1. Introduction

With the considerable motivation from globalization and capital account openness, labour mobility becomes essential in managing labour market equilibrium in both developed and emerging countries. Associated with this mobility, remittances by migrants flow from remitting countries to recipient countries and have considerable effects on economies from different perspectives. For instance, remittance flows to recipient countries are essential in managing the balance of payments and an important source of foreign exchange reserves. It plays a considerable role in enhancing national savings and raising money’s velocity (

Mehta et al. 2021).

On the other hand, remittance outflows through several channels could affect the macroeconomics of remitting countries. Remittance outflows could raise the interest rate by reducing the money supply and foreign reserves by lowering customers’ loans for investment and decreasing current consumption spending in the economic system. In addition, remittance outflows could cause depreciation of the actual exchange rate and the current account deficit. From these perspectives, remittance outflows are assumed to negatively impact the economy (

Alkhathlan 2013;

Khan et al. 2019;

Alsamara 2022). From another perspective, remittance outflows could decrease the inflationary pressure associated with increasing government expenditure and thus stabilize the aggregate demand and business cycle (

Termos and Genc 2013). Furthermore, remittance outflows may mitigate the negative effects of the actual currency rate rise brought on by the oil boom (

Razgallah 2008).

Despite that, the effect of remittance inflows has been paid considerable interest in academic writing; there is not much work on the impacts of outflows of remittances in remitting economies (

Alkhathlan 2013;

Khan et al. 2019;

Alsamara 2022). This could be due to the insignificant ratio of remittances outflows to GDP (

Alsamara 2022). However, in specific countries like Saudi Arabia, remittance outflows are considered an essential macroeconomic variable. As an oil-dependent economy, the increase in oil price and thus the government’s revenue of oil are usually transmitted through government expenditure to finance economic development plans that require highly skilled human capital. The lack of local skilled labour leads to further dependency on external labour. In addition, the increase in government expenditure would motivate investment in the private sector and further increase the need for external labour. The reliance on external labour while bridging the demand gap in the labour force increases the cash flows out of the Saudi economy. These remittance outflows are considered a leakage from the cyclical flow of income that reduces the money supply’s amount.

Consequently, it is supposed that remittance outflows harm the economy’s improvement. The impact of outflows of remittances on economic growth should be of high interest to policymakers who aim to maximize the benefit of revenues and rationalize the expenditure on economic development. Therefore, this research seeks to investigate the impact of remittance outflows on non-oil economic development in Saudi Arabia using recent data containing several economic reforms led by impetuous Vision 2030 to develop the Saudi non-oil financial sector. Although few studies have been established on remittance outflows and their relation to economic growth, these studies use models that implicitly assume that the dependency between economic development and remittance outflows is symmetrical. However, remittances are directly affected by the oil price changes, where oil price increases could have different impacts than oil price decreases (

Hathroubi and Aloui 2016). Thus, the effects of negative and positive shocks of remittance outflows on GDP could differ in magnitude and significance. This paper examines the nonlinear nexus between economic development and remittance outflows.

The findings of this study will help policymakers, regulators, and service providers who enable remittances and investments to establish regulations that will maintain remittance inflows and target the right cohorts for their services.

For this purpose, we used the NARDL, to investigate the impact of remittance outflows on Saudi Arabia’s NOGDP. We find that employment force and remittance outflows (both beneficial and negative) are the key predictors of NOGDP using the NARDL model. Moreover, the negative and positive changes in remittance outflows asymmetrically affect remittances. The following is the rest of this empirical investigation. The literature review is presented in

Section 2. The approach used in this investigation is described in

Section 3. The empirical findings are investigated and explained in

Section 4. Then, finally,

Section 5 ends with conclusions.

3. Methodology and Data

This paper aims to analyze the interrelationship between remittance outflows and economic development using annual data from 1990–2020. Pesaran suggested an ARDL and NARDL bound testing approach (2001) to investigate how this relationship affects economic growth empirically. NOGDP, labour force, capital formation, and remittance outflows are all included in our dataset. The growth of NOGDP is obtained to be our indicator of economic growth for at least two reasons. First, NOGDP is more appropriate to measure the actual economic activities in Saudi Arabia due to its exclusion of the oil GDP, which is more related to changes in oil prices and affected by geopolitical risks. Secondly, focusing on the determinants of NOGDP is more suiChart to yield policy implications for policymakers who, according to the 2030 vision, aim to develop the non-oil sectors and decrease the dependency on oil.

Table 1 includes the variables used in the approach and a brief description, name, and data source for each variable.

