Exploring Distributions of House Prices and House Price Indices

Abstract

1. Introduction

2. Generalized Beta Distribution Function

3. Fitting Distribution of House Prices and House Price Indices

3.1. Methodology

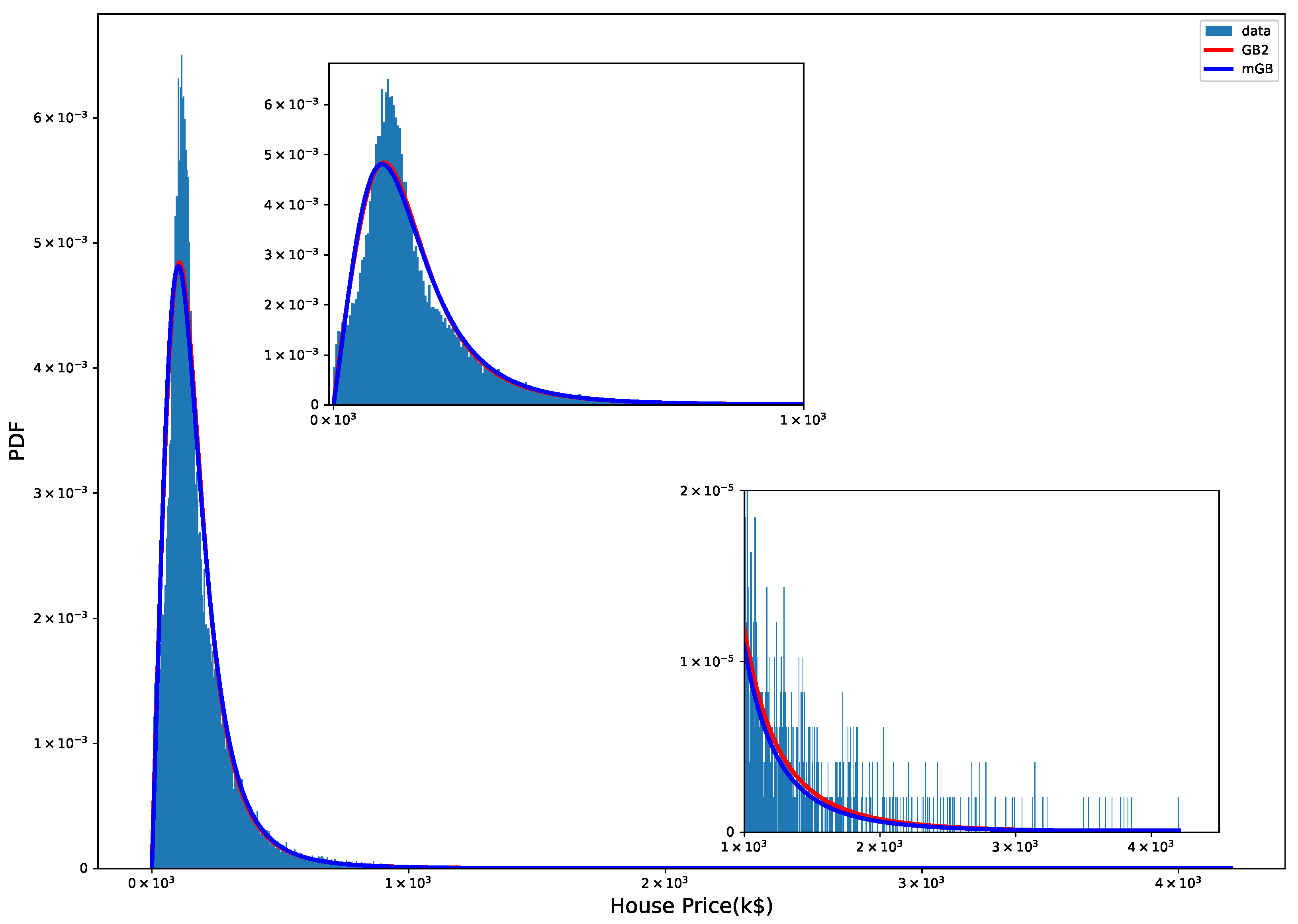

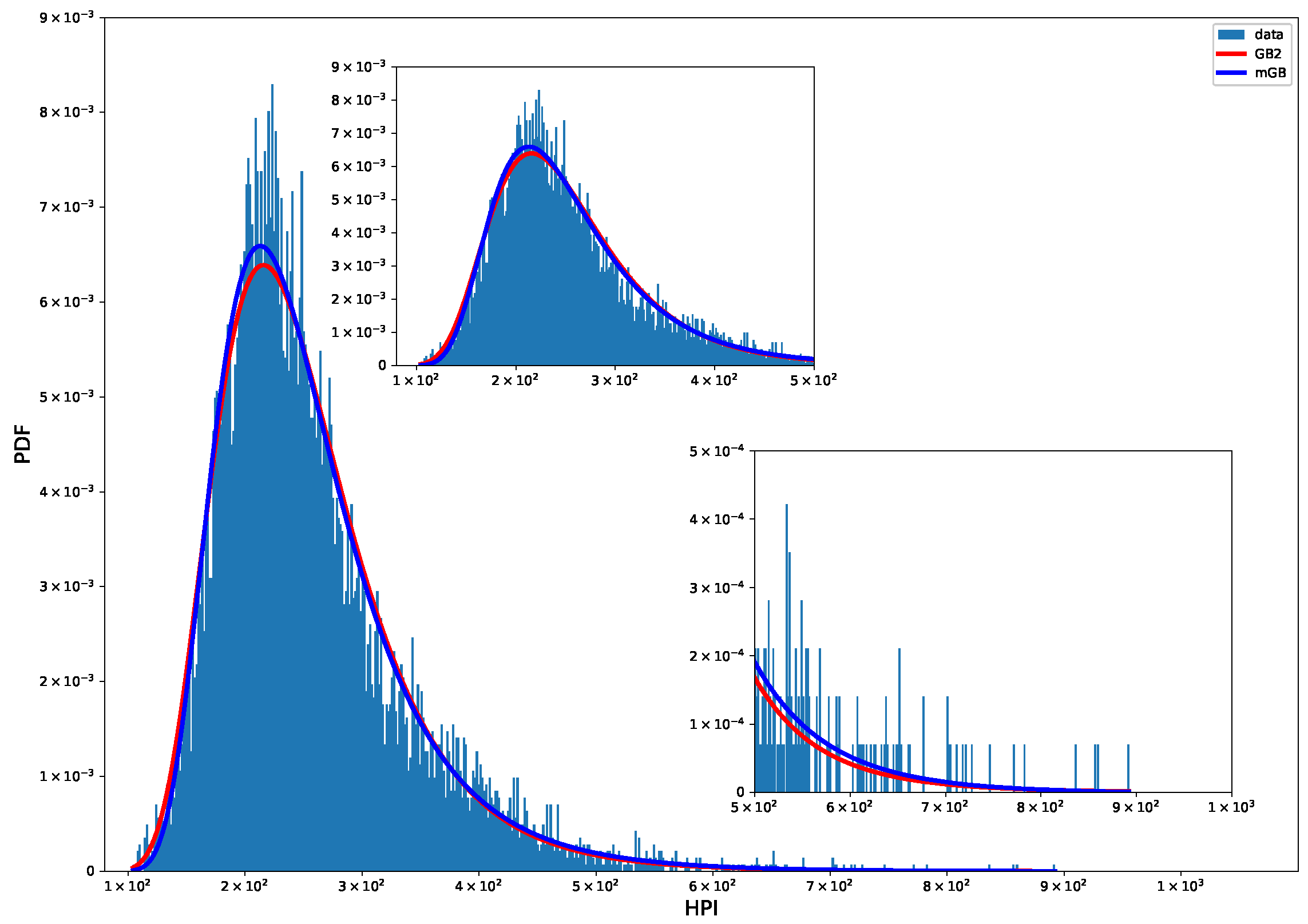

