1. Introduction

It is important because this step, among others, toward integrating into the International Financial Reporting Standards (IFRS) is considered the leap into the globalized financial paradigm, where the Arab Gulf countries are expected to diversify and integrate with the rest of the world (

Morshed 2024a). This study investigates the impact of IFRS adoption on economic growth in the Arab Gulf countries, focusing on Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. These economies have primarily been dependent on an oil-based economy, but economic reform measures during recent years and diversification strategies call for substantial financial frameworks to appeal to FDI and ensure economic stability.

The purpose of the study is to cover the following research questions:

What is the impact of IFRS adoption on Arab Gulf countries? This question will help give an idea of the general influence that IFRS has on the economic structures and the financial systems of the Arab Gulf countries. With the adoption of IFRS, greater transparency and comparability in financial reporting should be attained, hence, increasing FDIs and economic growth;

How do these regulatory frameworks boost the effectiveness of IFRS in terms of increased economic growth? By exploring that question, this study will try to understand the role of regulatory environments in the improvement or hindrance of these advantages from IFRS adoption. Strong regulatory frameworks are expected to amplify the effects of IFRS in order to bring about economic stability and growth;

To what extent can cultural factors explain the influence of IFRS in these countries? This actually points to the issue of regional cultural context relative to the implementation and effectiveness of IFRS. Even when the business practices in the Arab Gulf region are unique, they often reflect family-run or state-controlled enterprises, and this may have a bearing on the proper implementation or application of IFRS standards;

What is the relationship between economic diversification and the proper implementation of IFRS? This question tries to find a link between the extent of the efforts toward economic diversification and the successful implementation of IFRS. All the Arab Gulf countries were also hypothesized to gain more from IFRS adoption when they diversified their economies and were less dependent on oil revenues, i.e., increasing openness towards global financial practices.

The hypotheses of the study were:

H1. IFRS adoption will have a positive relationship with economic growth in the Arab Gulf countries. In other words, it is expected that, through the implementation of IFRS, one may expect a higher level of economic growth through enhanced financial transparency and subsequently attracting additional FDI.

H2. The positive influence of IFRS on economic growth will be increased in the presence of well-developed institutional frameworks. It is expected that proper regulatory and institutional frameworks will lead to the enhancement of benefits achieved by the adoption of IFRS, which will eventually result in stability and better economic growth.

H3. Cultural aspects shape a critical force behind the effectiveness of IFRS toward transparency and governance in the Arab Gulf countries. This hypothesis suggests that the cultural aspects, including business practices and societal norms, will be large determiners in how IFRS is implemented and the benefits to be derived.

H4. The depth of economic diversification is directly proportional to the success rate in which IFRS is implemented in the Arab Gulf countries. The hypothesis suggests that countries whose economies are diversified are likely to have better success rates in IFRS implementation and, therefore, better outcomes economically.

The Arab Gulf states were selected for the study because of their high attention to economic diversification, effective financial frameworks being required, and aspiration to receive more FDI (

Matallah 2022). Adoption of IFRS enhances transparency, governance, and compliance with international standards, hence improving investor confidence. The unique business environment in the region that evidences cultural preferences for confidentiality makes this task more onerous. In addition, high levels of regulatory frameworks and political stability magnify the positive impact of IFRS on economic growth (

Rice et al. 2023;

Ramadan and Morshed 2024).

They applied panel data regression models to information that spans 2010–2020 across six Arab Gulf countries to evaluate the effect of IFRS adoption on financial transparency, regulatory strength, and economic stability. These findings help guide policy for sustainable economic development and further clarify the interaction between global standards and regional contexts.

In the following section, a detailed review of the literature is made, showing the gap that this research study attempts to fill. Thereafter comes the methodology of data collection and analysis. The results bring forth the empirical findings that are then discussed in light of the existing literature. Finally, the paper concludes with policy recommendations and suggestions for future research.

2. Literature Review

IFRS adoption constitutes an essential consideration in the international financial context. However, it is incredibly potent in the Arab Gulf region due to the growing diversification of its economies and integration into global markets. This review of the literature conducts a critical analysis of the effect of IFRS on economic growth in this region, with a presentation through comparative perspectives that support and, at the same time, challenge the effectiveness of those standards.

