Abstract

The objectives of the research are to investigate the characteristics of the Board of Directors on the financial performance of the enterprise using sample data from 52 construction and real estate enterprises listed on the Vietnam stock exchange in the period 2006–2020. Using typical regression methods such as pooled OLS, FEM, REM, and assessing the defects of the research model, the FGLS method is selected. At the same time, due to the existence of endogenous phenomena and the nature of interdependence among enterprises in Vietnam, research using the instrumental variables two-step generalized method of moments (IV-GMM) is conducted in order to correct for cross-sectional dependence, autocorrelation, endogeneity, and heteroskedasticity in the analysis. Research results suggest that board size, female board members, meeting frequency, and board members’ education have a positive influence on financial performance. Moreover, as the independence of the Board of Directors increases, the business efficiency decreases. The research also found a positive relationship of tangible fixed assets, and a negative relationship between capital structure choice, firm size, and corporate financial performance. Finally, we propose some implications for enhancing the financial performance of Vietnamese firms.

1. Introduction

The Board of Directors (BOD) has the main task of representing shareholders to participate in the governance and management of the enterprise in accordance with the development orientation of the enterprise. The Board of Directors is the governing body in a joint-stock company with full authority to represent the company to decide and perform the obligations and interests of the company. In general, through management decisions, the Board of Directors has a great impact on the operation of the enterprise in particular, and the business performance of the enterprise in general. Therefore, improving the performance of the Board of Directors and improving the business performance of enterprises has been a point of interest in several recent studies.

Vietnam is considered as a fast-growing country in Asia (Nguyen 2020; Nguyen and Nguyen 2022). Nonetheless, in the early period after the unification of the country, Vietnam did not have laws regarding enterprises because Vietnam formed a planned economy and did not encourage the development of the private economy. However, since 1990, Vietnam began to implement the Law on Companies and the Law on Private Enterprises, which was the first legal basis to allow business in a number of industries. In 1999, the Law on Enterprises was officially promulgated for the first time with full regulations on all types of enterprises, as it is today.

Due to the economic development situation, Vietnam continued to reform the enterprise law in 2005, which does not distinguish between state-owned and private enterprises, or foreign direct investment enterprises. Since then, the Law on Enterprises has been supplemented several times in 2014 and 2020, which has brought many benefits to the formation and management of enterprises. In particular, the Board of Directors also stipulates more clearly, the role of independent board members has more voice, and it contributes significantly to the development of the business.

Some previous studies by Abdul Gafoor et al. (2018), Assenga et al. (2018), and Tan et al. (2019) suggested that variables such as board size, percentage of independent members, percentage of female members, and education level have a positive impact on business performance, and the duality of the Board of Directors has a negative impact on business performance. For Vietnam, there have been domestic studies on the role of the board of directors. The study by Pham et al. (2021a) at 26 banks in Vietnam suggested that the diversity of the Board of Directors and the distance between the chairman of the Board of Directors and the CEO have an influence on the bank’s risk. Research by Pham et al. (2021b) on the Vietnamese stock exchange during the period from 2015 to 2019, using the fixed effects method, did not show the impact of board characteristics and financial performance. It can be seen that research data on the subject are relatively limited and the research method is not effective enough, so the results do not really describe the characteristics of Vietnam.

In addition, in Vietnam’s development conditions, the construction and real estate industries are two of the important industries that play a great role in the construction of technical infrastructure and urban development in the country. Since then, the construction and real estate industries—along with other economic sectors—have carried out the mission of turning Vietnam into a high-middle-income economy by 2035 (Pham 2020). The construction and real estate industries have a large investment value and a long payback period, so an effective business model is a prerequisite for these businesses to develop in the future. Especially associated with corporate law, the role of the Board of Directors is enhanced. Each decision of the Board of Directors has a great influence on the future of the business. Specifically, the Board of Directors must have the most capacity, human resources, and understanding to build the most suitable governance system for the business. Studying the influence of the Board of Directors on the business performance of enterprises in the construction and real estate industries will help provide suggestions for corporate governance, contributing to increasing operational efficiency for the construction and real estate industries in Vietnam.

Another possibility is to study the impact of board characteristics and financial performance in the case of Vietnam, that is, the study of Abdul Gafoor et al. (2018) conducted in India and investigated in the banking system. However, banks operate quite differently from other businesses, especially as banking activities are often closely governed by the central bank and are generally more closely monitored for their operations, organization, and Board of Directors than other enterprises. In another investigation conducted by Assenga et al. (2018) in Tanzania, the study was conducted on unbalanced panel data. However, the Tanzanian data sample was not sufficient to help the authors carry out the research more comprehensively. Simultaneously, the data were collected in the period from 2006 to 2013, when the country’s economy did not have a deep integration into the global economy as it is now. Further, the study of Tan et al. (2019) also used the regression method according to DEA—data development analysis—besides performing traditional regression, so the endogenous effects in the research model have not been fully evaluated. This is why we are conducting another study in Vietnam on listed companies, using the traditional regression analysis as well as performing the assessment of endogeneity in the model.

