1. Introduction

In Malaysia, crude palm oil (CPO) is the second black gold after crude oil. It contributes significantly to the gross domestic product (GDP), making Malaysia one of the largest exporters in the world. Overall, the Malaysian agriculture sector contributes about 7% to the GDP, and at least 30% comes from agricultural and industrial activities related to palm oil (see

Figure 1). CPO-related activities involve productions and refineries, as well as other downstream activities, subsequently positioning the agriculture sector as one of the top contributors to the country’s GDP.

Ziaei and Ali’s (

2021) findings suggested that an increase in palm oil production may increase macroeconomic variables such the private capital stock, wealth in the private sector, real income, public capital stock, and human capital stock. The results indicate the significance of CPO to national economic development.

As CPO business activities grew over the decades, many palm oil companies decided to list their shares on the Kuala Lumpur Stock Exchange (KLSE) and make Bursa Malaysia their home. To date, 42 companies are listed, with a total market capitalisation of more than MYR 100 billion. The overall share price performance of these 42 palm oil companies can be seen from the general performance of the Plantation index. The demand for CPO shows a steady increase due to the role of key ingredients in the food processing industry and its wide use as cooking oil (

Arshad and Mohamed 1991;

Lestari and Oktavilia 2020). Accordingly, Bursa Malaysia launched another three palm oil indexes, namely, the Malaysian palm index, the Asian palm index in Malaysian Ringgits (MYR), and the Asian palm index in American Dollars (USD) (

Asia Asset Management 2009). The purpose of these indexes is to expose and boost interest and investment of foreign investors in palm oil companies. More indexes allow fund managers, investors, and traders to track the performance of palm oil-listed companies that derive substantial revenue from palm oil-related activities.

Similar to other commodities, the share price performance of palm oil companies is subject to market risk, and the CPO is subject to significant price fluctuation. Several previous studies (

Alias and Othman 1998;

Yu et al. 2006;

Khin et al. 2013;

Rahman 2013;

Bergmann et al. 2016;

Lestari and Oktavilia 2020;

Isa et al. 2020;

Zaidi et al. 2022) to discover the possible factors that influence the price movement of CPO also support this view. These studies explained that macroeconomic variables such as export, productions, and stockpile have a significant long-run relationship with the CPO. Thus, the movement in export, production, and stockpile will be reflected in the CPO price (

Khin et al. 2013;

Rahman 2013;

Ziaei and Ali 2021). The interest rate, exchange rate, and industrial production index (IPI) also have a significant relationship with CPO (

Ahmed et al. 2020). Despite this convincing evidence, fund managers, investors, and traders still have difficulty forecasting the CPO prices based on these variables. One of the main setbacks is that these data are only available monthly, whereas the information on the trading of CPOs and shares of palm oil companies is available daily. Furthermore, more factors may influence the price movement of CPOs and the stock price of palm oil companies.

As CPO trading integrates with the international financial markets, it is crucial to consider the price movement of other commodities. For example, several studies found significant relationships between CPO prices and commodity prices of other agricultural and energy sectors (

Yusoff 1988;

Alias and Othman 1998;

Vo et al. 2019). As a substitute for cooking oil, the prices of soybean have a long-run relationship and positive response to any changes in the price of CPO (

Zaidi et al. 2022). This association is consistent with the classic demand hypothesis, which states that a rise in the palm oil price of substitute products will raise palm oil demand, which in turn increases palm oil prices. In addition, soybean and CPO influence each other or have a bi-directional relationship (

Yu et al. 2006).

Apart from that, other studies also stressed that crude oil is equally as crucial as soybean in determining the price movement of CPO and results in a significant relationship between CPO and crude oil (

Yu et al. 2006;

Campiche et al. 2007;

Nazlioglu and Soytas 2012;

Bergmann et al. 2016). This explains the CPO’s response to the price movement of crude oil in Malaysia, especially when Malaysia is taking steps to introduce biodiesel as an alternative to crude oil. As CPO was one of the biodiesel feedstocks, the increased production of biodiesel simultaneously increases the demand for CPO exports while minimising crude oil consumption (

Murti 2017). Even some researchers in the related studies argued that their findings on crude oil influencing stock prices are significant and can play a vital role in making an investment decision, derivatives valuation, and hedging strategies (

Raza et al. 2016;

Mishra et al. 2019).

