Abstract

The relationship between green technology innovation and corporate financial performance has gained considerable traction in academics and businesses. However, there is limited overall bibliometric analysis on this topic. To meet the research need, this study, using Citespace (Citespace5.8r3 version, ChaomMei Chen, Philadelphia), performed the bibliometric analysis of the relationship between green technology innovation and corporate financial performance from 2007 to 2021, with 251 academic papers published in the Web of Science databases being analyzed, thus identifying the research hotspots and trends. The results showed that: (i) the number of publications has moved from slow to rapid growth and is expected to ramp up further; (ii) only a small collaboration network has been formed among the authors; (iii) institutions’ work operates relatively independently. There is still more room for inter-institutional or cross-discipline cooperation against geographical regions. However, there is a strong network of cooperation among countries. China performs best in this research area, followed by Spain and the UK; (iv) several significant co-citation relationships are also formed in the literature network. The burst literature on green innovation, product innovation, and financial performance is considered a research hotspot; and (v) “green innovation”, “corporate performance”, “legitimacy”, “environmental disclosure”, and “corporate sustainability” have become trends in research. Our results provide academics and practitioners with a robust roadmap on the relationship between green technology innovation and corporate financial performance.

1. Introduction

The study of the relationship between green technology innovation and corporate financial performance can provide valuable insights into sustainable innovation strategies for managers (Frempong et al. 2021). As the issue of global environmental degradation attracts scholars’ attention, it is also a widespread concern of firms and policymakers (Su et al. 2021). A growing number of entrepreneurs are becoming aware of their dependence on the environment. As a result, they are more heedful of financial returns and their contribution to the society and environment (Akbar et al. 2021). Considering the stakeholders’ requirements and institutional environmental pressures, the link between environmental sustainability and corporate financial performance is catching the spotlight (Rabadán et al. 2019; Jan et al. 2019; de Padua et al. 2020). It is believed that this link is essential to the commercial success (Chen and Liu 2018). Consistent with these developments, the relationship between green technology innovation and corporate financial performance currently occupies a prominent position in the broad research community (Wang et al. 2021; Ma et al. 2021; Li et al. 2021). For example, the existing literature on some topics deals with this relationship including environmental regulations (Ren et al. 2022), proactive environmental strategy (Ahmed et al. 2021), eco-innovation (Salim et al. 2019), environmental innovation (Ren et al. 2021), and corporate social responsibility (Sardana et al. 2020). Although hundreds of studies on this topic are in existence, the findings have been inconsistent and disappointing, most of which considering the relationship between green technology innovation and corporate financial performance to be positive (de Azevedo Rezende et al. 2019; Lin et al. 2019), which can not only bring benefits to consumers and firms, but also significantly release the environmental burden (e.g., in energy conservation, pollution prevention, waste recycling, green product design, and environmental management). However, other studies have shown that this relationship is negative (Baah et al. 2021a), U-shaped (Riillo 2017; Jin and Xu 2020) and inverted U-shaped (Deng and Li 2020; Zhang et al. 2020).

In addition, previous studies consider the theoretical predictive motives of the relationship between green technology innovation and corporate financial performance. Scholars have proposed four dominant theories for studying the relationship, namely resource-based view (Russo and Fouts 1997), legitimacy theory (Preston and O’Bannon 1997), institutional theory (Aguilera-Caracuel and Ortiz-de-Mandojana 2013), and stakeholder theory (Weng et al. 2015), all of which have been used in the literature on the relationship. The resource-based view provides a tool for environmental innovation researchers. It clarifies the relationship between internal resources, technological capabilities, and performance, which forms the basis for a holistic discussion of the relationship between green technology innovation and corporate financial performance (Cheng et al. 2014; Tariq et al. 2019; Johl and Toha 2021). Moreover, legitimacy theory holds that public disclosure of environmental and social information for a way of the firm’s continued existence or legitimizing to society (Gray and Lavers 1995). Scholars have suggested that environmental disclosure can positively or negatively influence financial performance and profitability by building on legitimacy theory (Neu et al. 1998). For example, the authors who find a negative relationship argue that disclosing CSR is a disadvantage for stakeholders since firms must expend significant resources in fulfilling their social responsibilities (Preston and O’Bannon 1997). However, other scholars argue that legitimacy pressure significantly impacts green innovation and positively influences corporate financial performance (Li et al. 2017; Nguyen et al. 2021). Thus, the theory also provides a comprehensive theoretical perspective to study the relationship between green technology innovation and financial performance. Furthermore, institutional theory suggests that a firm’s environmental management practices and policies also depend on its national institutional context (Kostova and Roth 2002). The effects of green innovation on a firm’s financial, social and environmental outcomes are equally likely to be highly influenced by the national institutional context (e.g., environmental regulatory and normative dimensions) in which the firm conducts its activities (Li et al. 2017; Zhang et al. 2021). Besides, another compelling argument behind the motivation of firms to engage in green technology innovation is based on stakeholder theory (Baah et al. 2021b). Increasingly, firms use green technology innovation to promote socially responsible action and respond effectively to stakeholder needs (Weng et al. 2015). These existing studies are critical for academics and businesses working on sustainable innovation (Cupertino et al. 2021).

With this in mind, we want to get a comprehensive understanding of the contributions of the literature on the relationship between green technology innovation and corporate financial performance in the academic field. Specifically, we wonder about the following research questions: (i) Is the number of relevant publications still growing? (ii) Who are the influential contributors to this field? (iii) Which countries, research institutions, and journals are the most active parts of this study? (iv) What are the field’s knowledge clusters of research hotspots? (v) What are the research frontiers and trends in the field? Although several scholars have reviewed the existing literature on some topics, such as green innovation (Albort-Morant et al. 2017; Yin et al. 2018; Karimi Takalo et al. 2021), green and low carbon technology innovation (Shi and Lai 2013), sustainability innovation and financial performance (Alshehhi et al. 2018; Bartolacci et al. 2020), environmental innovation impacts on financial performance (Molina-Azorín et al. 2009; Albertini 2013; Hizarci-Payne et al. 2021), and corporate social responsibility (Ye et al. 2020; Losse and Geissdoerfer 2021). However, to our knowledge, there is still limited systematic bibliometric review covering these issues on the relationship between green technology innovation and corporate financial performance. In particular, focus on the perspective of corporate financial performance and the help of computer software such as Citespace. Therefore, to address this critical research gap and deal with the above questions, we conducted a quantitative bibliometric analysis of the relationship between green technology innovation and corporate financial performance with the help of Citespace tool. By obtaining a sample of publications from the Web of Science database and visually analyzing 251 articles on their relationship from 2007 (the first article was published; Russo and Fouts 1997) to 2021, in doing so, we offer a holistic, systematic, and scientific review of this field.

2. Materials and Methods

2.1. Selecting Tool

We chose bibliometric analysis as the research method to create an illustrative map of the relationship between green technology innovation and corporate financial performance. The technique of bibliometrics is based on quantitative analysis to assess a researcher’s interest in a particular field (Prashar and Sunder 2020; Yu et al. 2021). It is now widely used to measure research in various disciplines (Du et al. 2013; Chen 2017). It allows for the study of many literature entries and reveals features such as research topics, authors, publications, time frames, number of citations, research hotspots, and trends. As can be seen, the analysis of this research method objectively assesses information about the work of researchers in this field. It is sufficient for a bibliometric study of the content of our selected literature (Karimi Takalo et al. 2021; da Cunha Bezerra et al. 2020). Therefore, a literature review through a bibliometric analysis approach facilitates our review of the relationship between green technology innovation and corporate financial performance. In addition, we main use Citespace software. Knowledge is effectively mapped by analyzing the structure of various social networks of scientific publications (Losse and Geissdoerfer 2021), including author co-citation networks, national and institutional collaboration networks, and keyword co-occurrence networks. We identify the top contributing authors, the highest contributing countries and institutions, high-level journals, and research hotspots and trends for the development of the field.

