Remittances, Development Level, and Long-Run Economic Growth

Abstract

:1. Introduction

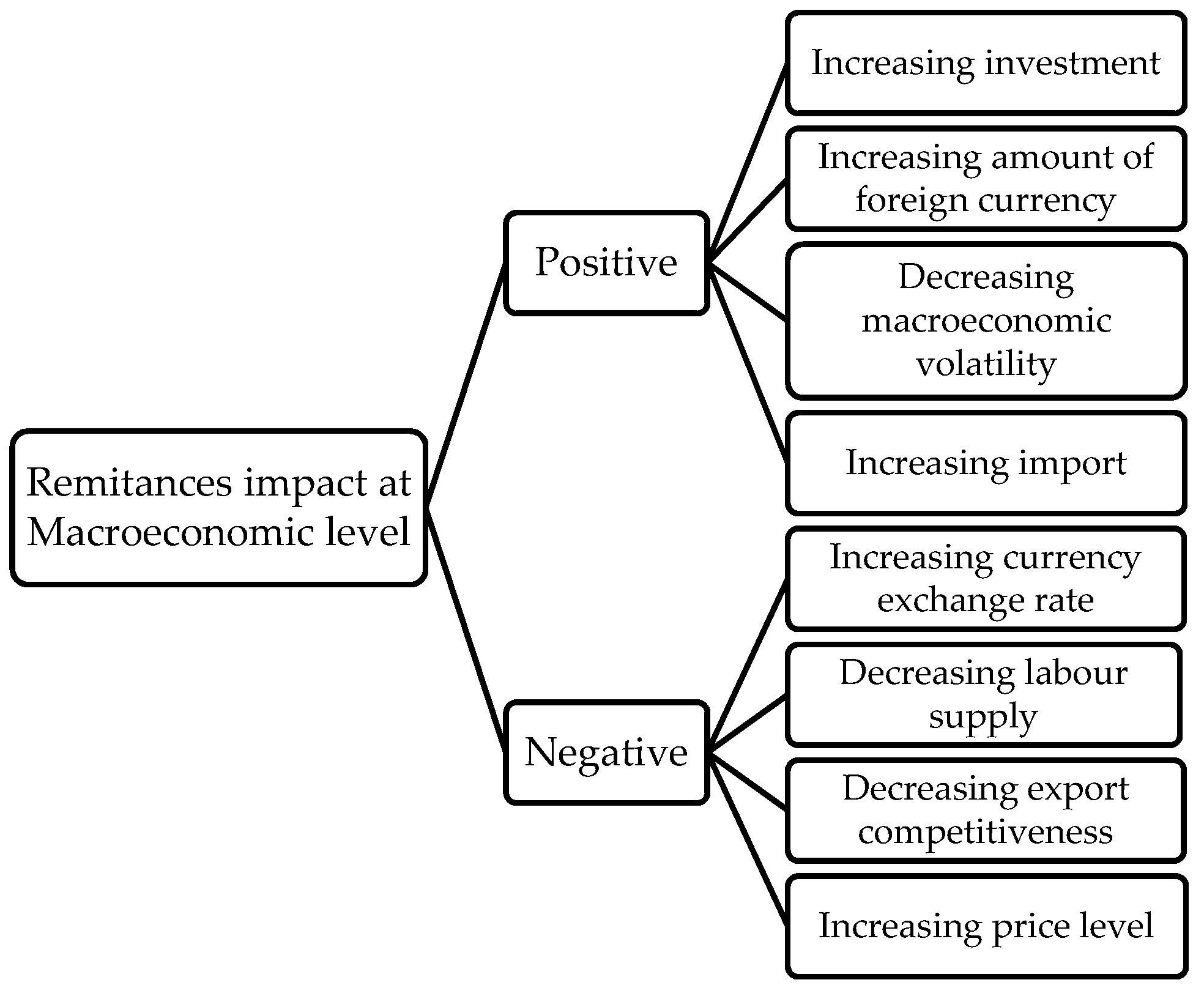

2. Literature Review

3. Data and Methodology

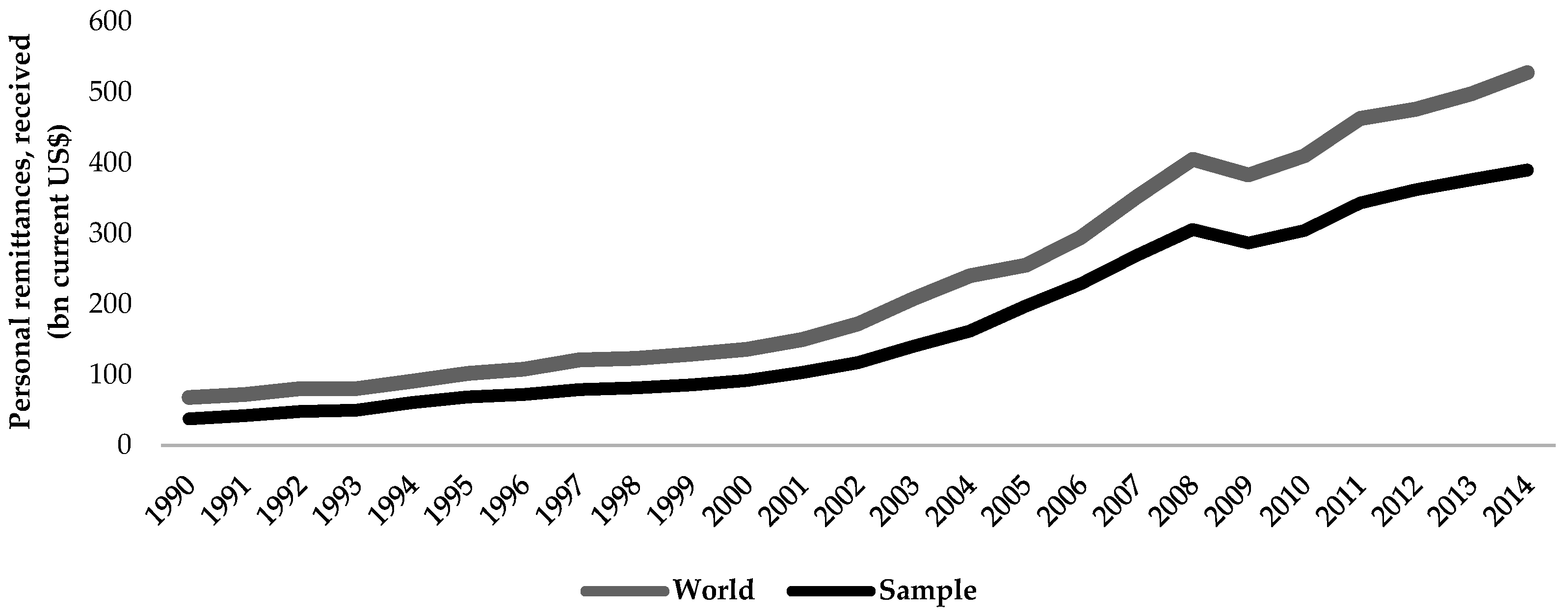

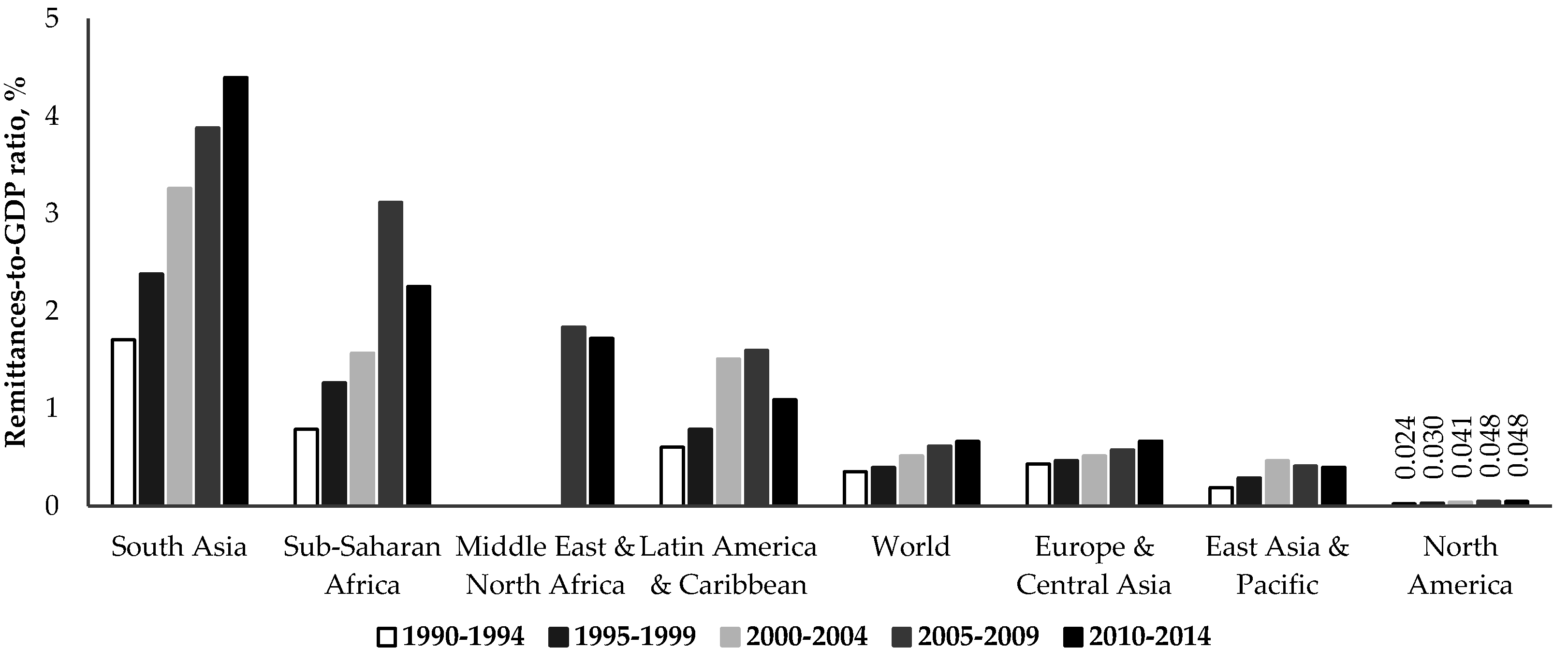

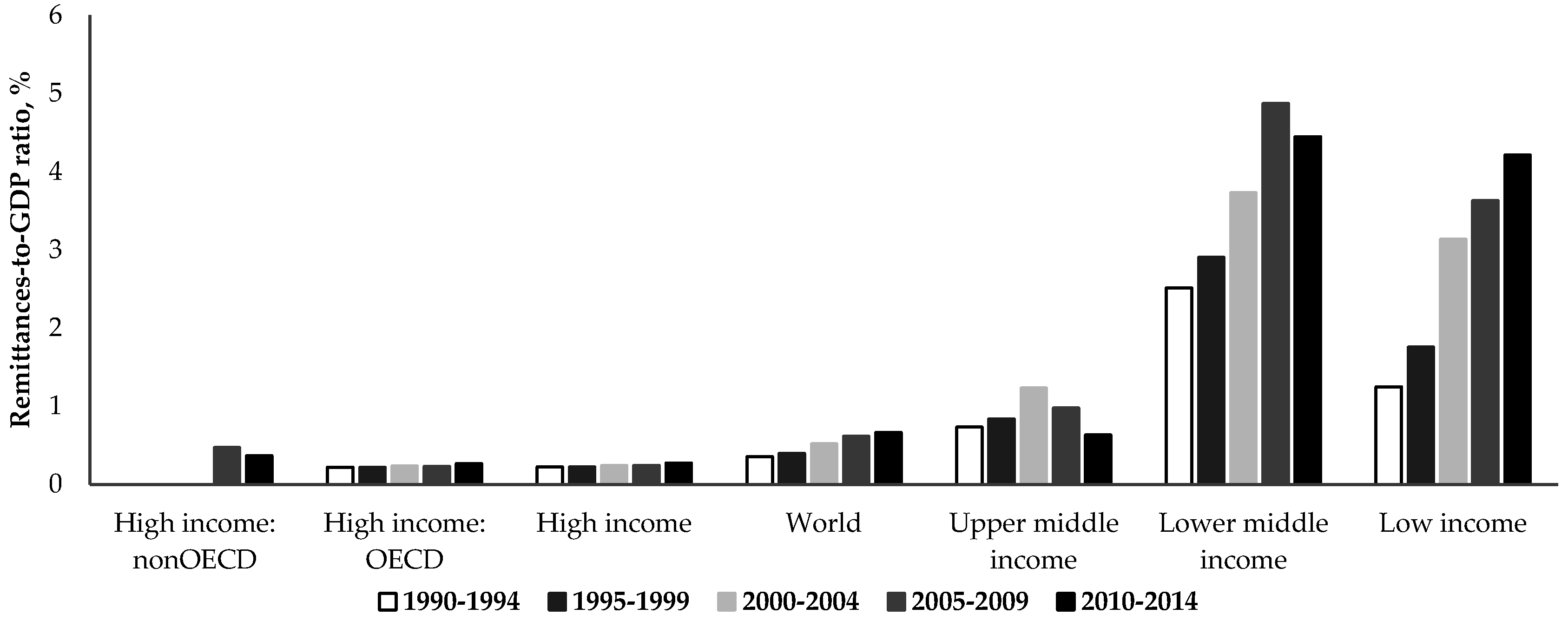

3.1. Source and Brief Analysis of Data

3.2. Econometric Model of Remittance Impact on Long-Run Economic Growth

4. Empirical Analysis

5. Summary of Empirical Results

6. Conclusions

Author Contributions

Conflicts of Interest

Appendix A. Sample of Countries

| Afghanistan | Egypt, Arab Rep. | Sri Lanka | Paraguay |

| Albania | Estonia | Lesotho | Qatar |

| Armenia | Fiji | Lithuania | Romania |

| Antigua and Barbuda | United Kingdom | Latvia | Russian Federation |

| Australia | Georgia | Macao SAR, China | Rwanda |

| Benin | Ghana | Morocco | Sudan |

| Burkina Faso | Grenada | Moldova | Senegal |

| Bangladesh | Guatemala | Madagascar | El Salvador |

| Bulgaria | Hong Kong | Maldives | Serbia |

| Bosnia and Herzegovina | Honduras | Mexico | Suriname |

| Belize | Croatia | Macedonia, FYR | Slovak Republic |

| Brazil | Hungary | Mali | Sweden |

| Barbados | Indonesia | Mongolia | Seychelles |

| Bhutan | India | Mozambique | Togo |

| Botswana | Iran, Islamic Rep. | Mauritius | Thailand |

| Switzerland | Iceland | Malaysia | Trinidad and Tobago |

| Chile | Israel | Namibia | Tunisia |

| Cote d’Ivoire | Jamaica | Nigeria | Turkey |

| Cameroon | Jordan | Nicaragua | Tanzania |

| Congo, Rep. | Japan | Norway | Uganda |

| Colombia | Kazakhstan | Nepal | Ukraine |

| Cabo Verde | Kenya | New Zealand | Uruguay |

| Costa Rica | Kyrgyz Republic | Oman | United States |

