Abstract

This paper empirically investigates the link between the level of government revenue per capita and six indicators of the quality of governance in an unbalanced panel data set consisting of all countries in the world (217 countries; due to some missing data, (this was reduced to 196) using data from 1996 to 2020. It uses single-equation generalised method of moment (GMM) techniques and a vector autoregressive (VAR) and vector error correction model (VECM) approach to investigate this issue. The results suggest a strong effect over time whereby an increase in government revenue leads to a steady improvement in governance. These findings suggest an important virtuous circle between government revenue and governance. As a result, additional government revenue can significantly impact the Sustainable Development Goals more than our previous work has suggested.

1. Introduction

In September 2015, world leaders agreed on a road map to a more equitable and sustainable future and adopted an agenda for sustainable development and 17 Sustainable Development Goals (SDGs) with 169 targets. The SDGs are grounded in human rights law and are a unique opportunity to advance the realisation of human rights (United Nations—Office of the High Commissioner of Human Rights 2021). However, many low- and lower–middle-income (hereafter lower-income) countries are unlikely to reach the SDGs, especially the targets on safe sanitation (SDG 6) and secondary school completion (SDG 4). Most premature maternal and child deaths result from inadequate access to critical determinants of health: clean water, sanitation, education, gender equality, and healthcare (SDGs 3,4, 5, and 6) (Kuruvilla et al. 2014; Moyer and Hedden 2020). Heads of state and governments have affirmed their commitment to act in partnership to achieve the SDGs. They acknowledged that there must be a credible way of financing the goals through increased government revenues. The General Assembly reiterated that each country has a primary responsibility for their economic development, for which increased domestic resource mobilisation will be critical, but they need to operate in an enabling global economic environment.

In O’Hare and Hall (2022), we modelled government revenue and governance on eight SDGs indicators (under-five mortality, maternal death rates in childbirth, basic water supply, safe water supply, basic sanitation, safe sanitation, education, and immunisation rates). We found that an increase in government revenues positively affected all these SDGs; however, the result was highly non-linear, with a much more significant effect in lower-income countries than in high-income countries. We also found that this relationship is strongly affected by a range of quality of governance indicators (O’Hare and Hall 2022). A weakness of this earlier work is that we treated the governance indicators as exogenous variables. However, we believe that governance will also respond to economic development. By ignoring this effect, we may have underestimated the impact of an increase in government revenue on the SDG indicators. Thus, an increase in government revenue will directly impact the SDGs, but it will also have an indirect effect through an improvement in governance. In this paper, we investigate the importance of this route with the aim of combining these sets of equations in a single model which will capture both effects. Thus, the objective here is to estimate a set of relationships that will explicitly model the link between government expenditure and the various measures of the quality of governance.

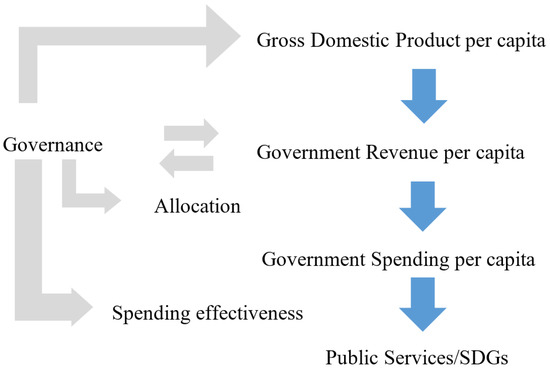

Gross Domestic Product (GDP) per capita in 2018 in low-income countries was, on average, USD 750 compared to USD 40,000 in high-income countries. The government revenue/GDP ratio is much smaller in low-income countries, 13%, compared to 35% in high-income countries. In low-income countries, government revenue per capita is USD 100 compared to USD 14,000 in high-income countries (O’Hare et al. 2020). There are several steps, acting in both directions, along the pathway between GDP, tax revenue mobilisation, and the SDGs, that are influenced by governance (O’Hare and Hall 2022). Figure 1 provides an overview of the interactions we believe are important. In this paper, we build a model of the linkage from government revenue to governance. There is obviously a close link between government revenue and GDP; in almost all countries, the correlation between these two is very high. In our modelling, we have focused on government revenue rather than GDP because one of our concerns is the effect of tax avoidance on the SDGs. When this is reduced, government revenue will increase, but GDP may not. We, therefore, focus on the link from revenue to the quality of governance rather than GDP.

Figure 1.

The governance, tax revenue, and SDG inferential framework.

2. Literature Review

Multiple studies demonstrate that increased government spending on public services drive progress toward the SDGs (Anyanwu and Erhijakpor 2009; Gupta et al. 2002; Haile and Niño-Zarazúa 2018; Sanoussi and Boukari 2020). Notably, the relative increase in spending on public services is more significant in lower-income countries than in upper-middle and high-income (hereafter higher-income) countries when there is an increase in government revenue (Long and Miller 2017; Reeves et al. 2015; Tamarappoo et al. 2016). In addition, the impact of government revenue and spending on progress towards the SDGs is non-linear, with lower-income countries achieving higher benefits from marginal increases in government revenue compared to higher-income countries (Hall et al. 2020; O’Hare and Hall 2022).

The impact of governance on economic growth has also been studied. Ugur (2014) used a meta-regression analysis on 327 estimates of corruption’s effect on economic growth and demonstrated that reducing corruption would positively impact long-run economic growth in low-income countries (Ugur 2014). Since that publication, Chan et al. (2017) empirically showed that efficient government spending and transparent tax administrations increase economic growth (Chan et al. 2017). In addition, Factor and Kang (2015) show, using structural equation modelling, that lowers corruption levels are associated with economic growth (Factor and Kang 2015). A similar finding was made by Chong and Calderón (2000). Moreover, governance impacts non-income pathway, critical for economic growth, including peace and stability and the effective regulation of institutions that provide and regulate critical sectors (Langnel and Buracom 2020).