Thus, limited studies have addressed the relationship between soybean and crude oil with palm oil indexes, especially in Malaysia. As indicated earlier, the existing studies mainly focus on the relationship between commodity prices such as soybean and crude oil with CPO prices (

Vo et al. 2019). The approach in the current study is considered novel as the closest studies conducted previously examined the relationship between energy commodities and stock market indexes. For example, crude oil had a long-run relationship with six stock indexes of OECD countries (

Miller and Ratti 2009), and a crude oil shock influenced Greece’s stock market (

Filis 2010). Crude oil also affected the Toronto Stock Exchange, NYSE, AMEX, NASDAQ (

Kang and Ratti 2013), and Dow Jones Global Islamic Index (

Mishra et al. 2019). Further, researchers observed a significant short-run causality from crude oil to stock exchanges in India, Brazil, and Thailand made an emerging stock market more vulnerable (

Raza et al. 2016). Another study based in China revealed that oil shocks affected a firm’s profitability due to fluctuations in output and inflation and a decline in real consumption (

Sim and Zhou 2015;

Zhao et al. 2016). Interestingly, none of these studies found that the stock indexes could influence the price movement of crude oil, which indicates there is only a one-way causal relationship.

As previously discussed, the theoretical link between soybean and crude oil futures with crude palm oil or stock market indexes has been widely acknowledged in the literature. The relationships between soybean and crude oil futures and crude palm oil have been confirmed in a number of empirical studies (

Yusoff 1988;

Alias and Othman 1998;

Yu et al. 2006;

Nazlioglu and Soytas 2012;

Bergmann et al. 2016;

Vo et al. 2019;

Zaidi et al. 2022). Studies on crude oil futures with stock market indexes have also been confirmed (see

Miller and Ratti 2009;

Filis 2010;

Kang and Ratti 2013;

Raza et al. 2016;

Mishra et al. 2019). Considering these convincing empirical findings on both commodity (crude palm oil) and equity (stock market index), the same significant link or notion could be established between soybean and crude oil futures with palm oil indexes (equity). This view is also supported by

Feng et al. (

2003), who suggested including soybean and crude oil futures in any research related to palm oil such as commodities (crude palm oil) and equities (palm oil index). Similar to crude palm oil or stock market indexes, this current study predicted a positive relationship between palm oil indexes with soybean futures and an inverse relationship with crude oil futures.

To recap, many studies found a relationship between soybean and crude oil futures with crude palm oil. Several studies also investigated the relationship between crude oil futures with stock market indexes. Most of the studies focus on crude palm oil, both in the physical and futures markets. However, studies that specifically focus on the palm oil indexes are lacking in the literature. This study takes a different path by investigating the performance of palm oil indexes, where palm oil-related companies are listed, and each investor can participate by owning palm oil stocks. Since these stocks are publicly listed, price fluctuations not only affect the companies, but also the public who own stocks as well. Investors, especially fund managers, have a mandate to only invest in low-risk investments, and these palm oil indexes can assist them to track stock performance of palm oil-related companies. This study is predicted to assist investors to better understand these indexes, especially in terms of the factors that can cause the price fluctuations of these listed palm oil companies.

The economic motivation of this study lies in the fact that palm oil is the second most valuable commodity after crude oil in Malaysia, as it contributes around 7% of the GDP. Malaysia allows crude palm oil to be run by private companies, and these companies expand their ownership by publicly listing their companies on Bursa Malaysia. This allows public investors who wish to participate in palm oil-related businesses to invest their capital in these companies, with the expectation of returns in terms of dividends and capital gains. However, it is not easy to monitor every stock, as there are more than 100 publicly listed companies in the palm oil-related business. Bursa Malaysia took the initiative to launch palm oil indexes to help investors track the performance of these palm oil companies. By providing these indexes, retail investors, fund managers, and hedge fund managers can participate by investing their funds in these companies. This translates into capital inflows and allows these palm oil companies to use this additional capital by expanding their businesses for better performance, revenue, and returns. This study was conducted to better understand the factors that can cause price fluctuations of these indexes. The results of this study can assist retail and institutional investors to better understand these indexes, especially when making investment decisions. Soybean as an oil substitute for crude palm oil is the primary vegetable oil traded worldwide. Price movements in the soybean market are expected to affect the price of palm oil and indirectly affect the palm oil indexes. Meanwhile, crude oil futures, the world’s top traded energy commodity futures, have an inverse relationship with crude palm oil. Price fluctuations in both soybean and crude oil futures are expected to cause changes in the price of crude palm oil and indirectly cause changes in the stock price of palm oil companies.

