Abstract

This paper proposes a methodology for calculating the cost of equity for unlisted agricultural companies in Poland. An analysis of a fixed effects panel model was conducted on a sample of 79 agricultural enterprises from the Farm Accountancy Data Network (FADN) field of observation in 2012–2015. The empirical model includes a value of land, agricultural area, depreciation, sale earnings, and payables. The study confirmed that in the valuation of the cost of equity capital in agricultural enterprises, factors that are specific to this sector must be taken into account. As the basic source of production is agricultural land, it must be taken into consideration while estimating the cost of equity capital. This factor was included in the theoretical model.

Keywords:

cost of equity capital; agricultural business; Farm Accountancy Data Network (FADN); farmland value factor; risk of the depreciation of farmland JEL Classification:

G31; Q12

1. Introduction

The cost of capital at agricultural establishments substantiates the need for a research area to be defined for the search for a capital cost estimation method that includes the relation between agriculture and farmland. This area of study is even more niche considering that the farm and the business establishment constitute a single unit for agricultural operators, with the farmer and his family running a household and an enterprise at the same time.

The issue of measuring the cost of capital has been analyzed since Modigliani and Miller’s pioneering research in the 1950s. Specifically, Modigliani and Miller made the following claims: ‘much remains to be done before the cost of capital can be put away on the shelf among the solved problems’. Our approach has been of static, partial equilibrium analysis (Modigliani and Miller 1958). In their further research, Miller and Modigliani argued that ‘… the cost of capital of the firm is the same regardless of how the investments are financed or how fast the firm is growing. The function of the cost of capital in capital budgeting is to provide the “cut-off rate” in the sense of the minimum yield that investment projects must promise to be worth undertaking from the point of view of the current owners’ (Miller and Modigliani 1961). This interesting discussion was continued, among others, by Gordon (1962); Lintner (1963); Sharpe (1964); Ross (1976); Myers (1984); Myers and Majluf (1984); Botosan (1997); McConaughy (1999); Gebhardt et al. (2001); Câmara et al. (2008); Dzuričková et al. (2015). Of particular importance is the conclusion reached by Fama and French, who claim that ‘… estimates of the cost of equity are distressingly imprecise’ (Fama and French 1997). They also emphasize the uncertainty and lack of precision as to the determination of risk premium amounts in subsequent periods and across different projects. In a similar vein, Korkeamaki and Moore (2004) point to the issue of defining the parameters for estimating the cost of capital. Thus, notwithstanding the passage of time and the volume of research, the problem of establishing an integrated approach to estimating the cost of capital, particularly at agricultural businesses, remains unsolved. This field of study is, therefore, likely to undergo dynamic development in the future and our team would like to contribute to filling a considerable research gap in this area.

The purpose of the study was to expand the traditional method of measuring the cost of capital. As part of this novel solution, new principles of measuring the cost of capital have been proposed for agricultural business operators, which take into account the unique characteristics of agricultural activities. These activities depend on weather conditions, live organisms management, specific work factors and production factors risk. The agricultural business was defined for the purpose of the study as agricultural activity in the area of production and distribution of a food (Ioris 2016). Our research hypothesis was formulated as follows: the measurement of equity capital and its cost by agricultural entrepreneurs requires a unique approach which makes allowance for certain variables that are different from those applicable to other sectors, and therefore specific to agricultural activities.

In this paper, we contribute to the capital structure literature on developing the concept of the cost of equity capital measurement by adding one more factor: the risk of the land value change. The calculation presented below could affect the farmers’ decisions on whether or not to adjust capital structure. Our empirical findings suggest that a given farm’s specific factor could not be isolated in a cost capital calculation and could play an important role in explaining the target leverage. These findings are important, as they enhance the understanding of farmers’ actions with regard to decisions concerning capital structure process decisions.

This paper is divided into three parts. The first section introduces and discusses the issues of the cost of capital, as well as the cost of capital in the agricultural sector. The second section shows data, samples and variables. The third section presents the empirical results for Polish agriculture companies of a panel model and the basic statistical data. The conclusion summarizes the main findings and implications for the measurement of the cost of capital in agricultural enterprises.

2. Theoretical Framework and Hypothesis

The issue of the cost of equity capital for an enterprise may be viewed from multiple perspectives, given its application in accounting as well as in financial research. The cost of equity capital is the basis for determining the premium for capital risk, valuation of businesses, and investment decisions (Câmara et al. 2008). In their research, Miller and Modigliani referred to factors determining the debt-to-equity relationship, while Gordon and Linter also considered the businesses’ investment plans (Gordon 1962; Lintner 1963). This division had an impact on subsequent research. The cost of capital is most commonly estimated using the capital assets pricing model (CAPM), the discounted cash flows (DCF) method, the yield-to-maturity method with risk premium, and arbitrage pricing models (APM). The Sharpe–Lintner CAPM model, as the most common model, equalizes the cost of capital with systematic risk (Chawla 2014), assuming that the cost of equity equals the sum of risk-free rate of return and market risk premium adjusted by the beta factor (Lintner 1965; Sharpe 1964). This model evaluates the relationship between the market risk and investment return rate (Dzuričková et al. 2015). This method is mainly applicable to public companies and carries the most significant information value for investors (Habib 2006). The construction of the discounted cash flows method covers the data of the contemplated profit distribution and the current price of the given public company’s shares. The yield-to-maturity method with risk premium is applied to businesses that have issued corporate bonds; it is not applicable otherwise. Arbitrage pricing theory (APT) in Ross’s model (1976) is a single-factor model, compared to the CAPM model, with the risks assigned to a single variable. This model considers the risk to income dependency. In addition to the models specified above, the dividend growth model for pricing a dividend-paying stock (McConaughy 1999) is also applied in the measurement of the cost of equity capital. This model is optimized for businesses that pay out dividends without interruption and have a solid dividend history. Average ex-post rates of return with ex-ante estimations can be used to estimate the cost of equity for management purposes and in order to evaluate the value of capital and investment decisions (Gebhardt et al. 2001). This methodology, according to Fama and French, is characterized by a lack of precision, as it does not make allowance for any premium for the risk suffered by the party concerned (1977). Another approach to the cost of equity capital measurement is the method proposed by Botosan (1997), where forecasts of future profits and assets were utilized on the basis of the book value, along with an estimation of the maximum and minimum prices of the company’s shares, and price/equity (P/E) ratio estimation. This model was characterized by an increase in equity and higher market risks, along with lower costs for smaller businesses. However it does not fit the agriculture sector due to the fact that it uses market data.

