1. Introduction

The cross-country study on the contribution of SMEs to economic growth and development in Sub-Saharan African countries reveals that in South Africa alone, SMEs contribute 50–60% to the Gross Domestic Product (GDP) and account for 60% of the country’s employment sector. The study further concludes that SMEs contribute over 50% to the GDP of most African countries and, on average, 70% to employment. Additionally, SMEs are key components in economies, as they represent over 90% of private businesses and contribute approximately 40% of the national income (GDP) in emerging economies (

Ramatu and Kasim 2020;

Tewari et al. 2013). According to the National Institute of Statistics of Rwanda (

NISR) (

2020), 99.7% of businesses in Rwanda fall under the category of micro-, small, and medium enterprises (MSMEs). The 2020 establishment census in Rwanda further shows that SMEs account for more than 98.9% of total employment, while large businesses represent only 0.2%, and micro-businesses account for 92.6% of total workers (

NISR 2020).

This prevalence of SMEs in the employment sector indicates the extent to which any economic shocks affecting SMEs have a direct pass-through effect on a country’s economic performance; therefore, any disruption in economic activities directly affects SMEs and the overall economic performance in particular.

The Government of Rwanda has introduced a series of policies and strategies to strengthen SMEs by improving local competitiveness. These include the “Made in Rwanda Policy” and the “Domestic Market Recapturing Strategy (DMRS)”. Both initiatives aim to increase trade competitiveness and reduce trade imbalances in domestic products relative to imports. Agri-business, including the wood sector and agroforestry, are among the key cluster areas that the Government of Rwanda considers a priority for the development of SMEs through the promotion of the light manufacturing industry in Rwanda (

The Ministry of Commerce and Industry (MINICOM) 2017). Evidence suggests that the wood sub-sector, mainly timber exports, has a significant effect on the economic growth, both in the short and the long runs. This applies in developing, emerging, and developed economies (

Forgha and Aquilas 2015;

Trømborg et al. 2000).

The SMEs, especially those linked with the wood sub-sector, constitute an important downstream activity of the agriculture sector in the Rwandan economy. This is due to their high relevance in adding economic value to business activities, supporting the diversification of locally produced products and increasing income and employment for involved business operators, as well as their direct linkages with other economic sectors, mainly manufacturing and service sectors.

In this respect, (

Scherr 2004) concluded that wood-related products make an important market with the potential to offer valuable economic opportunities for hundreds of millions of small-scale agroforestry producers in a situation where they can offer competitive advantages, which include the control over commercially valuable tree resources, lower cost structures, better monitoring and protection or branding for socially responsible markets, and the impact is amplified when there is lack of high-scale industries in the wood-processing sub-sector.

The Government of Rwanda through the Ministry of Trade and Industry (

MINICOM) (

2020) has established four main categories of SMEs, subdivided as follows: (i) micro-businesses, which employ between 1 and 3 workers, (ii) small businesses, which use between 4 and 30 workers, (iii) medium-sized businesses, engaging between 31 and 100 workers, and (iv) large businesses, which have at least 100 workers on board. However, while the standard definition of SMEs includes all business entities with fewer than 250 employees, there is no single and internationally agreed-upon definition of SMEs, as the definitions differ by country, industry, sector, assets and products, business size, and national policies (

Muriithi 2017).

The COVID-19 pandemic has interrupted Rwanda’s growth trajectory, from the 9.4% annual decades-long GDP growth to a contraction of 3.4% in 2020. This economic crisis affected all sectors of the economy. For instance, export growth fell by 9%, mining and quarrying recorded a contraction of 31%, wood and paper printing dropped by 9%, the overall service sector fell by 6%, and transport dropped by 24%, while the hotels and restaurant sub-sector was particularly hard-hit with a contraction of 40% (

NISR 2021). This economic downturn was directly attributed to the COVID-19 pandemic and the associated containment measures. These included restrictions on the movement of people and goods, business shutdowns, and border, and airspace closures along with supply chain disruptions.

Additionally, heightened uncertainty exerted pressure on the exchange rate, leading to tighter financial conditions and a contraction of economic activities. According to the National Bank of Rwanda (BNR) and The

International Monetary Fund (IMF) (

2020 June), there was a drastic drop (by 62.9%) in the economy as measured by the Composite Index of Economic Activity (CIEA). By Mid-2020, the Ministry of Finance and Economic Planning (MINECOFIN), reported that weekly transactions declined by 75% compared to the same week in 2019 (

National Bank of Rwanda 2020;

The International Monetary Fund (IMF) 2020). This reflects a massive downturn in business operations. Furthermore, Google’s COVID-19 Community Mobility Report shows that between February and March 2019, the mobility index dropped by 56%, and movement in retail and recreation spaces fell by 57%.

Recalling that the World Health Organization (

WHO 2020) declared COVID-19 a global pandemic on 11 March 2020, Rwanda was among the first African countries to implement measures aimed at halting the rapid transmission of the virus and preventing overwhelming the health sector in the absence of vaccination or therapeutics of the virus. Rwanda recorded its first COVID-19 case on 14 March 2020, and the number of positive cases sharply increased in July and December 2020.

In light of the above background, this study was conducted to quantify the impact of COVID-19 on SMEs operating in Rwanda using quantitative survey data. Also, this analysis aims to identify recovery strategies and propose actionable policy recommendations to enhance the SMEs resilience to shocks and promote employment opportunities in the post-COVID-19 era. Special emphasis is placed on wood-based SMEs and their operators due to their significant influence on other economic sectors and the widespread prevalence of the wood industry across the country.

Data from the NISR show that agroforestry contributes more than 5% to the national GDP, while agriculture, forestry, and fishing combined contribute 45.3% to national employment, with the forestry sub-sector alone accounting for 6.6% of national employment (

NISR 2022). However, these data do not account for the impact of transport, wholesale, and retail activities linked with wood SMEs on the Rwandan economy nor the indirect effects in construction and other uses of wood products.

The main objective of the study is to analyse the impact of COVID-19 on SMEs in Rwanda, with special emphasis on wood-focused businesses; specifically, the analysis has helped to (i) assess the quantitative effects of the COVID-19 pandemic on the sales and employment among SMEs and (ii) identify the approaches applied by SMEs in the reopening and recovery process.

2. Literature Review

SMEs are a cornerstone of economic development in emerging and developing countries, including most Sub-Saharan African countries. However, a study on SME financing in Africa (

Beck and Cull 2014) indicates that SMEs are particularly vulnerable due to difficulties in accessing necessary financing. The regression results showed that smaller firms are 30% less likely to access formal loans, with rates ranging between 13% and 14% relative to larger firms (

Beck and Cull 2014).

The study conducted by the Center for International Forestry Research

German Cooperation (GIZ) and CIFOR (

2019) estimated that in Rwanda, there were approximately 1100 individuals involved in wood-based SMEs as producers, along with 1000 traders. In total, the production segment accounts for around 6600 permanent jobs and 10,000 temporary jobs (

German Cooperation (GIZ) and CIFOR 2019). The Ministry of Trade and Industry (MINICOM) highlighted that value chain finance for SMEs holds enormous potential to increase access to finance for SMEs through facilitating an environment for them to access credit in competitive markets (

MINICOM 2010).

A study conducted in China in 2020 to assess the perceived impact of the COVID-19 epidemic showed that most SMEs faced cash-flow risks due to existing obligations to continue paying various recurrent and statutory expenditures, regardless of whether they had little or no revenue. Additionally, many SMEs failed to resume activities due to already-depleted operating costs (

Lu et al. 2020). Another study conducted in Spain using the hypothetical extraction method (HEM) to explore the sequence of reactions associated with shocks arising from the COVID-19 lockdown in SMEs showed that SMEs explained 43% of the income loss and two-thirds of the employment decline caused by the COVID-19 pandemic (

Pedauga et al. 2021).

According to the

International Labour Organization (ILO) (

2020), most SMEs are business entities often run by women, operate in drenched sectors of the informal sector, and lack protection mechanisms. Under these conditions, MSMEs are the first to suffer devastating consequences of economic downturns. The United Nations Development Programme

UNDP (

2021) reported that SMEs were likely to be among the most vulnerable businesses following the imposition of travel bans, border closures, and quarantine measures. Many workers could not move to their place of work or carry out their jobs, which had knock-on effects on incomes, particularly for informal and casually employed workers.

