1. Introduction

The self-financing capability, profitability and market power of companies, as a determinant of management decisions, may vary across industries (

Eide et al. 2020;

Pervan et al. 2019) and within industries if their operations are exposed to particularly high risk (

Dhanora et al. 2018). Pharmaceuticals is a special industry in which rewards from innovation in the form of intellectual property rights give rise to market power (

Akcigit et al. 2021) whose impact on financial flexibility is most likely to be seen at the top segment of the industry. The managers of multinational companies that can be classified in that segment can use their more powerful industry-specific competitive advantage to increase their bargaining power against their customers and suppliers through the manipulation of prices and average payment deadlines, thereby also increasing their financial flexibility, which refers to the greater self-financing capability that can result from:

On the one hand, maintaining sales prices at a higher level than given purchase prices (or maintaining purchase prices at a lower level than a given sales prices), resulting in higher gross profit and profitability ratios (

Ittelson 2009;

Madhavi and Nageswara 2017);

In this study there is only a focus on the financial impact of the legally conferred monopoly power due to patents on pharmaceuticals produced by R&D activity, inside the top segment of the industry, by comparing the companies that produce them with the same financial data of pharmaceutical companies not engaged in R&D (this means the “commercial” category in this analysis), supporting development policy decisions both at company and macro levels.

As

Ittelson (

2009) points out, gross profit margin, as opposed to liquidity, is one of the profitability indicators of the long-term health of companies, which measures, as a percentage of sales, whether a company can cover its product sales, development and administration activities while maintaining profits. In other words, this indicator measures how much it costs a company to produce its products and what price it can afford to pay to generate profit on SG&A expenses.

Fairfield and Yohn (

2001) used the relationship between profitability rates to show that although the decomposition of ROA into asset turnover rate and gross profit does not provide additional information for the one-year forecast of ROA change, this is no longer true in that case when considering changes in the ratios that explain ROA, which used in calculations can lead to more useful forecasts.

Madhavi and Nageswara (

2017), using financial ratios of sixty-seven listed companies in Southeast Asia from 2012 to 2016, showed that profitability has a positively significant relationship with the inventory turnover ratio and negatively significant with the debt-to-equity ratio and the asset turnover ratio. However, their findings were also noteworthy for the purpose of this study, that company size, liquidity ratios, retained earnings ratio and capital intensity ratio had negative and insignificant relationships with profitability. The latter findings mostly confirmed by

Endri et al. (

2020b) with the difference that the fixed asset turnover has a significantly positive impact on ability of companies to earn profits through own assets. Using 10 years of panel data from 20 leading and listed pharmaceutical companies in Bangladesh,

Islam and Khan (

2019) estimated that operating income, return on equity and firm size were impacted positively, while operating costs and firm liabilities inversely affected profitability. Profitability plays a vital role in increasing long-term returns, increasing workers’ incomes, better quality of products, a greener environment, creating more employment opportunities and increasing future investments (

Madhavi and Nageswara 2017). For the healthcare providers studied by

Wahlen et al. (

2015) between 1990 and 2004, based on median values, the return on sales was above 3.5%, while most of them were able to efficiently use their assets (they could rotate them at least once in an average year), so that the return on assets for the industry was above 3%, although it was below the profitability rates of food producers or the retail segment. This was influenced by, according to the interpretation of

Wahlen et al. (

2015):

Firstly, that most pharmaceutical manufacturers have a product life cycle of around seven years, so that their products, with a shorter life cycle than those of food processors or soft drinks manufacturers, are less likely to require additional expenditure to develop substitutes or new products.

Another influencing factor is that the industry has a very high market entry threshold compared to the food industry, which is mainly due to the extremely high capital requirements of their R&D activities, which are lengthy and highly uncertain in terms of future success: patent protection obtained after a successful testing and licensing process allows pharmaceutical companies to realise much higher profit margins on their products than food businesses can on their own products.

