1. Introduction

Economic growth is the foundation of a country’s economic development, which manifests in increasing or improving production of goods and services, increasing quality of life, and meeting people’s needs. Achieving certain rates of economic growth is a strategic goal set by many countries. Yet each country uses its own model of economic development based on its historical background and ethnic characteristics, current production factors and efficiency of their management, extent of innovations and high tech, development of institutional foundations, etc.

An analysis of the global economic growth situation has confirmed a significant slowdown in the global economy’s growth rate in recent years compared to levels prior to 2020. Amid a slow recovery in global economic growth, risks remain, including geopolitical tensions, trade fragmentation, a prolonged period of elevated interest rates, and climate change.

The World Bank projects a stabilization rate of global economic growth at 2.6% in 2024, going into a slight increase in subsequent years (

World Bank 2024a). The International Monetary Fund believes the group of developed countries will see a growth rate of 1.7% in 2024, while in the group of emerging market and developing countries, the economic growth rate in 2024 will be slightly higher and amount to 4.3% (

International Monetary Fund 2024). In addition, the economic growth in Central Asian countries is projected to be 4.6% in 2024 (

United Nations 2024). Following the situation in Kazakhstan, where economic growth was recorded at 5.1% in 2023, a decline to 3.4% is expected in 2024 (

World Bank 2024b). At the same time, Kazakhstan is striving to achieve an ambitious goal—GDP growth by 2029 of

$450 billion with an average annual economic growth rate of 6–7% (

The National Development Plan of Kazakhstan 2024). This objective necessitates the implementation of effective policies, including increasing investments and promoting productivity growth.

In the structure of closely interrelated factors of economic growth, the productivity indicator stands out. The global importance of productivity is reflected in the fact that countries with a high level of production efficiency, all other things being equal, are among the leaders in the socio-economic domain. By specifying the significance of labor productivity, we can express it through the ratio of labor result to cost in the form of working time. Notice how labor result is often reflected in the form of GDP when considered nationwide. That said, labor productivity is the most important feature and condition for stable and accelerated economic development. In turn, productive capacity depends on production and economic factors and processes, management systems, and human capital.

In Kazakhstan’s case, the need to increase productivity to maintain the growth of the economy is due to the projected depletion of the current resource base and the relative decline in the manufacturing industry. Investment infusions can provide a strong impetus for labor productivity growth and qualitative development. Therefore, Kazakhstan’s investment policy should focus on enhancing investment potential and directing investment flows into economy sectors that can yield significant returns.

Although fixed capital investment and R&D investment and their role in Kazakhstan’s economic development have attracted researchers’ attention, their specific impact on labor productivity remains underexplored. Most of the exiting literature has concentrated on the effects of different types of investment across various sectors, such as energy production (

Bolganbayev et al. 2022), agriculture (

Mizanbekov and Kalym 2024), the scientific sphere (

Abdikadirova et al. 2024), and the renewable energy sector (

Lan et al. 2024). Despite these studies, a clear research gap persists, highlighting the need to investigate the influence of fixed capital investment and R&D investment on labor productivity.

This paper examines fixed assets investment and R&D expenditure and analyzes their effect on labor productivity growth in Kazakhstan and six other countries for comparison. We utilize a two-stage lagged regression model covering the period from 1997 to 2022. The findings indicate that both fixed capital investment and R&D investment positively influence labor productivity growth. Moreover, R&D investment has a larger effect on labor productivity than fixed assets investment. The robustness of our results is confirmed through the Prais–Winsten estimator and residual autocorrelation. Python and SPSS were used to construct the model and visualize the data. Additionally, we assess the effect of the crises experienced by economies during the period of 1997–2022 on the relationship between investment and labor productivity.

Our research makes a substantial input with its detailed description of the contributions of fixed capital and R&D investments to labor productivity growth. This study contributes to the scientific literature in the following ways. Firstly, it analyzes the relationship between fixed capital and R&D investments and labor production capacity. Secondly, the study identifies the optimal level of investment in fixed capital and R&D that will have the maximum effect on labor productivity growth for the analyzed countries. Finally, the results of the study can be used in developing strategic investment policies that will lean against the possibility of changing the ratio between investment in fixed capital and investment in R&D to predetermine the growth of labor productivity and, consequently, economic growth. To achieve this goal, the study uses a regression model, the main implications of which are focused on the analysis of the relationship between indicators and finding optimal values.

This paper is organized as follows.

Section 2 provides a brief review of the literature on the research topic, identifies existing gaps, and generates research hypotheses.

Section 3 presents the data taken for the empirical analysis and methodology used.

Section 4 presents the results of the study and a discussion.

Section 5 provides conclusions and recommendations for further research.

2. Literature Review and Research Hypothesis

Economic literature presents various conceptual models of economic growth, including classical, neoclassical, and endogenous growth theories, among others. These models identify key drivers of growth, such as specialization, capital accumulation, technological advancements, and rising investment levels. Based on the recommendations of scientific theories, governments implement various tools to stimulate and influence economic growth and prosperity. Among these, investments are regarded as the most crucial instrument of economic policy.

Overall, research confirms that investments have a positive impact on economic development (

Makuyana and Odhiambo 2018). In the study by

Afonso and Aubyn (

2019), VAR analysis was used to examine the effects of crowding out and crowding in across 17 OECD countries, revealing a positive impact of investments on economic growth in most countries. Similarly,

Berg et al. (

2018) conducted an in-depth analysis of the effects of public investments on economic growth and investment returns in both efficient and inefficient countries, drawing on the Cobb–Douglas production function and the neoclassical growth model. They concluded that both high- and low-efficiency countries benefit from economic growth through increased public investment expenditures. The study by

Sağdıç et al. (

2021) further supported the significant influence of investment incentives on regional and sectoral growth. These incentives included exemptions from customs duties, VAT, reductions in corporate tax, project investments, land allocation, infrastructure support, and others.

An important area of research, in our view, is the study of the impact of specific types of investment on economic growth. It is worth noting that investments in fixed capital and R&D are closely tied to production processes, as they focus on improving technology and equipment, reducing production costs, and increasing labor productivity, ultimately leading to permanent economic growth. Moreover, investments in fixed assets and R&D consist of both public and private contributions, making them valuable tools in growth-stimulating policies. Econometric studies on investment in R&D and fixed capital, productivity growth, and economic expansion can provide a broader perspective on the returns of these investments for a country’s economy.

Exiting studies on the impact of fixed capital investments on economic growth can be highlighted (

Tang 2010). Then,

Li and Peng (

2011) expanded the study of fixed investment by empirically analyzing its impact not only on economic growth, but also the environment.

Zhang (

2019) explores investment in fixed assets as an important component of investment. His article used the ARIMA model to give an in-depth analysis of fixed capital investments and to obtain forecast estimates. Additionally, using correlation-regression analysis,

Makohon et al. (

2020) found out that, in most countries analyzed, increased investment in fixed assets led to faster economic growth. However, the impact was heterogeneous depending on the level of financial market development and the degree of the country’s resource orientation.