Several studies have empirically demonstrated that good governance and tax administration improve the tax/GDP ratio. Gupta (2007) found that corruption negatively affects tax revenue. Arif and Rawat (2018) studied ten emerging economies and found that tax revenue generation increases if there is a reduction in corruption and good governance (Arif and Rawat 2018). Other researchers have used empirical methods to confirm this (Igbinovia and Marcella Ekwueme 2020; Dang et al. 2022; Abbas et al. 2021; Almustafa et al. 2023; Musa et al. 2023). Jahnke (2017) shows that a lower perception of corruption is associated with higher tax compliance using Afro barometer survey results (Jahnke 2017).

Baskaran and Bigsten (2013) argued that there are reasons why we should expect a relationship between fiscal capacity and quality of governance in Africa and empirically studied the impact of increased tax revenue on governance. They used the tax/GDP ratio from the World Development Indicators, governance indicators from the Worldwide Governance Indicators (WGI) project, and democracy from Polity IV’s democracy score. They studied 31 sub-Saharan African countries between 1990 and 2005 and showed that a 1% increase in the tax/GDP ratio reduces corruption by 0.04–0.08 points (measured on a scale of 0–6). For government efficiency, they explored two channels in which an increase in revenue might impact governance: 1. More revenue means better salaries for staff and reduced corruption. 2. Citizens demand better governance if they carry a fiscal burden, i.e., a solid fiscal contract. Their findings indicate that the second channel predominates. They also found that neither development aid nor resource rents affect government quality (Baskaran and Bigsten 2013). Political scientists have long argued that improved fiscal capacity improves governance and that governments are more accountable to their citizens when dependent on them for tax revenue (Moore 2007). Empirical work supports this by showing that the higher the tax/GDP level, the lower the perceived level of corruption (Besley and Persson 2014; Cooray et al. 2017; Gupta 2007). In addition, governments responsive to their citizens are more stable, less likely to be toppled, and can focus public spending on productive sectors that generate higher revenues (Acemoglu and Robinson 2012; Cooray et al. 2017). Delavallade (2006) conducted an empirical study of 64 countries, showing that corruption resulted in less social spending (Delavallade 2006). Conversely, reduced corruption resulted in increased education spending (Mauro 1998; Nyamongo and Schoeman 2010).

Researchers have studied the interaction of governance and health expenditure to demonstrate that good governance improves health outcomes from health expenditure (Farag et al. 2013; Makuta and O’Hare 2015; Rajkumar and Swaroop 2008). Others confirm these findings (Baldacci et al. 2008; Çevik and Okan Taşar 2013; Dhrifi 2020; Hanf et al. 2013; Murshed and Ahmed 2018; Nketiah-Amponsah 2019). Thus, good governance is vital in translating public spending into progress toward the SDGs (Hu and Mendoza 2013).

3. Research Question, Methods, and Data

3.1. The Research Question

Our previous work, O’Hare and Hall (2022), focused on the determination of seven of the SDG indicators and the impact of government revenue and governance on them. The question being asked in this paper is this: what is the effect of government revenue on the governance indicators themselves? This work treated governance as an exogenous variable, which is probably a valid assumption as governance changes relatively slowly and is unlikely to respond to current government revenue; hence it is weakly exogenous. However, if, in the longer run, governance does change slowly over time in response to a change in revenue (and so governance is not super exogenous (Cuthbertson et al. 1992), then the policy implications could be quite significant.

3.2. The Data

This paper empirically investigates the link between the level of government revenue per capita and six indicators of the quality of governance in an unbalanced panel data set consisting of all countries in the world where data is available (196 countries) using data from 1980 to 2020 (exact data definitions and sources are in the data appendix). We used the latest update of the Government Revenue Database (GRD). The GRD data has both general and central government revenue, and we used the latter. The reason for this preference is that spending on the SDGs typically comes from central government funds (not local government). Data which include and exclude grants are available, and we use total general government revenue, excluding grants, as this variable best reflects the capacity of domestic resource mobilisation. For the same reason, we used data that includes social contributions, even though it may be incomplete. The GRD expresses all data as a percentage of GDP taken from the World Economic Outlook (WEO) in Local Currency Units (UNU-WIDER 2022). We converted government revenue as % of GDP into government revenue per capita. As in O’Hare and Hall (2022), we used the six dimensions of the quality of governance of a country using the World Bank Worldwide Governance Indicators (Kaufmann and Kraay 2013).

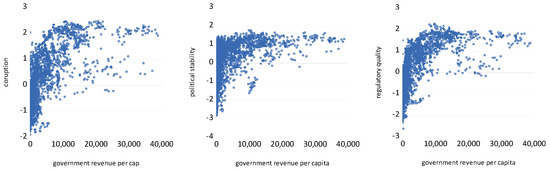

Figure 2 shows the scatter plots of the relationship between government revenue per capita and the governance indicators.

Figure 2.

Government revenue per capita in US dollars (constant 2015) and governance indicators.

These scatter plots clearly show a strong positive relationship between government revenue per capita and the governance indicators. However, there is also clearly a group of countries where the level of government revenue has little effect on the quality of governance. This trend appears to be particularly strong for voice and accountability. This is echoed in our results below. There is clearly a non-linear relationship between government revenue and governance indicators. This closely approximates a log function; therefore, we used the logarithm of government revenue from this point onwards. The simple descriptive statistics of the data are presented in Table A2 in the Appendix A.

