Abstract

The digital economy has risen dramatically in the global environment, and many developing countries, including African countries, have seen a spike in digital activity over recent years. The digital economy’s growth has resulted in an increase in digital financial services (DFS) in Africa and other developing regions. Since many African countries are under pressure to raise domestic revenue, taxing the digital economy has become a viable option. As a result, this study attempted to respond to the following questions: first, what is the link between DFS growth and digital inclusion in African countries? Second, what justifies the imposition of DFS taxes in Africa? Third, what are the potential consequences of DFS taxes in African countries? Using secondary data from the literature review and document analysis, a systematic technique for assessing or evaluating printed and electronic documents, and computer-based and internet-transmitted material, the study discovered that digital financial inclusion is driving financial inclusion on the African continent. The study also found that, despite several negative consequences associated with the growth of the digital economy, most African economic activities are informal and are being aided by various digital financial services. Therefore, it is equally crucial that when adopting digital finance taxes, care is taken to avoid excluding low-income earners from the financial sector and to take note of the usage, affordability, and distortive implications of taxation.

1. Introduction

The digital economy has grown significantly in the global landscape due to the impact of Industry 4.0 technologies. Many developing countries have seen a surge in digital activities over the years and the African countries are no exception. As affirmed by Munoz, Mascagni, Prichard, and Santoro (Munoz et al. 2022), “For example, 469 million mobile money accounts had been registered in Sub Saharan Africa by 2019, with over 181 million accounts active monthly. This is equivalent to over 40 per cent of the region’s total population having a mobile money account with over 15% active users”. These activities accelerated due to the COVID-19 pandemic. As the digital economy grew, mobile money-driven activities also expanded, resulting in noteworthy outcomes in certain African countries such as Kenya (M-Pesa), Zimbabwe (Ecocash) and South Africa (E-wallet) among others.

The burgeoning of the digital economy has seen an expansion in digital financial services (DFS) in Africa and other developing countries (Demirgüç-Kunt et al. 2018a). These countries are faced with pressure to mobilise domestic revenue by taxing the digital economy (Bunn et al. 2020; Kelbesa 2020). Several African countries have turned towards the implementation of new DFS taxes, and/or the advancement of existing ones. This desire to generate additional tax revenue has also seen countries introduce a tax on DFS, including taxes on mobile money transactions and transfers (Mullins et al. 2020). The justification for introducing DFS taxes and the likely consequences on revenue mobilisation, financial inclusion, market structure and usage of digital services remain debatable and concerning (Ahmed et al. 2021; Ahmed and Gillwald 2020; Santoro et al. 2022). Mobilisation of tax revenue and the widening of the tax base in Africa is crucial (given the narrow tax bases, as stated by Mpofu (2021a) and Sebele-Mpofu (2021)), and a comprehensive evaluation of the possibility of negative externalities is fundamental. An increase in tax rates above the optimal point can cause tax revenues to fall due to tax avoidance and evasion. The likelihood of market distortions might accordingly increase as certain services are offered and others not. Therefore, unwarrantedly excessive taxation of DFS is likely to reverse the positives for financial inclusion and increase the use of cash transactions to avoid or evade taxes. The banked might end up being unbanked (Demirgüç-Kunt et al. 2018b). This might result in lower tax compliance and lower mobilisation of revenue for the government. The likely impacts on financial inclusion remain contested.

Although several studies have recently researched the challenges of taxing the digital economy, there is a dearth in the literature that specifically focuses on DFS taxes and financial inclusion in Africa. Financial inclusion in African countries is itself gaining a presence in the field of economic research, but its link with digital taxation (which is in its early stages of legislative development in Africa) is one novel contribution of this paper. Constructed on the argument that digital financial inclusion is a vital avenue and a game changer in ensuring progress towards the attainment of the United Nations Sustainable Development Goals (SDGs) through global financial inclusion, especially in developing countries, this paper focuses on DFS taxes and financial inclusion in Africa. For example, SDG5 5 refers to achieving gender equality, SDG8 to decent work and economic growth, and SDG10 addresses the need to reduce inequalities. In addition to the research gaps identified above, DFS taxes remain under-evaluated (Clifford 2020; Lees and Akol 2021), as evidence of their impact on revenue mobilisation and other key economic objectives is comparatively low and weakly documented. The importance of financial inclusion in attaining these and other SDGs cannot be over-emphasised. This paper seeks to answer the following questions. First, what is the relationship between the growth of DFS and digital inclusion in African countries? Second, what is the justification for levying DFS taxes in Africa? Third, what is the possible impact of implementing DFS taxes in African countries?

2. Review of Important Literature

In this age of Industry 4.0, there is a greater emphasis on digital transformation, with new advancements and inventions coming at a rapid speed, accelerating the growth of the digital economy. The global economy and developing economies can immensely benefit from this growth. Policymakers must work towards a way of making sure the benefits are distributed equitably. With the increase in DFS also comes a variety of challenges. Of particular interest is the fact that the growth of the digital economy and increase in DFS poses challenges for domestic revenue mobilisation and international taxation (Juswanto and Simms 2017; Matheson and Petit 2021). As taxes are the major source of revenue for governments to finance public expenditure, tax authorities must find ways to tax digital financial services and other digital activities within the economy. However, governments must strike an equilibrium between tax revenue mobilisation and other important goals such as reduced inequality, financial inclusion, and poverty reduction. Taxes on DFS must be carefully considered. This study centres on DFS taxes and financial inclusion in Africa. According to Ndung’u (2019), it is important to situate the review within the wider range of DFS and financial service providers, to contextualise the arguments about the outcomes of DFS tax policy on equity, revenue mobilisation and financial inclusion. This section of our paper accordingly reviews the literature on the DFS landscape in Africa, the justification for imposing DFS taxes and the possible impact of levying DFS taxes.

2.1. Industry 4.0, Digitisation, Digitalisation, DFS and Financial Inclusion Defined

The growth of the digital economy must be viewed in the context of the fourth industrial revolution (4IR). After the first industrial revolution employed waterpower, mechanisation, and steam power, the second revolution relied on mass manufacturing through electricity and assembly lines. The third industrial revolution centred on automation, electronics, and computers (Juswanto and Simms 2017). The 4IR focuses on the use of technology, digitization of processes and digital transformation. The key terms in the research are explained below.

2.1.1. Industry 4.0

According to Mhlanga (2020), Industry 4.0, often known as the “fourth industrial revolution”, is defined as the emergence of cyber-physical systems that provide people and machines with whole new capabilities. Schwab (2015) stated that even though these capabilities are based on the third industrial revolution’s technologies and infrastructure, Industry 4.0 represents fundamentally new methods through which technologies are integrated into communities and even our bodies. The term “Industry 4.0” refers to an advancement in technologies that blurs the distinctions between the physical, digital, and biological worlds. Klaus Schwab, the World Economic Forum’s founder, and executive chairman created the phrase 4IR. The 4IR is commonly compared to an approaching rainstorm, a sweeping pattern of change appears in the distance that arrives quickly and leaves little time to prepare. While some people are up to the task, equipped with the tools to face the change and capitalize on its impacts, others are completely unaware that a storm is coming (Mhlanga 2020, 2021, 2022). Industry 4.0 has an impact on practically every aspect of our everyday lives, influencing how people interact with technology, and altering how and where work is done.

2.1.2. Digitisation

Digitization has increased the provision of financial services in most countries. Digitization and big data analytics have led to the transformation of digital services, financial products (Ndung’u 2019), as well as business models in the financial sector.

2.1.3. Financial Inclusion

Financial inclusion is described as the sustainable supply of cheaper, achievable, and safe financial services, through an all-encompassing system that allows opportunities for sending, receiving, depositing, and withdrawing funds as well as allowing for capital growth and risk reduction. Financial inclusion is described as an inclusive approach to providing financial services to citizens, ensuring the unbanked population is brought into the mainstream financial sector (Ozili 2018, 2020, 2021). According to the United Nations, financial inclusion is described as “the process of ensuring access to financial services, timely and enough credit for vulnerable groups such as weaker sections and low-income groups at an affordable cost for vulnerable groups such as weaker sections and low-income groups at an acceptable cost”. The World Bank describes financial inclusion as “the process by which individuals and businesses have access to usable and affordable financial products and services that satisfy their needs responsibly and sustainably, it includes transactions, payments, savings, credit, and insurance”.

