Effect of Investment Promotion through the Special Economic Zone Mechanism on the Distribution of FDI in Cambodia

Abstract

1. Introduction

2. Background, Literature, and Significance of the Study

3. Cambodia Context and Fact Data

4. Methodology, Estimation Strategy, and Data

5. Results

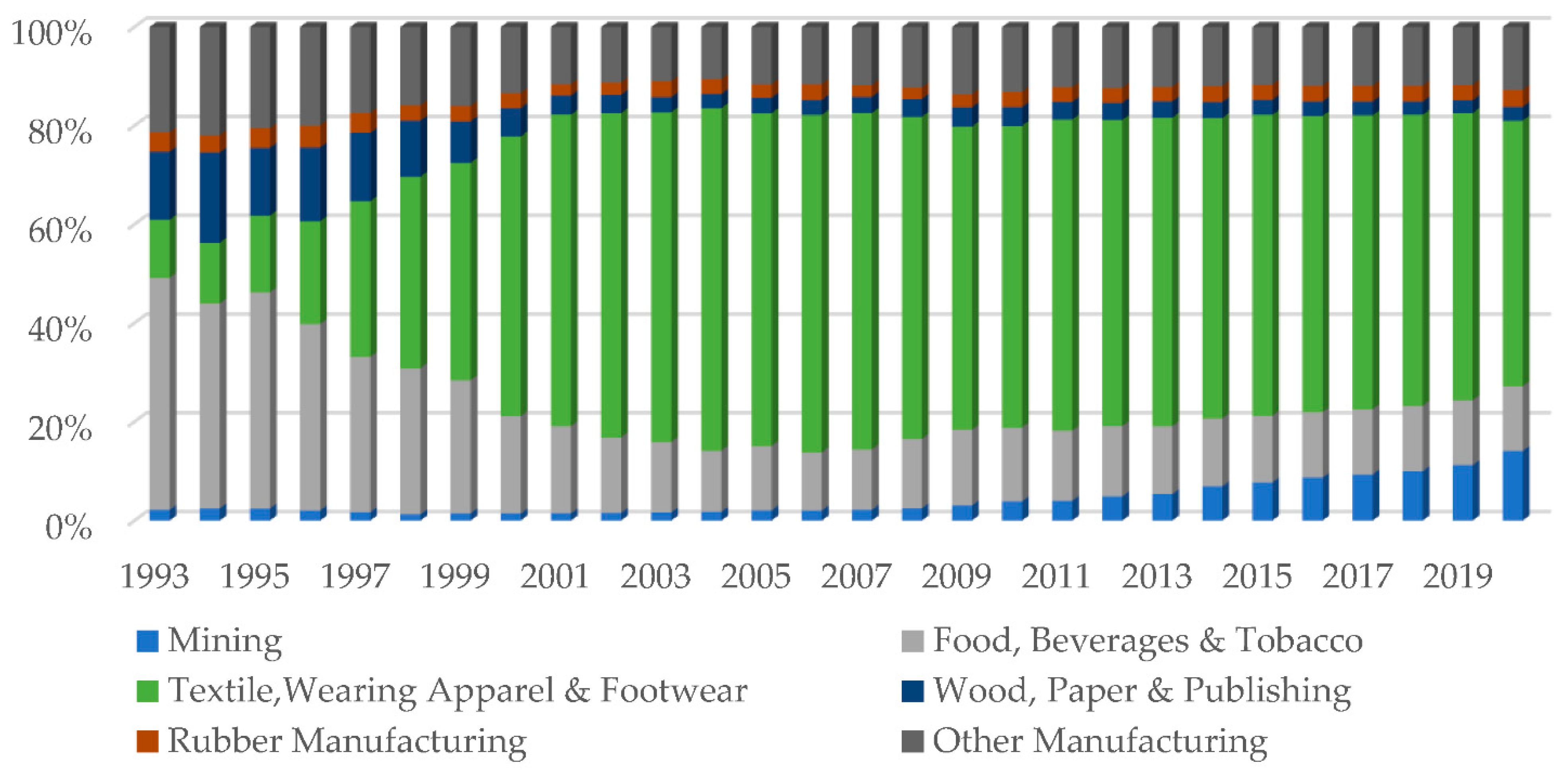

5.1. Descriptive Statistics

5.2. Estimation Results of a t-Test

5.3. Estimation Results Using GMM and Discussion

6. Conclusions, Policy Implications, and Limitations

6.1. Key Findings

6.2. Discussion and Policy Implications

6.3. Limitation and Improvement for Future Research

Funding

Conflicts of Interest

Appendix A

| Dependent Variables | Sources | |

|---|---|---|

| lnFDIit (1000 USD) | Foreign direct investment (FDI) inflow (or refers to general FDI) into province i, at time t, measured by the absolute value of foreign capital in the form of its logarithm. is the lag of . FDI for the provincial level used the committed investment of a qualified investment project (QIP), recorded in CDC’s database. FDI is calculated based on foreign ownership/share in a QIP. | CDC |