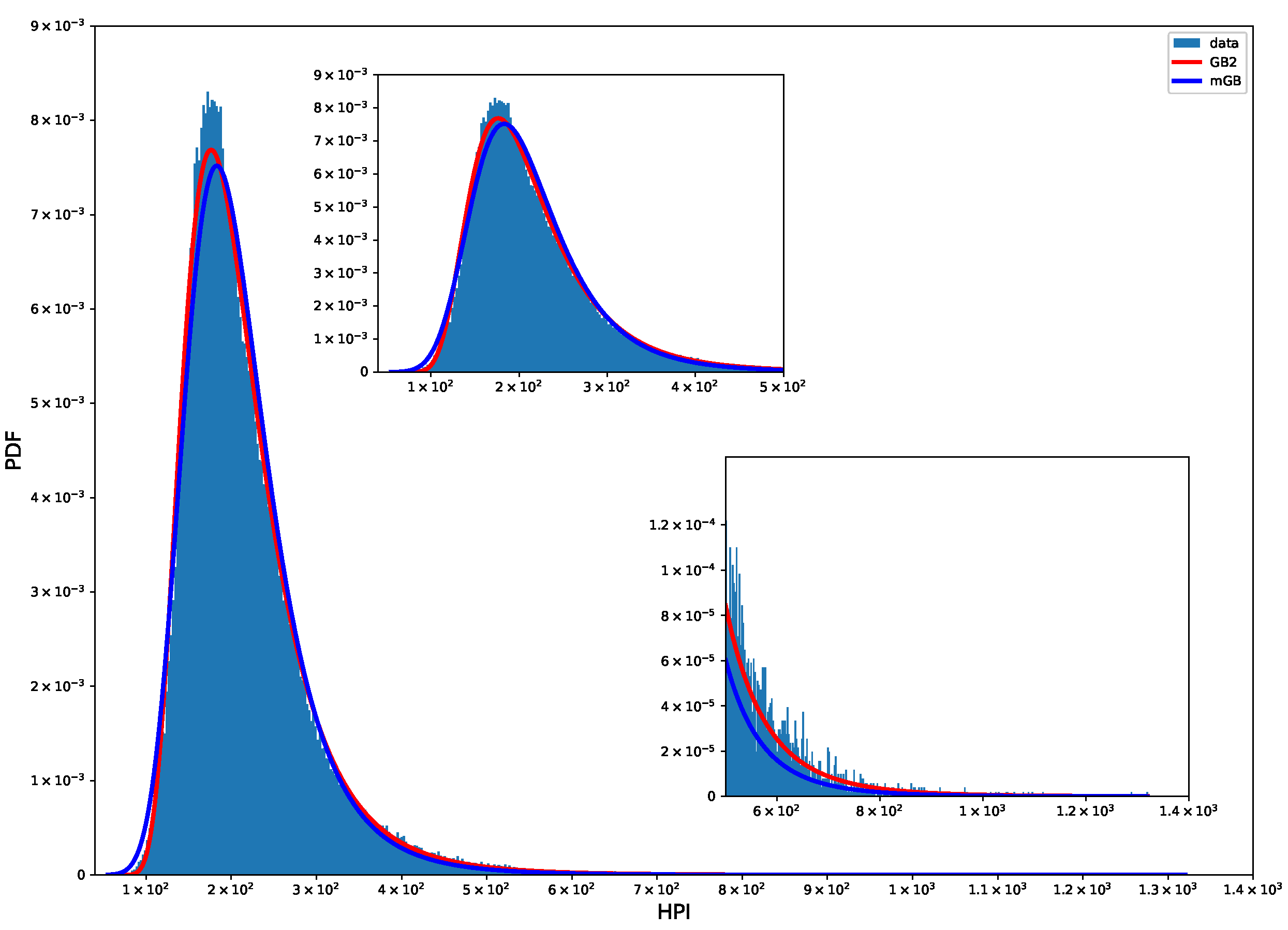

- PDF of the distribution

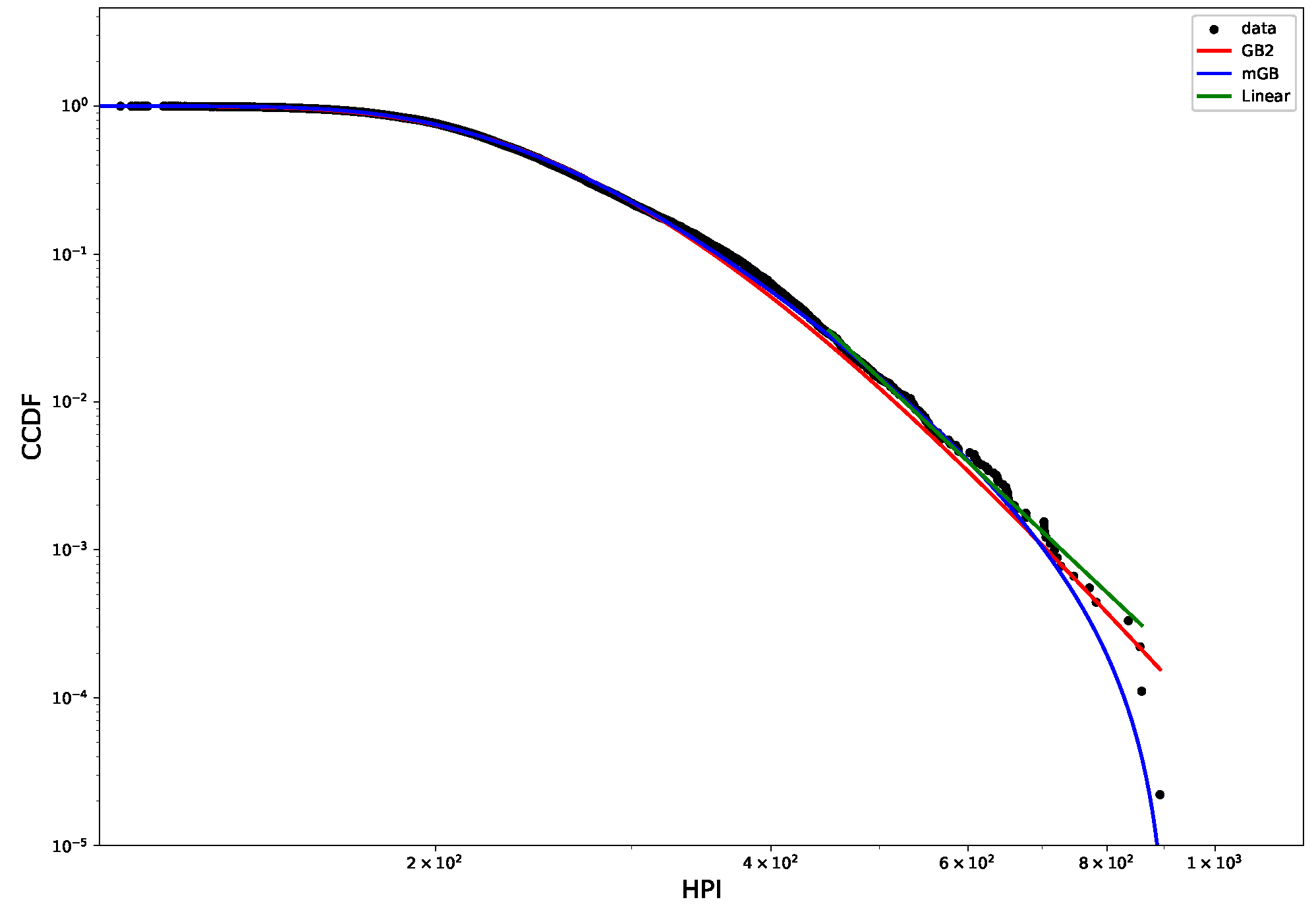

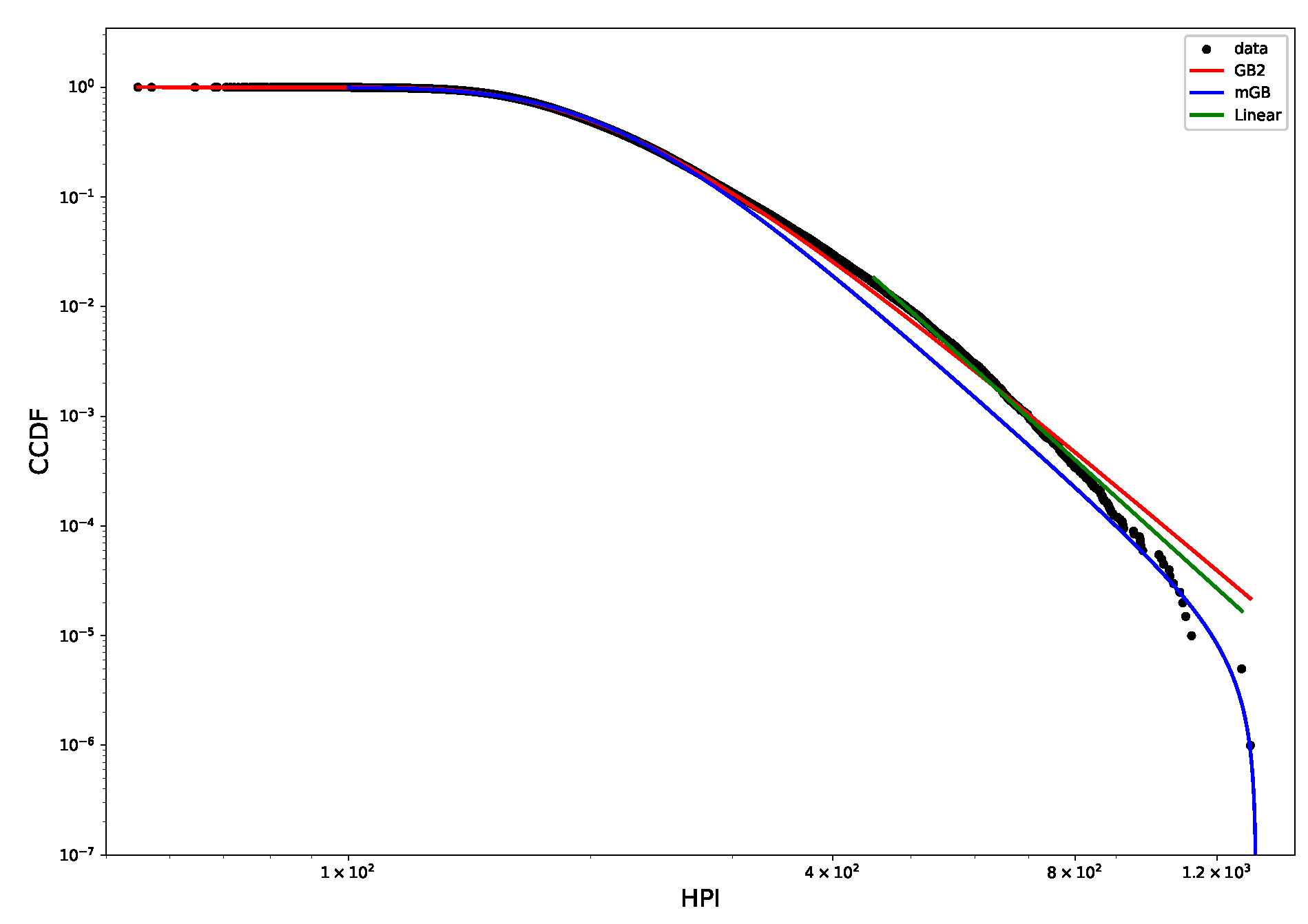

