Impact of MiFID II on Romanian Stock Market Liquidity—Comparative Analysis with a Developed Stock Market

Abstract

:1. Introduction

2. Theoretical Background

- For investors, the liquidity of the stock markets is associated with the ease of moving in and out of an investment, lower transaction costs, lower price volatility and improved price formation;

- For issuers, liquidity is important from the point of view of the cost of raising capital and accurate market valuations;

- For stock exchanges, liquidity means more market participation, greater investor confidence, and a greater ability to attract new issuers;

- For the economy, it means attractive alternative ways of raising capital at a reasonable cost, which triggers investments.

- Article 24 (4): supply of appropriate information in good time to investors or potential investors regarding the investment firm that intermediates their transactions and its services, the financial instruments and proposed strategies, the execution venues and so on;

- Article 25 (1–2): realization of suitability tests for the investors through which at the moment of providing investment advice and portfolio management the investment firm is obliged to take into account the potential client’s knowledge and experience, risk aversion and financial situation;

- Article 25 (6): increased reporting obligations for investment firms, associated with the transactions and services undertaken on behalf of the investors;

- Article 27 (8): best execution of transactions for the investors;

- Article 28 (1): order handling rules for investment firms, ensuring prompt, fair and expeditious execution of client orders, relative to the trading interests of the investment firm.

3. Data and Methodology

3.1. Data

3.2. Methodology

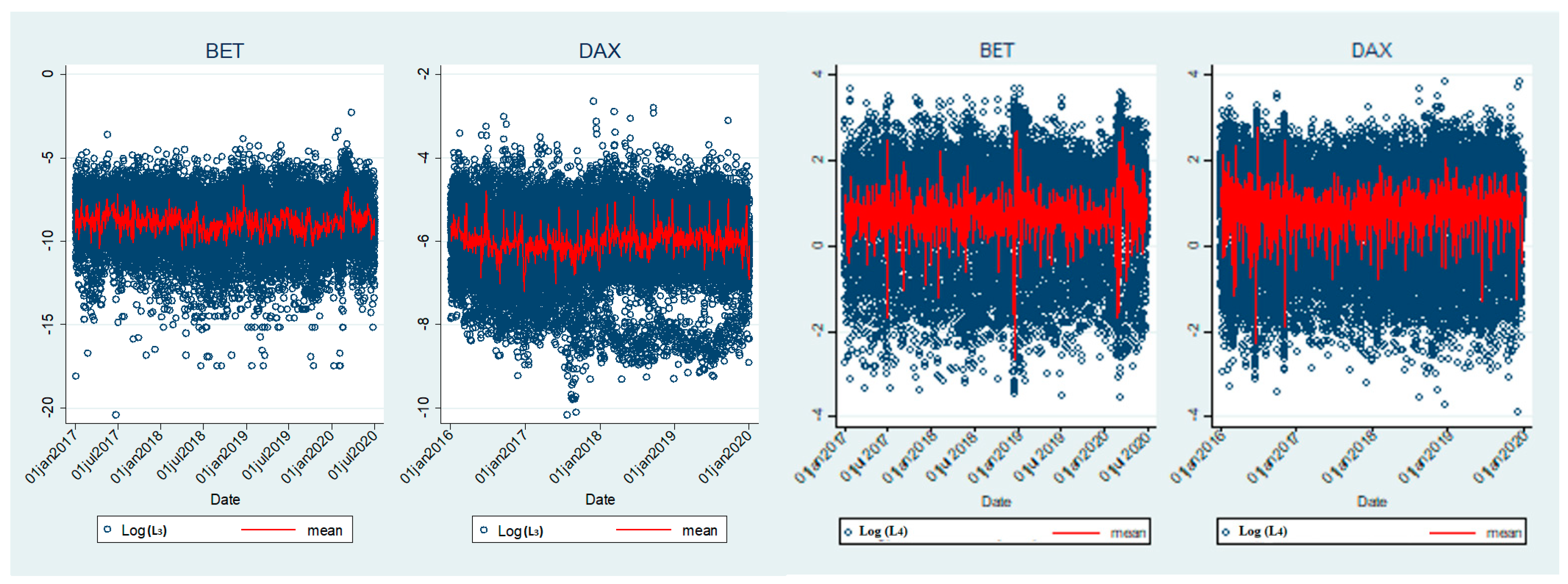

- The Hui and Heubel liquidity ratio () is computed as:where stands for the highest daily price over a 5-day period, stands for the lowest daily price over the same horizon, V is the total volume of assets traded over the same horizon, NS is the total number of assets outstanding and is the average closing price over a 5 day period; a lower value of implies higher liquidity;

- The Daily Amihud illiquidity ratio () is computed as:where is the daily closing price return on day t and is the total volume of assets on day t and is the daily closing price; a lower value of ILLIQ implies higher liquidity;

- The turnover ratio () is computed as:where is the number of assets units traded at time t for stock j, while is the total number of asset units outstanding; a higher value of TR implies higher liquidity;

- The Corwin–Schultz bid–ask spread () is computed as:where the expression for the estimate of is:where and are computed as:where denotes the high price over the two days t and t + 1 and is the low price over days t and t + 1. A reduction of the bid–ask spread implies higher liquidity.