| Cyprus | Cambodia | Pakistan | Venezuela, RB |

| Czech Republic | St. Kitts and Nevis | Panama | Vanuatu |

| Dominica | Korea, Rep. | Peru | West Bank and Gaza |

| Denmark | Lao PDR | Philippines | South Africa |

| Dominican Republic | Lebanon | Papua New Guinea | Congo, Dem. Rep. |

| Algeria | St. Lucia | Poland | Zambia |

Appendix B. Variables and Explanation 1

| Variable (Name in the Equations) | Description |

|---|---|

| Long-run economic growth (lrgrwth) | Measured as growth of real per capita GDP in constant PPP dollars. |

| Development level (dev) | Measured as log of real per capita GDP in constant PPP dollars. PPP GDP is gross domestic product converted to international dollars using purchasing power parity rates. Data are in constant 2011 international dollars. |

| Remittances (rem) | Log of personal remittances, received (current US$). Personal remittances comprise personal transfers and compensation of employees. Personal transfers consist of all current transfers in cash or in kind made or received by resident households to or from non-resident households. Personal transfers thus include all current transfers between resident and non-resident individuals. Compensation of employees refers to the income of border, seasonal, and other short-term workers who are employed in an economy where they are not resident and of residents employed by non-resident entities. Data are the sum of two items defined in the sixth edition of the IMF’s Balance of Payments Manual: personal transfers and compensation of employees. Data are in current U.S. dollars. |

| Remittances intensity in the economy (remint) | Measured as log of Personal remittances, received (% of GDP) |

| Controls | |

