Green Finance and Fintech Adoption Services among Croatian Online Users: How Digital Transformation and Digital Awareness Increase Banking Sustainability

Abstract

1. Introduction

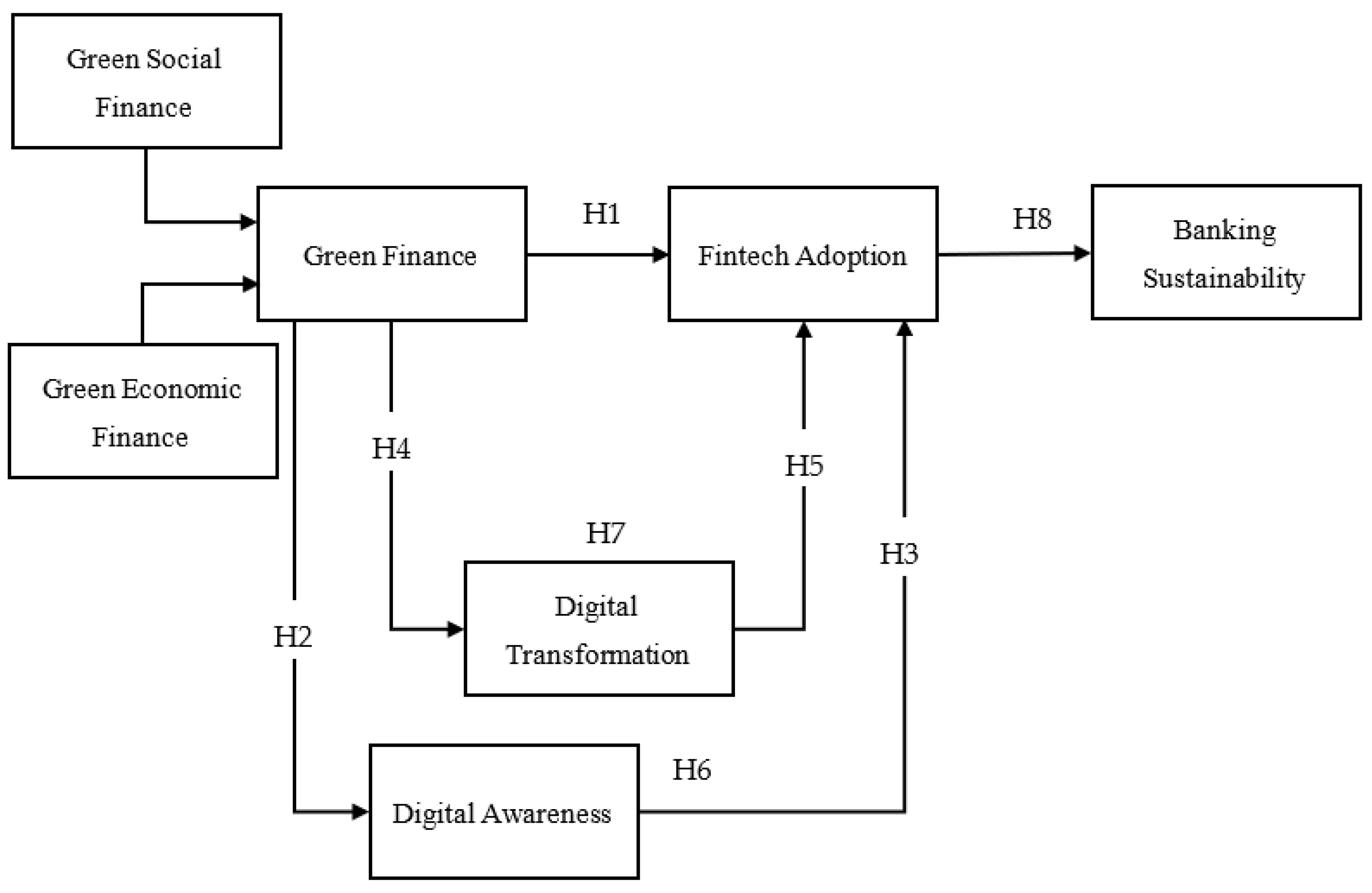

- To examine the influence of green finance on Fintech adoption, digital transformation, and digital awareness, in turn, on banking sustainability in the Croatian banking industry.

