Credit Constraints and Investment-Cash Flow Sensitivity in Declining Economic Conditions: The Role of Reliance on Bank Debt

Abstract

1. Introduction

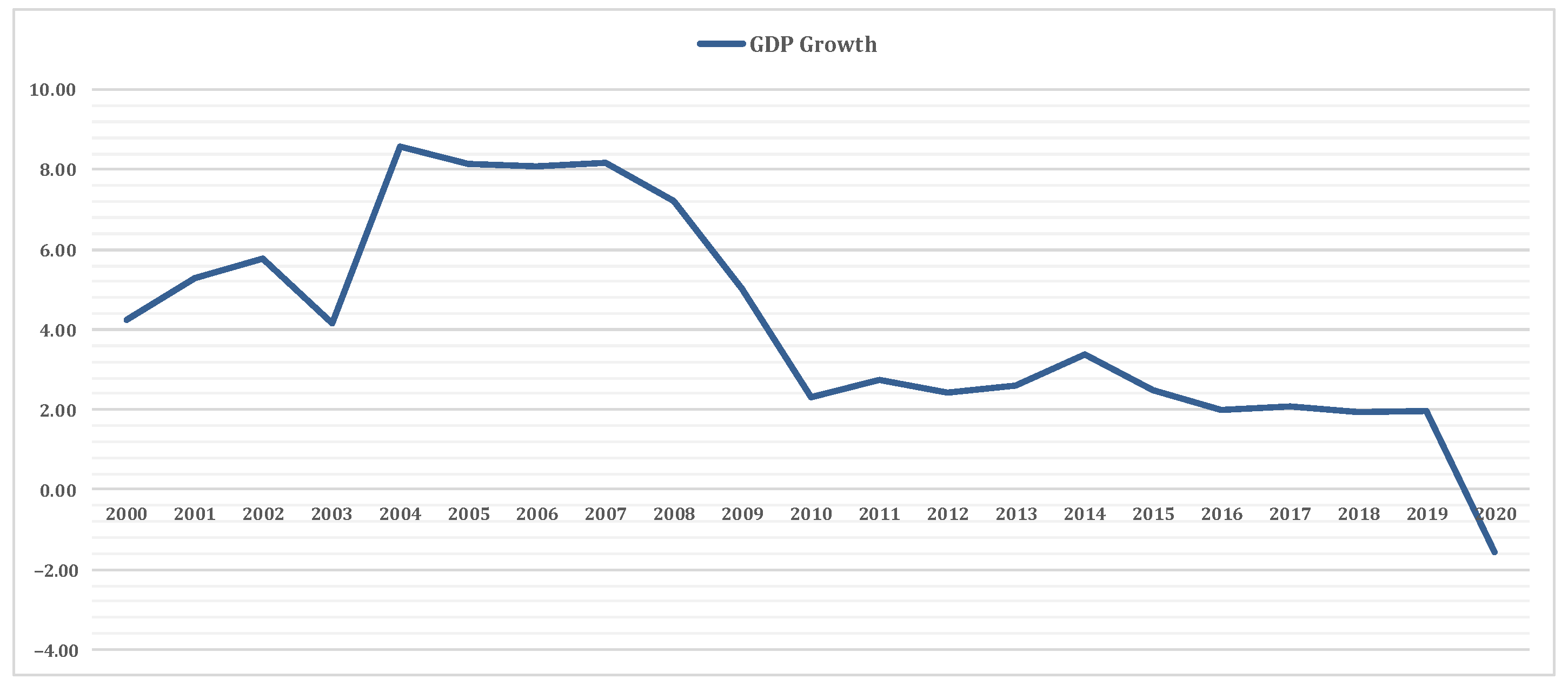

2. Jordanian Economy: A Background

3. Methodology and Research Design

3.1. Hypotheses Motivation

3.2. Model, Variables and Empirical Procedure

3.3. Estimation Methods

4. Sample, Data and Summary Statistics

5. Results

5.1. Investment-Cash Flow Sensitivity and Declining Economic Conditions

5.2. Investment-Cash Flow Sensitivity and Access to a Line of Credit

5.3. Investment-Cash Flow Sensitivity and Access to a Line of Credit

6. Discussion

7. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ağca, Şenay, and Abon Mozumdar. 2017. Investment–Cash flow sensitivity: Fact or fiction? Journal of Financial and Quantitative Analysis 52: 1111–41. [Google Scholar] [CrossRef]

