Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. The Data

3.2. Variables Used in the Analysis

3.3. Methodology

4. Empirical Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abreu, Margarida, and Victor Mendes. 2001. Commercial bank interest margins and profitability: Evidence for some EU countries. Paper presented at Pan-European Conference Jointly Organized by the IEFS-UK & University of Macedonia Economic & Social Sciences, Thessaloniki, Greece, May 17–20; pp. 17–20. [Google Scholar]

- Aftab, Nadeem, Nayyer Samad, and Tehreem Husain. 2015. Historical Analysis of Bank Profitability Using CAMEL Parameters: Role of Ownership and Political Regimes in Pakistan. International Journal of Economics and Finance 7: 144–55. [Google Scholar] [CrossRef]

- Ahmad, Rubi, Eric H. Y. Koh, and Shahrin Saaid Shaharuddin. 2016. Determinants of bank profitability: A comparative study of East Asia and Latin America. International Journal of Banking, Accounting and Finance 7: 34–51. [Google Scholar] [CrossRef]

- Albertazzi, Ugo, Alessandro Notarpietro, and Stefano Siviero. 2016. An Inquiry into the Determinants of the Profitability of Italian Banks (No. 364). Rome: Bank of Italy, Economic Research and International Relations Area. [Google Scholar]

- Alhassan, Abdul Latif, Michael Lawer Tetteh, and Freeman Brobbey Owusu. 2016. Market power, efficiency and bank profitability: Evidence from Ghana. Economic Change and Restructuring 49: 71–93. [Google Scholar] [CrossRef]

- Al-Jafari, Mohamed Khaled, and Mohammed Alchami. 2014. Determinants of bank profitability: Evidence from Syria. Journal of Applied Finance and Banking 4: 17–45. [Google Scholar]

- Alshatti, Ali Sulieman. 2015. The Effect of the Liquidity Management on Profitability in the Jordanian Commercial Banks. International Journal of Business and Management 10: 62–71. [Google Scholar] [CrossRef]

- Anarfi, Daniel, Emmanuel Joel Aaikins Abakah, and Eunice Boateng. 2016. Determinants of Bank Profitability in Ghana: New Evidence. Asian Journal of Finance & Accounting 8: 194–204. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Ariyadasa, Chatura, Eliyathamby Antony Selvanathan, M. A. B. Siddique, and Saroja Selvanathan. 2016. On the profitability of commercial banks: The Sri Lankan case. Applied Economics, 1–11. [Google Scholar] [CrossRef]

- Aydemir, Resul, and Gokhan Ovenc. 2016. Interest rates, the yield curve and bank profitability in an emerging market economy. Economic Systems 40: 670–82. [Google Scholar] [CrossRef]

- Boitan, Iustina Alina. 2015. Determinants of Sustainable Banks’ profitability. Evidence from EU Countries. Financial Studies 19: 21–39. [Google Scholar]

- Borjas, George J., and Kirk B. Doran. 2012. The Collapse of the Soviet Union and the Productivity of American Mathematicians (No. w17800). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Buchory, Herry Achmad. 2015. Determinant of Banking Profitability in Indonesian Regional Development Bank. Paper presented at the First International Conference “Actual Economy: Local Solutions for Global Challenges: ACE-2015, Pataya, Thailand, July 2–3; pp. 2–3. [Google Scholar]

- Chowdhury, Reza H. 2015. Equity capital and bank profitability: Evidence from the United Arab Emirates. Afro-Asian Journal of Finance and Accounting 5: 1–20. [Google Scholar] [CrossRef]

- Dawood, Usman. 2014. Factors impacting profitability of commercial banks in Pakistan for the period of (2009–2012). International Journal of Scientific and Research Publications 4: 1–7. [Google Scholar]

- Demirgüç-Kunt, Asli, and Harry Huizinga. 1999. Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Vojislav Maksimovic. 1998. Law, finance, and firm growth. The Journal of Finance 53: 2107–37. [Google Scholar] [CrossRef]

- Deng, Angela. 2016. Determinants and Differences of Domestic and Foreign Commercial Bank Profitability. Master thesis, University of New Hampshire, Durham, NH, USA. [Google Scholar]

- Dincer, Hasan, Umit Hacioglu, and Serhat Yuksel. 2016. Balanced Scorecard-based Performance Assessment of Turkish Banking Sector with Analytic Network Process. International Journal of Decision Sciences & Applications-IJDSA 1: 1–21. [Google Scholar]