2.1.4. Digital Financial Services

Digital financial services are financial services accessed and provided through digital means and mobile devices. These include those offered by banks, such as debit and credit cards as well as cell phone banking. These services also encompass novel designs constructed on cloud computing, such as digital platforms, mobile payments, and crypto assets, among other services. These are normally referred to as Fintech (Agur et al. 2020; Tafotie 2020). DFS was harnessed to minimise the challenges associated with COVID-19.

2.1.5. Digital Financial Inclusion

According to the World Bank (2020), “Digital financial inclusion involves the deployment of the cost-saving digital means to reach currently financially excluded and underserved populations with a range of formal financial services suited to their needs that are responsibly delivered at a cost affordable to customers and sustainable for providers”. Through digital financial inclusion, a greater part of the previously excluded and underserved vulnerable population is transitioning away from solely using cash-supported transactions, towards formal financial services and channels such as savings, payments, insurance, and credit, using mobile money or other digital technology.

2.2. The Financial Services Sector in Africa

To inform the study and debate on taxation of DFS and financial inclusion, it is necessary to give a contextual background by analyzing the general landscape of financial services in Africa, although these financial services might vary from country to country. The financial services sector in most African countries was traditionally characterized by an underdeveloped market. This market includes traditional banks, building societies, savings and credit-offering financial institutions, and microfinance houses. The services offered include savings, credit, withdrawals, and at times the facilitation of payments (Munoz et al. 2022). Over the past decade, the growth of DFS has ushered in a wide range of financial services provided by digital means. These include savings, remittances, payments, credit, and insurance. According to Munoz et al. (2022, p. 11), “Digital financial channels refer to the internet, mobile phones, automated teller machines (ATMs), point of sale (POS) terminals, etc.”. New entrants into the digital financial services sector also include mobile networks and Fintech, among others, and traditional banks have digitally transformed their operations to make room for digital financial services. Despite the possible variations in digital financial services offered across African countries, there is an urgent need to assess their taxation.

2.2.1. Usage of Digital Financial Services

A comprehensive understanding of the providers and users of financial services is pivotal in the discussion of DFS taxes and financial inclusion. The unpacking of the usage of DFS illuminates the appreciation of those who would be potentially affected by the impacts of taxes on financial inclusion (Munoz et al. 2022). This understanding is important in arguing the case for financial inclusion and in the discussion of how governments must position the mobilization of tax revenue from DFS within wider policy objectives such as financial inclusion.

Traditionally, formal banks served rich individuals, businesses and the formally employed. Marginalised groups such as the informal sector and the unemployed were not fully accommodated in the traditional banking system (Sekantsi 2019). In many developing countries in Africa and elsewhere, mobile money usage has grown consequentially to fill this void, thus broadening financial inclusion. Munoz et al. (2022) estimated that in SSA in 2019 more than 40 percent of the region’s population used mobile money accounts, though the actual percentages vary from country to country. For example, countries like Kenya, Namibia, Uganda, Zimbabwe, Tanzania, and Ghana rely heavily on mobile money for formal and informal transactions (Kakungulu-Mayambala and Rukundo 2018; Ndung’u 2019; Simatele 2021). Across different countries, there is variation in the use of DFS in line with demographic characteristics such as gender and age, as well as with other factors such as employment, type of business and income levels. For example, while in Lesotho most rural dwellers were financial excluded (Sekantsi and Motelle 2018), the opposite was true in Tanzania where most people were financially included using mobile money, as compared to those in urban areas (Munoz et al. 2022).

Mobile money usage, therefore, provides financial services in Africa to the generally unbanked portion of the population, thus ushering them into the conventional financial system. This promotes the possibility of savings mobilization for the financially disadvantaged, the informal sector, low-income earners, and the poor (Ouma et al. 2017). According to Pushkareva (2021), DFS has provided SSA countries with an opportunity to enhance sustainable economic growth, as it avails additional revenue through taxation and can “even improve gender balance”.

Demirgüç-Kunt et al. (2018b) allude to the increase 2017 in peer-to-peer remittance transactions through banks and mobile money in low-income countries. The sophistication of DFS has advanced to include payments for government services through digital means, from governments to individuals, and individuals to individuals. In most African countries, the primary dependence on and the usage of cash was reduced by the COVID-19 pandemic. Financial services stimulate development. They facilitate a country’s investment in businesses, education, security, and health, in addition to assisting in poverty alleviation (Demirgüç-Kunt et al. 2020). Increased access to the internet and mobile phones improves efficiency and speed of payments as well as security, especially with the reduction in cash usage. Safety, affordability, accessibility and tax implications determine the provision and usage of financial services, ultimately affecting financial inclusion.

2.2.2. Digital Financial Services and Financial Inclusion in Africa

Through rapid technological advancements, which include artificial intelligence, the internet and cloud computing among others, digital transformation has led to modification in the financial services sector and has improved the access to and usage of financial services (Llewellyn-Jones 2016). Ahmad et al. (2020) posited that the SSA financial sector in partnership with banks, governments and other agencies has created a digital payments ecosystem. The researchers give the example of the Ecocash platform in Zimbabwe as a celebrated success story, suggesting that the platform transacted over US$78.4 billion in 2019, boosting financial inclusion from as low as 32% to approximately 90%. This consequently improved financial, economic, and social inclusion.

Financial exclusion remains high in low-income countries and among disadvantaged groups in the population, especially those in rural areas (Demirgüç-Kunt et al. 2018b; Demirgüç-Kunt and Klapper 2012). Physical financial infrastructure is more developed in urban areas. Factors such as high banking costs, costs of maintaining back accounts, lack of interoperability, and inadequate documentation, among other reasons, have discouraged the uptake and use of formal financial services (Demirgüç-Kunt et al. 2018a; Sekantsi 2019). These factors and others led policy makers in Lesotho to work towards the Lesotho Scaling Inclusion Mobile Money project, in a bid to enhance financial inclusion (Sekantsi and Motelle 2018).

An inclusive financial sector is considered fundamental for economic growth and development in all countries globally, as it allows ease of accessibility, availability, and the use of financial services by all segments of the population. Population groups include the banked, the underbanked, and the unbanked, as well as all genders (Sekantsi 2019). Financial inclusion allows the achievement of SDG5, which emphasises the importance of addressing gender equality. It is argued that women and girls are still marginalised, vulnerable and disadvantaged (Siwela and Njaya 2021). They are described as lacking economic, financial, and social independence, thus signalling gender disparity in financial inclusion in Africa. Despite the fourth industrial revolution making inroads in Africa, in countries like Kenya, Lesotho, Ghana, Namibia, South Africa and Zimbabwe, women continue their struggle to achieve digital financial inclusion (Ojo 2020, 2022; Ojo and Zondi 2021; Sekantsi and Motelle 2018; Siwela and Njaya 2018). Though women are considered financially excluded compared to men, DFS has been identified as the panacea to address this inequality, through platforms such as electronic and mobile money. These platforms are considered key in heightening the financial inclusion of women.

Mobile money is argued to have transformative power for non-banked and underbanked females operating in the informal sector in Zimbabwe (Siwela and Njaya 2021). Mobile banking was crucial in reducing the heavy dependence on cash transactions in the country, in the face of chronic cash shortages. Mobile money brings convenient, reliable, and accessible financial services to the non-banked or underbanked segments of the population who are commonly financial excluded and underserved. Affordability of the internet and digital devices was considered a restrictive factor for financial inclusion. Table 1 presents studies on the importance of DFS in fostering financial inclusion.

Table 1.

Selected studies on DFS and financial inclusion.