Through the research, we analyze 52 typical enterprises on the Vietnamese stock exchange. These are large enough and have a long enough listing period, and all operate under the 2005 Enterprise Law. The research prioritizes the selection of analysis time from 2006 onwards. The study uses traditional analysis methods such as pooled least squares regression, random effects model, and fixed effect model, and we then research and evaluate the model’s shortcomings. When defects occur, the study uses defect correction regression. In particular, the impact of board characteristics—especially board independence—can affect firm performance in the long run, however, according to Baum (2008), medium-sized enterprise dependencies may exist in industries, since firms in the same industry often operate in similar products, share markets, and may sometimes be rivals. In addition, the study was conducted on 52 enterprises during the period from 2006 to 2020, so the number of enterprises N is larger than the study period T. Therefore, the study is likely to occur endogenous phenomenon in the regression model. To make the research results more reliable, in this study, we performed regression by using the instrumental variables two-step generalized method of moments (IV-GMM). Specifically, the IV-GMM technique is used to correct for cross-sectional dependence, autocorrelation, endogeneity, and heteroskedasticity in the analysis (Baum 2008; Pham et al. 2021c).

The main findings of this paper can be indicated as follows: board size, female board members, meeting frequency, and board members’ education have a positive influence on financial performance. In addition, as the independence of the Board of Directors increases, the business efficiency decreases. From the above results, it can be seen that the characteristics of the Board of Directors have different effects on the financial performance of the firm, and that this is a typical example for a rapidly developing country like Vietnam.

In addition to the rationale for conducting the study discussed in Section 1, the remainder of the study consists of the following: Section 2 discusses the overview of previous research, Section 3 discusses data sources and research methods, Section 4 presents the results, and finally, Section 5 is the general conclusion of the study.

2. Theoretical Background and Literature Review

2.1. Theoretical Background

The M&M theoretical framework on capital structure choice is that choosing equity capital or choosing external capital sources does not affect the value of the enterprise. According to Myers (1984), firm value is not affected by the choice of capital structure. However, according to the pecking order theory developed by Myers and Majluf (1984), firms often prefer to use internal capital—especially from retained earnings—then firms consider using borrowed capital, and finally firms choose to finance with its equity. This selection process is shaped by asymmetric information in the market when the director—the leader of the business—has more information than the investor.

The agency theory developed by Jensen and Meckling (1976) analyzes the relationship between managers and shareholders in the enterprise, in which shareholders are the principal and managers are representatives with the role of agents and executors, as entrusted by shareholders. Thus, the representative must be fully capable and capable of managing at the request of shareholders to ensure improved shareholder benefits. However, separation of ownership and management of a business can lead to information asymmetry when each party pursues a different interest and ultimately shareholders’ interests are not achieved as desired.

The resource dependency theory states that businesses always want to implement and achieve strategic goals and sustainable development. In order to have enough resources, businesses need to expand cooperation with other businesses in order to have enough resources for carrying out business development. However, this sharing process reduces the autonomy of the enterprise and makes the enterprise dependent on other enterprises (Selznick 1948).

The pecking order theory also explains why firms with low profitability tend to take on more debt. It reflects the capital that plays an important role in a business. However, the quality of human capital and especially the level of technological indicator has a great influence on enterprise productivity. This is explained by the Cobb-Douglas production function, where the output can be formed on three factors: capital, labor, and technological level. The Cobb-Douglas function can be expressed as follows: Q = ALα Kβ.

In which, Q is the output, A, α, β are positive, and the TFP—Total factor productivity. Finally, L is the labor and K is the capital used.

According to previous studies, human capital can affect corporate governance, especially the quality of the board of directors. The Board of Directors is considered as the heart of the enterprise. When an enterprise has a high- quality board, this means that a firm with a great human capital can support its performance, as confirmed by Tan et al. (2019), Assenga et al. (2018), and Abdul Gafoor et al. (2018).

2.2. Literature Review

The Board of Directors is considered the heart of each joint-stock enterprise; all activities of the enterprise are usually decided by the Board of Directors, which is a group of large, influential, and reputable shareholders in the company. In addition, the Board of Directors can be independent thanks to the participation of an independent member who does not hold ownership in the company but has experience in participating in the management or criticism of, and contributing valuable ideas for, business development goals.