| Investment (invGDP) | Gross Fixed Capital Formation (formerly gross domestic investment) (% of GDP) |

| Fiscal Balance (fb) | Ratio between Tax revenue and Expense, %. |

| Tax revenue refers to compulsory transfers to the central government for public purposes. Certain compulsory transfers such as fines, penalties, and most social security contributions are excluded. Refunds and corrections of erroneously collected tax revenue are treated as negative revenue. | |

| Expense is cash payments for operating activities of the government in providing goods and services. It includes compensation of employees (such as wages and salaries), interest and subsidies, grants, social benefits, and other expenses, such as rent and dividends. | |

| Openness (opn) | Exports plus Imports as a share of GDP, %. |

| Inflation (cpi) | Percentage change in Consumer price index (2010 = 100) |

| Population growth (pop) | Log difference of Population |

| Credit (crdGDP) | Domestic credit to private sector by banks (% of GDP). Domestic credit to private sector by banks refers to financial resources provided to the private sector by other depository corporations (deposit taking corporations except central banks), such as through loans, purchases of non-equity securities, and trade credits and other accounts receivable, that establish a claim for repayment. For some countries these claims include credit to public enterprises. |

| Liquid liabilities (m2GDP) | Money and quasi money (M2) as % of GDP. Money and quasi money comprise the sum of currency outside banks, demand deposits other than those of the central government, and the time, savings, and foreign currency deposits of resident sectors other than the central government. |