3. Understanding the Cost of Capital

According to Patterson (1995) the cost of capital can be misleading when contemplated only from the perspective of financing sources. Therefore in this vein, according to Pederson (1998), the viewpoint on capital as a source of financing should be changed and replaced with a view on capital as an alternative source of use. In this context, the cost of capital is the ‘cost of opportunity’ related to capital investment. Furthermore, it is problematic to determine all costs in the case of cooperatives, which are not active participants in the public trading system. A similar problem occurs with Polish agricultural businesses. Another matter that needs to be resolved is the approach to the cost of capital as ‘cost of opportunity’, as Polish agricultural entrepreneurs are strongly emotionally attached to their resources. However, it would be difficult to determine whether obtaining a higher rate of return would change this attitude. A certain claim is sometimes made in agricultural finance literature, expressed by Clapp and Martin (2015), to the effect that private capital will not be keen to invest in the food industry and farming without government guarantees or financial support. This is confirmed by research conducted by Kulawik and Góral (2015), who point to subsidies as an additional driver of land price growth in Poland. Subsidies should also probably be perceived as a factor which may affect the cost of capital engaged in agriculture. Nevertheless, attempts are made at estimating the cost of equity in business establishments operating outside the public market. Relevant studies were conducted, for instance, by Abudy et al. (2016). For the aforementioned reason, the cost of capital may be approached from different viewpoints. However, the authors have specifically applied the approach presented, among other, by Meyers, as equity constitutes the main source of funding for agricultural establishments. Agricultural entrepreneurs (particularly those within the field of observation of the Farm Accountancy Data Network (FADN)) are reluctant to use debt instruments and if they do use any borrowing, the scale is relatively small. Nevertheless, it was necessary to take a broader approach to the problem and to consider multiple variables and, therefore, the dominant role of the farmer in the decision-making process (see e.g., the dominant role of the stakeholder, as recognized in research by Luo et al. 2015).

In the Polish farming industry, the unique aspects of business taxation constitute a particularly relevant problem, along with the farmers’ reluctance to take out any loans, which on the one hand implies certain development options for agricultural establishments, yet on the other, constitutes a common limiting factor. Farming is most definitely a unique area of this kind. Agricultural business managers deliver a product which is essential for the sustenance and growth of humanity, i.e., food, but they also operate in a strong dependency on weather conditions, seasonal factors (and weather anomalies), or live organisms management, where developments are not always possible to foresee. These matters are related to the level of risk which, as specified by Stasytytė and Dužinskytė (2016), is higher in the farming industry, which is perceived as a high-risk sector. It is worth mentioning at this point that risk is also the determining factor of the cost of capital (although in this case, the type of risk is different).

Ng and Rezaee (2015) considered the link between the cost of capital and the overall sustainability of business undertakings, with due consideration of environmental and social factors, and concluded that the correlation between sustainable growth and cost of equity capital tends to strengthen with the increase in performance.

Padro and Gupta (2014), having conducted their studies in the Asian countries, point to the significance of adopting international accounting standards for determining the cost of capital. Prior research of Easley and O’Hara (2004) argues that not only the scope of information presented but also the structure of information was relevant for determining the cost of capital (this was certainly related to the measurement of the value of assets). In this context, studies by Baek and Lee (2016) also merit attention, as they mention the issue of fair value and revaluation of the assets, which can affect the cost of capital.1 The disclosure issue is also mentioned by Dutta and Nezlobin (2017), who point out that: ‘a firm’s cost of capital decreases (increases) in the precision of public disclosure if the firm’s growth rate is below (above) a certain threshold. The threshold growth rate is higher when the firm’s cash flows are more persistent, or when other firms in the economy are growing at low rates (Dutta and Nezlobin 2017). These authors also emphasize the need for further research which will take into account inter-sectoral relationships or other unique aspects.

