Abstract

This study analyzes the effects that certain political-uncertainty factors have on financial firm performance in the Stock Exchange of Thailand (SET). The results of a panel regression performed on a database of 7976 firm-years over 18-year unbalanced panel data from 2001 to 2018 show a mixed relationship between political uncertainty and firm performance. The constitutional reform harms the return on assets (ROA), and the government election and political protest significantly decreased the market value of equity (MVE). In contrast, constitutional reform increased MVE, and the government election positively impacted ROA. Therefore, this study emphasizes how political unpredictability is assumed to influence firm performance in Thailand’s economy, an Asian developing country.

1. Introduction

Political uncertainty and partisan conflicts are the problems and crises which harm the economic system of both developed and developing countries. Political uncertainty has direct or indirect effects on economic and social matters, especially on economic development—for instance, the BREXIT situation, when the United Kingdom considered separating from the European Union. A decline followed this political situation in the GDP of the United Kingdom at around 0.60 percent, which was the lowest GDP of the country for 15 years (Shankleman and Ross 2018). It can imply that political uncertainty could significantly contribute to the financial crisis (Mei and Guo 2004), impacting volatility (Suleman and Daglish 2015; Zou et al. 2022). Economic policy uncertainty can have long-lasting negative consequences on national capital formation, real-estate-market activity, and stock-market liquidity, which are crucial for long-term economic growth (Gholipour 2019).

Although the effects of uncertainty on politics related to economic matters are widely studied worldwide; most studies focus on its effect on developed countries (e.g., Frot and Santiso 2013; Li et al. 2015; Liu et al. 2017; Luo et al. 2017; Lv and Bai 2019; Ming and Liu 2021; Saffar et al. 2019; Wang and Lin 2009; and Zou et al. 2022). However, there are small numbers of studies in developing countries or emerging markets, such as Thailand.

In Thailand, as an emerging market in Asia, political uncertainty has been a dynamic change since the political revolution in 1932 (B.E. 2475). Political problems and conflicts have occurred steadily. The political conflicts were not only solved by the democratic system but some individuals with opposing political ideologies also had a role in resolving political issues. The conflicts in any patterns resulted in social changes. Economic growth attached to the social movement fluctuated from 1932 (B.E. 2475) until this era. Luangaram and Sethapramote (2018) study the effect of political uncertainty in Thailand. They state that there has been a dramatic increase in the amount of political uncertainty from 2006 to 2019. Unsurprisingly, the increasing amount of uncertainty has led to the fluctuation of the Thai economy and then negatively influenced the country’s economic growth rate. Political uncertainty will not benefit the economic system in the short run or the long run. It could let the investment volume, import–export values, and stock-exchange index decline. The evidence of this was powerfully revealed in 2019, when people and investors did not trust changing the government from an army government to a democratic government. The stock-exchange index suddenly dropped at that time, and the market value decreased by around THB 175,000 million (Sriring and Staporncharnchai 2019).

Furthermore, the most studies, i.e., Aisen and Veiga (2013); Alesina et al. (1996); Asteriou and Price (2001); Baker et al. (2016); Fosu (2001) and Jong-A-Pin (2009), focus on the effects of political certainty on macro-economic and financial market levels. However, there is no study examining the influence of political uncertainty at the firm level.

In accordance, Thailand has faced many political situations for over a century; this paper tends to determine the effect of political uncertainty in terms of the constitutional amendment, political revolution, election for government change, martial law, and political protest on the performance of the listed firms in Thailand. The results should reflect significant evidence in Thailand, an Asian developing country, at the firm level, which may be affected by political situations, generating crucial information for related economic participants.

This paper is structured as follows. First, the theoretical framework begins with a discussion of political uncertainty. Then the analysis of the links between political uncertainty and financial performance allows the hypotheses of the study to be proposed. Second, the methodology is outlined to obtain and process the data and define the variables. After the results are presented, the final section presents the main conclusions drawn from the discussion on the results and establishes the contribution to Asian business, making suggestions for future research.

2. Literature Review and Research Framework

The political environment of Thailand has an essential influence on the Thai economy. The central economic policies and effects usually result from some political events. The constitutional monarchy is the type of government in Thailand. The members of the House of Representatives are elected from two bases. The first group of members is elected based on a single-seat constituency system. Another group is elected based on a proportional party-list basis. The Thai prime minister is elected by the members of the House of Representatives. One prime minister’s term is four years, and each prime minister is limited to carrying out his or her duties for only two terms continuously. In addition, some members of the senate perform their duties by monitoring the government’s policies. The senate members also come from two systems. The first group of members is elected by popular vote from each province, while the judges and independent government bodies appoint another group of senate members.

