5.1. Food Producer Price Volatility Analysis

This study draws on monthly producer price data for six major food commodities in Indonesia: chicken, egg, chili, cayenne, shallot, and rice. The dataset spans 14 years, from January 2009 to December 2022, providing 168 monthly observations for each commodity. These data were obtained from the Village Producer Price Survey conducted by Statistics Indonesia (BPS).

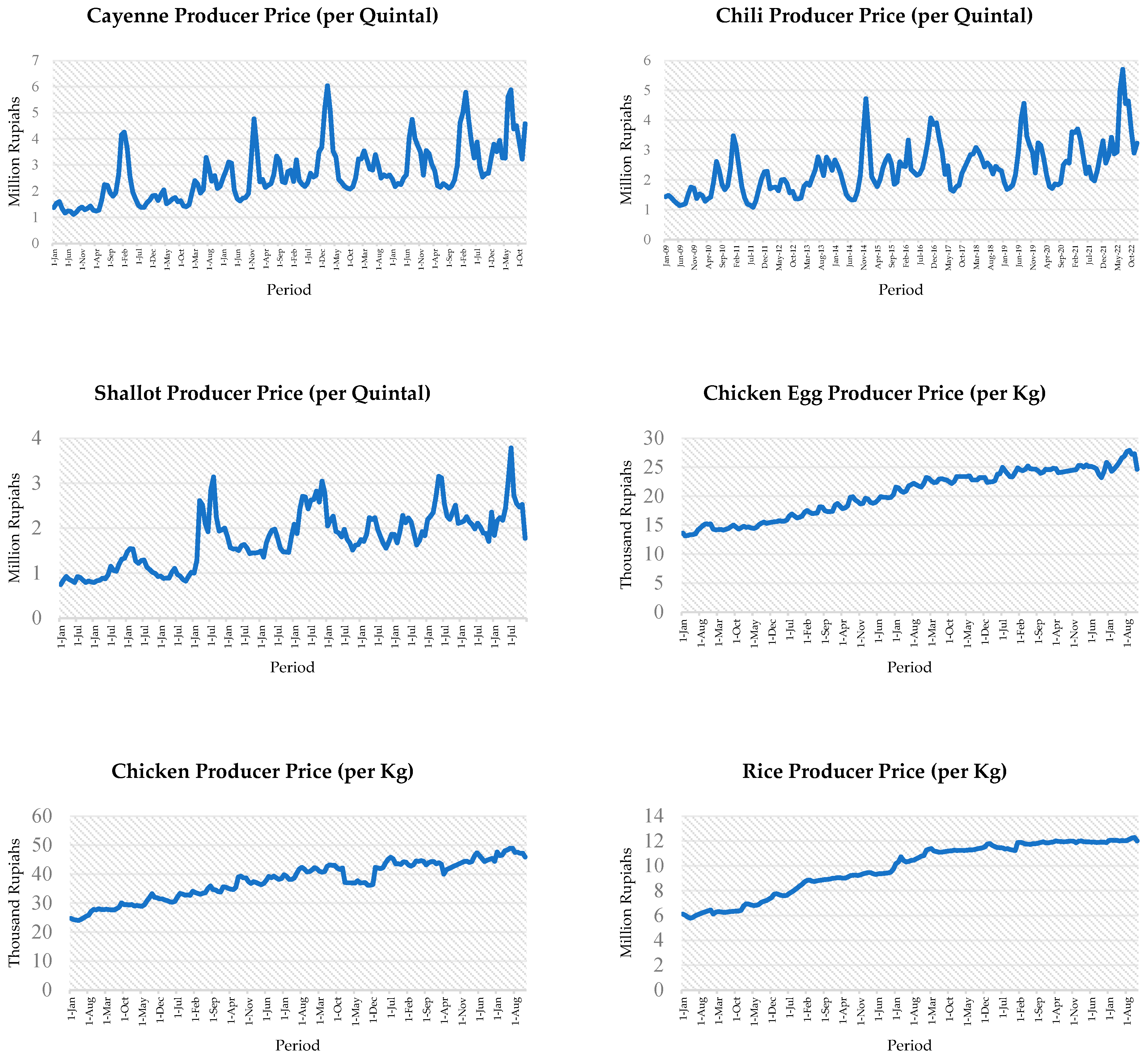

Figure 1 illustrates the time series for each commodity, highlighting the trends and fluctuations in producer prices over time.

