Impact of Patent Signal on Firm’s Performance at IPO: An Empirical Analysis of Japanese Firms

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. IPO, Information Asymmetry, and Quality Signal

2.2. Patent Practices in the IPO Context

2.3. Patent Practice and Industry Characteristics

3. Methodology

3.1. Data

3.2. Variables

3.2.1. Dependent Variables

3.2.2. Independent Variables

3.2.3. Control Variables

- Firm Size: Larger firms (in terms of size) generally perform better than smaller firms (Ritter and Welch 2002). We calculate the firm size (SIZE) as the natural logarithm of the total number of employees in the year preceding IPO (Welbourne and Andrews 1996).

- Firm Age: In general, older businesses perform better than newer ones (Ritter 1998). The natural logarithm of the interval between the year of the IPO and the year of the business’s founding is used to determine the firm age (AGE).

- Financial Ratio: To measure the stability of a firm, we choose the leverage ratio debt-to-equity ratio in the year preceding the IPO (D/E RATIO) (Herawati 2017). The more stable and less risky the financial structure, the smaller this ratio. We use a natural log transformation of D/ERATIO to account for the data’s skewedness.

- High-tech Dummy: To distinguish high-tech from traditional firms, we have constructed two dummy variables using information drawn from the international standard industrial classification conducted by the OECD (Galindo-Rueda and Verger 2016). This categorizes industries by their R&D intensity (See Appendix B for the industrial classification). The sector is high-tech if the R&D intensity is above 5%, and low-tech if below 5%. The HILO_DUMMY variable is assessed as “1” for high-tech IPOs and “0” for low-tech IPOs.

- Underwriter Reputation Dummy: High-ranking underwriters signal a high-quality offering, which may improve the success of an IPO (Loughran and Ritter 2004; Brau and Fawcett 2006). To measure the effect of underwriter reputation on IPO performance, we include UW_DUMMY to our model. UW_DUMMY variable is assessed as “1” if the underwriter belongs to one of top five Japanese underwriters: Mizuho, Nomura, Daiwa, Mitsubishi UFJ Morgan Stanley, or SMBC Nikko according to Statista and “0” otherwise.

- Stock Exchange Dummy: Decisions made by investors may be influenced by the stock exchanges on which the IPO firm’s shares are listed (Corwin and Harris 2001). We add the STOCK_DUMMY variable to our model to represent the exchange in which the IPO firm is listed. The STOCK_DUMMY recorded a value of 1 for the firm that is listed on the Tokyo Stock Market (TSE), the largest stock exchange in Japan, and a value of 0 for all other companies.

- Venture Capitalist Backing Dummy: We also accounted for the potential implications of venture capital backing (VC_DUMMY) (Certo et al. 2001). This factor has been demonstrated to have an impact on how well an IPO business can raise money (Brav and Gompers 2003; Gulati and Higgins 2003). We count a value of 1 for IPOs backed by venture capitalists and 0 otherwise.