Mobile money usage has been also argued to drive the relationship between financial inclusion, the use of DFS, digital financial inclusion, and the attainment of the 2030 sustainable development goals (SDGs) (El-Zoghbi et al. 2019; Evans 2018) and inclusive financial systems (El-Zoghbi 2019). The growth of mobile money services in Africa has helped millions of people who previously had no access to financial services and were excluded from carrying out financial transactions in a relatively safe, affordable, and reliable manner (Triki and Faye 2013; Ozili 2020; Shipalana 2019). The expansion of mobile money and other DFSs has also allowed international remittances to take place. Sile (2013) stated that in fragile states such as Somalia and Zimbabwe, the use among adults of accounts to receive international remittances was estimated at 55% and 66% respectively. The increase in financial inclusion and the flow of resources could help to address SDGs in Africa, for example, SDG 1 of poverty alleviation and SDG 10 of reduced inequality. Meanwhile, the flow of resources through international remittances could heighten financial inclusion, reduce poverty and hunger, minimize inequality, and provide resources for populations in fragile states to access education and health services. These issues relate to SDGs 1, 2, 3, 4, and 10. These arguments were also affirmed by Koomson et al. (2022) who pointed to the positive impact of mobile money on the development and expansion of entrepreneurship, by Asongu and Odhiambo (2018) who alluded to mobile money being a driver of inclusive growth in Africa, and by Baganzi (2018) who stated that mobile money helps the fulfilment of SDGs in Uganda by contributing to reductions in inequalities and poverty. Adaba, Ayoung and Abott (Adaba et al. 2019) and Asongu and Odhiambo (2022) contended that mobile money innovations and activities contribute to the well-being of citizens.

Having alluded to the likely benefits of mobile money usage, and the application of DFS with digital financial inclusion and the SDGs, it is important to briefly highlight the associated risks that can discourage the use of these services or lead to lower customer morale, decreased usage, and increased frustration, ultimately influencing the level of digital financial inclusion in Africa. The risks include consumer fraud, cybercrime, hacking and phishing, invasion of privacy, surveillance of transactions, inadequate data security, lack of timely recourse in cases of fraud, and excessive consumer debt due to easy access to credit and aggressive marketing by DFS providers (Ozili 2018, 2020; Shipalana 2019). The influence of mobile money taxes and DSTs on the use of DFSs, financial inclusion and digital financial inclusion cannot be viewed in isolation. Tax is one factor, but the risk is another factor that consumers generally consider before adopting or deciding whether to continue using DFS.

2.3. The Rationale for Taxation of Digital Financial Services in Africa

The main motive for taxing DFS in Africa is to tap revenue and strengthen revenue generation in the continent (Bunn et al. 2020; Clifford 2020; Kelbesa 2020). Other minor motives include the need for equity, to ensure that all companies in the financial sector contribute toward tax revenue. Digital transactions had escaped taxation due to the source rule or the physical presence that was the anchor of previous international tax legislation. This led to companies such as Facebook, Amazon, Netflix, and Google going untaxed, due to their digital nature, although they were making enormous profits. Taxation of the digital economy will lead to the principle of equity being upheld (Munoz et al. 2022).

2.3.1. Digital Financial Services Taxes in Africa

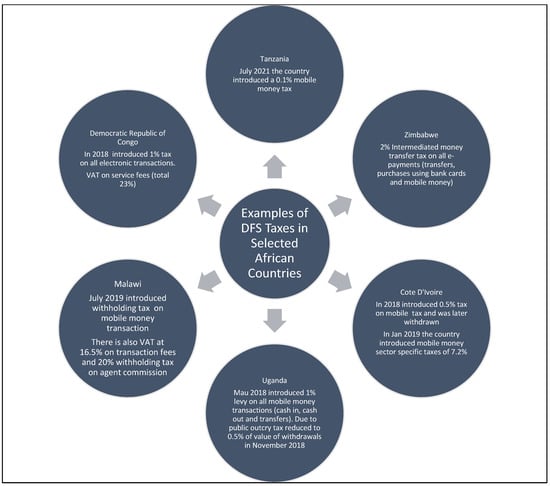

Over the years, mobile money has gained ground in the financial services sector as a way of addressing market failures and gaps in service provision that are linked to conventional financial service providers. Key to these gaps is the financial exclusion of vulnerable groups of the population. Mobile money plays a fundamental role in financial intermediation, enhancing productivity, stimulating employment creation, and facilitating economic growth. It is key to digital transformation in developing countries and contributes to the fulfilment of the 2030 Sustainable Development Agenda. Globally, countries are currently debating how to tax the growing digital economy. Due to tax policy weaknesses, taxation of the digital economy is particularly daunting for African countries. Some of these African countries have put in place DFSTs to collect tax revenues from digital financial transactions and services. These taxes include specific taxes on mobile money transactions, widening of excise duty frameworks on transaction fees, and direct taxes on financial transactions. Figure 1 provides a summary of some of the DFSTs in use in selected African countries. It is important to note that in all the countries shown in Figure 1, the taxes are only applicable to mobile money transactions and do not extend to traditional banking services, except in Zimbabwe where 2% is also levied on transactions involving bank cards and on bank transfers. In addition to the countries displayed in Figure 1, Ghana introduced a 1.5% levy on mobile money and Cameroon a 0.2% tax on mobile money transactions

Figure 1.

Summary of Selected African Countries DSTs. Source: Authors’ compilation from various sources.

2.3.2. Digital Services Taxes and Financial Inclusion in African countries

The impact of DFS taxes and financial inclusion can be explored from four main dimensions, namely: (1) the increase in the tax burden, (2) modifications in the usage of DFS, (3) market development or market structure changes, (4) trust and tax morale.

Increase in the Tax Burden and Prices of DFS

The implications of taxation on pricing decisions affect the welfare and economic wellbeing of users of DFS and the companies offering them. The impact of DFS taxes on prices is somewhat complicated and controversial, as it depends on how the tax-motivated price increase is distributed between consumers and suppliers of DFS. One of the most unlikely outcomes of DFS taxes is to have the tax burden shouldered by the financial services supplier, resulting in a reduction in profits. The other most frequent scenario is to have the tax burden borne by the consumers, leading to increased prices (Munoz et al. 2022). How the tax burden is shared is dependent to a great extent on the nature of the competition in the market for financial services. Where the competition is price-based and substitutes for the service(s) exist, suppliers are likely to be more prepared to share or shoulder the tax burden to some extent. For example, in Cote d’Ivoire, suppliers of DFS were compelled to bear DFS tax costs to stimulate the usage of DFS, which was considered as low as 20%. The sustainability of such an endeavour remains unclear, as suppliers may find other less direct options to pass the costs onto consumers.

Contrastingly, in cases where there is minimal or no price sensitivity, suppliers are likely to push the tax burden to consumers through price increases. If the tax burden is passed onto consumers, there is a possible welfare loss and the impact is likely to be felt more by vulnerable groups such as low-income earners, the informal sector, and women (Munoz et al. 2022). Carboni and Bester (2020), explained that in Rwanda consumers could easily switch to cash, implying that consumers in the country were significantly sensitive to an increase in fees, leading to the usage of DFSs as suppliers increased their prices as a way of forcing customers to absorb the tax cost. Therefore, an increase in fees and taxes would likely lead to a reversal of the progress made in financial inclusion.

Where the cost is borne by suppliers of DFS in the form of lower profits, this would consequentially result in the reduction of investments in DFS. Either of the two scenarios discussed could unfavourably affect financial inclusion as users of financial services either opt for alternatives or reduce their usage, or firms would reduce the provision of digital financial services. These arguments remain comparatively unexplored through empirical analysis.

Usage Implications

In addition to welfare costs, taxes on DFS might result in modification of the usage patterns for financial services. Although in some cases the change in usage might be minimal, in some instances the modification in usage might have substantial welfare impacts. This depends on whether there are substitutes for the service in question, as well as the criticality of the service for medium- and long-term development possibilities. Opponents of DFS taxes suggest that these taxes would lead to a high reduction in the use of DFS (Munoz et al. 2022), thus negatively affecting economic development and economic growth, including reversing the progress made towards financial inclusion in general and digital financial inclusion in Africa. This is contrary to the United Nations’ stipulation that countries should work towards universal financial inclusion. Financial inclusion involves access to and usage of sufficient, affordable, and relevant financial services. Mungai and van der Linden (2021) reported that in Rwanda there was an increase in the adoption and use of DFS when the National Bank of Rwanda scrapped fees on digital person-to-person and merchant payments. Data on DFS taxes and usage and their implications for financial inclusion remain scarcely evaluated. Perhaps there is a need to contextualise such implications for poor groups such as the informal sector, low-income earners, the poor, and women, as these might differ depending on the group studied. Implications may also diverge with tax structures in a country. Critics of DFS taxes advocate for their eradication, based on their possible negative influence on financial inclusion. These opponents have further championed the need for expanding the use of DFS by offering tax incentives to stimulate their provision by companies. This could increase the scope and breadth of financial inclusion in developing countries. These arguments remain insufficiently investigated. Questions persist on how tax policy can be structured in a way that stimulates investment and development to broaden financial inclusion.