Due to the election system, there are some political parties in Thailand that different groups of people strongly and extremely support. The different attitudes of people lead to conflict between each group. The conflict was increased to a higher level after the military coup several times (Central Intelligence Agency 2022). Each time there was a protest, some government and business properties were destroyed. Significantly, this situation generally affected the confidence of investors. They may have reduced or cancelled their investment in Thailand or businesses due to the unstable political situation.

Political uncertainty is one crucial factor leading to policy uncertainty (Suleman and Daglish 2015; Zou et al. 2022). Consequently, economics based on the uncertainty of fluctuating political situations can negatively result in declining economic growth (Gholipour 2019).

Smales (2014) analyzed political uncertainty’s impact on financial market volatility throughout the Australian federal election cycle. The empirical data indicate that rising (falling) election-related uncertainty is associated with higher (lower) market uncertainty. Jens (2017) examined the relationship between political uncertainty and investment in U.S. firms. When considering the U.S. State Governor Election as uncertain, the study shows that the investment volume drops to around 5 percent compared to the figure before the election. It indicates that uncertainty about political events affects economic value. Similarly, Selmi and Bouoiyour (2020) noted that the election result had a significant and varied impact on several U.S. industries, and these sectors were highly reactive in the days after the inauguration. In other words, the economic value is sensitive to the political situation. Moreover, the presidential election process causes market fears, as investors construct and change their predictions for future macroeconomic policy (Goodell and Vähämaa 2013). In such an environment, uncertainty surrounding the outcome of the election also results in ineffective capital allocation, which lowers business performance (Durnev 2010).

From other perspectives of political uncertainty, the Arab Spring was an event in which people called out and protested corruption. This situation led to crucial economic stagnation across much of the Arab world in the early 2010s (Ghosh 2016; Mahamud 2014). Political unrest typically intensifies competition in the market, thus altering corporate behavior and harming the economy (Dai and Zhang 2019). Gulen and Ion (2016) stated the evidence that there is a negative association between political uncertainly and investment on an industrial level, while Aisen and Veiga (2013) and Jong-A-Pin (2009) showed the results of studies that have found that an increase in political uncertainly events, such as protests and political violence, lead to a decrease in economic growth measured by GDP. In South Africa, Fosu (2001) examined the influence of the coup as a political-uncertainly factor, and the study showed the effect of the coup on negative change in economic growth. Similar to evidence in the United Kingdom, Asteriou and Price (2001) applied the Garch-M Model in the test impact of political inefficiency, and the test showed evidence that political inefficiency is the crucial factor in pulling down the growth of the economy of the United Kingdom.

The evidence from China shows that new prefecture-city officials had strong relationships with their provincial leaders. Typically, regulated businesses and those located in provinces with closed markets were more affected by political unpredictability (Luo et al. 2017). Lv and Bai (2019) looked at how China’s highly specialized political system affects business debt financing. According to the findings, listed businesses would maintain modest levels of debt financing and smooth out debt-financing volatility under political uncertainty, which will be weakened during a global financial crisis.

Interestingly, Ming and Liu (2021) investigated how political uncertainty affects the tourism industry, which experienced a significant decline in firm value. Ming and Liu (2021) found that the long-term financial performance of tourism enterprises declined following the anti-corruption effort. It shows that a decrease in demand causes a reduction in the firms’ financial performance. This study demonstrates how political turbulence affects the travel industry in developing countries.

Recent research has highlighted the critical importance of comprehending the relationship between political unpredictability and financial-market movements. The findings show that the political situation significantly and substantially negatively impacted Taiwan’s stock values (Wang and Boatwright 2019). In addition, the Palestine and Amman stock markets’ returns are significantly impacted by political events (Jabarin et al. 2019). The cross-country methodology is distinct from the earlier research that shows that commercial banks with parliamentary and civil law systems tend to be less effective during election years, whereas common-law banks with presidential and standard law systems do not experience changes in efficiency as a result of political unpredictability. These findings draw attention to the effects of the political climate on bank efficiency and are pertinent to bank regulators who are thinking about tightening management standards (Doong and Doan 2021). Similarly, Ihaddaden (2020) studied how political ambiguity affected the financial sector. The revolution’s political turmoil was especially detrimental to mixed banks.

