Impact of Output Gap, COVID-19, and Governance Quality on Fiscal Space in Sub-Saharan Africa

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Literature

2.2. Brief Overview of the Concept of Fiscal Space

2.3. Determinants of Fiscal Space

3. Methodology

3.1. Data and Measurement

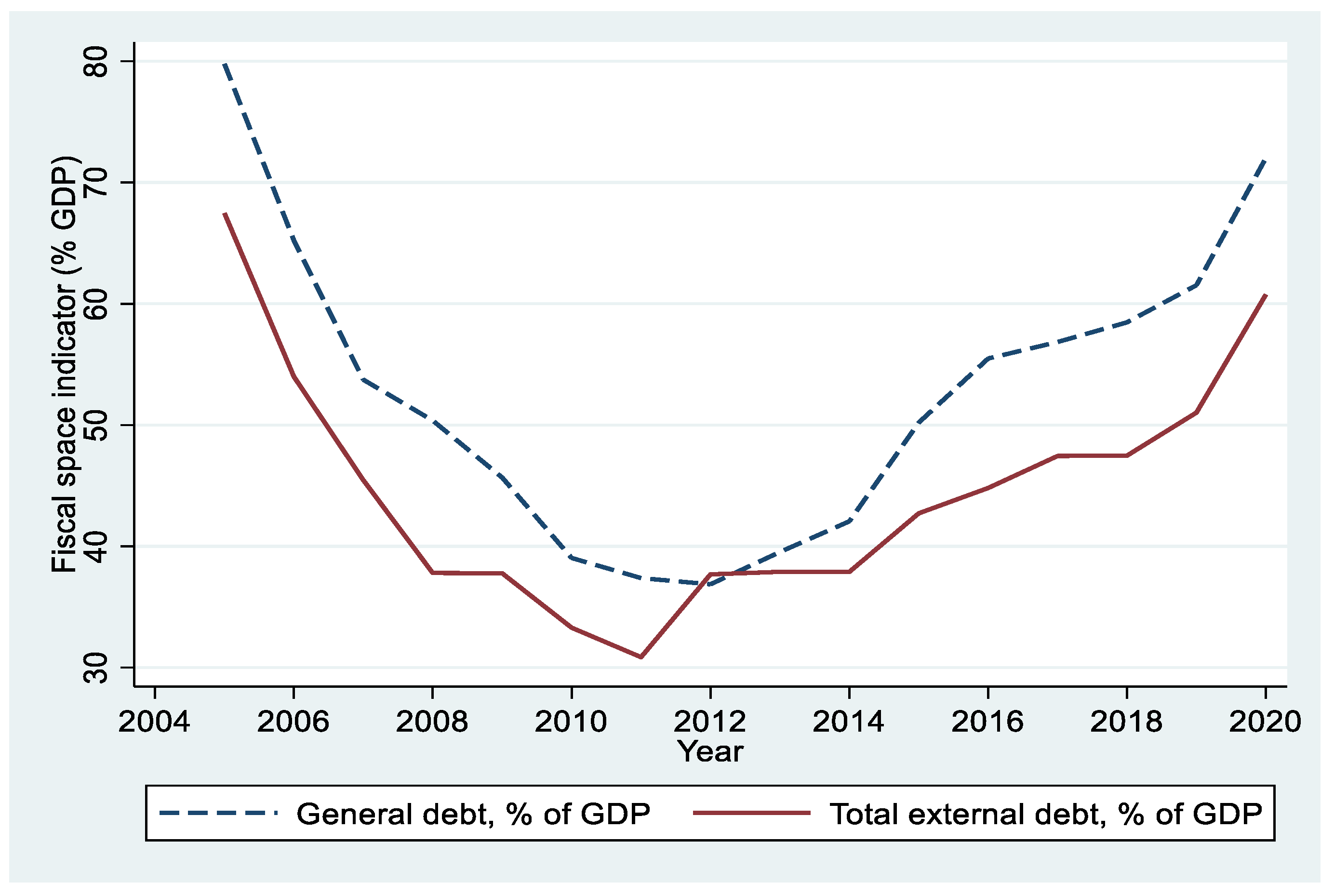

3.1.1. Measuring Fiscal Space

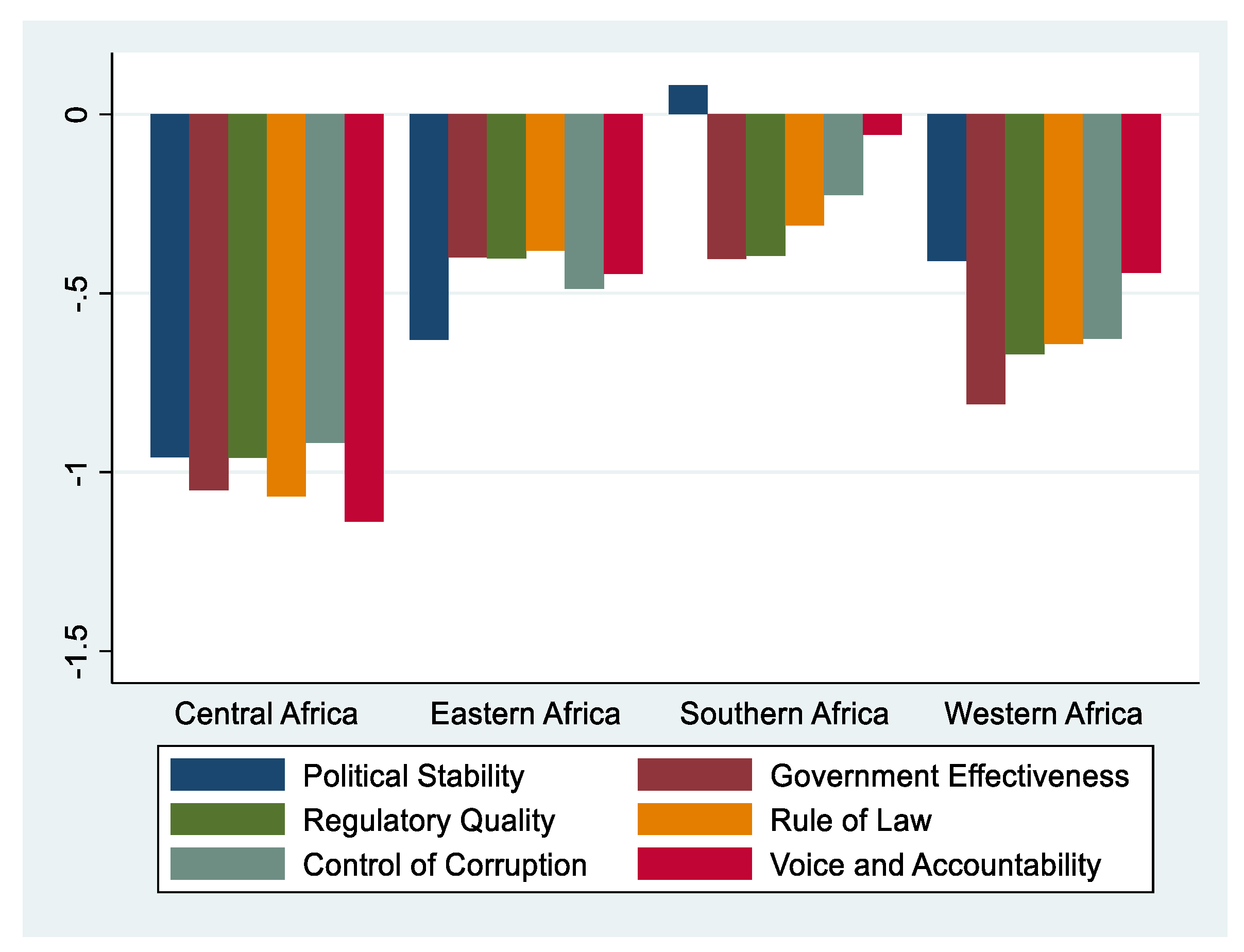

3.1.2. Measuring Governance Quality

3.1.3. Measuring Output Gap (OGAP)

3.1.4. Measuring COVID-19 Dummy (COVID)

3.1.5. Other Control Variables

3.2. Model Specification

4. Empirical Results and Analysis

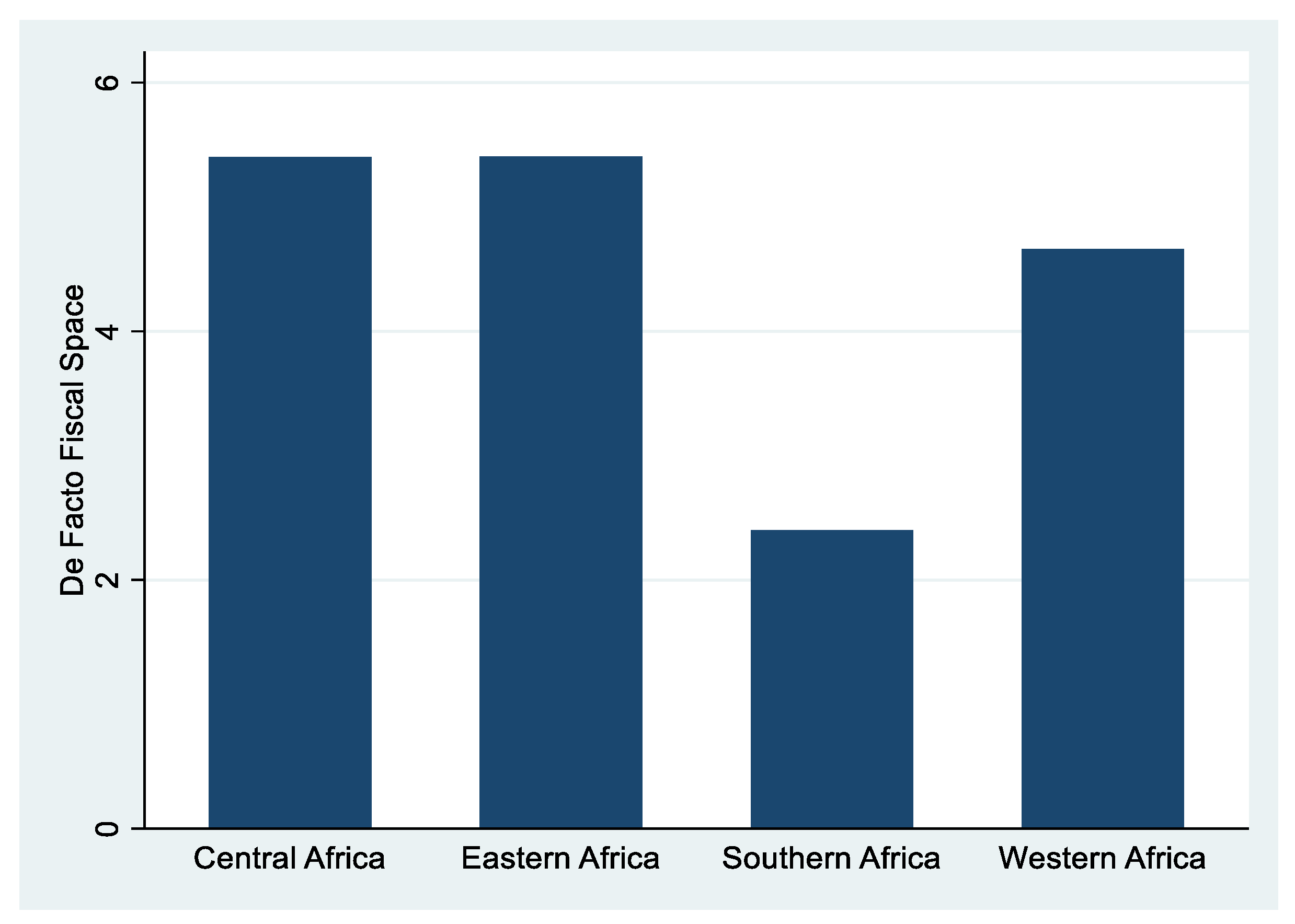

4.1. Descriptive Analysis

4.2. Correlation Analysis

4.3. Unit Root Results

4.4. Principal Component Analysis

4.5. Regression Results

4.5.1. Governance Quality Threshold Level and Effect on DFSP in a Parsimonious Model

4.5.2. COVID-19 Pandemic and Output Gap Effect on DFSP

4.5.3. Subsample Analysis of the Effects of Governance Quality, Output Gap, and COVID-19 on DFSP

| (17) | (18) | (19) | (20) | |

