Abstract

There is ample evidence that Islamic stock markets perform differently from conventional stock markets, particularly when economic policy uncertainty (EPU) or any other uncertainty such as geopolitical uncertainty is present. Considering this context, this paper examines the US EPU’s cross-correlation with both conventional and Islamic stock markets from the perspective of multifractality. Daily stock market prices of five main countries are considered: US, Thailand, Indonesia, Pakistan, and India. Using the multifractal detrended cross-correlation analysis (MF-DCCA), we validate the existence of long-range cross-correlation between US EPU and all the stock markets considered, demonstrating that all pairs of US EPU have strong power law and multifractal characteristics. Furthermore, all pairs display varying levels of multifractal strength, with the US EPU and US conventional stock market exhibiting the strongest multifractal patterns. Additionally, a cross-correlation between US EPU and the different stock markets is found to be persistent. The results of this study are pertinent to the various market participants in both conventional and Islamic markets, particularly investors, who may be able to draw useful conclusions from them for purposes such as portfolio diversification.

1. Introduction

Recently, there has been great interest in studying uncertainty (Adebayo et al. 2022; Aslam et al. 2022b, 2022c; Fernandes et al. 2022). Different measures include the geopolitical risk index (GPR) of Caldara and Iacoviello (2022), the economic policy uncertainty (EPU) indices of Baker et al. (2016), Arbatli et al. (2017) and Moore (2017) and the uncertainty index based on Google trends data of Castelnuovo and Tran (2017). EPU, however, has drawn more attention than other measures of uncertainty since major financial, economic, and political shocks, such as the Global Financial Crisis (GFC) of 2007–2008, the United Kingdom (UK) exit from the European Union (EU) in 2020, China and United States (US) trade wars, the European debt crisis, and the recent COVID-19 pandemic (Gu and Liu 2022; Zhao and Wang 2022). In this aspect, many studies have shown the major and wide-ranging impacts of EPU on economy (Bloom 2014; Zhu et al. 2021), investment decisions (Stokey 2016), financial markets (Lyu et al. 2021; Tang and Wan 2022; Wang et al. 2022; Yuan et al. 2022), financial stability (Leduc and Liu 2016) and output (Baker et al. 2016), as well as the effects of economic and financial recessions and delays in the recovery process (Gu and Liu 2022).

Policy makers, investors, market participants, and portfolio managers have been baffled by the increased economic policy uncertainty and financial risk as the global economy has deteriorated recently, particularly in the wake of the recent COVID-19 outbreak and the Ukraine–Russia war. As a consequence, the uncertainty of government policies lowers equity prices, increases market volatility and has a relevant impact on investment choices and consumer spending (Gomes et al. 2012; Pastor and Veronesi 2012). For instance, Arouri et al. (2016) found that stock returns decrease significantly as a result of increased EPU, with this effect becoming stronger and more enduring during periods of excessive volatility. Dai et al. (2021) examined the impact of EPU on the possibility of a US stock market crash during COVID-19 and found a strongly negative correlation, implying that the crash risk increases as EPU worsens. Moreover, the negative correlation became higher during the global COVID-19 outbreak, indicating that the US stock market is more vulnerable to a meltdown during an epidemic due to EPU. Similarly, Ma et al. (2022b) examined the spillover effect of EPU on the realized volatility (RV) of stock markets, and found that EPU spillover gets stronger during extreme events such as GFC 2007–2008, Brexit and COVID-19.

There are various channels through which EPU affects stock markets. Firstly, EPU may cause firms and other economic agents to postpone and change important decisions such as investment, employment, saving and consumption (Gulen and Ion 2016). Secondly, EPU may also raise the production and financial costs which affect demand and supply side and accelerate disinvestment or even cause economic recessions (Arouri et al. 2016). For example, on the demand side, consumers will consume less durable items (Carroll 1997), and businesses could give up from projects or cause lower investment demand (Christou et al. 2017). Due to these possible weaknesses in economies, stock market prices frequently fall. Thirdly, EPU may also affect interest rates, inflation and expected risk premiums, which may lead to lower returns and higher volatility in stock markets (Pastor and Veronesi 2012). Lastly, the impact of policy uncertainty in the US economy on international stock market returns cannot be denied, as the US is a major player in the global economy, with impact in other countries’ stock markets through uncertainty spillover effects (Christou et al. 2017).

At these times of increased economic and financial uncertainty, investors naturally search for safe havens and portfolio diversifying assets to safeguard their investments (Albuquerque et al. 2022). Islamic financial markets which are based on Shariah compliant assets, exhibited their safe haven qualities in contrast to their conventional counterparts during the GFC of 2008 (Erdoğan et al. 2020). Since then, these securities have gained a reputation as safe havens. The unique characteristics such as lack of tolerance for interest based leverage, ratio screening, ethical investing and limitations on derivatives, result in making the risk and return profiles Islamic and conventional stock markets different (Saiti et al. 2014). Islamic stock markets use strict screening criteria such as excluding industrial sectors involved in prohibited activities such as gambling and alcohol, tobacco, weapons, entertainment, and pork-related products, limiting the debt-to-equity ratio to not more than 33%, and leading to excessive risk taking products. Hence, it is theoretically anticipated that the performance of conventional and Islamic stock markets is not expected to be the same (Ali et al. 2018).

However, the latest systemic crisis brought on by the COVID-19 pandemic has called into question the safe haven characteristics of Islamic markets, as many recent studies have shown contradictory findings. For instance, Hasan et al. (2021) discovered that during COVID-19, both Islamic and conventional stock markets had a strong correlation and frequently moved in the same way. This result also implies that investors should be aware that Islamic stocks do not offer a greater investment opportunity, particularly during times of economic unrest, due to their conservative traits. Similarly, Hasan et al. (2022) confirm that COVID-19-induced extreme market instability also affected Islamic financial markets, virtually to the same extent. Contrarily, other research shows that, compared to conventional markets, Islamic markets are more resilient to economic and financial instability (Adekoya et al. 2022a; Chowdhury et al. 2022; Hassan et al. 2022). For example, Setiawan et al. (2022) conducted a study examining multiple markets, including Islamic stock markets, G7 countries’ conventional stock markets, commodities such as oil and rubber, precious metals, bonds, and Bitcoin. They found that the pandemic had an impact on price differentials in these markets, but there were minimal changes in the risk patterns of these markets.

Studies on the relationship between EPU and Islamic markets are found to be quite scarce when compared to conventional markets. For example, Chau et al. (2014) discovered that the Middle East and North Africa (MENA) region’s Islamic and conventional stock markets respond differently to political unpredictability. While the revolt had a reduced impact on the volatility of conventional markets, they discovered a considerable increase in the volatility of Islamic markets during times of political instability. According to Hammoudeh et al. (2016), the Islamic as well as the Asian, European and US stock markets are negatively affected by US EPU shocks. However, it turns out that EPU has no impact on Islamic bonds (Sukuk) (Reboredo and Naifar 2017). While examining the causal relationship of EPU with Dow Jones based Islamic stock market indices, Ftiti and Hadhri (2019) found that the lagged EPU enhances the forecasting of Islamic stock market returns. However, Aziz et al. (2020) found that Islamic stock markets are less likely to be impacted by global macroeconomic factors and economic policies. Hence, the stability of these markets allows portfolio diversification, especially in the presence of extreme events. Recently, Umar et al. (2022) investigated the impact of EPU on the relationship between Islamic indices and the Coronavirus media coverage index (MCI). The findings show that EPU can anticipate the degree of net connectivity between Islamic sectoral equities and the MCI.