As other commodities have a relationship with CPO and stock market indexes, the question of whether commodity prices such as that of soybean and crude oil would have such relations to palm oil indexes remains a mystery. Such information is essential to fund managers, share investors, and other industrial players actively trading in the palm oil market indexes concerning decision making on investment, trading, hedging, managing risk, and designation of the investment portfolio. Thus, this paper contributes to the literature by offering new insights and evidence on the relationship between palm oil indexes with soybean and crude oil futures. The findings may improve decision making among managers of palm oil companies as well as market participants such as fund managers, investors, and traders who have previously given utmost monitoring to the CPO movement.

According to a statistical report by

FTSE Russell (

2022), although Malaysia is the second largest producer of crude palm oil, it takes the lead by bringing all palm oil-related businesses to the capital markets. In total, 60.12% of palm oil equity businesses originate from Malaysia, followed by Singapore (30.87%) and Indonesia (9.01%). Indonesia is the largest producer and exporter of crude palm oil, but many companies are privately owned in the country. The top five constituents listed the three largest palm oil companies from Malaysia, namely, Sime Darby, Kuala Lumpur Kepong, and IOI. Meanwhile, the top two in Singapore are Wilmar Limited and Golden Agri Resources. Thus, Malaysia has become a paradise for investors, especially fund managers who aim to participate in palm oil-related companies by owning palm oil stocks in return for dividend and capital gains. For these reasons, the author chose the Malaysian market over other markets such as Singapore and Indonesia. However, we include these two markets later for potential future research related to palm oil indexes.

The paper is organised as follows. The next section explains the data and methodology; the following section discusses the empirical findings; and the final section concludes the findings, along with some recommendations for future research directions.

2. Data and Methodology

Unlike many previous studies that examined the relationship among the commodities, this study investigates the relationship between soybean and crude oil futures with three palm oil indexes. The Plantation index measures the share price performance of all listed palm oil companies. Meanwhile, the Malaysian palm index comprises the top 30 palm oil companies in Malaysia. The Asian palm index, on the other hand, represents all 15 palm oil companies with a market capitalisation of more than USD 100 million in Malaysia, Singapore, and Indonesia.

In this study, the author examined monthly activity over ten years, from January 2010 until June 2020. The Plantation index (PI), Malaysian palm index (MPI), and Asian palm index (API) represent the palm oil indexes (POI) as dependent variables. Since 1970, the Plantation index has been in the market. In 2009, the other two indexes launched by Bursa Malaysia provided exposure to investors in tracking the performance of palm oil companies. The Plantation index represents all 42 palm oil companies in Malaysia, while the Malaysian palm index constitutes 30 selected companies taken from the FBM Emas index that derive revenue from palm oil activities. The Asian palm index included 15 palm oil companies listed in Malaysia, Singapore, and Indonesia with a minimum market capitalisation of USD 100 million, more than 30% of revenue from palm oil activities, and a weighted index for more than 2% in particular exchanges. In addition, the soybean futures (SBF) and Brent crude oil futures (BCF) represent the independent variables. The controlled variables selected in this study are Crude Palm oil (CPO) and exchange rate (ER). All data were obtained from the Bloomberg terminal database.

To start, let the basic model represent the palm oil indexes (POI) as a function of soybean futures (SBF) and Brent crude oil futures (BCF) along with crude palm oil (CPO) and exchange rate (ER) as in Equation (1).

Equation (1) can also be written in the log (

L) linear form of an econometric model as:

where POI represents the Asian palm index (API), Malaysian palm index (MPI), or Plantation index (PI).

is a constant term,

denotes unknown parameters to be estimated and

is a random error term. The preliminary analysis in this study is to perform the descriptive statistics analysis for data overview and to find the stationarity and level of integration for each variable using the well-established unit root tests of Augmented Dicker–Fuller (ADF) and Phillips–Perron (PP).

Dickey and Fuller (

1979) and

Phillips and Perron (

1988) provide further details on the features of the tests. Although the ARDL model does not require pre-testing of unit root on variable series, whether the underlying variables are I(0), I(1), or a combination of both (

Nkoro and Uko 2016), it is necessary to ascertain that no variables integrated beyond I(1).

