Cost Inefficiency of Japanese Railway Companies and Impacts of COVID-19 Pandemic and Digital Transformation

Abstract

1. Introduction

2. Literature Review

2.1. Stochastic Frontier Analysis (SFA)

2.2. Efficiency Analysis of the Railway Sector

2.3. Efficiency Analysis of Public Transport Other Than the Railway Sector

2.4. The Impact of the COVID-19 Pandemic and Digital Transformation

2.5. The Method to Improve Cost Inefficiency

2.6. Position of This Study

3. Methodology

3.1. Methodology

- (i)

- (percentage of local lines’ operating kilometers): to examine whether inefficiency increases with a higher percentage of local routes and fewer users.

- (ii)

- (number of transformer substations): to examine whether the cost of operating equipment represented by transformer substations, including overhead line facilities and other ground infrastructure required for electric railways, affects inefficiency.

- (iii)

- (population density of railway operating areas: to examine whether population density in relation to the number of railway passengers affects inefficiency.

- (iv)

- (railway usage rate): to examine whether railway usage rate affects inefficiency.

- (v)

- (dummy variable of regional core city) and (dummy variable of local areas): to examine whether there are differences in inefficiency according to city size and location.

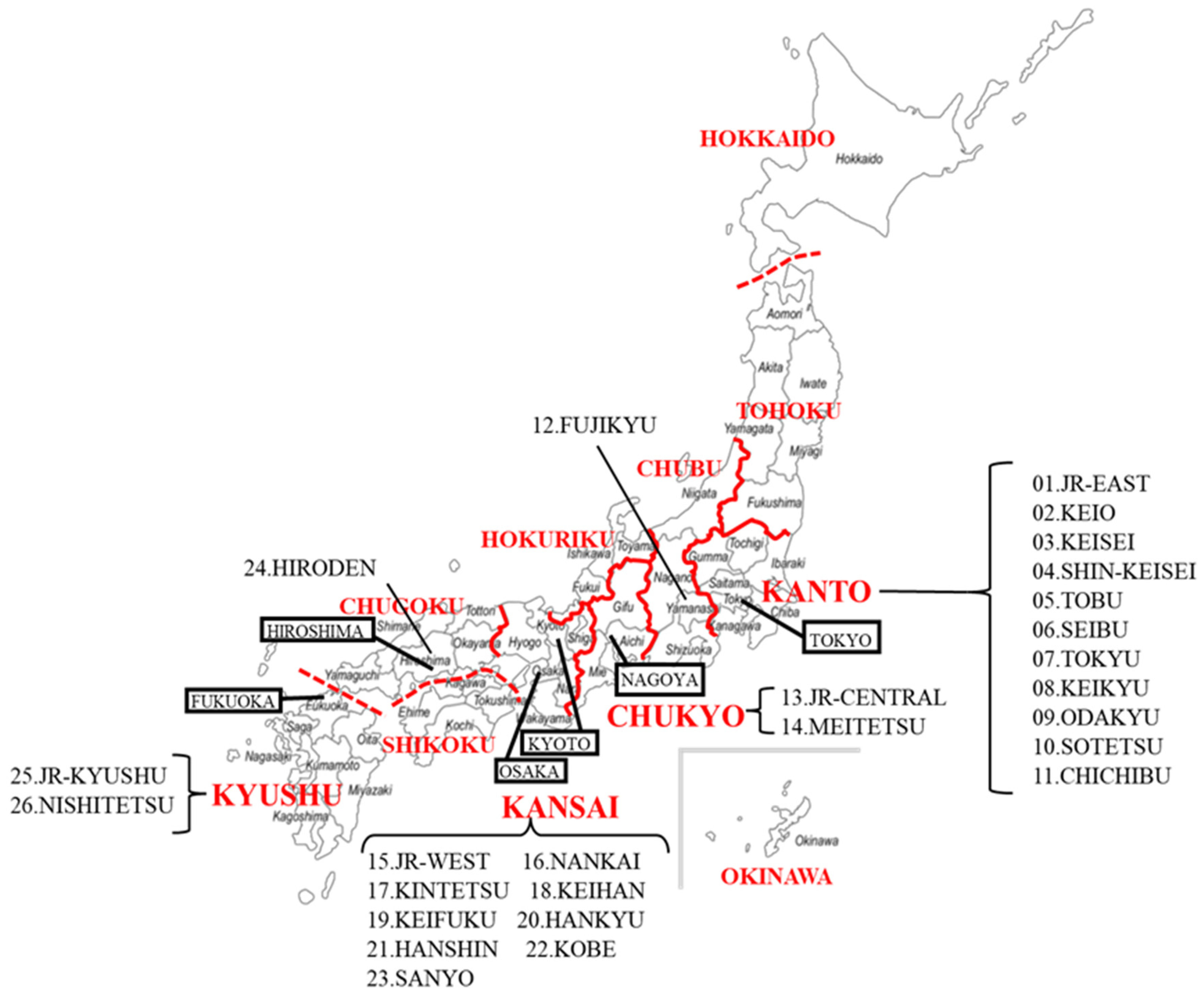

3.2. Data

- (i)

- Percentage of operating kilometers of local lines: We used data from the Annual Report on Railway Statistics. Specifically, this is the ratio of all local lines’ operating kilometers, calculated as an average daily transit capacity (transit density) of local lines with less than 2000 passengers/day to the total operating kilometers. Here, the limit of 2000 passengers/day is determined by Japan National Railways as a guideline for discontinuing railway lines.

- (ii)

- Number of transformer substations: We used data from the annual securities reports of each railway company. This number represents the total number of traction substations owned by each railway company.

- (iii)

- Population density of railway operating areas: We used census data for the population and the area of each prefecture. As the census is conducted every 5 years, the most recent census data are used for several years. For example, 2005 data were used from 2005 to 2009 and 2010 data were used from 2010 to 2014. Specifically, we used the population density of the prefecture in which each railway company operates. If the operating area extended over several prefectures, the population density was calculated using the average value.

- (iv)

- Railway usage rate. We used data from the inter-prefectural passenger table of the Inter-Regional Travel Survey in Japan. However, as we could not access data on private car use, we used the percentage of railway users relative to that of the entire public transport system. Specifically, we calculated the rate for the four JR companies (JR-EAST, JR-CENTRAL, JR-WEST, and JR-KYUSHU) and for the OPR companies using Equation (6):

- (v)

- Dummy of regional core city: It takes 1 if the operating area includes an ordinance-designated city, excepting three metropolitan areas (Tokyo, Kanagawa, Saitama, Chiba, Osaka, Kyoto, Hyogo, Nara, Wakayama, Aichi, Gifu, and Mie prefectures), that is, Fukuoka, Kumamoto, Hiroshima, Okayama, Shizuoka, Hamamatsu, Niigata, or Sendai City, and 0 otherwise.

- (vi)

- Dummy of local areas: It takes 1 if the three metropolitan areas and regional core city are not included in the operating area, and 0 otherwise.

