Sharia Economy, Islamic Financial Performance and Factors That Influence It—Evidence from Indonesia

Abstract

1. Introduction

2. Literature Review

2.1. Financial Literacy Dan Innovation to Increase Islamic Financial Performance

2.2. Digital Transformation of the Economy and Islamic Financial Performance

2.3. Human Capital, the Role of Islamic Financial Institution and Government Support

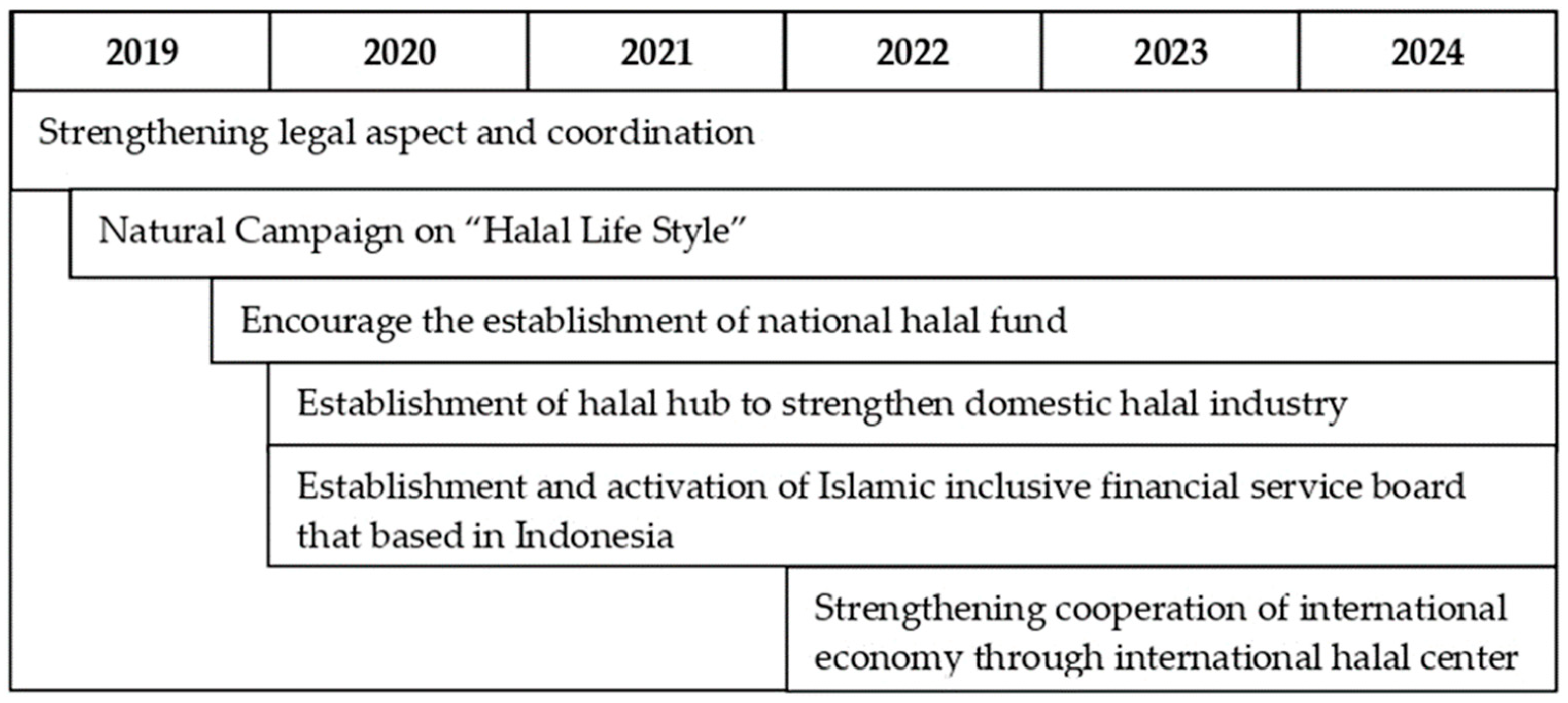

2.4. Strengthening for Sharia Economy

3. Research Method

3.1. Research Design

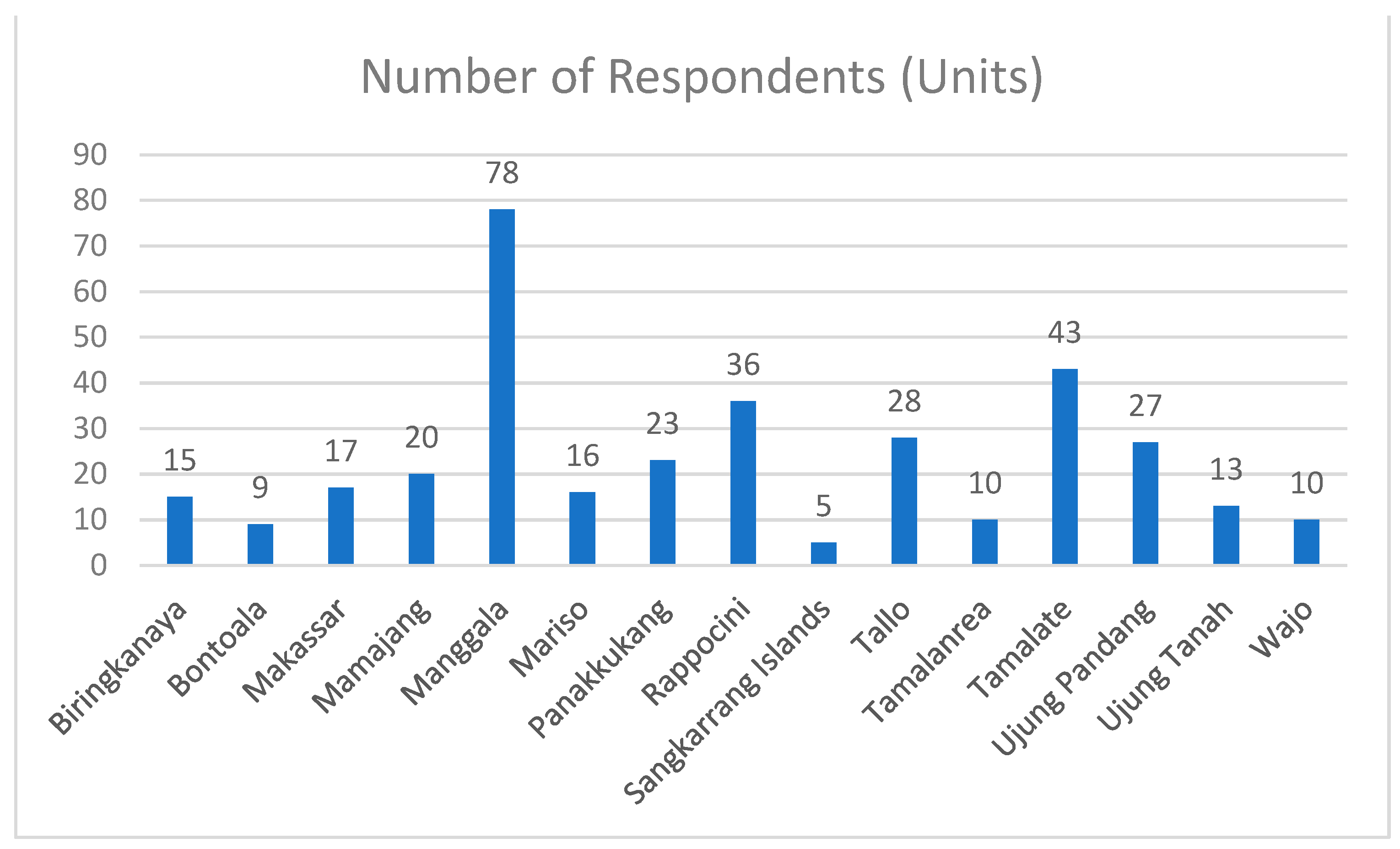

3.2. Study Area

3.3. Method of Collecting Data

3.4. Research Respondents

3.5. Data Validity and Reliability

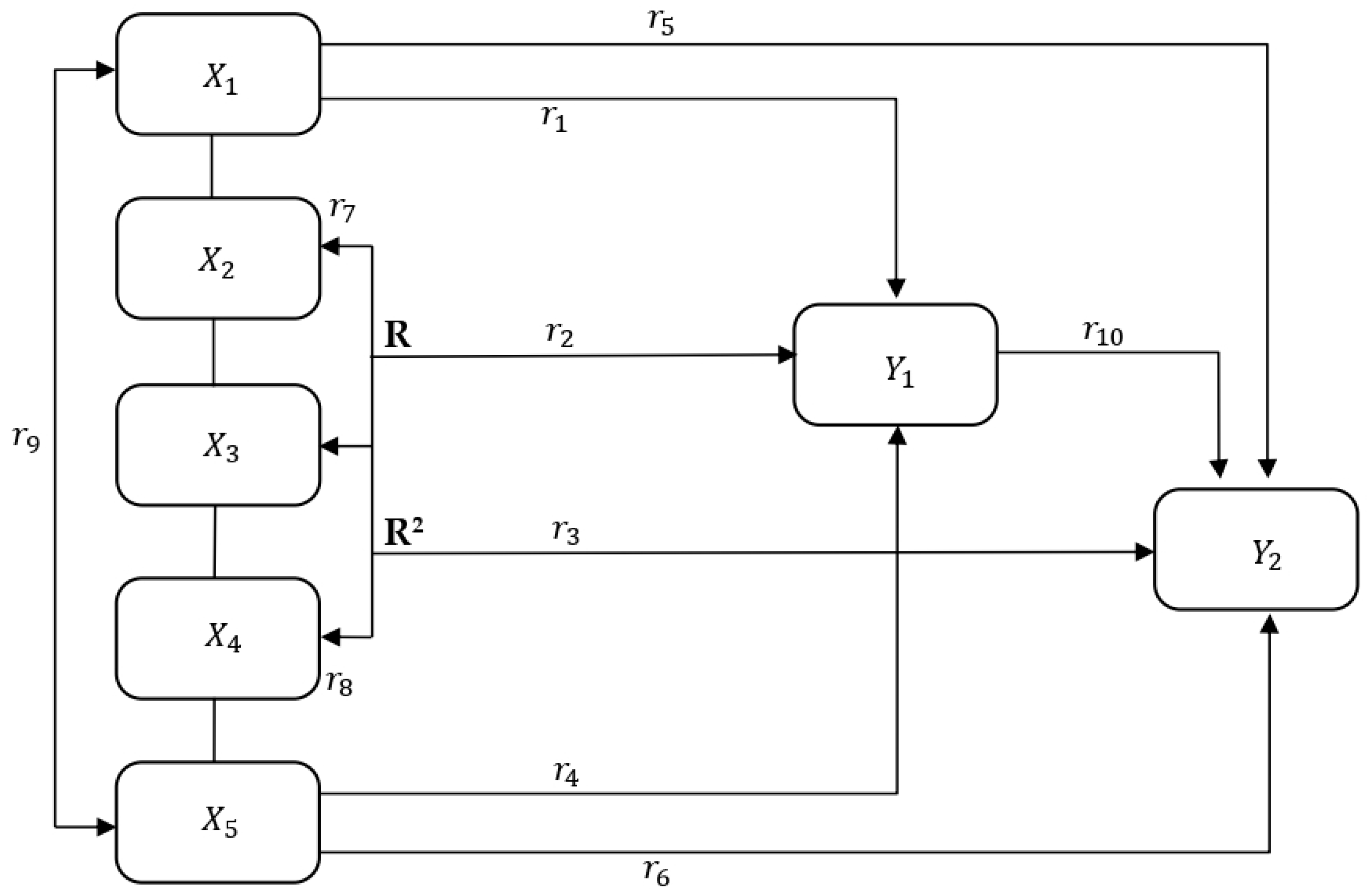

3.6. Data Analysis Method

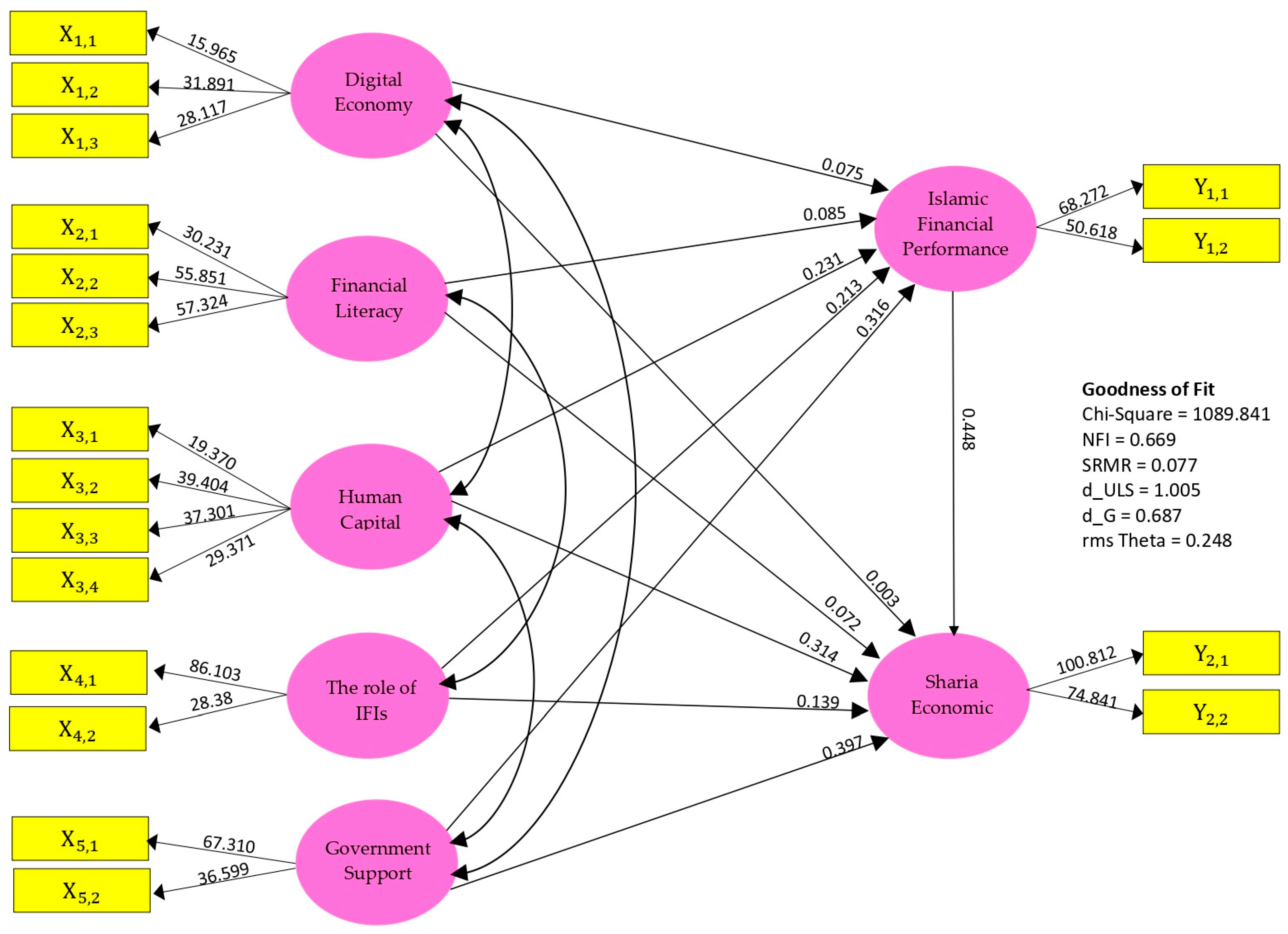

4. Results

4.1. Determinants of Strengthening Sharia Economy and Financial Performance

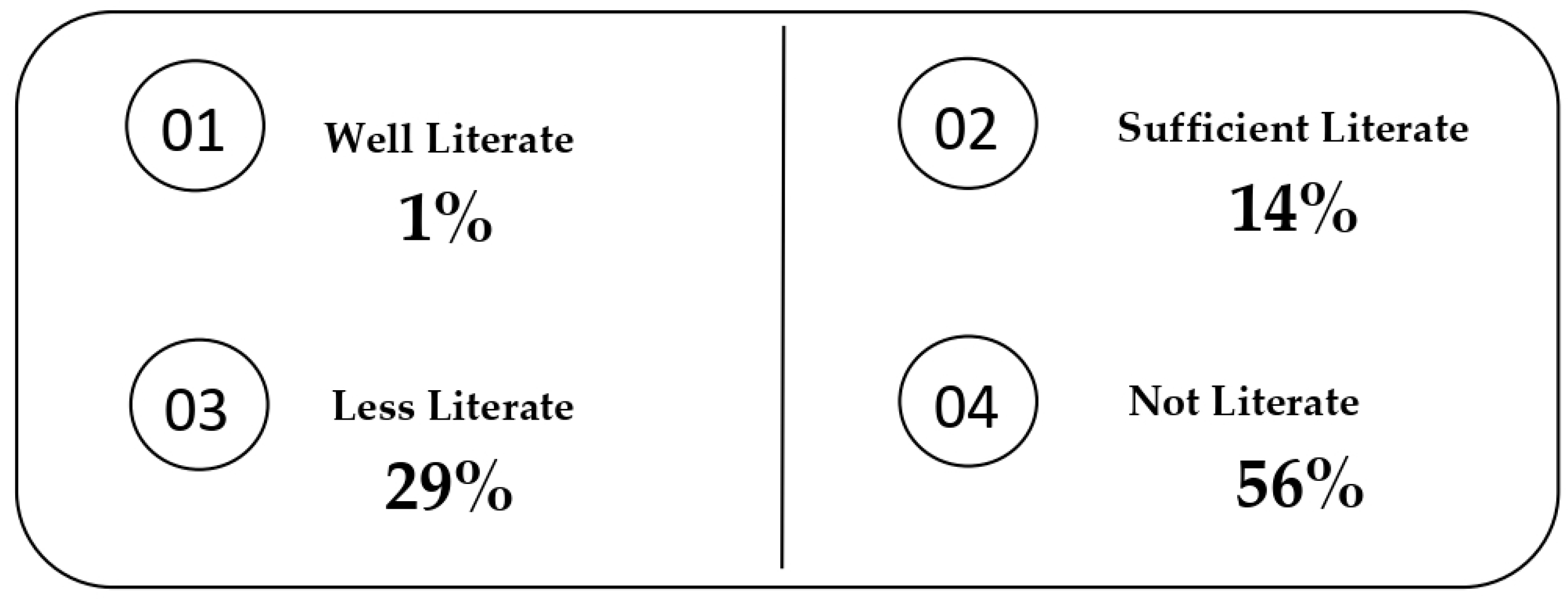

4.2. Development of Financial Literacy and Digital Economy of SMEs

