Nonlinear Dynamics of the Financial–Growth Nexus in African Emerging Economies: The Case of a Macroprudential Policy Regime

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Debate on Financial Growth

2.2. Empirical Review

3. Research Methods and Data Adopted for This Study

Panel Smooth Transition Regression Model

4. Empirical Analysis of the Study

4.1. The Results of the Transition Variable, Homogeneity Test and Selection of the Order m of the PSTR

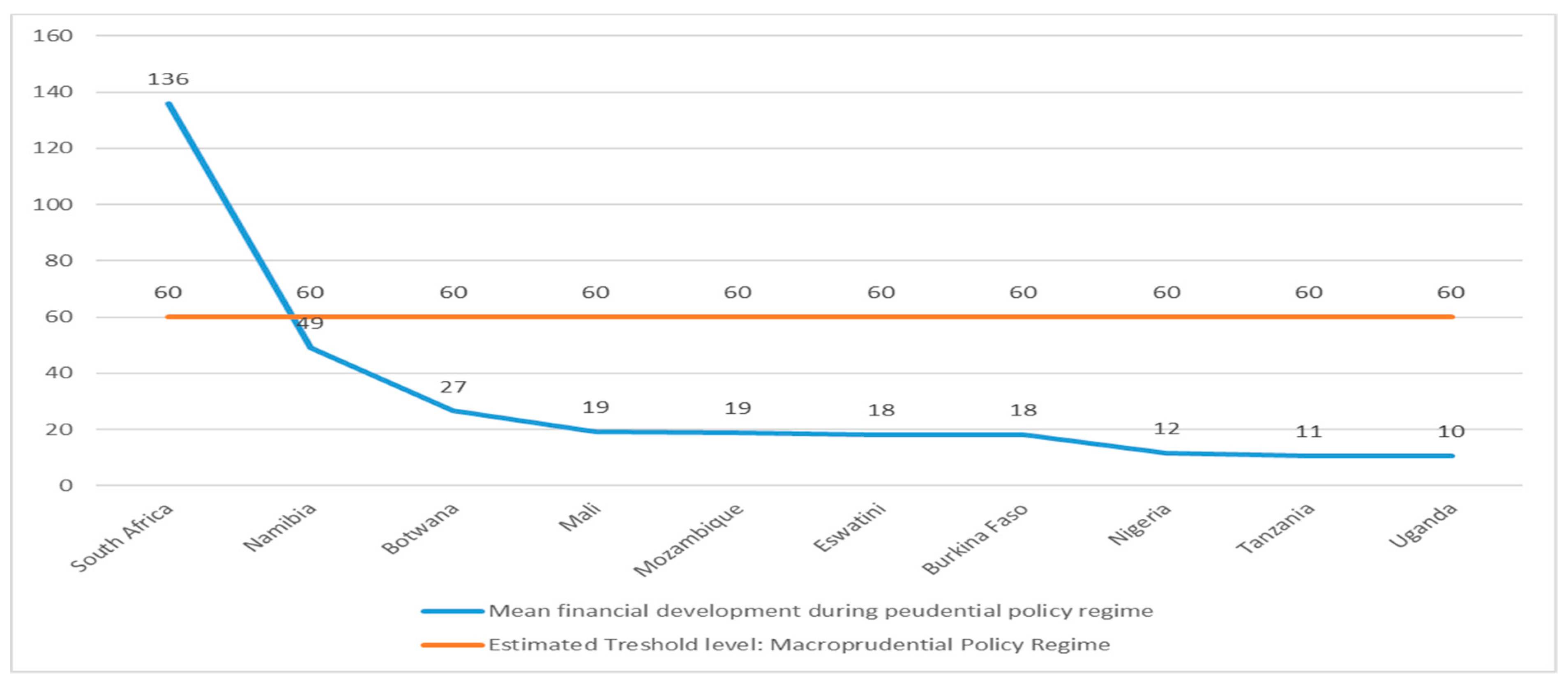

4.2. Model Evaluation and the Estimated Threshold of the PSTR Model

4.3. Empirical Results of the PSTR and FE Models

4.4. Robustness Checks and Sensitivity Analysis

5. Conclusions and Policy Recommendations

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|

| Growth | 7.448093 | 1.199798 | 5.086570 | 9.487033 |

| DCPS | 70.85394 | 7.92579 | 28.636358 | 80.91936 |

| MPIF | 0.672004 | 0.783259 | 0.000000 | 6.441176 |

| INFL | 7.835168 | 0.3430 | 6.04124 | 11.2325 |

| INV | 21.41213 | 8.053423 | 2.631579 | 52.93884 |

| TR | 52.13190 | 15.30813 | 2.774000 | 70.77984 |

| TOD | 52.13190 | 15.30813 | 2.774000 | 70.77984 |

| G | 26.33704 | 1.259438 | 24.32601 | 29.17810 |

| 1 | González et al. (2005) consider that it is sufficient to consider m = 1 or m = 2, as these values allow for commonly encountered types of variation in the parameters. |

| 2 | The sequence for selecting the order of the transition function under the for selection . If it is rejected, it will continue to test and , in selection . If it still fails, will be selected as default (Teräsvirta 1994; Teräsvirta et al. 2010). |

References

- Abeka, Mac Junior, Eric Andoh, John Gartchie Gatsi, and Seyram Kawor. 2021. Financial development and economic growth nexus in SSA economies: The moderating role of telecommunication development. Cogent Economics and Finance 9: 25. [Google Scholar] [CrossRef]

- Abu-Lila, Ziad, Sameh Ajlouni, and Abdallah Ghazo. 2021. Nonlinearity between financial development and the shadow economy: Evidence from Jordan. Accounting 7: 1049–54. Available online: www.GrowingScience.com/ac/ac.html (accessed on 30 December 2021). [CrossRef]