- Djalilov, Khurshid, and Jenifer Piesse. 2016. Determinants of bank profitability in transition countries: What matters most? Research in International Business and Finance 38: 69–82. [Google Scholar] [CrossRef]

- Duraj, Brunilda, and Elvana Moci. 2015. Factors Influencing the Bank Profitability-Empirical Evidence from Albania. Asian Economic and Financial Review 5: 483–94. [Google Scholar] [CrossRef]

- Garcia, Maria Teresa Medeiros, and Joao Pedro Silva Martins Guerreiro. 2016. Internal and external determinants of banks’ profitability: The Portuguese case. Journal of Economic Studies 43: 90–107. [Google Scholar] [CrossRef]

- Goddard, John, Phil Molyneux, and John O. Wilson. 2004. The profitability of European banks: A cross-sectional and dynamic panel analysis. The Manchester School 72: 363–81. [Google Scholar] [CrossRef]

- Güngör, Bener. 2007. Türkiye’de Faaliyet Gösteren Yerel ve Yabancı Bankaların Kârlılık Seviyelerini Etkileyen Faktörler”. İşletme ve Finans Dergisi 258: 41–61. [Google Scholar]

- Gyamerah, Ishmael Appiah, and Benjamin Amoah Benjamin Amoah. 2015. Determinants of Bank Profitability in Ghana. International Journal of Accounting and Financial Reporting 5: 173–87. [Google Scholar] [CrossRef]

- Hanna, Gabi. 2016. Factors Affecting Bank Profitability during War Conflicts: Evidence from Syria. Master thesis, Jönköping International Business School, JIBS, Business Administration, Jönköping University, Jönköping, Sweden. [Google Scholar]

- Hu, Ti, and Chi Xie. 2016. Competition, Innovation, Risk-Taking, and Profitability in the Chinese Banking Sector: An Empirical Analysis Based on Structural Equation Modeling. Discrete Dynamics in Nature and Society. [Google Scholar] [CrossRef]

- Islam, Md. Shahidul, and Shin-Ichi Nishiyama. 2016. The Determinants of Bank Profitability: Dynamic Panel Evidence from South Asian Countries. Journal of Applied Finance and Banking 6: 77–97. [Google Scholar]

- Jabra, Wiem. Ben, Zouheir Mighri, and Faysal Mansouri. 2016. Bank capital, profitability and risk in BRICS banking industry. Global Business and Economics Review 19: 89–119. [Google Scholar] [CrossRef]

- Javaid, Muhammed Ehsan. 2016. Bank Specific and Macroeconomic Determinants of Bank Profitability. Journal of Management 10: 38–54. [Google Scholar]

- Khatun, Mahfuza, and Sikandar Siddiqui. 2016. Size, Equity Backing, and Bank Profitability: A Case Study Using Panel Data from Bangladesh. Journal of Applied Finance and Banking 6: 1–14. [Google Scholar]

- Kiganda, Evans Ovamba. 2014. Effect of macroeconomic factors on commercial banks profitability in Kenya: Case of equity bank limited. Journal of Economics and Sustainable Development 5: 46–56. [Google Scholar]

- Kolapo, Funso Tajudeen, Lawrence B. Ajayi, and Olufemi Adewali Aluko. 2016. How is Size Related to Profitability? Post-Consolidation Evidence from Selected Banks in Nigeria. International Journal of Finance & Banking Studies 5: 30–38. [Google Scholar]

- Laryea, Esther, Matthew Ntow-Gyamfi, and Angela Azumah Alu. 2016. Nonperforming loans and bank profitability: Evidence from an emerging market. African Journal of Economic and Management Studies 7: 462–81. [Google Scholar] [CrossRef]

- Lipunga, Andrew Munthopa. 2014. Determinants of Profitability of Listed Commercial Banks in Developing Countries: Evidence from Malawi. Research Journal of Finance and Accounting 5: 41–49. [Google Scholar]

- Menicucci, Elisa, and Guido Paolucci. 2016. The determinants of bank profitability: Empirical evidence from European banking sector. Journal of Financial Reporting and Accounting 14: 1–23. [Google Scholar] [CrossRef]

- Molyneux, Philip, and John Thornton. 1992. Determinants of European bank profitability: A note. Journal of banking & Finance 16: 1173–78. [Google Scholar] [CrossRef]

- Naudé, Wim A., and Andrea Saayman. 2005. Determinants of tourist arrivals in Africa: A panel data regression analysis. Tourism Economics 11: 365–91. [Google Scholar] [CrossRef]