Due to the high business risks associated with product liability and competition, the willingness of pharmaceutical companies to raise debt financing typically lags behind other industry players, as confirmed by

DiMasi et al. (

2016). Although the indebtedness of pharmaceutical companies is still quite high in some regions (

Endri et al. 2020a), the higher credit risk may also be explained by the fact that the inflow of cash from industry players is reduced by the impact of several factors which are not present in other industries: directly, by more limited insurance subsidies and the time and administrative requirements of drug development; and indirectly, by the increasing proportion of elderly people who receive pension transfers, which have decreasing purchasing power (

Dickson and Gagnon 2004). Due to low leverage, the sectoral return on equities is also lower than in agriculture or clothing, and is on par with retail at around 13% (

Subramanyam 2014). For investors, the return on invested capital is relevant, and for creditors, solvency is relevant to the assessment of the financial performance of companies compared to benchmarks, for which profitability indicators can be of considerable help (

Finkler et al. 2019). Within this context, corporate measures to maximise ROS and ROA ratios have a prominent role to play in increasing the efficiency of operations (

Shah et al. 2010;

Subramanyam 2014), although these ratios may be distorted to some degree of uncertainty related to accounting and valuation methods (

Helfert 2001).

3. Data and Methodology

For the analysis, we used data from all of the world’s 100 highest sales-generating pharmaceutical companies in 2020, based on Statista’s report (

Statista 2020), whose shares are publicly traded on a stock exchange, and therefore whose reporting data are also publicly available on the Wall Street Journal’s website. In this analysis, instead of all listed companies, only the sample of companies with the largest global turnover and therefore the largest global market share was used. This is explained by the fact that:

Firstly, the research focused on the management of companies that also serve as a benchmark for smaller companies;

Secondly, smaller-turnover companies with no R&D activities may have lower financial margins compared to R&D companies not only because of their lack of R&D activities but also because of their lower market shares, lobbying and their limited capital resources for marketing, but the differences in relative global market position of competitors are more significant only in the top segment of the market and hence their effects also can be better detected in that segment;

Thirdly, the inclusion of all company data would lead to higher data dispersion and lower reliability of the regression model due to the differences of economies of scale that would result from the above.

Within this narrower set of companies, a total of 61 companies based in the USA (38), China (13), Germany (6) and Switzerland (4) were selected for further data processing. The selection of countries was based on the high number of companies operating in each country (e.g., USA), and their role in the world economy and their different economic systems (e.g., China). Furthermore, we selected Germany, which is at the forefront of the EU in Europe, and Switzerland, which is at the forefront within the pharmaceutical industry, while being outside the EU and less benefiting from its support policies. This panel database, based on publicly available, online financial reporting data of listed companies (

WSJ Markets 2022), included data on sales turnover, gross profit, stocks of inventories, trade receivables and payables to suppliers for a four-year period from 2017 to 2020. All financial data were recorded in the database in thousands of dollars translated at the exchange rate prevailing at the balance sheet date of the year.

For our analysis, we used the Stata statistical software package version 13. The test of our hypothesis required a longitudinal analysis of time-varying indicator values, so we performed a panel regression analysis of the indicators formed from the financial data retrieved, which is suitable for separately detecting the time factor and the individual effects of time-varying unit values on the unit values (

Hsiao 2007). The financial margins formulated in our hypothesis can be reflected in the relative magnitude of difference of selling and purchasing prices and in changes in the payment concessions given to or received from business partners. For this reason, we also consider the EBIT (or operating profit) and the values of the cash cycle as output variables, and we examined the results in a two-panel regression model.

As one of the output variables in the analysis, the gross profit, according to Equation (1), is defined in terms of net sales and cost of goods sold, which shows how high the company can validate sales prices relative to the purchase prices of materials or goods:

We expressed the days sales of inventory (DSI), days sales outstanding (DSO) and days payable outstanding (DPO) as a ratio of inventories, trade receivables and trade payables to one day’s sales, from which we determined the cash cycle as the other output variable of the analysis, which depends partly on the length of the period of stock holding time and partly on the relative size of the bargaining power with both buyers and suppliers, as described in Equation (2):

If the company is in a stronger bargaining position both with its customers and its supplier partners, and assuming that this is reflected not only in prices but also in the payment discounts granted, the company can typically recover its cash with a shorter DSO than DPO, while in the opposite case it has to finance its operations partly or mostly from its own profits or with costly debt financing which refers to higher cash cycle.