| ln_divFDIit (1000 USD) | divFDI refers to FDI investing in diversified manufacturing sectors, not infrastructure, land economic concession, mining, and natural resources sectors. These kinds of diversified manufacturing sectors focus on agricultural processing, electric and electronic, automotive parts and bicycles, and other manufacturing rather than garments and footwear, e.g. what Cambodia’s current economy mostly depends on. Its unit and form of measurement are the same as FDI’s. | CDC |

| Key explanatory variables: promotion efforts (PE: SEZ it−1) | ||

| dumSEZit–1 | Dummy variable specifying whether the province has an SEZ by time t − 1. Its value is 1 if a province has SEZ, and if not, the value is 0. | CDC |

| NbSEZsit–1 | Accumulated number of operating SEZs in province i by time t − 1 (non-operating or inactive SEZs are excluded). | CDC |

| SEZdit–1 | SEZd denotes SEZ intensity, and it is the dummy for multiple SEZs. The indicator variable, SEZd, is equal to 1 if, by the time t − 1, a province has more than 1 SEZ, and otherwise, it becomes 0. | CDC |

| lnCapSEZsit–1 (1000 USD) | Accumulated investment capital for SEZ development in province i, by the time t − 1. It is in the form of its logarithm in USD 1000s. | CDC |

| AgeSEZit–1 | This refers to the age of the first established SEZ in a province. AgeSEZ is defined as the difference between the year t – 1 and the year of establishment of the first SEZ in province i. The longer the entry time of SEZ, the more information they have disseminated and provided to investors. Similar to dumSEZt-1, the first lag of AgeSEZ is also used to incorporate possible time lags between information dissemination from SEZ and decisions about FDI. Similarly, Ni et al. (2017) also used lag of firm age as a variable of firm characteristics. | CDC |

| Control variables | ||

| The annual government expenditure for province i at time t − 1 in USD 1000s in the form of its logarithm. This is a proxy for provincial effort. | Province | |

| The number of public relations that a province has received the public guests, including foreign investors, at time t − 1. Moreover, it is a proxy of provincial effort. PR is broad as the public guests who have been received are not solely foreigners. | Province | |

| The vector of provincial characteristics, a group of control variables including population density (PD), number of the population aged 18 years old and over (Pop18), number of high school graduates (SucNb), and time-invariant control variables including distance to the capital (DisToCap), a dummy for international gates (IntGate), and a dummy for sea and inland ports (Ports). SucNb could be used as a proxy to demonstrate the labor force or skill availability and trainability in a province. IntGate refers to international gates, including international airports, international ports, and international border gates. | Province | |

| The year effect and error term: | ||

| The year dummy effect and error term, respectively. | ||

Appendix B

| lnFDI1 | ln_div FDI1 | Dum SEZ | Nb SEZs | SEZd | lnCap SEZs1 | Age SEZ | Ln AExp1 | PR | PD | Pop 18 | Suc Nb | Dis ToCap | Int Gate | Ports | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| lnFDI1 | 1.00 | ||||||||||||||

| ln_divFDI1 | 0.59 | 1.00 | |||||||||||||

| dumSEZ | 0.41 | 0.68 | 1.00 | ||||||||||||

| NbSEZs | 0.34 | 0.63 | 0.71 | 1.00 | |||||||||||

| SEZd | 0.27 | 0.55 | 0.71 | 0.81 | 1.00 | ||||||||||

| lnCapSEZs1 | 0.42 | 0.70 | 0.99 | 0.77 | 0.77 | 1.00 | |||||||||

| AgeSEZ | 0.40 | 0.68 | 0.96 | 0.74 | 0.72 | 0.96 | 1.00 | ||||||||

| lnAExp1 | −0.20 | 0.01 | 0.03 | 0.09 | 0.03 | 0.03 | 0.11 | 1.00 | |||||||

| PR | −0.13 | −0.04 | −0.05 | 0.21 | 0.05 | −0.03 | −0.01 | 0.20 | 1.00 | ||||||

| PD | 0.29 | 0.39 | 0.34 | 0.07 | 0.05 | 0.33 | 0.37 | 0.03 | −0.08 | 1.00 | |||||

| Pop18 | 0.22 | 0.28 | 0.14 | −0.09 | −0.08 | 0.10 | 0.13 | 0.04 | −0.08 | 0.49 | 1.00 | ||||

