Is There Financialization of Housing Prices? Empirical Evidence from Santiago de Chile

Abstract

1. Introduction

2. Methodology

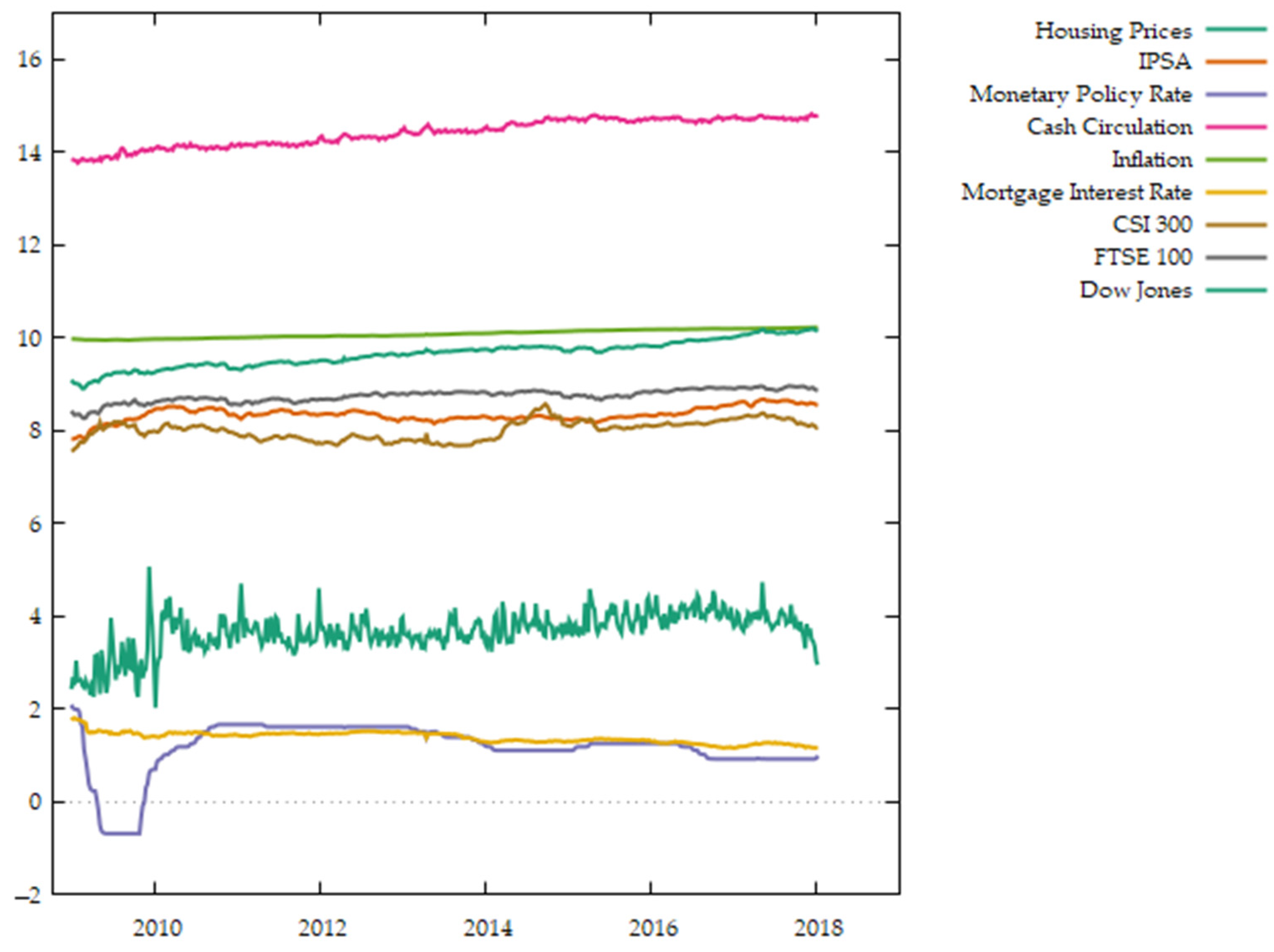

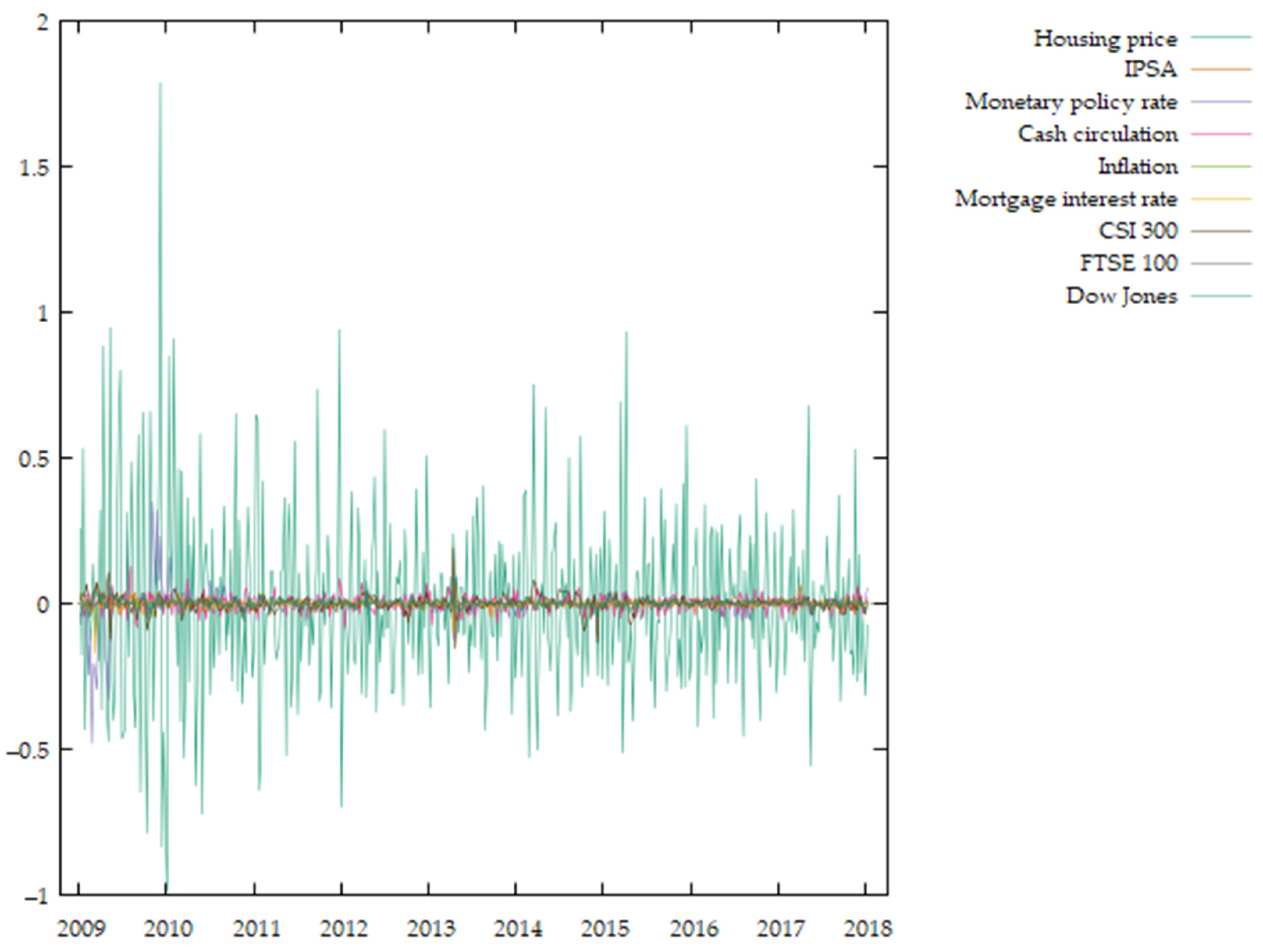

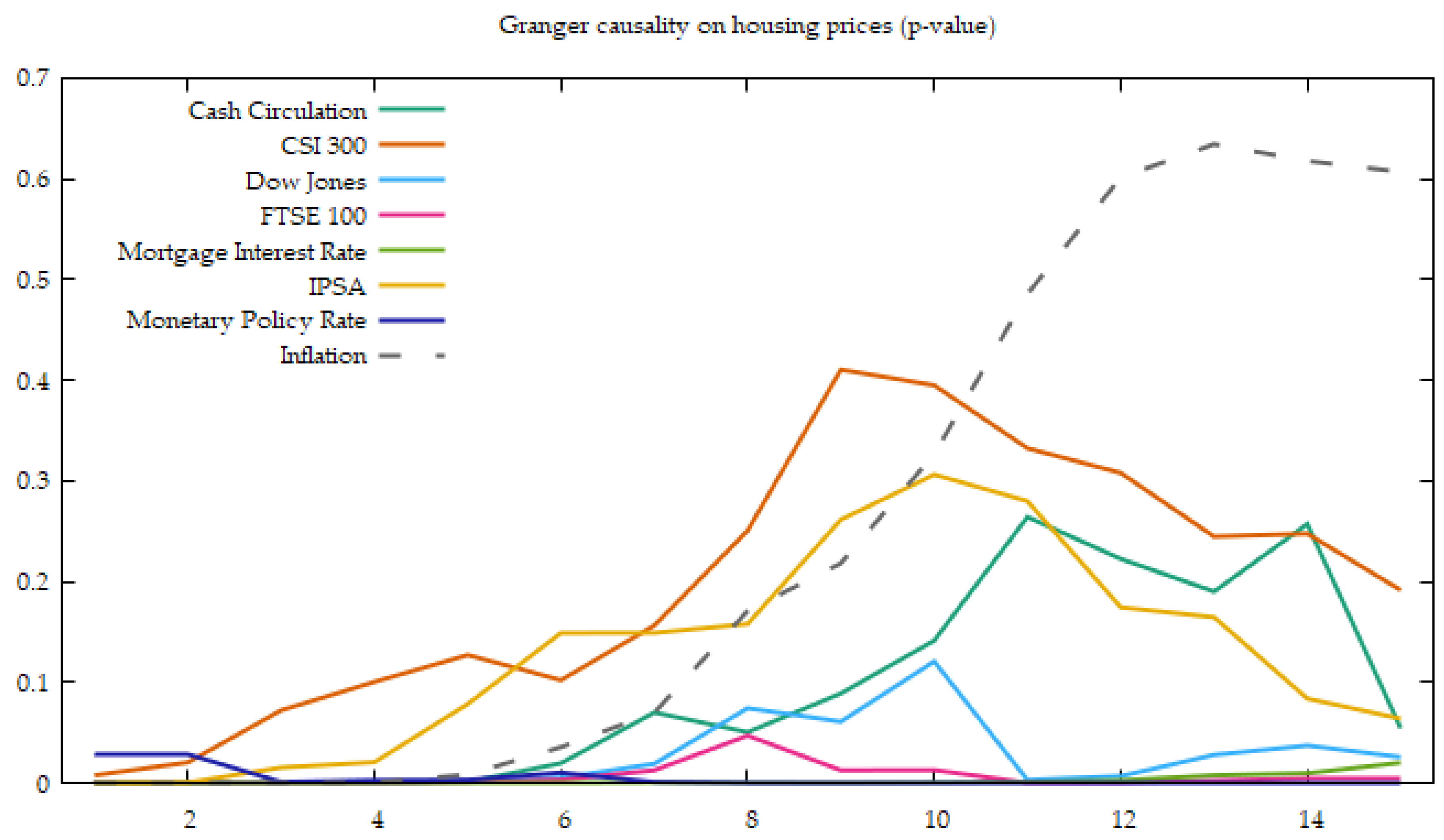

3. Results

4. Discussion

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aalbers, Manuel B. 2015. The Potential for Financialization. Dialogues in Human Geography 5: 214–19. [Google Scholar] [CrossRef]

- Akhtar, Aasim Sajiad, and Ammar Rashid. 2021. Dispossession and the Militarised Developer State: Financialisation and Class Power on the Agrarian-Urban Frontier of Islamabad, Pakistan. Third World Quarterly 42: 1866–84. [Google Scholar] [CrossRef]