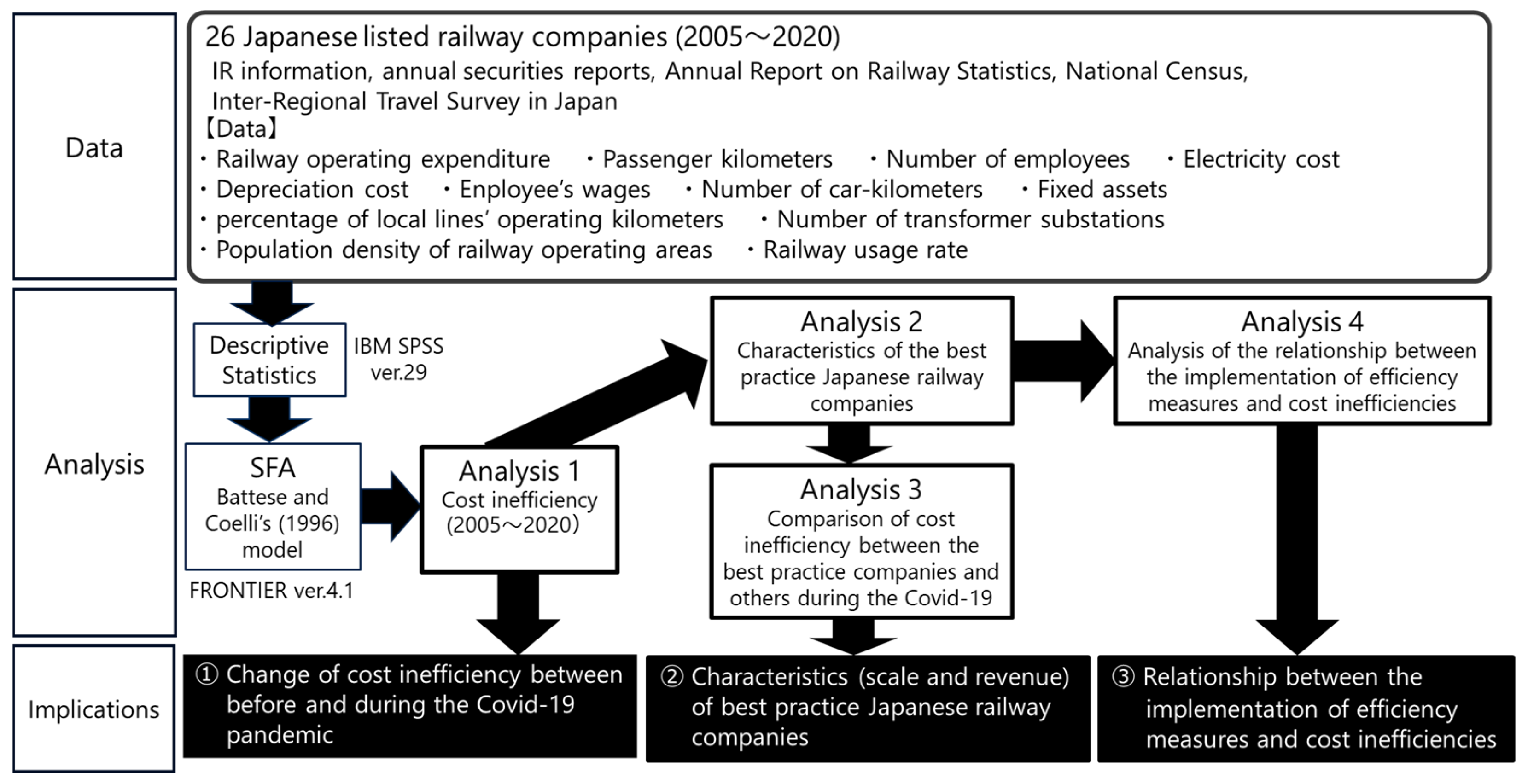

3.3. Flow of Analysis

4. Results and Discussion

4.1. Estimation Results for Stochastic Cost Frontier Function

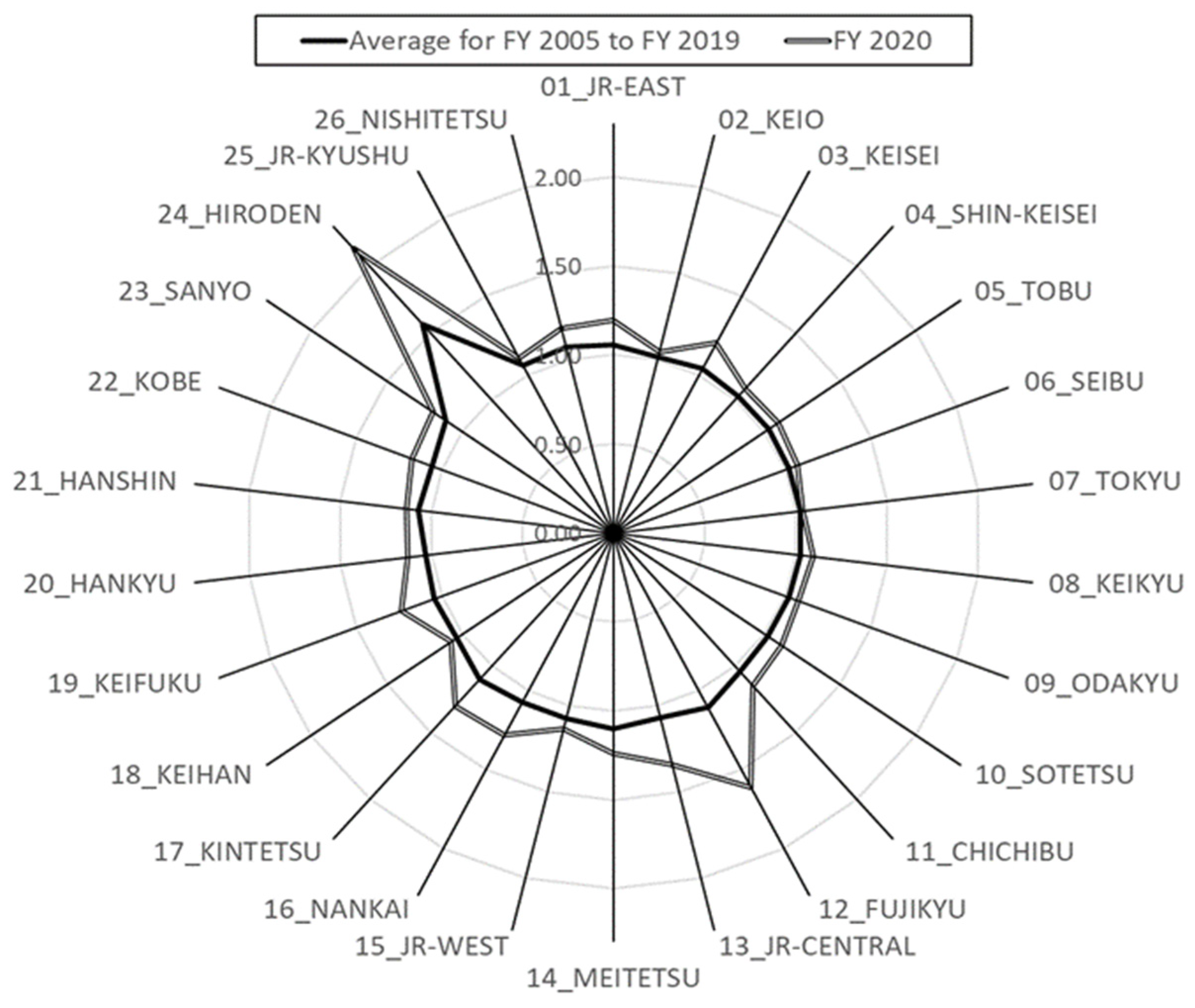

4.2. Estimation Results of Cost Inefficiency

4.3. Comparison of Cost Inefficiency Before and during the COVID-19 Pandemic

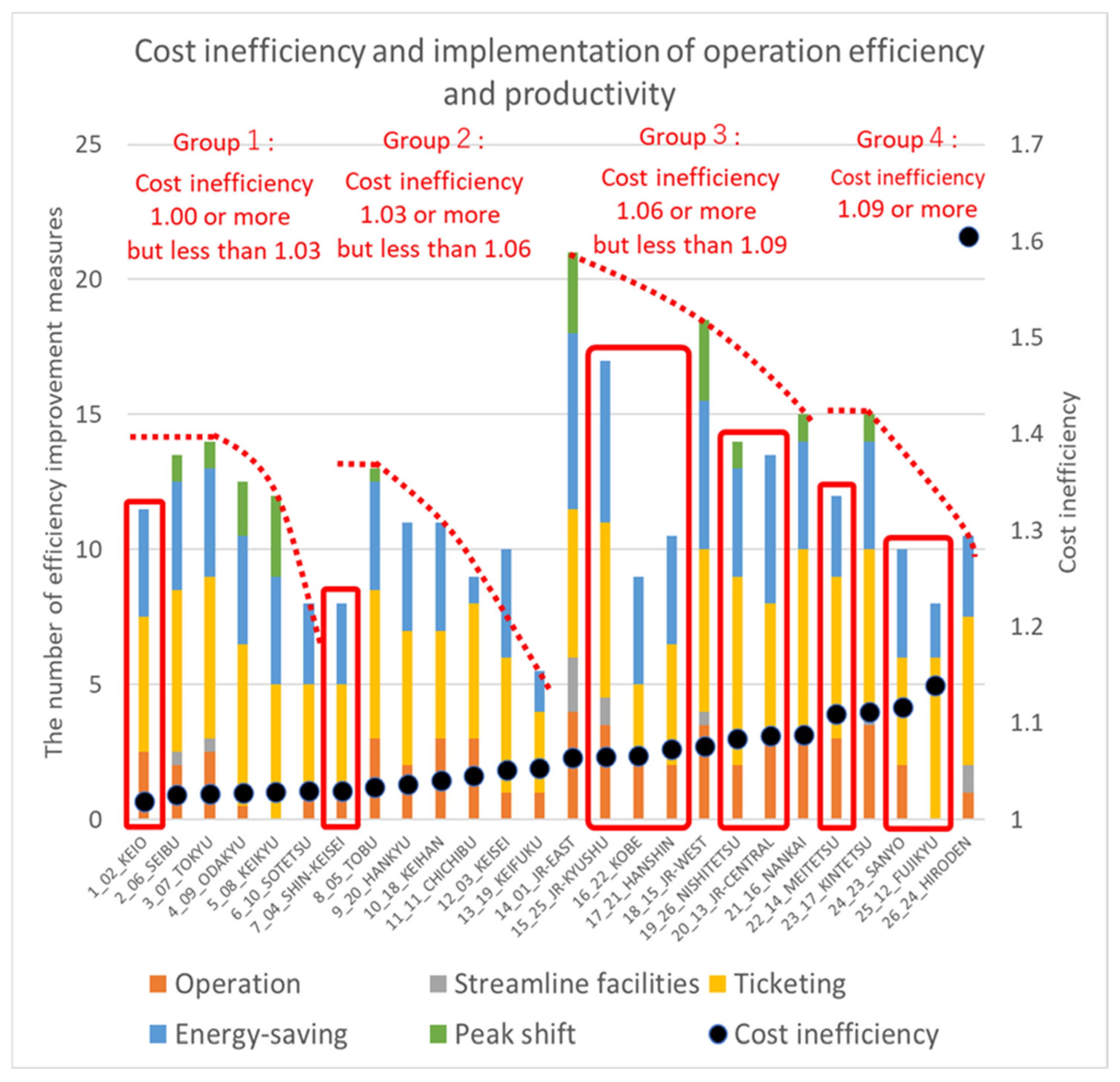

4.4. Measures for Efficiency Improvement

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aigner, Dennis, C. A. Knox Lovell, and Peter Schmidt. 1977. Formulation and estimation of stochastic frontier production function models. Journal of Econometrics 6: 21–37. [Google Scholar] [CrossRef]

- Altieri, Marcelo, Erza Raskova, and Álvaro Costa. 2022. Differences in railway strategies: The empirical case of private, public-owned, and third-sector railways in Tokyo. Research in Transportation Business & Management 43: 100787. [Google Scholar] [CrossRef]

- Amornkitvikai, Yot, Martin O'Brien, and Ruttiya Bhula-or. 2024. Toward green production practices: Empirical evidence from Thai manufacturers’ technical efficiency. Journal of Asian Business and Economic Studies. [Google Scholar] [CrossRef]

- Asmild, Mette, Torben Holvad, Jens Leth Hougaard, and Dorte Kronborg. 2009. Railway reforms: Do they influence operating efficiency? Transportation 36: 617–38. [Google Scholar] [CrossRef]

- Battese, George, and Tim J. Coelli. 1995. A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empirical Economics 20: 325–32. [Google Scholar] [CrossRef]

- Battese, George, and Tim J. Coelli. 1996. Identification of factors which influence the technical inefficiency of Indian farmers. Australian Journal of Agricultural Economics 40: 103–28. [Google Scholar] [CrossRef]

- Bergantino, Angela Stefania, Mario Intini, and Nicola Volta. 2021. The spatial dimension of competition among airports at the worldwide level: A spatial stochastic frontier analysis. European Journal of Operational Research 295: 118–30. [Google Scholar] [CrossRef]