Juergensen et al. (

2020), in their analysis of European SMEs amidst the COVID-19 crisis, found that SMEs of all categories have experienced immediate shocks from the lockdowns, affecting both upstream and downstream activities. Specifically, there was a sharp decline in demand, drops in consumer confidence, and employment reductions, among other short-, medium-, and long-term effects. While their paper provides a strong foundation for impact analysis, it remains silent on quantifying the magnitude of the COVID-19 pandemic on SMEs through firm-level data analysis, as there are several variations among SMEs.

Lu et al. (

2020) conducted an analysis on 4800 SMEs in China using an online questionnaire and complemented this with follow-up interviews to better understand the challenges linked with the COVID-19 pandemic prevention and response measures. This analysis found that the majority of SMEs in China were not able to resume work due to a lack of epidemic prevention tools, the inability of employees to report back to work, large disruptions of supply chains, and significant reductions in market sizes. These findings are consistent with the results from the Rwandan context; however, the magnitude of the effect differs, especially in sales and the level of employment.

Al-Fadly (

2020) analysed the impact of COVID-19 on SMEs and employment in Kuwait and found that SMEs’ revenues dropped by 30–50% during the lockdown. Cash flow had come to a standstill, and phone orders, which used to generate 40% of restaurant income, were halted, leading to increased financial expenses relative to revenues. This analysis was robust due to the fact that the author provided a detailed framework of the impact of the COVID-19 pandemic.

A study conducted by the Africa Natural Resources Management and Investment Centre (ANRC) on the impact of COVID-19 on African timber and wood trades showed that even though COVID-19 did not have direct effects on forests and tree performance, the sector was impacted indirectly by the pandemic through changing consumer demands, social distancing, health measures, lower production, and poor market access due to disrupted supply chains, including the closure of export terminals (

African Development Bank Group 2022).

Additionally, while investigating the impacts of COVID-19 on African SMEs, possible remedies, and sources of funding,

Muriithi (

2017) found out that SMEs employ more than 70% of the continental population, and the COVID-19 consequences have been severe, affecting the prospects of business operations. Additionally, the analysis revealed that major challenges confronting SMEs were linked with lack of adequate financing to restart their activities once the pandemic changed course and governments eased some restrictive measures.

In their analysis (

Hu 2010) on SMEs and economic growth, it was found that there is a statistically significant relationship between entrepreneurship and employment in economies with a larger share of SMEs. The devastating effects of the COVID-19 pandemic on overall employment in most economies during 2020 and 2021 have been transmitted through the inability of SMEs to function due to restrictive measures imposed by governments to contain the rapid spread of the COVID-19 virus.

Rajagopaul et al. (

2020), in their analysis of how SMEs should survive under economic shocks such as COVID-19, found that SMEs in South Africa, like elsewhere in Africa, face multiple challenges related to limited access to low- and medium-cost funding, which constrains business growth, low awareness of available financing opportunities, and slow demand, which further hinder their expansion plans and their ability to identify alternative channels to sell their products. Specifically, wood-based SMEs face challenges relating to environmental policy regulations, highly dynamic local demands, and weak national-level support (

Makinen and Selby 2006;

Teischinger 2012).

3. Materials and Methods

Recalling that the main objective of this research was to assess the COVID-19 pandemic effect on SMEs, with a particular focus on wood-based enterprises across the country, this section presents models and data analysis methods applied to come up with the quantified impacts of the COVID-19 pandemic on SMEs in Rwanda.

3.1. Data

To analyse the impact of the COVID-19 pandemic on SMEs in Rwanda, we used cross-sectional data collected between August and September 2020 among wood-based business operators across the country in 14 districts. This period of reference was chosen because the Government of Rwanda (GoR) was embarking on a gradual reopening of the economy through a relaxation of business operations and movement restrictions measures for people, thus transitioning from a total lockdown to relaxed measures, allowing for increased mobility and the resumption of some economic activities. However, the full economic activities and border openings had not yet taken place during the time of data collection.

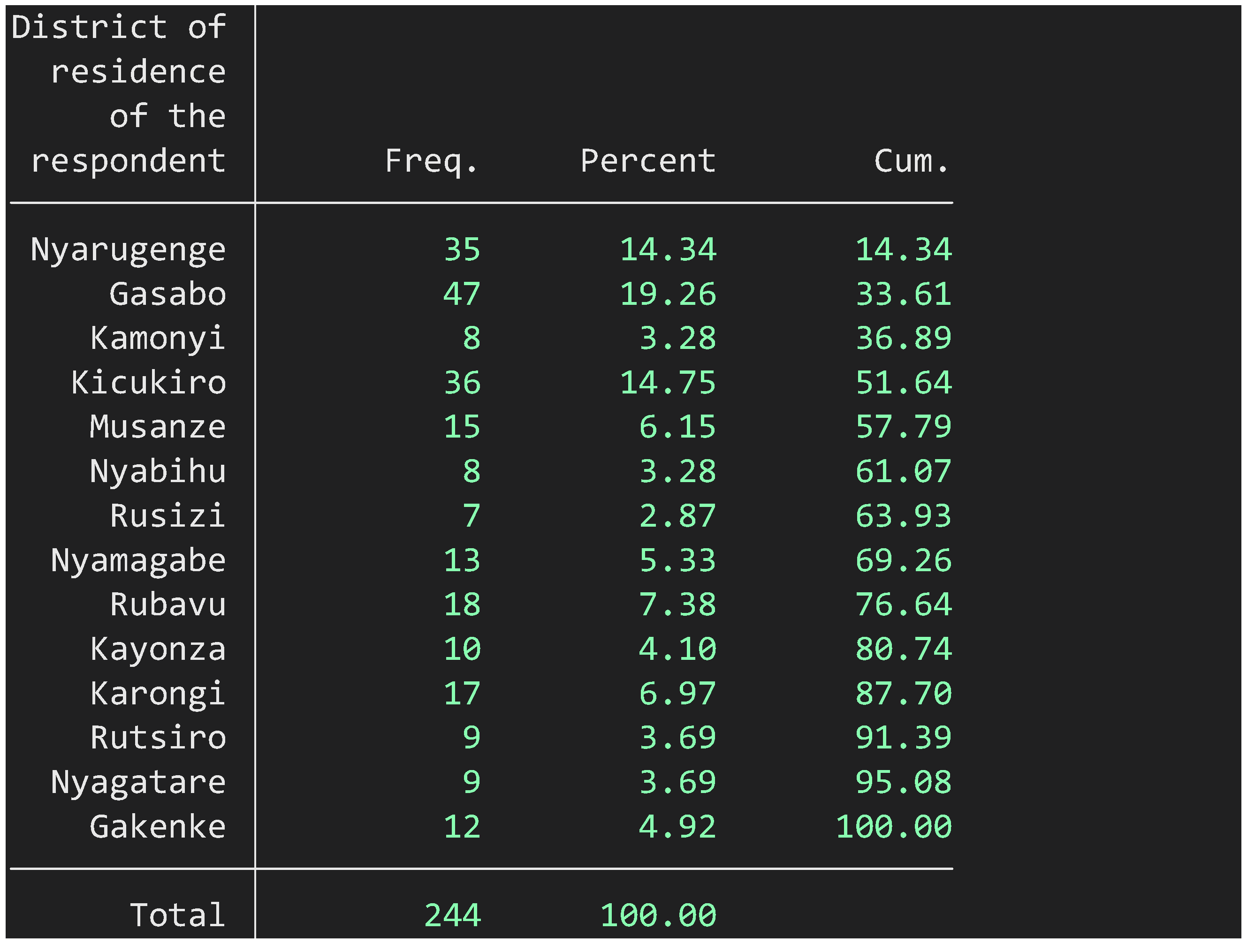

The study utilised the Simple Random Sampling (SRS) technique to determine the optimal sample size, with a total of 244 SMEs participating in the study. To select the sample, the district served as the primary sampling unit, and the locations (business centres) of SMEs were the secondary sampling units, which were randomly selected. Within each business centre, enumerators were guided by a sampling list that comprised all business operators registered in the wood value-chain association. This list was supplemented by other SMEs involved in the wood value chain.

To define the minimum sample size, the following sampling was applied:

where

: minimum sample size;

: confidence interval (1.96);

: 0.13, represents 13% relative precision; and

: our expected proportion, 0.50.