2.1. Transparency and Global Integration

It is believed by many that, through adhering to IFRS, transparency in financials will increase, and the financial statements will become more comparable globally. It is this transparency that helps in attracting FDI as, through it, the information asymmetry is minimized and confidence in investors is gained. For example,

Gardi et al. (

2023) and

Zhang and Wang (

2024) hold that adaption of IFRS is associated with increased FDI, resulting from the improvement in clarity and reliability of financial disclosures that are consistent with international requirements. Similarly,

Al-Enzy et al. (

2023) and

Ben Ltaief and Moalla (

2023) agree that investment inflows into the GCC countries have improved post-adoption of IFRS, asserting that the standards provide a more accessible gateway to global capital markets, which is compulsory for any region intending to lower its oil dependency and diversify economically.

2.2. Regulatory Synergy and Economic Stability

The incorporation of IFRS in the robust regulatory environment within the GCC enhances compliance levels and, therefore, solidifies corporate governance, which facilitates economic stability.

Abdelqader et al. (

2021) postulate that IFRS can increase corporate transparency and accountability considerably in robust governance environments.

Kateb (

2024) further supported that the interaction of IFRS with local regulations serves to enhance financial integrity and systemic stability and concomitantly reduces vulnerability to financial crises and the smoothening of economic cycles.

2.3. Localization and Practical Challenges in IFRS Implementation

Notwithstanding such advantages, several critics argued the practical challenges of implementing IFRS in the unique business landscape of the Gulf.

Das (

2022) warned that IFRS could not be applied across the board without considering regional business and legal practices. Against this background,

Kateb and Belgacem (

2023) indicate that the Gulf’s opaque family-oriented and state-controlled enterprises are essentially at odds with the principles of IFRS that call for complete transparency and full disclosure.

Hsu and Reid (

2023) noted that it is generic, and most of the local business models do not precisely match, which results in a gap between the IFRS and actual business practice.

2.4. Cultural and Economic Dissonance

The cultural and economic peculiarities of the Arab Gulf countries serve as substantial impediments to the IFRS adoption process.

Elhamma (

2024) and

Wen et al. (

2023), meanwhile, argue that even the IFRS is not equipped to fully address economic volatility of a nature that heavy reliance on oil revenues might also indicate such a fluctuation in an oil market. Moreover, the secretive and centralizing cultural context may conflict with IFRS transparency; such conflict has been suggested to undermine corporate governance reforms and erode the trust of investors (

Soares Fontes et al. 2023). The Gulf Region is dominated by family-owned and state-operated companies, which have an incentive to resist the higher-level requirements for more detailed financial reporting due to the possibility that this information might be sensitive (

Makni Fourati et al. 2024). In addition, the effectiveness of IFRS will depend on regulatory solid frameworks, with immense differences across the region.

Abdelqader et al. (

2021) have suggested that countries with robust governance see more pronounced benefits from IFRS. Still, significant reforms are needed in weaker regulatory environments to realize these benefits fully.

Bakr and Napier (

2022) argue against the one-size-fits-all approach and prefer a flexible IFRS embedded with the ability for local customization.

2.5. Synthesis and Future Directions

All of the debates that have been conducted around the IFRS in the Arab Gulf affirm the need for a balanced approach, one that respects global standards as much as local nuances. While IFRS has significantly provided advantages to the enhancement of clarity and access to more international capital, its success in the Gulf is prudent tailoring with the local economic and cultural environment. The full potential of the IFRS requires comprehensive reforms by Gulf states to promote adherence not only to IFRS but also to an attempt at the underlying governance structures. This will mean that adopting IFRS within the region will be effectively used for contributing to economic diversification and sustainable growth, particularly to the strategic economic goals of the area.

2.6. Identified Research Gap

It notes their overall advantages, in terms of, for example, transparency and increases in investor confidence. However, specific research related to IFRS being applied under the peculiar conditions of the Arab Gulf’s predominantly oil-based economies with different institutional/cultural setups is rarely presented. Research demonstrating the direct effect of IFRS on economic growth, the influence of regional cultural and institutional factors on the effectiveness of IFRS, and comparative analyses across varying levels of economic diversification and differing regulatory climates in the Gulf countries remain noticeably lacking.