Bi and Zhao (

2017) projected investment in fixed assets based on the mathematical statistical models ARIMA and Gray Neural Network. The use of these models allowed them to identify a significant impact of investment in fixed capital on China’s macroeconomic indicators, especially on economic growth, optimization of resource allocation, and employment expansion.

As for investment in R&D, the study by

Yahyazadehfar and Shababi (

2018) can be referenced. Based on the reviewed relevant literature and content analysis, they found investment in R&D to be one of the effective factors of economic growth. An expanded bibliometric study allowed

Arana-Barbier (

2023) to further explore the relationship between R&D investment and economic growth. He concluded that investment in R&D has a close relationship with the size of developed and developing country economies. Moreover, his new indicator based on the number of scientific articles for every 1% of R&D investment turned out to be statistically significant in relation to economic growth.

Researchers

Mudronja et al. (

2019),

Hapson et al. (

2014), and

Wynn et al. (

2022) have deepened the study on R&D investment’s role in economic development of individual regions and industries. Further,

Almeida and Amoedo (

2020) added a sustainability index in their empirical analysis. Using linear regression, cluster analysis, and analysis of variance (ANOVA), they determined that R&D expenditure is a determinant of a country’s sustainable development.

Using a sample of 25 OECD countries,

Aali-Bujari and Venegas-Martinez (

2023) conducted Granger causality test to estimate an MGM system’s dynamic panel model. They obtained empirical evidence of bidirectional causality between R&D investment and GDP per capita.

Meanwhile,

Tung and Hoang (

2024) explored 29 emerging economies. Having applied a production function theoretical framework, they found that national R&D expenditure positively affects economic growth of emerging economies. In addition, their panel cointegration test demonstrated the existence of a long-run cointegration relationship between economic growth and independent variables characterizing R&D investment and R&D activities.

Kazakhstan’s case has been examined by

Colapinto et al. (

2020), who concluded that Kazakhstan would require significant investments in six major economic sectors to effectively increase their contribution to the overall GDP. The authors suggested that R&D investments must be narrowed toward green sustainability. Their study is based on the use of a classical weighted GP (WGP) model, where the total amount of public R&D investment was introduced as a constraint.

Huseynli (

2023) examined the impact of R&D investment on accelerating economic growth in several countries in the Central Asian region, including Kazakhstan, Kyrgyzstan, and Azerbaijan. The study used econometric analysis (Granger test) and the EViews statistical package. The correlation analysis results showed a negative insignificant relationship between R&D expenditure and GDP growth in Kazakhstan.

A review of the existing literature identified a research gap in exploring the impact of investments in fixed assets and R&D on labor productivity, a key qualitative characteristic of economic growth. Our study attempts to find out which of the two types of investment is a more significant factor for productivity growth in modern conditions: investment in fixed capital or investment in R&D. This is necessary to implement a more effective investment policy and ensure the required levels of economic growth. We propose hypothesis H1 based on the above analysis.

H1. Investment in fixed assets and R&D expenditures affect labor productivity growth and, consequently, economic growth.

To achieve the maximum return on investments, it is important to determine whether there are limits to increasing investment volumes. Endogenous growth models address the impact of investments on economic growth and the limits of their positive effects (

Lukas 1988;

Aghion and Howitt 1992). The article by

Baneliene et al. (

2018) attempted to determine the optimal level of investment. They proved that investment in R&D in EU countries had the greatest multiplier effect when the GDP exceeded 10,397 euros per capita. Thus, in more developed European economies, R&D investment drives greater GDP growth. These findings regarding the greater impact of R&D investment on economic growth in well-developed EU economies were confirmed in a more recent study by

Baneliene and Melnikas (

2020). Based on empirical analysis of data from European Union countries, they proposed a modeling framework for conducting assessments.

Focusing on R&D investments and productivity,

Verbic et al. (

2011) found that increasing government spending on R&D enhances the long-term productivity of the Slovenian economy and boosts company revenues. Concurrently, the authors concluded that total factor productivity at the nation level is positively dependent on both total R&D output and the degree of the country’s economy openness.

For their input,

Filippetti and Peyrache (

2016) examined catch-up productivity growth in developing countries while arguing that investment in technology and fixed assets is important for catch-up development because, ultimately, it reduces the technology gap.

Corrado et al. (

2018) analyzed sources of productivity growth based on the contributions of investments in tangible and intangible assets for the United States and eighteen European countries. They concluded that countries with higher ICT intensity and lower manufacturing shares invest more in intangible assets than they do in tangible assets. Moreover, the results of their empirical study showed that investment in intangible assets is relatively high in countries with significant public investment in R&D.

The swift advancement of the digital economy, particularly in digital finance, greatly influences production processes and labor productivity. According to

Liao and Du (

2024), digital finance serves as a powerful catalyst for economic growth by enhancing public health, which is closely tied to sustaining work capacity and boosting labor productivity. To explore this, they performed a longitudinal data analysis using Probit models and heterogeneous analyses in their study.

Borkovic and Tabak (

2018) focused on different types of public investment as one of the main drivers of Croatian public and private company performance in various sectors of the economy. They estimated industry production functions, applied two sets of GMM (Generalized Method of Moments) instruments, and tested the key factor influence on total factor productivity growth.

Coccia (

2009) used a general dynamic linear regression model to determine the optimal level of R&D investment for enhancing long-term productivity in open economies.

Our approach builds on the

Coccia (

2009) model by incorporating investment in fixed capital as an additional area of focus. We estimate the impact of fixed assets investment and R&D investment on labor productivity growth. Previously, the relationships between fixed investment, R&D investment, and productivity have been studied separately, focusing on R&D investment and R&D activity. Moreover, researchers have shown greater interest in studying investment and economic development in developed and developing countries. Thus, as a gap in the literature, one can identify the lack of empirical research into the relationship between these indicators in Kazakhstan where issues of stimulating economic development are very relevant. The significance of this study is due to the need to fill the identified gap and provide data in this area. We propose hypothesis H2 based on the above analysis.

H2. There is a certain optimal level of investment in fixed capital and investment in R&D that leads to maximum growth in labor productivity.

3. Data and Methods

3.1. Description of Variables and Data

A review of the literature on the research topic allowed us to select indicators for modeling the dynamic relationships and testing the hypotheses. We used the following variables for the study: growth in labor productivity (RGLP), investment in fixed assets as a percentage of GDP (GFCF), investment in R&D as a percentage of GDP (GERD), employment rate (EMPR), and gross domestic product per capita according to purchasing power parity (GDPC).

Table 1 describes the selected variables.

The paper uses the labor productivity growth rate (RGLP), which characterizes the qualitative side of economic growth. It is measured as GDP growth per hour worked.

The fixed capital investment indicator is measured as costs associated with fixed capital formation as a percentage of GDP (GFCF). This indicator is required to measure domestic investment and its significance for the economy.