Another important problem which is strictly related to the farming sector is posed by the biological assets and the determination of the value of such assets. Measuring the value of biological assets in the context of third party capital cost was an issue studied by Daly and Skaife (2016). They state that ‘… the cost of debt is associated with the measurement method they use to account for their biological assets.’ They also mention ‘… that the cost of debt is higher for firms using the fair value method of accounting for their biological assets relative to firms using historical cost. However, the positive association between the cost of debt and fair value is driven by firms that transform bearer plants, i.e., living plants that ultimately bear produce for more than one year.’ Furthermore, according to Musshoff and Hirschauer (2011), the return on capital and the cost of capital for the farmer should be estimated in order to reduce financial risk. These conclusions provide further evidence of a gap in the field of research on the cost of capital in agriculture and on verifying the merits of the methodological issues mentioned.

Castillo et al. (2017) stated that a dependency of the optimized structure of capital and cost of capital on the tax system operates. They further note that the tax advantages from debt (tax shield) tends to vary greatly across different tax systems. They also claim that the average cost of capital should be determined for each state separately (Castillo et al. 2017). The above claims support our view that it is necessary to establish a different method of estimating the cost of equity for agricultural businesses. In Poland, farm entrepreneurs operate under a separate tax regulation, distinct from other sectors of the economy (Bereżnicka 2016). Thus, the tax arrangements which apply to this group of businesses tend to be highly specific. Following the suggestions presented by Castillo et al. (2017), it would be advisable to define a unique method of considering the factors characteristic of agricultural establishments in determining the cost of capital for these establishments.

The tax shield effect has an influence on the choice of financing sources and, therefore, on the weighted average cost of capital (Barry et al. 2000). Farms in Poland do not pay income tax,2 as they are subject to agricultural tax charged on the basis of the arable land area and location within a specified tax region (Wasilewski et al. 2016). Thus, the tax shield issue was not included in the study.

A study based on Sulewski (2015) proposes a model of risk measurement in agriculture on the example of Polish farms. Presented findings are transposed to the field of Polish agricultural establishments, exempt from income tax, investments in these types of activities and could be considered to lead to a lower growth rates than required. The results of relevant research are presented in Table 1, which provides a summary overview of the main areas of the cost of capital.

Table 1.

Literature background on the issue of the cost of capital—summary.

The method for measuring the cost of equity proposed by the authors includes the risk of impairment of farmland value, and thereby is a novel contribution to research on the cost of capital. Properly estimated risk plays an essential role in adjusting the firm’s capital structure to market changes after highlighting the land value factor in the cost of capital estimation.

4. Methodology

The study covers balanced panel data of 79 farms within the FADN’s field of observation in the period 2012–2015. The units in the selected sample from the FADN system had a double status—they provide data like a large farm but legally have a status of a company. These entities provided data during the whole research period. The remaining part of the FADN sample consists of individual holdings that have not been tested. The data were collected by farmer consultancy centers at individuals’ and legal persons’ farming establishments for statistical and comparative purposes of the European Union. According to the farm classification principles, farms engaged in agricultural activities are classified according to uniform standards, i.e., on the basis of their economic size and agricultural type, taking into account their location within one of the 4 FADN regions.3 The establishments have been selected for this study in accordance with the selection plan criteria. Despite the small size of the sample, it could be considered as representative for companies not included in the FADN’s field of observation due to the differences occurring between the real and theoretical sample structure, which was determined in the selection plan by FADN; new weightings were established in order to ensure the data set was fully representative.4

To ensure the high quality of data, the data was tested to eliminate any possible errors. This paper proposes a modified methodological approach to the measurement of the cost of capital of agricultural establishments. Models have been developed to determine the factors of this cost (see e.g., He et al. 2013). In addition, comparative analysis of the cost of equity was conducted between the value determined according to the traditional method and the proposed original solution. The fixed effects panel model was used (Franc-Dąbrowska 2009). This model takes into account the effects of all the unique factors of a given establishment which are not variable in time. The individual results are eliminated by averaging of the model against time (t index) (Kufel 2007). The model formula can be presented as follows:

where:

- —dependent variable,

- —individual effect for each tested entity,

- —dependent variable vector,

- —vector of parameters in the model,

- —random component in the model.

Analyzing the value of equity (k€) has been taken as the response variable.5 Financial measures were taken as explanatory variables (data was taken from the balance sheet and the income statement, as well as organizational data). Following the subject-matter verification of the variables (Jajuga 1998) (a total of 45 variables were considered), 15 variables were ultimately used to build the model. In addition, variability in the data over time (dt_2013-dt_2014) has also been included. Following the variable inflation factor (VIF) determination, relevant regression models were developed.

However, bearing in mind that the paper presents the results of studies in which the Sulewski (2015) model was adapted and that it proposed new solutions for estimating the cost of equity in agricultural enterprises, we are cautious in generalizing the results and we consider them as a starting point for further wide-ranging research. In view of the findings by Sulewski (2015) concerning the measurement of risk of the cost of capital of an agricultural enterprise, we implemented an accounting measure for the average equivalent of certainty, i.e., the average costs of risk. Taking into account the capital valuation models recognized in literature, we hereby suggest that the cost of equity of an agricultural enterprise should represent the sum of the ‘risk-free’ percentage rate, which is associated with the rate of interest on 10-year state treasury bonds (rf). One of the most common ways to add risk premium for an investment is to apply a risk-free rate—in Poland, 10-year state treasury bonds are used for the purpose of business investments (in the case under consideration, operating a farming establishment). The average interest rate on 10-year state treasury bonds during the study period (2012–2015) can be established at 3.39%.6

The premium for the risk of land value impairment was near 0% during 2012–2015, and the average certainty equivalent rate was at 3.73%. Thus, the following formula can be applied in the estimation of the cost of capital of an agricultural enterprise (taking the CAPM7 as the starting point):

where:

- —anticipated rate of return for an agricultural operator,

- —risk-free rate,

- —anticipated rate of return from farming activities,

- —risk of impairment of farmland value,

- —risks of average equivalent of certainty,

where:

- n—number of years,

- rral—average rate of return from purchase/sale of arable land,

- —coupon payment paid in each period,

- —yield to maturity,

- —family farm income,

- —the average value of assets.