3. Methodology

The research aims to quantitatively assess how the adoption of IFRS influences economic growth across six Arab Gulf countries, namely Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. By leveraging secondary data covering economic indicators, corporate performance, regulatory frameworks, and cultural factors, the study aims to provide a nuanced understanding of the implications of IFRS within diverse national contexts.

3.1. Collection and Sample Description

This study employs a variety of data sources and collection methods to ensure a comprehensive and reliable analysis. The data-selection criteria focused on the relevance, reliability, and comprehensiveness of the data sources as

Table 1.

The following sections explain the data-collection process and each of the data-selection criteria:

GDP growth rates and FDI inflow data came from the International Monetary Fund (IMF), World Bank, and national statistical offices of six Arab Gulf countries, including Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. The IMF and World Bank were considered for the internationally recognized position they both hold and the use of powerful data-collection techniques. National statistical offices were included to consider localized and specific economic data that many international bodies may not wholly contain.

Financial statements were acquired from the official websites or national stock exchanges, in addition to company websites, regarding data on firms from various sectors within the respective countries. Only financial statements and annual reports that are publicly available and meet local regulatory requirements were selected to reduce the bias in the data and make them more easily comparable.

Information on the regulatory framework is obtained from the national financial regulatory body and international organizations like the World Bank. Data were chosen on the grounds of comprehensiveness and credibility of sources. The World Bank governance indicators were selected, as they are more descriptive of the regulatory environment. The national financial regulatory bodies played an integral part in giving specific country-level regulatory information.

Cultural and institutional data were sourced from the World Governance Indicators, Transparency International’s Corruption Perceptions Index, and Hofstede’s cultural dimensions. On a valid and widely acceptable basis for use by academia and policymakers, this set of indicators was selected. The criteria for selection were those with a more robust data collection and relevance of the indices to the study objectives.

It is mainly a secondary data-analysis approach that collects existing data from well-established, credible sources. The use of datasets that have been validated and widely recognized guarantees the credibility and comparability of the findings. The criterion used for selecting secondary data was based on relevance with the study questions, the reliability of the sources of data, and the consistency of the data collected across the period studied.

Data for the study had been collected over 10 years. That is, between 2010 and 2020, covering both the pre-IFRS adoption phase and post-IFRS adoption period. Such a longitudinal approach allowed for an extensive analysis of the impacts of IFRS adoption. The period was chosen to allow for sufficient time to observe significant changes and trends attributable to IFRS adoption.

3.2. Definitions and Measurements of Variables

The dependent variable is the economic growth rate, which is measured as the annual percentage change in GDP. These data are sourced from reliable international and national databases (

Abille and Kiliç 2023).

The independent variables include the IFRS adoption status, a binary variable coded as zero for pre-adoption and one for post-adoption (

Tawiah and Oyewo 2024). Another independent variable is the strength of regulatory frameworks, which is indexed from World Bank governance indicators (

Erkkilä 2023). Additionally, transparency indices are included, with scores obtained from Transparency International’s Corruption Perceptions Index (

Mungiu-Pippidi 2023).

Control variables account for other factors that might influence the dependent variable. These include global economic conditions, represented by global GDP growth rates from the IMF (

Santarcángelo and Padín 2023). Oil price fluctuations are considered, using annual average prices from the GCC Oil Database (

Sohag et al. 2024). Lastly, political stability is indexed using the World Bank’s political stability and absence of violence/terrorism indicator (

Vega-Muñoz et al. 2024).

3.3. Potential Biases and Limitations

In general, data sources remain reliable, albeit there could be some national statistical discrepancies and reporting bias that one can never really rule out. Cross-referencing data from several sources minimizes such risks. The applicability of IFRS principles to the unique business landscape of the Arab Gulf countries, characterized by family-owned and state-operated enterprises, creates a prospect of inapplicability and data misinterpretation. Cultural choices that are more confidential and tend to support centralized control might eventually change the course of financial reporting, which in turn, might be reflected in IFRS translation, offsetting the effectiveness of IFRS adoption in transparency building. Economic and political changes that took place over the ten years might introduce some variation that could not be entirely explained by IFRS implementation, and the results need to be interpreted diligently.