3.3. The Methods

This study explores this critical channel between government revenue and the quality of governance over time. We used a panel database involving every country worldwide over the longest time available. We explored a range of techniques, as, in applied econometric work, it is often impossible to know a ’priori’ which approach will prove the most effective. First, we considered the broad properties of our data and decided whether the analysis should be carried out in level or difference form. The data are unusual in that the governance indicators all lie within a range from −2.5 to +2.5 and thus do not meet the normal requirements for testing stationarity. We argue below that all the data are, in fact, stationary. We began by using a single equation approach to the issue using a single equation equilibrium correction model (ECM) for each governance measure and government revenue, which had to allow for the endogeneity of government revenue; therefore, we used an estimation technique that can deal with this, namely, a panel instrumental generalised method of moments (one step GMM). We then checked the robustness of these results by using a completely different approach, vector autoregressive (VAR) analysis, looking at the dynamic interactions between government revenue and each of the six dimensions of governance quality. This allows a complex and possibly slow interaction between the two to be explored. We then built a panel vector error correction model (VECM), which allowed us to model the dynamic adjustment towards the long-run equilibrium fully. We were then able to contrast the adjustment process for the two approaches.

In a panel data set, there are many factors which influence the quality of governance in individual countries. These include previous colonisation, inherited legal systems, and wars. For this reason, we used a fixed effect modelling approach for our estimation, as the fixed effects remove all these time-invariant, country-specific effects.

4. The Econometric Analysis and Results

Modern time series econometrics now emphasise the importance of the stationarity and cointegration properties of the data for valid estimation work (Asteriou and Hall 2021). Over the last 10 to 15 years, this analysis has been extended to a panel data setting, and it is now well understood that, even in a panel context, these issues cannot be ignored. However, our data does not easily fit into the standard I (1) or I (0) framework; all the governance variables we have are bounded between −2.5 and +2.5; therefore, they certainly cannot be random walk variables, as, asymptotically, a random walk is unbounded. However, the definition of weak stationarity is that the mean and variance of a series are constant over time. Given this caveat regarding testing, we begin by applying the standard panel stationarity in Table 1.

Table 1.

Panel stationarity tests for the variables.

The formal interpretation of these results is quite clear; in the case of all the governance indicators, we can reject the null hypothesis of a unit root, while, in the case of government revenue per capita, we can reject the hypothesis at a 10% level in the case of three of the tests and cannot reject for one test.

Given this slight ambiguity in the stationarity tests, it is important to allow for the possibility that the governance indicators are, in fact, non-stationary. The key issue for estimation is, therefore, if the variables are not weakly stationary, we need to know that they cointegrate; if they are weakly stationary, then we may proceed regardless. Therefore, if they are either weakly stationary or cointegrate, the appropriate modelling strategy is to keep the variables in level form. Consequently, we begin by testing for bivariate cointegration between government revenue per capita and each of the governance variables. Here, we perform three panel cointegration tests, i.e., the Kao test (Kao 1999), the Engle–Granger-based test, and two versions of the combined Johansen test based on the Fisher procedure of averaging the individual test statistics (Fisher 1922), see Table 2.

Table 2.

Panel cointegration tests between the log of government revenue per capita and each of the governance variables.

Table 1 shows that, in every case, for the Kao test, the null hypothesis of no cointegration is rejected. For the two Fisher type tests, we reject both the null that r = 0 and the null that r = 1. This implies that both variables are stationary, which confirms the finding in Table 1 that the log of government revenue per capita is also stationary. Therefore, we can proceed to the estimation in a valid way on the assumption that the data may be regarded as stationary (or, if we still doubt this conclusion, it convincingly cointegrates).

We begin by estimating a set of single-equation relationships between each of our governance indicators and the logarithm of government revenue per capita (lgovrev). There are several difficulties with estimating a relationship between these two. First, we cannot assume that government revenue is independent of the quality of governance; that is, it is weakly exogenous in econometric terms. Second, it is evident that the quality of governance is affected by government revenue only slowly over time; therefore, our specification must allow for a gradual adjustment of the governance indicators to an increase in government revenue. This implies that our model must be dynamic (Asteriou and Hall 2021). Therefore, we employ a generalised method of moments (GMM-one step) estimator that deals with the possible endogeneity of government revenue.

The general structure of each equation takes the form of a bivariate dynamic equilibrium correction model with up to a two-year lag structure. We begin with this general model and then remove any insignificant effects to achieve a parsimonious model in a standard general to a specific methodology. The general model is, therefore:

where is the first difference operator, lgov is the log of government revenue, GI is one of the governance indicators, is a fixed effect which varies for each country to allow for non-time varying differences between countries, are parameters, k is a suitable maximum lag length, and is the error term. For stability in the long run, we require that , where this parameter also governs the speed of adjustment so that a value close to −1 would imply a rapid adjustment process and a value close to 0 would imply slow adjustment. The long-run total effect on GI is given by so that is the long-run semi-elasticity of GI with respect to lgov. During estimation, a maximum k = 1 was found.

Table 3 shows the parsimonious estimates for each of the GMM estimates for each governance indicator.

Table 3.

GMM estimation of the equilibrium correction models for governance indicators.