In addressing the main objectives in this study, the author utilised the Autoregressive Distributed Lag (ARDL) bounds testing approach of

Pesaran et al. (

2001) for cointegration and long-run relationship between palm oil indexes and the regressors. The ARDL model can solve different levels of integration between the dependent variable and a group of regressors within I(0) and I(1) levels. In comparison, other traditional cointegration methods such as the Engle–Granger (

Engle and Granger 1987) and Johansen (

Johansen 1988,

1991;

Johansen and Juselius 1990) require all variables to be integrated at the same level, i.e., I(1). Furthermore, while both long-run and short-run coefficients can be estimated simultaneously, the ARDL approach offers fewer problems related to endogeneity as it is free from residual correlation. The Error Correction Model (ECM) is derived from the ARDL model for short-run adjustment with long-run equilibrium without losing any long-run information (

Nkoro and Uko 2016). An additional advantage of ARDL is its robust application on small sample time-series data (

Pesaran et al. 2001).

The presence of cointegration among variables within the ARDL framework uses the bounds test F-statistic with two asymptotic bounds critical values when the regressors are I(d) where

(

Pesaran et al. 2001). If the F-statistic value exceeds the upper bound critical value, it indicates that a cointegration exists. Otherwise, the null hypothesis of no cointegration cannot be rejected where the test statistic falls below the lower bound critical value or lies between lower and upper bounds. In the current study, following

Pesaran et al. (

2001), the specific ARDL models can be written as follows:

where dependent variables represent the respective palm oil indexes,

is soybean futures,

is Brent crude oil futures, and

is the exchange rate between USD against MYR. The parameters

are the short-run dynamics and

represents the corresponding cointegration multiplier of the underlying ARDL. The null hypothesis of no cointegration in Equations (3)–(5) is

. If the null hypothesis is rejected, this indicates the presence of cointegration between palm oil indexes and the regressors. Apart from cointegration, another corresponding objective in the current study is the short-run causal impact of the regressors on palm oil indexes. The causality analysis through Error Correction Model (ECM)-based ARDL leads to the following equations.

where

in Equations (6)–(8) represent the performance of dependent variables to the lagged deviation from the long-run equilibrium path, and

denotes the coefficient of the speed of adjustment of the error correction term.

has a statistically significant coefficient with a negative sign. The above Equations (6)–(8) are valid if there is evidence of cointegration from Equations (3)–(5). Otherwise, no ECT will be included in Equations (6)–(8) in the absence of cointegration. In the case of no cointegration, the author employed the short-run model-based ARDL framework in the first difference form as in Equations (6)–(8) without the ECT in determining the causality relationship between the palm oil indexes and the regressors. The author did not use the traditional causality test based on the Vector Autoregression (VAR) framework because of concern over the mixed level of stationarity of the studied variables, as previously explained. In the current study, an analysis of the short-run causal impacts of CPO, SBF, BCF, and ER on the palm oil indexes is tested using the Wald test on the null hypothesis of no causality on

,

,

, and

, respectively.

3. Empirical Findings and Discussion

Table 1 shows summary descriptive statistics of 126 data observations. All variables were converted into logarithms for a more approximate normal distribution. The first moment statistic value, the mean, indicates that all variables experience a positive mean value—LAPI being the highest value (9.856), followed by LMPI (9.650), LPI (8.947), and LCPO (7.834). The LER recorded the lowest value (1.289). In terms of standard deviation (second moment), LBCF recorded the highest value (0.377) with the highest volatility or risk and the LPI recorded the lowest value (0.093) with the lowest volatility. The LBCF, LSBF, LCPO, and LER exhibit greater volatility than palm oil indexes. However, among the palm oil indexes, the LMPI recorded the highest value for standard deviation, implying greater volatility or risk than LAPI and LPI.

Furthermore, almost all variables exhibit asymmetric or lack of symmetric distribution and recorded negative value for skewness (third moment), which indicated being longer-tailed on the left side of the distribution, except for LSBF and LCPO that indicated longer-tailed on the right side. In addition, the LER exhibits more symmetric distribution with the skewness value closer to zero. Most variables also experience negative excess kurtosis (fourth moment) values, implying light-tailed or platykurtic distribution, where the kurtosis value is less than 3 (normal distribution), except for LBCF with heavy-tailed or leptokurtic distribution (the kurtosis value is more than 3). However, further inspection of the distributional assumption using Jarque–Bera test statistic indicates that almost all variables exhibit non-normal distribution except for LAPI and LCPO.

