1. Introduction

Globally, the technological revolution rendered technology an integral part of the daily life of society, and technology in our daily lives has become increasingly prevalent. Various fields, including research, business, economics, education, and health, have been improved due to the development of information and communication technologies (

Malaquias and Hwang 2019;

Bankole and Bankole 2017;

Alduais 2013). As a result of technological development, electronic payments have emerged as one of the manifestations of technological development. The use of electronic payments is on the rise throughout the world (

León 2021;

Qin et al. 2017). Its success depends on the accessibility of new technologies, the changing lifestyle choices of consumers, and many economic factors (

Liébana-Cabanillas and Lara-Rubio 2017). E-payments have become an increasingly popular trend in a rapidly expanding market. Further research is required to comprehend the adoption process of these tools and monitor the impact of different financial solutions on consumer perceptions and daily lives (

de Luna et al. 2019).

Payments for e-commerce purchases can be made in various ways, both on- and offline. Most retail businesses accept online payments, for which customers may pay through the Internet directly using credit cards, electronic cash, and smart cards (

Iman 2018). Offline payments are not possible through the Internet; instead, customers must use other payment options, such as bank transfers, post office payments, and payment on delivery. It can be concluded that consumers will decide whether to use payment services via e-commerce based on their perception regarding two factors, which are the recognition of the benefits and usability of the system. E-payment systems have been widely studied in developed countries due to technological advancements in payment systems. Few studies have examined the acceptance of these systems in developing countries, such as those in the Arab region (

Al-Okaily et al. 2020;

Al-Ajam and Md Nor 2015). Yemen still falls behind in terms of using the Internet and electronic payment systems compared with its neighbors. Accordingly, the current study fills the gap mentioned above and identifies important factors that affect the acceptance of e-payment systems in Yemen. Providing and using the electronic payment system has become the main challenge for many developing countries, including Yemen.

The electronic payment system has many great features that may be valuable. However, the successful use of an electronic payment system depends on understanding the adoption factors and the main challenges facing current electronic payment systems. There is a lack of agreement about the challenges and critical factors that constitute the successful use of an electronic payment system, especially in a country like Yemen; hence, an evident knowledge gap has been identified regarding the challenges and critical factors of using electronic payment. This study aims to explore the critical challenges facing the current electronic payment systems and investigate the main factors that support using the e-payment system. Using UTAUT 2 by researchers such as (

Yaseen and El Qirem 2018) is consistent with the study of consumers’ continuity of the use of the payment system and their acceptance of costs and experience. Accordingly, our research on the intention and acceptance of digital payment systems is based on the UTAUT model. A study conducted by UTAUT identified four key constructs, i.e., performance and effort expectancies, social influence, and facilitating conditions, that influence behavior related to the behavioral intention to use technology (

Venkatesh et al. 2012).

The present study is primarily designed to identify the factors that facilitate users’ acceptance of new technologies. A contribution of this study is the analysis of variables examined in traditional models UTAUT to determine the direct and indirect effects of determinants related to the adoption of e-payment systems. Additionally, this research employs a set of variables widely used in the scientific literature in most countries within UTAUT but not in Yemen. Furthermore, this study examines the most popular and widely accepted e-payment methods perceived by smartphones, tablets, computers, and desktop users. Overall, a clear research purpose is essential for predicting customer behavior towards e-payment systems currently available in different markets and assessing possible future intentions associated with this study area.

The rest of this paper is organized as follows:

Section 2 reviews the literature and develops hypotheses.

Section 3 describes the methodology of the study.

Section 4 presents the data analysis and results. The discussion is presented in

Section 5. The final section,

Section 6, outlines the research conclusions, contributions, limitations, and recommendations for future research.