References

- C.W. Stahl, and F. Arnold. “Overseas Workers’ Remittances in Asian Development.” Int. Migr. Rev. 20 (1986): 899–925. [Google Scholar] [CrossRef] [PubMed]

- R.E.B. Lucas, and O. Stark. “Motivations to Remit: Evidence from Botswana.” J. Political Econ. 93 (1985): 901–918. [Google Scholar]

- I. Adelman, and J.E. Taylor. “Is structural adjustment with a human face possible? The case of Mexico.” J. Dev. Stud. 26 (1990): 387–407. [Google Scholar] [CrossRef]

- R.H. Adams. “The Effects of International Remittances on Poverty, Inequality, and Development in Egypt.” IFPRI Research Report 86. 1991. Available online: http://www.ifpri.org/sites/default/files/publications/rr86.pdf (accessed on 23 May 2016).

- R. Faini. “Migration, Remittances, and Growth.” In Studies in Development Economics and Policy. New York, NY, USA: Springer, 2002, pp. 171–187. [Google Scholar]

- R. Faini. “The Brain Drain: An Unmitigated Blessing? ” Centro Studi luca d’Agliano Development Studies Working Paper 173. 2003. Available online: http://www.dagliano.unimi.it/media/WP2003_173.pdf (accessed on 23 May 2016).

- J.P. Azam, and F. Gubert. “Migrants’ Remittances and the Household in Africa: A Review of the Evidence.” J. Afr. Econ. 15 (2006): 426–462. [Google Scholar] [CrossRef]

- R.H. Adams. “International Remittances and the Household: Analysis and Review of Global Evidence.” J. Afr. Econ. 15 (2006): 396–425. [Google Scholar] [CrossRef]

- J. Jongwanich. “Workers’ Remittances, Economic Growth and Poverty in Developing Asia and the Pacific Countries.” UNESCAP Working Paper 07/01. 2007. Available online: http://www.unescap.org/pdd/publications/workingpaper/wp_07_01.pdf (accessed on 22 May 2016).

- E.M. Ekanayake, and H. Mihalis. “Do remittances and foreign direct investment promote growth? Evidence from developing countries.” J. Int. Bus. Econ. 8 (2008): 1–15. [Google Scholar]

- B. Fayissa. “The Impact of Remittances on Economic Growth and Development in Africa.” Department of Economics and Finance Working Paper Series 2008. Available online: http://frank.mtsu.edu/~berc/working/WP2008_02remittances.pdf (accessed on 20 May 2016).

- G. Pradhan, M. Upadhyay, and K. Upadhyaya. “Remittances and economic growth in developing countries.” Eur. J. Dev. Res. 20 (2008): 497–506. [Google Scholar] [CrossRef]

- D.A. Adenutsi. “Financial development, international migrant remittances and endogenous growth in Ghana.” Stud. Econ. Financ. 28 (2011): 68–89. [Google Scholar] [CrossRef]

- R. Chami, C. Fullenkamp, and S. Jahjah. Are Immigrant Remittance Flows a Source of Capital for Development? IMF Working Paper WP/03/189; Washington, DC, USA: International Monetary Fund, 2003, Available online: https://www.imf.org/external/pubs/ft/wp/2003/wp03189.pdf (accessed on 27 May 2016).

- C.L. Freund, and N. Spatafora. “Remittances: Transaction Costs, Determinants, and Informal Flows.” World Bank Policy Research Working Paper 3704. 2005. Available online: http://library1.nida.ac.th/worldbankf/fulltext/wps03704.pdf (accessed on 27 May 2016).

- International Monetary Fund (IMF). “Two Current Issues Facing Developing Countries.” World Economic Outlook 2005. Available online: https://www.imf.org/external/pubs/ft/weo/2005/01/pdf/chapter2.pdf (accessed on 27 May 2016).

- A. Barajas, R. Chami, C. Fullenkamp, M. Gapen, and P. Montiel. “Do Workers’ Remittances Promote Economic Growth? ” IMF Working Paper WP/09/153. 2009. Available online: https://www.imf.org/external/pubs/ft/wp/2009/wp09153.pdf (accessed on 27 May 2016).

- A. Barajas, R. Chami, C. Ebeke, and S.J.A. Tapsoba. “Workers’ Remittances: An Overlooked Channel of International Business Cycle Transmission? ” IMF Working Paper WP/12/251. 2012. Available online: https://www.imf.org/external/pubs/ft/wp/2012/wp12251.pdf (accessed on 27 May 2016).

- S. Feeny, and L. McDonald. “Vulnerability to Multidimensional Poverty: Findings from Households in Melanesia.” J. Dev. Stud. 3 (2016): 447–464. [Google Scholar] [CrossRef]

- G. Bettin, A. Presbitero, and N. Spatafora. “Remittances and Vulnerability in Developing Countries.” IMF Working Papers 14/13. 2014. Available online: https://www.imf.org/external/pubs/ft/wp/2014/wp1413.pdf (accessed on 27 May 2016).

- P. Giuliano, and M. Ruiz-Arranz. “Remittances, Financial Development, and Growth.” IMF Working Paper 05/234. 2005. Available online: https://www.imf.org/external/pubs/ft/wp/2005/wp05234.pdf (accessed on 27 May 2016).

- G. Bettin, and A. Zazzaro. “Remittances and financial development: Substitutes or complements in economic growth? ” Bull. Econ. Res. 64 (2012): 509–536. [Google Scholar]

- D. Ratha. “Leveraging Remittances for Development.” Policy Brief, Migration Policy Institute, 2007. Available online: http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1110315015165/LeveragingRemittancesForDevelopment.pdf (accessed on 20 May 2016).

- D. Ratha, S. Mohapatra, and E. Scheja. “Impact of Migration on Economic and Social Development.” World Bank Policy Research Working Paper 5558. 2011. Available online: https://www.shareweb.ch/site/Migration/Resources_Migration/library/Documents/resourcessharewebResource_en_7560.pdf (accessed on 22 May 2016).