With digital transformation in economies, Mungai and van der Linden (2021) raised the question of whether governments can afford the developmental impact of taxing digital payments without reversing the digitalization successes achieved during the pandemic. It is not enough to interrogate financial inclusion and exclusion from the tax perspective, because the state of infrastructure, regulatory requirements, and internet connectivity also affect the demand and supply of financial services and financial inclusion. The introduction of tax incentives and other incentives, and their possible impact on the use of financial services and financial inclusion, requires further exploration, bearing in mind the ineffectiveness and abuse of tax incentives in developing countries. In an African context, Oguttu (2018) pointed to the abuse of tax incentives by multinational enterprises engaging in base erosion and profit-shifting behaviour.

If taxes were levied on DFS suppliers only and not on traditional service suppliers, tax policy would be considered discriminatory and against the principles of equity and fairness. Digital financial inclusion would be impinged on, as consumers would shift to cheaper, untaxed traditional financial services. The field of competition would be uneven, as the cost impact of taxation would result in DFS being expensive. This unfair competition from traditional financial services could reduce the profitability of DFS companies (Munoz et al. 2022). With reduced profitability, the survival and continuity of some digital operations would be compromised, thus negatively influencing financial inclusion. African governments should consider how to design DFS tax policies in a way that fosters developmentally advantageous changes in the market structure, especially interoperability between different works.

The Influence on Market Development or Structure

DFS taxes could influence significant medium- and long-term changes in the market of specific DFSs, or the DFS market in general. In cases where taxes are imposed on some financial services and not applied to others, economic distortions could occur as consumers opt for cheaper alternatives. Tax is a cost that is normally factored into pricing decisions. New taxes on DFS or the expansion of existing taxes on financial services, in general, could impede the financial growth of the digital economy (Munoz et al. 2022). The impact on market dynamics, long-term development and growth, investment decisions, and the growth or decline of the DFS usage all contribute to whether the change in market structure is viewed as favourable or unfavourable in terms of financial inclusion. The impact of digital taxes on the economy is influenced by government attempts to bring an equilibrium between the goals of revenue maximisation from a previously undertaxed sector, long-term development of financial services, and financial inclusion of vulnerable groups.

Two possible interpretations are evident: first, warranted taxation of a growing but undertaxed sector, and second, the likelihood of stifling an emerging and growing infant sector. Concerning the first argument, in Africa, especially SSA, the tax to GDP ratio is low and estimated at around 15.6%, while those of Europe and North America is estimated at 24% and 24.2% respectively. DFS can be a source of revenue for African countries where public expenditure normally exceeds domestic revenue. Budget deficits have been further increased by the impact of COVID-19 which has negatively affected the economic growth and development trajectories of most countries (Mungai and van der Linden 2021). Taxation of DFS presents an efficient means of domestic revenue mobilization but carries a likelihood of damaging long-term developmental consequences. Despite the possibility of inclusive public expenditure from the distribution of resources pooled together through taxes, consumers can be disincentivized from using DFSs such as mobile money, and this would reduce the benefits of financial inclusion.

Concerning the second point of view, if taxes are levied on DFS suppliers only and not on traditional financial services suppliers, tax policy would be considered discriminatory and against the principles of equity and fairness. Digital financial inclusion would be impinged on, as consumers would shift to cheaper, untaxed traditional financial services. The competition field would be uneven, as the cost impact of taxation would result in DFSs being expensive. This unfair competition from traditional financial services could reduce the profitability of DFS companies (Munoz et al. 2022). With reduced profitability, the survival and continuity of some digital operations would be compromised, thus negatively influencing financial inclusion. African governments should consider how to design DFS tax policies in a way that fosters developmentally advantageous changes in the market structure, especially interoperability between different works.

Trust and Tax Morale

Taxation of digital transactions, especially payments, can lower the trust of users in the DFS if the information on these taxes is not transparently communicated and effectively understood. The ambiguity of tax policy, lack of consistency in policymaking processes, and inadequate stakeholder engagement in DFS taxes in most African countries have led to strong mistrust and suspicion of governments, in some cases crippling the use of digital financial services (GSMA 2021). For example, in Zimbabwe, consumers and businesses raised an outcry about the 2% IMTT. Mungai and van der Linden (2021) pointed out that users of DFS in Uganda were effectively taxed four times. They were taxed while depositing money, sending money, and receiving money, as well as when making withdrawals. This was viewed as over-taxation and customers responded with a reduction in the use of digital financial services. Person-to-person transactions dropped by over 50%. In response to the public outcry and potentially detrimental implications for financial inclusion, the Ugandan government reduced the DFS tax rates and levied them only on withdrawals, thus eliminating them for the other three areas. The impact of reduced trust might be two-fold, i.e., reduced usage and diminished tax morale that can result in reduced tax income. To build trust and acceptance, governments must charge tax rates to uphold the tax principle of the economy. This principle holds that citizens must not be left worse off or driven into poverty through taxation. Governments must also conduct stakeholder consultations with DFS suppliers as well as consumer associations. In this way, governments can access data on digital transactions, which is argued to be one constraint in effectively evaluating the impact of taxation on various economic issues, including financial inclusion. African countries need to cooperate, collaborate, come together, and forge forward with fundamental tax reforms, and improved DFS structures and administration. There is a need to continuously draw on each other’s experiences.

Invasion of Privacy Due to Tax Audits and Surveillance to Foster Tax Compliance

Taxation is generally an information game (Mpofu 2021a, 2021c). The nature of mobile money taxes is such that the service providers, for example, Econet in the case of Ecocash in Zimbabwe, deduct the tax as transaction tax charges. In the case of the 2% IMTT or on swipe transactions, the banks withhold the tax and remit it to the Zimbabwe Revenue Authority, (ZIMRA) (Simatele 2021). Accordingly, to satisfy themselves that the correct tax amount was collected and remitted, revenue authorities must have access to the personal data of customers, including their bank accounts as well as transactions on their mobile money accounts. The inspection of meta data may give revenue officers or governments access to private information or information that can lead to the identification of users or customers. This may lead to the loss of privacy and troubling concerns surrounding surveillance or inclusive DFS usage in Africa, as alluded to by Shipalana (2019), Ozili (2018), Martin (2019) and De Koker and Jentzsch (2013). Harris et al. (2012) were among the earlier researchers who raised privacy and security concerns linked to mobile money. While the negative impact is apparent in the violation of privacy, one could argue that the same violation occurs for “legal personas” such as companies in cases of corporate tax and value-added tax (VAT) audits, and for individual employees in the case of pay as you earn (PAYE) audits. This infringement corresponds with the role of tax as a governance tool to foster governance, security, and legitimacy (Rogan 2019; Sebele-Mpofu 2021). Governments must be able to monitor transactions and activities within their respective countries, to detect fraudulent activities and illegal shadow economy activities including human trafficking and the drugs trade, and surveillance of income and financial activities are one such governance measure. From another angle, the use of banks and mobile money networks increases efficiency and tax compliance as well as leads to the reduction of administration costs, as governments can collect from fewer taxpayers compared to millions of people spread all over the country. This enhances simplicity, economy, effectiveness, and efficiency, which are the key principles of a good tax system as propounded by Smith (1776).