Studies have employed a variety of econometric techniques to investigate how economic policy uncertainty affects various financial markets (Chiang 2019; Fasanya et al. 2021a; Gao et al. 2019; Liu and Zhang 2015; Raza et al. 2018b; Yang et al. 2021; Zhu et al. 2020). The majority of these studies are based on the Efficient Market Hypothesis (EMH) (Fama 1970), neglecting the non-linearity of these markets and focusing on the linear correlation of fluctuations in prices. However, with the recent COVID-19 outbreak, more empirical investigations have shown that the relationship between the EPU and other financial markets is non-linear, complex, chaotic, and with a high multifractal level (Gu and Liu 2022). For example, Fernandes et al. (2022) used various multifractal approaches to evaluate the non-linear cross-correlation between US EPU and the metal commodity indices. All of the US EPU-metals commodity pairs were found to have persistent cross-correlation, with gold found to be more closely related to the other commodities than US EPU. Aslam et al. (2022c) compared industrial metals with precious metals in terms of their relationship with US EPU. The empirical results support the interdependence between the US EPU and all metal markets, with precious metals exhibiting persistent cross-correlations and industrial metals exhibiting anti-persistent cross-correlations with the US EPU. Using similar multifractal approaches, the relationship with EPU is examined for European carbon market prices (Ye et al. 2021), Sino-US economic fluctuations (Zhao and Dai 2021), agricultural future markets (Feng et al. 2022), the cryptocurrency market (Ma et al. 2022a), the forex market (Zhao and Cui 2021), foreign flows in Chinese A-Share markets (Bing et al. 2021) and stock market trading volume (Pak and Choi 2022), among others.

However, there is relatively less literature addressing the interaction between EPU and stock markets in a multifractal context. For example, Jiang et al. (2021) look at the cross-correlations of EPU with US stock markets of NASDAQ, S&P500 and Dow Jones. Their findings demonstrate a non-linear relationship between changes in EPU and US stock markets, where the cross-correlations exhibit high multifractal patterns, and these cross-correlations are significantly influenced by major global events. In another study, Dehua and Xiangyu (2020) quantify the cross-correlations of EPU and UK and US stock markets and discover that the cross-correlation between trading volume and EPU is more persistent than that of the cross-correlation between stock returns and EPU. For the Shanghai stock market and EPU, the multifractal cross-correlations are found to be strongly anti-persistent (Lu 2019). However, we found no study on the relationship of EPU with Islamic stock markets, or comparing EPU with Islamic and conventional stock markets, considering a multifractal background. Therefore, studying the cross-correlation between EPU and Islamic and conventional equity markets may help to improve our understanding about the dynamics of these markets and their interrelationship with EPU.

The Fractal Market Hypothesis (FMH) of Peters (1994) serves as the foundation for the notion of multifractality, which supersedes the earlier theory (EMH) and is based on the self-similar complex patterns within financial markets. The rescaled range analysis (R/S), a pioneer fractal research-based methodology, was developed by Hurst (1951) which was initially used in econophysics literature. Later, Peters (1996) discovered that when R/S is employed, many financial markets exhibit long-term autocorrelation, indicating that these financial markets are inefficient. However, according to Lo (1991), R/S may contribute to the short-term autocorrelation problem, suggesting that there may be deviations for unstable financial data. Peng et al. (1994) addressed this issue by introducing detrended fluctuation analysis (DFA), separating local correlations from long-term correlations. Based on this, Kantelhardt et al. (2002) developed an advanced method for multifractal time series data called multifractal detrended fluctuation analysis (MF-DFA), which has been widely used in many areas including physics, social sciences and chemistry (Ali et al. 2021; Aslam et al. 2021a, 2021b). Later, based on the long-term cross-correlation of two time series proposed by Podobnik and Stanley (2008) called detrended cross-correlation analysis (DCCA), Zhou (2008) presented the enhanced multifractal detrended cross-correlation analysis (MF-DCCA), which builds on the MF-DFA and DCCA methodologies, to examine multifractal power law cross-correlations between two time series. Since then, many studies have largely relied on DCCA and MF-DCCA methodologies to investigate the cross-correlations between various time series (Aslam et al. 2022b, 2022c; Bing et al. 2021; Feng et al. 2022; Ma et al. 2022a; Pak and Choi 2022; Ye et al. 2021; Zhao and Cui 2021; Zhao and Dai 2021).

In view of the above, our study is distinctive and enriches the existing literature in three main ways. Firstly, to the best our knowledge, this is the first study to evaluate the relationship between EPU and conventional and Islamic markets from a multifractal perspective, to determine whether Islamic markets are an exception during periods of economic and financial upheaval. Secondly, we use the world’s largest economy’s uncertainty index, i.e., US economic policy uncertainty (US EPU) index, developed by (Baker et al. 2016), to understand its multifractal characteristics and mutual influences on the conventional and Islamic stock markets. Thirdly, we present compelling evidence of the power law cross-correlation and apparent multifractal features of US EPU with Islamic and conventional stock markets based on the robust, physics-based technique of MF-DCCA. Hence, by using this methodology, we aim to answer the following three questions: (1) Do pairs of US EPU with both conventional and Islamic markets exhibit multifractal characteristics? (2) How do the multifractal patterns of these pairs differ in terms of strength? (3) Is there persistence in the multifractality of the cross-correlation between US EPU and both Islamic and conventional stock markets?

2. Literature Review

The early literature on EPU looked at how it affects major economic activities such as economic growth, inflation, output, unemployment, and monetary policy (Yuan et al. 2022). The recent extreme financial market volatility, caused by COVID-19 and the Russia-Ukraine war, rekindled academic interest in examining the connection between EPU and financial markets, emphasizing the significance of uncertain economic policy. Increased policy uncertainty may deter businesses from engaging in new investment endeavors and encourage consumers to adopt more frugal purchasing habits, which can have a variety of negative effects on investors, firms and consumers (Hung 2021). It applies to lenders because they might adopt a more cautious approach to their lending procedures, due to heightened uncertainty about governmental economic policy. As a result, the direct effects of policy uncertainty could eventually influence financial markets worldwide as well as the entire global economy. Our research in this area is a major addition to the literature on the relationship between conventional and Islamic equities markets and EPU.