- Bonanno, Graziella, and Filippo Domma. 2022. Analytical Derivations of New Specifications for Stochastic Frontiers with Applications. Mathematics 10: 3876. [Google Scholar] [CrossRef]

- Bourjade, Sylvain, and Catherine Muller-Vibes. 2023. Optimal leasing and airlines’ cost efficiency: A stochastic frontier analysis. Transportation Research Part A 176: 103804. [Google Scholar] [CrossRef]

- Bulková, Zdenka, Milan Dedík, Michal Lovíšek, Katarína Janošková, and Juraj Vaculík. 2023. Increasing the quality and efficiency of the transportation process in railway passenger transport in the case of another pandemic period. Transport Technic and Technology 19: 7–12. [Google Scholar] [CrossRef]

- Catalano, Giuseppe, Cinzia Daraio, Marco Diana, Martina Gregori, and Giorgio Matteucci. 2019. Efficiency, effectiveness, and impacts assessment in the rail transport sector: A state-of-the-art critical analysis of current research. International Transactions in Operational Research 26: 5–40. [Google Scholar] [CrossRef]

- Chauhan, Rahul, Matthew Bhagat-Conway, Tassio B. Magassy, Neil Corcoran, Ehsan Rahim, Amie Dirks, Ram M. Pendyal, Abolfazl Mohammadian, Sybil Derrible, and Deborah Salon. 2024. COVID Future panel survey: A unique public dataset documenting how U.S. residents’ travel-related choices changed during the COVID-19 pandemic. Transportation. [Google Scholar] [CrossRef]

- CHICHIBU. 2022. Press Release (27 January 2022). Kumagaya Chichibu Railway Co., Ltd. Available online: https://www.chichibu-railway.co.jp/assets/newsrelease/20220127_ICcard.pdf (accessed on 10 July 2024).

- Chiscano, Cerdan Monica, and Siman Darcy. 2022. An accessible and inclusive public transportation management response to COVID-19 through a co-creation process with people with disability. The case of Metro Barcelona. Research in Transportation Business & Management 45: 100880. [Google Scholar] [CrossRef]

- Chung, Yi-Shih, and Yu-Chiun Chiou. 2023. On the efficiency of subsidized bus services in rural areas: A stochastic metafrontier approach. Research in Transportation Business & Management 46: 100811. [Google Scholar] [CrossRef]

- Coelli, T. Jim. 1996. A Guide to FRONTIER Version 4.1: A Computer Program for Stochastic Frontier Production and Cost Function Estimation. CEPA Working Paper. Armidale: University of New England, p. 22. [Google Scholar]

- Couto, Antonio, and Daniel J. Graham. 2009. The determinants of efficiency and productivity in European railways. Applied Economics 41: 2827–51. [Google Scholar] [CrossRef]

- Durand, Anne, Toon Zijlstra, Marije Hamersma, Arjen’t Hoen, Niels van Oort, Serge Hoogendoorn, and Sascha Hoogendoorn-Lander. 2023. Fostering an inclusive public transport system in the digital era: An interdisciplinary approach. Transportation Research Interdisciplinary Perspectives 22: 100968. [Google Scholar] [CrossRef]

- Erdei, László, Péter Tamás, and Béla Illés. 2023. Improving the Efficiency of Rail Passenger Transportation Using an Innovative Operational Concept. Sustainability 15: 5582. [Google Scholar] [CrossRef]

- Faber, Rachel, Marije Hamersma, Jil Brimaire, Michiel Kroesen, and Elic J. E. Molin. 2023. The relations between working from home and travel behaviour: A panel analysis. Transportation. [Google Scholar] [CrossRef]

- Filippini, Massimo, Martin Koller, and Giuliano Masiero. 2015. Competitive tendering versus performance-based negotiation in Swiss public transport. Transportation Research Part A: Policy and Practice 82: 158–68. [Google Scholar] [CrossRef]

- Forchini, Giovanni, and Raoul Theler. 2023. Semi-parametric modelling of inefficiencies in stochastic frontier Analysis. Journal of Productivity Analysis 59: 135–52. [Google Scholar] [CrossRef]

- Fraczek, Bożena, and Anna Urbanek. 2021. Financial inclusion as an important factor influencing digital payments in passenger transport: A case study of EU countries. Research in Transportation Business & Management 41: 100691. [Google Scholar] [CrossRef]

- Friebel, Guido, Marc Ivaldi, and Catherine Vibes. 2010. Railway (de)regulation: A European efficiency comparison. Economica 77: 77–91. [Google Scholar] [CrossRef]

- Fukui, Yoshitaka, and Kyoji Oda. 2012. Discussion paper: Who should take responsibility for unexpected interest changes? Lesson from the privatization of Japanese railroad system. Networks and Spatial Economics 12: 263–78. [Google Scholar] [CrossRef]

- Galli, Federica. 2023. A spatial stochastic frontier model introducing inefficiency spillovers. Applied Statistics 72: 346–67. [Google Scholar] [CrossRef]

- HANKYU. 2021. Press Release (2 February 2021). Osaka: Hankyu Corporation. Available online: https://www.hankyu-hanshin.co.jp/release/docs/0015f1a66bbcab7d76b2eab4c826f6780b7e6f5d.pdf (accessed on 10 July 2024).

- HANSHIN. 2021. Press Release (12 February 2021). Osaka: Hanshin Electric Railway Co., Ltd. Available online: https://www.hankyu-hanshin.co.jp/release/docs/f34b37234313316be2d8c0e291d103b1f84c12fb.pdf (accessed on 10 July 2024).

- Holmgren, Johan. 2013. The efficiency of public transport operations: An evaluation using stochastic frontier analysis. Research in Transportation Economics 39: 50–58. [Google Scholar] [CrossRef]

- Holmgren, Johan. 2018. The effects of using different output measures in efficiency analysis of public transport operations. Research in Transportation Business & Management 28: 12–22. [Google Scholar] [CrossRef]

- Holvad, Torben. 2020. Efficiency analyses for the railway sector: An overview of key issues. Research in Transportation Economics 82: 100877. [Google Scholar] [CrossRef]

- Hussain, Zahide, Chunhui Huo, Jabbar UI-Haq, Hubert Visas, and Muhammad Umair. 2024. Estimating the effects of income inequality, information communication technology, and transport infrastructure on transport-oriented household expenditures. Transportation. [Google Scholar] [CrossRef]

- Ichijo, Yuta. 2020. JR East, JR West to start last train runs up to 30 minutes earlier. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/13697072 (accessed on 1 July 2024).

- Ichijo, Yuta. 2021. JR East rolls out point service for commuting in off-peak hours. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/14146729 (accessed on 1 July 2024).

- Ishida, Munehisa. 2020. JR Kyushu to reduce train service due to plummeting demand amid pandemic. The Mainichi. Available online: https://mainichi.jp/english/articles/20200827/p2a/00m/0na/008000c. (accessed on 1 July 2024).

- Jansson, Emil, Nils O. E. Olsson, and Fröidh Oskar. 2023. Challenges of replacing train drivers in driverless and unattended railway mainline systems—A Swedish case study on delay logs descriptions. Transportation Research Interdisciplinary Perspectives 21: 100875. [Google Scholar] [CrossRef]

- Jarboui, Sami, and Hind Alofaysan. 2024. Global Energy Transition and the Efficiency of the Largest Oil and Gas Companies. Energies 17: 2271. [Google Scholar] [CrossRef]

- JR-CENTRAL. 2021. Press Release (17 December 2021). Nagoya: Central Japan Railway Company. Available online: https://jr-central.co.jp/news/release/_pdf/000041637.pdf (accessed on 10 July 2024).

- JR-EAST. 2020. Press Release (21 October 2020). Tokyo: East Japan Railway Company. Available online: https://www.jreast.co.jp/press/2020/20201021_ho01.pdf (accessed on 10 July 2024).

- JR-EAST. 2021. Press Release (11 May 2021). Tokyo: East Japan Railway Company. Available online: https://www.jreast.co.jp/press/2021/20210511_ho01.pdf (accessed on 10 July 2024).

- JR-KYUSHU. 2020. Press Release (18 December 2020). Fukuoka: Kyushu Railway Company. Available online: https://www.jrkyushu.co.jp/news/__icsFiles/afieldfile/2020/12/18/2021daiyaminaoshi_1_1.pdf (accessed on 10 July 2024).

- JR-KYUSHU. 2021. Press Release (23 December 2021). Fukuoka: Kyushu Railway Company. Available online: https://www.jrkyushu.co.jp/news/__icsFiles/afieldfile/2021/12/23/211223_ekitaisei_minaoshi.pdf (accessed on 10 July 2024).

- JR-WEST. 2020a. Press Release (16 December 2020). Osaka: West Japan Railway Company. Available online: https://www.westjr.co.jp/press/article/2020/12/page_17086.html (accessed on 10 July 2024).

- JR-WEST. 2020b. Press Release (18 December 2020). Osaka: West Japan Railway Company. Available online: https://www.westjr.co.jp/info/saisyuuressya.html (accessed on 10 July 2024).

- Karanki, Fecri, and Siew Hoon Lim. 2021. Airport use agreements and cost efficiency of U.S. airports. Transport Policy 114: 68–77. [Google Scholar] [CrossRef]

- Kawaguchi, Daiji, Sagiri Kitao, and Manabu Nose. 2022. The impact of COVID-19 on Japanese firms: Mobility and resilience via remote work. International Tax and Public Finance 29: 1419–49. [Google Scholar] [CrossRef] [PubMed]

- KEIFUKU. 2021. Press Release (12 February 2021). Kyoto: Keifuku Electric Railroad Co., Ltd. Available online: https://www.keihan-holdings.co.jp/news/upload/2021-02-12_keifuku.pdf (accessed on 10 July 2024).

- KEIHAN. 2021. Press Release (8 Jury 2021). Osaka: Keihan Electric Railway Co., Ltd. Available online: https://www.keihan.co.jp/corporate/release/upload/2021-07-08_diagram.pdf (accessed on 10 July 2024).

- KEIKYU. 2020. Press Release (27 November 2020). Yokohama: Keikyu Corporation. Available online: https://www.keikyu.co.jp/assets/pdf/20210127HP_20136EW.pdf (accessed on 10 July 2024).