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abbass, Kashif, Halima Begum, A. S. A. Ferdous Alam, Abd Hair Awang, Mohammed Khalifa Abdelsalam, Ibrahim Mohammed Massoud Egdair, and Ratnaria Wahid. 2022. Fresh Insight through a Keynesian Theory Approach to Investigate the Economic Impact of the COVID-19 Pandemic in Pakistan. Sustainability 14: 1054. [Google Scholar] [CrossRef]

- Abdallah, Ali. 2021. Has the Lack of a Unified Halal Standard Led to a Rise in Organised Crime in the Halal Certification Sector? Forensic Sciences 1: 181–93. [Google Scholar] [CrossRef]

- Akben-Selcuk, Elif. 2019. Corporate Social Responsibility and Financial Performance: The Moderating Role of Ownership Concentration in Turkey. Sustainability 11: 3643. [Google Scholar] [CrossRef]

- Alamsyah, Andry, Naufal Hakim, and Ratih Hendayani. 2022. Blockchain-Based Traceability System to Support the Indonesian Halal Supply Chain Ecosystem. Economies 10: 134. [Google Scholar] [CrossRef]

- Albaity, Mohamed, Ray Saadaoui Mallek, and Hasan Mustafa. 2022. Bank Stock Return Reactions to the COVID-19 Pandemic: The Role of Investor Sentiment in MENA Countries. Risks 10: 43. [Google Scholar] [CrossRef]

- Alhammadi, Salah. 2022. Analyzing the Role of Islamic Finance in Kuwait Regarding Sustainable Economic Development in COVID-19 Era. Sustainability 14: 701. [Google Scholar] [CrossRef]

- Amin, Muhammad. 2021. Growing Indonesia’s sharia Economy Requires Focus on ‘Four Energy Pillars’. Available online: https://www.thejakartapost.com/academia/2021/02/22/growing-indonesias-sharia-economy-requires-focus-on-four-energy-pillars.html (accessed on 29 January 2022).

- Arner, Douglas W., Ross P. Buckley, Dirk A. Zetzsche, and Robin Veidt. 2020. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review 21: 7–35. [Google Scholar] [CrossRef]

- Azevedo, Américo, and António Henrique Almeida. 2021. Grasp the Challenge of Digital Transition in SMEs—A Training Course Geared towards Decision-Makers. Education Sciences 11: 151. [Google Scholar] [CrossRef]

- Bahrini, Raéf, and Alaa A. Qaffas. 2019. Impact of Information and Communication Technology on Economic Growth: Evidence from Developing Countries. Economies 7: 21. [Google Scholar] [CrossRef]

- Bank Indonesia. 2017. Islamic Economy and Finance Development Blue Print. Available online: https://www.bi.go.id/en/fungsi-utama/moneter/pengembangan-ekonomi/cetak-biru/default.aspx (accessed on 11 January 2022).