3. Review Methodology

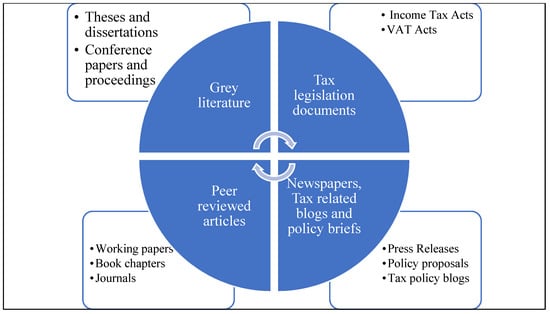

The purpose of this study is to answer the following questions: what is the relationship between the expansion of digital financial services and digital inclusion in African countries? Second, what justifies the imposition of DFS taxes in Africa? Third, what are the potential consequences of DFS taxes in African countries? To answer these questions, the study made use of secondary sources of data through literature review and document analysis. A systematic technique for assessing or evaluating documents, including printed, electronic, computer-based, and internet-transmitted material, is known as document analysis (Bowen 2009; Marinai 2008). Document analysis, like other qualitative research methodologies, necessitates the examination and interpretation of data to extract meaning, gain insight, and develop empirical knowledge (Bowen 2009; Marinai 2008). Documents that were used for systematic evaluation as part of this study took a variety of forms, which included those listed in Figure 2.

Figure 2.

Documents that may be used for systematic evaluation in Document Analysis. Source: The authors’ analysis.

Figure 2, above, outlines the articles and documents that were used for systematic evaluation in the literature review and document analysis, respectively. These documents include the following: “background papers, books and book chapters and journals articles on digital taxation and DFSTs, press releases, policy proposals, policy briefs by developmental organizations and tax bodies such the Organization of Economic Cooperation and Development (OECD), and working papers from the international centre of Tax and Development (ICTD)”. According to Kayesa and Shung-King (2021), the phrase “document analysis”, also known as “document review”, refers to a method of obtaining data and information in several disciplines and has various meanings depending on how it is conducted, interpreted, and used. Kayesa and Shung-King (2021) went on to explain that systematic collection, documentation, analysis, interpretation, and organization of data, whether printed or electronic, is a research data collection approach. Document analysis, according to Karppinen and Moe (2019), entails skimming, in-depth reading, scrutinizing content, and document interpretation. A grading scale, checklist, or matrix analysis can be used to examine the content, depending on the study objective.

For this study, a critical literature review approach was adopted for reviewing the literature sources described in Figure 2. The researchers adopted this review method because it allows in-depth and critical analysis of literature in the subject area and can show the knowledge gaps in the literature, as well as policy gaps (Mpofu 2021b; Snyder 2019). The researchers searched the Scopus database as well as the Google Scholar database for articles to consider in the review. The researchers employed key search terms including “Digital services taxes (DTSs) in Africa”, “the structure of digital services taxes in African countries”, “Digital services taxes in Africa and Digital Financial Inclusion”, and “Digital financial inclusion and the Fourth Industrial Revolution in Africa” and “The effect of digital service taxes in African economies”, among others. The search yielded several articles from organizations such as the World Bank, the International Monetary Fund, the ICTD, the Africa Portal, and the Institute of Development Studies, as well as journal articles from different journals. These articles were reviewed for relevance to the study by considering their tittles, abstracts, and introductions.

Most of the articles reviewed were current articles that ranged from 2012 to 2020, with many of them from 2018 to 2022 (this reflects the novel nature of DSTs, which were largely introduced around 2019 to 2020, as displayed in Figure 1). Some of the early articles focused on mobile money taxes relevant to the taxation of digital financial services, but the focus of this review was on the newly introduced DSTs. The existing literature briefly touched on mobile money taxes but without going deeper into these. The link between DSTs and digital financial inclusion is therefore a new research area that is still being explored and has been characterised by only a few articles especially focusing on Africa. The search yielded specific results that were supported by articles from tax blogs and policy release statements. A total of 75 papers were reviewed and included in the study. The presentation of the findings was guided by themes emanating from the three questions that informed the study.

4. Discussion of Findings

This section addresses the goals of this research, which relate first to uncovering the relationship between the growth of digital financial services and digital inclusion in African countries. Second, how can the imposition of DFS tariffs in Africa be justified? Third, what are the potential ramifications of DFS taxes in African nations?

4.1. The Relationship between the Expansion of Digital Financial Services and Digital Inclusion in African Countries

In many African countries, the introduction and growth of digital financial services have resulted in an unprecedented increase in the number of people who now have access to official financial services (Bille et al. 2018). The African continent already has more digitized financial service engagement than any other continent on the planet, according to the World Bank (2022a). Africa is also thought to account for over half of all consumers of digital financial services. In remote villages and urban neighbourhoods where no bank has ever constructed a branch, mobile money solutions and agent banking provide cheaper, instant, and dependable payments, savings, loans, and sometimes even insurance alternatives. Mhlanga (2020) adduced those digital financial services in Africa have placed banking at everyone’s fingertips, especially benefitting the impoverished. Mhlanga (2020) further argued that the influence of digital financial products extends further than the individual and that huge differences for small and medium enterprises, or rural farmers, transcend into greater gains for society.

According to Bille et al. (2018), 10 years since the breakthrough of digital financial services in Sub-Saharan Africa, the evidence was clear; according to their field research, access to mobile money services raised households’ daily per capita spending levels, pulling them out of extreme poverty. Mobile money services, on the other hand, have altered lives by assisting women in transitioning from subsistence agriculture to commercial vocations and sustainable livelihoods. According to the World Bank, “its partnership with African financial services providers resulted in 7.2 million new digital financial services users on the continent, a 250 percent increase over the baseline, with approximately 45,000 new banking agents and $300 million in monthly transactions, between 2012 and 2016”. Machasio (2020) reported that during COVID-19, public officials and healthcare staff were urged to use contactless payment and card payment methods to reduce the risk of virus transmission through cash handling, thereby opening new opportunities for the adoption of DFS. Machasio (2020) argued that digital financial inclusion can benefit small businesses and low-income households by allowing them to benefit directly from technological solutions such as mobile financial services, internet banking, and other financial technology advancements. It is widely assumed that digital financial inclusion may greatly contribute to economic growth, poverty reduction, and income inequality reduction without jeopardizing financial market stability (Khera et al. 2021).

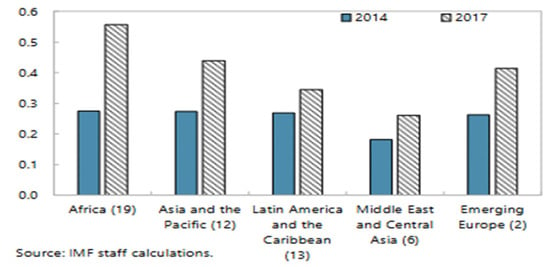

In a global comparison, the countries with the highest degree of digital financial inclusion are Africa, Asia, and the Pacific, according to the International Monetary Fund. Ghana, Kenya, and Senegal were the African nations that scored in the top quartile of the digital financial inclusion index in 2017. Digital financial inclusion in Africa is depicted in Figure 3.

Figure 3.

Digital financial inclusion in Africa. Source: International Monetary Fund (2021).

Figure 3, above, shows that many countries witnessed an increase in digital financial inclusion in the period 2014 and 2017. However, it is clear from the figures that there was comparatively more improvement in Africa, with countries like Ghana, Benin and Senegal contributing significantly to the gain in digital financial inclusion. According to Khera et al. (2021), the major increase in the digital financial inclusion index was driven by aspects of access and usage. When comparing traditional financial inclusion indicators to digital financial inclusion indicators, the International Monetary Fund (2021) found that digital financial services drive financial inclusion in Africa to a greater extent. According to Khera et al. (2021), nations like Ghana, Senegal, Uganda, and Rwanda were among those with high digital financial inclusion scores but low to medium traditional inclusion indexes. Fintech is filling the gap in the availability of financial services supplied by financial institutions in these countries. Figure 4 shows traditional financial inclusion in Africa.

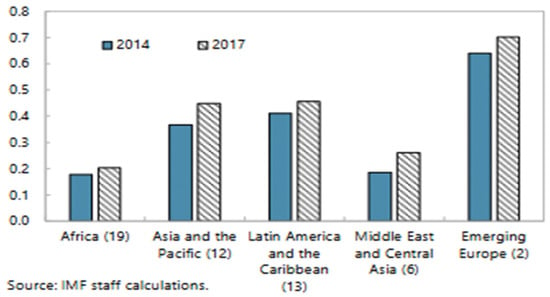

Figure 4.

