1. Introduction

In the EU, banks are the cornerstone of firm financing since bank loans are the most important external source of capital (

WSBI-ESBG 2015). Between 2000 and 2010, bank financing amounted to an average of 31% in the United States. In most European countries, the share of bank financing as opposed to capital market financing is even larger, reaching approximately 57% in Germany, 67% in Italy, and 73% in Spain. The EU’s dependence on the banking sector can also be observed in the ratio of the total domestic banking sector (measured as the size of banks’ assets) to the GDP, which amounted to 255% in the EU while only reaching 60% in the US. While dependence on bank financing varies according to company size, all companies in both the EU and the US are vulnerable to the tightening of bank lending (

WSBI-ESBG 2015). This reliance on bank financing is one of the reasons why the banks should operate as efficiently as possible.

Nevertheless, data from the

ECB (

2021b) shows that European banks are, on average, not performing with optimal profitability. Moreover, the situation worsened with the deterioration of economic activity because of the COVID-19 pandemic (

ECB 2021a), and the ROE for the 2nd quarter of 2021 was less than 4% for the EU member states (

ECB 2021b). While improvements are projected, the expected EU banks’ ROE of 6% by 2022 is still much lower than the estimated median required ROE, which is close to 10% (

Altavilla et al. 2021). Moreover, the expected ROE for the EU banks is low in comparison with large US banks, whose ROE is expected to reach about 12% by 2022 (

ECB 2021a).

In response to such external shocks, banks are restructuring their strategic and business models and trying to improve their productivity and efficiency. Due to the above-established EU dependence on a functional and efficient banking system, their success is crucial for the entire EU economy.

This paper focuses on the commercial banks in 11 Central and Eastern European (CEE) countries. Although these countries have been part of the EU since 2004 (Romania and Bulgaria since 2007 and Croatia since 2013), five of them are also part of the euro area. There are only a few studies that study the commercial banks’ efficiency and productivity in these countries. The paper therefore aims to add to the literature by evaluating the productivity change of the CEE commercial banks with a focus on the 2013–2018 period. This period is important for more in-depth analysis for two reasons. First, the year 2013 marks the beginning of the post-crisis period of stable economic growth, when the GDP began to steadily increase for the first time since 2012—the real GDP growth in the EU-28 reached 0.3% and increased to 1.8% in 2014, followed by a steady rise to 2.6% in 2017 and a slow decline to 1.8% in 2018. A similar trend is also observed in the studied CEE countries—the average real GDP growth in the observed countries amounted to 1.1% and increased to 4% in 2018 (

Eurostat 2022). Second, this period is also marked by the implementation of Basel III and CRD IV,

1 which, among others, tightened the capital requirements and introduced new leverage and liquidity requirements (see

Bank for International Settlements 2022) with the aim of ensuring financial stability with possible implications for banks’ productivity. The objective of this paper is, therefore, to observe how these challenges influenced the productivity of the CEE commercial banks. We measure productivity change by applying the Malmquist Productivity Index (MPI), developed by