- Nisar, Shoaib. 2015. Determinants Of Bank’s Profitability in Pakistan: A Latest Panel Data Evidence. Ph.D. dissertation, Shenzhen Graduate School, Shenzhen, China. [Google Scholar]

- Noman, Abu Hanifa Md., Mustafa Manir Chowdhury, Najmeen Jahan Chowdhury, Mohammad Jonaed Kabir, and Sajeda Pervin. 2015. The Effect of Bank Specific and Macroeconomic Determinants of Banking Profitability: A Study on Bangladesh. International Journal of Business and Management 10: 287–97. [Google Scholar] [CrossRef]

- Opoku, Richard Takyi, Peter Lawer Angmor, and Lawrence Asare Boadi. 2016. Credit Risk and Bank Profitability: Evidence from Ghana Stock Exchange. Journal for Studies in Management and Planning 2: 89–96. [Google Scholar]

- Ozili, Peterson K. 2016. Bank Profitability and Capital Regulation: Evidence from Listed and non-Listed Banks in Africa. Journal of African Business, 1–26. [Google Scholar] [CrossRef]

- Petria, Nicolae, Bogdan Capraru, and Iulian Ihnatov. 2015. Determinants of banks’ profitability: Evidence from EU 27 banking systems. Procedia Economics and Finance 20: 518–24. [Google Scholar] [CrossRef]

- Pradhan, Radhe Shyam. 2016. Bank Specific and Macroeconomic Determinants of Bank Profitability: A Case of Nepal. SSRN 2793484. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2793484 (accessed on 13 July 2018).

- Pradhan, Radhe Shyam., and Deepanjal Shrestha. 2016. Impact of Liquidity on Bank Profitability in Nepalese Commercial Banks. SSRN 2793458. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2793458 (accessed on 13 July 2018).

- Regehr, Kristen, and Rajdeep Sengupta. 2016. Has the Relationship between Bank Size and Profitability Changed? Economic Review-Federal Reserve Bank of Kansas City 101: 49–72. [Google Scholar]

- Saeed, Muhammed Sajid. 2014. Bank-related, industry-related and macroeconomic factors affecting bank profitability: A case of the United Kingdom. Research Journal of Finance and Accounting 5: 42–50. [Google Scholar]

- Stata. 2018. Xtabond—Arellano–Bond Linear Dynamic Panel-Data Estimation. Available online: https://www.stata.com/manuals13/xtxtabond.pdf (accessed on 15 June 2018).

- Tan, Aoran Yong, Christos Floros, and John R. Anchor. 2016. The Profitability of Chinese banks: Impacts of risk, competition and efficiency. Review of Accounting and Finance. [Google Scholar] [CrossRef]

- Terinte, Paula, Mihaela Onofrei, and B. Firtescu. 2016. Internal Audit Implications on Bank Profitability. The Romanian Case. Annals of the University of Oradea, Economic Science Series 25: 790–99. [Google Scholar]

- Tunay, K. Batu, and Shahriyar Mukhtarov. 2016. Determinants of Bank Profitability in Azerbaijan. Akademik Bakiş Dergisi 54: 689–704. [Google Scholar]

- Tunay, K. Batu, and A. Murat Silpar. 2006. Türk Ticari Bankacılık Sektöründe Karlılığa Dayalı Performans Analizi-I. Araştırma Tebliğleri Serisi, 1. Istanbul: Türkiye Bankalar Birliği. [Google Scholar]

- Wali Ullah, G. W., Mohammed Nasrah Faisal, and Sadaqa Tuz Zuhra. 2016. Factors Determining Profitability of the Insurance Industry of Bangladesh. International Finance and Banking 3: 138–47. [Google Scholar] [CrossRef]

- World Bank. 2018a. Word Development Indicators. Available online: http://www.worldbank.org (accessed on 10 May 2018).

- World Bank. 2018b. Global Financial Development. Available online: http://www.worldbank.org (accessed on 10 May 2018).