- Barus, Elida, and Andri Soemitra. 2021. Islamic Fintech Collaboration: Indonesia’s Economic Readiness Towards a New Normal Era. Proceeding International Seminar on Islamic Studies 2: 1. Available online: http://jurnal.umsu.ac.id/index.php/insis/article/view/5859 (accessed on 23 June 2021).

- Bassiouni, M. Cherif. 2012. Islamic Law-The Shariah. The Middle East Institute. Available online: https://www.mei.edu/publications/islamic-law-shariah (accessed on 6 March 2023).

- Becker, Gary S. 1994. Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education, 3rd ed. Chicago: The University of Chicago Press. Available online: https://www.nber.org/books-and-chapters/human-capital-theoretical-and-empirical-analysis-special-reference-education-third-edition (accessed on 8 March 2023).

- Bikse, Veronika, Inese Lusena-Ezera, Peteris Rivza, and Baiba Rivza. 2021. The Development of Digital Transformation and Relevant Competencies for Employees in the Context of the Impact of the COVID-19 Pandemic in Latvia. Sustainability 13: 9233. [Google Scholar] [CrossRef]

- BPS Kota Makassar. 2021. Kota Makassar Dalam Angka 2021. Available online: https://makassarkota.bps.go.id/publication/2021/02/26/be312e3f776bcfd005978bda/kota-makassar-dalam-angka-2021.html (accessed on 6 November 2021).

- Burger, Nicholas, Charina Chazali, Arya Gaduh, Alexander D. Rothenberg, Indrasari Tjandraningsih, and Sarah Weilant. 2015. Reforming Policies for Small and Medium Enterprises in Indonesia, Jakarta, Indonesia, RAND Corporation in collaboration with Tim Nasional Percepatan Penanggulangan Kemiskinan (TNP2K), Jakarta, Indonesia. Available online: http://www.tnp2k.go.id/images/uploads/downloads/Reforming%20SMEs_0529_lowres_2015-1.pdf (accessed on 5 March 2022).

- Chen, Chun-Liang, Yao-Chin Lin, Wei-Hung Chen, Cheng-Fu Chao, and Henry Pandia. 2021. Role of Government to Enhance Digital Transformation in Small Service Business. Sustainability 13: 1028. [Google Scholar] [CrossRef]

- Cueto, Lavinia Javier, April Faith Deleon Frisnedi, Reynaldo Baculio Collera, Kenneth Ian Talosig Batac, and Casper Boongaling Agaton. 2022. Digital Innovations in MSMEs during Economic Disruptions: Experiences and Challenges of Young Entrepreneurs. Administrative Sciences 12: 8. [Google Scholar] [CrossRef]

- Dariah, Atih Rohaeti, Rose Abdullah, Asep Ramdhan Hidayat, and Fuad Matahir. 2022. Sustainable Economic Sectors in Indonesia and Brunei Darussalam. Sustainability 14: 3044. [Google Scholar] [CrossRef]

- Deuraseh, Nurdeng, Norailis Ab. Wahab, and Nor Surilawana Sulaima. 2020. Empowering Halal SMEs for Economic Growth and Sustainability. Paper presented at the International Annual Conference on Islamic Economics and Law (ACIEL), Islamic Faculty University of Trunojoyo Madura, Jawa Timur, Indonesia, December 15; Available online: https://www.researchgate.net/publication/348648553_Empowering_Halal_SMEs_for_Economic_Growth_and_Sustainability (accessed on 28 March 2022).

- DinarStandar. 2020. State of the Global Islamic Economic Report. Available online: https://cdn.salaamgateway.com/reports/pdf/862e1c9a9d925c5cd6aacae31b0ea102e21778a9.pdf (accessed on 25 November 2021).

- Doh, Soogwan, and Byungkyu Kim. 2014. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Reseacrh Policy 43: 9. [Google Scholar] [CrossRef]

- Fàbregues, Sergi, Quan Nha Hong, Elsa Lucia Escalante-Barrios, Timothy C. Guetterman, Julio Meneses, and Michael D. Fetters. 2020. A Methodological Review of Mixed Methods Research in Palliative and End-of-Life Care (2014–2019). International Journal of Environmental Research and Public Health 17: 3853. [Google Scholar] [CrossRef]

- Faiz, Ihda Arifin. 2020. Fintech Syariah dan Bisnis Digital. Penerbit: Media Rakyat Nusantara, Yogyakarta. Available online: http://opac.lib.ugm.ac.id/index.php?mod=book_detail&sub=BookDetail&act=view&typ=htmlext&buku_id=807048&obyek_id=1&unitid=200&jenis_id= (accessed on 5 December 2021).

- Fan, Peilei, Jiquan Chen, and Tanni Sarker. 2022. Roles of Economic Development Level and Other Human System Factors in COVID-19 Spread in the Early Stage of the Pandemic. Sustainability 14: 2342. [Google Scholar] [CrossRef]

- Franzoni, Simona, and Asma Ait Allali. 2018. Principles of Islamic Finance and Principles of Corporate Social Responsibility: What Convergence? Sustainability 10: 637. [Google Scholar] [CrossRef]

- Garcia-Castro, Roberto, Miguel A. Ariño, and Miguel A. Canela. 2010. Does Social Performance Really Lead to Financial Performance? Accounting for Endogeneity. Journal of Business Ethics 92: 107–26. [Google Scholar] [CrossRef]

- Gheeraert, Laurent. 2014. Does Islamic finance spur banking sector development? Journal of Economic Behavior and Organization 103: S4–S20. [Google Scholar] [CrossRef]

- Glavina, Sofya, Irina Aidrus, and Anna Trusova. 2021. Assessment of the Competitiveness of Islamic Fintech Implementation: A Composite Indicator for Cross-Country Analysis. Journal of Risk and Financial Management 14: 602. [Google Scholar] [CrossRef]

- González, María de la O., Francisco Jareño, and Camalea El Haddouti. 2019. Sector Portfolio Performance Comparison between Islamic and Conventional Stock Markets. Sustainability 11: 4618. [Google Scholar] [CrossRef]

- Hair, J. F., Jr., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hamadamin, Halbast Hussein, and Tarik Atan. 2019. The Impact of Strategic Human Resource Management Practices on Competitive Advantage Sustainability: The Mediation of Human Capital Development and Employee Commitment. Sustainability 11: 5782. [Google Scholar] [CrossRef]

- Harmen, Hamdi, and Endang Pitaloka. 2014. Strategic Human Resource Management and Sustainable Competitive Advantage: The Role of Dynamics and Innovation Capabilities. South East Asia Journal of Contemporary Business, Economics and Law 5: 2. Available online: http://seajbel.com/wp-content/uploads/2014/12/bus-42-amended.pdf (accessed on 28 March 2022).

- Hartono, Jogiyanto. 2016. Menyambut Ekonomi Digital. Available online: https://feb.ugm.ac.id/en/research/lecturer-s-article/2211-menyambut-ekonomi-digital (accessed on 20 February 2022).