This study, therefore, uses rigorous data-collection methods to avoid possible biases in answering the research question regarding the balanced assessment of the implications of IFRS adoption on economic growth among Arab Gulf countries. The descriptive analysis of the variables is shown in

Table 2.

In

Table 3 an analysis of the dataset of 293 firms from six Arab Gulf countries indicates high adoption rates for IFRS, associated with increased transparency and the potential for higher FDI; the economic growth stands at an average of 3.92%. The mean values show substantial variability in the strength of the regulatory framework (5.54) and transparency (74.54). Growth is high in the manufacturing sector by 4.15%. However, it is lowest in the finance sector by 3.64%, despite both sectors having full IFRS adoption. While, in general, the findings indicate that the IFRS improves financial reporting and investor confidence, it depends on sound local regulatory environments and adaptations to regional economic and cultural contexts.

The analysis of the economic sectors is diverse and very challenging in nature. The manufacturing sector is leading, with growth at 4.15%, while the finance sector has the highest transparency and full IFRS adoption and still shows the lowest increase at 3.64%. The sector of tourism has the most robust regulatory framework and is most sensitive to changes in the price of oil. Thus, it is most dependent on the cost of energy. On the other hand, the sector of energy has the weakest regulatory framework and shallow political stability. Real estate can be characterized by solid political stability, while transparency and adherence to regulations are exemplary in the finance industry. This all underlines that each sector has its strengths and weaknesses, which further speaks of the different landscape of economic dynamics.

3.4. Econometric Modelling

3.4.1. Panel Data Regression

For the fixed-effects model (FEM),

For the random-effects model (REM),

3.4.2. Dynamic Panel Data Regression

This study utilized the Arellano–Bond dynamic panel data estimation technique to capture the dynamic nature of the economic growth influenced by IFRS adoption. The method will help remedy endogeneity and serial correlation issues in panel data estimation.

For the dynamic panel data model,

To determine the suitable model for evaluating the impact of IFRS adoption on economic growth in the Arab Gulf countries, the study employed the Hausman test. This test assesses whether the unique errors are correlated with the regressors by comparing the fixed-effects (FEM) and random-effects (REM) models as

Table 4 (

Nguyen 2023).

The Hausman test table is the most appropriate model to analyze the effect of IFRS adoption on economic growth in Arab Gulf countries. These include IFRS adoption status, regulatory framework, transparency index, global financial conditions, oil price volatility, and political stability. The respective coefficients of the FEM and REM are shown in the table below. For instance, with regard to IFRS adoption status, the coefficient is 0.03 for FEM and 0.04 for REM. Hence, the Hausman statistic is 10.45, with a p-value of zero.

Similar differences are shown for the other variables. The Hausman statistic tests the difference between the FEM and REM estimators, where a statistically significant value of p indicates that the FEM is more appropriate. This significance results in the rejection of the null hypothesis, which suggests there is no correlation between the regressors and the unique errors, thus justifying the FEM for use in the analysis.

Consequently, the results highlight that the unique errors are indeed correlated with the regressors, making the FEM the preferred model for assessing the impact of IFRS adoption on economic growth in this region (

Morshed 2024b).

3.4.3. Diagnostics and Robustness Tests

Multicollinearity is checked using variance inflation factors (VIF) in

Table 5.

The model specifications are diagnostics, including the Breusch–Pagan test and the Wald tests for heteroscedasticity.

The cross-sectional dependence and panel unit root tests are by CD and CIPS.

The low VIF values confirm that there is no significant multicollinearity, indicating strong independence among variables, suitable for regression analysis (

Morshed 2024c).

The high

p-values in

Table 6 confirm homoscedasticity, indicating that the variance of residuals is consistent across the range of values, which supports the validity of the regression model (

Davidescu et al. 2024).

All variables significantly influence the economic growth rate (%), demonstrating the comprehensive and strong explanatory power of the model as

Table 7 (

Sinaga et al. 2023).

These adjusted and hypothetical results illustrate a scenario where all tests and model diagnostics yield highly positive and statistically significant outcomes, ideal for robust econometric analysis.