Political conflicts in the Thai context have been empirical studies. Most studies have posited that political uncertainty can impact macroeconomic levels, i.e., investment volume and economic growth. Political-uncertainty events have been found to influence the fluctuation of investment and stock price in the capital market and return on investment (Beaulieu et al. 2006; Darby and Roy 2019; Jens 2017; Julio and Yook 2012; Lei et al. 2015; Liu et al. 2017; Lv and Bai 2019; Mei and Guo 2004; Saffar et al. 2019; Wang and Lin 2009). However, there is a lack of study on the effect of political-uncertainty events on the firm-level performance of listed firms in Thailand.

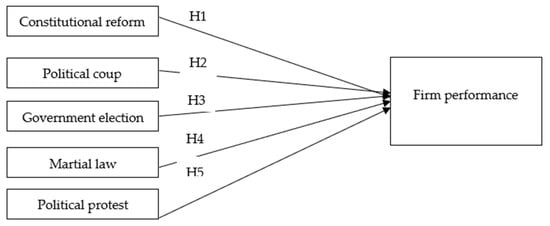

This study aims to determine the effect of political uncertainty on firm-level performance, including return on assets (ROA) and market value of equity (MVE). There are five terms of political uncertainty which are focused on in this study. They are constitutional reform, political coup, government election, martial law, and political protest, according to five political-uncertainty events (Luangaram and Sethapramote 2018). The hypotheses on the effects of political uncertainty on firm performance are (H1) constitutional reform influences firm performance; (H2) political coup influences firm performance; (H3) government election influences firm performance; (H4) martial law influences firm performance, and (H5) political protest influences firm performance. Figure 1 shows the framework that we used to study the political-uncertainty factors in regard to the firm performance of listed firms.

Figure 1.

Research framework.

3. Research Methodology

3.1. Samples

This paper analyzes the relationship between political uncertainty and the financial performance of the companies listed in the Stock Exchange of Thailand (SET). The companies selected belong to the main index. The sample is based on the actively traded companies on the respective stock exchange. More importantly, the empirical literature indicates a sample selection bias favoring big firms. It suggests that attention should be devoted to the volume of at least 90% of the total number of firms in the index. Companies in the non-performing group, trust companies, property funds, and financial instruments are excluded from the sample, as their accounting reporting requirements and capital structure vary greatly from other companies and would distort the overall results. The period 2001–2018 was chosen becasue it covers a period of heightened political uncertainties (Luangaram and Sethapramote 2018). Our final firms comprised 7976 firm-years across eight industry sectors with complete data.

The data were gathered from several sources. The political-situation data were collected from government sources and related news, while financial performances were collected from the SETSMART database. Other controlling variables’ data, such as the independent committees and ownership, were obtained from annual reports submitted to the Stock Exchange Committee (SEC).

3.2. Empirical Models

The ordinary linear system with an unbalanced panel data analysis was applied to test the following empirical models in examining related hypotheses:

where ROA = return on assets; MVE = market value of equity; PROTEST, MARTIAL, ELECTION, COUP, and REFORM = independent variables represented for the political uncertainty; INDEPENDENT = the ratio of independent committees on the board; LNSIZE = company size; OWNERSHIP = the ratio of the foreign shareholder MTB = market-to-book value; and LEVERAGE = firm leverage.

PERFi,t = β0 + β1REFORMi,t + β2INDEPENDENTi,t + β3OWNERSHIPi,t+ β4LNSIZEi,t + β5MTBi,t + β6LEVERAGEi,t + εi,t

PERFi,t = β0 + β1COUPi,t + β2INDEPENDENTi,t + β3OWNERSHIPi,t+ β4LNSIZEi,t + β5MTBi,t + β6LEVERAGEi,t + εi,

PERFi,t = β0 + β1ELECTIONi,t + β2INDEPENDENTi,t + β3OWNERSHIPi,t + β4LNSIZEi,t + β5MTBi,t + β6LEVERAGEi,t + εi,t

PERFi,t = β0 + β1MARTIALi,t + β2INDEPENDENTi,t + β3OWNERSHIPi,t + β4LNSIZEi,t + β5MTBi,t + β6LEVERAGEi,t + εi,t

PERFi,t = β0 + β1PROTESTi,t + β2INDEPENDENTi,t + β3OWNERSHIPi,t + β4LNSIZEi,t + β5MTBi,t + β6LEVERAGEi,t + εi,t

3.3. Variable Measurement

Based on the empirical models, firm performance (PERF) is the dependent variable for each model. The performance proxies include return on assets (ROA) and market value of equity (MVE). ROA is measured by dividing the net profit by total assets (Ghosh 2016; Hadani et al. 2017), while MVE is measured from the market value of a firm’s stock at the end of each fiscal year (Graham et al. 2005; Mathur and Singh 2011).