- Yuksel, Serhat, Hasan Dincer, and Umit Hacioglu. 2015. CAMELS-based Determinants for the Credit Rating of Turkish Deposit Banks. International Journal of Finance & Banking Studies 4: 1–17. [Google Scholar] [CrossRef]

| Authors | Scope | Method | Result |

|---|---|---|---|

| Molyneux and Thornton (1992) | 18 European countries | Regression | Defined that higher capital and interest rate will increase the profitability of the banks. |

| Demirgüç-Kunt and Maksimovic (1998) | 30 different countries | Regression | Identified that there is a positive relationship between size and profitability of the bank. |

| Demirgüç-Kunt and Huizinga (1999) | 80 different countries | Regression | Determined that inflation rate positively affects profitability of the banks. |

| Abreu and Mendes (2001) | 4 European Union (EU) countries | Regression | Identified that a high amount of capital increases bank profitability. |

| Goddard et al. (2004) | 6 EU countries | Generalized Method of Moments (GMM) | Determined that there is a positive relationship between bank size and profitability. |

| Tunay and Silpar (2006) | Turkey | Regression | Determined that bank size, inflation rate and economic growth have a significant influence on profitability. |

| Kiganda (2014) | Kenya | Regression | Identified that macroeconomic factors do not affect bank profitability in Kenya. |

| Saeed (2014) | UK | Regression | Concluded that inflation rate affects bank profitability negatively whereas bank size has a positive influence. |

| Al-Jafari and Alchami (2014) | Syria | GMM | Reached a conclusion that inflation rate and economic growth affect bank profitability. |

| Dawood (2014) | Pakistan | Regression | Identified that capital adequacy influences bank profitability. |

| Lipunga (2014) | Malawi | Regression | Defined bank size as the most important factor of bank profitability. |

| Chowdhury (2015) | United Arab Emirates | GMM | Determined that higher capital improves bank profitability. |

| Aftab et al. (2015) | Pakistan | Regression | Reached a conclusion that private banks are more profitable in comparison with others. |

| Boitan (2015) | European Union | Granger Causality Analysis | Defined GDP growth rate as having a positive and high influence on the profitability of banks. |

| Gyamerah and Amoah (2015) | Ghana | Regression | Concluded that risk management plays an important role with respect to the profitability of the banks. |

| Duraj and Moci (2015) | Albania | Regression | Macroeconomic variables are as important as bank specific variables in order to evaluate profitability. |

| Nisar (2015) | Pakistan | Regression | Determined that a high amount of non-performing loans leads to a decrease in profitability of banks. |

| Petria et al. (2015) | European Union | Regression | Identified economic growth as a significant indicator of bank profitability. |

| Buchory (2015) | Indonesia | Regression | Concluded that loan to deposit ratio and capital adequacy ratio do not have significant effect on the profitability of the banks. |

| Noman et al. (2015) | Bangladesh | GMM | Defined that real interest rate affects the probability of the banks negatively whereas capital adequacy, size and inflation rate have a positive influence. |

| Alshatti (2015) | Jordan | Regression | Identified liquidity ratio as very significant in order to increase profitability. |

| Pradhan and Shrestha (2016) | Nepal | Regression | Determined that higher capital adequacy ratio positively affects the profitability of banks. |

| Aydemir and Ovenc (2016) | Turkey | Regression | Understood that bank profits in Turkey are sensitive to interest rates |

| Alhassan et al. (2016) | Ghana | DAE | Defined a positive relationship between size and profitability of the banks. |

| Garcia and Guerreiro (2016) | Portugal | Regression | Reached a conclusion that interest rate has no effect on the profitability of the banks. |

| Albertazzi et al. (2016) | Italy | Regression | Decrease in economic growth is the main cause of low profitability of Italian banks. |

| Ariyadasa et al. (2016) | Sri Lanka | VECM | Identified interest rate and non-performing loans as having a negative effect on bank profitability. |

| Menicucci and Paolucci (2016) | 35 European banks | Regression | Concluded that size and capital ratio are important determinants of banks’ profitability. |

| Tan et al. (2016) | China | GMM | Identified credit risk as negatively related to bank profitability. |

| Opoku et al. (2016) | Ghana | Regression | Determined that non-performing loans have a negative effect on bank profitability. |

| Terinte et al. (2016) | Romania | Regression | Identified independent auditors as influencing bank profitability. |

| Islam and Nishiyama (2016) | South Asia | GMM | It was defined that interest rate positively affects bank profitability. |

| Anarfi et al. (2016) | Ghana | Regression | Concluded that bank size and deposit do not affect bank profitability. |

| Regehr and Sengupta (2016) | US | Regression | Reached a conclusion that there is a direct relationship between size and profitability of banks. |

| Deng (2016) | US | Regression | Defined GDP growth as having a positive influence on bank profitability. |

| Djalilov and Piesse (2016) | 8 transition countries | GMM | Concluded that credit risk, capital, size, concentration, GDP growth, inflation, financial freedom and property rights influence bank profitability |