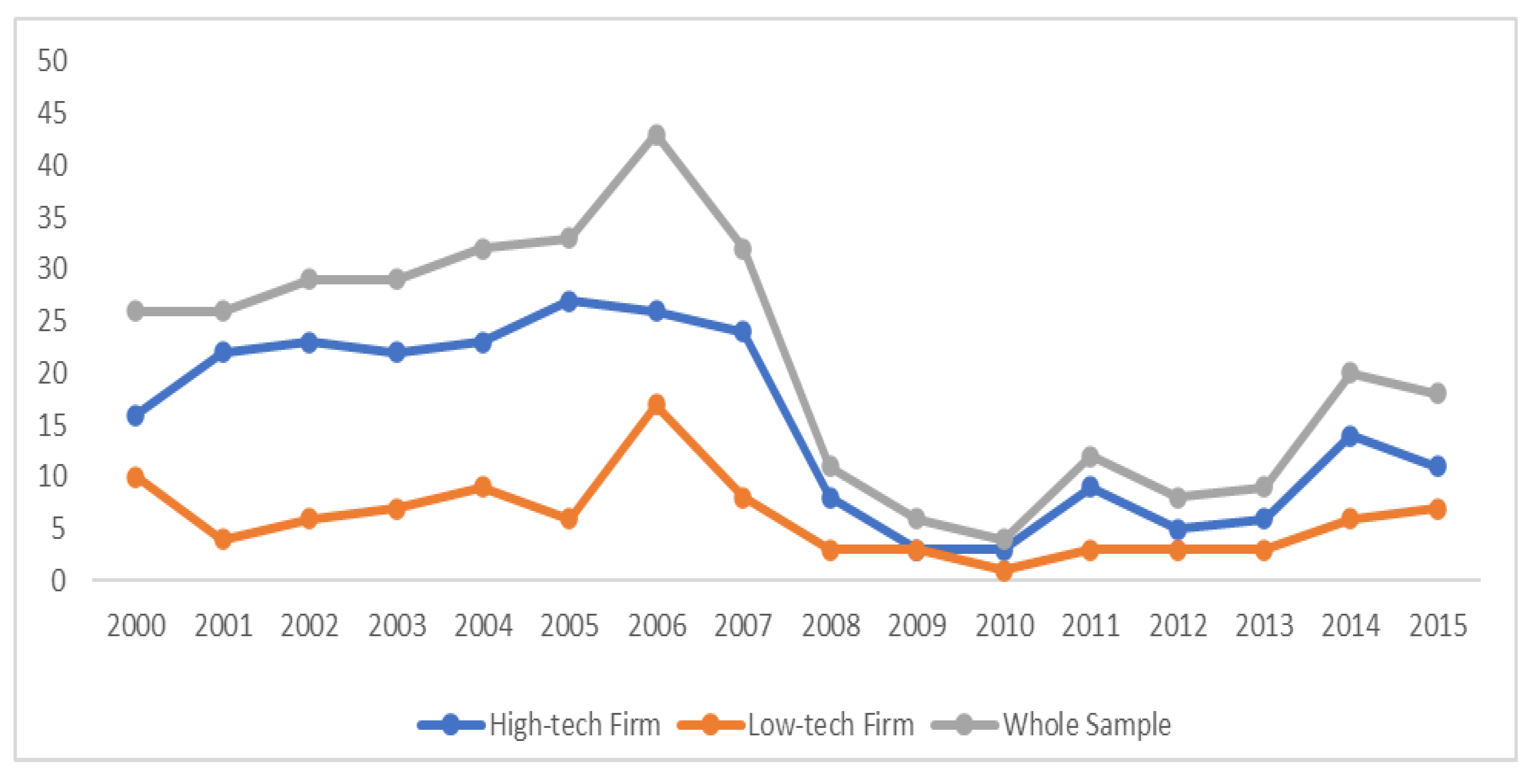

- Year Dummy: To account for IPO time-specific tendencies, we additionally append the whole set of year dummies as “Year2000” through “Year2015”.

3.3. Econometric Model

4. Result

4.1. Preliminary Analysis

4.2. Main Analysis

4.3. Robustness Test

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Panel I (OECD Classification) STOCK_PATENT = PAT5 | Panel II (Thomson Reuter Classification) STOCK_PATENT = PAT5 | |||

|---|---|---|---|---|

| Model 1 (H1) | Model 2 (H2) | Model 3 (H1) | Model 4 (H2) | |

| Intercept | 5.7679 *** 0.391 | 5.6627 *** 0.393 | 5.6594 *** 0.409 | 5.6253 *** 0.406 |

| PAT5 | 0.0003 * 0.000 | 0.0035 *** 0.002 | 0.0004 ** 0.000 | 0.0014 *** 0.000 |

| PAT5*HILO_DUMMY | −0.0032 * 0.002 | −0.0012 ** 0.000 | ||

| SIZE | 0.3917 *** 0.058 | 0.3884 *** 0.058 | 0.3878 *** 0.058 | 0.3652 *** 0.058 |

| AGE | −0.3592 *** 0.093 | −0.3496 *** 0.092 | −0.3113 *** 0.097 | −0.2884 *** 0.096 |

| D/E RATIO | −0.0569 0.063 | −0.0548 0.062 | −0.0624 0.062 | −0.0595 0.061 |

| HILO_DUMMY | 0.3221 ** 0.152 | 0.4364 *** 0.162 | 0.3309 ** 0.149 | 0.2132 *** 0.076 |

| UW_DUMMY | 0.2750 * 0.166 | 0.2759 * 0.165 | 0.2753 * 0.166 | 0.3132 * 0.196 |

| STOCK_DUMMY | 0.4982 ** 0.193 | 0.4347 ** 0.195 | 0.5224 *** 0.192 | 0.4891 ** 0.191 |

| VC_DUMMY | −0.1470 0.147 | −0.1588 0.146 | −0.1573 0.147 | −0.2067 0.147 |

| YEAR_DUMMY | Yes | Yes | Yes | Yes |

| Adj_R_square | 0.272 | 0.278 | 0.283 | 0.284 |

| F-STATISTIC | 16.72 | 15.40 | 15.79 | 15.88 |

| PROB(F-STATISTIC) | 8.34 × 10−21 | 6.09 × 10−21 | 1.87 × 10−21 | 1.42 × 10−21 |

| Observation | 338 | 338 | 338 | 338 |

Appendix B

| High-Tech | Low-Tech | |

|---|---|---|

| Manufacturing | Air and spacecraft and related machinery; Pharmaceuticals; Computer, electronic, and optical products; Weapons and ammunition; Motor vehicles, trailers, and semi-trailers; Medical and dental instruments; Machinery and equipment n.e.c; Chemicals and chemical products; Electrical equipment; Railroad, military vehicles, and transport. | Rubber and plastic products; Building of ships and boats; Other manufacturing except medical and dental instruments; Other non-metallic mineral products; Basic metals; Repair and installation of machinery and equipment; Textiles; Leather and related products; Paper and paper products; Food products, beverages, and tobacco Wearing apparel; Fabricated metal products except for weapons and ammunition; Coke and refined petroleum products; Furniture; Wood and products of wood and cork; Printing and reproduction of recorded media. |

| Non-Manufacturing | Scientific research and development; Software publishing; IT and other information services. | Professional, scientific, and technical activities, except for scientific R&D; Telecommunications; Mining and quarrying; Publishing of books and periodicals; Financial and insurance activities; Electricity, gas and water supply, waste management, and remediation; Audiovisual and broadcasting activities; Wholesale and retail trade; Agriculture, forestry, and fishing; Construction; Administrative and support service activities; Arts, entertainment, repair of household goods, and other services; Transportation and storage; Accommodation and food service activities; Real estate activities. |

| 1 | We report regression results where PAT5 is used as an independent variable in Model 1 and Model 2 in Appendix A. |

| 2 | The finding also holds true when we use PATENT_STOCK, which is equal to PAT5 as an independent variable. The coefficient of PAT5 in Model 1 received the positive value of 0.0003 at the 5% significant level (see Model 1 in Appendix A for details). |

| 3 | The result when we apply PATENT_STOCK is equal to PAT5, which also shows a consistent result with Model 2. Specifically, the sign of the interaction PAT5*HILO_DUMMY is negative (−0.0032*) and significant at 10% (see Model 2 in Appendix A for details). |

| 4 | The coefficients of PAT5 in Model 3 also receive the positive value of 0.0004 at the 5% significant level (see Model 3 in Appendix A for details). |

| 5 | The result when we apply PATENT_STOCK is equal to PAT5, which also shows a consistent result with Model 2. Specifically, the signs of the interaction PAT5*HILO_DUMMY are negative (−0.0012) and significant at 10% (see Model 4 in Appendix A for details). |

