Are There Conditions That Can Predict When an M&A Works? The Case of Italian Listed Banks

Abstract

1. Introduction

2. Literature Review on Mergers and Acquisitions

3. M&A Italian Listed Banks versus M&A European Listed Banks

- Liquidity: A bank’s ability to quickly convert assets into cash. (Federal Reserve 2014; Chen et al. 2018);

- Performance: A bank’s ability to provide its services to consumers and businesses while generating sustainable profitability (Anbar and Alper 2011);

- Profitability: A bank’s ability to generate revenue that can cover costs, thus being profitable. This result is crucial for both the ongoing activity of the bank and its investors to obtain fair returns. Moreover, this index is carefully observed by the supervisory authorities, as it ensures more resilient solvency ratios, particularly in the context of a riskier entrepreneurial environment (Abdul 2017; Athanasoglou et al. 2008);

- Quality: This set of indicators analyses the quality of the customer portfolio based on the quality of non-performing loans (Chiorazzo et al. 2008);

- Structural/Capital ratio: This indicates the level of capitalisation of the banks and their ability to cope with lean periods using their own resources. Capital takes on the role of a financial cushion to tackle unexpected losses. (Posner 2015).

4. Theoretical Assumptions, Modelling and Econometric Issues

4.1. Theoretical Framework

4.2. Modelling and Econometric Issues

5. Methodology

5.1. The Probability of Increasing M&A Activity

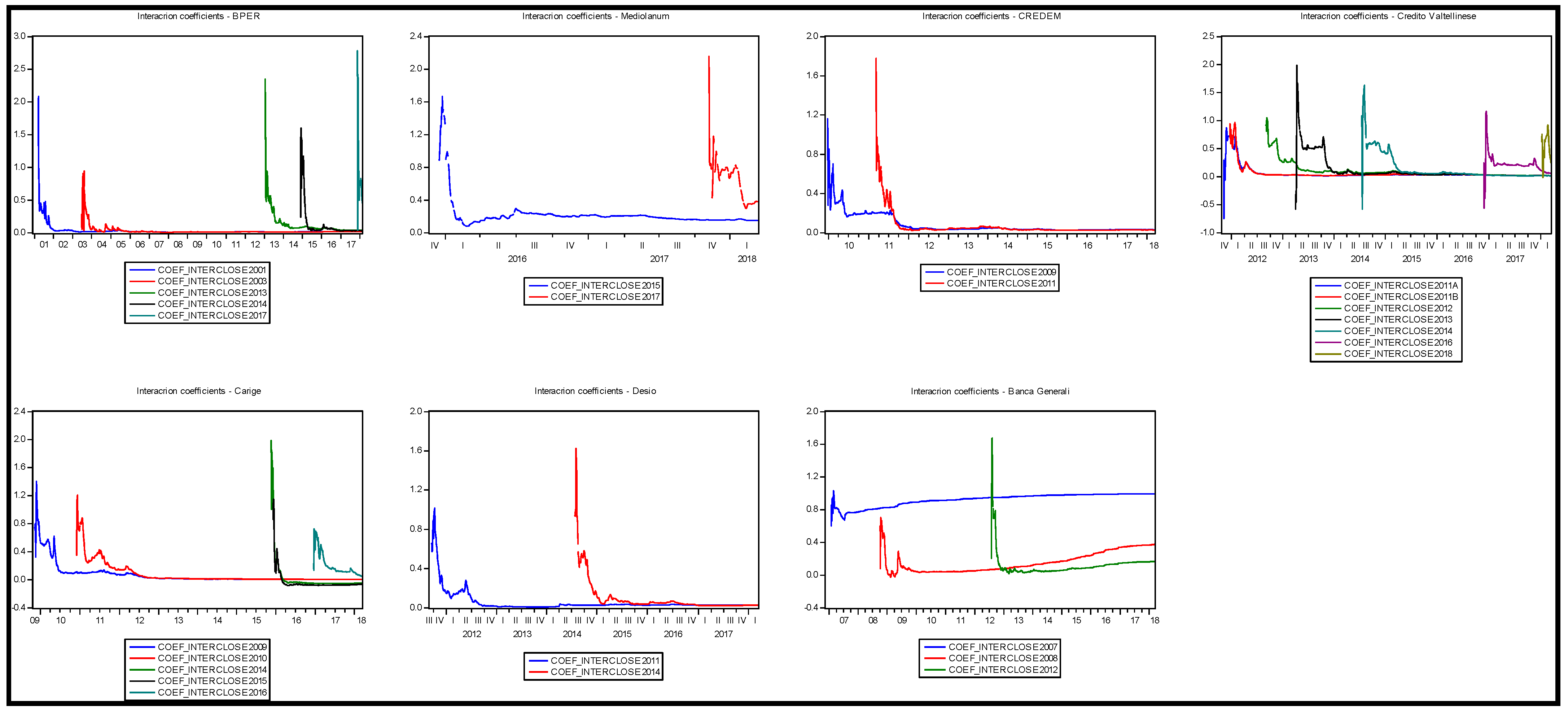

5.2. Short-Run Analysis

5.3. From Short-Run to Medium/Long-Run Analysis

6. Results

Instrumental Variable Approach

7. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Bank Name | City | Country Code | Total Assetsm USD | Country Rank | World Rank | |

|---|---|---|---|---|---|---|

| 1. | UniCredit SpA | MILAN | IT | 1,003,562 | 1 | 30 |

| 2. | Intesa Sanpaolo | TURIN | IT | 955,675 | 2 | 36 |

| 3. | Banco BPM SpA | MILAN | IT | 193,335 | 3 | 142 |

| 4. | Banca Monte dei Paschi di Siena | SIENA | IT | 166,888 | 5 | 154 |

| 5. | Unione di Banche Italiane SpA | BERGAMO | IT | 152,762 | 6 | 167 |

| 6. | BPER Banca SpA | MODENA | IT | 85,557 | 8 | 278 |

| 7. | Mediobanca SpA (Mediobanca) | MILAN | IT | 84,288 | 9 | 285 |

| 8 | Banca Mediolanum SpA | BASIGLIO | IT | 51,890 | 13 | 426 |

| 9. | Banca Popolare di Sondrio | SONDRIO | IT | 49,920 | 14 | 448 |

| 10. | Credito Emiliano SpA (CREDEM) | REGGIO-EMILIA | IT | 49,872 | 15 | 449 |

| 11. | Banca Piccolo Credito Valtellinese | SONDRIO | IT | 29,931 | 20 | 673 |

| 12. | Banca Carige SpA | GENOVA | IT | 29,886 | 21 | 675 |

| 13 | Banca di Desio e della Brianza | DESIO | IT | 16,785 | 31 | 1036 |

| 14 | Banca Generali SpA (Generbanca) | TRIESTE | IT | 10,783 | 43 | 1363 |

| A | Total assets of 14 listed banks | 2,956,461 | ||||

| B | Total assets of all listed banks | 3,040,606 | ||||

| C | A/B | 0.97 |

| Macroarea | Description | N. | Indicator | Label |

|---|---|---|---|---|

| Liquidity | The extent to which banks have liquidity on hand and are funded by relatively stable and predictable (mainly retail) deposits, rather than by potentially more volatile wholesale debt funding | 1 | Liquid assets/total deposit and borrowing | liquidass_Dep_Bor |

| 2 | Liquid assets/deposits and short-term funding | liquidass_Dep_stfunding | ||

| Performance | The bank’s ability to provide its services to consumers and businesses | 3 | Return on average assets (ROAA) | Roaa |

| 4 | Return on average equity (ROAE) | Roae | ||

| 5 | Return on risk-weighted assets (RORWA)—operating profit/RWA | Rorwa | ||

| Profitability | The bank’s ability to generate revenue that can cover costs, thus being profitable | 6 | Operating profit/average equity | oper_profit_avg_equity |

| 7 | Operating profit/total deposit | operpro_tdep | ||

| 8 | Profit before tax/total deposit | prof_bef_tax_totdep | ||

| Quality | Analyses the quality of the customers’ portfolio based on the quality of non-performing loans present | 9 | Impaired/non-performing loans/equity | impair_npl_equ |

| 10 | Impaired/non-performing loans | impaired_npl | ||

| Structural/capital ratio | Indicates the level of capitalisation of the banks and their ability to cope with stressful periods using their own resources | 11 | Equity/total assets | equity_totassets |

| 12 | Net profit/(loss) for the year from discontinued operations | Netprofit_disc | ||

| 13 | Total capital ratio | tot_capital_ratio | ||

| 14 | Tier 1 ratio | Tier_1 | ||

| 15 | Equity/net loans | equ_netloans |

| Liquid Assets/Deposits and Short-Term Funding Ratio | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 28.5 | 29.7 | 28.2 | 25.7 | 25.1 | 23.5 |

| 2. | Intesa Sanpaolo | 38.2 | 37.6 | 35.0 | 32.0 | 33.4 | 33.5 |

| 3. | Banco BPM SpA | 9.9 | 9.3 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 13.5 | 20.9 | 15.8 | 17.6 | 19.9 | 28.8 |

| 5. | UBI Banca SCpA | 6.5 | 7.0 | 7.6 | 11.5 | 15.0 | 14.4 |

| 6. | BPER Banca SpA | 4.7 | 5.2 | 7.6 | 7.6 | 10.6 | 14.9 |

| 7. | Mediobanca SpA | 32.9 | 39.4 | 42.2 | 40.3 | 34.7 | n.a. |

| 8 | Banca Mediolanum SpA | 97.8 | 77.5 | 73.6 | 8.0 | 11.2 | 21.3 |

| 9. | Banca Popolare di Sondrio SCpA | 12.0 | 12.7 | 13.0 | 15.4 | 13.2 | 15.9 |

| 10. | CREDEM SpA | 14.4 | 11.9 | 9.9 | 9.3 | 10.0 | 11.2 |

| 11. | Banca Piccolo Credito Valtellinese | 5.1 | 4.8 | 5.4 | 6.0 | 9.5 | 10.2 |