4. Results and Interpretation

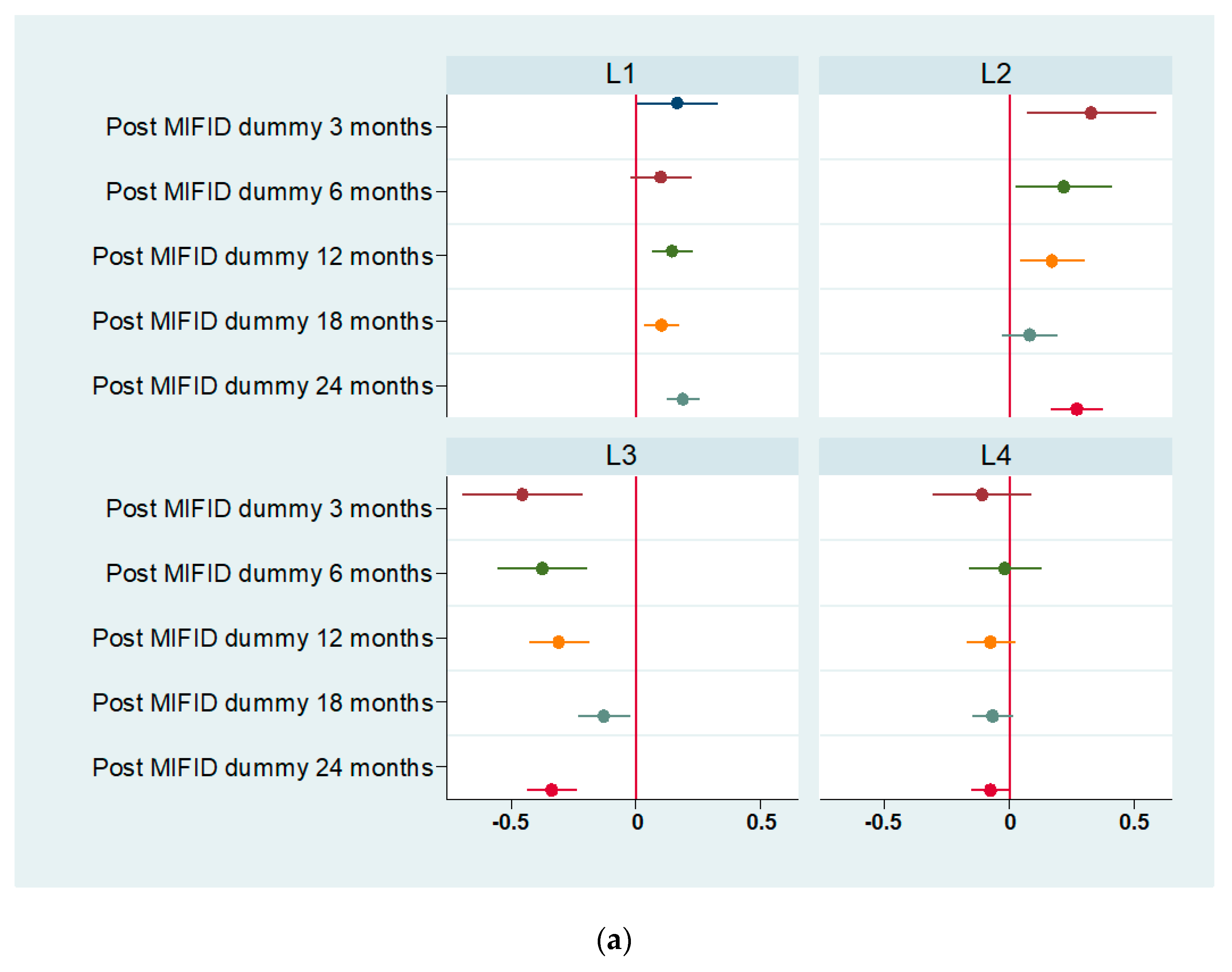

- Increase in the Hui–Heubel ratio by 16.5% on the 3-month horizon, 14.6% in 12 months, 10.4% in 18 months and 19% in 24 months;

- Increase in Amihud ratio by 32.9% on the 3-month horizon, 21.7% in 6 months, 17.2% in 12 months, and 27% in 24 months;

- Decrease in the turnover ratio by 45.4% on the 3-month horizon, 37.5% in 6 months, 30.7% in 12 months, 12.7% in 18 months and 33.7% in 24 months;

- Decrease in the Corwin–Schultz bid–ask by 7.58% in 24 months.