References

- Acharya, Viral, and Zhaoxia Xu. 2017. Financial dependence and innovation: The case of public versus private firms. Journal of Financial Economics 124: 223–43. [Google Scholar] [CrossRef]

- Aggarwal, Rajesh, Sanjai Bhagat, and Srinivasan Rangan. 2009. The impact of fundamentals on IPO valuation. Financial Management 38: 253–84. [Google Scholar] [CrossRef]

- Ahlers, Gerrit K. C., Douglas Cumming, Christina Günther, and Denis Schweizer. 2015. Signaling in equity crowdfunding. Entrepreneurship Theory and Practice 39: 955–80. [Google Scholar] [CrossRef]

- Ahmad-Zaluki, Nurwati A., and Lim Boon Kect. 2012. The investment performance of mesdaq market initial public offerings (IPOs). Asian Academy of Management Journal of Accounting & Finance 8: 1–23. [Google Scholar]

- An, Heng Hunter, and Kam C. Chan. 2008. Credit ratings and IPO pricing. Journal of Corporate Finance 14: 584–95. [Google Scholar] [CrossRef]

- An, Le, Yoshiyuki Matsuura, and Norliza Yahya. 2022. Patent Signals of IPO Performance: Evidence from High- and Low-Tech Industries in Japan. The Asian Journal of Technology Management (AJTM) 15: 21–39. [Google Scholar] [CrossRef]

- Asteriou, Dimitros, and Stephen G. Hall. 2011. Applied Econometrics. London: Palgrave Macmillan. [Google Scholar]

- Baum, Joel A. C., and Brian S. Silverman. 2004. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing 19: 411–36. [Google Scholar] [CrossRef]

- Bergh, Donald D., Brian L. Connelly, David J. Ketchen, Jr., and Lu M. Shannon. 2014. Signalling theory and equilibrium in strategic management research: An assessment and a research agenda. Journal of Management Studies 51: 1334–60. [Google Scholar] [CrossRef]

- Bessler, Wolfgang, and Claudia Bittelmeyer. 2008. Patents and the performance of technology firms: Evidence from initial public offerings in Germany. Financial Markets and Portfolio Management 22: 323–56. [Google Scholar] [CrossRef]

- Brau, James C., and Stanley E. Fawcett. 2006. Evidence on what CFOs think about the IPO process: Practice, theory, and managerial implications. Journal of Applied Corporate Finance 18: 107–17. [Google Scholar] [CrossRef]

- Brav, Alon, and Paul A. Gompers. 2003. The role of lockups in initial public offerings. The Review of Financial Studies 16: 1–29. [Google Scholar] [CrossRef]

- Brown, James R., Gustav Martinsson, and Bruce C. Petersen. 2012. Do financing constraints matter for R&D? European Economic Review 56: 1512–29. [Google Scholar]

- Buenechea-Elberdin, Marta, Aino Kianto, and Josune Sáenz. 2018. Intellectual capital drivers of product and managerial innovation in high-tech and low-tech firms. R&D Management 48: 290–307. [Google Scholar]

- Buenechea-Elberdin, Marta, Josune Sáenz, and Aino Kianto. 2017. Exploring the role of human capital, renewal capital and entrepreneurial capital in innovation performance in high-tech and low-tech firms. Knowledge Management Research & Practice 15: 369–79. [Google Scholar]

- Cao, Jerry, and Po-Hsuan Hsu. 2011. The informational role of patents in venture capital financing. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Cao, Zixia, Reo Song, Alina Sorescu, and Ansley Chua. 2022. Innovation Potential, Insider Sales, and IPO Performance: How Firms Can Mitigate the Negative Effect of Insider Selling. Journal of Marketing. [Google Scholar] [CrossRef]

- Carpenter, Mason A., Timothy G. Pollock, and Myleen M. Leary. 2003. Testing a model of reasoned risk-taking: Governance, the experience of principals and agents, and global strategy in high-technology IPO firms. Strategic Management Journal 24: 803–20. [Google Scholar] [CrossRef]

- Carter, Richard B., Frederick H. Dark, and Ajai K. Singh. 1998. Underwriter reputation, initial returns, and the long-run performance of IPO stocks. The Journal of Finance 53: 285–311. [Google Scholar] [CrossRef]

- Certo, S. Trevis. 2003. Influencing initial public offering investors with prestige: Signaling with board structures. Academy of Management Review 28: 432–46. [Google Scholar] [CrossRef]

- Certo, S. Trevis, Catherine M. Daily, and Dan R. Dalton. 2001. Signaling firm value through board structure: An investigation of initial public offerings. Entrepreneurship Theory and Practice 26: 33–50. [Google Scholar] [CrossRef]

- Certo, S. Trevis, R. Michael Holmes, Jr., and Tim R. Holcomb. 2007. The influence of people on the performance of IPO firms. Business Horizons 50: 271–76. [Google Scholar] [CrossRef]

- Certo, S. Trevis, Tim R. Holcomb, and R. Michael Holmes, Jr. 2009. IPO research in management and entrepreneurship: Moving the agenda forward. Journal of management 35: 1340–78. [Google Scholar] [CrossRef]

- Chahine, Salim, and Marc Goergen. 2013. The effects of management-board ties on IPO performance. Journal of Corporate Finance 21: 153–79. [Google Scholar] [CrossRef]