| SucNb | 0.18 | 0.30 | 0.23 | −0.03 | −0.11 | 0.19 | 0.26 | 0.32 | −0.05 | 0.62 | 0.82 | 1.00 | |||

| DisToCap | −0.25 | −0.45 | −0.41 | −0.21 | −0.13 | −0.39 | −0.38 | 0.00 | −0.05 | −0.46 | −0.71 | −0.64 | 1.00 | ||

| IntGate | 0.13 | 0.42 | 0.57 | 0.52 | 0.58 | 0.60 | 0.60 | 0.00 | −0.07 | 0.29 | 0.18 | 0.25 | −0.22 | 1.00 | |

| Ports | 0.08 | 0.13 | 0.34 | 0.28 | 0.26 | 0.37 | 0.34 | 0.00 | −0.08 | 0.08 | −0.16 | −0.06 | −0.08 | 0.33 | 1.00 |

Appendix C

| Abbreviation | Explanation |

|---|---|

| ABT | Arellano-Bond Test |

| AR | Autocorrelation |

| CDC | The Council for the Development of Cambodia |

| FDI | Foreign Direct Investment |

| GMM | Generalized Methods of Moments |

| IDP | Industrial Development Policy 2015–2025 |

| Nb | Number |

| QIP | Qualified Investment Project |

| RGC | Royal Government of Cambodia |

| SEZ | Special economic zone |

References

- Balasubramanyam, Venkataraman N., Mohammed Salisu, and David Sapsford. 1996. Foreign direct investment and growth in EP and IS countries. Economic Journal 106: 92–105. [Google Scholar] [CrossRef]

- Barrell, Ray, and Nigel Pain. 1997. Foreign direct investment, technological change, and economic growth within Europe. Economic Journal 107: 1770–86. [Google Scholar] [CrossRef]

- Blomström, Magnus, and Håkan Persson. 1983. Foreign investment and spillover efficiency in an underdeveloped economy: Evidence from the Mexican manufacturing industry. World Development 11: 493–501. [Google Scholar] [CrossRef]

- Brussevich, Mariya. 2020. The Socio-Economic Impact of Special Economic Zones: Evidence from Cambodia. IMF Working Papers. Available online: https://www.elibrary.imf.org/view/journals/001/2020/170/001.2020.issue-170-en.xml (accessed on 18 January 2022).

- Caves, Richard E. 1974. Multinational firms, competition and productivity in host-country markets. Economica 41: 176–93. [Google Scholar] [CrossRef]

- Chakraborty, Tamali, Haripriya Gundimeda, and Vinish Kathuria. 2017. Have the special economic zones succeeded in attracting FDI?—Analysis for India. Theoretical Economics Letters 7: 623–42. [Google Scholar] [CrossRef]

- Cooray, Arusha, Artur Tamazian, and Krishna Chaitanya Vadlamannati. 2014. What drives FDI policy liberalization? An empirical investigation. Regional Science and Urban Economics 49: 179–89. [Google Scholar] [CrossRef]

- Daniel, Kobina Egyir, and Xavier Forneris. 2010. Investment Law Reform: A Handbook for Development Practitioners. Washington, DC: The World Bank Group. [Google Scholar]

- De Mello, Luiz R. 1999. Foreign direct investment-led growth: Evidence from time series and panel data. Oxford Economic Papers 51: 133–51. [Google Scholar] [CrossRef]

- Dunning, John H. 1998. Location and the multinational enterprise: A neglected factor? Journal of International Business Studies 29: 45–66. [Google Scholar] [CrossRef]

- Dunning, John H. 2015. The eclectic paradigm of international production: A restatement and some possible extensions. In The Eclectic Paradigm. pp. 50–84. Available online: https://link.springer.com/chapter/10.1007/978-1-137-54471-1_3 (accessed on 4 February 2022).