In selecting the set of explanatory variables through backward regression, we treated countries, the presence/absence of R&D and time as dummy variables. For the latter, we treated as a separate group all companies that produce own developed products and thus incur R&D costs and those that do not incur such costs because they either produce only generic products or are engaged in pharmaceutical commercialisation. In the panel regression, we wanted to filter as control variables:

The time variable, all factors affecting relative wealth change that are associated with global changes in the pharmaceutical market, controlled separately for each year under review;

The days sales of inventory or inventory holding period, all factors affecting the cash cycle that do not depend on the evolution of the size of the bargaining power against counterparties;

The value of total assets relative to the same data of the company with the lowest assets in a given year, which filter the extent of volume effect from the gross profit;

The market share of the companies, defined as their turnover in a given year;

And (at examining the Hypothesis 1 and 3) the country variables, which can express all the macroeconomic factors that improve the gross profitability and market position of the companies engaged in R&D through public support schemes for R&D activities.

Thus, the regression model described in Equation (3) used for Hypothesis 1:

in Equation (4) used for Hypothesis 2:

in Equation (5) used for Hypothesis 3:

where DSI indicates the days sales of inventory, RTA shows the relative total assets, while the activity, each country and each year represents a dummy variable, and

is an error term of the model. The correctness of the model is tested by a global F-test, the significance of the effect of the variables is tested by z-probe with the significance level at 5%, while the verification of the model assumptions is tested by Kolmogorov–Smirnov test of the metric parameters. The variables at high measurement level were logarithmised in order to avoid heteroskedasticity. The basic assumptions for modelling the regression relationship between the explanatory and outcome variables have been examined and verified, as a result of which it has been established that the explanatory variables are independent of each other and that there is no multicollinearity between them (

Table 1), that the variances of the error terms are independent of those of the model variables, that they are not correlated with each other. The correlation matrix between the explanatory, ratio scale measurement level variables are shown by

Table 1 below:

4. Results

4.1. Descriptive Statistical Characterisation of Explanatory Variables

In the descriptive statistical analysis of the data, firstly we examined the statistically relevant characteristics of the main explanatory variables. If we take into account the extreme and outlier values, the standard deviation of the inventory ratios, apart from 2018, although always lower than their arithmetic mean, still indicated overall high enough results for the latter values to be able to characterise a large number of enterprises statistically with full confidence, but the comparison of their values gives an interesting picture. The only outlier in the total sample of pharmaceutical companies surveyed was the average value in 2018: the 24% recorded in that year was almost three times higher than in the other years under review. Striking differences in inventory levels can be observed when the group of companies that develop and manufacture new medicines is separated from those that do not engaged in R&D activities: while both groups include companies that do not maintain safety inventory levels, low inventory levels are more pronounced for large pharmaceutical companies (also due to the optimal use of the benefits of the just-in-time system and the common practice of market leaders to minimise inventory costs), but less so for those performing R&D activities with higher operational risks. This is reflected in the fact that while more than half of the commercial elements in the sample were able to demonstrate an inventory level below 5%, only a quarter of those involved in the R&D segment were able to demonstrate this. However, the interquartile range in the commercial sample group is much larger, as the data of the eight companies that make up half of it with inventory levels above 2% had a spectacularly larger dispersion, with those in the top quarter already having at least 15% of their assets tied up in inventory, and those with the largest inventory levels increasing their investment in this asset, with the exception of 2019, until they reached inventory levels of 35% in 2020. In contrast, only a quarter of R&D-engaged pharma companies had a ratio above 10%, and only a fraction of these held a fifth or more of their assets in inventory (see on

Figure 1).