Generally, the unit root test results using Augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) show mixed evidence of stationarity. The LPI and LCPO were stationary at the level (specifically for the ADF test), while the rest were stationary at the first difference. On the contrary, all variables were stationary at the first difference using the PP test. None of the variables were stationary beyond I(1) (see

Table 2). By considering the unit root test results, the ARDL model is effective and is the most suitable for cointegration analysis between palm oil indexes and the regressors.

Table 3 shows the results of the bounds test for cointegration.

The optimal ARDL lags for Equation (3) are (1, 1, 1, 2, 1) with the lowest AIC value, while they are (1, 1, 2, 0, 1) for Equation (4) and (1, 1, 1, 2, 2) for Equation (5). Based on the bounds test results for cointegration in

Table 3, only the LAPI has a cointegration relationship with the LCPO, LSBF, LBCF, and LER. This finding indicates the potential co-movement among LAPI and the regressors towards long-run equilibrium. Nevertheless, no evidence of cointegration exists for LMPI and LPI with the regressors.

Table 4 shows the long-run regression coefficients estimated for the LAPI model as in Equation (3).

In addition to LCPO, the LBCF significantly influences the LAPI. Both the Brent crude oil futures and crude palm oil are statistically significant at the 5% significance level. However, the findings showed no evidence of a significant relationship between the Asian palm index with the soybean futures and exchange rate. A 1% increase in crude palm oil leads to a higher Asian palm index by 0.230%, which implies a positive relationship between the two. The coefficient of LBCF of 0.107 indicates that a 1% increase in Brent crude oil futures responds to a 0.107% increase in the Asian palm index, indicating a positive relationship between the LAPI and LBCF. In the current study, the positive relationship between the Asian palm index and crude oil partly corroborates the finding of

Yu et al. (

2006),

Campiche et al. (

2007),

Miller and Ratti (

2009),

Nazlioglu and Soytas (

2012),

Kang and Ratti (

2013),

Bergmann et al. (

2016), and

Mishra et al. (

2019). These studies found a significant positive relationship between either CPO or stock index and crude oil. Nevertheless, none of the studies specifically investigated the relationship between the palm oil indexes (or Asian palm index) and crude oil (and also soybean). Since the Malaysian Palm Oil Board (MPOB) and palm oil companies are exploring biodiesel technology as an alternative to crude oil, any changes in crude oil price will impact palm oil companies. Similarly, higher prices of crude oil will increase demand for biodiesel and cheap oil means biodiesel becomes less valuable. Accordingly, fund managers in palm oil companies will pay more attention to the price movement of crude oil.

While literature claims that the soybean futures and exchange rate are considered explanatory variables for crude palm oil, it is interesting to find out the possible explanation of the insignificant impact of soybean futures and exchange rate on the Asian palm index in the long-run as in the current study. This view is due to the fact that soybean is a substitute commodity for crude palm oil, and several previous studies (

Yusoff 1988;

Alias and Othman 1998) found a significant relationship between these two commodities. The possible explanation is that the big palm oil companies are not hedging or doing any activities related to soybean futures as they prefer to hedge the uncertainties of crude palm oil by using futures crude palm oil (FCPO). Further, the exchange rate is one of the significant variables for crude palm oil (

Ahmed et al. 2020). Government intervention to maintain the currency stability does not substitute the commodity available for the crude palm oil companies in controlling the exchange rate risk that leads to an insignificant effect on the Asian palm index.

Further analysis of the causality relationship between the regressors and the respective palm oil indexes provides substantial statistical evidence of short-run impacts, as shown in

Table 5 and

Table 6. Where cointegration was evident, the causality analysis applied the ECM-based ARDL.

Table 5 shows the results for the Asian palm index (API) model. Strong evidence existed for causal impacts from the crude palm oil (CPO), soybean futures (SBF) and Brent crude oil futures (BCF) to the API, but insignificant causal impact from the exchange rate (ER). This indicates the significant role of the CPO, SBF, and BCF in predicting the behaviour and movement of the API in the short run. Moreover, the significant coefficient of the ECT theoretically met with the negative sign. The coefficient of −0.282 suggests that about 28.2% of disequilibrium is corrected every month for about 3.6 months

.