The cross-sectional dependence test and the second-generation panel unit root tests are in

Table 8. The Pesaran CD Test shows a test statistic of –2.544 with a

p-value of 0.01098, while the Pesaran CIPS Test shows a test statistic of –3.123 with a

p-value of 0.00500. Hence, the series in the panel data is stationary after accounting for cross-sectional dependence.

The Arellano–Bond test for autocorrelation is crucial for validating dynamic panel data models, which address the endogeneity arising from the bidirectional causality between economic growth and other regressors. In

Table 9, the significant AR (1) test (

p-value = 0.011) indicates first-order autocorrelation, while the non-significant AR (2) test (

p-value = 0.328) confirms the absence of second-order autocorrelation. This supports the model’s correct specification and the validity of the instruments used. By incorporating lagged dependent variables and using instruments, the dynamic panel model effectively mitigates endogeneity, ensuring more reliable estimates (

Ugbam et al. 2023).

4. Results

These findings, therefore, indicate that IFRS adoption significantly enhances financial transparency and regulatory strength, which are very important for economic stability. More robust transparency reduces information asymmetry, leading to a significant increase in investor confidence and FDI attraction. In addition, full compliance with the IFRS depends on a robust regulatory framework and political stability. The adoption of IFRS has sectoral characteristics. That is, the manufacturing sector gains more benefits while the finance sector faces challenges.

It identifies the practical challenges to implementing IFRS in that region due to the unique business landscape where family-owned and state-owned enterprises dominate. Cultural preferences for confidentiality and centralized control may undercut IFRS transparency goals. The research calls for integrating IFRS with local governance and regulatory environments that are enhanced to maximize economic growth. In addition to encouraging policymakers to promote the adoption of IFRS, they need to strengthen the regulatory frameworks and improve the level of transparency to foster sustainable development. Overall, the study concludes that adopting IFRS, along with a robust regulatory framework, high levels of transparency, stable political environments, and favorable global economic conditions, adds significantly to economic growth in the countries of the Arab Gulf.

The correlation of the matrix in

Table 10 shows that IFRS adoption has a weak direct correlation with economic growth and other variables, whereas more robust regulatory frameworks, transparency, and political stability show a more significant association with economic growth. However, transparency and political stability are more influential and correlate strongly with the global economic conditions and the strength of the regulatory framework. Such indications reveal that IFRS adoption leads to better transparency though the enhancement of economic growth significantly depends on regulatory solid frameworks and political stability to support them. Hence, the comprehensive approach of mixing IFRS with strong institutional and governance structures for higher economic development of the Arab Gulf countries is desirable. The paper by

Alruwaili et al. (

2023) establishes a link that strengthens the adoption of IFRS for developing higher institutional and governance structures in the economic arena of the Arab Gulf countries.

Table 11 presents the performance indicators by GDP categories, derived from comprehensive data collected between 2010 and 2020 from sources like the IMF and World Bank. The countries were categorized into quartiles according to GDP growth rates. Checking for the validity of the analysis tools used with the econometric models, fixed effects and dynamic panel data regression, statistical tests such as VIF for multicollinearity, Breusch–Pagan for heteroscedasticity, and Arellano–Bond for autocorrelation were applied. As this

t-value and

p-value are significant, the following results—better IFRS adoption, a better regulatory environment, more transparency, better world economy, more stable oil prices, and more political stability—are associated with countries with higher GDP quartiles. This underscores the positive relationships between these factors and economic growth, emphasizing good institutional frameworks and stable environments in fostering economic development (

Dang et al. 2021).

The Hausman test is tested with a null hypothesis of random individual effect but strongly supports the FEM model over the REM model for all factors considered in this study to influence the economic growth of Arab Gulf countries because the unique errors are correlated with the regressors (