Traditional financial inclusion in Africa. Source: International Monetary Fund (2021).

Figure 4, above, shows that traditional financial inclusion in Africa is very low when compared to other regions, such as emerging Europe. Nations like Ghana, Senegal, Uganda, and Rwanda were among those with high digital financial inclusion scores but low to medium traditional inclusion indexes. International Monetary Fund (2021) reported that this is not surprising, because in East African countries there was high adoption of mobile money. The information suggests that financial inclusion in Africa is mainly driven by digital financial services. Bille et al. (2018) reached similar conclusions, claiming that mobile money and agent banking have been the primary drivers of financial inclusion in Sub-Saharan Africa in the last few years. According to Bille et al. (2018), traditional financial institution accounts have grown slowly in Sub-Saharan Africa, and where this does occur, it often appears to be because of the mobile money revolution. Bille et al. (2018) also stated that financial inclusion on the African continent in the future will be driven mainly by digital financial inclusion.

4.2. Justification for DFS Taxes in Africa

The predominance of the informal sector in many African countries has made it a prominent target for tax generation for many African governments (Sebele-Mpofu 2020, 2021). As a result, the prevalence of the informal sector, as well as the necessity to broaden the tax base, are the foundations for digital financial taxation in many African countries. According to the World Bank (2022a), the development of a strong informal sector in many African countries prompted its targeting by revenue authorities to broaden its tax base. Again, the World Bank posits that the informal sector accounts for more than half of economic activity and the bulk of employment in many African countries, making the sector a good platform for expanding the tax base. Mobile money is one of the most popular methods of payment in the informal sector, making its taxation the best way to expand the tax base by attracting new taxpayers. Therefore, taxing mobile money is in some ways appealing to tax authorities (World Bank 2022b). Munoz et al. (2022) assert that digital financial services (DFS) have rapidly spread across Africa and other low-income nations, while low-income countries have faced tremendous demands to enhance domestic resource mobilization and despite the major obstacles in taxing the digital economy, digital financial service taxes present an opportunity to these countries.

Another key factor is that many African countries are either emerging or undeveloped, therefore, to promote economic development, countries must find long-term funding sources that can support national social programs and public expenditures. Programs that provide health, education, infrastructure, and other amenities are vital for Africa’s prosperity and to have a functional society. However, these programs necessitate financing, which can be obtained through taxation. Taxation not only pays for public goods and services, but it is also a vital component of the social compact among people and the economy, according to the World Bank (2022a). Ndung’u (2019) further notes that tax administration is evolving as the environment in which it works gets wider and deeper, owing mostly to the massive growth in digital information flows, which is accompanied by obstacles when advanced innovation and analytical tools are introduced. Because of the changes in the landscape, African countries must also adapt to these changes in their tax system. Therefore, African countries are urged to reform their tax structures to accommodate the digital economy. Again, digital financial tax is critical for Africa because it can help the continent achieve its Sustainable Development Goals.

According to the World Bank, Tajikistan, which is “a landlocked and the smallest nation in Central Asia by area,” has considered tax reform a top priority in its efforts to meet its economic goals. Tajikistan began the Tax Administration Reform Project in 2013, and as a result, the nation has developed a more functional, open, and service-oriented taxation system. The establishment of a single tax administration system and the modernization of IT infrastructure boosted efficiency and minimized physical encounters among tax officers and customers. The number of available enterprises and individual taxpayers paying taxes has doubled because of improved taxpayer services, and revenue collections have increased significantly. In 2016, a Tajikistan client spent 28 days complying with all tax regulations, compared to 37 days in 2012. Tajikistan is like many African countries as a result African countries could implement the digital financial services tax with guaranteed results especially if the procedure followed by Tajikistan is maintained in Africa. The digital financial services tax can also go a long way in allowing the African nations to attain sustainable development goals provided these countries overhaul their tax systems.

Sustainable Development Goals, according to Akanle et al. (2022), are the most comprehensive development frameworks for promoting equitable development internationally. However, various efforts to attain development have been done in Africa, but much more effort is required to get the desired results. As a result, we argue in this paper that taxing the digital economy can be one of the ways to generate money that can be utilized to fund programs aimed at achieving sustainable development goals. The reason for this is that “Overseas Development Assistance” and “Foreign Direct Investments”, which used to have a good impact on development on the continent, have been on the decline, even as African countries continue to struggle with development efforts, as described by Akanle et al. (2022). According to Juju et al. (2020), despite tremendous improvements in recent decades, Sub-Saharan Africa is the world the world’s poorest and least developed region. Many locations across the African continent are characterized by high levels of poverty, food insecurity, and environmental degradation, as well as limited access to infrastructure and institutional capacity.

According to the World Bank (2022b), the financial shortfall for developing nations to achieve the Sustainable Development Goals is almost $2.5 trillion per year. According to the World Bank, much of this funding shortfall will have to be filled by increasing private-sector investment in sustainability, which would necessitate suitable tax policies to establish the necessary price incentives. Because most African economic activities are informal and are aided by various digital tools, taxing the digital economy can help extend the tax base, which supports our opinion that taxing the digital economy can be a game-changer for African content.

4.3. Potential Consequences of DFS Taxes in African Countries

Taxes and fees are an important source of public revenue for governments, allowing them to pay investment in personnel, infrastructures, as well as the provision of services to citizens and enterprises. According to Ndajiwo (2020), although the introduction of digitalized business models has the potential to promote trade in Africa, it has exacerbated the two main issues of international taxation. As articulated by Ndajiwo (2020) the first issue is defining taxable presence, and the second is allocating multinational companies’ (MNEs) business income among the several jurisdictions in which they operate. The main argument by Ndajiwo (2020) is that the challenge to taxing highly digitalised enterprises is not their lack of taxable presence in African countries, but rather the attribution of earnings. Ndajiwo (2020) cautioned African countries on digital transaction taxes, advising that if African countries opt to levy digital transactional taxes, they must be progressive to avoid regressive effects.

One area that is impacted, according to Clifford (2020), is mobile money users. “Informal companies, women, small-holder farmers, refugees, and young people” utilize mobile money in disproportionately large amounts and while those with greater means utilize the service as well, evidence from many African countries suggests that they also have access to the banking system and may avoid paying a mobile money transaction fee if necessary. People with lower earnings do not have this luxury; their only option is to return to cash and forgo mobile money. Cash, on the other hand, lacks the convenience of sending funds remotely via digital methods, leaving low-income people with little choice except to use mobile money to execute these transactions. The implication is that people with lower incomes pay a disproportionate share of these taxes and that the burden of payment falls disproportionately on the poor, not the wealthy.

To better comprehend the relationship between taxes on DFS such as mobile money and services such as money transfers, international remittances, and swipe transactions, it would be fundamental to give a brief overview of the motives of taxation in the economy. Generally, taxation has several roles in the economy, though its most discussed role is revenue mobilisation to fund public expenditure and economic growth. Taxation has other critical roles including minimising market externalities, fostering redistribution of resources, stimulating representation, discouraging the consumption or use of certain goods, and protecting local industries, among several other roles. From the importance of mobile money and other DFSs as enablers of financial inclusion, digital financial inclusion and fruition of the SDGs, the motive behind the taxation of DFSs was to expand the narrow tax bases in the continent, through DSTs, DFS taxes (such as the tax on swipe transactions and 2% intermediate Monetary Tax on Transactions (IMTT) and the recently implemented 4% of local foreign currency remittances in Zimbabwe) and mobile money taxes. Considering that tax policy can have the main objective and anticipated outcomes, it is crucial to note that there are always negative externalities associated with any policy, tax policy included. Accordingly, in cases where taxes are used as a tool to discourage usage, the anticipated result is a direct relationship in which as usage decreases so too does revenue mobilisation, as is the case with environmental taxes such as carbon taxes. In the cases of mobile money taxes and other DFS taxes, the reduction in usage is a negative externality that occurs on the basis that tax is cost and as such would discourage consumption, but this is not the ultimate motive of most African governments. In this case, in terms of the correlation between digital financial inclusion and the taxation of digital services in general and DFSs in particular, an inverse relationship is implied. As DFSs and mobile money are taxed, the adoption of these services is negatively affected or reduced, leading to a reduction in digital financial inclusion. This scenario was evident in Uganda, where the 2017 internet disruptions are argued to have cost the country an estimated revenue loss of US$ 1 762 475 per day. Kakungulu-Mayambala and Rukundo (2018) argued that welfare gains from online digital services in African countries have often been overlooked. According to Rukundo (2017), mobile money in Uganda “has 20 million users and 39% of the country’s GDP moves through this service”. According to Silue (2021), the demand for cash increased following the introduction of mobile money taxes, thus reducing financial inclusion. Lees and Akol (2021) and Adegoke (2018) stated that mobile money taxes often result in double or multiple taxations, reduce financial inclusion, lead to a reduction in employment for mobile money agents, impede the achievement of SDGs, and heighten the burden for the poor. The contribution of mobile money to the attainment of SDGs in SSA was affirmed by Juju et al. (2020).