2. Literature Review and Hypotheses Development

Since the Unified Theory of Acceptance and Use of Technology (UTAUT) was developed by (

Venkatesh et al. 2003), it has been composed of four constructs. This model consists of the same four constructs: performance expectancy (PE), effort expectancy (EE), social influence (SI), and facilitating conditions (FCS). These four factors are directly associated with user acceptance of an e-payment system and usage behavior. They are concerned with the users’ perception concerning the usefulness of an e-payment system (

Lutfi 2022). The UTAUT model has been tested and used in many previous studies (

Yaseen and El Qirem 2018;

Abushanab and Pearson 2007;

Al-Somali et al. 2009;

Riffai et al. 2012;

Nasri and Charfeddine 2012;

Lutfi 2022). There is no doubt that the UTAUT model is highly effective in examining how technology is adopted in literature, particularly in determining the factors that influence the intention to use and actual use of technology (

Venkatesh et al. 2003;

Venkatesh et al. 2012). Hence, this study adopts the UTAUT model for understanding the adoption and usage of digital payment systems. (

Alsyouf and Ishak 2018;

Lutfi 2022) illustrated how the UTAUT captures and enfolds the concept of technology acceptance into a single view, combining theories and models related to technology acceptance.

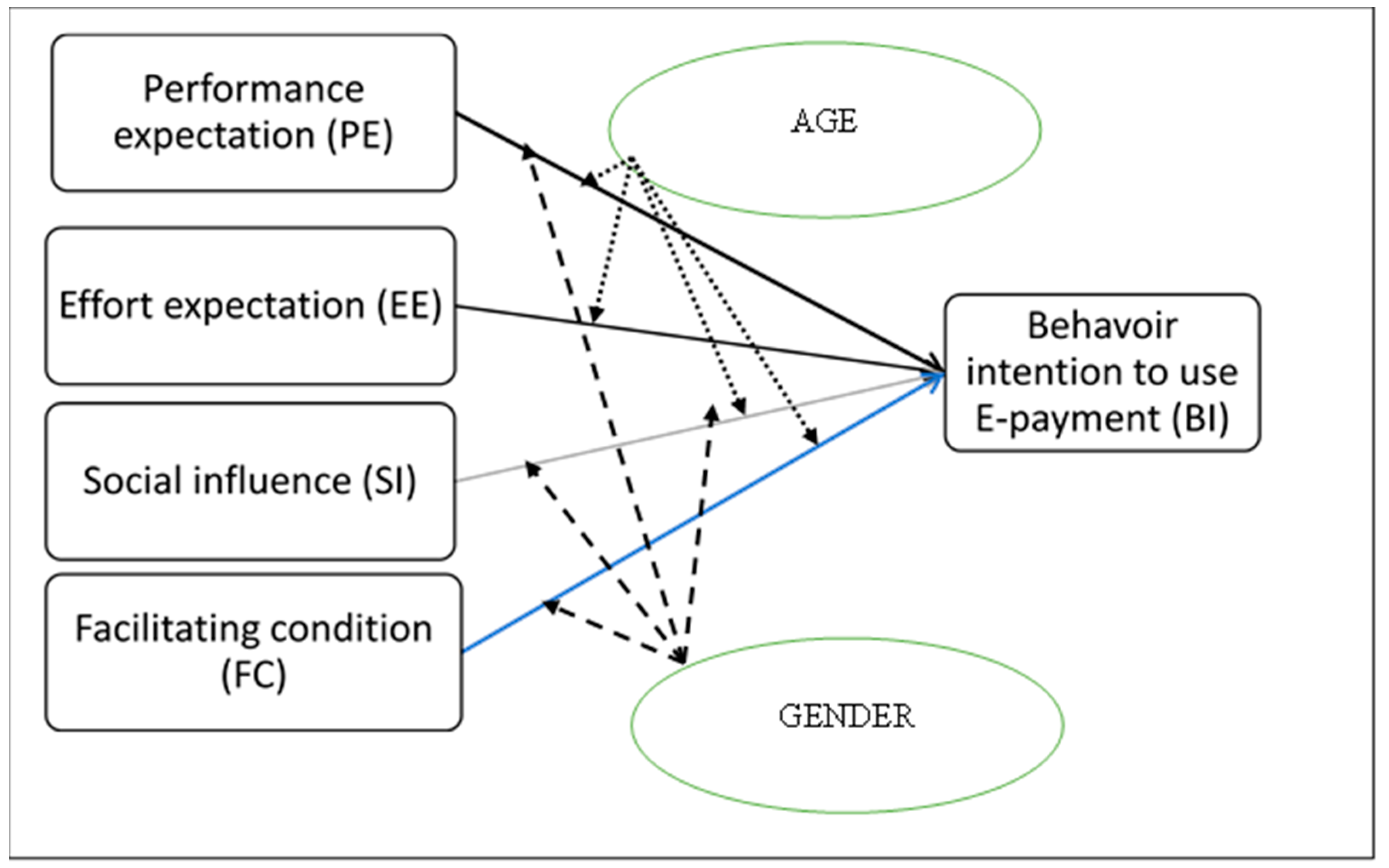

The purpose of this study is to investigate the intention of customers in Yemen to use e-payment using the UTAUT by testing hypotheses concerning the effects of the UTAUT factors on the behavioral intention to use the e-payments. Moreover, this hypothetical model (see

Figure 1), derived from a literature review, explains the relationship between the four factors and consumers’ behavioral intention to accept and use e-payments (

Venkatesh et al. 2003). According to the structural model, the relationship is moderated by gender and age in the second stage.

2.1. Factors Affecting the Intention to Use E-Payment

The UTAUT model is useful in studying the factors influencing technology adoption (

Venkatesh et al. 2003,

2011). In the IT field, the UTAUT model combines theoretical and experimental findings concerning user acceptance relationships (

Lutfi 2022;

Al-Okaily et al. 2020). This study considers the intention to use rather than continuance intention as a dependent factor since the sample frame consists of Yemeni consumers who use electronic payment systems. Currently, the use of e-payment systems in Yemen just takes place through banking applications, which are still in their infancy, and purchases through e-payment systems are pretty limited.

2.1.1. Performance Expectancy

2.1.4. Facilitating Conditions

According to (