Färe et al. (

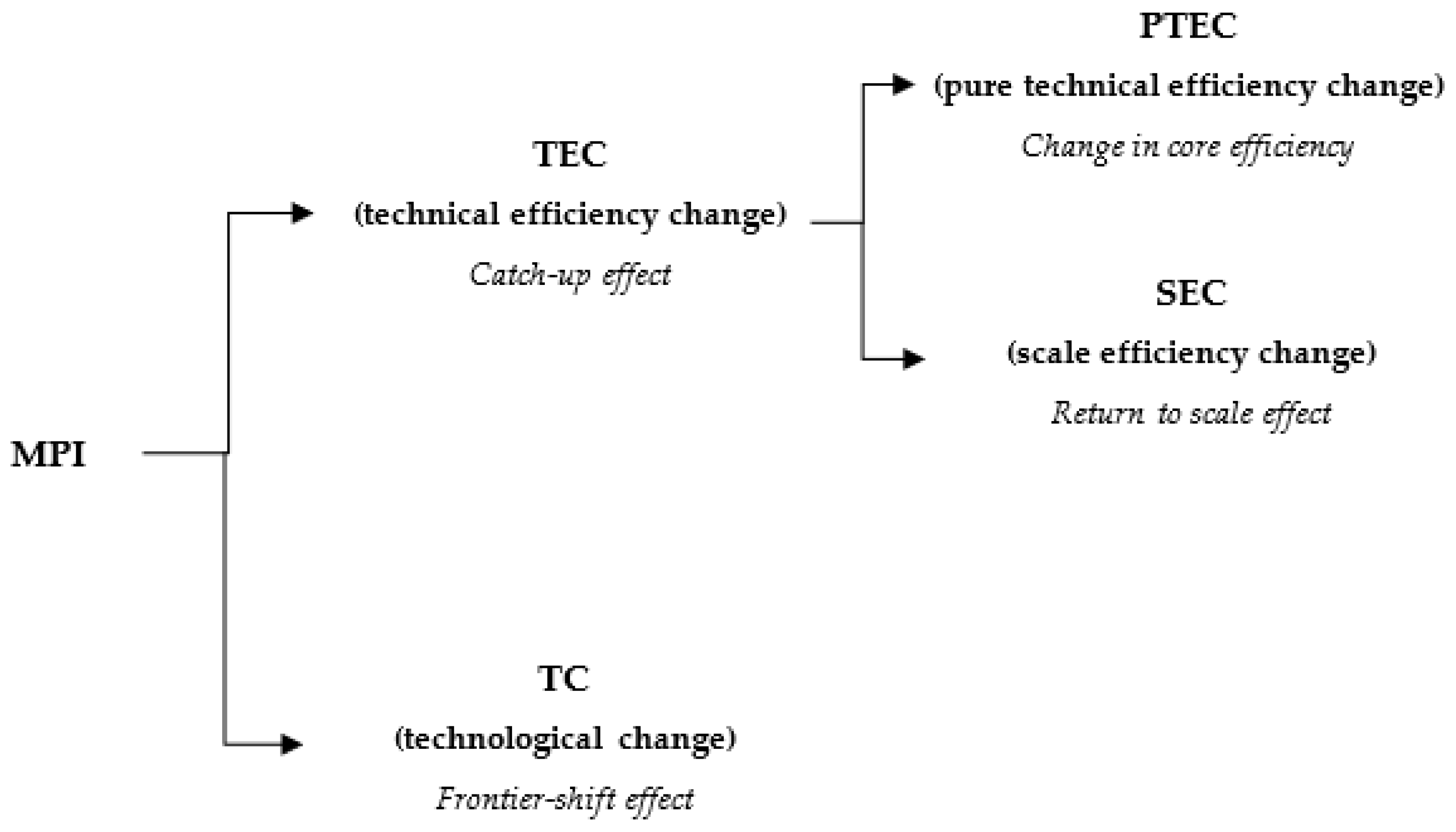

1994). The later was used to decompose the productivity change into technological change and efficiency change.

The analysis is based on data from the annual financial statements and a balanced panel of 181 commercial banks in the CEE countries. Empirical findings based on the asset-oriented intermediation approach show that in most CEE countries, the productivity of commercial banks, on average, decreased over the 2013–2018 period, with a decline ranging from 1% to 6.9%. On the other hand, following the profit-oriented intermediation approach, commercial banks in all CEE countries, on average, recorded an increase in productivity over the 2013–2018 period. Similar findings were also reported by some other studies for the CEE countries, although the majority of these studies focused on the pre-crisis period (see

Section 2). Among recent studies,

Paleckova (

2019) reported increased efficiency among Czech and Slovak commercial banks during economic expansion. The increase in productivity over the 2013–2018 period might be attributed to a stable economic recovery and cheap financing for banks due to the expansionary monetary policies. In addition, empirical results show that a decline in productivity under the asset-oriented intermediation approach was, on average, higher among the CEE commercial banks that are part of the euro area.

The paper adds to the literature in three ways. First, it focuses on the post-crisis period of stable GDP growth accompanied by the implementation of Basel III and CRD IV, the period that has been analyzed only by a few studies (for example,

Huljak et al. 2022;

Degl’Innocenti et al. 2017;

Kourtzidis et al. 2019). Second, it focuses on the commercial banks in the CEE countries. There are only a few studies on the productivity change of banks in these countries, with very few of them using data after 2010. Third, the paper uses two approaches to estimate the productivity change (the asset- and profit-oriented intermediation approach) and provides a detailed decomposition of the productivity change, meaning that it identifies the efficiency components of the productivity change over the observed period. In the empirical analysis, it also differentiates the CEE commercial banks by their membership in the euro area.

The structure of the paper is as follows:

Section 2 gives a literature review on the efficiency and productivity of banks. This is followed by a description of the methodology and data used in

Section 3.

Section 4 presents empirical findings, whereas

Section 5 provides discussion and concluding remarks.

2. Literature Review

The primary function of the financial sector, with banks serving as one of its main agents, is to effectively allocate capital to the most profitable investments. This involves reducing the risks associated with adverse selection and moral hazards, as well as lowering transaction costs. By performing these functions, banks present one of the most significant drivers of economic growth (

Rajan and Zingales 1998).

In theory, in a perfectly competitive financial market, firms make investment decisions independently of their financial position. Yet, in practice, this does not hold, as internal and external financial resources are not substitutes. According to

Davidson (

1994), they can even be treated as complements. Firms’ investment decisions are limited by the available financial resources they generate or acquire on the financial markets. Limited availability and high costs of obtaining financial resources on the capital markets force firms (especially medium and small ones) to obtain the necessary financial resources in the form of loans from intermediaries, mostly banks (

Mishkin 2019). Banks play a crucial role in transforming the risk, size, and maturity of assets and facilitating the transfer of funds from savers to investors, thereby supporting the realization of investment opportunities and contributing to productivity and economic growth (

Casu et al. 2006). Banks’ productivity and efficiency are therefore important driving forces of economic development and should present an important issue in policymaking.

An important determinant of banks’ efficiency and productivity is also regulation and supervision, although studies provide mixed findings, varying also on the type of regulation (

Hassan 2020). For example, using data for banks in 22 countries over the period 1999–2009,

Delis et al. (

2011) showed that regulations related to private monitoring and banks’ activities in securities, insurance, real estate, and ownership of nonfinancial firms had a positive effect on productivity, whereas regulations relating to capital requirements and strengthening supervisory powers had no effect.

Hassan (

2020) found that high capital requirements positively contributed to the growth of productivity in banks in North and Latin America, but not in Europe, Africa, or Asia. Similar findings were reported for regulations relating to supervisory powers. Moreover, the author reported that restrictions on real estate, insurance, and securities activities impeded productivity change in all high-income economies. Using data for banks in 22 EU countries, including also the CEE countries, between 2000 and 2008,

Chortareas et al. (

2012) found that tightening of capital restrictions and strengthening official supervisory institutions can improve the efficiency of bank operations, with the effect being higher in countries with more quality institutions. They also found that interventionist supervisory and regulatory policies, such as private sector monitoring and restricting bank activities, can lower bank efficiency levels.

Psillaki and Mamatzakis (

2017) found for banks in the CEE countries that credit regulation had a positive effect on cost efficiency over the 2004–2009 period, with better capitalized banks being more cost efficient.