- Al-Masum, Md Abdullah, and Chyi Lin Lee. 2019. Modelling Housing Prices and Market Fundamentals: Evidence from the Sydney Housing Market. International Journal of Housing Markets and Analysis 12: 746–62. [Google Scholar] [CrossRef]

- Arias-Loyola, Martín. 2021. Evade neoliberalism’s turnstiles! Lessons from the Chilean Estallido Social. Environment and Planning A: Economy and Space 53: 599–606. [Google Scholar] [CrossRef]

- Aye, Goodness C. 2018. Causality between Economic Policy Uncertainty and Real Housing Returns in Emerging Economies: A Cross-Sample Validation Approach. Cogent Economics & Finance 6: 1473708. [Google Scholar] [CrossRef]

- Bangura, Mustapha, and Chyi Lin Lee. 2022. Housing Price Bubbles in Greater Sydney: Evidence from a Submarket Analysis. Housing Studies 37: 143–78. [Google Scholar] [CrossRef]

- Bissoondeeal, Rakesh K. 2021. The Links between Regional House Prices and Share Prices in the UK. Regional Studies 55: 256–68. [Google Scholar] [CrossRef]

- Boano, Camillo, and Francisco Vergara-Perucich. 2017. Neoliberalism and Urban Development in Latin America. Available online: https://www.routledge.com/Neoliberalism-and-Urban-Development-in-Latin-America-The-Case-of-Santiago/Boano-Vergara-Perucich/p/book/9781138123694 (accessed on 30 March 2022).