The proposed solution disregards β as a risk measure typical of the CAPM model, as farm enterprises are not publicly traded companies. Nevertheless, a risk-free rate has been taken into account (as in the standard model), adjusted by the anticipated rate of return from farming activities (it is not possible to determine the anticipated rate from a market portfolio for the same reasons that prevent a precise determination of the value of β). A similar idea of model extension concept was proposed by Hitchner (2017) who added to the basic CAPM model a risk premium attributable to other company risk factors. We additionally propose further adjustment to the risk premium attributable to the depreciation of farmland, along with a risk premium of the average equivalent of certainty. As a result, an anticipated return rate measurement model is derived for agricultural operators which can be used as a kind of method for the valuation of the cost of capital at any agricultural enterprise. This method takes into account certain characteristics that are typical of agricultural operations.

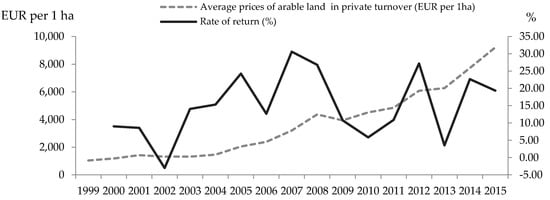

Considering the findings presented in literature and in the model analyses, we have reviewed the purchase and sale prices of land in Poland. Figure 1 shows land purchase and sale prices per 1 hectare of agricultural area (data from the Polish Central Statistical Office (GUS), https://bdl.stat.gov.pl/BDL/dane/podgrup/temat/). Annual rates of return were determined for the 1999–2015 time series. During the period of study (2012–2015), certain major legislative changes occurred in Poland, affecting the prices of land; 2015 was the final year when foreigners were legally permitted to buy agricultural land in Poland under the provisions of the amended Act of 24 March 1920 (Sikorska 2016).

Figure 1.

Average prices and rate of return on arable land in private turnover. Note: Euro exchange rate adjusted for conversion subsidies. Source, NBP, http://www.nbp.pl.

The average purchase and sale price of land during 2012–2015 was €7.3k and the annual rate of return was 18.2% for this type of investment. Within the presented time series of 1999–2015, the average rate of return on purchasing/selling land was 14.9%, with standard deviation at 9.5% and coefficient of variation at 63.6%. For the same period, the rate of return on 10-year state treasury bonds was 5.7% on average (3.39% on average for 2012–2015), with standard deviation at 2.1%. Returns on bonds were less volatile than the rates of return from purchases of land, at 36.4%.

Considering the increase in the price of farmland purchase/sale, which was particularly significant between 2012 and 2015, we assumed that the premium for the risk of impairment of farmland was negative during that period (due to the high positive variability of prices). Nevertheless, the legislation restricting trading in farmland, which came into force in 2016, will affect transaction prices in the upcoming periods. In addition, it should be borne in mind that the value of farmland depends on the level of support provided under the Common Agricultural Policy, which is evolving as well. Furthermore, we need to remember that certain other factors are linked to agricultural activities and strongly connected to land, which determines the farmers’ earnings. We believe that the premium for operating a farm establishment should also make allowance for natural factors, although these did not directly involve land in the period 2012–2015. Here, the changing weather conditions may be perceived as essential variables. The average costs of risk were determined at 3.73% per establishment in accordance with the Sulewski methodology (2015).8

5. Characteristics of Farming Activities

The number of establishments over 300 hectares within FADN’s field of observation varied from 23 in 2012 with 18 in 2013 and 19 in 2014–2015 (Table 2). This is not a large group of establishments, yet these are all establishments that can be recognized as farm enterprises the data for which was collected under the FADN scheme. Therefore, the sample may be considered representative. One of the key features of agricultural establishments is their strong dependency on land as a production factor. For the establishments under study, the arable land area showed an upward trend between 2012 and 2014, growing by almost 14 hectares of farmland on average, yet in the last year of study, it decreased by ca. 20 hectares. This can be due to a change in legislation, with restrictions in farmland trading implemented at the beginning of 2016. This was also demonstrated in the value of farmland, which increased in 2012–2014 but decreased in the final year of study. The obvious conclusion is that land continues to be and is going to remain an essential production factor, given the unique characteristics of farming activities, with a potential to affect the value of enterprises and, thereby, the value of equity capital. This, in turn, may generate further risks of depreciation of land, firstly as a consequence of its limited resources and, secondly, as a consequence of the change in legislation on the freedom of trading in farmland (or, rather, as a consequence of restrictions on such trading). The changes in the applicable law may affect the volatility of land prices in the future. However, the recent volatility of farmland prices was not statistically significant and, therefore, did not affect the results of the survey. In the following part of the article, the risk of price volatility as an element in the evaluation of the cost of capital is presented. Thus, the model makes an allowance for the variability of agricultural land prices which may be the result of legislative changes and of the firms’ specific performance.

Table 2.

Selected data characterizing the companies under study.