Even though the question of the productivity and efficiency of banks attracts many researchers, measuring and interpreting the two phenomena is ambiguous and can be approached in several different ways. The most commonly used approach to estimate efficiency and productivity change is the intermediation approach, developed by

Sealey and Lindley (

1977). This approach shows the cost-efficiency of banks in the production of outputs (loans and other earning assets) with the inputs used (deposits and total costs) and emphasizes the role of banks as a financial intermediary. There are several methods to implement this analysis, with two being most commonly used: Stochastic Frontier Analysis (SFA), which is stochastic and parametric, and Data Envelopment Analysis (DEA), which is deterministic and non-parametric (see

Koetter et al. 2006).

In the economic literature, we can find several studies that deal with the efficiency and productivity of banks (for literature reviews, see

Sharma et al. 2013;

Ahmad et al. 2020;

Maradin et al. 2019,

2021). In the last few years, several of them have focused on banks in developing countries (see, for example,

Khaksar and Malakoutian 2020). Nevertheless, only a very narrow strand of the literature focuses on the banks in the CEE countries in the recent period. In the continuation, we focus on studies for the CEE banks, in which we present studies that used DEA, SFA, or other methodological approaches. Most of the existing studies focus on the years before the 2009 global economic crisis, meaning that there is a lack of current research results, confirming the value added of this paper.

Several studies report on improving the efficiency and productivity of banks in the CEE countries in the pre-2009 crisis years. For example,

Yildirim and Philippatos (

2007) examined the costs and profitability efficiency of the CEE banks between 1993 and 2000, providing several important empirical findings. First, they found that managerial inefficiencies were significant, with cost efficiency for 12 examined countries averaging 72% for the deterministic frontier approach (DFA) and 77% for the SFA. Second, they discovered that alternative profit efficiency levels were significantly lower relative to cost efficiency. Third, about a third of banks’ profits were lost due to inefficiency, according to the SFA, and almost half were lost, according to the DFA. Using the 2000–2006 data for Romania, Czech Republic, and Hungary and applying both the SFA and DEA approaches,

Andrieş and Cocriş (

2010) reported increased cost efficiency of banks in all three studied countries, with Romania noticing the greatest improvement. Similar findings were reported by

Andrieş (

2011) for seven CEE countries over the 2004–2008 period—the average productivity of banks (calculated with a Malmquist productivity index) had increased in 2008 by approximately 24.3% from 2004, mostly due to technological modifications. Likewise,

Kenjegalieva and Simper (

2011), using the Luenberger productivity index, showed that the main driver of positive productivity change in the CEE banks over the 1998–2003 period was technological improvement. Also,

Stubelj and Dolenc (

2013) reported an improved average efficiency of banks in the CEE countries that were new EU member states. According to the authors, the growth in the average efficiency of banks in the new EU member states even surpassed the efficiency of banks in the old EU member states in the years from 2005 to 2008. The efficiency of banks in the new EU member states initially lagged behind that of old members but began converging towards that of old members by the end of the observed period. In the last year, this trend stopped, and a small difference in efficiency remained. Their findings on the ranking of efficiency scores among the old member states are similar to the findings of

Casu and Girardone (

2008).

The literature suggests that there are significant differences in banks’ efficiency and productivity with regard to the structure of the banking industry, individual bank characteristics, a country’s macroeconomic variables, and risk in the economy (

Košak and Zajc 2006;

Kenjegalieva and Simper 2011).

Yildirim and Philippatos (

2007) found that during 1993–2000, higher efficiency levels were associated with large and well-capitalized CEE banks. Similar findings were reported also by

Pančurová and Lyócsa (

2013) for banks in 11 CEE countries over the 2005–2008 period,

Kozak and Wierzbowska (

2019) for CEE banks over the 2000–2017 period, and

Papadopoulos and Karagiannis (

2009) for South European banks over the 1997–2003 period. The latter showed that the largest banks enjoyed greater benefits from technological progress, while they did not show scale economy or efficiency advantages over smaller banks. Studies also show that foreign banks, located in the CEE countries, were more cost-efficient, but less profit-efficient (

Yildirim and Philippatos 2007) or revenue-efficient (

Pančurová and Lyócsa 2013) than domestic banks. Moreover, degree of competition had a positive effect on cost efficiency and a negative effect on profit efficiency of the CEE banks in the pre-crisis period, whereas market concentration was negatively associated with banks’ efficiency (

Yildirim and Philippatos 2007;

Koutsomanoli-Filippaki et al. 2009). In a later study,

Kozak and Wierzbowska (

2019), using a longer time period of observation (i.e., 2000–2017), showed that a growing market concentration had a positive impact on the efficiency of banks operating in this market.

Niţoi and Spulbar (

2015) analyzed the determinants of cost efficiency in commercial banks from six European transition countries during 2005–2011, considering the macroeconomic environment and performance indicators of banks. Their main conclusions were that: (1) high macroeconomic stability is positively associated with the efficiency of commercial banks; (2) there is a negative relation between the ratio of domestic credit provided by the banking sector over GDP and the efficiency of the banking sector; (3) banks with less liquidity, a lower solvency rate, and higher credit risk are more inefficient; (4) high-performance banks are more efficient; and (5) all the banking systems included in their study increased the level of efficiency until 2008. In 2009, the efficiency of banks in Poland, Romania, Russia, and Hungary decreased, whereas in Bulgaria and the Czech Republic, banks’ efficiency remained at a comparable level.

Empirical findings show that regulatory changes and reforms had a considerable effect on banks’ efficiency in the CEE countries.