2.2. Data Acquisition

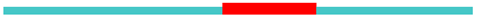

Most bibliometric analyses have a shared data source: Thomson Reuters’ Web of Science (WoS) and Elsevier’s Scopus (Mongeon and Paul-Hus 2016). However, we selected only Web of Science as the data source for our bibliometric analysis. There are two main reasons: on the one hand, it is one of the largest repositories from 1900 to nowadays, covering the best publications in a wide range of academic fields (Ye et al. 2020), ensuring that indexed articles are of high quality (Rey-Martí et al. 2016). On the other hand, the database is also the main reference data platform for existing literature review researchers (Leydesdorff et al. 2013; Mazzi et al. 2016). It includes all the bibliographic information for analysis, such as authors, citations, journals, countries/regions, and affiliations, which can meet our problem’s solution needs and help us accomplish our research objectives. In addition, we also follow the procedures of a bibliometric literature review (Hosseini et al. 2018; Hristov et al. 2021), and the steps of our data collection are shown in Figure 1.

Figure 1.

The steps of data collection.

2.2.1. Step 1: Systematic Literature Search

In the literature, four different concepts/terms are used to describe innovations that have a less negative effect on the environment. “Green”, “Eco”, “Environmental”, and “Sustainable”. To a large extent, they are synonymous, and there are only minor differences between these terms (Schiederig et al. 2012; Forsman 2013; Tariq et al. 2017). Our study uses “green technology innovation” as the core term. To adequately capture the relationship between green technology innovation and corporate financial performance, we found it necessary to include all the different terms associated with these types of innovations. This approach has also been used in previous literature reviews (e.g., Bocken et al. 2014; Gonzales-Gemio et al. 2020). Therefore, in the literature search, we follow Pittaway et al. (2004), where keywords and synonyms are combined with “OR” and “AND”. We carefully selected English peer-reviewed articles belonging to the strings TS = environmental innovation, eco-innovation, green technology innovation, green technology, and low-carbon technology and TS = financial performance. Refined document type “ARTICLE”, where the “TS” operator allows searching in titles, abstracts, and keywords, was implemented on 6 October 2021. Documents were searched from the Web of Science database. The article’s timeline covers 15 years from the first article (2007) to the most recent year (2021). Notably, we only search one element for “financial performance” since our objective focuses on the firm’s financial perspective, filling the gap in previous studies. Furthermore, although we searched strictly for it, we still obtained 1260 articles in the initial phase, as shown in Table 1.

Table 1.

Search strings for bibliometric analysis in Web of Science.

2.2.2. Step 2: Choice of Articles

Consistent with previous studies (Taherdangkoo et al. 2017; Hristov et al. 2021), we first read the 1260 documents searched. Second, we remove duplicates, topic-irrelevant, and non-firm-level articles based on the search string in Table 1. The number of articles removed is 1009. At the end of the process, 251 articles published from 2007 to 2021 are retained. The number of articles in the selection process is shown in Table 2. In addition, these records and citation meta-data were downloaded and imported into Citespace for data cleaning and analysis for our bibliometric analysis.

Table 2.

The number of articles in the selection process.

2.2.3. Step 3: Analysis of Articles

It is necessary to perform several aspects of our bibliometric literature analysis using the Citespace tool. As Prashar and Sunder (2020) suggested, a scientometric technique mainly includes author co-citation, keyword clustering, and literature co-citation. First, we measured the number of publications, authors, countries, institutions, and other indicators, and we learned whether the number of publications in the field is continuously growing? Who are the most critical contributors? Which countries and institutions are most interested in the topic? Secondly, based on a cluster analysis of the co-cited literature, we explored the high-level literature and journal in the research area. Finally, we analyzed keywords clustering to focus on the current and possible future research themes or trends.

3. Results and Discussion

3.1. Is Research on the Relationship between GTI and CFP Growing?

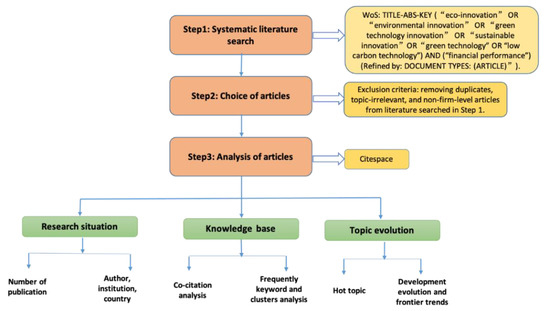

The literature on the relationship between green technology innovation and corporate financial performance has steadily and gradually expanded over the past 15 years. The number and trend of publications in this field by year from 2007 to 2021 are shown in Figure 2.

Figure 2.

Development of annual publications.

We found that the earliest published articles related to green technology innovation and corporate financial performance appeared in 2007. From 2007 to 2014, the number of related literatures is small and growing slowly, only one to seven articles per year. However, starting from 2015, the number of publications per year proliferates, reaching a peak of 56 articles by 2020. In the figure for 2021, only the number of publications from January to September is shown. Therefore, the growing trend in the literature shows that research on the relationship between green technology innovation and corporate financial performance is prevalent. The main reason for this phenomenon is that firms in various countries face many challenges from environmental changes while promoting economic growth. Seeking a sustainable development strategy in harmony with the environment has become a global issue.

3.2. Who Are the Most Productive Authors?

The author collaboration network reflects the core group of authors of the study and their collaborative relationships, and the total number of publications in journals represents, to a certain extent, the academic status of the authors in the field. Therefore, by analyzing the number of authors’ publications and the links between authors, we can identify the highly productive authors and high-impact authors in this field of the relationship between green technology innovation and corporate financial performance. Table 3 lists the top 10 authors with the highest number of published articles on the relationship between green technology innovation and corporate financial performance. In addition, the author and collaborative network knowledge graphs are shown in Figure 3.

Table 3.

Top ten most prolific authors.

Figure 3.

Knowledge map of authors and collaborative networks.

It can be seen from Table 3. The number of publications per author is relatively small; the top three are Yaw Agyabengmensah with six, Ebenezer Afum with five, Charles Baah, and Chee Yew Wong with three, respectively, and the other authors with two or fewer publications. Among them, Yaw Agyabengmensah is the most productive author, whose works are highly collaborative with other writers and have a variety of subjects. By analyzing his papers’ relative importance and high citation rate, we found that most of his papers are on green supply chain management and performance. For example, one of the topics includes exploring the impact of green logistics management practices on financial performance and examining the mediating effects of market, environmental and social performance (Agyabeng-Mensah et al. 2020). The study by Afum et al. (2020) explored the links between green manufacturing practices, operational competitiveness, corporate reputation, and sustainable performance dimensions, emphasizing that green manufacturing has a significant positive impact on social, economic, and environmental performance. Also, social performance was found to play a mediating role in the relationship between green manufacturing and economic performance. CHARLES BAAH’s research mainly emphasizes the impact of green manufacturing practices on firm performance (e.g., Baah et al. (2021a)). explored the impact of environmental production practices on firm performance from both active and passive perspectives and found that active environmental production practices were positively associated with the process and environmental performance but were negatively associated with financial performance. Meanwhile, Baah et al. (2021b). explored how green legitimacy and regulatory stakeholder requirements drive the adoption of environmental and social responsibility and the impact of its implementation on environmental and financial performance in emerging economies. He found a significant positive effect of environmental responsibility on environmental performance, moreover, social responsibility on financial performance.

