce the potential biases and imprecision associated with the difference estimator. Furthermore, this estimator helps avoid magnifying gaps when the panel dataset is unbalanced (which is an important weakness of the difference GMM estimator) (see

Roodman 2009). To assess whether the two-step system GMM estimator is appropriate for estimating Model (1), we perform several standard diagnostic tests. The first test is the Arellano-Bond test of first-order serial correlation in the error term (denoted AR(1)). The second test is the Arellano-Bond test of no second-order autocorrelation in the error term (denoted AR(2)). The last test is the Sargan test of over-identifying restrictions, which determines the validity of the instruments used in the estimations. Lastly, we report the number of instruments used in the regressions because a higher number of instruments than the number of countries in the regressions may reduce the power of the previously mentioned tests, including the Sargan test (

Ziliak 1997,

Bowsher 2002, and

Roodman 2009). The outcomes of the estimation of Model (1) by means of the two-step system GMM estimator are presented in column (1) of

Table 2. The results of the estimation of Model (1) by means of the two-step system GMM estimator are reported in

Table 2.

6. Interpretation of Empirical Results

Results across the four columns of

Table 1 suggest that aid for trade policies and regulations (in real values or in % GDP) is positively associated with tariffs volatility. However, in the majority of the cases, the estimate is statistically significant only at the 10% level (it is statistically significant at the 1% level only in column (3), i.e., for the model specification with “AfTPOLCST,” estimated with the RE estimator). Across columns (1) and (2), the magnitudes of the effect of aid for trade policies and regulations on tariffs’ volatility are quite similar. Concerning control variables, we note that improvements in the trade balance induce lower tariffs’ volatility only in columns (3) and (4)). In the other columns, the estimates are not statistically significant at the 10% level. For all other variables, we find no significant effect (at the 10% level) on tariffs’ volatility.

Turning to the results provided in

Table 2, we observe across the two columns of this table that the coefficient of the one-year lag of the dependent variable is always positive and statistically significant, which confirms the persistence of tariff policy volatility over time. Additionally, at the bottom of these columns, we find that the

p-values associated with the AR(1) test are always 0, i.e., lower than 0.01 (the 1% level of statistical significance), while the

p-values relating to the AR(2) test are higher than 0.10 (i.e., the 10% level of statistical significance). The

p-values associated with the Sargan test are always higher than 0.10, and the number of countries is consistently higher than the number of instruments across the two columns of this table. Taken together, these outcomes suggest that the previously mentioned diagnostic tests to check the validity of the two-step system GMM estimator are fully satisfactory. We, therefore, conclude that the two-step system GMM estimator is very appropriate to perform the empirical analysis.

Let us now consider the estimates presented in

Table 2. Results in columns (1) and (2) indicate that both real values of aid for trade policies and regulations and aid for trade policies and regulations (% GDP) exert a negative and significant (at the 1% level) effect on tariff volatility. Interestingly, the magnitudes of these two effects are quite similar. Specifically, a 1 dollar increase in aid for trade policies and regulations is associated with a 0.165 percentage decline in tariffs volatility. Likewise, a 1 percentage increase in aid for trade policies and regulations (% GDP) induces a 0.15 percentage decline in tariff volatility.