The R&D investment indicator is defined as gross domestic expenditure on research and development as a percentage of GDP (GERD). This one can act as an indicator of financing innovation, which is a driving factor in increasing labor productivity and accelerating economic growth.

In addition, to take into account additional factors, the study used the following indicators: employment rate as a percentage of population (EMPR), as well as gross domestic product per capita at purchasing power parity (GDPC).

Using these variables, we aimed to find evidence of a positive relationship between investments in fixed capital and R&D and productivity growth. Due to existing limitations in access to information, we took data for the following seven countries between 1997 and 2022: Kazakhstan, Germany, USA, Ireland, Japan, Canada, and China. We used Python and SPSS to calculate evaluation indicators.

Table 2 shows the descriptive characteristics of selected variables, including the mean, minimum, and maximum values for the data of the seven countries listed above.

The paper analyzes the performance of seven countries—Kazakhstan, Germany, USA, Ireland, Japan, Canada, and China. Although this is a relatively small sample, it is highly relevant to our study. Our choice of these seven countries is based on several key reasons. Kazakhstan is central to our research as we aim to enhance the investment climate there by drawing on successful practices from other countries and scientific insights. China, Kazakhstan’s nearest neighbor and a major trade partner, has shown impressive growth over recent decades, making its investment policy model particularly relevant for our study. Germany is included as a representative of advanced European economies, known for its effective policies that contribute to high standards and prosperity. We utilized German data to investigate the relationship between R&D and fixed capital investments and labor productivity. The USA and Japan, recognized leaders in R&D and technology, provide valuable insights into how investments in these areas impact labor productivity in the leading economies. Ireland’s rapidly growing economy, evidenced by significant GDP growth between 2017 and 2022, largely driven by the manufacturing sector, prompted us to examine how investments in fixed assets and R&D contributed to this growth. Canada, with its robust development and focus on mineral extraction and oil exports, is also pertinent to our study, especially in relation to Kazakhstan’s own oil-dependent export structure. These factors guided our selection of these seven countries to explore the effects of investments in fixed capital and R&D on labor productivity and economic growth, and to determine the optimal investment levels.

3.2. Regression Model

Taking Mario Coccia’s work as a basis (

Coccia 2009), we used models (1) and (2), as follows:

These establish the relationship between labor productivity and investments in fixed capital and R&D.

The research took into account a certain time lag after which the investment’s payoff can be obtained. Accordingly, the time lag effect has been included in the condition for constructing the model. That is, labor productivity in t period is assumed to may be influenced by investments in fixed capital and R&D made in t-2 period.

The article used regression analysis of statistical data using a quadratic function, particularly, a leading indicator model, as follows:

where

i is a country, and

t is time.

Accordingly, model (1) for investment in fixed capital will take the following form:

In the case of investment in R&D, model (2) will take the following form:

Equations (4) and (5) calculate the interfactor relationship using the ordinary least squares (OLS) method. Presumably, the causal relationship between fixed and R&D investments and productivity growth is reciprocal. In this case, using only the time lag between variables might not be enough. In this regard, we need to apply two-stage last squares estimation (2SLS), where in the first stage, investment in fixed assets and R&D is taken as a dependent variable and becomes a function of two independent variables: GDP per capita PPP (GDPC) and employment level (EMPR).

For investments in fixed capital:

At the second stage,

and

values obtained during the regression analysis become independent variables. Productivity growth rate (RGLP) becomes a dependent variable.

High correlation issues are eliminated using the Prais–Winsten estimation method. Regression analysis allows us to determine the degree of the relationship between productivity growth and investment in fixed assets, as well as between productivity growth and investment in R&D. The dependencies estimated as a result of regression analysis are of great value for our research. Because functions (8) and (9) are continuous and infinitely differentiable, we can calculate the optimum, which can indicate the maximum amount of investments in fixed capital and R&D that brings the maximum effect on productivity growth, and therefore on economic growth.

We also bear in mind that one of the required conditions for one variable’s function, for the solution

x = x* to be maximum or minimum, is as follows:

In this case, x is a stationary point. If the function is concave (or convex), then this condition is not only required but also sufficient for x* to be a general (global) maximum (minimum).

4. Empirical Research Results and Discussion

In the countries in question, the propensity to invest in fixed assets and R&D varies significantly. For instance, according to

Table 2, in Kazakhstan, the share of investment in fixed capital to GDP on average for the analyzed period is 23.8% and the share of investment in R&D is only 0.18%. These values are 21.2% and 2.8% in the USA, 25.3% and 3.2% in Japan, 20.4% and 2.8% in Germany, 40.7% and 1.7% in China, 26.7% and 1.3% in Ireland, and 22.6% and 1.8% in Canada. Consequently, among the countries under study, China, Ireland, and Japan invest significantly in fixed capital (over 25% of GDP) while Japan, the USA, and Germany invest in R&D (over 2% of GDP).

4.1. Fixed Investment and Productivity Growth

The estimated dependencies are polynomial functions (continuous and differentiable), which means classical optimization methods can be applied. The estimated function of the impact of investment in fixed capital on labor productivity growth for Kazakhstan (KZ) is presented in model (11):

The required condition for calculating the maximum is as follows:

Let us equate the first derivative to 0, which results in the following relationship:

With a GFCF/GDPC of 23.8%, productivity growth is maximized at:

More than that, on the interval of [0; 23.8] and on the interval of [23.8; +∞]; is a convex downward function. Mathematical and graphical analysis shows that condition (12) is sufficient to find the maximum.