By replacing the functions into the value, the optimum sample size n was 227.

The data collection process was facilitated by a team of 4 data collectors who were deployed in different districts of SME operations across the country by the identified SME operators linked with wood activities. In

Appendix A, we present a table of districts and the number of businesses surveyed. The selection of businesses that were surveyed was guided by the list of business operators who are members of the Rwanda Wood Value Chain Association (RWVA) and all business operating in wood value chain located in the sampled business centre.

3.2. Models

The analysis framework began with Exploratory Data Analysis (EDA), which involved analysing and investigating patterns in the datasets and summarising the main characteristics through descriptive statistics. The EDA approach helped quantify and visualise the direct effects of the COVID-19 pandemic on SMEs through the following three pillars:

- (i).

the amounts of sales;

- (ii).

the number of employments;

- (iii).

the amount of taxes paid to the government (local and central) by comparing before and after the outbreak of the COVID-19 pandemic in Rwanda.

To ascertain the statistical significance of the impact, three multivariate linear regression models using the Ordinary Least Squares (OLS) method were applied (

Gujarati and Porter 2009). Additionally, our empirical analysis used Stata software version 18, while we produced graphs using Excel for better data visualisation.

The general multiple regression is specified as:

where

represents the dependent variable, b

0 is the intercept, b

i is the coefficient of independent variables represented by

, and

is the error terms.

Since the data are drawn from the sample, the analysis framework followed the following representation, which is believed to be the best approximate to the population:

To estimate the coefficient

, we followed the residual sum of squares (RSS) minimisation vector, summarised here as follows:

Model 1: Modelling effect on amounts of sales

To estimate the effect of the COVID-19 pandemic on SMEs, we used the financial data as recorded between March and June 2019 (Y

t−1 and March–June 2020 (Y

t)). We modelled the differences of sales between the two intervals and applied the following formula:

Thus, , where

represents sales in the COVID-19 period, and represents sale levels before lockdown. is the wood product sales in 2020, and is wood product sales in 2019. refers to the dependent variable computed as the dynamic difference between two reference periods. Since sales values are large number, we applied log transformation to reduce the size of the coefficients.

Therefore, the fitted regression model is represented as follows:

where

tax_after is the amount of taxes paid between April and May 2020,

Size_Entreprise is the dummy variable indicating the size of the business (small, medium, or large),

experience is the number of years the business has been in operations,

Outstanding_loan is the loan amount the business owes to others,

Business_Plan refers to existence of a business plan in a business,

Owner is the categorical variable explaining the ownership status (owned, cooperative, and partnership), and

Sex is the dummy variable indicating the gender of the business owner (female vs. male);

Type_Industry refers to types of activities performed by SMEs, here categorised into (i) wood wholesales, (ii) timber processors, (iii) mixed operations, and (iv) trees growing.

Model 2: Effect on Employment

To measure the impact of the COVID-19 pandemic on the employment effect, the reference period was set to the number of employees who were working in the business other than the owners and unpaid family members as of March 2020 and May 2020 (where the government had been implementing a gradual reopening of economic activities. The following formula was used to compute the difference in the number of employees:

where

is the number of employees reported in May 2020,

is the employees who were employed in March 2020, and

is the difference of the two reference periods.

Model 3: Effect on taxes

The analytical model to estimate the impact of COVID-19 on the tax effect took the reference period for the tax amount paid by the business owners between December 2019 (p

t−1) and January 2020 (p

t) relative to the amount of taxes paid between April and May 2020.

Here,

is the amount paid in the pre-pandemic period,

is the amount of tax paid amidst the crisis, and

is the dependent variable measuring the change in the taxes between the reference period. To deal with the large number of taxes, the amounts of the taxes were log transformed.

4. Results

4.1. Descriptive Statistics

In total, 207 (84.8%) small businesses, 27 (11) medium-sized enterprises, and 10 (4.1%) large-business owners or their representatives were surveyed from various regions of Rwanda. The sample size distribution by SME location shows that the City of Kigali was largely represented, accounting for 48.4% of respondents; the respondents from other districts were distributed as follows: Rubavu (7.4%), Karongi (7.0%), Musanze (6.2%), and Kamonyi and Nyabihu (3.3% each), while the Rusizi district was represented by 2.9% of the total respondents.

Figure A1 in

Appendix A provides the distribution of the respondents by district.

The demographic analysis of SME owners shows that 47.0% of business owners fall within the age range of 36–45 years, while 25% are between 24 and 35 years old. Regarding business ownership, sole proprietorships accounted for 72.1% of participants, while cooperatives constituted 20.1% of the total participants. Additionally, 22% of enterprises are in the forest or timber-growing category, 35.2% fall under the category of timber processing, including furniture making, 32% are involved in sales, including the wholesale of wood products, while 10.6% are involved in more than one category of wood businesses.

4.2. SME Characteristics before and after COVID-19

The survey data show that 42.9% of SMEs had an annual turnover ranging between FRW 2,000,000 and FRW 12,000,000, and 40.1% had an annual turnover amounting to FRW 2 million or USD 2000 or below. Furthermore, 83% of surveyed businesses were classified as small, and the medium enterprises accounted for 12.4% (

Table 1). SMEs in Rwanda are categorised as follows: FRW 0.3 to FRW 12 million are small enterprises, medium-sized enterprises are FRW 12 million to FRW 50 million, while large enterprises are those with an annual turnover of more than FRW 50 million (

MINICOM 2020). Additionally, 41% of businesses were in their early years of existence, while 27% of surveyed businesses had been in existence for more than 5 years.

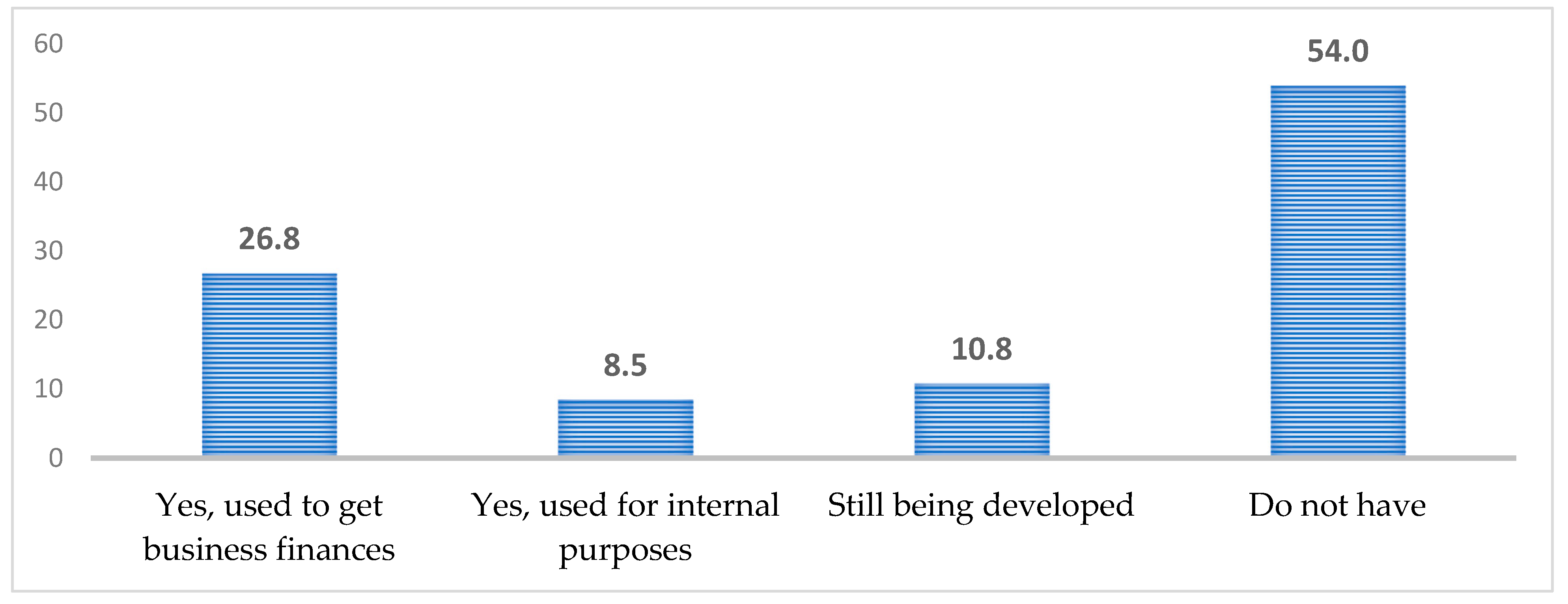

According to the Professional Accountants in Business Committee a business plan is a strategic instrument that serves a dual role. On one hand, it serves as an external tool used to obtain the funding essential for the development and growth of the business, and on the other hand, internally, it provides a plan for early strategic and corporate development (

Ball 2006). Among the surveyed SMEs, 26.8% had developed their business plans and used them to access funding in form of loans, 10.8% were still in the process of developing their business plans, while more than half of the SMEs (54.0%) did not have business plans (

Figure 1).