|---|---|---|---|---|

| Central Africa | Eastern Africa | Southern Africa | Western Africa | |

| L.DFSP | 0.3438 ** | 0.6294 *** | 0.2688 *** | 0.7932 *** |

| (0.1371) | (0.0622) | (0.0599) | (0.0190) | |

| GDPR | −13.953 ** | −14.543 *** | −4.2382 *** | −14.680 *** |

| (7.0579) | (4.8090) | (1.2872) | (5.5445) | |

| TOP | 2.1577 * | 1.4262 * | 1.1326 ** | 1.4264 ** |

| (1.3957) | (0.8954) | (0.5443) | (0.6277) | |

| GRSK | −0.03144 | 0.005661 | 0.0005439 | −0.03801 ** |

| (0.0640) | (0.0212) | (0.0080) | (0.0180) | |

| POGR | 280.04 * | −4.5131 | −188.94 *** | 592.19 *** |

| (146.9299) | (20.7251) | (66.8400) | (63.2679) | |

| PC1 | −4.0261 ** | −1.5292 *** | −0.9332 *** | −1.1228 * |

| (1.7664) | (0.5635) | (0.2178) | (0.6085) | |

| C | −2.1432 | 3.0793 *** | 2.8978 *** | 1.8598 *** |

| (3.2341) | (0.6812) | (0.3716) | (0.3731) | |

| N | 80 | 128 | 128 | 192 |

| AR(1) | 0.0280 | 0.0000 | 0.0097 | 0.0009 |

| AR(2) | 0.1190 | 0.9543 | 0.1382 | 0.0589 |

| Sargan (p value) | 0.2409 | 1.0000 | 1.0000 | 0.8472 |

4.5.4. Governance, COVID-19 Pandemic, and Output Gap Effect on DFSP