- International Organization of Migration (IOM). “International Migration Report 2006: A Global Assessment.” Available online: http://www.un.org/esa/population/publications/2006_MigrationRep/report.htm (accessed on 20 May 2016).

- H. Oda. “The Impact of Workers’ Remittances on Economic Growth.” In International Labour Migration from South Asia. Edited by O. Oda. ASEDP 70; Chiba, Japan: IDE, 2004, Available online: http://www.ide-jetro.jp/English/Publish/Download/Asedp/pdf/70_07.pdf (accessed on 22 May 2016).

- R. Chami, A. Barajas, T. Cosimano, C. Fullenkamp, M. Gapen, and P. Montiel. “Macroeconomic Consequences of Remittances.” International Monetary Fund Occasional Paper 259. 2008. Available online: http://www.imf.org/external/pubs/ft/op/259/op259.pdf (accessed on 26 May 2016).

- United Nations. “Remittances.” INSTRAW Working Paper 4. Remittances 2007. Available online: http://www.flacsoandes.org/generoycultura/Publicaciones/Publicacionesprofesoras/Profesorasasociadas/Perez-Orozco-Amaia/Papers/Amaia_Perez_Orozco_WorkingPaper4.pdf (accessed on 25 May 2016).

- H. De Haas. “The Impact of International Migration on Social and Economic Development in Moroccan Sending Regions: A Review of the Empirical Literature.” International Migration Institute Working Papers 3. 2007. Available online: http://edoc.bibliothek.uni-halle.de/servlets/MCRFileNodeServlet/HALCoRe_derivate_00002625/The%20impact%20of%20international%20migration.pdf (accessed on 26 May 2016).

- C. Bliss. “Trade and development.” In Handbook of Development Economics. Edited by H. Chenery and T.N. Srinivasan. Amsterdam, The Netherlands: Elsevier Science Publishers, 1989, pp. 1187–1240. [Google Scholar]

- R. Garza. “The Costs and Benefits of Migration to Sending States: The More You Look, the Worse It Gets.” Cent. Migr. Stud. Spec. Issues 21 (2008): 187–207. [Google Scholar] [CrossRef]

- G. Ramey, and V.A. Ramey. “Cross-country evidence on the link between volatility and growth.” Am. Econ. Rev. 85 (1995): 1138–1151. [Google Scholar]

- J. Frankel. “Are bilateral remittances countercyclical? ” Open Econ. Rev. 22 (2011): 1–16. [Google Scholar] [CrossRef] [Green Version]

- J. Connell, and D. Conway. “Migration and Remittances in Island Micro-states: A Comparative Perspective on the South Pacific and the Caribbean.” Int. J. Urban Reg. Res. 24 (2000): 52–78. [Google Scholar] [CrossRef]

- M.G. Quibria. “International Migration, Remittances and Income Distribution in the source country: A Synthesis.” Bull. Econ. Res. 49 (1996): 29–46. [Google Scholar] [CrossRef]

- E.J. Taylor. “The New Economics of Labour Migration and the Role of Remittances in the Migration Process.” Int. Migr. 37 (1999): 63–88. [Google Scholar] [CrossRef] [PubMed]

- J.E. Taylor, J. Arango, G. Hugo, A. Kouaouci, D. Massey, and A. Pellegrino. “International Migration and National Development.” Popul. Index 62 (1996): 181–212. [Google Scholar] [CrossRef] [PubMed]

- J.E. Taylor, and T.J. Wyatt. “The Shadow Value of Migrant Remittances, income, and Inequality in a Household-Farm Economy.” J. Dev. Stud. 32 (1996): 899–912. [Google Scholar] [CrossRef]

- B. McCormick, and J. Wahba. “Overseas Employment and Remittances to a Dual Economy.” Econ. J. 110 (2000): 509–534. [Google Scholar] [CrossRef]

- S. Feeny, S. Iamsiraroj, and M. Mcgillivray. “Remittances and economic growth. Larger impact in smaller countries? ” J. Dev. Stud. 50 (2014): 1055–1066. [Google Scholar] [CrossRef]

- U.G. Nwaogu, and M.J. Ryan. “FDI, Foreign Aid, Remittance and Economic Growth in Developing Countries.” Rev. Dev. Econ. 19 (2015): 100–115. [Google Scholar] [CrossRef]

- M. Tahir, I. Khan, and A.M. Shah. “Foreign Remittances, Foreign Direct Investment, Foreign Imports and Economic Growth in Pakistan: A Time Series Analysis.” Arab Econ. Bus. J. 10 (2015): 82–89. [Google Scholar] [CrossRef]

- E.A. Olubiyi. “Trade, remittances and economic growth in Nigeria: Any causal relationship? ” Afr. Dev. Rev. 26 (2014): 274–286. [Google Scholar] [CrossRef]

- G. Zizi. “Remittances as an economic development factor. Empirical evidence from the CEE countries.” Procedia Econ. Financ. 10 (2014): 54–60. [Google Scholar]

- R.R. Kumar, and H.T.T. Vu. “Exploring the nexus between ICT, remittances and economic growth: A study of Vietnam.” J. Southeast Asian Econ. 31 (2014): 104–120. [Google Scholar] [CrossRef]

- K.S. Imai, R. Gaiha, A. Ali, and N. Kaicker. “Remittances, growth and poverty: New evidence from Asian countries.” J. Policy Model. 36 (2014): 524–538. [Google Scholar] [CrossRef] [Green Version]

- J.D. Nyeadi, and O. Atiga. “Remittances and economic growth: Empirical evidence from Ghana.” Eur. J. Bus. Manag. 6 (2014): 142–149. [Google Scholar]

- R.R. Kumar, and P.J. Stauvermann. “Exploring the nexus between remittances and economic growth: A study of Bangladesh.” Int. Rev. Econ. 61 (2014): 399–415. [Google Scholar] [CrossRef]

- M. Salahuddin, and J. Gow. “The relationship between economic growth and remittances in the presence of cross-sectional dependence.” J. Dev. Areas 49 (2015): 207–221. [Google Scholar] [CrossRef]

- S. Lim, and W.O. Simmons. “Do remittances promote economic growth in the Caribbean Community and Common Market? ” J. Econ. Bus. 77 (2015): 42–59. [Google Scholar] [CrossRef]