In addition, in Figure 3, each node represents an individual author, and the more papers published, the larger the node’s size. The size of these links and the different nodes represent the pattern of collaboration and closeness of partnership. Furthermore, a node with a thick line indicates that the node has a high degree of centrality. In other words, it plays a crucial role in integrating other papers or serving as a theoretical basis for the field. We found 271 nodes and 212 connections in the authors and collaborative network with an overall network density of 0.0058. it indicates that the collaborative network among authors in the field of research on the relationship between green technology innovation and corporate financial performance is weak. The most influential author collaborative group consists of Yaw Agyabengmensah, Ebenezer Afum, etc. They are also the group with the highest collaborative density and, at the same time, one of the newest groups. Therefore, it can be assumed that only a tiny collaborative network has been formed in this research area. The authors’ analysis allows us to highlight not only the most influential authors in the study of the relationship between green technology innovation and corporate financial performance but also to identify their valuable works that reflect important research themes of previous studies. The articles of the most insightful authors represent, to some extent, a valuable research theme. In addition, the articles of the most cited authors are the most important basis for research in the field, regardless of the theory or methodology on which it is based. For these reasons, we believe that an analysis of authorship is worthwhile.

3.3. Which Country Has the Most Interest in This Research Topic?

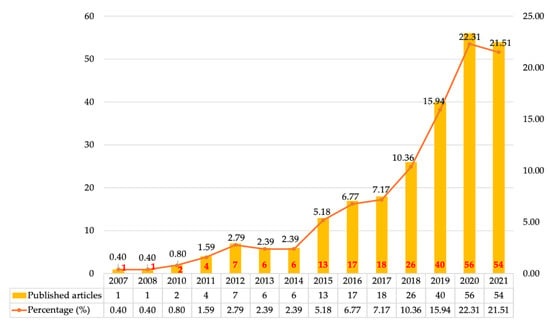

We set the node type of Citespace to country (i.e., we analyze the distribution of countries focusing on this field, and we can obtain a visualization of the inter-country collaboration network, as shown in Figure 4). Where each node represents a country, the node size represents the number of papers published in that country, the links between the nodes indicates the cooperation between different countries. Those with the same color represent a single cluster—a group with a similar research focus, and the thickness of the links represents the degree of close cooperation between countries.

Figure 4.

Visualization of country cooperation networks.

As can be seen from Figure 4, there are 59 nodes and 104 links in the cooperative network among countries, and the overall network density is 0.0608, which indicates that the cooperative network among countries is relatively close. Among them, China is the largest research country, followed by Spain, Pakistan, and the England, indicating that these countries pay more attention to the research on the relationship between green technology innovation and corporate financial performance. However, South Korea and Italy have the lowest degree of cooperation.

In addition, the top 10 most productive countries are listed in Table 4. It is worth noting that the top 10 countries include both developed and developing countries, indicating that focusing on the relationship between green technology innovation and corporate financial performance has become a global issue. China ranks first with 99 publications and is far ahead of other countries. This may be due to the fact that Chinese firms, as essential players in emerging markets, are pursuing sustainable development strategies. Firms are focusing on following the intrinsic requirements of green economic development and actively taking responsibility to address environmental challenges. Moreover, when countries started to study the relationship between green technology innovation and corporate financial performance, the USA and the England started their studies earlier. In contrast, all other countries started after 2010.

Table 4.

The top 10 most productive countries.

3.4. Which Institution Has Paid the Most Attention to This Research Area?

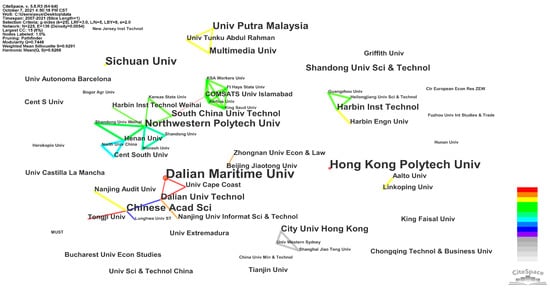

Institutional collaboration networks can illustrate the spatial distribution of research in this field, reflect the collaboration between institutions, and provide a reference for the scientific evaluation of the influence of institutions in the academic sphere. We used Citespace software to visualize and analyze the data, set the Time Slicing to “2007–2021”, Years Per Slice to “1”, the Node Types panel was selected as “Institution”, and other options were set as the system default. The distribution of network visualization of the institution was obtained by running the software, as shown in Figure 5. The node size indicates the number of journal articles published by the institution, and the line between the nodes indicates the strength of cooperation between different institutions.

Figure 5.

Visualization results of the institutional cooperation network.

We found that the study sample contained 225 nodes and 136 links, with a network density of 0.054, indicating that more institutions are studying the relationship between green technology innovation and corporate financial performance. Among them are two apparent institutional cooperation networks: Network 1: Dalian Maritime University and Chinese Academy of Sciences, which is the densest cooperation network; Network 2: Northwestern Polytechnical University and South China University of Technology. In addition, to a deeper analysis of the inter-institutional outcomes and collaborative relationships, the top ten most productive institutions were obtained by further data mining of Figure 5, as shown in Table 5.

Table 5.

The top ten most productive institutions.

The results in Table 5 show that the institutions with the highest number of publications are Dalian Maritime University (7), Hong Kong Polytechnic University (6), and Sichuan University (5). However, the degree of cooperation between these three universities and other institutions is not high, indicating that they do not cooperate closely with other institutions even though they are highly productive institutions. However, Northwestern Polytechnical University, which does not have a high volume of publications, has the highest collaboration density. Therefore, research on the relationship between green technology innovation and corporate financial performance is mainly run by independent institutions, and there is still more room for inter-institutional cooperation. Thus, they should establish more in-depth cooperative relationships across disciplines and regions in the future.

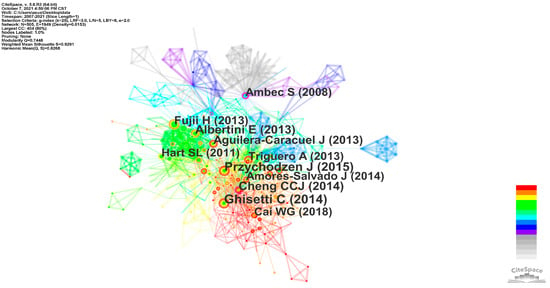

3.5. What Are the High-Level Literature and Journals in the Research Field?

Literature co-citation analysis refers to the analysis of the co-citation of literature in a research area and to explore the high-level literature in that area. The more co-citations there are, the more significant the correlation between the literature, indicating the more vital role of high-level literature. Figure 6 shows the literature co-citation relationships.

Figure 6.

The literature co-citation relationships.