4.6. Robustness Checking

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

|---|---|---|---|---|---|---|---|

| L.DFSP | 0.8164 *** | 0.8013 *** | 0.8184 *** | 0.8215 *** | 0.8147 *** | 0.8205 *** | 0.8259 *** |

| (0.0062) | (0.0091) | (0.0068) | (0.0047) | (0.0056) | (0.0080) | (0.0076) | |

| GDPR | −19.971 *** | −14.204 *** | −21.918 *** | −18.688 *** | −20.990 *** | −20.930 *** | −19.799 *** |

| (1.3969) | (0.9462) | (0.8591) | (0.9969) | (1.1895) | (0.6494) | (1.1976) | |

| TOP | 0.8916 *** | 0.6927 *** | 0.8120 *** | 1.2294 *** | 0.8816 *** | 0.8245 *** | 1.0570 *** |

| (0.0720) | (0.1738) | (0.1572) | (0.0795) | (0.1157) | (0.1524) | (0.1119) | |

| GRSK | −0.002134 | 0.001944 | −0.002100 | −0.007289 *** | −0.005217 ** | 0.001328 | −0.001013 |

| (0.0024) | (0.0028) | (0.0028) | (0.0018) | (0.0022) | (0.0027) | (0.0038) | |

| POGR | 77.228 *** | 87.129 *** | 85.994 *** | 60.798 *** | 79.974 *** | 85.076 *** | 74.866 *** |

| (8.4137) | (13.0141) | (7.0775) | (9.2616) | (8.7676) | (13.2355) | (9.6359) | |