- KEIO. 2021. Press Release (17 January 2021). Tokyo: Keio Corporation. Available online: https://www.keio.co.jp/news/update/news_release/news_release2020/nr20201118_shuden.pdf (accessed on 10 July 2024).

- KEISEI. 2020. Press Release (27 November 2020). Ichikawa: Keisei Electric Railway Co., Ltd. Available online: https://www.keisei.co.jp/information/files/info/20201210_093928130620.pdf (accessed on 10 July 2024).

- Keuchel, Stephan. 2020. Digitalisation and automation of transport: A lifeworld perspective of travellers. Transportation Research Interdisciplinary Perspectives 7: 100195. [Google Scholar] [CrossRef]

- Khetrapal, Pavan. 2020. Performance analysis of electricity distribution sector post the implementation of electricity act 2003: Empirical evidence from India. Journal of Advances in Management Research 17: 669–96. [Google Scholar] [CrossRef]

- KINTETSU. 2021. Press Release (12 May 2021). Osaka: Kintetsu Railway Co., Ltd. Available online: https://www.kintetsu.co.jp/all_news/news_info/daiyahenkou.pdf (accessed on 10 July 2024).

- KOBE. 2021. Press Release (12 February 2021). Kobe: Kobe Electric Railway Co., Ltd. Available online: https://www.shintetsu.co.jp/release/2020/210212.pdf (accessed on 10 July 2024).

- Krljan, Tomislav, Ana Grbčić, Svjetlana Hess, and Neven Grubisic. 2021. The Stochastic Frontier Model for Technical Efficiency Estimation of Interconnected Container Terminals. Journal of Marine Science and Engineering 9: 515. [Google Scholar] [CrossRef]

- Kumbhakar, Subal C., and C.A. Knox Lovell. 2000. Stochastic Frontier Analysis. Cambridge: Cambridge University Press, pp. 1–344. [Google Scholar]

- Kuramoto, Takashi, and Haruaki Hirota. 2008. Efficiency analysis of third sector railway. Osaka University Knowledge Archive 47: 296–309. [Google Scholar] [CrossRef]

- Lastauskaite, Aiste, and Rytis Krusinskas. 2024. The Impact of Production Digitalization Investments on European Companies’ Financial Performance. Economies 12: 138. [Google Scholar] [CrossRef]

- Le, Yiping, Minami Oka, and Hironori Kato. 2022. Efficiencies of the urban railway lines incorporating financial performance and in-vehicle congestion in the Tokyo Metropolitan Area. Transport Policy 116: 343–54. [Google Scholar] [CrossRef]

- Lee, Kwang-Sub, and Jin Ki Eom. 2023. Systematic literature review on impacts of COVID-19 pandemic and corresponding measures on mobility. Transportation. [Google Scholar] [CrossRef]

- Magoutas, Anastasios, Maria Chaideftou, Dimitra Skandali, and Panos T. Chountalas T. 2024. Digital Progression and Economic Growth: Analyzing the Impact of ICT Advancements on the GDP of European Union Countries. Economies 12: 63. [Google Scholar] [CrossRef]

- Maharjan, Rajali, and Hironori Kato. 2023. Logistics and Supply Chain Resilience of Japanese Companies: Perspectives from Impacts of the COVID-19 Pandemic. Logistics 7: 27. [Google Scholar] [CrossRef]

- Matsumoto, Shinya. 2023. JR East to Give Commuter Pass Discount If Users Avoid Peak Hours. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/14811739 (accessed on 1 July 2024).

- Meeusen, Wim, and Julien Van Den Broeck. 1977. Efficiency estimation from Cobb–Douglas production functions with composed error. International Economic Review 18: 435–44. [Google Scholar] [CrossRef]

- MEITETSU. 2021. Press Release (16 March 2021). Nagoya: Nagoya Railroad Co., Ltd. Available online: https://www.meitetsu.co.jp/profile/news/2020/__icsFiles/afieldfile/2021/08/11/210316_daiyakaisei.pdf (accessed on 10 July 2024).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2005–2020. Inter-Regional Travel Survey in Japan. Available online: https://www.e-stat.go.jp/stat-search/files?page=1&layout=datalist&toukei=00600460&tstat=000001016696&cycle=8&tclass1=000001067591&tclass2val=0 (accessed on 31 January 2023).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2019a. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001461912.xlsx&wdOrigin=BROWSELINK (accessed on 12 October 2022).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2019b. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001577584.xlsx&wdOrigin=BROWSELINK (accessed on 9 February 2022).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2020a. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001594348.xlsx&wdOrigin=BROWSELINK (accessed on 31 January 2023).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2020b. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001584561.xlsx&wdOrigin=BROWSELINK (accessed on 31 January 2023).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2021a. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001744994.xlsx&wdOrigin=BROWSELINK (accessed on 4 February 2024).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2021b. Annual Report of Railway Statistics in Japan. Available online: https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.mlit.go.jp%2Ftetudo%2Fcontent%2F001744993.xlsx&wdOrigin=BROWSELINK (accessed on 4 February 2024).

- Ministry of Land, Infrastructure, Transport and Tourism, Government of Japan. 2024. Recently Discontinued Railway Track lines (List of Discontinued railway lines in Japan since 2000). Available online: https://www.mlit.go.jp/common/001344605.pdf (accessed on 10 July 2024).

- Mitsel, Arthur, Aliya Alimkhanova, and Marina Grigorieva. 2021. Advancing the multifactor model of stochastic frontier analysis. Eastern-European Journal of Enterprise Technologies 3: 58–64. [Google Scholar] [CrossRef]

- Mizutani, Fumitoshi, Hideo Kozumi, and Noriaki Matsushima. 2009. Does yardstick regulation really work? Empirical evidence from Japan’s rail industry. Journal of Regulatory Economics 36: 308–23. [Google Scholar] [CrossRef]

- NANKAI. 2021. Press Release (11 March 2021). Osaka: Nankai Electric Railway Co., Ltd. Available online: https://www.nankai.co.jp/library/company/news/pdf/210311_1.pdf (accessed on 10 July 2024).

- NISHITETSU. 2020. Press Release (28 August 2020). Fukuoka: Nishi-Nippon Railroad Co., Ltd. Available online: https://www.nishitetsu.co.jp/ja/news/news20200828102928/main/0/link/20_034.pdf (accessed on 10 July 2024).

- NISHITETSU. 2022. Press Release (17 February 2022). Fukuoka: Nishi-Nippon Railroad Co., Ltd. Available online: https://www.nishitetsu.co.jp/ja/news/news20220217103067/main/0/link/21_097.pdf (accessed on 10 July 2024).

- ODAKYU. 2020. Press Release (18 December 2020). Tokyo: Odakyu Electric Railway Co., Ltd. Available online: https://www.odakyu.jp/news/o5oaa1000001v1lj-att/o5oaa1000001v1lq.pdf (accessed on 10 July 2024).

- Rothengatter, Werner, Junyi Zhang, Yoshitsugu Hayashi, Anastasiia Nosach, Kun Wang, and Tae Hoon Oum. 2021. Pandemic waves and the time after COVID-19—Consequences for the transport sector. Transport policy 110: 225–37. [Google Scholar] [CrossRef]

- SEIBU. 2020. Press Release (9 November 2020). Tokyo: Seibu Railway Co., Ltd. Available online: https://www.seiburailway.jp/file.jsp?news/news-release/2020/20201109_daiyakaisei.pdf (accessed on 10 July 2024).

- Sharma, Manish, and Bhavesh Kumar Chauhan. 2022. Timetable rationalization & Operational improvements by human intervention in an urban rail transit system: An exploratory study. Transportation Research Interdisciplinary Perspectives 13: 100526. [Google Scholar] [CrossRef]

- Song, Yeon-Jung, and Kenichi Shoji. 2016. Effects of diversification strategies on investment in railway business: The case of private railway companies in Japan. Research in Transportation Economics 59: 368–96. [Google Scholar] [CrossRef]

- SOTETSU. 2021. Press Release (2 February 2021). Yokohama: Sagami Railway Co., Ltd. Available online: https://cdn.sotetsu.co.jp/media/2021/pressrelease/pdf/r21-07-b9h.pdf (accessed on 10 July 2024).

- Srivastava, Bhavya, Shveta Singh, and Sonali Jain. 2024. A frontier-based parametric framework for exploring the competition–efficiency nexus in commercial banking: Insights from an emerging economy. Managerial Finance 50: 854–89. [Google Scholar] [CrossRef]

- The Asahi Shimbun. 2021. Tokyo-Area Railways to Stop Last Trains Earlier Starting Jan. 20. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/14102594 (accessed on 1 July 2024).

- The Asahi Shimbun. 2022. JR East Reveals a Third of Its Rail Lines Are Bleeding Money. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/14682618 (accessed on 1 July 2024).

- The Asahi Shimbun. 2023. Big Railways to Raise Fares from Spring to Cover Safety Measures. The Asahi Shimbun. Available online: https://www.asahi.com/ajw/articles/14843295 (accessed on 1 July 2024).

- TOBU. 2021. Press Release (26 January 2021). Tokyo: Tobu Railway Co., Ltd. Available online: https://www.tobu.co.jp/cms-pdf/releases/20210126140455jW-dd1SriaYe3dhM3z0pXw.pdf (accessed on 10 July 2024).

- TOKYU. 2021. Press Release (26 January 2021). Tokyo: Tokyu Railways. Available online: https://www.tokyu.co.jp/image/news/pdf/20210126-1.pdf (accessed on 10 July 2024).