Košak et al. (

2009) examined banks’ cost efficiency in five new EU Member States from the CEE and three Baltic countries from 1996 to 2006. Prior to reaching EU membership in 2004, the banking industry in these countries had undergone a remarkable transformation. The authors examined the differences in cost efficiency between countries and the efficiency improvements driven by intensive legislative and regulatory changes and extensive ongoing structural and institutional reforms. Their analysis showed an improvement in cost efficiency during the observed period.

Andrieş and Capraru (

2013) analyzed the impact of financial liberalization and reforms on banking performance in 17 CEE countries for 2004–2008. In the first step of their empirical model, they assessed the performance of banks and its determinants in the second. They discovered that banks from the CEE countries with a higher degree of liberalization and openness were capable of increasing cost efficiency and eventually offering cheaper services to customers. On the contrary, banks from non-EU countries were less cost-efficient but had a significantly higher level of overall productivity growth. Large banks were far more cost-efficient than medium and small banks, but small banks showed the highest productivity growth. The same authors researched the effect of the EU integration process on bank efficiency and the convergence of cost efficiency across CEE banking systems in 2014. Analyzing the period between 2004 and 2010, they found large discrepancies in the levels of cost efficiency among national banking systems but did identify a universal increase in banking efficiency until 2008, a trend that reversed in 2009. The authors proved the β-convergence and σ-convergence in terms of cost efficiency among the banking systems, especially in the years 2009 and 2010.

Only a few studies have explored the efficiency and productivity dynamics of banks in the years after the 2009 crisis.

Degl’Innocenti et al. (

2017) researched the efficiency of banks in nine new EU members from 2004 to 2015. They found a relatively stable and slight increase in overall efficiency until 2010, followed by a slight decrease in the next few years. Similar findings were also reported by

Erina and Erins (

2020) for banks in seven CEE countries from 2006 to 2011. They found that banking systems operated most effectively in Lithuania and Slovenia, while the Latvian banking system was most inefficient in the analyzed period. Moreover, they showed that bank efficiency in the CEE countries decreased when the financial crisis started, with some exceptions.

Paleckova (

2019) compared the cost efficiency of the Czech and Slovak commercial banks within the 2005–2015 period and found higher efficiency among the Czech banks. Moreover, she reported higher efficiency among larger banks with higher liquidity risk and a lower net interest margin. She also showed that banks were most cost-efficient during economic expansion. In contrast,

Kourtzidis et al. (

2019) reported that the financial crises did not affect the banks of the CEE countries, by which they studied productivity changes for three periods of the financial crisis—the US subprime crisis (2007–2008), the global financial crisis (2008–2010), and the sovereign debt crisis (2010–2012). Furthermore, they analyzed the β-convergence and found a strong pattern for convergence among the banks of the CEE countries.

To summarize, the literature review shows that research prior to 2008 showed an increase in bank efficiency in the CEE banks, while research including both pre- and post-crises data showed an increase in efficiency and a moderate decrease in efficiency after the year 2009. In the continuation of this paper, we focus on a more recent period of 2013–2018 and use the Malmquist productivity index to measure changes in banks’ productivity.