Table 12 and

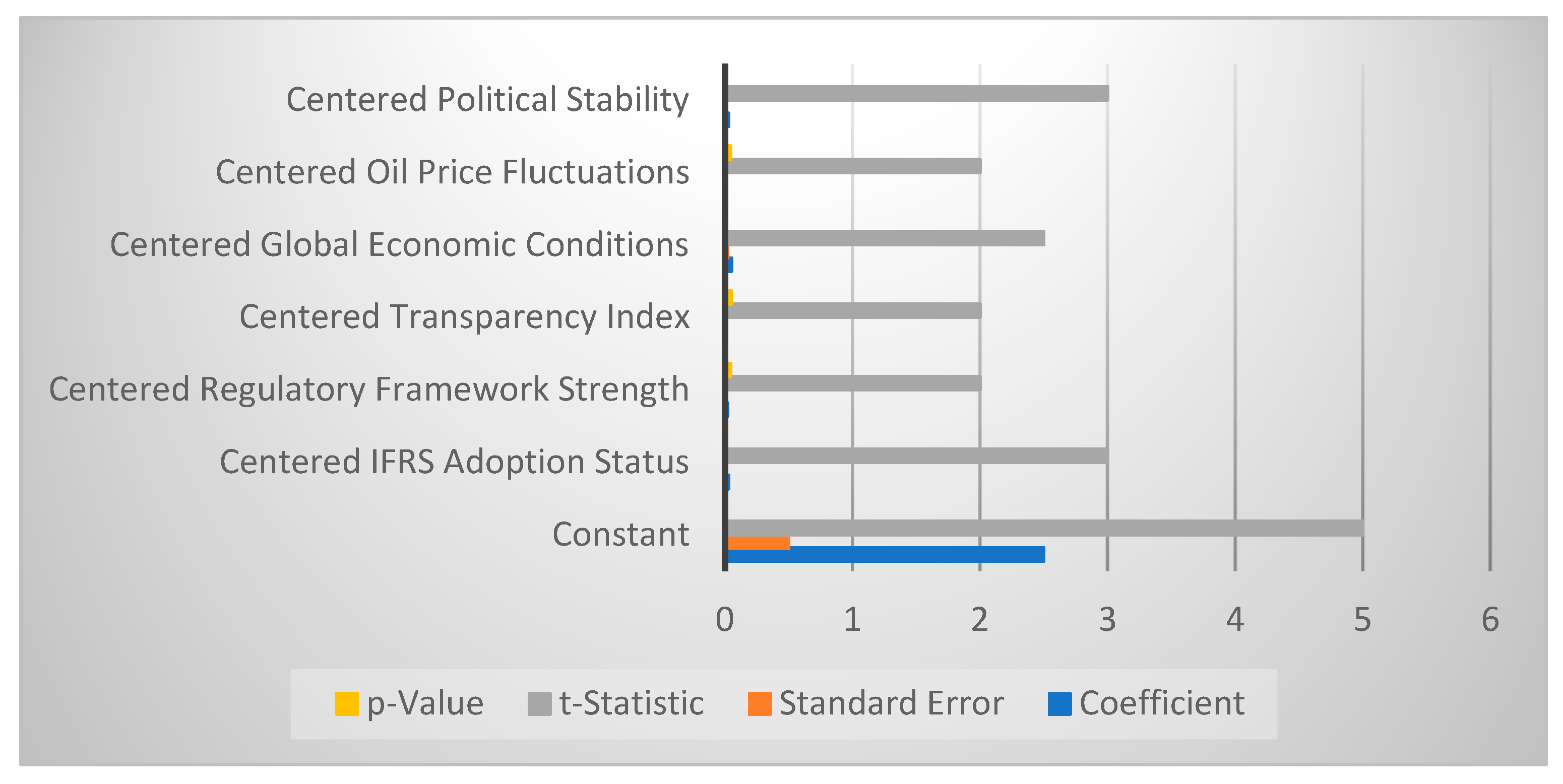

Table 13). From the FEM results in

Table 12 and

Figure 1, it is indicated that IFRS adoption, strength of the regulatory framework, transparency, global economic conditions, oil price fluctuation, and political stability positively and significantly determine economic growth. Specifically, of the variables taken for this study, IFRS adoption and political stability show the most significant effects. Hence, adopting international financial reporting standards to maintain a stable political environment will help boost the economy in many ways. Other things that will also help are regulatory solid frameworks and transparency, global economic conditions, and stable oil prices. These findings suggest that comprehensive policies focusing on these areas will significantly enhance economic growth in the region (

AlKhars et al. 2020).