| 12. | Banca Carige SpA | 13.1 | 8.4 | 5.7 | 8.2 | 12.2 | 14.7 |

| 13. | Banca di Desio e della Brianza SpA | 25.1 | 1.6 | 3.6 | 3.8 | 7.1 | 8.6 |

| 14. | Banca Generali SpA | 12.7 | 8.9 | 7.4 | 9.1 | 16.0 | 15.1 |

| Average | 21.6 | 18.9 | 18.7 | 15.0 | 16.8 | 17.7 | |

| Liquid Assets/Total Deposits/Loans Ratio | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 21.1 | 21.5 | 19.2 | 17.7 | 16.2 | 14.9 |

| 2. | Intesa Sanpaolo | 24.4 | 22.5 | 19.7 | 18.1 | 17.9 | 17.8 |

| 3. | Banco BPM SpA | 7.4 | 6.4 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 10.7 | 14.3 | 11.0 | 11.5 | 12.1 | 16.9 |

| 5. | UBI Banca SCpA | 4.5 | 4.5 | 4.6 | 6.9 | 8.8 | 8.0 |

| 6. | BPER Banca SpA | 4.0 | 4.1 | 5.8 | 5.8 | 7.6 | 9.9 |

| 7. | Mediobanca SpA | 16.7 | 20.4 | 19.4 | 17.9 | 14.3 | n.a. |

| 8 | Banca Mediolanum SpA | 77.5 | 66.0 | 66.3 | 7.8 | 10.8 | 20.2 |

| 9. | Banca Popolare di Sondrio SCpA | 10.8 | 11.4 | 11.6 | 13.8 | 11.9 | 14.2 |

| 10. | CREDEM SpA | 11.2 | 9.2 | 7.6 | 7.3 | 7.8 | 8.4 |

| 11. | Banca Piccolo Credito Valtellinese | 4.4 | 3.9 | 4.2 | 4.8 | 7.3 | 7.5 |

| 12. | Banca Carige SpA | 9.7 | 5.9 | 3.8 | 5.5 | 7.9 | 8.9 |

| 13. | Banca di Desio e della Brianza SpA | 19.7 | 1.6 | 3.6 | 3.8 | 7.1 | 8.6 |

| 14. | Banca Generali SpA | 12.7 | 8.9 | 7.4 | 9.1 | 16.0 | 15.1 |

| Average | 16.2 | 13.9 | 13.7 | 10.0 | 11.2 | 12.5 | |

| Return on Average Assets (ROAA) | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | −1.3 | 0.2 | 0.3 | −1.5 | 0.1 | −1.0 |

| 2. | Intesa Sanpaolo | 0.5 | 0.4 | 0.2 | −0.7 | 0.3 | −1.3 |

| 3. | Banco BPM SpA | −1.0 | 0.4 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | −2.0 | 0.2 | −2.9 | −0.7 | −1.4 | −2.0 |

| 5. | UBI Banca SCpA | −0.7 | 0.1 | −0.6 | 0.2 | 0.1 | −1.4 |

| 6. | BPER Banca SpA | 0.0 | 0.4 | 0.1 | 0.0 | −0.1 | 0.4 |

| 7. | Mediobanca SpA | 0.9 | 0.8 | 0.6 | −0.2 | 0.1 | n.a. |

| 8 | Banca Mediolanum SpA | 0.9 | 1.0 | 1.0 | 1.8 | 2.0 | 0.8 |

| 9. | Banca Popolare di Sondrio SCpA | 0.3 | 0.4 | 0.4 | 0.2 | 0.1 | 0.3 |

| 10. | CREDEM SpA | 0.3 | 0.5 | 0.5 | 0.4 | 0.4 | 0.3 |

| 11. | Banca Piccolo Credito Valtellinese | −1.3 | 0.4 | −1.2 | 0.1 | −1.1 | 0.2 |

| 12. | Banca Carige SpA | −1.1 | −0.3 | −1.4 | −3.9 | −0.1 | 0.4 |

| 13. | Banca di Desio e della Brianza SpA | 8.9 | 2.1 | 1.0 | 0.9 | 1.3 | 0.7 |

| 14. | Banca Generali SpA | 2.2 | 3.3 | 2.5 | 2.1 | 2.2 | 1.7 |

| Average | 0.5 | 0.7 | 0.1 | −0.1 | 0.3 | −0.1 | |

| Return on Average Equity (ROAE) | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | −23.4 | 3.9 | 4.6 | −23.3 | 2.0 | −16.1 |

| 2. | Intesa Sanpaolo | 6.5 | 5.8 | 2.9 | −9.6 | 3.4 | −17.0 |

| 3. | Banco BPM SpA | −13.0 | 5.3 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | −40.2 | 5.1 | −90.4 | −22.8 | −36.6 | −42.7 |

| 5. | UBI Banca SCpA | −8.6 | 1.4 | −6.5 | 2.5 | 0.9 | −18.9 |

| 6. | BPER Banca SpA | 0.3 | 3.9 | 0.6 | 0.3 | −0.7 | 5.1 |

| 7. | Mediobanca SpA | 6.8 | 7.1 | 6.2 | −2.7 | 1.2 | n.a. |

| 8 | Banca Mediolanum SpA | 18.7 | 22.6 | 21.4 | 29.8 | 39.0 | 22.5 |

| 9. | Banca Popolare di Sondrio SCpA | 3.8 | 5.4 | 5.6 | 3.1 | 2.1 | 4.1 |

| 10. | CREDEM SpA | 5.3 | 6.8 | 6.7 | 5.6 | 6.7 | 5.9 |

| 11. | Banca Piccolo Credito Valtellinese | −16.7 | 5.8 | −16.4 | 0.7 | −15.4 | 3.1 |

| 12. | Banca Carige SpA | −12.8 | −4.8 | −31.6 | −66.8 | −1.9 | 6.6 |

| 13. | Banca di Desio e della Brianza SpA | 77.4 | 32.0 | 23.4 | 24.6 | 30.9 | 13.5 |

| 14. | Banca Generali SpA | 24.3 | 34.7 | 32.0 | 33.8 | 40.5 | 29.5 |

| Average | 2.8 | 9.9 | −1.9 | −1.9 | 5.5 | −0.4 | |

| Return on Risk-Weighted Assets (RoRWA)—Operating Profit/RWA | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank Name | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | −3.0 | 0.4 | 0.7 | −1.8 | −0.1 | 0.2 |

| 2. | Intesa Sanpaolo | 1.0 | 1.3 | 1.0 | −0.9 | 1.0 | 0.3 |

| 3. | Banco BPM SpA | −3.1 | 0.6 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | −5.1 | 0.2 | −9.7 | −2.5 | −2.3 | −0.5 |

| 5. | UBI Banca SCpA | −2.0 | 0.4 | 0.2 | 0.3 | 0.2 | −0.3 |

| 6. | BPER Banca SpA | 0.1 | 0.5 | 0.2 | 0.2 | −0.1 | 1.1 |

| 7. | Mediobanca SpA | 0.9 | 0.9 | 0.4 | 0.3 | 0.3 | n.a. |

| 8 | Banca Mediolanum SpA | 5.4 | 7.1 | 6.2 | 10.2 | 8.8 | 3.2 |

| 9. | Banca Popolare di Sondrio SCpA | 0.5 | 0.8 | 0.8 | 0.5 | 0.4 | 0.6 |

| 10. | CREDEM SpA | 1.5 | 1.8 | 1.5 | 1.3 | 1.0 | 1.2 |

| 11. | Banca Piccolo Credito Valtellinese | −2.5 | −1.1 | −1.9 | 0.2 | −0.7 | 0.6 |

| 12. | Banca Carige SpA | −2.5 | −1.0 | −2.8 | −4.7 | −1.4 | 1.2 |

| 13. | Banca di Desio e della Brianza SpA | 10.4 | 7.5 | 5.2 | 5.9 | 5.6 | 2.2 |

| 14. | Banca Generali SpA | 7.4 | 8.9 | 7.9 | 9.2 | 8.0 | 4.8 |

| Average | 1.1 | 2.3 | 0.7 | 1.4 | 1.6 | 1.2 | |

| Operating Profit/Average Equity | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | −24.0 | 3.1 | 5.2 | −12.9 | −0.8 | 2.0 |

| 2. | Intesa Sanpaolo | 5.6 | 8.0 | 5.7 | −5.2 | 6.3 | 1.7 |

| 3. | Banco BPM SpA | −18.2 | 3.8 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | −41.5 | 2.2 | −123.5 | −33.8 | −24.6 | −4.7 |

| 5. | UBI Banca SCpA | −12.4 | 2.3 | 1.3 | 1.7 | 1.1 | −2.8 |

| 6. | BPER Banca SpA | 0.6 | 3.8 | 1.2 | 1.7 | −0.5 | 10.9 |

| 7. | Mediobanca SpA | 5.2 | 6.3 | 3.4 | 2.6 | 2.8 | n.a. |

| 8 | Banca Mediolanum SpA | 20.0 | 27.8 | 29.0 | 43.0 | 54.0 | 25.7 |

| 9. | Banca Popolare di Sondrio SCpA | 4.4 | 7.2 | 8.9 | 6.3 | 5.3 | 7.6 |

| 10. | CREDEM SpA | 8.3 | 9.7 | 10.9 | 10.2 | 8.9 | 12.6 |

| 11. | Banca Piccolo Credito Valtellinese | −18.5 | −7.9 | −16.4 | 1.3 | −6.7 | 5.6 |

| 12. | Banca Carige SpA | −18.0 | −9.6 | −32.8 | −38.4 | −10.6 | 9.6 |

| 13. | Banca di Desio e della Brianza SpA | 81.1 | 48.6 | 35.4 | 41.6 | 48.6 | 21.3 |

| 14. | Banca Generali SpA | 28.8 | 40.6 | 40.2 | 45.1 | 51.7 | 33.9 |

| Average | 2.7 | 11.2 | −0.4 | 4.9 | 10.4 | 10.3 | |

| Operating Profit/Total Deposits | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2. | Intesa Sanpaolo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 3. | Banco BPM SpA | 0.0 | 0.0 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 0.0 | 0.0 | −0.1 | 0.0 | 0.0 | 0.0 |