Concerning control variables, we obtain similar results across the two columns, except for the variable “GROWTHVOL” and “GDPC.” An improvement in trade balance influences negatively and significantly tariffs volatility in recipient countries of aid for trade policies and regulations. Higher volatility of the real effective exchange rate results in lower tariffs volatility, which could reflect the fact that, in the context of severe fluctuations of real effective exchange rate that could adversely affect trading firms, governments tend to mitigate these adverse effects by making tariffs less volatile. Economic growth volatility influences negatively and significantly tariffs’ volatility in column (2), but exerts no significant effect (at least at the 10% level) on tariffs’ volatility in column (1). The argument developed above to explain the negative effect of the volatility of the real effective exchange rate on tariffs’ volatility also applies in this case to explain the possible rationale for the negative effect of growth volatility on tariffs’ volatility. We also obtain that good institutional and governance quality is positively and significantly (at the 1% level) associated with tariffs’ volatility in recipient countries of aid for trade policies and regulations. This result concerning the institutional and governance quality tends to confirm our hypothesis that, even in the context of improvement of the institutional and governance quality, policymakers may regularly change their tariffs (which would lead to higher tariffs’ volatility) in order to address, for example, some macroeconomic imbalances such as higher trade deficits through certain trading partners. Nonetheless, it is worth underlining that this positive effect of institutional and governance quality on tariff volatility represents an average effect across all AfT recipient countries considered in the analysis, and may, therefore, hide different effects (including in terms of magnitude, sign, and statistical significance) across countries in the full sample.

Before turning to the next section, it is worth emphasizing that we have included time dummies in the various specifications of Model (1), including the two aiding trade policies and regulation variables. However, we find no significant effects of these time dummies on the tariff volatility variable. Additionally, the inclusion of these dummies in the model specification does not alter significantly the effects of the AfT variables on the tariff policy volatility. Similar findings are also obtained when we replace the time dummies with a dummy variable aiming to capture the 2007 to 2009 financial crisis.

We further examine whether the effect of each of the two pieces of aid for trade policies and regulations variables on tariff policy volatility varies across sub-groups of countries, and more generally for varying countries’ development levels. To do so, we first consider whether the effect of each of the two pieces of aid for trade policies and regulations variables on tariffs volatility in LDCs (qualified by the United Nations as the poorest and most vulnerable countries in the world—see for more information, see online at:

http://unohrlls.org/about-ldcs/) is different from that of non-LDCs. In that respect, a dummy variable (denoted “LDC”) is created, which takes the value 1 for countries qualified as LDCs and 0, otherwise. This dummy variable is subsequently introduced in the specifications of Model (1), along with its interaction with each of the Aid for Trade policies and regulations variables. The results of the estimations of these model specifications are reported in columns (1) and (2) of

Table 3. Furthermore, as noted above, we push the analysis further by examining, more generally, the extent to which the effect of the Aid for Trade policies and regulations on tariffs’ volatility depends on countries’ development levels, which is proxied by their real per capita income. To do so, we include in Model (1) the interaction between the Aid for Trade policies and regulations variable and the real per capita income. The results of the estimation are presented in columns (3) and (4) of

Table 3.

Additionally, the puzzling positive effect of the institutional and governance variable on tariffs’ volatility prompts us to examine whether this effect varies across countries, which is for various countries’ development levels. To check these, we introduce in the specifications of Model (1) (that is, with each of the Aid for Trade policies and regulations variables) the interaction between the institutional and governance quality variable and the real per capita income variable. The outcome of the estimation of this model specification using the two-step system GMM estimator is presented in columns (5) and (6) of

Table 3.

The results in column (1) suggest that the coefficient related to the interaction variable [LDC × (Log(AfTPOLCST))] is positive and statistically significant at the 1% level, which indicates that real Aid for Trade policies and regulations exerts a higher positive significant effect on tariffs’ volatility in LDCs than in non-LDCs. Specifically, the net effect of the real Aid for Trade policies and regulations on tariffs volatility in LDCs and non-LDCs are, respectively, given by −0.002 (= −0.154 + 0.152) and −0.154. These two outcomes indicate that real Aid for Trade policies and regulations exerts a reducing effect on tariffs volatility even thoughthe magnitude is far higher for non-LDCs than for LDCs (for LDCs, the magnitude of the effect is very small). Likewise, results in column (2) of