- To examine the influence of digital transformation and digital awareness on Fintech adoption in the Croatian banking industry.

- To explore the mediating role of digital transformation and awareness between green finance and Fintech adoption in the Croatian banking industry.

2. Literature Review

2.1. Underpinning Theory to Support Digitalization and Sustainability

2.2. Green Finance and Fintech Adoption (Online Payment)

2.3. Green Finance and Green Awareness

2.4. Green Awareness and Fintech Adoption (Online Payment)

2.5. Green Finance and Digital Transformation

2.6. Digital Transformation and Fintech Adoption (Online Payment)

2.7. Mediation of Digital Awareness between Green Finance and Fintech Adoption (Online Payment)

2.8. Mediation of Digital Transformation between Green Finance and Fintech Adoption (Online Payment)

2.9. Green Adoption (Online Payment) and Banking Sustainability

3. Research Methodology

3.1. Quantitative Research Design

3.2. Data Collection Procedure

3.3. Measurement Scales

3.4. Data Analysis

4. Findings of the Study

4.1. Demographic Analysis

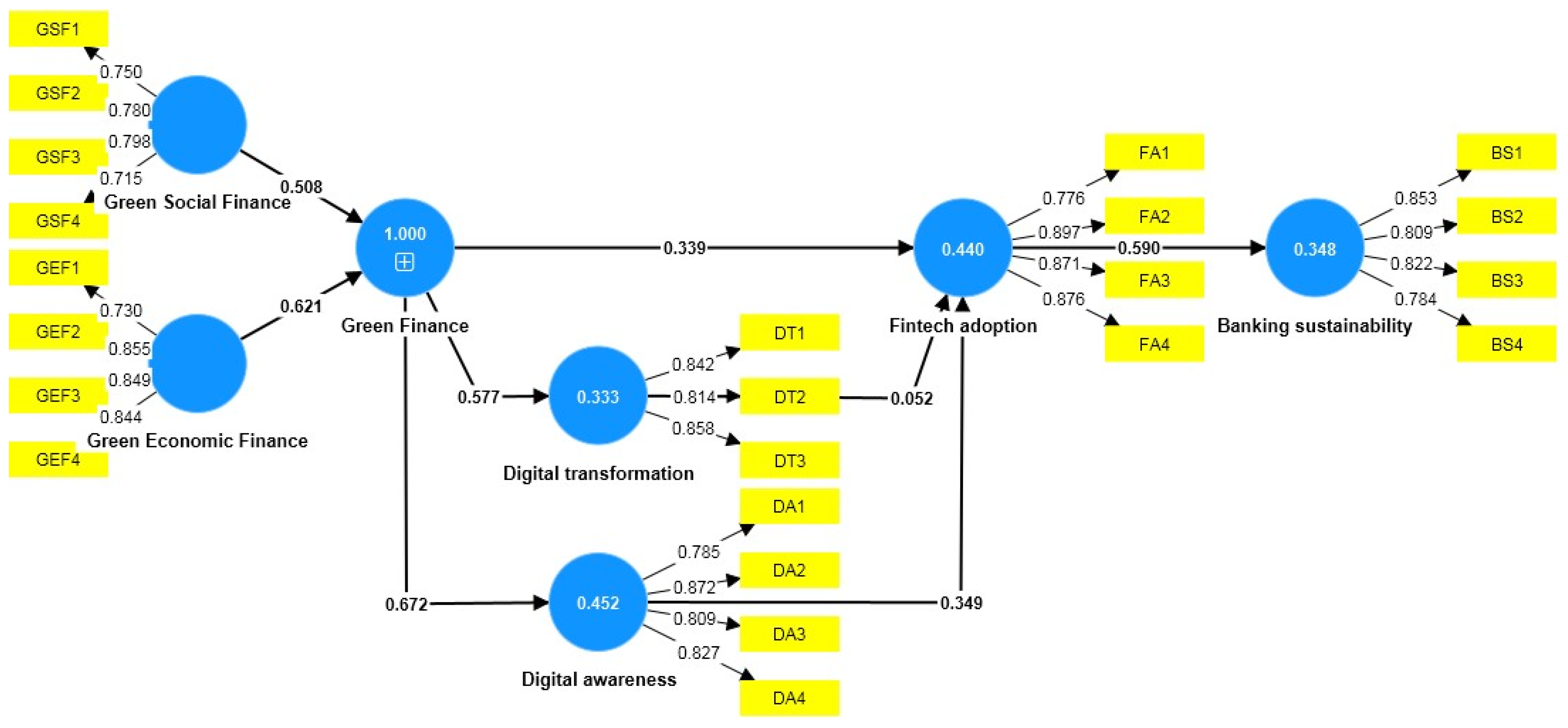

4.2. Assessment of Measurement Model

4.3. Heterotrait–Monotrait Ratio (HTMT)

4.4. Model Fitness

4.5. Assessment of Path Model

4.6. Assessing Mediating Effects

5. Discussion

5.1. Managerial and Practical Implications

5.2. Limitations and Future Directions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdul-Rahim, Ruzita, Siti Aisah Bohari, Aini Aman, and Zainudin Awang. 2022. Benefit–risk perceptions of Fintech adoption for sustainability from bank consumers’ perspective: The moderating role of fear of COVID-19. Sustainability 14: 8357. [Google Scholar] [CrossRef]

- Aboalsamh, Hoda M., Laith T. Khrais, and Sami A. Albahussain. 2023. Pioneering Perception of Green Fintech in Promoting Sustainable Digital Services Application within Smart Cities. Sustainability 15: 11440. [Google Scholar] [CrossRef]

- Abuatwan, Nariman. 2023. The Impact of Green Finance on the Sustainability Performance of the Banking Sector in Palestine: The Moderating Role of Female Presence. Economies 11: 247. [Google Scholar] [CrossRef]

- Barroso, Marta, and Juan Laborda. 2022. Digital transformation and the emergence of the Fintech sector: Systematic literature review. Digital Business 2: 100028. [Google Scholar] [CrossRef]