| Hanna (2016) | Syria | Regression | Identified a negative relationship between bank profitability and non-performing loans. |

| Javaid (2016) | Pakistan | Regression | Defined that macroeconomic factors as having no effect on bank profitability. |

| Kolapo et al. (2016) | Nigeria | Regression | Defined size of the banks as having no effect on bank profitability. |

| Laryea et al. (2016) | Ghana | Regression | Identified non-performing loans as affecting the profitability of the banks negatively. |

| Hu and Xie (2016) | China | Structural Equation Modeling | Concluded that risk-taking is positively related to profitability of the banks. |

| Pradhan (2016) | Nepal | Regression | Determined that higher credit to asset ratio increases the profitability of banks. |

| Khatun and Siddiqui (2016) | Bangladesh | Regression | Defined capital adequacy ratio as positively affecting profitability of banks. |

| Ozili (2016) | Africa | GMM | Determined that higher capital amount increases the profitability of African banks. |

| Wali Ullah et al. (2016) | Bangladesh | Regression | Identified a positive relationship between economic growth and profitability. |

| Jabra et al. (2016) | BRICS countries | GMM | Concluded that bank capital has the greatest positive effect on bank profitability. |

| Ahmad et al. (2016) | 78 Asian and 89 American banks | Regression | Determined that bank-specific variables rather than macroeconomic variables influence bank profitability. |

| Variables | Details | References |

|---|---|---|

| Capital | Capital Adequacy Ratio | Molyneux and Thornton (1992); Ahmad et al. (2016); Hanna (2016); Djalilov and Piesse (2016); Menicucci and Paolucci (2016) |

| Inflation Rate | (CPIt-CPIt-1)/CPIt-1) | Kiganda (2014); Saeed (2014); Al-Jafari and Alchami (2014) |

| Loans/Deposits Ratio | Total Loans/Total Deposits | Hanna (2016); Regehr and Sengupta (2016); Menicucci and Paolucci (2016) |