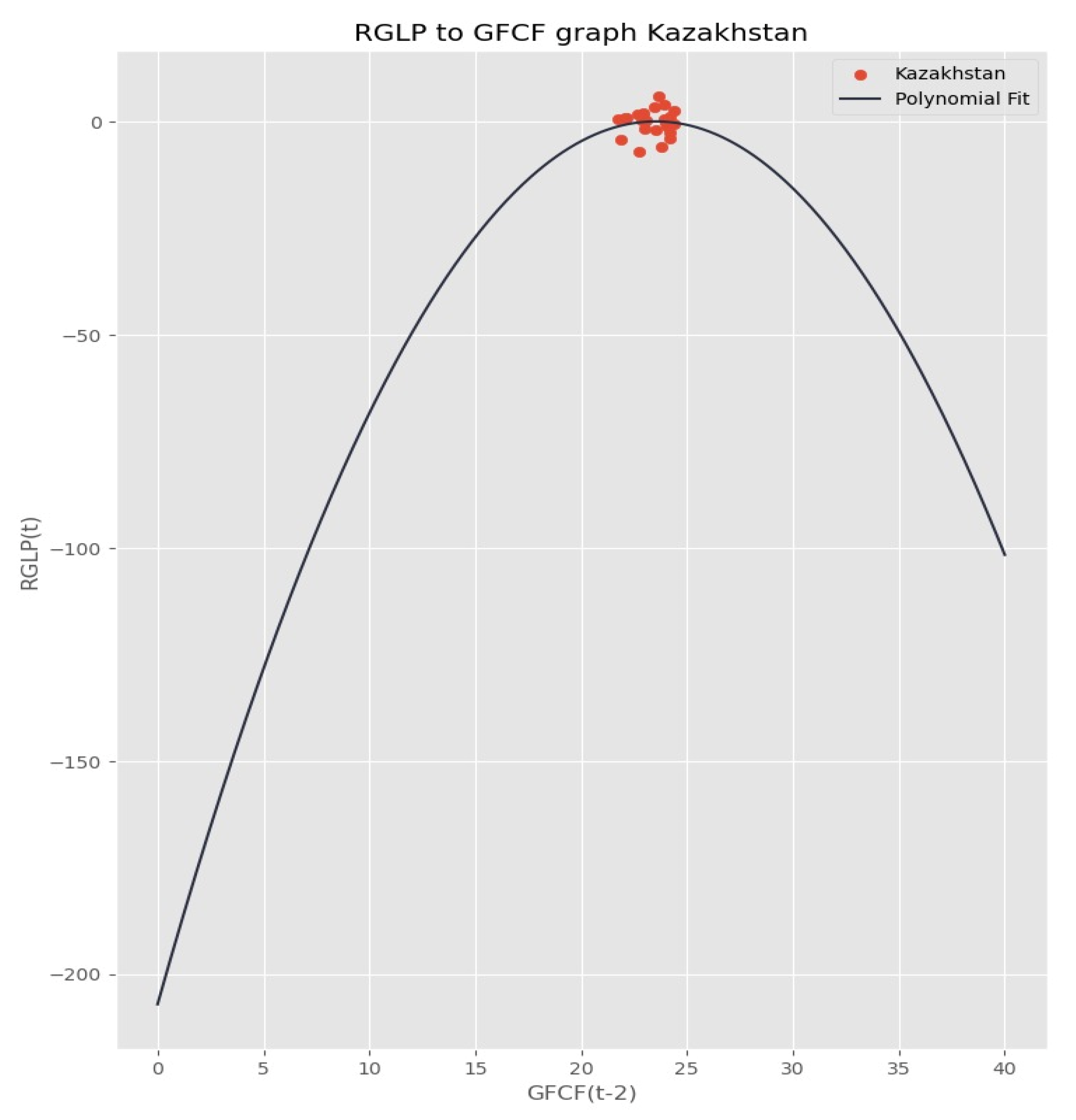

Figure 1 graphically presents the relative growth in labor productivity (RGLP) regression model values at t moment depending on the investment in fixed capital (GFCF) at t-2 moment in Kazakhstan.

Similarly, for the analyzed countries, we constructed regressions using formulas (6) and (8) and determined the optimal values of investment in fixed capital for labor productivity growth.

Table 3 presents the regression analysis results for the countries under study.

The first three columns of

Table 3 present the constant and βi estimates. The fourth column shows the coefficient of determination R

2 followed by the results of the Fisher’s test (F) and its significance. The last column contains the Durbin–Watson (DW) test, which is an indicator of autocorrelation.

Certainly, there are differences in the explanation of variation in the dependent variable since different economies show distinctive development trajectories. For one, in China, the coefficient of determination (R-square) has a fairly high value of 0.648. That is, approximately 64.8% of the variability in the growth in the labor productivity variable is explained by the influence of the independent variable, gross fixed capital formation. The coefficients of determination of other country indicators are below 0.3, which means a weak connection between investment in fixed capital and labor productivity. Analysis of the data for Kazakhstan demonstrated the lowest coefficient of determination of 0.012 compared to the other countries under study, which indicates an insignificant impact of investment in fixed capital on labor productivity growth.

The F statistic is a measure of a regression model’s overall significance. A high F statistic suggests that the model is statistically significant. A p-value close to zero (sig. 0.00) indicates that the overall regression model is statistically significant. The Durbin–Watson statistic value is close to 2, suggesting the absence of autocorrelation.

In general, the regression analysis provided a fairly reliable and adequate model for each country.

Table 3 data illustrates a certain connection between investment in fixed capital and labor productivity in almost all countries.