Looking at the sizes of SMEs, the data show that only the relatively large businesses have and use business plans to access finances, as reported by 80%. However, the rate of utilisation reduces among medium-sized enterprises, decreasing to 65.2%, and further declines substantially among small businesses. Only 18.9% of small businesses had business plans that were used to access finances prior to the survey period. Additionally, 6.9% had business plans for internal purposes only (

Table 2). The lack of business plans increases SMEs’ vulnerability, as they are not able to make internal growth projections, have risk mitigation and preparedness plans, and, in most cases, cannot access finances due to the absence of the relevant information on business growth prospects.

To understand the implications of the COVID-19 pandemic on SMEs in Rwanda, it is important to recall the duration of the lockdown period, which refers to the time where businesses were not operational due to the full implementation of virus containment measures, which principally aimed at limiting large-scale transmission within the community. In that respect, the data show that the average duration of the lockdown was 53.8 days (±18.9 standard deviation), with the maximum duration of business closures amounting to 109 days or 30% of the working days per year. These reported numbers of lockdowns are consistent with the national guidelines on business closures between March and May 2020, followed by gradual relaxations of lockdown measures afterwards.

4.3. Findings on the Effects of the COVID-19 Pandemic on SMEs

The analysis of the effect of COVID-19 on SMEs in Rwanda is structured around three main themes, mainly (i) sales, (ii) taxes, and (iii) employment.

4.3.1. The Effects on Business Sales

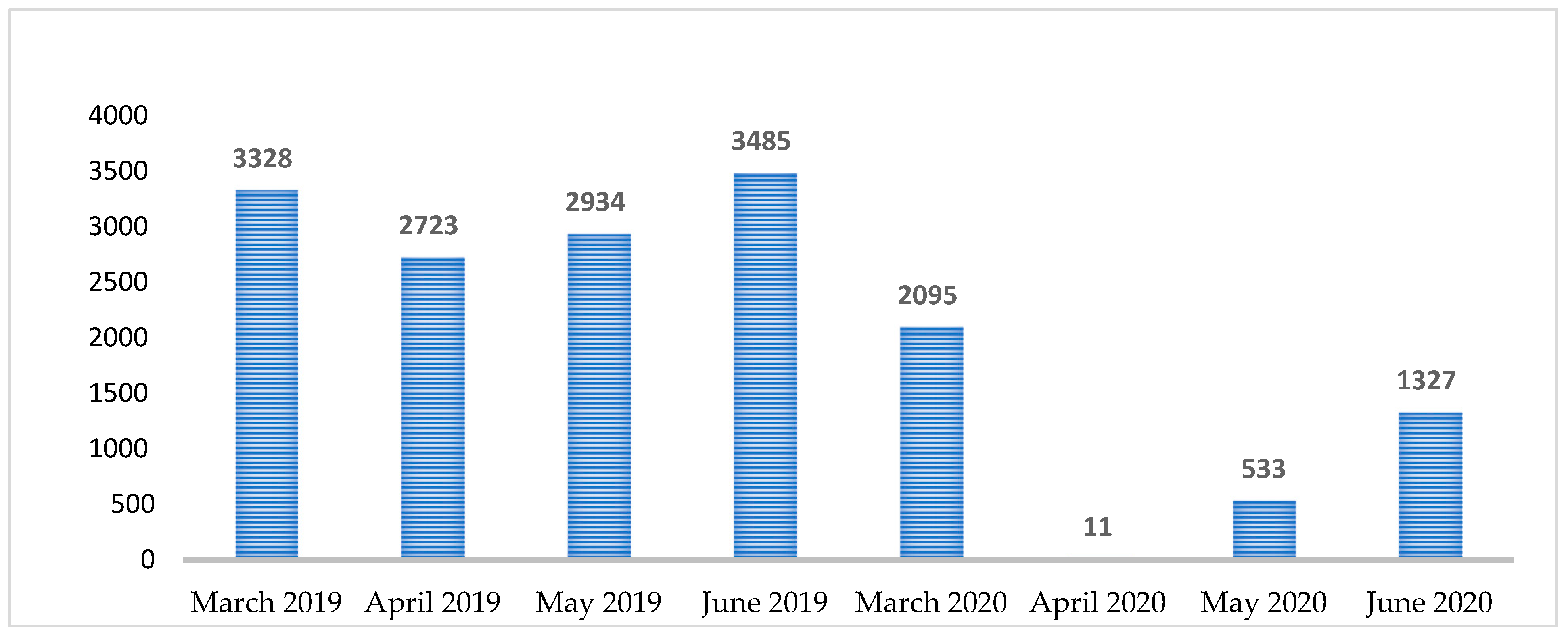

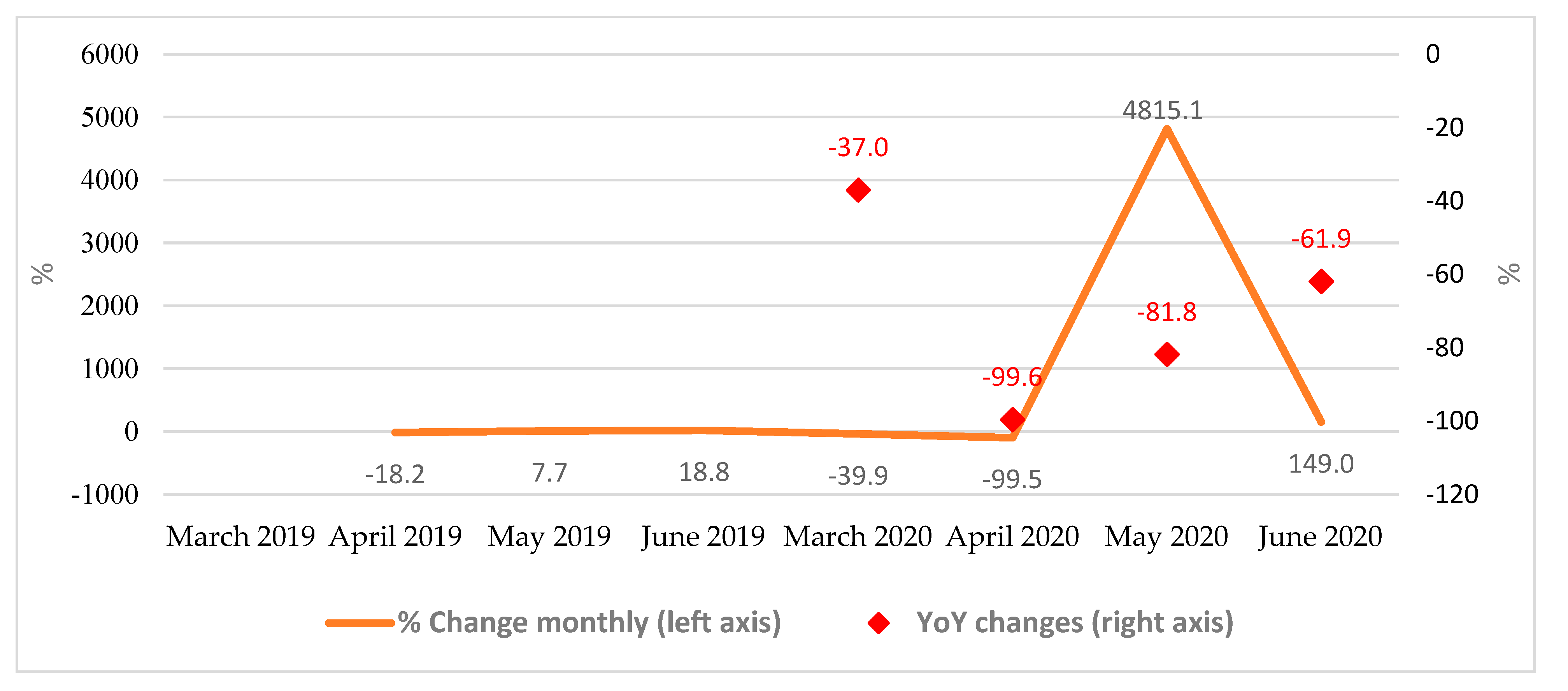

The guidelines for the lockdown indicated that only essential businesses could remain open. The guidelines allowed for the continuity of SMEs operating in pharmaceuticals, sanitation, and food provision. The data from surveyed businesses (

Figure 2 and

Figure 3) show a drastic downward trend compared to 2019 data. In March 2019, there was an average of sales of FRW 3.3 million, but this dropped to FRW 2.09 million, reflecting a decrease of 37% year on year. The sales plummeted even further in April 2020, declining by about 99% to only FRW 11,000 compared to FRW 2.3 million in April 2019.