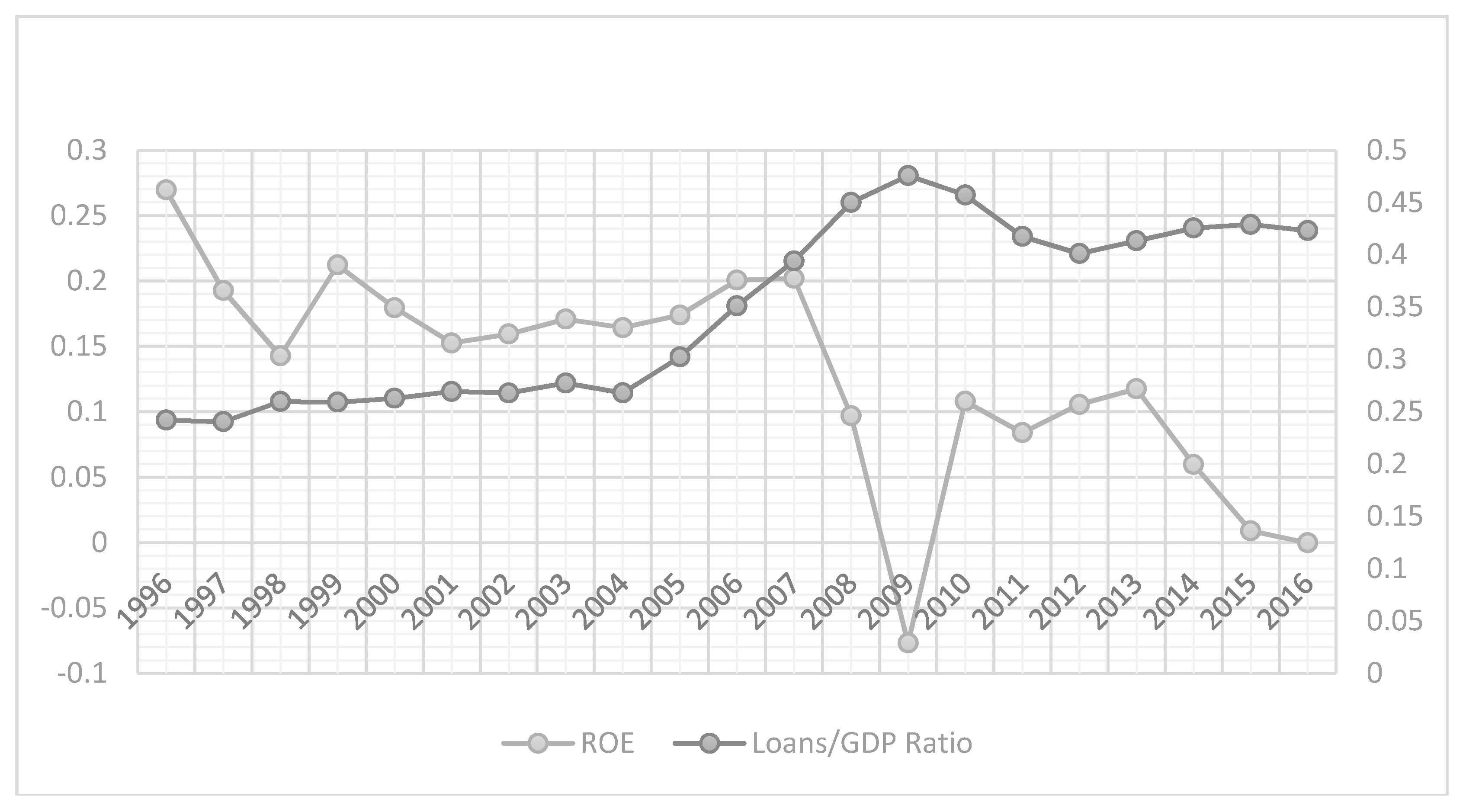

| Loans/GDP Ratio | Total Loans/GDP | Regehr and Sengupta (2016); Menicucci and Paolucci (2016); Alhassan et al. (2016) |

| Size | Total Assets/GDP | Regehr and Sengupta (2016); Menicucci and Paolucci (2016); Demirgüç-Kunt and Maksimovic (1998) |