International studies have studied the board and its characteristics, such as research by Tan et al. (2019), Assenga et al. (2018), Abdul Gafoor et al. (2018), and Pucheta-Martínez and Gallego-Álvarez (2020). The Board of Directors is said to be the backbone of corporate governance, as an effective board helps strengthen corporate governance to develop. Most significant corporate failures and financial scandals stem from problems caused by underperforming boards. Corporate governance reform aims to improve the effectiveness of the Board of Directors. Most of the research on corporate governance has been conducted in developed countries, while there have been few in-depth studies on board characteristics and financial performance in developing countries in recent times (Assenga et al. 2018). Researching through data including DEA on a sample of 400 listed companies in Southeast Asian countries from 2009 to 2015, Tan et al. (2019) showed the negative impact of the Board of Directors on corporate performance. Moreover, the duality of the Board of Directors hinders the efficiency of the enterprise due to the issue of autocratic management and control of decisions. From there, the study shows the limitations for the duality of the Board of Directors in the excessive duality of the Board of Directors. In another study, Assenga et al. (2018) found that CEO duality has a negative impact on financial performance in listed companies in Tanzania.

There are a number of other studies that have found a positive relationship between board characteristics and financial performance. There exists a significant relationship between board size and business performance; when the board size is from 6 to 9 members, there is a positive relationship between BOD independence and business performance. Furthermore, the study found that the number of board meetings and the number of financial specialists on the board are critical to business performance (Abdul Gafoor et al. 2018). The study by Pucheta-Martínez and Gallego-Álvarez (2020) analyzed the characteristics of the Board of Directors that affect the firm’s performance, and suggested that the characteristics of the board, such as board size, board independence, and having a female director are positively related to company performance, while CEO duality also has a positive impact on company performance. However, there are also some studies that do not find any relationship between the effects of board characteristics and financial performance, such as Assenga et al. (2018) who argued that the independent board of directors, the size of the board of directors, and the foreign directors have no relationship with the financial performance of the company. It can be argued that the lack of independence and appropriate professional competence could be one of the reasons for this insignificant relationship. Abdul Gafoor et al. (2018) also confirmed that there was no significant improvement in business performance when separating the roles of the General Director and the Chairman. Research shows that board size and board independence need to be rationalized. Using fuzzy set qualitative comparative analysis for a sample data of 295 Southern Europe firms during 2001–2010, it was claimed that firm financial performance is associated with a complete configuration of board features such as board size and board independence (García-Ramos and Díaz 2021).

Ararat and Yurtoglu (2021) studied a time series in Turkey and found that female directors have no influence on the profitability of the business. However, the presence of an independent female director makes the business more profitable. The 100 largest companies by market capitalization on the European stock market were researched using OLS, FEM, and IV analysis, and confirmed the positive impact of female board representatives on firm performance (Green and Homroy 2018).

Studies show that other factors also have an influence on corporate financial performance. Sudharika et al. (2018) researched the Colombo Stock Exchange (CSE) over a 5-year period from 2012–2017; they used the total debt-to-equity ratio to measure capital structure and argued that capital structure has a negative impact on the financial performance of the firm. Nassar (2016) conducted research at 136 industrial companies listed on the Istanbul Stock Exchange (ISE) over a period of 8 years from 2005 to 2012, and also confirmed a significant negative relationship between capital structure and business performance. Thereby, companies should choose equity to finance the company’s project. The study further extended the capital structure impact of Bangladeshi companies listed on the Dhaka Stock Exchange in the period 2007–2012 Hasan et al. (2014) indicated that there was a positive impact from short-term debt and a negative impact from long-term debt on business performance, as measured by EPS, but no impact on business performance, measured by ROE and Tobin’s Q, and a negative relationship of capital structure to ROA. In addition, Chandren et al. (2021) indicated that Chairman ownership is positively and significantly consistent with liquidity and not with firm performance. However, having a long-tenured Chairman is associated with poor firm performance.

There have been very few studies conducted in Vietnam on board relationships and financial performance. Pham et al. (2021b) studied the Vietnamese stock exchange during the period from 2015 to 2019 using the fixed effects method, and the results have not shown an impact of board characteristics on financial performance. Chu (2020) studied in the period from 2016 to 2018 and suggested that the duality of the Board of Directors has a positive impact on financial performance. However, the study in Vietnam only used a relatively simple method of static analysis and the research time was short, so it is not comprehensive.