| PC1 | −0.7646 *** | ||||||

| (0.1214) | |||||||

| PVE | −2.0138 *** | ||||||

| (0.2808) | |||||||

| GEE | −1.1110 *** | ||||||

| (0.3476) | |||||||

| RLE | 1.5894 *** | ||||||

| (0.2481) | |||||||

| RQE | −2.1493 *** | ||||||

| (0.5130) | |||||||

| CCE | −3.3284 *** | ||||||

| (0.5616) | |||||||

| VAE | −2.3255 *** | ||||||

| (0.4420) | |||||||

| C | 1.5839 *** | 0.3121 * | 0.8802 *** | 2.3728 *** | 0.4242 | −0.3319 | 0.3433 ** |

| (0.1090) | (0.1778) | (0.2561) | (0.2094) | (0.3039) | (0.3099) | (0.1720) | |

| N | 528 | 528 | 528 | 528 | 528 | 528 | 528 |

| AR(1) | 0.0153 | 0.0268 | 0.0093 | 0.0145 | 0.0113 | 0.0083 | 0.0181 |

| AR(2) | 0.5444 | 0.9999 | 0.4395 | 0.6577 | 0.7282 | 0.7975 | 0.5119 |

| Sargan (p-value) | 0.9077 | 0.9077 | 0.9077 | 0.8648 | 0.9077 | 0.9077 | 0.9077 |

References

- Abdi, Hervé, and Lynne J. Williams. 2010. Principal Component Analysis. Wiley Interdisciplinary Reviews: Computational Statistics 2: 433–59. [Google Scholar] [CrossRef]

- Aizenman, Joshua, and Yothin Jinjarak. 2010. De Facto Fiscal Space and Fiscal Stimulus: Definition and Assessment. No. 16539. Available online: https://www.nber.org/papers/w16539 (accessed on 25 August 2023).

- Aslam, Aqib, Samuel Delepierre, Raveesha Gupta, and Henry Rawlings. 2022. Revenue Mobilization in Sub-Saharan Africa during the Pandemic. Special Series on COVID-19; Washington, DC: International Monetary Fund. [Google Scholar]

- Aslan, Okan. 2022. Determinants of Fiscal Space: An Empirical Analysis for OECD Countries. Ankara: Hacettepe University Graduate School of Social Sciences. [Google Scholar]

- Assa, Boka Stéphane Kévin. 2018. Foreign Direct Investment, Bad Governance and Forest Resources Degradation: Evidence in Sub-Saharan Africa. Economia Politica 35: 107–25. [Google Scholar] [CrossRef]

- Bah, Mamadou, Henri Atangana Ondoa, and Koffi Délali Kpognon. 2021. Effects of Governance Quality on Exports in Sub-Saharan Africa. International Economics 167: 1–14. [Google Scholar] [CrossRef]

- Bekana, Dejene Mamo. 2023. Governance Quality and Financial Development in Africa. World Development Sustainability 2: 100044. [Google Scholar] [CrossRef]

- Bernheim, B. Douglas. 1989. A Neoclassical Perspective on Budget Defcits. Journal of Economic Perspectives 3: 55–72. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial Conditions and Moment Restrictions in Dynamic Panel Data Model. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Botev, Jarmila, Jean-Marc Fournier, and Annabelle Mourougane. 2016. A Re-Assessment of Fiscal Space in OECD Countries. OECD Economics Department Working Paper, No. 1352. Paris: OECD. [Google Scholar] [CrossRef]

- Endris Mekonnen, Ebrahim, and Andualem Kassegn Amede. 2022. Food Insecurity and Unemployment Crisis under COVID-19: Evidence from Sub-Saharan Africa. Cogent Social Sciences 8: 2045721. [Google Scholar] [CrossRef]

- Fund for Peace. 2021. Fragile States Index Annual Report 2021. Available online: https://fragilestatesindex.org/wp-content/uploads/2021/05/fsi2021-report.pdf (accessed on 25 August 2023).

- Ghosh, Atish R., Jun I. Kim, Enrique G. Mendoza, Jonathan D. Ostry, and Mahvash S. Qureshi. 2013. Fiscal Fatigue, Fiscal Space and Debt Sustainability in Advanced Economies. The Economic Journal 123: F4–F30. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm, and Jean-François Brun. 2020. Tax Reform and Fiscal Space in Developing Countries. Eurasian Economic Review 10: 237–65. [Google Scholar] [CrossRef]

- Hamilton, James. 2018. Why You Should Never Use the Hodrick-Prescott Filter. The Review of Economics and Statistics 100: 831–43. [Google Scholar] [CrossRef]

- Hammadi, Amine, Marshall Mills, Nelson Sobrinho, Vimal Thakoor, and Ricardo Velloso. 2019. A Governance Dividend for Sub-Saharan Africa? WP/19/1. Washington, DC: International Monetary Fund. [Google Scholar]

- Heller, Peter S. 2005. Understanding Fiscal Space. IMF Policy Discussion Paper 05/4. Washington, DC: International Monetary Fund. [Google Scholar]

- Ibrahim, Muazu, Emmanuel Kumi, and Thomas Yeboah. 2015. Greasing or Sanding the Wheels? Effect of Corruption on Economic Growth in Sub-Saharan Africa. African J of Economic and Sustainable Development 4: 157–73. [Google Scholar] [CrossRef]