Our results find several more significant co-citation relationships in the literature with nodes N = 505, the number of connections E = 1949, and network density D = 0.0153. The more recent co-citations network includes Cai and Li (2018), Przychodzen and Przychodzen (2015), Ghisetti and Rennings (2014), Cheng et al. (2014), and Amores-Salvadó et al. (2014). Cai and Li (2018) reveals the drivers of eco-innovation and its effect on firm performance. Their findings suggest that technological capabilities, organizational capabilities, market-based tools, competitive pressures, and green consumer demand are drivers of eco-innovation. Eco-innovation behavior can significantly improve a firm’s environmental performance and indirectly positively impact the firm’s economic performance through environmental performance. Przychodzen and Przychodzen (2015) analyzed the effect of four categories of eco-innovation (product, process, market, and sources of supply) on financial performance. Their findings indicate that eco-innovation firms typically have higher average returns on assets and equity and lower earnings retention rates. Ghisetti and Rennings (2014) categorized environmental innovations into innovations that reduce negative externalities and innovations that increase efficiency and cost savings, respectively. They analyzed the degree of effect of these two types of environmental innovations on firm profitability, and it was found that these two innovations have a positive effect on profitability. Cheng et al. (2014) studied the interrelationship between three types of eco-innovation (process, product, organization) and their effect on firm performance from a resource-based view theory. They found that eco-organizational innovation has the most substantial effect on firm performance. Amores-Salvadó et al. (2014) analyzed the effect of environmental product innovation capability and the firm’s green image on firm performance. The results show that firms’ commitment to environmental product innovation positively impacts firm performance. Moreover, the green image of the firm has a significant positive moderating effect on the relationship between environmental product innovation and firm performance. Furthermore, other scholars have also co-citations networks, such as Aguilera-Caracuel and Ortiz-de-Mandojana (2013), Albertini (2013), Fujii et al. (2013), Triguero et al. (2013), Hart and Dowell (2011), and Ambec and Lanoie (2008).

In addition, Table 6 shows the journal sources corresponding to the top 10 co-cited literature. The Journal of Cleaner Production is the most prolific journal with 40%. The second-ranked journal is Organization and Environment with 20%, indicating that they are important and influential journals in this field with high-quality publications and high citation rates. Furthermore, journals such as Business Strategy and the Environment, Journal of Management, Ecological Economics, Academy of Management Perspective are essential sources of highly cited literature. It indicates that the literature on the relationship between green technology innovation and corporate financial performance is mainly concentrated in these top journals, indicating that these journals have a particular influence in this field.

Table 6.

The high-level journals in this field.

3.6. What Are the Research Hotspots and Trends?

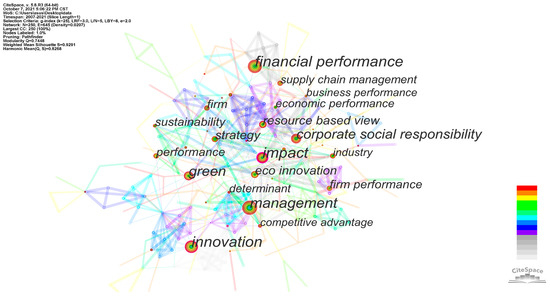

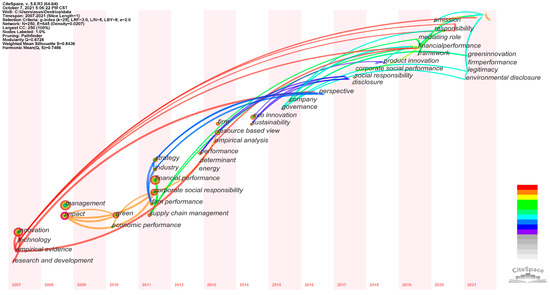

3.6.1. Keyword Co-Occurrence

Keyword co-occurrence can explain the hot spots of research in a field over time. Figure 7 shows the hot keyword co-occurrences in the literature. We found 250 keywords based on the literature and formed 645 concatenated lines. The circle size represents the frequency of keyword co-occurrence, and the nodes represent the number of keywords. The connecting lines between nodes indicate the correlation degree of keywords at different times, and the thickness of the connecting lines indicates the intensity of keyword co-occurrence. The larger the node’s size, the higher frequency of keyword co-occurrence, which means the higher the relevance of the node and the more influential the node is in the network. From Figure 7, we can see that “financial performance” is the most significant node, and “innovation”, “impact”, and “management” are the second most important nodes.

Figure 7.

Keyword co-occurrence mapping.

Meanwhile, the top ten high-frequency keywords are listed in Table 7. The results show that the frequency of keywords “innovation” and “firm performance” both reached 69 times, indicating that the correlation between them and other hot keywords is important, which shows that the study of the relationship between green technology innovation and corporate financial performance is centered on these keywords.

Table 7.

The top ten high-frequency keywords.

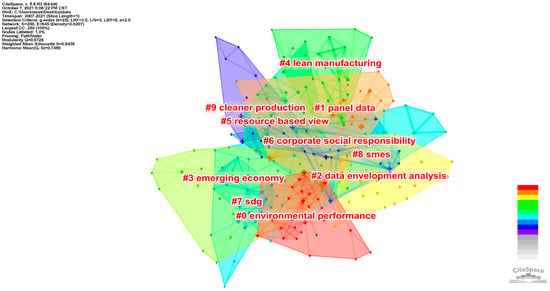

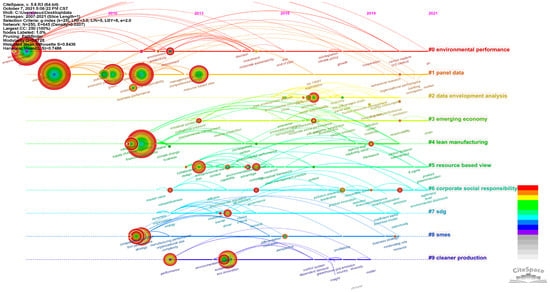

3.6.2. Keyword Clustering

Keyword clustering analysis can visualize the research hotspots in a specific field. Figure 8 shows the keyword clustering of research on the relationship between green technology innovation and corporate financial performance. The color block represents the area of clustering, with node N = 250, the number of connections E = 645, and network density D = 0.0207. In this network, we need to pay attention to two values, Q value and S value, (1) modularity value (Q) size is related to the sparsity of nodes; the larger the Q value, the better the clustering effect; (2) silhouette (S) size can be used to measure the homogeneity of the clusters, the larger the S value indicates the higher homogeneity of the network, indicating that the clusters are with high confidence. In addition, number 0–9 is the order, and the smaller the number, the more keywords are included in the clusters.

Figure 8.

Keyword clustering.

From Figure 8, we can see that Q = 0.8436, which indicates that the network structure has a good clustering effect, and S = 0.7486, which indicates that the homogeneity is high and the different clustering is well divided. At the same time, we also found clustering areas centered on “environmental performance”, “panel data”, and “data envelopment analysis”.

In addition, Table 8 presents the average year and the number of keywords for the top five clusters. The average years of the top five clusters are in 2012–2017, which indicates that the research on the relationship between green technology innovation and corporate financial performance became hot during this period. Among them, the largest cluster is “environmental performance” with the year 2012 and contains 29 keywords, and the main keywords are free cooling systems, super-efficient data envelopment analysis, Chinese listed companies, market demand. Therefore, we argue that the research on the relationship between green technology innovation and corporate financial performance mainly focuses on environmental performance, Chinese listed companies, and conducts super-efficient data envelopment analysis method by test to meet the market demand.

Table 8.

Main keywords of clustering.

3.6.3. Keyword Emergence

Keyword emergence is a high-frequency word appearing in a certain period, and its change can reflect the hotspots of scholars’ research in the field in that period. Moreover, it is also a kind of judgment basis for the evolutionary development trend of the field, which can be clearly shown the start time, emergent intensity, and emergent duration. Therefore, to deeply understand the evolutionary development trend of the relationship between green innovation technology and corporate financial performance. We obtained the emergence of keywords in this field. The results are shown in Table 9.

Table 9.

Keyword emergence.