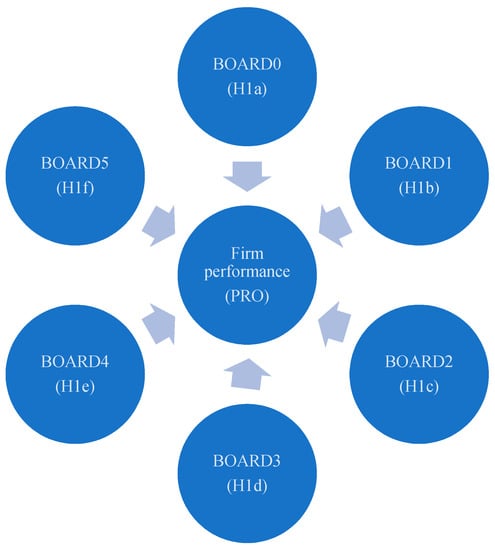

Hypothesis: Do the characteristics of the Board of Directors have an effect on the Corporate financial performance for the case of Vietnam? More specifically, the specific hypotheses can be stated in Figure 1 as follows:

Figure 1.

Hypotheses development.

H1a.

The size of the Board of Directors (BODs) has a significant and positive impact on firm performance.

H1b.

The independent of the Board of Directors (BODs) has a significant and positive impact on firm performance.

H1c.

The participation of women in the Board of Directors (BODs) has a significant and positive impact on the profitability of firm.

H1d.

The frequency of board meetings has a significant and positive impact on firm performance.

H1e.

The concurrently holding the title is significantly and positively associated with firm performance.

H1f.

The academic level in the Board of Directors (BODs) is significantly and positively associated with financial performance of firm.

3. Data and Methodology

3.1. Data Collection

Due to the availability of the data, the study uses data of 52 typical companies on the Vietnamese stock exchange. In addition, Vietnam has 65 construction and real estate firms listed in the stock market, of which some have just been listed for a number of years, so there are not enough data for analysis. Therefore, the final sample is closed to 52 companies dealing in construction and real estate, with the criteria of being a relatively large company, having a relatively long listing period, and being relatively representative of the construction and real estate industries in the Vietnamese stock market.

In addition, the research period is from 2006 to 2020. The data are collected from the audited financial statements, annual reports, and prospectus, in accordance with Vietnamese law. The data are corrected for errors, then used in quantitative analysis. The variables are explained in Table 1:

Table 1.

Variables used in the model.

3.2. Methodology

According to previous studies by Assenga et al. (2018) and Hussain et al. (2021), we develop this model by adding other variables. The regression equation is as follows:

In which is the profit of the business, measured by one of the following three variables: , or . The variables are representative of the board’s characteristics.

Empirical research through regression Pooled OLS, FEM, REM, and the F test and Hausman test were used to select the model. In addition, the study also tested for multicollinearity (VIF), heteroskedasticity, and autocorrelation. From there, the study used the FGLS tool to correct the defects.

Contrary to previous studies discussed in literature review, in this study, we use the product of 52 typical enterprises in the construction and real estate industries. Firms in the same industry often operate in the same product lines, share the market, and can sometimes be competitors, and at the same time to eliminate endogeneity in the research model, the study performed a regression by using the instrumental variables two-step generalized method of moments (IV-GMM) in order to correct for cross-sectional dependence, autocorrelation, endogeneity, and heteroskedasticity in the analysis (Baum 2008).

4. Results

4.1. Descriptive Statistics

Table 2 shows the descriptive statistics of variables in the model. Firstly, ROA variable (Return on Total Assets): For the ROA variable, the average value is 3.0876%, corresponding to the minimum value (Min) −28.0502% and the maximum value (Max) 83.9056%; the standard deviation is 5.9755%. The ROA variable has a rather large volatility, showing a large difference in the profitability of the business. Similarly, the variable ROE (Return on Equity) has an average value of 7.1092%, corresponding to a minimum value (Min) of −175.5021%, a maximum value (Max) of 149.0710%, and a standard deviation of 7.1092%, which shows that the range of variation is large. Earnings per share have an average value of 1, 424,666 (Vietnamdong) and also vary widely among businesses in the industry.

Table 2.

Descriptive statistics.

BOARD0 variable (Board size): With the variable BOARD0, the mean is 5.1448 and the standard deviation is 0.7503. The variation from Min of 3 to Max of 9 is relatively high. Variable BOARD1 (proportion of Independent Board Members): For this variable, the mean is 1.0269, the standard deviation of this variable is 1.0940, and the variation from Min value of 0 to Max value of 5 is quite a large variation range for this variable BOARD1. Variable BOARD2 (proportion of female members): For this variable, the mean value is 0.3974, with a significance level of 0.6767, and the variation from the Min value of 0 to the Max value of 5 is quite large. It reflects that there are enterprises with many female members on the board of directors, and there are also enterprises with no female members.