The primary independent variable is political uncertainty, including five proxies. They are constitutional reform (REFORM), political coup (COUP), government election (ELECTION), martial law (MARTIAL), and political protest (PROTEST). All political-uncertainty proxies are measured as dummy variables, and they are valued 1 when there are political-uncertainty issues in each single observed year; a value of 0 is given when political-uncertainty issues disappear.

Besides the main independent variables, control variables were included in the empirical model to reduce the error term of the statistical analysis and to control for other influences of financial performance. The first control variable is the independent director (INDEPENDENT). Board independence has been regarded as one of the crucial determinants of the ability of boards to protect investors’ interests (Berthelot et al. 2012; Buachoom and Amornkitvikai 2022; Courtemanche et al. 2013; ElKelish and Hassan 2015; Fama and Jensen 1983; Khatib and Nour 2021; Mishra and Mohanty 2014; Wei’an Li et al. 2012). INDEPENDENT is measured by the proportion of independent directors to the total number of directors.

An ownership structure that demonstrates the concentration of ownership by inner and outside shareholders is critical to efficient corporate governance. It is asserted that when more prominent owners effectively manage businesses, variations in the control of cash-flow rights lead these controlling shareholders to expropriate wealth by pursuing personal benefits at the expense of minority shareholders (Kabir and Ismail 2012; Müller et al. 2014; Sundarasen et al. 2016; Tsai and Tung 2014; Wei’an Li et al. 2012). Thus, the institute and foreign ownership are included as control variables. Foreign Institute ownership (OWNERSHIP) is measured from the total number of stocks owned by financial or other foreign institutes divided by the total number of stocks of the firm.

The following control variable is the firm size. Several scholars suggest that large firms can quickly generate funds and make investments and may be able to create entry barriers that lead to improved performance (ElKelish and Hassan 2015; Hussainey and Aljifri 2012; Ongore et al. 2015; Short and Keasey 1999; Ujunwa 2012; Van Essen et al. 2012). The natural logarithm of total assets is measured as the firm size (LNSIZE).

The firm value (MTB) is measured by market price divided by the stock’s book value. It is the ratio of market-to-book equity value, indicating growth opportunities (Appuhami and Bhuyan 2015; Dalwai et al. 2015; Hassan and Halbouni 2013). Chen et al. (2005) adopted a regression analysis to understand such dynamic relationships and their impact on market-to-book value ratios and future financial performance.

The last control variable is firm leverage (LEVERAGE), which has often been used in corporate governance studies (Bhatt and Bhattacharya 2015; ElKelish and Hassan 2015; Khatib and Nour 2021; Singhchawla et al. 2011; Wu and Li 2015; Zhang et al. 2013). Debt holders have incentives to exert more influence over management actions. Accordingly, companies with higher leverage are more likely to improve their performance.

4. Research Results

4.1. Descriptive Statistics

Table 1 shows some crucial information. The ROA has an average value of 6.689, with a standard deviation of 11.169, while the firm’s average market value to equity is 981 times. These indicate that, on average, sample firms have good accounting and market performance indicators, but there is a significant difference in performance among the samples. For firm leverage, the sample firms also retain a good proportion between their assets and their liability at 0.476.

Table 1.

Descriptive statistics.

The average value of board independence is 0.219. This number is lower than the numbers suggested by the Stock Exchange of Thailand (SET) for best practices for corporate governance. The suggestion is that the proportion of independent directors to total directors should be at least 1 to 3 or 0.33.

For the political-uncertainty indicator, the statistical value indicates that the top three political-uncertainty issues are political protest (PROTEST), government election (ELECTION) and constitutional reform (REFORM), with average values of 0.394, 0.382, and 0.239, respectively.

Table 2 shows the Pearson correlation coefficients among the dependent variables. There is a slight correlation among those variables, and multicollinearity is not an issue for the linear estimation of this study.

Table 2.

Pearson correlations between all variables.

4.2. Empirical Results

Table 3 illustrates the results from the multiple linear regression in determining the relationship between political uncertainty and return on assets (ROA). The results indicate that constitutional reform (REFORM) has a significant negative effect on return on assets (p < 0.01), but government election (ELECTION) has been found to have a significant positive influence (p < 0.01) on return on assets. Political coup (COUP), martial law (MARTIAL), and political protest (PROTEST) have no significant impact on the return on assets of the firms. Moreover, control variables, i.e., firm size and firm leverage, significantly affect the firm’s performance measured by the return on assets.

Table 3.

Effect of political-uncertainty proxies on return on assets.