Five of the six models perform well, and are significant and correctly signed in all the models except voice, where is not significant although still correctly signed. This suggests that, apart from voice, there is a significant and important link from government revenue to the governance indicators. The first three models have dropped the dynamic terms, which suggests that the adjustment process is very smooth; moreover, the last three have some dynamic terms; however, these are small, suggesting again that the governance indicators are quite smooth with only small perturbations around the smooth path. is a very similar order of magnitude in all cases, which suggests that the speed of adjustment is very similar across the indicators.

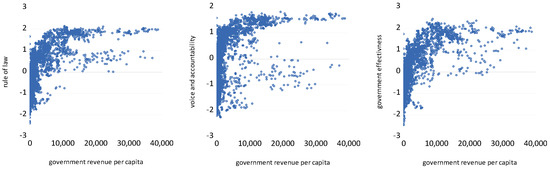

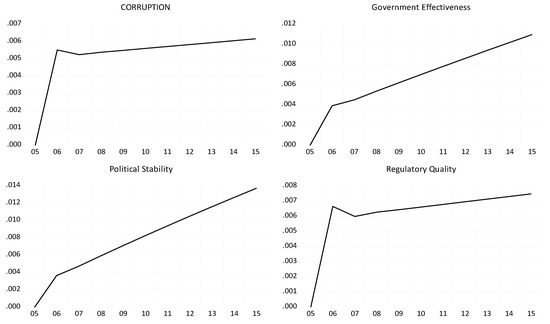

We have performed a simple simulation exercise to provide a clearer idea of the speed of adjustment of the governance indicators. We have simulated a fixed 10% increase in government revenue per capita over ten years and graphed the adjustment process for each of the five indicators with significant effects (not voice). This is shown in Figure 3.

Figure 3.

The adjustment process implied by the GMM estimates to a 10% increase in government revenue per capita.

This figure illustrates the smooth transition in response to a 10% increase in government revenue per capita for each of the five governance indicators, which have a significant effect. They all show a smooth transition except for a very small initial negative effect in the rule of law, which is rapidly eliminated. While the change in governance in these figures seems relatively small, the reader must bear in mind two factors: the scaling of the governance variables (between −2.5 and 2.5) is arbitrary; if the scaling were bigger, then the change would be correspondingly bigger. In fact, a change of this magnitude amongst developing counties could easily change our view on relative corruption rates. Secondly, this is the effect of a 10% increase in government revenue per capita; in fact, to move from being one of the poorest countries to being amongst the richest would require an increase of many 100s of percent. Therefore, in 2020, Guinea had a government revenue per capita of USD 72 (2015 prices), while the USA had a revenue of over USD 10,000. To move Guinea to USA revenue levels would need an increase of 13,000%, and this would imply a considerable decrease in corruption levels.

While these results seem very satisfactory, we felt it would be worth checking their robustness using a completely different methodology. We, therefore, now turn to an investigation of the same question but using a panel vector autoregressive (VAR) model. A VAR model avoids the problem of the endogeneity of some of the variables by treating all variables in an equivalent manner, that is, as endogenous. Therefore, we begin by estimating a series of bivariate VAR models between each of our governance indicators and government revenue. We then estimate a single VAR for all five indicators, which work well (again, not voice) and government revenue.

A standard VAR may be expressed in the following general way:

where is a vector of n variables for each country i and over t time periods and is a matrix lag polynomial. In our initial VARs, n = 2, that is, each of our governance and government revenue measures. In the final VAR, n = 6 for the five governance measures together and government revenue. One of the advantages of the VAR methodology is that the investigator only must make a limited range of decisions. First, the investigator must choose the variables of interest. Then, the only other choice to make is the number of lags in the matrix lag polynomial. We have decided to base this decision on a range of information criteria. In particular, we used the final prediction error (FPE) criteria, the Akaike information criteria (AIC), the Schwarz information (SC) criteria, and the Hannan–Quinn (HQ) information criteria. Table 4 shows the recommended lag length by each of these criteria for each of the VARS, along with our final decision.

Table 4.

The choice of lag length for each VAR.

The first six rows show the chosen number of lags for each measure of governance with government revenue for each of the four information criteria and the choice of lags we have made based on this. Generally speaking, the FPE and AIC chose quite a long lag length of around 7, while the SC and HQ criteria chose a much shorter lag length of 1 or 2. Given the well-known result that SC and HQ often perform better in Monte Carlo studies (see, for example, Chan et al. (2017)) and our general preference for a shorter VAR length (as this usually produces smoother responses), our chosen number of lags is generally 1 or 2. Row 7 shows the results for a single VAR containing all the governance indicators except voice (where the VAR proved unsatisfactory, matching the GMM results) and government revenue.

To interpret the results of the VAR estimation more easily, we decided to reparametrise the VAR into a vector error correction model (VECM) in the following way.

This is simply a generalisation of the equilibrium correction model to a vector setting. The key vectors of the parameters of interest here are , which control the speed of adjustment to the equilibrium ( is the effect in the governance equation and is the effect in the government revenue equation) and which show the long-run relationship between the variables. For the two variable cases, we normalise so that is the long-run effect of government revenue on each of the governance indicators (because government revenue is in logs, we divide by 100 so that we may interpret the effect as a response to a 1% change in government revenue). While the general condition for stability in this model is complex, a sufficient condition is that and . The estimated values of the dynamic parameters of the system are of little interest; therefore, we did not report these, although we did show some simulations of each equation which contains the full dynamic specification of the VECM1. Table 5 reports the key parameters of interest.

Table 5.

The key parameters for the six bivariate VECM models.