Based on the frequency of newspaper coverage, Baker et al. (2016) created the first EPU index for the US, starting from 1985. Following Baker et al. (2016), many studies developed other uncertainty measures as a benchmark for measuring EPU and examined its impact on various financial markets. For instance, Mokni et al. (2022) investigated the use of gold and the top five cryptocurrencies as a safe haven or hedging against the US EPU both before and during the COVID-19 pandemic. Their findings indicate that neither gold nor cryptocurrencies can serve as a reliable hedge against US EPU before or during COVID-19. According to Fasanya et al. (2021b), US EPU is a substantial driver of risk transmissions across the oil market and the majority of globally traded forex market currency pairs. For bond spreads and their volatility in developing markets, Balcilar et al. (2021) look into the predictive power of regional and global EPU measures. The results demonstrate EPU measures’ ability to forecast bond spreads in both upper and lower quantiles of the market.

In comparison to other financial markets, the literature on EPU and stock markets indicated a strong negative impact. Hung (2021), for instance, examined the mean spillover effects of EPU with the stock markets of BRICS countries, i.e., Brazil, Russia, India, China, and South Africa. Their findings point to a significant bidirectional return spillover effect between EPU and BRICS stock markets in the wake of the EU debt crisis and GFC of 2007–2008. Similarly, Nusair and Al-Khasawneh (2022) examined the long- and short-term impacts of EPU on the G7 stock markets, i.e., Canada, France, Germany, Italy, Japan, the UK and the US. They found that all these markets, except for the UK, have considerable short-term effects from EPU on their stock values, which persist over time. According to Zhu et al. (2022), in extremely volatile market conditions, EPU and crude oil have a very good predictive power over industrial stock returns. Furthermore, EPU is better able to explain long-term industry stock returns than short-term returns. Chiang (2022) investigates the effects of changes in the shock of US EPU and COVID-19 on sixteen global stock markets and finds that higher economic uncertainty decreases stock market returns significantly, also causing negative spillover effects. Adekoya et al. (2022b) compare the effects of EPU, crude oil prices, and stock market fluctuations on the stock returns of 62 energy companies, concluding that two market-based uncertainties are overshadowed by EPU. Rehman et al. (2021) used weekly frequency data to analyze the sensitivity of the major US sectoral equity indices to investor sentiments and EPU. Their findings show that sentiments, in comparison to EPU, are important drivers of US sectoral returns. More recently, Tang and Wan (2022) investigate the impact of policy uncertainty on the informativeness of enterprises’ stock prices and discover a positive correlation.

Only a small amount of research has been done on the multifractality of EPU, and most of it has relied on MF-DCCA to look at how EPU correlates with other financial markets. For example, Yao et al. (2020) adopted MF-DFA as well as MF-DCCA to explore multifractal properties in the cross-correlation between US EPU, US stock market and WTI crude oil. They found that all the assets studied show multifractality. However, the prices of the US stock market and WTI oil have the strongest cross-correlation in their multifractality. Ye et al. (2021) employed both linear and non-linear cross-correlation (MF-DCCA) approaches to examine the relationship of EPU with European carbon market price. Interestingly, the findings of the linear analysis show no linear relationship between the return on the EU carbon market and EPU. Contrarily, with the non-linear analysis, i.e., MF-DCCA, the authors found the existence of cross-correlations, and the behavioral structure of cross-correlations across various carbon trading periods differs. In the same way, Zhao and Dai (2021) employed MF-DCCA and discovered significant cross-correlations between EPU of China and US, where power law cross-correlations existed for the variation of most scaling orders. Using the same methodology, Feng et al. (2022) examined the cross-correlations of EPU with agricultural futures returns in the US and China. The results suggest considerable cross-correlations in multifractality between agricultural future returns and EPU, and such cross-correlations are higher and less persistent in China than they are in the US.

The following conclusions can be drawn from the above literature. Firstly, there has been an increase in studies examining the impact of EPU on various financial markets following the introduction of Baker et al. (2016)’s EPU index. Secondly, stock markets appear to be more strongly affected by EPU than other financial markets. However, there is a scarcity of literature examining the impact of EPU on Islamic stock markets or comparing the effect of EPU on Islamic and conventional stock markets. Thirdly, considering the multifractal context, we found few studies examining the cross-correlation of EPU with US stock market, crude oil, (Yao et al. 2020), European carbon market (Ye et al. 2021), industrial and precious metal markets (Aslam et al. 2022c). Lastly, there are no studies that we are aware of that examine the relationship between EPU and both conventional and Islamic markets from a multifractal perspective.

3. Data and Methodology

3.1. Data

In this study, we used the stock market closing prices from the following five countries: United States, Thailand, Indonesia, Pakistan, and India, because they have both conventional and Islamic markets and have long time periods of available data. These indices cover a wide period from 1 April 2013 to 30 July 2021, with a total of 1701 observations each (after the data cleaning process). Data were sourced from DataStream. For EPU, the daily US EPU index of Baker et al. (2016) is collected from the Economic Policy Uncertainty (EPU) website, which is based on 12,000 newspaper coverage frequency. Baker et al. (2016) developed this index for 27 major countries, and it has been used in various studies. Major spikes in the US EPU index are observed for major events such as the Gulf wars of 1990 and 2003, the episode of 11 September (2001), the Lehman Brothers failure and other major disputes over fiscal policy uncertainties. Table 1 shows the list of conventional and Islamic equity market indices, the time period and the total of number of observations for each series.

Table 1.

List of Islamic and Conventional Stock Markets.

Furthermore, the daily changes in US EPU () and the stock markets return () are calculated as:

Table 2 shows the descriptive statistics of US EPU along with Islamic and conventional market indices. The highest mean return in the entire data set, is observed for US EPU which is 16.12%, while SETI, FTSTSH, and JKII show the lowest average return of 0.00%. The markets of DJIA, NSE, and IMUSL show the same average returns of 0.07%. Interestingly, the highest maximum return in a day (19.53%) and the highest daily loss (16.08%) are both observed for NI50SH Indian Islamic market. Similarly, NI50SH is seen to be the most volatile among all considered markets. All series’ skewness values are negative, except for JKSE, JKII, NI50SH and US EPU. All market values have kurtosis levels greater than three, indicating that these markets share the stylized facts of fat tails.

Table 2.

The Descriptive Statistics of Stock Markets and US EPU.

3.2. Multifractal Detrended Cross-Correlation Analysis (MF-DCCA)

By extending the DCCA of Podobnik and Stanley (2008), Zhou (2008) introduced the robust MF-DCCA, which is a crucial method to determine the cross-correlation properties of two time series. The steps in the MF-DCCA process are as follows.

It is assumed there are two time-varying sequential data, and , to investigate cross-correlation. The length of this time series is assumed to be equal, . The first step is to calculate the signal profiles.

where

with the mean values of the considered time series represented as and .

In a second step, the detrended time series and are further broken into non-overlapping equal segments with observations as , with the integer function represented by . Because the length of the time series might not be an integer multiple of scale , the short segment at the end of each series could be discarded. In order to include the end part of the segment in the analysis, the same process is repeated in reverse order. Hence, a total of non-overlapping windows are estimated.