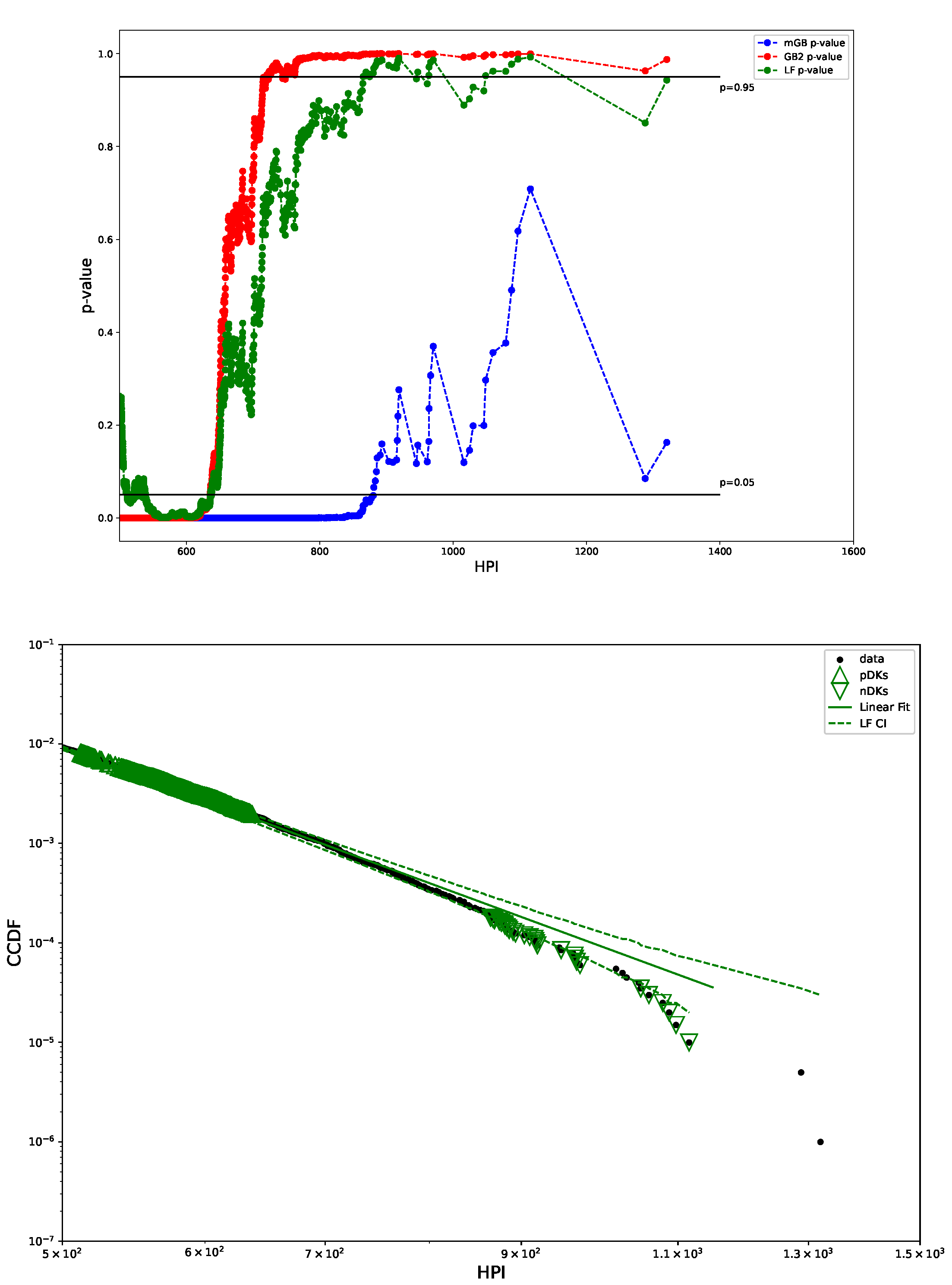

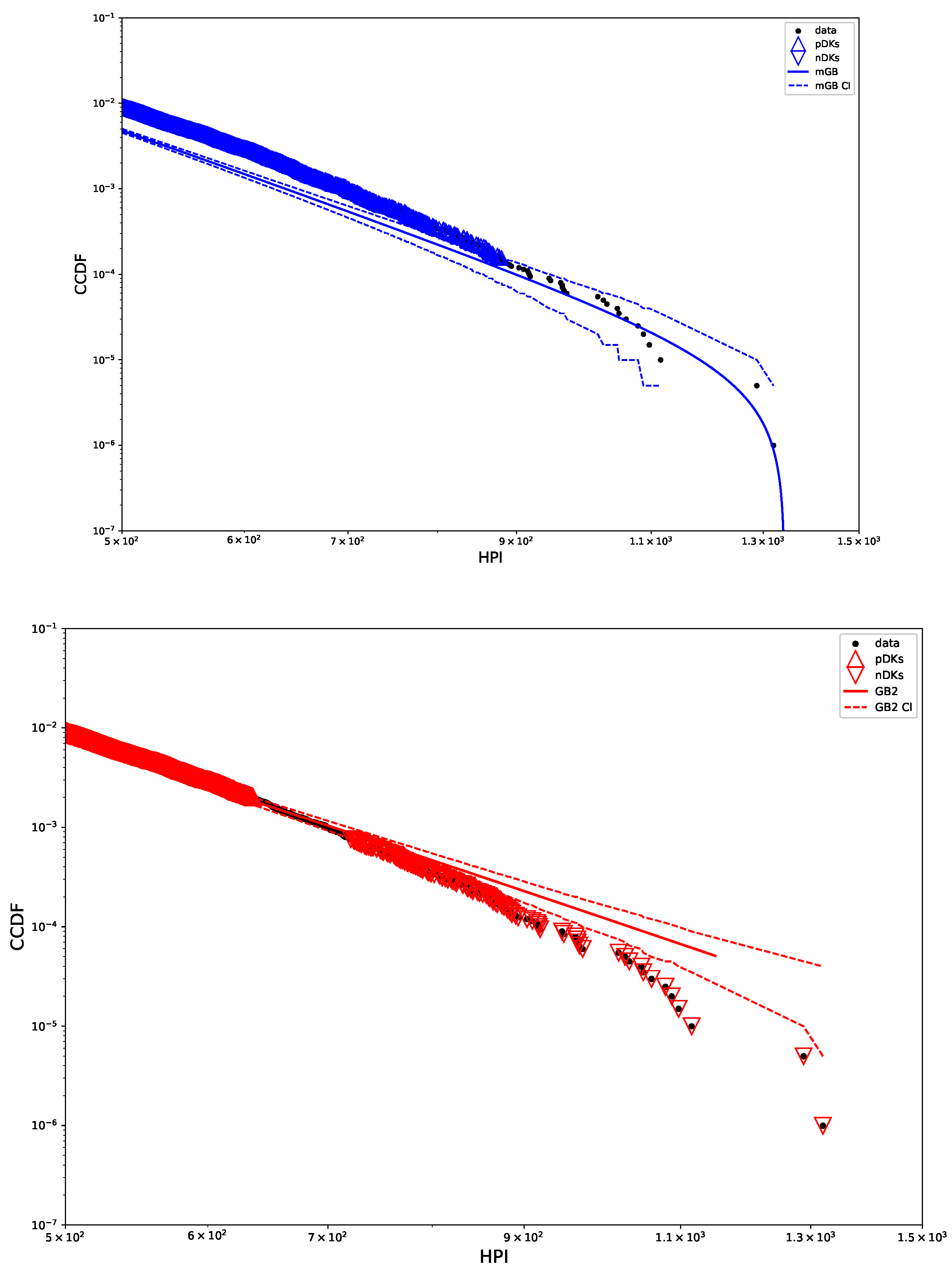

- Full data CDF fit with mGB and GB2 and LF of the tails;