The volatility behavior of these food commodity prices provides critical insight into market efficiency, supply chain robustness, and the vulnerability of consumers and producers to shocks. Using a GARCH modeling framework, the results reveal stark differences in the nature and persistence of volatility across the six staples (

Table 1). Nearly all commodities exhibit volatility persistence parameters (α + β) close to 1, indicating that rural producer prices are highly volatile and shocks have long-lasting effects. For instance, chili, chicken, rice, egg, and cayenne all have α + β values exceeding 0.99, implying extremely unstable prices prone to large fluctuations. Such high volatility is often driven by inefficiencies in supply chains, including poor infrastructure, logistical challenges, and delays in transportation and distribution. Adverse weather conditions (droughts, floods, storms) also play a crucial role by disrupting supply and causing sharp price spikes (

Qin & Zhang, 2016;

Nazlioglu et al., 2013). In addition, speculative trading based on expectations of future shortages or gluts can exacerbate price swings, as traders might buy or sell large quantities in anticipation of price movements.

Table 1 confirms that volatility persistence is near-unit for most commodities. In practical terms, this means markets experience volatility clustering: periods of calm are followed by prolonged periods of high volatility, as shocks echo through time rather than dissipating quickly. Weak storage systems, limited market integration, and slow transportation can amplify these patterns. Under such conditions, even minor disruptions, such as a fuel price hike, a brief export ban, or a local harvest shortfall, can trigger disproportionate and enduring price surges (

Gilbert & Morgan, 2010;

FAO et al., 2011). These volatility episodes pose serious risks, undermining food security and complicating inflation control.

Visually, price trajectories for cayenne, shallots, and chili display sharp seasonal peaks and pronounced fluctuations, consistent with their perishable nature and exposure to weather and supply chain disruptions (

Rahmawati et al., 2019;

Haile et al., 2019). By contrast, staples such as rice and eggs exhibit relatively smoother price paths over time. The visual trends do not contradict the statistical findings in

Table 1: whereas

Figure 1 presents raw price levels,

Table 1 summarizes volatility metrics from univariate ARCH/GARCH models. The ARCH coefficients capture short-term jumps in volatility from recent shocks, while the GARCH coefficients reflect the persistence or “memory” of volatility over time, patterns not always apparent from raw price series (

Engle, 1982;

Bollerslev, 1986). For example, rice and eggs, despite modest day-to-day price movements, register high and statistically significant GARCH coefficients, suggesting that their volatility is persistent and systemic rather than episodic. This indicates that even in the absence of dramatic price spikes, these commodities carry substantial long-term uncertainty (

Haile et al., 2019). On the other hand, cayenne and shallots show both visible price spikes and elevated ARCH/GARCH effects, underscoring their role as the most unstable items in the rural food system (

Rahmawati et al., 2019).

Table 1 shows that for five of the six commodities, the GARCH term (β) is very close to 1 and dominates the volatility dynamics. In these cases, once a shock hits, its influence on volatility decays extremely slowly. For shallots, however, the sum (α + β) is about 0.8745, which, while still high, is noticeably lower than the 0.999 seen for the others. Shallots have a significant ARCH term (α ≈ 0.35) and a moderate GARCH term (β ≈ 0.524), indicating that shallot price volatility is driven more by short-term shocks than by prolonged volatility clustering. In other words, the shallot market appears somewhat more responsive in the short run (e.g., prices jump with a bad harvest) but does not sustain volatility as long as the other commodities. If shallot cultivation and distribution are relatively more resilient to disruptions (for instance, due to quicker harvest cycles or better local storage/trade networks), prices would exhibit less persistence in volatility. This suggests that shallot price dynamics are dominated by recent shocks rather than long memory of past volatility, perhaps due to faster supply responses or a more competitive, responsive market structure. Indeed, the volatility persistence for shallots (0.8745) is significantly lower than the nearly unitary values observed for the other commodities. This finding aligns with the idea that certain horticultural crops with more efficient distribution channels or a larger number of market participants exhibit lower volatility persistence.