- Bayram, Orkun, Isilay Talay, and Mete Feridun. 2022. Can Fintech promote sustainable finance? Policy lessons from the case of Turkey. Sustainability 14: 12414. [Google Scholar] [CrossRef]

- Bryman, Alan. 2016. Social Research Methods. Oxford: Oxford University Press. [Google Scholar]

- Chaudhuri, Atanu, Nachiappan Subramanian, and Manoj Dora. 2022. Circular economy and digital capabilities of SMEs for providing value to customers: Combined resource-based view and ambidexterity perspective. Journal of Business Research 142: 32–44. [Google Scholar] [CrossRef]

- Chueca Vergara, Cristina, and Luis Ferruz Agudo. 2021. Fintech and sustainability: Do they affect each other? Sustainability 13: 7012. [Google Scholar] [CrossRef]

- Corbet, Shaen, and Larisa Yarovaya. 2020. The environmental effects of cryptocurrencies. Cryptocurrency and Blockchain Technology 1: 149. [Google Scholar] [CrossRef]

- Creswell, John W. 2014. Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. Thousand Oaks: Sage Publications. [Google Scholar]

- Danladi, Sagir, M. S. V. Prasad, Umar Muhammad Modibbo, Seyedeh Asra Ahmadi, and Peiman Ghasemi. 2023. Attaining Sustainable Development Goals through Financial Inclusion: Exploring Collaborative Approaches to Fintech Adoption in Developing Economies. Sustainability 15: 13039. [Google Scholar] [CrossRef]

- Dapp, Thomas F. 2017. Fintech: The digital transformation in the financial sector. Sustainability in a Digital World: New Opportunities Through New Technologies, 189–99. [Google Scholar] [CrossRef]

- Dash, Ganesh, and Justin Paul. 2021. CB-SEM vs. PLS-SEM methods for research in social sciences and technology forecasting. Technological Forecasting and Social Change 173: 121092. [Google Scholar] [CrossRef]

- David-West, Olayinka, Nkemdilim Iheanachor, and Ikechukwu Kelikume. 2018. A resource-based view of digital financial services (DFS): An exploratory study of Nigerian providers. Journal of Business Research 88: 513–26. [Google Scholar] [CrossRef]

- Dell’Erba, Marco. 2021. Sustainable digital finance and the pursuit of environmental sustainability. Sustainable Finance in Europe: Corporate Governance, Financial Stability and Financial Markets, 61–81. [Google Scholar] [CrossRef]