- Hehanussa, Umi Kalsum, and Syarifuddin Syarifuddin. 2021. The Role of Sharia Fintech in Developing Islamic Economy in the Digital Era in Indonesia. Islamic Economics, Finance, and Banking Review 1: 2. Available online: http://journal2.uad.ac.id/index.php/IEFBR/article/view/4753 (accessed on 10 January 2022). [CrossRef]

- Hernita, Hernita, Batara Surya, Iwan Perwira, Herminawaty Abubakar, and Muhammad Idris. 2021. Economic Business Sustainability and Strengthening Human Resource Capacity Based on Increasing the Productivity of Small and Medium Enterprises (SMEs) in Makassar City, Indonesia. Sustainability 13: 3177. [Google Scholar] [CrossRef]

- Hidayat, Anwar. 2012. Uji Pearson Product Moment dan Asumsi Klasik. Available online: https://www.statistikian.com/2012/07/pearson-dan-asumsi-klasik.html (accessed on 25 January 2022).

- Hidayat, Khomarul. 2021. Jadi Sumber Pertumbuhan Ekonomi, Kontribusi Ekonomi Syariah ke PDB Terus Meningkat. Available online: https://nasional.kontan.co.id/news/jadi-sumber-pertumbuhan-ekonomi-kontribusi-ekonomi-syariah-ke-pdb-terus-meningkat (accessed on 11 January 2022).

- Huntjens, Patrick, and René Kemp. 2022. The Importance of a Natural Social Contract and Co-Evolutionary Governance for Sustainability Transitions. Sustainability 14: 2976. [Google Scholar] [CrossRef]

- Huston, Sandra J. 2010. Measuring financial literacy. Journal of Consumer Affairs 44: 296–316. [Google Scholar] [CrossRef]

- IAI (Ikatan Akuntansi Indonesia). 2021. Standar Akuntansi Keuangan. Available online: http://iaiglobal.or.id/v03/standar-akuntansi-keuangan/sak-efektif-21-sak-efektif-per-1-Januari-2021 (accessed on 1 February 2022).

- Indonesia Ministry of National Development Planning. 2019. Indonesia Islamic Economic Masterplan 2019–2024. Copyright ©2019. Available online: https://knks.go.id/storage/upload/1560308022-Indonesia%20Islamic%20Economic%20Masterplan%202019-2024.pdf (accessed on 29 January 2022).

- Iqbal, Kamran, Hafiz Suliman Munawar, Hina Inam, and Siddra Qayyum. 2021. Promoting Customer Loyalty and Satisfaction in Financial Institutions through Technology Integration: The Roles of Service Quality, Awareness, and Perceptions. Sustainability 13: 12951. [Google Scholar] [CrossRef]

- Irawan, Enjang Pera, Suwandi Sumartias, Soeganda Priyatna, and Agus Rahmat. 2022. A Review on Digitalization of CSR during the COVID-19 Pandemic in Indonesia: Opportunities and Challenges. Social Sciences 11: 72. [Google Scholar] [CrossRef]

- Istifadhoh, Nurul, Inarotul A’yun, and Hafidhotul Mufidhoh. 2021. Sharia Fintech as An Instrument of National Economic Recovery Amid the Covid-19 Pandemic. Jurnal Ekonomi dan Keuangan Islam 8: 66–77. [Google Scholar] [CrossRef]

- Jailani, Novalini, and Hendri Hermawan Adinugraha. 2022. The Effect of Halal Lifestyle on Economic Growth in Indonesia. Journal of Economics Research and Social Sciences 6: 44–53. Available online: https://journal.umy.ac.id/index.php/jerss/article/view/13617 (accessed on 28 March 2022). [CrossRef]

- Jie, Ferry, Harisah Harisah, and Zubaidi Sulaiman. 2019. Acceleration of Mega-Merger of SOE Sharia Banks in Indonesia through Revitalization of Sharia Economic Law in Islamic Boarding Schools. Li Falah-Journal of Economics and Business Studies 4: 38–52. [Google Scholar] [CrossRef]

- Juminawati, Sri, Abd Hamid, Euis Amalia, M. Arif Mufraini, and Ade Sopyan Mulazid. 2021. The Effect of Micro, Small and Medium Enterprises on Economic Growth. Budapest International Research and Critics Institute-Journal (BIRCI-Journal) 4: 5697–704. Available online: https://repository.uinjkt.ac.id/dspace/bitstream/123456789/59652/1/17.%20Artikel%20The%20Effect%20of%20Micro%20Agust%202021.pdf (accessed on 28 March 2022). [CrossRef]

- Khan, Shahnawaz, and Mustafa Raza Rabbani. 2020. In Depth Analysis of Blockchain, Cryptocurrency and Sharia Compliance. International Journal of Business Innovation and Research 1: 1–15. [Google Scholar] [CrossRef]

- Kieso, Donald E., Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, and Bruce J. McConomy. 2011. Intermediate Accounting: IFRS Edition. Hoboken: United State of America (USA) John Wiley & Sons, Inc., vol. 1, Available online: https://books.google.co.id/books?id=_tmMkC5DNuAC&printsec=copyright#v=onepage&q&f=false (accessed on 28 March 2022).

- Kim, Kihyon, and Gyoogun Lim. 2022. International Dynamic Marketing Capabilities of Emerging-Market Small Business on E-Commerce. Journal of Theoretical and Applied Electronic Commerce Research 17: 199–211. [Google Scholar] [CrossRef]

- Kooli, Chokri, and Riad Abadli. 2022. Could Education Quality Audit Enhance Human Resources Management Processes of the Higher Education Institutions? Vision 26: 482–90. [Google Scholar] [CrossRef]

- Kooli, Chokri, Mohammed Shanikat, and Raed Kanakriyah. 2022. Towards a new model of productive Islamic financial mechanisms. International Journal of Business Performance Management 23: 119551. [Google Scholar] [CrossRef]

- Kucharcíková, Alžbeta, and Martin Miciak. 2021. Human Capital Management and Industry 4.0. Paper prestented at the SHS Web of Conferences, International Conference on Entrepreneurial Competencies in a Changing World, 90, České Budějovice, Czech Republic, November 24. [Google Scholar] [CrossRef]

- Kuchciak, Iwa, and Izabela Warwas. 2021. Designing a Roadmap for Human Resource Management in the Banking 4.0. Journal of Risk and Financial Management 14: 615. [Google Scholar] [CrossRef]

- Kunjana, Gora. 2021. Syariah Inclusion. Available online: https://investor.id/editorial/syariah-inclusion (accessed on 11 January 2022).

- Lassala, Carlos, Andreea Apetrei, and Juan Sapena. 2017. Sustainability Matter and Financial Performance of Companies. Sustainability 9: 1498. [Google Scholar] [CrossRef]

- Lee, MinHwa, JinHyo Joseph Yun, Andreas Pyka, DongKyu Won, Fumio Kodama, Giovanni Schiuma, HangSik Park, Jeonghwan Jeon, KyungBae Park, KwangHo Jung, and et al. 2018. How to Respond to the Fourth Industrial Revolution, or the Second Information Technology Revolution? Dynamic New Combinations between Technology, Market, and Society through Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 4: 21. [Google Scholar] [CrossRef]

- Lengnick-Hall, Cynthia A., Tammy E. Beck, and Mark L. Lengnick-Hall. 2011. Developing a capacity for organizational resilience through strategic human resource management. Human Resource Management Review 21: 3. [Google Scholar] [CrossRef]

- Limanseto, Haryo. 2022. Stengthenin the Halal Value Chain Ecosystem to Support Sharia Economy and Halal Industry. Available online: https://www.ekon.go.id/publikasi/detail/4233/strengthening-the-halal-value-chain-ecosystem-to-support-sharia-economy-and-halal-industry (accessed on 15 September 2022).