- J. Jouini. “Economic growth and remittances in Tunisia: Bi-directional causal links.” J. Policy Model. 37 (2015): 355–373. [Google Scholar] [CrossRef]

- G. Kasnauskienė, and L. Buzytė. “Emigrantų piniginiai pervedimai ir jų poveikis ekonomikai.” Pinigų Studijos 1 (2011): 31–47. [Google Scholar]

- R. Faini. “Migration and Remittances: The Impact on Countries of Origin. In Migration and Development: Mutual Benefits? Proceedings of the 4th AFD-EUDN Conference, Paris, France, 8 November 2006.” Available online: http://www.ffem.fr/jahia/webdav/site/afd/shared/PUBLICATIONS/RECHERCHE/Archives/Notes-et-documents/35-notes-documents-VA.pdf#page=185 (accessed on 25 May 2016).

- R. Faini. “Remittances and the Brain Drain: Do the More Skilled Migrants Remit More? ” World Bank Econ. Rev. 21 (2007): 177–191. Available online: http://ftp.iza.org/dp3393.pdf (accessed on 25 May 2016). [Google Scholar] [CrossRef]

- N. Catrinescu, M. Leon-Ledesma, M. Piracha, and B. Quillin. “Remittances, Institutions and Economic Growth.” World Dev. 37 (2009): 81–92. [Google Scholar] [CrossRef]

- A.V. Cooray. “The impact of migrant remittances on economic growth: Evidence from South Asia.” Rev. Int. Econ. 20 (2012): 985–998. [Google Scholar] [CrossRef]

- E.K.K. Lartey, F.S. Mandelman, and P.A. Acosta. “Remittances, Exchange Rate Regimes and the Dutch Disease: A Panel Data Analysis.” Rev. Int. Econ. 20 (2012): 377–395. [Google Scholar] [CrossRef]

- M.D. Ramirez, and H. Sharma. “Remittances and Growth in Latin America: A Panel Unit Root and Panel Cointegration Analysis.” Working Papers 51. 2008. Available online: http://economics.yale.edu/sites/default/files/files/Working-Papers/wp000/ddp0051.pdf (accessed on 5 August 2016).

- World Bank. “Global Economic Prospects 2006: Economic Implications of Remittances and Migration.” 2006. Available online: http://pubdocs.worldbank.org/en/346121443469727614/Global-Economic-Prospects-2006-Economic-implications-of-remittances-and-migration.pdf (accessed on 5 August 2016).

- N.P. Glytsos. “Dynamic Effects of Migrant Remittances on Growth: An Econometric Model with an Application to Mediterranean Countries.” Centre of Planning and Economic Research 74. 2002. Available online: http://econwpa.repec.org/eps/lab/papers/0505/0505014.pdf (accessed on 5 June 2016).

- N.P. Glytsos. “The contribution of remittances to growth: A dynamic approach and empirical analysis.” J. Econ. Stud. 32 (2005): 468–496. [Google Scholar] [CrossRef]

- A. Edwards, and M. Ureta. “International migration, remittances, and schooling: Evidence from El Salvador.” J. Dev. Econ. 72 (2003): 429–461. [Google Scholar] [CrossRef]

- N. Hildebrandt, and D. McKenzie. “The effects of migrations on child health in Mexico.” Economia 6 (2005): 257–289. [Google Scholar]

- J. López-Córdova. “Globalization, Migration and Development: The Role of Mexican Migration Remittances.” Argentina: Inter-American Development Bank Working Paper 20. 2006. Available online: http://www.rrojasdatabank.info/iadbremit/globmigdev.pdf (accessed on 5 June 2016).

- S.R. Gitter, and B.L. Barham. “Credit, natural disasters, coffee, and educational attainment in rural Honduras.” World Dev. 35 (2007): 498–511. [Google Scholar] [CrossRef]

- C. Amuedo-Dorantes, A. Georges, and S. Pozo. “Migration, Remittances and Children’s Schooling in Haiti.” Institute for the Study of Labor Discussion Paper 3657. 2008. Available online: http://ftp.iza.org/dp3657.pdf (accessed on 5 June 2016).

- P. Acosta, C. Calderón, P. Fajnzylber, and H. Lopez. “What is the impact of international remittances on poverty and inequality in Latin America? ” World Dev. 36 (2008): 89–114. [Google Scholar] [CrossRef]

- A. Demirgüç-Kunt, E.L. Córdova, M. Peria, and C. Woodruff. “Remittances and banking sector breadth and depth: Evidence from Mexico.” J. Dev. Econ. 95 (2011): 229–241. [Google Scholar] [CrossRef]

- M. Jackman, R. Craigwell, and W. Moore. “Economic volatility and remittances: Evidence from SIDS.” J. Econ. Stud. 36 (2009): 135–146. [Google Scholar] [CrossRef]

- P.K. Narayan, S. Narayan, and S. Mishra. “Do remittances induce inflation? Fresh evidence from developing countries.” South. Econ. J. 77 (2011): 914–933. [Google Scholar] [CrossRef]

- C. Amuedo-Dorantes, and S. Pozo. “Workers’ remittances and the real exchange rate: A paradox of gifts.” World Dev. 32 (2004): 1407–1417. [Google Scholar] [CrossRef]

- C. Amuedo-Dorantes, and S. Pozo. “Remittance receipt and business ownership in the Dominican Republic.” World Econ. 29 (2006): 939–956. [Google Scholar] [CrossRef]

- C. Woodruff, and R. Zenteno. “Migration networks and microenterprises in Mexico.” J. Dev. Econ. 82 (2007): 509–528. [Google Scholar] [CrossRef]

- M.A. Clemens, and D.J. McKenzie. “Why Don’t Remittances Appear to Affect Growth? ” World Bank Policy Research Working Paper 6856. 2014. Available online: https://ssrn.com/abstract=2433809 (accessed on 5 May 2016).

- G.W. Imbens. “Instrumental Variables: An Econometrician’s Perspective.” IZA Discussion Paper 8048. 2014. Available online: https://arxiv.org/pdf/1410.0163.pdf (accessed on 5 May 2016).