4. Results

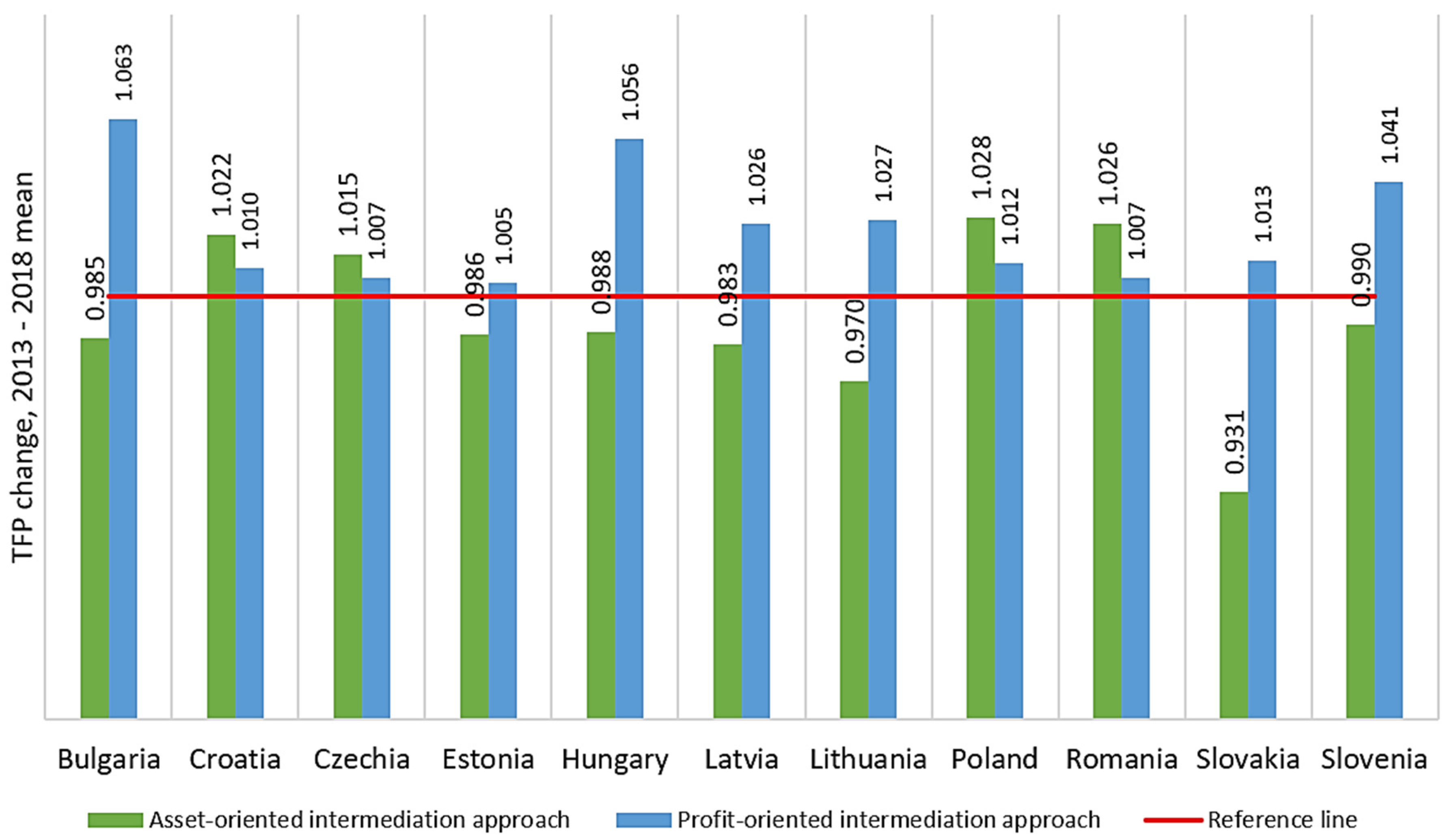

Figure 2 compares the means of the annual geometric means of the MPI index for commercial banks in each observed CEE country over the 2013–2018 period using both an asset-oriented and profit-oriented intermediation approach. A value of MPI greater than one indicates positive TFP growth, while a value less than one will indicate TFP decline.

Following the asset-oriented intermediation approach, in only four CEE countries, commercial banks recorded productivity growth over the observed period—Czechia (on average, 1.5%), Croatia (on average, 2.2%), Romania (on average, 2.6%), and Poland (on average, 2.8%). In all other countries, the productivity of commercial banks, on average, declined, with the decline being the highest in Slovakia (on average, by 6.9%). It seems that banks were more prudent in transforming the inputs (deposits and short-term funding, operating expenses, and fixed assets) into outputs (loans and other earning assets), worsening the inputs-to-outputs ratio.

Estimates using the profit-intermediation approach provide different results. As shown in Figure below, on average, in all CEE countries, commercial banks recorded productivity growth, indicating that commercial banks took advantage of a period of stable economic growth, which was also boosted by expansionary monetary policy and low-interest financing to banks. Banks were able to increase the interest or non-interest income relative to expenses. It seems that this effect prevailed over the possible negative effect of stricter regulation on productivity. The growth was the highest in Bulgaria (on average, 6.3%) and in Hungary (on average, 5.6%).

Decompositions of the MPI show that the average productivity growth estimated under the asset-oriented intermediation approach has been mainly driven by a positive technological change (TC), a common result found also in the literature (see, for example,

Kenjegalieva and Simper 2011;

Stubelj and Dolenc 2013;

Degl’Innocenti et al. 2017 for the CEE countries;

Boucinha et al. 2013;

Casu et al. 2016;

Huljak et al. 2022 for the EU banks). As shown in

Table 3, all CEE countries, on average, recorded a substantial positive technological change over the observed period, with the highest in Estonia (+13.9%) and Lithuania (+10.4%). On the other hand, the average overall technical efficiency (TEC) of commercial banks declined in all CEE countries, with the decline being the highest in Slovakia (−14.6%), Estonia (−12.5%), and Lithuania (−10.8%). Similar findings were also reported by some other studies for the CEE countries (

Degl’Innocenti et al. 2017), the EU countries (

Maudos et al. 2002;

Huljak et al. 2022), and for other countries (see

Sharma et al. 2013;

Maradin et al. 2021 for literature reviews). The TEC can be further decomposed into pure technical efficiency change (PTEC) and scale efficiency change (SEC). A closer look at the results shows that the decline in TEC was mainly driven by the decline in PTEC—on average, PTEC decreased by 3% to 10.7%.