- Liu, Yang, Yanlin Yang, Huihui Li, and Kaiyang Zhong. 2022. Digital Economy Development, Industrial Structure Upgrading and Green Total Factor Productivity: Empirical Evidence from China’s Citie. International Journal of Environmental Research and Public Health 19: 2414. [Google Scholar] [CrossRef] [PubMed]

- Lu, Cheng, Tongyu Gu, Jie Chen, and Zunli Liu. 2021. Will Internet Market Newness Improve Performance? An Empirical Study on the Internet Market Innovation of Offline Retailers in China. Sustainability 13: 12619. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011. Financial literacy around the world: An overview. Journal of Pension Economics and Finance 10: 497–508. [Google Scholar] [CrossRef]

- Lynch, Marc. 2022. The Future of Islamism through the Lens of the Past. Religions 13: 113. [Google Scholar] [CrossRef]

- Maksum, Irfan Ridwan, Amy Yayuk Sri Rahayu, and Dhian Kusumawardhani. 2020. A Social Enterprise Approach to Empowering Micro, Small and Medium Enterprises (SMEs) in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity 6: 50. [Google Scholar] [CrossRef]

- Mallin, Christine, Hisham Farag, and Kean Ow-Yong. 2014. Corporate Social Responsibility and Financial Performance in Islamic banks. The Journal of Economic Behavior and Organization 103: S21–S38. [Google Scholar] [CrossRef]

- Martani, Dwi, Nps Veronica Sylvia, Wardhani Ratna, Farahmita Aria, and Tanujaya Edward. 2012. Akuntansi Keuangan Menengah Berbasis PSAK, Jakarta, Salemba Empat. Available online: https://ebook.sultrakini.com/id/akuntansi-keuangan-menengah-dwi-martani.pdf (accessed on 28 March 2022).

- Mavlutova, Inese, Andris Fomins, Aivars Spilbergs, Dzintra Atstaja, and Janis Brizga. 2022. Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia. Sustainability 14: 339. [Google Scholar] [CrossRef]

- Menne, Firman, Lanita Winata, and Mohammad Hossain. 2016. The Influence of CSR Practices on Financial Performance: Evidence from Islamic Financial Institution in Indonesia. Journal Modern Accounting Auditing 12: 77–90. [Google Scholar] [CrossRef]

- Menne, Firman, Batara Surya, Muhammad Yusuf, Seri Suriani, Muhlis Ruslan, and Iskandar Iskandar. 2022. Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 8: 18. [Google Scholar] [CrossRef]

- Messabia, Nabil, Paul-Rodrigue Fomi, and Chokri Kooli. 2022. Managing restaurants during the COVID-19 crisis: Innovating to survive and prosper. Journal of Innovation & Knowledge 7: 2022. [Google Scholar] [CrossRef]

- Ministry of Finance, Republic of Indonesia. 2021. Government Strengthens Sharia Economy and Finance. Available online: https://www.kemenkeu.go.id/en/publications/news/government-strengthens-sharia-economy-and-finance/ (accessed on 10 January 2022).

- Najib, Mukhamad, Wita Juwita Ermawati, Farah Fahma, Endri Endri, and Dwi Suhartanto. 2021. FinTech in the Small Food Business and Its Relation with Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 88. [Google Scholar] [CrossRef]

- Nawaz, Tasawar. 2018. Lifting the Lid on Financial Inclusion: Evidence from Emerging Economies. International Journal of Financial Studies 6: 59. [Google Scholar] [CrossRef]

- Nurdiana, Juli, Maria Laura Franco-Garcia, and Michiel Adriaan Heldeweg. 2021. How Shall We Start? The Importance of General Indices for Circular Cities in Indonesia. Sustainability 13: 11168. [Google Scholar] [CrossRef]

- Oshora, Betgilu, Goshu Desalegn, Eva Gorgenyi-Hegyes, Maria Fekete-Farkas, and Zoltan Zeman. 2021. Determinants of Financial Inclusion in Small and Medium Enterprises: Evidence from Ethiopia. Journal of Risk and Financial Management 14: 286. [Google Scholar] [CrossRef]

- Parida, Vinit, David Sjödin, and Wiebke Reim. 2019. Reviewing Literature on Digitalization, BusinessModel Innovation, and Sustainable Industry: Past Achievements and Future Promises. Sustainability 11: 391. [Google Scholar] [CrossRef]

- Poon, Jessie, Yew Wah Chow, Michael Ewers, and Razli Ramli. 2020. The Role of Skills in Islamic Financial Innovation: Evidence from Bahrain and Malaysia. Journal of Open Innovation: Technology, Market, and Complexity 6: 47. [Google Scholar] [CrossRef]

- Prado, Silvia Mariela Méndez, Marlon José Zambrano Franco, Susana Gabriela Zambrano Zapata, Katherine Malena Chiluiza García, Patricia Everaert, and Martin Valcke. 2022. A Systematic Review of Financial Literacy Research in Latin America and The Caribbean. Sustainability 14: 3814. [Google Scholar] [CrossRef]

- Pu, Ganlin, M. D. Qamruzzaman, Ahmed Muneeb Mehta, Farah Naz Naqvi, and Salma Karim. 2021. Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability 13: 9218. [Google Scholar] [CrossRef]

- Purnamasari, Deti Mega, and Bayu Ma’ruf Nilai Galih. 2021. 2021 Momentum Kebangkitan Ekonomi Syariah, Ini Alasanya. Available online: https://nasional.kompas.com/read/2021/10/22/12292861/maruf-nilai-2021-momentum-kebangkitan-ekonomi-syariah-ini-alasannya?page=all (accessed on 27 January 2022).

- Qalati, Sikandar Ali, Wenyuan Li, Naveed Ahmed, Manzoor Ali Mirani, and Asadullah Khan. 2021. Examining the Factors Affecting SME Performance: The Mediating Role of Social Media Adoption. Sustainability 13: 75. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood Asad Mohd Ali, Habeeb Ur Rahiman, and Md Shabbir Alam. 2021a. Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System. Journal of Open Innovation: Technology, Market, and Complexity 7: 136. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Mahmood Asad Mohd Ali, Habeeb Ur Rahiman, Mohd Atif, Zehra Zulfikar, and Yusra Naseem. 2021b. The Response of Islamic Financial Service to the COVID-19 Pandemic: The Open Social Innovation of the Financial System. Journal of Open Innovation: Technology, Market, and Complexity 7: 85. [Google Scholar] [CrossRef]

- Reimann, Caroline, Fernando Carvalho, and Marcelo Duarte. 2021. The Influence of Dynamic and Adaptive Marketing Capabilities on the Performance of Portuguese SMEs in the B2B International Market. Sustainability 13: 579. [Google Scholar] [CrossRef]