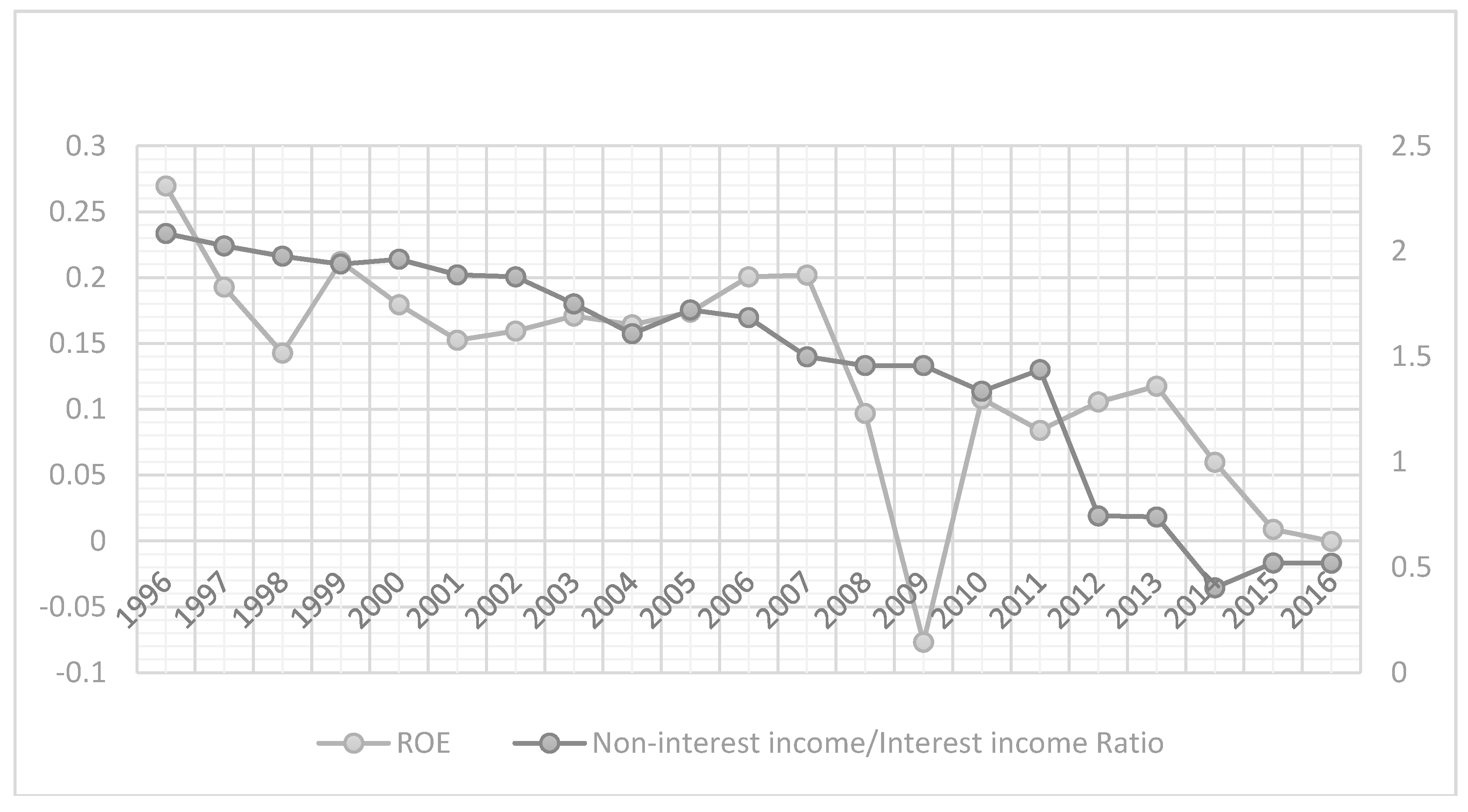

| Non-Interest/Interest Income | Non-Interest Income/Interest Income | Javaid (2016); Albertazzi et al. (2016); Nisar (2015) |

| Interest Rate | Deposit Interest Rate | Ariyadasa et al. (2016); Boitan (2015); Noman et al. (2015); Saeed (2014) |