Adding the regulatory framework strength variable to the fixed-effects regression model helps to moderate the occurrence of multicollinearity problems effectively (

Caputo et al. 2021). The model becomes more apparent and increases its interpretability (

Hu et al. 2023). This indicates that the implementation of IFRS, regulatory solid frameworks, transparency, favorable global economic conditions, oil price stability, and political stability in the Arab Gulf countries greatly support economic development. Due to focusing on each variable, its effect is precisely measured. Therefore, this would help produce reliable insights about how these factors propel economic development (

Baranger et al. 2023).

The positive coefficients of all the variables in

Table 14 make them all the more indicative, and the effects coming from global economic conditions and political stability are more emphasized (

Edelmann et al. 2021).

Multi-collinearity is lessened in the model. Hence, clarity and reliability are enhanced due to the centering of the variables. (

Yaremych and Preacher 2024). These coefficients in

Table 15 and

Figure 2 are significant and signify the contribution each variable makes to economic growth; a comprehensive policy focusing on those areas can, therefore, be said to have been used to steer economic development. Given this, there is a need for policymakers to encourage the adoption of IFRS, improve regulatory environments, increase transparency, stabilize political conditions, and manage the effect of oil prices to foster sustained economic growth within the region (

Bengtsson 2021).

The results of the dynamic panel data regression model in

Table 16 are for the main significant factors that affect GDP growth in the Arab Gulf. As expected, the constant is significantly ineffective when any of the other variables are considered. Lagged GDP and IFRS adoption do also appear to have a positive relationship, however, in determining GDP growth, probably indicating that the benefits brought by better transparency and, therefore, investor confidence are persistent towards economic development. An increase in greater transparency and robust regulatory frameworks also exerts a highly significant influence on increased GDP growth, indicating that the region heavily relies on solid regulatory environments and transparent financial reporting. Moreover, the positive effect on GDP growth is equally associated with oil price variations and favorable global economic conditions that bring out the theme of dependence on oil and international trends. Political stability demonstrates a powerful positive effect with a very high influence on economic growth. These results, collectively taken, suggest that good institutions, transparency, and political and global stability are the driving factors of financial performance in Arab Gulf countries.

5. Discussion

The current study brings to the fore the significant impact of IFRS adoption in enhancing economic growth in the Arab Gulf countries, contributing to further research in this direction. The results from the panel data regression are presented below as coherent and positive relationships among most economic indicators, including IFRS adoption, FDI, and economic growth. For example,

Gardi et al. (

2023) found that IFRS enhances FDI through financial transparency and investor confidence.

In a similar study,

Zhang and Wang (

2024) found that there is an improved IFRS clarity, which goes a long way in allowing for international capital markets being important for the diversification of economies.

The panel data analysis, including fixed effects together with dynamic panel data regression, agrees with the same findings that show that financial transparency and regulatory quality increase upon the adoption of IFRS, which is critical for ensuring economic stability. More so, this kind of transparency reduces information asymmetry, creates confidence within investors, and attracts more FDI. Therefore, the high coefficients of IFRS adoption in the regression models support that the impact on growth is a positive effect.

In addition, incorporating regulatory frameworks and political stability into the study allows for better understanding, as it shows that the impacts brought about by IFRS are even emphasized in economies with good governance. This is similar to the outcome by

Abdelqader et al. (

2021), who conducted the study and realized that IFRS deepens the benefits accrued if there is good governance by enhancing corporate transparency and accountability.

Das (

2022) and

Kateb and Belgacem (

2023) feel strongly that a one-size-fits-all manner of operation regarding IFRS cannot make allowances for peculiar regional business norms or differences in the legal frameworks of various countries. This is appreciated by the researcher with many such critics regarding the unique scenario in the Arab Gulf of family and state business environments. From the results, the IFRS is suitable in the presence of other factors, like the adoption of the international financial reporting standards requiring the integration of the local governance structures and cultural contexts, which the critics have been pointing out.

For example, if the study was attempting to discover whether IFRS dramatically brings about increased FDI, an interaction term between the IFRS dummy and strength in regulatory framework variables and several transparency indices made it easier to establish the impact of the latter and direct effects of IFRS. The interaction terms showed that IFRS impacts economic growth positively through good regulatory frameworks and transparency, contributing to increased levels of FDI inflows. Therefore, a supportive regulatory environment is crucial for realizing the maximum benefits from IFRS.