- Duhnea, Cristina, and Georgiana-Loredana Schipor. 2021. The Fintech Industry in Romania—Assessing the Level of Acceptance for the Financial Services Consumers. Ovidius University Annals, Economic Sciences Series 21: 1013–22. [Google Scholar]

- Elsinger, Helmut, Pirmin Fessler, Judith Feyrer, Konrad Richter, Maria Silgoner, and Andreas Timel. 2018. Digitalization in financial services and household finance: Fintech, financial literacy and financial stability. Financial Stability Report 35: 50–58. [Google Scholar]

- Folwarski, Mateusz. 2021. The FinTech Sector and Aspects on the Financial Inclusion of the Society in EU Countries. European Research Studies Journal 24: 459–67. [Google Scholar] [CrossRef] [PubMed]

- Fowler, Floyd J., Jr. 2014. Survey Research Methods. Thousand Oaks: Sage Publications. [Google Scholar]

- Golubić, Gordana. 2019. Do digital technologies have the power to disrupt commercial banking? InterEULawEast 6: 83–110. [Google Scholar] [CrossRef]

- Guang-Wen, Zheng, and Abu Bakkar Siddik. 2023. The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: The role of green innovation. Environmental Science and Pollution Research 30: 25959–71. [Google Scholar] [CrossRef] [PubMed]

- Gupta, Gaurav, Kevin Tee Liang Tan, Yaw Seng Ee, and Cynthia Su Chen Phang. 2018. Resource-based view of information systems: Sustainable and transient competitive advantage perspectives. Australasian Journal of Information Systems 22. [Google Scholar] [CrossRef]

- Hair, Joseph F., Claudia Binz Astrachan, Ovidu I. Moisescu, Lǎcrǎmioara Radomir, Marko Sarstedt, Santha Vaithilingam, and Christian M. Ringle. 2021. Executing and interpreting applications of PLS-SEM: Updates for family business researchers. Journal of Family Business Strategy 12: 100392. [Google Scholar] [CrossRef]

- Hanafizadeh, Payam, and Hamid Reza Khedmatgozar. 2012. The mediating role of the dimensions of the perceived risk in the effect of customers’ awareness on the adoption of Internet banking in Iran. Electronic Commerce Research 12: 151–75. [Google Scholar] [CrossRef]

- Handro, Paul. 2018. The role of customer experience in retail bankingand the rise of Fintech. Annals—Economy Series 1: 175–85. [Google Scholar]

- Haq, Muhibul. 2014. A Comparative Analysis of Qualitative and Quantitative Research Methods and a Justification for Adopting Mixed Methods in Social Research. Annual PhD Conference, University of Bradford Business School of Management. Available online: http://hdl.handle.net/10454/7389 (accessed on 8 November 2023).

- Kamis, Arasinah, Ramdzan Ali Saibon, FaizalAmin Yunus, Mohd Bekri Rahim, Lazaro Moreno Herrera, and Pedro Luis Yturria Montenegro. 2020. The SmartPLS analyzes approach in validity and reliability of graduate marketability instrument. Social Psychology of Education 57: 987–1001. [Google Scholar]

- Kasturi, Srini. 2023. Evolving consumer expectations and the future of digital banking. The Journal of Digital Banking 8: 37–48. [Google Scholar]

- Lapinskienė, Giedrė, and Irena Danilevičienė. 2023. Assessment of Green Banking Performance. Sustainability 15: 14769. [Google Scholar] [CrossRef]

- Leavy, Patricia. 2022. Research Design: Quantitative, Qualitative, Mixed Methods, Arts-Based, and Community-Based Participatory Research Approaches. New York: Guilford Publications. [Google Scholar]

- Lee, In, and Yong Jae Shin. 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons 61: 35–46. [Google Scholar] [CrossRef]

- Liu, Hongda, Pinbo Yao, Shahid Latif, Sumaira Aslam, and Nadeem Iqbal. 2022. Impact of Green financing, Fintech, and financial inclusion on energy efficiency. Environmental Science and Pollution Research 29: 18955–66. [Google Scholar] [CrossRef] [PubMed]

- Macchiavello, Eugenia, and Michele Siri. 2022. Sustainable finance and Fintech: Can technology contribute to achieving environmental goals? A preliminary assessment of ‘green Fintech’and ‘sustainable digital finance’. European Company and Financial Law Review 19: 128–74. [Google Scholar] [CrossRef]