The uncertainty about further anticipated growth is clearly visible in the sample of farms studied, not only in terms of the land factor, but also in terms of headcount, which tended to vary. The case was similar for animal counts at the studied farms, decreasing systematically after the initial rise, i.e., from 2013. A different tendency was observed in the average area of cereal production, which increased by 37% during the research period.

The farm establishments analyzed were also characterized by varying values of fixed assets, which nevertheless increased in value during the subsequent years (with a relatively minor decrease during the last year of study). Generally, farm entrepreneurs were investing their monies. Another variable position was the average value of current assets, at €298.75k in the four-year perspective. The major decrease in the level of income from a family-owned farm should be considered a reason for concern (a decrease of 37.5% as compared to the baseline year). It means a major decrease in the primary category of income for a farming family. Another implication is that in the four-year perspective of the study, agricultural entrepreneurs operating on relatively large areas in Poland (over 300 hectares of farmland) were not gaining higher incomes from their operations; on the contrary, their income would even decrease. It also illustrates the potential instability of income generated from agricultural activities.

A characteristic feature of the Polish agricultural market is the high proportion of financing with equity (Table 3). This was also the case with the farms under study, which illustrates the great importance of self-financing for farm entrepreneurs. The prevailing proportion of equity is supplemented by a minor proportion of long-term debt and a negligible share of short-term liabilities. This is generally a distinctive feature of Polish farm entrepreneurs, who tend to mitigate their risks and are not particularly keen to use debt resources. This attitude leads to a significant share of equity engaged in production which, in turn, leads to an increase of risk of that capital being used in agricultural activities that are exposed to numerous weather hazards or to the risk of dependency on plant and animal growth and development opportunities.

Table 3.

Selected financial data characterizing the capital of the companies studied (€ thousands).

Due to the low level of debt at agricultural enterprises, interest on third-party capital was low as well. Such interest is unlikely to have constituted an excessive payment burden for farm operators and, as such, it is unlikely to have caused any liquidity issues. On the other hand, agricultural entrepreneurs tended to restore their cash assets with subsidies, at tenfold the rate of interest on third-party capital, on average. During periods of cash shortage, this could serve as collateral, securing the liquidity of agricultural operators, which should be considered a positive phenomenon.

Land was certainly an asset of the greatest value. This again illustrates the importance of this aspect of farm operations (Table 4). It is also particularly relevant in the period of legislative changes that occurred in Poland recently. Thus, this aspect needs to be taken into consideration in the valuation of the cost of equity. Another important asset is the inventory of products, followed by receivables and cash. These assets, together with short-term debt, constitute the working capital; at the enterprises studied, the inventories, receivables and cash resources may be considered high in the study period, which in practice guaranteed the ability to repay debt in a timely manner (particularly with the low level of short-term liabilities).

Table 4.

Selected financial data characterizing assets and cash flow (€ thousands).

6. Empirical Panel Model—Basic for Theoretical Concepts

When looking for factors specific to the measurement of the cost of capital for agricultural enterprises, a panel model has been developed with equity as the response variable. This is due to the assumed importance of identifying specific variables (associated with farming operations) that could be taken into account in the measurement of the cost of equity capital as an additional risk factor.

Table 5 shows the results of a panel estimation for the response variable of the value of equity capital. Of all the variables that can be considered in subsequent iterations, the following were adopted in the model: short-term payables (value), long-term payables (value), value of land (value), agricultural area (ha), depreciation (value) and sales earnings (value).

Table 5.

Panel model for equity as dependent variable.

The dt_2013-dt_2014 variables allow for the time factor to be included in the model and make it possible to verify whether data volatility is relevant for the final model results. The variables describing the period did not affect the final result obtained in the model. Based on the tests conducted, the model was considered correct in both formal and substantive terms.

7. Results

The study conducted with the use of the model indicates that the value of land is a factor which has the most significant effect on the value of the equity capital of an agricultural enterprise. This is one of the basic production factors of special importance to farm activities. Although land was treated as non-multiplying, non-movable and non-destructible, all these qualities can no longer be considered valid. Land, particularly when used in farming, is becoming a rare asset which can no longer be viewed as non-destructible (draining of natural resources leading to soil impoverishment). This factor should be taken into consideration in estimating the cost of capital. The risk of depreciation of the value of land justifies increasing the premium for risk associated with agricultural operations with regard to the land factor. As many plant cultures can be produced without a direct link to land and given the fact that a lot of land in agricultural use is of poor quality and deteriorates further due to intensive production utilization, it seems reasonable to consider a premium for the impairment of the value of land when measuring the cost of capital.

Short- and long-term debt constitute further important factors determining the cost of capital. These variables seem to be traditionally inherent in such models, even as we consider using financial leverage and increasing capital efficiency by raising more debt. In this respect, long-term third-party capital of lower value will contribute to an increase in the value of equity, while short-term debt will, rather, foster the growth of capital value.