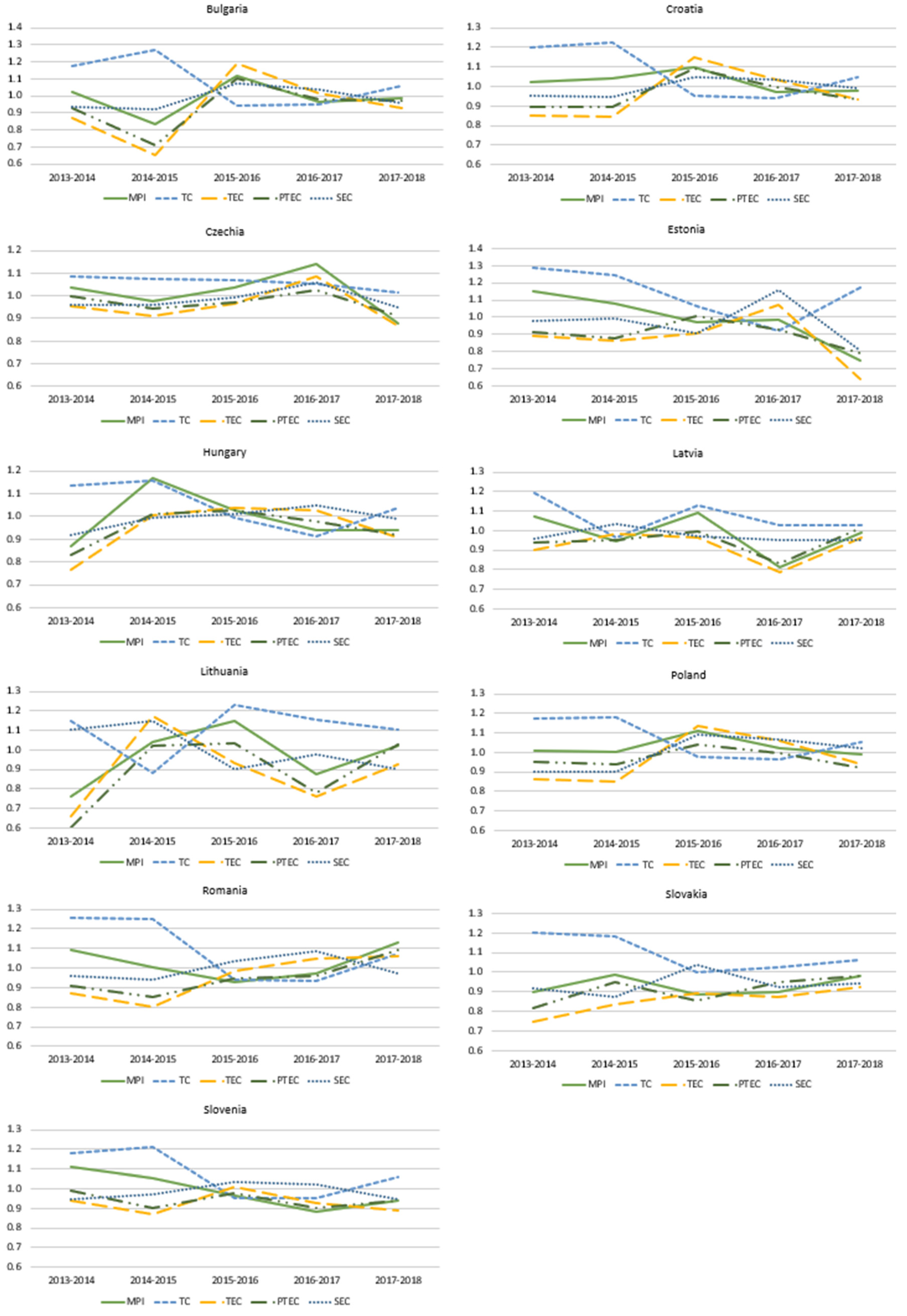

How has the productivity of commercial banks changed over the years? As shown in

Figure 3, there is a very high cross-country and cross-year variation in the productivity changes. For example, there was an increasing trend of productivity growth in Croatia (2013–2015), Czechia (over the 2014–2016 period), Lithuania (2013–2015), Poland (2013–2015), and Slovakia (2015–2018), whereas Estonia (over the 2013–2016 period), Hungary (2014–2017), and Slovenia (2013–2017) recorded a decline in productivity for most of the observed years. Analysis of the average MPI values for all CEE countries over the years shows that the MPI increased from above 0.6% in 2014 to 3.3% in 2016, followed by a strong decline in 2017 (−4.9%) with a negative trend continuing by 2018 (−0.7%). A decline in productivity growth after 2013 was also reported for the EU banks (

Casu et al. 2016;

Huljak et al. 2022) and can be associated with the financial crisis. In the majority of the CEE countries, productivity growth over time was driven by technological change (TC), which was especially evident at the beginning of the observation period. In 2014 and 2015, the TC increased, compared to previous years, on average, by 18.7% and 15.1%, respectively. In later years, which were marked by a MPI decline, TC was lower compared to previous years, and in 2017, declined by 1.5% compared to the previous year. The decrease in TC was also accompanied by a decrease in TEC (it declined by 9.3% in 2017 compared to 2016), although most of the countries recorded a slight improvement in TEC in 2015 and/or 2016. This finding is comparable to

Huljak et al. (

2022), who showed that TEC was a main driver of a decline in total factor productivity in the post-crisis period in the euro area banking sector.