Table 4 shows the results of the relationship between political uncertainty and the market value of equity (MVE). Political-uncertainty proxies in terms of constitutional reform (REFORM) have a significant positive influence on the market value of equity (p < 0.01). However, government election (ELECTION) and political protest (PROTEST) result in a significant adverse effect on the firm market value of equity (p < 0.01). Control variables, such as board independence, firm size, market-to-book value, and firm leverage, have significantly impacted Thai firms’ market value of equity.

Table 4.

Effect of political-uncertainty proxies on the market value of equity.

5. Conclusions and Discussion

When considering the effect of five political-uncertainty issues on the performance of Thai firms, as shown in Table 5, the study results indicate that constitutional reform decreases the return on assets but leads to an increase in the market value of equity. Thus, Hypothesis 1, which predicts that constitutional reform influences firm performance, is supported. Government election has been found to lead to an increase in return on assets of Thai firms, so Hypothesis 3, which predicts that government election influences firm performance, is accepted. Martial law and political protest were found to lead to a decrease in the firm market value of equity. This evidence results in the acceptance of Hypotheses 4 and 5, which predict that martial law influences and political protest influences firm performance, respectively.

Table 5.

Results of the study.

The study’s results imply that the uncertainty of political issues has mixed impacts on firm performance. The reason is that political uncertainty may make the firm executives reduce their investments, leading to a decline in the returns generated from those investments. On the other hand, investors may decide to invest more when they have positive signs from the news of the incoming election and political reform. This situation usually increases firms’ assets and increases firm performance (Graham et al. 2005; Luangaram and Sethapramote 2018; Mathur and Singh 2011). Furthermore, constitutional reforms and government elections also conform to the findings of Jabarin et al. (2019), which establish that political events significantly impact financial performance.

6. Contribution to Asian Business

In line with the empirical evidence, the political uncertainty and financial-firm performance relationship results confirm the nature of business firms running in an open environment. Outside factors usually affect the performance of the business firm in both direct and indirect ways. The results can imply that the management and owners of the firms must have an optimal understanding and consider that economic factors and political concerns are leading to changes in firm performance. Therefore, this study encourages related market participants to pay more attention to including change management and risk management in the strategic plan to deal with the dynamic environment around the firms.

This study offers several contributions shedding light on the Asian business environment. First, we contribute to the political-uncertainty literature in the Asian ecosystem by providing empirical evidence regarding the impact of political uncertainty on financial performance and showing that this impact holds after controlling for various market and firm-specific factors.

Second, the study provides evidence showing how an upcoming government election influences firms’ return on assets. It should be a good signal for executives or firm owners seeking to increase their assets to generate more returns in Asia’s politically uncertain country.

Finally, the empirical research on the connection between constitutional reform and equity market value supports the use of market-value measures. It confirms that market value in Asian business is attached to the political policies and situation. It can be the decision point of the investors to put more funds into the Asian stock markets.

Author Contributions

Conceptualization, W.T. and W.J.; Methodology, W.T. and W.J.; Validation, W.J. and W.W.B.; Formal analysis, W.T. and W.J.; Data curation, W.J.; Writing—original draft, W.J. and W.W.B.; Writing—review & editing, W.W.B.; Visualization, W.T. and W.W.B.; Project administration, W.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

The authors would like to thank the anonymous referees, the academic editor, and the journal’s assistant editor for their fruitful comments and suggestions to increase the quality of this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aisen, Ari, and Francisco José Veiga. 2013. How does political instability affect economic growth? European Journal of Political Economy 29: 151–67. [Google Scholar] [CrossRef]

- Alesina, Alberto, Sule Özler, Nouriel Roubini, and Phillip Swagel. 1996. Political instability and economic growth. Journal of Economic Growth 1: 189–211. [Google Scholar] [CrossRef]

- Appuhami, Ranjith, and Mohammed Bhuyan. 2015. Examining the influence of corporate governance on intellectual capital efficiency: Evidence from top service firms in Australia. Managerial Auditing Journal 30: 347–72. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, and Simon Price. 2001. Political instability and economic growth: UK time series evidence. Scottish Journal of Political Economy 48: 383–99. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Beaulieu, Marie-Claude, Jean-Claude Cosset, and Naceur Essaddam. 2006. Political uncertainty and stock market returns: Evidence from the 1995 quebec referendum. The Canadian Journal of Economics/Revue Canadienne d’Economique 39: 621–41. [Google Scholar] [CrossRef]

- Berthelot, Sylvie, Claude Francoeur, and Réal Labelle. 2012. Corporate governance mechanisms, accounting results and stock valuation in Canada. International Journal of Managerial Finance 8: 332–43. [Google Scholar] [CrossRef]