In the absence of cointegration, the short-run causality test results shown in

Table 6 provide strong evidence for causal impacts from the crude palm oil (CPO) to the Malaysian palm index (MPI) and Plantation index (PI). Meanwhile, the soybean futures (SBF) have a significant causal impact on the MPI but none on the PI. Moreover, the significant causal impact from the Brent crude oil futures (BCF) to the PI were also evident, but insignificant to the MPI. In addition, the causal impact of the exchange rate (ER) is only significant to PI, indicating a relatively weak role of the exchange rate in influencing the movement of the palm oil indexes. Further, the significant short-run causal impact from crude oil supported the studies of

Filis (

2010),

Sim and Zhou (

2015),

Raza et al. (

2016), and

Zhao et al. (

2016). However, those studies were relatively different from the current study that specifically uses palm oil indexes instead of stock market indexes.

The additional tests addressed in this study relate to the goodness of fit of the ARDL model. A series of diagnostic tests of the residual series and stability tests were conducted. The normality test result based on the Jarque–Bera test statistic shows that the null hypothesis of normal distribution is not rejected for Equations (3) and (5), indicating normal distribution of the residual series. However, in Equation (4), the residual series showed contrary evidence. The results also showed the remaining residual series in Equations (3) to (5) free from autocorrelation and heteroskedasticity problems (see

Table 7). Such findings indicate that the models used in this study are relatively effective and adequate in predicting the movement and behaviour of palm oil indexes.

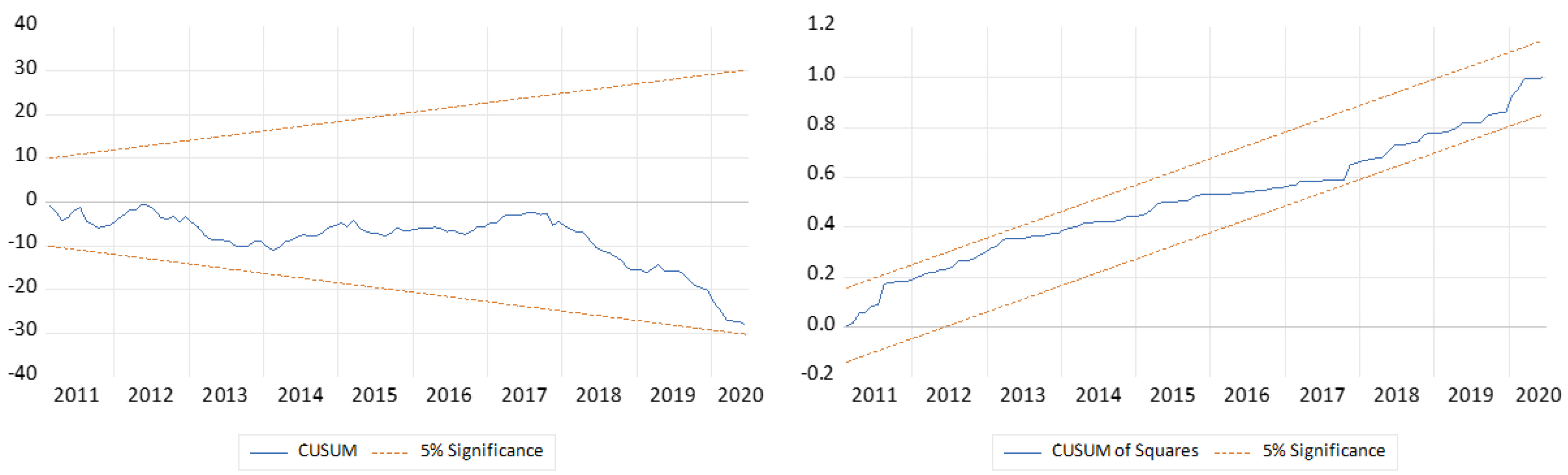

As financial data may be exposed to structural changes, the cumulative sum (CUSUM) of recursive residuals and squares tests were performed to check the stability of the models, as depicted in

Figure 2,

Figure 3 and

Figure 4. The CUSUM tests indicate that all regression coefficients are stable over time. The CUSUM series does not cross the critical bounds or lines at the 5% significance level, indicating that the models are correctly specified and stable. Except for the LAPI model, the CUSUM of squares tests, on the other hand, showed that the variance or volatility of the LMPI and LPI models is not stable, as indicated by the CUSUM series that crossed the critical bounds or lines at the 5% significance level.