- Erliza, Ayu, Roni Zakaria, Wahyudi Sutopo, Anugerah Widiyanto, and Eko Supriyanto. 2014. Formulation strategy for promoting investment of technopolis: A case study. In Proceedings of the International MultiConference of Engineers and Computer Scientists. Hong Kong: IMECS, vol. 2, pp. 12–14. [Google Scholar]

- Farole, Thomas, and Gokhan Akinci. 2011. Special Economic Zones: Progress, Emerging Challenges, and Future Directions. Washington, DC: The World Bank Group. [Google Scholar]

- Globerman, Steven. 1979. Foreign direct investment and spillover efficiency benefits in Canadian manufacturing industries. Canadian Journal of Economics 12: 42–56. [Google Scholar] [CrossRef]

- Harding, Torfinn, and Beata Javorcik. 2011. Roll out the red carpet and they will come: Investment promotion and FDI inflows. The Economic Journal 121: 1445–76. [Google Scholar] [CrossRef]

- Hebous, Sarah, Priyanka Kher, and Trang Thu Tran. 2020. Regulatory Risk and FDI. Global Investment Competitiveness Report 2019/2020: Rebuilding Investor Confidence in Times of Uncer-tainty. Washington, DC: The World Bank Group. [Google Scholar]

- Hou, Lei, Kunpeng Li, Qi Li, and Min Ouyang. 2021. Revisiting the location of FDI in China: A panel data approach with heterogeneous shocks. Journal of Econometrics 221: 483–509. [Google Scholar] [CrossRef]

- Kapuria, Cheshta, and Neha Singh. 2019. Determinants of sustainable FDI: A panel data investigation. In Management Decision. Bingley: Emerald Publishing Limited. [Google Scholar]

- Leone, Tharcisio. 2021. Striving for Educational Improvement: Essays on Intergenerational Mobility and Teacher Bonus Programs in Contemporary Brazil. Berlin: Freie Universitaet Berlin (Germany). [Google Scholar]

- Lillo, Romilio Labra, and Celia Torrecillas. 2018. Estimating dynamic Panel data. A practical approach to perform long panels. Revista Colombiana de Estadística 41: 31–52. [Google Scholar] [CrossRef]

- Loewandahl, Henry. 2001. A framework for FDI promotion. Transnational Corporations 10: 1–42. [Google Scholar]

- Marks-Bielska, Renata, Jaroslaw M. Nazarczuk, and Izabela Rogalska. 2022. Institutions versus Location of New Firms: Does Distance Matter? Evidence from the Polish economy. Economic Research-Ekonomska Istraživanja 35: 894–914. [Google Scholar] [CrossRef]

- Nazarczuk, Jaroslaw M., and Stanislaw Umiński. 2019. Foreign Trade in Special Economic Zones in Poland. UWM w Olsztynie. [Google Scholar]

- Ni, Bin, Yasuyuki Todo, and Tomohiko Inui. 2017. How effective are investment promotion agencies? Evidence from china. The Japanese Economic Review 68: 232–43. [Google Scholar] [CrossRef]

- Ocaya, Bruno, Charles Ruranga, and William Kaberuka. 2013. Foreign direct investment and economic growth in Rwanda: A time series analysis. Journal of Business Management and Corporate Affairs 2: 11–18. [Google Scholar]

- Rana, Seemab, Sulaiman Mohammed Ali Bait Ali, and Salman Muhammad Shabbir. 2020. Oman’s ability to attract FDI: Dunning instrument survey analysis. Lima, Perú: Universidad San Ignacio de Loyola 8: e640. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The STATA Journal: Promoting Communications on Statistics and Stata 9: 86–136. [Google Scholar] [CrossRef]

- Royal Government of Cambodia. 2015. Cambodia Industrial Development Policy 2015–2025; Phnom Penh: RGC. Available online: https://cdc.gov.kh/industrial-development-policy (accessed on 20 April 2022).

- Royal Government of Cambodia. 2018. Rectangular Strategy: Phase IV; Phnom Penh: RGC. Available online: https://www.mfaic.gov.kh/Home/RectangularStrategies (accessed on 6 April 2022).