High price volatility has serious implications for both consumers and producers. For consumers, especially low-income households, volatile food prices make budgeting difficult and can threaten food security as spikes force reductions in food quantity or quality. For producers, high volatility means greater uncertainty in income, making it challenging to plan investments or manage resources. Farmers might hesitate to invest in expanding production if prices swing unpredictably, and sudden price drops can devastate their earnings. Policymakers, therefore, face pressure to stabilize food prices by addressing the underlying causes of volatility. This could involve investing in infrastructure to improve supply chain efficiency (e.g., better rural roads, cold storage facilities), implementing measures to mitigate the impact of climatic variability (such as irrigation and drought-resistant seeds), and regulating speculative activities in commodity markets to prevent excessive price swings.

From a policy perspective, the divergence in volatility patterns across commodities implies that a one-size-fits-all approach to market stabilization would be inefficient. For commodities with extremely high GARCH persistence (almost unit-root behavior), interventions should prioritize long-term infrastructure and capacity investments. Examples include cold storage facilities, rural transportation improvements, and crop insurance schemes to buffer against climate-induced supply shocks. These measures can help mitigate the supply-side constraints that often prolong volatility episodes. Conversely, for commodities like shallots that exhibit more short-term volatility, targeted short-term interventions may be more effective. This could involve improving market information systems (so farmers and traders can respond quickly to gluts or shortages), providing temporary subsidies or purchasing programs during harvest gluts to prevent price crashes, and strengthening demand-side measures such as promoting processing or storage for surplus produce. Moreover, the near-unit-root behavior of volatility in staple commodities (rice, chicken, eggs) underscores the importance of building early warning systems and adaptive policy frameworks. Rapid response mechanisms, such as timely release of government buffer stocks, import/export adjustments, or emergency transport logistics, can help prevent localized price shocks from ballooning into broader crises, particularly for low-income households that spend a large share of their income on food.

5.2. Volatility Spillover Effect of Food Producer Price Analysis

We now turn to the spatial volatility spillovers across regions. The DCC-GARCH model allows us to quantify how volatility in Java’s producer prices co-moves with volatility in other regions. In what follows, we present the results for each major island group vis-à-vis Java, including a summary of production shares (to contextualize market size and dependence) and the estimated dynamic conditional correlations.

Java vs. Sumatra: Table 2 summarizes the average monthly production of the six commodities in Java and Sumatra, as well as the joint test probabilities for the DCC-GARCH correlations (dcca1 for short-run, dccb1 for long-run). The comparison of production highlights Java’s dominance: Java produces over 65% of Indonesia’s chicken and eggs, and more than 50% of national rice and shallot output. Sumatra’s contributions are much lower; only in rice does Sumatra exceed 15% of national production. This concentration suggests a pronounced asymmetry in production that could influence price dynamics and volatility spillovers, given Sumatra’s reliance on inflows from Java for many commodities.

The DCC-GARCH estimates show statistically significant volatility co-movement between Java and Sumatra for all six commodities, as indicated by the dcca1 joint

p-values, which are essentially zero for every commodity (

Table 2). In other words, we decisively reject the null hypothesis that price volatilities in Java and Sumatra evolve independently. Volatility shocks in one region tend to be mirrored in the other, a clear sign of inter-regional price integration (

Barrett & Li, 2002;

Serra & Goodwin, 2003).

However, the strength of these linkages varies by commodity, especially in the long run. The dccb1 probabilities in

Table 2 point to heterogeneous correlation magnitudes. Commodities like cayenne, rice, and chicken show very high long-run correlation (dccb1

p-values around 0.90 or above), implying tightly synchronized volatility movements between Java and Sumatra. This is plausible given Java’s role as a supply hub and Sumatra’s dependence on inter-island trade flows for staple and high-demand items. In contrast, shallots and chili have lower (though still significant) long-run correlations (around 0.66 and 0.84, respectively), suggesting relatively weaker integration for these commodities. This may reflect the more localized nature of shallot and chili markets, both in production (certain areas specialize in these spices) and in consumption preferences, or logistical frictions in transporting perishable produce over long distances. Differing harvest calendars, limited cold storage, and region-specific varieties could also dampen the volatility linkage for these crops.