- Mavlutova, Inese, Aivars Spilbergs, Atis Verdenhofs, Andris Natrins, Ilja Arefjevs, and Tatjana Volkova. 2022. Digital transformation as a driver of the financial sector sustainable development: An impact on financial inclusion and operational efficiency. Sustainability 15: 207. [Google Scholar] [CrossRef]

- Mejia-Escobar, Juan Camilo, Juan David González-Ruiz, and Eduardo Duque-Grisales. 2020. Sustainable financial products in the Latin America banking industry: Current status and insights. Sustainability 12: 5648. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Muhammad Umar, Ayesha Afzal, and Saba Firdousi Firdousi. 2023. The role of Fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone. Economic Analysis and Policy 78: 33–40. [Google Scholar] [CrossRef]

- Muganyi, Tadiwanashe, Linnan Yan, and Hua-Ping Sun. 2021. Green finance, Fintech and environmental protection: Evidence from China. Environmental Science and Ecotechnology 7: 100107. [Google Scholar] [CrossRef] [PubMed]

- Nagy, Judith, Judith Oláh, Edina Erdei, Domicián Máté, and József Popp. 2018. The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary. Sustainability 10: 3491. [Google Scholar] [CrossRef]

- Namahoot, Kanokkan Snae, and Tipparat Laohavichien. 2018. Assessing the intentions to use internet banking: The role of perceived risk and trust as mediating factors. International Journal of Bank Marketing 36: 256–76. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis. 2023. Can Central Bank Digital Currencies be green and sustainable? Green Finance 5: 603–23. [Google Scholar] [CrossRef]

- Nassiry, Darius. 2018. The Role of Fintech in Unlocking Green Finance: Policy Insights for Developing Countries (No. 883). Asian Development Bank Institute Working Paper. Available online: https://www.adb.org/sites/default/files/publication/464821/adbi-wp883.pdf (accessed on 9 November 2023).

- Nenavath, Sreenu, and Shashwat Mishra. 2023. Impact of green finance and fintech on sustainable economic growth: Empirical evidence from India. Heliyon 9. [Google Scholar] [CrossRef] [PubMed]

- Omarini, Anna. 2017. The digital transformation in banking and the role of Fintechs in the new financial intermediation scenario. International Journal of Finance, Economics and Trade 1: 1–6. Available online: https://scidoc.org/articlepdfs/IJFET/IJFET-2643-038X-01-101.pdf (accessed on 9 November 2023).

- Ozili, Peterson K. 2024. Dangers of Digital-Only Financial Inclusion. In Business Drivers in Promoting Digital Detoxification. Hershey: IGI Global, pp. 54–70. [Google Scholar] [CrossRef]

- Pallant, Julie. 2020. SPSS Survival Manual: A Step by Step Guide to Data Analysis Using IBM SPSS. London: Routledge. [Google Scholar]

- Rajkumar, Singh Ravins, Popat Ronak, Dhruv Dilip, Vipal Jha, Popat Parth, and Riddhi Joshi. 2020. A research study on awareness of fin-tech among millennial. International Journal on Integrated Education 3: 78–87. [Google Scholar]

- Rasoolimanesh, S. Mostafa. 2022. Discriminant validity assessment in PLS-SEM: A comprehensive composite-based approach. Data Analysis Perspectives Journal 3: 1–8. [Google Scholar]

- Rehman, Shafiq Ur, Mustafa Al-Shaikh, Patrick Bernard Washington, Ernesto Lee, Ziheng Song, Ibrahim A. Abu-AlSondos, Maha Shehadeh, and Mahmoud Allahham. 2023. Fintech Adoption in SMEs and Bank Credit Supplies: A Study on Manufacturing SMEs. Economies 11: 213. [Google Scholar] [CrossRef]

- Ringle, Christian M., Marko Sarstedt, Rebecca Mitchell, and Siegfried P. Gudergan. 2020. Partial least squares structural equation modeling in HRM research. The International Journal of Human Resource Management 31: 1617–43. [Google Scholar] [CrossRef]

- Ringle, Christian M., Sven Wende, and Jan-Michael Becker. 2022. SmartPLS 4. Oststeinbek: SmartPLS GmbH. Available online: https://www.smartpls.com (accessed on 15 November 2023).