The coefficient for the long-run effect of government revenue on the quality of governance indicators is generally significant and of the same order of magnitude as in Table 2 above. However, the two parameters which govern the rate of adjustment towards this long-run equilibrium are smaller and, in two cases (the rule of law and voice and accountability), are actually the wrong sign for , which could imply that the model does not move toward this long-run effect at all. All the adjustment coefficients for government revenue are correctly signed and significant, although they are still small. This suggests that there is a strong long-run effect of changes in the governance indicators on increasing government revenue; however, again, it is a slow effect. This emphasises the important simultaneity which links government revenue and governance together. In these results, there is again an incorrect sign in the adjustment coefficient on voice and accountability; therefore, in a similar result to the GMM results, voice and accountability does not seem to be affected by government revenue.

The picture given by these results is clear: (1) there is a very strong bi-directional link between government revenue and governance. (2) There is a similar order of magnitude in the long-run link between the two here and in the GMM results, and it is reasonable to assume that the adjustment process over a ten-year horizon will be very similar. We confirm this conjecture below.

We then went on to estimate a five-variable VECM involving corruption, government effectiveness, political stability, regulatory quality, and the rule of law; however, we did not include voice and accountability as the bivariate model performed so poorly. All the long-run coefficients were significant, as were the adjustment coefficients. However, for space reasons, we will not report these results as they add little to the analysis.

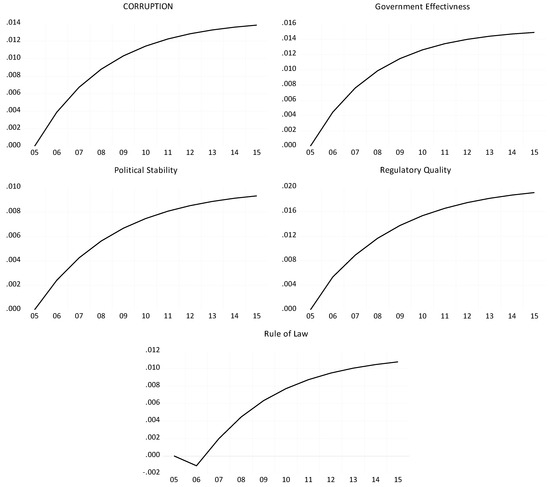

The next step in a standard VAR is to carry out impulse response analysis, that is, to shock the residuals of the VAR or VECM to determine how the system adjusts to a shock. The shock is usually set at one standard deviation of the variables in question, and this shock is usually only a one period shock; however, it can be set as a permanent change by cumulating the impulse responses over time. We have decided to depart from the standard procedure for several reasons: (1) the standard shock of one standard deviation turns out to be very large, as this would be calculated across all the countries in our sample and one standard deviation then represents a shock to government revenue of over 40%, which is unreasonably large. (2) Because government revenue is a part of the model, it also reacts to the shock, and government revenue continues to rise dramatically. Hence, the effect on the governance indicators becomes much larger than the initial effect would have been. This is then difficult to interpret. Because of this, we have decided to perform a different set of simulations which are more comparable to Figure 3. We take the estimated VECM and treat government revenue as exogenous and then increase government revenue by 10% and then solve for the increase in each of the governance indicators. Figure 4 shows the effects of this simulation experiment.

Figure 4.

The effect within the bi-variate VECMs of a 10% increase in per capita government revenue.

When Figure 4 is compared with Figure 3, the two sets of results are actually quite similar in the response over a ten-year horizon. These results are not quite as smooth as the GMM results, and this is because the dynamic effects in the VECM have not been removed when they are insignificant (as is standard in VAR analysis). However, the main point is that both techniques result in a very similar adjustment profile.

5. Conclusions and Policy Implications

In O’Hare and Hall (2022), we model the effect of government revenue and governance on SDG indicators (under-five mortality, maternal death rates in childbirth, basic water supply, safe water supply, basic sanitation, safe sanitation, percentage schooling and immunisation rates). We find that an increase in government revenues has a positive effect on these SDG indicators, and it is highly non-linear, with a much more significant impact in low-income countries than in high-income countries. We also find that this relationship is strongly affected by a range of quality of governance indicators. A weakness of this work is that we treated the governance indicators as exogenous variables. We believe that governance will also respond to economic development and that, by ignoring this effect, we may be underestimating the impact of an increase in government revenue on the SDG indicators. Thus, an increase in government revenue will directly impact the SDGs, but it will also have an indirect effect through an improvement in governance. In this study, we investigated the importance of this route with the aim of combining these sets of equations in a single model which will capture both effects.

We have employed two contrasting econometric methodologies to quantify the effects of an increase in the log of government revenue per capita on various indicators of governance quality (single equation GMM and a Vector Error Correction VECM model). Both models show significant effects of increasing government revenues on the governance indicators. The estimates of the long-run effects are of a similar order of magnitude, as is the speed of adjustment to this equilibrium. This yields a remarkably consistent picture over a ten-year horizon, as shown in Figure 3 and Figure 4.

The important insight gained from the VECM model is that, generally, we should not treat government revenue per capita as an exogenous variable. There is important feedback from governance to government revenue and from government revenue to governance. The simulations we have presented treat government revenue as an exogenous process and simply add a fixed amount to it to investigate the effect on governance. However, the VECM results suggest that there is more to the story. Over time, as governance improves, there will be further increases in government revenue which further improves governance, forming an important virtuous circle.

We have previously shown that the impact of government revenue and spending on progress towards the SDGs is non-linear (O’Hare and Hall 2022), with lower-income countries achieving higher benefits from marginal increases in government revenue compared to higher-income countries. This model shows that an increase in government revenue has a much more significant impact on progress towards the SDGs than our current model. Through its effects on improving the quality of governance over time, this is a slow effect that builds up significantly. Thus, identifying sources of lost revenues and inefficiencies could hold enormous potential for progress toward the SDGs.