Firstly, in terms of the year of the emergence of the keywords highlight, the “technology” keyword started the earliest; however, “green innovation”, “mediating role”, and “financial performance” keywords started the latest and have been continued until now, which will be the hot spots for future research. Secondly, according to the emergence strength of keywords, we can find that “technology” (Strength = 3.28), “energy” (Strength = 2.69), “corporate sustainability” (Strength = 2.68) has a very high emergence intensity, which indicates that they emergence to change significantly in frequency. Finally, in terms of duration, the “technology” keyword has the most extended duration (2007–2014) with eight years, while “pay”, “business”, and “product innovation” also have the long duration, indicating that they have been the hotspots of research for an extended period in this field. Thus, in general, “product innovation” and “green innovation” are considered the latest research hotspots due to their high emergence intensity and time for new.

3.6.4. Keyword Time Zone Map

In order to study the evolutionary process of the relationship between green technology innovation and corporate financial performance from the time dimension, we use the time zone diagram in the Citespace tool to analyze it. The time zone diagram clearly shows the update of the literature and the interrelationship between the literature in a two-dimensional coordinate with time as the horizontal axis according to the chronological order, as shown in Figure 9. In the time zone diagram, the node’s size indicates the frequency of the keyword, the year of the node indicates the first appearance of the keyword, the line between the nodes indicates that different keywords appear in the same literature at the same time. The number of literatures appearing in different years represents the results published at that time, indicating the period or stage of the field.

Figure 9.

Keyword time zone map.

In Figure 9, the most significant node is “financial performance” for the relationship between green technology innovation and corporate financial performance. Moreover, the keywords that appear are innovation, technology, R&D, and empirical evidence. The high-frequency keywords of the research on the relationship between green technology innovation and corporate financial performance are concentrated in the 2007–2014 period, which indicates that the research intensity in this period is high. In addition, scholars’ research in this field has proposed new concepts after 2015, such as “green innovation”, “firm performance”, “legitimacy”, “environmental disclosure”. These new concepts are expected to be the new direction of future research on the relationship between green technology innovation and corporate financial performance.

3.6.5. Research Timeliness

We extracted keywords from 251 articles and visualized a clustering network of keywords (based on the frequency of keyword occurrences) using the Citespace timeline. The network showed the clustering from left to right along a horizontal timeline (Figure 10). The index words extracted from the keywords are the cluster names labeled by the LLR algorithm and arranged vertically in decreasing size. The curves indicated the association links between clustering. Ten central clustering were generated in the hybrid network.

Figure 10.

Keyword timeliness.

Figure 10 shows the timeline of research on the relationship between green technology innovation and corporate financial performance, which shows that the duration of research hotspots varies by clustering, representing the evolution of research hotspots. Among them, the largest cluster is “environmental performance”, containing 29 keywords with the average year of 2012, including keywords such as technology and empirical evidence proposed. As time progresses, new keywords appear in the recent clustering results, such as “climate policy”, “corporate sustainability”, “carbon capture”.

4. Conclusions

This paper presents a bibliometric analysis of developments in research on the relationship between green technology innovation and corporate financial performance based on 251 articles from Web of Science using the Citespace tool. Based on our analysis, some conclusions can be drawn: (i) the literature on the relationship between green technology innovation and corporate financial performance first appeared in 2007 and has seen a surge in the number of publications since 2015, with 54 papers published between January and September 2021 alone, indicating that this field of research is receiving increasing attention from scholars; (ii) Yaw Agyabengmensah is the most productive author, whose works are highly collaborative with other writers and have a variety of subjects. However, there is only a small collaboration network among other authors; (iii) China is the largest research country, followed by Spain, Pakistan, and England. It indicates that focusing on the relationship between green technology innovation and corporate financial performance has become a common concern in developed and developing countries and is a research interest for scholars worldwide. Dalian Maritime University, Hong Kong Polytechnic University, and Sichuan University are highly productive institutions, but they do not work closely with other institutions; they operate relatively independently in this field. It indicates that institutions should further establish deeper collaborative relationships across disciplines and regions. In addition, the Journal of Cleaner Production is the most productive journal with 40%. The second-highest ranking is Organization & Environment with 20%, which indicates that the literature on the relationship between green technology innovation and corporate financial performance is concentrated in these top journals, indicating that these journals have a unique influence in the field; (iv) we also find that the keywords “financial performance”, “environmental performance”, “green innovation”, and “product innovation” are the hot spots for scholars to focus on in this field; and (v) “green innovation”, “corporate performance”, “legitimacy”, “environmental disclosure”, and “corporate sustainability” these concepts are expected to be new directions for further research on the relationship between green technology innovation and corporate financial performance.

5. Contributions, Limitations and Future Research

We have contributed to the study of mapping and visualizing the relationship between green technology innovation and corporate financial performance in three ways. First, our findings contribute academic value to the bibliometric research on the relationship between green technology innovation and corporate financial performance. There is a lack of bibliometric analysis in previous studies that comprehensively and scientifically evaluates their relationship. However, whether it pays to be “green” has been a core debate in the academic circle. Our study is the first comprehensive and holistic bibliometric analysis of the relationship between green technology innovation and corporate financial performance. In particular, we focus on green technology innovation from a corporate financial performance perspective. Second, our findings also contribute a valuable addition to the methodological use of this research area. Previous reviews have generally taken a systematic approach (Mazzi et al. 2016; Hermundsdottir and Aspelund 2021). In contrast, our study uses computer software, such as the Citespace tool. We provide direct visualization of research hotspots and trends in the relationship between green technology innovation and corporate financial performance. A visualization network helps researchers gain a clearer and more transparent understanding of the field and draw inspiration from various backgrounds. Third, our research also helps those in engineering, management, and social sciences to understand the latest advances in the relationships between green technology innovation and corporate financial performance. Since we offer the most popular topics, main keywords of clustering, and focal areas in this field.

In addition, we recommend the firm’s policymakers in four ways: (1) firms should implement green technology innovation to improve their financial performance; (2) firms create an organizational climate that encourages green technology innovation activities to improve the organization’s environmental, social, and financial performance; (3) firms should tilt their development strategies toward green innovation. For example, they create green policies to develop their green industries, thus gaining a competitive advantage in the marketplace and gradually outperforming their competitors; and (4) equally important, firms should also note that there is value in implementing green technology innovation. It is not just for developed countries but for developing countries since it is worth paying to be green.

However, this bibliometric review also has some limitations. (1) Our choice of the database may affect the number of relevant articles. We selected literature from only a single database (WoS), although this decision is based on the fact that the articles and citations collected from the WoS and Scopus databases were highly similar. However, using other databases may increase the number of articles on the research question. Future studies may consider selecting additional databases (e.g., Scopus and Google scholar) for a bibliometric review in this field; (2) due to the wide variation in content and definitions of green technology innovation (Hermundsdottir and Aspelund 2021), literature on other terms of this keyword may be overlooked in the search process. Future studies should fully consider the comprehensiveness and completeness of the concepts of the topic; (3) although some criteria were included in the literature search as much as possible for the literature review, there is still a certain degree of personal subjectivity, which may also be a limitation of this study (Gonzales-Gemio et al. 2020). Future studies should adopt more objective criteria to clean and organize the literature; (4) our objective is to explore only a bibliometric analysis of the relationship between green technology innovation and corporate financial performance. We don’t take into account the resilience and risk mitigation of an enterprise in the current work. However, their connection to sustainable finance and green innovation strategies may also be fantastic. Future studies should be engaged in this debate; (5) predicting emerging areas is also widely applied in patents analysis and provides a source of equal importance for nourishing an innovation strategy. However, our study has not yet mentioned this. Future studies could carefully consider this work; and (6) a meta-analysis of the relationships between green technology and corporate financial performance may also be interesting. A meta-analysis may provide a statistical integration of the accumulated research on their relationship. Future studies could take this approach to conduct further a complete and comprehensive literature review on the relationship between green technology innovation and corporate financial performance.