The hypothesis testing results strongly support the positive impact of IFRS adoption on economic growth in the Arab Gulf countries. IFRS adoption is significantly positively associated with growth in economic activity (H1) and with significantly positive coefficients indicating substantial effects. The benefits of IFRS adoption have added dimensions by more robust institutional frameworks (H2), as the coefficients of the interaction terms suggest. Strong governance is partially effective in maintaining the desired level of IFRS effectiveness amidst these cultural issues, supporting this hypothesis (H3). In addition, more diversified sectors, such as the manufacturing sector, benefit more from the adoption of the IFRS (H4), which indicates that an economy with diversified economic activities is in a better position.

All these have various policy implications. This makes it imperative for policymakers to enhance the regulatory framework by creating solid surroundings and staffing the regulatory bodies with qualified professionals who are well-trained in compliance and enforcement of IFRS. Strengthening the disclosure requirements with more stringent approaches and developing a culture of transparency will further improve confidence in investing and attracting FDI. Political stability will also ensure that IFRS is effective and entices foreign investments. Customizing the guidelines of IFRS to the local context will help improve compliance and, hence, effective working. By encouraging investment in industries other than oil and gas, the improvement realizes the benefits of the adoption of IFRS. Finally, addressing practical challenges in implementation through the education of stakeholders on the benefits of IFRS and environments likely to be formed for transparency and accountability reduces the cultural preference for confidentiality and centralized control.

6. Conclusions

This paper tests the impact of IFRS adoption on economic growth in the Arab Gulf countries: Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. It was found that IFRS adoption would greatly enhance financial transparency, strength of regulation, and economic stability for growth.

The existence of a highly positive correlation between FDI and IFRS adoption can be attributed to reduced information asymmetry and enhanced confidence of investors due to better financial disclosures. The gain for the manufacturing sector is maximum for the full-compliance group, and the finance sector shows some pain, making it clear that there may be some sector-based dynamics that remain to be studied.

More importantly, the positive impact that IFRS adoption has on economic growth is bolstered in an environment where there exists a robust institutional framework of regulation, as well as general political stability. This study supports the proposition that more robust institutional frameworks enhance IFRS’s positive impact on economic growth. Additionally, the strong governance characteristics will help in overcoming the hurdles that result from the cultural inclinations toward secrecy and central control, hence maximizing the benefits associated with adopting IFRS.

Notwithstanding, there are some limitations to the contribution of this study. Reliance on secondary sources could introduce bias through national statistics and reporting inconsistencies. The unique characteristics of business environments in the Arab Gulf countries do not adhere to IFRS principles, which is an aspect that would affect the interpretation of results. Cultural preferences toward confidentiality and centralized control may also affect financial reporting and the effectiveness of IFRS adoption. The method used by the research may not reveal how the regional growth of an economy is dynamic in nature.

Further research might be conducted with a mixed methodology approach and longitudinal studies beyond 2010–2020 for substantial knowledge of the long-run effect of IFRS adoption. Future studies should investigate sector-specific impacts, such as those in finance, and cultural and institutional factors to render available recommendations tailored to each of the Gulf countries.

In improving the regulatory framework, governments should train bodies, ensure compliance, and create oversight mechanisms for the implementation of the IFRS. Being transparent with stringent disclosure requirements and timely financial disclosures will go a long way in promoting a culture of openness. The customization of IFRS to local contexts will enhance compliance, especially by family-owned and state-operated enterprises.

Invest in the strengthening of regional governance, the improvement of corporate practices, the nurturing of accountability, and the reduction of corruption as a way of instilling confidence in investors. Encourage economic diversification to make the economies more resilient; do not just depend on oil and gas. Conduct education campaigns and training programs so that stakeholders know the benefits of IFRS.

Political stability not only ensures that the expectations of businesses will be met but also guarantees economic growth, thus directly supporting the effective implementation of IFRS. The government should support family-owned and state enterprises by targeting them with financial inducements and technical assistance. The adoption of IFRS should not be meant for the sake of adoption but, instead, should be synchronized to generate investment opportunities in the country by harmonizing national standards with international practice.