- Reinartz, Werner, Nico Wiegand, and Monika Imschloss. 2019. The impact of digital transformation on the retailing value chain. International Journal of Research in Marketing 36: 3. [Google Scholar] [CrossRef]

- Remondino, Marco, and Alessandro Zanin. 2022. Logistics and Agri-Food: Digitalization to Increase Competitive Advantage and Sustainability. Literature Review and the Case of Italy. Sustainability 14: 787. [Google Scholar] [CrossRef]

- Rieger, Marc Oliver. 2020. How to Measure Financial Literacy? Journal of Risk and Financial Management 13: 324. [Google Scholar] [CrossRef]

- Saleem, Adil, Budi Setiawan, Judit Bárczi, and Judit Sági. 2021a. Achieving Sustainable Economic Growth: Analysis of Islamic Debt and the Islamic Equity Market. Sustainability 13: 8319. [Google Scholar] [CrossRef]

- Saleem, Adil, Judit Sági, and Budi Setiawan. 2021b. Islamic Financial Depth, Financial Intermediation, and Sustainable Economic Growth: ARDL Approach. Economies 9: 49. [Google Scholar] [CrossRef]

- Saleh, Haeruddin, Batara Surya, Despry Nur Annisa Ahmad, and Darmawati Manda. 2020. The Role of Natural and Human Resources on Economic Growth and Regional Development: With Discussion of Open Innovation Dynamics. Journal of Open Innovation: Technology, Market, and Complexity 6: 103. [Google Scholar] [CrossRef]

- Santarelli, Enrico, and Samuele D’Altri. 2003. The Diffusion of E-Commerce Among SMEs: Theoretical Implications and Empirical Evidence. Small Business Economics 21: 3. [Google Scholar] [CrossRef]

- Santoso, Wimboh, Palti Marulitua Sitorus, Sukarela Batunanggar, Farida Titik Krisanti, Grisna Anggadwita, and Andry Alamsyah. 2020. Talent mapping: A strategic approach toward digitalization initiatives in the banking and financial technology (FinTech) industry in Indonesia. Journal of Science and Technology Policy Management 12: 2053–4620. [Google Scholar] [CrossRef]

- Saputri, Apik Anitasari Intan. 2020. QuoVadis Regulation of Islamic Economics in Post-Reform Indonesia. International Journal of Science and Society 2: 507–22. [Google Scholar] [CrossRef]

- Sekaran, Uma, and Roger Bougie. 2013. Research Methods for Business. In A Skill-Building Approach (Seventh Ed, hal. 237–266). Chichester: Wiley. Available online: https://www.wiley.com/en-ie/Research+Methods+For+Business:+A+Skill+Building+Approach,+7th+Edition-p-9781119266846#download-product-flyer (accessed on 25 January 2022).

- Setijawan, Edi, Muhammad Algifari Sulistyoningsih, Tika Arundina, M. Budi Prasetyo, and Fauziah Rizki Yuniarti. 2021. Does Social Performance Enhance Financial Inclusion? Evidence from Indonesia’s Islamic Banking Industry. OJK Research Seminar in November 26–27. Available online: https://www.ojk.go.id/id/data-dan-statistik/research/working-paper/Documents/OJK_WP.21.07.pdf (accessed on 5 March 2022).

- Sima, Violeta, Ileana Georgiana Gheorghe, Jonel Subić, and Dumitru Nancu. 2020. Influences of the Industry 4.0 Revolution on the Human Capital Development and Consumer Behavior: A Systematic Review. Sustainability 12: 4035. [Google Scholar] [CrossRef]

- Sohibien, Gama Putra Danu, Lilis Laome, Achmad Choiruddin, and Heri Kuswanto. 2022. COVID-19 Pandemic’s Impact on Return on Asset and Financing of Islamic Commercial Banks: Evidence from Indonesia. Sustainability 14: 1128. [Google Scholar] [CrossRef]

- Sombultawee, Kedwadee, Pattama Lenuwat, Natdanai Aleenajitpong, and Sakun Boon-itt. 2022. COVID-19 and Supply Chain Management: A Review with Bibliometric. Sustainability 14: 3538. [Google Scholar] [CrossRef]

- Songling, Yang, Muhammad Ishtiaq, Muhammad Anwar, and Hamid Ahmed. 2018. The Role of Government Support in Sustainable Competitive Position and Firm Performance. Sustainability 10: 3495. [Google Scholar] [CrossRef]

- Soyer, Kemal, Hale Ozgit, and Husam Rjoub. 2020. Applying an Evolutionary Growth Theory for Sustainable Economic Development: The Effect of International Students as Tourists. Sustainability 12: 418. [Google Scholar] [CrossRef]

- Soytas, Mehmet Ali, Meltem Denizel, and Damla Durak Usar. 2019. Addressing endogeneity in the causal relationship between sustainability and financial performance. International Journal of Production Economics 210: 56–71. [Google Scholar] [CrossRef]

- Srisusilawati, Popon, Zaini Abdul Malik, Irma Yulita Silviany, and Nanik Eprianti. 2021. The Roles of Self Efficacy and Sharia Financial Literacy to SMES Performance: Business Model as Intermediate Variable. F1000Research 10: 1310. [Google Scholar] [CrossRef]

- Stalmachova, Katarina, Roman Chinoracky, and Mariana Strenitzerova. 2022. Changes in Business Models Caused by Digital Transformation and the COVID-19 Pandemic and Possibilities of Their Measurement—Case Study. Sustainability 14: 127. [Google Scholar] [CrossRef]

- Stofkova, Katarina Repkova, Dominik Laitkep, and Zuzana Stofkova. 2022. Shopping Behavior in the Context of the Digital Economy. Journal of Risk and Financial Management 15: 39. [Google Scholar] [CrossRef]

- Surya, Batara. 2015. The Dynamics of Spatial Structure and Spatial Pattern Changes at the Fringe Area of Makassar City. Indonesian Journal of Geography 47: 11–19. [Google Scholar] [CrossRef]

- Surya, Batara, Firman Menne, Hernita Sabhan, Seri Suriani, Herminawaty Abubakar, and Muhammad Idris. 2021. Economic Growth, Increasing Productivity of SMEs, and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 20. [Google Scholar] [CrossRef]

- Surya, Batara, Hernita Hernita, Agus Salim, Seri Suriani, Iwan Perwira, Yulia Yulia, Muhlis Ruslan, and Kafrawi Yunus. 2022. Travel-Business Stagnation and SME Business Turbulence in the Tourism Sector in the Era of the COVID-19 Pandemic. Sustainability 14: 2380. [Google Scholar] [CrossRef]

- Suryani. 2012. The Significance of Islamic Economics Study in Discipline of Modern Economics. Journal of Indonesian Economy and Business 27: 1. [Google Scholar] [CrossRef]

- Swiecka, Beata, Eser Yeşildağ, Ercan Özen, and Simon Grima. 2020. Financial Literacy: The Case of Poland. Sustainability 12: 700. [Google Scholar] [CrossRef]

- Syed, Mohammad Haider, Shahnawaz Khan, Mustafa Raza Rabbani, and Yannis E. Thalassinos. 2020. An Artificial Intelligence and NLP based Islamic FinTech Model Combining Zakat and Qardh-Al-Hasan for Countering the Adverse Impact of COVID 19 on SMEs and Individuals. International Journal of Business and Administrative VIII: 351–64. [Google Scholar] [CrossRef]