Depreciation is an important factor in any discussion of the financial standing of agricultural enterprises and for this reason it forms part of the developed models. In the model discussed here, the cost of depreciation (consumption) of fixed assets is also an essential factor that determines the value of equity capital. This factor is particularly important for agricultural enterprises which hold fixed assets of significant value, e.g., in the case of animal production (e.g., milk cattle, swine) or plant production, where larger establishments have machinery and facilities of significant value which are used for carrying out farming activities Thus, on the basis of the model, it should be concluded that land, specifically the value of agricultural land, is a characteristic of prevailing significance and specific for farming operations. In Poland, the value of land (and the fluctuations in this value) is probably going to have an observable and more significant impact on the financial standing of agricultural enterprises in years to come, which is due to the restriction of freedom of trading in farmland from 2016 onwards. This subject can be investigated further to verify the validity of the proposal we presented for considering the risk of land value variation in valuation of the cost of capital and to assess whether the risk premium was estimated at an adequate level.

Table 6 presents the results of the anticipated return rate model for an agricultural enterprise (). The factor that had the strongest impact on in the study period was the change in the rate of return on agricultural operations, established as the relationship of income from a family-owned farm establishment to the value of assets of the parties tested. The 7.44 p.p. decrease in that value during 2012–2014 determined the lower value of , which decreased from 20.36% in 2012 to 11.72% in 2014. Such significant variance substantiated the need to make allowance for this factor in establishing a procedure for estimating the cost of equity for agricultural holdings. Farmers often assess equity as cost-free capital—without considering the volatility —and, thus, they ignore the risk of loss of equity value, or even the possible risk of bankruptcy. The variations in the risk-free rate, assumed as a return on 10-year state treasury bonds, did not have a significant impact on the variability of . The assumed risk of an average equivalent of certainty for an agricultural enterprise () translated into the following respective weightings in the calculations: from 0.18 in 2012 to 0.32 in 2014 and, therefore, constituted an important factor in estimating the cost of equity. In the authors’ view, there is no doubt that agricultural activity is highly specific, and farmers should manage the finances of an agricultural holding at the same time. Therefore, it is important to accept and emphasize that the cost of the equity measure should include the cropland area factor as one of the determinants. The proposed changes in evaluating the equity cost in agricultural enterprises are essential for the final result of calculating the efficacy of business activity and the real financial results from agricultural performance.

Table 6.

The results of the model for the anticipated rate of return for an agricultural operator (%).

8. Discussion and Conclusions

The value of agricultural land was the factor that had the strongest impact on the value of equity at agricultural enterprises, despite the diversity of farming operations among the parties studied. The importance of land as a production factor can be the basis of the distinction between valuation of the cost of capital for non-agricultural and agricultural operators. In the establishments studied, despite the relatively low levels of debt, a change of short- and long-term external financing would also lead to an increase in equity. Depreciation was another important factor for capital growth, serving as an additional source of internal financing in relation to the importance of fixed assets in the operations of the enterprises studied.

The unique character of cost of capital measurements in Poland, due to the arrangements in the tax system, excludes the tax shield effect, thereby increasing the importance of other factors in determining these values. Estimation of the cost of equity is the most problematic aspect of these measurements. The proposed model for the valuation of cost of capital for agricultural enterprises makes it possible to determine the market risk associated with the operations of these enterprises by adding a variable that represents the risk of depreciation of the value of land in the event of a decrease in arable land purchase/sale prices and the risk associated with the average equivalent of certainty estimated for the agricultural sector. The results obtained in the proposed model point to the predominant importance of the parameters related to the anticipated rate of return from agricultural operations and the risk rate applied for the average certainty equivalent. These determinants contributed to the decrease in the anticipated growth rates for entrepreneurs during the study period.

The issue of the cost of equity capital at business organizations is highly complex and multi-faceted. Therefore, the matter is far from being straightforward and the area would benefit from further research. Nevertheless, researchers emphasize the importance of the cost of capital. The cost of capital is most commonly considered in the perspective of the public market and the enterprises operating on that market, yet still without clear solutions for parties not taking an active part in the public trading system; literature on agricultural enterprises is particularly sparse. It is, however, important to bear in mind that farmers also incur the costs of ownership.

9. Research Findings

The study has confirmed that sector-specific factors should be taken into account in the measurement of the cost of capital at agricultural enterprises. As land is the primary farm production factor, this aspect should be considered in estimating the cost of equity.

The findings are designed for application. They enable agricultural entrepreneurs to consider the threats and to evaluate the risk of capital in their agricultural operations. In a turbulent environment, this will enable them to counteract crises, whether at a single farm or in a multiple-farm environment (thus being able to prevent the bankruptcy of such establishments). The findings are also relevant for the perceptions of cost of capital, where the valuation makes an additional allowance for the impact of farm-specific factors, i.e., specific threats related to weather conditions and live organisms management.

10. Limitation of the Study and Further Research

The increase in land prices which occurred in the study period is due to such factors as legislative changes in Poland. Further research, with a long-term perspective, may contribute to a change of trends for arable land sale and purchase prices. The risk premium assumed in the study for impairment of the value of land, which approximates zero, can be negative in the subsequent periods.

Author Contributions

J.F.-D., M.M.-S. and J.B. designed the paper together; J.F.-D., M.M.-S. prepare the literature review; J.F.-D., M.M.-S. and J.B. analyzed the data and completed the empirical study; J.F.-D., M.M.-S. wrote the paper together.