Author Contributions

Conceptualization, L.Q. and D.C.; methodology, L.Q., D.C. and Y.-S.O.; software, L.Q., X.M. and A.A.D.; validation, L.Q., X.M. and A.A.D.; formal analysis, L.Q.; investigation, L.Q., X.M. and A.A.D.; resources, L.Q. and D.C.; data curation, L.Q., X.M. and A.A.D.; writing—original draft preparation, L.Q.; writing—review and editing, L.Q. and A.A.D.; visualization, L.Q., X.M. and A.A.D.; supervision, D.C. and Y.-S.O.; project administration, D.C. and Y.-S.O.; funding acquisition, D.C. and Y.-S.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Afum, Ebenezer, Yaw Agyabeng-Mensah, Zhuo Sun, Bright Frimpong, Lawrence Yaw Kusi, and Innocent Senyo Kwasi Acquah. 2020. Exploring the Link between Green Manufacturing, Operational Competitiveness, Firm Reputation and Sustainable Performance Dimensions: A Mediated Approach. Journal of Manufacturing Technology Management 31: 1417–38. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, Javier, and Natalia Ortiz-de-Mandojana. 2013. Green Innovation and Financial Performance: An Institutional Approach. Organization & Environment 26: 365–85. [Google Scholar] [CrossRef]

- Agyabeng-Mensah, Yaw, Ebenezer Afum, and Esther Ahenkorah. 2020. Exploring Financial Performance and Green Logistics Management Practices: Examining the Mediating Influences of Market, Environmental and Social Performances. Journal of Cleaner Production 258: 120613. [Google Scholar] [CrossRef]

- Ahmed, Rizwan Raheem, Grigorios L. Kyriakopoulos, Dalia Streimikiene, and Justas Streimikis. 2021. Drivers of Proactive Environmental Strategies: Evidence from the Pharmaceutical Industry of Asian Economies. Sustainability 13: 9479. [Google Scholar] [CrossRef]

- Akbar, Ahsan, Xinfeng Jiang, Muhammad Azeem Qureshi, and Minhas Akbar. 2021. Does Corporate Environmental Investment Impede Financial Performance of Chinese Enterprises? The Moderating Role of Financial Constraints. Environmental Science and Pollution Research International 28: 58007–17. [Google Scholar] [CrossRef] [PubMed]

- Albertini, Elisabeth. 2013. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organization & Environment 26: 431–57. [Google Scholar] [CrossRef]

- Albort-Morant, Gema, Jörg Henseler, Antonio Leal-Millán, and Gabriel Cepeda-Carrión. 2017. Mapping the Field: A Bibliometric Analysis of Green Innovation. Sustainability 9: 1011. [Google Scholar] [CrossRef] [Green Version]

- Alshehhi, Ali, Haitham Nobanee, and Nilesh Khare. 2018. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 10: 494. [Google Scholar] [CrossRef] [Green Version]

- Ambec, Stefan, and Paul Lanoie. 2008. Does It Pay to Be Green? A Systematic Overview. The Academy of Management Perspectives 22: 45–62. [Google Scholar]

- Amores-Salvadó, Javier, Gregorio Martín-de Castro, and José E. Navas-López. 2014. Green Corporate Image: Moderating the Connection between Environmental Product Innovation and Firm Performance. Journal of Cleaner Production 83: 356–65. [Google Scholar] [CrossRef]

- Baah, Charles, Douglas Opoku-Agyeman, Innocent Senyo Kwasi Acquah, Yaw Agyabeng-Mensah, Ebenezer Afum, Daniel Faibil, and Farid Abdel Moro Abdoulaye. 2021a. Examining the Correlations between Stakeholder Pressures, Green Production Practices, Firm Reputation, Environmental and Financial Performance: Evidence from Manufacturing SMEs. Sustainable Production and Consumption 27: 100–14. [Google Scholar] [CrossRef]

- Baah, Charles, Yaw Agyabeng-Mensah, Ebenezer Afum, and Minenhle Siphesihle Mncwango. 2021b. Do Green Legitimacy and Regulatory Stakeholder Demands Stimulate Corporate Social and Environmental Responsibilities, Environmental and Financial Performance? Evidence from an Emerging Economy. Management of Environmental Quality 32: 787–803. [Google Scholar] [CrossRef]

- Bartolacci, Francesca, Andrea Caputo, and Michela Soverchia. 2020. Sustainability and Financial Performance of Small and Medium Sized Enterprises: A Bibliometric and Systematic Literature Review. Business Strategy and the Environment 29: 1297–309. [Google Scholar] [CrossRef]

- Bocken, Nancy M. P., Samuel W. Short, Padmakshi Rana, and Steve Evans. 2014. A Literature and Practice Review to Develop Sustainable Business Model Archetypes. Journal of Cleaner Production 65: 42–56. [Google Scholar] [CrossRef] [Green Version]

- Cai, Wugan, and Guangpei Li. 2018. The Drivers of Eco-Innovation and Its Impact on Performance: Evidence from China. Journal of Cleaner Production 176: 110–18. [Google Scholar] [CrossRef]

- Chen, Chaomei. 2017. Science Mapping: A Systematic Review of the Literature. Journal of Data and Information Science 2: 1–40. [Google Scholar] [CrossRef] [Green Version]

- Chen, Jiawen, and Linlin Liu. 2018. Profiting from Green Innovation: The Moderating Effect of Competitive Strategy. Sustainability 11: 15. [Google Scholar] [CrossRef] [Green Version]

- Cheng, Colin C. J., Chen-Lung Yang, and Chwen Sheu. 2014. The Link between Eco-Innovation and Business Performance: A Taiwanese Industry Context. Journal of Cleaner Production 64: 81–90. [Google Scholar] [CrossRef] [Green Version]

- Cupertino, Sebastiano, Gianluca Vitale, and Angelo Riccaboni. 2021. Sustainability and Short-Term Profitability in the Agri-Food Sector, a Cross-Sectional Time-Series Investigation on Global Corporations. British Food Journal 123: 317–36. [Google Scholar] [CrossRef]

- da Cunha Bezerra, Maria Clara, Cláudia Fabiana Gohr, and Sandra Naomi Morioka. 2020. Organizational Capabilities towards Corporate Sustainability Benefits: A Systematic Literature Review and an Integrative Framework Proposal. Journal of Cleaner Production 247: 119114. [Google Scholar] [CrossRef]

- de Azevedo Rezende, Lígia, Ana Claudia Bansi, Marlon Fernandes Rodrigues Alves, and Simone Vasconcelos Ribeiro Galina. 2019. Take Your Time: Examining When Green Innovation Affects Financial Performance in Multinationals. Journal of Cleaner Production 233: 993–1003. [Google Scholar] [CrossRef]

- de Padua, Luciano Barcellos, Pontificia Universidad Catolica del Peru, Sandra Liliana Palacio Velez, Hermilson Velasquez Ceballos, and Victor Manuel Oquendo Trujillo. 2020. Exploring the Link between Environmental Practices and Financial Performance: An Empirical Study. Journal of Environmental Science and Management 23: 29–39. [Google Scholar] [CrossRef]