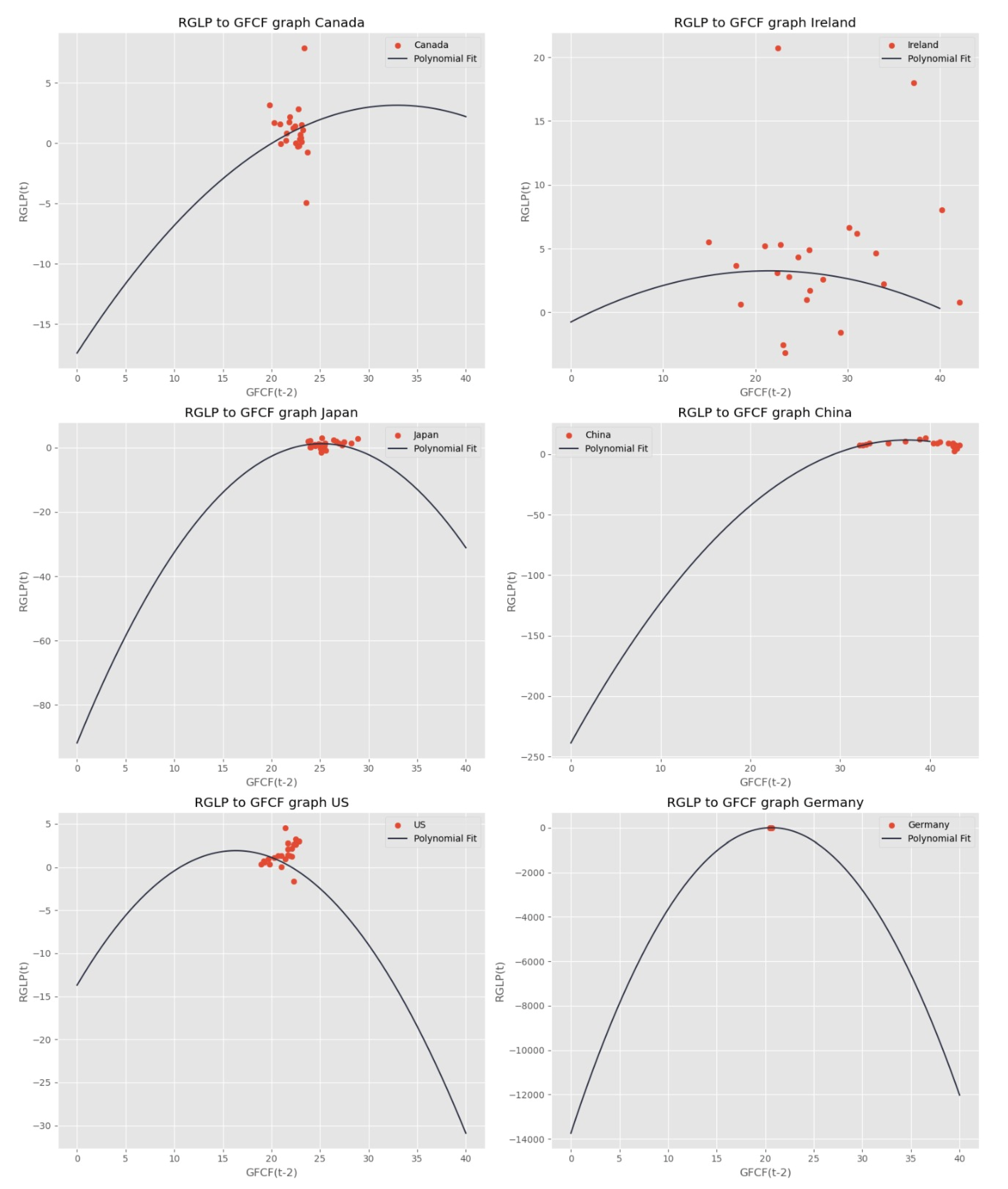

Figure 2 and

Figure 3 show the optimal values of investment in fixed capital ensuring growth in labor productivity in the context of each country under study and for all seven countries. The graphs are downward parabolic, which is explained by diminishing returns on investment in fixed capital.

By differentiating the evaluation functions, we determined the optimal values of investment in fixed capital for each country (see

Table 4).

Table 4 demonstrates that, by a large margin from the other countries under study, China shows the highest indicators both in terms of investment in fixed assets and in terms of the effect it has on productivity growth. The model effectively shows that 64.8% of the variance in productivity growth can be explained by the impact of the GFCF value. In the period between 1997 and 2022, China annually invested over 40% of GDP in fixed assets on average. According to the model, the optimal amount of investment in fixed capital for China is at the level of 37.4%, at which its impact on labor productivity growth is maximized. Then there is a diminishing return on investment in fixed capital. In Ireland, the maximum increase in labor productivity (3.74) was recorded when they invested in fixed capital at the level of 21.5% of GDP. In Germany, the optimal level of investment in fixed capital is 20.67% of GDP, at which an increase of up to 1.43 in labor productivity is achieved. Quite slow productivity growth due to investment in fixed assets is observed in the USA (0.070) and Japan (0.758).

Despite significant investment in fixed capital at the level of 32.94% of GDP, in Canada, labor productivity is declining: negative labor productivity growth was recorded in 2021–2022. Perhaps, according to

Globerman (

2024), since 2014, investment has been directed mainly into residential real estate rather than into productive capital. Put differently, there has been a significant shortfall of Canadian business investment critical for productivity growth.

For Kazakhstan, even a significant increase in investment in fixed capital results in a small payoff on labor productivity. The optimal level of investment in fixed capital in the case of Kazakhstan is 23.5% of GDP and the highest point of productivity growth is 0.055.

4.2. R&D Investment’s Impact on Productivity Growth

We applied a classical optimization method to construct an evaluation function of the impact of investment in R&D on productivity growth for Kazakhstan:

The required condition for calculating the maximum is as follows:

Let us equate the first derivative to 0, which results in the following:

With a GERD/GDPC of 0.18%, productivity growth is maximized at:

Moreover, on the interval of [0; 0.18], on [0.18; +∞], and is a downward convex function. Condition (14) is sufficient to find the maximum.

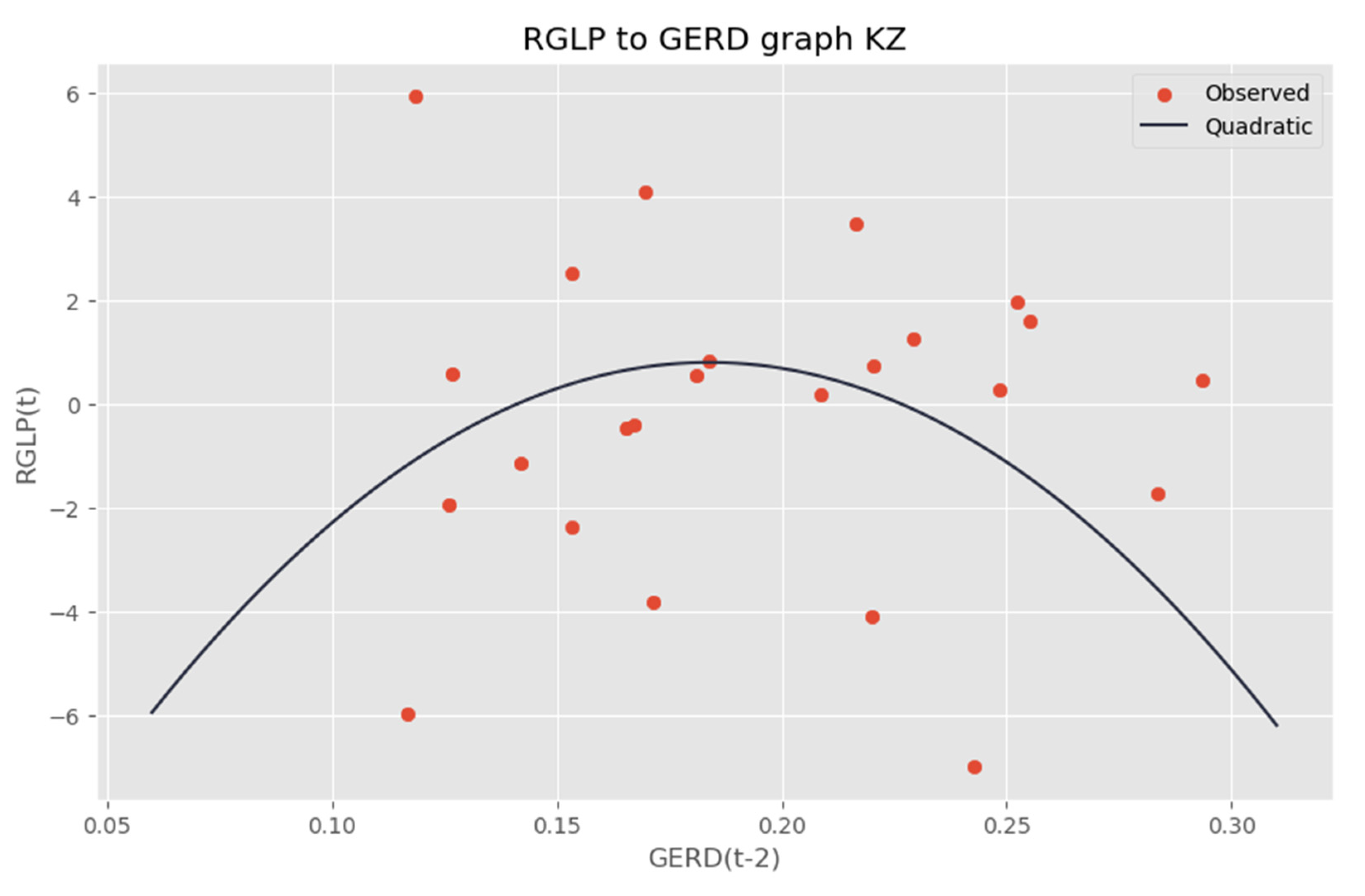

Figure 4 graphically presents relative growth in labor productivity (RGLP) regression model values at t moment depending on investment in R&D (GERD) at t-2 moment in Kazakhstan.