- Tomikawa, Tadaaki, and Mika Goto. 2022. Efficiency assessment of Japanese National Railways before and after privatization and divestiture using data envelopment analysis. Transport Policy 118: 44–55. [Google Scholar] [CrossRef]

- Tsukamoto, Takahiro. 2019. A spatial autoregressive stochastic frontier model for panel data incorporating a model of technical inefficiency. Japan & The World Economy 50: 66–77. [Google Scholar] [CrossRef]

- Varotsis, Nikolaos. 2022. Digital Entrepreneurship and Creative Industries in Tourism: A Research Agenda. Economies 10: 167. [Google Scholar] [CrossRef]

- Vašaničová, Petra, and Katarina Bartók. 2024. Exploring the Nexus between Employment and Economic Contribution: A Study of the Travel and Tourism Industry in the Context of COVID-19. Economies 12: 136. [Google Scholar] [CrossRef]

- Vigren, Andreas. 2016. Cost efficiency in Swedish public transport. Research in Transportation Economics 59: 123–32. [Google Scholar] [CrossRef]

- Watanabe, Manabu. 2020. The COVID-19 Pandemic in Japan. Surgery Today 50: 787–93. [Google Scholar] [CrossRef]

- Wheat, Phill, Alexander D. Stead, and William H. Greene. 2019. Robust stochastic frontier analysis: A Student’s t-half normal modelwith application to highway maintenance costs in England. Journal of Productivity Analysis 51: 21–38. [Google Scholar] [CrossRef]

- Whitmore, Allant´e, Constantine Samaras, Chris T. Hendrickson, H. Scott Matthews, and Gabrielle Wong-Parodi. 2022. Integrating public transportation and shared autonomous mobility for equitable transit coverage: A cost-efficiency analysis. Transportation Research Interdisciplinary Perspective 14: 100571. [Google Scholar] [CrossRef]

- Wiegmans, Bart, Alex Champagne-Gelinas, Samuël Duchesne, Brian Slack, and Patrick Witte. 2018. Rail and road freight transport network efficiency of Canada, member state of the EU, and the USA. Research in Transportation Business & Management 28: 54–65. [Google Scholar] [CrossRef]

- Yin, Yonghao, Dewel Li, Songliang Zhang, and Lifu Wu. 2021. How Does Railway Respond to the Spread of COVID-19? Countermeasure Analysis and Evaluation Around the World. Urban Rail Transit 7: 29–57. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Fengxiu. 2021. Evaluating public organization performance under extreme weather events: Does organizational adaptive capacity matter? Journal of Environmental Management 296: 113388. [Google Scholar] [CrossRef]

- Zhang, Xuexun, and Yong Wu. 2023. Analysis of public transit operation efficiency based on multi-source data: A case study in Brisbane, Australia. Research in Transportation Business & Management 46: 100859. [Google Scholar] [CrossRef]

| Fiscal Year | The Number of Surplus Companies | The Number of Loss-Making Companies |

|---|---|---|

| 2019 | 25 | 1 |

| 2020 | 0 | 26 |

| 2021 | 5 | 21 |

| No. | Company | 2019 (a) | 2020 (b) | 2021 (c) | Percentage in 2020 to 2019 (b)/(a) | Percentage in 2021 to 2019 (c)/(a) |

|---|---|---|---|---|---|---|

| 1 | JR-EAST | 254,877 | 252,115 | 248,331 | 98.9% | 97.4% |

| 2 | KEIO | 14,713 | 14,582 | 14,404 | 99.1% | 97.9% |

| 3 | KEISEI | 13,933 | 13,524 | 13,804 | 97.1% | 99.1% |

| 4 | SHIN-KEISEI | 2465 | 2469 | 2683 | 100.2% | 108.8% |

| 5 | TOBU | 37,895 | 38,329 | 38,294 | 101.1% | 101.1% |

| 6 | SEIBU | 20,247 | 20,115 | 20,100 | 99.3% | 99.3% |

| 7 | TOKYU | 19,995 | 20,065 | 19,440 | 100.4% | 97.2% |

| 8 | KEIKYU | 15,823 | 15,761 | 15,546 | 99.6% | 98.2% |

| 9 | ODAKYU | 20,998 | 20,883 | 20,614 | 99.5% | 98.2% |

| 10 | SOUTETSU | 5052 | 5215 | 4941 | 103.2% | 97.8% |

| 11 | CHICHIBU | 2075 | 1649 | 1729 | 79.5% | 83.3% |

| 12 | FUJIKYU | 723 | 532 | 662 | 73.6% | 91.6% |

| 13 | JR-CENTRAL | 112,178 | 104,671 | 103,473 | 93.3% | 92.2% |

| 14 | MEITETSU | 40,075 | 39,522 | 38,685 | 98.6% | 96.5% |

| 15 | JR-WEST | 189,530 | 182,932 | 175,333 | 96.5% | 92.5% |

| 16 | NANKAI | 16,347 | 15,760 | 15,714 | 96.4% | 96.1% |

| 17 | KINTETSU | 56,638 | 55,820 | 53,302 | 98.6% | 94.1% |

| 18 | KEIHAN | 13,240 | 13,169 | 11,937 | 99.5% | 90.2% |

| 19 | KEIFUKU | 940 | 934 | 920 | 99.4% | 97.9% |

| 20 | HANKYU | 21,889 | 21,827 | 21,766 | 99.7% | 99.4% |

| 21 | HANSHIN | 8404 | 8410 | 8391 | 100.1% | 99.8% |

| 22 | KOBE | 4308 | 4154 | 4138 | 96.4% | 96.1% |

| 23 | SANYO | 6847 | 6871 | 6819 | 100.4% | 99.6% |

| 24 | HIRODEN | 4817 | 4817 | 4208 | 100.0% | 87.4% |

| 25 | JR-KYUSHU | 63,352 | 59,658 | 59,767 | 94.2% | 94.3% |

| 26 | NISHITETSU | 8686 | 8435 | 8302 | 97.1% | 95.6% |

| Company | Region | Start Year and Month | Number of Implemented Lines | Time to Move Up the Last Train (Minutes) | Source |

|---|---|---|---|---|---|

| JR-EAST | KANTO | March 2021 | 17 | 3–37 | (JR-EAST 2020) |

| KEIO | KANTO | March 2021 | 2 | 10–30 | (KEIO 2020) |

| KEISEI | KANTO | March 2021 | 5 | 10–20 | (KEISEI 2020) |

| TOBU | KANTO | March 2021 | 3 | 9–15 | (TOBU 2021) |

| SEIBU | KANTO | March 2021 | 10 | 20–30 | (SEIBU 2020) |

| TOKYU | KANTO | March 2021 | 7 | 8–26 | (TOKYU 2021) |

| KEIKYU | KANTO | March 2021 | 4 | 14–30 | (KEIKYU 2020) |

| ODAKYU | KANTO | March 2021 | 3 | 7–23 | (ODAKYU 2020) |

| SOTETSU | KANTO | March 2021 | 2 | 15–20 | (SOTETSU 2021) |

| JR-CENTRAL | CHUKYO | March 2022 | 2 | 15–21 | (JR-CENTRAL 2021) |

| MEITETSU | CHUKYO | May 2021 | 5 | 5–30 | (MEITETSU 2021) |

| JR-WEST | KANSAI | March 2021 | 12 | 10–30 | (JR-WEST 2020b) |

| NANKAI | KANSAI | May 2021 | 2 | 15–17 | (NANKAI 2021) |

| KINTETSU | KANSAI | July 2021 | 14 | 8–29 | (KINTETSU 2021) |

| KEIHAN | KANSAI | September 2021 | 5 | 13–21 | (KEIHAN 2021) |

| KEIFUKU | KANSAI | March 2021 | 1 | 15 | (KEIFUKU 2021) |

| HANKYU | KANSAI | March 2021 | 3 | 13–32 | (HANKYU 2021) |

| HANSHIN | KANSAI | March 2021 | 1 | 10–14 | (HANSHIN 2021) |

| KOBE | KANSAI | March 2021 | 2 | 15–21 | (KOBE 2021) |

| JR-KYUSHU | FUKUOKA | March 2021 | 2 | 18–20 | (JR-KYUSHU 2020) |

| NISHITETSU | FUKUOKA | March 2021 | 1 | 13–30 | (NISHITETSU 2020) |

| Company | Reduction in the Number of Stations with Staffed Ticket Counters | Source |

|---|---|---|

| JR-EAST | 300 (2021–2025) | (JR-EAST 2021) |

| JR-WEST | 160 (2020–2022) | (JR-WEST 2020a) |

| JR-KYUSHU | 48 (2022) | (JR-KYUSHU 2021) |

| CHICHIBU | 27 (2022) | (CHICHIBU 2022) |

| NISHITETSU | 24 (2020) 9 (2022) | (NISHITETSU 2020) (NISHITETSU 2022) |

| Company | Region | Line Name | Operating Kilometers | Date of Abolition |

|---|---|---|---|---|

| JR-EAST | TOHOKU | Ofunato | 43.7 | 1 April 2020 |

| JR-EAST | TOHOKU | Kesennuma | 55.3 | 1 April 2020 |

| No. | Company Name | Business Type | Service Area |

|---|---|---|---|

| 01 | JR-EAST | JR | KANTO, TOHOKU, CHUBU (Yamanashi, Nigata, Nagano, Shizuoka) |

| 02 | KEIO | OPR | KANTO (Tokyo) |

| 03 | KEISEI | OPR | KANTO (Tokyo, Chiba) |

| 04 | SHIN-KEISEI | OPR | KANTO (Chiba) |

| 05 | TOBU | OPR | KANTO (Tokyo, Saitama, Gunma, Tochigi, Chiba) |

| 06 | SEIBU | OPR | KANTO (Tokyo, Saitama) |

| 07 | TOKYU | OPR | KANTO (Tokyo, Kanagawa) |

| 08 | KEIKYU | OPR | KANTO (Tokyo, Kanagawa) |

| 09 | ODAKYU | OPR | KANTO (Tokyo, Kanagawa) |

| 10 | SOTETSU | OPR | KANTO (Kanagawa) |

| 11 | CHICHIBU | OPR | KANTO (Saitama) |

| 12 | FUJIKYU | OPR | CHUBU (Yamanashi) |

| 13 | JR-CENTRAL | JR | KANTO (Tokyo, Kanagawa), CHUBU (Shizuoka, Nagano, Yamanashi), CHUKYO (Aichi, Gifu, Mie), KANSAI (Shiga, Kyoto, Osaka) |

| 14 | MEITETSU | OPR | CHUKYO (Aichi, Gifu, Mie) |

| 15 | JR-WEST | JR | CHUBU (Nigata, Nagano), HOKURIKU, KANSAI, CHUGOKU, KYUSHU (Fukuoka) |