Variable BOARD3 (Frequency of Board of Directors meetings): This variable has a mean value of 6.1589 with a standard deviation of 4.1376, which is relatively high. The range between the Min value of 3 and the Max value of 24 is relatively high. Regarding title duality, there is variable BOARD4 (Concurrently holding two titles): This variable has a mean of 2.1717 and a standard deviation of 1.025, which is relatively high. The large variation range is from a Min of 0 to a Max of 5. This shows that holding two positions in the Board of Directors helps to concentrate leadership. However, previous studies have shown that this will increase motivation to hold the position for longer and may reduce the supervisory effectiveness of the board. Variable BOARD5 (Board education level): This variable gives a mean value of 0.9315, which is quite reasonable, and a standard deviation of 1.0420, which is acceptable. The large variation range is from a Min of 0 to a Max of 5. This shows that there is a difference in the educational attainment of BOD members.

With the SIZE variable, the mean is 11.8073 and the standard deviation is 0.5370. The variation from Min of 9.1129 to Max of 13.50008 is relatively small. It shows that there is not a large difference between the size of the businesses.

LIQ (Liquidity): This variable gives a mean of 1.0182, which is relatively safe, and standard deviation of 1.2718, which is very high. It has a very large range from a Min of 0.01 to a Max of 10.9516. This shows that there are many illiquid enterprises along with companies with very good liquidity, and that businesses with high liquidity will be able to finance investments more easily and meet short-term financial commitments better. Variable FIXED (Fixed Assets): This variable has a mean of 10.5614, which is quite high, and standard deviation of 0.8250, which is quite low. The relatively large range is from a Min of 6.4291 to a Max of 12.9551. The variable LEV (Financial leverage): This variable has an average value of 66.34%, which is relatively high, showing that construction and real estate enterprises mainly use borrowed capital. The range if from a Min of 11.55% to a Max of 100%, showing that there are enterprises that use very high borrowed capital, but there are also many enterprises that do not use financial leverage well, showing a very low loan ratio of 11.55%.

4.2. Correlation Coefficient Matrix Analysis

In order to test the correlation between the independent variables to evaluate the phenomenon of multicollinearity, the study uses correlation matrix analysis, as shown in Table 3 below:

Table 3.

Correlation matrix.

From the table above, we can see that some pairs of variables have a positive correlation relationship and some pairs of variables have a negative relationship. Independent variables have low correlation with each other; the correlation coefficient <0.8 is unlikely to occur multicollinearity.

According to (Chu 2020), predictors with VIF values <10, the research model is considered to have no serious influence on multicollinearity. The results as shown in Table 4 and also show that there is no possibility of multicollinearity affecting the regression results.

Table 4.

VIF analysis.

4.3. Regression Results

After performing the regression according to Pooled OLS, FEM, REM methods with dependent variables ROA, ROE, EPS, we have a summary table of variables and regression results according to the respective models as shown in Table 5 below:

Table 5.

Regression results.

In order to choose the most suitable regression model for the research, we conduct the Hausman test. After using Hausman test, it shows that the REM model is better selected than the FEM model. The Hausman test results in all cases give Prob value > chi2 < 1%, so we reject hypothesis H1 (εi and independent variable are not correlated) and accept hypothesis H0 (εi and independent variable are correlated). Thus, the Hausman test for the REM model results is the best.

The study continues to use the F test to choose between FEM and Pooled OLS models. After using the F test to choose between the FEM and Pooled OLS models, the FEM model is selected. The results of the F test, Prob value > F = 0.0000–0.0003 and all < 1% should reject hypothesis H0 (Pooled OLS method is the best) and accept hypothesis H1 (REM method is the best). Thus, the F test is the best option to choose the FEM model.

Both the Hausman test and the F test select the REM regression model as the most suitable. However, the study needs to perform additional testing of hetetoskedasticity and autocorrelation of the REM regression model; the results are shown in Table 6 as follows:

Table 6.

Test of hetetoskedasticity and autocorrelation.

Table 6 indicates that when the dependent variable is ROA and ROE, and there is a phenomenon of hetetoskedasticity. Further, for the dependent variable of EPS, there is a phenomenon of autocorrelation. Thus, Table 7 showsthe FGLS regression for overcoming the above phenomena, and the results are as follows:

Table 7.

Regression results of FGLS.

The analysis is also conducted by using the instrumental variables two-step generalized method of moments (IV-GMM) in order to correct for cross-sectional dependence, autocorrelation, endogeneity, and heteroskedasticity in the analysis. Firstly, checking the endogeneity according to the Hausman—Wu test in Table 8 as follows:

Table 8.

Results of the Hausman—Wu test.

The results of Table 8 show that the p-values of LEV and SIZE are less than 0.1, that is, the hypothesis H0 is exogenous variables are rejected, meaning that both LEV and SIZE are endogenous variables. In addition, the p-value of BOARD1, BOARD2, BOARD3, and BOARD5 is also less than 0.1. Therefore, this study gives the use of the instrumental variables two-step generalized method of moments (IV-GMM) as the estimation method. Therefore, the regression results based on IV-GMM are shown in the following Table 9:

Table 9.