However, the rate of sales reduction eased in May 2020, with a contraction rate of 81.8%. The average sales reported were FRW 533,000, down from FRW 2.9 million in the same month of 2019. Further negative sales were reported in June 2020, with reported changes dropping by 61.9% to an average of sales amounting to FRW 1.3 million compared to FRW 3.4 million in 2019. This slowness in the further decline of sales was a result of the gradual opening of economic activities in the country.

The sudden sales changes of SMEs and other business linked with the wood industry is a testament of a strong economic interconnectedness of the wood sector with other sectors in the economy.

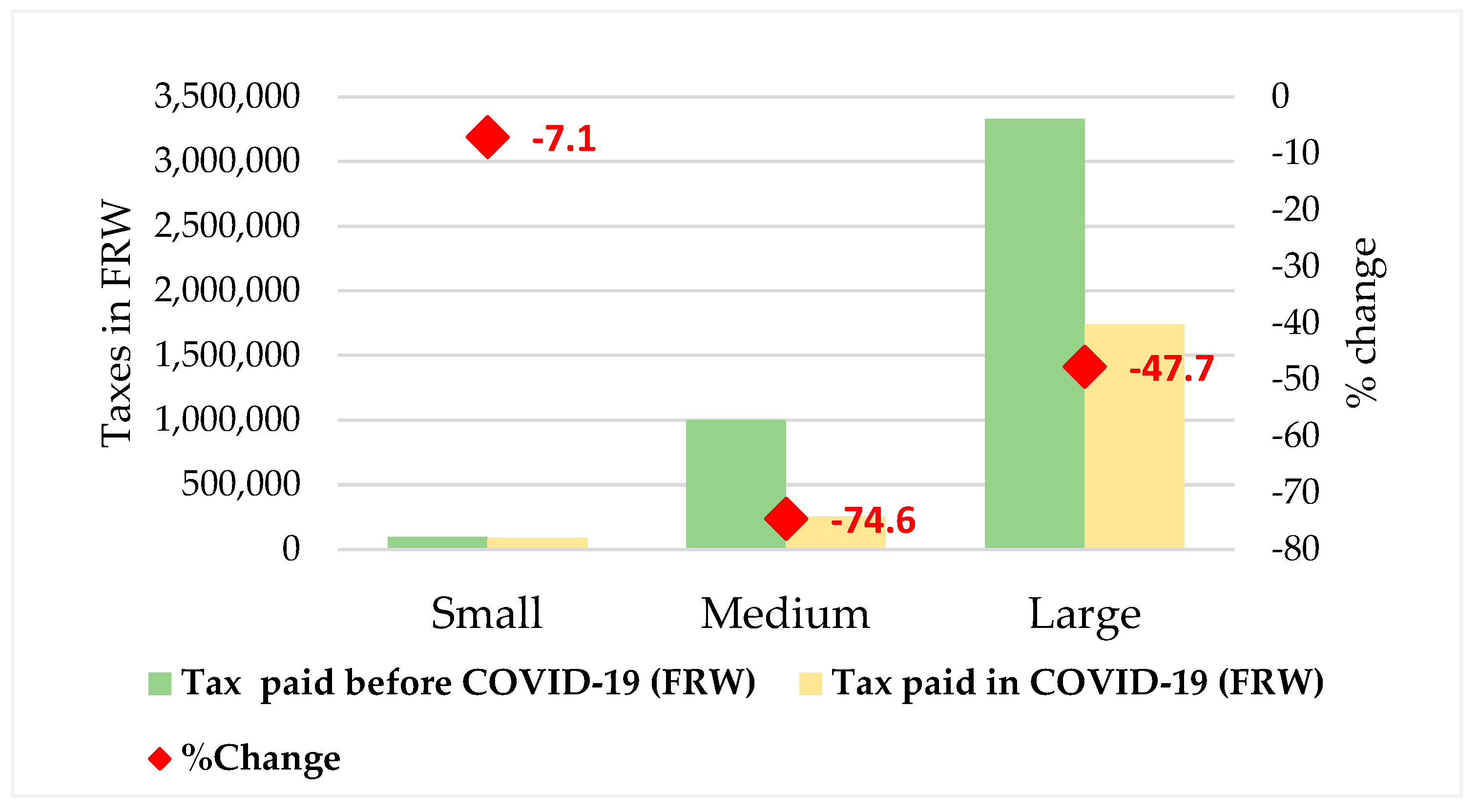

4.3.2. Effects on Taxes Paid to the Government

To measure the effect of the COVID-19 pandemic on tax levels, we examined two months preceding the lockdown (December 2019 and January 2020) and two months of lockdown (April and May 2020) and computed the effects by sub-activities. The data show that the taxes paid by SMEs decreased by 43.8% in April 2020 and further decreased to 81.2% in May 2020. Furthermore, considering the combined effect of COVID-19 on taxes before and during the lockdown period, the amount of taxes paid significantly decreased by 74.6% among medium-sized enterprises, by 7.1% among small-sized enterprises, and by 47.7% among large businesses (

Figure 4). This pattern among small enterprises can be partly explained by the types of taxes and local levies imposed on them, which are mainly independent of sales or turnover, while a higher impact was largely felt among medium-sized enterprises.