- Szustak, Grażyna, Piotr Dąbrowski, Witold Gradoń, and Łukasz Szewczyk. 2022. The Relationship between Energy Production and GDP: Evidence from Selected European Economies. Energies 15: 50. [Google Scholar] [CrossRef]

- Tinungki, Georgina Maria, Robiyanto Robiyanto, and Powell Gian Hartono. 2022. The Effect of COVID-19 Pandemic on Corporate Dividend Policy in Indonesia: The Static and Dynamic Panel Data Approaches. Economies 10: 11. [Google Scholar] [CrossRef]

- Toader, Elena, Bogdan Narcis Firtescu, Angela Roman, and Sorin Gabriel Anton. 2018. Impact of Information and Communication Technology Infrastructure on Economic Growth: An Empirical Assessment for the EU Countries. Sustainability 10: 3750. [Google Scholar] [CrossRef]

- Tok, Evren, and Abdurahman Jemal Yesuf. 2022. Embedding Value-Based Principles in the Culture of Islamic Banks to Enhance Their Sustainability, Resilience, and Social Impact. Sustainability 14: 916. [Google Scholar] [CrossRef]

- Yang, Guoge, Feng Deng, Yifei Wang, and Xianhong Xiang. 2022. Digital Paradox: Platform Economy and High-Quality Economic Development—New Evidence from Provincial Panel Data in China. Sustainability 14: 2225. [Google Scholar] [CrossRef]

- Ye, Jianmu, and KMMCB Kulathunga. 2019. How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability 11: 2990. [Google Scholar] [CrossRef]

- Yu, Krista Danielle S., Kathleen B. Aviso, Joost R. Santos, and Raymond R. Tan. 2020. The Economic Impact of Lockdowns: A Persistent Inoperability Input-Output Approach. Economies 8: 109. [Google Scholar] [CrossRef]

- Yue, Wenze, Jiabin Gao, and Xuchao Yang. 2014. Estimation of Gross Domestic Product Using Multi-Sensor Remote Sensing Data: A Case Study in Zhejiang Province, East China. Remote Sensing 6: 7260–75. [Google Scholar] [CrossRef]

- Yusuf, Arief Anshory, Akhmad Rizal Shidiq, and Hariyadi Hariyadi. 2020. On Socio-Economic Predictors of Religious Intolerance: Evidence from a Large-Scale Longitudinal Survey in the Largest Muslim Democracy. Religions 11: 21. [Google Scholar] [CrossRef]

| Variables | Indicator | Outer Loading | Description |

|---|---|---|---|

| Digital Economy () | 0.800 | Valid | |

| 0.815 | Valid | ||

| 0.779 | Valid | ||

| 0.572 | Invalid | ||

| Financial Literacy () | 0.822 | Valid | |

| 0.909 | Valid | ||

| 0.362 | Invalid | ||

| 0.883 | Valid | ||

| Human Capital () | 0.786 | Valid | |

| 0.869 | Valid | ||

| 0.851 | Valid | ||

| 0.814 | Valid | ||

| The Role of IFIs () | 0.925 | Valid | |

| 0.829 | Valid | ||

| 0.072 | Invalid | ||

| Government Support () | 0.902 | Valid | |

| 0.860 | Valid | ||

| Financial Performance () | 0.919 | Valid | |

| 0.902 | Valid | ||

| Sharia Economics () | 0.936 | Valid | |

| 0.928 | Valid |

| Variables | Average Variance Extracted (AVE) | Description |

|---|---|---|

| Digital Economy () | 0.678 | Valid |

| Financial Literacy () | 0.770 | Valid |

| Human Capital () | 0.690 | Valid |

| The Role of IFIS () | 0.771 | Valid |

| Government Support () | 0.777 | Valid |

| Financial Performance () | 0.829 | Valid |

| Sharia Economic () | 0.869 | Valid |

| Variable | Cronbach’s Alpha | Composite Reliability | rho_A | Description |

|---|---|---|---|---|

| Digital Economy () | 0.763 | 0.863 | 0.768 | Reliable |

| Financial Literacy ) | 0.851 | 0.909 | 0.865 | Reliable |

| Human Capital () | 0.850 | 0.899 | 0.854 | Reliable |

| The Role of IFIs () | 0.714 | 0.871 | 0.790 | Reliable |

| Government Support () | 0.714 | 0.874 | 0.727 | Reliable |

| Financial Performance () | 0.795 | 0.907 | 0.800 | Reliable |

| Sharia Economic () | 0.849 | 0.930 | 0.851 | Reliable |

| Correlation | Coefficient | Error | T-Count | T-Table |

| Digital Economics toward Financial Performance | 0.075 | 0.050 | 1.509 | 1.92 |

| Digital Economics toward Sharia Economy | −0.003 | 0.056 | 0.539 | 1.92 |

| Financial Literacy toward Financial Performance | 0.085 | 0.055 | 1.545 | 1.92 |

| Financial Literacy toward Sharia Economy | 0.034 | 0.054 | 0.628 | 1.92 |

| Human Capital toward Financial Performance | 0.231 | 0.076 | 3.018 | 1.92 |

| Human Capital toward Sharia Economy | 0.210 | 0.089 | 2.352 | 1.92 |

| The Role of IFIs toward Financial Performance | 0.213 | 0.058 | 3.694 | 1.92 |

| The Role of IFIs toward Sharia Economy | 0.004 | 0.056 | 0.778 | 1.92 |

| Government Regulation toward Financial Performance | 0.316 | 0.065 | 4.860 | 1.92 |

| Government Regulation toward Sharia Economy | 0.256 | 0.078 | 3.279 | 1.92 |

| Financial Performance toward Sharia Economic | 0.448 | 0.105 | 4.264 | 1.92 |

| Regression Residual | R Square | R Square Adjusted | ||

| Financial Performance | 0.585 | 0.577 | ||

| Islamic Economic Revival | 0.716 | 0.709 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Menne, F.; Mardjuni, S.; Yusuf, M.; Ruslan, M.; Arifuddin, A.; Iskandar, I. Sharia Economy, Islamic Financial Performance and Factors That Influence It—Evidence from Indonesia. Economies 2023, 11, 111. https://doi.org/10.3390/economies11040111

Menne F, Mardjuni S, Yusuf M, Ruslan M, Arifuddin A, Iskandar I. Sharia Economy, Islamic Financial Performance and Factors That Influence It—Evidence from Indonesia. Economies. 2023; 11(4):111. https://doi.org/10.3390/economies11040111

Chicago/Turabian StyleMenne, Firman, Sukmawati Mardjuni, Muhammad Yusuf, Muhlis Ruslan, A. Arifuddin, and Iskandar Iskandar. 2023. "Sharia Economy, Islamic Financial Performance and Factors That Influence It—Evidence from Indonesia" Economies 11, no. 4: 111. https://doi.org/10.3390/economies11040111

APA StyleMenne, F., Mardjuni, S., Yusuf, M., Ruslan, M., Arifuddin, A., & Iskandar, I. (2023). Sharia Economy, Islamic Financial Performance and Factors That Influence It—Evidence from Indonesia. Economies, 11(4), 111. https://doi.org/10.3390/economies11040111