- An increase in the Hui–Heubel ratio of over 4.62% over a 3-month period, a decrease of 6.54% over a 12-month period, followed by an increase of the ratio of 4.21% over an 18-month period and of 4.03% over a 24-month period;

- A decrease in the Amihud ratio by 7.54% over a 6-month period, 8.74% over a 12-month period, and an increase of 4.02% over a 24-month period;

- An increase in the general liquidity ratio by 13.6% over a 3-month period, 16.2% over a 6-month period, 17.9% over 12 months, 11.5% over 18-month period and 17.4% over 24 months;

- An increase in the Corwin–Schultz bid–ask spread by 4.38% over 18 months and 5.62% over the 24-month period.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Company | Start Date of Analysis | End Date of Analysis |

|---|---|---|

| Alro | 6 July 2016 | 6 July 2020 |

| BRD Groupe Societe Generale | 6 July 2016 | 6 July 2020 |

| Bursa de Valori București | 6 July 2016 | 6 July 2020 |

| Conpet | 6 July 2016 | 6 July 2020 |

| Digi Communications N.V. | 17 May 2017 | 6 July 2020 |

| Societatea Energetică Electrica | 6 July 2016 | 6 July 2020 |

| Fondul Proprietatea | 6 July 2016 | 6 July 2020 |

| MedLife | 22 December 2016 * | 6 July 2020 |

| Sphera Franchise Group | 10 November 2017 * | 6 July 2020 |

| S.N.G.N. Romgaz | 6 July 2016 | 6 July 2020 |

| S.N. Nuclearelectrica | 6 July 2016 | 6 July 2020 |

| OMV Petrom | 6 July 2016 | 6 July 2020 |

| C.N.T.E.E. Transelectrica | 6 July 2016 | 6 July 2020 |

| S.N.T.G.N. Transgaz | 6 July 2016 | 6 July 2020 |

| Banca Transilvania | 6 July 2016 | 6 July 2020 |

| Teraplast | 6 July 2016 | 6 July 2020 |

| Purcari Wineries Public Company Limited | 16 February 2018 * | 6 July 2020 |

| Company | Start Date of Analysis | End Date of Analysis | Company | Start Date of Analysis | End Date of Analysis |

|---|---|---|---|---|---|

| Adidas | 3 January 2016 | 3 January 2020 | E.ON SE | 3 January 2016 | 3 January 2020 |

| Allianz | 3 January 2016 | 3 January 2020 | Fresenius SE | 3 January 2016 | 3 January 2020 |

| BASF | 3 January 2016 | 3 January 2020 | Fresenius ST | 3 January 2016 | 3 January 2020 |

| Bayer | 3 January 2016 | 3 January 2020 | Heidelbergcement | 3 January 2016 | 3 January 2020 |

| Beiersdorf AG | 3 January 2016 | 3 January 2020 | Henkel VZO | 3 January 2016 | 3 January 2020 |

| BMW ST | 3 January 2016 | 3 January 2020 | Infineon | 3 January 2016 | 3 January2020 |

| Continental AG | 3 January 2016 | 3 January 2020 | Linde PLC | 3 January 2016 | 3 January 2020 |

| Covestro | 3 January 2016 | 3 January 2020 | Merck | 3 January 2016 | 3 January 2020 |

| Daimler | 3 January 2016 | 3 January 2020 | MTU Aero | 3 January 2016 | 3 January 2020 |

| Delivery Hero | 3 July 2017 | 3 January 2020 | Muenc.Rueckvers. | 3 January 2016 | 3 January 2020 |

| Deutsche Bank AG | 3 January 2016 | 3 January 2020 | RWE AG ST | 3 January 2016 | 3 January 2020 |

| Deutsche Boerse | 3 January 2016 | 3 January 2020 | SAP | 3 January 2016 | 3 January 2020 |

| Deutsche Post | 3 January 2016 | 3 January 2020 | Siemens AG | 3 January 2016 | 3 January 2020 |

| Deutsche Telekom AG | 3 January 2016 | 3 January 2020 | Volkswagen VZO | 3 January 2016 | 3 January 2020 |

| Deutsche Wohnen | 3 January 2016 | 3 January 2020 | Vonovia | 3 January 2016 | 3 January 2020 |