- Chatzoglou, Prodromos, and Dimitrios Chatzoudes. 2017. The role of innovation in building competitive advantages: An empirical investigation. European Journal of Innovation Management 21: 44–69. [Google Scholar] [CrossRef]

- Coad, Alex, Agustí Segarra, and Mercedes Teruel. 2016. Innovation and firm growth: Does firm age play a role? Research Policy 45: 387–400. [Google Scholar] [CrossRef]

- Cohen, Boyd D., and Thomas J. Dean. 2005. Information asymmetry and investor valuation of IPOs: Top management team legitimacy as a capital market signal. Strategic Management Journal 26: 683–90. [Google Scholar] [CrossRef]

- Cohen, Wesley M., Richard Nelson, and John P. Walsh. 2000. Protecting Their Intellectual Assets: Appropriability Conditions and Why US Manufacturing Firms Patent (Or Not). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011. Signaling theory: A review and assessment. Journal of Management 37: 39–67. [Google Scholar]

- Conti, Annamaria, Jerry Thursby, and Marie Thursby. 2013. Patents as signals for startup financing. The Journal of Industrial Economics 61: 592–622. [Google Scholar] [CrossRef]

- Corwin, Shane A., and Jeffrey H. Harris. 2001. The initial listing decisions of firms that go public. Financial Management, 35–55. [Google Scholar]

- Cozza, Claudio, Franco Malerba, Maria Luisa Mancusi, Giulio Perani, and Andrea Vezzulli. 2012. Innovation, profitability and growth in medium and high-tech manufacturing industries: Evidence from Italy. Applied Economics 44: 1963–76. [Google Scholar] [CrossRef]

- Czarnitzki, Dirk, and Cindy Lopes-Bento. 2014. Innovation subsidies: Does the funding source matter for innovation intensity and performance? Empirical evidence from Germany. Industry and Innovation 21: 380–409. [Google Scholar] [CrossRef]

- Daily, Catherine M., S. Trevis Certo, and Dan R. Dalton. 2005. Investment bankers and IPO pricing: Does prospectus information matter? Journal of Business Venturing 20: 93–111. [Google Scholar] [CrossRef]

- De Carolis, Donna Marie. 2010. Technological Characteristics of Industries. Chippenham: Wiley-Blackwell. [Google Scholar]

- De Rassenfosse, Gaètan, Helene Dernis, Dominique Guellec, Lucio Picci, and Bruno van Pottelsberghe de la Potterie. 2013. The worldwide count of priority patents: A new indicator of inventive activity. Research Policy 42: 720–37. [Google Scholar] [CrossRef]

- Deeds, David L., Dona Decarolis, and Joseph E. Coombs. 1997. The impact of firmspecific capabilities on the amount of capital raised in an initial public offering: Evidence from the biotechnology industry. Journal of Business Venturing 12: 31–46. [Google Scholar] [CrossRef]

- Detragiache, Enrica, Poonam Gupta, and Asli Demirgüç-Kunt. 2000. Inside the Crisis: An Empirical Analysis of Banking Systems in Distress. Washington, DC: World Bank. [Google Scholar]

- Dong, Ming, Jean-Sébastien Michel, and J. Ari Pandes. 2011. Underwriter quality and long-run IPO performance. Financial Management 40: 219–51. [Google Scholar] [CrossRef]

- Feldman, Robin, and Evan Frondorf. 2015. Patent demands and initial public offerings. Stanford Technology Law Review 19: 52. [Google Scholar]

- Galindo-Rueda, Fernando, and Fabien Verger. 2016. OECD Taxonomy of Economic Activities Based on R&D Intensity. Paris: OECD. [Google Scholar]

- Gao, Simon, and Tony Chieh-Tse Hou. 2019. An empirical examination of IPO underpricing between high-technology and non-high-technology firms in Taiwan. Journal of Emerging Market Finance 18: 23–51. [Google Scholar] [CrossRef]

- Gompers, Paul A. 1996. Grandstanding in the venture capital industry. Journal of Financial Economics 42: 133–56. [Google Scholar] [CrossRef]

- Graham, Stuart, and Ted Sichelman. 2008. Why Do Start-Ups Patent? Berkeley Technology Law Journal 23: 1063. [Google Scholar]

- Greenberg, Gili. 2013. Small firms, big patents? Estimating patent value using data on israeli start-ups’ financing rounds. European Management Review 10: 183–96. [Google Scholar] [CrossRef]

- Griliches, Zvi. 1998. Patent statistics as economic indicators: A survey. In R&D and Productivity: The Econometric Evidence. Chicago: University of Chicago Press, pp. 287–343. [Google Scholar]

- Gu, Anthony Yanxiang. 2003. State ownership, firm size, and IPO performance: Evidence from Chinese “A” share issues. American Business Review 21: 101. [Google Scholar]

- Guiso, Luigi. 1998. High-tech firms and credit rationing. Journal of Economic Behavior and Organization 35: 39–59. [Google Scholar] [CrossRef]

- Gulati, Ranjay, and Monica C. Higgins. 2003. Which ties matter when? The contingent effects of interorganizational partnerships on IPO success. Strategic Management Journal 24: 127–44. [Google Scholar] [CrossRef]

- Guo, Wen-Chung, Shin-Rong Shiah-Hou, and Wei-Jer Chien. 2012. A study on intellectual capital and firm performance in biotech companies. Applied Economics Letters 19: 1603–8. [Google Scholar] [CrossRef]

- Haeussler, Carolin, Dietmar Harhoff, and Elisabeth Mueller. 2014. How patenting informs VC investors—The case of biotechnology. Research Policy 43: 1286–98. [Google Scholar] [CrossRef]