- A.C. Cameron, and P.K. Trivedi. Microeconometrics, Methods and Applications. Cambridge, UK: Cambridge University Press, 2005. [Google Scholar]

- J.H. Stock, and M.W. Watson. “Heteroskedasticity-robust standard errors for fixed effects panel data regression.” Econometrica 76 (2008): 155–174. [Google Scholar] [CrossRef]

- J.M. Wooldridge. Econometric Analysis of Cross Section and Panel Data. Cambridge, MA, USA: MIT Press, 2002. [Google Scholar]

| Author | Research Period | Research Sample | Research Methods | Research Results |

|---|---|---|---|---|

| Feeny et al. [40] | 1971–2010 | 136 developing countries | Ordinary Least Squares | Remittances have no impact on per capita income growth |

| Nwaogu, Ryan [41] | 1970–2009 | 53 African, 34 Latin American and Caribbean countries | Dynamic spatial-lag model | Positive impact of the remittances on economic growth |

| Tahir et.al. [42] | 1977–2013 | Pakistan | Autoregressive Distributed Lag Model | Remittances have a significant positive impact on economic growth |

| Olubiyi [43] | 1980–2012 | Nigeria | VECM Granger causality | Unidirectional causality |

| Zizi [44] | 1995–2011 | CEE countries | Panel regression | Remittances have positive impact on economic growth |

| Kumar, Vu [45] | 1980–2012 | Vietnam | Autoregressive distributed lag (ARDL) co-integration, Granger causality | Bidirectional causality between remittances and economic growth |

| Imai et al. [46] | 1980–2009 | Asia and Pacific countries | Panel data analysis | Remittances have positive impact on economic growth |

| Nyeadi, Atiga [47] | 1980–2012 | Ghana | Johansen and Juselius co-integration test, Granger causality test | Unidirectional causality from remittances to economic growth |

| Kumar, Stauvermann [48] | 1979–2012 | Bangladesh | ARDL co-integration, Granger causality test | Positive in the long run, bidirectional causality |

| Salahuddin, Gow [49] | 1977–2012 | Bangladesh, India, Pakistan and the Philippines | Panel co-integration tests, Pooled Mean Group (PMG) regression | Positive in the long run, statistically insignificant impact in the short run |

| Lim, Simmons [50] | 1990–2012 | Caribbean Community and Common Market | Panel co-integration test | No significant relationship between remittances and economic growth in the long run |

| Jouini [51] | 1970–2010 | Tunisia | ARDL co-integration | No impact on the economic growth in the long run and bidirectional causality between remittances and growth in the short run |

| Region of the World | Number of Countries out of Total in Region | Part of the Sample, % | Income Group | Number of Countries out of Total in Income Group | Part of the Sample, % |

|---|---|---|---|---|---|

| East Asia & Pacific | 16 out of 36 | 14 | High income: non-OECD | 17 out of 47 | 14 |

| Europe & Central Asia | 29 out of 57 | 25 | High income: OECD | 18 out of 32 | 15 |

| Latin America & Caribbean | 25 out of 41 | 22 | High income | 35 out of 79 | 29 |

| Middle East & North Africa | 11 out of 21 | 9 | Upper middle income | 36 out of 53 | 33 |

| North America | 1 out of 3 | <1 | Lower middle income | 33 out of 51 | 28 |

| South Asia | 7 out of 8 | 6 | Low income | 12 out of 31 | 10 |

| Sub-Saharan Africa | 27 out of 48 | 23 | |||

| Total | 116 out of 214 | 100 | Total | 116 out of 214 | 100 |

| Pooled OLS | Pooled OLS with FD Transformation 1 | FE | |

|---|---|---|---|

| Constant | −0.9192 *** | 0.09543 *** | 8.511 *** |

| (0.2891) | (0.01910) | (2.622) | |

| Initial development level | −0.006061 | 0.3162 *** | −0.5473 *** |

| (0.01367) | (0.07614) | (0.08700) | |

| Remittances | 0.01150 ** | 0.01483 ** | 0.01390 ** |

| (0.005006) | (0.006089) | (0.006607) | |

| Investment | 0.1324 *** | 0.1530 *** | 0.1678 *** |

| (0.03368) | (0.02827) | (0.03322) | |

| Fiscal balance | 0.02867 | 0.1046 *** | 0.1088 ** |

| (0.03201) | (0.03650) | (0.04648) | |

| Openness | 0.005256 | −0.09449 ** | −0.07334 * |

| (0.01825) | (0.04016) | (0.03970) | |

| Consumer price index | −0.07368 ** | −0.06471 ** | −0.07139 *** |

| (0.03393) | (0.02852) | (0.02638) | |

| Population | 0.0009954 | −0.3216 ** | −0.3245 ** |

| (0.005688) | (0.1264) | (0.1300) | |

| Credit | 0.005385 | 0.05299 ** | 0.01603 |

| (0.02292) | (0.02179) | (0.02450) | |

| Liquid liabilities | −0.01788 | 0.01564 | 0.06326 |

| (0.02437) | (0.05194) | (0.05280) | |

| n | 352 | 232 | 352 |

| Number of countries | 116 | 105 | 116 |

| Adj. R2 | 0.2262 | 0.4693 | 0.6634 |

| p-value AR(1) test | 0.0815 | 0.2903 | 0.0672 |

| Pooled OLS | Pooled OLS with FD Transformation 1 | FE | |

|---|---|---|---|

| Constant | 5.525 *** | −0.003382 | 5.396 *** |

| (0.6645) | (0.009669) | (1.314) | |

| Initial development level | −0.6358 *** | 0.02573 | −0.9675 *** |

| (0.06453) | (0.03178) | (0.03874) | |

| Remittances | −0.2873 *** | −0.3526 *** | −0.3626 *** |

| (0.03028) | (0.02778) | (0.03316) | |

| Remittances * Initial development level | 0.03157 *** | 0.03905 *** | 0.04021 *** |