- Bone, John D. 2009. The Credit Crunch: Neo-Liberalism, Financialisation and the Gekkoisation of Society. Sociological Research Online 14: 103–10. [Google Scholar] [CrossRef]

- Cattaneo Pineda, Rodrigo Andres. 2011. Real Estate Investment Trusts and private housing production in Santiago de Chile: A new step towards the finantiarization of the city? Eure-Revista Latinoamericana De Estudios Urbano Regionales 37: 5–22. [Google Scholar]

- Chee-Yin, Yip, and Lim Hock-Eam. 2014. The Opportune Time to Invest in Residential Properties—Engle-Granger Cointegration Test and Granger Causality Test Approach. AIP Conference Proceedings 1635: 948–55. [Google Scholar] [CrossRef]

- Correa-Parra, Juan, José-Francisco Vergara-Perucich, and Carlos Aguirre-Núñez. 2020. Towards a Walkable City: Principal Component Analysis for Defining Sub-Centralities in the Santiago Metropolitan Area. Land 9: 362. [Google Scholar] [CrossRef]

- Costello, Greg, Patricia Fraser, and Nicolaas Groenewold. 2011. House Prices, Non-Fundamental Components and Interstate Spillovers: The Australian Experience. Journal of Banking & Finance 35: 653–69. [Google Scholar] [CrossRef]

- Cotter, John, and Simon Stevenson. 2008. Modeling long memory in REITs. Real Estate Economics 36: 533–54. [Google Scholar] [CrossRef]

- Farha, Leilani. 2018. Report of the Special Rapporteur on Adequate Housing as a Component of the Right to an Adequate Standard of Living, and on the Right to Non-Discrimination in This Context, on Her Mission to Chile. Vol. A/HRC/37/5. United Nations. Available online: https://documents-dds-ny.un.org/doc/UNDOC/GEN/G18/009/43/PDF/G1800943.pdf?OpenElement (accessed on 30 March 2022).

- Fauveaud, Gabriel. 2020. The New Frontiers of Housing Financialization in Phnom Penh, Cambodia: The Condominium Boom and the Foreignization of Housing Markets in the Global South. Housing Policy Debate 30: 661–79. [Google Scholar] [CrossRef]

- Fernandez, Rodrigo, and Manuel B. Aalbers. 2020. Housing Financialization in the Global South: In Search of a Comparative Framework. Housing Policy Debate 30: 680–701. [Google Scholar] [CrossRef]

- Fernandois, Antonio, Carlos A. Medel, Antonio Fernandois, and Carlos A. Medel. 2020. Geopolitical Tensions, Opec News, and the Oil Price: A Granger Causality Analysis. Revista de Análisis Económico 35: 57–90. [Google Scholar] [CrossRef]

- Ferreri, Mara, and Alexander Vasudevan. 2019. Vacancy at the Edges of the Precarious City. Geoforum 101: 165–73. [Google Scholar] [CrossRef]

- Fine, Ben. 2022. Commentary on Financialisation Theme Issue Papers. Environment and Planning A Economy and Space 54: 199–203. [Google Scholar] [CrossRef]

- Fix, Mariana, and Pedro Fiori Arantes. 2021. On Urban Studies in Brazil: The Favela, Uneven Urbanisation and Beyond. Urban Studies 59: 893–916. [Google Scholar] [CrossRef]

- Granger, C. W. J. 1969. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 37: 424. [Google Scholar] [CrossRef]

- Grubbauer, Monika. 2019. Housing Microfinance and the Financialisation of Housing in Latin America and beyond: An Agenda for Future Research. International Journal of Housing Policy 19: 436–47. [Google Scholar] [CrossRef]

- Grubbauer, Monika. 2020. Assisted Self-Help Housing in Mexico: Advocacy, (Micro)Finance and the Making of Markets. International Journal of Urban and Regional Research 44: 947–66. [Google Scholar] [CrossRef]

- Gujarati, Damodar N., and D. C. Porter. 2009. Basic of Econometric, 5th ed. New York: McGraw-Hill Education. [Google Scholar]

- Hamilton, J. D. 2018. Why you should never use the Hodrick-Prescott filter. Review of Economics and Statistics 100: 831–43. [Google Scholar] [CrossRef]

- Harvey, David, and Neil Smith. 2005. Capital Financiero, Propiedad Inmobiliaria y Cultura. Barcelon: Universidad Autónoma de Barcelona. [Google Scholar]

- Harvey, David. 1985. The Urbanization of Capital. Oxford: Blackwell. [Google Scholar]

- Harvey, David. 2009. Social Justice and the City. Athens: University of Georgia Press. [Google Scholar]

- Hidalgo Dattwyler, Rodrigo, Luis Daniel Santana Rivas, and Felipe Link. 2019. New Neoliberal Public Housing Policies: Between Centrality Discourse and Peripheralization Practices in Santiago, Chile. Housing Studies 34: 489–518. [Google Scholar] [CrossRef]