- Aghion, Levine, Peter Howitt, and Ross Levine. 2018. Financial development and innovation-led growth. In Handbook of Finance and Development. Edited by Thorsten Beck and Ross Levine. Cheltenham: Edward Elgar Publishing, pp. 3–30. [Google Scholar]

- Allen, Franklin, Xian Gu, and Oskar Kowalewski. 2018. Financial structure, economic growth and development. In Handbook of Finance and Development. Edited by Thorsten Beck and Ross Levine. Cheltenham: Edward Elgar Publishing, pp. 31–62. [Google Scholar]

- Azimli, Asil. 2022. The impact of policy, political and economic uncertainty on corporate capital investment in the emerging markets of Eastern Europe and Turkey. Economic Systems 64: 100974. [Google Scholar] [CrossRef]

- Beck, Roland, Georgios Georgiadis, and Roland Straub. 2014. The finance and growth nexus revisited. Economics Letters 124: 382–85. [Google Scholar] [CrossRef]

- Berger, Allen N., and Gregory F. Udell. 1995. Relationship lending and lines of credit in small firm finance. Journal of Business 68: 351–81. [Google Scholar] [CrossRef]

- Bikas, Egidijus, and Evelina Glinskytė. 2021. Financial factors determining the investment behavior of Lithuanian business companies. Economies 9: 45. [Google Scholar] [CrossRef]

- Bloom, Nicholas. 2017. Observations on uncertainty. Australian Economic Review 50: 79–84. [Google Scholar] [CrossRef]

- Brown, James R., and Bruce C. Petersen. 2009. Why has the investment-cash flow sensitivity declined so sharply? Rising R&D and equity market developments. Journal of Banking & Finance 33: 971–84. [Google Scholar] [CrossRef]

- Bucă, Andra, and Philip Vermeulen. 2017. Corporate investment and bank-dependent borrowers during the recent financial crisis. Journal of Banking & Finance 78: 164–80. [Google Scholar] [CrossRef]

- Cama, Freddy A. Rojas, and Noha Emara. 2022. Financial inclusion and gross capital formation: A sectoral analysis approach for the MENA region and EMs. International Review of Financial Analysis 79: 101993. [Google Scholar] [CrossRef]

- Campello, Murillo, Erasmo Giambona, John R. Graham, and Campbell R. Harvey. 2011. Liquidity management and corporate investment during a financial crisis. The Review of Financial Studies 24: 1944–79. [Google Scholar] [CrossRef]

- Campello, Murillo, John R. Graham, and Campbell R. Harvey. 2010. The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics 97: 470–87. [Google Scholar] [CrossRef]

- Chen, Xikai, Cao Hoang Anh Le, Yaowen Shan, and Stephen Taylor. 2020. Australian policy uncertainty and corporate investment. Pacific-Basin Finance Journal 61: 101341. [Google Scholar] [CrossRef]

- Chiu, Chun-Ju, Amy Yueh-Fang Ho, and Li-Fang Tsai. 2022. Effects of financial constraints and managerial overconfidence on investment-cash flow sensitivity. International Review of Economics & Finance 82: 135–55. [Google Scholar] [CrossRef]

- Chodorow-Reich, Gabriel. 2014. The employment effects of credit market disruptions: Firm-level evidence from the 2008–9 financial crisis. The Quarterly Journal of Economics 129: 1–59. [Google Scholar] [CrossRef]

- Cingano, Federico, Francesco Manaresi, and Enrico Sette. 2016. Does credit crunch investment down? New evidence on the real effects of the bank-lending channel. The Review of Financial Studies 29: 2737–73. [Google Scholar] [CrossRef]

- Dessaint, Olivier, Thierry Foucault, Laurent Frésard, and Adrien Matray. 2019. Noisy stock prices and corporate investment. The Review of Financial Studies 32: 2625–72. [Google Scholar] [CrossRef]

- Edmans, Alex, Sudarshan Jayaraman, and Jan Schneemeier. 2017. The source of information in prices and investment-price sensitivity. Journal of Financial Economics 126: 74–96. [Google Scholar] [CrossRef]

- Ek, Chanbora, and Guiying Laura Wu. 2018. Investment-cash flow sensitivities and capital misallocation. Journal of Development Economics 133: 220–30. [Google Scholar] [CrossRef]

- Fazzari, Steven, R. Glenn Hubbard, and Bruce C. Petersen. 1988. Financing constraints and corporate investment. Brookings Papers on Economic Activity 1: 141–206. [Google Scholar] [CrossRef]