| 5. | UBI Banca SCpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 6. | BPER Banca SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7. | Mediobanca SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | n.a. |

| 8 | Banca Mediolanum SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 9. | Banca Popolare di Sondrio SCpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 10. | CREDEM SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 11. | Banca Piccolo Credito Valtellinese | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 12. | Banca Carige SpA | 0.0 | 0.0 | 0.0 | −0.1 | 0.0 | 0.0 |

| 13. | Banca di Desio e della Brianza SpA | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 14. | Banca Generali SpA | 0.0 | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 |

| Average | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Operating Profit/Total Deposits | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2. | Intesa Sanpaolo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 3. | Banco BPM SpA | 0.0 | 0.0 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 0.0 | 0.0 | −0.1 | 0.0 | 0.0 | 0.0 |

| 5. | UBI Banca SCpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 6. | BPER Banca SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7. | Mediobanca SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | n.a. |

| 8 | Banca Mediolanum SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 9. | Banca Popolare di Sondrio SCpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 10. | CREDEM SpA | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 11. | Banca Piccolo Credito Valtellinese | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 12. | Banca Carige SpA | 0.0 | 0.0 | 0.0 | −0.1 | 0.0 | 0.0 |

| 13. | Banca di Desio e della Brianza SpA | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 14. | Banca Generali SpA | 0.0 | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 |

| Average | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Impaired/Non-Performing Loans/Equity | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 1.8 | 1.5 | 1.5 | 1.5 | 1.1 | 1.1 |

| 2. | Intesa Sanpaolo | 1.2 | 1.3 | 1.3 | 1.2 | 0.9 | 0.8 |

| 3. | Banco BPM SpA | 3.4 | 2.0 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 6.9 | 4.6 | 7.1 | 5.0 | 3.9 | 1.8 |

| 5. | UBI Banca SCpA | 1.4 | 1.3 | 1.1 | 1.0 | 0.9 | 0.8 |

| 6. | BPER Banca SpA | 2.0 | 2.0 | 1.8 | 2.0 | 1.5 | 1.3 |

| 7. | Mediobanca SpA | 0.2 | 0.2 | 0.2 | 0.2 | 0.1 | n.a. |

| 8 | Banca Mediolanum SpA | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 |

| 9. | Banca Popolare di Sondrio SCpA | 1.5 | 1.4 | 1.3 | 1.2 | 0.7 | 0.5 |

| 10. | CREDEM SpA | 0.6 | 0.6 | 0.5 | 0.5 | 0.5 | 0.5 |

| 11. | Banca Piccolo Credito Valtellinese | 2.9 | 2.4 | 2.1 | 1.7 | 1.3 | 1.0 |

| 12. | Banca Carige SpA | 3.4 | 2.6 | 3.4 | 3.1 | 0.7 | 0.7 |

| 13. | Banca di Desio e della Brianza SpA | 1.4 | 1.2 | 1.0 | 1.1 | 1.5 | 1.7 |

| 14. | Banca Generali SpA | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.2 |

| Average | 1.9 | 1.5 | 1.7 | 1.4 | 1.0 | 0.9 | |

| Impaired/Non-Performing Loans | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 75,483,530 | 80,005,187 | 77412983 | 74,310,248 | 69,602,096 | 62,011,648 |

| 2. | Intesa Sanpaolo | 57,853,000 | 62,142,000 | 58,559,000 | 52,619,000 | 42,851,000 | 36,452,000 |

| 3. | Banco BPM SpA | 25,888,394 | 26,429,293 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 44,672,678 | 44,027,989 | 41,327,529 | 31,003,497 | 24,966,976 | 20,237,777 |

| 5. | UBI Banca SCpA | 12,407,687 | 13,196,123 | 11,641,365 | 10,967,663 | 9,584,547 | 7,514,979 |

| 6. | BPER Banca SpA | 11,015,891 | 11,110,712 | 10,064,663 | 9,393,477 | 7,314,886 | 5,919,843 |

| 7. | Mediobanca SpA | 1,998,478 | 1,930,737 | 1,927,976 | 1,133,655 | 909,043 | n,a, |

| 8 | Banca Mediolanum SpA | 112,837 | 107,114 | 87,210 | 61,983 | 55,370 | 170,222 |

| 9. | Banca Popolare di Sondrio SCpA | 4,087,552 | 3,768,117 | 3,105,902 | 2,485,175 | 1,435,197 | 1,009,034 |

| 10. | CREDEM SpA | 1,360,080 | 1,360,631 | 1,233,072 | 1,149,257 | 961,320 | 826,946 |

| 11. | Banca Piccolo Credito Valtellinese | 5,171,495 | 5,274,281 | 4,207,025 | 3,280,051 | 2,502,824 | 2,020,046 |

| 12. | Banca Carige SpA | 7,212,565 | 6,545,468 | 6,134,241 | 5,071,102 | 2,711,748 | 2,115,125 |

| 13. | Banca di Desio e della Brianza SpA | 1,761,638 | 667,992 | 430,480 | 435,427 | 467,885 | 330,005 |

| 14. | Banca Generali SpA | 41,859 | 43,486 | 54,271 | 51,293 | 39,155 | 49,844 |

| Average | 17,790,549 | 18,329,224 | 16,629,671 | 14,766,294 | 12,569,388 | 11,554,789 | |

| Solvency: Equity/Total Assets | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 5.0 | 6.2 | 6.3 | 5.9 | 7.2 | 5.9 |

| 2. | Intesa Sanpaolo | 6.8 | 7.2 | 7.0 | 7.2 | 7.5 | 7.5 |

| 3. | Banco BPM SpA | 7.1 | 7.7 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 4.2 | 5.7 | 3.2 | 3.1 | 3.0 | 4.6 |

| 5. | UBI Banca SCpA | 8.1 | 9.0 | 8.5 | 9.0 | 8.0 | 7.6 |

| 6. | BPER Banca SpA | 8.6 | 9.2 | 9.1 | 7.6 | 7.7 | 7.7 |

| 7. | Mediobanca SpA | 12.8 | 12.5 | 11.3 | 9.5 | 8.4 | n.a. |

| 8 | Banca Mediolanum SpA | 5.1 | 4.6 | 4.3 | 5.7 | 6.3 | 3.8 |

| 9. | Banca Popolare di Sondrio SCpA | 7.2 | 7.5 | 7.0 | 6.1 | 6.0 | 6.5 |

| 10. | CREDEM SpA | 6.3 | 6.6 | 6.8 | 6.8 | 6.5 | 5.3 |

| 11. | Banca Piccolo Credito Valtellinese | 6.9 | 8.1 | 7.0 | 7.0 | 6.7 | 7.5 |

| 12. | Banca Carige SpA | 8.2 | 8.2 | 4.7 | 3.9 | 7.5 | 6.4 |

| 13. | Banca di Desio e della Brianza SpA | 14.1 | 8.2 | 5.3 | 3.4 | 3.8 | 5.0 |

| 14. | Banca Generali SpA | 7.7 | 10.4 | 8.7 | 7.1 | 5.4 | 5.8 |

| Average | 7.8 | 7.9 | 6.7 | 6.3 | 6.5 | 6.1 | |

| Net Profit/(Loss) for the Year from Discontinued Operations | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 630,111 | −295,426 | −124,126 | −760,471 | −174,808 | 0 |

| 2. | Intesa Sanpaolo | 987,000 | 59,000 | −48,000 | 0 | 0 | 0 |

| 3. | Banco BPM SpA | 2524 | −7280 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 0 | 0 | 0 | −51,224 | 10,807 | 17,675 |

| 5. | UBI Banca SCpA | 0 | 0 | 0 | 0 | 0 | 248 |

| 6. | BPER Banca SpA | 0 | 0 | 0 | 1,258 | 0 | −6572 |

| 7. | Mediobanca SpA | 0 | 0 | 0 | 0 | 0 | n.a. |

| 8 | Banca Mediolanum SpA | 0 | 0 | 212 | 0 | 0 | −59 |

| 9. | Banca Popolare di Sondrio SCpA | 0 | 0 | 0 | 0 | 0 | 0 |

| 10. | CREDEM SpA | 0 | 0 | 0 | 0 | 0 | 6692 |

| 11. | Banca Piccolo Credito Valtellinese | 0 | 20,070 | −1125 | 0 | 26,430 | 0 |

| 12. | Banca Carige SpA | 0 | 71,216 | −138,706 | 0 | 0 | 0 |

| 13. | Banca di Desio e della Brianza SpA | 0 | 0 | 0 | 0 | 0 | 0 |

| 14. | Banca Generali SpA | 0 | 0 | 3051 | −124 | 451 | 1835 |

| Average | 115,688.2 | −10,887.1 | −23,745.7 | −62,350.9 | −10,547.7 | 1,651.6 | |

| Tier 1 Ratio | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 9.0 | 11.5 | 11.1 | 10.1 | 11.4 | 9.3 |

| 2. | Intesa Sanpaolo | 13.9 | 13.8 | 14.2 | 12.3 | 12.1 | 11.5 |

| 3. | Banco BPM SpA | 12.5 | 12.7 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 8.2 | 12.9 | 8.5 | 10.6 | 9.6 | 11.1 |

| 5. | UBI Banca SCpA | 11.5 | 12.1 | 12.3 | 13.2 | 10.8 | 9.1 |

| 6. | BPER Banca SpA | 13.9 | 11.3 | 11.3 | 8.6 | 8.3 | 7.9 |

| 7. | Mediobanca SpA | 12.1 | 12.0 | 11.1 | 11.8 | 11.5 | n.a. |

| 8 | Banca Mediolanum SpA | 20.0 | 19.7 | 18.4 | 14.4 | 12.1 | 9.4 |

| 9. | Banca Popolare di Sondrio SCpA | 11.1 | 10.5 | 9.8 | 7.9 | 7.6 | 7.8 |

| 10. | CREDEM SpA | 13.2 | 13.5 | 11.1 | 9.9 | 9.4 | 8.7 |

| 11. | Banca Piccolo Credito Valtellinese | 11.8 | 13.1 | 11.0 | 8.6 | 8.1 | 7.3 |