In the third step, the local trend of each segment is estimated by using the split segments. Particularly, the detrended covariance of each segment is specifically denoted as , and can be calculated using the following equations:

For every ,

and for each

In the fourth step, the order fluctuation function is estimated by averaging the local covariance of the detrended segments. Hence, the following equation is used to construct the fluctuation function :

and for

The large and small fluctuations are differentiated by the parameter, where the larger fluctuations are for and smaller fluctuations are for . We obtain the DCCA procedure at . The trends of are calculated to explore the scaling behavior of , for each value of . In the case of cross-correlation of and , tends to grow with , indicating a power law relationship on segment size. The power law cross-correlation is represented as:

Here, the generalized Hurst cross-correlation exponent is denoted by , describing the power cross-correlation between two time series. For mono-fractal paired time series, the scaling exponent for remains unchanged, whereas the scaling exponent for changes in the case of multifractality. The scaling exponent for all positive , shows scaling behavior of large fluctuations, while for negative , it shows the scaling behavior of small fluctuations. The univariate Hurst exponent and the bivariate Hurst exponent have the same properties and explanation (Kristoufek 2011). As suggested by (Oświȩcimka et al. 2014), the scales are selected according to the series length N while the maximum scale is taken as .

The Hurst exponent at explains the persistent behavior in the cross-correlations, where the shows the anti-persistent and indicates the persistent cross-correlation behavior between two time series. The scaling tendency of sub-intervals with small variations is depicted by the anti-persistent cross-correlation, whereas the scaling tendency of sub-intervals with large fluctuations is reflected by the persistent cross-correlation. Such that, if and rises (declines), it is invariably preceded by another decline (rise). However, if , then and are no longer cross-correlated.

, on other hand, denotes the strength of multifractality, where higher values of show stronger multifractal strengths, while lower values of show weaker multifractal characteristics, i.e.,

Another measure which can be used to examine multifractality within time series is the Rényi exponent , as shown in the following equation:

Finally, in order to increase the robustness of multifractality, we perform a singularity spectrum analysis. The Legendre transformation allowed for the acquisition and presentation of the singularity spectrum , based on the participation of the Hölder exponent and the Rényi exponent , could be, respectively, obtained as

4. Results

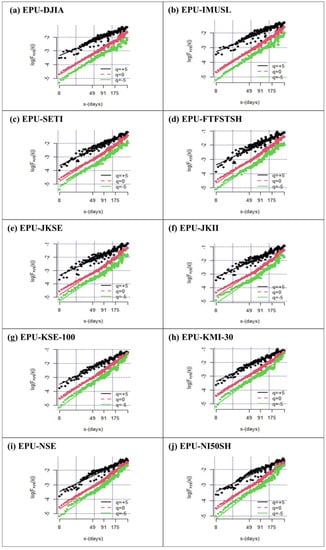

By employing MF-DCCA, we present a quantitative analysis of the non-linear properties in the cross-correlation of US EPU with conventional and Islamic stock markets. The fluctuation function , is calculated with increasing scaling order, and values are assigned to at intervals of , with a minimum value of −5 and a maximum of +5. The log–log trends of , which varies with time length are plotted in Figure 1 for the pairs of US EPU and the indices of Islamic and conventional stock markets. The scale order represented by the lines, which grow from bottom to top, range from −5 to +5. This indicates that a power law connection exists inside each of these pairs as exhibits an apparent rising trend with the progressive growth of with all scale orders.

Figure 1.

The log–log plot of Fxyq(S) versus s for US EPU and conventional and Islamic stock markets.

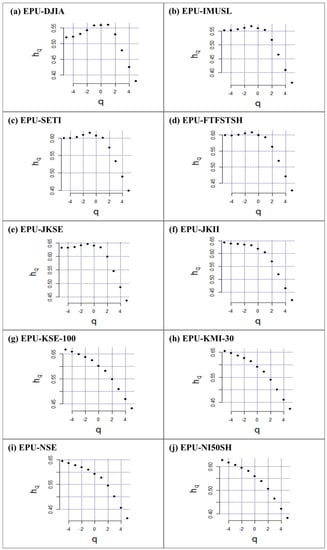

We compute the generalized Hurst exponent , which is one of the crucial inspection steps for the cross-correlation check between the US EPU and stock markets. Figure 2 shows the evolution pattern of the Hurst exponent, under variations in order −5 to +5. It is noted that all the pairs of US EPU’s Hurst exponent values show a changing pattern with rising scale order. For example, the values of for the pair of US EPU/DJUS gradually decrease from 0.52 at q = −5 to 0.56 at q = 0, and then drop to 0.38 at q = +5 (see Table 3). Similar patterns can be seen in other US EPU pairs with sampled stock markets.

Figure 2.

The generalized Hurst exponent Hxy(q).

Table 3.

Generalized Hurst Exponents Ranging from q = −5 to q = 5.

Furthermore, the values of , which is estimated by taking the difference between and , as suggested by Yuan et al. (2009), are reported in the last row of Table 3. This acts as a measurement tool to examine the strength or the degree of multifractal characteristics. Overall, the values of vary from the maximum of 0.24 for US EPU/NI50SH to the minimum of 0.14 for US EPU/DJUS. In particular, the pairs of Pakistani (KSE100) and Indian (NSE) stock markets with US EPU are found to have the maximum degree of multifractality, while the US stock market DJUS with US EPU is regarded to have the lowest degree of multifractality, within conventional stock markets. Similarly, for Islamic stock markets, the pairs of Indian and Pakistani stock markets with US EPU have the highest multifractality, whereas US stock market has the lowest multifractality of all. Interestingly, both pairs of US stock markets with US EPU seem to have the lowest multifractal patterns.

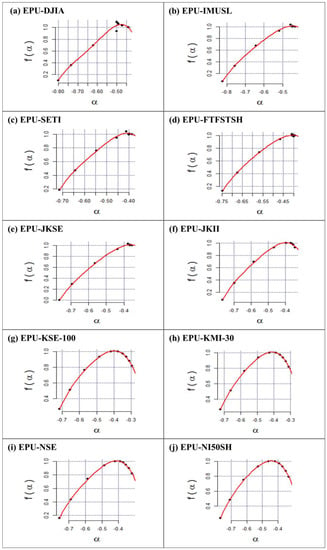

Figure 3 illustrates the width of multifractal spectrums, further supporting the findings regarding the strength of multifractality. The multifractal spectrum for these markets exhibits variation with , demonstrating significant presence of multifractal patterns within these pairs. Additionally, the complexity of the local fluctuation of time series increases with the difference between the extreme values of . Moreover, can show the relatively low and high trend as well as how fluctuations behave. The greater multifractal spectrum widths support the Adaptive Market Hypothesis (AMH) of Kristoufek and Vosvrda (2013) by demonstrating that they are not produced by the random walk process.

Figure 3.

The multifractal spectrum.