- Fazzari, Steven, R. Glenn Hubbard, and Bruce C. Petersen. 2000. Investment-cash flow sensitivities are useful: A comment on Kaplan and Zingales. The Quarterly Journal of Economics 115: 695–705. [Google Scholar] [CrossRef]

- Guizani, Moncef, and Ahdi Noomen Ajmi. 2020. Financial conditions, financial constraints and investment-cash flow sensitivity: Evidence from Saudi Arabia. Journal of Economic and Administrative Sciences 37: 763–84. [Google Scholar] [CrossRef]

- Gül, Selçuk, and Hüseyin Taştan. 2020. The impact of monetary policy stance, financial conditions, and the GFC on investment-cash flow sensitivity. International Review of Economics & Finance 69: 692–707. [Google Scholar]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. The Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Gupta, Gaurav, Jitendra Mahakud, and Vishal Kumar Singh. 2022. Economic policy uncertainty and investment-cash flow sensitivity: Evidence from India. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Hayashi, Fumio. 1982. Tobin’s marginal q and average q: A neoclassical interpretation. Econometrica: Journal of the Econometric Society 15: 213–24. [Google Scholar] [CrossRef]

- Hoshi, Takeo, Anil Kashyap, and David Scharfstein. 1991. Corporate structure, liquidity, and investment: Evidence from Japanese industrial groups. The Quarterly Journal of Economics 106: 33–60. [Google Scholar] [CrossRef]

- Hunjra, Ahmed Imran, Muhammad Azam, Maria Giuseppina Bruna, and Dilvin Taskin. 2022. Role of financial development for sustainable economic development in low middle income countries. Finance Research Letters 47: 102793. [Google Scholar] [CrossRef]

- Iyer, Rajkamal, José-Luis Peydró, Samuel da-Rocha-Lopes, and Antoinette Schoar. 2014. Interbank liquidity crunch and the firm credit crunch: Evidence from the 2007–2009 crisis. The Review of Financial Studies 27: 347–72. [Google Scholar] [CrossRef]

- Jeon, Haejun, and Michi Nishihara. 2014. Macroeconomic conditions and a firm’s investment decisions. Finance Research Letters 11: 398–409. [Google Scholar] [CrossRef]

- Kaplan, Steven N., and Luigi Zingales. 1997. Do investment-cash flow sensitivities provide useful measures of financing constraints? The Quarterly Journal of Economics 112: 169–215. [Google Scholar] [CrossRef]

- Larkin, Yelena, Lilian Ng, and Jie Zhu. 2018. The fading of investment-cash flow sensitivity and global development. Journal of Corporate Finance 50: 294–322. [Google Scholar] [CrossRef]

- Lewellen, Jonathan, and Katharina Lewellen. 2016. Investment and cash flow: New evidence. Journal of Financial and Quantitative Analysis 51: 1135–64. [Google Scholar] [CrossRef]

- Machokoto, Michael, Umair Tanveer, Shamaila Ishaq, and Geofry Areneke. 2021. Decreasing investment-cash flow sensitivity: Further UK evidence. Finance Research Letters 38: 101397. [Google Scholar] [CrossRef]

- Masuda, Koichi. 2015. Fixed investment, liquidity constraint, and monetary policy: Evidence from Japanese manufacturing firm panel data. Japan and the World Economy 33: 11–19. [Google Scholar] [CrossRef]

- Morikawa, Masayuki. 2016. What types of policy uncertainties matter for business? Pacific Economic Review 21: 527–40. [Google Scholar] [CrossRef]

- Moshirian, Fariborz, Vikram Nanda, Alexander Vadilyev, and Bohui Zhang. 2017. What drives investment–cash flow sensitivity around the World? An asset tangibility Perspective. Journal of Banking & Finance 77: 1–17. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Nguyen, Thi Anh Nhu. 2022. Financial Development, Human Resources, and Economic Growth in Transition Countries. Economies 10: 138. [Google Scholar] [CrossRef]

- Popov, Alexander. 2018. Evidence on finance and economic growth. In Handbook of Finance and Development. Edited by Thorsten Beck and Ross Levine. Cheltenham: Edward Elgar Publishing, pp. 63–104. [Google Scholar]

- Schoder, Christian. 2013. Credit vs. demand constraints: The determinants of US firm-level investment over the business cycles from 1977 to 2011. The North American Journal of Economics and Finance 26: 1–27. [Google Scholar] [CrossRef][Green Version]

- Sufi, Amir. 2009. Bank lines of credit in corporate finance: An empirical analysis. The Review of Financial Studies 22: 1057–88. [Google Scholar] [CrossRef]