4. Conclusions

Compared to previous studies that focus on the relationship between soybean and crude oil with the CPO prices or stock market indexes, this study offers a different perspective by investigating the relationship between soybean futures and crude oil futures with the palm oil indexes. This approach is considered novel as the closest studies previously examined the link between soybean and crude oil with CPO or energy commodities and stock market indexes.

This study investigates the impact of soybean and crude oil futures on the Asian palm index, Malaysian palm index, and Plantation index, utilising monthly data spanning from January 2010 to June 2020. The impact was analysed using an ARDL bounds test approach and causality test. The statistical findings revealed the evidence of a long-run relationship between the Asian palm index with crude oil futures and crude palm oil, and a short-run relationship with soybean futures, crude oil futures, and crude palm oil. The Malaysian palm index, on the other hand, has a short-run relationship with soybean futures and crude palm oil, whereas the Plantation index features crude oil futures, crude palm oil, and exchange rate. In the long-run strategy, this study recommends the close monitoring of crude oil futures. Meanwhile, the short-run strategy requires the close monitoring of the crude oil and soybean futures. The empirical findings proposed that interested parties such as fund managers, investors, and traders should pay close attention to crude oil and soybean futures to mitigate risk and diversify their portfolios, with a greater emphasis on crude oil futures.

Beside CPO and stock market examined in previous studies, the current study provides sufficient statistical evidence of the significant role of crude oil, soybean, and crude palm oil in influencing the behaviour of palm oil indexes, especially the Asian palm index. The empirical findings in this study are crucial and valuable to fund managers in palm oil companies and future palm oil investors. Apart from the CPO, the fund managers and future investors will monitor the price movements of soybean to mitigate risk and for hedging strategy. Risk in crude oil changes should be considered, especially in profit and loss expectations, assets allocations, and designation of the investment portfolio, as any changes in crude oil will influence the stock price of palm oil companies in Malaysia, Singapore, and Indonesia.

Although fund managers are not allowed to engage in risky investments, palm oil companies may consider using the services provided by hedge fund managers. The hedge fund managers are allowed to trade in risky products, especially commodities derivatives. Further, futures of crude palm oil (FCPO), soybean futures, and Brent crude oil futures will be highly traded in Bursa Malaysia Derivatives (BMD), Chicago Mercantile Exchange (CME), and Intercontinental Exchange (ICE) as hedging products. By actively engaging in commodities derivatives, palm oil companies can anticipate risk and respond to any event, especially catastrophic events such as the commodities crash in 2006, the food crisis, and oil shocks in 2014/2015.

By extending this study, future research could focus on individual palm oil stocks listed on all three exchanges. There are nine palm oil stocks listed from Malaysia, nine from Indonesia, and four from Singapore, with a total market capitalisation of over MYR 69 billion. Other than that, future research could include other agricultural and energy commodities, such as grains, oilseeds, fertilisers, biofuels, and renewable energy, as independent variables. Future research can also consider using daily data with several sub-samples, while taking into account the time of the crisis. Crises such as the food crisis, the COVID-19 pandemic, and the Russia–Ukraine war are among the possible crises suggested, since they directly affect the relationship between the variables of interest. In terms of methodological novelty, future research may consider including volatility spillovers and asymmetric effects of soybean and crude oil futures on palm oil indexes, utilising volatility and nonlinear models. Additionally, future research should extend the scope of this study to firm-level analysis by exploring the effects of CPO, soybean, and crude oil on each publicly-listed palm oil company in Bursa Malaysia, Singapore Stock Exchange, and Indonesia Stock Exchange, based on recent data with a more novel method of analysis such as the quantile ARDL (QARDL), which accounts for the entire distributional assumption of the palm oil indexes at various quantiles.

In conclusion, any changes (especially sudden ones) in CPO, soybean futures, and crude oil futures consequently impact and increase the vulnerability of palm oil indexes (companies) both in the long and short run. Understanding the behaviour of crude oil prices plays a vital role in formulating investment policy and hedging strategies. Additionally, fund managers, investors, and traders should be familiar with crude oil market trends to forecast palm oil stock prices.