The estimated effect of the GERD/GDPC on maximizing productivity growth in Kazakhstan is 0.18%. Additionally, these estimated relationships have a negative quadratic term, meaning the increase is not linear because it exerts a downward force on the function. Model (13) effectively shows that when the GERD/GDPC increases by 1%, the average productivity growth estimate is given by a linear term of 161.74 and a quadratic term of −439.79. In general, the model demonstrates that adequate performance and R&D investment have a positive return.

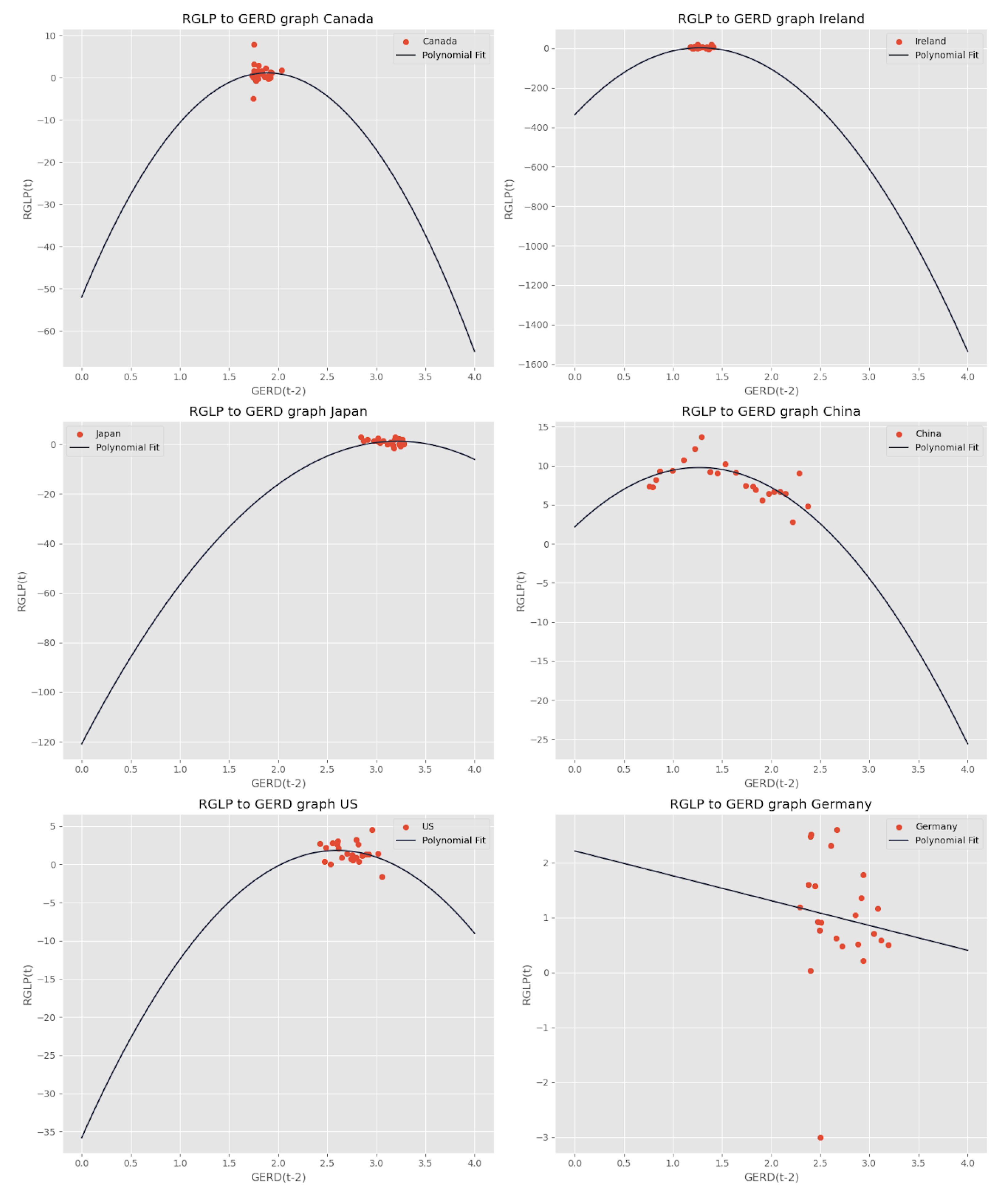

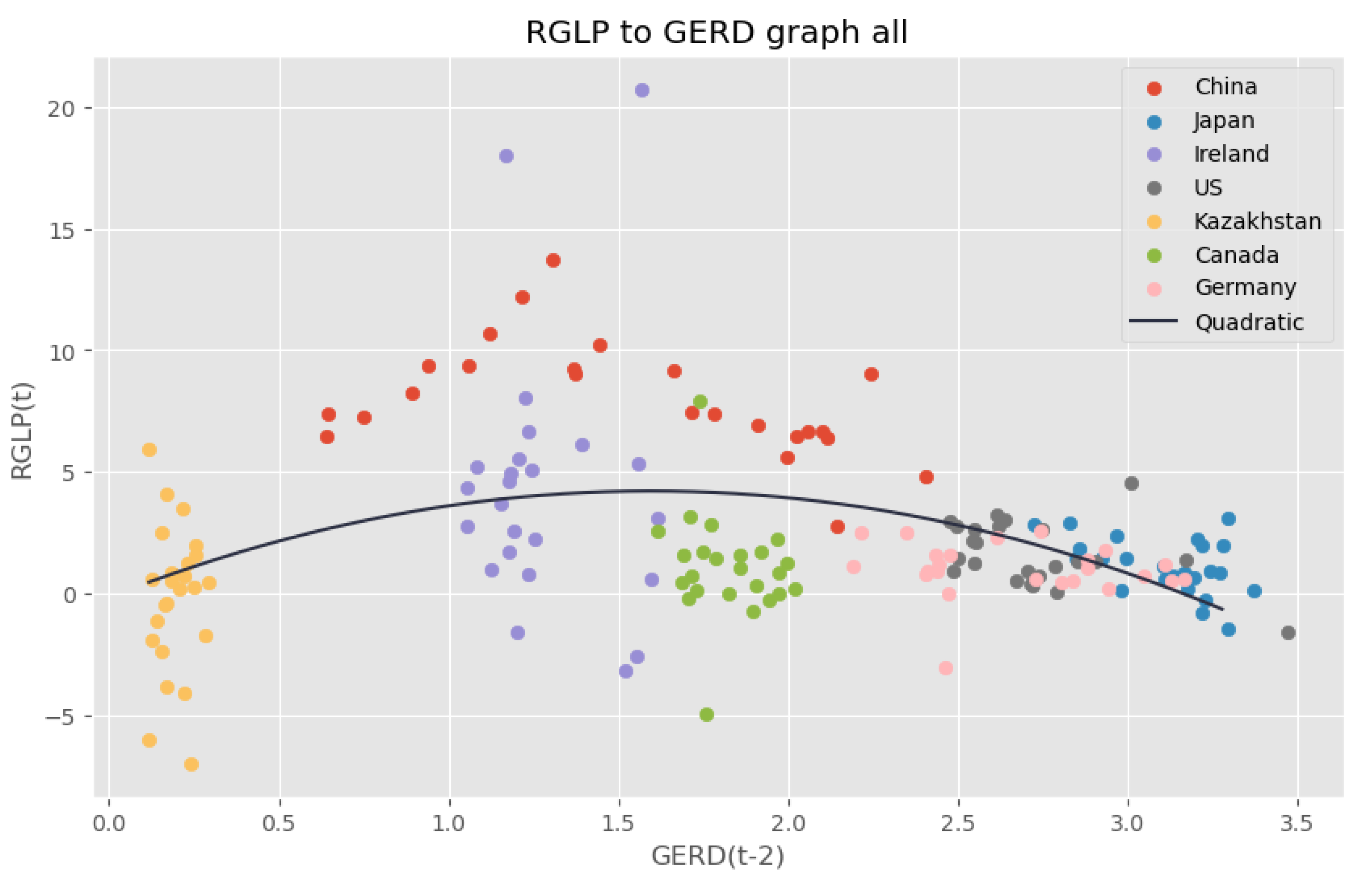

Using Formulas (7) and (9), we constructed regressions according to the formulas and determined the optimal values of investment in R&D to increase labor productivity for the countries in question (see

Figure 5 and

Figure 6).

The graphs for the countries under study are downward parabolic, showing diminishing returns on R&D investment with the exception of Germany. Germany graphically shows a downward trend in productivity’s dependence on R&D investment.

Cerniglia and Saraceno (

2020) noted that it is likely that Germany’s current economic development issues may be the consequence of insufficient public investment.

Table 5 presents the regression model indicators for the seven countries under study.

The R

2 coefficient values are quite low for the countries under study (except for China), which indicates the low influence of the research and development expenditure (GERD) indicator on the labor productivity growth rate. By contrast, the coefficient of determination for China demonstrates the significant influence of research and development expenditure on labor productivity growth among the analyzed countries, i.e., 49.3% of the variation in productivity growth is due to the influence of investment in R&D. The Fisher test gives an estimate of the resulting regression as a whole (

p-value must be below 0.05).

Table 5 shows that the statistical estimates according to the Fisher criterion conform to norms only in China and Germany. The Durbin–Watson statistic value indicates the presence of positive or negative autocorrelation. When DW = 2, autocorrelation between the variables is non-existent. In our example, only Germany shows a value conforming to norms. Therefore, we needed to adjust the model to improve the values and use them to calculate the optimal variable values.

To eliminate autocorrelation, we applied the Price–Winsten estimation method in SPSS. Based on the results obtained, we calculated the extreme values for the analyzed countries (see

Table 6).

Table 6 shows a relationship between investment in R&D and labor productivity growth. Investment in R&D is an important driver of labor productivity growth for the period between 1997 and 2022. The USA shows the highest R&D investment payoff: at an investment in R&D of 2.63%, the increase in labor productivity will be 29.36. A significant impact of R&D investment is confirmed in China, where R&D expenditure at 1.39% of GDP contributes to productivity growth of 9.72. Ireland also shows fairly high productivity growth of 3.26 for R&D investment of 1.28% of GDP.

The low level of investment in R&D observed in Kazakhstan has a significant payoff too: the maximum increase in labor productivity is 1.65 with investment amounting to 0.14% of GDP. It is possible that volumes of investment in R&D in Kazakhstan are low because of the weak development of the manufacturing industry and the service and transport sectors.

In Germany, Japan, and Canada, R&D investment’s impact on productivity growth is smaller. At a high optimal level of investment in R&D (3.77, 3.09, and 1.95, respectively) the maximum productivity growth does not exceed 0.97.