- Hagedoorn, John. 2003. Sharing intellectual property rights—An exploratory study of joint patenting amongst companies. Industrial and Corporate Change 12: 1035–50. [Google Scholar] [CrossRef]

- Hall, Bronwyn H., Adam Jaffe, and Manuel Trajtenberg. 2005. Market value and patent citations. RAND Journal of Economics 36: 16–38. [Google Scholar]

- Hall, Bronwyn H., and Christian Helmers. 2019. The impact of international patent systems: Evidence from accession to the European Patent Convention. Research Policy 48: 103810. [Google Scholar] [CrossRef]

- Hall, Bronwyn H., and Rosemarie Ham Ziedonis. 2001. The patent paradox revisited: An empirical study of patenting in the US semiconductor industry, 1979–1995. Rand Journal of Economics, 101–28. [Google Scholar]

- Häussler, Carolin, Dietmar Harhoff, and Elisabeth Müller. 2012. To Be Financed or Not…-The Role of Patents for Venture Capital-Financing. ZEW-Centre for European Economic Research Discussion Paper. Mannheim: ZEW. [Google Scholar]

- He, Ping. 2007. A theory of IPO waves. The Review of Financial Studies 20: 983–1020. [Google Scholar] [CrossRef]

- Heeley, Michael B., Sharon F. Matusik, and Neelam Jain. 2007. Innovation, appropriability, and the underpricing of initial public offerings. Academy of Management Journal 50: 209–25. [Google Scholar] [CrossRef]

- Herawati, Aty. 2017. The Factors Affecting Initial Return on IPO Company in IDX 2007–2012. International Journal of Economic Perspectives 11: 1499–509. [Google Scholar]

- Higgins, Matthew J., Paula E. Stephan, and Jerry G. Thursby. 2011. Conveying quality and value in emerging industries: Star scientists and the role of signals in biotechnology. Research Policy 40: 605–17. [Google Scholar] [CrossRef]

- Higgins, Monica C., and Ranjay Gulati. 2006. Stacking the deck: The effects of top management backgrounds on investor decisions. Strategic Management Journal 27: 1–25. [Google Scholar] [CrossRef]

- Hoenen, Sebastian, Christos Kolympiris, Wilfred Schoenmakers, and Nicholas Kalaitzandonakes. 2014. The diminishing signaling value of patents between early rounds of venture capital financing. Research Policy 43: 956–89. [Google Scholar] [CrossRef]

- Hoenig, Daniel, and Joachim Henkel. 2015. Quality signals? the role of patents, alliances, and team experience in venture capital financing. Research Policy 44: 1049–64. [Google Scholar] [CrossRef]

- Hsu, David H., and Rosemarie H. Ziedonis. 2008. Patents as Quality Signals for Entrepreneurial Ventures. Briarcliff Manor: Academy of Management. [Google Scholar]

- Hsu, David H., and Rosemarie H. Ziedonis. 2013. Resources as dual sources of advantage: Implications for valuing entrepreneurial-firm patents. Strategic Management Journal 34: 761–81. [Google Scholar] [CrossRef]

- Jain, Bharat A., and Omesh Kini. 1999. The life cycle of initial public offering firms. Journal of Business Finance & Accounting 26: 1281–307. [Google Scholar]

- Jelic, Ranko, Brahim Saadouni, and Richard Briston. 2001. Performance of Malaysian IPOs: Underwriters reputation and management earnings forecasts. Pacific-Basin Finance Journal 9: 457–86. [Google Scholar] [CrossRef]

- Khoury, Theodore A., Marc Junkunc, and David L. Deeds. 2013. The social construction of legitimacy through signaling social capital: Exploring the conditional value of alliances and underwriters at IPO. Entrepreneurship Theory and Practice 37: 569–601. [Google Scholar] [CrossRef]

- Kim, Jaemin, Kuntara Pukthuanthong-Le, and Thomas Walker. 2008. Leverage and IPO under-pricing: High-tech versus low-tech IPOs. Management Decision 46: 106–30. [Google Scholar] [CrossRef]

- Kirkulak, Berna. 2008. The initial and long-run returns of Japanese venture capital-backed and non-venture capital-backed IPOs. International Journal of Managerial Finance 4: 112–35. [Google Scholar] [CrossRef]

- Lange, Julian E., William Bygrave, Sakura Nishimoto, James Roedel, and Walter Stock. 2001. Smart money? The impact of having top venture capital investors and underwriters backing a venture. Venture Capital: An International Journal of Entrepreneurial Finance 3: 309–26. [Google Scholar] [CrossRef]

- Leone, Andrew J., Steve Rock, and Michael Willenborg. 2007. Disclosure of intended use of proceeds and underpricing in initial public offerings. Journal of Accounting Research 45: 111–53. [Google Scholar] [CrossRef]

- Levin, Richard C., Alvin K. Klevorick, Richard R. Nelson, Sidney G. Winter, Richard Gilbert, and Zvi Griliches. 1987. Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity 1987: 783–831. [Google Scholar] [CrossRef]

- Levitas, Edward, and M. Ann McFadyen. 2009. Managing liquidity in research-intensive firms: Signaling and cash flow effects of patents and alliance activities. Strategic Management Journal 30: 659–78. [Google Scholar] [CrossRef]

- Li, Yue, and Bruce J. McConomy. 2004. Simultaneous signaling in IPOs via management earnings forecasts and retained ownership: An empirical analysis of the substitution effect. Journal of Accounting, Auditing & Finance 19: 1–28. [Google Scholar]

- LiPuma, Joseph A. 2012. Internationalization and the IPO performance of new ventures. Journal of Business Research 65: 914–21. [Google Scholar] [CrossRef]