- Santos, Gervásio F. 2013. Fuel demand in Brazil in a dynamic panel data approach. Energy Economics 36: 229–40. [Google Scholar] [CrossRef]

- Singhania, Monica, and Neha Saini. 2018. Determinants of FDI in Developed and Developing Countries: A Quantitative Analysis Using GMM. Glasgow: Department of Economics, University of Strathclyde. [Google Scholar] [CrossRef]

- Song, Yijia, Ruichen Deng, Ruoxi Liu, and Qian Peng. 2020. Effects of special economic zones on FDI in emerging economies: Does institutional quality matter? Sustainability 12: 8409. [Google Scholar] [CrossRef]

- Subramaniam, Thirunaukarasu. 2008. The dynamic interaction among foreign direct investment, unemployment, economic growth and exports: Evidence from Malaysia. JATI Journal of Southeast Asian Studies 13: 35–48. [Google Scholar]

- Te Velde, Dirk Willem. 2001. Policies towards Foreign Direct Investment in Developing Countries: Emerging Best-Practices and Outstanding Issues. London: Overseas Development Institute, pp. 1–62. [Google Scholar]

- UNCTAD-United Nations Conference on Trade and Development. 1998. World Investment Report 1998: Trends and Determinants. Geneva: UNCTAD. [Google Scholar]

- Wang, Jin. 2013. The economic impact of special economic zones: Evidence from Chinese municipalities. Journal of Development Economics 101: 133–47. [Google Scholar] [CrossRef]

- Wang, Shufang, Guangwen Meng, Jun Zhou, Liran Xiong, Yuxin Yan, and Na Yu. 2021. Analysis on geo-effects of China’s overseas industrial parks: A case study of Cambodia Sihanoukville special economic zone. Journal of Geographical Sciences 31: 712–32. [Google Scholar] [CrossRef]

- Warr, Peter, and Jayant Menon. 2016. Cambodia’s special economic zones. Southeast Asian Economies 33: 273–90. [Google Scholar] [CrossRef]

- Wells, L. T., and A. G. Wint. 1990. Marketing a Country: Promotion as a Tool for Attracting Foreign Direct Investment. Washington, DC: International Financial Corporation. [Google Scholar]

| Determinants | Motives of FDI |

|---|---|

| |

| Resource-seeking (1) | |

| Market-seeking | |

| Efficiency seeking | |

| Strategic asset-seeking | |

| |

| |

| |

| Variable | Explanation | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| FDI | Foreign Direct Investment (in 1000 USD) | 95 | 150,381.7 | 336,843.8 | 0 | 2,520,142 |

| lnFDI1 | FDI in logarithm form | 95 | 8.13 | 5.09 | 0 | 14.74 |

| divFDI | Diversified FDI (in 1000 USD) | 95 | 30,719.87 | 86,615.17 | 0 | 623,797.5 |

| ln_divFDI1 | Diversified FDI in logarithm form | 95 | 4.50 | 5.09 | 0 | 13.34 |

| dumSEZ | Dummy if a province has an SEZ | 95 | 0.43 | 0.50 | 0 | 1 |

| NbSEZs | Accumulated number of SEZ | 95 | 1.12 | 1.81 | 0 | 8 |

| SEZd | SEZ density/dummy for multiple SEZs | 95 | 0.27 | 0.45 | 0 | 1 |

| CapSEZs | Accumulated capital for SEZ development (in 1000 USD) | 95 | 62,718.95 | 119,467.1 | 0 | 518,400 |

| lnCapSEZs1 | Accumulated capital for SEZ development in logarithm form | 95 | 4.91 | 5.71 | 0 | 13.16 |

| AgeSEZ | Age of first established SEZ | 95 | 4.47 | 5.36 | 0 | 13 |

| AExp | Annual government expenditure (in 1000 USD) | 95 | 12,742.92 | 35,361.32 | 577.90 | 252,424.6 |

| lnAExp1 | Annual government expenditure in logarithm form | 95 | 9.17 | 0.79 | 8.20 | 10.12 |

| PR | Number of public relations | 95 | 3758.52 | 9300.28 | 23 | 65,784 |

| PD | Population density | 95 | 237.95 | 511.81 | 5 | 3136 |

| Pop18 | Number of population age 18 years old and over | 95 | 457,343.8 | 290,637.3 | 37,604 | 972,286 |