4.3.3. The COVID-19 Pandemic Effect on Employment among SMEs

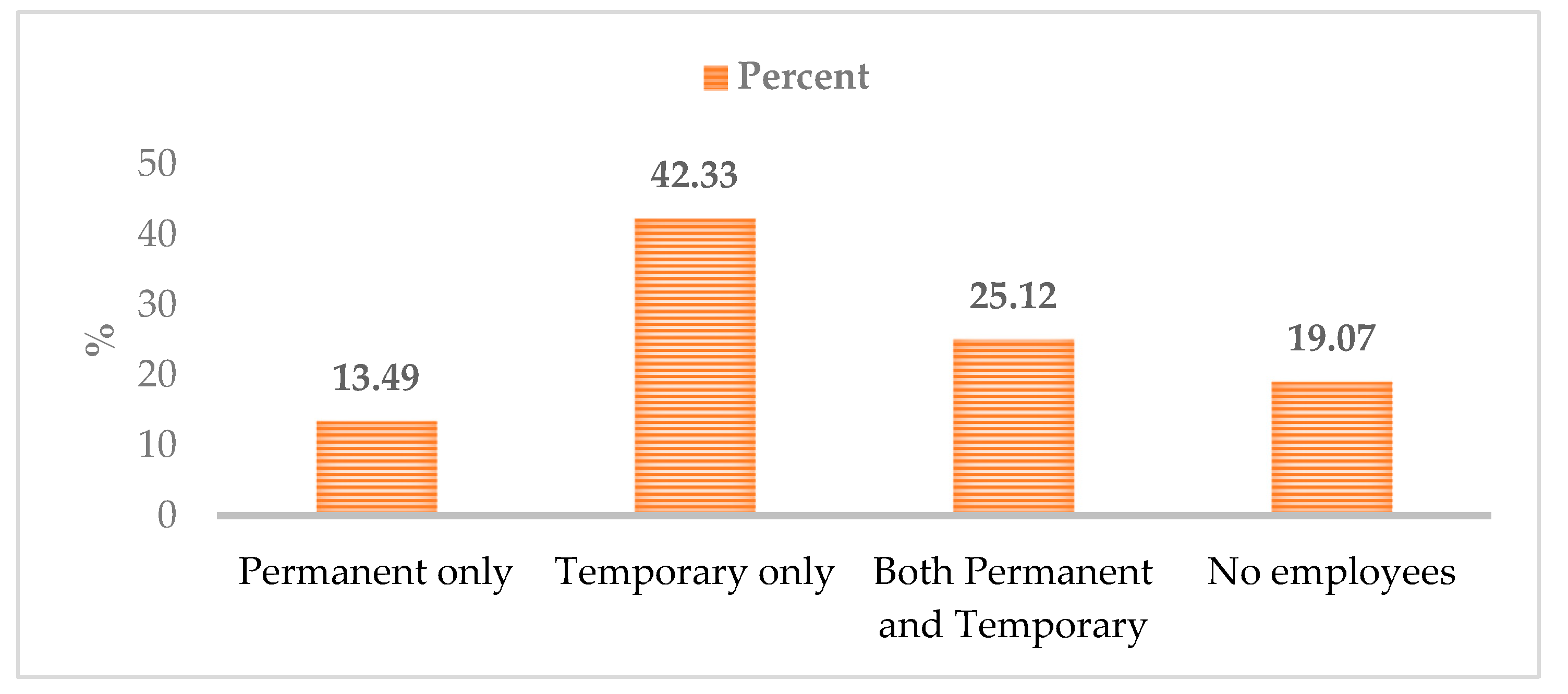

In total, 81% of surveyed businesses had at least one employee.

Figure 5 shows that SMEs mainly employed temporary employees (42.3%), hired on an as-needed basis. Moreover, the data reveal that one in four SMEs employed both temporary and permanent employees, while 13.5% had only permanent employees. However, 19% of surveyed businesses had no employees or unpaid family members. This indicates that the business owner was the sole individual working for the business.

The research further found that businesses with fewer than five employees overall were not significantly affected by the employment changes, experiencing a positive change of 33.3%. However, this was because businesses with more than five employees downsized the number of employees during the lockdown period. There was a 35.9% reduction in employment among businesses with 5–10 employees, and a reduction of 24% among those with 10–30 employees. Among the businesses that employed more than 50 employees (both permanent and temporary employees combined), there was a negative change of 36.4%. The average employment loss was estimated at 12.6% among the surveyed SMEs in Rwanda (

Table 3).

To test the relevance of the Ordinary Least Squares regression in this study, we tested the normality assumptions of the variable of interest with the Shapiro–Wilk (S-W) test of normality.

Table 4 shows that all variables are normally distributed (

Jiajuan et al. 2009).

Through regression analysis, the analysis shows the following distribution of the relative effect of employment on each category of business in

Table 5.

The COVID-19 pandemic has had a significantly higher magnitude of negative effects on small businesses, with a −1.17-likelihood relative to medium-sized enterprises. Conversely, during the opening period, medium-sized enterprises had a higher likelihood (+1.17) of employing more people relative to small enterprises. Both findings for small- and medium-sized enterprises were significant at the 0.05 level. Among large enterprises, there was a −1.3 likelihood of employing more people relative to medium-sized enterprises. However, descriptive data demonstrated that in the early opening period, large enterprises and medium-sized businesses started with a small number of employees due to gathering restrictions and uncertainty amidst the crisis.

4.4. Findings of Multivariable Regression Analysis

The multivariable regression analysis (

Table 6) confirms the effect of the COVID-19 pandemic on employment among SMEs (Model 1). The main drivers were (i) reduced sales levels, which is highly significant at a

p-value of 0.001 compared to a 0.05 significance level; (ii) the size of the enterprise, where the effect was felt more among the medium-sized enterprises, significant at

p = 0.03 < 0.05; and (iii) taxes paid: while this variable is significant at 0.1, the

p-value 0.055 is slightly still closer to a 0.05 significant level, which would imply that enterprises who had more taxes to pay were more likely reduce employment during the pandemic period.

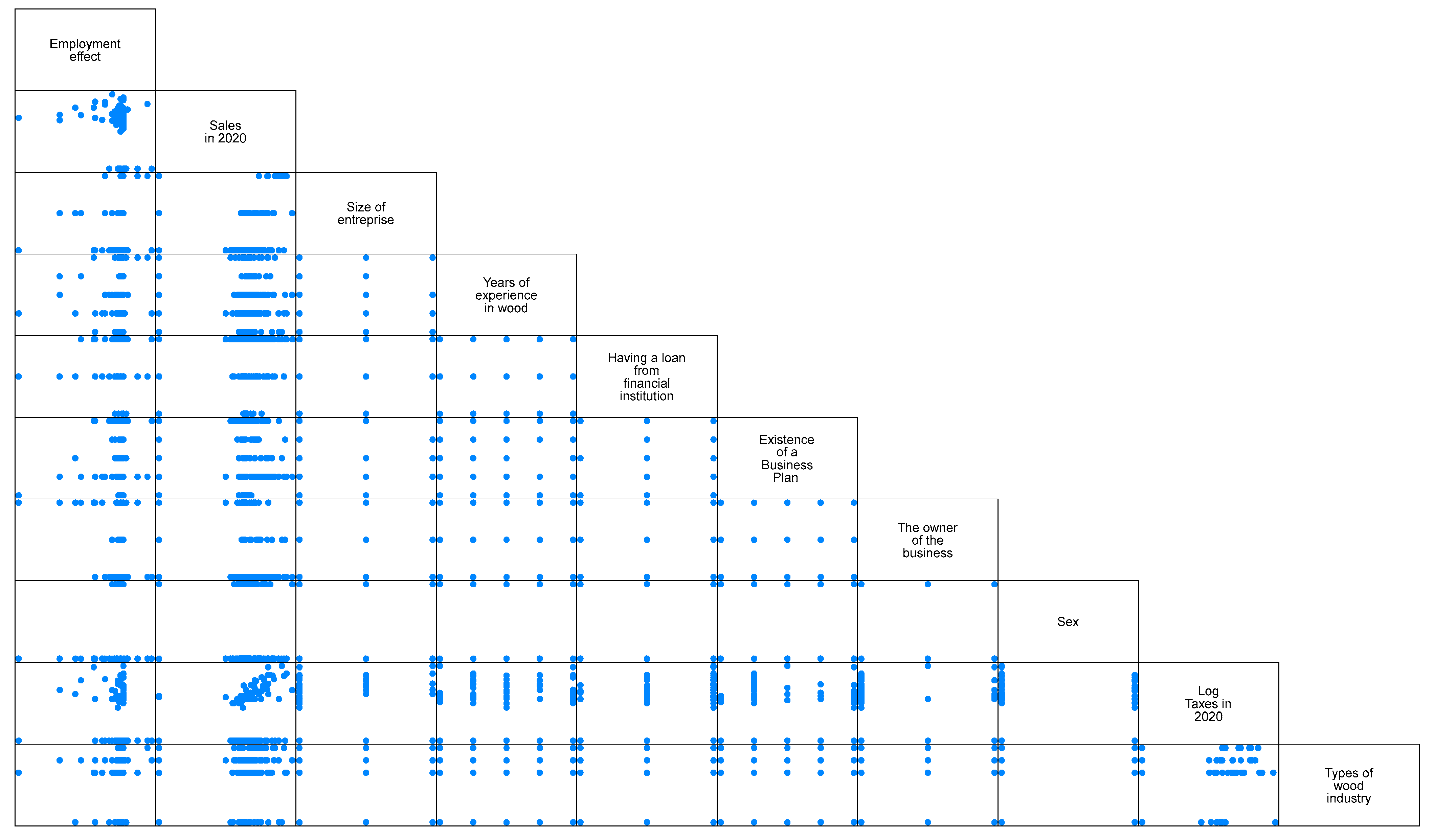

Figure A2 in

Appendix A provides the correlation distribution of the critical variables for analysis.