Overall, the Java–Sumatra results underscore two insights. First, Java functions as a central node in Indonesia’s food supply network: its production dominance translates into volatility dominance, meaning price volatility originating in Java has a broad national reach. Second, the strong dynamic volatility correlations between Java and Sumatra indicate a high degree of market integration between the two largest island economies. Any major disruption in Java, be it a natural disaster, a transportation bottleneck, or a policy change, can induce volatility spillovers in Sumatra. This interdependence has important policy implications. It highlights the need for regional buffer mechanisms (such as decentralized food storage facilities or redundant logistics routes) to cushion Sumatra against volatility emanating from Java. For example, maintaining buffer stocks in Sumatra or improving port and shipping resilience could help moderate transmitted shocks, especially for highly volatile and crucial commodities like chili, chicken, and rice.

Java vs. Bali–Nusa Tenggara: Java and the combined region of Bali–Nusa Tenggara present a different dynamic (

Table 3). Java consistently dominates national production for all commodities, providing over 65% of eggs and chicken and more than 50% of rice, shallots, and cayenne. Bali–Nusa Tenggara, in contrast, contributes relatively modest shares; its highest contributions are approximately 31.9% for chili and 23.1% for shallots, while for other commodities it supplies under 15% of national output (

BPS, 2022). This skewed production structure reinforces Java’s role as the core food supply hub and implies that Bali–Nusa Tenggara relies substantially on inflows from Java for many staples.

Despite this asymmetry, the DCC-GARCH results reveal notable volatility correlations, but with some variation across commodities. The short-run co-movement (dcca1) is statistically significant for most commodities, indicating that volatility shocks in Java do transmit to Bali–Nusa Tenggara in the immediate term. In particular, we find highly significant short-run correlations for shallot and cayenne (p = 0.000000), and significant (at 5% level) for chicken (p ≈ 0.044) and egg (p ≈ 0.046). Chili is an exception in the short run, with a dcca1 p-value (around 0.442) that is not significant, suggesting that short-term volatility in chili prices may not be strongly synchronized between Java and Bali–Nusa Tenggara. This could be due to Bali–Nusa Tenggara’s partial self-sufficiency in chili or short-term trade frictions (perhaps chili supply to Bali comes from closer islands or is limited by inter-island transport capacities in the short run).

In the long run, the dccb1 results indicate strong integration for certain commodities. For example, the long-run volatility correlation for shallots between Java and Bali–Nusa is extremely high (dccb1 p ≈ 0.97), implying that over time their volatility patterns become almost unified. Chicken, rice, and egg also show high long-run correlations (roughly 0.90 or above), consistent with Bali–Nusa Tenggara’s heavy dependence on Java for these staples. On the other hand, chili and cayenne exhibit more moderate long-run correlations with Java (dccb1 values in the 0.64–0.74 range). This suggests that while Bali–Nusa Tenggara is integrated with Java’s markets in general, certain spice commodities still retain some independent volatility behavior in the long run, potentially due to local consumer preferences, smaller trade volumes, or isolated production pockets within Bali–Nusa that buffer long-term volatility.

In summary, Java and Bali–Nusa Tenggara have intermediate integration with some commodity-specific nuances. The existence of significant volatility co-movement for most commodities confirms that Java’s market shocks reverberate in Bali–Nusa Tenggara. However, the variation for chili and cayenne indicates selective integration, possibly influenced by fragmented transport links or commodity-specific trade patterns. Policy-wise, this points to the value of infrastructure development and market harmonization in the Bali–Nusa Tenggara region. Strengthening ferry links and roads, improving storage for perishable goods, and aligning market information systems could enhance integration where needed and reduce regional price volatility disparities. For example, if chili volatility is less connected, efforts to integrate Bali–Nusa Tenggara’s chili market with Java (through better logistics or encouraging inter-island trade) could help stabilize prices on both ends.

Java vs. Kalimantan: Table 4 presents the production and DCC-GARCH correlation results for Java and Kalimantan. Kalimantan represents a middle-ground case: it is neither as large a producer as Java nor as minor as regions like Maluku. It contributes moderately to national output in some items, about 10.25% for chicken and 8.77% for rice, but remains very small in others (less than 2% for chili and under 1% for shallots). This mix suggests that Kalimantan has some self-sufficiency in certain staples but is largely dependent on Java for others, especially horticultural products and perishables.