- Acemoglu, Daron, and Fabrizio Zilibotti. 1997. Was Prometheus unbound by chance? risk, diversification and growth. Journal of Political Economy 105: 709–51. [Google Scholar] [CrossRef] [Green Version]

- Adeniyi, Oluwatosin, Abimbola Oyinlola, Olusegun Akini Omisakinb, and Festus Oyinlola Egwaikhide. 2015. Financial development and economic growth in Nigeria: Evidence from threshold modelling. Economic Analysis and Policy 47: 11–21. [Google Scholar] [CrossRef]

- Aluko, Olufemi Adewale, Olufemi Patrick Adeyeye, and Pratric Olajide Oladele. 2020. Finance–growth nexus in sub-Saharan Africa revisited: Evidence based on a new composite index. Economic Change and Restructuring 53: 333–55. [Google Scholar] [CrossRef]

- Ang, James. 2008. Are financial sector policies effective in deepening the Malaysia financial system. Contemporary Economic Policy 26: 623–35. [Google Scholar] [CrossRef]

- Arcand, Jean-louis, Enrico Berkes, and Ugo Panizza. 2012. Too Much Finance? Journal of Economic Growth 20: 105–48. [Google Scholar] [CrossRef]

- Assefa, Tibebe, and Assefa Andre Mollick. 2017. Financial Development and Economic Growth in Africa. Journal of African Business 18: 320–39. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, and Konstantinou Spanos. 2019. The relationship between financial development and economic growth during the recent crisis: Evidence from the EU. Finance Research Letters 28: 238–45. [Google Scholar] [CrossRef] [Green Version]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ross Levine. 2007. Finance, inequality and the poor. Journal of Economic Growth 12: 27–49. [Google Scholar] [CrossRef]

- Bist, Jagadish Prasad. 2018. Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries. Cogent Economics and Finance 6: 1–18. [Google Scholar] [CrossRef] [Green Version]

- Boamah, John, Felix Atanga Adongo, Richmond Essieku, and John Aamo Lewis. 2019. Financial Depth, Gross Fixed Capital Formation and Economic Growth: Empirical Analysis of 18 Asian Economies. International Journal of Scientific and Education Research 2: 2018. [Google Scholar] [CrossRef]