| Period of Analysis | chi2 | p-Value | Preferred Model | |

|---|---|---|---|---|

| L1 | 3 months | 10.50 | 0.0147 | FE |

| 6 months | 2.72 | 0.4374 | RE | |

| 12 months | 4.63 | 0.2010 | RE | |

| 18 months | 4.55 | 0.2078 | RE | |

| 24 months | 10.61 | 0.0050 | FE | |

| L2 | 3 months | 13.37 | 0.0039 | FE |

| 6 months | 23.07 | 0.0000 | FE | |

| 12 months | 10.51 | 0.0147 | FE | |

| 18 months | 23.39 | 0.0000 | FE | |

| 24 months | 33.39 | 0.0000 | FE | |

| L3 | 3 months | 13.39 | 0.0039 | FE |

| 6 months | 18.56 | 0.0003 | FE | |

| 12 months | 8.13 | 0.0434 | FE | |

| 18 months | 18.75 | 0.0003 | FE | |

| 24 months | 28.57 | 0.0000 | FE | |

| L4 | 3 months | 1.80 | 61.50 | RE |

| 6 months | 2.03 | 0.5655 | RE | |

| 12 months | 1.35 | 0.7168 | RE | |

| 18 months | 4.99 | 0.1725 | RE | |

| 24 months | 1.16 | 0.7623 | RE |

| Period of Analysis | chi2 | p-Value | Preferred Model | |

|---|---|---|---|---|

| L1 | 3 months | 13.34 | 0.0013 | FE |

| 6 months | 5.21 | 0.0739 | RE | |

| 12 months | 7.90 | 0.0481 | FE | |

| 18 months | 8.57 | 0.0356 | FE | |

| 24 months | 6.73 | 0.0346 | FE | |

| L2 | 3 months | 7.40 | 0.0247 | FE |

| 6 months | 7.35 | 0.0253 | FE | |

| 12 months | 17.02 | 0.0007 | FE | |

| 18 months | 11.88 | 0.0078 | FE | |

| 24 months | 2.81 | 0.2451 | RE | |

| L3 | 3 months | 42.03 | 0.0000 | FE |

| 6 months | 10.76 | 0.0046 | FE | |

| 12 months | 17.35 | 0.0006 | FE | |

| 18 months | 13.77 | 0.0032 | FE | |

| 24 months | 4.09 | 0.1293 | RE | |

| L4 | 3 months | 2.09 | 0.3515 | RE |

| 6 months | 2.88 | 0.2373 | RE | |

| 12 months | 2.04 | 0.5633 | RE | |

| 18 months | 2.32 | 0.5080 | RE | |

| 24 months | 7.77 | 0.0206 | FE |

| 1 | See (Arouri et al. 2013) for more details on related research in emerging markets. |

| 2 | See https://bvb.ro/AboutUs/MediaCenter/PressItem/Historic-moment-Emerging-Romania.-The-Romanian-capital-market-becomes-Emerging-Market/5172 (accessed on 5 November 2021). |

| 3 | See (Kawai and Prasad 2011) for more details regarding the financial market regulation and reforms in emerging markets. |

References

- Aghanya, Daniel, Vineet Agarwal, and Sunil Poshakwale. 2020. Market in Financial Instruments Directive (MiFID), stock price informativeness and liquidity. Journal of Banking & Finance 113: 105730. [Google Scholar]

- Anselmi, Giulio, and Giovanni Petrella. 2021. Regulation and stock market quality: The impact of MiFID II provision on research unbundling. International Review of Financial Analysis 76: 101788. [Google Scholar] [CrossRef]

- Arouri, Mohammed El Hedi, Sabri Boubaker, and Duc Khuong Nguyen, eds. 2013. Emerging Markets and the Global Economy: A Handbook, 1st ed. Cambridge, MA, USA: Academic Press. [Google Scholar]

- Beck, Thorsten, Asli Demirgüc-Kunt, and Ross Levine. 2003. Law, endowments, and finance. Journal of Financial Economics 70: 137–81. [Google Scholar] [CrossRef]

- Biffany, Brendan. 2018. Fixing soft dollars is not that hard: A consent and reporting framework for regulating client commission arrangements. Duke Law Journal 68: 141–74. [Google Scholar]

- Brockman, Paul, and Dennis Y. Chung. 2003. Investor protection and firm liquidity. The Journal of Finance 58: 921–37. [Google Scholar] [CrossRef]

- Christensen, Hans B., Luzi Hail, and Christian Leuz. 2016. Capital-market effects of securities regulation: Prior conditions, implementation, and enforcement. The Review of Financial Studies 29: 2885–924. [Google Scholar] [CrossRef] [Green Version]

- Claessens, Stijn, and Luc Laeven. 2003. Financial development, property rights, and growth. The Journal of Finance 58: 2401–36. [Google Scholar] [CrossRef]

- Corwin, Shane A., and Paul Schultz. 2012. A simple way to estimate bid-ask spreads from daily high and low prices. The Journal of Finance 67: 719–60. [Google Scholar] [CrossRef]

- Crockett, Andrew. 2008. Market liquidity and financial stability. Financial Stability Review 11: 13–17. [Google Scholar]

- Cumming, Douglas, Sofia Johan, and Dan Li. 2011. Exchange trading rules and stock market liquidity. Journal of Financial Economics 99: 651–71. [Google Scholar] [CrossRef] [Green Version]

- Deakin, Simon, Prabirjit Sarkar, and Mathias Siems. 2018. Is there a relationship between shareholder protection and stock market development? Journal of Law, Finance and Accounting 3: 115–46. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1991. Efficient capital markets: II. The Journal of Finance 46: 1575–617. [Google Scholar] [CrossRef]

- Fang, Bingxu, Ole-Kristian Hope, Zhongwei Huang, and Rucsandra Moldovan. 2020. The effects of MiFID II on sell-side analysts, buy-side analysts, and firms. Review of Accounting Studies 25: 855–902. [Google Scholar] [CrossRef]

- Gabrielsen, Alexandros, Massimiliano Marzo, and Paolo Zagaglia. 2011. Measuring Market Liquidity: An Introductory Survey, Quaderni DSE, Working Papers No. 802, Dipartimento Scienze Economiche, Universita’ di Bologna. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1976149 (accessed on 5 December 2020).