- Deng, Xiang, and Li Li. 2020. Promoting or Inhibiting? The Impact of Environmental Regulation on Corporate Financial Performance-an Empirical Analysis Based on China. International Journal of Environmental Research and Public Health 17: 3828. [Google Scholar] [CrossRef] [PubMed]

- Du, Huibin, Linxue Wei, Marilyn A. Brown, Yangyang Wang, and Zheng Shi. 2013. A Bibliometric Analysis of Recent Energy Efficiency Literatures: An Expanding and Shifting Focus. Energy Efficiency 6: 177–90. [Google Scholar] [CrossRef]

- Forsman, Helena. 2013. Environmental Innovations as a Source of Competitive Advantage or Vice Versa? Business Strategy and the Environment 22: 306–20. [Google Scholar] [CrossRef]

- Frempong, Michelle Frempomaa, Yinping Mu, Stephen Sarfo Adu-Yeboah, Md Altab Hossin, and Mavis Adu-Gyamfi. 2021. Corporate Sustainability and Firm Performance: The Role of Green Innovation Capabilities and Sustainability-Oriented Supplier–Buyer Relationship. Sustainability 13: 10414. [Google Scholar] [CrossRef]

- Fujii, Hidemichi, Kazuyuki Iwata, Shinji Kaneko, and Shunsuke Managi. 2013. Corporate Environmental and Economic Performance of Japanese Manufacturing Firms: Empirical Study for Sustainable Development. Business Strategy and the Environment 22: 187–201. [Google Scholar] [CrossRef]

- Ghisetti, Claudia, and Klaus Rennings. 2014. Environmental Innovations and Profitability: How Does It Pay to Be Green? An Empirical Analysis on the German Innovation Survey. Journal of Cleaner Production 75: 106–17. [Google Scholar] [CrossRef] [Green Version]

- Gonzales-Gemio, Carla, Claudio Cruz-Cázares, and Mary Jane Parmentier. 2020. Responsible Innovation in SMEs: A Systematic Literature Review for a Conceptual Model. Sustainability 12: 10232. [Google Scholar] [CrossRef]

- Gray, Rob, Reza Kouhy, and Simon Lavers. 1995. Corporate Social and Environmental Reporting: A Review of the Literature and a Longitudinal Study of UK Disclosure. Accounting Auditing & Accountability 8: 47–77. [Google Scholar] [CrossRef]

- Hart, Stuart L., and Glen Dowell. 2011. Invited Editorial: A Natural-Resource-Based View of the Firm: Fifteen Years After. Journal of Management 37: 1464–79. [Google Scholar] [CrossRef]

- Hermundsdottir, Fanny, and Arild Aspelund. 2021. Sustainability Innovations and Firm Competitiveness: A Review. Journal of Cleaner Production 280: 124715. [Google Scholar] [CrossRef]

- Hizarci-Payne, Ayça Kubra, İlayda İpek, and Gülüzar Kurt Gümüş. 2021. How Environmental Innovation Influences Firm Performance: A Meta-analytic Review. Business Strategy and the Environment 30: 1174–90. [Google Scholar] [CrossRef]

- Hosseini, M. Reza, Igor Martek, Edmundas Kazimieras Zavadskas, Ajibade A. Aibinu, Mehrdad Arashpour, and Nicholas Chileshe. 2018. Critical Evaluation of Off-Site Construction Research: A Scientometric Analysis. Automation in Construction 87: 235–47. [Google Scholar] [CrossRef]

- Hristov, Ivo, Andrea Appolloni, Antonio Chirico, and Wenjuan Cheng. 2021. The Role of the Environmental Dimension in the Performance Management System: A Systematic Review and Conceptual Framework. Journal of Cleaner Production 293: 126075. [Google Scholar] [CrossRef]

- Jan, Amin, Maran Marimuthu, Muhammad Pisol bin Mohd, and Mat Isa. 2019. The Nexus of Sustainability Practices and Financial Performance: From the Perspective of Islamic Banking. Journal of Cleaner Production 228: 703–17. [Google Scholar] [CrossRef]

- Jin, Zhenji, and Jian Xu. 2020. Impact of Environmental Investment on Financial Performance: Evidence from Chinese Listed Companies. Polish Journal of Environmental Studies 29: 2235–2245. [Google Scholar] [CrossRef]

- Johl, Satirenjit Kaur, and Md Abu Toha. 2021. The Nexus between Proactive Eco-Innovation and Firm Financial Performance: A Circular Economy Perspective. Sustainability 13: 6253. [Google Scholar] [CrossRef]

- Karimi Takalo, Salim, Hossein Sayyadi Tooranloo, and Zahra Shahabaldini parizi. 2021. Green Innovation: A Systematic Literature Review. Journal of Cleaner Production 279: 122474. [Google Scholar] [CrossRef]

- Kostova, Tatiana, and Kendall Roth. 2002. Adoption of an Organizational Practice by Subsidiaries of Multinational Corporations: Institutional and Relational Effects. Academy of Management Journal 45: 215–33. [Google Scholar] [CrossRef]

- Leydesdorff, Loet, Stephen Carley, and Ismael Rafols. 2013. Global Maps of Science Based on the New Web-of-Science Categories. Scientometrics 94: 589–93. [Google Scholar] [CrossRef] [Green Version]

- Li, Dayuan, Mi Zheng, Cuicui Cao, Xiaohong Chen, Shenggang Ren, and Min Huang. 2017. The Impact of Legitimacy Pressure and Corporate Profitability on Green Innovation: Evidence from China Top 100. Journal of Cleaner Production 141: 41–49. [Google Scholar] [CrossRef] [Green Version]

- Li, Fengshu, Xinliang Xu, Zhiwei Li, Pengcheng Du, and Jiangfeng Ye. 2021. Can Low-Carbon Technological Innovation Truly Improve Enterprise Performance? The Case of Chinese Manufacturing Companies. Journal of Cleaner Production 293: 125949. [Google Scholar] [CrossRef]

- Lin, Woon-Leong, Jun-Hwa Cheah, Mohamed Azali, Jo Ann Ho, and Nick Yip. 2019. Does Firm Size Matter? Evidence on the Impact of the Green Innovation Strategy on Corporate Financial Performance in the Automotive Sector. Journal of Cleaner Production 229: 974–88. [Google Scholar] [CrossRef]

- Losse, Markus, and Martin Geissdoerfer. 2021. Mapping Socially Responsible Investing: A Bibliometric and Citation Network Analysis. Journal of Cleaner Production 296: 126376. [Google Scholar] [CrossRef]

- Ma, Yuan, Qiang Zhang, and Qiyue Yin. 2021. Top Management Team Faultlines, Green Technology Innovation and Firm Financial Performance. Journal of Environmental Management 285: 112095. [Google Scholar] [CrossRef]

- Mazzi, Anna, Sara Toniolo, Alessandro Manzardo, Jingzheng Ren, and Antonio Scipioni. 2016. Exploring the Direction on the Environmental and Business Performance Relationship at the Firm Level. Lessons from a Literature Review. Sustainability 8: 1200. [Google Scholar] [CrossRef] [Green Version]

- Molina-Azorín, José F., Enrique Claver-Cortés, Maria D. López-Gamero, and Juan J. Tarí. 2009. Green Management and Financial Performance: A Literature Review. Management Decision 47: 1080–100. [Google Scholar] [CrossRef]

- Mongeon, Philippe, and Adèle Paul-Hus. 2016. The Journal Coverage of Web of Science and Scopus: A Comparative Analysis. Scientometrics 106: 213–28. [Google Scholar] [CrossRef]