In the findings of the COVID-19 pandemic’s effect on sales among SMEs (Model 2), there is evidence of a drastic negative impact among the surveyed SMEs. The main determinants of the reduction in sales are (i) the level of taxes, (ii) size of the enterprise, and (iii) type of ownership. It is worth mentioning that the effect was highly significant (computed p-value is 0.013 versus a 0.05 significance level) among small enterprises. However, the magnitude of the effect reduces among medium-sized enterprises. This suggests a certain level of resilience as enterprises move up the classification ladder. However, the data do not show statistically significant variation in the magnitude of the effect of other variables such as the gender, type of industry, existence of a business plan, years of experience in business operations, and changes in employment.

Regarding the effect of the COVID-19 pandemic on taxes, as expected, the COVID-19 pandemic effect on taxes is linked with reduced sales levels across all SMEs. The findings are statistically significant at a p-value of 0.000 compared to 0.05 significant levels. The data suggest that any unit change (in absolute terms) of sales contribute to a change in taxes by 50%. Additionally, the impact of taxes was more pronounced among medium and large enterprises, though this variation was not statistically significant. By industry type, the effect was observed to be more significant among timber processors, with a p-value of 0.037 compared to the 0.05 significance level. Other variables in the models do not appear to be statistically significant on tax changes. Therefore, the effects of COVID-19 on SME taxes do not vary significantly across SMEs based on characteristics such as ownership, years of experience in business operations, and gender of the owner, among others.

4.4.1. Other Reported Effects of the COVID-19 Pandemic on SMEs

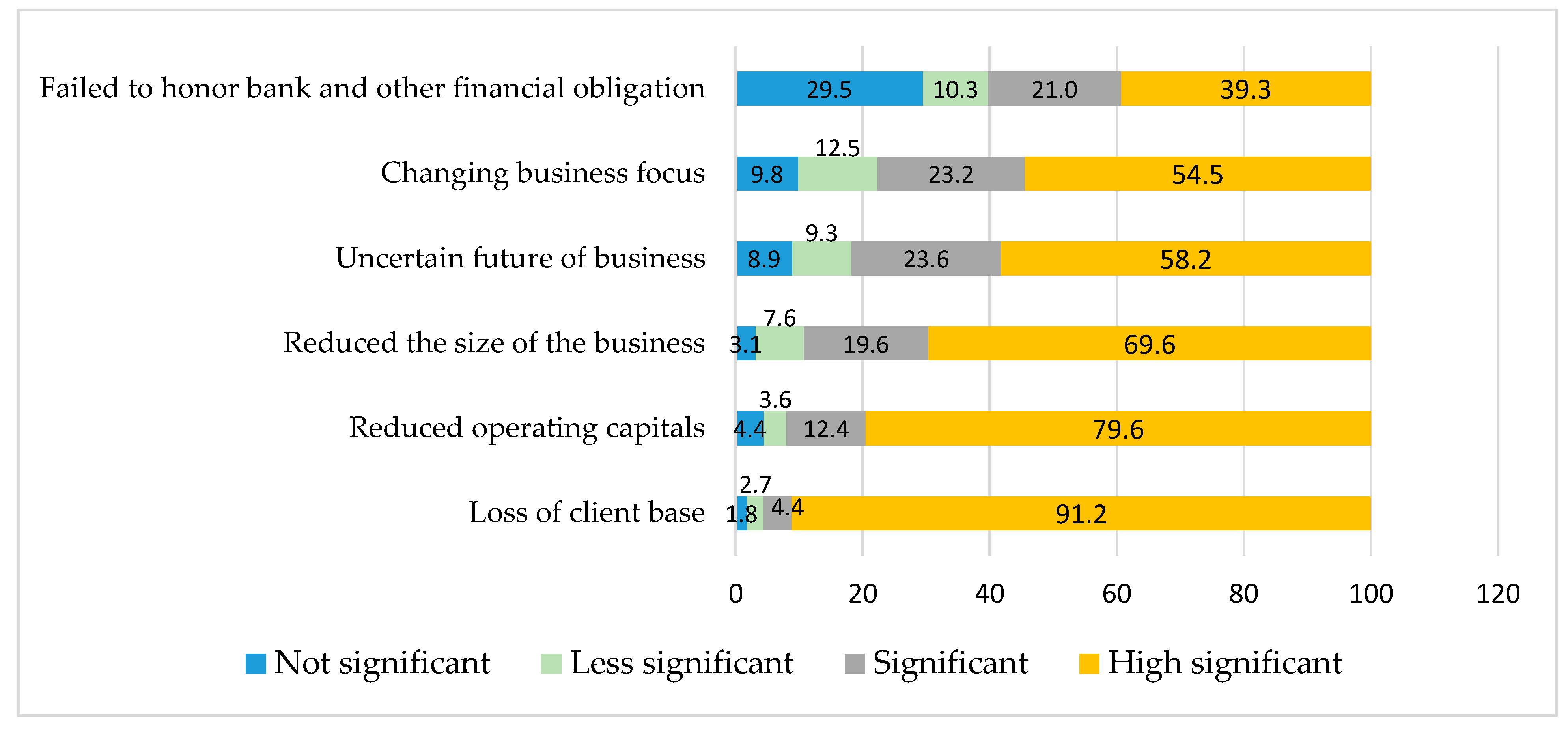

As discussed in the literature reviews, some studies suggested that due to high vulnerability to shocks, SMEs had difficulties in reopening their businesses after a very long time of inactivity. In the survey, the business owners were asked to share their perceptions of the other consequences that COVID-19 had caused them.

The following areas emerged as key areas that were severely affected SMEs: (i) loss of client base, reported by 91.2%; (ii) reduction in operating capital, indicated by 79.6%; and (iii) reduction in the size of the business, reported by 67%. However, more than half (60.3%) of the respondents noted that they failed to honour their financial obligations with banks or other financial institutions as a result of the COVID-19 pandemic and its associated prevention measures (

Figure 6).