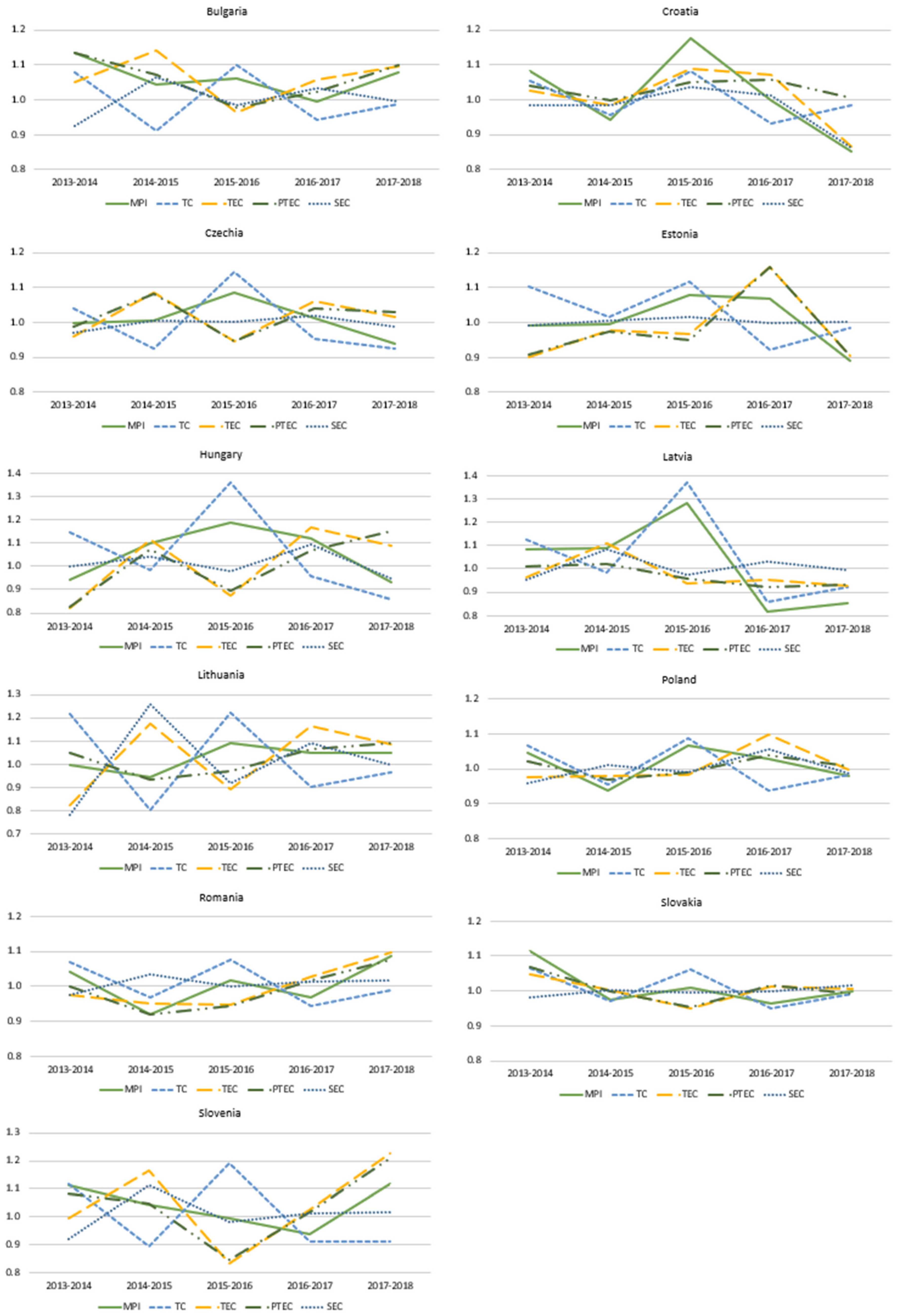

Table 4 presents the average MPI and its sub-components estimated by the profit-oriented intermediation approach. The profit-oriented intermediation approach differs from the asset-oriented intermediation approach by focusing on financial income measures. In contrast to the estimates based on the asset-oriented intermediation approach, commercial banks in all the CEE countries, on average, recorded a positive productivity change over the 2013 to 2018 period under the profit-oriented approach (see

Figure 2). The average productivity growth was the highest in Bulgaria (+6.3%) and Hungary (+5.6%). A year-by-year analysis of the average MPI values for all CEE countries shows that the MPI increased at most in 2016 (by 9.5% compared to the year before), followed by a small decline in the two following years (0.4% in 2017 and 2% in 2018). A similar trend in the decline of average productivity growth for the CEE region in these years was also observed under the asset-oriented intermediation approach, yet more significant in size, and was reported in some of the studies for the euro area (for example,

Casu et al. 2016). Yet, under the profit-oriented intermediation approach, productivity growth was not only driven by technological change (TC). Although all CEE countries, with the exception of Czechia, recorded a positive technological change over the observed period, the majority of them also recorded a positive technical efficiency change (TEC), mostly driven by the change in pure technical efficiency (PTEC). We can therefore observe both the frontier-shift and catching-up effects.

An analysis of the trends in the MPI and its sub-components under the profit-oriented intermediation approach again points to high cross-country and cross-year variation (see

Figure 4). Several countries recorded a peak in productivity growth over 2015/2016 (on average, 9.5%), when several countries recorded an increase in economic growth, which might be associated with higher demand for loans. In this year, commercial banks in the CEE countries, on average, recorded the highest increase in technological change (TC, by 16.5%, being the highest in Hungary and Latvia).