- Guo, Yifeng, and Lira Mota. 2021. Should information be sold separately? Evidence from MiFID II. Journal of Financial Economics 142: 97–126. [Google Scholar] [CrossRef]

- Huang, Tao, Fei Wu, Jing Yu, and Bohui Zhang. 2020. Investor protection and the value impact of stock liquidity. Journal of International Business Studies 51: 72–94. [Google Scholar] [CrossRef]

- IOSCO. 2007. Factors Influencing Liquidity in Emerging Markets. Available online: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD258.pdf (accessed on 5 December 2020).

- 2011. Financial Market Regulation and Reforms in Emerging Markets. Asian Development Bank Institute and the Brookings Institution. Available online: https://www.adb.org/publications/financial-market-regulation-and-reforms-emerging-markets (accessed on 5 June 2021).

- King, Robert G., and Ross Levine. 1993. Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Lang, Mark H., Jedson Pinto, and Edward Sul. 2019. MiFID II Unbundling and Sell Side Analyst Research. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3408198 (accessed on 10 June 2021).

- Lee, J. 2018. Where Are the Analysts? Europe Small Caps Battle to Be Seen. Bloomberg. Available online: https://www.bloomberg.com/news/articles/2018-09-10/where-are-the-analysts-europe-s-small-caps-battle-to-be-seen (accessed on 10 June 2021).

- Miloș, Marius C. 2021. Impact of MiFID II on the market volatility–analysis on some developed and emerging European stock markets. Laws 10: 55. [Google Scholar] [CrossRef]

- OECD. 2021. OECD Capital Market Review of Romania 2021. Mapping Report. Available online: https://www.oecd.org/corporate/OECD-Capital-Market-Review-Romania-2021-Mapping-Report.pdf (accessed on 5 November 2021).

- Roulston, Darren T. 2003. Analyst following and market liquidity. Contemporary Accounting Research 20: 552–78. [Google Scholar] [CrossRef]

- Santoso, Wimboh, Cicilia A. Harun, Taufik Hidayat, and Hero Wonida. 2010. Market Liquidity Risk as an Indicator of Financial Stability: The Case of Indonesia. Available online: https://www.bis.org/repofficepubl/arpresearch201003.05.pdf (accessed on 10 December 2020).

- Sarr, Abdourahmane, and Tonny Lybeck. 2002. Measuring Liquidity in FINANCIAL markets, IMF Working Paper 02/232. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Measuring-Liquidity-in-Financial-Markets-16211 (accessed on 10 December 2020).

- Siri, Michele, and Shanshan Zhu. 2019. Will the EU Commission successfully integrate sustainability risks and factors in the investor protection regime? A research agenda. Sustainability 11: 6292. [Google Scholar] [CrossRef] [Green Version]

- Utkilen, Henriette, and Synne Wakeford-Wesmann. 2019. Liquidity Following MiFID II. Estimating the Effect of Research Unbundling on Norwegian Small- and Mid-Cap Stocks. Master’s thesis, Norwegian School of Economics, Bergen. Available online: https://openaccess.nhh.no/nhh-xmlui/handle/11250/2609729 (accessed on 10 December 2020).

- Wyman, Oliver, and World Federation of Exchanges. 2020. Enhancing Liquidity in Emerging Market Exchanges. Available online: https://www.world-exchanges.org/storage/app/media/research/Studies_Reports/liquidity-in-emerging-market-exchanges-wfe-amp-ow-report.pdf (accessed on 5 June 2021).

| GDPcap | NC | ND | EP | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Pre-MiFID II (Romanian stock market) | ||||||||||

| Average | 7.23 | −3.98 | −8.78 | 0.75 | 21.64 | 0.01 | 27,442.34 | |||

| SD | 2.29 | 2.41 | 1.60 | 1.17 | 1.34 | 0.01 | 907.3988 | |||

| Min | 0.72 | −9.98 | −20.39 | −3.38 | 18.83 | 0.00 | 25,601.19 | |||

| Max | 13.40 | 8.78 | −3.60 | 3.64 | 23.75 | 0.10 | 29,029.47 | |||

| Post-MiFID II (Romanian stock market) | ||||||||||

| Mean | 7.38 | −3.53 | −8.93 | 0.76 | 21.47 | 0.01 | 31,402.64 | 1986.9 | 65.5 | 10.95 |

| SD | 2.31 | 2.49 | 1.68 | 1.19 | 1.45 | 0.01 | 1336.53 | 2344.8 | 55.4 | 28.62 |

| Min | 0.21 | −10.11 | −17.47 | −3.57 | 18.43 | 0.00 | 29,049.85 | 0.00 | 1.0 | 0.00 |