Moreover, to investigate whether the cross-correlation between US EPU and the Islamic and conventional stock markets has persistency in their multifractality, the Hurst exponent at is examined. As shown in Table 3, all pairs of US EPU with stock markets have values higher than their critical value of , with the exception of the US EPU/NI50SH pair, which is close to . This suggests that the cross-correlations of all of these pairs are persistent. The US EPU/NI50SH pair, however, only shows weak evidence of cross-correlation.

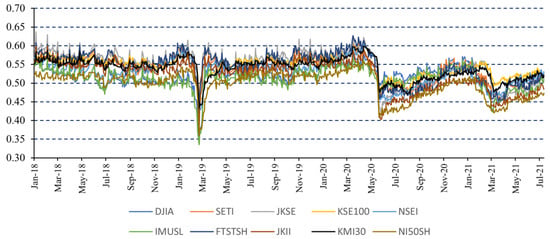

Finally, given the presence of significant economic and political events in the data, we applied the rolling window approach on MF-DCCA, considering a window length of 1000 trading days. This analysis was performed to better understand the time-varying cross-correlation characteristics between US EPU and stock markets. Figure 4 plots the evolution of Hurst exponent at q = 2, for all the pairs, being clear that the cross-correlation of all pairs of US EPU with all the stock markets tend to exhibit similar trends and behaviors. We observe three notable moments of anti-persistent cross-correlation of US EPU with stock markets, namely during February–March 2019, May–June 2020, and March–April 2021. The first could be caused by a shift in Federal Reserve strategy away from monetary tightening bias as well as renewed optimism around a potential US–China trade deal in the first quarter of 2019 (Murphy 2019). The second moment could be attributed to the severe COVID-19 pandemic, while the third one could be supported by the roll-out of COVID-19 vaccines.

Figure 4.

Dynamic Hurst exponents evolution for US EPU and conventional and Islamic stock markets (q = 2, and window = 1000).

5. Conclusions and Discussion

Since the GFC 2007–2008, there have been growing concerns about the policy uncertainty surrounding economic policies and monetary decisions. A growing number of studies have documented how EPU has a negative impact on various financial markets, with conventional stock markets being more impacted than others. Since then, investors have been more interested in alternative investments, i.e., Islamic stock markets, as the volatility surrounding conventional stock markets has grown. Islamic markets, due to their independence from conventional markets, have seen extraordinary development in the aftermath of GFC 2007–2008. However, since the COVID-19 pandemic, there has been an increase in the unpredictability of economic policy across the globe, with Islamic stock markets being almost equally impacted. In this context, this study focuses on investigating the cross-correlation of US EPU with conventional and Islamic stock markets in the multifractal background, which is absent from the literature. A relevant number of studies in the financial field have established the MF-DCCA as a reliable tool to detect cross-correlation multifractal characteristics between two time series. From this perspective, we make use of the daily US EPU index from Baker et al. (2016), as well as the conventional and Islamic stock market prices of five countries—the US, Thailand, Indonesia, Pakistan, and India.

The empirical findings of this study are presented as follows. Firstly, the fluctuation function of all pairs of US EPU with both types of stock markets shows an evident rising trend, indicating the existence of power law cross-correlation within all pairs. Secondly, all pairs are seen to have a declining generalized Hurst exponent trend with increasing scale, further supporting the presence of multifractality in these pairs. Thirdly, all pairs exhibit a different level of multifractal strength, i.e., , where the highest multifractal patterns are observed for the pair of US EPU with the Islamic Indian stock market of NI50SH. This result, however, contradicts the earlier investigations that found the highest connection of US EPU with US stock markets (He et al. 2020; Raza et al. 2018a; Yao et al. 2020), since the home country’s EPU could have a greater impact on its stock market than it does on other markets. Additionally, we found that all pairs of conventional and Islamic stock markets’ relationship with US EPU show Hurst exponents that are above the critical levels for all scaling orders, demonstrating the validity of cross-correlation persistence behavior.

The above findings have a number of implications for decision-makers, investors and policy makers who work in both the conventional and Islamic stock markets. Firstly, the internal dynamics of the cross-correlations between US EPU and stock markets cannot be modelled using conventional linear models such as vector-regression, OLS or correlation coefficient. The existence of multifractal patterns could be related, for example, with the presence of fat tails, suggesting a non-linear structure in the cross-correlations between the pairs of markets, which cannot be explained by using the assumptions of linearity and stationarity of the data (Aslam et al. 2022a). Secondly, the US EPU has a substantial impact on both the conventional and Islamic stock markets, and so it is advisable to take these differences into account when developing a portfolio and diversification strategy. Investors are advised to be aware that, particularly during times of economic policy instability and financial crisis, Islamic stocks’ conservative characteristics do not provide better investing choices or hedging opportunities. Our findings may help Islamic regulatory bodies to formulate regulations and policies that will shield Islamic sharia-compliant portfolios and investors from high risk and volatility in the mainstream equity market. Lastly, both Pakistani markets appear to be more efficient than other markets since US EPU multifractality is lower with Pakistani markets than with others. In other words, other stock markets are more susceptible to EPU shocks than Pakistani ones. As a result, by investing in Pakistani markets, investors may maximize their portfolio returns through diversification, particularly during periods of significant economic policy uncertainty and financial turmoil. We advise future studies to use more Islamic instruments on intraday data sets or take other uncertainty measures in order to understand its relationship with EPU and other uncertainty measures more precisely. By modifying the MF-DCCA model, this study can also potentially be expanded to examine the cross-correlation between several variations in the Islamic markets.

Author Contributions

Conceptualization, F.A. and P.F.; data curation, F.A., A., P.F. and H.A.; formal analysis, P.F., H.A., A. and M.O.; funding acquisition, F.A.; writing—original draft, F.A., A., P.F., H.A. and M.O.; writing—review and editing, F.A., A., P.F. and M.O. All authors have read and agreed to the published version of the manuscript.

Funding

Paulo Ferreira acknowledges the financial support of Fundação para a Ciência e a Tecnologia (grants UIDB/05064/2020 and UIDB/04007/2020).

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are openly available at the Economic Policy Uncertainty (EPU) website.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adebayo, Tomiwa Sunday, Seyi Saint Akadiri, and Husam Rjoub. 2022. On the relationship between economic policy uncertainty, geopolitical risk and stock market returns in South Korea: A quantile causality analysis. Annals of Financial Economics 17: 2250005. [Google Scholar] [CrossRef]

- Adekoya, Oluwasegun B., Johnson A. Oliyide, and Aviral Kumar Tiwari. 2022a. Risk transmissions between sectoral Islamic and conventional stock markets during COVID-19 pandemic: What matters more between actual COVID-19 occurrence and speculative and sentiment factors? Borsa Istanbul Review 22: 363–76. [Google Scholar] [CrossRef]

- Adekoya, Oluwasegun B., Johnson A. Oliyide, Oluwademilade T. Kenku, and Mamdouh Abdulaziz Saleh Al-Faryan. 2022b. Comparative response of global energy firm stocks to uncertainties from the crude oil market, stock market, and economic policy. Resources Policy 79: 103004. [Google Scholar] [CrossRef]