- Caldera-Sánchez, Aida, and Oliver Röhn. 2016. How Do Policies Influence GDP Tail Risks? OECD Economics Department Working Papers. Paris: OECD. [Google Scholar]

- Cerutti, Eugenio, Stijn Claessens, and Luc Laeven. 2017. The use and effectiveness of macroprudential policies: New evidence. Journal of Financial Stability 28: 203–24. [Google Scholar] [CrossRef]

- Chen, Hao, Duncan Hongo, Maz William Ssali, Maurice Simiyu Nyaranga, and Consolata Warimu Nderitu. 2020. The Asymmetric Influence of Financial Development on Economic Growth in Kenya: Evidence from NARDL. SAGE Open. Available online: https://journals.sagepub.com/doi/10.1177/2158244019894071 (accessed on 12 September 2021).

- Doumbia, Djeneba. 2015. Financial Development and Economic Growth: Evidence of Non-Linearity. MPRA Paper. Paris School of Economics, Université Paris, Panthéon-Sorbonne, January 31. Available online: https://mpra.ub.uni-muenchen.de/63983/ (accessed on 14 December 2021).

- Eitrheim, Øyvind, and Timo Terasvirta. 1996. Testing the Adequacy of Smooth Transition Autoregressive Models. Journal of Econometrics 74: 59–75. [Google Scholar] [CrossRef]

- Elijah, Sunday, and Namadina Hamza. 2019. The relationship between financial sector development and economic growth in Nigeria: Cointegration with structural break approach. International Journal of Engineering and Advanced Technology 8: 1081–88. [Google Scholar] [CrossRef]

- Gambacorta, Leonardo, Jing Yang, and Kostas Satsaronis. 2014. Financial structure and growth. BIS Quarterly Review March, 21–35. Available online: https://www.bis.org/publ/qtrpdf/r_qt1403e.pdf (accessed on 1 December 2021).

- Goldsmith, Raymond. 1969. Financial Structure and Development. New Haven: Yale University Press. [Google Scholar] [CrossRef]

- González, Andres, Timo Teräsvirta, and Dick Van Dijk. 2005. Panel Smooth Transition Regression Models. Research Paper 165. Available online: https://EconPapers.repec.org/RePEc:hhs:hastef:0604 (accessed on 23 May 2021).

- González, Andres, Timo Teräsvirta, Dick van Dijk, and Yukai Yang. 2017. Panel Smooth Transition Regression Models. SSE/EFI Working Paper Series in Economics and Finance 604, Stockholm School of Economics, revised 11 October 2017. Available online: https://ideas.repec.org/p/hhs/hastef/0604.html (accessed on 24 October 2021).

- Gouider, Afrah Larnaout, and Mohamend Trabelsi. 2006. Does financial market development matter in explaining growth fluctuations? Savings and Development 30: 469–95. [Google Scholar]

- Granger, Clive William John, and Timo Terasvirta. 1993. Modelling non-linear economic relationships. In OUP Catalogue. Oxford: Oxford University Press, Available online: https://ideas.repec.org/b/oxp/obooks/9780198773207.html (accessed on 20 November 2021).

- Greenwood, Jeremy, and Boyan Jovanovic. 1990. Financial development, growth, and the distribution of income. Journal of Political Economy 98: 1076–107. Available online: http://www.jstor.org/stable/2937625 (accessed on 7 November 2021). [CrossRef] [Green Version]

- Ho, Sin-Y, and Bernard Njindan Iyke. 2020. The determinants of economic growth in Ghana: New empirical evidence. Global Business Review 21: 626–44. [Google Scholar] [CrossRef] [Green Version]

- Ibrahim, Muazu, and Imhotep Paul Alagidede. 2018. Nonlinearities in financial development—Economic growth nexus: Evidence from sub-Saharan Africa. Research in International Business and Finance 46: 95–104. [Google Scholar] [CrossRef]