- Rodríguez-Espíndola, Oscar, Soumyadeb Chowdhury, Prasanta Kumar Dey, Pavel Albores, and Ali Emrouznejad. 2022. Analysis of the adoption of emergent technologies for risk management in the era of digital manufacturing. Technological Forecasting and Social Change 178: 121562. [Google Scholar] [CrossRef]

- Roemer, Ellen, Florian Schuberth, and Jörg Henseler. 2021. HTMT2–an improved criterion for assessing discriminant validity in structural equation modeling. Industrial Management and Data Systems 121: 2637–50. [Google Scholar] [CrossRef]

- Sarfraz, Muddassar, Zhixiao Ye, Doina Banciu, Florin Dragan, and Larisa Ivascu. 2022. Intertwining digitalization and sustainable performance via the mediating role of digital transformation and the moderating role of Fintech behavior adoption. Studiesin Informatics Control 31: 35–44. [Google Scholar] [CrossRef]

- Shibin, K. T., Ramerhwar Dubey, Angappa Gunasekaran, Benjamin Hazen, David Roubaud, Shivam Gupta, and Cyril Foropon. 2020. Examining sustainable supply chain management of SMEs using resource based view and institutional theory. Annals of Operations Research 290: 301–26. [Google Scholar] [CrossRef]

- Tamasiga, Phemelo, Helen Onyeaka, and El Houssin Ouassou. 2022. Unlocking the Green Economy in African Countries: An Integrated Framework of FinTech as an Enabler of the Transition to Sustainability. Energies 15: 8658. [Google Scholar] [CrossRef]

- Udeagha, Maxwell Chukwudi, and Edwin Muchapondwa. 2023. Green finance, Fintech, and environmental sustainability: Fresh policy insights from the BRICS nations. International Journal of Sustainable Development and World Ecology 30: 633–49. [Google Scholar] [CrossRef]

- Udeagha, Maxwell Chukwudi, and Nicholas Ngepah. 2023. The drivers of environmental sustainability in BRICS economies: Do green finance and Fintech matter? World Development Sustainability 3: 100096. [Google Scholar] [CrossRef]

- Yadav, Uma Shankar, Ravindra Tripathi, and Mano Ashish Tripathi. 2022. Effect of Digital and Financial Awareness of Household Womens on the Use of Fin-Tech in India: Observing the Relation with (Utaut) Model. Journal of Sustainable Business and Economics 5: 18–26. [Google Scholar] [CrossRef]

- Yan, Chen, Abu Bakkar Siddik, Li Yong, Qianli Dong, Guang-Wen Zheng, and Md Nafizur Rahman. 2022. A two-staged SEM-artificial neural network approach to analyze the impact of Fintech adoption on the sustainability performance of banking firms: The mediating effect of green finance and innovation. Systems 10: 148. [Google Scholar] [CrossRef]

| Demographics | Details | Categories | Frequency | Total Frequency | Percent |

|---|---|---|---|---|---|

| Fintech Apps | |||||

| Online mobile applications | Employees | 123 | 164 | 53.9% | |

| Apple pay/Google Pay/Revolut/PayPal, Aircash/Western Union/MoneyGram | Customers | 181 | 140 | 46.1% | |

| Purpose of Use | |||||

| Sending Funds | 76 | 25.0% | |||

| Shopping | 201 | 66.1% | |||

| Educational Purpose | 27 | 8.9% | |||

| Gender | |||||

| Male | 267 | 87.8% | |||

| Female | 37 | 12.2% | |||

| Online Banking Experience | |||||

| Less than 1 Year | 24 | 7.9% | |||

| 1–3 Years | 111 | 36.5% | |||

| 4–6 Years | 98 | 32.2% | |||

| More than 6 Years | 71 | 23.4% | |||

| Education | |||||

| High School | 4 | 1.3% | |||

| Bachelor’s Equivalent Degree | 55 | 18.1% | |||

| Master Equivalent Degree | 209 | 68.8% | |||

| Postgraduate or PhD Degree | 36 | 11.8% | |||

| Total | 304 | 100.0% |

| Variables | Items | Loadings | AVE | Cronbach’s Alpha | Composite Reliability |