Venkatesh et al. 2003), facilitating conditions describe how much an individual believes that organizational and technical infrastructure exists to facilitate the use of a system. This definition encompasses three different constructs: perceived behavioral control (

Taylor and Todd 1995a,

1995b;

Ajzen 1991), facilitating conditions, and compatibility (

Thompson et al. 1991). According to the current study, facilitating conditions refer to customer perceptions that specific factors in the infrastructure of the e-payment system either prevent or promote the acceptance and use of e-payment. Based on the findings of (

Zhou et al. 2010;

Sivathanu 2019), FC is positively associated with using mobile payment. In our study, we hypothesized that it might be positively associated with BI to the use of e-payment. Therefore, we propose the following hypothesis:

H4: Facilitating conditions significantly and positively influence the BI to use e-payments.

2.2. Impact of the Factors on Intentions to Use E-Payment Moderating by Gender and Age

In our study, we adopted gender and age from (

Venkatesh et al. 2003) to moderate the relationship between PE, EE, SI, and FCs and behavioral intention. Based on (

Venkatesh et al. 2003), gender, age, experience, and voluntariness of use moderate the relationships between behavioral intention and other factors. Then we hypothesize the following:

H5: The impact of performance expectancy on behavioral intention will be moderated by gender and age.

H6: The impact of effort expectancy on behavioral intention will be moderated by gender and age.

H7: The impact of social influence on behavioral intention will be moderated by gender and age.

H8: The impact of facilitating conditions on behavioral intention will be moderated by gender and age.

5. Discussion

Contrary to expectations, the relationship between performance expectancy, social influence, and behavioral intention to use e-payment systems was not moderated by age; therefore, the related hypothesis is not supported. Our findings were inconsistent with (

Koenig-Lewis et al. 2015;

Wu and Wang 2005;

Koufaris 2002); they have previously found insignificant relationships between ease to use (represents a construct of TAM theory) and behavioral intention, which has been shown in our results as effort expectancy based on the UTAUT model. Moreover, we found evidence that customers have neither acceptance nor intention to use electronic payment as long as the infrastructure is inadequate. They think the Internet is not fast and its quality is poor, which does not help them access e-payments. Our results show that consumers will use less traditional and digital payment methods in the coming years, consistent with (

Qin et al. 2017;

Liébana-Cabanillas et al. 2014;

de Luna et al. 2019).