- Hidalgo, Rodrigo, Pascal Volker, and Natalia Ramírez. 2014. La Ciudad Inmobiliaria: Mecanismos Institucionales, Relaciones de Poder y Mercantilización Del Medio Natural. El Caso Del Área Metropolitana de Valparaíso. Scripta Nova. Revista Electrónica de Geografía y Ciencias Sociales 18: 1–19. [Google Scholar] [CrossRef]

- Hong, Yun, and Yi Li. 2020. Housing Prices and Investor Sentiment Dynamics: Evidence from China Using a Wavelet Approach. Finance Research Letters 35: 101300. [Google Scholar] [CrossRef]

- Hurn, Stan, Shuping Shi, and Ben Wang. 2022. Housing Networks and Driving Forces. Journal of Banking & Finance 134: 106318. [Google Scholar] [CrossRef]

- Idrovo-Aguirre, Byron J., and Javier E. Contreras-Reyes. 2021. The Response of Housing Construction to a Copper Price Shock in Chile (2009–2020). Economies 9: 98. [Google Scholar] [CrossRef]

- Irandoust, Manuchehr. 2021. The Causality between House Prices and Stock Prices: Evidence from Seven European Countries. International Journal of Housing Markets and Analysis 14: 137–56. [Google Scholar] [CrossRef]

- Ivanova, Maria N. 2017. Profit Growth in Boom and Bust: The Great Recession and the Great Depression in Comparative Perspective. Industrial and Corporate Change 26: dtw013. [Google Scholar] [CrossRef][Green Version]

- Jacobs, Keith, and Tony Manzi. 2020. Conceptualising “Financialisation”: Governance, Organisational Behaviour and Social Interaction in UK Housing. International Journal of Housing Policy 20: 184–202. [Google Scholar] [CrossRef]

- Lapavitsas, Costas. 2009. Financialised Capitalism: Crisis and Financial Expropriation. Historical Materialism-Research in Critical Marxist Theory 17: 114–48. [Google Scholar] [CrossRef]

- Lee, Chyi Lin, Simon Stevenson, and Ming-Long Lee. 2018. Low-frequency volatility of real estate securities and macroeconomic risk. Accounting & Finance 58: 311–42. [Google Scholar] [CrossRef]

- Leung, Charles. 2004. Macroeconomics and Housing: A Review of the Literature. Journal of Housing Economics 13: 249–67. [Google Scholar] [CrossRef]

- Liang, Jiaochen, Qin Fan, and Yong Hu. 2021. Dynamic Relationships between Commodity Prices and Local Housing Market: Evidence for Linear and Nonlinear Causality. Applied Economics 53: 1743–55. [Google Scholar] [CrossRef]

- Liu, Renhe, Eddie Chi-man Hui, Jiaqi Lv, and Yi Chen. 2017. What Drives Housing Markets: Fundamentals or Bubbles? The Journal of Real Estate Finance and Economics 55: 395–415. [Google Scholar] [CrossRef]

- Observatorio Urbano. 2022. MINVU. Estadísticas Habitacionales. January 1. Available online: https://www.observatoriourbano.cl/estadisticas-habitacionales/ (accessed on 3 March 2022).

- Randolph, Bill, and Andrew Tice. 2014. Suburbanizing Disadvantage in Australian Cities: Sociospatial Change in an Era of Neoliberalism. Journal of Urban Affairs 36: 384–99. [Google Scholar] [CrossRef]

- Reid, Carolina K. 2017. Financialization and the Subprime Subject: The Experiences of Homeowners during California’s Housing Boom. Housing Studies 32: 793–815. [Google Scholar] [CrossRef]

- Sabaté, Irene. 2016. Mortgage Indebtedness and Home Repossessions as Symptoms of the Financialisation of Housing Provisioning in Spain. Critique of Anthropology 36: 197–211. [Google Scholar] [CrossRef]

- Sabatini, Francisco, Alejandra Rasse, María Paz Trebilcock, and Ricardo Greene. 2020. Ciudad y Segregación Vapuleadas Por El Capitalismo. Crítica de Los Enfoques Idealistas. Urbano 23: 8–17. [Google Scholar] [CrossRef]

- Sanfelici, Daniel, and Ludovic Halbert. 2014. Financial Markets, Developers and the Geographies of Housing in Brazil: A Supply-Side Account. Urban Studies 53: 1465–85. [Google Scholar] [CrossRef]

- Toro, Fernando, and Hernan Orozco. 2018. Concentración y Homogeneidad Socioeconómica: Representación de La Segregación Urbana En Seis Ciudades Intermedias de Chile. Revista de Urbanismo 1: 1–21. [Google Scholar] [CrossRef]