In general, when comparing values in

Table 4 and

Table 6, we can see that with a relatively small share of investment in R&D, its contribution to the growth of labor productivity is several times higher than the return on investment in fixed capital.

4.3. Impact of Global Crises

An important question is whether economic crises influence the effect of investment of labor productivity growth. Crises not only lead to economic downturns and reduce investment but also alter the nature of the relationship. During the period from 1997 to 2022, which was the focus of our study, economies faced the Asian financial crisis (1997–1998), the global financial crisis (2007–2009), and the COVID-19 pandemic (2020–2022). To ensure the accuracy of our results, we accounted for the impact of these crises by incorporating three dummy variables into the model at both stages of the regression. The results of this analysis are presented in

Table 7.

Since our study covered the 1997–2022 period, the impact of the Asian crisis (1997–1998) on our results was minimal due to the time lag of investment effects on productivity. This is evidenced by the regression coefficients, which are close to zero.

At the same time, the modeling results show that the effects of the global crisis (2007–2009) and the COVID-19 pandemic (2020–2022) were more significant. In Japan and Canada, the regression coefficients are negative, indicating that the global crisis and the COVID-19 pandemic reduced the impact of both types of investments—fixed assets investment (GFCF) and R&D investment (GERD)—on labor productivity (RGLP).

Data from Germany and Kazakhstan suggest a negative impact of the COVID-19 pandemic on the relationship between R&D and fixed capital investments and productivity growth. Meanwhile, although the global crisis negatively affected R&D investment, it had a positive effect on the influence of fixed capital investments on productivity in these two countries.

Regression analysis revealed a negative effect of the global crisis and the COVID-19 pandemic on the relationship between fixed capital investments and productivity in China and the USA. Conversely, these same crises had a positive effect on the influence of R&D investment on labor productivity in both countries. This means that the crises, particularly the COVID-19 pandemic, strengthened the impact of R&D investment on productivity growth in China and the USA.

This result is a similar to the findings of

Brown and Petersen (

2014). They confirmed that companies take a differentiated approach to fixed investment and R&D during a financial crisis. In response to a negative financial shock, they reduce investment in fixed assets to a greater extent than R&D expenditures.

In Ireland, the global crisis had a negative impact on the effects of R&D investment and a positive impact on the effects of fixed capital investment. Significant positive regression coefficients were obtained in the analysis of the effects of the COVID-19 pandemic, indicating an increased influence of both fixed capital and R&D investments on labor productivity during the pandemic period.

In general, the results show the negative impact of crises on labor productivity growth in all of the countries studied, on investment volumes in several countries, and the relationship between investment and labor productivity. Moreover, the crisis situation is more critical for Kazakhstan: a significant negative impact of the global crisis and the pandemic on the volume of investments in fixed assets and labor productivity, as well as on the dependence of investments and productivity, has been revealed.