| 12. | Banca Carige SpA | 12.0 | 12.8 | 8.7 | 5.8 | 7.4 | 5.7 |

| 13. | Banca di Desio e della Brianza SpA | 15.1 | 15.0 | 14.0 | 13.7 | 12.9 | 11.2 |

| 14. | Banca Generali SpA | 16.7 | 14.3 | 12.2 | 14.2 | 11.8 | 11.1 |

| Average | 13.1 | 13.4 | 12.0 | 10.9 | 10.2 | 9.2 | |

| Equity/Net Loans | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 9.7 | 11.3 | 11.2 | 10.0 | 12.2 | 9.8 |

| 2. | Intesa Sanpaolo | 13.5 | 14.0 | 13.3 | 13.1 | 13.3 | 12.7 |

| 3. | Banco BPM SpA | 10.1 | 11.7 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 6.1 | 8.6 | 4.8 | 4.7 | 4.6 | 7.5 |

| 5. | UBI Banca SCpA | 11.1 | 12.4 | 12.1 | 12.7 | 11.4 | 9.9 |

| 6. | BPER Banca SpA | 12.2 | 12.9 | 12.6 | 10.1 | 9.9 | 9.6 |

| 7. | Mediobanca SpA | 23.6 | 23.9 | 21.7 | 19.1 | 15.8 | n.a. |

| 8 | Banca Mediolanum SpA | 24.9 | 27.7 | 26.8 | 20.9 | 21.9 | 13.1 |

| 9. | Banca Popolare di Sondrio SCpA | 10.6 | 11.0 | 10.4 | 8.4 | 7.7 | 8.0 |

| 10. | CREDEM SpA | 10.5 | 10.7 | 11.0 | 10.8 | 9.6 | 8.3 |

| 11. | Banca Piccolo Credito Valtellinese | 10.1 | 11.5 | 10.7 | 9.5 | 9.0 | 9.6 |

| 12. | Banca Carige SpA | 11.7 | 11.6 | 7.7 | 6.5 | 12.2 | 10.7 |

| 13. | Banca di Desio e della Brianza SpA | 20.7 | 16.7 | 15.6 | 16.6 | 13.5 | 11.4 |

| 14. | Banca Generali SpA | 34.4 | 33.1 | 29.9 | 31.3 | 30.2 | 27.0 |

| Average | 16.4 | 18.3 | 16.6 | 14.5 | 13.2 | 11.5 | |

| Total Capital Ratio | |||||||

|---|---|---|---|---|---|---|---|

| N. | Bank | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1. | UniCredit SpA | 11.7 | 14.2 | 13.4 | 13.6 | 14.5 | 12.4 |

| 2. | Intesa Sanpaolo | 17.0 | 16.6 | 17.2 | 14.8 | 13.6 | 14.3 |

| 3. | Banco BPM SpA | 14.9 | 15.2 | n.a. | n.a. | n.a. | n.a. |

| 4. | Banca Monte dei Paschi di Siena SpA | 10.4 | 16.0 | 12.8 | 15.2 | 13.8 | 15.7 |

| 5. | UBI Banca SCpA | 14.1 | 13.9 | 15.3 | 18.9 | 16.0 | 13.5 |

| 6. | BPER Banca SpA | 15.2 | 12.5 | 12.2 | 11.9 | 12.1 | 11.5 |

| 7. | Mediobanca SpA | 15.3 | 14.9 | 13.8 | 15.6 | 14.2 | n.a. |

| 8 | Banca Mediolanum SpA | 20.0 | 19.7 | 18.4 | 18.0 | 13.8 | 12.1 |

| 9. | Banca Popolare di Sondrio SCpA | 13.6 | 13.4 | 11.3 | 10.5 | 10.5 | 10.3 |

| 10. | CREDEM SpA | 14.4 | 14.8 | 11.8 | 13.4 | 13.6 | 11.6 |

| 11. | Banca Piccolo Credito Valtellinese | 13.0 | 15.2 | 14.0 | 12.2 | 11.5 | 10.6 |

| 12. | Banca Carige SpA | 13.9 | 14.9 | 11.2 | 9.2 | 10.5 | 8.0 |

| 13. | Banca di Desio e della Brianza SpA | 15.4 | 15.4 | 14.2 | 13.5 | 12.7 | 10.8 |

| 14. | Banca Generali SpA | 18.4 | 15.9 | 14.2 | 14.8 | 13.0 | 12.8 |

| Average | 14.9 | 15.2 | 13.8 | 14.0 | 13.1 | 12.0 | |

| Country Name | Bank Name | |

|---|---|---|

| 1 | AUSTRIA (AT) | Raiffeisen Bank International AG |

| 2 | Volksbank Vorarlberg e. Gen. | |

| 3 | Wiener Privatbank SE | |

| 4 | Autobank AG | |

| 5 | BELGIUM (BE) | KBC Groep NV/KBC Groupe SA/KBC Group |

| 6 | Banca Carige SpA | |

| 7 | CYPRUS (CY) | TCS Group Holding PLC |

| 8 | CZECH REPUBLIC (CZ) | Komercni Banka |

| 9 | GERMANY (DE) | Deutsche Bank AG |

| 10 | Commerzbank AG | |

| 11 | Deutsche Boerse AG | |

| 12 | Wüstenrot & Württembergische AG | |

| 13 | Deutsche Pfandbriefbank AG | |

| 14 | Aareal Bank AG | |

| 15 | Comdirect Bank AG | |

| 16 | Oldenburgische Landesbank—OLB | |

| 17 | ProCredit Holding AG & Co. KGaA | |

| 18 | Baader Bank AG | |

| 19 | Niiio Finance Group | |

| 20 | DENMARK (DK) | Danske Bank A/S |

| 21 | Jyske Bank A/S (Group) | |

| 22 | Alm. Brand A/S | |

| 23 | Ringkjoebing Landbobank | |

| 24 | Vestjysk Bank A/S | |

| 25 | Nordjyske Bank A/S | |

| 26 | ESTONIA (EE) | AS LHV Group |

| 27 | SPAIN (ES) | Banco Santander SA |

| 28 | Banco Bilbao Vizcaya Argentaria SA (BBVA) | |

| 29 | Caixabank, S.A. | |

| 30 | Banco de Sabadell SA | |

| 31 | Bankia, SA | |

| 32 | Bankinter SA | |

| 33 | Unicaja Banco SA | |

| 34 | Liberbank SA | |

| 35 | FRANCE (FR) | BNP Paribas |

| 36 | Crédit Agricole SA | |

| 37 | Société Générale SA | |

| 38 | Natixis SA | |

| 39 | Caisse régionale de credit agricole mutuel Sud Rhône/Alpes SC Credit Agricole Sud Rhône Alpes | |

| 40 | Amundi SA | |

| 41 | Caisse régionale de crédit agricole mutuel de Normandie-Seine | |

| 42 | THE UNITED KINGDOM (GB) | HSBC Holdings PLC |

| 43 | Barclays PLC | |

| 44 | Lloyds Banking Group PLC | |

| 45 | The Royal Bank of Scotland Group PLC | |

| 46 | Standard Chartered PLC | |

| 47 | Cybg PLC | |

| 48 | Virgin Money Holdings (Uk) PLC | |

| 49 | TP ICAP PLC | |

| 50 | Investec PLC | |

| 51 | Bank BGZ BNP Paribas SA | |

| 52 | Paragon Banking Group PLC | |

| 53 | Close Brothers Group PLC | |

| 54 | 3i Group PLC | |

| 55 | Intermediate Capital Group PLC | |

| 56 | RIT Capital Partners PLC | |

| 57 | Rathbone Brothers PLC | |

| 58 | Electra Private Equity PLC | |

| 59 | Brewin Dolphin Holdings PLC | |

| 60 | Shore Capital Group Limited | |

| 61 | Cenkos Securities PLC | |

| 62 | Arden Partners PLC | |

| 63 | Fiske PLC | |

| 64 | GREECE (GR) | Piraeus Bank SA |

| 65 | National Bank of Greece SA | |

| 66 | Alpha Bank AE | |

| 67 | Eurobank Ergasias SA | |

| 68 | Attica Bank SA/the Bank of Attica SA | |

| 69 | CROATIA (HR) | Zagrebacka Banka d.d. |

| 70 | Privredna Banka Zagreb d.d/Privredna Banka Zagreb Group | |

| 71 | HUNGARY (HU) | FHB Mortgage Bank PLC/FHB Jelzalogbank Nyrt |

| 72 | LIECHTENSTEIN (LI) | Liechtensteinische Landesbank AG/National Bank of Liechtenstein |

| 73 | THE NETHERLANDS (NL) | ING Groep NV |

| 74 | Van Lanschot Kempen NV | |

| 75 | Flow Traders NV | |

| 76 | BinckBank NV | |

| 77 | POLAND (PL) | Powszechna Kasa Oszczednosci Bank Polski SA—PKO BP SA |

| 78 | Bank Polska Kasa Opieki SA/Bank Pekao SA | |

| 79 | Bank Zachodni WBK SA | |

| 80 | mBank SA | |

| 81 | Alior Bank Spólka Akcyjna | |

| 82 | Getin Noble Bank SA | |

| 83 | Getin Holding SA | |

| 84 | Idea Bank SA | |

| 85 | PORTUGAL (PT) | Banco Comercial Português, SA/Millennium bcp |

| 86 | Banco BPI SA | |

| 87 | ROMANIA (RO) | Transilvania Bank-Banca Transilvania SA |

| 88 | BRD—Groupe Societe Generale SA | |

| 89 | SWEDEN (SE) | Nordea Bank AB (publ) |

| 90 | Svenska Handelsbanken AB | |

| 91 | Skandinaviska Enskilda Banken AB | |

| 92 | Swedbank AB | |

| 93 | Avanza Bank Holding AB | |

| 94 | Hoist Finance AB | |

| 95 | TF Bank AB | |

| 96 | SLOVAKIA (SK) | Prima banka Slovensko, a.s. |

| Liquidity | Performance | Profitability | Quality | Structural | Capital ratio | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (D) | (E) | (F) | (G) | (H) | (I) | (L) | (M) | (N) | (O) | (P) | (Q) | ||