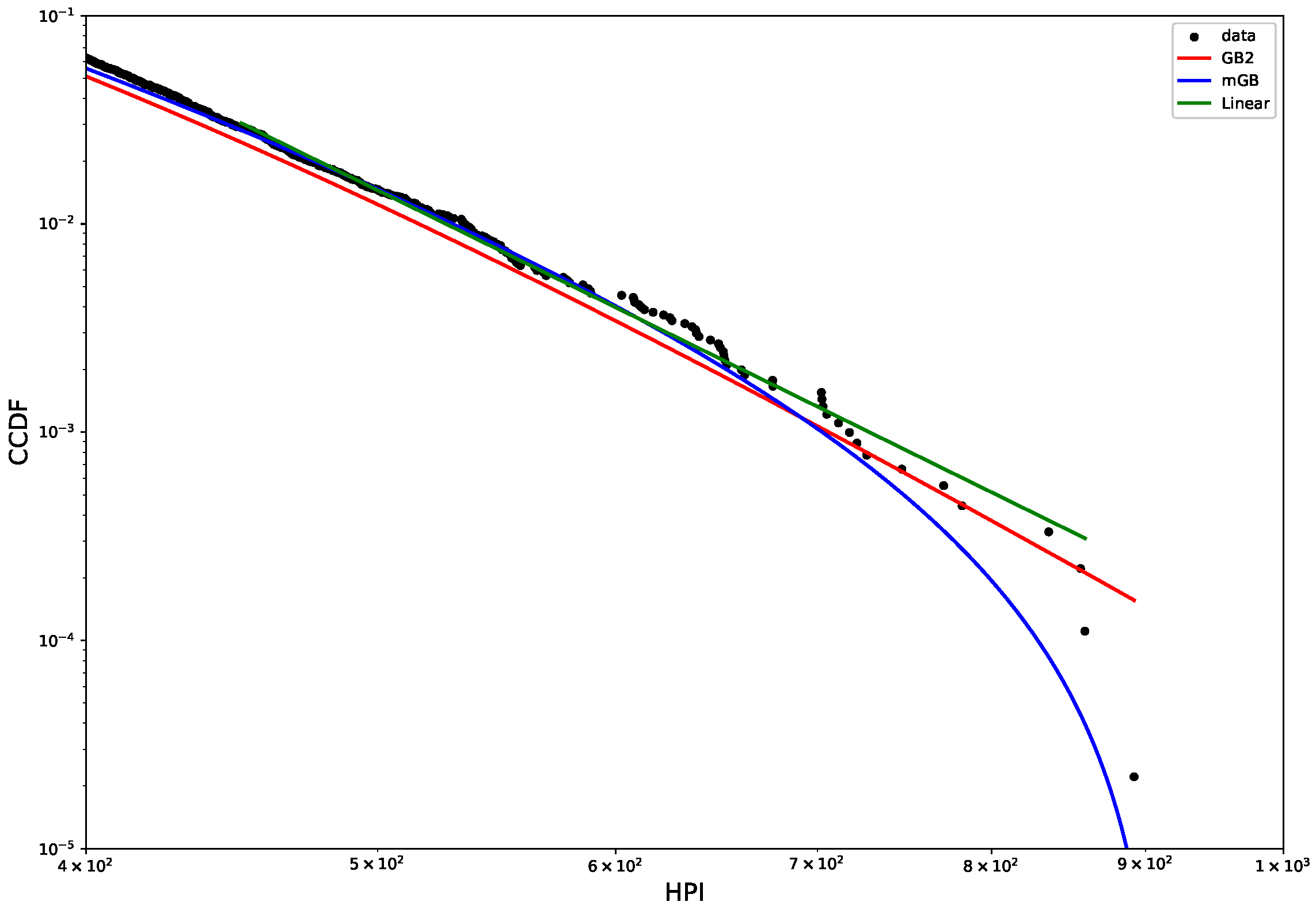

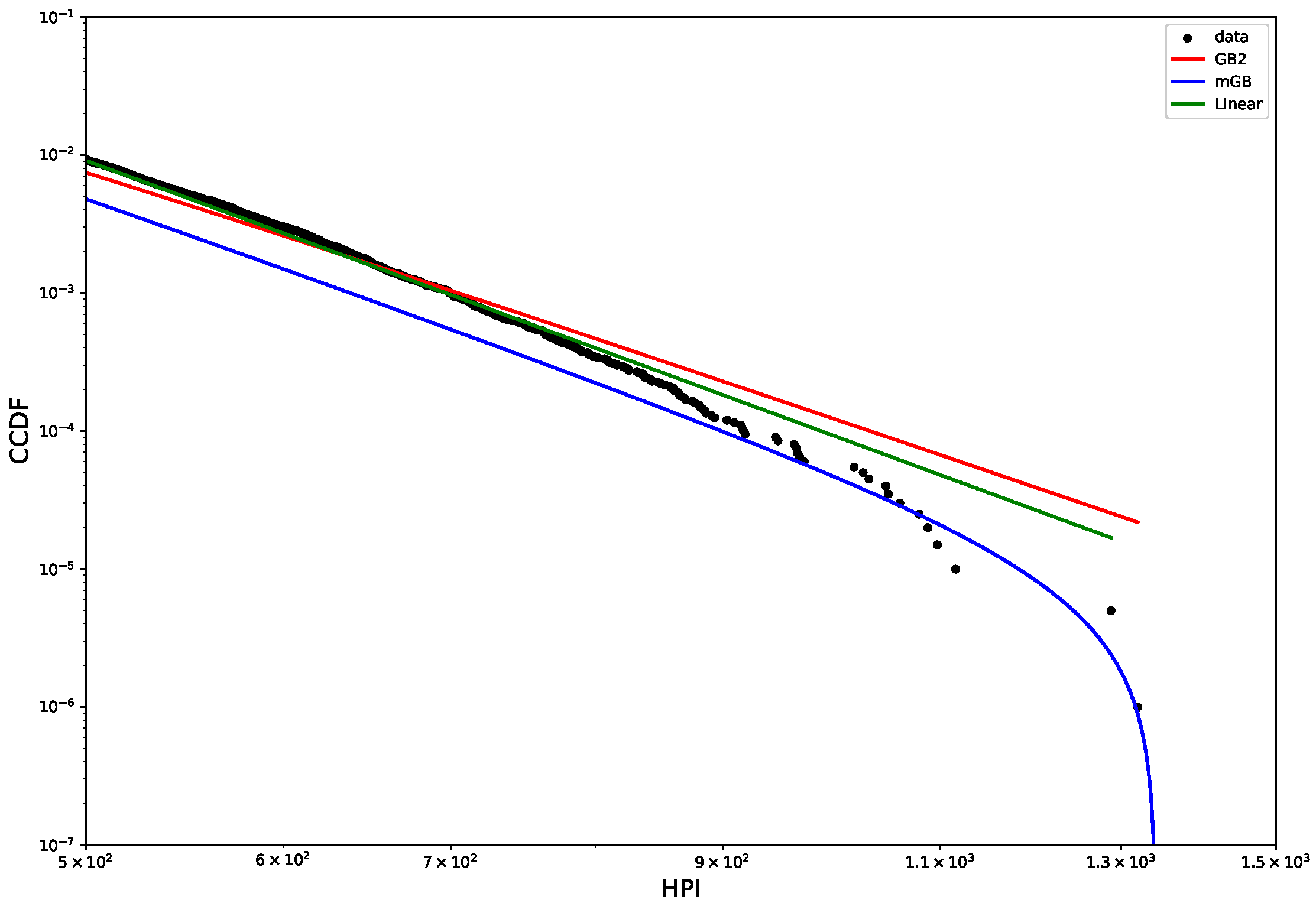

- Same as above but showing specifically the tail region;