Kalimantan’s DCC-GARCH results show strong long-run volatility co-movements (dccb1) across nearly all commodities with Java. Specifically, chicken, rice, egg, and cayenne all have very high long-run correlation p-values (around 0.91–0.96), indicating that in the long term, volatility in those markets moves closely in tandem with Java. This suggests that Kalimantan’s food markets have become increasingly integrated with Java’s over time, likely due to inter-island trade flows, nationwide pricing policies, and the growing penetration of common distribution networks. For instance, staples and proteins like chicken and rice might be subject to national market forces (e.g., government rice operations, large poultry distributors) that link Kalimantan prices to conditions in Java.

In the short run, the picture is more nuanced. The short-run correlation (dcca1) for chili is not statistically significant (p ≈ 0.1603), implying that immediate volatility shocks in Java’s chili prices do not strongly affect Kalimantan’s chili market. This could be due to logistical delays (chili takes time to ship from Java to Kalimantan, so a shock today in Java might reach Kalimantan with a lag), perishability (spice prices in Kalimantan might spike due to local factors before Java’s influence kicks in), or generally weaker short-term market responsiveness for that commodity. In contrast, all the other commodities do show significant short-run co-movement: chicken, rice, egg, and cayenne each have dcca1 p-values of 0.000000, indicating rapid transmission of volatility from Java to Kalimantan for those goods. These products likely benefit from well-functioning trade channels and fast price signal transmission, perhaps because they are traded in high volumes year-round (chicken, rice, eggs) or because markets arbitrage quickly (as with nationally traded staples).

These findings suggest that Kalimantan is transitioning from a peripheral market to a semi-integrated regional hub, particularly for key proteins and staples. The region’s exposure to Java’s volatility is high in both the short and long run for most commodities, meaning Kalimantan’s consumers and traders feel the ripple effects of shocks in Java fairly quickly and persistently. The exception of chili highlights a commodity where Kalimantan might have a bit more insulation or delay. Policy strategies for Kalimantan, therefore, should aim to further upgrade intra-regional logistics and market linkages, especially to improve short-run integration for perishables like chili and shallots. Investments in cold storage, better inter-island shipping capacity, and local production incentives for these commodities could reduce delays and improve price stability. Additionally, implementing Java-Kalimantan coordinated price management systems (for instance, synchronized release of stockpiles or transport subsidies during price spikes) would be beneficial for commodities like chicken and rice, where co-movements are strongest and the stakes for food security are high.

More broadly, the Java-Kalimantan analysis reinforces a general pattern: volatility co-movement is not solely a function of a region’s production share. Infrastructure quality, trade connectivity, and supply chain integration play crucial roles. Kalimantan’s rice volatility, for example, co-moves strongly with Java’s despite Kalimantan producing less than 9% of the rice, underscoring that even regions with modest production can be highly integrated if distribution networks tightly link them to the core.

Java vs. Sulawesi: Table 5 shows the results for Java and Sulawesi. Java continues to dwarf Sulawesi in production of most commodities, providing over 65% of the national chicken and egg supply and more than half of rice, shallots, and cayenne. Sulawesi’s contributions are modest, ranging from about 2.8% of national chili production to roughly 12.9% of rice (its highest share). This asymmetry is somewhat less extreme than in the Maluku or Papua cases, but it still positions Java as the dominant market that likely drives national price trends, with Sulawesi being a secondary player.

Despite Sulawesi’s lower production shares, the DCC-GARCH results indicate statistically significant short-run volatility co-movement for nearly all commodities. The dcca1 tests are essentially zero (highly significant) for chili, shallot, chicken, rice, and egg, implying that price volatility shocks in Java are transmitted quickly to Sulawesi for those items. This finding is consistent with spatial price transmission theory and previous evidence of inter-island price linkages in archipelagic economies: even if Sulawesi produces only a small fraction of, say, Java’s rice, any volatility in Java’s large market can rapidly spill over via trade and expectations into Sulawesi’s prices.