- Tang, Huoqing, Chengsi Zhang, and Hong Zhou. 2022. Monetary policy surprises and investment of non-listed real sector firms in China. International Review of Economics & Finance 79: 631–42. [Google Scholar] [CrossRef]

- Tayeh, Mohammad, Adel Bino, Diana Abu Ghunmi, and Ghada Tayem. 2015. Liquidity commonality in an emerging market: Evidence from Amman stock exchange. International Journal of Economics and Finance 7: 203–13. [Google Scholar] [CrossRef][Green Version]

- Tayem, Ghada. 2015a. Does foreign ownership increase firms’ productivity? Evidence from firms listed on Amman Stock Exchange. Review of Middle East Economics and Finance 11: 25–54. [Google Scholar] [CrossRef]

- Tayem, Ghada. 2015b. Ownership concentration and investment sensitivity to market valuation. Corporate Ownership & Control 13: 1228–40. [Google Scholar] [CrossRef][Green Version]

- Tayem, Ghada. 2017. To Bank or Not to Bank: The Determination of Cash Holdings and Lines of Credit. Cairo: Economic Research Forum. [Google Scholar]

- Tayem, Ghada. 2022. Loan portfolio structure: The impact of foreign and Islamic banks. EuroMed Journal of Business. ahead-of-print. [Google Scholar] [CrossRef]

- Tirole, Jean. 2010. The Theory of Corporate Finance. Princeton: Princeton University Press. [Google Scholar]

- Tobin, James. 1969. A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking 1: 15–29. [Google Scholar] [CrossRef]

- Verona, Fabio. 2020. Investment, Tobin’s Q, and cash flow across time and frequencies. Oxford Bulletin of Economics and Statistics 82: 331–46. [Google Scholar] [CrossRef]

- Wang, Yizhong, Carl R. Chen, and Ying Sophie Huang. 2014. Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance Journal 26: 227–43. [Google Scholar] [CrossRef]

- Zhao, Yijia Eddie. 2021. Does credit type matter for relationship lending? The special role of bank credit lines. Finance Research Letters 38: 101507. [Google Scholar] [CrossRef]

- Zubair, Siraz, Rezaul Kabir, and Xiaohong Huang. 2020. Does the financial crisis change the effect of financing on investment? Evidence from private SMEs. Journal of Business Research 110: 456–63. [Google Scholar] [CrossRef]