| 1 | AUSTRIA (AT) | 30.37 | 27.78 | 0.80 | 3.63 | 2.89 | 4.50 | 0.02 | 0.02 | 0.45 | 2,716,643.51 | 10.82 | 44.28 | 33.83 | 47.51 | |

| 2 | BELGIUM (BE) | 19.25 | 13.68 | −0.24 | −5.99 | 0.22 | −1.70 | 0.00 | −0.01 | 1.54 | 8,519,354.08 | 6.37 | −103,624.17 | 11.75 | 11.43 | 14.51 |

| 3 | CYPRUS (CY) | 21.27 | 19.74 | 4.39 | 17.60 | 31.84 | 0.11 | 0.09 | 0.47 | 169,720.59 | 18.32 | 15.90 | 28.14 | 20.36 | ||

| 4 | CZECH REPUBLIC (CZ) | 16.08 | 15.05 | 1.52 | 13.14 | 3.97 | 15.86 | 0.02 | 0.02 | 0.26 | 954,386.09 | 11.60 | 15.48 | 20.36 | 15.67 | |

| 5 | GERMANY (DE) | 44.48 | 36.44 | −1.91 | 2.77 | 1.88 | 5.22 | −3.68 | −3.67 | 0.26 | 3,151,317.80 | 11.96 | 276,985.00 | 17.87 | 115.67 | 19.60 |

| 6 | DENMARK (DK) | 76.55 | 66.74 | 0.58 | 3.12 | 2.04 | 7.08 | 0.02 | 0.02 | 1.04 | 2,053,167.73 | 10.33 | 3767.49 | 18.78 | 26.66 | 19.48 |

| 7 | ESTONIA (EE) | 49.96 | 49.93 | 1.91 | 19.21 | 3.07 | 18.34 | 0.02 | 0.02 | 0.25 | 11,063.75 | 9.83 | 2051.50 | 16.36 | 18.05 | 22.82 |

| 8 | SPAIN (ES) | 16.09 | 12.68 | 0.07 | −13.07 | 0.84 | −10.95 | 0.00 | 0.00 | 1.00 | 14,442,362.65 | 6.06 | 383,215.78 | 11.82 | 10.31 | 13.01 |

| 9 | FRANCE (FR) | 127.05 | 43.28 | 0.92 | 5.78 | 2.95 | 8.90 | 0.03 | 0.03 | 0.30 | 15,494,717.19 | 12.60 | −315,666.67 | 11.91 | 16.75 | 17.10 |

| 10 | THE UNITED KINGDOM (GB) | 112.47 | 105.08 | 0.99 | 8.87 | 3.72 | 4.67 | 0.03 | 0.03 | 0.81 | 13,460,632.54 | 25.20 | −237,215.28 | 13.91 | 29.10 | 41.65 |

| 11 | GREECE (GR) | 5.55 | 5.26 | −2.65 | 9.19 | −5.96 | −5.76 | −0.07 | −0.07 | 1.80 | 16,532,888.64 | 6.19 | −583,119.04 | 12.39 | 11.01 | 12.82 |

| 12 | CROATIA (HR) | 25.91 | 23.44 | 1.09 | 6.01 | 2.37 | 8.13 | 0.02 | 0.02 | 0.60 | 1,292,087.40 | 15.99 | 22.30 | 24.21 | 21.96 | |

| 13 | HUNGARY (HU) | 34.84 | 22.82 | −1.29 | −10.78 | −2.35 | −11.43 | −0.03 | −0.03 | 0.81 | 197,192.94 | 10.48 | −423.16 | 12.97 | 18.04 | 16.16 |

| 14 | LIECHTENSTEIN (LI) | 52.86 | 48.50 | 0.35 | 3.79 | 0.96 | 4.41 | 0.00 | 0.00 | 0.20 | 294,043.61 | 8.43 | 17.98 | 16.17 | 20.60 | |

| 15 | THE NETHERLANDS (NL) | 21.40 | 38.38 | 0.83 | 15.17 | 2.64 | 16.80 | 0.01 | 0.01 | 0.23 | 5,185,282.11 | 7.83 | 109,363.44 | 21.62 | 40.65 | 22.20 |

| 16 | POLAND (PL) | 10.16 | 9.54 | 1.45 | 13.17 | 2.19 | 12.71 | 0.02 | 0.02 | 0.58 | 1,218,123.48 | 11.37 | 17,830.35 | 13.59 | 17.31 | 14.74 |

| 17 | PORTUGAL (PT) | 13.29 | 11.85 | 0.04 | −3.81 | −0.36 | −7.47 | 0.00 | 0.00 | 0.67 | 2,386,481.42 | 5.53 | 165,624.75 | 11.46 | 8.64 | 12.32 |

| 18 | ROMANIA (RO) | 17.29 | 16.91 | 1.30 | 10.58 | 3.00 | 11.61 | 0.02 | 0.02 | 0.98 | 1,075,909.62 | 11.43 | 18.06 | 20.45 | 18.18 | |

| 19 | SWEDEN (SE) | 51.32 | 32.16 | 1.17 | 16.46 | 4.50 | 21.56 | 0.03 | 0.03 | 0.14 | 1,798,725.65 | 7.12 | −31,759.49 | 16.88 | 13.79 | 18.08 |

| 20 | SLOVAKIA (SK) | 10.46 | 10.10 | −0.09 | −5.01 | 0.88 | −3.53 | 0.00 | 0.00 | 1.25 | 126,389.83 | 5.66 | 8.41 | 14.22 | ||

| 1 | In total, 19 listed banks undertook M&As from 2000 to 2018. |

| 2 | Note: more than one M&A can be undertaken in the same year. The whole dataset is available upon request from the authors. |

| 3 | For this econometric analysis, we used daily observations only for weekdays. |

| 4 | For the choice of indicator, see Section 6. |

References

- Abdul, Jalloh Mamoud. 2017. Impact of Capital Adequacy on the Performance of Nigerian Banks Using the Basel Accord Framework. East Africa Research Papers I Business, Entrepreneurship and Management. Jonkoping, Sweden. Available online: https://ju.se/download/18.68c8babe1613ff331d2cd7e/1520578357831/EARP-BEM%202017-07%20Mamoud.pdf (accessed on 16 February 2024).

- Albertazzi, Ugo, Alessandro Notarpietro, and Stefano Siviero. 2016. An Inquiry into the Determinants of the Profitability of Italian Banks. Bank of Italy Occasional Paper (364). Available online: https://ssrn.com/abstract=2917215 (accessed on 16 February 2024). [CrossRef]

- Anbar, Adem, and Deger Alper. 2011. Bank Specific and Macroeconomic Determinants of Commercial Bank Profitability: Empirical Evidence from Turkey. Business and Economics Research Journal 2: 139–52. Available online: https://ssrn.com/abstract=1831345 (accessed on 16 February 2024).

- Asimakopoulos, Ioannis, and Panayiotis P. Athanasoglou. 2013. Revisiting the merger and acquisition performance of European banks. International Review of Financial Analysis 29: 237–49. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimis, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Ayadi, Rym, Willem De Groen, Ibtihel Sassi, Walid Mathlouthi, Harol Rey, and Olivier Aubry. 2016. Banking Business Models Monitor 2015 Europe. Available online: https://ssrn.com/abstract=2784334 (accessed on 16 February 2024). [CrossRef]

- Badik, Marek. 2007. Motives and reasons of the bank mergers in the EU. Paper presented at 11th International Conference on Finance and Banking: Future of the European Monetary Integration, Karvina, Czech Republic, October 17–18; pp. 57–69. [Google Scholar]

- Baglioni, Angelo S., Luca Colombo, and Paola Rossi. 2018. Debt Restructuring with Multiple Bank Relationships, Bank of Italy, Working Paper No. 1191. Available online: https://ssrn.com/abstract=3415667 (accessed on 16 February 2024). [CrossRef]

- Baltagi, Badi H., Qu Feng, and Chihwa Kao. 2016. Estimation of heterogeneous panels with structural breaks. Journal of Econometrics 191: 176–95. [Google Scholar] [CrossRef]

- Bank of Italy. 2019a. Banks and Financial Institutions: Branch Network—Year 2018. Available online: www.bancaditalia.it/statistiche/index.htm (accessed on 16 February 2024).

- Bank of Italy. 2019b. Financial Stability Report, no. 1. May. Available online: https://www.bancaditalia.it/media/notizia/financial-stability-report-no-1-2019/ (accessed on 16 February 2024).

- Berger, Allen N., and Emilia Bonaccorsi Di Patti. 2006. Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. Journal of Banking & Finance 30: 1065–102. [Google Scholar]

- Bonasia, Mariangela, Elina De Simone, Marcella D’Uva, and Oreste Napolitano. 2022. Environmental protection and happiness: A long-run relationship in Europe. Environmental Impact Assessment Review 93: 106704. [Google Scholar] [CrossRef]

- Borio, Claudio, and Leonardo Gambacorta. 2017. Monetary policy and bank lending in a low interest rate environment: Diminishing effectiveness? Journal of Macroeconomics 54: 217–31. [Google Scholar] [CrossRef]

- Canale, Rosaria Rita, Paul De Grauwe, Pasquale Foresti, and Oreste Napolitano. 2018. Is there a trade-off between free capital mobility, financial stability and fiscal policy flexibility in the EMU? Review of World Economics 154: 177–201. [Google Scholar] [CrossRef]

- Chen, Yi-Kai, Chung-Hua Shen, Lanfeng Kao, and Chuan-Yi Yeh. 2018. Bank Liquidity Risk and Performance. Review of Pacific Basin Financial Markets and Policies 21: 1850007. [Google Scholar] [CrossRef]

- Chiorazzo, Vincenzo, Carlo Milani, and Francesca Salvini. 2008. Income diversification and bank performance: Evidence from Italian banks. Journal of Financial Services Research 33: 181–203. [Google Scholar] [CrossRef]

- Chu, Kam Hon. 2010. Bank mergers, branch networks and economic growth: Theory and evidence from Canada, 1889–1926. Journal of Macroeconomics 32: 265–83. [Google Scholar] [CrossRef]

- Coccorese, Paolo, and Giovanni Ferri. 2020. Are mergers among cooperative banks worth a dime? Evidence on efficiency effects of M&As in Italy. Economic Modelling 84: 147–64. [Google Scholar]

- Cornaggia, Jess, and Jay Yin Li. 2019. The value of access to finance: Evidence from M&As. Journal of Financial Economics 131: 232–50. [Google Scholar]

- Donnellan, John, and Wanda Rutledge. 2016. Agency Theory in Banking-‘Lessons from the 2007–2010 Financial Crisis’. International Journal of Business and Applied Social Science 2. Available online: https://ssrn.com/abstract=2940060 (accessed on 16 February 2024).