However, cayenne is a notable outlier. The short-run correlation for cayenne (dcca1 p ≈ 0.0743) is above conventional significance thresholds, indicating weak or no immediate volatility co-movement between Java and Sulawesi for this commodity. This parallels what we saw with chili in Kalimantan (and to a lesser extent chili in Bali–Nusa Tenggara): certain spices or perishable commodities do not show fast volatility transmission, likely due to localized market conditions or less integrated trade flows for those specific crops. For cayenne, it could be that Sulawesi has distinct production cycles or varieties, or that the inter-island trade in cayenne is limited/slow, leading to a dampened immediate response to Java’s price shocks.

In terms of long-run volatility integration, the dccb1 results reveal high and significant correlations for most commodities. Shallot stands out with an extremely high long-run correlation (0.9706), meaning Sulawesi’s shallot market volatility eventually moves almost in lockstep with Java’s. Rice, egg, and chicken also have quite high long-run correlations (0.86–0.92 range), suggesting that over time, volatility shocks in Java persist and become synchronized with price movements in Sulawesi, despite the production gap. The mechanism here is likely through wholesale and distribution channels: if prices in Java stay high or volatile due to a prolonged shock, suppliers and traders in Sulawesi adjust their prices in response (and vice versa to some extent), leading to converging volatility trends.

Interestingly, chili and cayenne show only moderate long-run correlations (around 0.58 and 0.64, respectively). This could imply that Sulawesi retains a bit more independent price formation for these volatile perishables. Perhaps local demand and supply factors (like the extent of chili pepper cultivation in Sulawesi’s uplands, or consumption preferences) cause some decoupling in volatility from Java over the long run. It echoes prior research that perishables can be regionally segmented due to spoilage risks, higher transport costs relative to value, and asynchronous harvests (

Nazlioglu et al., 2013).

From a policy standpoint, the Sulawesi case emphasizes that the island is not insulated from Java’s volatility shocks, even though it contributes less to overall production. Sulawesi experiences both quick and enduring volatility spillovers for staples and poultry. Therefore, reinforcing intra-regional resilience is important. This could involve building more localized storage systems (to buffer short-term supply shocks), providing production incentives to increase Sulawesi’s self-sufficiency in key foods (reducing over-reliance on Java), and granting greater logistic autonomy (e.g., dedicated shipping routes or emergency stock release for Eastern Indonesia) to manage volatility. For commodities with especially high DCC values (rice, eggs, chicken), the national food policy should explicitly coordinate inter-island supply chains and include price stabilization tools that account for Java’s centrality in driving price dynamics. In practice, this might mean synchronizing rice reserve releases between Java and Sulawesi during a shock, or ensuring telecommunication networks quickly disseminate price information to dampen panic and allow arbitrage.

Java vs. Maluku: Moving to one of the smallest contributors,

Table 6 details Java versus Maluku. Java’s dominance is extreme here: Java produces over 65% of several commodities, whereas Maluku produces well under 1% of national output for most items (e.g., ~0.7% of chili, 0.3% of shallots, 0.08% of chicken). Maluku’s highest share in this list is not even 1% (cayenne might be slightly higher, but still negligible). This stark imbalance illustrates Maluku’s deep structural dependence on Java and other islands for food supply.

Even with Maluku’s minimal production, the DCC-GARCH results show statistically significant short-run and long-run volatility co-movements for nearly all commodities. All dcca1 p-values are essentially zero, which means volatility shocks in Java do have an immediate and statistically significant impact on Maluku’s price volatility for those commodities. This finding is striking: despite Maluku producing almost none of these products, its markets are not isolated. It implies that Maluku’s prices respond to news or supply changes in Java very quickly, likely because Maluku imports a large portion of its food, so local prices adjust as soon as Jakarta or Java prices move (plus perhaps speculative stockpiling behavior by traders anticipating changes).

The long-run correlations (dccb1) are also high for most items. For instance, shallots, chicken, and rice show dccb1 values around 0.90 or above, indicating very strong persistent co-movement in volatility with Java. This is intuitive; Maluku’s prices in the long term largely reflect the conditions in the markets of Java (and possibly Sulawesi/Papua if they serve as intermediate hubs), given Maluku’s negligible local supply. The chili case is a bit different: the long-run correlation for chili is lower (around 0.34), which is surprisingly low compared to others. It might be an anomaly or possibly indicates that Maluku does not rely on Java for chili to the same extent (maybe obtaining it from Sulawesi or local gardens), thus having a somewhat independent volatility pattern. Alternatively, it could reflect limited data or an outlier issue. Nonetheless, all commodities have highly significant dcca1 (short-run) links, so even chili shows an immediate reaction, even if the sustained correlation is lower.