- Kaiser, Henry F. 1974. An Index of Factorial Simplicity. Psychometrika 39: 31–36. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators: A Summary of Methodology, Data and Analytical Issues. Hague Journal on the Rule of Law 3: 220–46. [Google Scholar] [CrossRef]

- Ko, Hyejin. 2020. Measuring Fiscal Sustainability in the Welfare State: Fiscal Space as Fiscal Sustainability. International Economics and Economic Policy 17: 531–54. [Google Scholar] [CrossRef]

- Kose, M. Ayhan, Sergio Kurlat, Franziska Ohnsorge, and Naotaka Sugawara. 2017. A Cross-Country Database of Fiscal Space. Working Paper, No. 1713. Istanbul: Koç University TÜSİAD Economic Research Forum (ERF). [Google Scholar]

- Kose, M. Ayhan, Sergio Kurlat, Franziska Ohnsorge, and Naotaka Sugawara. 2022. A Cross-Country Database of Fiscal Space. Journal of International Money and Finance 128: 102682. [Google Scholar] [CrossRef]

- Kraay, Aart, Daniel Kaufmann, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators: Methodology and Analytical Issues. Policy Research Working Papers. Washington, DC: The World Bank. [Google Scholar] [CrossRef]

- Mawejje, Joseph, and Nicholas M. Odhiambo. 2020. The Determinants of Fiscal Deficits: A Survey of Literature. International Review of Economics 67: 403–17. [Google Scholar] [CrossRef]

- Musavengane, Regis, Pius Siakwah, and Llewellyn Leonard. 2019. ‘Does the Poor Matter’ in pro-Poor Driven Sub-Saharan African Cities? Towards Progressive and Inclusive pro-Poor Tourism. International Journal of Tourism Cities 5: 392–411. [Google Scholar] [CrossRef]

- Ostry, Jonathan, Atish Ghosh, Jun Kim, and Mahvash Qureshi. 2010. Fiscal Space. IMF Staff Position Notes. SPN/10/11. Washington, DC: International Monetary Fund, vol. 2010. [Google Scholar] [CrossRef]

- Romer, Christina D., and David H. Romer. 2019. Fiscal Space and the Aftermath of Financial Crises: How It Matters and Why. Brookings Papers on Economic Activity. Washington, DC: Brookings, vol. 2019. [Google Scholar] [CrossRef]

- Roy, Rathin, Antoine Heuty, and Emmanuel Letouze. 2007. Fiscal Space for What? Analytical Issues from a Human Development Perspective. In Fiscal Space: Policy Options for Financing Human Development. London: Routledge. [Google Scholar] [CrossRef]

- Sabir, Samina, and Meshal Qamar. 2019. Fiscal Policy, Institutions and Inclusive Growth: Evidence from the Developing Asian Countries. International Journal of Social Economics 46: 822–37. [Google Scholar] [CrossRef]

- Seo, Myung Hwan, Sueyoul Kim, and Young-Joo Kim. 2019. Estimation of Dynamic Panel Threshold Model Using Stata. The Stata Journal: Promoting Communications on Statistics and Stata 19: 685–97. [Google Scholar] [CrossRef]

- World Bank. 2021. Global Economic Prospects, January 2021: COVID-19 Crisis Update. Washington, DC: World Bank. Available online: http://hdl.handle.net/10986/34710 (accessed on 25 August 2023).

- Yohou, Hermann D. 2023. Corruption, Tax Reform and Fiscal Space in Emerging and Developing Economies. The World Economy 46: 1082–18. [Google Scholar] [CrossRef]

- Zandi, Mark, Xu Cheng, and Tu Packard. 2012. Fiscal Space. Available online: https://www.economy.com/mark-zandi/documents/2011-12-13-fiscal-space.pdf (accessed on 25 August 2023).

| Variable | Measurement | Expected Relationship | Supporting Literature | Source |

|---|---|---|---|---|

| Economic growth rate (GDPR) | GDP growth (annual percentage) | − | Botev et al. (2016) | The World Bank (World Development Indicators) |

| Population growth (POPG) | Population growth (annual percentage) | +/− | Endris Mekonnen and Amede (2022) | |

| Global risk (GRSK) | Global risk (CBOE Volatility Index: VIX, Annual) | − | Aslan (2022) | FRED St. Louis Fed Database |

| Trade openness (TOP) | Trade openness (sum of goods and services imports and exports as a percentage of the GDP) | +/− | Yohou (2023) | Our World Data |

| Variable | VIF |

|---|---|

| GDPR | 1.6300 |

| OGAP | 1.4200 |

| COVID | 1.2000 |

| TOP | 1.2600 |

| GRSK | 1.0500 |

| POGR | 1.3200 |

| PC1 | 1.2800 |

| Mean VIF | 1.3100 |

| Critical Value | |||||

|---|---|---|---|---|---|

| Variable | CIPS Statistic | Order of Integration | 10% | 5% | 1% |

| DFSP | −2.552 | (0) | −2.03 | −2.11 | −2.25 |

| GDPR | −2.844 | (0) | −2.03 | −2.11 | −2.25 |

| GRSK | 2.61 | (0) | −2.03 | −2.11 | −2.25 |

| OGAP | −2.364 | (0) | −2.03 | −2.11 | −2.26 |

| COVID | 2.61 | (0) | −2.03 | −2.11 | −2.25 |

| TOP | −3.5 | (I) | −2.03 | −2.11 | −2.25 |

| POGR | −2.433 | (I) | −2.03 | −2.11 | −2.25 |

| PC1 | −3.583 | (I) | −2.03 | −2.11 | −2.25 |

| Horn’s Parallel Analysis for Principal Components | |||

| Component or Factor | Adjusted Eigenvalue | Unadjusted Eigenvalue | Estimated Bias |