- Ibrahim, Muazu, and Imhotep Paul Alagidede. 2020. Asymmetric effects of financial development on economic growth in Ghana. Journal of Sustainable Finance and Investment 10: 371–87. [Google Scholar] [CrossRef]

- Jobarteh, Mustapha, and Huseyin Kaya. 2019. Revisiting Financial Development and Income Inequality Nexus for Africa. The African Finance Journal 21: 1–22. [Google Scholar]

- Keho, Yaya. 2017. The impact of trade openness on economic growth: The case of Cote d’Ivoire. Cogent Economics & Finance 5: 1332820. [Google Scholar] [CrossRef]

- King, Robert, and Ross Levine. 1993. Finance and growth: Schumpeter might be right. Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Law, Siong Hook, and Wan Ngah Wan Azman-Saini. 2012. Institutional quality, governance and financial development. Economics of Governance 13: 217–36. [Google Scholar] [CrossRef] [Green Version]

- Law, Siong Hook, and Nirvika Singh. 2014. Does too much finance harm economic growth? Journal of Banking and Finance 41: 36–44. [Google Scholar] [CrossRef] [Green Version]

- Levine, Ross. 2003. More on finance and growth: More finance, more growth? Federal Reserve Bank of St. Louis Review 85: 31–46. [Google Scholar] [CrossRef]

- Levine, Ross. 2005. Finance and growth: Theory and evidence. In Handbook of Economic Growth. Edited by Philippe Aghion and Steven Durlauf. Amsterdam: Elsevier, pp. 865–934. [Google Scholar] [CrossRef]

- Machado, Celsa, Antonio Saraiva, and Paulo Vieira. 2021. Finance-growth nexus in sub-Saharan Africa. South African Journal of Economic and Management Sciences 24: 3435. [Google Scholar] [CrossRef]

- Menyah, Kojo, Saban Nazlioglu, and Yemnane Wolde-Rufael. 2014. Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach. Economic Modelling 37: 386–94. [Google Scholar] [CrossRef]

- Opoku, Eric Evans Opoku, Mauzu Ibrahim, and Yakubu Awudu Sare. 2019. The causal relationship between financial development and economic growth in Africa. International Review of Applied Economics 33: 789–812. [Google Scholar] [CrossRef]

- Oro, Oro Ufuo, and Paul Alagidede. 2018. The Nature of the finance–growth relationship: Evidence from a panel of oil-producing countries. Economic Analysis and Policy 60: 89–102. [Google Scholar] [CrossRef]

- Oro, Oro Ufuo, and Imhetep Paul Alagidede. 2019. The non-linear relationship between financial development, economic growth and growth volatility: Evidence from Nigeria. African Review of Economics and Finance 11. Available online: https://hdl.handle.net/10520/EJC-1a94657a2e (accessed on 1 December 2021). [CrossRef]

- Ouedraogo, Salifou, and Hamidou Sawadogo. 2020. Financial development, financial structure and economic growth in the Sub-Saharan African countries. International Journal of Finance and Economics 1: 24. [Google Scholar] [CrossRef]

- Patrick, Hugh. 1966. Financial development and economic growth in underdeveloped countries. Economic Development and Cultural Change 14: 74–189. [Google Scholar] [CrossRef]

- Puatwoe, Janice Tieguhong, and Serge Mandiefe Piabuo. 2017. Financial sector development and economic growth: Evidence from Cameroon. Financial Innovation 3: 25. [Google Scholar] [CrossRef]

- Rioja, Felix, and Neven Valev. 2004. Does one size fit all? A re-examination of the finance and growth relationship? Journal of Development Economics 74: 429–47. [Google Scholar] [CrossRef]

- Robinson, James. 1952. The generalisation of the general theory. In The Rate of Interest and Other Essays. London: Macmillan. [Google Scholar]

- Romer, Paul Michael. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef] [Green Version]

- Samargandi, Nahla, Jan Fidrmuc, and Sugata Ghosh. 2015. Is the relationship between financial development and economic growth monotonic? Evidence from a sample of Middle-Income Countries. World Development 68: 66–81. [Google Scholar] [CrossRef] [Green Version]