In specifying the economic growth of Saudi, a set of explanatory variables has been set. This study aims to analyze the short and long-run relationships between remittance outflows and the development economy of non-oil sectors during the 1990–2020 periods. We start our survey by describing data. In the second step, we defined the econometric model by writing the ARDL and NARDL models. The results of tests and estimates are designed in step three.

Data and their descriptive statistics are shown in

Table 2 as follows:

The annual average growth rates of NOGDP, labour force, and population are all shown in the descriptive data. Capital formation and remittances outflows are approxi-mately 13, 9, 25, and 16% in the full sampling period. These variables have astronomi-cally massive standard deviations, much exceeding the mean and median, indicating Saudi Arabia’s level of economic uncertainty. In particular, for NOGDP and remittances outflow, aberrant distribution as defined by kurtosis and skewness tests boosts these out-comes. With more considerable standard deviations, NOGDP is more volatile.

These descriptive statistics, on the whole, paint a picture of economic indicator vola-tility. As a result, empirical studies are needed to highlight this instability and to study the impact of these widely varying variables on Saudi Arabia’s NOGDP per capita.

Our model includes the most important variables used in the neoclassical growth model: physical capital and labour force. We assume that remittances outflowing negatively influences non-oil economic growth due to the economy’s unique traits. Saudi Arabia is one of the major countries in terms of outflows. As a result, the log-linear stationary model of economic growth function is as follows:

The research concentrates on the short-long-term relationships between NOGDP, labour, physical capital, and remittance outflows in Saudi Arabia.

The econometric model used for examination comes in the following form:

where:

t: White-noise disturbance term.

Y,

CF, and

LFT are NOGDP, labour force, and capital formation, and RMO is the remittance outflows, respectively.

LFT and

CF are predicted to have beneficial effects on NOGDP; however, remittance outflows are expected to have negative effects. According to Equation (2), the relationship between NOGDP and its explanatory variables is linear. Changes in oil price directly impact the economy, with oil price hikes having a more distinct impact than oil price declines (

Hathroubi and Aloui 2016). Assuming the linear effect of remittances outflow on NOGDP could lead to misleading results, as a result, we will estimate a nonlinear model of NOGDP in which remittances outflow (

RMO) should have an unbalanced effect on NOGDP in the Saudi economy. As a result, we deconstruct the explanatory variable term (

RIM) into positive and negative charges, producing the NARDL form of Equation (2) as shown below:

The empirical technique that will be utilized to examine the impact of outflow remittances and other explanatory variables on Saudi Arabia’s NOGDP is explained in this section. To do this, we employ a unique advanced econometric technique developed by

Shin et al. (

2014): the nonlinear Autoregressive Distributed Lag (ARDL) model. The nonlinear ADRL model is an atypical variation of

Pesaran et al. (

2001). This strategy avoids categorizing variables as I(1) or I(0) by creating crucial value bands that identify whether the variables are stationary or non-stationary processes. Different from the previous cointegration procedures (e.g., Johansen’s procedure), the linear ARDL model gives an alternate test for assessing a long-run connection regarding whether these underlying variables are purely I(0) or I(1), even if fractionally integrated. As a result, unit root testing of the variables is no longer required.

Furthermore, typical cointegration methods may have endogeneity issues, whereas the ARDL technique can discriminate between dependent and explanatory variables. As a result, estimates generated using the ARDL technique of cointegration analysis are unbiased and efficient, as they avoid the issues that can develop when serial correlation and endogeneity are present. Nevertheless, Pesaran and Shin concluded that modifying the ordering of the ARDL model appropriately is enough to adjust for residual serial correlation and endogenous variable problems concurrently.

Once cointegration between variables has been proven, we apply the VECM Granger causality technique to evaluate the direction of causation between variables.

The VECM is a VAR limitation. The ECT (error correction term) is a cointegration term that causes endogenous variables to converge to cointegration relationships while allowing for short-term dynamic changes. The VECM can be used to estimate short-term partnerships, whereas the ECT can be used to confirm the existence of long-term relationships.

Narayan and Smyth (

2006) proposed that short-run causal relationships will be modelled by using an autoregressive vector framework (VAR) as follows:

Y is the dependent variable (NOGDP), and p, q, θ, , , µ, , are the long-run and short-run coefficients that need to be calculated.

The vector error correction model (VECM) will be practiced to conduct Granger-causality tests. The equation of VECM is modeled as follows:

where

,

γ,

δ,

ϵ,

ϑ,

μ,

π are parameters to be estimated;

is the white noise error term; ECT is the error correction term which represents the long-run equilibrium relationship.