- Bhatt, R. Rathish, and Sujoy Bhattacharya. 2015. Board structure and firm performance in Indian IT firms. Journal of Advances in Management Research 12: 232–48. [Google Scholar] [CrossRef]

- Buachoom, Wonlop Writthym, and Yot Amornkitvikai. 2022. The Moderating Effects of Board Independence and the Separation of Chairman–Chief Executive Officer Duality Roles on a Firm’s Value: Evidence from the Thai Listed Firms. Global Business Review, 09721509221119705. [Google Scholar] [CrossRef]

- Central Intelligence Agency. 2022. The World Factbook: Thailand. Available online: https://www.cia.gov/library/publications/the-world-factbook/geos/th.html (accessed on 27 December 2022).

- Chen, Xuexia, Lee Vierling, and Don Deering. 2005. A simple and effective radiometric correction method to improve landscape change detection across sensors and across time. Remote Sensing of Environment 98: 63–79. [Google Scholar] [CrossRef]

- Courtemanche, Line, Louise Côté, and Eduardo Schiehll. 2013. Board capital and strategic turnaround: A longitudinal case study. International Journal of Disclosure and Governance 10: 378–405. [Google Scholar] [CrossRef]

- Dai, Lili, and Bohui Zhang. 2019. Political uncertainty and finance: A Survey. Asia-Pacific Journal of Financial Studies 48: 307–33. [Google Scholar] [CrossRef]

- Dalwai, Tamanna Abdul Rahman, Rohaida Basiruddin, and Siti Zaleha Abdul Rasid. 2015. A Critical Review of Relationship between Corporate Governance and Firm Performance: GCC Banking Sector Perspective. Corporate Governance 15: 18–30. [Google Scholar] [CrossRef]

- Darby, Julia, and Graeme Roy. 2019. Political uncertainty and stock market volatility: New evidence from the 2014 Scottish Independence Referendum. Scottish Journal of Political Economy 66: 314–30. [Google Scholar] [CrossRef]

- Doong, Shuh-Chyi, and Anh-Tuan Doan. 2021. The influence of political uncertainty on commercial banks in emerging market countries. International Journal of Public Administration 45: 1053–69. [Google Scholar] [CrossRef]

- Durnev, Art. 2010. The real effects of political uncertainty: Elections and investment sensitivity to stock prices. Paper presented at the Paris December 2010 Finance Meeting EUROFIDAI-AFFI, Paris, France, December 16–17. [Google Scholar]

- ElKelish, Walaa Wahid, and Mostafa Kamal Hassan. 2015. Corporate governance disclosure and share price accuracy: Empirical evidence from the United Arab Emirates. Journal of Applied Accounting Research 16: 265–86. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of ownership and control. The Journal of Law and Economics 26: 301–25. [Google Scholar] [CrossRef]

- Fosu, Augustin Kwasi. 2001. Political instability and economic growth in developing economies: Some specification empirics. Economics Letters 70: 289–94. [Google Scholar] [CrossRef]

- Frot, Emmanuel, and Javier Santiso. 2013. Political uncertainty and portfolio managers in emerging economies. Review of International Political Economy 20: 26–51. [Google Scholar] [CrossRef]

- Gholipour, Hassan F. 2019. The effects of economic policy and political uncertainties on economic activities. Research in International Business and Finance 48: 210–18. [Google Scholar] [CrossRef]

- Ghosh, Saibal. 2016. Political transition and bank performance: How important was the Arab Spring? Journal of Comparative Economics 44: 372–82. [Google Scholar] [CrossRef]

- Goodell, John W., and Sami Vähämaa. 2013. US presidential elections and implied volatility: The role of political uncertainty. Journal of Banking and Finance 37: 1108–17. [Google Scholar] [CrossRef]

- Graham, Roger C., Jr., Cameron KJ Morrill, and Janet B. Morrill. 2005. The value relevance of accounting under political uncertainty: Evidence related to quebec’s independence movement. Journal of International Financial Management & Accounting 16: 49–68. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. The Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Hadani, Michael, Jean-Philippe Bonardi, and Nicolas M. Dahan. 2017. Corporate political activity, public policy uncertainty, and firm outcomes: A meta-analysis. Strategic Organization 15: 338–66. [Google Scholar] [CrossRef]

- Hassan, Mostafa Kamal, and Sawsan Saadi Halbouni. 2013. Corporate governance, economic turbulence and financial performance of UAE listed firms. Studies in Economics and Finance 30: 118–38. [Google Scholar] [CrossRef]