- Neu, D., H. Warsame, and K. Pedwell. 1998. Managing Public Impressions: Environmental Disclosures in Annual Reports. Accounting, Organizations and Society 23: 265–82. [Google Scholar] [CrossRef]

- Nguyen, Thanh Hung, Quang Trong Vu, Duc Minh Nguyen, and Hoang Long Le. 2021. Factors Influencing Corporate Social Responsibility Disclosure and Its Impact on Financial Performance: The Case of Vietnam. Sustainability 13: 8197. [Google Scholar] [CrossRef]

- Pittaway, Luke, Maxine Robertson, Kamal Munir, David Denyer, and Andy Neely. 2004. Networking and Innovation: A Systematic Review of the Evidence. International Journal of Management Reviews 5–6: 137–68. [Google Scholar] [CrossRef]

- Prashar, Anupama, and Vijaya M. Sunder. 2020. A Bibliometric and Content Analysis of Sustainable Development in Small and Medium-Sized Enterprises. Journal of Cleaner Production 245: 118665. [Google Scholar] [CrossRef]

- Preston, Lee E., and Douglas P. O’Bannon. 1997. The Corporate Social-Financial Performance Relationship: A Typology and Analysis. Business and Society 36: 419–29. [Google Scholar] [CrossRef]

- Przychodzen, Justyna, and Wojciech Przychodzen. 2015. Relationships between Eco-Innovation and Financial Performance—Evidence from Publicly Traded Companies in Poland and Hungary. Journal of Cleaner Production 90: 253–63. [Google Scholar] [CrossRef]

- Rabadán, Adrián, Ángela González-Moreno, and Francisco J. Sáez-Martínez. 2019. Improving Firms’ Performance and Sustainability: The Case of Eco-Innovation in the Agri-Food Industry. Sustainability 11: 5590. [Google Scholar] [CrossRef] [Green Version]

- Ren, Shenggang, Helin Sun, and Tao Zhang. 2021. Do Environmental Subsidies Spur Environmental Innovation? Empirical Evidence from Chinese Listed Firms. Technological Forecasting and Social Change 173: 121123. [Google Scholar] [CrossRef]

- Ren, Shenggang, Min Huang, Donghua Liu, and Ji Yan. 2022. Understanding the Impact of Mandatory CSR Disclosure on Green Innovation: Evidence from Chinese Listed Firms. British Journal of Management 00: 1–19. [Google Scholar] [CrossRef]

- Rey-Martí, Andrea, Domingo Ribeiro-Soriano, and Daniel Palacios-Marqués. 2016. A Bibliometric Analysis of Social Entrepreneurship. Journal of Business Research 69: 1651–55. [Google Scholar] [CrossRef]

- Riillo, Cesare Antonio Fabio. 2017. Beyond the Question ‘Does It Pay to Be Green?’: How Much Green? And When? Journal of Cleaner Production 141: 626–40. [Google Scholar] [CrossRef]

- Russo, Michael V., and Paul A. Fouts. 1997. A Resource-Based Perspective on Corporate Environmental Performance and Profitability. Academy of Management Journal 40: 534–59. [Google Scholar] [CrossRef] [Green Version]

- Salim, Norhuda, Mohd Nizam Ab Rahman, and Dzuraidah Abd Wahab. 2019. A Systematic Literature Review of Internal Capabilities for Enhancing Eco-Innovation Performance of Manufacturing Firms. Journal of Cleaner Production 209: 1445–60. [Google Scholar] [CrossRef]

- Sardana, Deepak, Narain Gupta, Vikas Kumar, and Mile Terziovski. 2020. CSR ‘Sustainability’ Practices and Firm Performance in an Emerging Economy. Journal of Cleaner Production 258: 120766. [Google Scholar] [CrossRef]

- Schiederig, Tim, Frank Tietze, and Cornelius Herstatt. 2012. Green Innovation in Technology and Innovation Management—An Exploratory Literature Review. R&D Management 42: 180–92. [Google Scholar] [CrossRef]

- Shi, Qian, and Xiaodong Lai. 2013. Identifying the Underpin of Green and Low Carbon Technology Innovation Research: A Literature Review from 1994 to 2010. Technological Forecasting and Social Change 80: 839–64. [Google Scholar] [CrossRef]

- Su, Wunhong, Chun Guo, and Xiaobao Song. 2021. Media Coverage, Environment Protection Law and Environmental Research and Development: Evidence from the Chinese-Listed Firms. Environment Development and Sustainability, 1–31. [Google Scholar] [CrossRef]

- Taherdangkoo, Mohammad, Kamran Ghasemi, and Mona Beikpour. 2017. The Role of Sustainability Environment in Export Marketing Strategy and Performance: A Literature Review. Environment Development and Sustainability 19: 1601–29. [Google Scholar] [CrossRef]

- Tariq, Adeel, Yuosre F. Badir, Waqas Tariq, and Umair Saeed Bhutta. 2017. Drivers and Consequences of Green Product and Process Innovation: A Systematic Review, Conceptual Framework, and Future Outlook. Technology in Society 51: 8–23. [Google Scholar] [CrossRef]

- Tariq, Adeel, Yuosre Badir, and Supasith Chonglerttham. 2019. Green Innovation and Performance: Moderation Analyses from Thailand. European Journal of Innovation Management 22: 446–67. [Google Scholar] [CrossRef]

- Triguero, Angela, Lourdes Moreno-Mondéjar, and María A. Davia. 2013. Drivers of Different Types of Eco-Innovation in European SMEs. Ecological Economics 92: 25–33. [Google Scholar] [CrossRef]

- Wang, Mingyue, Yingming Li, Junqiang Li, and Zitong Wang. 2021. Green Process Innovation, Green Product Innovation and Its Economic Performance Improvement Paths: A Survey and Structural Model. Journal of Environmental Management 297: 113282. [Google Scholar] [CrossRef]

- Weng, Hua-Hung, Ja-Shen Chen, and Pei-Ching Chen. 2015. Effects of Green Innovation on Environmental and Corporate Performance: A Stakeholder Perspective. Sustainability 7: 4997–5026. [Google Scholar] [CrossRef] [Green Version]

- Ye, Nan, Tung-Boon Kueh, Lisong Hou, Yongxin Liu, and Hang Yu. 2020. A Bibliometric Analysis of Corporate Social Responsibility in Sustainable Development. Journal of Cleaner Production 272: 122679. [Google Scholar] [CrossRef]

- Yin, Jianhua, Lidong Gong, and Sen Wang. 2018. Large-Scale Assessment of Global Green Innovation Research Trends from 1981 to 2016: A Bibliometric Study. Journal of Cleaner Production 197: 827–41. [Google Scholar] [CrossRef]

- Yu, Xiaobing, Ye Mao, Dongmei Huang, Zhoubao Sun, and Tingliao Li. 2021. Mapping Global Research on Green Finance from 1989 to 2020: A Bibliometric Study. Advances in Civil Engineering 2021: 1–13. [Google Scholar] [CrossRef]

- Zhang, Yuanyuan, Jiuchang Wei, Yunhao Zhu, and Glory George-Ufot. 2020. Untangling the Relationship between Corporate Environmental Performance and Corporate Financial Performance: The Double-Edged Moderating Effects of Environ-mental Uncertainty. Journal of Cleaner Production 263: 121584. [Google Scholar] [CrossRef]

- Zhang, Minhao, Wenjuan Zeng, Ying Kei Tse, Yichuan Wang, and Palie Smart. 2021. Examining the Antecedents and Consequences of Green Product Innovation. Industrial Marketing Management 93: 413–27. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).