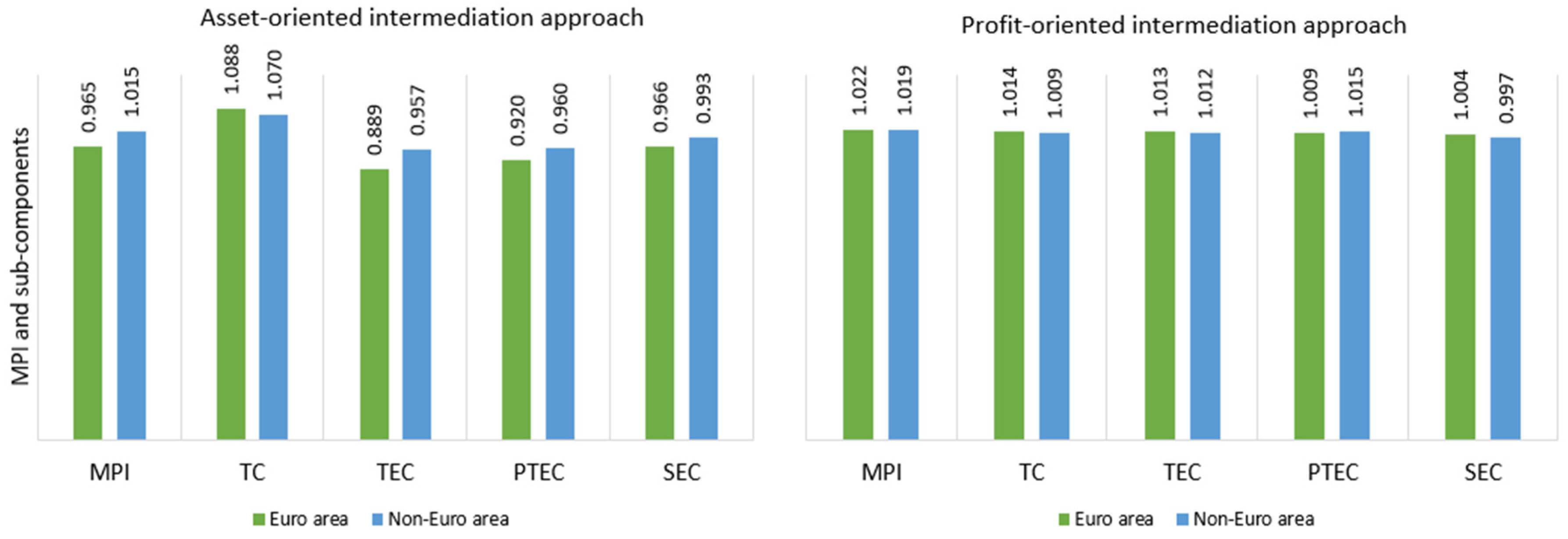

Figure 5 presents the average MPI and its subcomponents for the CEE commercial banks that are part of the euro area and for those that are not. Differences in productivity changes between euro and non-euro area commercial banks are very low under the profit-oriented intermediation approach. On the other hand, estimates under the asset-oriented intermediation approach show that, on average, the non-euro CEE commercial banks have recorded a positive productivity change (+1.5%) over the 2013–2018 period, whereas in the CEE commercial banks that are part of the euro area, average productivity declined. Further decompositions point out that the decline in average productivity in these countries can be attributed to the decline in technical efficiency (TEC)—on average, in the euro area CEE commercial banks, the TEC has declined by 11.1% (for comparison, in the non-euro CEE commercial banks, the TEC decreased by 4.3%). A drop in technical efficiency in the post-crisis period for the euro area banks was also reported by

Casu et al. (

2016) and

Huljak et al. (

2022).

How do you explain differences in commercial banks’ productivity across the CEE countries? A more detailed look at the data shows that banks in most CEE countries with, on average, higher productivity changes (estimated by the asset-oriented intermediation approach) and in years with the highest average productivity growth recorded lower loans-to-assets ratios and lower profitability, as measured by the ROAA. This implies that banks in these countries were less exposed to regulatory changes. Moreover, in years with the highest productivity growth (measured with the profit-oriented intermediation approach), i.e., 2015 and 2016, commercial banks in the CEE countries also recorded the highest net interest margin (6.65 and 6.04, respectively).

5. Conclusions and Policy Implications

We employ a non-parametric DEA approach to estimate the productivity changes of the commercial banks in the CEE countries over the 2013–2018 period as measured by the MPI. To the knowledge of the authors, there are only a small number of studies that analyze the performance and productivity of the banking system in the period that is observed in this study, and there is a lack of studies that focus on the CEE (transition) countries. The observed period is of special importance for two reasons. First, 2013 marks the post-crisis recovery after the 2009 global financial crisis and the European sovereign debt crisis. We expect that economic growth might have contributed to the productivity of commercial banks. Second, over this period, the implementation of Basel III and CRD IV in the EU started. Although we do not estimate the effects of regulation on commercial banks’ productivity, we, following the findings in the literature, believe it might have important implications for commercial banks’ productivity. Along with the time and geographical added value, the paper also adds to the literature by estimating productivity changes and their sub-components in commercial banks in all CEE countries using two intermediation approaches—asset- and profit-oriented intermediation approaches.

We find that productivity, measured with the asset-oriented intermediation approach, declined in most of the CEE countries, with a decline ranging from 1% in Bulgaria and Slovenia to 6.9% in Slovakia. The drop in productivity in these countries was mostly driven by a decline in technical efficiency, and it was higher for euro area commercial banks. Similar findings were provided by Degl’Innocenti et al. 2017 for the CEE countries, Casu et al. 2016 and Huljak et al. 2022 for the euro area, and also by some international studies (see

Sharma et al. 2013 for a review). It seems that commercial banks were more prudent in transforming the inputs into outputs. Estimates using the profit-intermediation approach provide different results. On average, in all CEE countries, commercial banks recorded productivity growth, ranging from 0.5% in Estonia to 6.3% in Hungary. This might indicate that commercial banks took advantage of a period of stable economic growth, which was also boosted by expansionary monetary policy and other central banks’ measures that provided low-interest and stable financing to banks. Banks were able to increase income (interest, non-interest) relative to expenses (interest, non-interest). This effect might prevail over the possible negative effect of stricter regulation on productivity. Moreover, the results also show that productivity growth tends to be higher in the CEE countries with, on average, a lower loans-to-asset ratio, making them less exposed to changing regulatory and economic conditions. Under both approaches, one of the important drivers of positive productivity changes was technological change.

The findings from the present studies have some policy implications for commercial banks in the CEE region. They currently operate in an environment with increasing interest rates and are faced with high cost burdens (

Huljak et al. 2022). To facilitate productivity growth, they should increase investment in digital transformation (for example, by digitalizing processes or investing in online banking) and in changing their business models. As shown above, technological change was an important determinant of productivity growth in the post-crisis period. This might decrease their costs, increase their efficiency, and, by addressing changing customer demands, have positive effects on their revenues. Technological improvement and change in business operations are especially important in an environment that is faced with increasing risks due to the political situation in nearby regions and the increasing competition of neobanks and other fintech institutions.

Although the paper adds to the literature by estimating the productivity changes in the CEE banking system in the post-crisis period, there is still room for further research. This includes an in-depth study of the effect of Basel III reform and also of macro- and micro-economic determinants on the productivity and performance of commercial banks in the CEE. According to

Kenjegalieva and Simper (

2011), several external factors, such as risk, banking production, and the macroeconomic environment, affect the productivity of banks. Furthermore, a larger set of variables and additional models could be used to closely observe the productivity and efficiency changes in the CEE commercial banks. As shown also by

Ahn and Le (

2014), different input/output combinations and approaches to measuring productivity bring different results on productivity changes. These methodological issues should be examined more closely.