Acknowledgments

We would like to express our gratitude to the employees of the Institute of Agricultural and Food Economics at the National Research Institute (IERiGŻ-PIB) for the opportunity to use the FADN database. Our further acknowledgments go to the Management of the Faculty of Economic Science of the Warsaw University of Life Sciences for the opportunity to pursue our task within the framework of the finance discipline.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abudy, Menachem, Simon Benninga, and Efrat Shust. 2016. The cost of equity for private firms. Journal of Corporate Finance 37: 431–43. [Google Scholar] [CrossRef]

- Arthur, Lousie M., Colin A. Carter, and Fay Abizadeh. 1988. Arbitrage pricing, capital asset pricing, and agricultural assets. American Journal of Agricultural Economics 70: 359–65. [Google Scholar] [CrossRef]

- Sikorska, Alina. 2016. IERIGŻ-PIB, ANR, Rynek ziemi rolnej, December. Available online: http://www.ierigz.waw.pl/publikacje/analizy-rynkowe/rynek-ziemi-rolniczej/20595,2,3,0,nr-19-2016-rynek-ziemi-rolniczej.html/ (accessed on 2 May 2017).

- Floriańczyk, Zbigniew, Dariusz Osuch, and Renata Płonka. 2016. Standard Results of Polish FADN Agricultural Holdings. Warszawa: IERiGŻ-PIB. Available online: http://fadn.pl/wp-content/uploads/2015/12/SRwaz_2015_www.pdf/ (accessed on 1 October 2017).

- Baek, H. Young, and Dong Young Lee. 2016. Motives for and Effects of Asset Evaluation: An Examination of South Korean Data. Emerging Markets Finance & Trade 52: 2808–17. [Google Scholar]

- Barry, Peter J., Ralph W. Bierlen, and Narda L. Sotomayor. 2000. Financial structure of farm businesses under imperfect capital markets. American Journal of Agricultural Economics 82: 920–33. [Google Scholar] [CrossRef]

- Bereżnicka, Joanna. 2016. Financial leverage and rate of growth in a family-owned small business (based on Polish family-owned farms). Economic Science for Rural Development 43: 240–47. [Google Scholar]

- Bjornson, Bruce, and Robert Innes. 1992. Another look at returns to agricultural and nonagricultural assets. American Journal of Agricultural Economics 74: 109–19. [Google Scholar] [CrossRef]

- Botosan, Christine A. 1997. Disclosure level and the cost of equity capital. Accounting Review 72: 323–49. [Google Scholar]

- Câmara, Antonio, San-Lin Chung, and Yaw-Huei Wang. 2008. Option implied cost of equity and its properties. Journal of Future Markets 29: 599–629. [Google Scholar] [CrossRef]

- Castillo, Augusto, Jorge Niño, and Salvador Zurita. 2017. Debt Tax Shields around the OECD World. Emerging Markets Finance & Trade 53: 26–43. [Google Scholar]

- Chawla, Gurdeep K. 2014. Estimating cost of capital in today’s economic environment. Journal of Business and Behavior Sciences 26: 102–11. [Google Scholar]

- Clapp, Jennifer, and Sarah Martin. 2015. Finance for Agriculture or Agriculture of Finance? Journal of Agrarian Change 15: 549–59. [Google Scholar]

- Daly, Abbie, and Hollis Skaife. 2016. Accounting for Biological Assets and the Cost of Debt. Journal International Accounting Research 15: 31–47. [Google Scholar] [CrossRef]

- Dutta, Sunil, and Alexander Nezlobin. 2017. Information disclosure. Firm growth and the cost of capital. Journal of Financial Economics 123: 415–31. [Google Scholar] [CrossRef]

- Dzuričková, Jana, Radka Fabinyová, and Bohuslava Mihalčová. 2015. The opportunity cost of equity capital. Procedia Economics and Finance 23: 1492–98. [Google Scholar] [CrossRef]

- Easley, David, and Maureen O’Hara. 2004. Information and the cost of capital. The Journal of Finance 59: 1553–83. [Google Scholar] [CrossRef]

- Estenson, Paul S. 1987. Farm debt and financial instability. Journal of Economic Issues 21: 617–27. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1997. Industry costs of equity. Journal of Financial Economics 43: 153–93. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, Justyna. 2009. Praktyczne zastosowanie wybranych modeli panelowych do oceny sytuacji finansowej przedsiębiorstw rolniczych. Zeszyty Naukowe SGGW w Warszawie Ekonomika i Organizacja Gospodarki Żywnościowej 76: 31–40. [Google Scholar]

- Gebhardt, William R., Charles Lee, and Bhaskaran Swaminathan. 2001. Toward an implied cost of capital. Journal of Accounting Research 39: 135–76. [Google Scholar] [CrossRef]

- Gordon, Myron J. 1962. The Investment. Financing, and Valuation of the Corporation. Homewood: Ill Richard Irwin. [Google Scholar]

- Habib, Ahsan. 2006. Information risk and the cost of capital: Review of the Empirical Literature. Journal of Accounting Literature 25: 127–68. [Google Scholar] [CrossRef]

- Hall, Rosemar Jose, Kaveski Simao, David Itzhak, and Nelson Hein. 2014. Analysis of debt and the impact on the cost of debt and profitability of companies in the Brazilian agribusiness listed on BM&FBovespa. Custos E Agronegocio on Line 10: 39–59. [Google Scholar]

- He, William Peng, Andrew Lepone, and Henry Leung. 2013. Information asymmetry and the cost of equity capital. International Review of Economics and Finance 27: 611–20. [Google Scholar] [CrossRef]

- Hitchner, James R. 2017. Financial Valuation: Applications and Models, 4th ed.Hoboken: Wiley, chp. 6. [Google Scholar]