- Albuquerque, Rui A., Yrjo Koskinen, and Raffaele Santioni. 2022. Mutual Fund Trading and ESG Stock Resilience During the COVID-19 Stock Market Crash. Bank of Italy Temi di Discussione (Working Paper) No 1371. Brussels: European Corporate Governance Institute. [Google Scholar]

- Ali, Haider, Faheem Aslam, and Paulo Ferreira. 2021. Modeling Dynamic Multifractal Efficiency of US Electricity Market. Energies 14: 6145. [Google Scholar] [CrossRef]

- Ali, Sajid, Syed Jawad Hussain Shahzad, Naveed Raza, and Khamis Hamed Al-Yahyaee. 2018. Stock market efficiency: A comparative analysis of Islamic and conventional stock markets. Physica A: Statistical Mechanics and its Applications 503: 139–53. [Google Scholar] [CrossRef]

- Arbatli, Elif C., Steven J. Davis, Arata Ito, and Naoko Miake. 2017. Policy Uncertainty in Japan. Cambridge: NBER. [Google Scholar]

- Arouri, Mohamed, Christophe Estay, Christophe Rault, and David Roubaud. 2016. Economic policy uncertainty and stock markets: Long-run evidence from the US. Finance Research Letters 18: 136–41. [Google Scholar] [CrossRef]

- Aslam, Faheem, Ijaz Ali, Fahd Amjad, Haider Ali, and Inza Irfan. 2022a. On the inner dynamics between Fossil fuels and the carbon market: A combination of seasonal-trend decomposition and multifractal cross-correlation analysis. Environmental Science and Pollution Research, 1–19. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Fahd Amjad, and Haider Ali. 2021a. The Efficiency of Sin Stocks: A Multifractal Analysis of Drug Indices. The Singapore Economic Review, 1–22. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Haider Ali, and Ana Ercília José. 2022b. Application of Multifractal Analysis in Estimating the Reaction of Energy Markets to Geopolitical Acts and Threats. Sustainability 14: 5828. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Haider Ali, and Sumera Kauser. 2021b. Herding behavior during the COVID-19 pandemic: A comparison between Asian and European stock markets based on intraday multifractality. Eurasian Economic Review 12: 333–359. [Google Scholar] [CrossRef]

- Aslam, Faheem, Rashida Bibi, and Paulo Ferreira. 2022c. Cross-correlations between economic policy uncertainty and precious and industrial metals: A multifractal cross-correlation analysis. Resources Policy 75: 102473. [Google Scholar] [CrossRef]

- Aziz, Tariq, Jahanzeb Marwat, Sheraz Mustafa, and Vikesh Kumar. 2020. Impact of economic policy uncertainty and macroeconomic factors on stock market volatility: Evidence from islamic indices. The Journal of Asian Finance, Economics and Business 7: 683–92. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Ojonugwa Usman, Hasan Gungor, David Roubaud, and Mark E. Wohar. 2021. Role of global, regional, and advanced market economic policy uncertainty on bond spreads in emerging markets. Economic Modelling 102: 105576. [Google Scholar] [CrossRef]

- Bing, Tao, Fei Hu, and Hongkun Ma. 2021. The Cross-Correlations between Foreign Flows in Chinese A-Share Markets and Uncertainties in Home Markets. Discrete Dynamics in Nature and Society 2021: 6541902. [Google Scholar] [CrossRef]

- Bloom, Nicholas. 2014. Fluctuations in uncertainty. Journal of economic Perspectives 28: 153–76. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring geopolitical risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- Carroll, Christopher D. 1997. Buffer-stock saving and the life cycle/permanent income hypothesis. The Quarterly Journal of Economics 112: 1–55. [Google Scholar] [CrossRef]

- Castelnuovo, Efrem, and Trung Duc Tran. 2017. Google it up! a google trends-based uncertainty index for the united states and australia. Economics Letters 161: 149–53. [Google Scholar] [CrossRef]

- Chau, Frankie, Rataporn Deesomsak, and Jun Wang. 2014. Political uncertainty and stock market volatility in the Middle East and North African (MENA) countries. Journal of International Financial Markets, Institutions and Money 28: 1–19. [Google Scholar] [CrossRef]

- Chiang, Thomas C. 2019. Economic policy uncertainty, risk and stock returns: Evidence from G7 stock markets. Finance Research Letters 29: 41–49. [Google Scholar] [CrossRef]

- Chiang, Thomas Chinan. 2022. Evidence of economic policy uncertainty and COVID-19 pandemic on global stock returns. Journal of Risk and Financial Management 15: 28. [Google Scholar] [CrossRef]

- Chowdhury, Md Iftekhar Hasan, Faruk Balli, and Anne de Bruin. 2022. Islamic equity markets versus their conventional counterparts in the COVID-19 age: Reaction, resilience, and recovery. International Review of Finance 22: 315–24. [Google Scholar] [CrossRef]

- Christou, Christina, Juncal Cunado, Rangan Gupta, and Christis Hassapis. 2017. Economic policy uncertainty and stock market returns in PacificRim countries: Evidence based on a Bayesian panel VAR model. Journal of Multinational Financial Management 40: 92–102. [Google Scholar] [CrossRef]

- Dai, Peng-Fei, Xiong Xiong, Zhifeng Liu, Toan Luu Duc Huynh, and Jianjun Sun. 2021. Preventing crash in stock market: The role of economic policy uncertainty during COVID-19. Financial Innovation 7: 1–15. [Google Scholar] [CrossRef] [PubMed]

- Dehua, Shen, and Kong Xiangyu. 2020. Dynamic Cross-Correlations Analysis on Economic Policy Uncertainty: Evidence from US and UK Stock Markets. Journal of Systems Science and Mathematical Sciences 40: 701. [Google Scholar]

- Erdoğan, Seyfettin, Ayfer Gedikli, and Emrah İsmail Çevik. 2020. Volatility spillover effects between Islamic stock markets and exchange rates: Evidence from three emerging countries. Borsa Istanbul Review 20: 322–33. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient market hypothesis: A review of theory and empirical work. Journal of Finance 25: 28–30. [Google Scholar] [CrossRef]

- Fasanya, Ismail O., Johnson A. Oliyide, Oluwasegun B. Adekoya, and Taofeek Agbatogun. 2021a. How does economic policy uncertainty connect with the dynamic spillovers between precious metals and bitcoin markets? Resources Policy 72: 102077. [Google Scholar] [CrossRef]

- Fasanya, Ismail O., Oluwasegun B. Adekoya, and Abiodun M. Adetokunbo. 2021b. On the connection between oil and global foreign exchange markets: The role of economic policy uncertainty. Resources Policy 72: 102110. [Google Scholar] [CrossRef]

- Feng, You-Shuai, Yang Li, and Bao-Ming Cao. 2022. Asymmetric Multifractal Cross-Correlations Between Economic Policy Uncertainty and Agricultural Futures Prices. Fluctuation and Noise Letters 21: 2250035. [Google Scholar] [CrossRef]