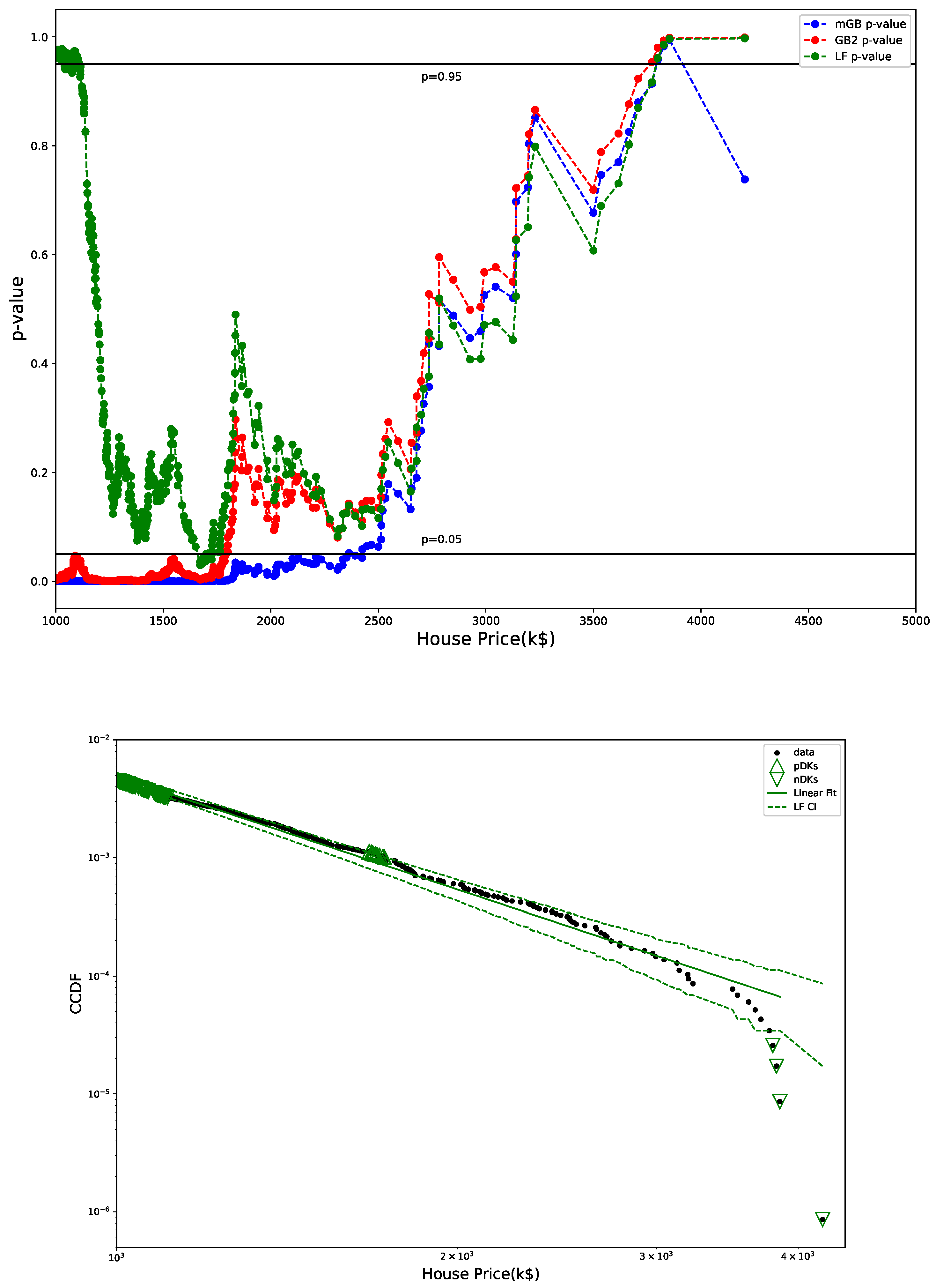

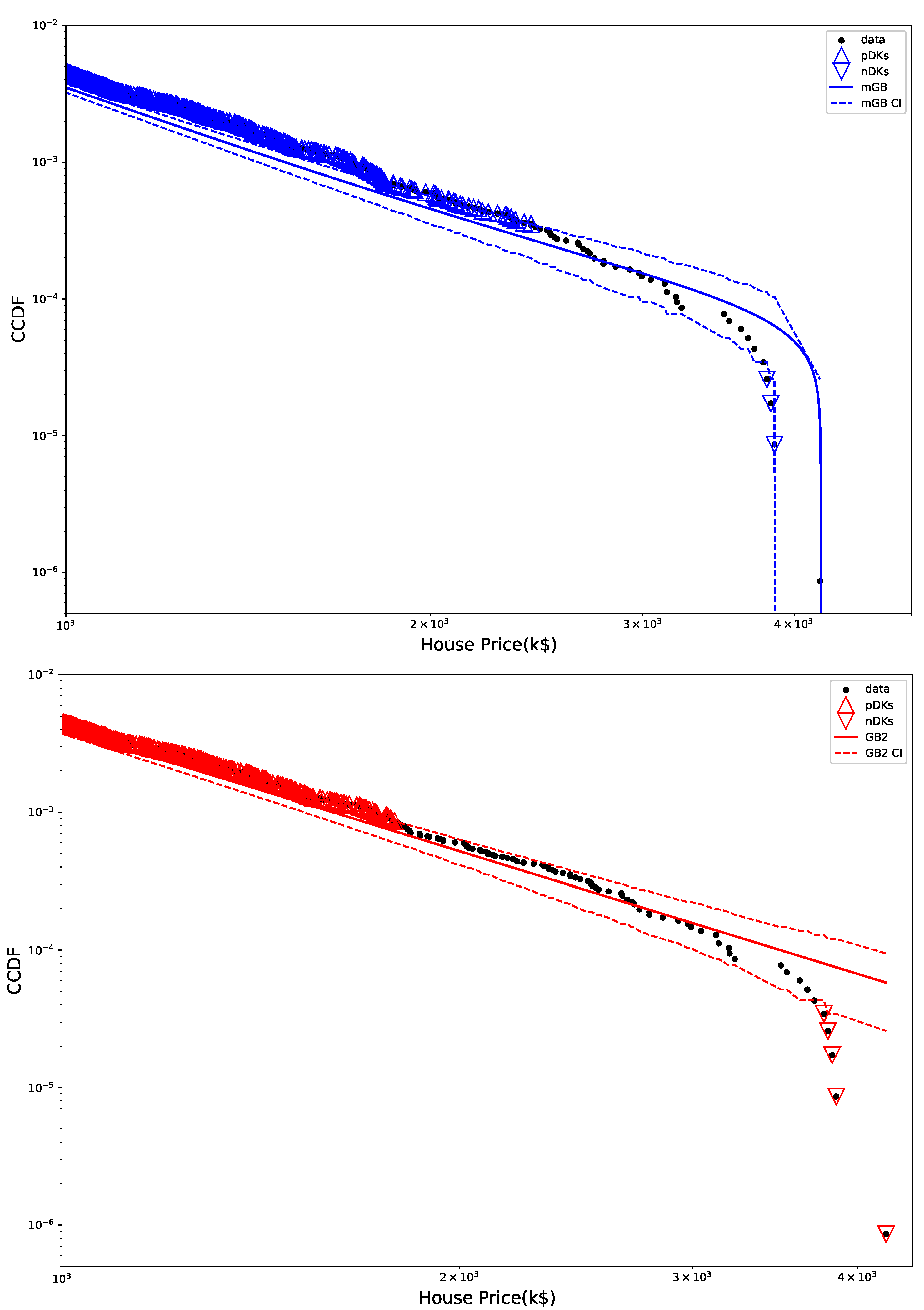

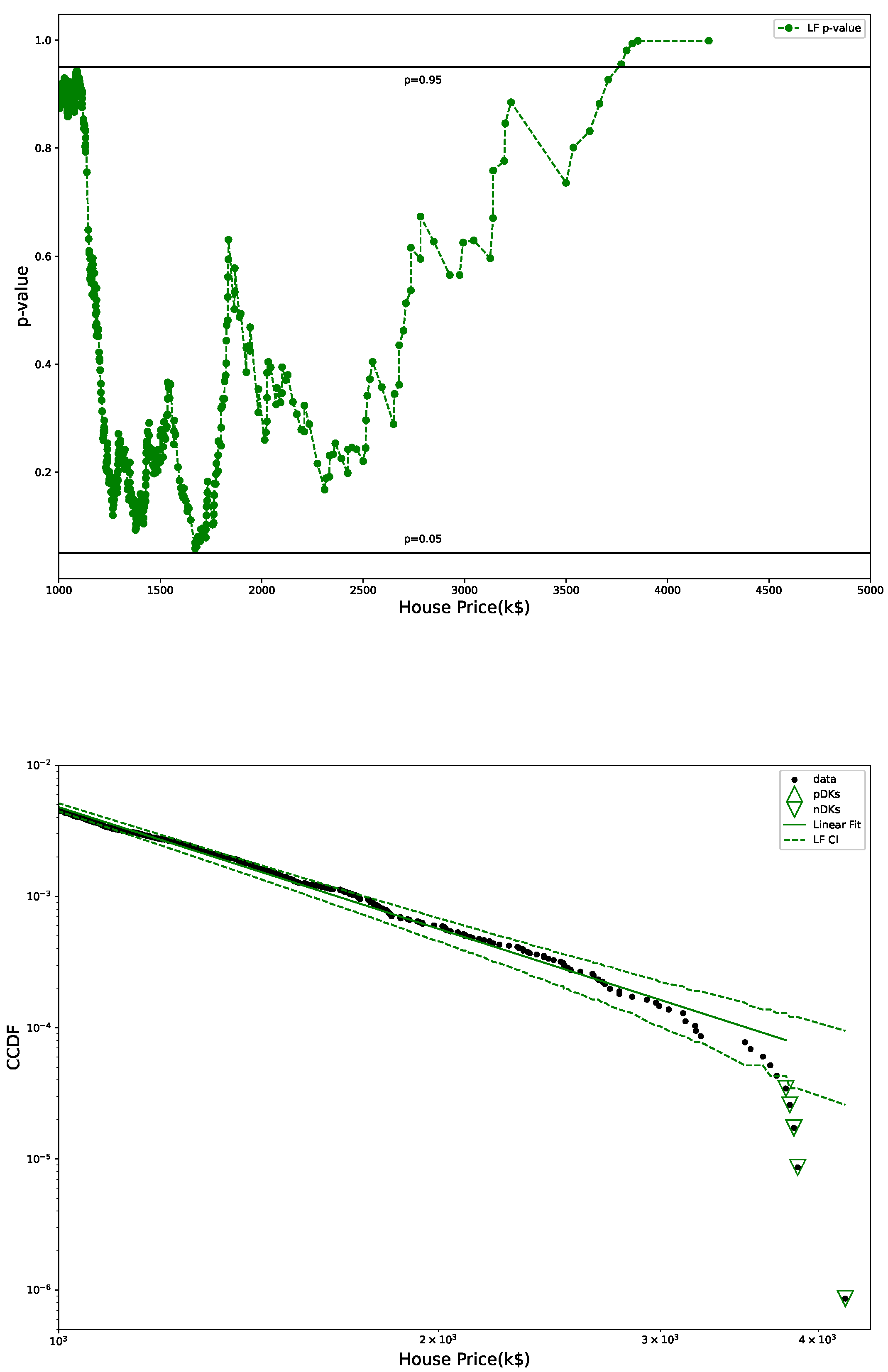

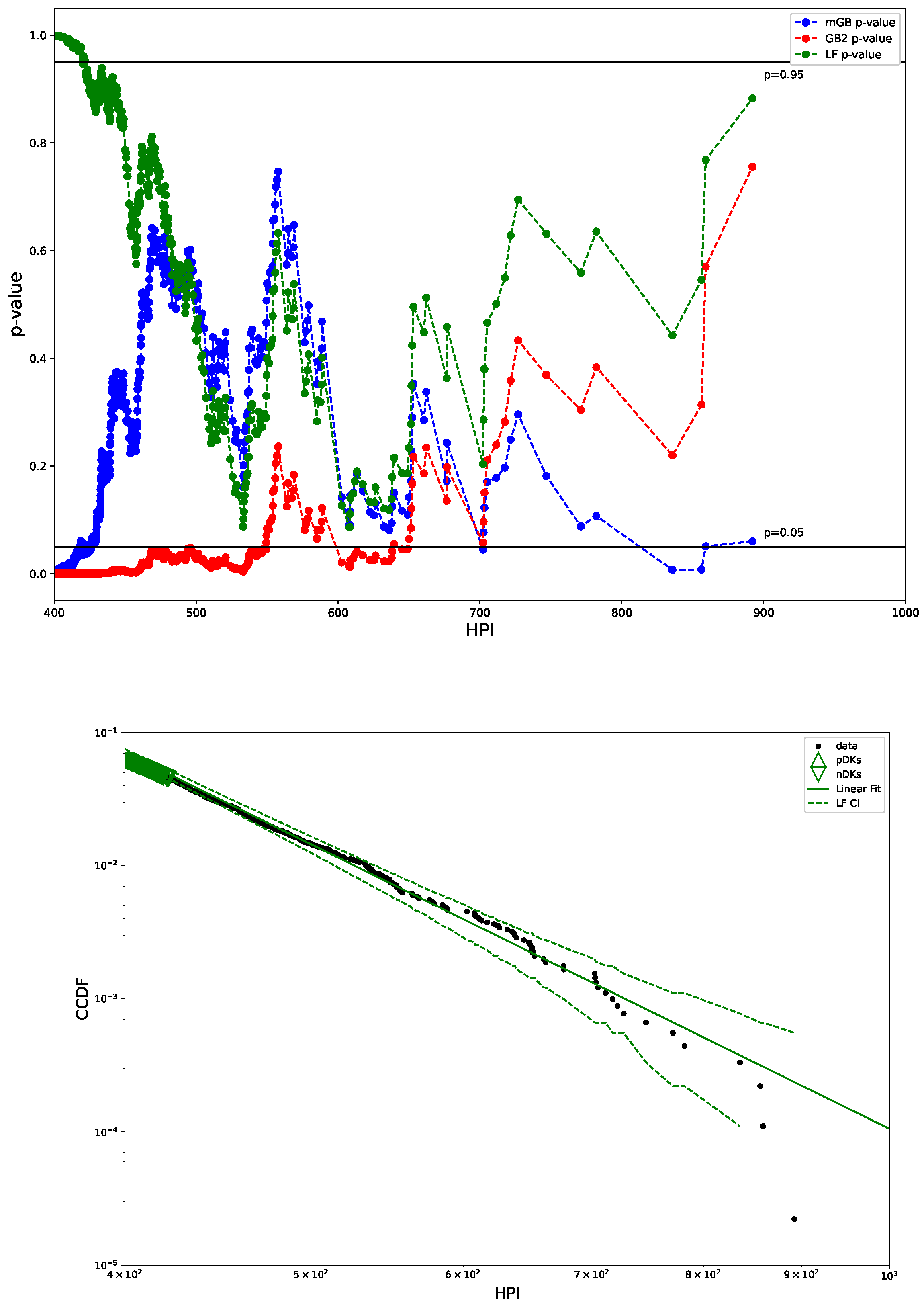

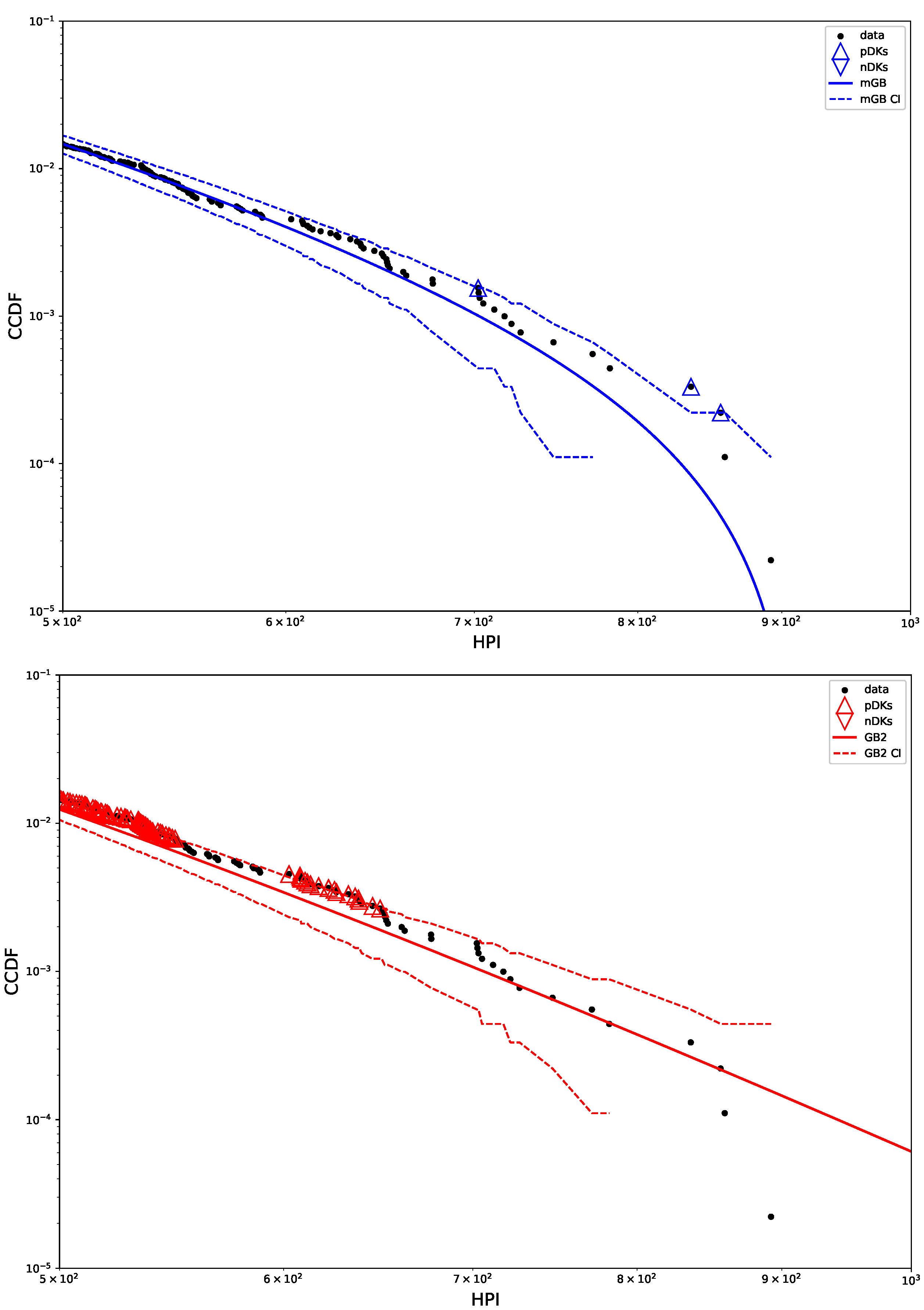

- p-values of all three fits in the tail region, with indicating DK (up triangles) and nDK (down triangles);

- LF with its CI;

- GB2 fit with its CI;

- mGB fit with its CI.