- Schumpeter, Joseph Alois. 1934. The Theory of Economic Development. Translated by Redvers Opie. Cambridge: Harvard University Press. [Google Scholar]

- Swamy, Vighneswara, and Munusamy Dharani. 2019. The dynamics of finance-growth nexus in advanced economies. International Review of Economics and Finance 64: 122–46. [Google Scholar] [CrossRef]

- Teräsvirta, Timo, Dag Tjøstheim, and Clive William John Granger. 2010. Modelling Nonlinear Economic Relationships. Oxford: Oxford University Press. [Google Scholar] [CrossRef]

- Teräsvirta, Timo. 1994. Specification, estimation, and evaluation of smooth transition autoregressive models. Journal of the American Statistical Association 89: 208–18. [Google Scholar] [CrossRef]

- Ustarz, Yazidu, Ashenafi Beyene Fanta, and Wai Chaing Poon. 2021. Financial development and economic growth in sub-Saharan Africa: A sectoral perspective. Cogent Economics and Finance 9: 1–22. [Google Scholar] [CrossRef]

- World Development Indicators. 2021. Washington, D.C.: World Bank. Available online: http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 24 October 2021).

- Yilmazkuday, Hakan. 2011. Thresholds in the finance-growth nexus: A cross-country analysis. The World Bank Economic Review 25: 278–95. Available online: http://www.jstor.org/stable/23029753 (accessed on 1 November 2021). [CrossRef]

- Zungu, Lindokuhle Talent, and Lorraine Greyling. 2021a. Financial Development and Income Inequality: A Nonlinear Econometric Analysis of 21 African Countries, 1994–2015. Ersa Working Paper. Cape Town: Economic Research South Africa. [Google Scholar]

- Zungu, Lindokuhle Talent, and Lorraine Greyling. 2021b. Government size and economic growth in African emerging economies: Does the BARS curve exist? International Journal of Social Economics 49: 356–71. [Google Scholar] [CrossRef]

- Zungu, Lindokuhle Talent, Lorraine Greyling, and Mashapa Siphasi Sekome. 2020. Government expenditure and economic growth: Testing for nonlinear effects among SADC countries, 1994–2017. African Journal of Business and Economic Research 15: 37–69. [Google Scholar] [CrossRef]

| Transition Variable DCPSit−1 | Results of the H0 | Selecting Order m | ||||||

|---|---|---|---|---|---|---|---|---|

| Fs | 3.51 | 3.10 | 2.17 | 14.28 | 3.69 | 9.84 | 8.50 | |

| p-v | 0.00009 | 0.01604 | 0.00020 | 0.59 | ||||

| Fs | 15.06 | 13.58 | 12.04 | 9.20 | 7.40 | 54.86 | 48.01 | |

| p-v | 0.00 | 0.43 | ||||||

| WB | p-v | - | - | - | 0.00 | - | - | - |

| WCB | p-v | - | - | - | 0.00 | - | - | - |

| Parameter Constancy Test | ||||

|---|---|---|---|---|

| ) | ||||

| ) | ||||

| No Remaining Nonlinearity | ||||

| 1 (p-value) | ||||

| 1 (p-value) | ||||

| Results of the Estimated Threshold model | ||||

| Model 1: Baseline | Model 2: Baseline | Model 3: Robustness | Model 4: Robustness | |

| 0.605 *** (0.02) | 0.529 *** (0.05) | 0.592 *** (0.01) | 0.581 ** (0.10) | |

| 18.11 ** (4.20) | 10.03 ** (5.04) | 10.08 **(4.10) | 12.90 ** (5.01) | |

| Variables: Growth | Model I: Financial Growth: Macroprudential Policy Regime (2000–2020) | Model II: Financial Growth: Non-Macroprudential Policy Regime (1983–1999) | ||||

|---|---|---|---|---|---|---|

| PSTR | FE | PSTR | FE | |||

| Low Regime | High Regime | Low Regime | High Regime | |||

| −4.62 ** (1.08) | 3.62 ** (0.31) | 3.50 ** (0.87) | −0.88 *** (0.04) | 1.03 (1.33) | −1.40 ** (0.02) | |