| 16 | NANKAI | OPR | KANSAI (Osaka, Wakayama) |

| 17 | KINTETSU | OPR | CHUKYO (Aichi Mie), KANSAI (Osaka, Kyoto, Nara) |

| 18 | KEIHAN | OPR | KANSAI (Osaka, Kyoto) |

| 19 | KEIFUKU | OPR | HOKURIKU (Fukui), KANSAI (Kyoto) |

| 20 | HANKYU | OPR | KANSAI (Osaka, Kyoto, Hyogo) |

| 21 | HANSHIN | OPR | KANSAI (Osaka, Hyogo) |

| 22 | KOBE | OPR | KANSAI (Hyogo) |

| 23 | SANYO | OPR | KANSAI (Hyogo) |

| 24 | HIRODEN | OPR | CHUGOKU (Hiroshima) |

| 25 | JR-KYUSHU | JR | KYUSHU |

| 26 | NISHITETSU | OPR | KYUSHU (Fukuoka) |

| Variable Name | Minimum Value | Maximum Value | Average Value | Standard Deviation |

|---|---|---|---|---|

| Railway operating expenditure (million yen) | 1147 | 1,715,178 | 170,278 | 348,194 |

| Passenger-kilometer (million passenger kilometers) | 18 | 137,598 | 13,406 | 26,987 |

| Labor price | 1194 | 9905 | 5577 | 1533 |

| Capital price | 0.01 | 36.86 | 0.15 | 1.80 |

| Fuel price | 16.70 | 65.63 | 33.99 | 9.29 |

| Number of personnel | 97 | 54,697 | 5680 | 10,535 |

| Power cost (million yen) | 46 | 71,577 | 8167 | 14,380 |

| Depreciation cost (million yen) | 105 | 298,807 | 34,033 | 66,131 |

| Salary cost (million yen) | 262 | 297,516 | 32,717 | 58,231 |

| Car kilometer (million passenger kilometers) | 0.89 | 2343 | 275 | 509 |

| Percentage of local lines operating kilometers | 0.00 | 0.54 | 0.07 | 0.14 |

| Number of substations | 1 | 339 | 43.92 | 74.07 |

| Population density | 181 | 6403 | 1824 | 1662 |

| Railway usage rate | 0.06 | 0.66 | 0.48 | 0.14 |

| Dummy of regional core city | 0.00 | 1.00 | - | - |

| Dummy of local areas | 0.00 | 1.00 | - | - |

| Variable | Coefficient | Standard Error | t-Value | |

|---|---|---|---|---|

| β0 | Constant term | 0.0155 | 0.1153 | 0.1344 |

| β1 | Passenger-kilometers | 0.2477 *** | 0.0378 | 6.5461 |

| β2 | Labor price/Capital price | 0.7876 *** | 0.0362 | 21.7366 |

| β3 | Fuel price/Capital price | 0.8416 *** | 0.0532 | 15.8068 |

| δ0 | Constant term | 0.2795 *** | 0.093 | 3.0052 |

| δ1 | Percentage of local lines operating kilometers | −0.0001 | 0.0003 | −0.4658 |

| δ2 | Number of substations | −0.0001 *** | 0.0000 | −15.145 |

| δ3 | Population density | −0.6801 *** | 0.2457 | −2.7674 |

| δ4 | Railway (JR/OPR) usage rate | 0.2107 *** | 0.0538 | 3.914 |

| δ5 | Dummy of regional core city | −0.3352 *** | 0.0731 | −4.5863 |

| δ6 | Dummy of local areas | 0.4352 *** | 0.0743 | 5.851 |

| lnsigma2 | 0.0317 *** | 0.0547 | 5.7998 | |

| Γ | 0.8396 *** | 0.0350 | 23.9845 | |

| loglikelihood | 411.9217 | - | - | |

| Number of observations | 416 | - | - | |

| LR test of the one-sided error | 213.8084 | - | - | |

| No. | Company | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Event | Financial crisis | Financial crisis | Great East Japan Earthquake | Before COVID-19 | During COVID-19 | |||||||||||||

| 1 | JR-EAST | 1.0796 | 1.0968 | 1.0780 | 1.0524 | 1.0556 | 1.0495 | 1.0491 | 1.0413 | 1.0373 | 1.0380 | 1.0536 | 1.0591 | 1.0530 | 1.0447 | 1.0504 | 1.1949 | 1.0646 |

| 2 | KEIO | 1.0155 | 1.0164 | 1.0173 | 1.0178 | 1.0251 | 1.0216 | 1.0197 | 1.0168 | 1.0145 | 1.0138 | 1.0147 | 1.0180 | 1.0173 | 1.0155 | 1.0159 | 1.0434 | 1.0190 |

| 3 | KEISEI | 1.0405 | 1.0408 | 1.0407 | 1.0317 | 1.0451 | 1.0527 | 1.0522 | 1.0422 | 1.0331 | 1.0320 | 1.0383 | 1.0477 | 1.0441 | 1.0361 | 1.0426 | 1.2047 | 1.0515 |

| 4 | SHIN-KEISEI | 1.0269 | 1.0275 | 1.0288 | 1.0271 | 1.0365 | 1.0357 | 1.0308 | 1.0233 | 1.0192 | 1.0181 | 1.0204 | 1.0265 | 1.0254 | 1.0236 | 1.0251 | 1.0834 | 1.0299 |

| 5 | TOBU | 1.0354 | 1.0356 | 1.0360 | 1.0320 | 1.0255 | 1.0430 | 1.0360 | 1.0299 | 1.0214 | 1.0202 | 1.0223 | 1.0276 | 1.0263 | 1.0234 | 1.0324 | 1.0880 | 1.0334 |

| 6 | SEIBU | 1.0315 | 1.0251 | 1.0280 | 1.0241 | 1.0318 | 1.0288 | 1.0263 | 1.0182 | 1.0161 | 1.0163 | 1.0177 | 1.0220 | 1.0206 | 1.0185 | 1.0211 | 1.0732 | 1.0262 |

| 7 | TOKYU | 1.0255 | 1.0324 | 1.0269 | 1.0266 | 1.0403 | 1.0327 | 1.0354 | 1.0259 | 1.0220 | 1.0192 | 1.0201 | 1.0283 | 1.0247 | 1.0223 | 1.0141 | 1.0386 | 1.0272 |

| 8 | KEIKYU | 1.0213 | 1.0213 | 1.0244 | 1.0213 | 1.0327 | 1.0306 | 1.0303 | 1.0248 | 1.0196 | 1.0190 | 1.0204 | 1.0283 | 1.0264 | 1.0210 | 1.0242 | 1.0964 | 1.0289 |

| 9 | ODAKYU | 1.0288 | 1.0274 | 1.0277 | 1.0248 | 1.0374 | 1.0326 | 1.0277 | 1.0208 | 1.0179 | 1.0165 | 1.0182 | 1.0248 | 1.0223 | 1.0203 | 1.0212 | 1.0762 | 1.0278 |

| 10 | SOTETSU | 1.0304 | 1.0300 | 1.0339 | 1.0286 | 1.0135 | 1.0279 | 1.0273 | 1.0209 | 1.0183 | 1.0182 | 1.0209 | 1.0262 | 1.0239 | 1.0214 | 1.0200 | 1.1153 | 1.0298 |

| 11 | CHICHIBU | 1.0540 | 1.0492 | 1.0458 | 1.0352 | 1.0462 | 1.0397 | 1.0395 | 1.0326 | 1.0287 | 1.0258 | 1.0301 | 1.0414 | 1.0372 | 1.0345 | 1.0365 | 1.1493 | 1.0454 |

| 12 | FUJIKYU | 1.1173 | 1.1389 | 1.1115 | 1.0781 | 1.1257 | 1.1085 | 1.0944 | 1.0620 | 1.0479 | 1.0589 | 1.0790 | 1.1203 | 1.1153 | 1.1266 | 1.2375 | 1.6133 | 1.1397 |

| 13 | JR-CENTRAL | 1.0796 | 1.0854 | 1.0832 | 1.0791 | 1.1284 | 1.1137 | 1.0897 | 1.0759 | 1.0473 | 1.0421 | 1.0449 | 1.0558 | 1.0460 | 1.0371 | 1.0491 | 1.3425 | 1.0875 |

| 14 | MEITETSU | 1.1182 | 1.1235 | 1.1372 | 1.1163 | 1.1543 | 1.1383 | 1.1148 | 1.0978 | 1.0848 | 1.0623 | 1.0709 | 1.0954 | 1.0775 | 1.0638 | 1.0564 | 1.2413 | 1.1096 |

| 15 | JR-WEST | 1.0760 | 1.0845 | 1.0884 | 1.0749 | 1.1079 | 1.0982 | 1.0888 | 1.0781 | 1.0550 | 1.0499 | 1.0570 | 1.0691 | 1.0583 | 1.0579 | 1.0447 | 1.1337 | 1.0764 |

| 16 | NANKAI | 1.0465 | 1.0709 | 1.0743 | 1.0747 | 1.1196 | 1.0982 | 1.0979 | 1.0884 | 1.0527 | 1.0492 | 1.0479 | 1.0607 | 1.0609 | 1.0869 | 1.0989 | 1.2808 | 1.0880 |

| 17 | KINTETSU | 1.0723 | 1.0598 | 1.1335 | 1.1257 | 1.1500 | 1.1456 | 1.1340 | 1.1117 | 1.0772 | 1.0688 | 1.0718 | 1.0910 | 1.0798 | 1.0812 | 1.0873 | 1.2979 | 1.1117 |

| 18 | KEIHAN | 1.0381 | 1.0414 | 1.0442 | 1.0435 | 1.0518 | 1.0534 | 1.0500 | 1.0467 | 1.0314 | 1.0282 | 1.0285 | 1.0313 | 1.0291 | 1.0360 | 1.0278 | 1.0745 | 1.0410 |

| 19 | KEIFUKU | 1.0369 | 1.0358 | 1.0476 | 1.0348 | 1.0414 | 1.0384 | 1.0390 | 1.0389 | 1.0346 | 1.0353 | 1.0337 | 1.0483 | 1.0521 | 1.0535 | 1.0566 | 1.2368 | 1.0540 |