- Hayn, Carla. 1995. The information content of losses. Journal of Accounting and Economics 20: 125–153. [Google Scholar] [CrossRef]

- Ioris, Antonio A. 2016. Rent of agribusiness in the Amazon: A case study from Mato Grosso. Land Use Policy 59: 456–66. [Google Scholar] [CrossRef]

- Jajuga, Krzysztof. 1998. Ekonometria: Metody i analiza problemów ekonomicznych. Wrocław: Wydawnictwo Akademii Ekonomicznej im, Oskara Lanego we Wrocławiu. [Google Scholar]

- Korkeamaki, Timo, and William T. Moore. 2004. Capital investment timing and convertible debt financing. International Review of Economics and Finance 13: 75–85. [Google Scholar] [CrossRef]

- Kufel, Tadeusz. 2007. Ekonometria: Rozwiązywanie problemów z wykorzystaniem programu GRETL. Warsaw: Wydawnictwo Naukowe PWN. [Google Scholar]

- Kulawik, Jacek, and Justyna Góral. 2015. Problem kapitalizacji subsydiów w rolnictwie. Zagadnienia Ekonomiki Rolnej 1: 3–24. [Google Scholar]

- Lintner, John. 1963. The cost of capital and optimal financing of corporate growth. Journal of Finance 18: 292–310. [Google Scholar] [CrossRef]

- Lintner, John. 1965. The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. The Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Luo, Qi, Hui Li, and Biao Zhang. 2015. Financing constraints and the cost of equity; Evidence on the moral hazard of the controlling shareholder. International Review of Economics & Finance 36: 99–106. [Google Scholar]

- McConaughy, Daniel L. 1999. Is the cost of capital different for family firms? Family Business Review 12: 353–60. [Google Scholar] [CrossRef]

- Miller, Merton H., and Franco Modigliani. 1961. Dividend Policy, Growth and the Valuation of Shares. The Journal of Business 34: 411–33. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review 48: 261–97. [Google Scholar]

- Musshoff, Oliver, and Norbert Hirschauer. 2011. A behavioral economic analysis of bounded rationality in farm financing decisions. Agricultural Finance Review 71: 62–83. [Google Scholar] [CrossRef]

- Myers, Stewart C. 1984. The capital structure puzzle. Journal of Finance 39: 575–92. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Ng, Aanthony, and Rezaee Zabihollah. 2015. Business sustainability performance and cost of equity capital. Journal of Corporate Finance 34: 128–49. [Google Scholar] [CrossRef]

- Padro, Archana, and Viktor K. Gupta. 2014. Impact of International Financial Reporting Standards on Cost of equity Capital for Asian countries. International Journal of Accounting and Financial Reporting 4: 148–61. [Google Scholar] [CrossRef]

- Patterson, Cleveland S. 1995. The Cost of Capital: Theory and Estimation. London: Greenwood Publishing Group. [Google Scholar]

- Pederson, Glenn D. 1998. Cost of Capital for Agricultural Cooperatives; RBS Research Report 163; Washington: Unites States Department of Agriculture, Rural Business Cooperative Service, pp. 1–30.

- Ross, Steven A. 1976. The arbitrage theory of capital asset pricing. Journal of Economic Theory 13: 341–60. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Shiha, Amr N., and Jean-Paul Chavas. 1995. Capital market segmentation and US farm real estate pricing. American Journal of Agricultural Economics 77: 397–407. [Google Scholar] [CrossRef]

- Stasytytė, Viktorija, and Viktorija Dužinskytė. 2016. Agriculture Sector Risk Management. Future of Lithuania 8: 200–11. [Google Scholar] [CrossRef]

- Sulewski, Piotr. 2015. Ekonomiczny wymiar ryzyka produkcyjnego w rolnictwie. Rozprawy Naukowe i Monografie 456. Warsaw: Wydawnictwo SGGW. [Google Scholar]

- Wasilewski, Mirosław, Marzena Ganc, and Magdalena Mądra-Sawicka. 2016. Models of the Effects of the Introduction of the Lump Sum from Recorded Revenues in Individual Farms in Poland. Problems of Agricultural Economics 3. Available online: https://ssrn.com/abstract=2851428 (accessed on 2 December 2017).

| 1 | They are referring to (Hayn 1995), pointing to the possible financial returns of scale when a company overstates the value of its assets, causing a decrease of the cost of capital. |

| 2 | Excluding special areas of agricultural production. |

| 3 | Considering the differences between the actual structure and the theoretical structure of the sample defined in the selection plan, new weightings were determined in the selection plan for 2015 so that the sample of agricultural establishments is fully representative of the total of 730,895 farms (Floriańczyk et al. 2016). |

| 4 | For more about that: FADN data collection. |

| 5 | In view of the characteristics of the variables, both the response variables and the explanatory variables were subject to a logarithm-finding procedure. |

| 6 | 2.7% during the initial 1-year interest period; for the subsequent 1-year interest periods: 1.50% margin + inflation, with interest capitalized annually (Source, http://www.obligacjeskarbowe.pl/oferta-obligacji/obligacje-10-letnie-edo/edo0227/). |

| 7 | The CAPM was utilized in the context of agriculture in modeling farmland returns by Arthur et al. (1988); Bjornson and Innes (1992); Shiha and Chavas (1995). |

| 8 | The studies conducted by Sulewski covered 600 establishments within the field of observation of the FADN during 2004–2012. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).