The high dispersion of inventory levels in commercial companies in terms of average DSI can already be observed in the R&D-engaged firms, even if extreme values are not considered. Although both groups of companies studied had members that were not forced to hold inventories for reasons of efficiency or demand, this was more the case for commercial pharmaceutical companies that were better able to apply efficient inventory holding policies. Even so, half of the latter companies held inventories for less than 10 days on average until sale and only in 2020—due to the logistical supply problems caused by the coronavirus epidemic—did this figure rise to over 50 days for the industry players with the longest DSI (see on

Figure 2). On the other hand, in the R&D sector, half of the items in the sample had a DSI of at least 50 days, while for some R&D-engaged companies, especially in 2018 and 2019, the indicator was three times higher, which may be partly explained by the nature of the activity, the extended period of drug R&D and the inventorying of chemical and pharmaceutical raw materials for this purpose, which extended the production cycle.

The descriptive statistical characteristics of the DSI indicator for each year, independently of pharmaceutical market activity, are presented in

Table 2 below.

There is a similar but opposite difference in market share: while commercial companies typically had a turnover of between 0.2% and 2%, R&D companies had a wider spread, with several of these companies having a global turnover of more than 5% of the total market. Both groups were characterised by a share of at least 0.2% of the world pharmaceutical market, with half of the companies surveyed having a share of 1% of the world pharmaceutical market (see on

Figure 3). In addition, a quarter of the players in the pharmaceutical development sector were able to achieve a world market share of more than 2%, which only one of the other market players surveyed managed to do. The increase in DSI was also clearly evident in the final year of the period under review in the group of companies that carried out the drug improvements.

The descriptive statistical characteristics of the market share indicator for each year, independently of pharmaceutical market activity, are presented in

Table 3 below.