Mobile funds transfer taxes appear to contradict the development agenda aims in numerous ways, according to the World Bank (2022a). Financial inclusion is a stated development goal of any government, with mobile money serving as a critical enabler. Mobile money taxes, on the other hand, have a clear influence on financial inclusion goals, both directly by reducing demand for these services and causing poorer people to return to cash, and indirectly by removing active agents from the system. According to the World Bank, this is especially harmful to people living in rural regions who do not have access to traditional financial services. These rural residents are mostly subsistence farmers with significantly lower wages than their urban counterparts. Mobile money is used to boost social inclusion in many African countries, including in areas of agriculture, energy, health, and education. The application of a mobile money transaction tax is expected to have a negative impact on these activities. The World Bank cited Uganda as an example, where an increasing number of smallholder coffee, seed oil, and dairy producers had been paid via mobile money, which was their first exposure to the service. However, research suggests that after the mobile money tax was implemented, there was an instantaneous drop in the use of the service. In addition, Kenya imposed a tax on cell phone transactions and airtime, which has expanded to other African nations. Due to the rising turnover of transactions and the formal nature of these transactions by formal and informal firms, some countries in Sub-Saharan Africa have viewed mobile phones as a booming sub-sector that is easy to tax. However, the rising tax burden on the sub-sector and its customers has sparked fears that the significant advances in financial inclusion made possible by retail electronic payments platforms via mobile phone transactions may be reversed, leading to a return to cash transactions.

This is not to say this is always the case; in some cases, usage has increased even in the face of taxation. For example, Ebong and George (2021) posited in the Ugandan context that taxes have not deterred the use of mobile money in Africa. It is important, however, to contextualise this statement in the COVID-19 pandemic era. This observation could be due to circumstances surrounding the COVID-19 pandemic that made travel and access to banks and cash impractical, hence forcing most of the population and businesses to use DFS, mobile money included. The continued use and growth of mobile money were driven by the global pandemic and the growth of the digital economy and do not in any way trivialize the impact of taxation but explain the absence of substitute-driven usage. Although mobile money services and other DFSs such as swipe payments and transfers became expensive because of the tax element, consumers had little choice in the face of lockdown restrictions. This could explain the continued expansion of mobile money in Africa in the years 2020 to 2021. In addition, the fact that banks have linked customers’ bank accounts with their mobile phones through banking apps, has indirectly forced customers to use mobile money and DFSs. From this angle, the expansion could also be seen as the result of a lack of alternatives. According to GSMA (2021), in Africa in 2020 mobile money accounts expanded by 12% to 562 million, and the total volume of transactions grew by 15% to 27 billion. Shapshack (2021) reported that the mobile value of mobile money rose by 23% up to US$ 495 billion due to the pandemic.

5. Conclusions

Due to the advent of the Fourth Industrial Revolution, the digital economy has risen dramatically in the global landscape, and many developing countries including those in Africa have seen a boom in digital activity over recent years. The burgeoning of the digital economy has seen an expansion in digital financial services (DFS) in Africa and other developing regions. Because many African nations are faced with pressure to mobilise domestic revenue, taxing the digital economy has become an obvious option. Therefore, this paper sought to answer the following questions. First, what is the relationship between the growth of DFS and digital inclusion in African countries? Second, what is the justification for levying DFS taxes in Africa? Third, what is the possible impact of implementing DFS taxes in African countries? Using secondary sources of data and document analysis, a systematic technique for assessing or evaluating documents, including printed, electronic, computer-based, and Internet-transmitted material, the study found that financial inclusion in Africa is driven by digital financial inclusion. Despite several negative consequences raised, the study discovered that most African economic activities are informal and are aided by various digital tools and that taxing the digital economy can help extend the tax base in Africa.

Firstly, it was evident from the research that the expansion of DFS in Africa was an important driver for digital financial inclusion. Most previously excluded groups of the population, including youth, the unemployed, low-income earners, and those in the informal sector greatly benefited from the use of digital financial services such as cellphone banking, mobile money services, and other digital services, to conduct financial transactions affordably, reliably, and conveniently. Therefore, access to DFSs enables digital financial inclusion.

Secondly, the review concluded that the taxation of DFSs in Africa is crucial for revenue mobilization, and the introduction of DSTs is essential to widen the tax base and collect the necessary tax revenues from the growing digital economy. Taxes are important for domestic revenue generation and for supporting government expenditure. Taxation of DFSs also ensures that principles of taxation such as equity are upheld, as segments of the population such as the informal sector contribute to tax revenue. However, it is also important that when implementing digital finance taxes care is taken to avoid excluding low-income earners from participating in the financial market.

Thirdly, the review concluded that the impact of DFS taxes on the economy is complicated and mixed. While the likelihood of tax revenue generation was evident, the possibility of negative outcomes was also indicated by the review. Unfavourable Impacts include reduced usage of DFS, crippling financial and digital financial inclusion effects, and reduced growth of the digital economy. The emphasis on the negative impact of taxation on the usage and expansion of DFSs, market structure, and digital financial inclusion, does not preclude the fact that these effects are a function of several variables. These variables include the fact that the active number of mobile money accounts does not necessarily translate to the usage of mobile money activities, or that users use mobile money for various activities. Furthermore, mobile money usage depends on the availability of the requisite infrastructure, digital financial literacy, and internet connectivity, as well as the risk perception of users. Therefore, mobile money and DFS usage, financial inclusion, digital financial inclusion, and the attainment of the SDGs, are driven by an array of factors, taxation included. The study’s weaknesses are that it relied on secondary sources of data, through literature review and document analysis, to answer the questions. In the future, it will be critical for researchers to use primary data and conduct statistical analyses to obtain a deeper understanding of the interactions between variables.

Author Contributions

Conceptualization, F.Y.M. and D.M.; methodology, D.M., F.Y.M.; validation, F.Y.M., D.M.; formal analysis, D.M., F.Y.M.; investigation, D.M.; writing original draft preparation, F.Y.M., D.M.; writing—review and editing, D.M., F.Y.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adaba, Godfriend B., Daniel A. Ayoung, and Pamela Abbott. 2019. Exploring the contribution of mobile money to well-being from a capability perspective. The Electronic Journal of Information Systems in Developing Countries 85: e12079. [Google Scholar] [CrossRef] [Green Version]

- Adegoke, Yinka. 2018. Ugandans are Furious with a New Tax for Using Social Media and Mobile Money. Quartz Africa 1: 1–3. [Google Scholar]

- Agur, Itai, Soledad Martinez Peria, and Celine Rochon. 2020. Digital financial services and the pandemic: Opportunities and risks for emerging and developing economies. International Monetary Fund Special Series on COVID-19 Transactions 1: 2. [Google Scholar]

- Ahmad, Ahmad Hassan, Christopher Green, and Fei Jiang. 2020. Mobile money, financial inclusion and development: A review with reference to African experience. Journal of Economic Surveys 34: 753–92. [Google Scholar] [CrossRef]

- Ahmed, Shamira, and Alison Gillwald. 2020. Multifaceted Challenges of Digital Taxation in Africa. Available online: https://www.africaportal.org/documents/20840/Final-Tax-PB_30112020.pdf (accessed on 10 March 2022).