- Dymski, Gary. 2016. The Bank Merger Wave: The Economic Causes and Social Consequences of Financial Consolidation: The Economic Causes and Social Consequences of Financial Consolidation. New York: Routledge. ISBN 9781315292458. [Google Scholar] [CrossRef]

- EBA. 2018. EU-WIDE STRESS TEST–RESULTS. Available online: https://eba.europa.eu/documents/10180/2419200/2018-EU-wide-stress-test-Results.pdf (accessed on 16 February 2024).

- Efendic, Adnan, Geoff Pugh, and Nick Adnett. 2011. Institutions and economic performance: A meta-regression analysis. European Journal of Political Economy 27: 586–99. [Google Scholar] [CrossRef]

- Engler, Philipp, and Mathias Klein. 2017. Austerity measures amplified crisis in Spain, Portugal, and Italy. DIW Economic Bulletin 7: 89–93. [Google Scholar]

- Esposito, Lorenzo. 2014. Con Annibale Alle Porte. L’Internazionalizzazione Del Sistema Bancario E Il Caso Italiano (With Hannibal at the Gates. The Internationalization of the Banking System and the Italian Case). Moneta e Credito 67: 311–38. [Google Scholar]

- Farinha, Luísa, Marina-Eliza Spaliara, and Serafeim Tsoukas. 2019. Bank shocks and firm performance: New evidence from the sovereign debt crisis. Journal of Financial Intermediation 40: 100818. [Google Scholar] [CrossRef]

- Federal Reserve. 2014. Available online: https://www.federalreserve.gov/faqs/cat_21427.htm (accessed on 16 February 2024).

- Ferri, Giovanni. 2017. The evolution of banking regulation in the post-crisis period: Cooperative and savings banks’ perspective. In Institutional Diversity in Banking: Small Country, Small Bank Perspectives. London: Palgrave Macmillan, pp. 1–31. ISBN 978-3-319-42072-1. [Google Scholar]

- Fiordelisi, Franco. 2009. M&A of Financial Institutions: Literature Review. In Mergers and Acquisitions in European Banking. London: Palgrave Macmillan, pp. 85–106. [Google Scholar]

- Focarelli, Dario, Fabio Panetta, and Carmelo Salleo. 2002. Why do banks merge? Journal of Money, Credit and Banking 2: 1047–66. [Google Scholar] [CrossRef]

- Friedman, Yair, Abraham Carmeli, Asher Tishler, and Katsuhiko Shimizu. 2016. Untangling micro-behavioral sources of failure in mergers and acquisitions: A theoretical integration and extension. The International Journal of Human Resource Management 27: 2339–69. [Google Scholar] [CrossRef]

- Goetz, Martin R., Luc Laeven, and Ross Levine. 2016. Does the geographic expansion of banks reduce risk? Journal of Financial Economics 120: 346–62. [Google Scholar] [CrossRef]

- Greene, William H. 2003. Econometric Analysis, 7th ed. Harlow: Pearson Education Limited, ISBN 13: 978-0-273-75356-8. [Google Scholar]

- Hagendorff, Jens, Michael Collins, and Kevin Keasey. 2007. Bank deregulation and acquisition activity: The cases of the US, Italy and Germany. Journal of Financial Regulation and Compliance 15: 199–209. [Google Scholar] [CrossRef]

- Hassan, Ibne, Pervez N. Ghauri, and Ulrike Mayrhofer. 2018. Merger and acquisition motives and outcome assessment. Thunderbird International Business Review 60: 709–18. [Google Scholar] [CrossRef]

- Haunschild, Pamela R. 1994. How much is that company worth? Interorganizational relationships, uncertainty, and acquisition premiums. Administrative Science Quarterly 39: 391–411. [Google Scholar] [CrossRef]

- Himalayan News Service. 2015. Monetary Policy: Old Wine in New Bottle. The Himalayan Times. Available online: http://thehimalayantimes.com/business/monetary-policy-old-wine-in-new-bottle/ (accessed on 30 November 2016).

- Hoskisson, Robert E., Michael A. Hitt, and Charles W. L. Hill. 1993. Managerial incentives and investment in R&D in large multiproduct firms. Organization Science 4: 325–41. [Google Scholar]

- Jassaud, Nadège, and Kenneth Kang. 2015. A strategy for developing a market for nonperforming loans in Italy (No. 15–24). Washington, DC: International Monetary Fund. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kandilov, Ivan T., Aslı Leblebicioğlu, and Neviana Petkova. 2017. Cross-border mergers and acquisitions: The importance of local credit and source country finance. Journal of International Money and Finance 70: 288–318. [Google Scholar] [CrossRef]

- Keong, Choong Chee, Zulkornain Yusop, and Venus Khim-Sen Liew. 2003. Export-led growth hypothesis in Malaysia: An application of two-stage least square technique. International Finance 3: 1–21. [Google Scholar]

- Kim, Ji-Yub, Jerayr Haleblian, and Sydney Finkelstein. 2011. When firms are desperate to grow via acquisition: The effect of growth patterns and acquisition experience on acquisition premiums. Administrative Science Quarterly 56: 26–60. [Google Scholar] [CrossRef]

- Kim, Ji-Yub, Sydney Finkelstein, and Jerayr Haleblian. 2015. All aspirations are not created equal: The differential effects of historical and social aspirations on acquisition behavior. Academy of Management Journal 58: 1361–88. [Google Scholar] [CrossRef]

- KPMG. 2017. Rapporto Mergers & Acquisitions. Consolidamento Settoriale e Fusioni Alimentano Volumi Record. Available online: https://assets.kpmg/content/dam/kpmg/it/pdf/2018/08/KPMG-Rapporto-M&A-2017-fusioni-acquisizioni.pdf (accessed on 16 February 2024).

- Kravet, Todd D., Sarah E. McVay, and David P. Weber. 2018. Costs and benefits of internal control audits: Evidence from M&A transactions. Review of Accounting Studies 23: 1389–423. [Google Scholar]

- Kyriazopoulos, George, and Evangelos Drymbetas. 2015. Do domestic banks mergers and acquisitions still create value? Recent evidence from Europe. Journal of Finance 3: 100–16. [Google Scholar] [CrossRef][Green Version]

- Mastromatteo, G., and L. Esposito. 2016. Minsky at Basel: A Global Cap to Build an Effective Postcrisis Banking Supervision Framework. Levy Economics Institute, Working Papers Series. No. 875. Available online: https://ssrn.com/abstract=2845995 (accessed on 16 February 2024). [CrossRef]

- Michie, Jonathan, and Christine Oughton. 2013. Measuring diversity in financial services markets: A diversity index. Centre for Financial and Management Studies Discussion Paper Series 113. [Google Scholar] [CrossRef]

- Milbourn, Todd T., Arnoud W. A. Boot, and Anjan V. Thakor. 1999. Megamergers and expanded scope: Theories of bank size and activity diversity. Journal of Banking & Finance 23: 195–214. [Google Scholar]

- Montanaro, Elisabetta, and Mario Tonveronachi. 2017. Vulnerabilità del sistema bancario italiano. Diagnosi e rimedi (Dealing with the vulnerability of the Italian banking system). Moneta e Credito 70: 299–368. [Google Scholar]

- Moreira, Marcelo J. 2009. A maximum likelihood method for the incidental parameter problem. The Annals of Statistics 37: 3660–96. Available online: https://projecteuclid.org/euclid.aos/1250515401 (accessed on 16 February 2024). [CrossRef]

- Novickytė, Lina, and Graziano Pedroja. 2015. Assessment of mergers and acquisitions in banking on small open economy as sustainable domestic financial system development. Economics and Sociology 8: 72–88. [Google Scholar] [CrossRef]

- Paladino, Giovanna. 2007. Location Decisions of Italian Banks: Drivers of Expansion into Emerging and Transition Economies. LLEE Working Document No. 51. Available online: https://ssrn.com/abstract=1298977 (accessed on 16 February 2024). [CrossRef]

- Palia, Darius, and Robert Porter. 2007. Agency theory in banking: An empirical analysis of moral hazard and the agency costs of equity. Banks & Bank Systems 2: 142–56. [Google Scholar]

- Pannetta, Fabio. 2017. The Italian banking system and the exit from the crisis, Speech by the Deputy Governor of the Bank of Italy Fabio Panetta. In Associazione Bancaria Italiana, Unione Bancaria e Basilea 3—Risk & Supervision 2017. Available online: https://www.bis.org/review/r170629e.pdf (accessed on 16 February 2024).

- Pascual, Antonio Garcia. 2003. Assessing European stock markets (co) integration. Economics Letters 78: 197–203. [Google Scholar] [CrossRef]

- Pathak, Atul Arun. 2016. Seller side HR perspectives during M&A deals: The journey from “intent” to “deal fruition”. Strategic Direction 32: 19–22. [Google Scholar]

- Pinotti, Paolo. 2015. The economic costs of organised crime: Evidence from Southern Italy. The Economic Journal 125: F203–F232. [Google Scholar] [CrossRef]

- Posner, Eric A. 2015. How do bank regulators determine capital-adequacy requirements. University of Chicago Law Review 82: 1853. [Google Scholar] [CrossRef]

- Rahman, Zahoor, Arshad Ali, and Khalil Jebran. 2018. The effects of mergers and acquisitions on stock price behaviour in banking sector of Pakistan. The Journal of Finance and Data Science 4: 44–54. [Google Scholar] [CrossRef]

- Ravenscraft, David J., and Frederic M. Scherer. 1989. The profitability of mergers. International Journal of Industrial Organization 7: 101–16. [Google Scholar] [CrossRef]

- Renaud, Rob. 2016. Why Do Companies Merge with or Acquire Other Companies? Available online: http://www.investopedia.com/ask/answers/06/mareasons.asp (accessed on 27 November 2016).