| (0.003251) | (0.002721) | (0.003304) | |

| Investment | 0.06425 ** | 0.05164 *** | 0.05258 ** |

| (0.02793) | (0.01584) | (0.02072) | |

| Fiscal balance | −0.001501 | 0.03683 ** | 0.03379 |

| (0.02514) | (0.01678) | (0.02519) | |

| Openness | −0.01014 | −0.02939 | −0.03825 * |

| (0.01562) | (0.01782) | (0.01982) | |

| Consumer price index | −0.006905 | −0.04996 *** | −0.03760 ** |

| (0.01563) | (0.01823) | (0.01854) | |

| Population | −0.01108 ** | −0.2141 *** | −0.1765 ** |

| (0.005282) | (0.07422) | (0.07605) | |

| Credit | 0.004893 | 0.01521 * | 0.01265 |

| (0.01454) | (0.008869) | (0.01184) | |

| Liquid liabilities | 0.01738 | 0.02869 | 0.04727 * |

| (0.01901) | (0.02465) | (0.02805) | |

| n | 352 | 232 | 352 |

| Number of countries | 116 | 105 | 116 |

| Adj. R2 | 0.6271 | 0.8623 | 0.8987 |

| p-value AR(1) test | 0.0714 | 0.3080 | 0.0592 |

| Pooled OLS | Pooled OLS with FD Transformation 1 | FE | |

|---|---|---|---|

| Constant | −0.5402 | 0.08035 *** | 7.942 *** |

| (0.3460) | (0.01676) | (2.446) | |

| Initial development level | −0.06134 * | 0.2778 *** | −0.5994 *** |

| (0.03348) | (0.06191) | (0.07787) | |

| Remittances | 0.05499 ** | 0.1195 *** | 0.1227 *** |

| (0.02362) | (0.03279) | (0.03795) | |

| Remittances * Remittances-to-GDP ratio | −0.02296 ** | −0.05108 *** | −0.04953 *** |

| (0.001090) | (0.001859) | (0.002032) | |

| Remittances-to-GDP ratio | −0.06454 * | −0.02750 | −0.02688 * |

| (0.01357) | (0.02502) | (0.01426) | |

| Investment | 0.1320 *** | 0.1204 *** | 0.1316 *** |

| (0.03438) | (0.03026) | (0.03311) | |

| Fiscal balance | 0.02102 | 0.1040 *** | 0.09756 ** |

| (0.03236) | (0.03254) | (0.04005) | |

| Openness | 0.01820 | −0.05457 | −0.04463 |

| (0.01787) | (0.04653) | (0.04291) | |

| Consumer price index | −0.04915 | −0.05352 * | −0.04446 |

| (0.03049) | (0.02858) | (0.03218) | |

| Population | −0.03939 * | −0.3938 *** | −0.3952 *** |

| (0.02181) | (0.1090) | (0.1168) | |

| Credit | 0.005487 | 0.04199 ** | 0.007871 |

| (0.02161) | (0.01794) | (0.02121) | |

| Liquid liabilities | 0.008399 | 0.02680 | 0.07520 |

| (0.02396) | (0.04403) | (0.04578) | |

| n | 352 | 232 | 352 |

| Number of countries | 116 | 105 | 116 |

| Adj. R2 | 0.2425 | 0.5409 | 0.7084 |

| p-value AR(1) test | 0.0900 | 0.2602 | 0.0610 |

| Average Real per Capita GDP in Constant PPP U.S. Dollars | |||

|---|---|---|---|

| Below 8500 | Above 8500 | ||

| Average Remittances-to-GDP ratio, % | Above 11 | A | B |

| Albania, Armenia, Bosnia and Herzegovina, Cabo Verde, Jamaica, Kyrgyz Republic, Lesotho, Moldova, Nepal, El Salvador, West Bank and Gaza | Jordan, Lebanon | ||

| Below 11 | C | D | |

| Afghanistan, Benin, Burkina Faso, Bangladesh, Belize, Bhutan, Cote d’Ivoire, Cameroon, Congo, Rep., Egypt, Arab Rep., Fiji, Georgia, Ghana, Guatemala, Honduras, Indonesia, India, Kenya, Cambodia, Lao PDR, Sri Lanka, Morocco, Madagascar, Mali, Mongolia, Mozambique, Namibia, Nigeria, Nicaragua, Pakistan, Peru, Philippines, Papua New Guinea, Paraguay, Rwanda, Sudan, Senegal, Togo, Tunisia, Tanzania, Uganda, Ukraine, Vanuatu, Congo, Dem. Rep., Zambia | Antigua and Barbuda, Australia, Bulgaria, Brazil, Barbados, Botswana, Switzerland, Chile, Colombia, Costa Rica, Cyprus, Czech Republic, Dominica, Denmark, Dominican Republic, Algeria, Estonia, United Kingdom, Grenada, Hong Kong SAR, China, Croatia, Hungary, Iran, Islamic Rep., Iceland, Israel, Japan, Kazakhstan, St. Kitts and Nevis, Korea, Rep., St. Lucia, Lithuania, Latvia, Macao SAR, China, Maldives, Mexico, Macedonia, FYR, Mauritius, Malaysia, Norway, New Zealand, Oman, Panama, Poland, Qatar, Romania, Russian Federation, Serbia, Suriname, Slovak Republic, Sweden, Seychelles, Thailand, Trinidad and Tobago, Turkey, Uruguay, United States, Venezuela, RB, South Africa | ||

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Matuzeviciute, K.; Butkus, M. Remittances, Development Level, and Long-Run Economic Growth. Economies 2016, 4, 28. https://doi.org/10.3390/economies4040028

Matuzeviciute K, Butkus M. Remittances, Development Level, and Long-Run Economic Growth. Economies. 2016; 4(4):28. https://doi.org/10.3390/economies4040028

Chicago/Turabian StyleMatuzeviciute, Kristina, and Mindaugas Butkus. 2016. "Remittances, Development Level, and Long-Run Economic Growth" Economies 4, no. 4: 28. https://doi.org/10.3390/economies4040028

APA StyleMatuzeviciute, K., & Butkus, M. (2016). Remittances, Development Level, and Long-Run Economic Growth. Economies, 4(4), 28. https://doi.org/10.3390/economies4040028