| 1 | 4.8041102 | 4.9506418 | 0.14653158 |

| Bartlett test of sphericity | |||

| Chi-square | 4147.407 | ||

| Degrees of freedom | 15 | ||

| p-value | 0.0000 | ||

| Kaiser–Meyer–Olkin Measure of Sampling Adequacy | |||

| KMO | 0.8977 | ||

| Eigenvalues: (N = 561; Trace = 6; Number of Components = 1) | Eigenvectors (Loadings) | ||||||

|---|---|---|---|---|---|---|---|

| Component | Eigenvalue | Difference | Proportion | Cumulative | Variable | Comp1 | Unexplained |

| Comp1 | 4.95064 | 4.51572 | 0.8251 | 0.8251 | PVE | 0.3574 | 0.3675 |

| Comp2 | 0.434918 | 0.148625 | 0.0725 | 0.8976 | GEE | 0.424 | 0.1101 |

| Comp3 | 0.286294 | 0.102263 | 0.0477 | 0.9453 | RQE | 0.4171 | 0.1387 |

| Comp4 | 0.18403 | 0.106082 | 0.0307 | 0.976 | RLE | 0.4362 | 0.05804 |

| Comp5 | 0.077949 | 0.011781 | 0.013 | 0.989 | CCE | 0.4155 | 0.1453 |

| Comp6 | 0.066167 | 0.011 | 1 | VAE | 0.3945 | 0.2297 | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| KINK_SLOPE | 4.61 *** | 11.6 *** | 12.2 *** | 35.7 *** | 26.3 *** | 21.1 *** | 19.8 *** |

| (0.592) | (1.777) | (0.968) | (2.435) | (1.209) | (1.708) | (1.970) | |

| THRESHOLD | −0.23 *** | 0.36 *** | −0.61 *** | −0.37 *** | −0.98 *** | −0.15 *** | −0.15 *** |

| (0.034) | (0.069) | (0.009) | (0.016) | (0.009) | (0.028) | (0.008) | |

| PC1_B | −2.53 *** | ||||||

| (0.570) | |||||||

| PVE_B | −3.58 *** | ||||||

| (0.251) | |||||||

| GEE_B | −11.3 *** | ||||||

| (0.642) | |||||||

| RQE_B | −29.6 *** | ||||||

| (1.666) | |||||||

| RLE_B | −21.5 *** | ||||||

| (1.144) | |||||||

| CCE_B | −2.77 *** | ||||||

| (0.267) | |||||||

| VAE_B | −3.09 *** | ||||||

| (0.440) | |||||||

| N | 33 | 33 | 33 | 33 | 33 | 33 | 33 |

| Bootstrap linearity test (p-value) | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| (15) | (16) | |