According to the study, gender significantly influenced the relationship between factors and intention to accept electronic payments. However, the results indicated that age did not affect the relationship between performance expectancy, behavior influence, and the intention to use e-payments, which is in line with (

Riskinanto et al. 2017), who indicated that most of the constructs’ associations are not affected by age. In addition, our findings revealed that the factor of facilitating conditions is the most crucial factor and the most important motivation for electronic payment usage. The study found that the performance expectation factor had a higher significance and a higher positive significance than the other factors, which is in line with (

Abrahão et al. 2016). Moreover, the findings suggested that users will likely use this feature if it is available. This study developed a model for predicting the intention to accept electronic payments and tested it in a country that has not given enough attention to this topic. The UTAUT model was applied and tested to the electronic payment system in Yemen. Finally, the study clarified that the infrastructure in Yemen significantly impacts the intention to use electronic payment.

6. Conclusions

E-payments have recently gained popularity as a result of the increasing use of smartphones and their applications all over the world. There are few studies on this technology in Yemen, such as (

Al-Ajam and Md Nor 2015). This study highlights the importance of examining the primary factors that affect Yemeni users’ decisions to adopt and use an e-payment system. Based on the UTAUT model, the study examined behavioral intention as an independent variable and gender and age as moderating variables (

Venkatesh et al. 2003). Based on the findings, it is possible to draw a few conclusions. The first finding confirms some of the UTAUT model’s predictions, although all predictors were significant. According to the research findings, performance and effort expectancies and social influence were significant and positive predictors of the intention to accept e-payments. However, facilitation conditions are significant and negative because they indicate that consumers are dissatisfied with the infrastructure of Yemen’s Internet. The main statistical results of the study confirmed the predictive validity of the research model. Furthermore, they explain (R

2: 0.757) the variance in the intention to use e-payment systems.

The findings have several practical implications for researchers, practitioners, and policymakers. Because the abolishment of traditional payment systems is a rare phenomenon that occurs in any economy, the findings of this study provide economists with valuable insights for designing a transition matrix for a smooth transition from cash-based payment systems to cashless digital payment systems. It is essential for the long-term sustainable adoption of digital payment systems that they consider consumer desires, meet their needs, and provide the infrastructure needed for their use. The government has a crucial role in increasing awareness, promoting digital literacy among consumers, and facilitating adoption by providing supportive infrastructure. By doing so, the transition from traditional to digital payment systems will be more accessible. Furthermore, this study provides valuable insights to system developers and business decision-makers regarding the services they provide to consumers, as well as to the telecommunications authority and other companies operating in the telecommunications industry in Yemen. Studying the intention of using electronic payment in general, we focused on users and target consumers who can access the Internet through a personal computer, laptop, tablet, or smartphone. We concentrated on the UTAUT theory only because the study was applied in Yemen, and the e-payment service is still not widely accepted without the infrastructure that contributes to attracting and protecting consumers (

Qin et al. 2017).

Furthermore, the results of this study offer several recommendations and suggestions for researchers and practitioners in the field of e-payment technology development to facilitate a greater acceptance of mobile payments. The study recommends that academics and researchers perform complementary studies in this field and continue to explore the determinants of the intention to use e-payment, as there is a lack of research in this area. Due to the present significance of electronic payment systems and the need to keep up with technological developments in other countries, researchers should consider promoting research on using electronic payment systems in Yemen. Moreover, telecommunications companies should promote the use of the Internet, encourage citizens to download applications for electronic payment, and provide the necessary protection throughout the purchasing process. Furthermore, since the study results explained 75% of the variance in the intention of use among the participants, further research should be conducted to incorporate variables from other theories, including ease to use, perceived risk, security, etc. Providing the basic requirements to use the digital payment system is necessary, and the monopoly of competent authorities on the Internet has contributed to the delay in using the digital payment system over the phone and the lack of interest in the current payment systems through using banking services.