| SucNb | Number of high school graduates | 95 | 2093.22 | 1717.45 | 72 | 7358 |

| DisToCap | Distance to the capital | 95 | 226.37 | 164.42 | 0 | 588 |

| IntGate | Dummy for international gate | 95 | 0.53 | 0.50 | 0 | 1 |

| Ports | Dummy for ports (0 no port, 1 inland port, 2 small seaports, and 3 deep-sea ports) | 95 | 0.63 | 0.88 | 0 | 3 |

| Indicators (Dependent Variables) | Mean Values | Test of Significance of Mean Differences | |||

|---|---|---|---|---|---|

| Non-SEZ Province | SEZ Province | Diff. | Non-SEZ vs. SEZ Provinces | ||

| t-Statistic | p-Value | ||||

| lnFDI1 | 6.31 (0.74) | 10.52 (0.53) | −4.22 | −4.63 | 0.00 |

| ln_divFDI1 | 1.52 (0.47) | 8.42 (0.65) | −6.91 | −8.85 | 0.00 |

| Observation | 54 | 41 | |||

| FDI (lnFDI1) | Diversified FDI (ln_divFDI1) | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Lagged dependent variable | ||||||||

| ∆lnFDI1 | 0.01 | −0.04 | −0.03 | −0.08 | −0.09 | −0.11 | −0.06 | −0.09 |

| (0.29) | (0.30) | (0.30) | (0.30) | (0.31) | (0.31) | (0.27) | (0.29) | |

| Key explanatory variables: Promotion efforts (SEZ mechanism) | ||||||||

| ∆NbSEZs | 2.974 ** | 2.099 * | 1.195 *** | 1.022 * | ||||

| (1.095) | (1.023) | (0.403) | (0.554) | |||||

| ∆lnCapSEZs1 | 19.01 | 12.02 | 10.51 * | 9.16 | ||||

| (12.55) | (11.04) | (6.043) | (5.94) | |||||

| Control variables | ||||||||

| ∆lnAExp1 | −1.783 ** | −1.842 * | −0.31 | −0.45 | ||||

| (0.802) | (0.931) | (0.34) | (0.37) | |||||

| ∆PR | 0.00 | 0.00 | 0.00 | 0.00 | −0.00 | −8.3 × 10−5 * | −0.00 | −8.3 × 10−5 * |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (4.6 × 10−5) | (0.00) | (4.2 × 10−5) | |

| ∆PD | 0.0937 * | 0.103 ** | 0.103 * | 0.111 ** | −0.06 | −0.06 | −0.05 | −0.05 |

| (0.0521) | (0.0454) | (0.0548) | (0.0448) | (0.09) | (0.08) | (0.09) | (0.09) | |

| ∆Pop18 | 0.00 | 0.00 | 0.00 | 0.00 | 4.4 × 10−5 ** | 4.3 × 10−5 ** | 4.5 × 10−5 ** | 4.5 × 10−5 ** |

| (0.00) | (0.00) | (0.00) | (0.00) | (1.6 × 10−5) | (1.6 × 10−5) | (1.7 × 10−5) | (1.6 × 10−5) | |

| ∆SucNb | 0.00 | 0.00 | 0.00 | −0.0010 * | 0.00 | 0.00 | 0.00 | 0.00 |

| 0.00 | 0.00 | 0.00 | (0.0006) | 0.00 | 0.00 | 0.00 | 0.00 | |

| Observations | 57 | 57 | 57 | 57 | 57 | 57 | 57 | 57 |

| Nb. of group | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 |

| Year dummy | Yes | No | Yes | No | Yes | No | Yes | No |

| Nb. of instruments | 13 | 11 | 13 | 11 | 13 | 11 | 13 | 11 |

| ABT, AR (1) | 0.03 | 0.01 | 0.02 | 0.01 | 0.85 | 0.79 | 0.76 | 0.71 |

| ABT, AR (2) | 0.77 | 0.26 | 0.78 | 0.30 | 0.05 | 0.05 | 0.05 | 0.05 |

| Hansen test of overid. restrict. | 0.23 | 0.04 | 0.38 | 0.05 | 0.32 | 0.38 | 0.25 | 0.30 |

| FDI (lnFDI1) | Diversified FDI (ln_divFDI1) | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Lagged dependent variable | ||||||||