- Vergara-Perucich, Francisco. 2019. Urban Design Under Neoliberalism: Theorising from Santiago. London: Routledge. [Google Scholar]

- Vergara-Perucich, Francisco. 2021a. Precios y Financierización: Evidencia Empírica En Mercado de La Vivienda Del Gran Santiago. Revista INVI 36: 1–30. [Google Scholar] [CrossRef]

- Vergara-Perucich, Jose Francisco. 2021b. Urban determining factors of housing prices in Chile: A statistical exploration. Urbano 24: 40–51. [Google Scholar] [CrossRef]

- Vergara-Perucich, Jose Francisco, and Camillo Boano. 2019. Vida Urbana Neoliberal: Estudio de Factores de Jerarquización y Fragmentación Contra El Derecho a La Ciudad En Chile. Revista de Direito Da Cidade 11: 426–52. [Google Scholar] [CrossRef]

- Vergara-Perucich, José Francisco, and Carlos Aguirre-Nuñez. 2020. Housing Prices in Unregulated Markets: Study on Verticalised Dwellings in Santiago de Chile. Buildings 10: 6. [Google Scholar] [CrossRef]

- Wang, Jianing, and Chyi Lin Lee. 2022. The Value of Air Quality in Housing Markets: A Comparative Study of Housing Sale and Rental Markets in China. Energy Policy 160: 112601. [Google Scholar] [CrossRef]

- Wilhelmsson, Mats. 2020. What Role Does the Housing Market Play for the Macroeconomic Transmission Mechanism? Journal of Risk and Financial Management 6: 112. [Google Scholar] [CrossRef]

- Wu, Changshan, and Rashi Sharma. 2012. Housing Submarket Classification: The Role of Spatial Contiguity. Applied Geography 32: 746–56. [Google Scholar] [CrossRef]

- Yang, Yang, Mingquan Zhou, and Michael Rehm. 2019. Housing Prices and Expectations: A Study of Auckland. International Journal of Housing Markets and Analysis 13: 601–16. [Google Scholar] [CrossRef]

| Variables | Obs | Min. | Max. | Mean | St. Dv. | Kurtosis |

|---|---|---|---|---|---|---|

| Housing Prices (ln) | 472,000 | 2020 | 5060 | 3658 | 0.434 | 1.554 |

| IPSA (Santiago Blue Chip Index) (ln) | 472,000 | 7810 | 8670 | 8341 | 0.155 | 1.304 |

| Monetary Policy Rate Chilean Central Bank (ln) | 472,000 | −0.690 | 2090 | 1157 | 0.554 | 4.419 |

| Cash Circulation (ln) | 472,000 | 13,770 | 14,820 | 14,414 | 0.292 | −1.145 |

| Inflation (ln) | 472,000 | 9940 | 10,220 | 10,080 | 0.085 | −1.381 |

| Mortgage Interest Rate (ln) | 472,000 | 1150 | 1800 | 1378 | 0.119 | 0.395 |

| CSI 300 (ln) | 472,000 | 7560 | 8570 | 8004 | 0.206 | −0.808 |

| FTSE 100 (ln) | 472,000 | 8260 | 8960 | 8743 | 0.135 | 1.010 |

| Dow Jones (ln) | 472,000 | 8900 | 10,190 | 9646 | 0.285 | −0.487 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 10,906.55 | NA | 8.32 × 10−33 | −48.32617 | −48.24412 | −48.29383 |

| 1 | 11,195.36 | 564.8127 | 3.31 × 10−33 | −49.24772 | −48.42725 * | −48.92437 * |

| 2 | 11,288.50 | 178.4303 | 3.14 × 10−33 | −49.30155 | −47.74266 | −48.68719 |

| 3 | 11,375.56 | 163.3013 | 3.06 × 10−33 | −49.32840 | −47.03109 | −48.42303 |

| 4 | 11,458.73 | 152.7111 | 3.03 × 10−33 | −49.33807 | −46.30233 | −48.14168 |

| 5 | 11,537.39 | 141.2606 | 3.07 × 10−33 | −49.32766 | −45.55350 | −47.84026 |

| 6 | 11,639.13 | 178.6770 | 2.82 × 10−33 * | −49.41966 * | −49.0708 | −47.64125 |