|---|---|---|---|---|---|

| Green Economic Finance | GEF1 | 0.730 | 0.674 | 0.837 | 0.892 |

| GEF2 | 0.855 | ||||

| GEF3 | 0.849 | ||||

| GEF4 | 0.844 | ||||

| Green Social Finance | GSF1 | 0.750 | 0.580 | 0.758 | 0.846 |

| GSF2 | 0.780 | ||||

| GSF3 | 0.798 | ||||

| GSF4 | 0.715 | ||||

| Digital Transformation | DT1 | 0.842 | 0.703 | 0.790 | 0.876 |

| DT2 | 0.814 | ||||

| DT3 | 0.858 | ||||

| Digital Awareness | DA1 | 0.785 | 0.679 | 0.842 | 0.894 |

| DA2 | 0.872 | ||||

| DA3 | 0.809 | ||||

| DA4 | 0.827 | ||||

| Fintech Adoption | FA1 | 0.776 | 0.733 | 0.877 | 0.916 |

| FA2 | 0.897 | ||||

| FA3 | 0.871 | ||||

| FA4 | 0.876 | ||||

| Banking Sustainability | BS1 | 0.853 | 0.668 | 0.834 | 0.890 |

| BS2 | 0.809 | ||||

| BS3 | 0.822 | ||||

| BS4 | 0.784 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Digital awareness | 0.811 | |||||

| Digital transformation | 0.708 | 0.701 | ||||

| Fintech adoption | 0.687 | 0.705 | 0.531 | |||

| Green economic finance | 0.682 | 0.713 | 0.619 | 0.636 | ||

| Green finance | 0.766 | 0.792 | 0.693 | 0.696 | 0.890 | |

| Green social finance | 0.715 | 0.729 | 0.644 | 0.631 | 0.700 | 0.880 |

| Variables | R-Square | R-Square Adjusted |

|---|---|---|

| Banking sustainability | 0.348 | 0.346 |

| Digital awareness | 0.452 | 0.450 |

| Digital transformation | 0.333 | 0.331 |

| Fintech adoption | 0.440 | 0.434 |

| Green finance | 1.000 | 1.000 |

| Relationships | Direct Beta | Mediating Beta | t-Value | p-Value | Decision | |

|---|---|---|---|---|---|---|

| H1 | GF -> FA | 0.339 | 4.653 | 0.000 | Accepted | |

| H2 | GF -> DA | 0.672 | 18.707 | 0.000 | Accepted | |

| H3 | DA -> FA | 0.349 | 4.737 | 0.000 | Accepted | |

| H4 | GF -> DT | 0.577 | 11.029 | 0.000 | Accepted | |

| H5 | DT -> FA | 0.052 | 0.892 | 0.373 | Rejected | |

| H8 | FA -> BS | 0.590 | 13.457 | 0.000 | Accepted | |

| H6 | GF -> DA -> FA | 0.234 | 4.520 | 0.000 | Accepted | |

| H7 | GF -> DT -> FA | 0.030 | 0.880 | 0.379 | Rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Serdarušić, H.; Pancić, M.; Zavišić, Ž. Green Finance and Fintech Adoption Services among Croatian Online Users: How Digital Transformation and Digital Awareness Increase Banking Sustainability. Economies 2024, 12, 54. https://doi.org/10.3390/economies12030054

Serdarušić H, Pancić M, Zavišić Ž. Green Finance and Fintech Adoption Services among Croatian Online Users: How Digital Transformation and Digital Awareness Increase Banking Sustainability. Economies. 2024; 12(3):54. https://doi.org/10.3390/economies12030054

Chicago/Turabian StyleSerdarušić, Hrvoje, Mladen Pancić, and Željka Zavišić. 2024. "Green Finance and Fintech Adoption Services among Croatian Online Users: How Digital Transformation and Digital Awareness Increase Banking Sustainability" Economies 12, no. 3: 54. https://doi.org/10.3390/economies12030054

APA StyleSerdarušić, H., Pancić, M., & Zavišić, Ž. (2024). Green Finance and Fintech Adoption Services among Croatian Online Users: How Digital Transformation and Digital Awareness Increase Banking Sustainability. Economies, 12(3), 54. https://doi.org/10.3390/economies12030054