Regression results of IV-GMM.

4.4. Discussions

In this study, we performed many techniques to estimate the relationship between the characteristics of the Board of Directors and the corporate financial performance. The final results are shown in Table 7 and Table 9, and these results will be used for the discussions in the next steps.

Firstly, Table 7 indicates that the variables that have a positive and statistically significant impact on financial performance are as follows: BOARD0, BOARD2, BOARD3, BOARD4, FIXED, and LIQ. Variables that have a negative and statistically significant impact on financial performance are as follows: LEV, LIQ, and SIZE.

Secondly, Table 9 indicates that the variables that have a positive and statistically significant impact on financial performance are as follows: BOARD0, BOARD2, BOARD3, BOARD5, FIXED, and LIQ. Variables that have a negative and statistically significant impact on financial performance are as follows: LEV, SIZE, BOARD1, and BOARD4. The results in Table 9 based on two-step generalized method of moments (IV-GMM) also show the robustness check for the analysis.

4.4.1. For the Characteristic of Board of Directors

For the variable BOARD0 (board size): This variable in all analytical methods shows a positive impact on business performance. However, this variable only has statistical significance expressed through ROA and ROE, and is not significant with EPS. This result is consistent with the theory of corporate governance, which states that an effective Board of Directors is capable of effective corporate governance, and demonstrates the role of the board’s backbone for the company’s operations (Assenga et al. 2018).

For the variable BOARD1 (proportion of independent members): This variable suggests a negative impact on corporate financial performance. However, the regression coefficient of this variable is only statistically significant for EPS, not statistically significant for ROA and ROE. Thus, it can be seen that the higher the percentage of independent members, the lower the business efficiency. According to Pucheta-Martínez and Gallego-Álvarez (2020), the independence of the Board of Directors is reflected in the decision-making ability that is consistent with development strategies in the business and the ability to improve operational efficiency. Adversely, the companies that are dominated by family factors are unlikely to develop, or the lack of independence of the Board of Directors may be the reason for this insignificant relationship, as discussed by Abdul Gafoor et al. (2018).

For the variable BOARD2 (proportion of female members): This variable is statistically significant in the case of the dependent variable ROA or EPS. It shows that the percentage of female members has a positive impact on business performance. Thus, having many female members in the Board of Directors significantly increases the business efficiency of the enterprise. Currently, there are no similar studies to assess the impact of members of the Board of Directors on corporate financial performance for the case of Vietnam, especially for the case of construction and real estate industry. However, Pucheta-Martínez and Gallego-Álvarez (2020) believed that businesses with female directors have higher performance. Therefore, increasing the participation of women in the business can improve financial performance.

For the variable BOARD3 (frequency of meetings): This variable is statistically significant and has a positive effect on the two dependent variables, ROA and ROE, and has no statistical significance on the EPS variable. It shows that meeting frequency has a positive effect on business performance, that is, businesses with more meeting frequency will have better business efficiency. This result is similar to the study of Abdul Gafoor et al. (2018) when the enterprise can maintain regular meetings of the Board of Directors. In this case, shareholders or members of the Board of Directors are able to regularly discuss the development decisions of the enterprise. It helps the business to be able to operate effectively and in the spirit that shareholders require.

For the variable BOARD4 (concurrently holding two titles): This variable is statistically significant and has a positive effect in the case of the dependent variable EPS. However, the study also found a negative effect of BOARD4 on financial performance, measured by ROA or ROE. It is shown that duality has a positive effect on earnings per share and a negative effect on return on assets or on equity. It can be seen that the impact in this case is not really clear. In another study, Assenga et al. (2018) found that CEO duality has a negative impact on financial performance in listed companies in Tanzania. For a developing country, concurrently holding a title can make the power in the hands of the Board of Directors relatively more significant, and this more or less affects the management decision of the head. However, in developed countries—where businesses operate under the strict supervision of corporate law and shareholders have highly specialized knowledge and critical ability—concurrent positions are often less frequent, affecting financial performance.

For variable BOARD5 (academic level): This variable has only statistical significance and positive impact if the dependent variable is ROE or EPS. It shows that the level of education has a great influence on the business performance of enterprises in the construction and real estate industries. Research results show that the higher the level of education, the higher the business performance. If there is a financial expert present in the Board of Directors, the business performance of the enterprise will improve, thereby reflecting the Board’s education, which affects the management of the business and helps the business to achieve the best results (Abdul Gafoor et al. 2018).