In essence, Maluku emerges as extremely dependent on Java: it is a price-taker region with volatility essentially imported from Java’s market. When Java sneezes, Maluku catches a cold, so to speak, in terms of price volatility. This condition justifies targeted interventions. The findings support policies such as establishing regional food buffer stocks in Maluku, subsidizing inter-island logistics to ensure consistent supply (so that small disruptions do not cause huge local price spikes), and even modest local production incentives for strategic commodities. For example, encouraging small-scale poultry or egg production in Maluku could provide a local buffer against volatility in those markets. Similarly, improving the shipping frequency and capacity between Maluku and Java (or Sulawesi) could reduce volatility by smoothing out supply delays.

Java vs. Papua: Finally, Java versus Papua represents the most extreme core-periphery relationship in our study. Papua is geographically distant, has an isolated and often undersupplied market, and produces less than 1% of the national supply for almost all commodities. Indeed, Papua’s highest contribution among these is about 1.98% for cayenne and just 0.24% for shallots (

BPS, 2022). This vast gap confirms Papua’s role as a structurally dependent region in Indonesia’s food system, heavily reliant on shipments from Java and other islands.

The DCC-GARCH analysis (

Table 7) shows that short-run volatility co-movement between Java and Papua is significant for all commodities except one. The dcca1 tests are 0.000000 for five commodities (rice, chili, shallot, egg, cayenne), meaning Java’s volatility immediately transmits to Papua’s prices in those cases. The only exception is chicken, where the

p-value is ~0.0516 (just above the 5% threshold) (

BPS, 2022). This suggests that short-run volatility in chicken prices in Java nearly spills over to Papua (and likely does so in a slightly delayed or slightly weaker fashion), which is not surprising, as Papua imports most of its chicken and eggs from other regions, but local market frictions may slightly delay the impact of Java’s volatility in the very short run. Still, the near-significance indicates that even chicken is on the cusp of immediate integration.

The long-run correlations are very high across the board (

Nazlioglu et al., 2013;

Qin & Zhang, 2016). Essentially, Papua’s volatility correlations with Java are all strong in the long term, meaning Papua’s price volatility trends align closely with Java’s when viewed over longer periods. Even for chicken, which had a marginal short-run link, the long-run correlation becomes strong (Papua’s chicken prices eventually reflect Java’s volatility). This outcome underscores the central vulnerability of Papua’s food system: despite minimal local production, Papua’s markets experience volatility that is effectively imported from Java. Papua is a classic price-taker region; its food security is tightly coupled with Java’s market behavior.

This reality reflects Papua’s limited food sovereignty. Because it produces so little of what it consumes, any volatility in the prices at the sources (Java or Sulawesi) is passed through to Papua. There might be slight dampening or delays due to transport time (it takes time for goods to travel to Papua), but given the high costs and infrequent shipments, even small supply hiccups can cause big swings in local Papua prices.

Consequently, national food security policies must include tailored interventions for Papua. The analysis suggests several: (1) Establish regional price stabilization funds or buffer stocks specifically for remote provinces like Papua. This could help intervene in the market when volatility spikes (e.g., release rice stocks in Jayapura when prices jump unexpectedly). (2) Provide subsidized inter-island logistics for key perishable goods destined for Papua. If shipping operators are incentivized to maintain regular service (even at a loss) during bad times, Papua’s supply will be steadier, reducing volatility. (3) Incentivize local production through agronomic support, land development, and technology transfer. While Papua may never be self-sufficient in staples like rice, there may be potential to expand local output of certain vegetables, roots, or poultry to cushion against supply disruptions from Java. Even small increases in local supply or storage (e.g., small-scale silos or cold storage facilities) could dampen volatility. Finally, given how closely Papua’s fate is tied to Java’s markets, integrating Papua into national early warning systems is crucial. If price monitoring indicates a looming shortage in Java, Papua’s authorities need to prepare (perhaps by arranging emergency shipments or price controls) before the shock fully hits them. In short, Papua should be explicitly accounted for in any supply chain risk assessments, ensuring that measures are in place to protect this vulnerable region from the whiplash of Java’s volatility.