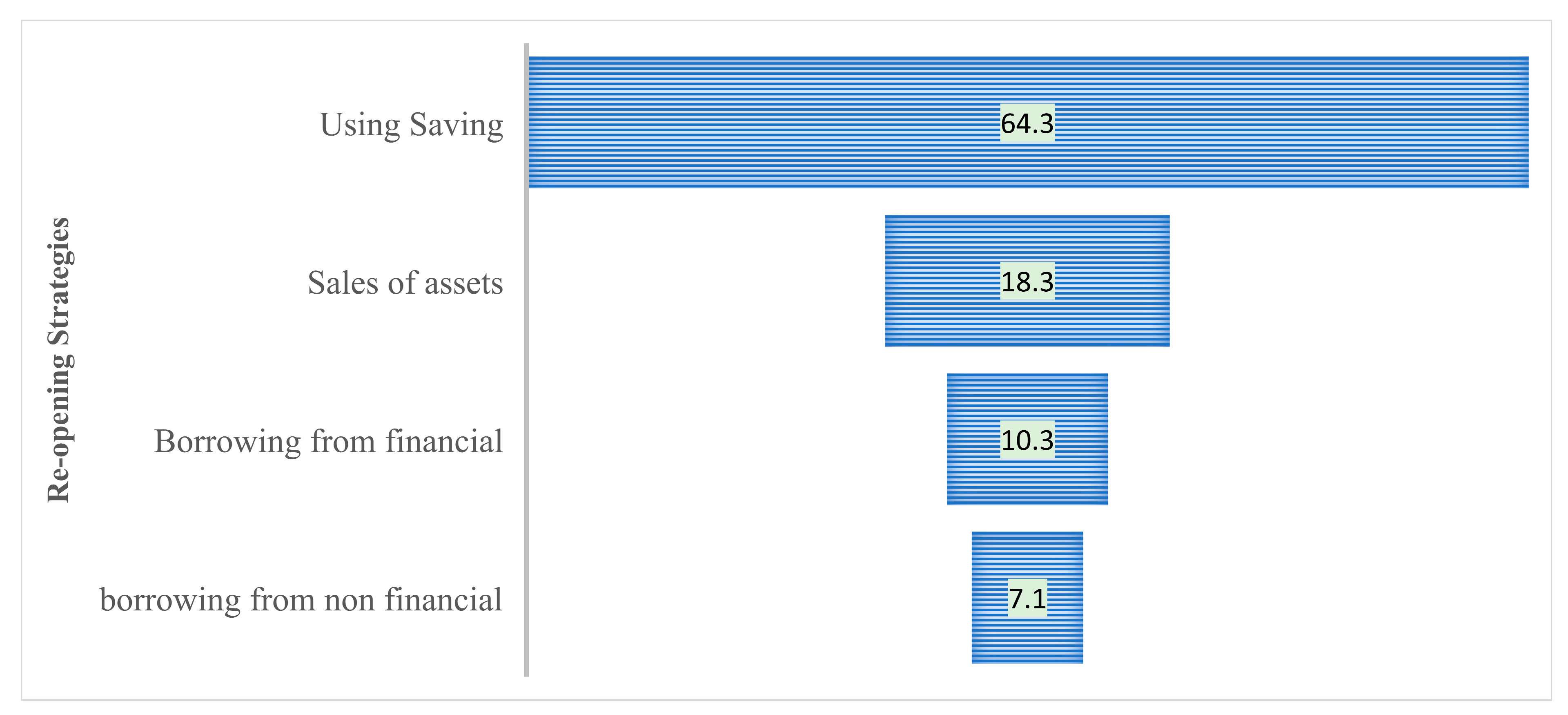

4.4.2. SME Reopening Strategies

After more than six weeks of a complete business closure, the Government of Rwanda began implementing gradual measures for reopening, allowing businesses to resume their operations. Building on the above findings, which indicated that business capital was depleted, and employment was severely affected, along with uncertainty about the future of businesses, SMEs adopted various measures to reopen. The data presented in

Figure 7 show that most SME operators had to resort to using their savings (64%), while a sizable proportion of business operators were compelled to sell their assets (18%) and borrow from financial institutions (10.3%) to reopen their business activities.

The strategies applied by SMEs to reopen their businesses statistically differ by the years in business operations (operational time), with a probability value of 0.008 against a 0.05 significance level. Among SMEs with less than 2 years of experience, 50% used their savings, while those with 5 to 10 years saw 72.7% utilising savings. For those with 10 to 15 years of experience, savings accounted for 50%, while 42.9% of SMEs opted for borrowing from financial institutions. This confirms the resilience-building aspects of SMEs that have operated for a longer period. However, the data show that one in five SMEs has chosen to sell their assets, including homes, to reopen business activities.

Regarding SME size, there is a difference among the options used to reopen; however, a large proportion (83.3%) of medium-sized enterprises used savings. Among small-sized businesses, 60.1% used savings, and 20.8% opted to sell some of their accumulated assets, including homes (

Table 7).

5. Discussion

The analysis of the effect of COVID-19 on SMEs in Rwanda shows that the effect from the COVID-19 pandemic and associated measures have impacted SMEs, especially wood-based business, in different dimensions. The effect was recorded, particularly on employment, because SMEs had opted to downsize their employment levels, and the levels of sales, relative to those recorded in 2019 were severely affected, down to closer to no sales in April of 2020. The April month shows the peak period of lockdown effects. A similar study conducted in Asia shows that during the complete lockdowns, firms reduced by 40% to their number of regular employees. The study has further confirmed the high vulnerability of employment in MSMEs (

Sonobe et al. 2021).

Regarding the pandemic effects on taxes, while there is a significant effect of COVID-19 on reduced taxes paid by enterprises, the main driver was the reduction in sales recorded during the lockdown period. Additionally, a significant tax reduction was observed among medium-sized enterprises, while among small-sized enterprises, a minimal reduction in taxes was paid. This can be explained partly by the fact that small enterprises pay quasi-fixed, or lump-sum amounts to the government; thus, the taxes are less likely to be inelastic to sales volumes or other temporary socio-economic shocks. A recent study on SME compliance with taxes shows that for SMEs to strengthen tax compliance, positive social behaviour and patriotism play a critical role along with the regulatory enforcement of tax authorities (

Bani-Khalid et al. 2022).

The findings from this study are consistent with other countries’ experiences during the lockdown.

Oyewale et al. (

2020), in their study on estimating the impact of the COVID-19 pandemic on small- and medium-scale enterprises in Nigeria, found out that that majority of entrepreneurs had been affected (both severely and slightly) by the COVID-19 pandemic through the partial or total lockdown and movement restrictions. Furthermore, the data show that the effect was much higher among the non-agriculture sector, which is the case for Rwanda. A similar studies conducted in Kenya and Malaysia (

Siddiqui et al. 2020;

Hasin et al. 2021) also showed that SMEs have been facing unprecedented income losses and uncertainties about their future because of business disruptions due to the outbreak of COVID-19, and the effect has been more perverse, because MSMEs lack financial reserves to meet needy expenses during emergencies like in lockdown.

However, a study conducted in Latin America (Brazil, Chile, Colombia, Mexico, Paraguay, and Peru) to measure the impact of the COVID-19 pandemic on SMEs shows a mixed effect; on one hand, there has been a rapid fall in revenue earnings across all SMEs, while on the other hand, the pandemic has led to a significant shift in sales from in-store based to online sales, along with a change in SME employee attitudes to work from home across most industries in Latin America (

Cerda et al. 2023).

The reopening strategies were diversified when the Government of Rwanda started to lift or relax some of the COVID-19 virus-containment measures; the SMEs had a personalised approach to address each company’s unique needs to better reopen, with most of the companies trying to rely on accumulated savings and selling their accumulated assets. These findings are also in line with results from a study conducted in Bangladesh exploring the adoption of innovations among SMEs triggered by the COVID-19 pandemic. The researchers concluded that SMEs’ sustainability positively accelerated by adopting innovative finance and integrating technological adaptation in their operations (

Pu et al. 2021).

However, the Government of Rwanda, through its economic recovery plan, put in place financing instruments to accompany the SMEs and large corporations in embarking on their rapid recovery.

6. Conclusions, Policy Implications, and Limitations

6.1. Conclusions

The study analysed the effects of the COVID-19 pandemic on small- and medium-sized enterprises (SMEs) in Rwanda using wood firm-level data. It aimed to generate evidence on the quantitative impact of the pandemic on SME sales, employment, and taxes in Rwanda while also assessing the approaches applied by SME owners in the reopening and recovery process, namely when business operations and movement restrictions measures of people were being lifted. The findings confirm that the COVID-19 pandemic has significantly affected sales, employment, and taxes paid by SMEs, with notable differences among SMEs based on their size and sales levels. Furthermore, the analysis reveals that SMEs resorted to using savings and selling already-accumulated assets to restart their businesses once the government began to gradually reopen economic activities.

6.2. Policy Recommendations

Given the above, the study recommends the following policy actions to ensure stronger SME resilience, foster employment creation, and thus accelerate the return of SMEs to the pre-COVID-19 situation in Rwanda and elsewhere:

To ensure sustainable access to business financing, SME operators should be given special consideration and prioritisation to access the government financing facilities to accelerate their operations and reach the pre-COVID-19 status. The Rwanda Private Sector Federation (PSF) and wood operators’ association in particular should establish additional financing and technical support to complement the government’s financing modalities and to avail adequate and affordable financing among SMEs, which will further strengthen emergency preparedness and responses.

The data show significant linkages between SME operations and taxes, among other financial obligations. There is a need to design SME-friendly fiscal policies and programmes, which should be activated during a socio-economic crisis to enable them to cushion the direct and indirect effects of the shocks.

Savings have proven to be a primary source of support during the hard times as the SMEs reopen and embark on recovery, and the government, in collaboration with the cooperatives and associations including Rwanda’s Private Sector Federation (PSF), and banks (both commercial and microfinances) will need to continually invest in promoting savings practices to increase the capacity of SMEs of all sectors and sub-sectors to face the future uncertainty and socio-economic shocks, thus paving the way to economic sustainability.

Additionally, there is a need to develop complementary savings products tailored to SMEs’ needs, to be relied upon during periods of economic hardships. Among SME operators in the wood sub-sector, they should leverage conducive government policies, mainly those relating to the “Made in Rwanda” programme and invest more in technological and financial innovations and product diversification to meet the market demand in SMEs.

6.3. Limitations

This analysis has some limitations related to the relatively small sample size, which may not fully represent the diverse SMEs operating in various sectors of the economy. Future studies should consider larger datasets encompassing a broader range of SMEs. Academically, there is also a need for a large-scale analysis of the COVID-19 pandemic on SMEs covering multiple types of businesses and using large-scale data sources, namely secondary data from financial and non-financial sources as well as survey data, to come up with a comprehensive understanding of the long-term effects of COVID-19 on SME operations.