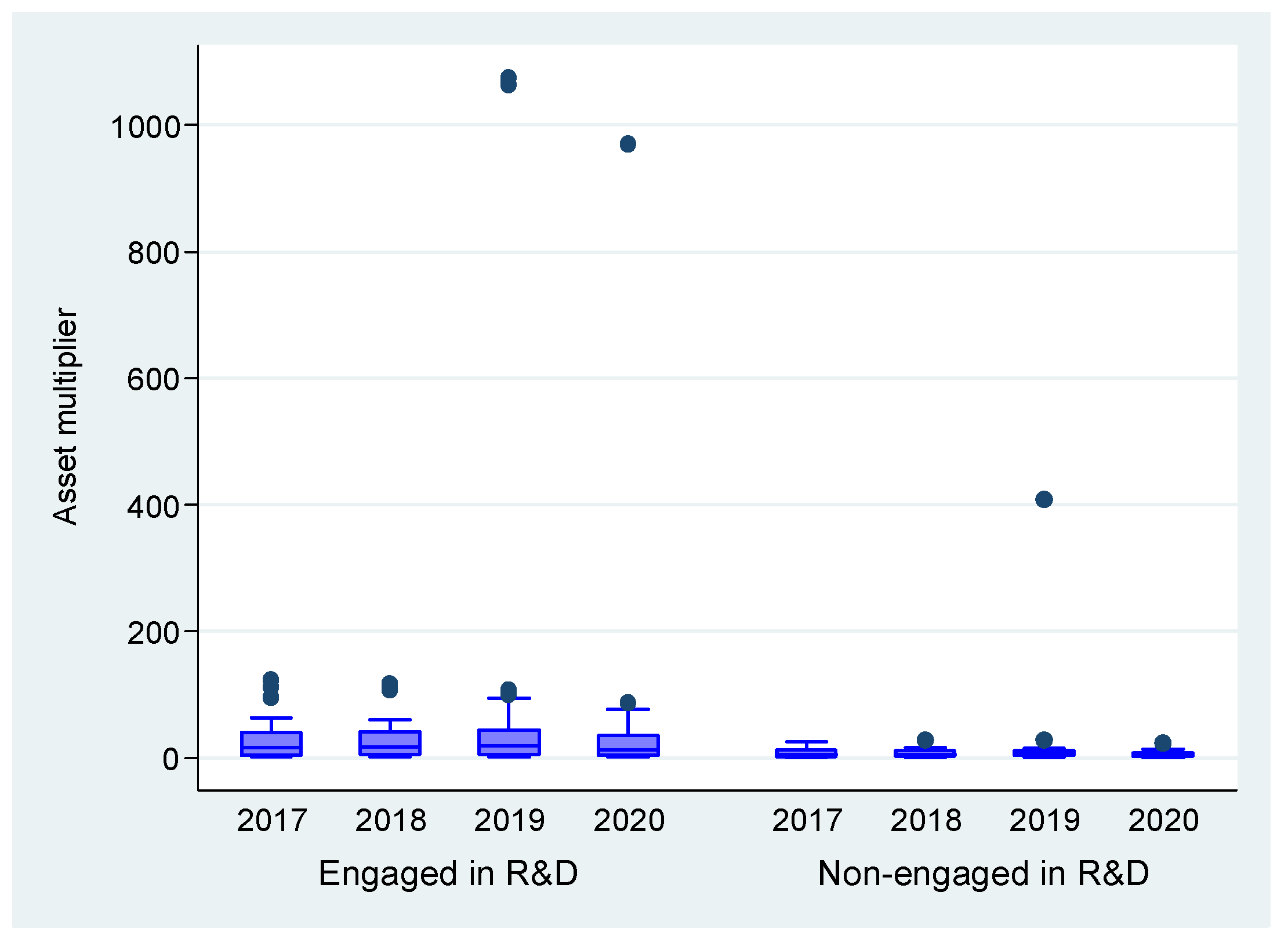

In addition to market turnover, differences in the relative wealth position of market participants can also affect their ability to rotate their assets profitably and the costs of holding the same assets. The RTA in the sample showed a very wide variation, while the average total assets were almost 20 times higher (in 2017 and 2018) and almost 60 times higher (in 2019) than the wealth of the smallest company, which fell by half in only the last year under review. The results were skewed by the fact that, two companies (Edwards Lifesciences Corp., Hologic Inc., Marlborough, MA, USA) had assets that were outstandingly 1000 times higher than the smallest wealth company in the sample in 2019. Aside from the outliers, there is at most only one order of magnitude difference in total assets between commercial companies, while the top 25% of development pharma companies have seen differences of at least 35–40 times as of 2018 (see on

Figure 4).

The descriptive statistical characteristics of the RTA indicator for each year, independent of pharmaceutical market activity, are presented in

Table 4 below.

4.2. Descriptive Statistical Characterisation of Outcome Variables

If we look at the results of all the pharmaceutical companies studied, the gross profit on sales was on average half of the sales achieved in almost all years, through the segment of development companies having higher profitability and a larger weight in the sample. This average value is more representative of the data than the explanatory variables, since the dispersion of the data was also 50% of the average, although the spread of that was twice as large for the R&D segment as for the commercial group. The average gross profit margin for the whole sample peaked in 2019, while it fell by more than two percentage points in the following year. In other words, contrary to popular belief, the impact of the coronavirus epidemic in 2020 did not yet increase, but actually mostly reduced, the profit margin that manufacturers could apply to the medicines they sold, while the healthcare sector, which represented a significant part of the uptake market, was burdened with the management of a well-known epidemic infection that was still marginally treatable with vaccines at that time. When looking at the whole sample, beside that there were no companies that could not sell their pharmaceutical inventories at a selling price at least marginally higher than their purchase price or cost of production, the companies with the lowest gross profit margin have seen their values steadily decrease. While the least profitable companies in the trading companies’ group have always performed below a 10% profit margin, it is only in 2020 that the values of the worst performing companies in the R&D group have fallen below this level (see on

Figure 5).

Overall, three quarters of R&D-engaged companies were able to claim at least 40% gross profit from their customers in all years, which some of the drug commercials, with one exception, were only able to do in 2018. Among the former, there were large companies that were able to recover almost twice the direct cost of R&D-engaged medicines, partly from customers and partly from insurers, in line with that this group is better able to validate on the competitive advantage of new drug patents to their customers in higher prices, to compensate for the high R&D costs of the past.