4.4.2. Other Factors

For the variable LEV (financial leverage): This variable represents the level of leverage in the business. The higher the index, the higher the leverage, and vice versa; a lower ratio reflects the firm’s use of equity. Research results show that financial leverage has a negative impact on business performance of enterprises, showing that an increase in financial leverage will reduce business performance. The results of this study are quite similar to many other studies, such as Sudharika et al. (2018) at Colombo Stock Exchange (CSE) and Nassar (2016) conducted at Istanbul Stock Exchange (ISE), who believed that businesses should seek funding through their own capital and should not be too dependent on external financing, as this is likely to bring high risks and reduce the financial performance of the company.

For the variable SIZE (Enterprise Size): Enterprise size is one of the important factors contributing to the business performance of the enterprise. Research shows that there is a negative impact on business performance of enterprises (ROA, ROE, EPS). It shows that the larger the enterprise size, the lower the business efficiency, and adversely, the smaller the enterprise size, the greater the business efficiency. It can be explained that because the Vietnamese economy is in a period of rapid growth, while large enterprises need time to accumulate, it is not possible to achieve immediate effects. Furthermore, the study also did not find a clear relationship between liquidity and financial performance. Liquidity shows—for every dollar of short-term debt a business holds—how many dollars of current assets the business can use for payments. If the liquidity ratio is less than 1, it shows that the business does not have enough assets to use to pay short-term debts. The research results confirm that this variable has a positive effect on EPS but a negative effect on ROA, and thereby the liquidity effect on financial performance is not really clear.

For the FIXED variable (tangible assets): This variable is statistically significant and has a positive impact on financial performance, and this result is consistent in all cases of the dependent variable. This variable has a positive effect on business performance of enterprises, which shows that construction and real estate enterprises holding a large number of fixed assets will have better business performance. The study also suggests that businesses in Vietnam should add fixed assets to help businesses have a more sustainable financial foundation to improve operational efficiency.

5. Conclusions

The Board of Directors is considered the heart of every company, whose role it is to carry out the management and governance of the company and ultimately help the company grow. The success of the company is often tied to shareholder interests, the value of the stock, and the value of the business increases. Vietnam is considered a developing country with a growing economy and the construction and real estate industries play many important roles in infrastructure construction and urban development. We conducted research on 52 construction and real estate enterprises listed on the Vietnam Stock Exchange in the period from 2006 to 2020, using typical regression methods such as pooled OLS, FEM, and REM, implementing the F test and Hausman test for model selection, and testing for multicollinearity (VIF), heteroskedasticity, and autocorrelation. In particular, to eliminate endogenous phenomena in the research model, we performed regression by using the instrumental variables two-step generalized method of moments (IV-GMM) in order to correct for cross-sectional dependence, autocorrelation, endogeneity, and heteroskedasticity in the analysis. The research results confirm the size of the board of directors, female members of the board, frequency of meetings, and education level of board members have a positive influence on the financial performance of the business. While the independence of the Board of Directors increases, business efficiency is likely to decrease. The study also found a positive relationship of tangible fixed assets on firm performance, and a negative relationship between capital structure choice, firm size, and business performance.

The study has some limitations, which are as follows: The study was only carried out on construction and real estate companies listed on Vietnam’s stock market, so future studies can be scaled up. Secondly, the study has not assessed the impact of the COVID-19 pandemic on firm performance, especially in the period from 2020 to the present; businesses in Vietnam in particular and in many countries in general are highly affected by the pandemic. Thirdly, the study has not fully quantified the influence of macro factors on the financial performance of enterprises, which are factors that should be studied in the future.

Author Contributions

Conceptualization, V.C.N. and T.N.T.H.; methodology, V.C.N. and T.N.T.H.; software, V.C.N. and T.N.T.H.; validation, V.C.N.; formal analysis, V.C.N.; investigation, V.C.N. and T.N.T.H.; resources, V.C.N. and T.N.T.H.; data curation, V.C.N. and T.N.T.H.; writing—original draft preparation, V.C.N. and T.N.T.H.; writing—review and editing, V.C.N.; visualization, V.C.N.; supervision, V.C.N.; project administration, V.C.N.; funding acquisition, V.C.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdul Gafoor, C. P., V. Mariappan, and S. Thiyagarajan. 2018. Board characteristics and bank performance in India. IIMB Management Review 30: 160–67. [Google Scholar] [CrossRef]

- Ararat, Melsa, and B. Burcin Yurtoglu. 2021. Female directors, board committees, and firm performance: Time-series evidence from Turkey. Emerging Markets Review 48: 100768. [Google Scholar] [CrossRef]

- Assenga, Modest Paul, Doaa Aly, and Khaled Hussainey. 2018. The impact of board characteristics on the financial performance of Tanzanian firms. Corporate Governance (Bingley) 18: 1089–106. [Google Scholar] [CrossRef]

- Baum, Christopher F. 2008. Using Instrumental Variables Techniques in Economics and Finance. Available online: https://www.stata.com/meeting/germany08/Baum.DESUG8621.beamer.pdf (accessed on 15 August 2022).