While the effects may appear small in Figure 3 and Figure 4, it must be remembered that to move from being one of the poorest to one of the wealthiest countries would require a percentage increase in government revenue of the order of 13,000%. The effects on corruption of growth of this magnitude would be considerable numerically and in terms of the people living in these countries.

The current plan is to combine these results with those of O’Hare and Hall (2022) in an online, publicly available model as part of the Government Revenue and Development (GRADE) project (https://medicine.st-andrews.ac.uk/grade/ (accessed on 13 February 2023)) where any user will be able to simulate the total combined effect of the work for any country in the world.

The main limitation of this research has been data limitations. Many developing countries have either poor quality data or missing data. This is partly offset by panel data techniques, but, of course, there will always be data issues in such a study. In the future, we intend to extend the range of SDGs which we can cover and investigate using alternative measures of the quality of governance.

Author Contributions

The authors have made equal contributions to this paper. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded under the UN-WIDER contract 605UU-000000003380.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

This data uses publicly available data, which may be obtained by request from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The Government Revenue Data set (GRD) expresses all data as a percentage of GDP taken from the World Economic Outlook (WEO) in Local Currency Units (UNU-WIDER 2022). We converted government revenue as % of GDP into government revenue per capita. We used the latest World Development Indicators (WDI) edition for 217 countries (The World Bank 2022). For government revenue per capita, revenue excluding grants as a percentage of GDP was multiplied by the GDP per capita in constant 2015 US dollars, using the exchange rate from the WDI.

The Worldwide Governance Indicators:

The WGI reports aggregate and individual governance indicators for over 200 countries and territories from 1996 to 2019 for six dimensions of governance, see Table A1. These are composite indicators based on more than thirty data sources. Firstly, individual questions from the underlying sources are assigned to one of the aggregate indicators. The compilers then rescale the data to make it comparable across sources using the unobserved components model. The resulting composite measures are in units of a standard normal distribution with mean zero, running from −2.5 to +2.5 and higher values corresponding to better governance (Kaufmann et al. 2010; Kaufmann and Kraay 2020).

Table A1.

Definitions of dimensions of governance.

Table A1.

Definitions of dimensions of governance.

| Dimension of Governance | What It Captures |

|---|---|

| Control of corruption | Perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests |

| Government effectiveness | Perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the ’government’s commitment to such policies |

| Political stability | Perceptions of the likelihood that the government will be destabilised or overthrown by unconstitutional or violent means, including politically motivated violence and terrorism |

| Regulatory quality | Perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development |

| The Rule of aw | Perceptions of the extent to which agents have confidence in and abide by the rules of society, and, in particular, the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence |

| Voice and accountability | Perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media |

Table A2.

Summary statistics for the data used.

Table A2.

Summary statistics for the data used.

| Summary Statistics | Log of GovRevenue | Corruption | Government Effectiveness | Political Stability | Regulatory Quality | Rule of Law | Voice |

|---|---|---|---|---|---|---|---|

| Mean | 6.615058 | −0.025456 | −0.027234 | −0.023309 | −0.027688 | −0.026333 | −0.020176 |

| Median | 6.737415 | −0.260044 | −0.168511 | 0.075102 | −0.151505 | −0.166980 | 0.017095 |

| Maximum | 10.56818 | 2.469991 | 2.436975 | 1.965062 | 2.260543 | 2.129668 | 1.800992 |

| Minimum | 0.698960 | −1.905176 | −2.475142 | −2.43999 | −2.445041 | −2.496445 | −2.313395 |

| Std. Dev. | 1.856025 | 0.999715 | 0.995194 | 1.000297 | 0.995114 | 0.995753 | 0.999529 |

| Obs. | 5255 | 4393 | 4379 | 4410 | 4379 | 4451 | 4445 |

Note

| 1 | In general, for a VAR with 1 lag, the VECM will not include lagged dynamic terms; where the VAR has 2 lags, there will be 1 lagged dynamic term. |

References

- Abbas, Qamar, Li Junqing, Muhammad Ramzan, and Sumbal Fatima. 2021. Role of governance in debt-growth relationship: Evidence from panel data estimations. Sustainability 13: 5954. [Google Scholar] [CrossRef]

- Acemoglu, Daron, and James A. Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity and Poverty. London: Profile Books. [Google Scholar]

- Almustafa, Hamza, Quang Khai Nguyen, Jia Liu, and Van Cuong Dang. 2023. The impact of COVID-19 on firm risk and performance in MENA countries: Does national governance quality matter? PLoS ONE 18: e0281148. [Google Scholar] [CrossRef]

- Anyanwu, John C., and Andrew E. O. Erhijakpor. 2009. Health Expenditures and Health Outcomes in Africa. African Development Review 21: 400–33. [Google Scholar] [CrossRef]

- Arif, Imtiaz, and Amna Sohail Rawat. 2018. Corruption, Governance, and Tax Revenue: Evidence from EAGLE Countries. Journal of Transnational Management 23: 119–33. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, and Stephen G. Hall. 2021. Applied Econometrics. New York: Palgrave Macmillan. [Google Scholar]

- Baldacci, Emanuele, Benedict Clements, Sanjeev Gupta, and Qiang Cui. 2008. Social Spending, Human Capital, and Growth in Developing Countries. World Development 36: 1317–41. [Google Scholar] [CrossRef]

- Baskaran, Thushyanthan, and Arne Bigsten. 2013. Fiscal Capacity and the Quality of Government in Sub-Saharan Africa. World Development 45: 92–107. [Google Scholar] [CrossRef]