- Roll, Richard. 1986. The hubris hypothesis of corporate takeovers. Journal of Business 59: 197–216. [Google Scholar] [CrossRef]

- Serena, José María, and Serafeim Tsoukas. 2020. International Bank Lending and Corporate Debt Structure. BIS Working Paper No. 857. Available online: https://ssrn.com/abstract=3576887 (accessed on 16 February 2024).

- Sharma, Sonia. 2013. Measuring post-merger performance—A study of metal industry. International Journal of Applied Research and Studies 2: 1–9. [Google Scholar] [CrossRef]

- Tang, Chor Foon. 2009. How Stable is the Demand for Money in Malaysia? New Empirical Evidence from Rolling Regression. IUP Journal of Monetary Economics 7: 85. [Google Scholar]

- Trocino, Antonella. 2016. Banking business models in Italy: A cluster analysis using Big Data. Bancaria, Journal of Italian Banking Association 3: 55–58. [Google Scholar]

- Uhlenbruck, Klaus, Margaret Hughes-Morgan, Michael A. Hitt, Walter J. Ferrier, and Rhett Brymer. 2017. Rivals’ reactions to mergers and acquisitions. Strategic Organization 15: 40–66. [Google Scholar] [CrossRef]

- Ullah, Muhammad Rizwan, Muhammad Azam, Muhammad Awais, and Mamoona Majeed. 2015. Effectiveness of Pakistani Banks after Merger and Acquisition. International Journal of Economics & Management Sciences 5: 2. [Google Scholar]

- Venanzi, Daniela. 2019. Gli NPL delle banche italiane tra campioni e bidoni (The Italian Banks’ NPLs from Peaches to Lemons). Available online: http://dx.doi.org/10.2139/ssrn.3059543 (accessed on 16 February 2024).

- Wang, Yu, and Marc F. Bellemare. 2019. Lagged Variables as Instruments. Working Paper. Minneapolis: Department of Applied Economics, University of Minnesota. Available online: http://marcfbellemare.com/wordpress/wp-content/uploads/2019/05/WangBellemareLaggedIVsMay2019.pdf (accessed on 20 May 2020).

- Weber, Anke. 2017. Bank Consolidation, Efficiency, and Profitability in Italy. IMF Working Paper No. 17/175. Available online: https://ssrn.com/abstract=3030768 (accessed on 16 February 2024).

- Wooldridge, J. M. 2015. Introductory Econometrics: A Modern Approach. Toronto: Nelson Education. [Google Scholar]

- Yang, Bo, Ji Sun, Jie Michael Guo, and Jiayi Fu. 2019. Can financial media sentiment predict merger and acquisition performance? Economic Modelling 80: 121–29. [Google Scholar] [CrossRef]

- Zedda, Stefano. 2016. Italian Banks’ Paths through the Crisis. Modern Economy 7: 239–49. Available online: http://www.scirp.org/journal/me (accessed on 16 February 2024). [CrossRef]

- Zhang, Yan-liang, Xiao-ye Zhang, and Le-ya Zhang. 2018. Literature Review of Cross-border M&A Performance Test and Path Selection by Chinese Banks. Paper presented at the 2018 International Conference on Education, Economics and Social Science (ICEESS 2018), Singapore, October 30–31; Paris: Atlantis Press. [Google Scholar]

- Zhang, Ziqiao, and Qiusheng Zhang. 2015. Does Stock for Stock M&A Exhibit Real Earnings Management? In LISS 2014. Berlin/Heidelberg: Springer, pp. 1077–83. [Google Scholar]

| Group 1 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|

| 1 | BPER Banca SpA (BPER) | 0 | 0 | 0 | 1 | 1 | 0 |

| 2 | Banca Mediolanum SpA (Medionalum) | 0 | 0 | 0 | 0 | 0 | 1 |

| 3 | Credito Emiliano SpA (CREDEM) | 1 | 1 | 0 | 0 | 0 | 0 |

| 4 | Banca Piccolo Credito Valtellinese (CREVAL) | 0 | 1 | 1 | 1 | 1 | 0 |

| 5 | Banca Carige SpA (Carige) | 1 | 0 | 0 | 0 | 0 | 1 |

| 6 | Banco di Desio e della Brianza (DESIO) | 0 | 1 | 1 | 0 | 0 | 0 |

| 7 | Banca Generali SpA (Generbanca) (BG) | 0 | 0 | 1 | 0 | 0 | 0 |

| Group 2 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| 1 | Banca Monte dei Paschi di Siena SpA (MPS) | 0 | 0 | 0 | 1 | 0 | 0 |

| 2 | Banca Popolare di Sondrio, Societa Cooperativa per Azioni (popso) | 1 | 0 | 0 | 0 | 0 | 0 |

| 3 | Banco Popolare di Milano (BPM) | 1 | 0 | 0 | 1 | 1 | 0 |

| 4 | Intesa Sanpaolo (Intesa) | 0 | 1 | 1 | 1 | 1 | 1 |

| 5 | Mediobanca SpA (Mediobanca) | 0 | 0 | 1 | 0 | 0 | 1 |

| 6 | UniCredit SpA (UniCredit) | 1 | 1 | 1 | 0 | 0 | 0 |

| 7 | Unione di Banche Italiane SCpA (UBI) | 1 | 1 | 1 | 0 | 0 | 0 |

| Average Europe 27 | Average Europe 5 = 100 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Index Class | Indicator | BPER | Mediolanum | CREDEM | CREVAL | Carige | DESIO | BG | BPER | Mediolanum | CREDEM | CREVAL | Carige | DESIO | BG |

| Liquidity | Liquid assets/deposits and short-term funding ratio | 22.8 | 115.9 | 28.9 | 18.5 | 28.2 | 23.5 | 31.4 | 18.9 | 94.5 | 24.0 | 15.4 | 23.7 | 20.6 | 26.3 |

| Liquid assets/ Total deposits and loans ratio | 20.1 | 103.0 | 25.1 | 17.3 | 21.6 | 21.9 | 37.0 | 16.7 | 77.0 | 20.0 | 14.3 | 17.6 | 17.7 | 30.5 | |

| Performance | ROAA | 0.6 | 469.8 | 111.2 | −255.7 | −180.5 | 336.8 | 312.9 | 8.0 | 607.3 | 139.5 | −315.3 | −137.6 | 548.8 | 802.0 |

| ROAE | 68.3 | 386.7 | 101.3 | 171.6 | −204.3 | 374.0 | 524.1 | 30.3 | 225.4 | 63.5 | −4.4 | −264.6 | 223.1 | 320.8 | |

| RoRWA | 7.0 | 468.2 | 76.8 | −64.0 | −148.2 | 379.1 | 487.9 | 15.5 | 374.5 | 67.2 | −37.8 | −105.5 | 294.2 | 400.2 | |

| Profitability | Operating profit/average equity | 36.3 | 282.7 | 110.7 | −58.6 | −327.8 | 461.5 | 387.2 | 37.8 | 229.9 | 93.9 | −62.8 | −167.9 | 396.5 | 317.4 |

| Operating profit/total deposit | 60.9 | 284.9 | 124.6 | −0.6 | −113.8 | 159.3 | 347.2 | 12.6 | 262.8 | 89.7 | −33.6 | −192.5 | 137.8 | 297.2 | |

| Profit before tax/total deposit | 50.7 | 248.1 | 133.8 | −74.5 | −296.4 | 150.3 | 324.1 | 11.3 | 366.2 | 164.3 | −216.0 | −400.1 | 190.9 | 415.1 | |

| Quality | Impaired/NPL/equity | 316.2 | 28.5 | 100.2 | 319.3 | 359.2 | 277.1 | 24.5 | 418.4 | 22.2 | 124.1 | 467.1 | 557.9 | 315.2 | 24.3 |

| Impaired/NPL | 131.8 | 1.4 | 16.5 | 54.8 | 72.8 | 10.3 | 0.7 | 90.6 | 1.0 | 11.3 | 38.0 | 50.6 | 7.3 | 0.4 | |

| Structural | Equity/total assets | 76.5 | 46.8 | 59.0 | 67.0 | 60.4 | 56.0 | 66.6 | 70.7 | 44.1 | 54.7 | 62.2 | 56.7 | 49.8 | 60.2 |

| Net profit/(loss) for the year from discontinued operations | −2.1 | 0.0 | 2.2 | 1.4 | 19.5 | 0.0 | 0.4 | −0.6 | 0.0 | 0.7 | 0.1 | 7.5 | 0.0 | 0.1 | |

| Capital Ratio | Tier 1 ratio | 61.1 | 94.3 | 65.4 | 59.9 | 52.5 | 80.9 | 79.3 | 72.3 | 110.2 | 78.0 | 70.7 | 61.3 | 97.5 | 95.6 |

| Equity/net loans | 35.7 | 71.6 | 32.4 | 32.0 | 32.2 | 50.1 | 99.0 | 24.4 | 49.1 | 22.2 | 21.9 | 22.0 | 34.4 | 67.8 | |

| Total capital ratio | 59.9 | 81.3 | 63.1 | 61.0 | 53.2 | 65.3 | 70.6 | 60.0 | 80.6 | 63.4 | 60.7 | 52.3 | 65.1 | 70.3 | |

| Average Europe 27 | Average Europe 5 = 100 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Index Class | Indicator | UniCredit | Intesa | BPM | MPS | UBI | Mediobanca | Popso | UniCredit | Intesa | BPM | MPS | UBI | Mediobanca | Popso |