- Chandren, Sitraselvi, Sumaia Ayesh Qaderi, and Belal Ali Abdulraheem Ghaleb. 2021. The influence of the chairman and CEO effectiveness on operating performance: Evidence from Malaysia. Cogent Business & Management 8: 1935189. [Google Scholar] [CrossRef]

- Chu, Thi Thu Thuy. 2020. The impact of board characteristics on financial performance of joint stock companies listed on Vietnam stock market. The Journal of Asian Business and Economic Studies 31: 43–60. [Google Scholar]

- García-Ramos, Rebeca, and Belén Díaz Díaz. 2021. Board of directors structure and firm financial performance: A qualitative comparative analysis. Long Range Planning 54: 102017. [Google Scholar] [CrossRef]

- Green, Colin P., and Swarnodeep Homroy. 2018. Female directors, board committees and firm performance. European Economic Review 102: 19–38. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, A. F. M. Mainul Ahsan, Md Afzalur Rahaman, and Md Nurul Alam. 2014. Influence of Capital Structure on Firm Performance: Evidence from Bangladesh. International Journal of Business and Management 9: 184–94. [Google Scholar] [CrossRef]

- Hussain, Sarfraz, Van Chien Nguyen, Quang Minh Nguyen, Huu Tinh Nguyen, and Thu Thuy Nguyen. 2021. Macroeconomic factors, working capital management, and firm performance—A static and dynamic panel analysis. Humanities and Social Sciences Communication 8: 123. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Myers, Stewart C. 1984. The search for optimal capital structure. Midland Corporate Finance Journal 1: 6–16. [Google Scholar]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Nassar. 2016. The Impact of Capital Structure on Financial Performance of the Firms: Evidence From Borsa Istanbul. Journal of Business & Financial Affairs 5: 5–8. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai. 2020. Ownership structure and bank risk-taking in ASEAN countries: A quantile regression approach. Cogent Economics & Finance 8: 1809789. [Google Scholar]

- Nguyen, Van Chien, and Thu Thuy Nguyen. 2022. Dependence and contagion between Vietnamese and major East Asian stock markets. International Journal of Management Practice 15: 445–59. [Google Scholar] [CrossRef]

- Pham, H., T. P. Nguyen, and T. T. T. Nguyen. 2021a. Effects of diversification of the Board of Directors and the gap between the Chairman and Chief Executive Officer (CEO) on commercial banks’ risks. HCMCOUJS—Economics and Business Management 16: 126–40. [Google Scholar]

- Pham, M. V., T. N. T. Nguyen, and T. K. D. Nguyen. 2021b. Board characteristics and corporate financial performance: An empirical study with listed companies in Vietnam. Industry and Trade Magazine 6: 11–15. [Google Scholar]

- Pham, Tien Manh. 2020. Effects of age, education level of board members on financial performance of real estate enterprises. Vietnam Science and Technology Magazine B 62. Available online: https://b.vjst.vn/index.php/ban_b/article/view/27 (accessed on 5 November 2022).

- Pham, Thuy Tu, Le Kieu Oanh Dao, and Van Chien Nguyen. 2021c. The determinants of bank’s stability: A system GMM panel analysis. Cogent Business and Management 8: 1963390. [Google Scholar] [CrossRef]

- Pucheta-Martínez, María Consuelo, and Isabel Gallego-Álvarez. 2020. Do board characteristics drive firm performance? An international perspective. Review of Managerial Science 14: 1251–97. [Google Scholar] [CrossRef]

- Selznick, Philip. 1948. Foundations of the Theory of Organization. American Sociological Review 13: 25–35. [Google Scholar] [CrossRef]

- Sudharika, W. A. K. L., R. M. De Silva, G. T. Madhusankha, Y. V. Madhushanka, and L. L. Siriwardhana. 2018. The Impact of Capital Structure on Firms’ Performance: Evidence from Companies Listed in the Hotels and Travels Sector of Colombo Stock Exchange. pp. 1–25. Available online: https://mgt.sjp.ac.lk/acc/wp-content/uploads/2018/12/a-Article-Group-20.pdf (accessed on 5 November 2022).

- Tan, Khar Mang, Fakarudin Kamarudin, Bany-Ariffin Amin Noordin, and Norhuda Abdul Rahim. 2019. Firm Efficiency of East Asia Countries: The Impact of Board Busyness. Vision 23: 111–24. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).