| 7 | 11,714.53 | 129.3867 | 2.91 × 10−33 | −49.39479 | −44.14378 | −47.32537 |

| 8 | 11,766.53 | 87.17210 | 3.33 × 10−33 | −49.26621 | −43.27677 | −46.90576 |

| 9 | 11,833.97 | 110.3534 | 3.58 × 10−33 | −49.20606 | −42.47821 | −46.55461 |

| 10 | 11,909.86 | 121.1604 | 3.71 × 10−33 | −49.18342 | −41.71714 | −46.24095 |

| 11 | 11,966.63 | 88.35669 | 4.20 × 10−33 | −49.07595 | −40.87124 | −45.84246 |

| 12 | 12,029.92 | 96.00096 | 4.64 × 10−33 | −48.99745 | −40.05432 | −45.47295 |

| 13 | 12,086.15 | 83.02446 | 5.31 × 10−33 | −48.88757 | −39.20602 | −45.07206 |

| 14 | 12,139.93 | 77.27138 | 6.16 × 10−33 | −48.76686 | −38.34689 | −44.66034 |

| 15 | 12,214.02 | 103.5024* | 6.57 × 10−33 | −48.73624 | −37.57784 | −44.33870 |

| 16 | 12,286.64 | 98.54849 | 7.09 × 10−33 | −48.69909 | −36.80227 | −44.01054 |

| 17 | 12,359.48 | 95.93558 | 7.68 × 10−33 | −48.66290 | −36.02766 | −43.68334 |

| 18 | 12,432.43 | 93.16378 | 8.37 × 10−33 | −48.62719 | −35.25352 | −43.35661 |

| 19 | 12,508.79 | 94.47243 | 9.05 × 10−33 | −48.60660 | −34.49451 | −43.04501 |

| 20 | 12,584.95 | 91.19765 | 9.87 × 10−33 | −48.58516 | −33.73465 | −42.73256 |

| Variable | p-Value | Lags | Obs |

|---|---|---|---|

| Housing Prices | 5.14 × 10−20 | 15 | 470 |

| IPSA | 4.11 × 10−27 | 15 | 470 |

| Monetary Policy Rate | 1.25 × 10−9 | 15 | 470 |

| Cash Circulation | 1.72 × 10−11 | 15 | 470 |

| Inflation | 6.25 × 10−17 | 15 | 470 |

| Mortgage Interest Rate | 3.80 × 10−12 | 15 | 470 |

| CSI 300 | 1.99 × 10−38 | 15 | 470 |

| FTSE 100 | 6.04 × 10−29 | 15 | 470 |

| Dow Jones | 1.22 × 10−36 | 15 | 470 |

| Variables on Housing Prices | Lags | Engle-Granger Coefficient | p-Value |

|---|---|---|---|

| IPSA | 15 | −7.1113275 | 0.01 |

| Monetary Policy Rate | 15 | −6.8507553 | 0.01 |

| Cash Circulation | 15 | −7.6780385 | 0.01 |

| Inflation | 15 | −7.5782503 | 0.01 |

| Mortgage Interest Rate | 15 | −7.6728005 | 0.01 |

| CSI 300 | 15 | −7.7215235 | 0.01 |

| FTSE 100 | 15 | −7.8595879 | 0.01 |

| Dow Jones | 15 | −7.6870395 | 0.01 |

| Lags | Null Hypothesis: | Cash Circulation Does Not Granger Cause Housing Prices | CSI 300 Does Not Granger Cause Housing Prices | Dow Jones Does Not Granger Cause Housing Prices | FTSE 100 Does Not Granger Cause Housing Prices | Mortgage Interest Rate Does Not Granger Cause Housing Prices | IPSA Does Not Granger Cause Housing Prices | Monetary Policy Rate Does Not Granger Cause Housing Prices | Inflation Does Not Granger Cause Housing Prices |

|---|---|---|---|---|---|---|---|---|---|

| 15 | F-Statistic | 1.66765 | 1.31067 | 1.85615 | 2.31413 | 1.91560 | 1.62597 | 4.23989 | 0.86258 |

| Prob. | 0.0545 | 0.1915 | 0.0258 | 0.0035 | 0.0202 | 0.0638 | 0.0000002 | 0.607 | |

| 14 | F-Statistic | 1.21990 | 1.23327 | 1.79310 | 2.37369 | 2.13138 | 1.57166 | 4.15127 | 0.84689 |

| Prob. | 0.2572 | 0.2476 | 0.0373 | 0.0035 | 0.0097 | 0.0838 | 0.0000008 | 0.6177 | |

| 13 | F-Statistic | 1.33299 | 1.24443 | 1.90314 | 2.51838 | 2.24169 | 1.38144 | 4.16712 | 0.82436 |

| Prob. | 0.1901 | 0.2447 | 0.028 | 0.0024 | 0.0076 | 0.1646 | 0.000002 | 0.6343 | |

| 12 | F-Statistic | 1.28750 | 1.16250 | 2.32321 | 3.05399 | 2.57383 | 1.37502 | 4.72740 | 0.84739 |