Shin et al. (

2014) derived the dynamic error correction representation related to a long-run asymmetric cointegration regression, leading to the construction of a NARDL model. In addition, these authors proposed asymmetric cumulative dynamic multipliers to plot the adjustment model, following positive and negative shocks of the exogenous variables. They introduced the following asymmetric long-run regression (

Shin et al. 2014):

represents the long-run coefficient related to positive changes in

xt,

is the long-run coefficient related to positive changes with negative changes in

, and

is decomposed as

, where

and

are partial sum processes of positive and negative changes in

:

If we take

as the remittance outflows, the remittance outflows shocks will be calculated according to the method of

Mork (

1989) where they are represented as follows:

represents increases in remittance outflows (LRMO), and represents decreases in remittance outflows.

We consider the following nonlinear ARDL model:

where

is a vector of multiple regressors of order (

k × 1) defined,

is the autoregressive factor,

and

are the asymmetrically distributed lag parameters, and

is the error of the model with zero mean and constant variance

. In this model, we will take the case where

is decomposed into

and

.

From

Pesaran et al. (

2001), it is easy to write the previous model again in the error-corrected form:

where

4. Results and Discussion

In accordance with the findings of the unit root tests of Dickey–Fuller Augmented (ADF) Phillips–Perron (PP) obtained previously, we concluded that the variables: NOGDP, positive remittances outflows shock (Pos_LnRMO), and negative remittances outflows shock (Neg_LnRMO) are stationary at their levels, and the labour force, capital formation is stationary after its first differentiation. Therefore, we confirmed that our variables are not stationary after their second differentiation, so either they are ordered and incorporated 0 [I(0)], or they are integrated of order 1 [I(1)], so such information allows us to apply the NARDL model procedure.

The Wald test will be used in the next stage to confirm a long-run cointegration connection between NOGDP and the three explicative variables.

The optimal number of delays was selected according to the Information criterion of Akaike (AIC) and for the duration of four periods. The optimal number of lags selected is the one that satisfies the no serial correlation criteria. Furthermore, we verify the presence of the long-run relationship for the NARDL model. Similarly, we apply Wald’s test to examine short- and long-term symmetry. However, the Wald test highlights the existence of a long-run skewness and a short-run symmetry. The empirical tests for model validation,

Table 3, namely the ARCH test for heteroscedasticity, the Jacque–Bera (JB) test for normality of residuals, and the Ramsey functional form test (RESET), confirm the absence of heteroscedasticity and normality of the residuals. Alternatively, the functionality of our specifications is correct.

These tests show that NOGDP’s nonlinear estimated specification is correctly defined.

Table 4 shows the Wald test results used to determine whether there is an asymmetric influence in both the short- and long-term. In this test, the null hypothesis of symmetry is compared to the alternative hypothesis of asymmetry. The alternative hypothesis is only accepted in the long run, according to the empirical data in

Table 4. The results indicated in

Table 4 show that the F-statistic value is significant at the 10% and 5% thresholds, which confirm the existence of long-term cointegration relationships between the endogenous variable and the exogenous variables.

If the F-statistics (Wald test) proves that there is only one long-term relationship and that the sample data size is small (n ≤ 30) or finite, the representation of the NARDL becomes significantly more efficient.