- Besley, Timothy, and Torsten Persson. 2014. Why Do Developing Countries Tax So Little? Journal of Economic Perspectives 28: 99–120. [Google Scholar] [CrossRef]

- Çevik, Savaş, and M. Okan Taşar. 2013. Public Spending on Health Care and Health Outcomes: Cross Country Comparison. Journal of Business, Economics & Finance 2: 82–100. [Google Scholar]

- Chan, Sok-Gee, Zulkufly Ramly, and Mohd Zaini Abd Karim. 2017. Government Spending Efficiency on Economic Growth: Roles of Value-Added Tax. Global Economic Review 46: 162–88. [Google Scholar] [CrossRef]

- Chong, Alberto, and César Calderón. 2000. Institutional Quality and Poverty Measures in a Cross-Section of Countries. Economics of Governance 1: 123–35. [Google Scholar] [CrossRef]

- Cooray, Arusha, Ratbek Dzhumashev, and Friedrich Schneider. 2017. How Does Corruption Affect Public Debt? An Empirical Analysis. World Development 90: 115–27. [Google Scholar] [CrossRef]

- Cuthbertson, Keith, Stephen G. Hall, and Mark P. Taylor. 1992. Applied Econometric Techniques. London: Philip Allan. [Google Scholar]

- Dang, Van Cuong, Quang Khai Nguyen, and Xuan Hang Tran. 2022. Corruption, institutional quality and shadow economy in Asian countries. Applied Economics Letters, 1–6. [Google Scholar] [CrossRef]

- Delavallade, Clara. 2006. Corruption and Distribution of Public Spending in Developing Countries. Journal of Economics and Finance 30: 222–39. [Google Scholar] [CrossRef]

- Dhrifi, Abdelhafidh. 2020. Public Health Expenditure and Child Mortality: Does Institutional Quality Matter? Journal of the Knowledge Economy 11: 692–706. [Google Scholar] [CrossRef]

- Factor, Roni, and Minah Kang. 2015. Corruption and Population Health Outcomes: An Analysis of Data from 133 Countries Using Structural Equation Modeling. International Journal of Public Health 60: 633–41. [Google Scholar] [CrossRef] [PubMed]

- Farag, Marwa, A. K. Nandakumar, Stanley Wallack, Dominic Hodgkin, Gary Gaumer, and Can Erbil. 2013. Health Expenditures, Health Outcomes and the Role worldwidernance. International Journal of Health Care Finance and Economics 13: 33–52. [Google Scholar] [CrossRef]

- Fisher, Ronald A. 1922. On the Interpretation of Χ2 from Contingency Tables, and the Calculation of P. Royal Statistical Society 85: 87–94. [Google Scholar] [CrossRef]

- Gupta, Abhijit Sen. 2007. Determinants of Tax Revenue Efforts in Developing Countries. IMF Working Paper 07/184. Singapore: International Monetary Fund. [Google Scholar]

- Gupta, Sanjeev, Marijn Verhoeven, and Erwin R Tiongson. 2002. The Effectiveness of Government Spending on Education and Health Care in Developing and Transition Economies. European Journal of Political Economy 18: 717–37. [Google Scholar] [CrossRef]

- Haile, Fiseha, and Miguel Niño-Zarazúa. 2018. Does Social Spending Improve Welfare in Low-Income and Middle-Income Countries? Journal of International Development 30: 367–98. [Google Scholar] [CrossRef]

- Hall, Stephen, Janine Illian, Innocent Makuta, Kyle McNabb, Stuart Murray, Bernadette A. M. O’Hare, Andre Python, Syed Haider Ali Zaidi, and Naor Bar-Zeev. 2020. Government Revenue and Child and Maternal Mortality. Open Economies Review 32: 213–29. [Google Scholar] [CrossRef]

- Hanf, Matthieu, Mathieu Nacher, Chantal Guihenneuc, Pascale Tubert-Bitter, and Michel Chavance. 2013. Global Determinants of Mortality in under 5s: 10 Year Worldwide Longitudinal Study. BMJ 347: f6427. [Google Scholar] [CrossRef] [PubMed]

- Hu, Bingjie, and Ronald U. Mendoza. 2013. Public Health Spending, Governance and Child Health Outcomes: Revisiting the Links. Journal of Human Development and Capabilities 14: 285–311. [Google Scholar] [CrossRef]

- Igbinovia, Ikponmwosa, and Chizoba Marcella Ekwueme. 2020. A Study on the Contributions of Corruption and Governance to the Productivity of Tax Systems in Sub-Saharan Africa. The Journal of Accounting and Management 10: 59–60. [Google Scholar]

- Jahnke, Björn. 2017. How Does Petty Corruption Affect Tax Morale in Sub-Saharan Africa? An Empirical Analysis Standard-Nutzungsbedingungen. UNU Wider Working Paper 2017/8. Helsinki: UNU-WIDER. [Google Scholar] [CrossRef]

- Kao, Chihwa. 1999. Spurious Regression and Residual-Based Tests for Cointegration in Panel Data. Journal of Econometrics 90: 1–44. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, and Aart Kraay. 2013. World Governance Indicators. Available online: https://info.worldbank.org/governance/wgi/ (accessed on 13 February 2023).

- Kaufmann, Daniel, and Aart Kraay. 2020. Worldwide Governance Indicators. Available online: http://info.worldbank.org/governance/wgi/ (accessed on 13 February 2023).