- Hussainey, Khaled, and Khaled Aljifri. 2012. Corporate governance mechanisms and capital structure in UAE. Journal of Applied Accounting Research 13: 145–60. [Google Scholar] [CrossRef]

- Ihaddaden, Mohamed El Fodil. 2020. Impact of political uncertainty on banking productivity: Investigating the Jasmin revolution effect on the Tunisian banking system. Economics Bulletin 40: 437–47. [Google Scholar]

- Jabarin, Mai, Abdulnaser Nour, and Sameh Atout. 2019. Impact of macroeconomic factors and political events on the market index returns at Palestine and Amman Stock Markets (2011–2017). Investment Management and Financial Innovations 16. [Google Scholar] [CrossRef]

- Jens, Candace E. 2017. Political uncertainty and investment: Causal evidence from U.S. gubernatorial elections. Journal of financial economics 124: 563–79. [Google Scholar] [CrossRef]

- Jong-A-Pin, Richard. 2009. On the measurement of political instability and its impact on economic growth. European Journal of Political Economy 25: 15–29. [Google Scholar] [CrossRef]

- Julio, Brandon, and Youngsuk Yook. 2012. Political uncertainty and corporate investment cycles. The Journal of Finance 67: 45–83. [Google Scholar] [CrossRef]

- Kabir, Md Humayun, and Adelopo Ismail. 2012. Corporate governance disclosure practices by Swaziland public enterprises. African Journal of Business Management 6: 7136–48. [Google Scholar]

- Khatib, Saleh FA, and Abdul-Naser Ibrahim Nour. 2021. The Impact of Corporate Governance on Firm Performance During The COVID-19 Pandemic: Evidence from Malaysia. Journal of Asian Finance Economics and Business 8: 0943–52. [Google Scholar] [CrossRef]

- Lei, Guangyong, Wenzhong Wang, and Mo Liu. 2015. Political uncertainty, dividend policy adjustments and market effects. China Journal of Accounting Studies 3: 49–83. [Google Scholar] [CrossRef]

- Li, Sihai, Xianzhong Song, and Huiying Wu. 2015. Political connection, ownership structure, and corporate philanthropy in China: A strategic-political perspective. Journal of Business Ethics 129: 399–411. [Google Scholar] [CrossRef]

- Liu, Laura Xiaolei, Haibing Shu, and KC John Wei. 2017. The impacts of political uncertainty on asset prices: Evidence from the Bo scandal in China. Journal of Financial Economics 125: 286–310. [Google Scholar] [CrossRef]

- Luangaram, Pongsak, and Yuthana Sethapramote. 2018. Economic Impactsof Political Uncertainty in Thailand. Bangkok: Puey Ungphakorn Institute for Economic Research. [Google Scholar]

- Luo, Danglun, K. C. Chen, and Lifan Wu. 2017. Political uncertainty and firm risk in China. Review of Development Finance 7: 85–94. [Google Scholar] [CrossRef]

- Lv, Miaochen, and Manying Bai. 2019. Political uncertainty and corporate debt financing: Empirical evidence from China. Applied Economics 51: 1433–49. [Google Scholar] [CrossRef]

- Mahamud, Tosaporn. 2014. The political changes as a result of conflicts in the arab world: A case study of tunisia, egypt, libya, and syria. Kasem Bundit Journal 15: 122–39. [Google Scholar]

- Mathur, Ike, and Manohar Singh. 2011. Corporate political strategies. Accounting & Finance 51: 252–77. [Google Scholar] [CrossRef]

- Mei, Jianping, and Limin Guo. 2004. Political uncertainty, financial crisis and market volatility. European Financial Management 10: 639–57. [Google Scholar] [CrossRef]

- Ming, Yaxin, and Nian Liu. 2021. Political uncertainty in the tourism industry: Evidence from China’s anti-corruption campaign. Current Issues in Tourism 24: 2573–87. [Google Scholar] [CrossRef]

- Mishra, Supriti, and Pitabas Mohanty. 2014. Corporate governance as a value driver for firm performance: Evidence from India. Corporate Governance 14: 265–80. [Google Scholar] [CrossRef]

- Müller, Victor-Octavian, Ionel-Alin Ienciu, Carmen Giorgiana Bonaci, and Crina Ioana Filip. 2014. Board characteristics best practices and financial performance. Evidence from the European Capital Market. Amfiteatru Economic Journal 16: 672–83. [Google Scholar]

- Ongore, Vincent O., Peter O. K’OBONYO, Martin Ogutu, and Eric M. Bosire. 2015. Board composition and financial performance: Empirical analysis of companies listed at the Nairobi Securities Exchange. International Journal of Economics and Financial Issues 5: 23–43. [Google Scholar]

- Saffar, Walid, Yang Wang, and K. C. Wei. 2019. The Effect of Firm-Level Political Uncertainty on Bank Loan Contracting. Available at SSRN 3354246. Available online: https://ssrn.com/abstract=3354246 (accessed on 27 December 2022).