- Long, Clarisa. 2002. Patent signals. The University of Chicago Law Review 69: 625–79. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay Ritter. 2004. Why has IPO underpricing changed over time? Financial Management 33: 5–37. [Google Scholar] [CrossRef]

- MacMillan, Ian C., Robin Siegel, and P. N. Subba Narasimha. 1985. Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing 1: 119–28. [Google Scholar] [CrossRef]

- Mann, Ronald J., and Thomas W. Sager. 2007. Patents, venture capital, and software start-ups. Research Policy 36: 193–208. [Google Scholar] [CrossRef]

- Mazzucato, Mariana. 2013. Financing innovation: Creative destruction vs. destructive creation. Industrial and Corporate Change 22: 851–67. [Google Scholar] [CrossRef]

- Mendonça, Sandro. 2009. Brave old world: Accounting for ‘high-tech’knowledge in ‘low-tech’industries. Research Policy 38: 470–82. [Google Scholar] [CrossRef]

- Morricone, Serena, Federico Munari, and Raffaele Oriani. 2010. Patent Commercialization Strategy and IPO Underpricing: Evidence from the US Semiconductor Industry. Available online: http://amsacta.unibo.it/2697/1/Morricone_paper_IPO_preprint.pdf (accessed on 18 January 2010).

- Morricone, Serena, Federico Munari, Raffaele Oriani, and Gaetan De Rassenfosse. 2017. Commercialization strategy and IPO underpricing. Research Policy 46: 1133–41. [Google Scholar] [CrossRef]

- Motohashi, Kazuyuki. 2008. Licensing or not licensing? An empirical analysis of the strategic use of patents by Japanese firms. Research Policy 37: 1548–55. [Google Scholar] [CrossRef]

- Motohashi, Kazuyuki. 2009. Catching up or lagging behind? Assessment of technological capacity of China by patent database. China Economic Journal 2: 1–24. [Google Scholar] [CrossRef]

- Mousa, Fariss–Terry, and Richard Reed. 2013. The impact of slack resources on high–tech IPOs. Entrepreneurship Theory and Practice 37: 1123–47. [Google Scholar] [CrossRef]

- Munari, Federico, and Laura Toschi. 2015. Do patents affect VC financing? Empirical evidence from the nanotechnology sector. International Entrepreneurship and Management Journal 11: 623–44. [Google Scholar] [CrossRef]

- Nagata, Kyoko, and Toyohiko Hachiya. 2007. Earnings management and the pricing of initial public offerings. Review of Pacific Basin Financial Markets and Policies 10: 541–59. [Google Scholar] [CrossRef]

- Pástor, Ľuboš, Lucian A. Taylor, and Pietro Veronesi. 2009. Entrepreneurial learning, the IPO decision, and the post-IPO drop in firm profitability. The Review of Financial Studies 22: 3005–46. [Google Scholar] [CrossRef]

- Peng, Xuan, Yibo Jia, Kam C. Chan, and Xiongyuan Wang. 2021. Let us work together: The impact of customer strategic alliances on IPO underpricing and post-IPO performance. Journal of Corporate Finance 67: 101899. [Google Scholar] [CrossRef]

- Phillips, Ryan L., and Rita Ormsby. 2016. Industry classification schemes: An analysis and review. Journal of Business & Finance Librarianship 21: 1–25. [Google Scholar]

- Pisano, Gary P. 2006. Can science be a business? Lessons from biotech. Harvard Business Review 84: 114–24. [Google Scholar] [PubMed]

- Prędkiewicz, Katarzyna, Marek Pauka, and Paweł Prędkiewicz. 2021. IPO Success of High-Technology Companies. European Research Studies Journal 24: 799–816. [Google Scholar] [CrossRef] [PubMed]

- Ragozzino, Roberto, and Dane P. Blevins. 2016. Venture–backed firms: How does venture Capital involvement affect their likelihood of going public or being acquired? Entrepreneurship Theory and Practice 40: 991–1016. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1998. Initial public offerings. Contemporary Finance Digest 2: 5–30. [Google Scholar]

- Ritter, Jay R., and Ivo Welch. 2002. A review of IPO activity, pricing, and allocations. The Journal of Finance 57: 1795–828. [Google Scholar] [CrossRef]

- Schankerman, Mark. 1998. How valuable is patent protection? Estimates by technology field. The RAND Journal of Economics 29: 77–107. [Google Scholar] [CrossRef]

- Schilling, Melissa A., and Ravi Shankar. 2019. Strategic Management of Technological Innovation. New York: McGraw-Hill Irwin Publisher. [Google Scholar]

- Solow, Robert M. 1957. Technical change and the aggregate production function. The Review of Economics and Statistics 39: 312–20. [Google Scholar] [CrossRef]

- Spence, A. Michael. 1973. Time and communication in economic and social interaction. The Quarterly Journal of Economics 87: 651–60. [Google Scholar] [CrossRef]

- Stuart, Toby E., Ha Hoang, and Ralph C. Hybels. 1999. Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly 44: 315–49. [Google Scholar] [CrossRef]

- Su, Chen, and Kenbata Bangassa. 2011. The impact of underwriter reputation on initial returns and long-run performance of Chinese IPOs. Journal of International Financial Markets, Institutions and Money 21: 760–91. [Google Scholar] [CrossRef]

- Taplin, Ruth. 2005. Risk Management and Innovation in Japan, Britain, and the United States. London: Routledge. [Google Scholar]

- Reuters. 2020. THE REFINITIV BUSINESS CLASSIFICATION METHODOLOGY. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/trbc-business-classifcation-methodology.pdf (accessed on 24 September 2020).