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators Methodology and Analytical Issues. Washington, DC: Development Research Group, The World Bank. [Google Scholar]

- Kuruvilla, Shyama, Julian Schweitzer, David Bishai, Sadia Chowdhury, Daniele Caramani, Laura Frost, Rafael Cortez, Bernadette Daelmans, Andres de Francisco, Taghreed Adam, and et al. 2014. Success Factors for Reducing Maternal and Child Mortality. Bull World Health Organ 92: 533–44. [Google Scholar] [CrossRef] [PubMed]

- Langnel, Zechariah, and Ponlapat Buracom. 2020. Governance, Health Expenditure and Infant Mortality in Sub-Saharan Africa. African Development Review 32: 673–85. [Google Scholar] [CrossRef]

- Larsson, Rolf, Johan Lyhagen, and Mickael Löthgren. 2001. Likelihood-based Cointegration Tests in Heterogeneous Panels. The Econometrics Journal 4: 109–42. [Google Scholar] [CrossRef]

- Long, Cathal, and Mark Miller. 2017. Taxation and the Sustainable Development Goals: Do Good Things Come to Those Who Tax More? Available online: https://odi.org/en/publications/taxation-and-the-sustainable-development-goals-do-good-things-come-to-those-who-tax-more/ (accessed on 13 February 2023).

- Makuta, Innocent, and Bernadette O’Hare. 2015. Quality of Governance, Public Spending on Health and Health Status in Sub Saharan Africa: A Panel Data Regression Analysis. BMC Public Health 15: 932. [Google Scholar] [CrossRef]

- Mauro, Paolo. 1998. Corruption and the Composition of Government Expenditure. Journal of Public Economics 69: 263–79. [Google Scholar] [CrossRef]

- Moore, Mick. 2007. How Does Taxation Affect the Quality of Governance? IDS WP 280. Available online: https://opendocs.ids.ac.uk/opendocs/handle/20.500.12413/12795 (accessed on 13 February 2023).

- Moyer, Jonathan D., and Steve Hedden. 2020. Are We on the Right Path to Achieve the Sustainable Development Goals? World Development 127: 104749. [Google Scholar] [CrossRef]

- Murshed, Muntasir, and Ashraf Ahmed. 2018. An Assessment of the Marginalizing Impact of Poor Governance on the Efficacy of Public Health Expenditure in LMICS. World Review of Business Research 8: 147–60. [Google Scholar]

- Musa, Kazi, Kazi Sohag, Jamaliah Said, Farha Ghapar, and Norli Ali. 2023. Public Debt, Governance, and Growth in Developing Countries: An Application of Quantile via Moments. Mathematics 11: 650. [Google Scholar] [CrossRef]

- Nketiah-Amponsah, Edward. 2019. The Impact of Health Expenditures on Health Outcomes in Sub-Saharan Africa. Journal of Developing Societies 35: 134–52. [Google Scholar] [CrossRef]

- Nyamongo, M. E., and Nicolaas Johannes Schoeman. 2010. The Quality of Governance and Education Spending in Africa. African Business 14: 1–23. Available online: https://www.ajol.info/index.php/sabr/article/view/76361 (accessed on 13 February 2023).

- O’Hare, Bernadette, and Steve G. Hall. 2022. The Impact of Government Revenue on the Achievement of the Sustainable Development Goals and the Amplification Potential of Good Governance. The Central European Journal of Economic Modelling and Econometrics 14: 109–29. [Google Scholar]

- O’Hare, Bernadette, Stephen Hall, and Stuart Murray. 2020. The Government Revenue and Development Estimations (GRADE). Available online: http://medicine.st-andrews.ac.uk/grade/ (accessed on 13 February 2023).

- Rajkumar, Andrew Sunil, and Vinaya Swaroop. 2008. Public Spending and Outcomes: Does Governance Matter? Journal of Development Economics 86: 96–111. [Google Scholar] [CrossRef]

- Reeves, Aaron, Yannis Gourtsoyannis, Sanjay Basu, David McCoy, Martin McKee, and David Stuckler. 2015. Financing Universal Health Coverage—Effects of Alternative Tax Structures on Public Health Systems: Cross-National Modelling in 89 Low-Income and Middle-Income Countries. The Lancet 386: 274–80. [Google Scholar] [CrossRef]

- Sanoussi, Yacobou, and Mamadou Boukari. 2020. Analysis of the Link between Health Expenditures and Health Outcomes in Africa. Ann. Univ. Lomé, série Sc. Eco. Gest XVII: 51–66. [Google Scholar]

- Tamarappoo, Ramji, Pooja Pokhrel, Muthu Raman, and Jincy Francy. 2016. Analysis of the Linkage Between Domestic Revenue Mobilization and Social Analysis of the Linkage Between Domestic Revenue Mobilization and Social Sector Spending. Available online: https://pdf.usaid.gov/pdf_docs/pbaae640.pdf (accessed on 13 February 2023).

- The World Bank. 2022. Databank: World Development Indicators. Available online: http://databank.worldbank.org/data/source/world-development-indicators (accessed on 13 February 2023).

- Ugur, Mehmet. 2014. Corruptions Direct Effects on per Capita-Income Growth; A Meta-Analysis. Journal of Economic Surveys 28: 472–90. [Google Scholar] [CrossRef]

- United Nations—Office of the High Commissioner of Human Rights. 2021. Sustainable Development Goals and Human Rights. Available online: https://www.ohchr.org/EN/Issues/SDGS/Pages/The2030Agenda.aspx (accessed on 13 February 2023).

- UNU-WIDER. 2022. Data for Tax Revenue Mobilization. Available online: https://www.wider.unu.edu/opportunity/data-tax-revenue-mobilization (accessed on 13 February 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).