| Max | 13.98 | 7.25 | −2.27 | 3.68 | 23.96 | 0.11 | 33,365.92 | 10,269 | 294 | 87.50 |

| Pre-MiFID II (German stock market) | ||||||||||

| Mean | 6.92 | −9.29 | −6.08 | 0.84 | 24.13 | 0.01 | 51,750.02 | |||

| SD | 1.16 | 1.39 | 0.72 | 1.00 | 0.78 | 0.01 | 1531.40 | |||

| Min | 3.11 | −15.27 | −10.15 | −3.44 | 22.08 | 0.00 | 48,763.08 | |||

| Max | 10.30 | −2.41 | −2.64 | 3.53 | 25.51 | 0.08 | 54,378.88 | |||

| Post-MiFID II (German stock market) | ||||||||||

| Mean | 6.91 | −9.42 | −5.94 | 0.88 | 24.20 | 0.01 | 55,742.49 | |||

| SD | 1.26 | 1.28 | 0.71 | 1.01 | 0.75 | 0.01 | 664.25 | |||

| Min | 2.89 | −14.64 | −9.30 | −3.88 | 22.36 | 0.00 | 54,381.12 | |||

| Max | 11.29 | −4.98 | −2.80 | 3.86 | 25.73 | 0.09 | 56,625.49 | |||

| Log (MCap) | SD | GDPcap | NC | ND | EP | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| BET | ||||||||||

| 1 | ||||||||||

| 0.38 | 1 | |||||||||

| −0.37 | −0.64 | 1 | ||||||||

| 0.03 | 0.02 | 0.15 | 1 | |||||||

| ) | −0.15 | −0.7 | 0.13 | −0.01 | 1 | |||||

| 0.07 | 0.16 | 0.06 | 0.2 | −0.07 | 1 | |||||

| GDPcap | 0.03 | 0.08 | −0.03 | 0.01 | −0.05 | 0.06 | 1 | |||

| NC | 0.02 | 0.03 | 0.01 | 0.03 | −0.03 | 0.08 | 0.06 | 1 | ||

| ND | 0.02 | 0.03 | 0.01 | 0.03 | −0.03 | 0.07 | 0.05 | 1 | 1 | |

| EP | 0.02 | 0.04 | 0.03 | 0.04 | −0.04 | 0.16 | 0.12 | 0.89 | 0.88 | 1 |

| DAX | ||||||||||

| 1 | ||||||||||

| 0.15 | 1 | |||||||||

| −0.6 | −0.17 | 1 | ||||||||

| −0.00 | 0.13 | 0.19 | 1 | |||||||

| ) | 0.31 | −0.52 | −0.22 | −0.05 | 1 | |||||

| −0.08 | 0.23 | 0.33 | 0.17 | −0.2 | 1 | |||||

| GDPcap | −0.01 | −0.1 | 0.03 | −0.01 | 0.07 | −0.13 | 1 |

| VARIABLES | L1 | L1 | L1 | L1 | L1 | L2 | L2 | L2 | L2 | L2 |

|---|---|---|---|---|---|---|---|---|---|---|

| MiFID II (3m) | 0.165 ** | 0.329 ** | ||||||||

| (0.0818) | (0.132) | |||||||||

| MiFID II (6m) | 0.101 | 0.217 ** | ||||||||

| (0.0623) | (0.0998) | |||||||||

| MiFID II (12m) | 0.146 *** | 0.172 *** | ||||||||

| (0.0415) | (0.0662) | |||||||||

| MiFID II (18m) | 0.104 *** | 0.0806 | ||||||||

| (0.0360) | (0.0569) | |||||||||

| MiFID II (24m) | 0.190 *** | 0.270 *** | ||||||||

| (0.0340) | (0.0531) | |||||||||

| Log (Mcap) | 1.171 *** | 0.398 ** | 0.578 *** | 0.538 *** | 1.068 *** | −0.202 | −0.674 ** | −1.327 *** | −1.510 *** | −0.796 *** |

| (0.326) | (0.180) | (0.0861) | (0.0566) | (0.0363) | (0.526) | (0.288) | (0.137) | (0.0895) | (0.0568) | |

| SD | 25.04 *** | 17.29 *** | 19.08 *** | 18.23 *** | 17.57 *** | 27.46 *** | 10.49 *** | 14.59 *** | 13.79 *** | 11.91 *** |

| (2.603) | (1.677) | (1.208) | (1.009) | (0.837) | (4.203) | (2.684) | (1.925) | (1.596) | (1.308) | |