- Ahmed, Shamira, Tapiwa Chinembiri, and Naila Govan-Vassen. 2021. COVID-19 Exposes the Contradictions of Social Media Taxes in Africa. Available online: https://www.africaportal.org/documents/21197/Covid-19-social_media_taxes_in_Africa.pdf (accessed on 10 March 2022).

- Akanle, Olayinka, Demilade Kayode, and Irenitemi Abolade. 2022. Sustainable development goals (SDGs) and remittances in Africa. Cogent Social Sciences 8: 2037811. [Google Scholar] [CrossRef]

- Asongu, Simplice, and Nicholas Odhiambo. 2022. The Role of Mobile Characteristics on Mobile Money Innovations. (No. 22/011). Brighton: African Governance and Development Institute. [Google Scholar]

- Asongu, Simplice A., and Nicholas M. Odhiambo. 2018. ICT, financial access and gender inclusion in the formal economic sector: Evidence from Africa. African Finance Journal 20: 45–65. [Google Scholar] [CrossRef] [Green Version]

- Baganzi, Amin. 2018. Internal Controls, Managerial Competence and Financial Accountability in Technical and Vocational Institutions in Uganda. Master’s thesis. Available online: https://mubsir.mubs.ac.ug/handle/20.500.12282/3119 (accessed on 10 March 2022).

- Bille, Fahima Said, Sinja Buri, Tiphaine A. Crenn, Lesley Sarah Denyes, Chabir Vali Taibo Hassam, Soren Heitmann, and Martinez Ramji. 2018. Digital Access: The Future of Financial Inclusion in Africa. (No. 128850). The World Bank: pp. 1–97. Available online: https://www.ifc.org/wps/wcm/connect/region__ext_content/ifc_external_corporate_site/sub-saharan+africa/resources/201805_report_digital-access-africa (accessed on 10 March 2022).

- Bowen, Glenn A. 2009. Document analysis as a qualitative research method. Qualitative Research Journal 9: 27–40. [Google Scholar] [CrossRef] [Green Version]

- Bunn, Daniel, Elke Asen, and Cristina Enache. 2020. Digital Taxation around the World. Washington, DC: Tax Foundation, Available online: https://files.taxfoundation.org/20200527192056/Digital-Taxation-Around-the-World.pdf (accessed on 12 March 2022).

- Carboni, Isabelle, and Hennie Bester. 2020. When the digital payment goes viral: Lessons from COVID-19’s impact on mobile money in Rwanda. Cenfri. May 19, pp. 1–8. Available online: https://cenfri.org/articles/covid-19s-impact-on-mobile-money-in-rwanda/ (accessed on 10 March 2022).

- Clifford, Killian. 2020. The Causes and Consequences of Mobile Money Taxation An Examination of Mobile Money Transaction Taxes in Sub-Saharan Africa. Available online: https://www.ictd.ac/event/mobile-money-taxation-africa-causes-consequences/ (accessed on 12 March 2022).

- De Koker, Louis, and Nicola Jentzsch. 2013. Financial inclusion and financial integrity: Aligned incentives? World Development 44: 267–80. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Leora F. Klapper. 2012. Financial inclusion in Africa: An overview. World Bank Policy Research Working Paper 6088. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/9335/WPS6088.pdf?sequence=1 (accessed on 10 March 2022).

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018a. Opportunities for Expanding Financial Inclusion Through Digital Technology. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978–1-4648–1259-0_ch6 (accessed on 12 March 2022).

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018b. The Unbanked. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978–1-4648–1259-0_ch2 (accessed on 12 March 2022).

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2020. The Global Findex Database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review 34: S2–S8. [Google Scholar]

- Ebong, Jimmy, and Babu George. 2021. Financial Inclusion through Digital Financial Services (DFS): A Study in Uganda. Journal of Risk and Financial Management 14: 393. [Google Scholar] [CrossRef]

- El-Zoghbi, Mayada. 2019. Global Developments in Inclusive Financial Systems. Available online: https://www.frbsf.org/community-development/wp-content/uploads/sites/3/el-zoghbi-global-developments-in-inclusive-financial-systems.pdf (accessed on 12 March 2022).

- El-Zoghbi, Mayada, Nina Holle, and Mathew Soursourian. 2019. Emerging Evidence on Financial Inclusion. Available online: https://www.findevgateway.org/paper/2019/08/emerging-evidence-financial-inclusion-moving-black-and-white-color (accessed on 12 March 2022).

- Evans, Olaniyi. 2018. Connecting the poor: The internet, mobile phones and financial inclusion in Africa. Digital Policy, Regulation and Governance 20: 568–81. [Google Scholar] [CrossRef]

- GSMA. 2021. State of the Industry Report on Mobile Money 2021. Available online: https://www.adfi.org/publications/state-industry-report-mobile-money-2021-gsma (accessed on 12 March 2022).

- Harris, Andrew, Seymour Goodman, and Patrick Traynor. 2012. Privacy and security concerns associated with mobile money applications in Africa. The Washington Journal of Law, Technology & Arts 8: 245. [Google Scholar]

- International Monetary Fund. 2021. Measuring Digital Financial Inclusion in Emerging Market and Developing Economies: A New Index. Asian Economic Policy Review. Available online: https://www.imf.org/-/media/Files/Publications/WP/2021/English/wpiea2021090-print-pdf.ashx (accessed on 12 March 2022).

- Juju, Denabo, Gideon Baffoe, Rodolfo Dam Lam, Alice Karanja, Merle Naidoo, Abaubakari Ahmed, and Alexandros Gasparatos. 2020. Sustainability challenges in sub-Saharan Africa in the context of the sustainable development goals (SDGs). In Sustainability Challenges in Sub-Saharan Africa I. Singapore: Springer, pp. 3–50. [Google Scholar]

- Juswanto, Wawan, and Rebecca Simms. 2017. Fair Taxation in the Digital Economy. Tokyo: Asian Development Bank Institute, Available online: https://www.adb.org/publications/fair-taxation-digital-economy (accessed on 12 March 2022).

- Kakungulu-Mayambala, Ronald, and Solomon Rukundo. 2018. Implications of Uganda’s new social media tax. East African Journal of Peace & Human Rights 24: 2. [Google Scholar]

- Karppinen, Kari, and Hallvard Moe. 2019. Texts as data I: Document analysis. In The Palgrave Handbook of Methods for Media Policy Research. Cham: Palgrave Macmillan, pp. 249–62. [Google Scholar]

- Kayesa, Naomi Karen, and Maylene Shung-King. 2021. The role of document analysis in health policy analysis studies in low and middle-income countries: Lessons for HPA researchers from a qualitative systematic review. Health Policy Open 2: 100024. [Google Scholar] [CrossRef]

- Kelbesa, Mergesa. 2020. Digital Service Taxes and Their Application. Available online: https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/16968/914_Digital_Service_Tax.pdf?sequence=1 (accessed on 17 March 2022).

- Kelikume, Ikechukwu. 2021. Digital financial inclusion, informal economy and poverty reduction in Africa. Journal of Enterprising Communities: People and Places in the Global Economy. Available online: https://www.emerald.com/insight/1750-6204.htm (accessed on 20 March 2022).

- Khera, Purva, Sumiko Ogawa, Ratna Sahay, and Mahima Vasishth. 2021. Is Digital Financial Inclusion Unlocking Growth? International Monetary Fund. Available online: https://www.imf.org/en/Publications/WP/Issues/2021/06/11/Is-Digital-Financial-Inclusion-Unlocking-Growth-460738 (accessed on 12 March 2022).

- Koomson, Isaac, Edward Martey, and Prince M. Etwire. 2022. Mobile money and entrepreneurship in East Africa: The mediating roles of digital savings and access to digital credit. Information Technology & People. ahead-of-print. [Google Scholar]

- Lees, Adrienne, and Doris Akol. 2021. There and Back Again: The Making of Uganda’s Mobile Money Tax. Available online: https://www.africaportal.org/documents/22362/ICTD_WP123.pdf (accessed on 17 February 2022).

- Llewellyn-Jones, Laura. 2016. Mobile money: Part of the African financial inclusion solution? Economic Affairs 36: 212–16. [Google Scholar] [CrossRef]