3.2. Distribution of House Prices

3.3. Distribution of House Price Indicies

3.3.1. Single-Year Distribuions

3.3.2. Muli-Year Distibuions

4. Discussion

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | In this regard, for HPI we presented mGB and GB2 with slightly higher Kolmogorov-Statistic but with better tail fits. |

References

- Bailey, Martin J., Richard F. Muth, and Hugh O. Nourse. 1963. A regression method for real estate price index construction. Journal of American Statistical Association 58: 933–42. [Google Scholar] [CrossRef]

- Bogin, Alexander N., William M. Doerne, and William D. Larson. 2016. Local House Price Dynamics: New Indices and Stylized Facts. Working Paper 16-01, Federal Housing Finance Agency. Available online: https://www.fhfa.gov/PolicyProgramsResearch/Research/Pages/wp1601.aspx (accessed on 8 February 2024).

- Bouchaud, Jean-Philippe, and Marc Mézard. 2000. Wealth condensation in a simple model of economy. Physica A: Statistical Mechanics and its Applications 282: 536–45. [Google Scholar] [CrossRef]

- Calhoun, Charles A. 1996. Ofheo House Price Indexes: Hpi Technical Description; Working Paper N508; Washington, DC: Office of Federal Housing Enterprise Oversight.

- Case, Karl E., and Robert J. Shiller. 1987. Prices of single-family homes since 1970: New indexes for four cities. New England Economic Review, 45–56. [Google Scholar]

- Case, Karl E., and Robert J. Shiller. 1989. The efficiency of the market for single-family homes. The American Economic Review 79: 125–37. [Google Scholar]

- Chotikapanich, Duangkamon, ed. 2008. Modeling Income Distributions and Lorenz Curves. Berlin/Heidelberg: Springer. [Google Scholar]

- Chotikapanich, Duangkamon, William E. Griffiths, Gholamreza Hajargasht, Wasana Karunarathne, and Prasada D. S. Rao. 2018. Using the gb2 income distribution. Econometrics 6: 21. [Google Scholar] [CrossRef]

- Dashti Moghaddam, M., Jeffrey Mills, and R. A. Serota. 2020. From a stochastic model of economic exchange to measures of inequality. Physica A 559: 125047. [Google Scholar] [CrossRef]

- Dashti Moghaddam, M., and R. A. Serota. 2021. Combined mutiplicative-heston model for stochastic volatility. Physica A: Statistical Mechanics and Its Applications 561: 125263. [Google Scholar] [CrossRef]

- FHFA. 2024. House Price Index; Washington, DC: FHFA.

- Filimonov, Vladimir, and Didier Sornette. 2015. Power law scaling and “dragon-kings” in distributions of intraday financial drawdowns. Chaos, Solitons Fractals 74: 27–45. [Google Scholar] [CrossRef]

- Hertzler, Greg. 2003. “Classical” probability distributions for stochastic dynamic models. Paper presented at 47th Annual Conference of the Australian Agricultural and Resource Economics Society, Fremantle, Australia, February 12–14. [Google Scholar]

- Janczura, J., and R. Weron. 2012. Black swans or dragon-kings? a simple test for deviations from the power law. European Physical Journal Special Topics 205: 79–93. [Google Scholar] [CrossRef]

- Johansen, Anders, and Didier Sornette. 2001. Large stock market price drawdowns are outliers. Journal of Risk 4: 69–110. [Google Scholar] [CrossRef]

- Liu, Jiong, and R. A. Serota. 2023a. Are there dragon kings in the stock market? arXiv arXiv:2307.03693. [Google Scholar]

- Liu, Jiong, and R. A. Serota. 2023b. Rethinking generalized beta family of distributions. The European Physical Journal B 96: 24. [Google Scholar] [CrossRef]

- Ma, Tao, John G. Holden, and R. A. Serota. 2013. Distribution of wealth in a network model of the economy. Physica A: Statistical Mechanics and Its Applications 392: 2434–41. [Google Scholar] [CrossRef]

- McDonald, James B. 2008. Modeling Income Distributions and Lorenz Curves. Edited by Duangkamon Chotikapanich. Berlin/Heidelberg: Springer, Chapters 3, 8. [Google Scholar]

- McDonald, James B., and Yexiao J. Xu. 1996. A generlazition of the beta distribution with applications. Journal of Econometrics 66: 133–52. [Google Scholar] [CrossRef]

- NIST Digital Library of Mathematical Functions. 2022. Available online: https://dlmf.nist.gov (accessed on 8 February 2024).

- Pisarenko, Vladilen F., and Didier Sornette. 2012. Robust statistical tests of dragon-kings beyond power law distribution. The European Physical Journal Special Topics 205: 95–115. [Google Scholar] [CrossRef]

- Sornette, Didier, and Guy Ouillon. 2012. Dragon-kings: Mechanisms, statistical methods and empirical evidence. The European Physical Journal Special Topics 205: 1–26. [Google Scholar] [CrossRef]

- Watorek, Marcin, Jaroslaw Kwapien, and Stanislaw Drozdz. 2021. Financial return distributions: Past, present, and covid-19. Entropy 23: 884. [Google Scholar] [CrossRef] [PubMed]

- Wheatley, Spencer, and Didier Sornette. 2015. Multiple Outlier Detection in Samples with Exponential & Pareto Tails: Redeeming the Inward Approach & Detecting Dragon Kings. arXiv arXiv:1507.08689. [Google Scholar]

| Fit | p | q | Slope of CCDF | |||

|---|---|---|---|---|---|---|

| mGB | 2.3717 | 4209.7557 | 187.7393 | 0.8597 | 0.3891 | |

| GB2 | 2.8732 | 178.0461 | 0.6692 | 1.0289 | −3.9562 | |

| LF-1 | −3.1880 | |||||

| LF-2 | −3.0796 |

| Fit | p | q | Slope of CCDF | |||

|---|---|---|---|---|---|---|

| mGB | 2.2532 | 914.3328 | 54.0456 | 71.5687 | 1.7586 | |

| GB2 | 1.6063 | 58.029 | 52.5168 | 5.6728 | −9.1122 | |

| LF | −7.1066 |

| Fit | p | q | Slope of CCDF | |||

|---|---|---|---|---|---|---|

| mGB | 3.3038 | 1342.3155 | 163.8916 | 3.6162 | 1.0004 | |

| GB2 | 2.1786 | 42.1151 | 75.7226 | 2.8667 | −6.2454 | |

| LF | −6.6488 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Farahani, H.; Serota, R.A. Exploring Distributions of House Prices and House Price Indices. Economies 2024, 12, 47. https://doi.org/10.3390/economies12020047

Liu J, Farahani H, Serota RA. Exploring Distributions of House Prices and House Price Indices. Economies. 2024; 12(2):47. https://doi.org/10.3390/economies12020047

Chicago/Turabian StyleLiu, Jiong, Hamed Farahani, and R. A. Serota. 2024. "Exploring Distributions of House Prices and House Price Indices" Economies 12, no. 2: 47. https://doi.org/10.3390/economies12020047

APA StyleLiu, J., Farahani, H., & Serota, R. A. (2024). Exploring Distributions of House Prices and House Price Indices. Economies, 12(2), 47. https://doi.org/10.3390/economies12020047