- Useche, Diego. 2014. Are patents signals for the IPO market? An EU-US comparison for the software industry. Research Policy 43: 1299–311. [Google Scholar] [CrossRef]

- Vaidya, Kirit, David Bennett, and Xiaming Liu. 2007. Is China’s manufacturing sector becoming more high-tech? Evidence on shifts in comparative advantage, 1987–2005. Journal of Manufacturing Technology Management 18: 1000–21. [Google Scholar] [CrossRef]

- Wagner, Stefan, and Iain Cockburn. 2010. Patents and the survival of Internet-related IPOs. Research Policy 39: 214–28. [Google Scholar] [CrossRef]

- Wang, Taiyuan, Israr Qureshi, David Deeds, and Yi Ren. 2019. How do technology ventures signal IPO quality? A configurational approach. Journal of Business Research 99: 105–14. [Google Scholar] [CrossRef]

- Welbourne, Theresa M., and Alice O. Andrews. 1996. Predicting the performance of initial public offerings: Should human resource management be in the equation? Academy of Management Journal 39: 891–919. [Google Scholar] [CrossRef]

- Yang, Qin, Monica Zimmerman, and Crystal Jiang. 2011. An empirical study of the impact of CEO characteristics on new firms’ time to IPO. Journal of Small Business Management 49: 163–84. [Google Scholar] [CrossRef]

- Zhang, Yeqing, and Xueyong Zhang. 2020. Patent growth and the long-run performance of VC-backed IPOs. International Review of Economics & Finance 69: 33–47. [Google Scholar]

- Zimmerman, Barry J. 2008. Investigating self-regulation and motivation: Historical background, methodological developments, and future prospects. American Educational Research Journal 45: 166–83. [Google Scholar] [CrossRef]

- Zingales, Luigi. 2000. In search of new foundations. The Journal of Finance 55: 1623–53. [Google Scholar] [CrossRef]

| Paper | Sample | Sectors | Signal |

|---|---|---|---|

| Wang et al. (2019) | IPO ventures in the US | Biotechnology | Patent citation |

| Morricone et al. (2017) | IPO companies in the US | Semiconductor industry | Patent granted |

| Munari and Toschi (2015) | VC-backed companies | Nanotechnology | Patent application |

| Hoenig and Henkel (2015) | German and US VCs | High-technology | Patent application Patent granted |

| Häussler et al. (2012) | United Kingdom and German VCs | Biotechnology | Patent application |

| Useche (2014) | US and EU IPO companies | Software | Patent application |

| Greenberg (2013) | Israel start-ups | Semiconductors, Communications, Life sciences, Cleantech, IT and enterprise software, and the internet | Patent application Patent citation |

| Cao and Hsu (2011) | VC-backed start-up firms | Computer-related | Patent application |

| Morricone et al. (2010) | US IPO companies | Semiconductor | Patent application |

| Häussler et al. (2012) | German and British VCs | Biotechnology | Patent application |

| Hsu and Ziedonis (2008) | US start-ups | Semiconductor | Patent application patent citation |

| Mann and Sager (2007) | US VC-backed companies | Software | Patent application Patent granted |

| Baum and Silverman (2004) | Canada startups | Biotechnology | Patent application Patent granted |

| Variable | Definition | Past Studies | Database |

|---|---|---|---|

| IPO performance * (PROCEED) | The amount of money raised by a firm via an IPO (million yen) | Useche (2014); Zimmerman (2008) | Thomson Reuter Eikon |

| Patent stock (PAT4) (PAT5) | Patent application by the company in the last 4 years prior to the IPO Patent application by the company in the last 5 years prior to the IPO | Useche (2014); Morricone et al. (2010) | Jplatpat |

| Firm Size * (SIZE) | Total number of employees at IPO | Welbourne and Andrews (1996) | FinancialQuest |

| Firm Age * (AGE) | Age of firm at IPO | Cao et al. (2022) | FinancialQuest |

| Financial Ratio * (D/E RATIO) | The ratio of debt to equity in the IPO year | Herawati (2017) | FinancialQuest |

| Hi-tech Dummy (HILO_DUMMY) | Dummy (1 if in high-tech industry and 0 if in low-tech industry) | Guiso (1998); Galindo-Rueda and Verger (2016) | OECD industrial classification Thomson Reuter Eikon classification |

| Underwriter Dummy (UW_DUMMY) | Dummy (1 if in the top 5 Japanese underwriters, 0 otherwise) | Brau and Fawcett (2006) | Thomson Reuter Eikon, Statista |

| Stock Exchange Dummy (STOCK_DUMMY) | Dummy (1 if in TSE, 0 otherwise) | Useche (2014) | Thomson Reuter Eikon, Japan Exchange Group |

| Venture Capitalist backing Dummy (VC_DUMMY) | Dummy (1 if the firm is backed by the venture capitalist sector, 0 otherwise) | Certo et al. (2001) | Thomson Reuter Eikon |

| Year Dummy Year 2000 to Year 2015 | Dummies (from Year 2000 to Year 2015) | Morricone et al. (2010) | FinanicalQuest |

| Covariate | Full Sample (N = 338) | High-Tech (N = 242) | Low-Tech (N = 96) | |||