| 20 | HANKYU | 1.0304 | 1.0356 | 1.0357 | 1.0307 | 1.0416 | 1.0406 | 1.0364 | 1.0321 | 1.0225 | 1.0212 | 1.0214 | 1.0238 | 1.0239 | 1.0290 | 1.0325 | 1.1303 | 1.0367 |

| 21 | HANSHIN | 1.0458 | 1.0828 | 1.0763 | 1.0739 | 1.1172 | 1.1207 | 1.1006 | 1.0880 | 1.0612 | 1.0440 | 1.0455 | 1.0478 | 1.0444 | 1.0566 | 1.0345 | 1.1345 | 1.0734 |

| 22 | KOBE | 1.0609 | 1.0741 | 1.0746 | 1.0646 | 1.0831 | 1.0725 | 1.0587 | 1.0622 | 1.0410 | 1.0382 | 1.0420 | 1.0531 | 1.0523 | 1.0572 | 1.0519 | 1.1765 | 1.0664 |

| 23 | SANYO | 1.1793 | 1.1678 | 1.1723 | 1.1409 | 1.1720 | 1.1172 | 1.1068 | 1.1240 | 1.0564 | 1.0538 | 1.0632 | 1.0864 | 1.0699 | 1.0734 | 1.0931 | 1.1961 | 1.1170 |

| 24 | HIRODEN | 1.5361 | 1.5372 | 1.5750 | 1.5197 | 1.5978 | 1.5986 | 1.5677 | 1.5770 | 1.5630 | 1.5448 | 1.5907 | 1.6176 | 1.5878 | 1.6036 | 1.5201 | 2.1363 | 1.6046 |

| 25 | JR-KYUSHU | 1.0822 | 1.0500 | 1.0783 | 1.0647 | 1.0902 | 1.0875 | 1.0631 | 1.0809 | 1.0515 | 1.0482 | 1.1075 | 1.0366 | 1.0338 | 1.0303 | 1.0308 | 1.1050 | 1.0650 |

| 26 | NISHITETSU | 1.0493 | 1.0551 | 1.0956 | 1.0958 | 1.1058 | 1.1165 | 1.1045 | 1.0905 | 1.0606 | 1.0608 | 1.0649 | 1.0821 | 1.0728 | 1.0597 | 1.0495 | 1.1813 | 1.0841 |

| Average | 1.0753 | 1.0787 | 1.0852 | 1.0746 | 1.0953 | 1.0901 | 1.0816 | 1.0750 | 1.0590 | 1.0555 | 1.0633 | 1.0719 | 1.0664 | 1.0667 | 1.0682 | 1.2094 | 1.0823 |

| No. | Company | Region | “FY 2005–FY 2019” | FY 2020 | Average Value for “FY 2005–FY2020” | Order | |||

|---|---|---|---|---|---|---|---|---|---|

| Lowest (Best) Cost Inefficiency | Fiscal Year | Highest (Worst) Cost Inefficiency | Fiscal Year | Highest Cost Inefficiency During Whole Period | |||||

| 1 | JR-EAST | TOHOKU KANTO CHUBU | 1.0373 | (2013) | 1.0968 | (2006) | 1.1949 | 1.0646 | 14 |

| 2 | KEIO | KANTO | 1.0138 | (2014) | 1.0251 | (2009) | 1.0434 | 1.0190 | 1 |

| 3 | KEISEI | KANTO | 1.0317 | (2008) | 1.0527 | (2010) | 1.2047 | 1.0515 | 12 |

| 4 | SHIN-KEISEI | KANTO | 1.0181 | (2014) | 1.0365 | (2009) | 1.0834 | 1.0299 | 7 |

| 5 | TOBU | KANTO | 1.0202 | (2014) | 1.0360 | (2007) | 1.0880 | 1.0334 | 8 |

| 6 | SEIBU | KANTO | 1.0161 | (2013) | 1.0318 | (2009) | 1.0732 | 1.0262 | 2 |

| 7 | TOKYU | KANTO | 1.0192 | (2014) | 1.0403 | (2009) | 1.0386 | 1.0272 | 3 |

| 8 | KEIKYU | KANTO | 1.0190 | (2014) | 1.0327 | (2009) | 1.0964 | 1.0289 | 5 |

| 9 | ODAKYU | KANTO | 1.0165 | (2014) | 1.0374 | (2009) | 1.0762 | 1.0278 | 4 |

| 10 | SOTETSU | KANTO | 1.0135 | (2009) | 1.0339 | (2007) | 1.1153 | 1.0298 | 6 |

| 11 | CHICHIBU | KANTO | 1.0258 | (2014) | 1.0540 | (2005) | 1.1493 | 1.0454 | 11 |

| 12 | FUJIKYU | CHUBU | 1.0479 | (2013) | 1.2375 | (2019) | 1.5977 | 1.1397 | 25 |

| 13 | JR-CENTRAL | KANTO CHUBU GHUKYO KANSAI | 1.0371 | (2018) | 1.1284 | (2009) | 1.3425 | 1.0875 | 20 |

| 14 | MEITETSU | CHUKYO | 1.0564 | (2019) | 1.1543 | (2009) | 1.2413 | 1.1096 | 22 |

| 15 | JR-WEST | HOKURIKU KANSAI CHUGOKU KYUSHU | 1.0447 | (2019) | 1.1079 | (2009) | 1.1337 | 1.0764 | 18 |

| 16 | NANKAI | KANSAI | 1.0479 | (2015) | 1.1196 | (2009) | 1.2808 | 1.0880 | 21 |

| 17 | KINTETSU | KANSAI | 1.0598 | (2006) | 1.1500 | (2009) | 1.2979 | 1.1117 | 23 |

| 18 | KEIHAN | KANSAI | 1.0278 | (2019) | 1.0534 | (2010) | 1.0745 | 1.0410 | 10 |

| 19 | KEIFUKU | KANSAI HOKURIKU | 1.0337 | (2015) | 1.0476 | (2007) | 1.2368 | 1.0540 | 13 |

| 20 | HANKYU | KANSAI | 1.0212 | (2014) | 1.0416 | (2009) | 1.1303 | 1.0367 | 9 |

| 21 | HANSHIN | KANSAI | 1.0345 | (2019) | 1.1207 | (2010) | 1.1345 | 1.0734 | 17 |

| 22 | KOBE | KANSAI | 1.0382 | (2014) | 1.0831 | (2009) | 1.1765 | 1.0664 | 16 |

| 23 | SANYO | KANSAI | 1.0538 | (2014) | 1.1723 | (2007) | 1.1961 | 1.1170 | 24 |

| 24 | HIRODEN | CHUGOKU | 1.5201 | (2019) | 1.5978 | (2009) | 2.1363 | 1.6046 | 26 |

| 25 | JR-KYUSHU | KYUSHU | 1.0303 | (2018) | 1.0902 | (2009) | 1.1050 | 1.0650 | 15 |

| 26 | NISHITETSU | KYUSHU | 1.0495 | (2019) | 1.1165 | (2010) | 1.1813 | 1.0841 | 19 |

| Average | 1.0513 | 1.1038 | 1.2088 | 1.0823 | |||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| The lowest (best) inefficiency value | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 3 | 11 | 3 | 0 | 0 | 2 | 5 | 0 |

| The second highest (worst) inefficiency value | 1 | 1 | 5 | 0 | 14 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| The highest (worst) inefficiency value | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 26 |

| Average of Best Practice Railway Companies | Average of the Other Railway Companies | |||||

|---|---|---|---|---|---|---|

| Before COVID-19 Pandemic in 2019 | During COVID-19 Pandemic in 2020 (Year on Year Rate) | Growth Rate | Before COVID-19 Pandemic in 2019 | During COVID-19 Pandemic in 2020 (Year on Year Rate) | Growth Rate | |

| Operating kilometers (km) | 133.6 | 133.6 | 100.0% | 1140 | 1134 | 99.4% |

| Number of stations | 83 | 84 | 100.1% | 306 | 304 | 99.4% |

| Number of rolling stocks | 1028 | 1022 | 99.5% | 1984 | 1984 | 100.0% |

| Number of transported passengers (thousand passengers) | 597,630 | 421,460 | 70.5% | 710,490 | 505,988 | 71.2% |

| Passenger-kilometers (million passenger-kilometers) | 7541 | 5092 | 67.5% | 18,624 | 10,660 | 57.2% |

| Car kilometer (thousand kilometers) | 136,728 | 137,251 | 100.4% | 371,850 | 362,859 | 97.6% |

| Number of employees in the railway sector | 2520 | 2535 | 100.6% | 7204 | 7140 | 99.1% |

| No. | Company | The Difference in Cost Inefficiency between FY 2020 and FY 2019 | No | Company | The Difference in Cost Inefficiency between FY 2020 and FY 2019 | No | Company | The Difference in Cost Inefficiency between FY 2020 and FY 2019 |

|---|---|---|---|---|---|---|---|---|

| 1 | JR EAST | 0.1445 | 11 | CHICHIBU | 0.1128 | 21 | HANSHIN | 0.1000 |

| 2 | KEIO | 0.0275 | 12 | FUJIKYU | 0.3758 | 22 | KOBE | 0.1246 |

| 3 | KEISEI | 0.1621 | 13 | JR CENTRAL | 0.2934 | 23 | SANYO | 0.1030 |

| 4 | SHIN-KEISEI | 0.0583 | 14 | MEITETSU | 0.1849 | 24 | HIRODEN | 0.6162 |

| 5 | TOBU | 0.0556 | 15 | JR WEST | 0.0890 | 25 | JR KYUSHU | 0.0742 |

| 6 | SEIBU | 0.0521 | 16 | NANKAI | 0.1819 | 26 | NISHITETSU | 0.1318 |

| 7 | TOKYU | 0.0245 | 17 | KINTETSU | 0.2106 | Average | 0.1398 | |

| 8 | KEIKYU | 0.0722 | 18 | KEIHAN | 0.0467 | Minimum | 0.0181 | |

| 9 | ODAKYU | 0.0550 | 19 | KEIFUKU | 0.1802 | Maximum | 0.6088 | |

| 10 | SOTETSU | 0.0953 | 20 | HANKYU | 0.0978 | Standard deviation | 0.1240 |

| Order | No. | Company | Region | Cost Inefficiency of Average Value for “FY 2005–FY2020” | Operating Kilometers (km) | Number of Stations | Number of Rolling Stocks | Passenger-Kilometers (Million Passenger-Kilometers) (a) | Number of Employees in the Railway Sector (b) | (a)/(b) |