| GDPcap | −0.000195 * | −0.000103 ** | *** | ** | *** | −0.000275 | ** | |||

| (0.000114) | ) | ) | ) | ) | (0.000185) | ) | ) | ) | ) | |

| NC | 8642 *** | 7100 *** | ||||||||

| (1198) | (1874) | |||||||||

| ND | −126,131 *** | −102,629 *** | ||||||||

| (17,274) | (27,009) | |||||||||

| EP | −0.00552 *** | −0.00655 *** | ||||||||

| (0.00134) | (0.00209) | |||||||||

| Constant | −12.35 | 1.602 | −4.006 ** | −3.995 *** | −14.98 *** | 8.457 | 13.50 ** | 25.45 *** | 27.98 *** | 13.97 *** |

| (8.643) | (4.300) | (1.930) | (1.194) | (0.784) | (13.96) | (6.884) | (3.077) | (1.888) | (1.226) | |

| Observations | 2084 | 4118 | 8058 | 11,907 | 14,042 | 2084 | 4118 | 8058 | 11,907 | 14,042 |

| R-squared | 0.049 | 0.027 | 0.036 | 0.033 | 0.086 | 0.023 | 0.008 | 0.026 | 0.036 | 0.029 |

| Number of FirmID | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | L3 | L3 | L3 | L3 | L3 | L4 | L4 | L4 | L4 | L4 |

| MiFID II (3m) | −0.454 *** | −0.109 | ||||||||

| (0.123) | (0.101) | |||||||||

| MiFID II (6m) | −0.375 *** | −0.0165 | ||||||||

| (0.0917) | (0.0751) | |||||||||

| MiFID II (12m) | −0.307 *** | −0.0749 | ||||||||

| (0.0617) | (0.0503) | |||||||||

| MiFID II (18m) | −0.127 ** | −0.0659 | ||||||||

| (0.0536) | (0.0427) | |||||||||

| MiFID II (24m) | −0.337 *** | −0.0758 * | ||||||||

| (0.0501) | (0.0410) | |||||||||

| Log(Mcap) | −1.036 ** | −0.379 | 0.190 | 0.407 *** | −0.230 *** | −0.125 | −0.218 | −0.0824 | 0.0195 | −0.0165 |

| (0.488) | (0.264) | (0.128) | (0.0844) | (0.0536) | (0.401) | (0.216) | (0.104) | (0.0672) | (0.0438) | |

| SD | 3.990 | 18.77 *** | 17.16 *** | 19.78 *** | 23.06 *** | 17.76 *** | 23.84 *** | 22.50 *** | 22.87 *** | 23.16 *** |

| (3.901) | (2.467) | (1.795) | (1.503) | (1.233) | (3.209) | (2.019) | (1.464) | (1.197) | (1.009) | |

| GDPcap | 0.000226 | 0.000156 ** | *** | *** | ||||||

| (0.000171) | ) | ) | ) | ) | (0.000141) | ) | ) | ) | ) | |

| NC | −8713 *** | 1688 | ||||||||

| (1767) | (1445) | |||||||||

| ND | 126,548 *** | −23,984 | ||||||||

| (25,466) | (20,823) | |||||||||

| EP | 0.00938 *** | −0.00118 | ||||||||

| (0.00197) | (0.00161) | |||||||||

| Constant | 6.720 | −5.409 | −15.64 *** | −17.69 *** | −5.650 *** | 0.962 | 6.686 | 2.044 | −0.188 | 0.495 |

| (12.95) | (6.328) | (2.868) | (1.779) | (1.156) | (10.66) | (5.179) | (2.340) | (1.417) | (0.945) | |

| Observations | 2084 | 4118 | 8058 | 11,907 | 14,042 | 2084 | 4118 | 8058 | 11,907 | 14,042 |

| R-squared | 0.013 | 0.023 | 0.015 | 0.020 | 0.032 | 0.018 | 0.036 | 0.029 | 0.030 | 0.039 |

| Number of FirmID | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 | 17 |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| VARIABLES | L1 | L1 | L1 | L1 | L1 | L2 | L2 | L2 | L2 | L2 |

|---|---|---|---|---|---|---|---|---|---|---|

| MiFID II (3m) | 0.0462 ** | −0.0382 | ||||||||

| (0.0190) | (0.0499) | |||||||||

| MiFID II (6m) | −0.00366 | −0.0754 * | ||||||||

| (0.0153) | (0.0393) | |||||||||

| MiFID II (12m) | −0.0654 *** | −0.0874 *** | ||||||||

| (0.0124) | (0.0321) | |||||||||

| MiFID II (18m) | 0.0421 *** | 0.00580 | ||||||||

| (0.0105) | (0.0274) | |||||||||

| MiFID II (24m) | 0.0403 *** | 0.0402 * | ||||||||

| (0.00909) | (0.0239) | |||||||||

| Log (Mcap) | 1.348 *** | 0.946 *** | 1.025 *** | 1.030 *** | 1.012 *** | −0.289 | −0.463 *** | −0.516 *** | −0.633 *** | −0.710 *** |

| (0.0776) | (0.0455) | (0.0223) | (0.0148) | (0.0110) | (0.203) | (0.117) | (0.0576) | (0.0386) | (0.0289) | |