|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | |

| PROCCED | 4878.916 | 12,479.669 | 5539.635 | 14,215.986 | 3213.351 | 5989.836 |

| PAT4 | 69.160 | 303.077 | 66.752 | 355.351 | 29.031 | 66.911 |

| PAT5 | 56.038 | 404.200 | 83.219 | 474.738 | 33.719 | 77.750 |

| SIZE | 974.956 | 3096.394 | 1066.711 | 3404.823 | 742.656 | 2127.505 |

| AGE | 26.760 | 20.565 | 24.967 | 19.745 | 31.281 | 21.961 |

| D/E RATIO | 2.331 | 4.038 | 2.031 | 3.142 | 3.088 | 5.655 |

| HILO_DUMMY | 0.716 | 0.452 | 1.000 | 0.000 | 0.000 | 0.000 |

| UW_DUMMY | 0.772 | 0.420 | 0.781 | 0.414 | 0.750 | 0.435 |

| STOCK_DUMMY | 0.222 | 0.416 | 0.240 | 0.428 | 0.177 | 0.384 |

| VC_DUMMY | 0.361 | 0.481 | 0.351 | 0.478 | 0.385 | 0.489 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| PROCEED (1) | 1 | |||||||||

| PAT4 (2) | 0.529 | 1 | ||||||||

| PAT5 (3) | 0.497 | 0.996 | 1 | |||||||

| SIZE (4) | 0.472 | 0.311 | 0.294 | 1 | ||||||

| AGE (5) | (-) 0.051 | (-) 0.117 | (-) 0.119 | 0.370 | 1 | |||||

| D/E Ratio (6) | 0.045 | 0.041 | 0.036 | 0.315 | 0.372 | 1 | ||||

| HILO_DUMMY (7) | 0.084 | 0.056 | 0.055 | (-) 0.063 | (-) 0.114 | (-) 0.125 | 1 | |||

| UW_DUMMY (8) | 0.066 | 0.015 | 0.018 | 0.098 | 0.171 | 0.037 | 0.033 | 1 | ||

| STOCK_DUMMY (9) | 0.380 | 0.229 | 0.211 | 0.510 | 0.241 | 0.148 | 0.067 | 0.118 | 1 | |

| VC_BACKED (10) | (-) 0.055 | (-) 0.023 | (-) 0.026 | (-) 0.234 | (-) 0.115 | (-) 0.182 | (-) 0.032 | 0.099 | (-) 0.193 | 1 |

| Model 1 (H1) | Model 2 (H2) | |

|---|---|---|

| Intercept | 5.7756 *** 0.391 | 5.6705 *** 0.394 |

| PAT4 | 0.0005 ** 0.000 | 0.0040 ** 0.002 |

| PAT4*HILO_DUMMY | −0.0035 * 0.002 | |

| SIZE | 0.3871 *** 0.058 | 0.3847 *** 0.058 |

| AGE | −0.3537 *** 0.093 | −0.3442 *** 0.0093 |

| D/E RATIO | −0.0575 0.062 | −0.0557 0.062 |

| HILO_DUMMY | 0.3203 ** 0.151 | 0.4288 *** 0.162 |

| UW_DUMMY | 0.2776 * 0.166 | 0.2780 * 0.165 |

| STOCK_DUMMY | 0.4890 ** 0.193 | 0.4285 ** 0.195 |

| VC_DUMMY | −0.1517 0.147 | −0.1611 0.146 |

| YEAR_DUMMY | Yes | Yes |

| Adj_R_square | 0.273 | 0.278 |

| F-STATISTIC | 16.84 | 15.44 |

| PROB(F-STATISTIC) | 5.96 × 10−21 | 5.29 × 10−21 |

| Observation | 338 | 338 |

| Model 1 (H1) | Model 2 (H2) | |

|---|---|---|

| Intercept | 5.6641 *** 0.409 | 5.6265 *** 0.406 |

| PAT4 | 0.0005 ** 0.000 | 0.0016 *** 0.001 |

| PAT4*HILO_DUMMY | −0.0013 ** 0.00 | |

| SIZE | 0.3830 *** 0.058 | 0.3640 *** 0.058 |

| AGE | −0.3053 *** 0.097 | −0.2842 *** 0.096 |

| D/E RATIO | −0.0630 0.061 | −0.0614 0.061 |

| HILO_DUMMY | 0.3323 ** 0.149 | 0.2085 *** 0.077 |

| UW_DUMMY | 0.2780 * 0.166 | 0.3146 * 0.165 |

| STOCK_DUMMY | 0.5121 *** 0.192 | 0.4818 ** 0.192 |

| VC_DUMMY | −0.1622 0.146 | −0.2084 0.147 |

| YEAR_DUMMY | Yes | Yes |

| Adj_R_square | 0.274 | 0.283 |

| F-STATISTIC | 16.92 | 15.79 |

| PROB(F-STATISTIC) | 4.76 × 10−21 | 1.87 × 10−21 |

| Observation | 338 | 338 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

An, L.T.N.; Matsuura, Y.; Tareq, M.A.; Issa, N.M.; Che-Yahya, N. Impact of Patent Signal on Firm’s Performance at IPO: An Empirical Analysis of Japanese Firms. Economies 2023, 11, 101. https://doi.org/10.3390/economies11040101

An LTN, Matsuura Y, Tareq MA, Issa NM, Che-Yahya N. Impact of Patent Signal on Firm’s Performance at IPO: An Empirical Analysis of Japanese Firms. Economies. 2023; 11(4):101. https://doi.org/10.3390/economies11040101

Chicago/Turabian StyleAn, Le Thuy Ngoc, Yoshiyuki Matsuura, Mohammad Ali Tareq, Nurhayati Md Issa, and Norliza Che-Yahya. 2023. "Impact of Patent Signal on Firm’s Performance at IPO: An Empirical Analysis of Japanese Firms" Economies 11, no. 4: 101. https://doi.org/10.3390/economies11040101

APA StyleAn, L. T. N., Matsuura, Y., Tareq, M. A., Issa, N. M., & Che-Yahya, N. (2023). Impact of Patent Signal on Firm’s Performance at IPO: An Empirical Analysis of Japanese Firms. Economies, 11(4), 101. https://doi.org/10.3390/economies11040101