| ∆lnFDI1 | 0.21 | 0.13 | 0.24 | 0.16 | 0.04 | 0.04 | 0.02 | 0.02 |

| (0.34) | (0.33) | (0.34) | (0.34) | (0.12) | (0.15) | (0.10) | (0.11) | |

| Key explanatory variables: Promotion efforts (SEZ mechanism) | ||||||||

| ∆NbSEZs | 1.217 * | 0.742 ** | 0.858 *** | 0.850 *** | ||||

| (0.642) | (0.328) | (0.225) | (0.187) | |||||

| ∆lnCapSEZs1 | 0.56 | 0.13 | 0.777 * | 0.846 ** | ||||

| (0.61) | (0.50) | (0.386) | (0.349) | |||||

| Control variables | ||||||||

| ∆lnAExp1 | −1.400 * | −1.166 * | −0.08 | 0.03 | ||||

| (0.679) | (0.625) | (0.35) | (0.36) | |||||

| ∆PR | −0.00 | −0.00 | −0.00 | −0.00 | −0.00 | −0.00 | −0.00 | −0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| ∆PD | 0.00 | 0.0037 * | −0.00 | 0.00 | 0.0038 *** | 0.0038 *** | 0.00 | 0.00 |

| (0.00) | (0.0018) | (0.00) | (0.00) | (0.0008) | (0.0010) | (0.00) | (0.00) | |

| ∆Pop18 | 0.00 | 0.00 | 0.00 | 0.00 | 4.55 × 10−6 * | 0.00 | 0.00 | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (2.55 × 10−6) | (0.00) | (0.00) | (0.00) | |

| ∆SucNb | 0.00 | −0.00 | 0.00 | −0.00 | −0.00 | −0.00 | −0.00 | −0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| DisToCap | 0.00 | 0.00 | 0.00 | 0.00 | −0.00 | −0.00 | −0.00 | −0.00 |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| IntGate | −1.43 | −0.48 | −2.99 | 0.06 | 1.664 * | 1.674 * | −2.21 | −2.70 |

| (1.45) | (1.25) | (4.48) | (3.59) | (0.896) | (0.880) | (2.96) | (2.93) | |

| Inland ports | −2.07 | −2.96 | 0.05 | −3.17 | −4.233 *** | −4.239 *** | −0.10 | 0.38 |

| (1.80) | (1.90) | (4.24) | (3.37) | (1.137) | (1.218) | (3.27) | (3.26) | |

| Small sea ports | 0.93 | 0.87 | −2.49 | 0.04 | −0.19 | −0.20 | −4.985 ** | −5.424 *** |

| (2.04) | (1.52) | (3.64) | (2.93) | (1.14) | (1.14) | (2.022) | (1.744) | |

| Deep see ports | 2.67 | 3.782 * | 2.08 | 4.39 | 4.790 *** | 4.807 *** | 2.809 * | 2.511 ** |

| (2.57) | (2.027) | (2.89) | (2.80) | (0.691) | (0.801) | (1.409) | (1.020) | |

| Observations | 76 | 76 | 76 | 76 | 76 | 76 | 76 | 76 |

| Nb. of group | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 |

| Year dummy | Yes | No | Yes | No | Yes | No | Yes | No |

| Nb. of instruments | 21 | 19 | 21 | 19 | 21 | 19 | 21 | 19 |

| ABT, AR (1) | 0.02 | 0.01 | 0.03 | 0.01 | 0.53 | 0.54 | 0.51 | 0.51 |

| ABT, AR (2) | 0.71 | 0.25 | 0.70 | 0.29 | 0.05 | 0.06 | 0.05 | 0.06 |

| Hansen test of overid. restrict. | 0.10 | 0.11 | 0.77 | 0.06 | 0.52 | 0.55 | 0.35 | 0.32 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Theot Therith, C. Effect of Investment Promotion through the Special Economic Zone Mechanism on the Distribution of FDI in Cambodia. Economies 2022, 10, 231. https://doi.org/10.3390/economies10090231

Theot Therith C. Effect of Investment Promotion through the Special Economic Zone Mechanism on the Distribution of FDI in Cambodia. Economies. 2022; 10(9):231. https://doi.org/10.3390/economies10090231

Chicago/Turabian StyleTheot Therith, Chuop. 2022. "Effect of Investment Promotion through the Special Economic Zone Mechanism on the Distribution of FDI in Cambodia" Economies 10, no. 9: 231. https://doi.org/10.3390/economies10090231

APA StyleTheot Therith, C. (2022). Effect of Investment Promotion through the Special Economic Zone Mechanism on the Distribution of FDI in Cambodia. Economies, 10(9), 231. https://doi.org/10.3390/economies10090231