| Prob. | 0.2226 | 0.3079 | 0.0069 | 0.0004 | 0.0026 | 0.1745 | 0.0000003 | 0.6013 | |

| 11 | F-Statistic | 1.23002 | 1.13423 | 2.61586 | 3.37394 | 2.88455 | 1.20657 | 5.14049 | 0.95678 |

| Prob. | 0.2642 | 0.3324 | 0.0031 | 0.0002 | 0.0011 | 0.2799 | 0.0000001 | 0.4855 | |

| 10 | F-Statistic | 1.48642 | 1.05652 | 1.54485 | 2.28446 | 3.24311 | 1.17396 | 3.56911 | 1.14528 |

| Prob. | 0.1414 | 0.3949 | 0.1208 | 0.0129 | 0.0005 | 0.3063 | 0.0001 | 0.3266 | |

| 9 | F-Statistic | 1.68988 | 1.03540 | 1.82947 | 2.36826 | 3.89792 | 1.25146 | 4.15348 | 1.33111 |

| Prob. | 0.089 | 0.4105 | 0.061 | 0.0127 | 0.00009 | 0.2616 | 0.00004 | 0.2182 | |

| 8 | F-Statistic | 1.95529 | 1.28220 | 1.80430 | 1.98247 | 3.78079 | 1.49112 | 4.83081 | 1.45661 |

| Prob. | 0.0505 | 0.2506 | 0.0743 | 0.0471 | 0.0003 | 0.158 | 0.00001 | 0.1709 | |

| 7 | F-Statistic | 1.88608 | 1.52580 | 2.42361 | 2.58599 | 3.75622 | 1.54800 | 3.54258 | 1.88767 |

| Prob. | 0.0701 | 0.1564 | 0.0191 | 0.0127 | 0.0006 | 0.1491 | 0.001 | 0.0698 | |

| 6 | F-Statistic | 2.54386 | 1.77635 | 3.11327 | 3.31692 | 4.56755 | 1.58742 | 2.82957 | 2.27513 |

| Prob. | 0.0197 | 0.1022 | 0.0053 | 0.0033 | 0.0002 | 0.149 | 0.0103 | 0.0356 | |

| 5 | F-Statistic | 4.09431 | 1.72642 | 3.86161 | 4.18497 | 4.69034 | 1.99215 | 3.62522 | 3.15170 |

| Prob. | 0.0012 | 0.1271 | 0.0019 | 0.001 | 0.0003 | 0.0785 | 0.0032 | 0.0083 | |

| 4 | F-Statistic | 6.39456 | 1.95411 | 5.98701 | 6.23305 | 6.50166 | 2.92652 | 4.11817 | 5.04417 |

| Prob. | 0.00005 | 0.1005 | 0.0001 | 0.00007 | 0.00004 | 0.0207 | 0.0027 | 0.0005 | |

| 3 | F-Statistic | 9.66062 | 2.34576 | 8.54242 | 8.97276 | 9.88393 | 3.50615 | 5.43691 | 8.03374 |

| Prob. | 0.000003 | 0.0722 | 0.00002 | 0.000009 | 0.000003 | 0.0154 | 0.0011 | 0.00003 | |

| 2 | F-Statistic | 20.0068 | 3.92675 | 17.1855 | 17.7262 | 14.3311 | 7.67253 | 3.57453 | 16.4387 |

| Prob. | 0.000000005 | 0.0204 | 0.00000006 | 0.00000004 | 0.0000009 | 0.0005 | 0.0288 | 0.0000001 | |

| 1 | F-Statistic | 40.9455 | 7.14528 | 34.8067 | 36.5728 | 30.8936 | 16.8868 | 4.81535 | 33.4936 |

| Prob. | 4 × 10−10 | 0.0078 | 0.000000007 | 0.000000003 | 0.00000005 | 0.00005 | 0.0287 | 0.00000001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vergara-Perucich, J.-F. Is There Financialization of Housing Prices? Empirical Evidence from Santiago de Chile. Economies 2022, 10, 125. https://doi.org/10.3390/economies10060125

Vergara-Perucich J-F. Is There Financialization of Housing Prices? Empirical Evidence from Santiago de Chile. Economies. 2022; 10(6):125. https://doi.org/10.3390/economies10060125

Chicago/Turabian StyleVergara-Perucich, José-Francisco. 2022. "Is There Financialization of Housing Prices? Empirical Evidence from Santiago de Chile" Economies 10, no. 6: 125. https://doi.org/10.3390/economies10060125

APA StyleVergara-Perucich, J.-F. (2022). Is There Financialization of Housing Prices? Empirical Evidence from Santiago de Chile. Economies, 10(6), 125. https://doi.org/10.3390/economies10060125