In

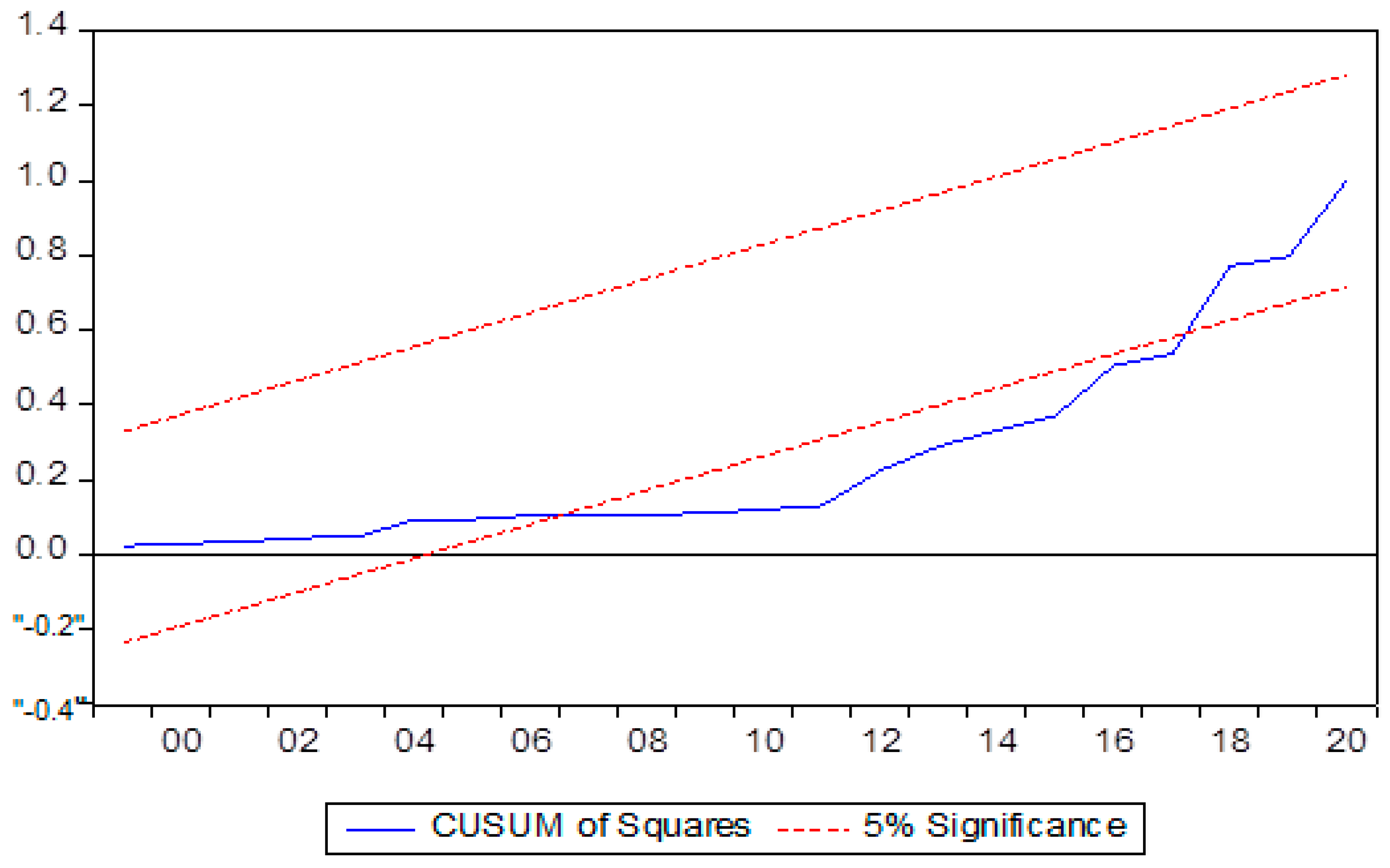

Table 5, we have employed a Breusch–Godfrey serial correlation LM test in order to detect the correlation of residuals. The results of each model show no serial correlation for residuals in both models. The results of the ARCH test indicate that models are free from heteroscedasticity and the normal distribution characterizes the distributions of error terms. In addition, we have employed the CUSUM and CUSUMSQ tests to verify the instability of NARDL model between the period 2007–2017. During this period, the instability of the model can be referred to as the global financial crisis of 2007 and the reduction in oil production of OPEC countries in 2017. The financial crisis in 2007 was mentioned by a liquidity crisis and caused a scarcity of credit to companies. This crisis has its origin in the deflation of price bubbles (including the American real estate bubble of the 2000s) and the large losses of financial companies caused by the subprime crisis. It was part of the “Great Recession” that started in 2008 and whose effects are felt beyond 2010.

The reduction in oil production by OPEC in 2017 caused significant losses of revenues for the world’s largest exporter and initiated the uncertainties weighing on the evolution of hydrocarbon prices. However, with the reforms launched by Riyadh under the vision of the new Crown Prince Mohammed bin Salman to free the country from its excessive dependence on oil, the growth of NOGDP became more notable. The results of the two shocks (2007 and 2017) appear in

Figure 1 and

Figure 2, where statistics should be between the critical bounds.

In the next step, we want to develop a causality test. In this way, we say that a causality test is a statistical hypothesis for determining whether one time series is a factor and offers helpful information in forecasting another time series. For our case, given a question: Could the variable NOGDP cause other variables, or do all other variables cause or not cause NOGDP?

Table 6 recapitulates the different results of the causality estimate.

According to the causality estimate, FC, RMO, RMO-POS, and RMO-NEG all positively affect NOGDP (

Figure 3). The various outcomes of causality estimates are shown in

Table 7.