Table 3 indicate that the net effects of Aid for Trade policies and regulations (% GDP) on tariffs volatility for LDCs and Non-LDCs are given, respectively, by −0.035 (=−0.113 + 0.0776) and −0.113. Once again, these outcomes show that Aid for Trade policies and regulations (% GDP) exert a far higher reducing effect on tariffs volatility in non-LDCs than in LDCs. Turning to results in column (3), we observe that the interaction variables between the real per capita income variable and each of the Aid for Trade policies and regulation variables are negative and statistically significant at the 1% level. Thereby, this indicates that the magnitude of the reducing effect of Aid for Trade policies and regulations on tariff volatility increases as countries experience higher development levels. Thus, relatively developed AfT recipient countries tend to experience a higher reducing effect of Aid for Trade policies and regulations on tariffs volatility compared to less developed recipient countries. This clearly confirms the previous finding concerning the higher reducing effect of Aid for Trade policies and regulations on tariffs volatility in LDCs compared to non-LDCs. Similarly, the interaction between the institutional and governance quality variable and the real per capita income variable (see columns (5) and (6) of

Table 3) exhibits negative and significant coefficients at the 1% level. This, therefore, suggests that better institutional and governance quality exerts a negative and significant effect on tariffs volatility. The magnitude of this reducing effect increases as countries further develop. In other words, relatively higher developed recipient countries tend to experience a higher reducing effect of Aid for Trade policies and regulations on tariffs’ volatility than do less developed recipient countries.

Lastly, estimates related to control variables are broadly consistent with those presented in

Table 2.

7. Further Analysis: Does the Effect of Aid for Trade Policies and Regulations on Tariff Policy Volatility Depend on the Institutional and Governance Quality?

The analysis has so far consisted of how Aid for Trade policies and regulations as well as institutional and governance quality could influence tariffs’ volatility. In this section, we investigate whether the effect of Aid for Trade policies and regulations on tariffs’ volatility depends on the quality of institutions and governance prevailing in the recipient countries. In light of the theoretical discussion provided above concerning the effect of Aid for Trade policies and regulations, and institutional and governance quality on tariff policy volatility, we postulate two hypotheses. To recall, on the one hand, AfT related to trade policies and regulations aims, inter alia, to help policymakers in recipient countries of Aid for Trade policies and regulations to better understand and comply with WTO Agreements and Decisions, and, ultimately, ensure the predictability and transparency of their trade policies (including tariffs policies). On the other hand, better institutional and governance quality could help improve the business environment and enhance trade flows, which could, in turn, further improve institutional and governance quality. Taken together, these two arguments suggest that better institutional and governance quality would enhance the negative effect of Aid for Trade policies and regulations on tariff policy volatility. At the same time, as noted above, governments of AfT recipient countries may be willing to devise tariffs’ policy that would generate higher tariffs volatility in order to address some macroeconomic imbalances such as trade deficits with their trading partners. Thus, even in the context of good institutions and governance quality, higher Aid for Trade policies and regulations might not necessarily lead to lower tariffs volatility. However, any positive effect in terms of Aid for Trade policies and regulations on tariffs’ volatility could be lower (in magnitude) in countries with higher institutional and governance quality than in countries with lower institutional and governance quality. Alternatively, one could also argue that, even though AfT recipient countries’ institutions and governance are weak, higher AfT related to trade policies and regulations would reduce the magnitude of the positive effect of the low quality of governance and institutions on tariffs volatility. In this scenario, the lower the quality of governance and institutions, the lower the positive effect of Aid for Trade policies and regulations on tariff policy volatility would be in this case.