| SD | 16.42 *** | 18.99 *** | 14.27 *** | 15.73 *** | 14.65 *** | 33.53 *** | 38.41 *** | 26.72 *** | 27.32 *** | 27.43 *** |

| (1.245) | (0.926) | (0.554) | (0.446) | (0.347) | (3.264) | (2.372) | (1.431) | (1.162) | (0.912) | |

| GDPcap | −0.000242 *** | −0.000120 *** | *** | *** | −0.000134 | ** | *** | *** | ||

| ) | ) | (5.05 × 10−6) | ) | ) | ) | ) | ) | ) | ) | |

| Constant | −12.87 *** | −9.741 *** | −18.30 *** | −15.34 *** | −15.36 *** | 4.373 | 5.127 * | 2.201 | 7.605 *** | 9.826 *** |

| (2.811) | (1.148) | (0.585) | (0.363) | (0.261) | (7.371) | (2.941) | (1.510) | (0.947) | (0.686) | |

| Observations | 3690 | 7440 | 14,819 | 22,192 | 29,597 | 3690 | 7440 | 14,819 | 22,192 | 29,597 |

| R-squared | 0.118 | 0.110 | 0.146 | 0.198 | 0.244 | 0.029 | 0.040 | 0.032 | 0.048 | 0.084 |

| Number of FirmID | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | L3 | L3 | L3 | L3 | L3 | L4 | L4 | L4 | L4 | L4 |

| MiFID II (3m) | 0.136 *** | −0.0293 | ||||||||

| (0.0196) | (0.0494) | |||||||||

| MiFID II (6m) | 0.162 *** | −0.00165 | ||||||||

| (0.0165) | (0.0377) | |||||||||

| MiFID II (12m) | 0.179 *** | 0.0276 | ||||||||

| (0.0133) | (0.0309) | |||||||||

| MiFID II (18m) | 0.115 *** | 0.0438 * | ||||||||

| (0.0114) | (0.0264) | |||||||||

| MiFID II (24m) | 0.174 *** | 0.0562 ** | ||||||||

| (0.00988) | (0.0237) | |||||||||

| Log(Mcap) | −1.122 *** | −0.545 *** | −0.473 *** | −0.386 *** | −0.318 *** | −0.266 | −0.199 * | −0.0557 | −0.0108 | −0.0433 |

| (0.0799) | (0.0489) | (0.0239) | (0.0161) | (0.0119) | (0.201) | (0.112) | (0.0555) | (0.0373) | (0.0286) | |

| SD | 20.00 *** | 17.88 *** | 19.46 *** | 20.43 *** | 20.53 *** | 29.87 *** | 27.84 *** | 23.10 *** | 23.89 *** | 22.19 *** |

| (1.281) | (0.995) | (0.595) | (0.484) | (0.377) | (3.230) | (2.275) | (1.379) | (1.122) | (0.903) | |

| GDPcap | 0.000199 *** | *** | *** | 0.000151 | ||||||

| ) | ) | ) | ) | ) | ) | ) | ) | ) | ) | |

| Constant | 10.14 *** | 2.636 ** | 4.820 *** | 1.428 *** | 1.206 *** | −1.254 | 3.535 | 1.585 | 1.159 | 1.922 *** |

| (2.892) | (1.233) | (0.628) | (0.394) | (0.283) | (7.293) | (2.820) | (1.456) | (0.914) | (0.678) | |

| Observations | 3690 | 7440 | 14,819 | 22,192 | 29,597 | 3690 | 7440 | 14,819 | 22,192 | 29,597 |

| R-squared | 0.212 | 0.154 | 0.166 | 0.170 | 0.164 | 0.028 | 0.023 | 0.023 | 0.023 | 0.024 |

| Number of FirmID | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miloș, M.C.; Miloș, L.R.; Barna, F.; Boțoc, C. Impact of MiFID II on Romanian Stock Market Liquidity—Comparative Analysis with a Developed Stock Market. Int. J. Financial Stud. 2021, 9, 69. https://doi.org/10.3390/ijfs9040069

Miloș MC, Miloș LR, Barna F, Boțoc C. Impact of MiFID II on Romanian Stock Market Liquidity—Comparative Analysis with a Developed Stock Market. International Journal of Financial Studies. 2021; 9(4):69. https://doi.org/10.3390/ijfs9040069

Chicago/Turabian StyleMiloș, Marius Cristian, Laura Raisa Miloș, Flavia Barna, and Claudiu Boțoc. 2021. "Impact of MiFID II on Romanian Stock Market Liquidity—Comparative Analysis with a Developed Stock Market" International Journal of Financial Studies 9, no. 4: 69. https://doi.org/10.3390/ijfs9040069

APA StyleMiloș, M. C., Miloș, L. R., Barna, F., & Boțoc, C. (2021). Impact of MiFID II on Romanian Stock Market Liquidity—Comparative Analysis with a Developed Stock Market. International Journal of Financial Studies, 9(4), 69. https://doi.org/10.3390/ijfs9040069