Researchers

Pellens et al. (

2024) found that innovation-leading countries implement countercyclical R&D spending policies during recessions, whereas less innovation-driven countries tend to follow an acyclical strategy during economic crises. This difference widens the gap between countries in terms of innovation and economic growth rates. To prevent such a situation, Kazakhstan should adopt a countercyclical policy during economic crises by increasing government support and spending on R&D and fixed capital formation, which would have synergistic effects on labor productivity and output.

4.4. Implications for Investment Policy

In recent years, the government of Kazakhstan has made significant efforts to create a favorable investment climate, including the creation of special economic zones, a cluster approach, the development of public–private partnerships, tax incentives, and other measures. The adopted initiatives have increased the inflow of foreign direct investment, which amounted to

$28 billion in 2022 and

$23 billion in 2023 (

National Bank of the Republic of Kazakhstan 2024). Notably, Kazakhstan’s specificity is that the bulk of that investment goes mainly to large capital-intensive industries, such as the oil and gas and mining sectors. At the same time, these sectors make the greatest contribution to the country’s economic growth.

Meanwhile, if Kazakhstan aims to achieve an annual growth rate of 6–7%, it will require a policy focused on boosting investments in fixed capital and R&D. This is due to the significant wear and outdated state of fixed assets (equipment/machinery) in various economic sectors, low capital intensity and technological levels of production, as well as the disconnect between scientific research and production processes.

Compared to other countries, Kazakhstan not only has low volumes of fixed capital and R&D investments but also low returns on such investments. According to the results of our study, the maximum return of investment for labor productivity growth is achieved when the level of fixed capital investment is above 23.5% of GDP and the share of R&D investment is above 0.14% of GDP. The results show that R&D investment is more effective and capable of providing the greatest return on labor productivity growth (1.65) compared to fixed capital investment (0.055).

The low returns on fixed capital investments are linked to their suboptimal structure, with extremely low shares of investment in manufacturing, transportation, and agriculture. These are sectors in which increasing labor productivity is a key condition for growth. This situation is largely due to insufficient internal funds available to enterprises for investment and limited access to credit. In their study,

Gomez Sanchez et al. (

2022) confirmed that policies should promote access to financial capital and investment.

Increasing the efficiency of R&D investment in Kazakhstan will be possible provided that human capital capable of solving complex technological problems is further developed. Given that less than 1% of production and less than 1% of total employment in Kazakhstan are related to R&D, intensifying measures and building capacity in this area are of national importance.

According to

Martin (

2007), the impact of R&D investment on productivity is stronger in high-tech sectors of the economy. This means that government policy should also aim to create conditions for increasing the complexity of the economy and the use of advanced technologies in production processes. In addition, as noted by

Shefer and Frenkel (

2005), R&D investment depends on the characteristics of the company, in particular its size, type of industry, location, and type of ownership. Therefore, the government should take these characteristics into account in its policies to stimulate R&D investment and industrial innovation.

Expansion of fixed capital and R&D investments could be achieved by increasing public investments, which currently account for less than 17% of total fixed assets investment (

Bureau of National Statistics 2024). As noted in the World Bank Report, “an increase in public investment by 1% of GDP in developing and emerging market countries may lead to an increase in production levels by 1.6% in the medium term” (

World Bank 2024a). This is due to the fact that public investment can create the conditions for productivity growth and stimulate private investment, collectively contributing to long-term economic growth.

Incorporating these recommendations into policy will help to improve the investment situation in Kazakhstan by boosting investments in fixed assets and R&D, thereby increasing their contribution to labor productivity growth and high-quality economic growth. Concurrently, strengthening investment dynamics is possible with a reduction in investment risks, macroeconomic balance, and structural changes in the economy.

5. Conclusions

The idea that investment can stimulate productivity and economic growth is a focus of wide discussions in the scientific community. This prompted us to conduct an empirical analysis of investments in fixed assets and R&D as factors determining labor productivity growth and as driving forces of economic growth. Summarizing the analytical study presented in

Section 4, we can summarize the following conclusions. First, for the period between 1997 and 2022, investment in fixed assets in all countries in question averaged no less than 20% of GDP, and investment in R&D was no less than 1% (except for Kazakhstan). During the analyzed period, Kazakhstan showed a lower value of the GERD indicator at an average level of 0.18%.

Second, our results show that investment, especially into R&D, positively affects productivity growth in the countries analyzed. However, the effects of investments in fixed assets and R&D vary among all seven countries. The analysis results show the strongest correlation between fixed capital and R&D investments and labor productivity growth in China compared to the other counties studied. In Kazakhstan, the weakest link between fixed capital and R&D investments and labor productivity is identified.

Third, the results of the empirical analysis indicate that labor productivity can be increased by achieving an investment level in fixed capital and R&D that is close to optimal. Calculating the optimal level of fixed capital investment revealed that it delivers the highest returns in China. By investing in fixed assets at the optimal level of 37.4% of GDP, China achieves maximum labor productivity growth at 11.8%. Accordingly, China is characterized by a high level of fixed capital formation and a higher capital payoff. R&D investment yields the highest returns in the United States compared to the other countries studied. In the USA, annual R&D investment averages 2.8% of GDP. The calculations show that the optimal level of R&D investment in the USA is 2.63% of GDP, at which the maximum labor productivity growth reaches 29.36.

In Kazakhstan, even investing at the optimal level has a minimal effect on labor productivity. The calculations show that when the optimal level of fixed capital investment (23.5% of GDP) is reached, labor productivity growth in Kazakhstan amounts to only 0.055. With R&D investment at the optimal level of 0.14% of GDP, labor productivity growth would reach 1.65.

Another important conclusion is that, while relatively small in volume, investment in R&D brings a greater effect on growth than investment in fixed assets.

Fourth, the impact of fixed capital and R&D investments on labor productivity growth changed somewhat during the global crisis (2007–2009) and the COVID-19 pandemic (2020–2022). These crises had a negative effect, reducing the influence of fixed capital and R&D investments on productivity in Japan and Canada. The analysis also revealed a positive effect of the COVID-19 pandemic on the relationship between R&D investment and labor productivity in China, the United States, and Ireland. In Kazakhstan, the crises generally had a negative impact on the studied indicators, with the exception of a slight positive effect of the global financial crisis (2007–2009) on the relationship between fixed capital investment and labor productivity growth.

Thus, the statistical results and graphical data demonstrate the presence of a certain dependence of labor productivity growth on investments in fixed capital and R&D. However, to be able to give more precise recommendations for improving investment policies, it is necessary to study other types of investment, including foreign investment, investment in human capital, the impact of public investment, and cyclical fluctuations. Government investment policies will be more effective if they promote domestic savings and investment while foreign direct investment flows are declining. Given the multifaceted nature of studying the issues of increasing productivity and economic growth, we also need to examine the influence of many other factors, thus opening up opportunities for further research on this topic.