|---|---|---|

| L.DFSP | 0.6749 *** | 0.8163 *** |

| (0.0039) | (0.0075) | |

| GDPR | −22.725 *** | −19.645 *** |

| (0.8354) | (0.7585) | |

| TOP | 1.0172 *** | 0.9754 *** |

| (0.1312) | (0.1216) | |

| GRSK | −0.007088 *** | −0.005149 * |

| (0.0023) | (0.0029) | |

| POGR | 54.885 *** | 86.283 *** |

| (5.0452) | (9.8193) | |

| OGAP | −5.4921 *** | |

| (0.5205) | ||

| COVID | 0.2051 ** | |

| (0.1013) | ||

| C | 2.3084 *** | 1.5387 *** |

| (0.0734) | (0.0842) | |

| N | 462 | 528 |

| AR(1) | 0.0105 | 0.0101 |

| AR(2) | 0.9989 | 0.6953 |

| Sargan (p-value) | 0.8088 | 0.9077 |

| (21) | (22) | (23) | (24) | |

|---|---|---|---|---|

| Central Africa | Eastern Africa | Southern Africa | Western Africa | |

| L.DFSP | 0.3505 ** | 0.4934 *** | 0.7050 *** | 0.6019 *** |

| (0.1697) | (0.0954) | (0.1054) | (0.0240) | |

| GDPR | −8.3279 | −31.593 *** | −7.8353 *** | −22.643 *** |

| (6.6828) | (11.4298) | (2.5681) | (4.0053) | |

| TOP | 7.6620 * | 1.2641 ** | 3.9928 ** | 1.0104 * |

| (4.0389) | (0.5458) | (1.7867) | (0.6153) | |

| GRSK | −0.004334 | −0.03484 | 0.01566 | −0.006978 |

| (0.0351) | (0.0297) | (0.0166) | (0.0101) | |

| POGR | 90.534 | 3.7389 | −163.50 | −5.9585 |

| (71.5448) | (23.6805) | (144.8065) | (49.9476) | |

| OGAP | −11.237 * | −26.112 *** | −4.1744 * | −7.0105 ** |

| (6.5689) | (10.0954) | (2.3985) | (3.1474) | |

| C | 3.6077 *** | 4.7927 *** | 0.7587 * | 2.4072 *** |

| (0.9348) | (1.1303) | (0.4228) | (0.2201) | |

| N | 70 | 112 | 112 | 168 |

| AR(1) | 0.016 | 0.0001 | 0.0002 | 0.0004 |

| AR(2) | 0.4594 | 0.6167 | 0.9919 | 0.7544 |

| Sargan (p value) | 0.9978 | 0.8893 | 0.8705 | 1.0000 |

| (25) | (26) | (27) | (28) | |

|---|---|---|---|---|

| Central Africa | Eastern Africa | Southern Africa | Western Africa | |

| L.DFSP | 0.5771 *** | 0.5815 *** | 0.3846 *** | 0.7844 *** |

| (0.0673) | (0.0813) | (0.0604) | (0.0133) | |

| GDPR | −15.755 *** | −20.441 *** | −5.8364 *** | −13.220 *** |

| (3.5892) | (7.9124) | (1.9378) | (4.3053) | |

| TOP | 4.2727 ** | 4.9645 ** | 1.02659 * | 0.97943 ** |

| (1.9577) | (2.2229) | (0.5896) | (0.4895) | |

| GRSK | −0.004086 | −0.02759 | −0.008346 | −0.02743 ** |

| (0.0268) | (0.0309) | (0.0087) | (0.0111) | |

| POGR | 116.52 * | 11.673 | −177.74 *** | 330.31 *** |

| (62.0150) | (24.5181) | (66.2695) | (41.4212) | |

| COVID | 1.4964 * | 5.2925 *** | 0.8954 *** | 0.8382 ** |

| (0.7820) | (1.2835) | (0.2846) | (0.4065) | |

| C | 2.6179 *** | 3.4094 *** | 1.7929 *** | 1.7779 *** |

| (0.6506) | (0.9676) | (0.2683) | (0.2455) | |

| N | 80 | 128 | 128 | 192 |

| AR(1) | 0.0032 | 0.0000 | 0.0065 | 0.0248 |

| AR(2) | 0.6460 | 0.5286 | 0.0770 | 0.1766 |

| Sargan (p-value) | 0.5482 | 1.0000 | 1.0000 | 1.0000 |

| (29) | (30) | (31) | (32) | (33) | (34) | (35) | |

|---|---|---|---|---|---|---|---|

| L.DFSP | 0.6401 *** | 0.5972 *** | 0.6655 *** | 0.6846 *** | 0.6756 *** | 0.6747 *** | 0.6820 *** |

| (0.0066) | (0.0057) | (0.0066) | (0.0076) | (0.0047) | (0.0064) | (0.0067) | |

| GDPR | −16.242 *** | −11.431 *** | −19.836 *** | −16.095 *** | −12.238 *** | −17.049 *** | −19.179 *** |

| (1.8424) | (0.9706) | (1.2379) | (0.9765) | (2.0349) | (1.7070) | (1.5912) | |

| TOP | 0.9447 *** | 0.9339 * | 1.1614 *** | 1.3539 *** | 0.2607 | 1.2729 *** | 1.0799 *** |

| (0.1829) | (0.4777) | (0.3903) | (0.1912) | (0.5584) | (0.2341) | (0.1706) | |

| GRSK | −0.001761 | −0.005516 ** | −0.006702 ** | −0.01809 *** | −0.01401 *** | −0.007595 *** | −0.009488 ** |

| (0.0034) | (0.0023) | (0.0029) | (0.0036) | (0.0023) | (0.0025) | (0.0037) | |

| POGR | 62.500 *** | 55.646 *** | 53.776 *** | 43.352 *** | 35.370 *** | 35.134 *** | 42.216 *** |

| (6.4218) | (4.5406) | (9.3011) | (5.5150) | (6.4703) | (10.4261) | (4.3730) | |

| COVID | 0.4724 *** | 0.6556 *** | 0.5176 *** | 0.7360 *** | 0.6628 *** | 0.6333 *** | 0.5181 *** |

| (0.0597) | (0.0762) | (0.0680) | (0.0839) | (0.1125) | (0.1050) | (0.1008) | |

| OGAP | −4.5792 *** | −3.8479 *** | −7.6709 *** | −3.2062 *** | −3.3130 *** | −4.4504 *** | −4.9825 *** |

| (0.9680) | (0.4930) | (0.9807) | (0.6633) | (1.2099) | (0.9637) | (0.6544) | |

| PC1 | −1.0551 *** | ||||||

| (0.1674) | |||||||

| PVE | −2.3473 *** | ||||||

| (0.3330) | |||||||

| GEE | −1.9692 *** | ||||||

| (0.2087) | |||||||

| RLE | 2.9629 *** | ||||||

| (0.3981) | |||||||

| RQE | −1.6140 *** | ||||||

| (0.2524) | |||||||

| CCE | −2.5302 *** | ||||||

| (0.4433) | |||||||

| VAE | −0.1046 | ||||||

| (0.2367) | |||||||

| C | 2.3779 *** | 1.0771 *** | 0.9823 *** | 3.7923 *** | 1.0581 *** | 0.5644 ** | 2.0587 *** |

| (0.1405) | (0.1753) | (0.1830) | (0.3142) | (0.1677) | (0.2527) | (0.1827) | |

| N | 462 | 462 | 462 | 462 | 462 | 462 | 462 |

| AR(1) | 0.0209 | 0.0308 | 0.0144 | 0.0171 | 0.0312 | 0.0170 | 0.0137 |

| AR(2) | 0.7904 | 0.7548 | 0.7193 | 0.9058 | 0.9262 | 0.8426 | 0.9951 |

| Sargan (p value) | 0.7393 | 0.7393 | 0.7393 | 0.7393 | 0.9999 | 0.9816 | 0.7393 |