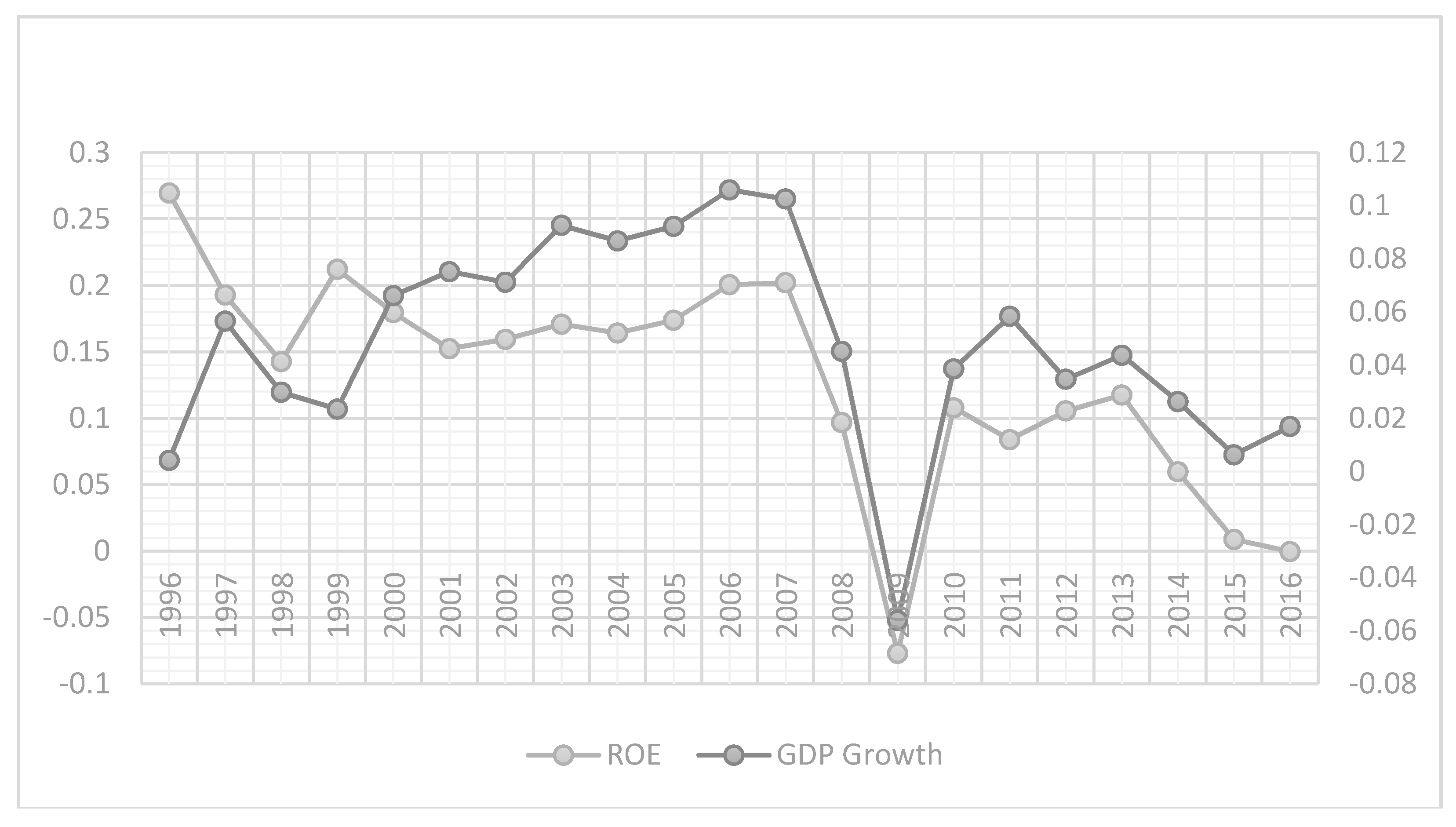

| Economic Growth | (GDPt-GDPt−1)/GDPt−1) | Kiganda (2014); Saeed (2014); Al-Jafari and Alchami (2014) |

| Variables | Returns on Equity (ROE) | Inflation Rate | Loans/Deposits | Capital Adequacy Ratio (CAR) | Loans/GDP | Interest Rate | Size | GDP Growth | Non-Interest/Interest Income |

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1 | ||||||||

| Inflation Rate | 0.0352 | 1 | |||||||

| Loans/Deposits | 0.0051 | −0.0553 | 1 | ||||||

| CAR | 0.0263 | 0.0301 | −0.2097 | 1 | |||||

| Loans/GDP | −0.2273 | −0.2282 | 0.4086 | −0.5881 | 1 | ||||

| Interest Rate | −0.0464 | 0.0492 | 0.0534 | 0.1362 | −0.1 | 1 | |||

| Size | −0.1111 | −0.0609 | 0.0881 | −0.2843 | 0.256 | −0.1912 | 1 | ||

| GDP Growth | 0.3 | −0.0617 | −0.0257 | 0.0675 | −0.1846 | 0.0592 | −0.1294 | 1 | |

| Non-interest/Interest Income | 0.2956 | 0.0262 | −0.1387 | 0.038 | −0.1942 | −0.2195 | −0.1112 | 0.0698 | 1 |

| Dependent Variable: ROE | ||

|---|---|---|

| Independent Variables | GMM | Fixed Effects |

| Lag ROE | 0.161 | |

| (0.144) | ||

| Inflation Rate | 0.0129 | 0.0331 |

| (0.0381) | (0.0400) | |

| Size | −0.000924 | −0.00173 |

| (0.00163) | (0.00143) | |

| Loan/Deposit Ratio | 0.00188 | 0.0137 |

| (0.0135) | (0.0152) | |

| CAR | −0.373 | −0.0556 |

| (0.268) | (0.307) | |

| Loan/GDP Ratio | −0.255 *** | −0.317 *** |

| (0.0823) | (0.0791) | |

| Interest Rate | −0.128 | −0.0137 |

| (0.441) | (0.268) | |

| Economic Growth | 0.839 *** | 0.546 ** |

| (0.196) | (0.219) | |

| Non-Interest/Interest Income | 0.0120 ** | 0.0164 ** |

| (0.00582) | (0.00556) | |

| 2009 Crisis Dummy | −0.0870 ** | −0.107 * |

| (0.0416) | (0.0509) | |

| Constant | 0.202 ** | 0.187 *** |

| (0.102) | (0.0584) | |

| Observations | 247 | 273 |

| R-squared | - | 0.281 |

| Number of countrynum | 13 | 13 |

| Prob > F | - | 0.0001 |

| Prob > chi2 | 0.0000 | - |

| AR(1) | 0.0250 | - |

| AR(2) | 0.1641 | - |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yüksel, S.; Mukhtarov, S.; Mammadov, E.; Özsarı, M. Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries. Economies 2018, 6, 41. https://doi.org/10.3390/economies6030041

Yüksel S, Mukhtarov S, Mammadov E, Özsarı M. Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries. Economies. 2018; 6(3):41. https://doi.org/10.3390/economies6030041

Chicago/Turabian StyleYüksel, Serhat, Shahriyar Mukhtarov, Elvin Mammadov, and Mustafa Özsarı. 2018. "Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries" Economies 6, no. 3: 41. https://doi.org/10.3390/economies6030041

APA StyleYüksel, S., Mukhtarov, S., Mammadov, E., & Özsarı, M. (2018). Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries. Economies, 6(3), 41. https://doi.org/10.3390/economies6030041