Looking at the full sample, the average length of the cash cycle was between 75 and 85 days, with only one outlier in 2019, which is an outlier from the upward trend over the whole period, although the least reliable due to a variance that is several times higher than the average that year. R&D-engaged firms also have to finance their own operations for longer periods on average due to their typically higher inventory levels and their operating cycle, but the spread in the length of days for both activity groups, apart from the extremes, was up to 50 days over the whole period under review. While the commercial sector needed around 50 days from payment of suppliers to the recovery of trade receivables, almost all R&D-engaged companies had a higher value, with half of the latter companies able to continue operating with a cash cycle of at least 80 days, with the value increasing until 2020 (see on

Figure 6). Although the R&D-engaged companies were not able to convert their competitive advantage, which was guaranteed at institutional level, into a stronger bargaining position against their competitors on the supplier market, they were able to finance the resulting higher cash cycle from their higher gross profit. In this respect, only the year 2020 may have posed a working capital problem for several companies, as gross profits fell while the cash cycle, to be partly financed from profits, increased. The higher cash cycle may be explained by the fact that the significantly higher selling price compared to the cost of production can only be best validated with customers if the DSO remains unchanged or increases. Apart from one R&D-engaged company, only among pharmaceutical commercials was it possible to find a company each year that financed almost its entire business with its suppliers free of charge and had little or no need to resort to additional, costly sources of financing. At the same time, there was only one drug developer company that, unlike the others, was able to collect the value of its sales from its customers in a timely manner, on average more than 3 months before it paid its debts to its suppliers.

4.3. Examining the Impact of Factors on the Financial Margin

We used panel regression analysis to examine the nature of the activity within the industry affect the financial scope of companies and the extent to which the bargaining power of the industry players. On the one hand, panel data allow us to examine the time-lagged consequences of certain decisions. On the other hand, the method of data collection, whereby the same firms are always observed at different points in time, allows us to control for unobservable characteristics of the cross-sectional units. Running first the fixed-effect and then the random-effect (GLS) regression model with the model parameters, comparing the coefficients of determination and correlation of the two models, the values indicating a stronger correlation were obtained for the random-effect panel regression (0.85), the difference from the fixed-effect model (0.63) is significant in this respect. The foregoing was also supported by a comparison of the two types of panel regression with the Hausman test, which, based on the chi-square test value, showed the use of random-effects regression to be superior to this test. In addition, the model included two time-independent variables whose effects on the outcome variable were examined separately: the country of residence of the companies and whether or not the company invested resources in drug development (R&D-engaged or not). The latter also justified the abandonment of the fixed-effect model and the use of a random-effect model.

With the explanatory variables statistically analysed above, the regression model fitted to the gross profit was found to be reliable. Of the eight explanatory variables included in the analysis, four variables remained in the model, all of which (together with the regression constant) significantly (p < 0.05) influenced the evolution of gross profit over the period under study, which together explained almost 80% of the variance of the same profit variable. The model explained 85% of the variance between individual panel units (pharmaceutical companies) and about half of the variance within panel units. While the RTA and DSI had no effect on gross profitability, a change of one order of magnitude in the global market share would increase gross profit by more than an increase of two orders of magnitude and a shift to R&D would increase gross profit significantly for pharmaceutical companies, all other things being equal. The same was found for the case of years: in 2018, compared to the previous year, the gross profits of the companies increased significantly in contrast to other years, but for the country variable the coefficient associated with it was meaningless. It can be observed that the idiosyncratic effect accounts for 83% of the total variance, which means that the time variation in the value of each firm is relatively decisive value. The individual effect, which can only be explained by company specificities, reached 17%.