| (36) | (37) | (38) | (39) | (40) | (41) | (42) | |

|---|---|---|---|---|---|---|---|

| L.DFSP | 0.5963 *** | 0.6496 *** | 0.6057 *** | 0.6038 *** | 0.6874 *** | 0.6069 *** | 0.6224 *** |

| (0.0038) | (0.0023) | (0.0021) | (0.0029) | (0.0018) | (0.0028) | (0.0029) | |

| GDPR | −12.895 *** | −13.717 *** | −13.595 *** | −12.582 *** | −13.834 *** | −9.6795 *** | −9.1871 *** |

| (0.9453) | (0.8050) | (0.8158) | (0.5341) | (0.5997) | (0.7397) | (1.0857) | |

| TOP | 0.8941 *** | 0.7684 *** | 1.0485 *** | 0.6926 *** | 1.0783 *** | 0.6540 *** | 0.5294 *** |

| (0.1624) | (0.1103) | (0.2266) | (0.1400) | (0.1666) | (0.1545) | (0.2007) | |

| GRSK | −0.01264 *** | −0.01803 *** | −0.01119 *** | −0.006040 *** | −0.02138 *** | 0.001578 | 0.001373 |

| (0.0016) | (0.0012) | (0.0014) | (0.0014) | (0.0017) | (0.0023) | (0.0010) | |

| POGR | 10.702 * | 16.823 *** | 10.433 | 14.193 *** | 14.779 | 5.2072 | 17.264 |

| (6.4807) | (5.7158) | (8.5629) | (4.9419) | (9.8767) | (8.1622) | (11.1476) | |

| COVID | 1.3923 *** | 1.2265 *** | 1.3370 *** | 1.1000 *** | 1.3002 *** | 1.4089 *** | 1.4406 *** |

| (0.0837) | (0.0994) | (0.0711) | (0.1078) | (0.0837) | (0.0674) | (0.1034) | |

| OGAP | −2.2761 *** | −3.4599 *** | −2.8520 *** | −2.5717 *** | −3.1315 *** | −1.6888 *** | −2.8157 *** |

| (0.7825) | (0.4710) | (0.3594) | (0.1931) | (0.2182) | (0.4025) | (0.7790) | |

| PC1 | −0.8663 *** | ||||||

| (0.0444) | |||||||

| PVE | −0.8070 *** | ||||||

| (0.0528) | |||||||

| GEE | −2.3408 *** | ||||||

| (0.2348) | |||||||

| RQE | −2.6295 *** | ||||||

| (0.1112) | |||||||

| RLE | 0.7394 *** | ||||||

| (0.0966) | |||||||

| CCE | −3.1943 *** | ||||||

| (0.2006) | |||||||

| VAE | −3.1761 *** | ||||||

| (0.0862) | |||||||

| C | 2.2359 *** | 1.8719 *** | 0.7907 *** | 0.5820 *** | 2.5271 *** | 0.1064 | 0.3128 *** |

| (0.0939) | (0.0554) | (0.2803) | (0.0786) | (0.1257) | (0.2927) | (0.1203) | |

| N | 462 | 462 | 462 | 462 | 462 | 462 | 462 |

| AR(1) | 0.0162 | 0.0188 | 0.0173 | 0.0218 | 0.0172 | 0.0180 | 0.0243 |

| AR(2) | 0.4673 | 0.6129 | 0.3097 | 0.9587 | 0.6961 | 0.9017 | 0.8117 |

| Sargan (p value) | 1.0000 | 0.2999 | 0.9998 | 0.3542 | 0.1933 | 0.2535 | 0.2452 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Katuka, B.; Mudzingiri, C. Impact of Output Gap, COVID-19, and Governance Quality on Fiscal Space in Sub-Saharan Africa. Economies 2023, 11, 256. https://doi.org/10.3390/economies11100256

Katuka B, Mudzingiri C. Impact of Output Gap, COVID-19, and Governance Quality on Fiscal Space in Sub-Saharan Africa. Economies. 2023; 11(10):256. https://doi.org/10.3390/economies11100256

Chicago/Turabian StyleKatuka, Blessing, and Calvin Mudzingiri. 2023. "Impact of Output Gap, COVID-19, and Governance Quality on Fiscal Space in Sub-Saharan Africa" Economies 11, no. 10: 256. https://doi.org/10.3390/economies11100256

APA StyleKatuka, B., & Mudzingiri, C. (2023). Impact of Output Gap, COVID-19, and Governance Quality on Fiscal Space in Sub-Saharan Africa. Economies, 11(10), 256. https://doi.org/10.3390/economies11100256