All of our variables are I(0) and I(1); in this case, we can directly pass to estimate a bound cointegration relationship by using ARDL and NARDL models. In recent econometric literature, we prefer to use this new evidence and not the classical VECM and VAR model. Therefore, we estimate our specification using the NARDL model in the next step.

Table 7 shows all results of linear and nonlinear ARDL estimation

The error correction term’s calculated coefficients are negative and statistically significant. This astonishing conclusion has implications for NOGDP. The estimated long-term coefficients indicate that labour force and remittances outflow (negative and positive changes) determine the developments of NOGDP in the economy of Saudi. The labour force has a significant and positive impact on (NOGDP) at the 1% level, and this result is consistent with the assumption of a positive impact of the labour force on non-oil economic growth. However, the impact of negative and positive shocks of remittance outflows was found to be significantly positive, in contrast to the assumption that remittance outflows have a negative influence on non-oil economic growth. This effect is asymmetric in the long run. Indeed, a 1% decrease in outflows of remittances leads to a 0.28% decrease in NOGDP (at the 10% level), whereas a 1% increase of RMO results in a 0.29% increase in NOGDP (at the 5% level).

Figure 4 shows the dynamic response of NOGDP to a negative and positive shock from remittance outflows; the graph shows that the impact of a negative shock (LRMO) dominates that of a positive shock (LRMO).

The unexpected positive impact of remittance outflows, in the long run, could be explained from several perspectives. First, most foreign laborer’s instantly and directly remit their monthly wages to their home countries (

Alkhathlan 2013). Consequently, analyzing the impact of remittances outflow on NOGDP via the channels suggested in the literature (foreign reserves, real exchange rate, and interest rate) could not be observed in the case of Saudi, especially with annual data. There has also been no chart in

Alkhathlan’s (

2013) results that found an insignificant long-run effect of remittances on Saudi GDP. Second, remittance outflows are usually associated with oil revenue and economic boom, which motivates the economic development plans and increases the skilled and productive labour force usually imported from the outworld. Therefore, the remittance outflows could work as an indicator of the stock of migrants (

Razgallah 2008), and it is a part of the returns on their contribution to the development of the non-oil sector. Research shows that foreign labour has played an essential role in developing the non-oil private sector and in expanding the diversification of Arab Gulf Countries’ economies (

Razgallah 2008;

Goyal 2003). Supporting this judgment is the strong positive impact of the labour force on NOGDP, as recorded in the results. According to the findings, the labour force is the most important determinant of NOGDP and is regarded as a strong driver of economic expansion. The error correction term’s calculated coefficients are negative and statistically significant. This astonishing conclusion has implications for NOGDP.

5. Conclusions and Policy Implications

The paper examines the dynamic effects of the cointegration between remittance outflows and NOGDP in the long and short terms using data covering the period between 1990 and 2020. The model consists of the labour force, capital formation, and remittance outflows. The NARDL technique was applied to assess the long and short-run asymmetric effects of cash outflows on the NOGDP. The empirical findings show that remittance outflows in the Saudi economy have an unbalanced and considerable impact on NOGDP. However, the positive coefficients of negative and positive shocks in remittance outflows indicate the benefits of remittance outflows to the Saudi non-oil sector.

The positive impact of remittances on the economic growth of Saudi is an important outcome that policymakers should consider in this regard. Remittance outflows, which could be an indicator of foreign labour stock, are usually associated with oil revenue and an economic boom that motivates the economic development projects. This increases the imported high-skilled and productive labour force, which plays a vital role in developing the non-oil private sector. Consequently, specific Saudi policies are needed to maintain this positive effect of the imported labour force and avoid its suggested adverse impact on the literature.

Therefore, Saudi Arabia’s labour market is characterized by a prolonged unemployment rate, a low private employment ratio, and a low labour participation rate for nationals. The system has a wide variety of labour market interventions to address these issues.

This empirical study uses the autoregressive distributed lag model to examine the existence of a long-run equilibrium relationship between all variables. The verification reveals that there is a strong long-run cointegration. The strength of the autoregressive distributed lag bounds test cointegration was confirmed using the newly developed combined cointegration, which also provided the same evidence for a strong long-run relationship. In the short term, the results confirm the existence of a causal relationship.

This could be through creating a diversified and competitive labour market that attracts a productive and high skilled labour force, creating interactive activities between local and foreign labour force that help to transmit the high skills and effective practices to the local labour force, encouraging foreign workers to spend in the economy of Saudi through developing the entertainment and tourism sector.