| Mean | Median | SD | Min | Max | |

|---|---|---|---|---|---|

| Book Assets (thousand JDs) | 56,400 | 14,700 | − | 320 | 1,220,000 |

| Fixed Assets (thousand JDs) | 15,900 | 4405 | − | 0 | 427,000 |

| Firm Investments (I/K) | 0.040 | 0.015 | 0.077 | 0 | 0.685 |

| Market to Book (Q) | 1.473 | 1.077 | 1.267 | 0.248 | 8.033 |

| Cash Flow (CashFlow) | 0.053 | 0.060 | 0.120 | −0.605 | 0.435 |

| Debt Ratio (DebtRatio) | 0.150 | 0.105 | 0.165 | 0 | 0.793 |

| Cash Ratio (CashRatio) | 0.073 | 0.024 | 0.125 | 0 | 0.876 |

| I/K | Q | CashFlow | DebtRatio | CashRatio | |

|---|---|---|---|---|---|

| Pre-2008 | |||||

| Mean | 0.054 | 1.671 | 0.078 | 0.144 | 0.075 |

| Observations | 416 | ||||

| Post-2008 | |||||

| Mean | 0.032 | 1.355 | 0.038 | 0.154 | 0.071 |

| Observations | 700 | ||||

| t-stat | 4.646 *** | 4.049 *** | 5.489 *** | −1.025 | 0.439 |

| Without a Line of Credit | |||||

| Mean | 0.034 | 1.537 | 0.055 | 0.079 | 0.111 |

| Observations | 453 | ||||

| With a Line of Credit | |||||

| Mean | 0.044 | 1.429 | 0.051 | 0.199 | 0.046 |

| Observations | 663 | ||||

| t-stat | −2.013 ** | 1.392 | 0.559 | −12.853 *** | 8.848 *** |

| (1) | (2) | (3) Pre-2008 | (4) Post-2008 | (5) Interaction Analysis | |

|---|---|---|---|---|---|

| Q | 0.0038 | 0.0029 | 0.0050 | 0.0021 | 0.0043 * |

| (1.61) | (1.21) | (0.90) | (0.75) | (1.76) | |

| CashFlow | 0.0515 ** | 0.0257 | −0.0691 | 0.0474 * | −0.0598 |

| (2.24) | (1.09) | (−1.15) | (1.88) | (−1.47) | |

| DebtRatio | −0.0437 ** | −0.0341 | −0.0163 | −0.0170 | −0.0332 |

| (−2.04) | (−1.60) | (−0.31) | (−0.67) | (−1.56) | |

| CashRatio | −0.0126 | −0.0085 | −0.0137 | −0.0124 | −0.0094 |

| (−0.41) | (−0.28) | (−0.21) | (−0.33) | (−0.31) | |

| 2008-Indicator | – | −0.0217 *** | – | – | −0.0300 *** |

| – | (−4.28) | – | – | (−5.00) | |

| CashFlow × 2008-Indicator | – | – | – | – | 0.1200 *** |

| – | – | – | – | (2.58) | |

| Observations | 1116 | 1116 | 416 | 700 | 1116 |

| F-test | 2.29 *** | 2.34 *** | 2.65 *** | 1.67 *** | 2.44 *** |

| Within R2 | 0.012 | 0.029 | 0.006 | 0.007 | 0.035 |

| (1) Without a Line of Credit | (2) With a Line of Credit | (3) Interaction Analysis | (4) Pre-2008 | (5) Post-2008 | |

|---|---|---|---|---|---|

| Q | 0.0048 | 0.0039 | 0.0038 | 0.0051 | 0.0024 |

| (1.40) | (1.10) | (1.60) | (0.93) | (0.83) | |

| CashFlow | 0.0549 ** | 0.0532 | 0.0479 | 0.0180 | 0.0376 |

| (2.02) | (1.40) | (1.56) | (0.22) | (1.22) | |

| DebtRatio | 0.0189 | −0.0796 ** | −0.0458 ** | −0.0101 | −0.0180 |

| (0.53) | (−2.56) | (−2.10) | (−0.19) | (−0.69) | |

| CashRatio | −0.0126 | 0.0477 | −0.0099 | −0.0310 | −0.0114 |

| (−0.36) | (0.82) | (−0.32) | (−0.47) | (−0.31) | |

| LineCredit | – | – | 0.0027 | −0.0050 | −0.0001 |

| – | – | (0.40) | (−0.31) | (−0.01) | |

| CashFlow × LineCredit | – | – | 0.0075 | −0.1563 * | 0.0229 |

| – | – | (0.19) | (−1.67) | (0.56) | |

| Observations | 453 | 663 | 1116 | 416 | 700 |

| F-test | 3.31 *** | 1.66 *** | 2.25 *** | 2.67 *** | 1.67 *** |

| Within R2 | 0.014 | 0.022 | 0.012 | 0.017 | 0.007 |

| (1) Without a Line of Credit | (2) With a Line of Credit | |

|---|---|---|

| Q | 0.0046 | 0.0053 |

| (1.34) | (1.44) | |

| CashFlow | 0.0218 | −0.1250 ** |

| (0.41) | (−2.02) | |

| DebtRatio | 0.0298 | −0.0574 * |

| (0.83) | (−1.86) | |

| CashRatio | −0.0117 | 0.0470 |

| (−0.33) | (0.82) | |

| 2008-Indicator | −0.0170 ** | −0.0433 *** |

| (−2.06) | (−4.87) | |

| CashFlow × 2008-Indicator | 0.0288 | 0.2118 *** |

| (0.48) | (2.87) | |

| Observations | 453 | 663 |

| F-test | 3.35 *** | 1.83 *** |

| Within R2 | 0.026 | 0.060 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tayem, G. Credit Constraints and Investment-Cash Flow Sensitivity in Declining Economic Conditions: The Role of Reliance on Bank Debt. Economies 2022, 10, 288. https://doi.org/10.3390/economies10110288

Tayem G. Credit Constraints and Investment-Cash Flow Sensitivity in Declining Economic Conditions: The Role of Reliance on Bank Debt. Economies. 2022; 10(11):288. https://doi.org/10.3390/economies10110288

Chicago/Turabian StyleTayem, Ghada. 2022. "Credit Constraints and Investment-Cash Flow Sensitivity in Declining Economic Conditions: The Role of Reliance on Bank Debt" Economies 10, no. 11: 288. https://doi.org/10.3390/economies10110288

APA StyleTayem, G. (2022). Credit Constraints and Investment-Cash Flow Sensitivity in Declining Economic Conditions: The Role of Reliance on Bank Debt. Economies, 10(11), 288. https://doi.org/10.3390/economies10110288