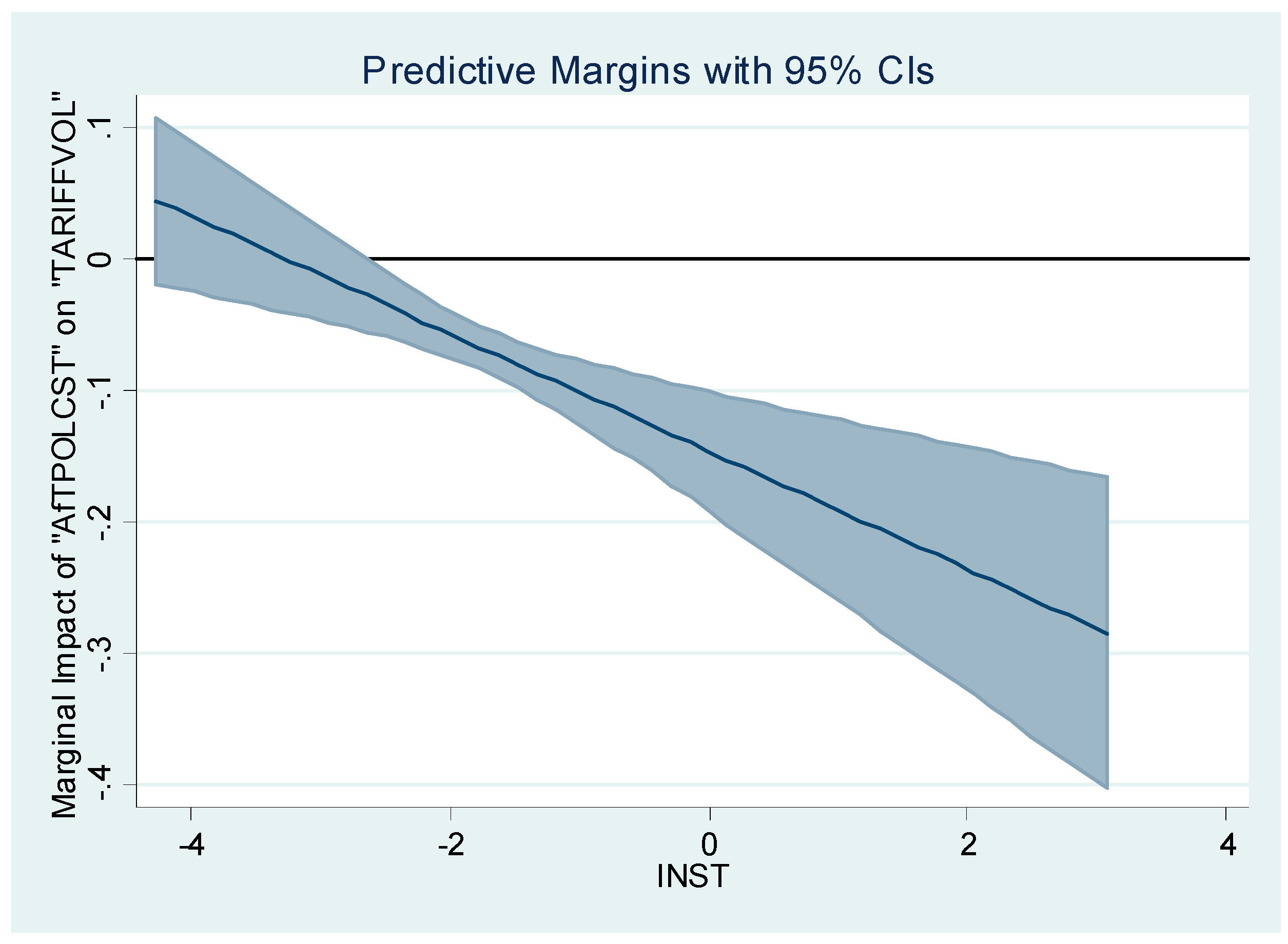

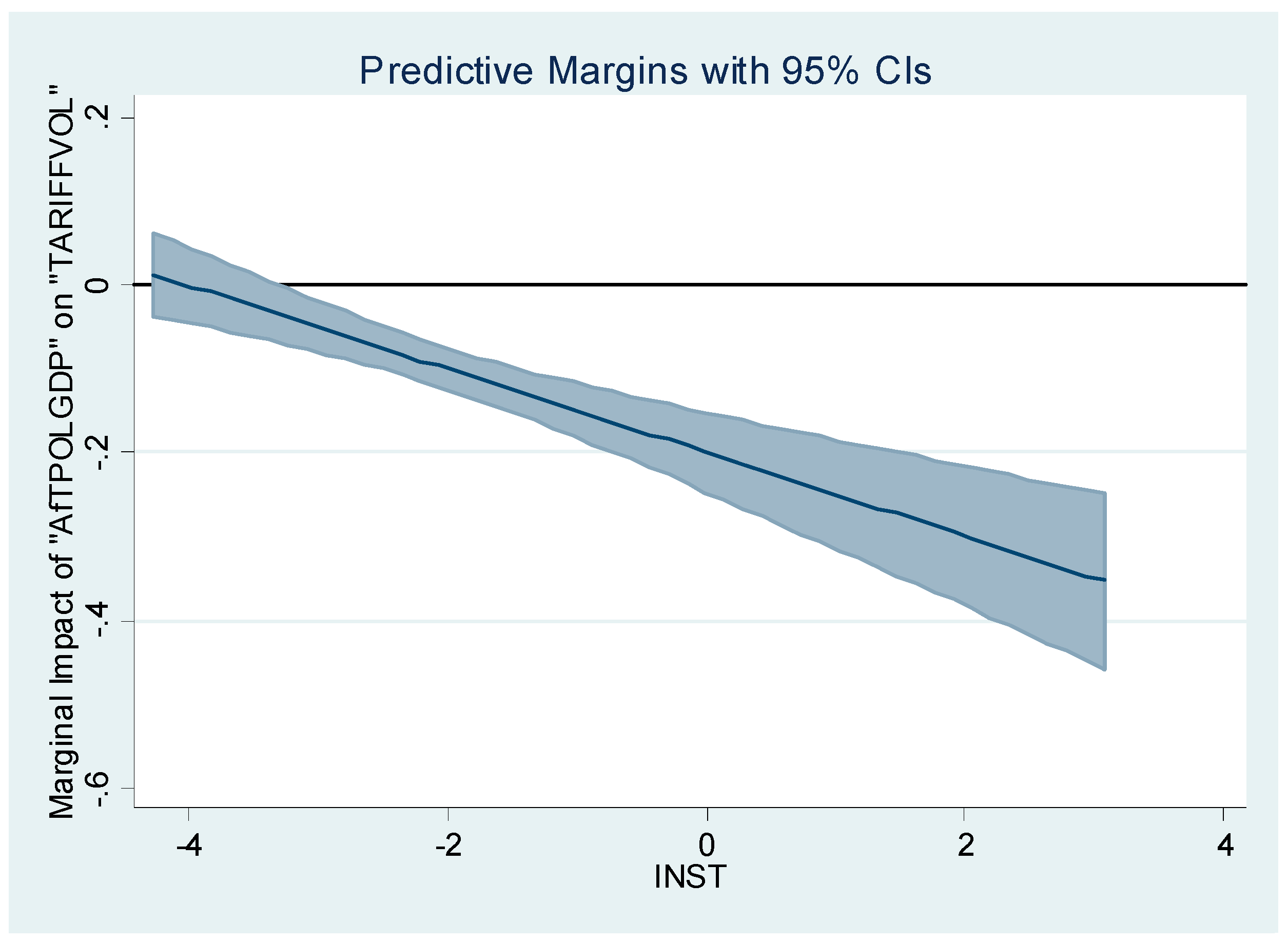

To investigate empirically whether the effect of Aid for Trade policies and regulations on tariffs volatility depends on the level of institutional and governance quality, we estimate a variant of Model (1) in which we include (once) a variable capturing the interaction between each of the “AfTPOL” variables and the variable “INST”. This variant of Model (1) is estimated by using the two-step system GMM approach. The estimations’ results are reported in

Table 4. It could be observed from the two columns of this table that, in addition to the persistence over time of the VOLTARIFF variable, all the diagnostic tests relating to the validity of the two-step system GMM approach are satisfactory. Turning now to the estimates, we are particularly interested in two coefficients, which are the coefficient associated with each of the variables “AfTPOL” (in Logs) and the interaction term related to the interaction variable “[INST] × [Log(AfTPOL)]”. In the two columns of