|---|---|---|---|---|---|---|---|---|---|---|

| 19 | 26 | NISHITETSU | KYUSHU | 1.0841 | 106.1 | 72 | 311 | 1574 | 600 | 2.62 |

| 20 | 13 | JR-CENTRAL | KANTO, CHUBU, GHUKYO, KANSAI | 1.0875 | 1970.8 | 405 | 4827 | 63,427 | 18282 | 3.46 |

| 21 | 16 | NANKAI | KANSAI | 1.0880 | 154.8 | 100 | 696 | 3922 | 2195 | 1.78 |

| - | - | SEMBOKU | KANSAI | 1.09※ | 14.3 | 6 | 112 | 441 | 258 | 1.70 |

| 22 | 14 | MEITETSU | CHUKYO | 1.1096 | 444.2 | 275 | 1070 | 7260 | 4085 | 1.77 |

| 23 | 17 | KINTETSU | KANSAI | 1.1117 | 501.1 | 286 | 1933 | 10,590 | 7226 | 1.46 |

| 24 | 23 | SANYO | KANSAI | 1.1170 | 63.2 | 49 | 236 | 891 | 715 | 1.24 |

| 25 | 12 | FUJIKYU | CHUBU | 1.1397 | 26.6 | 18 | 33 | 48 | 254 | 0.18 |

| - | - | TOYO-KOSOKU | KANTO | 1.15※ | 16.2 | 9 | 110 | 552 | 304 | 1.81 |

| 26 | 24 | HIRODEN | CHUGOKU | 1.6046 | 35.1 | 82 | 300 | 197 | 1728 | 0.11 |

| - | - | OSAKA-KOSOKU | KANSAI | 1.78※ | 28.0 | 18 | 88 | 311 | 241 | 1.29 |

| Categorization of Efficiency Improvement Measures | Items of Efficiency Improvement Measures |

|---|---|

| Operation |

|

| Streamline facilities |

|

| Ticketing |

|

| Energy-saving |

|

| Peak shift(reduce the number of trains operating during peak periods) |

|

| DX Investment Category | Operation | Streamline Facilities | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Order | Group | No. | Company Name | Autonomous Driving•Driver Only Operation | Smart Maintenance | Customer Service Automation | Operational Efficiency by DX | Asset Management | Wireless Railway Car Control Systems |

| 1 | 1 | 02 | KEIO | ○ | ○ | ○ | |||

| 2 | 06 | SEIBU | ○ | ○ | ○ | ○ | |||

| 3 | 09 | ODAKYU | ○ | ○ | ○ | ||||

| 4 | 08 | KEIKYU | ○ | ○ | ○ | ||||

| 5 | 05 | TOBU | ○ | ○ | ○ | ||||

| 6 | 07 | TOKYU | ○ | ○ | ○ | ○ | |||

| 7 | 10 | SOTETSU | ○ | ○ | ○ | ○ | |||

| 8 | 2 | 04 | SHIN-KEISEI | ||||||

| 9 | 20 | HANKYU | ○ | ||||||

| 10 | 11 | CHICHIBU | |||||||

| 11 | 18 | KEIHAN | ○ | ○ | ○ | ○ | |||

| 12 | 01 | JR-EAST | ○ | ○ | ○ | ○ | ○ | ||

| 13 | 19 | KEIFUKU | |||||||

| 14 | 03 | KEISEI | |||||||

| 15 | 25 | JR-KYUSHU | ○ | ○ | ○ | ○ | ○ | ||

| 16 | 15 | JR-WEST | ○ | ○ | ○ | ○ | ○ | ||

| 17 | 3 | 21 | HANSHIN | ○ | |||||

| 18 | 13 | JR-CENTRAL | |||||||

| 19 | 22 | KOBE | |||||||

| 20 | 16 | NANKAI | ○ | ○ | |||||

| 21 | 26 | NISHITESU | ○ | ○ | |||||

| 22 | 4 | 17 | KINTETSU | ○ | ○ | ○ | |||

| 23 | 14 | MEITETSU | ○ | ○ | ○ | ○ | |||

| 24 | 23 | SANYO | ○ | ||||||

| 25 | 12 | FUJIKYU | |||||||

| 26 | 24 | HIRODEN | ○ | ||||||

| DX Investment Category | Ticketing | Streamline Facilities | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Order | Group | No. | Company Name | Prepaid Transportation IC Cards | Cashless | Ticketless•QR Code | Smartphone Payment | Credit Card Touch Payments | Common System Infrastructure Development | Apps ※1 | MaaS ※2 | Point Service ※3 |

| 1 | 1 | 02 | KEIO | ○ | ||||||||

| 2 | 06 | SEIBU | ○ | ○ | ○ | ○ | ||||||

| 3 | 09 | ODAKYU | ○ | ○ | ○ | ○ | ○ | |||||

| 4 | 08 | KEIKYU | ○ | ○ | ○ | |||||||

| 5 | 05 | TOBU | ○ | ○ | ○ | ○ | ||||||

| 6 | 07 | TOKYU | ○ | ○ | ○ | |||||||

| 7 | 10 | SOTETSU | ○ | ○ | ○ | ○ | ○ | |||||

| 8 | 2 | 04 | SHIN-KEISEI | ○ | ||||||||

| 9 | 20 | HANKYU | ○ | ○ | ○ | ○ | ○ | |||||

| 10 | 11 | CHICHIBU | ○ | ○ | ||||||||

| 11 | 18 | KEIHAN | ○ | ○ | ○ | ○ | ||||||

| 12 | 01 | JR-EAST | ○ | ○ | ○ | ○ | ○ | ○ | ||||

| 13 | 19 | KEIFUKU | ○ | ○ | ||||||||

| 14 | 03 | KEISEI | ○ | |||||||||

| 15 | 25 | JR-KYUSHU | ○ | ○ | ○ | ○ | ||||||

| 16 | 15 | JR-WEST | ○ | ○ | ○ | ○ | ○ | ○ | ○ | |||

| 17 | 3 | 21 | HANSHIN | ○ | ○ | ○ | ○ | ○ | ||||

| 18 | 13 | JR-CENTRAL | ○ | ○ | ○ | ○ | ||||||

| 19 | 22 | KOBE | ||||||||||

| 20 | 16 | NANKAI | ○ | ○ | ○ | |||||||

| 21 | 26 | NISHITETSU | ○ | ○ | ○ | ○ | ○ | |||||

| 22 | 4 | 17 | KINTETSU | ○ | ○ | ○ | ○ | |||||

| 23 | 14 | MEITETSU | ○ | ○ | ||||||||

| 24 | 23 | SANYO | ○ | |||||||||

| 25 | 12 | FUJIKYU | ○ | |||||||||

| 26 | 24 | HIRODEN | ○ | ○ | ||||||||

| DX Investment Category | Service | New Business | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Order | Group | No. | Company Name | Marketing Analysis | Travel Web Reservation | Banking Services | Real-Digital Hybrid | EC Mall | Digital Service ※4 | Community Symbiosis Business | Digital Business | Open Innovation |

| 1 | 1 | 02 | KEIO | ○ | ○ | ○ | ||||||

| 2 | 06 | SEIBU | ○ | ○ | ||||||||

| 3 | 09 | ODAKYU | ○ | ○ | ○ | |||||||

| 4 | 08 | KEIKYU | ○ | |||||||||

| 5 | 05 | TOBU | ○ | ○ | ○ | |||||||

| 6 | 07 | TOKYU | ○ | ○ | ○ | |||||||

| 7 | 10 | SOTETSU | ○ | |||||||||

| 8 | 2 | 04 | SHIN-KEISEI | |||||||||

| 9 | 20 | HANKYU | ○ | ○ | ○ | |||||||

| 10 | 11 | CHICHIBU | ||||||||||

| 11 | 18 | KEIHAN | ○ | ○ | ○ | ○ | ||||||

| 12 | 01 | JR-EAST | ○ | ○ | ○ | ○ | ○ | ○ | ○ | |||

| 13 | 19 | KEIFUKU | ○ | |||||||||

| 14 | 03 | KEISEI | ||||||||||

| 15 | 25 | JR-KYUSHU | ○ | |||||||||

| 16 | 15 | JR-WEST | ○ | ○ | ○ | |||||||

| 17 | 3 | 21 | HANSHIN | ○ | ○ | |||||||

| 18 | 13 | JR-CENTRAL | ○ | |||||||||

| 19 | 22 | KOBE | ○ | |||||||||

| 20 | 16 | NANKAI | ○ | ○ | ○ | ○ | ||||||

| 21 | 26 | NISHITETSU | ○ | ○ | ○ | ○ | ||||||

| 22 | 4 | 17 | KINTETSU | ○ | ○ | ○ | ○ | ○ | ||||

| 23 | 14 | MEITETSU | ○ | ○ | ○ | |||||||

| 24 | 23 | SANYO | ||||||||||

| 25 | 12 | FUJIKYU | ||||||||||

| 26 | 24 | HIRODEN | ||||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Endo, H.; Goto, M. Cost Inefficiency of Japanese Railway Companies and Impacts of COVID-19 Pandemic and Digital Transformation. Economies 2024, 12, 196. https://doi.org/10.3390/economies12080196

Endo H, Goto M. Cost Inefficiency of Japanese Railway Companies and Impacts of COVID-19 Pandemic and Digital Transformation. Economies. 2024; 12(8):196. https://doi.org/10.3390/economies12080196

Chicago/Turabian StyleEndo, Hideaki, and Mika Goto. 2024. "Cost Inefficiency of Japanese Railway Companies and Impacts of COVID-19 Pandemic and Digital Transformation" Economies 12, no. 8: 196. https://doi.org/10.3390/economies12080196

APA StyleEndo, H., & Goto, M. (2024). Cost Inefficiency of Japanese Railway Companies and Impacts of COVID-19 Pandemic and Digital Transformation. Economies, 12(8), 196. https://doi.org/10.3390/economies12080196