| Liquidity | Liquid assets/deposits and short-term funding ratio | 68.9 | 90.4 | 7.5 | 50.8 | 28.0 | 79.2 | 35.9 | 52.9 | 58.2 | 5.2 | 39.0 | 20.0 | 39.1 | 37.2 |

| Liquid assets/ total deposits and loans ratio | 52.9 | 58.2 | 5.2 | 39.0 | 20.0 | 39.1 | 37.2 | 41.7 | 46.1 | 3.7 | 31.7 | 16.5 | 29.7 | 29.9 | |

| Performance | ROAA | −15.1 | 56.5 | −10.5 | −411.3 | −18.7 | 73.0 | 54.5 | −29.0 | 25.2 | −10.2 | −556.4 | −64.7 | 68.8 | 66.3 |

| ROAE | −200.6 | −233.8 | 16.0 | 1382.6 | −122.7 | −27.7 | −49.9 | −92.8 | −61.7 | 13.4 | −424.5 | −73.8 | 28.7 | 50.0 | |

| RoRWA | −61.6 | −2.7 | −16.7 | −139.3 | 37.9 | 23.6 | −53.3 | −30.1 | 23.7 | −16.2 | −183.2 | −6.1 | 19.9 | 30.5 | |

| Profitability | Operating profit/average equity | −93.8 | −6.6 | −22.9 | −520.4 | −9.0 | 39.9 | 76.0 | −54.2 | 22.5 | −31.1 | −393.1 | −22.7 | 30.5 | 62.8 |

| Operating profit/total deposit | −10.0 | 62.9 | 10.0 | −163.7 | 4.5 | 52.6 | 52.6 | −27.5 | 59.7 | 3.7 | −174.2 | 15.6 | 67.3 | 35.7 | |

| Profit before tax/total deposit | −127.6 | −170.0 | 10.7 | −396.3 | −117.1 | 21.2 | 50.5 | −70.5 | 45.0 | 3.9 | −456.1 | 4.1 | 92.3 | 51.4 | |

| Quality | Impaired/NPL/equity | 255.9 | 193.4 | 136.5 | 789.3 | 192.0 | 23.5 | 186.1 | 1042.6 | 743.8 | 141.0 | 500.1 | 156.5 | 19.5 | 39.1 |

| Impaired/NPL | 1042.6 | 743.8 | 141.0 | 500.1 | 156.5 | 19.5 | 39.1 | 710.6 | 509.9 | 103.1 | 345.4 | 107.3 | 13.6 | 27.2 | |

| Structural | Equity/total assets | 57.9 | 67.7 | 16.9 | 36.1 | 77.2 | 76.3 | 61.6 | 229.2 | 515.8 | 0.2 | 0.7 | 0.1 | 0.0 | 0.0 |

| Net profit/(loss) for the year from discontinued operations | 229.2 | 515.8 | 0.2 | 0.7 | 0.1 | 0.0 | 0.0 | −2.1 | 46.1 | −0.2 | −0.2 | 0.0 | 0.0 | 0.0 | |

| Capital Ratio | Tier 1 ratio | 61.6 | 76.9 | 26.2 | 59.6 | 68.2 | 58.6 | 54.3 | 75.3 | 92.9 | 27.0 | 73.6 | 82.4 | 67.6 | 64.9 |

| Equity/net loans | 34.3 | 42.6 | 10.9 | 19.2 | 37.1 | 54.8 | 29.6 | 23.4 | 29.1 | 7.6 | 13.1 | 25.4 | 37.9 | 20.3 | |

| Total capital ratio | 64.0 | 74.7 | 20.3 | 67.1 | 74.1 | 59.1 | 55.1 | 65.0 | 74.5 | 16.0 | 68.4 | 75.7 | 58.7 | 54.8 | |

| Method | CIPS-Test |

|---|---|

| Pesaran’s CIPS test (2007) Level | |

| 1 Merger | −0.734 |

| 2 Tier1_ratio | −2.106 |

| 3 Liquidass_Dep_Bor | −1.925 |

| 4 Oper_profit_avg_equit | −2.026 |

| 5 Impaired_npl | −1.269 |

| 6 Roae | −0.951 |

| Pesaran’s CIPS test (2007) 1st Diff. | |

| 1 Merger | 2.610 ** |

| 2 Tier1_ratio | 2.814 *** |

| 3 Liquidass_Dep_Bor | 2.527 ** |

| 4 Oper_profit_avg_equit | 2.901 *** |

| 5 Impaired_npl | 2.687 *** |

| 6 Roae | 2.419 ** |

| Group 1 | Group 2 | |

|---|---|---|

| merger | ||

| tier1_ratio | −0.1072 * | 2.02 × 10−8 ** |

| (0.0647) | (7.64 × 10−9) | |

| liquidass_Dep_Bor | 0.0197 | −0.0419 |

| (0.0383) | (0.0335) | |

| oper_profit_avg_equity | −7.3794 | 46.209 ** |

| (7.1516) | (22.508) | |

| impair_npl_equ | −0.0650 | −0.0835 |

| (0.2271) | (0.2262) | |

| roae | −0.07937 * | −0.2432 |

| (0.04418) | (0.24001) | |

| _cons | −5.0586 ** | −5.3382 ** |

| (2.0180) | (2.1117) | |

| N | 42 | 42 |

| pseudo R2 | 0.154 | 0.160 |

| Group 1 | α1 | Std. Error | t-Statistic | Obs | |

|---|---|---|---|---|---|

| 1 | BPER Banca SpA (BPER) | 0.996381 *** | 0.000913 | 1090.845 | 7351 |

| 2 | Banca Mediolanum SpA (Medionalum) | 0.990958 *** | 0.001742 | 568.8754 | 5409 |

| 3 | Credito Emiliano SpA (CREDEM) | 0.987000 *** | 0.003474 | 284.1477 | 2346 |

| 4 | Banca Piccolo Credito Valtellinese (CREVAL) | 0.970691 *** | 0.001068 | 933.6389 | 7895 |

| 5 | Banca Carige SpA (Carige) | 0.998903 *** | 0.000804 | 1242.504 | 5862 |

| 6 | Banco di Desio e della Brianza (DESIO) | 0.995733 *** | 0.001167 | 853.4398 | 5708 |

| 7 | Banca Generali SpA (Generbanca) (BG) | 0.00732 *** | 0.001792 | 4.087185 | 2868 |

| Group 2 | α1 | Std. Error | t-Statistic | Obs | |

| 1 | Banca Monte dei Paschi di Siena SpA (MPS) | 0 | 0 | 0 | |

| 2 | Banca Popolare di Sondrio Societa Cooperativa per Azioni (popso) | 0.998439 *** | 0.000997 | 1001.880 | 4702 |

| 3 | Banco Popolare di Milano (BPM) | 0.006593 *** | 0.038765 | 0.170079 | 5013 |

| 4 | Intesa Sanpaolo (Intesa) | 0.995146 *** | 0.000981 | 1014.899 | 8379 |

| 5 | Mediobanca SpA (Mediobanca) | 0.992721 *** | 0.001235 | 803.9053 | 8376 |

| 6 | UniCredit SpA (UniCredit) | 0.997471 *** | 0.000772 | 1291.868 | 8374 |

| 7 | Unione di Banche Italiane SCpA (UBI) | 0.998719 *** | 0.009735 | 102.5855 | 1561 |

| tier1_ratio (Group 1) | Equ_netloans (Group 1) | tier1_ratio (Group 2) | Equ_netloans (Gropp 2) | |

|---|---|---|---|---|

| Merger | −1.73094 * (0.98707) | −1.425071 (1.35475) | 1.70926 ** (0.85347) | 0.420315 * (0.230402) |

| Roae | −0.354115 | 2.81872 ** | 7.28038 *** | 5.4082 ** |

| (0.49284) | (1.21779) | (1.58717) | (2.41192) | |

| Liquidass_Dep_Bor | 0.13297 *** (0.049761) | 0.04796 ** (0.022295) | −0.07212 (0.126673) | 0.256082 * (0.136152) |

| Impaired_npl | 3.36 × 10−7 (2.74 × 10−7) | 3.49 × 10−7 *** (5.59 × 10−8) | 6.98 × 10−8 *** (2.36 × 10−8) | 3.74 × 10−8 ** (1.79 × 10−8) |

| Oper_prof_avg | 0.14014 * | 0.136591 | 0.738308 | 0.231248 * |

| (0.08072) | (0.19947) | (2.19074) | (0.227972) | |

| _cons | 7.31211 *** | 4.81130 *** | 9.25188 *** | 6.97251 * |

| (1.56646) | (0.70399) | (1.62849) | (3.72589) | |

| N | 35 | 35 | 35 | 35 |

| pseudo R2 | 0.30 | 0.41 | 0.37 | 0.64 |

| Wald|χ2 (5) | 14.97 | 23.22 | 38.74 | 12.37 |

| P-Val | 0.0105 | 0.0003 | 0.0000 | 0.0300 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arbolino, R.; Boffardi, R.; Kounetas, K.; Marani, U.; Napolitano, O. Are There Conditions That Can Predict When an M&A Works? The Case of Italian Listed Banks. Economies 2024, 12, 58. https://doi.org/10.3390/economies12030058

Arbolino R, Boffardi R, Kounetas K, Marani U, Napolitano O. Are There Conditions That Can Predict When an M&A Works? The Case of Italian Listed Banks. Economies. 2024; 12(3):58. https://doi.org/10.3390/economies12030058

Chicago/Turabian StyleArbolino, Roberta, Raffaele Boffardi, Konstantinos Kounetas, Ugo Marani, and Oreste Napolitano. 2024. "Are There Conditions That Can Predict When an M&A Works? The Case of Italian Listed Banks" Economies 12, no. 3: 58. https://doi.org/10.3390/economies12030058

APA StyleArbolino, R., Boffardi, R., Kounetas, K., Marani, U., & Napolitano, O. (2024). Are There Conditions That Can Predict When an M&A Works? The Case of Italian Listed Banks. Economies, 12(3), 58. https://doi.org/10.3390/economies12030058