- Fernandes, Leonardo H. S., José W. L. Silva, Fernando H. A. de Araujo, Paulo Ferreira, Faheem Aslam, and Benjamin Miranda Tabak. 2022. Interplay multifractal dynamics among metal commodities and US-EPU. Physica A: Statistical Mechanics and its Applications 606: 128126. [Google Scholar] [CrossRef]

- Ftiti, Zied, and Sinda Hadhri. 2019. Can economic policy uncertainty, oil prices, and investor sentiment predict Islamic stock returns? A multi-scale perspective. Pacific-Basin Finance Journal 53: 40–55. [Google Scholar] [CrossRef]

- Gao, Chai, Da-ming You, and Jin-yu Chen. 2019. Dynamic response pattern of gold prices to economic policy uncertainty. Transactions of Nonferrous Metals Society of China 29: 2667–76. [Google Scholar]

- Gomes, Francisco J., Laurence J. Kotlikoff, and Luis M. Viceira. 2012. The excess burden of government indecision. Tax Policy and the Economy 26: 125–64. [Google Scholar] [CrossRef]

- Gu, Rongbao, and Shengnan Liu. 2022. Nonlinear analysis of economic policy uncertainty: Based on the data in China, the US and the global. Physica A: Statistical Mechanics and its Applications 593: 126897. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. The Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat, Won Joong Kim, and Soodabeh Sarafrazi. 2016. Sources of fluctuations in Islamic, US, EU, and Asia equity markets: The roles of economic uncertainty, interest rates, and stock indexes. Emerging Markets Finance and Trade 52: 1195–209. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, Masnun Mahi, M. Kabir Hassan, and Abul Bashar Bhuiyan. 2021. Impact of COVID-19 pandemic on stock markets: Conventional vs. Islamic indices using wavelet-based multi-timescales analysis. The North American Journal of Economics and Finance 58: 101504. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, Md Mamunur Rashid, Muhammad Shafiullah, and Tapan Sarker. 2022. How resilient are Islamic financial markets during the COVID-19 pandemic? Pacific-Basin Finance Journal 74: 101817. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Md Iftekhar Hasan Chowdhury, Faruk Balli, and Rashedul Hasan. 2022. A note on COVID-19 instigated maximum drawdown in Islamic markets versus conventional counterparts. Finance Research Letters 46: 102426. [Google Scholar] [CrossRef]

- He, Feng, Ziwei Wang, and Libo Yin. 2020. Asymmetric volatility spillovers between international economic policy uncertainty and the US stock market. The North American Journal of Economics and Finance 51: 101084. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2021. Directional spillover effects between BRICS stock markets and economic policy uncertainty. Asia-Pacific Financial Markets 28: 429–48. [Google Scholar] [CrossRef]

- Hurst, Harold Edwin. 1951. Long-term storage capacity of reservoirs. Transactions of the American Society of Civil Engineers 116: 770–99. [Google Scholar] [CrossRef]

- Jiang, Wei, Jianfeng Li, and Guanglin Sun. 2021. Economic Policy Uncertainty and Stock Markets: A Multifractal Cross-Correlations Analysis. Fluctuation and Noise Letters 20: 2150018. [Google Scholar] [CrossRef]

- Kantelhardt, Jan W., Stephan A. Zschiegner, Eva Koscielny-Bunde, Shlomo Havlin, Armin Bunde, and H. Eugene Stanley. 2002. Multifractal detrended fluctuation analysis of nonstationary time series. Physica A: Statistical Mechanics and its Applications 316: 87–114. [Google Scholar] [CrossRef]

- Kristoufek, Ladislav, and Miloslav Vosvrda. 2013. Measuring capital market efficiency: Global and local correlations structure. Physica A: Statistical Mechanics and its Applications 392: 184–93. [Google Scholar] [CrossRef]

- Kristoufek, Ladislav. 2011. Multifractal height cross-correlation analysis: A new method for analyzing long-range cross-correlations. EPL (Europhysics Letters) 95: 68001. [Google Scholar] [CrossRef]

- Leduc, Sylvain, and Zheng Liu. 2016. Uncertainty shocks are aggregate demand shocks. Journal of Monetary Economics 82: 20–35. [Google Scholar] [CrossRef]

- Liu, Li, and Tao Zhang. 2015. Economic policy uncertainty and stock market volatility. Finance Research Letters 15: 99–105. [Google Scholar] [CrossRef]

- Lo, Andrew W. 1991. Long-term memory in stock market prices. Econometrica: Journal of the Econometric Society, 1279–313. [Google Scholar] [CrossRef]

- Lu, Zichen. 2019. Policy Uncertainty and Stock Market Returns: Nonlinear Analysis Based on MF-DCCA. Paper presented at the 2019 IEEE 4th Advanced Information Technology, Electronic and Automation Control Conference (IAEAC), Chengdu, China, December 20–22. [Google Scholar]

- Lyu, Yongjian, Siwei Tuo, Yu Wei, and Mo Yang. 2021. Time-varying effects of global economic policy uncertainty shocks on crude oil price volatility: New evidence. Resources Policy 70: 101943. [Google Scholar] [CrossRef]

- Ma, Junjun, Tingting Wang, and Ruwei Zhao. 2022a. Quantifying Cross-Correlations between Economic Policy Uncertainty and Bitcoin Market: Evidence from Multifractal Analysis. Discrete Dynamics in Nature and Society 2022: 1072836. [Google Scholar] [CrossRef]

- Ma, Yaming, Ziwei Wang, and Feng He. 2022b. How do economic policy uncertainties affect stock market volatility? Evidence from G7 countries. International Journal of Finance & Economics 27: 2303–25. [Google Scholar]

- Mokni, Khaled, Manel Youssef, and Ahdi Noomen Ajmi. 2022. COVID-19 pandemic and economic policy uncertainty: The first test on the hedging and safe haven properties of cryptocurrencies. Research in International Business and Finance 60: 101573. [Google Scholar] [CrossRef]

- Moore, Angus. 2017. Measuring economic uncertainty and its effects. Economic Record 93: 550–75. [Google Scholar] [CrossRef]

- Murphy, Maureen. 2019. First Quarter 2019 Financial Markets. Available online: https://www.woodstockcorp.com/first-quarter-2019-financial-markets-review-a-wild-shift-up/ (accessed on 10 November 2022).