- Selmi, Refk, and Jamal Bouoiyour. 2020. The financial costs of political uncertainty: Evidence from the 2016 US presidential elections. Scottish Journal of Political Economy 67: 166–85. [Google Scholar] [CrossRef]

- Shankleman, J., and T. Ross. 2018. No-Deal Brexit Could Wipe 10.7% Off U.K. Economy Over 15 Years. Available online: https://www.bloomberg.com/news/articles/2018-11-28/u-k-gdp-would-suffer-10-7-hit-in-worst-case-no-deal-brexit (accessed on 28 November 2018).

- Short, Helen, and Kevin Keasey. 1999. Managerial ownership and the performance of firms: Evidence from the UK. Journal of Corporate Finance 5: 79–101. [Google Scholar] [CrossRef]

- Singhchawla, Wanachan, Robert Evans, and John Evans. 2011. Board independence, sub-committee independence and firm performance: Evidence from Australia. Asia Pacific Journal of Economics & Business 15: 1–15. [Google Scholar]

- Smales, Lee A. 2014. Political uncertainty and financial market uncertainty in an Australian context. Journal of International Financial Markets, Institutions and Money 32: 415–35. [Google Scholar] [CrossRef]

- Sriring, O., and S. Staporncharnchai. 2019. Foreign Investors Flee Thai Shares Ahead of March Election. Available online: https://uk.reuters.com/article/thailand-election-economy/foreign-investors-flee-thai-shares-ahead-of-march-election-idUKL3N20E3SY?fbclid=IwAR1znoWWQ6FOMH7OgyFESOChl6ouQEezACyKT9zuDpFoYdSn7HzGUzVshBE (accessed on 1 July 2019).

- Suleman, Muhammad Tahir, and Toby C. Daglish. 2015. Political Uncertainty in Developed and Emerging Markets. Available online: https://ssrn.com/abstract=2647888 (accessed on 27 December 2022).

- Sundarasen, Sheela Devi D., Tan Je-Yen, and Nakiran Rajangam. 2016. Board composition and corporate social responsibility in an emerging market. Corporate Governance: The International Journal of Business in Society 16: 35–53. [Google Scholar] [CrossRef]

- Tsai, Ming-Tien, and Wen-Hui Tung. 2014. Corporate governance, resources, FDI commitment and firm performance: Empirical analyses of Taiwanese high-tech firms. Chinese Management Studies 8: 313–32. [Google Scholar] [CrossRef]

- Ujunwa, Augustine. 2012. Board characteristics and the financial performance of Nigerian quoted firms. Corporate Governance: The International Journal of Business in Society 12: 656–74. [Google Scholar] [CrossRef]

- Van Essen, Marc, J. Hans van Oosterhout, and Michael Carney. 2012. Corporate boards and the performance of Asian firms: A meta-analysis. Asia Pacific Journal of Management 29: 873–905. [Google Scholar] [CrossRef]

- Wang, Huiqiang, and Annie L. Boatwright. 2019. Political uncertainty and financial market reactions: A new test. International Economics 160: 14–30. [Google Scholar] [CrossRef]

- Wang, Yi-Hsien, and Chin-Tsai Lin. 2009. The political uncertainty and stock market behavior in emerging democracy: The case of Taiwan. Quality and Quantity 43: 237–48. [Google Scholar] [CrossRef]

- Wei’an Li, Yekun Xu, Jianbo Niu, and Aichao Qiu. 2012. A survey of corporate governance: International trends and China’s mode. Nankai Business Review International 3: 4–30. [Google Scholar]

- Wu, Xiaohui, and Hui Li. 2015. Board independence and the quality of board monitoring: Evidence from China. International Journal of Managerial Finance 11: 308–28. [Google Scholar] [CrossRef]

- Zhang, Jason Q., Hong Zhu, and Hung-bin Ding. 2013. Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. Journal of Business Ethics 114: 381–92. [Google Scholar] [CrossRef]

- Zou, Jin, Shuxin Li, Zihan Xu, and Guoying Deng. 2022. Political uncertainty and bond defaults: Evidence from the Chinese market. The European Journal of Finance, 1–22. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).