Table 4, we obtain that the interaction term as well as the coefficient of each of “AfTPOL” variables are negative and statistically significant at the 1% level. These suggest that the total effect of Aid for Trade policies and regulations on tariffs’ volatility is, on average, always negative and statistically significant, and the magnitude of this effect increases as countries enjoy better institutional and governance quality. We provide in

Figure 4 (for results reported in column (1) of

Table 4) and in

Figure 5 (for results reported in column (2) of

Table 4) a better picture of the effect of Aid for Trade policies and regulations on tariffs’ volatility. Thus,

Figure 4 and

Figure 5 show, at the 95% confidence intervals, respectively, the evolution of the marginal impact of “AfTPOLCST” and “AfTPOLGDP” on “VOLTARIFF” for different countries’ levels of institutional and governance quality. The marginal impacts that are statistically significant at the 95% confidence intervals are those encompassing only the upper and lower bounds of the confidence interval that are either above or below the zero line. It could be noted from these two figures that the marginal impact of Aid for Trade policies and regulations on tariff volatility takes positive and negative values, and declines as countries enjoy better institutional and governance quality. However, this marginal impact is not always statistically significant. In

Figure 4, it is statistically significant only for levels of institutional and governance quality strictly higher than the value −2.5 (it is worth recalling that, in the full sample, the values of the variable “INST” range between −4.266 and 3.079). In

Figure 5, the marginal effect is statistically significant only for levels of institutional and governance quality strictly higher than the value −3.24. Hence, in

Figure 4, countries whose level of institutional and governance quality is strictly lower than −2.5, experience no significant effect of real values of Aid for Trade policies and regulations on tariffs’ volatility. For the other countries, the effect of the real values of Aid for Trade policies and regulations on tariffs’ volatility declines as they enjoy better institutional and governance quality. In other words, for these countries, the better the institutional and governance quality, the higher the reducing effect of real Aid for Trade policies and regulations on tariffs’ volatility are. The same reasoning applies to

Figure 5 (related to Aid for Trade policies and regulations, in % GDP), but with the minimum value being −3.24 for institutional and governance quality (from which the effect of the Aid for Trade policies and regulation becomes statistically significant).

8. Conclusions

This article contributes to the literature on AfT effectiveness by examining, for the first time, the effect of Aid for Trade policies and regulations on tariffs’ volatility in recipient countries. The analysis has been carried out using an unbalanced panel dataset, which contains 107 recipient countries of Aid for Trade policies and regulations from 2002 to 2015. The findings suggest that Aid for Trade policies and regulations exerts a reducing effect on tariff policy volatility in recipient countries. This result is robust to the alternative use of real values of the gross disbursements of Aid for Trade policies and regulations and the Aid for Trade policies and regulations (% GDP). Interestingly, the analysis has shown that better institutional and governance quality enhances the reducing effect of Aid for Trade policies and regulations on tariff policy volatility.

These outcomes have several policy implications. First, by increasing their financial support in the form of Aid for Trade policies and regulations to build the capacity of policymakers in recipient countries, donors would contribute toward reducing the volatility of tariffs in these countries. The rise in Aid for Trade policies and regulations may even, in turn, benefit donors. This is because trading firms in the donor countries would enjoy a greater transparency and predictability of trade policies, and tariff policies in the recipient countries could result in a rise of exports from donor countries to the recipient countries. Second, the improvement of domestic institutions and governance in the recipient countries (including, eventually, with the help of donor countries) would enhance the effectiveness of this aid in reducing tariffs’ volatility, and this would, ultimately, benefit both beneficiaries and donor countries. In particular, lower tariffs volatility, thanks inter alia, to Aid for Trade policies and regulations would provide foreign and domestic investors in recipient countries with a predictable trade policy landscape, and, consequently, promote their exports, domestic investment, and foreign investments especially foreign direct investments.