- Nusair, Salah A., and Jamal A. Al-Khasawneh. 2022. Impact of economic policy uncertainty on the stock markets of the G7 Countries: A nonlinear ARDL approach. The Journal of Economic Asymmetries 26: e00251. [Google Scholar] [CrossRef]

- Oświȩcimka, Paweł, Stanisław Drożdż, Marcin Forczek, Stanisław Jadach, and Jarosław Kwapień. 2014. Detrended cross-correlation analysis consistently extended to multifractality. Physical Review E 89: 023305. [Google Scholar]

- Pak, Dohyun, and Sun-Yong Choi. 2022. Economic Policy Uncertainty and Sectoral Trading Volume in the US Stock Market: Evidence from the COVID-19 Crisis. Complexity 2022: 2248731. [Google Scholar] [CrossRef]

- Pastor, Lubos, and Pietro Veronesi. 2012. Uncertainty about government policy and stock prices. The Journal of Finance 67: 1219–64. [Google Scholar] [CrossRef]

- Peng, Chung-Kang, Sergey V. Buldyrev, Shlomo Havlin, Michael Simons, H. Eugene Stanley, and Ary L. Goldberger. 1994. Mosaic organization of DNA nucleotides. Physical Review E 49: 1685. [Google Scholar] [CrossRef]

- Peters, Edgar E. 1994. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics. New York: John Wiley & Sons, vol. 24. [Google Scholar]

- Peters, Edgar E. 1996. Chaos and Order in the Capital Markets: A New View of Cycles, Prices, and Market Volatility. New York: John Wiley & Sons. [Google Scholar]

- Podobnik, Boris, and H. Eugene Stanley. 2008. Detrended cross-correlation analysis: A new method for analyzing two nonstationary time series. Physical Review Letters 100: 084102. [Google Scholar] [CrossRef] [PubMed]

- Raza, Syed Ali, Isma Zaighum, and Nida Shah. 2018a. Economic policy uncertainty, equity premium and dependence between their quantiles: Evidence from quantile-on-quantile approach. Physica A: Statistical Mechanics and its Applications 492: 2079–91. [Google Scholar] [CrossRef]

- Raza, Syed Ali, Nida Shah, and Muhammad Shahbaz. 2018b. Does economic policy uncertainty influence gold prices? Evidence from a nonparametric causality-in-quantiles approach. Resources Policy 57: 61–68. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos, and Nader Naifar. 2017. Do Islamic bond (sukuk) prices reflect financial and policy uncertainty? A quantile regression approach. Emerging Markets Finance and Trade 53: 1535–46. [Google Scholar] [CrossRef]

- Rehman, Mobeen Ur, Ahmet Sensoy, Veysel Eraslan, Syed Jawad Hussain Shahzad, and Xuan Vinh Vo. 2021. Sensitivity of US equity returns to economic policy uncertainty and investor sentiments. The North American Journal of Economics and Finance 57: 101392. [Google Scholar] [CrossRef]

- Saiti, Buerhan, Obiyathulla I Bacha, and Mansur Masih. 2014. The diversification benefits from Islamic investment during the financial turmoil: The case for the US-based equity investors. Borsa Istanbul Review 14: 196–211. [Google Scholar] [CrossRef]

- Setiawan, Budi, Rifai Afin, Edza Aria Wikurendra, Robert Jeyakumar Nathan, and Maria Fekete-Farkas. 2022. COVID-19 pandemic, asset prices, risks, and their convergence: A survey of Islamic and G7 stock market, and alternative assets. Borsa Istanbul Review. in press. [Google Scholar] [CrossRef]

- Stokey, Nancy L. 2016. Wait-and-see: Investment options under policy uncertainty. Review of Economic Dynamics 21: 246–65. [Google Scholar] [CrossRef]

- Tang, Liang, and Xiangyu Wan. 2022. Economic policy uncertainty and stock price informativeness. Pacific-Basin Finance Journal, 101856. [Google Scholar] [CrossRef]

- Umar, Zaghum, Khaled Mokni, and Ana Escribano. 2022. Connectedness between the COVID-19 related media coverage and Islamic equities: The role of economic policy uncertainty. Pacific-Basin Finance Journal 75: 101851. [Google Scholar] [CrossRef]

- Wang, Jing, Muhammad Umar, Sahar Afshan, and Ilham Haouas. 2022. Examining the nexus between oil price, COVID-19, uncertainty index, and stock price of electronic sports: Fresh insights from the nonlinear approach. Economic Research-Ekonomska Istraživanja 35: 2217–33. [Google Scholar] [CrossRef]

- Yang, Jianlei, Chunpeng Yang, and Xiaoyi Hu. 2021. Economic policy uncertainty dispersion and excess returns: Evidence from China. Finance Research Letters 40: 101714. [Google Scholar] [CrossRef]

- Yao, Can-Zhong, Cheng Liu, and Wei-Jia Ju. 2020. Multifractal analysis of the WTI crude oil market, US stock market and EPU. Physica A: Statistical Mechanics and its Applications 550: 124096. [Google Scholar] [CrossRef]

- Ye, Shunqiang, Peng-Fei Dai, Hoai Trong Nguyen, and Ngoc Quang Anh Huynh. 2021. Is the cross-correlation of EU carbon market price with policy uncertainty really being? A multiscale multifractal perspective. Journal of Environmental Management 298: 113490. [Google Scholar] [CrossRef] [PubMed]

- Yuan, Di, Sufang Li, Rong Li, and Feipeng Zhang. 2022. Economic policy uncertainty, oil and stock markets in BRIC: Evidence from quantiles analysis. Energy Economics 110: 105972. [Google Scholar] [CrossRef]

- Yuan, Ying, Xin-tian Zhuang, and Xiu Jin. 2009. Measuring multifractality of stock price fluctuation using multifractal detrended fluctuation analysis. Physica A: Statistical Mechanics and its Applications 388: 2189–97. [Google Scholar] [CrossRef]

- Zhao, Ruwei, and Peng-Fei Dai. 2021. A multifractal cross-correlation analysis of economic policy uncertainty: Evidence from China and US. Fluctuation and Noise Letters 20: 2150041. [Google Scholar] [CrossRef]

- Zhao, Ruwei, and Yian Cui. 2021. Dynamic Cross-Correlations Analysis on Economic Policy Uncertainty and US Dollar Exchange Rate: AMF-DCCA Perspective. Discrete Dynamics in Nature and Society 2021: 6668912. [Google Scholar] [CrossRef]

- Zhao, Wen, and Yu-Dong Wang. 2022. On the time-varying correlations between oil-, gold-, and stock markets: The heterogeneous roles of policy uncertainty in the US and China. Petroleum Science 19: 1420–32. [Google Scholar] [CrossRef]

- Zhou, Wei-Xing. 2008. Multifractal detrended cross-correlation analysis for two nonstationary signals. Physical Review E 77: 066211. [Google Scholar] [CrossRef] [PubMed]

- Zhu, Huiming, Rui Huang, Ningli Wang, and Liya Hau. 2020. Does economic policy uncertainty matter for commodity market in China? Evidence from quantile regression. Applied Economics 52: 2292–308. [Google Scholar] [CrossRef]

- Zhu, Huiming, Yiwen Chen, Yinghua Ren, Zhanming Xing, and Liya Hau. 2022. Time-frequency causality and dependence structure between crude oil, EPU and Chinese industry stock: Evidence from multiscale quantile perspectives. The North American Journal of Economics and Finance 61: 101698. [Google Scholar] [CrossRef]

- Zhu, Xuehong, Jianhui Liao, and Ying Chen. 2021. Time-varying effects of oil price shocks and economic policy uncertainty on the nonferrous metals industry: From the perspective of industrial security. Energy Economics 97: 105192. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).