In order to interpret the coefficient of the country variable, we also it considered necessary to include each country separately as a dummy variable in the regression model, also because of the significant effect of the variable. In this case, the overall variance explained by the explanatory variables in the model was increased by an additional 0.5 percentage point, so the reliability of the model itself was not significantly affected by the country factor decomposition. The modified results also show that the share of global industry turnover increases gross profit the most, but also that the relocates of the main pharmaceutical activity to the USA, Germany or Switzerland would have a substantial impact on gross profit. Since, beyond the latter countries, only Chinese companies were included in the model, China was not included as a separate explanatory variable in the model: the results can be interpreted as what would happen if the management decided to relocate its activity from China to USA, Germany or Switzerland. Thus, the results also show these countries’ relative “competitiveness” in terms of Chinese companies.

The strength of a company’s bargaining position with other industry players (suppliers, buyers) can be well characterised by the length of its cash cycle or its shortness. On this basis, a panel regression model for the cash cycle in terms of days is no longer suitable for explaining the gross result: the same explanatory variables explained only about 40% of the variance of the cash cycle overall. The values of the cash cycle did not differ significantly between the years of the period under study, so that the supply chain difficulties in the last year even did not cause liquidity problems in the company’s operations to such an extent that they would have had a detectable impact on the results. Although overall the model can be considered reliable, as the global F-test statistic took a value below 5% and only the inventory holding period and the relocation of activity to Switzerland had a significant effect, this was of low significance in terms of the overall variance.

5. Discussion

Regardless of whether or not they were involved in patent production, the pharmaceutical companies surveyed had a relatively stable average DSI of 40–45 days over the period (see on

Table 2). The impact of acquisitions was only observed in 2019, with the inclusion of companies (engaged and non-engaged in R&D) with assets hundreds of times larger than the smallest companies, which significantly skewed the RTA averages and dispersion upwards (see on

Table 4). Based on descriptive statistical analysis (see

Figure 2), only R&D-engaged companies those could afford relatively low inventory holding time could take well-planned orders from their wholesale partners for the mass production of patented medicines that have passed earlier clinical trials. Although the overall average market share of the 60% the top 100 pharmaceutical companies with the highest sales remained stable at 1.4% throughout the period under review (see on

Table 3), and only the emergence of the coronavirus increased it marginally, the companies launching new medicines were able to gain impressive competitive advantages over their competitors which were operating without R&D, by exploiting the opportunities offered by patent rights. Furthermore, although the companies can achieve higher market turnover alongside R&D activity, they can only do so by investing in significantly larger assets.

In contrast to the first two factors, stronger bargaining power against customers, in terms of higher margins and gross profits, was more likely to validate if the company had a relatively higher market turnover than its competitors and thus a higher market share worldwide. The model results (see on

Table 5) also confirm that the significantly higher operational risk associated with R&D activities is in itself associated with a higher gross return than if the company were not engaged in R&D activities in the same industry, so Hypothesis 1 can be accepted as true, which is in line with the findings of

Scherer (

2001),

Eide et al. (

2020) and

Basu et al. (

2008), for the biotechnology sector too.

The summary results of the GLS panel regression are presented in

Table 5 below.

Although there were significant differences in the financial flexibility of groups engaged in double-examined sectoral activity in each examined country, the role of different accounting systems is non-exclusive because in other cases there would not be the same significant impact on profit if companies relocate their activity to USA (where US GAAP is used) or to Switzerland (where IFRS is used). The difference is partly explained by only the effect of the EU R&D support policy, which would lead to a significant extent in the difference between USA and Swiss companies in favour of the USA (referring to the stronger European regulations also mentioned by

Abbott and Vernon 2007;

Eger and Mahlich 2014). Consequently, the difference in the US case can be explained not only by the distortions introduced by the different accounting system (required cost accounting of R&D expenditures as incurred and much opportunity) but also by the different administrative requirements and regulatory framework for the approval of R&D, thus Hypothesis 2 can be accepted as true, in line with the findings and results of

Helfert (

2001) and

Pammolli et al. (

2011). Although several studies have shown a positive relationship between company size and profitability (

Madhavi and Nageswara 2017;

Endri et al. 2020b;

Islam and Khan 2019), this was not confirmed by the results of this analysis in terms of gross profit.