| 1.99 ** (0.09) | 0.99 (2.09) | |||||

| −4.42 ** (1.18) | 3.44 ** (1.48) | 3.44 ** (1.48) | ||||

| −0.06 (0.21) | 0.99 ** (0.35) | 0.99 ** (0.35) | −0.76 ** (0.31) | 0.05 (1.44) | 0.76 ** (0.31) | |

| 3.06 ** (0.91) | 1.73 ** (0.73) | 1.73 ** (0.73) | 1.79 *** (0.18) | 3.45 (4.60) | 1.79 *** (0.18) | |

| 4.63 *** (0.40) | 1.50 ** (0.37) | 1.50 ** (0.37) | 1.80 ** (0.24) | 0.3 ** (0.01) | 1.80 ** (0.24) | |

| 2.88 ** (0.78) | −3.15 ** (1.03) | −3.15 ** (1.03) | 1.56 ** (0.80) | −0.99 ** (0.02) | 1.56 ** (0.80) | |

| Dummy | Yes | No | No | Yes | No | No |

| Transition Parameters | ||||||

| 0.605 *** (0.02) | 0.529 * (0.05) | |||||

| 18.11 ** (4.20) | 10.03 ** (5.04) | |||||

| ESD | 0.045 | 0.024 | ||||

| Hansen: p-value | 0.679 | 0.702 | ||||

| 0.62 | 0.58 | |||||

| # of obs. | 210 | 170 | ||||

| # of countries | 10 | |||||

| Model III: Financial Growth: Macroprudential Policy Regime (2000–2020) | Model IV: Financial Growth: Non-Macroprudential Policy Regime (1983–1999) | |

|---|---|---|

| PSTR | Growth = −5.34DCPS1 *** − 2.89MPIF *** − 0.99INFL ** + 2.88TOD ** + 2.01INV ** + 2.98TR ** + 3.01G ** + 2.99DCPS1 ** + 1.29MPIF *** + 0.28INFL** + 3.40TOD *** + 2.99INV *** + 1.01TR ** + 2.31G *** | Growth = −0.99DCPS1 ** − 1.60INFL ** + 1.25TOD *** + 2.01INV ** + 1.56TR ** + 2.11G ** ] + 1.22DCPS1 + 0.29INFL + 3.88TOD ** + 1.09INV ** + 3.21TR ** + 1.10G ** |

| FE | Growth = −3.20DCPS1 ** + 2.67DCPS12 ** + 2.51MPIF *** + 1.03INFL ** + 3.76TOD *** + 1.89INV *** + 2.07TR ** + 2.00G *** Hansen: p-value 0.598 : 0.61 | Growth = −2.00DCPS1 ** + 1.56DCPS12 − 1.23INFL ** + 2.09TOD *** + 1.991INV ** + 1.82TR ** + 1.12G ** Hansen: p-value 0.709 : 0.68 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zungu, L.T. Nonlinear Dynamics of the Financial–Growth Nexus in African Emerging Economies: The Case of a Macroprudential Policy Regime. Economies 2022, 10, 90. https://doi.org/10.3390/economies10040090

Zungu LT. Nonlinear Dynamics of the Financial–Growth Nexus in African Emerging Economies: The Case of a Macroprudential Policy Regime. Economies. 2022; 10(4):90. https://doi.org/10.3390/economies10040090

Chicago/Turabian StyleZungu, Lindokuhle Talent. 2022. "Nonlinear Dynamics of the Financial–Growth Nexus in African Emerging Economies: The Case of a Macroprudential Policy Regime" Economies 10, no. 4: 90. https://doi.org/10.3390/economies10040090

APA StyleZungu, L. T. (2022). Nonlinear Dynamics of the Financial–Growth Nexus in African Emerging Economies: The Case of a Macroprudential Policy Regime. Economies, 10(4), 90. https://doi.org/10.3390/economies10040090