In this study, the gross profit indicator was not considered as a strictly profitability indicator but as an indicator of the strength of the enforcement of market prices against business partners, while other factors influencing it (company size, inventory level) were filtered out in our statistical model by means of control variables. However, the differences in these gross profits were not reflected in the cash cycle indicators similarly influenced by the strength of company’s market power, which forces us to reject Hypothesis 3 on this issue. This supports the results of

Chowdhury et al. (

2018) in the sense that while a strong positive effect would be indicated for the DPO, this could be neutralized by the negative relationship also shown by the author for the operating cycle.

It is clear from data that those large companies that manufacture only generic medicines would incur higher costs to launch drug research and development projects per se, but would also gain greater self-financing capacity and financial flexibility through the gross profit they would generate in the long run. Although the narrow range of potential input suppliers and their liquidity situation limit the possibility of financing their operations with them for a longer period (leading to a shorter cash cycle), their higher profit-generating capacity can compensate for this. As some of the necessary know-how and industrial contacts are also present in these manufacturing firms compared to other industries, it would be advisable for governments in highly developed countries to allow and encourage these companies to start R&D projects using additional fiscal instruments and development policy subsidies, and in Europe by easing legal regulations. In the longer term, the higher value added by companies would thus also lead to higher GDP at the level of the national economy.

6. Conclusions

The results of the model suggest that the gross profitability of firms with high DSI is not significantly worse than that of companies with efficient inventory management, and that company size did not affect the level of prices charged to customers or the level of sales volume and hence profitability. The different size of the companies’ assets was therefore not able to play a role as a control variable on the development of gross profit in dollar terms (and thus directly influenced by the level of sales volume). The impact of this and of the DSI (through the cost elements associated with it) would be statistically most apparent if the profit variable were replaced by operating profit (EBIT), taking into account selling and administrative expenses, instead of gross profit, although the evolution of the market position, which is the focus of this study, would be less likely to sharply affect this.

Our findings from the panel regression analysis are that while the gross profit was significantly influenced by the type of activity within the industry, the statement of the cash cycle as a margin for operational financing is no longer justified. Beside from this, if we de-composite the country factor in the model, pharmaceutical companies gain the most profit surplus, and if they decide to relocate their activity to USA from another country. However, in Europe the GDP advantage of Germany against Switzerland is eliminated within this industry; however, results better reflect the ranking of countries in terms of GDP per capita. The cash cycle values for all industry players were more likely to be influenced by the other two factors; DSO, which reflects the bargaining power with customers, and DPO, which reflects the effects of agreements with suppliers. We believe that the results of this study can contribute not only to the development decisions of smaller companies, but also to the R&D supporting economic policy decisions of political actors in developed countries.

However, the conclusions from the results are valid only with several limitations due to the database and methodology used. Some of our conclusions are over-generalised for firms belonging to different size classes and/or different industry clusters. In addition to other large-scale longitudinal studies, this study does not directly examine firm-level outcomes. The studied pharmaceutical companies were limited to the top pharmaceutical companies worldwide, which, although overall responsible for a not insignificant share of the global market turnover, showed extrapolatable results for the whole industry as benchmark companies, but the conclusions from the model would certainly be shaded by the inclusion of a broader set of large companies globally in the database under investigation. The same is true for the period under study, the results for the last year of which may have been strongly biased by the epidemic situation through logistics and demand for industry products. The time period of the years examined was limited by the fact that several companies in the sample did not yet have available financial data for 2021. It was a methodological constraint that the reliability of the panel regression model was met if the outcome variable was gross profit expressed in dollars rather than as a ratio, so that the strength of the bargaining position with business partners (profit margin) could not be inferred on its own, but only on its value when considered in conjunction with sales levels, which required the inclusion of many control variables into the model. Future research can focus on the extension of this results to all listed companies in all countries, and over a longer period of time, including the years following the epidemic, using size scaling and quantile regression.